- What is BP Prime?

- BP Prime Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- BP Prime Compared to Other Brokers

- Full Review of Broker BP Prime

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.2 / 5 |

| Deposit and Withdrawal Options | 4.2 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 3.9 / 5 |

What is BP Prime?

BP Prime is a brokerage firm based in the United Kingdom that offers CFD trading services on Forex, Commodities, and Indices. As we found, the company was established in 2013 by Forex professionals and traders, and it operates under the name Black Pearl Securities Limited in London, UK.

The company has established strong relationships with technology firms and liquidity providers to offer services to clients across Europe, Asia, and South America. Additionally, our research found BP Prime has obtained an additional license in Seychelles under the regulatory oversight of the FSA, operating under the name Gulf Brokers Ltd.

BP Prime Pros and Cons

Based on our findings, BP Prime brings a competitive offering of a combination of technology, tight pricing with market depth, and dedicated customer service. Moreover, the broker supports the NDD execution model, providing low spreads and commissions.

For the Cons, there is no 24/7 customer support, and the trading conditions might vary based on the entity. Also, the educational materials and research are limited, which may make it challenging for beginners to get started.

| Advantages | Disadvantages |

|---|

| Regulated and licensed broker | No 24/7 customer support |

| Competitive trading costs and spreads | Conditions might vary based on the entity |

| NDD execution | |

| FCA license and overseeing | |

| MT5 platform | |

BP Prime Features

Our research has revealed that BP Prime is a reliable brokerage firm that offers competitive trading conditions, combined with innovative features and tools. The broker provides a diverse range of CFD trading opportunities with low spreads and fees, which may be appealing to potential clients. Below, clients can have a quick view of the broker’s services in 10 points:

BP Prime Features in 10 Points

| 🗺️ Regulation | FCA, FSA |

| 🗺️ Account Types | Standard and Professional accounts |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | CFDs on Forex, Commodities, Indices, and Cryptos |

| 💳 Minimum deposit | $5,000 |

| 💰 Average EUR/USD Spread | 0.3 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | GBP, EUR, USD |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/6 |

Who is BP Prime For?

BP Prime’s proposal is tailored for various clients who are looking for top-tier regulations and competitive trading conditions. The broker can be a suitable choice for many; however, it is best suited for the following:

- Traders from the UK

- International traders

- MT4 trading platform users

- Advanced traders

- Investors

- CFD and currency trading

- NDD/STP execution

- Competitive spreads and costs

- Supportive customer support

- EA/Auto trading

BP Prime Summary

BP Prime is regulated by the world-renowned FCA and provides trading services through a secure environment. The broker operates under the agency model, which means there are no held positions or conflicts of interest, while customers execute their orders with the STP or NDD model.

However, BP Prime offers quite a high initial deposit requirement; hence, the broker is not the best option for beginner traders, yet it is a favorable option for professional traders. We also noticed that the broker does not provide webinars, seminars, and other educational materials that could be helpful for all levels of traders.

55Brokers Professional Insights

BP Prime is great choice for traders of larger size, and those who prefer trading of main major Forex currency pairs with tight regulated Broker and safe environment that is fine for long term trading, either holding of large trading portfolios. BP Prime has a great reputation with addition to FCA license, and combining safety with good market conditions. The two account types offering even better tailoring with Standard and Professional, for different preferences. Yet, since Broker specializes in traders with experience and larger size, for beginners also smaller size traders the minimum deposit requirement also almost an absence of the education section is downsizing. However, the availability of a demo account is an advantage for everyone. Also, the instruments are mainly the popular pairs, if you look for diversity better check other Brokers then.

The trading software is good, since conducted on the broker’s MT4 and MT5 platforms, so all tools along with EAs, robots, and good trading signals are available. All in all, the broker is more suitable and great for professional clients seeking fast execution, extensive trading tools, and tailored services with small trading fees for which we would definitely reccomend BP Prime.

Consider Trading with BP Prime If:

| BP Prime is an excellent Broker for: | - Institutional and professional clients

- Clients looking for tight spreads

- Traders prioritizing top-tier regulation

- CFD and currency trading

- MT4 and MT5 platforms enthusiasts

- International traders |

Avoid Trading with BP Prime If:

| BP Prime is not the best for: | - Beginner traders

- Clients looking for lower deposit requirement

- Copy traders

- Novice traders looking for extensive education

- Investors |

Regulation and Security Measures

Score – 4.4/5

BP Prime Regulatory Overview

BP Prime is a licensed brokerage company regulated by the world’s respected Financial Conduct Authority (FCA, UK). Additionally, the company has obtained the FSA license in Seychelles, ensuring the global reach of the broker.

Being overseen by the FCA, BP Prime is a legit and reliable broker that follows strict requirements, such as capital adequacy compliance, approved risk management procedures, accounting, and audits, along with honest and fair management of clients.

How Safe is Trading with BP Prime?

Financial security is a paramount priority for any regulated company. The risks taken on the market are measured by the authority, and funds are protected by segregated and separate accounts within top-tier banks.

This means the company can never use the client’s money for its own purposes; besides, the money is always protected and covered by the UK’s Financial Services Compensation Scheme (FSCS).

Consistency and Clarity

Based on our findings, BP Prime is seen as a consistent and transparent broker, combining credibility with efficiency.

The broker was established in 2013, and since 2015, it has operated under the FCA oversight. The broker has also been rewarded with multiple awards in various categories, further confirming its reliability.

The customer feedback is predominantly positive, pointing out the broker’s advanced platforms, equipped with research tools and solid execution. On the downside, customers mention the lack of live chat support, the unavailability of educational resources, and the high minimum deposit requirement.

We advise potential clients to review the offering and determine whether it meets their trading style and expectations. Also, the broker operates under two separate entities, causing differences in trading conditions.

Account Types and Benefits

Score – 4.3/5

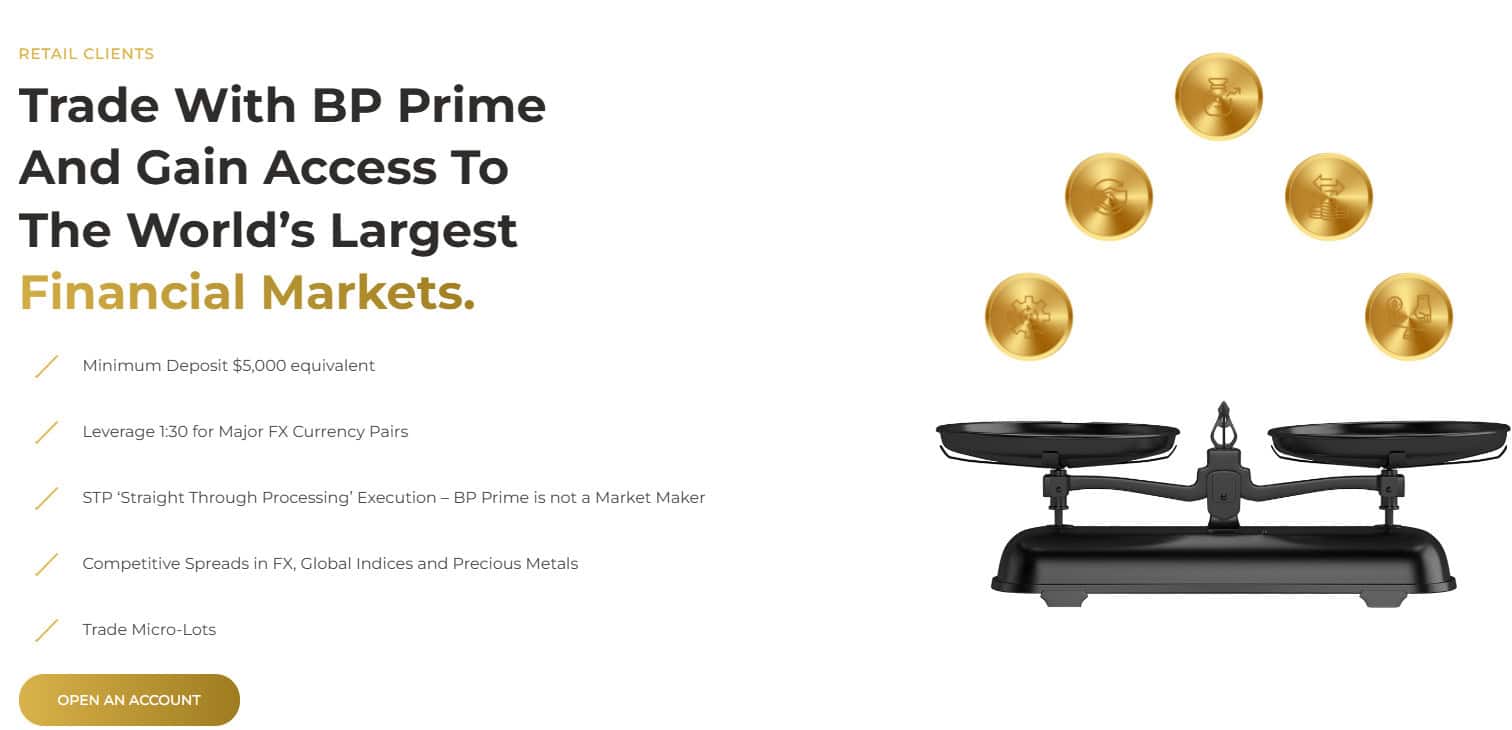

Which Account Types Are Available with BP Prime?

As we found, BP Prime offers two account types—Standard and Professional accounts. Each account is tailored for specific purposes and enables its clients to trade in a convenient, well-regulated, and competitive trading environment. Both account types have a very high initial deposit requirement; thus, the proposal is better suited for advanced and professional clients.

- The Standard accounts have no commissions and allow clients to trade all instruments offered by the broker. The fees are integrated into spreads. The account type allows leverage up to 1:30, based on the instrument. The minimum deposit is $5,000.

- The Professional account is tailored for those with substantial experience in the market. Before opening a Professional account, the broker verifies the client’s credibility. Professional clients have access to higher leverage, up to 1:400.

Regions Where BP Prime is Restricted

BP Prime is a global broker that offers services to international clients worldwide. However, following strong regulatory compliance, it does not offer services to the following countries:

- The United States

- Canada

- France

- Afghanistan

- Belgium

- Guinea Bissau

- Iran

- Israel

- Libya

- North Korea

- Russia

- Somalia

- South Sudan

- Syria

- Turkey

- Yemen

Cost Structure and Fees

Score – 4.4/5

BP Prime Brokerage Fees

Our research has revealed that BP Prime charges fees based on the type of account chosen. The Standard Account does not have any commission fees, while commission fees for the Professional Account are based on trading volumes. All in all, BP Prime offers competitive fees with variable spreads in line with the market average.

BP Prime spreads differ based on the type of account chosen, with a typical spread of 0.3 pips for the EUR/USD pair. Professional accounts may access tighter spreads, combined with commission charges per trade. In general, BP Prime offers some of the industry’s most competitive spreads.

BP Prime applies only spreads for its Standard account. For the Professional account, tight spreads are combined with commissions. However, there are no fixed commissions per trade, as commissions are calculated based on the trade volume.

It is important to note that if traders hold their positions open overnight, they will be charged overnight fees. The overnight fees depend on the instrument, and are changeable depending on market changes. BP Prime applies long and short swaps for each instrument.

How Competitive Are BP Prime’s Fees?

Based on our research, BP Prime applies competitive fees for its tradable products, offering tight spreads and different fee structures based on the account chosen. The average spread for the EUR/USD pair is 0.3 pips.

As we found, for its commission-based account, BP Prime applies spreads as low as 0.1 pips, combined with commissions. However, commissions are not fixed and depend on the trading volume.

Although BP Prime offers competitive conditions and low charges, it does not publicly mention all the applicable charges on its website, and traders need to reach out to the customer support team for more details and information. Besides, the fees and costs may differ based on the entity, which also requires careful consideration.

| Asset/ Pair | BP Prime Spread | JustMarkets Spread | Capital.com Spread |

|---|

| EUR USD Spread | 0.3 pips | 0.6 pips | 0.6 pips |

| Crude Oil WTI Spread | 0.01 | 4 cents | 0.4 |

| Gold Spread | 0.01 | 0.16 | 0.03 |

BP Prime Additional Fees

Based on our research, BP Prime does not impose an inactivity fee, which is considered an advantage. The broker also does not impose deposit charges for its UK clients, although there might be deposit and withdrawal fees based on the method used and the region where the client is based.

Score – 4.4/5

We found that BP Prime offers MetaTrader 4 and MT5 trading platforms, widely used and known for their user-friendly interfaces and advanced features. BP Prime clients can also access a variety of liquidity pools, including bank and non-bank providers. In addition, traders can benefit from the ECN-style execution via third-party trading platforms or through a GUI and FIX API.

Trading Platform Comparison to Other Brokers:

| Patforms | BP Prime Platforms | JustMarkets Platforms | Capital.com Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | No |

| cTrader | No | No | No |

| Own Platform | No | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

BP Prime Web Platform

BP Prime enables its clients to open positions and trade from any device, right from the browser, with internet connectivity. The web platforms of MT4 and MT5 offer the same extensive selection of tools and features available for the desktop platform. With full functionality, traders can access extensive charts, 50+ in-built indicators, full history, one-click trading, and a selection of timeframes and order types.

The web platform does not require downloads or installations, enabling traders to access their accounts directly, ensuring flexibility and efficiency of trades.

BP Prime Desktop MetaTrader 4 Platform

Based on our findings, the broker’s MT4 desktop platform provides a range of dynamic tools to support its clients in an efficient and profitable trading experience. Traders have access to the full range of financial instruments, including Forex pairs, commodities, and indices.

Traders also gain access to popular automated strategies, EAs, and vast order types, placed directly from the Market Watch. The platform allows perfect functionality, ease of trades, fast execution, and use of extensive research tools. Traders can also use risk management tools, such as stop orders and trailing stop functionalities. Besides, clients have access to the FIX API.

BP Prime Desktop MetaTrader 5 Platform

The MT5 platform is a more advanced version of the MT4 platform, which allows access to trading Forex pairs and commodities on CFDs. Trades can be conducted through the web, desktop, and mobile versions of the platform, enabling maximum flexibility and functionality. The platform provides the necessary analysis tools for an effective trading experience, offering access to technical indicators, charting capabilities, and EA trading to automate trades. Clients can also use different order types, such as stop, limit, and trailing orders, allowing them to manage risks.

Main Insights from Testing

Based on our testing of the broker’s platforms, we assess the proposal as effective and functional. Trades can be conducted through the MT4 or MT5 web, desktop, and mobile versions. The available diverse tools and features allow for in-depth research to make informed decisions. The choice of the platform depends on the trader. The MT4 platform has an easy-to-use interface combined with fast execution for Forex, commodities, and indices trading. The MT5 platform offers more functionality and an extensive selection of technical indicators, time frames, and other features.

BP Prime MobileTrader App

Regardless of the platform traders choose, MT4 or MT5, the mobile version is available for those who prioritize functionality and trading on the go. All the features and capabilities of the desktop platform are available through the mobile app as well, ensuring that clients can conduct trades with the same productivity. The mobile app is available for both iOS and Android devices, making trading on the go available for everyone.

Trading Instruments

Score – 4.2/5

What Can You Trade on the BP Prime Platform?

Our research indicates that BP Prime offers online trading services for CFDs on Forex, Commodities, and Indices, as well as shares under the international entity. These instruments are connected with market-leading aggregation, and BP Prime also provides access to over 10 index CFDs via FIX API for professional and institutional clients.

- Based on our findings, the platform offers access to over 40 currency pairs, major, minor, and exotic. Besides, clients can trade commodities and indices through the MT4 platform. The MT5 platform ensures a great trading experience for Forex and commodities trading.

Main Insights from Exploring BP Prime Tradable Assets

We have reviewed BP Prime’s instrument availability to find how the broker accommodates traders in diversifying their trades. Based on our research, the broker offers 50 to 60 tradable products, which is considered a limited proposal.

The currency pairs availability is rather good, with over 40 pairs. The broker also offers commodity trading, including gold, silver, Brent, and WTI. In addition, traders can access over 14 global indices. Traders looking for the most popular products with low spreads and good liquidity will benefit from the offering. However, clients who are interested in expanding their portfolios will not find the limited number of tradable products attractive.

- Another important note is that the global entity under Seychelles offers shares on CFDs of global companies. However, before opening an account with one of the broker’s entities, we advise traders to compare the offerings, as there are differences based on the jurisdiction.

Leverage Options at BP Prime

While trading with BP Prime, traders can use leverage, which is a loan from the broker. Leverage indeed brings vast capabilities and higher gains; however, it should be used smartly due to the potential to increase risks.

BP Prime leverage is offered in compliance with the FCA and FSA regulations.

- UK traders can use low leverage up to 1:30 for major currency pairs. Professionals can use up to 1:200.

- International traders are eligible to use a maximum of up to 1:500.

Deposit and Withdrawal Options

Score – 4.2/5

Deposit Options at BP Prime

As for the payment methods, at present, BP Prime does not publicly mention the methods it supports. However, based on our previous research and customer feedback, BP Prime offers the most popular methods, such as Bank Transfers and Credit or Debit Cards, as well as the option to use Neteller or VPay.

Minimum Deposit

The minimum deposit amounts depend on the trading accounts; the Standard Account requires $5,000 as an initial deposit, while the Professional Account requires higher funding, starting at $10,000.

Withdrawal Options at BP Prime

BP Prime offers fast and convenient deposit and withdrawal methods from various payment providers. The processing time for withdrawals may vary depending on the method chosen, but generally, withdrawals are processed within 24 hours.

Customer Support and Responsiveness

Score – 4.6/5

Testing BP Prime Customer Support

Based on our research, BP Prime provides 24/6 customer support through Phone Lines and Email. The broker has a support team of professionals who can assist traders on a range of matters, including analysis advice, technical support, operational issues, and general inquiries. As we have found, the broker used to provide support via Live chat; however, at the moment, the support option seems to be unavailable.

- The FAQ section provided by the broker answers only a short list of questions, such as account opening-related questions, available only for global entity clients.

Contacts BP Prime

The broker assists its clients via email and phone line, providing contacts to get in touch with the support team. As of now, traders can use the following contact options:

- Traders can use the provided phone number for direct communication with the broker: +44 (0) 20 3745 7101.

- Clients can also contact the broker by using the available email address: support@bpprime.com.

- Also, BP Prime customers can fill out the online inquiry form and direct their questions to the support team.

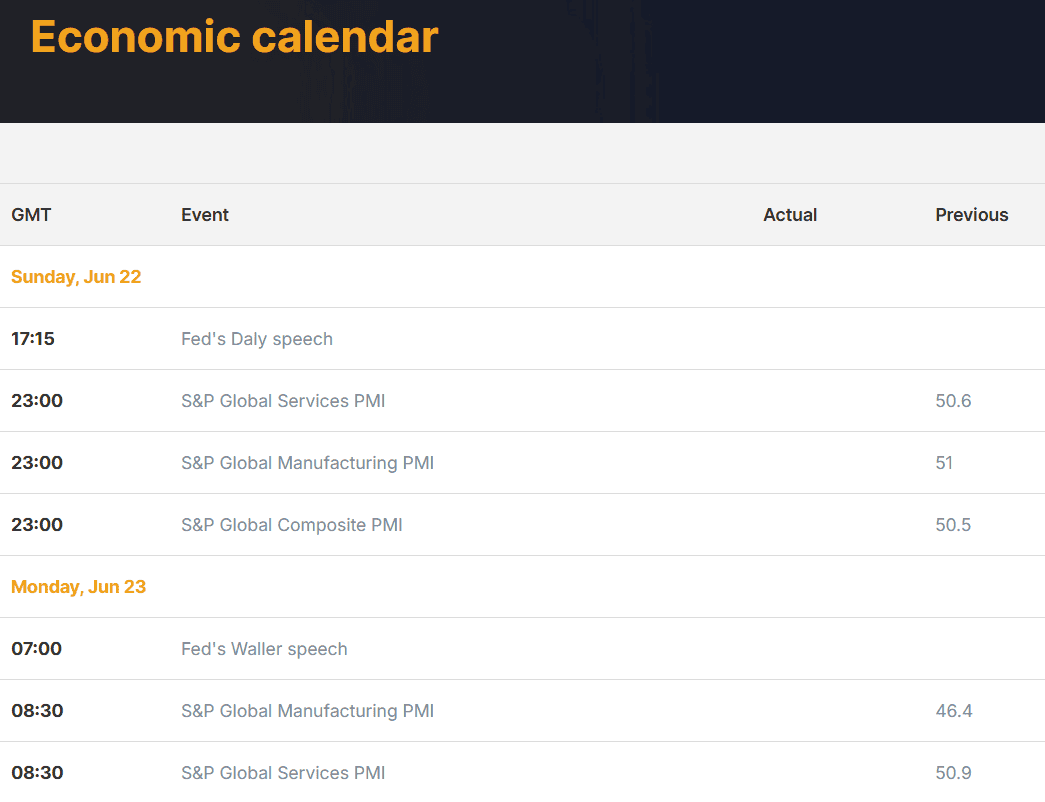

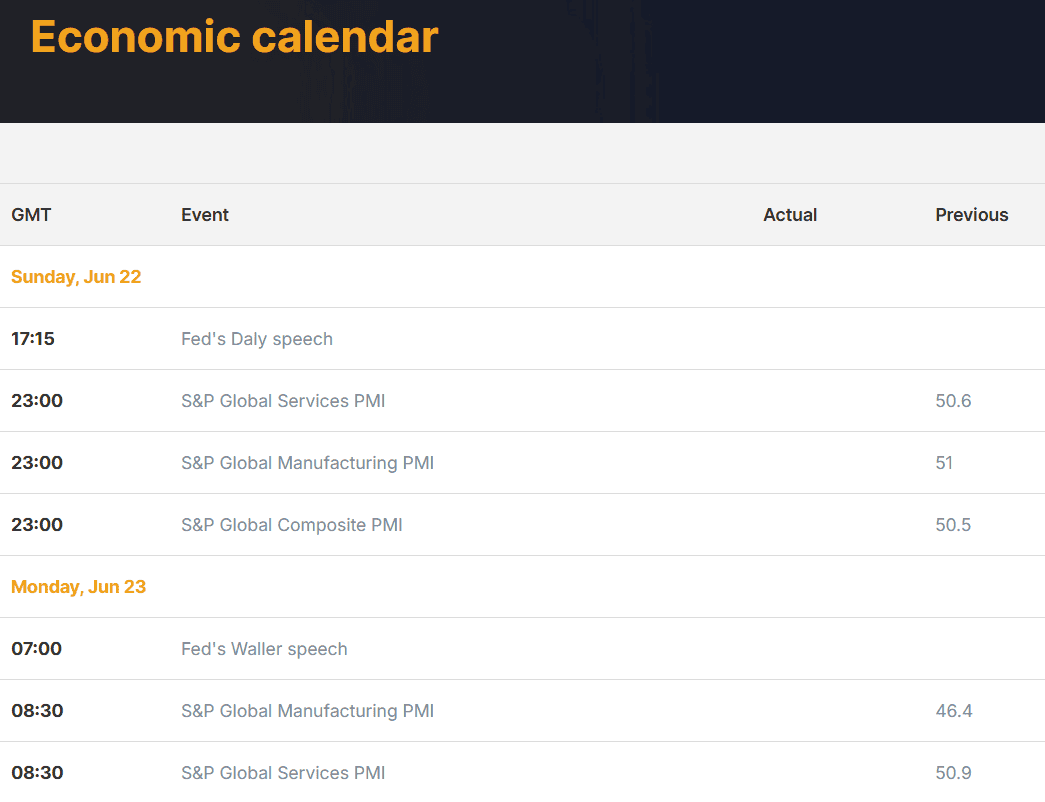

Research and Education

Score – 4.2/5

Research Tools BP Markets

Our research indicates that BP Prime offers a few research materials, such as an economic calendar and analysis. Besides, the broker’s platforms already include great research tools and features, enabling traders to conduct in-depth analysis. However, traders should remember that all the additional research features are available only through the global entity.

Education

Based on our findings, the broker does not provide extensive educational and learning materials, seminars, or webinars that are essential for beginner traders. Through its UK entity, BP Prime does not offer any educational resources. Yet, traders who sign in through the international entity can access the following materials:

- Educational videos to learn more about trading and enhance overall knowledge of the market.

- Traders can access tips provided by the broker for more insights into trading.

- The online trading academy is in Arabic with English subtitles, tailored for customers prior to trading, beginners, and advanced traders.

Is BP Prime a Good Broker for Beginners?

BP Prime is not a favorable broker for beginners for several reasons. It has a very high initial deposit requirement, starting from $5,000. Besides, the broker does not offer any educational materials for its UK clients. Also, the broker’s MT5 platform is for more advanced clients; however, the MT4 platform is easy to use and can be equally beneficial for both beginner and professional clients. Also, the demo account can be helpful for any trader.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options BP Prime

Based on our research, BP Prime offers a very small number of tradable products, which makes the broker an unfavorable choice for those who want to expand their portfolios and further explore the market. Besides, the range of financial assets is limited to Forex, commodities, and indices. Traders through the global entity can also access shares on CFDs. Still, traditional investors cannot benefit from the broker’s offering.

- In addition, we found that BP Prime does not offer any alternative options for investment, such as Copy trading, MAM, or PAMM account features.

Account Opening

Score – 4.5/5

How to Open a BP Prime Demo Account?

The demo account availability is one of the advantages of the broker, enabling traders to practice before switching to live trading. Opening a demo account with the broker requires only a few steps:

- Go to the broker’s website and choose the ‘Try free demo’ option.

- Fill out the form by providing your name, email, country of residence, account type, and phone number.

- Receive login credentials via the provided email.

- Download one of the available platforms, and access it by using your demo account credentials.

- Access the available $10,000 virtual funds and start practicing.

How to Open a BP Prime Live Account?

Opening an account with BP Prime is an easy and straightforward process. Traders should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open an Account” page.

- Enter the required personal data (name, email, phone number, country, postcode, etc.)

- Verify your identity by uploading documentation (residential proof, ID, etc.), and the compliance team reviews the information within 24 hours.

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Score – 3.9/5

We were impressed by BP Prime’s trading platforms and the availability of extensive research tools and features, including the EA availability, FIX API, great charting capabilities, in-built technical indicators, risk management tools, and many more.

- However, through its UK entity, the broker does not offer any additional tools and features for more advanced opportunities.

- The global entity offers a few research tools, which we have already discussed in the research and education sections, including the Economic Calendar, trading tips, and media highlights.

BP Prime Compared to Other Brokers

And, of course, we have compared different brokers to see where BP Prime stands and how its offerings align with the market standards.

By reviewing different brokers, we noticed that BP Prime offers great safety due to its FCA regulations. Not all brokers have the same level of security, such as MarketsVox, which holds only a license from the FSA. However, brokers like CMC Markets and Saxo Bank hold multiple licenses from well-respected firms, including the FCA, ASIC, BaFin, IIROC, and more.

Reviewing BP Prime’s trading costs, the broker stands out for very low spreads, an average of 0.3 pips. On the contrary, Accuindex offers spreads of an average of 1.5 pips, while MarketVox offers spreads starting from 0.1 pips.

As to the trading platforms, BP Prime includes the market standards, MT4 and MT5 platforms, available through web, desktop, and mobile versions. Most brokers we reviewed offer either MT4 or MT5 platforms. However, Saxo Bank offers its own proprietary platforms. As to the instrument availability, BP Prime’s tradable products are limited to 50+, while Saxo Bank, for instance, has an extensive offering of 71,000. Customer support is available 24/6, which is a better offering than most brokers have (mostly 24/5). And, at last, the minimum deposit requirement of BP Prime is $5,000, while Fusion Markets, Saxo Bank, City Index, and CMC Markets have a $0 minimum funding requirement.

| Parameter |

BP Prime |

Fusion Markets |

Saxo Bank |

City Index |

MarketsVox |

CMC Markets |

Accuindex |

| Spread-Based Account |

Average 0,3 pips |

Average 0.92 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 0.1 pips |

Average 0.5 pips |

Average 1.5 pips |

| Commission-Based Account |

0.0 pips + commissions based on the trading volume |

0.0 pips + $2.25 per side |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + $3 per side |

0.0 pips + $2.50 |

0.0 pips + $2.5 per side |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, cTrader, TradingView, DupliTrade, Fusion+ |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT5 |

CMC Markets Next Generation Web Platform, MT4 |

MT5, WebTrader |

| Asset Variety |

50+ instruments |

250+ instruments |

71,000+ instruments |

13,500+ instruments |

100+ instruments |

12,000+ instruments |

300+ instruments |

| Regulation |

FCA, FSA |

ASIC, VFSC, FSA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FSA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

ASIC, VFSC, FSA |

| Customer Support |

24/6 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/7 |

| Educational Resources |

Limited |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$5,000 |

$0 |

$0 |

$0 |

$100 |

$0 |

$100 |

Full Review of Broker BP Prime

After carefully reviewing BP Prime’s offerings, we found that its proposal is better suited for institutional clients or professionals. The broker is tightly regulated by the top-tier FCA, ensuring compliance with stringent laws and the MiFID II requirements. The broker also holds an FSA license, serving its international clients.

BP Prime offers great trading conditions and features through its MT4 and MT5 platforms, including EA availability, FIX API, risk management tools, and built-in technical indicators.

The availability of financial assets is limited to Forex, commodities, indices, and shares (for the global entity). Through the UK entity, traders can access only a limited number of instruments, 50+ in total. In addition, all the products are based on CFDs, limiting traditional investors. What is more, traders cannot access copy trading, PAMM, or MAM features.

The educational section is limited to a glossary and videos for global traders, while the UK entity does not offer any educational or research resources. While customer support is available 24/6, it is limited to email and phone lines.

All in all, BP Prime provides a well-regulated environment with competitive trading conditions for professional traders. Beginner clients will likely find the broker’s offering incompatible with their trading needs.

Share this article [addtoany url="https://55brokers.com/bp-prime-review/" title="BP PRIME"]