Apex Trader Funding 2025 Review

-

Updated:

Leverage: —

Regulation: USA

Min. Deposit: $147

HQ: Texas, USA

Platforms: Rithmic, NinjaTrader, Tradovate

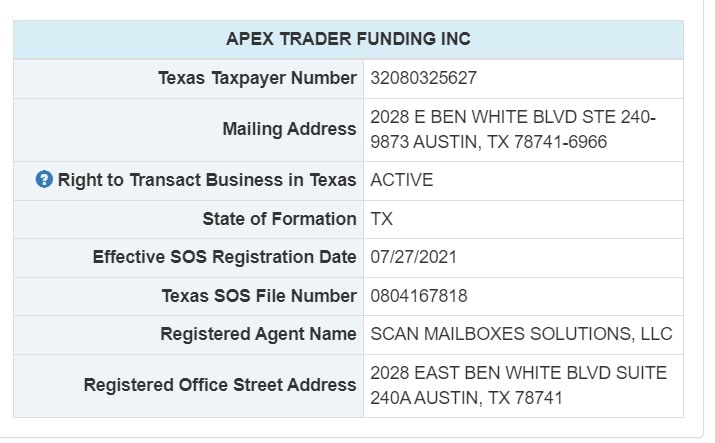

Found in: 2021

Advertising Disclosure

Updated:

Leverage: —

Regulation: USA

Min. Deposit: $147

HQ: Texas, USA

Platforms: Rithmic, NinjaTrader, Tradovate

Found in: 2021

Apex Trader Funding is an industry-leading futures funding evaluation firm that offers funding programs to traders. In such programs, traders are typically provided with a simulated or real trading account with a set balance and are required to follow certain rules and objectives, like profit targets and maximum drawdown limits.

If the trader successfully meets the criteria set by the program, they may be eligible to manage a larger funded accounts and keep a portion of the profits generated.

Apex Trader Funding, a prop trading firm, offers a unique chance to trade with minimal personal funds. Aspiring traders need to pass a challenge to access a funded account, allowing them to trade professionally with the company’s capital. For more on prop trading, follow this link. Note that there are significant risks involved, which we outline below.

| Apex Trader Funding Advantages | Apex Trader Funding Disadvantages |

|---|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | No 2-step Evaluation |

| Profit Share from Challenge | No MetaTrader Platform |

| NinjaTrader platform | Only Futures Trading |

| Can maintain u pto 20 account simultaneously | Fee is not refundable |

| Good range of Account Sizes |

Based in the USA, a nation known for its stringent financial regulations, Apex Trader Funding has carved out a reputation as a premier trading platform provider. It offers an exceptional trading experience, bolstered by top-notch support and educational resources, which has attracted a significant number of customers.

We reviewed the official information available on Apex Trader Funding’s website and found no clear evidence suggesting that the company is a scam. However, it’s important to remember that Prop Trading Firms generally operate with minimal regulation from financial authorities. This lack of strict oversight makes it more challenging to definitively assess the legitimacy or potential risks associated with such firms.

Our professional advice is to thoroughly educate yourself about Prop Trading and understand the associated risks before proceeding. It’s advisable to choose a company with a solid reputation and a track record of stability, ideally one that has been operating for several years. Although you won’t be investing substantial personal funds but rather paying subscription fees, the potential financial loss is generally lower in Prop Trading compared to trading with your own funds in the real market.

A crucial aspect of our review of Apex Trader Funding focuses on the structure and terms of the evaluation challenge. This involves understanding the specific test or criteria you need to meet to qualify for a Funded Trading Account and become a Proprietary Trader. Additionally, it’s important to consider the costs involved for traders to participate, which are typically in the form of a Registration Fee. This information is key to understanding the pathway to becoming a funded trader with the firm.

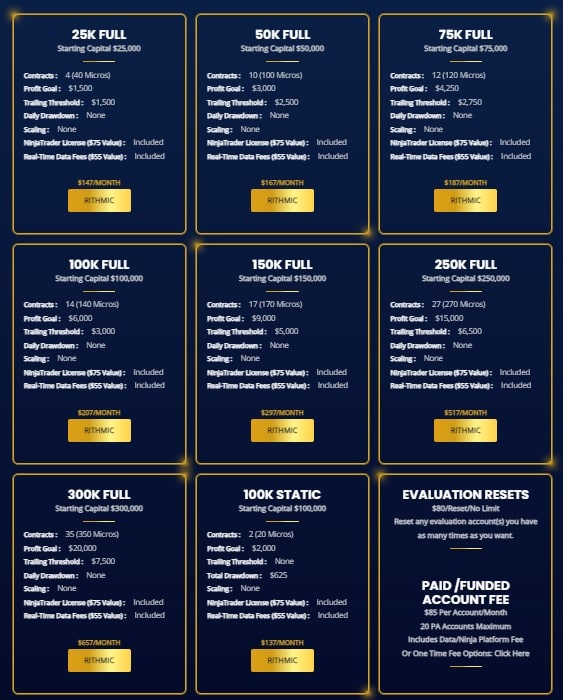

When signing up for Apex Trader Funding, you’ll need to choose an account model and balance, which determines the challenge’s conditions and the associated registration fee. Importantly, this fee is refunded once you qualify as a funded trader. For a concise comparison of fees for different account sizes, refer to their registration fee comparison table.

| Fees | Apex Trader Funding | FTMO | The Funded Trader |

|---|---|---|---|

| Minimum Account Size | $25,000 | $10,000 | $50,000 |

| Fee | $147 | €155 | $289 |

| Maximum Account Size | $300,000 | $200,000 | $400,000 |

| Fee | $657 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | No | Yes | Yes |

In the Apex Trader Funding challenge, traders must follow specific rules and achieve set Profit Targets, which vary by challenge level. Notably, traders can keep 100% of their first $25,000 earnings per account and 90% of any additional profits.

The maximum allowable loss across all account types in the Apex Trader Funding program is capped at 6%.

Another important rule typically used in Proprietary Trading tests is to be Profitable within minimum of the required days or periods. As we notice in Apex Trader Funding, the minimum of trading days are set to 7 for all account sizes.

See detailed table with Apex Trader Funding Challange conditions based on Account Size:

Our research indicates that Apex Trader Funding does not offer a Free Trial, as the evaluation phase effectively functions as the trial period. This approach is standard among numerous Prop Trading Firms, where free trials are generally not provided.

Upon successfully completing the test or challenge, a trader’s Funded Account is established, usually within a few business days. It’s important to note that the conditions and balance of this account will match those of the test you qualified for. If you wish to upgrade to a higher-tier account, you will need to undergo the evaluation process again, starting from scratch, for the desired account balance you aim to trade with.

The profit split in Apex Trader Funding’s program is structured to benefit traders. Once a trader becomes funded, they receive 100% of the first $25,000 in profits. Beyond that, the profit split is 90% to the trader and 10% to Apex Trader Funding.

Apex Trader Funding allows traders to request payouts twice per month. The specific request periods are from the 1st to the 5th and then again from the 15th to the 20th of each month. Payments are typically issued on the 15th for the first period and on the last day of the month for the second period.

After a payout is approved, it may take 3-7 business days for the funds to reach your bank account. It’s important to note that approval of the payout does not mean immediate transfer of funds.

Withdrawals are processed through ACH payments to U.S. bank accounts for U.S. traders, while non-U.S. traders are advised to use the ‘INTERNATIONAL OPTION’ to avoid delays. The minimum withdrawal amount is $500, and there are maximum limits for the first three months, with no maximum from the fourth month as long as the account maintains the required minimum balance.

In evaluating brokers, we thoroughly review account types, compatible trading platforms, available instruments, and trading costs. It’s also crucial to consider leverage levels and specific trading conditions, as some brokers may restrict certain strategies in funded accounts, potentially leading to account loss and the need for requalification. A detailed breakdown of these elements follows.

Apex Trader Funding specializes in offering only futures trading instruments. This includes a wide range of futures categories such as equity indices, interest rates, currencies, agriculture, energy, metals, and micro futures, as well as cryptocurrencies in the form of futures contracts.

Currently, there is no specific information available on the commission rates for Apex Trader Funding. For precise details about their commission structure, it would be best to directly reach out to their customer support for the most accurate and up-to-date information.

Based on our findings, Apex Trader Funding does not offer leverage. Instead, traders utilize their account balance as their buying power.

Apex Trader Funding provides access to a selection of robust trading platforms, including Rithmic, NinjaTrader, and Tradovate. These platforms offer traders a diverse range of tools and features to enhance their trading experience and strategy execution.

We examine various specific rules and conditions related to the trading conditions offered, including limitations and available strategies, as well as factors like slippage. However, for detailed and current information on these aspects, it’s advisable to consult the firm.

Taking into account all the information about Apex Trader Funding, we find that the firm presents an attractive opportunity for funded traders. The company offers competitive costs compared to industry competitors and provides a range of programs with lower fees, increasing opportunities for traders with reduced expenses.

No review found...

No news available.