- What is Cobra Trading?

- Cobra Trading Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

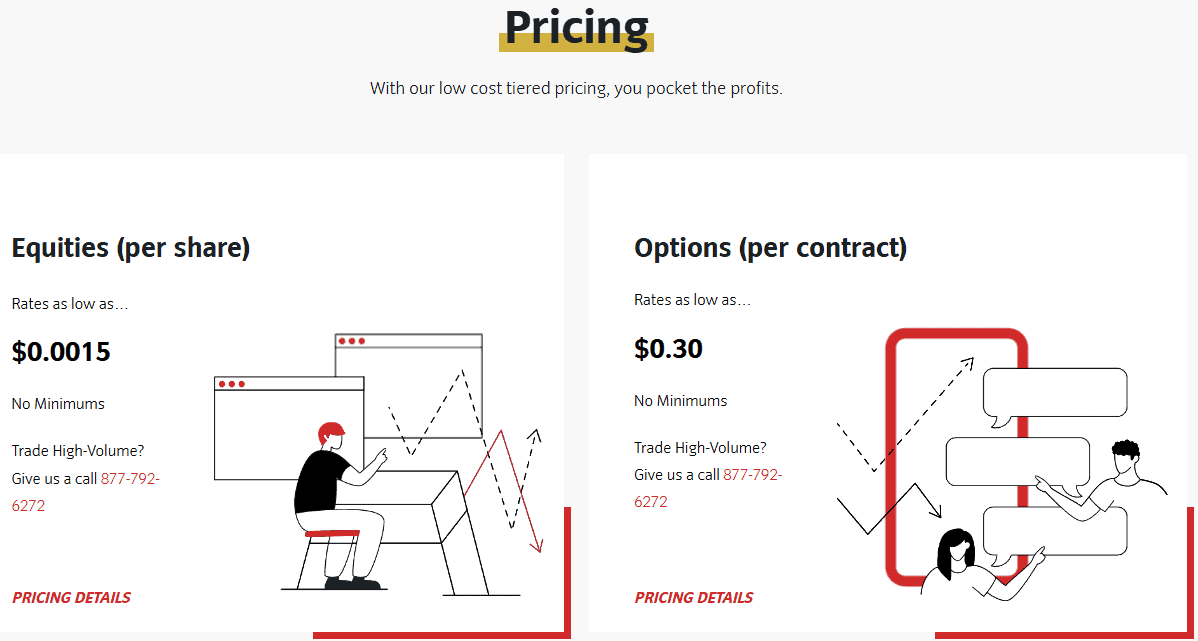

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

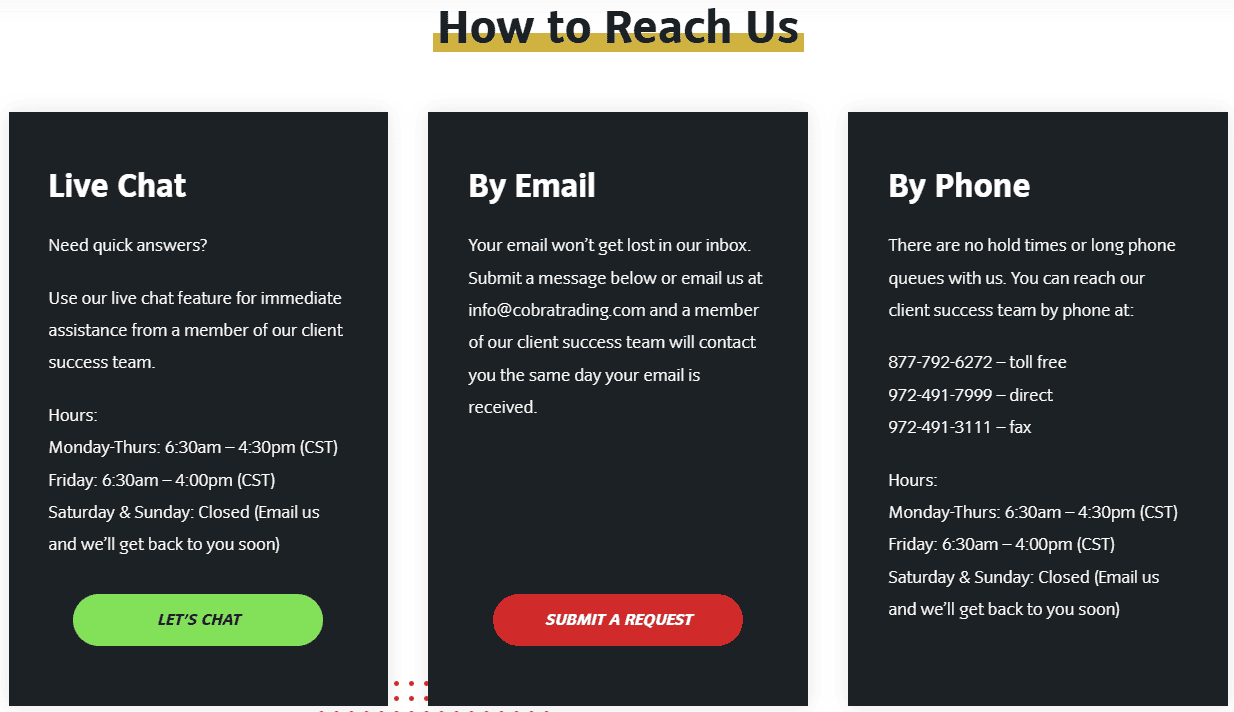

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

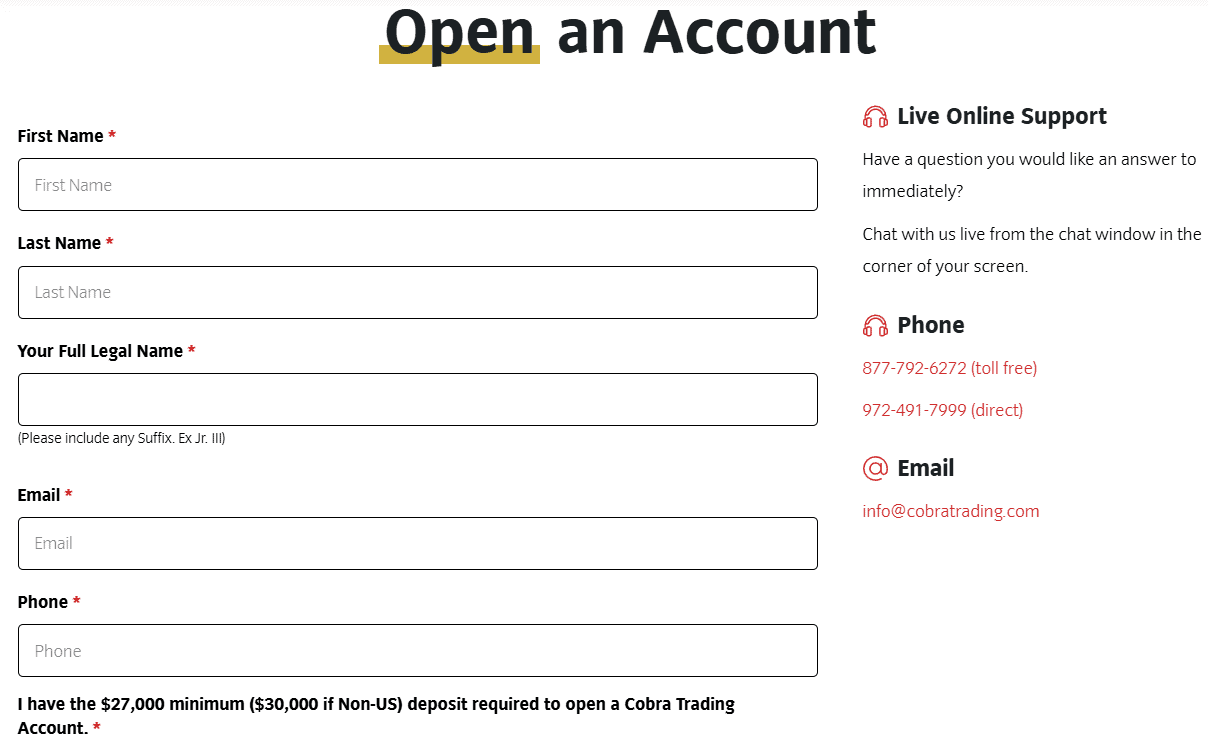

- Account Opening

- Additional Tools And Features

- Cobra Trading Compared to Other Brokers

- Full Review of Broker Cobra Trading

Overall Rating 4.5

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is Cobra Trading?

Cobra Trading is a U.S.-based Stock Broker that has been serving active and professional traders since 2004. Regulated by the SEC and FINRA, the firm offers a secure environment for stock and options trading, providing direct market access and advanced order routing.

It offers powerful platforms like DAS Trader Pro and Sterling Trader Pro, along with specialized tools for short selling and fast execution. Built for speed and efficiency, Cobra Trading is tailored to traders who require professional-grade technology and flexibility rather than entry-level or commission-free services.

Is Cobra Trading Stock Broker?

Yes, Cobra Trading is a stock broker that provides direct market access to U.S. equities and options. It is designed for active and professional traders, offering fast execution speeds, advanced order routing, and powerful trading platforms.

Cobra Trading Pros and Cons

Cobra Trading offers several advantages, including fast trade execution, direct market access, advanced routing options, and professional platforms like DAS Trader Pro and Sterling Trader Pro, making it a strong choice for active and experienced traders. It also provides reliable customer support and specialized tools for short selling.

For the Cons, the firm may not be ideal for beginners, as it requires higher account minimums, charges commission-based fees, and lacks access to asset classes like Forex or CFDs.

Overall, Cobra Trading is best suited for traders who prioritize speed, flexibility, and advanced features over low-cost or beginner-friendly services.

| Advantages | Disadvantages |

|---|

| US regulation and oversee | No 24/7 customer support |

| Secure investing environment | High minimum deposit amount |

| Suitable for active traders and professionals | Limited research and educational materials |

| Advanced trading platforms | Limited asset classes offered |

| Stocks and Options trading | |

| Competitive fees and commissions | |

| Suitable for long-term investing | |

| US investors | |

Cobra Trading Features

Cobra Trading offers a range of features specifically designed for active and professional traders. The broker provides direct market access, advanced order routing, and multiple professional platforms to ensure speed and precision. Below is a comprehensive list of its main features:

Cobra Trading Features in 10 Points

| 🏢 Regulation | SEC, FINRA, SIPC |

| 🗺️ Account Types | Individual & Joint, IRA, Business, Trust, Partnership Accounts |

| 🖥 Trading Platforms | DAS Trader Pro, Sterling Trader Pro, TradingView |

| 📉 Trading Instruments | Stocks, Options, ETFs |

| 💳 Minimum Deposit | $30,000 |

| 💰 Average Stock Commission | $0.0015 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | Articles, Blog, Trading Videos, Trader Meetups |

| ☎ Customer Support | 24/5 |

Who is Cobra Trading For?

Cobra Trading is best suited for experienced investors who prioritize speed, precision, and flexibility in their strategies. It appeals to traders who need advanced routing options, reliable short-selling capabilities, and access to professional platforms to support high-volume or complex trading styles. In our opinion, Cobra Trading is Good for:

- Investing

- US traders

- International trading

- Direct Market Access

- Real Stock Trading

- Competitive fees

- Options trading

- Advanced traders

- Professional trading

- Supportive customer service

- Long-term investors

Cobra Trading Summary

To sum up, Cobra Trading is a specialized brokerage that focuses on providing a professional environment with advanced tools and dedicated support.

The firm offers direct access to markets, flexible routing choices, and reliable short-selling capabilities, ensuring traders have the resources to implement complex strategies efficiently.

With a strong emphasis on transparency, client service, and platform performance, Cobra Trading delivers a tailored experience that appeals to active traders seeking more than the standard retail brokerage model.

55Brokers Professional Insights

Cobra Trading distinguishes itself as a broker dedicated to serving professional traders with a blend of advanced technology, platforms, and personalized service. Its direct market access ensures faster execution and greater transparency, while multiple routing options allow traders to control how their orders reach the market.

One of the broker’s standout strengths is its specialized short-selling tools, including advanced locate systems that provide access to hard-to-borrow stocks, giving traders an edge in volatile markets, which is very big advantage not every Stock or Optionn broker offers.

Cobra Trading also offers robust platforms such as DAS Trader Pro and Sterling Trader Pro, we enjoy navigating it; it is intuitive, yet packed with complex order types, real-time data, and customizable interfaces, great for professional use.

Beyond technology, the firm emphasizes client support, providing direct communication with knowledgeable representatives who can quickly assist with platform, account, or trading needs.

Consider Trading with Cobra Trading If:

| Cobra Trading is an excellent Broker for: | - Need a well-regulated broker.

- Suitable for professional traders and investors.

- Low fees and commissions.

- Stock Trading and Investment.

- Options Trading.

- Secure trading environment.

- For US investors.

- Access to robust trading platforms.

- High-Frequency traders.

- Long-term investors.

- Looking for broker with Top-Tier licenses.

- Advanced trading technology.

- Great customer support.

|

Avoid Trading with Cobra Trading If:

| Cobra Trading might not be the best for: | - Who need good research and educational materials.

- Looking for broker with 24/7 customer support.

- Forex or Futures traders.

- Beginner traders. |

Regulation and Security Measures

Score – 4.7/5

Cobra Trading Regulatory Overview

Cobra Trading operates as a fully regulated U.S. brokerage, ensuring a secure and transparent trading environment for its clients.

The firm is registered with the U.S. Securities and Exchange Commission (SEC), which oversees its compliance with federal securities laws. It is also a member of FINRA (Financial Industry Regulatory Authority), providing additional oversight and enforcing industry standards for fair and ethical practices.

Moreover, Cobra Trading is covered by the Securities Investor Protection Corporation, which protects client assets in the unlikely event of the firm’s financial failure.

How Safe is Trading with Cobra Trading?

Trading with Cobra Trading is considered safe for US investors, as the broker is regulated by the SEC and a member of FINRA, ensuring compliance with industry standards and legal requirements.

Client assets are also protected by SIPC insurance, which adds an extra layer of security in case of the firm’s financial difficulties. The firm’s regulatory oversight, transparent operations, and professional-grade infrastructure make it a reliable choice for investors.

Consistency and Clarity

Cobra Trading has established itself as a reputable broker within the professional trading community since its founding in 2003. It is regulated by the SEC, a member of FINRA, and covered by SIPC, which reinforces its credibility and commitment to client protection.

Trader reviews often highlight its fast execution, advanced platforms like DAS Trader Pro and Sterling Trader Pro, and responsive customer support as major advantages.

On the other hand, some users note the high minimum deposit and the lack of robust learning materials for beginners as drawbacks. While it may not be widely recognized among casual investors, Cobra Trading maintains a consistent reputation for reliability, specialized tools, and professional-grade services. The broker also participates in industry events and sponsorships, further strengthening its visibility and standing in the financial community.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Cobra Trading?

Cobra Trading offers a range of account types to cater to the diverse needs of investors. These include Individual and Joint accounts, Roth IRAs, Corporate and LLC accounts, as well as Trust and Partnership accounts, allowing flexibility for both personal and organizational trading.

The broker also provides a demo account, enabling prospective clients to explore its platforms, practice strategies, and familiarize themselves with the tools before committing real funds.

Individual Account

Cobra Trading’s Individual Accounts are tailored for active traders seeking professional-grade tools and direct market access. For U.S. residents, the minimum deposit to open a day-trading account is $27,000, with a required minimum balance of $25,000.

International clients are subject to a higher minimum deposit of $30,000. These accounts provide access to advanced trading platforms like DAS Trader Pro and Sterling Trader Pro, offering features such as Level II quotes, direct routing, and real-time data feeds.

Regions Where Cobra Trading is Restricted

Cobra Trading restricts clients from certain regions due to regulatory and compliance requirements, including:

- North Korea

- Iran

- Syria

- Cuba

- Sudan, etc.

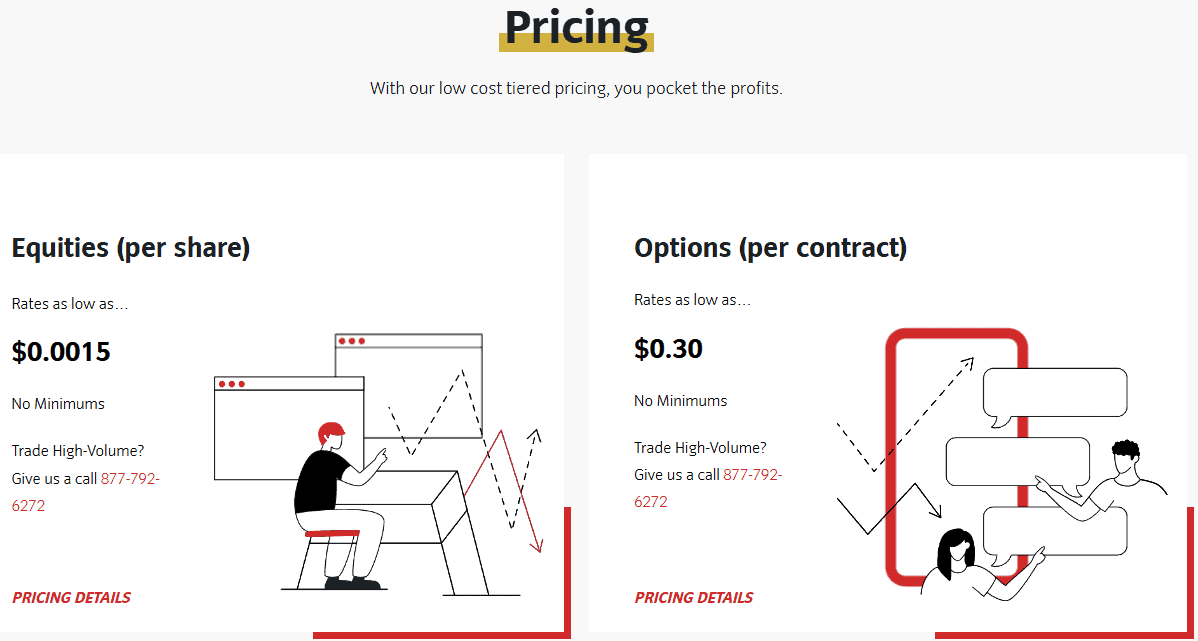

Cost Structure and Fees

Score – 4.5/5

Cobra Trading Brokerage Fees

Cobra Trading offers a transparent and competitive fee structure tailored for active and professional traders. Equity commissions are charged on a tiered per-share basis, while options trades carry fees per contract along with applicable exchange fees.

Margin rates are relatively low, making leveraged trading more cost-effective, and account-related fees, such as ACAT transfers or IRA maintenance, are clearly outlined.

The broker also charges for platform and market data access, though these costs may be reduced for high-volume traders. Overall, the firm’s fees reflect its focus on providing professional-grade tools, fast execution, and flexibility, balancing cost with the advanced services it offers to investors.

- Cobra Trading Commissions

Cobra Trading offers a competitive commission structure, with the average stock commission set at $0.0015 per share. Options trades are charged per contract, with additional fees depending on the exchange and routing.

The broker provides tiered pricing for higher-volume trading, allowing flexibility and cost efficiency. Combined with advanced platforms and direct market access, this commission setup helps traders execute strategies effectively while keeping costs transparent and manageable.

- Cobra Trading Exchange Fee

Cobra Trading applies exchange and regulatory fees to trades, which are separate from its standard commission structure. These fees vary based on the specific exchange and the nature of the trade.

For example, options trades may incur exchange fees ranging from $0.05 to $0.55 per contract, depending on the routing and exchange involved. Therefore, traders should consider both the potential exchange and regulatory fees when evaluating the total cost of their trades.

- Cobra Trading Rollover / Swaps

Cobra Trading primarily focuses on stocks and options trading, so traditional rollover or swap fees, as seen in Forex or CFD trading, do not typically apply.

For traders using margin, interest charges may be incurred on borrowed funds, which function similarly to financing costs. These margin rates are clearly outlined by the broker and depend on the amount borrowed, helping clients understand the cost of leveraged positions.

How Competitive Are Cobra Trading Fees?

Cobra Trading offers a clear and straightforward fee structure that makes it easy for traders to understand the costs involved. The broker discloses all account-related fees, platform charges, and data subscriptions upfront, ensuring transparency.

With its focus on reliable execution, consistent service, and no hidden costs, Cobra Trading provides a competitive pricing environment that appeals to those who value clarity and predictability in their expenses.

| Asset/ Pair | Cobra Trading Commission | BiG Commission | TradeZero Commission |

|---|

| Stocks Fees | From $0.0015 | From €6 | From $0 |

| Fractional Shares | - | - | - |

| Options Fees | $0.30 | From $0 | $0.42 |

| ETFs Fees | From $0.0015 | From €6 | From $0 |

| Free Stocks | No | No | Yes |

Cobra Trading Additional Fees

In addition to standard commissions, Cobra Trading charges several additional fees depending on the services used. These include account maintenance fees, wire transfer or ACH fees, ACAT transfer fees for moving accounts to another broker, and charges related to option assignment or exercise.

Market data and platform subscriptions may also carry monthly costs, though these can sometimes be waived for high-volume traders. By clearly outlining these potential charges, Cobra Trading ensures that clients have full visibility of all costs associated with their accounts.

Trading Platforms and Tools

Score – 4.6/5

Cobra Trading provides access to a range of professional-grade platforms designed to meet different styles and preferences.

Clients can choose DAS Trader Pro, known for its fast execution and advanced order routing; Sterling Trader Pro, which offers powerful tools for active trading and market analysis; or TradingView, a widely used platform with intuitive charting and community-driven features.

Together, these platforms give traders flexibility, robust analytical tools, and direct market access to execute strategies with efficiency and precision.

Trading Platform Comparison to Other Brokers:

| Platforms | Cobra Trading Platforms | BiG Platforms | MEXEM Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Cobra Trading Web Platform

Cobra Trading offers convenient web-based platforms for traders who prefer flexibility without installing desktop software. DAS Active Web Trader provides real-time quotes, advanced charting, and fast order execution directly from a browser, making it a practical option for those needing reliable performance on the go.

Similarly, Sterling Trader Web delivers essential trading tools and market access through an intuitive web interface, allowing users to monitor markets and place trades efficiently.

Main Insights from Testing

Testing Cobra Trading’s web platforms delivers a smooth and responsive experience with reliable market connectivity. The interfaces are user-friendly, making it easy to access charts, quotes, and order functions without the need for heavy installations.

Performance remains stable across browsers, and the platforms provide enough functionality for efficient trading while on the move, ensuring flexibility for traders who need quick and secure access from different devices.

Cobra Trading Desktop MetaTrader 4 Platform

Cobra Trading does not offer the MT4 platform. Traders looking to use MT4’s interface or automated features should consider alternative brokers that support it.

Cobra Trading Desktop MetaTrader 5 Platform

The broker does not offer access to the MetaTrader 5 platform. Traders looking for MT5 functionality will need to consider other brokers.

Cobra Trading MobileTrader App

Cobra Trading supports mobile trading through both DAS Mobile and Sterling Trader Mobile, giving clients access to markets directly from their smartphones or tablets.

These apps provide essential features like live quotes, order entry, account monitoring, and basic charting, ensuring traders can manage positions efficiently while away from their desktops.

AI Trading

Cobra Trading does not currently offer built-in AI trading features or automated AI-driven strategies within its platforms. Traders can, however, use third-party tools, custom algorithms, or Cobra Trading’s API on supported platforms like DAS Trader Pro or Sterling Trader Pro to implement automated strategies.

While the broker provides professional-grade technology and advanced order routing, any AI or algorithmic trading functionality relies on external software integration through the API rather than proprietary AI features.

Trading Instruments

Score – 4.5/5

What Can You Trade on Cobra Trading’s Platform?

On Cobra Trading’s platform, clients can trade a variety of instruments, including stocks, which cover U.S.-listed equities across multiple sectors; options, allowing strategies such as calls, puts, spreads, and other derivatives; and ETFs, offering diversified exposure to indices, sectors, and asset classes.

These instruments provide flexibility for traders to pursue different investment goals, from individual stock positions to complex options strategies and diversified portfolio management.

Main Insights from Exploring Cobra Trading’s Tradable Assets

Margin Trading at Cobra Trading

Cobra Trading offers margin trading, allowing clients to borrow funds to increase their market exposure and potentially enhance returns. The broker provides transparent margin rates and clear requirements, including minimum account balances and maintenance levels, to help manage risk.

With access to margin, traders can take larger positions in stocks, options, and ETFs, while leveraging Cobra Trading’s fast execution and advanced order types. However, as with all margin trading, clients should be aware that it amplifies both potential gains and potential losses.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Cobra Trading

Cobra Trading provides several deposit options to fund accounts conveniently and securely. Clients can use ACH transfers, wire transfers, and checks, allowing flexibility based on preference and location.

Cobra Trading Minimum Deposit

For U.S. residents, Cobra Trading requires a minimum deposit of $27,000 to open a day-trading account, with a $25,000 minimum balance to comply with the Pattern Day Trader (PDT) rule.

International clients face a slightly higher minimum deposit of $30,000 to start trading on the platform.

Withdrawal Options at Cobra Trading

Cobra Trading offers several withdrawal options to provide clients with flexible access to their funds. Traders can withdraw via ACH transfers, wire transfers, or checks, with processing times varying depending on the method.

The broker ensures secure and efficient transfers, allowing clients to access their capital reliably whenever needed.

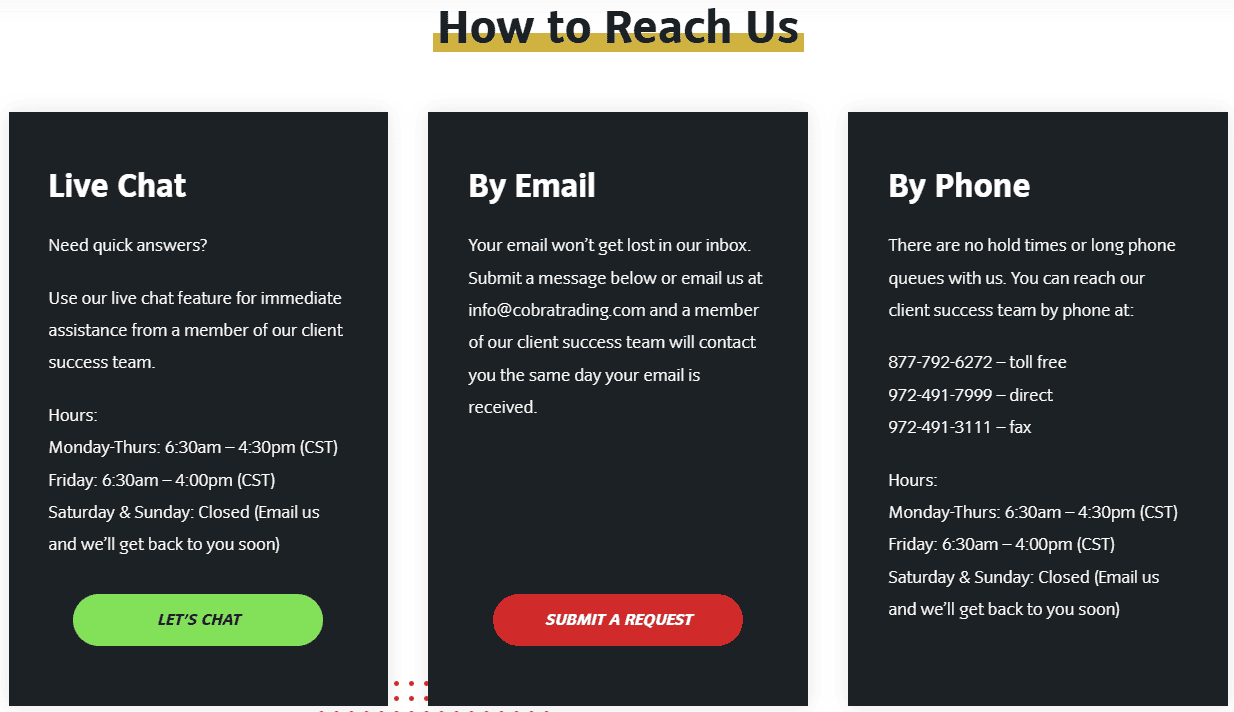

Customer Support and Responsiveness

Score – 4.5/5

Testing Cobra Trading’s Customer Support

The broker provides 24/5 customer support via phone, live chat, FAQs, and email.

Support representatives are generally quick to address account, platform, and funding inquiries, providing clear and practical guidance.

Contacts Cobra Trading

Cobra Trading can be reached through multiple channels for client support and inquiries. Traders may contact the team via email at info@cobratrading.com, call the toll-free number 877-792-6272, or use the direct line at 972-491-7999. These options provide accessible and reliable ways to connect with the broker for assistance with accounts, platforms, or services.

Research and Education

Score – 4.4/5

Research Tools Cobra Trading

Cobra Trading provides a variety of research tools across its website and platforms to support informed decision-making.

- Traders can utilize real-time market data, advanced charting, Level II quotes, customizable scanners, and order routing features to refine their strategies.

- In addition, the broker integrates with TradingView, giving users access to powerful charting, technical analysis, and social community insights directly linked to their Cobra Trading accounts for seamless trade execution.

Education

Cobra Trading provides educational support through a variety of resources designed to help traders sharpen their skills. Clients can access articles, blogs, and learning videos that cover market insights and platform tips, while trader meetups offer opportunities to network, share strategies, and learn from industry professionals.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options Cobra Trading

Cobra Trading primarily caters to active traders and does not provide traditional investment products like mutual funds or retirement accounts.

Instead, its focus is on direct market access to stocks, ETFs, and options, giving traders the tools and flexibility to build and manage their own investment strategies.

Account Opening

Score – 4.5/5

How to Open Cobra Trading Demo Account?

Opening a demo account with Cobra Trading is a straightforward process that allows traders to practice in a simulated market environment.

Interested users can request access through the broker’s website by filling out a short application form, after which login details are provided. The demo account offers access to the platform’s features and real-time market data, enabling traders to test strategies and get familiar with the tools before committing real funds.

How to Open Cobra Trading Live Account?

Opening a live account with Cobra Trading involves a structured application process designed to meet regulatory requirements and ensure a smooth onboarding experience. Traders can complete the process online by providing the necessary information and documentation. Here are the key steps:

- Visit the Cobra Trading website and select “Open an Account.”

- Choose the account type that best suits your trading needs.

- Complete the online application form with personal and financial details.

- Upload required identification and verification documents.

- Fund your account with the minimum deposit required.

- Receive account approval and login details to begin live trading.

Additional Tools and Features

Score – 4.4/5

In addition to research and trading integrations, Cobra Trading provides a range of extra tools and features that enhance the overall experience.

- These include risk management tools, real-time alerts, and customizable dashboards that allow traders to tailor their platforms to their strategies.

- The firm also provides access to Cobra Trading’s API, enabling traders to integrate custom algorithms, automated strategies, and third-party tools directly with their accounts for enhanced flexibility and efficiency.

Cobra Trading Compared to Other Brokers

Compared to many of its competitors, Cobra Trading is positioned as a broker tailored more toward experienced and active traders, particularly those seeking direct market access and advanced tools.

While other brokers often emphasize accessibility with lower entry requirements and broader asset coverage, Cobra Trading focuses on delivering professional-grade platforms and specialized financial services.

Its offering stands out in terms of robust execution options and support for sophisticated strategies, whereas competitors may appeal more to casual investors by providing a wider variety of asset classes, lower barriers to entry, or a stronger emphasis on education and beginner-friendly platforms.

| Parameter |

Cobra Trading |

BiG |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Stock Commission from $0.0015 |

Stock Commission from €6 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Average |

Low/Average |

Low |

Average |

Low |

Low/Average |

Low |

| Trading Platforms |

DAS Trader Pro, Sterling Trader Pro, TradingView |

PMyBOLSA, BiGlobal Trade, CFD Trading Platforms |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE Pro, Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, Options, ETFs |

Stocks, ETFs, ETPs, Futures, Options, Funds, CFDs, Warrants & Certificates |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds, CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEC, FINRA, SIPC |

Banco de Portugal, CMVM |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Limited |

Limited |

Excellent |

Good |

Limited |

Excellent |

Good |

| Minimum Deposit |

$30,000 |

€1,000 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Cobra Trading

Cobra Trading is a direct market access Stock brokerage tailored for active traders seeking professional-grade tools and efficient market access.

The broker offers a range of sophisticated platforms, including DAS Trader Pro and Sterling Trader Pro, which provide advanced charting, real-time data, and flexible order management to support various trading strategies.

Cobra Trading maintains competitive commission structures, with equity rates as low as $0.0015 per share, catering to high-volume traders. The firm also provides robust customer support, ensuring that traders receive timely assistance when needed.

While the firm requires a higher minimum deposit compared to some competitors, it compensates with its specialized offerings and commitment to serving the needs of active traders. Its services are particularly suited for those who prioritize precision, control, and direct access to U.S. markets.

Share this article [addtoany url="https://55brokers.com/cobra-trading-review/" title="Cobra Trading"]