- What is CapTrader?

- CapTrader Pros and Cons

- Regulation and Security Measures

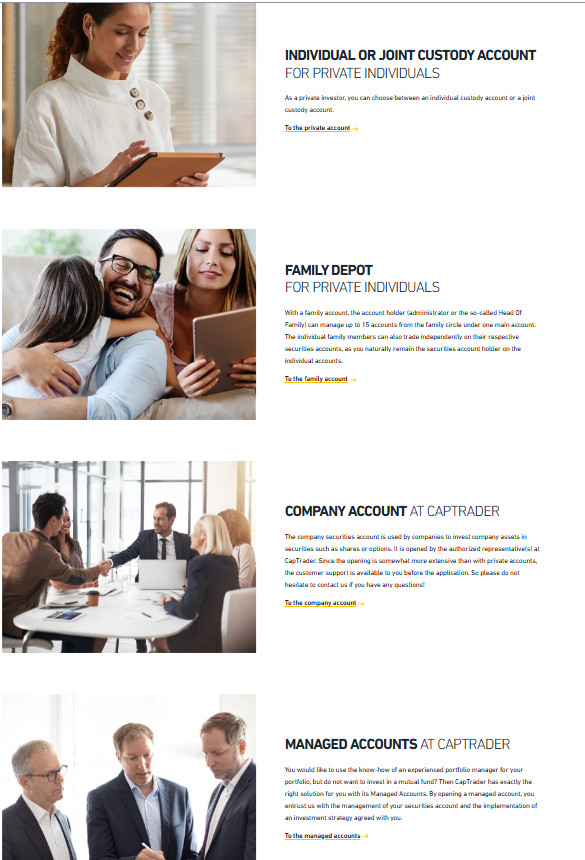

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

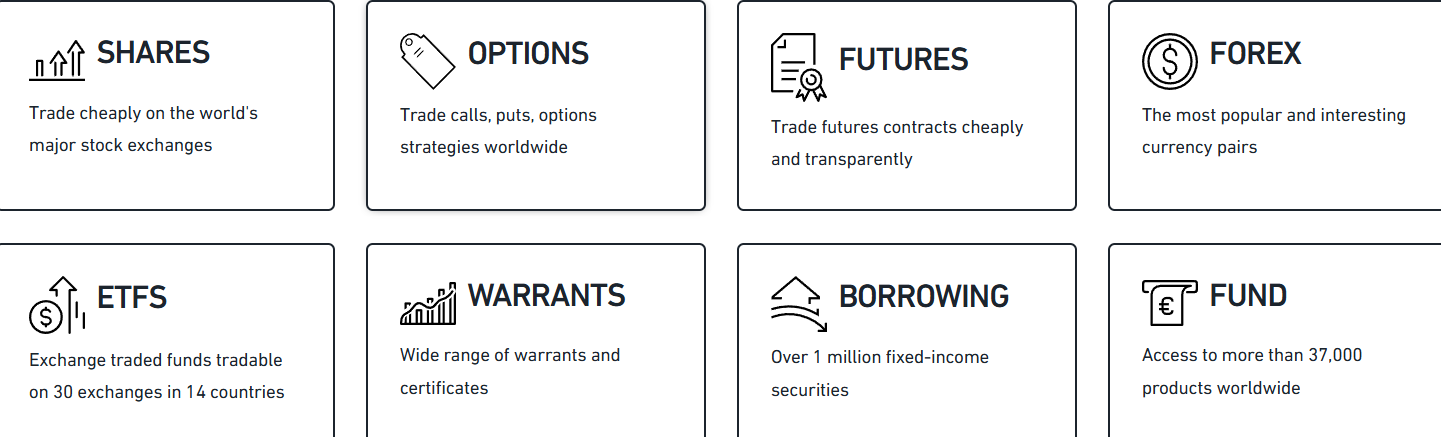

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

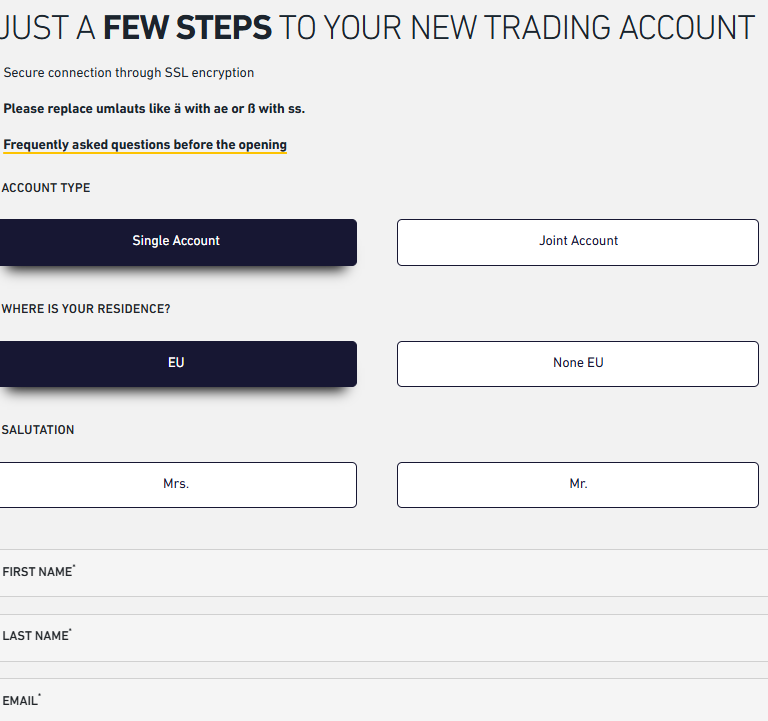

- Account Opening

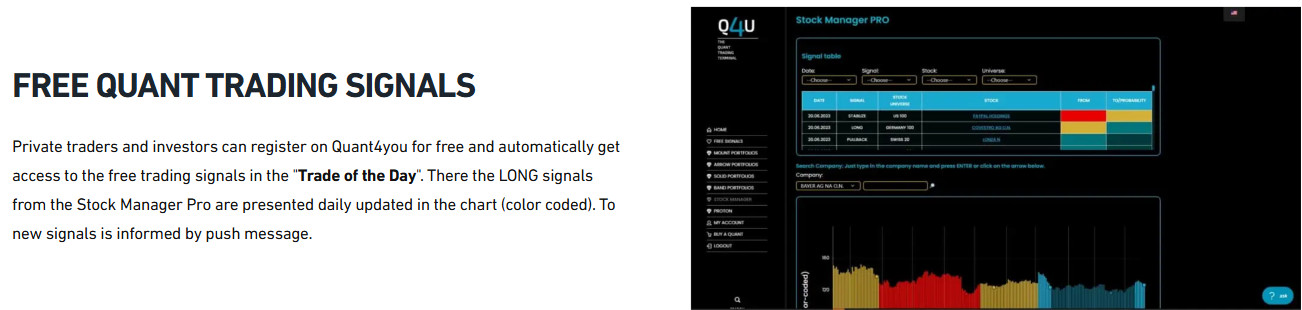

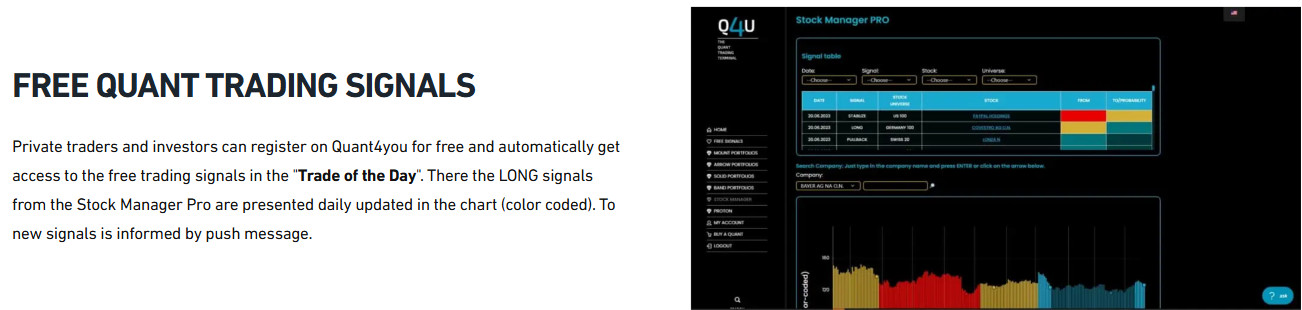

- Additional Tools And Features

- CapTrader Compared to Other Brokers

- Full Review of Broker CapTrader

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.8 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.1 / 5 |

What is CapTrader?

CapTrader is a Forex and CFD trading broker that provides its services to both individual and institutional clients. The broker offers over 1.2 million products in diverse asset categories like stocks, shares, Forex, CFDs, options, futures, ETFs, bonds, and more.

According to our findings, CapTrader operates under the regulation and authorization of the German Federal Financial Supervisory Authority (BaFin). Also, it is an introducing broker associated with Interactive Brokers, so it stands on the reliable ground IB provides as a leading brokerage firm worldwide. CapTrader offers support services to clients to establish a business relationship with Interactive Brokers and use the broker’s electronic order system while mainly focusing on trading offerings in Germany and Europe.

Overall, CapTrader aims to provide competitive and trustworthy conditions, a wide range of trading products, and advanced trading platforms suitable for beginners, experienced traders, and professionals.

CapTrader Pros and Cons

CapTrader has several advantages and disadvantages that you should consider when selecting the firm as your Forex trading broker. For the pros, the firm provides a diverse selection of products, a variety of trading accounts, competitive fees, and access to professional trading platforms.

For the cons, the minimum deposit requirement is relatively higher compared to some other brokerage firms, which could be a disadvantage for traders with limited capital. Another disadvantage is that there is no 24/7 customer support, and the website lacks comprehensive educational materials and research, which may not be ideal for traders seeking in-depth learning resources.

| Advantages | Disadvantages |

|---|

| European license and oversight | High minimum deposit |

| Professional trading platforms | No 24/7 customer support |

| Low costs | Limited education and research |

| Good trading tools | |

| Trading instruments | |

| Stands on reliable proposal of Interactive Brokers | |

| Available for European traders | |

CapTrader Features

CapTrader is a reliable broker with a respected license and cooperation with one of the leading brokers in the market, Interactive Brokers. The broker offers a large selection of account types and professional platforms to access an extensive range of tradable products across various financial assets. Below, you can see the details on the main aspects of trading with CapTrader.

CapTrader Features in 10 Points

| 🗺️ Regulation | BaFin |

| 🗺️ Account Types | Individual custody , Joint custody, Family and Company, Managed accounts |

| 🖥 Trading Platforms | Trader Workstation TWS, TradingView, AgenaTrader, Mobile App |

| 📉 Trading Instruments | Forex, CFDs, metals, stocks, shares, options, futures, ETFs, bonds, cryptocurrencies |

| 💳 Minimum deposit | $2.000 |

| 💰 Average EUR/USD Spread | 0.1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | EUR, GBP, USD |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is CapTrader For?

Based on our findings and financial expert opinions, CapTrader suits different needs and expectations. The broker mostly caters to professional traders, providing well-tailored accounts, advanced platforms, and over 1.2 million financial products. All in all, CapTrader is good for the following:

- European traders and Forex Traders from Germany

- Advanced and Professional Traders

- Traders who prefer the TradingView platform

- CFD and Currency trading

- Traders looking for a wide selection of Instruments

- STP execution

- Competitive spreads

- Low fees

- Good trading tools and Conditions

CapTrader Summary

CapTrader is a regulated Forex broker that offers competitive conditions, access to a wide range of financial instruments, and advanced trading platforms. The broker provides favorable pricing and commissions, along with tight spreads for various trading activities. The broker’s proposal is suitable for various traders since it is based on the Interactive Brokers’ trading services, known for its quality conditions.

Overall, the broker offers a competitive trading environment that caters to traders of various skill levels. However, CapTrader has limited educational resources and research materials, which may not be ideal for beginner traders. Moreover, the absence of 24/7 customer support is another drawback to consider.

55Brokers Professional Insights

CapTrader offers favorable trading conditions, including competitive spreads and fees for a wide range of products. As with our opinion, also for the conditions CapTrader offers we conclude Broker is more suitable for traders with experience, high volume trading, large capital investors and those that like proprietary software. Traders can benefit from access to advanced platforms that provide robust tools and features designed inhouse, we enjoyed navigating and trading on the software, yet if you still prefer popular platforms like MetaTrader or cTrader better check other proposals. CapTrader is an introducing broker for Interactive Brokers, a reliable and well-regarded broker in the Forex market, so the quality is in very good line.

Besides, the availability of instruments is striking, up to 1.2 million securities on over 150 exchanges. The broker offers futures, stocks, ETFs, Forex, and options with very low and competitive prices. The account selection is also wide, offering clients tailored trading conditions, which is also a very good plus. Overall, the trading proposal is quite large and might fit different preferences and conditions you may look will be at a place.

We mark the broker as a favorable solution for professional traders seeking high-level services to access the global markets, yet beginners may not find it best fit mainly due to high start capital, but still we would advise checking it out.

Consider Trading with CapTrader If:

| CapTrader is an excellent Broker for: | -Traders from Germany

-European traders

- Professional clients

- Futures and options traders

- Traditional investors

- Clients looking for a vast number of trading instruments

- Those looking for professional platforms

- TradingView enthusiasts

- Clients looking for competitive fees and conditions |

Avoid Trading with CapTrader If:

| CapTrader is not the best for: | - Beginner traders

- MT4 or MT5 platform enthusiasts

- Clients looking for high leverage options

- Traders looking for a comprehensive education section |

Regulation and Security Measures

Score – 4.5/5

CapTrader Regulatory Overview

CapTrader is a regulated brokerage firm authorized and supervised by the top-tier European BaFin. It holds the necessary license in the region it is registered, which is a European entity, and is considered safe. While regulatory oversight offers a high level of confidence, traders should still stay alert and thoroughly research the broker to ensure it aligns with their specific trading requirements. However, CapTrader can be considered safe since it operates under a European entity regulated by reputable German BaFIN, which adds a good layer of regulatory protection.

How Safe is Trading with CapTrader?

CapTrader adheres to certain industry standards and compliance requirements since it is strictly overseen by German regulators, which include client fund protection and segregation from company funds. Moreover, the broker offers additional protections, such as negative balance protection, which ensures that clients do not incur losses exceeding their account balance.

However, we recommend carefully reviewing the broker’s documentation, legal agreements, and policies to fully understand the specific trading protections offered by CapTrader before engaging in trading activities.

Consistency and Clarity

CapTrader is a reliable broker that mostly serves traders from Europe. With compliance with strict regulatory rules, traders have access to a safe trading environment. Since 1997, CapTrader has shown consistency in its services, constantly enhancing its services and meeting clients’ needs. We found that CapTrader has been honored and has received awards over time, confirming its reliability and striving for excellence.

We have also reviewed real customer feedback to see what they share about their experience. We found mixed reviews, but the positive ones are prevalent and point out the broker’s low fees, dedicated customer support, and advanced platforms excellent for professional needs. Some clients also share their personal negative experiences, mostly about account handling. Both negative and positive reviews are personal experiences that should be considered. But remember to conduct your research to see if the broker meets your trading needs.

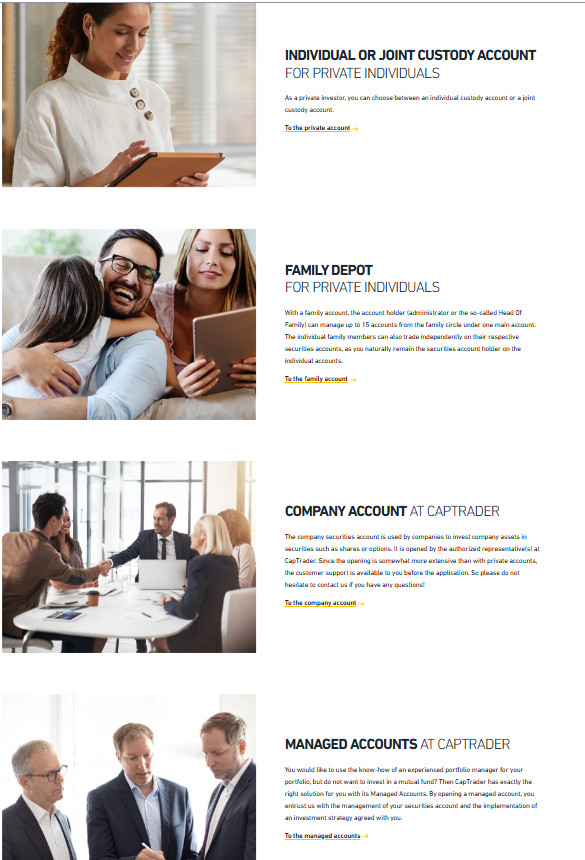

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with CapTrader?

Per our findings, traders are provided with a range of choices, including Single, Joint, Family, Company, and Cash and margin account types, when engaging in trading activities through CapTrader. Additionally, the availability extends to risk-free Demo and Paper Trading accounts as well.

- The Family account enables traders to manage up to 15 accounts within the family circle. Additionally, each family member can trade individually because they automatically become a security account holder.

- Company accounts are for companies that want to keep their company assets in securities. The Company account opening is considered a lengthy process that needs guidance. Thus, the customer support is available from the very start of the process.

- Managed accounts enable clients to have a professional account manager who takes care of the clients’ security accounts, develops and expands the portfolio.

- The Cash accounts are offered to clients from 18, while only clients above 21 can access the Margin accounts. The accessibility of the Cash and Margin accounts also depends on the residency. The trading conditions differ between the account types, the Margin account giving better trading opportunities to clients.

- Private Investors can benefit from Individual custody accounts or Joint custody accounts.The accounts enable access to over 1.4 million securities for trading on over 150 exchanges.

Regions Where CapTrader is Restricted

The broker is mainly available to European clients, offering its services to a large list of countries. However, due to regulatory reasons and international sanctions, the broker does not accept residents from the following countries:

- USA

- Canada

- North Korea

- Iran

- Syria

- Cuba

- Myanmar

Cost Structure and Fees

Score – 4.5/5

CapTrader Brokerage Fees

According to our research, CapTrader provides competitive pricing for a majority of its trading services. Traders have access to favorable, transparent fees. In addition to the common spreads and commissions that the broker charges, there are also a few extra fees that are added to the overall trading costs. We recommend that clients carefully examine the broker’s fee structure to fully understand the applicable charges and their potential impact on trading activities.

Based on our test trade, the broker provides competitive and tight spreads, with an average spread of 0.1 pips for the EUR/USD currency pair in the Forex market. However, spreads might vary depending on market conditions, volatility, and liquidity. Generally, spreads depend on the instrument traded and are combined with fixed commissions.

We found that CapTrader combines fixed commissions with very low variable spreads. The commissions depend on the instrument traded, and are as follows:

Shares, ETFs, Options, CFDs – $2 per trade

Futures – $1 per trade

Forex – $3.75 per trade

Warrants and Certificates – $6 per trade

Bonds – $8 per trade

How Competitive Are CapTrader Fees?

CapTrader offers competitive and transparent fees. The broker mentions the costs for each instrument, enabling traders to learn about the costs they are charged for each trade. Based on our research, the broker offers very low spreads from just 0.1 pips, combined with fixed commission fees. The commissions depend on the instrument chosen, and traders have access to detailed information about the offered conditions. All in all, CapTrader provides favorable conditions for traders, enabling them to access the global markets and a very large number of instruments with low fees and secure conditions.

| Asset/ Pair | CapTrader Spread | ATFX Spread | Admiral Markets Spread |

|---|

| EUR USD Spread | 0.1 pips | 1.8 pips | 0.6 pips |

| Crude Oil WTI Spread | 3 | 3 pips | 0.03 pips |

| Gold Spread | 1 | 3.8 pips | 0.25 pips |

CapTrader Additional Fees

CapTrader also charges a few additional fees that are included in the overall trading costs. We found that the broker does not apply charges for the first deposit. For the second deposit, the broker charges $1, while for all subsequent deposits during the month, the charge will be $8. The good thing is that CapTrader does not charge inactivity fees.

Score – 4.7/5

CapTrader provides clients with the professional Trader Workstation TWS, TradingView, and AgenaTrader trading platforms. These platforms are highly regarded in the industry for their robust features, user-friendly interfaces, advanced charting tools, and extensive trading capabilities.

Additionally, the broker’s Client Portal offers traders access to all resources they need to manage their CapTrader account with one single login.

| Platforms | CapTrader Platforms | ATFX Platforms | Admiral Markets |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

CapTrader Web Platform

Clients can conduct their trades through the broker’s TradingView web platform. This way, they gain access to the market without the need for downloads and installations. The web platform gives traders direct access to their accounts, enabling them to manage their trades with the advanced tools that TradingView offers. The platform includes great analysis tools, trading charts, and a range of indicators and studies. Traders can also backtest their strategies and enjoy the ease of navigating the platform.

CapTrader Desktop MetaTrader 4/5 Platforms

Based on our research, CapTrader is a better fit for professional clients, and the platforms it offers are also more advanced and complex. The broker does not offer the industry’s popular MT4 and MT5 platforms, which can complicate the trading process for beginner traders. Instead of the demanded retail platforms, clients can access the advanced TradingView, Trader Workstation, AgenaTrader, TraderFox, and other more professional platforms.

CapTrader TradingView Platform

CapTrader provides access to the industry-leader TradingView, a comprehensive and user-friendly trading solution. With the trading platform, traders can analyze markets, monitor trends, and execute trades with ease. TradingView provides a range of customizable charts, technical indicators, and tools, empowering clients to make informed decisions. Whether for beginners or experienced traders, the platform promotes a seamless trading experience by combining powerful features with intuitive navigation.

CapTrader Trader Workstation TWS Platform

The Trader Workstation TWS platform is the broker’s most powerful and demanded platform, standing out for its stability and reliable environment. The platform enables traders access to 160 global markets and to benefit from the advanced trading conditions and tools available within the platform. The platform includes more than 100 order types, algorithms, a good number of charts, and other advanced tools for a professional trading experience.

CapTrader MobileTrader App

The broker’s mobile app is an excellent alternative for those who prefer to trade on the go. It provides an intuitive and easy-to-use interface, making the trading process simple and beneficial. Clients can easily access their security account with ease from a smartphone or a tablet. Besides, traders can access technical and fundamental analysis, charts, and streaming quotes to manage their portfolio efficiently from anywhere in the world.

Main Insights from Testing

Our testing of the broker’s platforms has revealed a really extensive range of mostly professional-grade platforms, equipped with great analysis tools and features. Brokers can enjoy a perfect exposure to the market, access to over 160 markets, and the ability to expand their portfolios. Although the broker does not offer the popular MT4, MT5, or cTrader platforms, CapTrader still provides its traders with the best platforms, suitable for active and efficient trading.

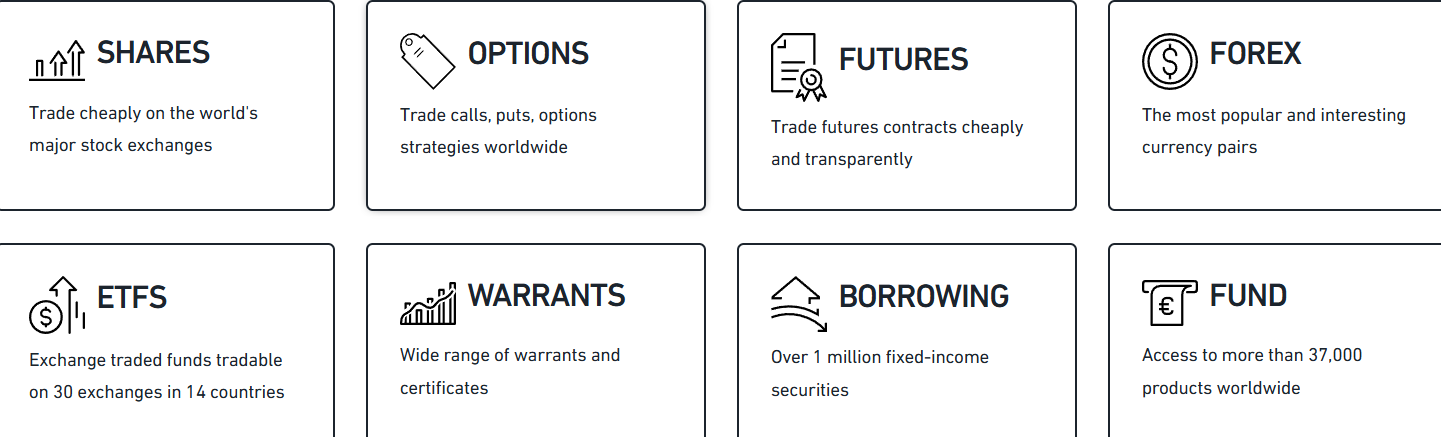

Trading Instruments

Score – 4.8/5

What Can You Trade on the CapTrader Platform?

CapTrader provides access to over 1.2 million trading instruments in diverse asset classes like stocks, shares, Forex, CFDs, metals, options, futures, ETFs, bonds, and more. This extensive selection allows traders to diversify their portfolios and engage in various markets according to their individual preferences and trading strategies.

CapTrader is an excellent broker for traders who are looking to diversify their portfolios and gain more exposure to the market. It offers numerous investment opportunities and access to an impressive suite of futures, all in perfect trading conditions, with low fees and advanced platforms to accommodate the trading process.

Main Insights from Exploring CapTrader Tradable Assets

CapTrader offers its clients access to over 150 markets in 36 countries. Traders can access a total of 100 currency pairs, including 27 currencies worldwide, over 80 stock exchanges, more than 20,000 ETFs, direct access to more than 35 futures exchanges, and over 1 million bonds worldwide.

This kind of extensive offering enables clients endless opportunities and excellent exposure to the global instruments across a wide range of assets. Long-term and traditional traders can easily engage in real investments, accessing the most popular global stocks, ETFs, bonds, and more.

Leverage Options at CapTrader

Traders can benefit from using leverage as it enables them to enter the market with a smaller initial investment. However, they should possess a comprehensive understanding of the associated risks before participating in leveraged trading.

CapTrader leverage is offered according to the BaFin regulation:

- European clients can use a maximum of up to 1:30 for major currency pairs.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at CapTrader

We found that currently, the broker offers its clients only the option of using bank transfers / SEPA as a method to deposit funds into their trading accounts for the Eurozone. Traders initiate the deposit within the Client portal. Traders are required to create a deposit note by inserting all the necessary details about the transfer.

Minimum Deposit

To open a live trading account with the broker, traders need to deposit $2,000 as an initial deposit amount, which is relatively high compared to other brokerage firms.

Withdrawal Options at CapTrader

As we found, withdrawals are primarily processed through bank transfers/SEPA. The first withdrawal every month is free. All the subsequent withdrawals within the same month apply $1 for SEPA and $8 for bank transfers. The processing time usually takes 1-2 days, yet it depends on the intermediate bank and can sometimes take longer.

Customer Support and Responsiveness

Score – 4.6/5

Testing CapTrader Customer Support

The broker offers 24/5 customer support through various channels, including phone, email, live chat, and social media channels. Moreover, the support team at CapTrader is proficient in addressing various needs, including technical inquiries, providing analysis recommendations, answering general questions, and assisting with operational matters, which overall provides a good quality level of support.

- The broker also has a Help Center where traders can find all the answers to the essential trading-related questions.

Contacts CapTrader

CapTrader offers dedicated support services to assist and guide its clients whenever they need help. To make the support more accessible, the broker has several contact options.

- The broker has a free hotline (0800-8723370) for emergency calls and urgent inquiries. The service is available on working days from 8.30 to 20.00.

- The callback service is another great option to contact the broker’s support team. Traders simply need to choose the inquiry category and mention the most suitable time for the callback, and the CapTrader’s team will contact them.

- Traders can also send their questions right from the broker’s Contact section by submitting the question and details like name, email, etc., in the Inquiry form.

- CapTrader’s live chat is an efficient way to get quick and detailed answers to urgent questions.

- Traders can also use the provided email address info@captrader.com to reach the broker from Monday to Friday.

- At last, traders can find updated information on the broker’s services and the market news on CapTrader’s social pages, including Facebook, X, Instagram, YouTube, and LinkedIn.

Research and Education

Score – 4.4/5

Research Tools CapTrader

CapTrader is a great broker offering a professional trading platform equipped with innovative tools and features to meet traders’ expectations. Besides, the broker has a good analysis section and provides a detailed analysis of the market.

- The Market Analysis section includes the latest in-depth market analysis. Clients can also access professional market analysis and predictions by leading professionals and analysts on different instruments and financial markets.

Education

CapTrader offers a good education section. Although the broker’s proposal is a better fit for professional traders, clients can still have access to a few helpful resources:

- A trading glossary is an essential offering for clients to understand the market better. Sometimes complex forex terms can mislead clients, and access to their explanations can make the trading process much easier.

- The media library includes recorded webinars, interviews with financial experts, and other forms of media to assist traders and equip them with market knowledge.

- The blog includes a large number of articles, mostly about the stock market.

- The Literature section includes quality recommendations by experts to polish financial knowledge and learn more.

Is CapTrader a Good Broker for Beginners?

CapaTrader is a favorable broker for different clients, but based on our findings, the broker’s offerings are mostly directed at professional traders. The minimum deposit requirement is also high, starting from $2000, which is much higher than the market average and is not a suitable offering for beginners or cost-conscious traders. Besides, the broker offers professional platforms that might be difficult for beginners to navigate.

Portfolio and Investment Opportunities

Score – 4.6 /5

Investment Options CapTrader

CapTrader is an excellent choice as a broker to build a portfolio. The broker has one of the most extensive offerings, enabling access to more than 1.2 million financial instruments. Traders can access various financial markets, including bonds, options, ETFs, futures, investment funds, and more. Any trader can take advantage of the offering, extending their portfolios and engaging in long-term investments.

Account Opening

Score – 4.6/5

How to Open a CapTrader Demo Account?

Opening a demo account with CapTrader is an easy process. The demo account enables traders to practice their skills and try new strategies before trading with real funds. Here are the steps to open a demo account:

- Visit the broker’s website.

- Choose the demo account option.

- Fill out the form with the required personal data following the broker’s instructions.

- Submit the form and receive the account credentials via email.

- Download CapTrader’s Trader Workstation platform.

- Use the account credentials and enter the demo account.

- Start practicing.

How to Open a CapTrader Live Account?

Opening an account with a broker is easy, as traders can log in and register with CapTrader within minutes. Clients need to follow the opening account or sign-in page and proceed with the guided steps.

- Select and click on the “Open an Account” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once the account is activated and proven, follow with the money deposit.

Score – 4.1/5

CapTrader is a broker with well-tailored trading tools and features. The broker includes in-depth analysis tools in its highly professional platforms. In addition, clients can find some extra tools and offerings that will take their trading experience to a higher level.

- CapTrader clients can use the API and FIX CTCI solutions. Clients can build their own trading applications to meet their specific trading expectations and strategies.

- Quant4you is an AI-powered platform that enables CapTrader clients access to the global stock market. Traders can also access meticulous stock assessments and analysis, trade liquid stocks, use advanced strategies, and get clear trading signals.

CapTrader Compared to Other Brokers

As a final step, we have compared CapTrader to other good-standing brokers in the market to see how the broker’s offerings align with the market average. We first compared CapTrader’s regulation to such well-regarded firms as Admirals and Pepperstone. CapTrader holds a license from the respected BaFin. Pepperstone also holds a license from BaFin, but it is also regulated by the top-tier FCA, ASIC, and CySEC, adding more layers of reliability to the broker. Admirals also has top-tier licenses, offering a well-regulated and safe trading environment to its clients.

As to the trading platforms, CapTrader offers highly professional trading platforms and tools, including Trader Workstation (TWS), TradingView, AgenaTrader, and a mobile app. Meanwhile, Exness and Eightcap offer the market-popular MT4 and MT5 platforms, and Eightcap also offers TradingView.

When reviewing CapTrader’s trading instruments, we were impressed by the number of 1.2 million tradable products across a range of financial markets. None of the brokers we reviewed includes such attractive instrument availability. For instance, FP Markets stands out for its extensive offering of 10,000+ tradable products; still, it is a modest offering when compared to CapTrader’s.

CapTrader also offers an excellent education section with a trading glossary, a blog, trading lessons, and recorded webinars. Exness, however, offers limited resources of research and educational materials, which can be rather limiting for traders, especially for beginners.

| Parameter |

CapTrader |

Pepperstone |

Admirals |

Exness |

FP Markets |

HFM |

Eightcap |

| Spread-Based Account |

From 0.1 pips |

From 1 pip |

From 0.6 pips (0.02 commissions for Share and ETF CFDs) |

From 0.2 pips |

From 1 pip |

Average 1 pip |

Average 1 pip |

| Commission-Based Account |

0.1 pips + from $1 to $8 based on the instrument |

0.0 pips + $3.5 |

0.0 pips + from $0.02 to $3.0 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + $3 |

0.0 pips + $3.5 |

| Fees Ranking |

Low/Average |

Low/Average |

Low/Average |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

Trader Workstation TWS, TradingView, AgenaTrader, Mobile App |

MT4, MT5, cTrader, TradingView |

MT4, MT5, Admiral Markets app |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, HFM App |

MT4, MT5, TradingView |

| Asset Variety |

12 million instruments |

Over 1,200 instruments |

8000+ instruments |

200+ instruments |

10,000+ instruments |

500+ instruments |

800+ instruments |

| Regulation |

BaFin |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

ASIC, SCB, CySEC, FCA |

| Customer Support |

24/5 support |

24/7 |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Excellent |

Excellent education and research |

Excellent |

Fair |

Excellent |

Good |

Good |

| Minimum Deposit |

$2000 |

$0 |

$1 |

$10 |

$100 |

$0 |

$100 |

Full Review of Broker CapTrader

In summary, CapTrader is a regulated broker that follows the strict guidelines and rules of the well-respected BaFin. CapTrader serves advanced clients, offering professional-grade account types, such as Individual custody, Joint custody, Family and Company, and Managed accounts. The trading conditions are highly competitive, as traders have access to low spreads from 0.1 pips and fixed commissions that range from $1 to $8 per trade based on the instrument traded. The broker offers access to a huge number of trading products. Clients can access over 1.2 million instruments across Forex, CFDs, metals, stocks, shares, options, futures, ETFs, bonds, and cryptocurrencies. Traders can trade about 100 currency pairs, access global stocks, and engage in traditional investments.

Although CapTrader’s proposal is better suited for professional clients, it still offers an excellent education and research section. Traders also find dedicated and responsive support 24/5 through live chat, hotline, callback service, email, and a trading inquiry form. However, CapTrader offers a high minimum deposit of $2,000, which is not a small amount for the first deposit and is considered higher than the market average.

All in all, CapTrader is a reliable and consistent offering, with a steady trading environment, professional approaches and solutions, and strict protection of its clients’ funds.

Share this article [addtoany url="https://55brokers.com/captrader-review/" title="CapTrader"]