Advertising Disclosure

- Our Review

- Alpha Capital Group 2025 User Reviews

- Alpha Capital Group 2025 News

- What is Alpha Capital Group?

- Alpha Capital Group Pros Cons

- Is Alpha Capital Group Legit?

- Alpha Capital Group Challenge

- Funded Account

- Account Conditions

- Payout

- Alpha Capital Group Alternative

What is Alpha Capital Group Prop Firm?

Alpha Capital Group is a trading education and training platform that offers simulated or virtual trading experiences to its customers. It focuses on helping traders learn effective trading strategies without engaging in actual financial transactions, thus not requiring authorization for regulated investment activities. Alpha Capital Group seeks to fund talented traders with live trading accounts, offering up to $200,000 with the potential for capital growth plans up to $2,000,000 for those demonstrating effective risk management and market responsiveness.

Alpha Capital Group, as a proprietary trading firm, provides a distinctive opportunity for individuals to participate in actual trading with minimal personal funds required. To become a funded trader, which means trading with the company’s funds, all a trader needs to do is successfully complete a test or challenge to gain access to a funded account. Once achieved, they can trade with a company account like a professional trader. Read more about Prop Trading here.

| Alpha Capital Group Advantages | Alpha Capital Group Disadvantages |

|---|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| High profit share | No Free Trail |

| MT5 with EAs | |

| Refundable Fee once you become Funded Trader | |

| Good Education |

Is Alpha Capital Group Legit?

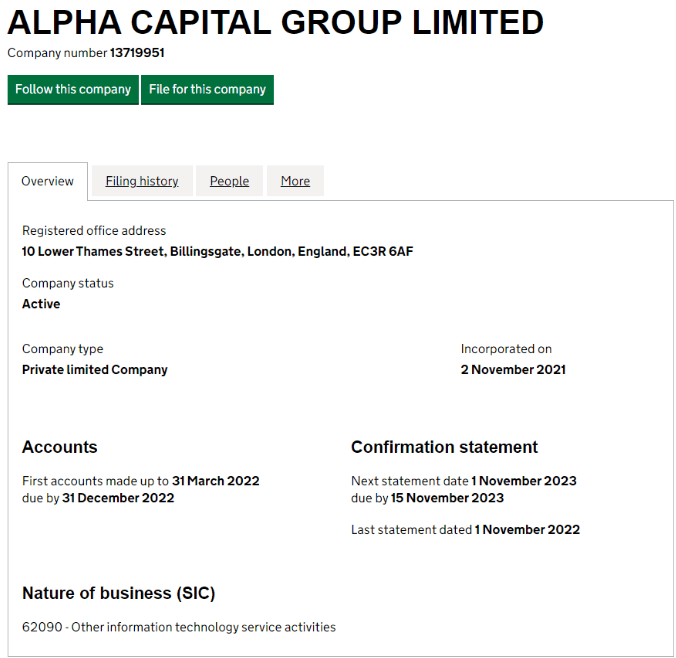

Alpha Capital Group is based in the United Kingdom, which indicates its operations and services are rooted in a major financial hub. The company’s UK base adds to its credibility, offering a strategic location known for strict financial regulations and a strong legal framework.

- However, as a typical rule, compared to Forex Brokers, Prop Trading firms are not operating under the Forex Broker license, therefore, are much less regulated and are not overseen by the industry regulators, as such are not highest level safe, since company is the one who maintains the whole operation and giving Funds to run Trading activity, so is important to understand all risks involved.

Is Alpha Capital Group Scam?

We examined the official information concerning Alpha Capital Group and found no evidence suggesting that the company operates as a scam. However, it’s important to note that proprietary trading firms generally do not fall under strict regulation by financial authorities, making it challenging to categorically determine the legitimacy or the true nature of such firms.

As our professional advise, it is best to learn well about Prop Trading, understand risks and choose Company with a good reputation also one operate for many years so the proposal is more stable. Yet, since you do not invest much money to trading but just pay subscription fees the potential losses still considered lower if compared to engaging into Real Trading with your own funds.

Alpha Capital Group Challenge Evaluation Rules

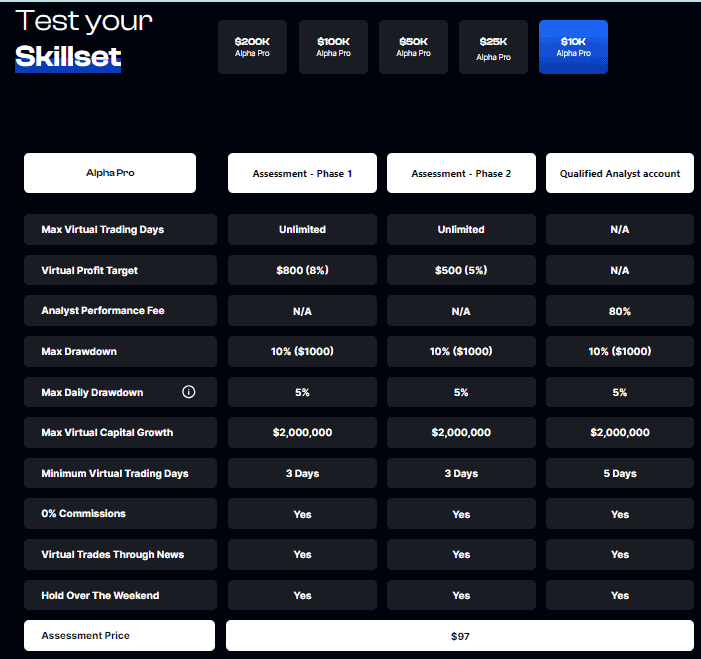

- The primary objective of the Challenge or Test is to demonstrate your trading proficiency. At Alpha Capital Group, the Evaluation process is divided into two phases, each with profit targets determined by the chosen Account Size. Generally, Phase 1 rules are more stringent, whereas Phase 2 offers slightly broader conditions, particularly concerning Drawdown, aimed at showcasing the sustainability of your trading activities over time.

Account Balance and Registration Fee

You must first choose the Account Balance for which you wish to qualify. The conditions of the challenge vary slightly depending on the size you select. Additionally, this choice influences the registration fee payable to the company to participate in the challenge. However, Alpha Capital Group provides a refund of the fee once you attain the status of a Funded Trader. Please refer to our Registration Fee comparison table below:

- Alpha Capital Group’s evaluation process is designed to assess and qualify traders before providing them with funded trading accounts.

- Alpha Capital Grou provides quite a diverse range of starting balance options which includes from $10,000 to $200,000

| Fees | Alpha Capital Group | FTMO | The Funded Trader |

|---|---|---|---|

| Minimum Account Size | $25,000 | $10,000 | $50,000 |

| Fee | $250 | €155 | $289 |

| Maximum Account Size | $2,000,000 | $200,000 | $400,000 |

| Fee | $15,000 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

Profit Target

Maximum Loss

Minimum Trading Period

Alpha Capital Group evaluation process for traders looking to manage funded accounts does not impose a minimum trading period requirement.

See the detailed table with Alpha Capital Group Challenge conditions based on Account Size:

Free Trial

Alpha Capital Group does not offer a free trial for their evaluation program. This is consistent with some proprietary trading firms that provide free trials, but the firm is not among them according to a recent comparison of prop firms and their offers regarding free trials.

Alpha Capital Group Funded Account

Profit Split

Payout and Withdrawals

Payouts after the first can be requested monthly, and the process for withdrawing profits involves submitting a request to the company, which then deposits the trader’s share of the profits into their account, allowing for various withdrawal methods

Withdrawal Method

Account Conditions

Trading Instruments

Alpha Capital Group Commission

The platform promotes a $0 commission policy on trades, real-time pricing for strategy assessment, and offers unlimited trading days to optimize trader performance without time constraints

Leverage

Alpha Capital Group offers leverage of up to 1:100 on its trading platforms. This level of leverage allows traders to control a large position with a relatively small amount of capital, providing the potential to amplify profits. However, it also increases the risk of losses, so it’s essential for traders to use leverage carefully and consider their risk management strategies.

Alpha Capital Group App Platform

Alpha Capital Group provides its traders with access to the MetaTrader 5 (MT5) platform, renowned for its comprehensive trading and analytical features. MT5 offers a customizable trading environment, advanced technical analysis tools, fundamental analysis capabilities, and fast execution speeds. It supports a wide array of order types and trading modes, making it suitable for traders of all experience levels.

Trading Conditions

Alpha Capital Group outlines specific strategy conditions and rules for traders in its evaluation and funded accounts. The trading rules are designed to maintain a fair and realistic trading environment. Key aspects include:

- These conditions include restrictions on the use of certain strategies such as martingale, prohibiting group copy trading and arbitrage, latency, front-running price feeds, high-frequency trading, and exploiting mispricing.

- Traders are limited to one active account with tradeable assets including FX, indices, and commodities, and must adhere to position size limits. Additionally, qualified traders face similar rules to those in the assessment stages, with the virtual profit target rule removed and a maximum lot exposure limit introduced.

Alpha Capital Group Promotions

Alpha Capital Group Alternative Brokers

It’s advisable to assess and compare proposals with those offered by other Proprietary Trading Firms. Some well-known firms may offer similar conditions or cater to specific traders with a broader range of instruments and platforms beyond MetaTrader. However, Alpha Capital Group also offers unique benefits. Here, we outline a range of alternatives and provide a table comparing Alpha Capital Group with other companies.

- FTMO — Great Swing Trading Prop Firm

- Lux Trading Firm — Good for USA Trading on Funded Accounts

- True Funded Trader — Best for Higher Account Size

No review found...

No news available.