- What is AMP?

- AMP Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

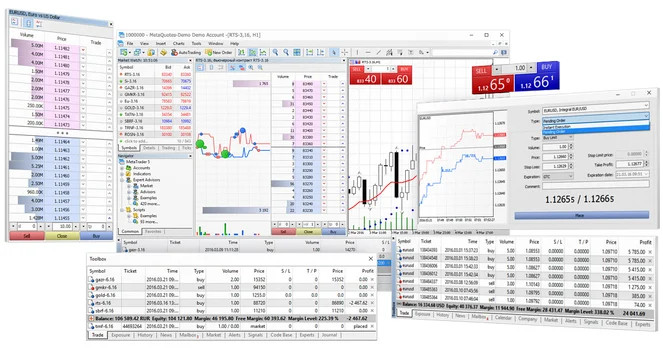

- Trading Platforms and Tools

- Trading Instruments

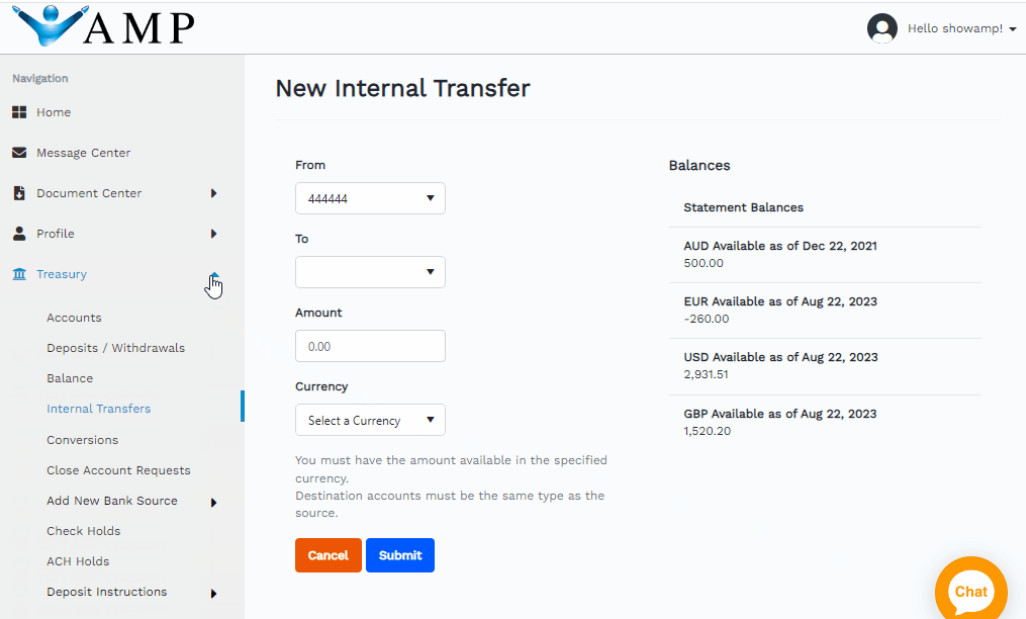

- Deposit and Withdrawal Options

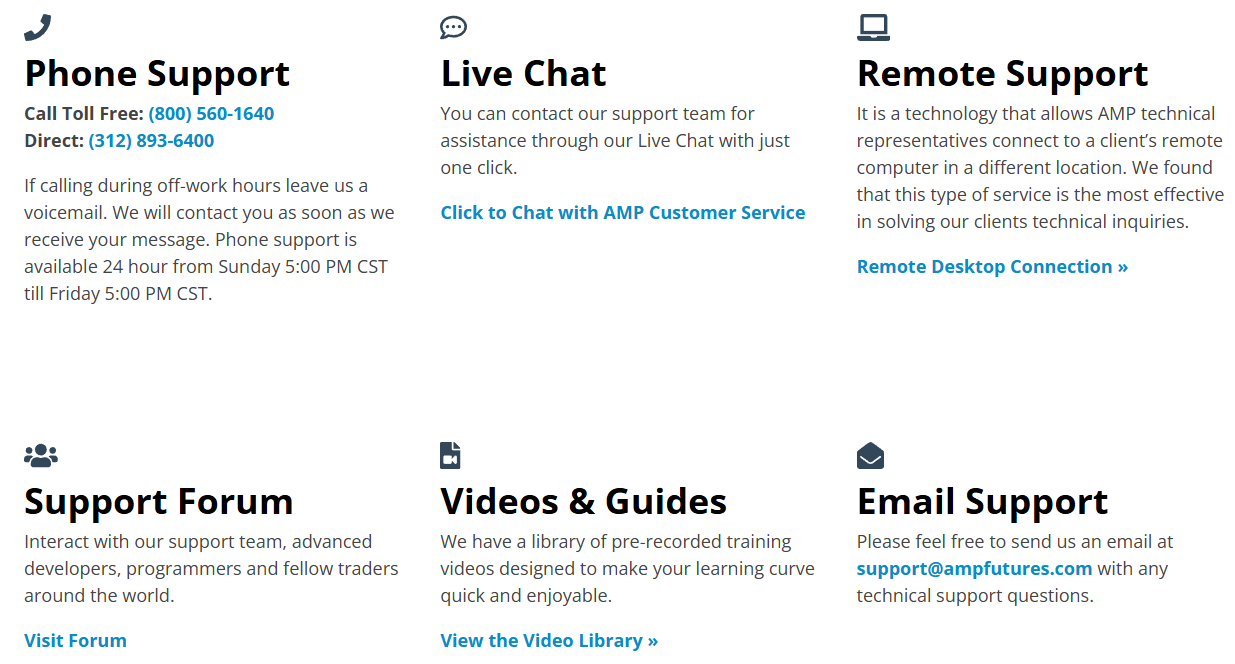

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

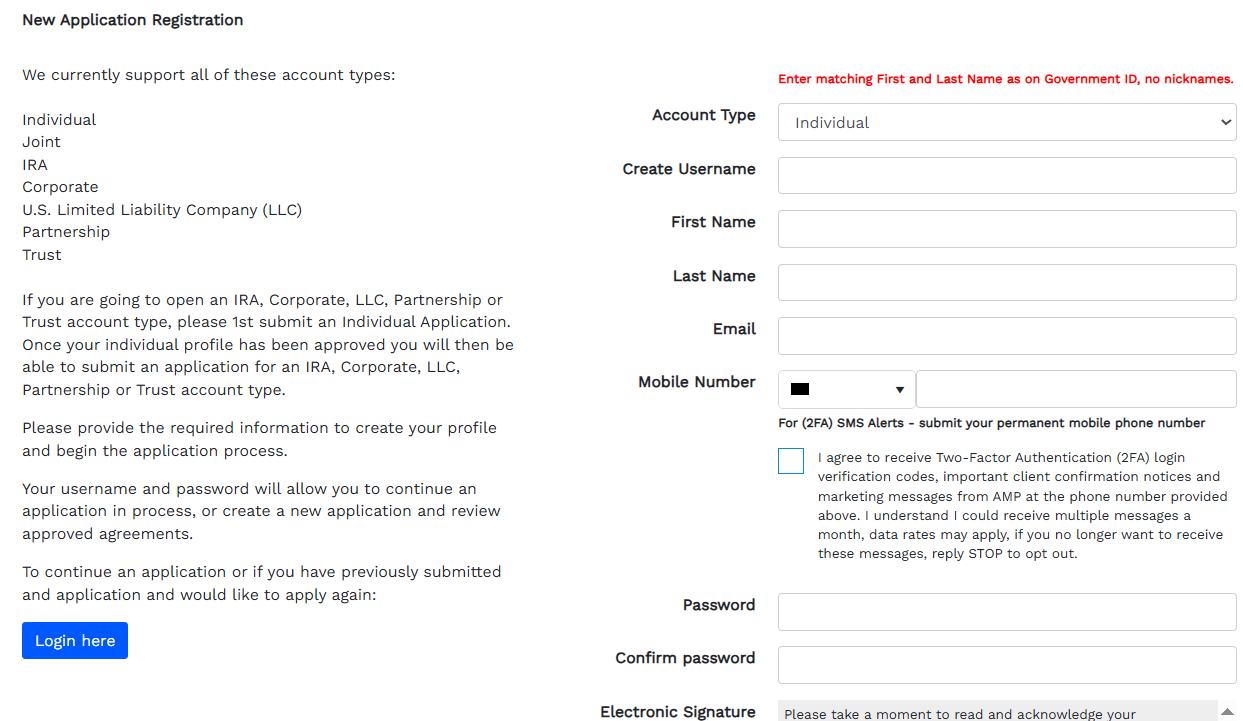

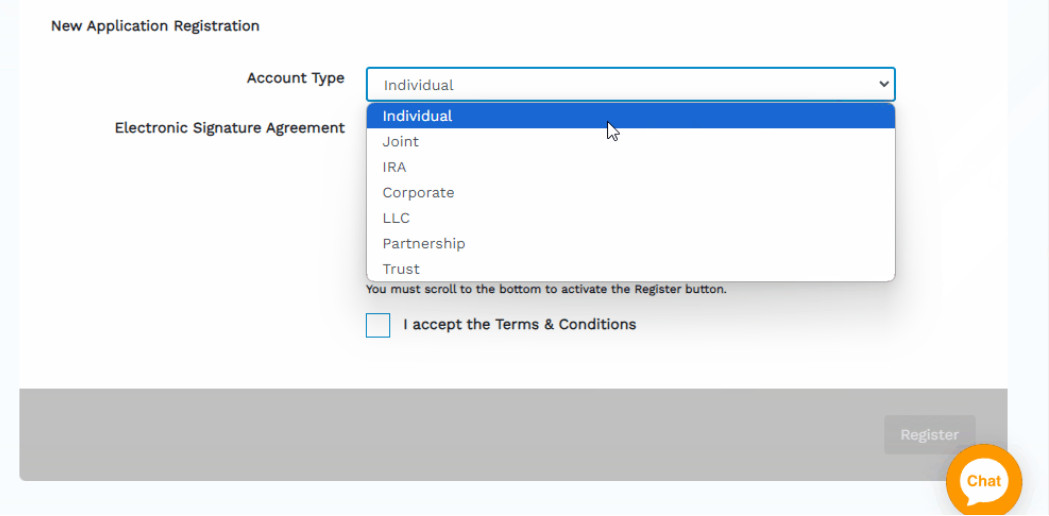

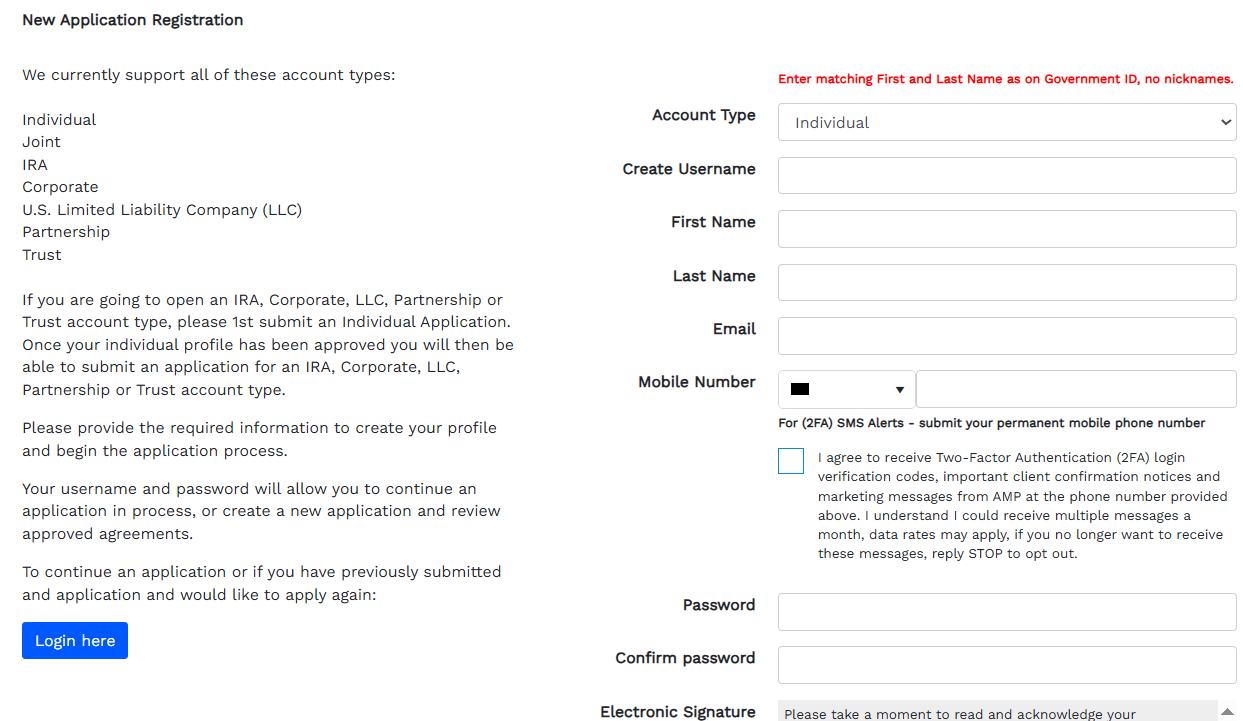

- Account Opening

- Additional Tools And Features

- AMP Compared to Other Brokers

- Full Review of Broker AMP

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.8 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 3.5 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

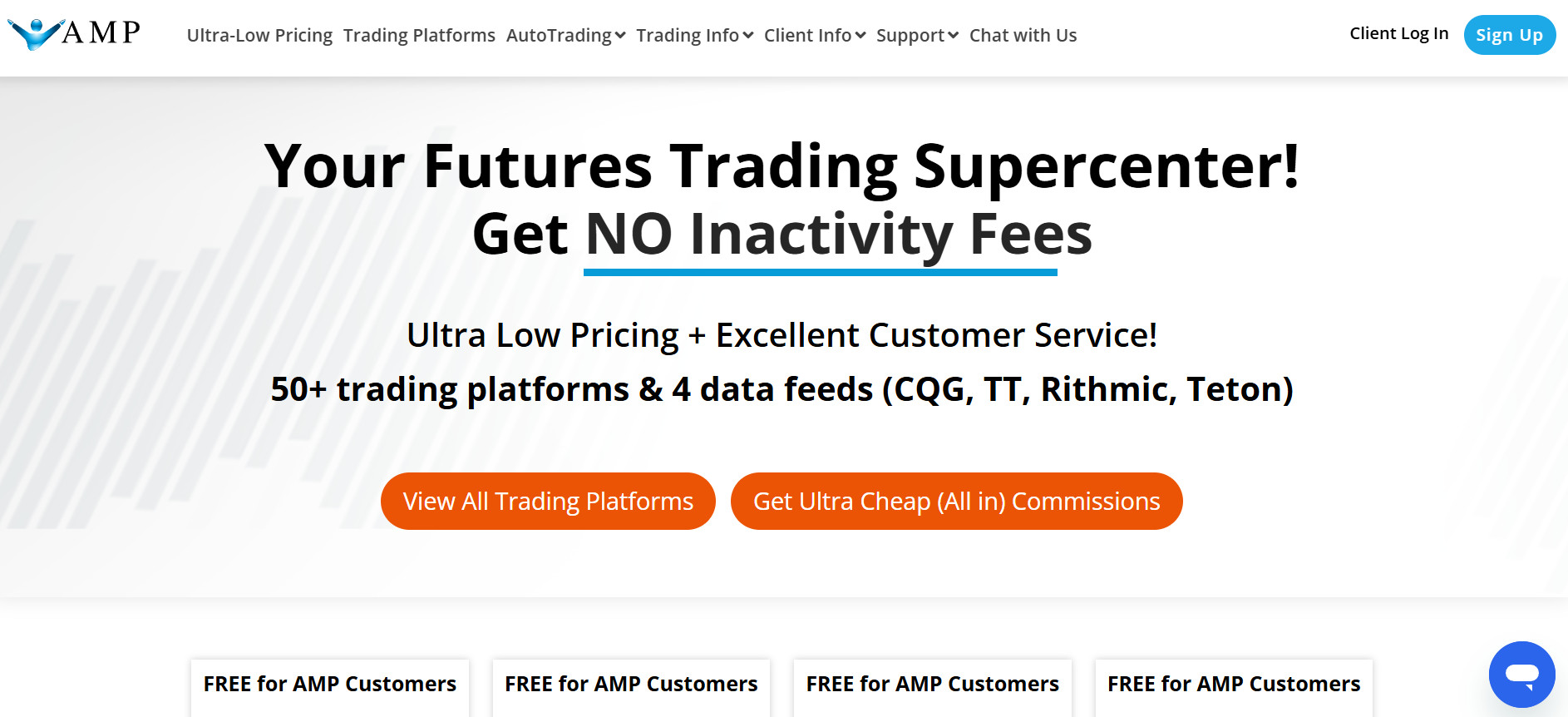

What is AMP?

AMP Global Clearing LLC, operating under the trading name AMP, is a US-based futures brokerage firm that is fully authorized as a Futures Commission Merchant and regulated by respected financial authorities Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). This regulatory oversight ensures that AMP adheres to strict compliance standards and financial transparency.

The firm’s product offering includes a wide range of futures contracts, as well as access to commodities and options on futures.

AMP provides access to a broad selection of advanced trading platforms, including MetaTrader 5, and third-party platforms such as CQG, Rithmic, TradingView, and more.

AMP Pros and Cons

AMP offers a range of advantages for investors, particularly those focused on futures markets. Its low commission structure, access to micro and mini contracts, and support for powerful trading platforms like MetaTrader 5 and CQG make it appealing to all levels of traders. AMP is also regulated by reputable authorities, adding a layer of security and trust.

For the cons, the broker’s product range is heavily centered on futures, with limited availability of traditional stocks or ETFs, and some users may find the platform selection and data feed setup complex at first. Overall, AMP is a strong choice for cost-conscious futures traders who value direct market access and platform flexibility.

| Advantages | Disadvantages |

|---|

| Strict regulation by NFA and CFTC | No 24/7 customer support |

| Access to Trade Real Futures | Limited asset classes |

| Professional trading | Not ideal for beginners |

| Robust trading platforms | |

| Ultra-low commissions | |

| Good research tools | |

| Demo account available | |

AMP Features

AMP offers a robust suite of features tailored to the needs of futures traders. With access to a range of global exchanges, advanced trading platforms, and low-cost commission structures, AMP provides a flexible and transparent trading environment. Below is a comprehensive list of its key features:

AMP Features in 10 Points

| 🏢 Regulation | NFA, CFTC |

| 🗺️ Account Types | Individual, Joint, IRA, Corporate, LLC, Partnership, Trust Accounts |

| 🖥 Trading Platforms | MT5, TradingView, CQG, Rithmic, TT, and more |

| 📉 Trading Instruments | Futures Contracts, Commodities, Options on Futures |

| 💳 Minimum Deposit | $100 |

| 💰 E-mini and Standard Contract | $1.25 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP |

| 📚 Trading Education | Trading Lessons, Videos & Guides, Market News and Analysis |

| ☎ Customer Support | 24/5 |

Who is AMP For?

AMP is ideal for active traders who are focused on futures trading. Its low-cost commission structure, wide selection of advanced trading platforms, and direct access to major global exchanges make it especially attractive for day traders, scalpers, and algorithmic traders. Based on our findings, AMP is Good for:

- Real Futures trading

- Investing

- US clients

- Advanced traders

- Competitive commissions

- Professional trading

- Direct market access

- Day Trading

- Scalping

- Great trading tools

- MT5 platform trading

- Good learning materials

AMP Summary

In conclusion, AMP is a well-regarded futures brokerage firm that offers direct access to global exchanges, competitive commission rates, and a wide selection of professional trading platforms.

Regulated by the CFTC and NFA in the USA, the firm provides a secure and transparent environment for trading futures, options on futures, and commodities.

Overall, we found that AMP provides a competitive trading environment. However, we advise conducting your research and evaluating whether the firm’s offerings align with your trading needs.

55Brokers Professional Insights

AMP stands out due to its highly competitive all-in commission structure, exceptional platform variety, and strong commitment to transparency. The broker provides traders with direct access to a wide range of global futures exchanges, with no markup on data or routing fees, making it a cost-effective choice for high-frequency and professional traders.

Its support for multiple advanced platforms, such as MetaTrader 5, CQG, and others, enables deep customization, advanced analytics, and algorithmic trading.

Additionally, AMP’s focus on regulated operations under the CFTC and NFA, along with responsive customer support and comprehensive educational materials, makes it a reliable choice for serious futures traders.

Consider Trading with AMP If:

| AMP is an excellent Broker for: | - Trading of Real Futures.

- Access to trade via CME, Eurex, CBOT/CME exchanges.

- Lower Commission on Futures Trading.

- MT5 platform for Futures.

- Extensive range of research tools.

- Variety of trading strategies supported.

- Margin trading on Futures.

- No platform fee.

- Provides copy trading features.

- Suitable for professional traders and investors.

- Looking for reputable firm.

- Access to VPS.

|

Avoid Trading with AMP If:

| AMP might not be the best for: | - Looking to trade CFDs, ETFs, Stocks, etc.

- High leverage or margin multiplier is not available on Real Futures.

- Looking for broker with 24/7 customer support.

- Need a broker with trading services worldwide. |

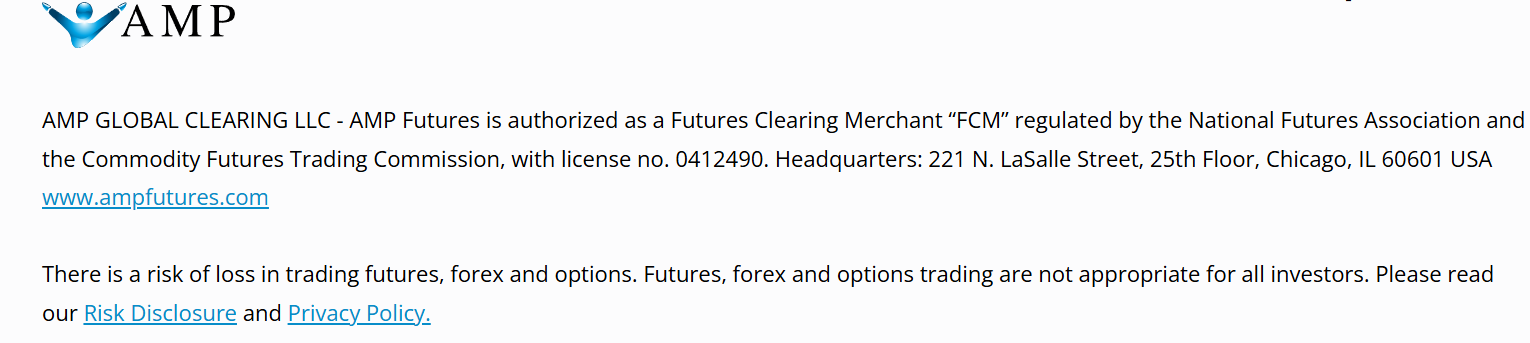

Regulation and Security Measures

Score – 4.7/5

AMP Regulatory Overview

AMP operates as a fully regulated Futures Commission Merchant in the United States, authorized and overseen by the CFTC and the NFA. This regulatory framework ensures that the broker adheres to strict financial, operational, and compliance standards, providing clients with a secure and transparent trading environment.

The firm’s commitment to regulatory integrity reinforces its reputation as a trustworthy futures trading broker.

How Safe is Trading with AMP?

Trading with AMP is safe due to its strong regulatory oversight and transparent business practices. As a registered Futures Commission Merchant, the firm must meet strict financial and compliance standards, including the segregation of client funds.

Additionally, the broker offers secure platforms and clear pricing with no hidden fees, reinforcing its reputation as a trustworthy and reliable broker in the futures trading industry.

Consistency and Clarity

AMP has built a solid reputation in the futures trading industry, backed by consistent performance, regulatory integrity, and positive feedback from a wide base of active traders.

User reviews often highlight the broker’s low commission structure, direct exchange access, and diverse platform support as major advantages, while some drawbacks mentioned include platform-specific learning curves and limited asset classes beyond futures and options.

While not known for financial awards or sponsorships, the broker maintains an active presence in the trading community through educational outreach, webinars, and platform partnerships.

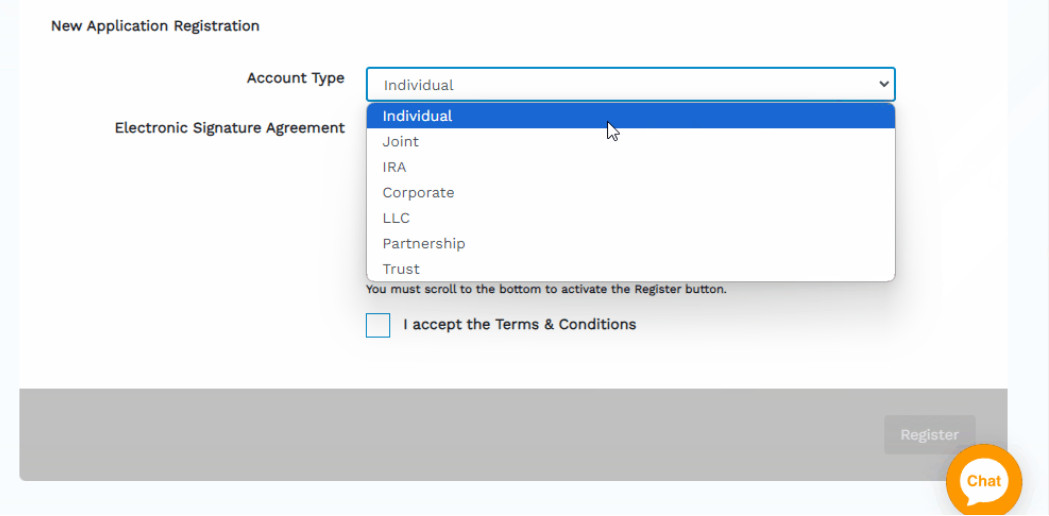

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with AMP?

AMP offers a comprehensive range of account types to cater to various trading needs and structures, including Individual, Joint, IRA, Corporate, LLC, Partnership, and Trust Accounts.

Additionally, the firm provides demo accounts, fully funded virtual environments for new and experienced traders to practice strategies, explore platform features, and simulate real-market conditions without risking actual capital.

Individual Account

AMP’s Individual Account is tailored for retail traders looking for straightforward access to futures and options on futures markets. It requires a minimum deposit of $100 to activate live trading, covering both trading connectivity and platform usage.

While that balance gets you started, actual trading depends on day-trading margin requirements. The broker charges clear, all-in commissions, exchange, clearing, routing, and regulatory fees, and imposes no inactivity or platform subscription fees, making it a cost-effective option for active traders.

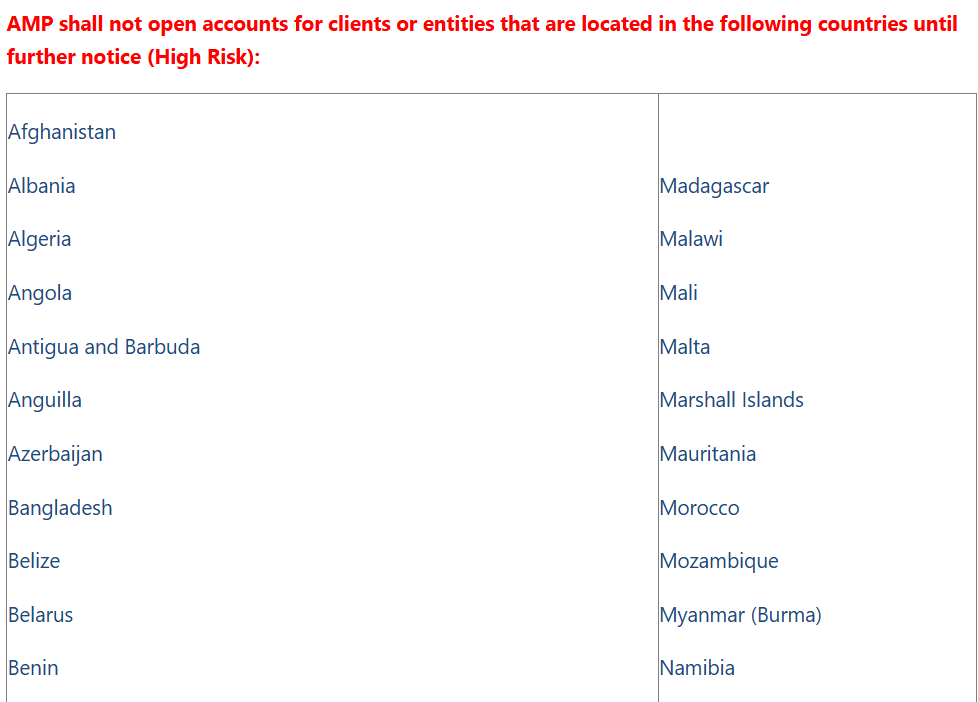

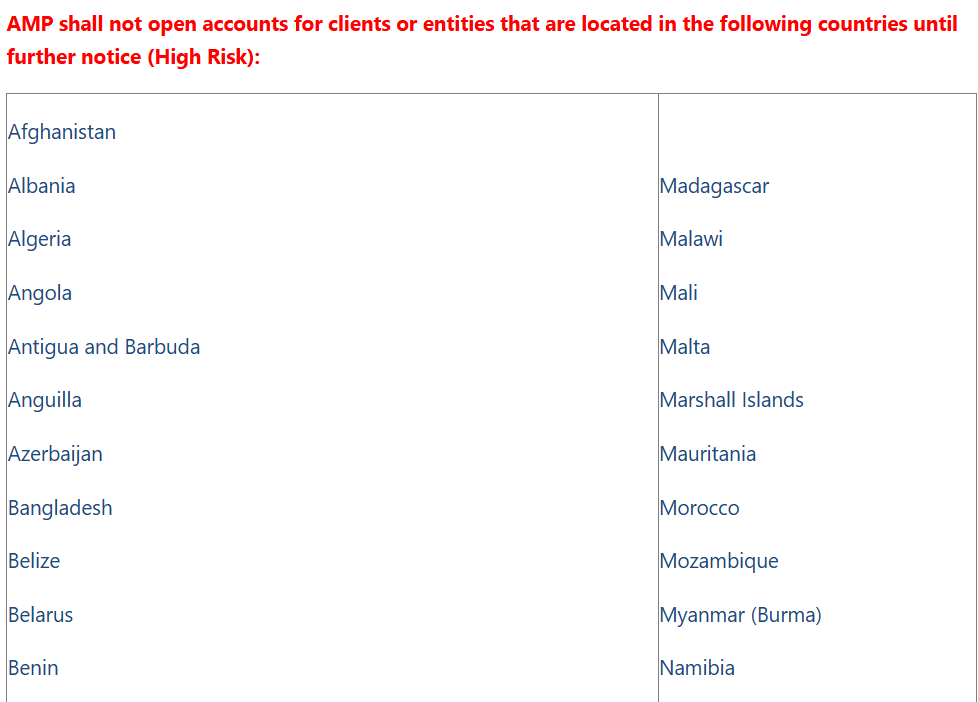

Regions Where AMP is Restricted

AMP maintains strict regional compliance based on international regulations and internal risk policies. As a result, the broker restricts account openings from various countries and jurisdictions, including:

- Some EU countries

- Afghanistan

- Albania

- Algeria

- Angola

- Antigua and Barbuda

- Anguilla

- Azerbaijan

- Bangladesh

- Belize

- Belarus

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Cape Verde

- Central African Republic, and more

Cost Structure and Fees

Score – 4.7/5

AMP Brokerage Fees

AMP offers a competitive and transparent fee structure, making it a cost-effective choice for active futures traders. The fees include exchange, clearing, and regulatory fees, with rates starting as low as $0.15 per side based on trading volume.

AMP does not charge inactivity or platform subscription fees, though market data and certain advanced platforms may incur additional monthly costs. Overall, AMP’s pricing is straightforward and tailored to meet futures traders’ needs.

AMP offers some of the most competitive broker fees in the futures trading industry, with transparent pricing for all levels of traders.

For Micro Contracts, commissions typically start as low as $0.37 per side, while E-Mini or Standard Contracts generally range from $0.50 to $1.25 per side.

AMP provides competitive exchange market data fees, which are billed monthly per user and depend on the selected data feed and exchange. For example, the CME bundle (Level 2) costs $41 per month through Rithmic or TT.

Non-U.S. exchanges like EUREX, ICE, and SGX have varying fees, such as €20 per month for EUREX. AMP charges the full monthly fee even if the data is enabled for only part of the month.

AMP Futures does not charge traditional swap or rollover fees associated with holding futures positions overnight. This makes it advantageous for traders who prefer to maintain positions beyond a single trading day without incurring additional costs.

How Competitive Are AMP Fees?

AMP’s fees are highly competitive within the futures trading industry, offering a transparent pricing model that appeals to both retail and professional traders. The broker’s fee structure allows traders to clearly understand their expenses beforehand.

This combination of transparency, affordability, and flexibility makes AMP an attractive option for those seeking cost-effective access to global futures markets.

| Fees | AMP Fees | AvaFutures Fees | TradeStation Fees |

|---|

| Broker Fee - E-mini and Standard Contract | $1.25 | $0.49 | $1.50 |

| Exchange Fee | Defined by Exchange | Defined by Exchange | Defined by Exchange |

| Trading Platform Fee | No | No | Yes |

| Data Fee | Yes | No | Yes |

| Fee ranking | Low | Low | Average |

AMP Additional Fees

While AMP does not impose inactivity or maintenance fees, certain services may incur additional costs. For instance, wire withdrawals, both domestic and international, are subject to a $30 fee per transaction.

Additionally, if an account balance falls below $100, market data access will be suspended until the balance is restored. To ensure clarity on all potential costs, traders should review the comprehensive list of fees provided on the broker’s website.

Trading Platforms and Tools

Score – 4.8/5

AMP offers a comprehensive range of trading platforms and tools to accommodate the various trading styles and experience levels. Traders can access the popular MetaTrader 5 for its intuitive interface, advanced charting, and automated trading capabilities.

Web-based enthusiasts can use TradingView, known for its powerful charts and social trading features. For professional-grade performance, the broker supports leading platforms like CQG, Rithmic, and Trading Technologies (TT), offering low-latency data and deep market access.

Additional platforms such as MultiCharts, Sierra Chart, BookMap, and Jigsaw provide further flexibility for technical analysis and algorithmic strategies, making AMP a well-equipped broker for futures traders of all levels.

Trading Platform Comparison to Other Brokers:

| Platforms | AMP Platforms | Fidelity Platforms | Freetrade Platforms |

|---|

| MT4 | No | No | No |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

AMP Web Platform

AMP offers access to the MetaTrader 5 Web Platform, providing traders with a convenient way to trade futures directly from their browser, no software installation needed.

The web platform provides all the essential features of the desktop version, including real-time quotes, interactive charts, technical indicators, trading signals, and one-click trading. It also supports advanced order types, market depth, and algorithmic and automated trading.

Main Insights from Testing

Testing the MT5 platform with AMP reveals a smooth, responsive trading experience backed by deep market access and robust execution speeds. The platform stands out for its advanced charting tools, support for algorithmic trading via Expert Advisors, and comprehensive range of order types.

AMP’s integration ensures reliable data feeds and minimal latency. Overall, MT5 offers a professional-grade trading environment, both powerful and accessible.

AMP Desktop MetaTrader 4 Platform

AMP does not offer the MT4 platform. Instead, the firm focuses on the more advanced MetaTrader 5 platform, which supports multi-asset trading, enhanced charting tools, and improved execution capabilities.

CQG Desktop Platform

CQG Desktop is a browser-based trading platform that delivers advanced charting, market data, and execution tools without requiring any software installation.

The platform offers an intuitive interface that integrates essential features like real-time charts, account monitoring, heat maps, and customizable layouts. It caters to traders who need efficient access to futures markets with reliable performance and visually rich tools.

AMP MobileTrader App

The MT5 mobile platform provides traders with the flexibility to manage their futures trades on the go. The app offers real-time quotes, advanced charting tools, multiple order types, and account management features, all optimized for smartphones and tablets.

With a user-friendly interface and seamless synchronization with the desktop platform, the app allows traders to stay connected to the markets anytime and anywhere.

Trading Instruments

Score – 4.5/5

What Can You Trade on AMP’s Platform?

On AMP’s platform, traders can access a diverse range of financial products focused on futures trading across major global exchanges. This includes a variety of futures contracts such as equity indices, commodities, currencies, interest rates, and energy products.

Additionally, the broker offers options on futures, enabling more advanced trading strategies like hedging and spreads.

Main Insights from Exploring AMP’s Tradable Assets

Exploring AMP’s tradable assets reveals a well-rounded offering that meets the needs of diverse trading styles and strategies. The broker provides access to a comprehensive set of futures markets.

This variety allows traders to diversify their portfolios and take advantage of different market conditions. Overall, the broker’s asset range supports speculative and hedging approaches, making it a good choice for futures traders.

Margin Trading at AMP

AMP offers margin trading with flexible and competitive requirements, starting from as low as $40 for Micro E-mini contracts and around $400 for E-mini contracts during intraday trading.

These reduced day trading margins allow traders to access a higher multiplier while the markets are open. For overnight positions, the broker enforces the full exchange maintenance margin, which is significantly higher to reflect increased risk.

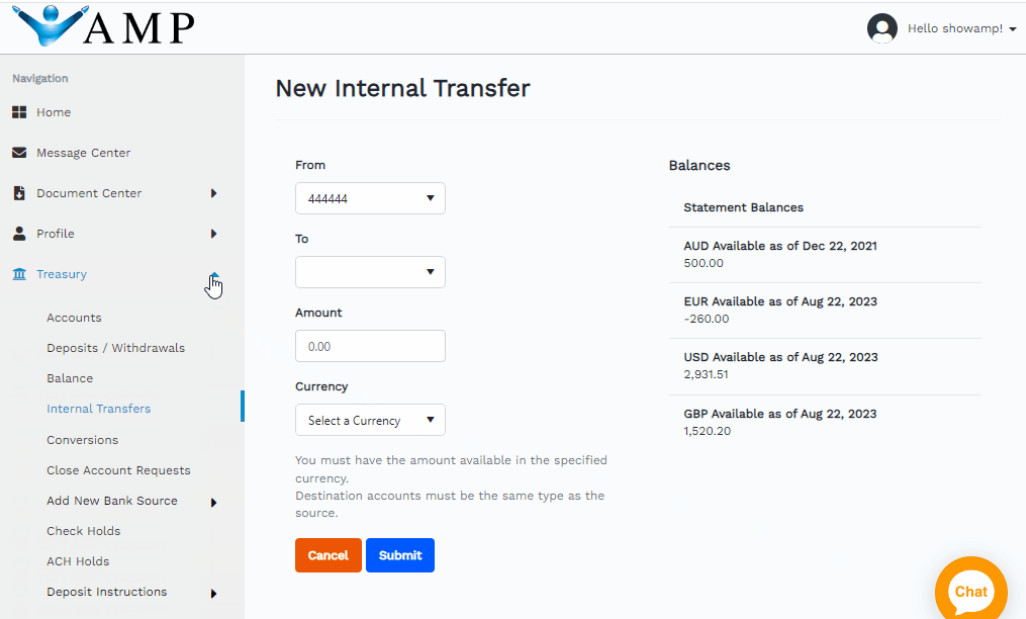

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at AMP

AMP offers several ways to deposit money into your account. These methods include:

AMP Minimum Deposit

To open a live trading account with the broker, clients need to deposit $100 as an initial deposit amount to activate their trading account.

Withdrawal Options at AMP

AMP offers two withdrawal methods: Bank Wire Transfer and ACH Transfer, with processing times varying depending on the method. Wire transfers are processed on the same business day if requested before 1 PM CST. ACH transfers are also processed the same day, but may be subject to varying bank processing times.

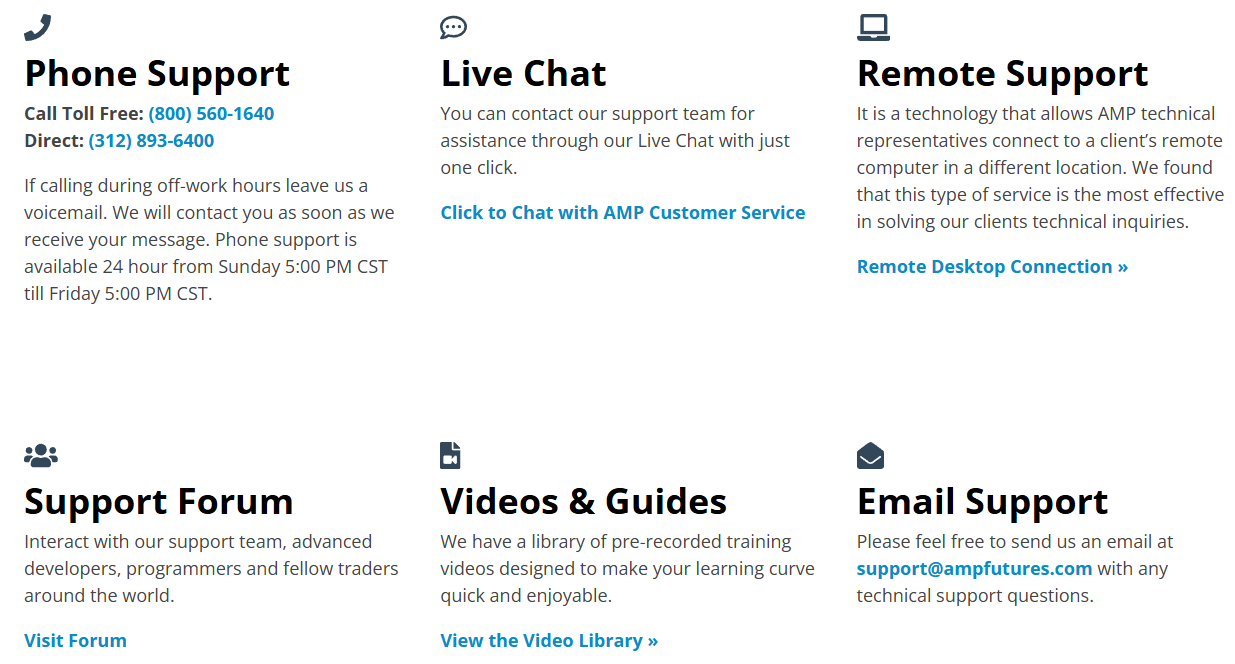

Customer Support and Responsiveness

Score – 4.5/5

Testing AMP’s Customer Support

The broker offers 24/5 customer support via phone, live chat, email, remote support, etc. Also, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

Contacts AMP

AMP provides phone support via its toll-free line at (800) 560‑1640 and a direct line at (312) 893‑6400 for more immediate assistance. For email inquiries, contact the support team at support@ampfutures.com for technical questions.

Research and Education

Score – 4.7/5

Research Tools AMP

AMP offers an extensive range of research and trading tools across its platforms and website, catering especially to professional and futures-focused traders.

- On the website and client portal, the broker provides an economic calendar, live quotes, and charts, complemented by video guides, FAQs, and a support forum.

- MT5 offers a range of charting tools, diverse timeframes, trading signals, technical indicators, and automated trading features that empower traders to recognize market trends and optimize their approaches to market entry and stop-loss strategies.

- For real-time trading and deeper analysis, AMP supports over 50 platforms, many free to clients, which provide advanced analytics, custom charting, and multiple order interfaces.

- Trading platforms like BookMap, TradingView offer unique features like order-flow visualization, automated strategy testing, professional-level charting, and backtesting.

Together, these tools give traders robust access to real-time market data, technical and fundamental analysis, and strategy development, all within a highly customizable and professional-grade environment.

Education

AMP provides a good range of educational resources, including comprehensive trading lessons, step-by-step video tutorials, and platform setup guides to help users get familiar with futures trading and various platforms.

AMP also features a dedicated YouTube channel, making it easier for traders to explore tools and strategies.

Portfolio and Investment Opportunities

Score – 3.5/5

Investment Options AMP

AMP focuses primarily on futures trading and does not offer traditional long-term investment products like stocks, mutual funds, or bonds. Therefore, investment is not exactly the main objective of the firm.

Account Opening

Score – 4.5/5

How to Open AMP Demo Account?

Opening a demo account with AMP is quick and free, giving traders a risk-free way to explore futures trading.

- Choose your preferred platform.

- For MetaTrader 5, download the platform from AMP’s official site.

- Launch the platform and go to “Open an Account.”

- Select the demo server.

- Fill in your name, email, and phone number.

- Verify via the code sent to your email/SMS.

How to Open AMP Live Account?

Opening an account with a broker is quite an easy process, as you can log in and register with AMP within minutes. Just follow the sign-up page and proceed with the guided steps:

- Select and click on the “Sign Up” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Additional Tools and Features

Score – 4.4/5

In addition to its main trading platforms, AMP offers several valuable tools and features to enhance the trading experience.

- These include a real-time margin calculator, an exchange margin requirements list, and performance tracking dashboards.

- Traders also benefit from order routing tools, platform comparison guides, and detailed fee breakdowns to help them choose the most cost-efficient setup. Combined, these tools support better planning, execution, and overall decision-making.

AMP Compared to Other Brokers

Compared to other major competitors, AMP stands out as a specialized futures trading firm offering a strong mix of advanced platforms and competitive pricing.

While it may not provide the extensive asset variety of multi-asset brokers like Interactive Brokers or Fidelity, AMP is focused on futures, commodities, and options on futures, ideal for traders in these markets.

Its platform diversity, including MT5, CQG, Rithmic, and TradingView, provides greater flexibility compared to competitors that offer fewer third-party integrations.

Overall, AMP provides a user-friendly structure, solid educational and research tools, and a cost-effective fee model tailored for active and professional traders.

| Parameter |

AMP |

AvaFutures |

Interactive Brokers |

TD Ameritrade |

Fidelity |

E-Trade |

WeBull |

| Broker Fee – Futures E-mini and Standard Contract |

$1.25 |

$0.49 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$1.50 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Low |

Low |

Average |

Low |

Average |

Average |

| Trading Platforms |

MT5, TradingView, CQG, Rithmic, TT, and more |

MT5 |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Active Trader Pro, Fidelity Go, Fidelity.com Web |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform |

| Asset Variety |

Futures Contracts, Commodities, Options on Futures |

Futures |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, Mutual Funds, ETFs, Options, Bonds, CDs, Precious Metals, Crypto |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, ETFs, OTC, ADRs, Crypto, Forex, Shares, Futures |

| Regulation |

NFA, CFTC |

ASIC, MiFID, Bank of Ireland, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

SEC, FINRA, IIROC |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Excellent |

Excellent |

Good |

Excellent |

Good |

Excellent |

| Minimum Deposit |

$100 |

$100 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker AMP

AMP is a US-regulated Futures Trading Broker offering low-cost, direct market access to major global exchanges. Known for its competitive commission structure and wide selection of advanced trading platforms like MetaTrader 5, CQG, and Rithmic, AMP caters primarily to active and professional traders.

It specializes in Futures trading with flexible margin requirements and transparent pricing. The broker also provides robust research tools, learning materials, and strong risk management features.

With diverse account types and competitive trading conditions, AMP is well-suited for traders focused on a cost-efficient futures trading environment.

Share this article [addtoany url="https://55brokers.com/amp-global-review/" title="AMP"]