- What is BiG?

- BiG Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

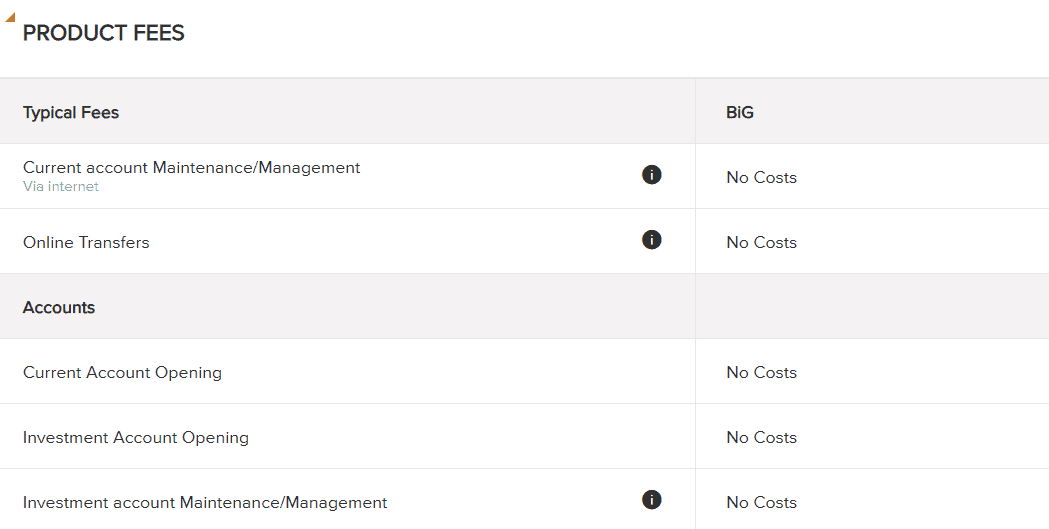

- Cost Structure and Fees

- Trading Platforms and Tools

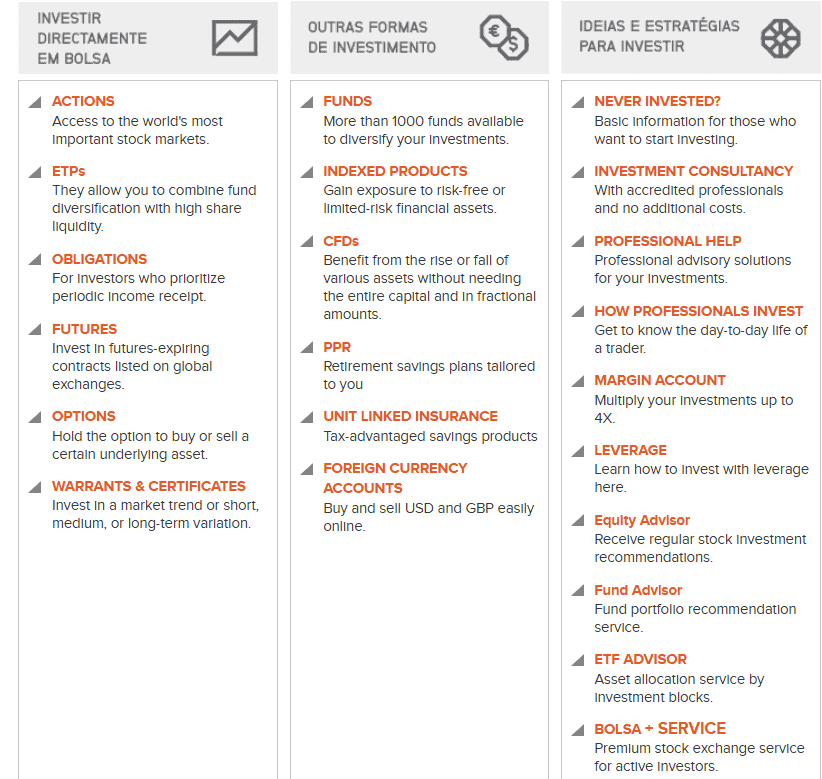

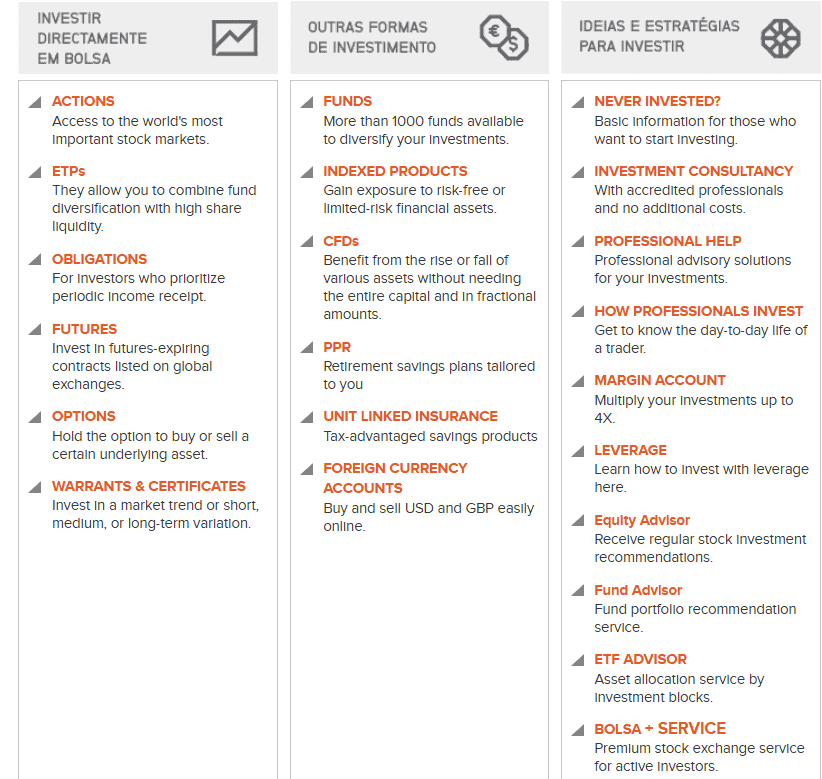

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- BiG Compared to Other Brokers

- Full Review of Broker BiG

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.5 / 5 |

What is BiG?

Banco de Investimento Global or BiG is a Portuguese investment bank and brokerage firm that provides a wide range of financial services to retail, corporate, and institutional clients.

Founded in 1998, BiG focuses on investment banking, wealth management, and online trading solutions. The bank offers access to global financial markets, including stocks, bonds, mutual funds, ETFs, derivatives, CFDs, and more, supported by its digital platforms.

Known for its emphasis on technology, transparency, and regulatory compliance under the supervision of the Bank of Portugal and the Portuguese Securities Market Commission, BiG caters to different levels of investors, combining innovative tools with personalized advisory services.

Is BiG Stock Broker?

Yes, BiG operates as a stock broker, giving clients direct access to thousands of shares listed on major global exchanges. Through its platforms, such as BiGlobal Trade, investors can trade over 19,000 stocks from markets worldwide, as well as ETFs and other exchange-traded products.

What is DIF Broker?

DIF Broker was a Portuguese brokerage, offering online trading in stocks, futures, CFDs, and other financial products to clients worldwide. It gained recognition as one of Portugal’s first independent brokers.

In 2021, DIF Broker was acquired by Banco de Investimento Global, and its operations were fully integrated into BiG’s investment banking and online trading services.

This acquisition allowed BiG to expand its client base and strengthen its position in the Portuguese and international brokerage market.

BiG Pros and Cons

BiG has several strengths and some drawbacks that investors should take into account. On the positive side, BiG is a well-regulated Portuguese bank that offers access to a wide range of financial instruments, supported by modern trading platforms. It is known for strong investor protection, transparency, and innovative digital tools.

For the Cons, the minimum deposit requirements might be high compared to other brokers, the fees on certain products are less competitive, and the firm’s services are more tailored to Portuguese and EU clients, which may limit accessibility for some international traders.

Overall, BiG provides a secure and diversified environment for investment; however, it may not be the most cost-efficient option for every investor.

| Advantages | Disadvantages |

|---|

| Secure investing environment | No 24/7 customer support |

| European regulation and oversee | Limited research and educational materials |

| Competitive conditions | Not available worldwide |

| Global market access | High minimum deposit amount |

| Suitable for long-term investing | |

| Advanced trading platforms | |

| Digital account opening | |

| Wide range of instruments | |

BiG Features

BiG combines traditional banking services with advanced investment solutions, making it a versatile choice for investors. With user-friendly digital tools and access to global markets, the broker provides clients with the flexibility to manage savings, trade actively, or invest for the long term. Below is a comprehensive list of its key features:

BiG Features in 10 Points

| 🏢 Regulation | Banco de Portugal, CMVM |

| 🗺️ Account Types | Super, BiG Savings, Margin, Securities Accounts |

| 🖥 Trading Platforms | MyBOLSA, BiGlobal Trade, CFD Trading Platforms |

| 📉 Trading Instruments | Stocks, ETFs, ETPs, Futures, Options, Funds, CFDs, Warrants & Certificates, and more |

| 💳 Minimum Deposit | €1,000 |

| 💰 Average Stock Commission | From €6 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, GBP |

| 📚 Trading Education | Trading Challenge, BiG Analysis, Courses |

| ☎ Customer Support | 24/5 |

Who is BiG For?

Banco de Investimento Global is best suited for investors and traders who want a reliable European broker with access to both traditional banking services and global financial markets. With tailored account options, BiG is attractive for young investors looking to start small, as well as businesses seeking more comprehensive investment solutions.

- Investing

- European traders

- Traders from Portugal

- Direct Market Access trading

- Real Stock Trading

- Competitive fees

- Great trading tools

- Advanced traders

- Professional trading

- Supportive customer service

- Long-term investors

BiG Summary

Overall, BiG is a Portuguese investment bank and broker that offers a blend of retail banking, wealth management, and online trading services.

Founded in 1998 and headquartered in Lisbon, the broker offers clients access to a diverse range of financial instruments, including stocks, ETFs, CFDs, futures, and options, through robust platforms such as MyBOLSA and BiGlobal Trade.

Known for its strong regulatory standing under the Portuguese Securities Market Commission, the bank combines security with flexibility, making it suitable for both beginners and experienced traders. With competitive conditions and account options tailored to individuals and businesses, BiG positions itself as a trusted gateway to global markets.

55Brokers Professional Insights

BiG stands out by its ability to merge the security of a fully regulated European bank with the versatility of a global broker. Unlike many competitors, the firm gives clients direct access to both exchange-traded and OTC instruments, covering equities, ETFs, futures, options, Forex, commodities, bonds, and even cryptocurrencies, so is suitable for a wide range of traders or investors, also those with various trading strategies looking for market diversification.

Its advanced platforms offer professional-grade tools and real-time execution for active traders, so is good for large-sized accounts or Pro traders alike. Beyond trading, BiG provides in-depth market research, podcasts, and educational initiatives like the BiG Trading Challenge, reinforcing its role as not just a broker but also an educator, which is a plus for beginners or individuals looking to learn more about markets.

Overall, we find the proposal with quite a good level, combining multiple account options, transparent regulation under CMVM, and deposit protection through the Portuguese Deposit Guarantee Fund, BiG appeals to a wide range of investors, from beginners to sophisticated professionals seeking a reliable gateway to global markets.

Consider Trading with BiG If:

| BiG is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- Suitable for professional traders and investors.

- Stock Trading and Investment.

- Access to robust trading platforms.

- Offering popular financial products.

- Secure trading environment.

- Access to robust proprietary trading platforms.

- Competitive trading conditions.

- Beginner and experienced investors.

- Good trading tools and trading technology.

- Low fees and commissions.

|

Avoid Trading with BiG If:

| BiG might not be the best for: | - Who need comprehensive educational materials.

- Looking for broker with 24/7 customer support.

- International investors. |

Regulation and Security Measures

Score – 4.5/5

BiG Regulatory Overview

Banco de Investimento Global operates as a fully licensed Portuguese investment bank, ensuring strong regulatory oversight and client protection.

The firm is supervised by the Banco de Portugal, the country’s central bank, which oversees its banking activities and financial stability. In addition, BiG is regulated by the CMVM, the Portuguese Securities Market Commission, which monitors its investment and brokerage services to ensure transparency and compliance with EU financial regulations.

How Safe is Trading with BiG?

As a member of the Portuguese Deposit Guarantee Fund, client deposits are protected up to €100,000, adding an extra layer of security. This dual regulatory framework positions BiG as a trustworthy and transparent broker for both retail and professional investors.

Consistency and Clarity

BiG has built a solid reputation since its establishment in 1998, combining the stability of a regulated Portuguese bank with the accessibility of a modern online broker.

Over the years, the firm has earned positive recognition for its transparency, regulatory compliance, and broad range of instruments, although some traders point out drawbacks such as relatively high minimum deposits and platform complexity for beginners.

The broker has also gained visibility through its university trading challenges, industry recognitions, and sponsorships, reinforcing its presence not only in financial markets but also in educational and social initiatives.

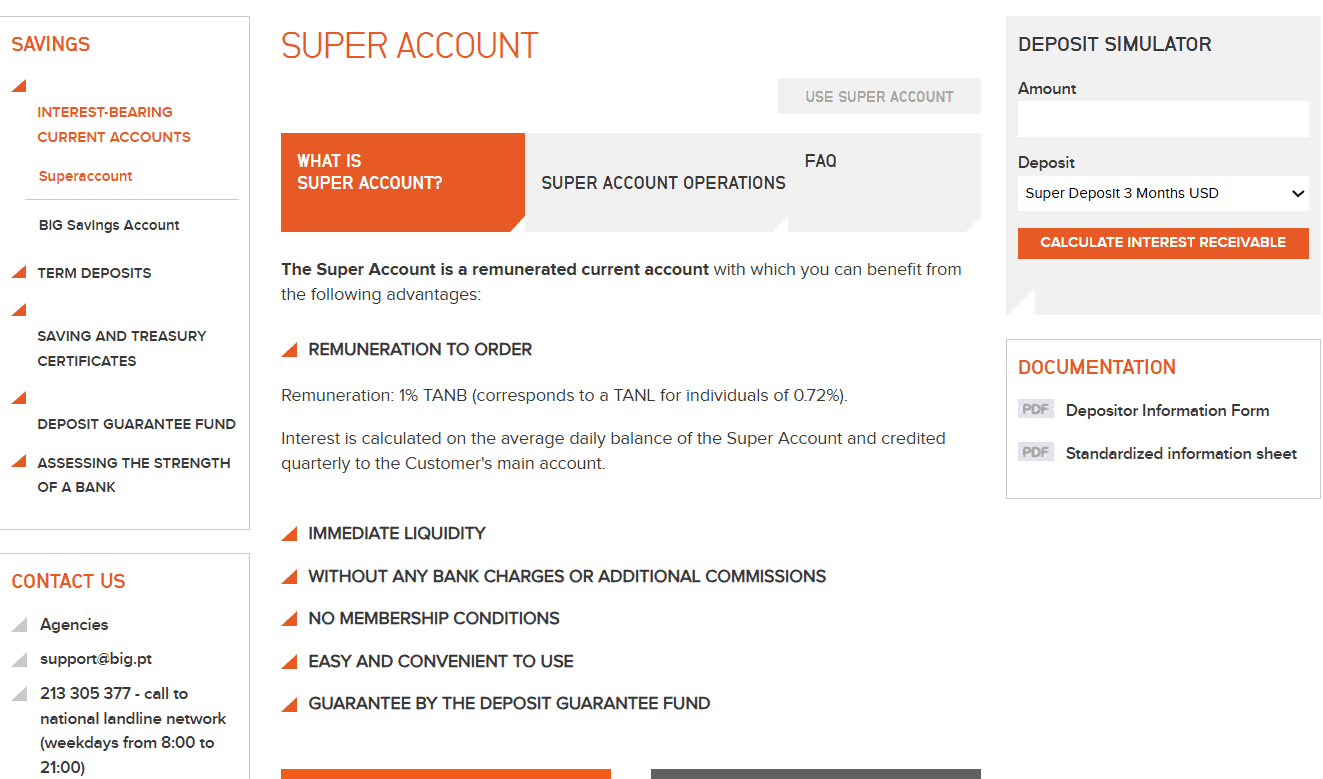

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with BiG?

BiG provides a diverse selection of account types tailored to different investment needs. The Super Account is an all-in-one entry point for everyday banking, savings, and access to investment services.

For clients looking to grow their capital securely, the BiG Savings Account offers a straightforward way to earn interest on deposits. More active traders can benefit from the Margin Account, which allows leveraged trading across various asset classes, while the Securities Account is intended for those interested in building and managing a portfolio of equities, ETFs, and bonds.

In addition, BiG provides a demo account, enabling new or prospective clients to explore the platform’s features, test strategies, and gain confidence without financial risk.

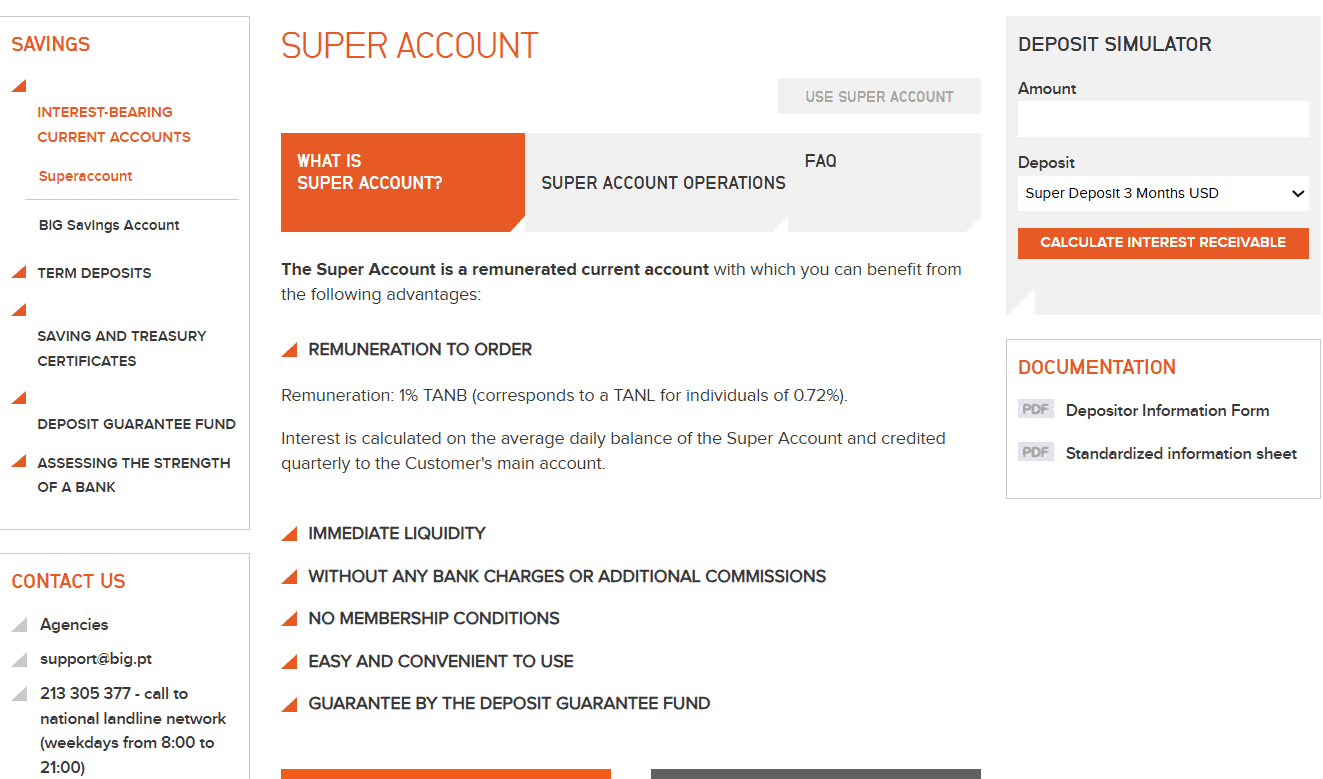

Super Account

The Super Account (Super Conta) at BiG is a remunerated current account that combines flexibility with attractive savings benefits. It allows clients to deposit funds without a minimum deposit requirement, earn daily interest at a competitive annual rate, and maintain full liquidity, meaning money can be withdrawn or transferred at any time without penalties.

The account has no maintenance fees or hidden costs, and interest is credited quarterly, making it a convenient option for both everyday banking and savings. In addition, deposits are protected up to €100,000 by the Portuguese Deposit Guarantee Fund, offering clients an added layer of security.

Regions Where BiG is Restricted

BiG primarily operates in Portugal and has a presence in Spain, but its services are generally limited to these markets. So clients outside these areas should confirm availability directly with BiG.

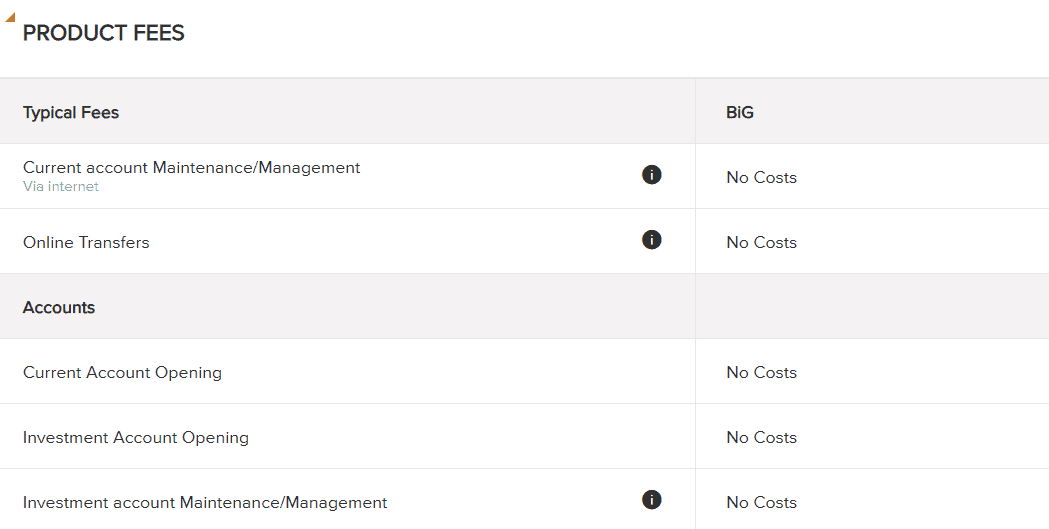

Cost Structure and Fees

Score – 4.5/5

BiG Brokerage Fees

BiG applies a transparent and competitive fee structure across its brokerage services, accessible to different types of investors. Clients trading in stocks, ETFs, or bonds pay commissions that vary depending on the market and order size, while derivatives and futures contracts are subject to exchange-related charges.

The broker emphasizes clarity by avoiding hidden costs and does not charge account maintenance fees on standard accounts. Additionally, BiG offers interest-bearing options like the Super Account without extra charges, ensuring that clients retain more of their returns.

BiG maintains a clear and competitive commission model to accommodate both retail and active investors. For stock trading, commissions start from €6 per trade, offering a cost-effective way to access domestic and international markets.

The broker also applies fair pricing for other instruments such as ETFs, bonds, and derivatives, ensuring transparency without hidden costs.

BiG applies standard exchange and regulatory fees that are directly linked to the markets where trades are executed. These fees are charged in addition to the broker’s own commissions and cover costs such as exchange transaction charges, clearing, and regulatory levies required by market authorities.

The exact amounts vary depending on the instrument and the exchange involved, but BiG ensures full transparency by itemizing these costs in client statements.

BiG applies rollover or swap fees on positions held overnight in leveraged products such as Forex and CFDs. These charges reflect the cost of carrying a position beyond the trading day and are influenced by factors like interest rate differentials between currencies, market conditions, and the type of instrument traded.

How Competitive Are BiG Fees?

BiG’s fee structure is attractive in a market where cost efficiency is increasingly important to investors. The broker emphasizes transparency, with clear pricing across different asset classes and no hidden charges, allowing clients to easily understand their trading costs.

While fees may vary depending on the instrument or market, BiG positions itself as a cost-conscious choice that balances affordability with reliable service.

| Asset/ Pair | BiG Commission | TradeZero Commission | Freetrade Commission |

|---|

| Stocks Fees | From €6 | From $0 | From $0 |

| Fractional Shares | - | - | £2 |

| Options Fees | From $0 | $0.42 | - |

| ETFs Fees | From €6 | From $0 | From $0 |

| Free Stocks | No | Yes | Yes |

BiG Additional Fees

In addition to standard commissions, BiG applies additional fees related to specific services such as currency conversions, custody of certain assets, or transfers involving external banks.

These charges are not part of regular trading activity but can arise depending on the type of account, transaction method, or market chosen.

Trading Platforms and Tools

Score – 4.6/5

BiG offers a variety of platforms and tools to suit different types of investors and traders. MyBOLSA provides a user-friendly interface for managing portfolios, monitoring markets, and accessing research insights.

For more advanced trading, BiGlobal Trade delivers professional-grade features, including real-time market data, customizable charts, and direct access to multiple global exchanges.

Additionally, BiG supports CFD trading platforms, which allow clients to trade derivatives on stocks, indices, commodities, and Forex with leverage. Together, these platforms provide a comprehensive suite of tools, combining accessibility, functionality, and the ability to execute diverse strategies.

Trading Platform Comparison to Other Brokers:

| Platforms | BiG Platforms | MEXEM Platforms | TradeZero Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

BiG Desktop Platform

BiG provides a desktop trading platform for professional and active traders who require advanced tools and real-time market access. The BiGlobal Trade platform is available as a desktop application, offering features such as customizable charts, technical analysis tools, multi-market access, and fast order execution.

The platform is ideal for clients who prefer a robust, full-featured environment for managing portfolios, executing complex trades, and monitoring multiple instruments simultaneously.

Main Insights from Testing

Testing the BiGlobal Trade desktop platform reveals a highly responsive and intuitive trading environment. The platform provides a wide range of technical analysis tools, real-time quotes, and advanced charting options that help users make informed decisions.

Its customizable interface allows traders to organize watchlists, alerts, and order types efficiently, while integrated research and market news keep clients updated on relevant developments.

BiG Desktop MetaTrader 4 Platform

BiG does not offer the MT4 platform. Traders looking to use MT4’s interface or automated trading features should consider alternative brokers that support it.

BiG Desktop MetaTrader 5 Platform

BiG does not offer access to the MetaTrader 5 platform. Traders looking for MT5 functionality will need to consider other brokers, as the broker primarily relies on proprietary platforms for executing trades and managing portfolios.

BiG MobileTrader App

The BiG Mobile App offers clients the convenience of managing investments and executing trades directly from their smartphones or tablets.

The app features real-time market data, portfolio monitoring, and essential trading tools, allowing users to place orders, set alerts, and track performance on the go.

AI Trading

BiG does not offer AI-powered tools or features. While the platform offers advanced charting and technical analysis tools, it does not feature AI-driven analytics or automated trading systems.

For clients interested in AI-assisted trading, alternative platforms offer AI-powered investment solutions that use proprietary algorithms to analyze global financial markets and execute trades on behalf of investors.

Trading Instruments

Score – 4.7/5

What Can You Trade on BiG’s Platform?

On BiG’s platforms, clients have access to a wide range of financial instruments, including stocks, ETFs, ETPs, futures, options, investment funds, CFDs, warrants, certificates, and more.

The diverse selection allows users to build comprehensive portfolios, engage in short- or long-term strategies, and access multiple global markets from a single account.

Main Insights from Exploring BiG’s Tradable Assets

Exploring BiG’s tradable assets highlights the broker’s emphasis on diversity and accessibility for a range of investors. The platform supports both high-liquidity instruments and niche products, enabling traders to implement varied strategies from conservative to more speculative approaches.

Margin Trading at BiG

BiG offers margin trading through its BiGlobal Trade platform, allowing investors to borrow funds to take larger positions in stocks, ETFs, futures, options, and CFDs.

This can amplify potential gains but also increases risk, so traders should carefully manage their strategies. The broker provides tools and resources to help clients trade responsibly and make informed decisions.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at BiG

BiG allows clients to fund their accounts via bank transfers, BiG current accounts, and the BiG Mobile App to initiate transfers to their accounts.

BiG Minimum Deposit

For trading purposes, the BiGlobal Trade account requires a minimum deposit of €1,000 to start trading across stocks, ETFs, futures, options, and other instruments.

In contrast, the Super or BiG Savings Accounts require no minimum deposit, allowing clients to start saving or managing their funds immediately without financial barriers.

Withdrawal Options at BiG

BiG provides various withdrawal options to ensure clients can access their funds conveniently. Clients can initiate withdrawals through bank transfers, including SEPA and international transfers, to their registered bank accounts.

Additionally, the broker offers the BiG Mobile App, allowing clients to manage their accounts and perform transactions on the go. Withdrawals are typically processed promptly, ensuring that clients have timely access to their funds.

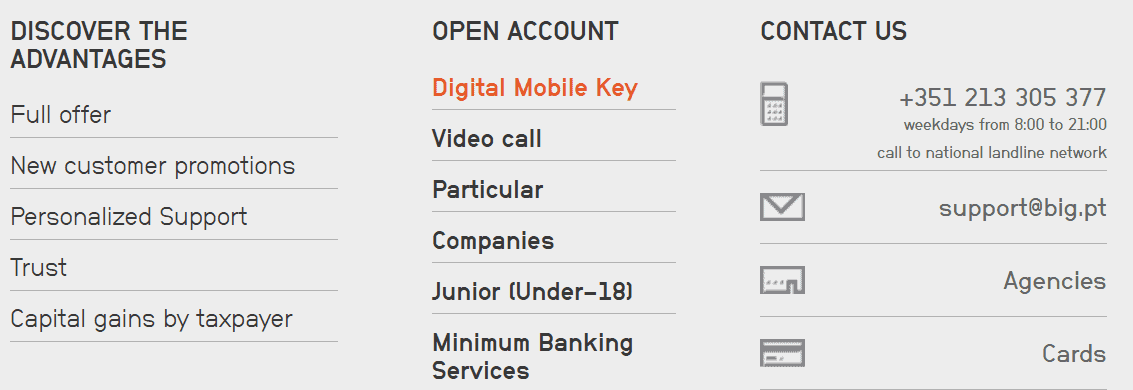

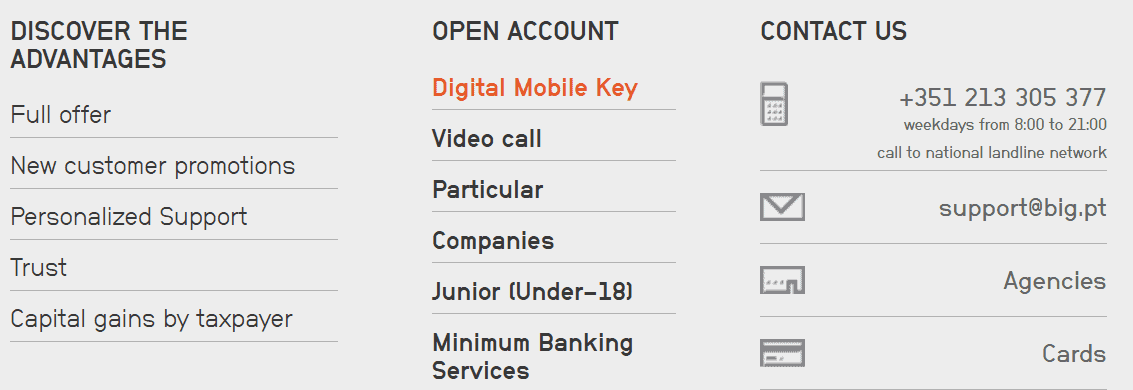

Customer Support and Responsiveness

Score – 4.4/5

Testing BiG’s Customer Support

The broker provides 24/5 customer support via phone and email. While live chat is not available, the other communication channels ensure that most queries are addressed efficiently during weekdays.

Contacts BiG

Clients can reach BiG through multiple contact channels for support and inquiries. In Portugal, the main phone number is +351 213 305 377, and email support is available at support@big.pt.

In Spain, clients can call +34 91 001 20 10 or email soporte@bancobig.es for general assistance, while brokerage-specific questions can be directed to broker@bancobig.es.

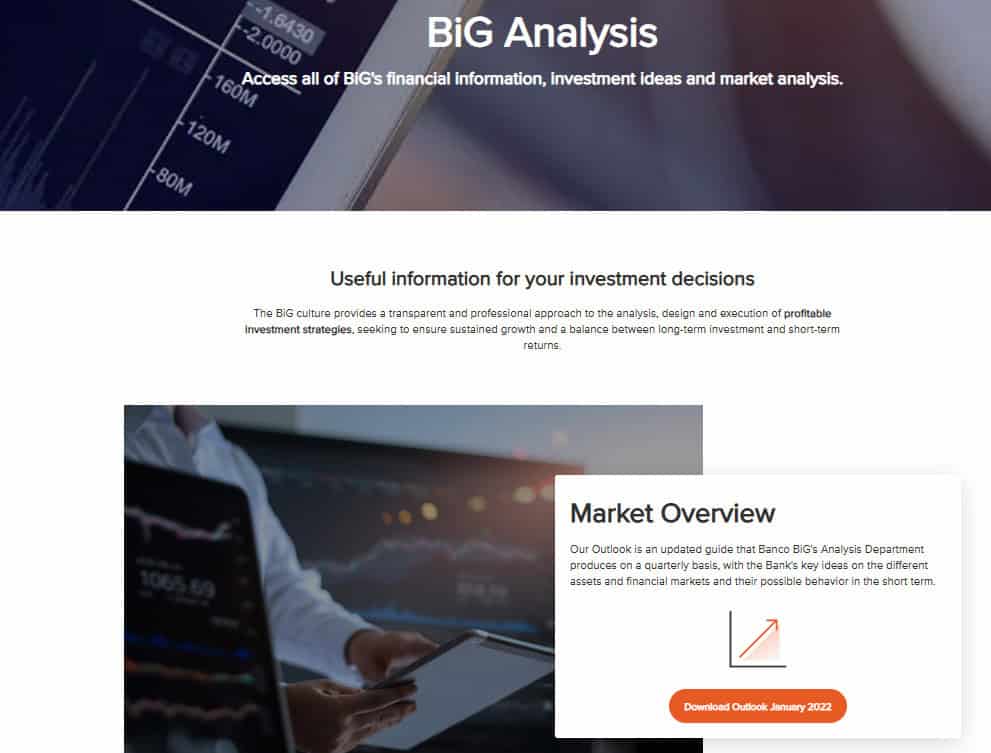

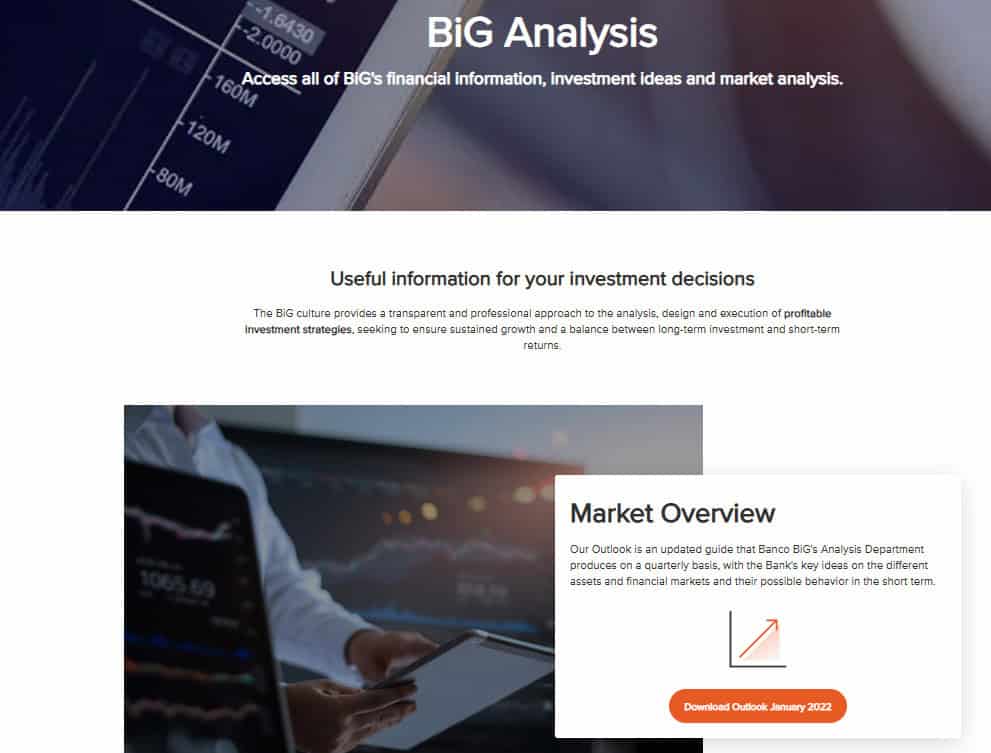

Research and Education

Score – 4.6/5

Research Tools BiG

BiG provides a range of research tools both on its website and within its trading platforms to support informed investment decisions.

- Through the BiGlobal Trade platform, clients can access advanced charting features, technical analysis indicators, transaction signals, and tools like economic calendars, dividend trackers, and portfolio benchmarking.

- Meanwhile, BiG’s website complements these resources with its Analysis section, offering quarterly market outlooks, weekly podcasts, and expert commentary on global economic and market trends.

Education

BiG offers a selection of educational resources, including its Trading Challenge, BiG Analysis, and various courses to help clients build market knowledge and practical skills.

While these materials provide useful insights and guidance, the range is not as comprehensive as the extensive educational libraries offered by some larger international brokers.

Portfolio and Investment Opportunities

Score – 4.5/5

Investment Options BiG

BiG provides a variety of investment solutions, including funds, bonds, ETFs, structured products, warrants and certificates, and unit-linked contracts.

With access to over 1,000 funds from global managers, the firm enables clients to build diversified portfolios suited to different risk profiles and investment goals.

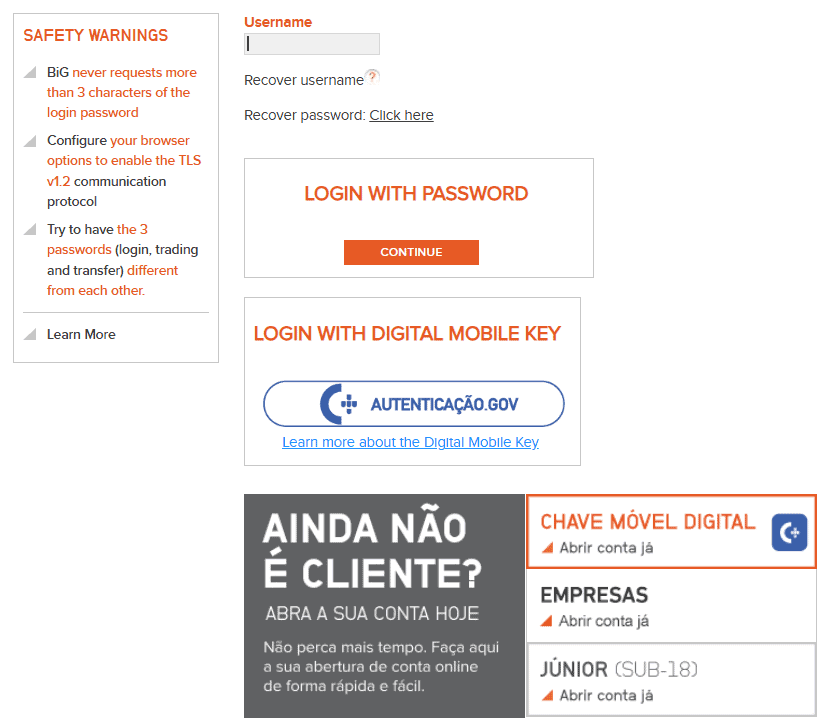

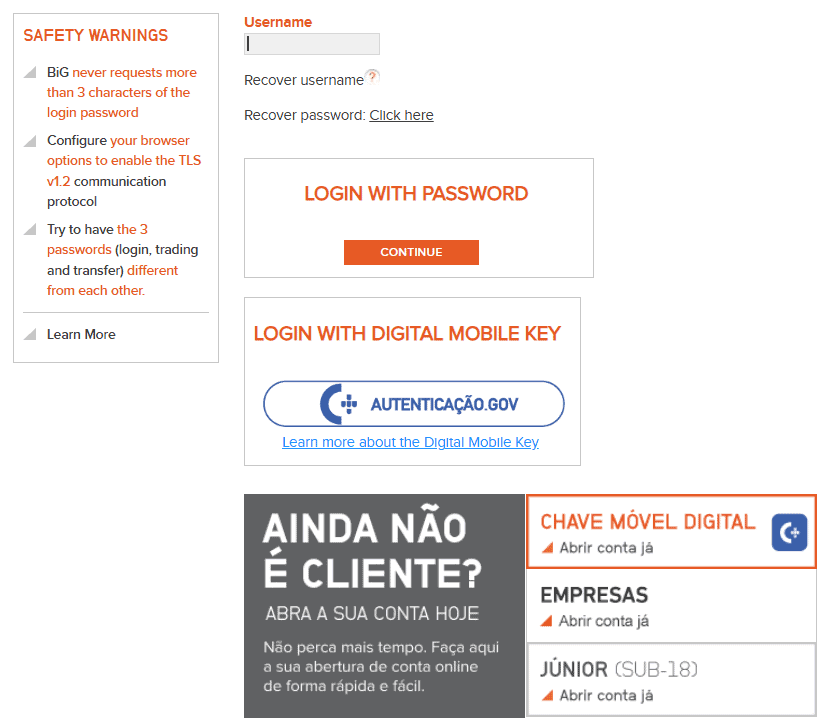

Account Opening

Score – 4.4/5

How to Open BiG Demo Account?

Opening a demo account with BiG is a simple way for traders to explore the platform and practice strategies without risking real money. Here is how you can get started:

- Visit the official BiG website and navigate to the trading platforms section.

- Select the option to open a demo account under the BiGlobal Trade or CFD platform.

- Fill out the online registration form with your basic details.

- Confirm your email address to receive login credentials.

- Download or access the platform online and start trading with virtual funds.

How to Open BiG Live Account?

To open a live account with BiG, clients need to complete an online application through the broker’s official website. The process typically involves filling out a registration form with personal and financial details, verifying identity and residence by uploading the required documents, and choosing the desired account type.

Once the account is approved, clients can fund it using available deposit methods, such as bank transfer or Big current account, and begin trading across the wide range of instruments offered.

Additional Tools and Features

Score – 4.5/5

In addition to its research resources, BiG provides a range of extra tools and features to enhance the trading experience.

- These include portfolio management solutions, customizable alerts and notifications, secure mobile banking integration, and access to market news feeds directly within the platforms. These tools empower users with deeper customization and decision-making capabilities across markets.

BiG Compared to Other Brokers

Banco de Investimento Global stands out as a regulated European broker offering a wide range of instruments, which gives it versatility for different types of investors.

Compared to its competitors, BiG provides solid trading platforms and tools, though its educational resources are somewhat limited relative to brokers with more comprehensive learning programs.

The broker maintains a professional standard with regulated oversight in Portugal and across Europe, and customer support is reliable, though operating primarily during standard market hours.

Overall, BiG is competitive in fees, asset variety, and platform functionality, making it a strong option for investors seeking a European-regulated brokerage, even if some global brokers offer broader educational content or 24/7 support.

| Parameter |

BiG |

Vanguard |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Stock Commission from €6 |

Futures contracts not available / Stock Commission from $0 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

No |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low |

Low |

Average |

Low |

Low/Average |

Low |

| Trading Platforms |

MyBOLSA, BiGlobal Trade, CFD Trading Platforms

|

Proprietary trading platform, Mobile App |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE Pro, Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, ETFs, ETPs, Futures, Options, Funds, CFDs, Warrants & Certificates |

Stocks, Options, CDs, ETFs, Bonds, Mutual Funds |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds, CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

Banco de Portugal, CMVM |

SEC, FINRA, SIPC, FCA, ASIC, Central Bank of Ireland |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Limited |

Limited |

Excellent |

Good |

Limited |

Excellent |

Good |

| Minimum Deposit |

€1,000 |

$0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker BiG

BiG is a well-regulated European broker offering a comprehensive range of financial instruments, including stocks, ETFs, futures, options, CFDs, and structured products.

It provides clients with versatile platforms, including MyBOLSA, BiGlobal Trade, CFD Trading Platforms, and mobile solutions, featuring advanced charting, portfolio management, and market analysis tools.

BiG maintains transparent fee structures, reliable customer support, and a variety of account types to suit both casual investors and active traders. While its educational resources are limited compared to some larger brokers, the broker’s research tools, expert insights, and investment solutions make it a solid choice for clients seeking a European-regulated brokerage with a professional trading environment.

Share this article [addtoany url="https://55brokers.com/big-review/" title="BiG"]