- What is CFI?

- CFI Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

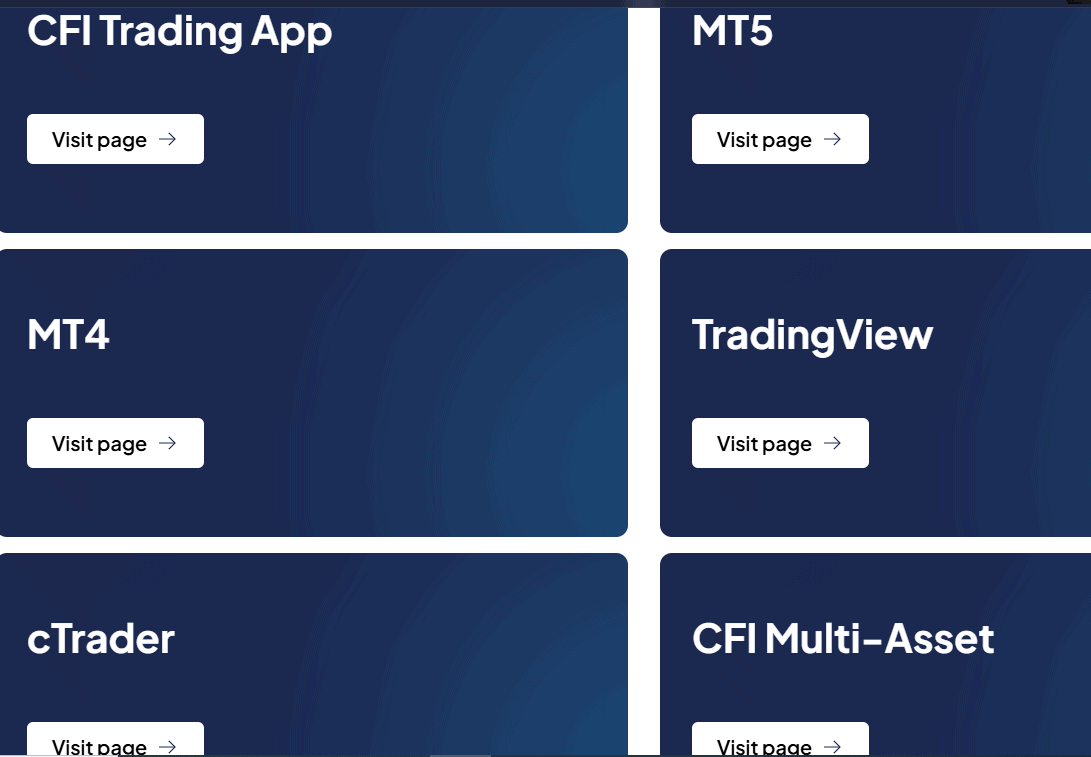

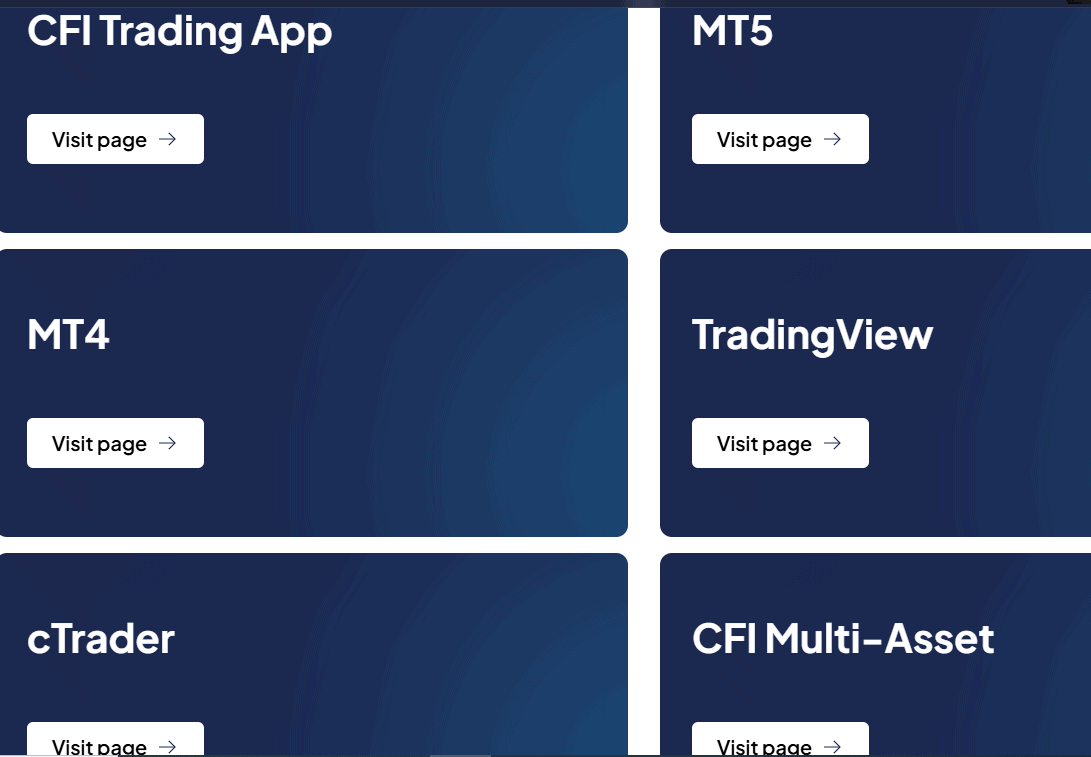

- Trading Platforms and Tools

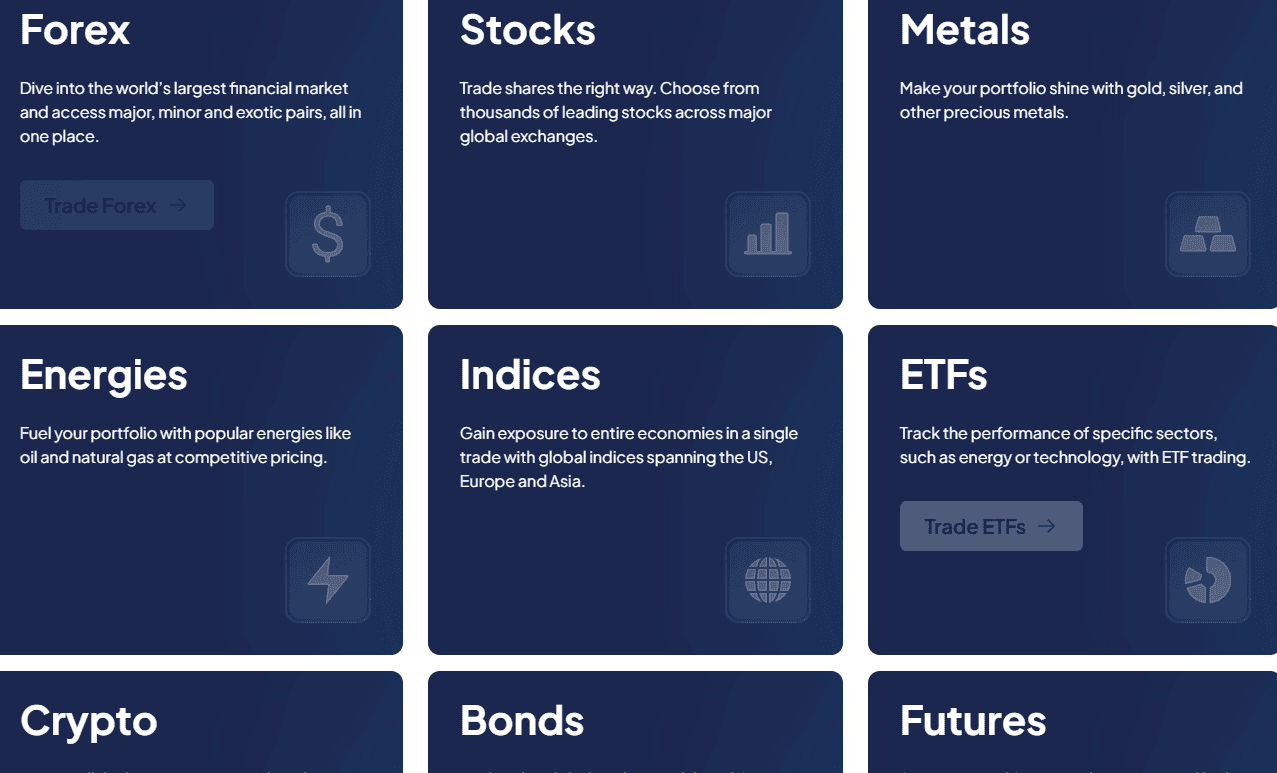

- Trading Instruments

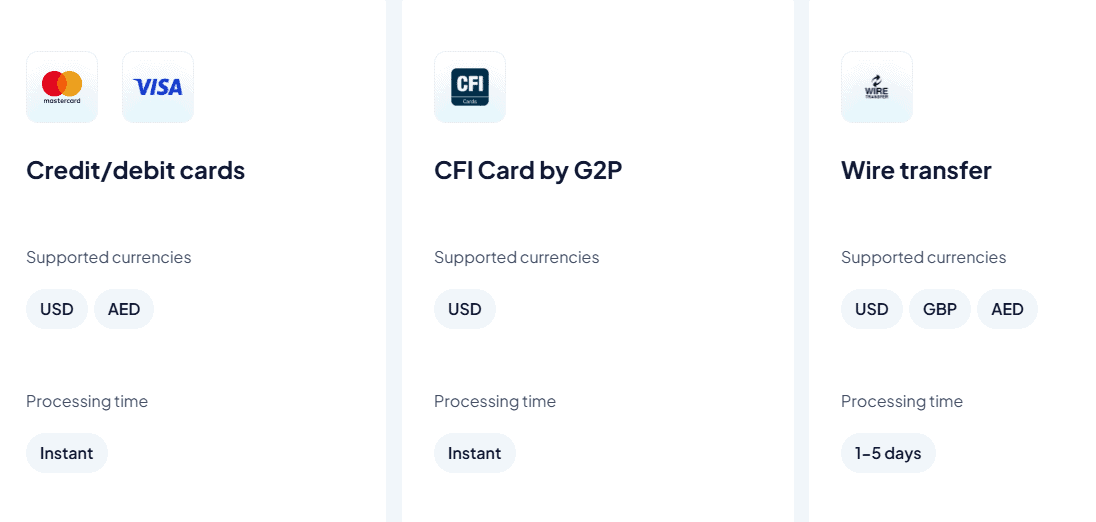

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

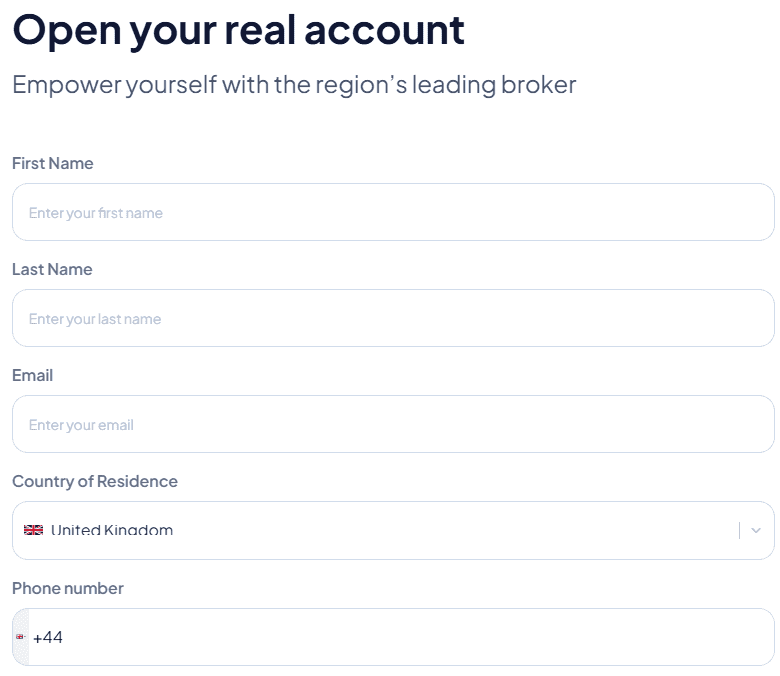

- Account Opening

- Additional Tools And Features

- CFI Compared to Other Brokers

- Full Review of Broker CFI

Overall Rating 4.5

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4.5 / 5 |

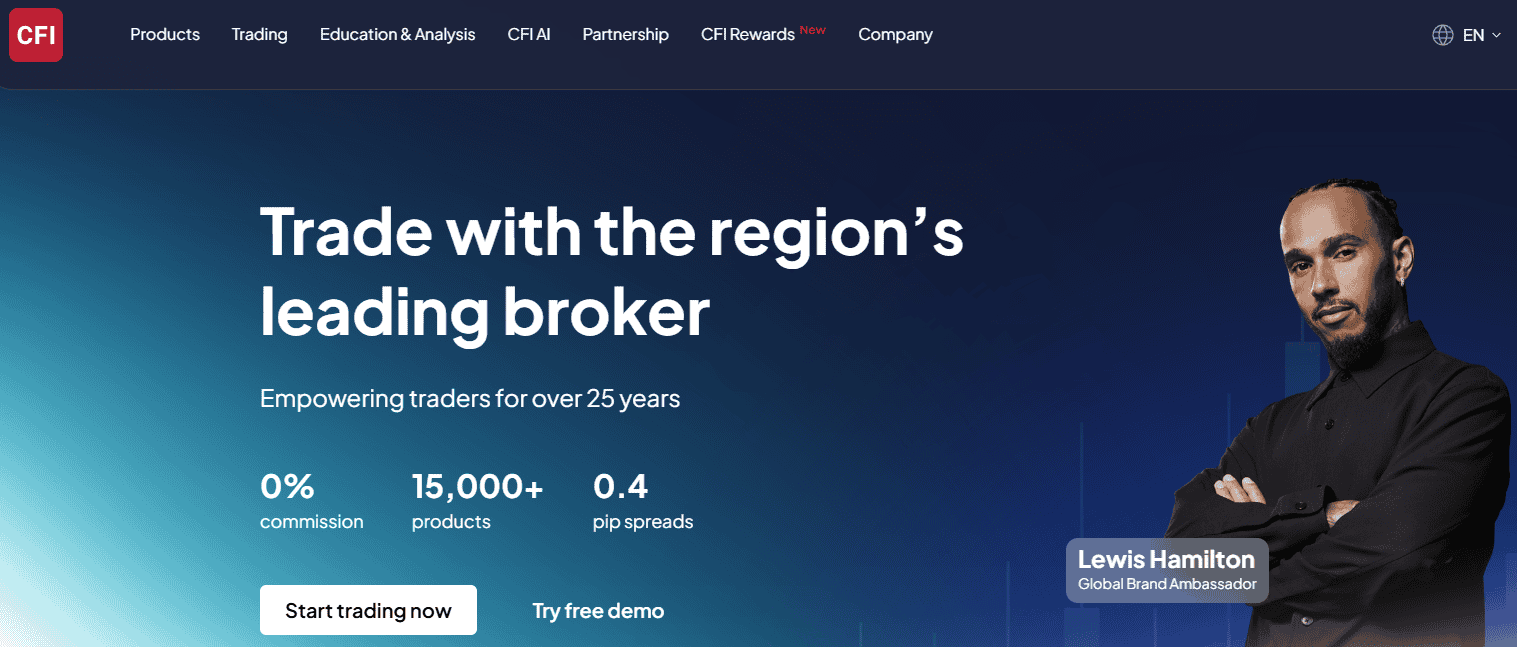

What is CFI?

Credit Financier Invest (CFI) is a Forex trading company that offers a range of financial services to individuals, corporations, and institutional clients. The broker operates in various global financial markets, including Forex, stocks, bonds, commodities, derivatives, and more. Besides brokerage services, CFI provides asset management, investment banking, and other financial solutions.

Based on our findings, CFI Financial Group has more than 25 years of industry experience and operates through multiple entities across various global locations such as London, Larnaca, Beirut, Amman, Dubai, and other regions.

In general, CFI is a well-established and reputable brokerage firm that provides comprehensive financial solutions to a wide range of clients globally.

CFI Pros and Cons

From our point of view, CFI has both advantages and disadvantages necessary to evaluate. The broker offers a wide selection of over 15.000+ trading instruments across various financial products, along with competitive trading costs. Traders have the flexibility to choose from advanced trading platforms like MT4, MT5, TradingView, and cTrader. Additionally, the broker’s regulatory compliance with multiple authorities, including the Top-tier FCA license brings a sense of trust and security. CFI also provides extensive learning resources and research materials which is great for beginners, also its expansion to the MENA region makes it a good choice for traders from this part of the world.

For the pros, conditions may vary based on the entity, and clients should be aware that market fluctuations can affect investment returns while trading via an international entity since regulations are not so tight there. Also, the broker’s UK entity website lacks 24/7 customer support.

| Advantages | Disadvantages |

|---|

| FCA license and oversee | Conditions might vary based on the entity |

| Top-tier license | Cryptocurrency CFDs not available for UK Traders |

| MT4/MT5, cTrader trading platforms | |

| No minimum deposit | |

| Trading instruments | |

| Multi-regulated | |

| Education and research | |

| Competitive spreads and fees | |

CFI Features

CFI is a broker with over 25 years of experience in the market and tight regulations in various regions. Licenses from authorities such as CySEC and FCA ensure the broker’s safety and reliability. Besides, CFI is equipped with great market conditions, offering some of the most popular platforms, a competitive fee structure, and an extensive educational section. Here is the breakdown of the main aspects of CFI for a quick look:

CFI Features in 10 Points

| 🗺️ Regulation | FCA, CySEC, DFSA, FSC, VFSC, FSA, JSC, BDL |

| 🗺️ Account Types | Zero Commission, Dynamic Trader |

| 🖥 Trading Platforms | MT4, MT5, cTrader, TradingView, CFI Multi-Asset |

| 📉 Trading Instruments | Forex, Stocks, Indices, Energies, Metals, Crypto, ETFs, Bonds, Futures |

| 💳 Minimum deposit | No minimum deposit |

| 💰 Average EUR/USD Spread | 0.4 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | GBP, EUR, USD |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/7 |

Who is CFI For?

Based on our findings and insights from financial experts, CFI is a well-regarded international broker, especially a preferred choice across the MENA region. CFI is particularly well-suited for the following:

- Clients from the UK

- Traders from the MENA Region, Dubai, Lebanon

- Islamic Trading and Swap-Free Trading

- Those who prefer the MT5 and cTrader trading platforms

- International traders

- CFD and currency trading

- Beginners

- European traders

- Institutional trading

- STP/NDD execution

- Swap-free trading

- Competitive spreads

- Good trading tools

- EA/Auto trading

CFI Summary

CFI is a trustworthy Forex broker that offers a competitive environment, a diverse range of products, and low trading fees for both retail and institutional clients. Since the broker provides popular platforms like MT4/MT5 and cTrader, which are equipped with advanced features and tools they are suitable for various levels of traders. The broker also provides a wide range of educational materials and research resources to support clients in expanding their knowledge and staying informed about the market. Another plus is no minimum requirement of deposit and quite a good coverage of the MENA region with swap-free and Islamic accounts.

However, there may be variations in conditions depending on the specific entity, as the broker has several entities in offshore zones, so mainly International clients are served by these entities which indeed offer lower security levels compared to its UK or Cyprus entity. Overall, we recommend conducting thorough research to ensure that the broker aligns with your individual trading needs, considering possible differences in conditions across different entities.

55Brokers Professional Insights

CFI is marked by us as a broker suitable for traders looking for serious Broker partner weather you’re tarder or investor, besides that company is operating for many years and has nearly excellent reputation the conditions and offering is great quality, pretty diverse and with good costs provided.

Due to multiple licenses, traders almost from any corner of the world may open and account, while the conditions offered are also great for every type of trader. With its no deposit requirement and good education and research section, the broker is a choice for beginners too. CFI is also suitable for advanced traders and for those who look for traditional investment opportunities which is remarkable feature, as company combine traditional trading and investment via offering of separate account types, while both are on great quality level.

Overall, almost all aspects of trading with the broker are well thought out and customer-oriented, making CFI a suitable choice for trading. However, traders should also consider the differences in offerings across various entities and conduct their own research to determine if the broker meets their expectations.

Consider Trading with CFI If:

| CFI is an excellent Broker for: | - You value market diversity

- Are a beginner trader with no experience

- Look for competitive fee structure and advanced conditions

- Value extensive education with webinars and seminars

- Want access to the most popular platforms, such as MT4/MT5, cTrader, and TradingView

- Prioritize tight regulation

- You are in the MENA region |

Avoid Trading with CFI If:

| CFI might not be the best for: | - Traders looking for very high leverage ratios |

Regulation and Security Measures

Score – 4.7/5

CFI Regulatory Overview

CFI is a trustworthy broker as it is regulated by the Top-tier FCA (UK), and also holds additional licenses in various jurisdictions allowing global expansion. The authority is known for enforcing stringent rules and regulations to maintain the highest standards in the financial industry. This regulatory oversight adds extra confidence in the broker’s operations, guaranteeing their adherence to regulatory requirements.

However, the broker also holds offshore licenses. Therefore, before engaging in trading activities you should carefully consider and understand the differences while trading in different jurisdictions even using the same Broker.

How Safe is Trading with CFI?

CFI follows industry standards and regulatory compliance setting quite a high security level for trading accounts. These include measures to safeguard client funds through segregation and offering protections like negative balance protection. As an STP and NDD broker, the broker creates a secure environment by directing all trades to global clearing banks, ensuring real-time execution at market prices.

- However, you should do your research and thoroughly review CFI’s documentation, legal agreements, and policies to gain a comprehensive understanding of the specific protections the firm offers, as international standards are much lower compared to UK ones so conditions might not suit some trading demands. This will help you make an informed decision before engaging in any trading activities.

Consistency and Clarity

Our research of CFI reveals the broker’s reliability and good standing in the market. The broker has been around for more than 25 years, constantly enhancing its conditions and offerings through the years. CFI has also expanded its scope of geography, gaining licenses in different regions and providing its services worldwide.

What we find great about the broker is the positive feedback from real traders who share their good experience with CFI, emphasizing responsive and professional customer support, favorable conditions with a competitive fee structure, and overall stating that trading with the broker proves to be profitable. Overall, the consistency in its offerings and clarity of services, with constant growth and development, makes the broker a reliable choice for traders.

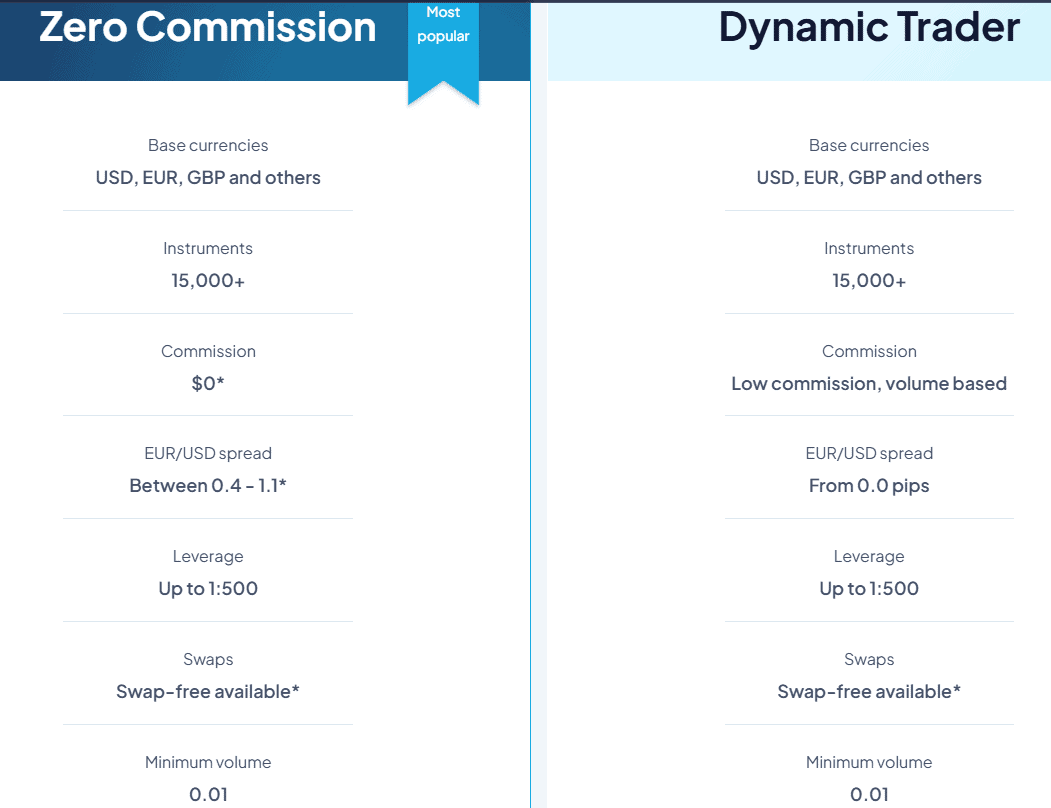

Account Types and Benefits

Score – 4.4/5

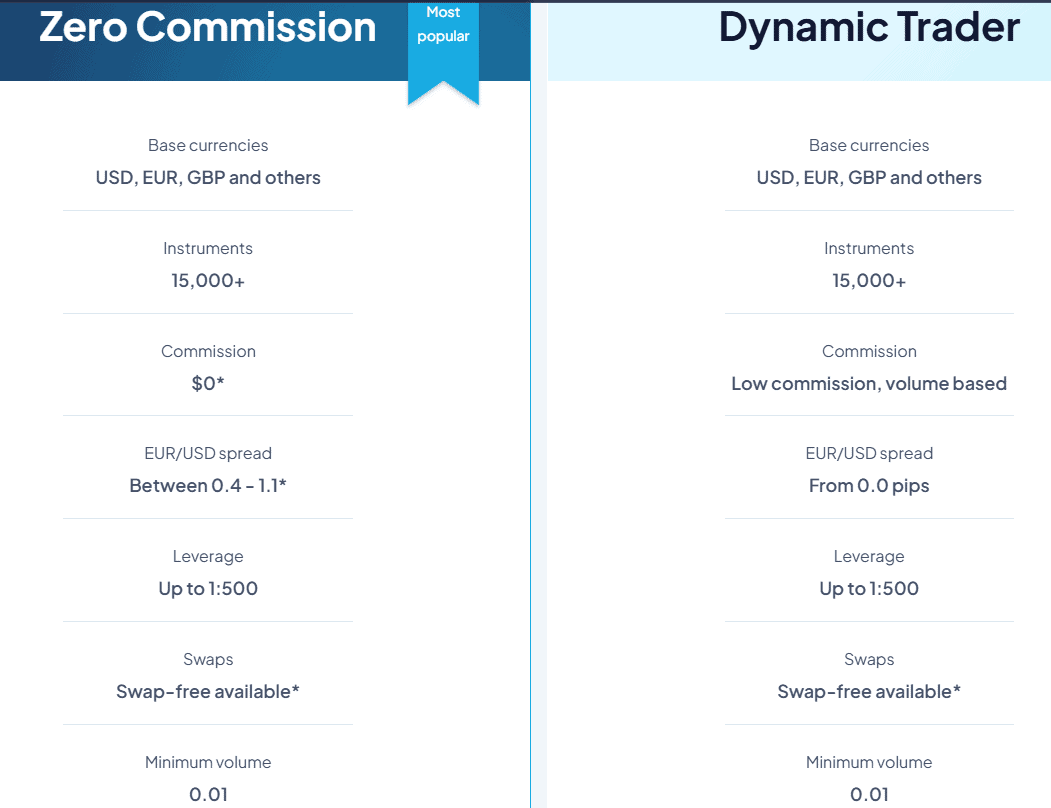

Which Account Types Are Available with CFI?

CFI offers two main account types, each of which offers a different fee structure and varying trading conditions tailored to meet various trading expectations. The most popular account type is the spread-based Zero commission, especially popular among beginner traders, while Dynamic Trader is a commission-based account. CFI also offers a separate account for physical Stock Investment. Traders should note that the offerings of the broker differ not only based on the account type but also based on the jurisdiction.

- The common feature among the account types is the up to 1:500 availability of leverage. But note that the higher leverage of 1:500 is only for professional traders. The instrument range of 15.000 is the same for both of the account types, too. Both account types have no minimum deposit requirement, providing flexibility for traders to start with an amount that suits their financial situation. Also, platforms to conduct trades are the same, enabling access to MT4, MT5, cTrader, Multi-Asset, Trading View, and CFI APP platforms, with great flexibility and versatility.

Below are the features characteristic for each of the CFI account types:

Zero Commission Account

Zero Commission is a popular account type that has a spread-based fee structure, with spreads varying between 0.4 to 1.1 pips. It is especially suitable for those looking for transparent fee structures and reduced costs. There are no commissions for this account type. Swap-free option for this account type is also available. The account also permits Algorithmic Trading, and offers advanced indicators and plug-ins.

Dynamic Trader Account

This account type is great for frequent traders. Access to a wide variety of assets is offered, and it provides trading on a commission-based structure, with raw spreads from as low as 0.0 pips, combined with very low commissions based on volume. Besides, among other advantages, advanced tool access and features, and swap-free options are supported.

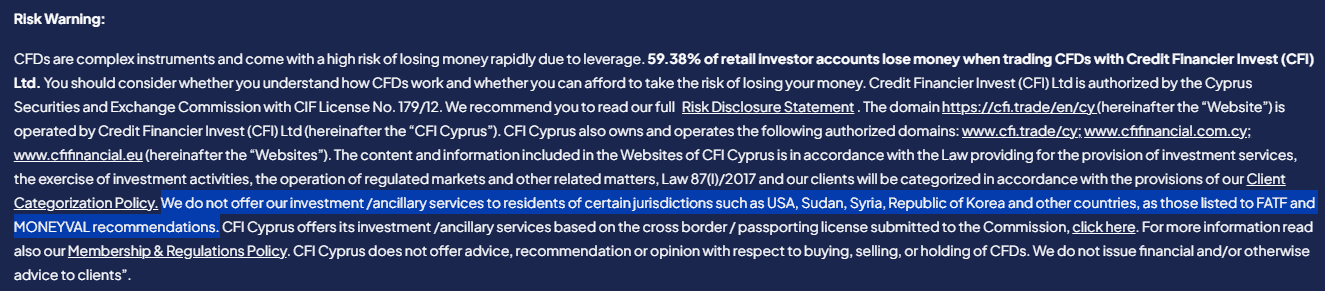

Regions Where CFI is Restricted

CFI has certain restrictions regarding regions and countries where its services are provided. Although the broker accepts clients from all over the world, below is the list of the few countries where CFI is not available:

- USA

- Sudan

- Syria

- Republic of Korea

Cost Structure and Fees

Score – 4.5/5

CFI Brokerage Fees

Generally, several factors define the fees and commissions of the broker. CFI’s fee structure mostly depends on the instrument to be traded, the jurisdiction under which the account is opened, the chosen account type, and several other factors. We have taken a closer look at CFI’s cost structure in detail, putting an accent on the offered spreads, commissions, and swaps. At the same time, we have taken a look at the additional fees that might be included in trading with CFI.

The broker offers two account types with different fee structures- the Zero Commission account, and as the name indicates, all the costs are built into spreads, and there are no commissions applied, and the Dynamic Trader account which has spreads starting from 0.0 pips, and commissions.

Spreads with the Zero Commission account start from 0.4 pips and vary up to 1.1 pips. The average EUR/USD pair spread is calculated at 0.4 pips. Spreads for Indices start from 0.47 pips and range up to 21 pips for some instruments. For gold, the average spread is 12 pips.

CFI imposes commissions only for its Dynamic Trader account type. The commissions are based on the trading volume and the instrument traded, with spreads as low as 0.0 pips. Traders should check the exact commission amount with the broker’s support team, as all the costs are changeable and should be specified beforehand. For the US-listed stocks and ETFs costs start from $0.005/share with a minimum of $1 per trade.

How Competitive Are CFI Fees?’

The cost structure of CFI is competitive and would attract traders looking for low trading fees and, at the same time, transparent pricing. It provides a commission-free account with very tight spreads from as low as 0.0 pips. In addition to its commission-free account type, CFI applies volume-based commissions. The broker also has competitive swap rates for positions held overnight, which helps traders handle rollover costs. This fair fee system makes CFI a good choice for those who want to access various tradable instruments for low costs.

| Asset/ Pair | CFI Spread | HFM Spread | Fortrade Spread |

|---|

| EUR USD Spread | 0.4 pips | 0.6 pips | 2 pips |

| Crude Oil WTI Spread | 2.6 | 4 cents | 0.04$ |

| Gold Spread | 12 | 0.16 | 0.45$ |

CFI Additional Fees

CFI does not charge any deposit or withdrawal fees. However, fees by any third party may be applied with the transfer of funds to and from an account. Other costs that clients may be liable for include swap or rollover fees for holding positions overnight. There is also an inactivity fee charged after a period of six months if the account is not used, meant to ensure that traders keep their accounts active. The exact fee depends on the account type and region.

Trading Platforms and Tools

Score – 4.7/5

CFI provides its customers with several advanced platforms like MT4, MT5, TradingView, and cTrader, available on desktop, mobile, and web versions. The platforms provide tools and features for a wide range of traders – from deep market analytics to indicators and customized tools.

| Platforms | CFI Platforms | JustMarkets Platforms | Fortrade Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | No |

| cTrader | Yes | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

CFI Web Platform

Web-based trading with CFI has a great amount of advantages, which enable traders to access the market directly from a web browser without any need for installations. CFI gives access to a variety of web-based platforms, such as the popular TradingView, which enables traders to use a large amount of charting and technical analysis. Besides, the traders will be able to conduct trades through the cTrader and MT5 web platforms, thus enabling diversity in managing trades and performing market analysis directly from browsers without the need to download software.

CFI Desktop MetaTrader 4 Platform

MT4 is an excellent platform, combining ease of use for beginners with powerful functionality for experienced traders. With an intuitive interface and strong capabilities, MT4 provides advanced charting tools, easily customizable indicators, and a number of chart types for analyzing the market. Among the benefits of the CFI MT4 desktop platform are 38 indicators, 9 time frames, and access to trading via any device, making trading flexible and comfortable. It also integrates live market news and supports 38 languages for users in any region around the world.

Additional tools include one-click order entry, provided with the platform, and low latency that enables fast trading. MT4 offers access to over 15,000 instruments for trading, including Forex, CFDs, and commodities. Traders can make use of automated trading facilitated through Expert Advisors, which enables traders to execute trades without the constant need to monitor them.

CFI Desktop MetaTrader 5 Platform

CFI MT5 Platform enables traders to access an advanced platform with the most innovative features and favorable conditions for a seamless trading experience. Many of the features the platform enables are similar to the MT4 features and tools. However, the MT5 platform allows more complex strategies and a slightly enhanced offering, more suitable for professionals.

Main Insights from Testing

We found both MetaTrader 4 and MetaTrader 5 powerful platforms that are user-friendly for both beginners and professionals. MT4 is known for its simplicity, advanced charting package, and great custom indicators, boasting 38 in-built indicators, low latency, one-click order entry, and access to more than 15,000 instruments. It is also highly used for automated trading with the help of Expert Advisors and allows smooth access across multiple devices. On the other hand, MT5 further expands the MT4 functions to include 21-time frames, over 1000 plugins, and more asset classes: stocks, indices, commodities, and so on. Moreover, it has better order management, sophisticated charting technology, and improved integration of market news.

TradingView Platform

By integrating the CFI account with TradingView, traders gain access to services with the most competitive conditions. The platform enables traders access to charting, chatting, and trading in one workspace, allowing them to trade over 15,000 instruments with no deposit or withdrawal fees. Users also benefit from more than 100 indicators already built-in the platform, 50+ drawing tools, ultra-fast execution, and spreads starting from as low as 0.0 pips. Moreover, there are no commissions on trades, and the platform offers 24/7 support, connecting traders to a large trading community. What is more, linking your CFI account to TradingView is absolutely free.

cTrader Platform

CFI also provides the opportunity to trade via cTrader, an award-winning platform known for advanced charting and ultra-fast execution. It offers 6 customizable chart types and over 50 built-in indicators. Besides, the platform supports professional-level automation which allows users to program strategies, indicators, and scripts using C#. The system also includes a large library of tutorial videos for easy guidance in navigating the platform.

CFI Multi-Asset Platform

CFI Multi-Asset is an advanced platform that links global financial markets into a single sophisticated system. It gives access to forex, CFDs, options, and stock investment for both beginners and experienced traders. The platform enables access to advanced charting, risk management tools, and top-tier technology to make trading smooth. With easy-to-navigate interfaces for beginners and sophisticated tools for professional traders, the platform

is suitable for a wide range of trading needs.

CFI Trading APP

With the CFI Trading App, traders have the global markets at their fingertips and are able to monitor their investments and trade wherever and whenever they like. The app is both convenient and efficient, integrating Trading Central signals and enhancing technical analysis with real-time support and resistance levels, comprehensive technical analysis, and potential price movements. The CFI Trading App offers traders a full suite of tools and real-time updates to keep them ahead of the market and support them in making better trading decisions on the go. The app offers flexibility, at the same time not restricting traders in regard to trading opportunities.

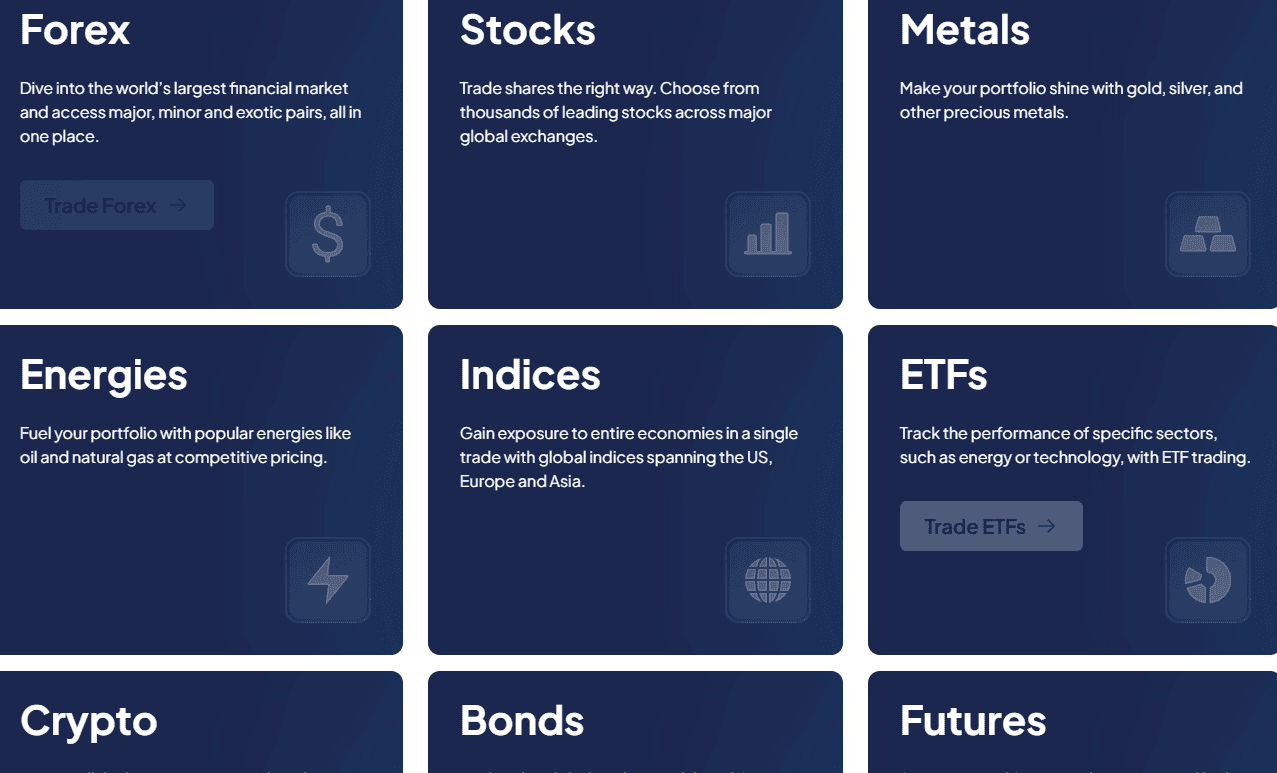

Trading Instruments

Score – 4.7/5

What Can You Trade on the CFI Platform?

CFI has a broad selection of trading instruments, including a wide range of assets with a total offering of 15.000 instruments, which is considered an extensive range. CFI includes major, minor, and exotic pairs in its currency offering, also thousands of leading stocks across global exchanges, Indices from the US, Asia, and Europe, and many other popular instruments across different assets. CFI also offers a good selection of digital currencies, such as Bitcoin, Ethereum, Ripple, etc. Below you can see the breakdown of the broker’s main instruments:

- Forex

- Stocks

- Metals

- Energies

- Indices

- ETFs

- Crypto

- Bonds

- Futures

Main Insights from Exploring CFI’s Tradable Assets

In terms of its instrument offerings, CFI truly stands out for the diversity and versatility it provides. The range of the tradable assets reaching 15.000 is one of the few opportunities with such an extensive selection. But what makes CFI really stand out is the traditional investment opportunity that the broker allows across real stock, Mena Stocks, ETFs, and options. After all, Stock investing has been one of the most powerful investment strategies for long-term investments, allowing traders to share in the success of leading companies, and becoming a shareholder.

However, we strongly recommend traders check the instrument availability across the jurisdictions, as some instruments might be limited in certain areas. Besides, the instrument availability also depends on the account type and platform choice.

Leverage Options at JustMarkets

Leverage is a useful tool that enables traders to enter the market with limited capital. However, its use can lead to substantial profits or losses as well. As such, you should have a comprehensive understanding of how leverage works and its possible consequences before engaging in any trading activities that involve leverage.

CFI leverage is offered according to the FCA, CySEC, DFSA, FSC, VFSC, FSA, JSC, and BDL regulations:

- UK traders are eligible to uselow leverage up to 1:30 for major currency pairs.

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- International traders may use higher leverage up to 1:500.

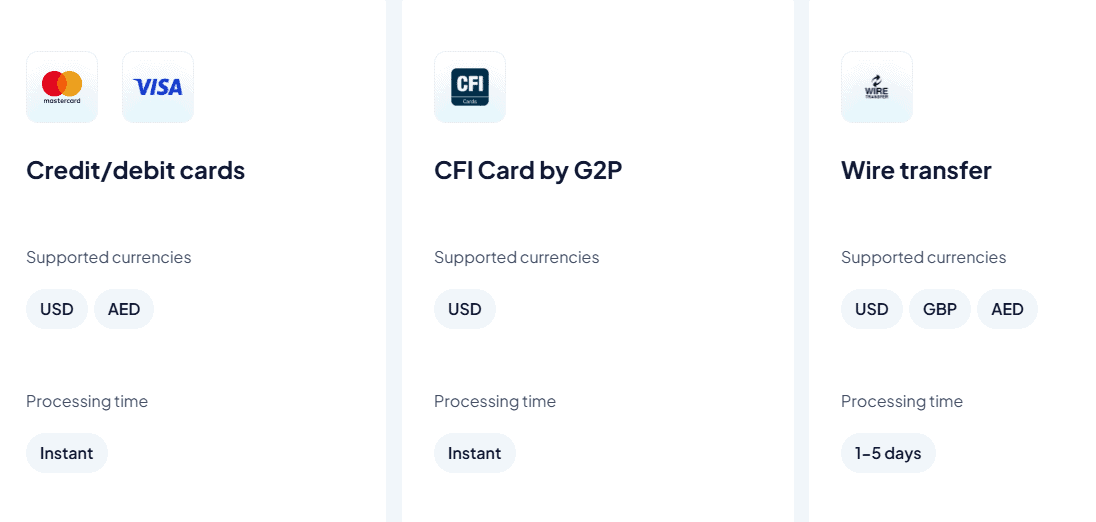

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at CFI

CFI provides its clients with the option to deposit funds into their trading accounts using Bank Wire and Credit/Debit card methods, CFI Card by G2P, and Apple Pay. However, certain payment methods may have specific requirements depending on the client’s bank or other financial institutions involved in the transaction. Generally, deposits made through credit/debit cards are processed instantly, whereas, wire transfers can take a few business days to appear in the account.

CFI Minimum Deposit

With CFI, there is no minimum deposit required to open an account. The broker recommends its clients start with an amount they feel comfortable about depositing. The no minimum deposit option enables traders to start as small as they choose and not risk an amount they are not ready to give away.

Withdrawal Options at CFI

We found that for Wire transfers and CFI Card by G2P, there are no additional charges for withdrawal, yet this also depends on the entity, so traders should check carefully. The withdrawal requests are made through the Client Portal. The withdrawal time is mostly due to the method used. Some withdrawal options provide instant processing of funds, while others, like wire transfers, might take several working days.

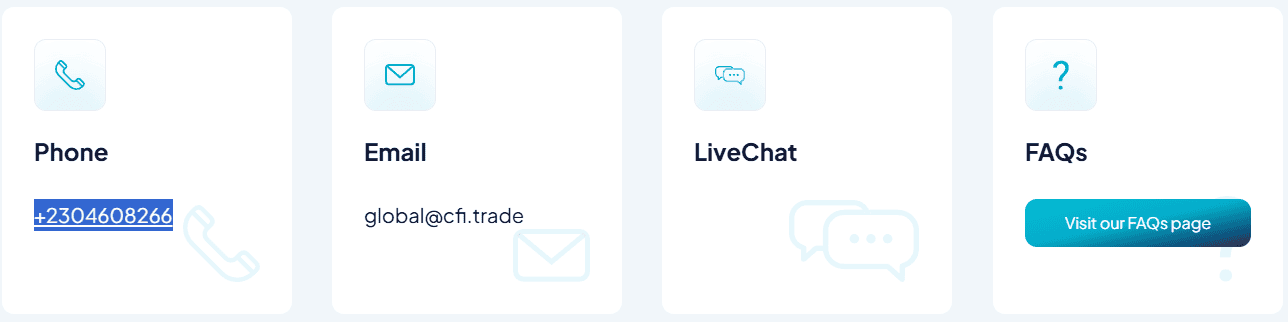

Customer Support and Responsiveness

Score – 4.5/5

Testing CFI’s Customer Support

Our experience showed that the CFI customer support is quite good, equipped with multiple options for communication, making it easier to reach the broker. CFI offers a variety of methods of support, including Live chat, email, and phone line.

The FAQ section is also helpful for finding answers to the most common questions, related to account opening, deposits and withdrawals, trading platforms, and other trading-related topics.

Contacts CFI

It is quite helpful when traders can issue their questions to the broker and find instant answers. Quick answers ensure trading efficiency, which is why CFI provides a few methods of support that are listed below:

- To reach the broker through email, traders can use the email address: global@cfi.trade

- Sometimes it is better to contact the broker through a phone line, to be able to be more specific about the inquiries. For this reason, clients are provided with a global phone number: +2304608266

- Live Chat is another great method to get instant answers. However, we noticed that the broker does not provide Live Chat support 24/7

- Traders can also Request a callback by filling in a short request form right on the broker’s website

Research and Education

Score – 4.4 /5

Research Tools CFI

Our research revealed that CFI provides a variety of tools and features integrated into its multiple platforms. However, its research section is limited to market reports that include quarterly, weekly, and daily reports on US Stocks, as well as technical and fundamental reports.

- Besides, the broker provides an Economic Calender that supports traders to stay ahead of important economic events. This tool is equally helpful both for beginner and professional traders, guiding them to make informed trading decisions.

Education

CFI provides a good educational section to guide its clients through trading. Here are the main resources traders can access and enhance their skills and market knowledge.

- The webinars CFI provides cover different trading topics and, therefore, are suitable for traders of different trading experiences and skills. On a monthly basis, the broker offers several webinars, covering a wide range of topics. Clients can register beforehand, right from the broker’s website.

- In addition to webinars, CFI provides insightful seminars to its clients which are directed at enhancing the traders’ skills and broadening their market knowledge.

- A great method for traders to educate themselves is by reading detailed articles on different subjects. The CFI article section is comprised of various articles on quite diverse subjects, answering to many questions clients might have at some point of their trading journey.

Is CFI a good broker for beginners?

By thoroughly researching different aspects of trading with CFI, we concluded that the broker is a favorable option for beginner traders. All in all, the broker’s offerings are aimed at providing stable, client-oriented services with no minimum deposit approach, a good education section, a competitive fee structure, and an extensive selection of platforms. We have also considered reviews from real traders, especially beginners, that state CFI to be a great option for beginners due to the broker’s dedicated customer support, low costs, and reliable environment.

Portfolio and Investment Opportunities

Score – 4.5/5

Investment Options CFI

We found that CFI grants some great options to its clients for traditional investment. The broker has a separate account specifically for investment purposes. Through it, traders are able to access stocks from some of the popular global companies, Mena stocks, and invest in options on US Securities. Besides, investing in ETFs is an affordable way of diversifying portfolios. Traders also gain exposure to a wide range of assets, such as bonds and options.

- Another opportunity for enriching one’s portfolio is Social trading. CFI allows its clients to invest in the strategies of successful traders from all over the world. For this, they just need to connect through their MT4/MT5 account, choose a strategy provider, and have their trades automatically replicated on their account.

Account opening

Score – 4.5/5

How to Open a CFI Demo Account?

It will take only a few minutes to open a CFI Demo account. Traders need to follow the simple steps listed below and quickly complete the registration:

- Visit the CFI website, and click “Open a free demo account”

- Complete the application form

- Receive an email and follow the instructions

- Specify the trading conditions, such as the account type, platform, etc.

- Start trading

How to open a CFI Live account?

Opening a live account does not differ much from the process of opening a Demo account, though some steps are different and need more attention:

- Go to the CFI homepage and click on “Open an account”

- Complete the online application form

- Verify your email address

- Log in to the Client Portal

- Submit the required documents

- Answer trading-related questions

- After the account is approved gain access to the account features

- Fund the account

Additional Tools and Features

Score – 4.5/5

CFI provides great trading tools and features through its good selection of platforms, meeting very different trading expectations. Additionally, CFI has also developed a few innovative and helpful features to boost client’s trading experience.

- CFI AI assistant- Kaiana, is built into the broker’s trading platform. The assistant helps traders navigate the financial market with real-time data, insights, alerts, live quotes, and recommendations.

- CFI Rewards, is a unique program for traders that money cannot buy. By registering with CFI, traders can take part in exclusive events from sports to live concerts, racing, and other unforgettable experiences. Clients should check the conditions and further steps.

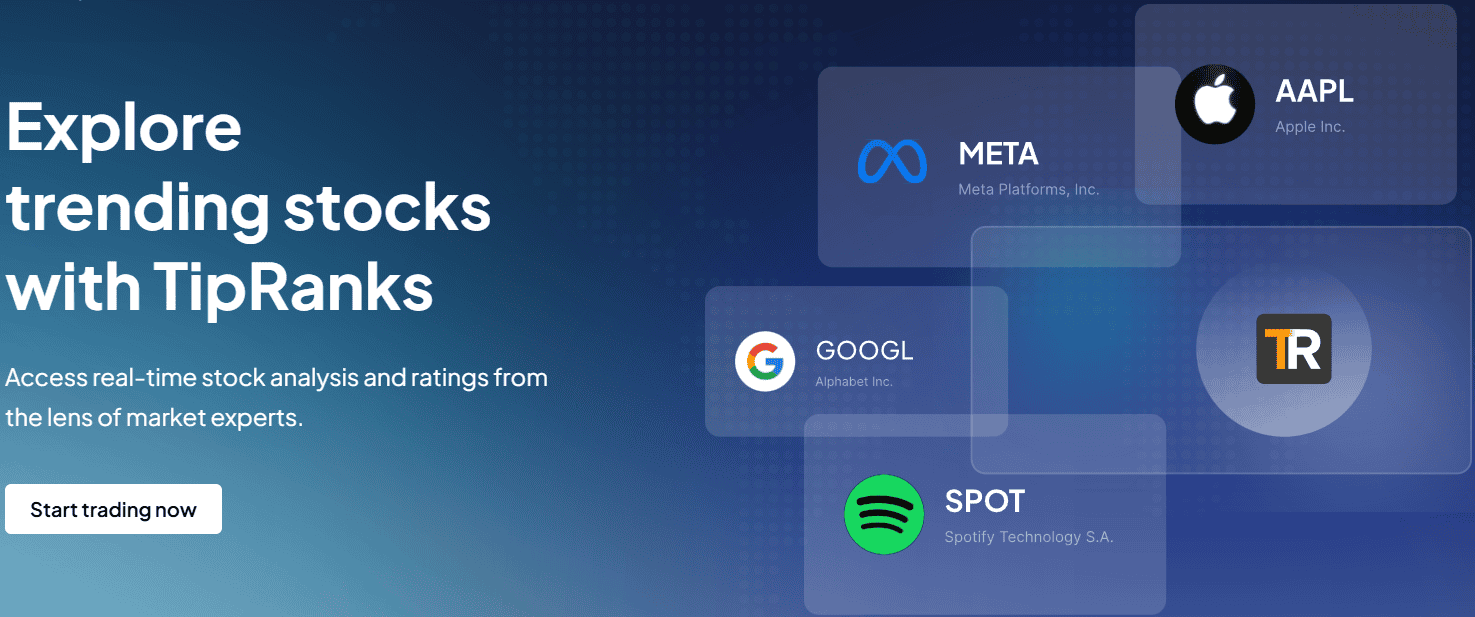

- TipRanks allows clients access to institutional-level data on thousands of companies, find trending stocks, check price targets, unlock profitable trading ideas, and uncover stock sentiment. Traders can also customize their trading insights and filter the data by country, rating, sector, etc.

- Trading Central is an award-winning AI tool that enables traders to access trading ideas and expert analysis, technical and fundamental analysis, and newsfeeds. Trading Central provides analysis on thousands of instruments including CFDs on forex, commodities, indices, stocks, and ETFs. Traders can access Trading Central through the client portal or CFI Trading App.

CFI Compared to Other Brokers

We have reviewed CFI from various aspects of its operation, also, comparing the broker to other similar options in the Market. Based on its tight regulation in a long list of jurisdictions, we found the broker on par with brokers like Pepperstone with extensive regulatory oversight. We also viewed CFI trading products offerings, finding the selection of instruments widely diverse, which is also true for RoboForex and BlackBull Markets. CFI also gives an opportunity to immerse in traditional investments, which is another great point about the broker.

The broker also stands out in terms of its trading platforms availability, and with its offering of MT4, MT5, cTrader, TradingView, and CFI Multi-Asset, it is considerably ahead of brokers like FXGT.com with only MT4/MT5 platforms availability. Also, the fees offered are mainly on the lower side, providing another advantage over brokers with higher trading costs.

| Parameter |

CFI |

FP Markets |

RoboForex |

FBS |

BlackBull Markets |

Eightcap |

FXGT.com |

| Spread Based Account |

From 0.4 pip |

From 1 pip |

Average 1.3 pip |

Average 0.7 pip |

From 0.8 Pips |

Average 1 pip |

Average 1.2 pip |

| Commission Based Account |

0.0 pips +commission based on the trading volume |

0.0 pips + $3 |

0.0 pips + $4 |

0.0 pips+$3 |

0.1 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $3 |

| Fees Ranking |

Low |

Low/ Average |

Average |

Low |

Low |

Average |

Average |

| Trading Platforms |

MT4, MT5, cTrader, TradingView, CFI Multi-Asset |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, R StocksTrader |

MT4, MT5, FBS App |

MT4, MT5, cTrader, TradingView |

MT4, MT5, TradingView |

MT4, MT5 |

| Asset Variety |

15.000+ instruments |

10,000+ instruments |

12,000+ instruments |

550+ instruments |

26000+ instruments |

800+ instruments |

1000+ instruments |

| Regulation |

FCA, CySEC, DFSA, FSC, VFSC, FSA, JSC, BDL |

ASIC, CySEC, FSCA, CMA |

FSC |

ASIC, CySEC, FSC |

FMA, FSA |

ASIC, SCB, CySEC, FCA |

FSCA, FSA, VFSC, CySEC |

| Customer Support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Excellent |

Good |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

No minimum deposit |

$100 |

$10 |

$5 |

$0 |

$100 |

$5 |

Full Review of Broker CFI

CFI is a reliable broker that offers a competitive trading environment for traders with different needs. With access to popular platforms like MT4, MT5, TradingView, and cTrader, clients can make use of advanced tools and a wide array of tradable instruments. We found that CFI provides an excellent experience for both beginner and professional traders, due to it having no minimum deposit requirement, a supportive customer team, and a good educational section. The availability of swap-free accounts, along with its powerful presence in the MENA region, shows that the broker strives to accommodate traders with different trading preferences and cultural requirements.

However, we recommend traders consider the broker’s variable regulatory structure, as there may be differences in trading conditions and security for its regulated and offshore entities. Despite this, CFI is a trustworthy and fully regulated broker from top-tier authorities with competitive fees, excellent trading platform selection, a range of innovative additional tools that elevate the trading experience, and a good education section with webinars and seminars.

Share this article [addtoany url="https://55brokers.com/cfi-review/" title="CFI"]

أريد أن أقدم بهم شكاية للفدرالية ، تم ايداع المبلغ و ارسلهم لهم و لم يتم الايداع في حساب CFI , و بعدها خسرت كل أموالي ، رغم هذا لم يعنرف بالحقيقه بل كان يماطلون و يراوغون ، مجرد لم يتم الرد و ايداع المبلغ في الحساب خسرت كل أموالي

Comparison is the thief of joy but not in this case. Since I’ve had an unpleasant experiences with fund withdrawals with my previous broker, I must highlight that it’s a smooth sailing here. Literally within minutes, the money lands in my account, never had any delay with withdrawals

I appreciate the variety of assets available here, including crypto. I’m new to trading, but it’s nice to have it all on one platform with other financial assets. Besides, the spreads are low, so CFI is a good choice.

Low commissions, tight spreads – what more could you ask for? 🙂 The customer support is quite responsive, the interface is user-friendly, and trading is very convenient. They offer MetaTrader 5, which generally suits me, but I also find the mobile app useful at times. So, there are options to choose from, and both are good

It’s good to have the opportunity to try the demo version and then decide whether to open an account or not. It was important for me to have the trial and after everything suited me, I’ve decided to jump in. I’ve been using it for about a month now, the spreads are low, so everything works good to me.

The customer support at this broker is one of the best I’ve seen among brokers in Lebanon. They reply quickly and give enough info, which is really important. Also, I’m happy with the low fees and no hidden fees and no overnight fees.

They offer 24/7 support, allowing you to reach out at any hour, whether it’s daytime or the middle of the night. While I typically contact them during regular exchange hours, there are occasions when I have inquiries related to forex, and I tend to be more active in that regard during nighttime hours. It’s reassuring to know that even at 11 pm I can still access expert guidance

I like that I can trade any of the instrument here, even exotic fx pairs and for me as a scalper it is important. It’s easier when everything is in one place, and I don’t have to jump from one broker to another. The platform itself is well-designed, and I primarily use MT5 for desktop, which is more convenient for me

You can reach out to customer support directly via chat, or more specifically, through your assigned manager in whatsapp. In my case, it’s Ahmad, and he’s always able to address all my queries. His responses are quite swift and thorough, so I usually turn to him for any questions.

Regardless of how bad the economy is, I’m making 10k EGP a week with CFI!! The market is profitable, when you are using a good broker and account manager that helps out with trades!!.

إنهم ينشرون تحليل السوق يوميا وإشارات التداول على Telegram باللغة العربية. دعم العملاء مفيد دائمًا.

CFI offers excellent spreads for oil and gold, and their zero-commission accounts are a game-changer. I prefer the MT5 version, it’s more advanced and user-friendly. In my opinion, CFI provides the best access to all markets without any hidden fees.

I’ve been CFI client for quite a while, and there haven’t been any issues with the broker during that time.. Low spreads and very reliable execution with minimum slippages, so trading is highly efficient. Plus, the support is great; there’s a manager on WhatsApp, and they always come to help when needed, although not always instantly. But overall, I’m satisfied.

what I like: lisenced broker, no minimum deposit requirements, zero fees for deposits and withdrawals, 24/7 support and they have an office in Lebanon

تعتبر CFI Financial Group شريك تداول موثوق وتأكدت من هذا من خلال تجربتي الشخصية. هم يستحقون 5 نجوم لفروق أسعارهم(speads) المنخفضة، والتداول بدون المبادلة وحسابات العمولة الصفرية

i liked the fast deposits and withdrawals here, zero commission for them, and also the ability to automate trading for free. the app is simple and user-friendly.

CFI consistently offers transparent trading conditions and low spreads. They have minimal commissions and a easy to use app. I did not find any cons for myself, transactions through them are successful.

I like their advanced trading tools, like free AI automation

سحوبات سريعة

قمت بسحب أموالي في بضع دقائق باستخدام بطاقة CFI gate2pay، سهلة جدًا.

Everything is great! This broker is flexible, offering different types of accounts so I can choose the most suitable one for my needs. But most importantly for me, they prioritize transparency in their processes.