- What is Admiral Markets?

- Admiral Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

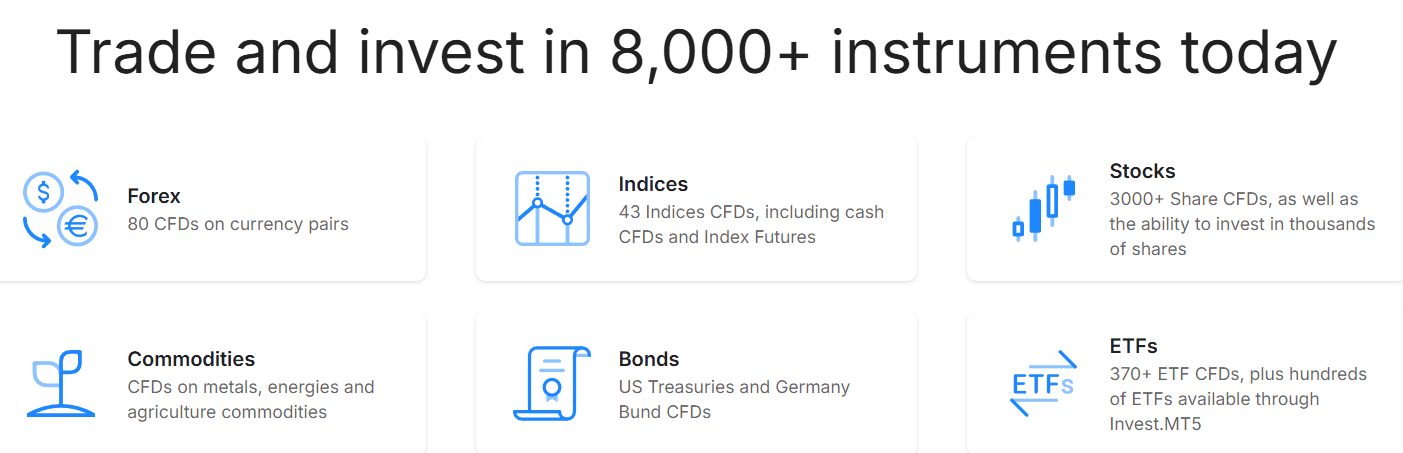

- Trading Instruments

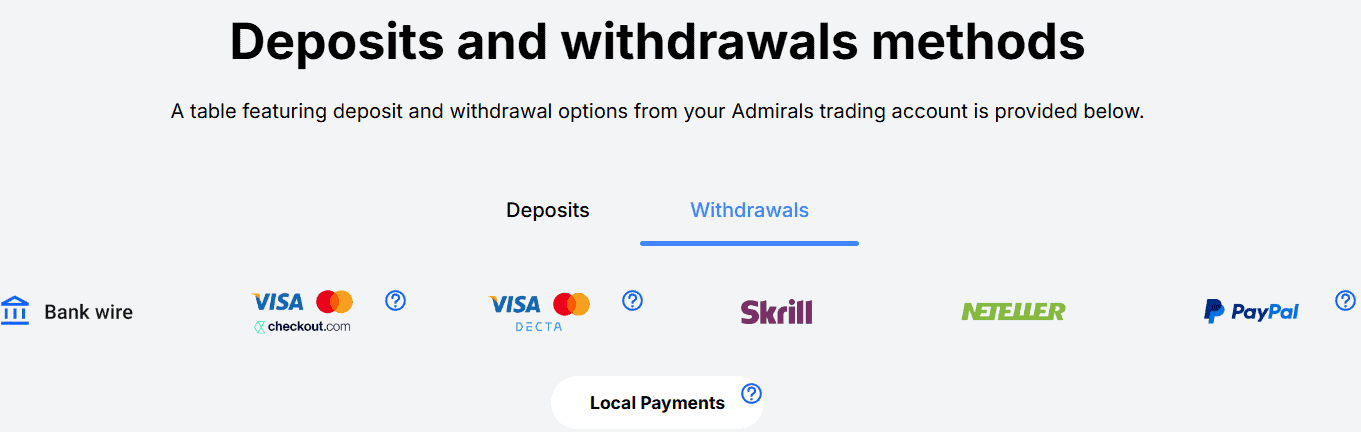

- Deposit and Withdrawal Options

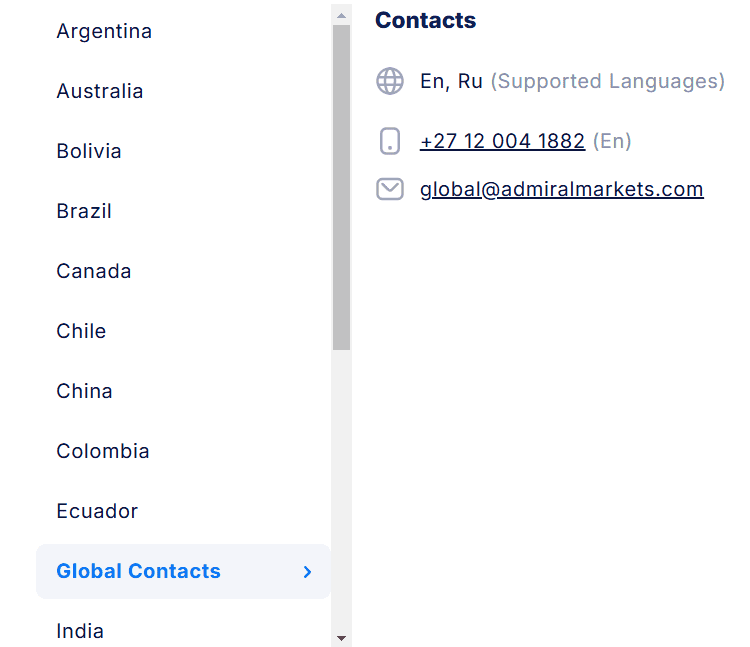

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Admiral Markets Compared to Other Brokers

- Full Review of Broker Admiral Markets

Overall Rating 4.5

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.6 / 5 |

What is Admiral Markets?

Founded in 2001, Admiral Markets (Admirals) is a well-established brand in investment financial services and one of the largest Forex and CFD brokers. The company continuously expands its offerings globally, with its headquarters in the UK and offices in Cyprus, Estonia, and Australia. On the eve of its 20th anniversary, Admiral Markets was rebranded to Admirals. The broker announced, that although there are changes in logo, name, and look, their commitment will stay the same. Admiral Markets aims to provide a functional software and high-quality offerings through transparent pricing and quick execution.

Admiral Markets operates using an STP and NDD execution model, though the specific conditions may vary depending on the entity and jurisdiction you are trading with.

We found Admiral markets providing competitive low spreads with deep liquidity, and no restriction on trading styles or strategies, which is good for different styles and sizes.

Admiral Markets Pros and Cons

Admiral Markets is a well-regarded broker with strong regulatory oversight and a solid reputation. Account opening is straightforward and fully digital. Based on our research, Admiral Markets offers some of the lowest spreads in the industry. Additionally, all trading strategies are supported, and traders can choose between the MT4 and MT5 platforms. The broker provides excellent educational resources, research tools, and 24/7 customer support. Strategies like automated trading and copy trading are also available, making Admiral Markets beginner-friendly.

There are only a few negative aspects of Admiral Markets. The conditions and proposals vary according to the entity rules also some deposit methods will add on commission in some jurisdictions, so is good to verify these conditions precisely. Furthermore, some traders have shared negative experiences on our website and other sources, thus it is better to check the broker’s conditions before getting started.

| Advantages | Disadvantages |

|---|

| Long history of operation and good record | Some deposit methods will have additional fees |

| Heavily regulated and well-regarded broker | Conditions and proposal may vary according to the entity rules |

| No restrictions on Strategies | |

| Mainstay on famous MT4 and MT5 with superior edition available | |

| 24/7 support | |

| Account suitable for beginners or professional investors | |

| Great education and leading Dow Jones analysis for free | |

Admiral Markets Features

Admiral Markets is a broker with a global presence and good standing that has a vast community of traders. With top-tier licenses, the broker provides robust financial security and various customer care policies. Admiral Markets provides high-level trading with innovative tools, advanced functionality, and a secure environment. The key features of the broker include, but are not limited to, the following:

Admiral Markets Features in 10 Points

| 🗺️ Regulation | ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

| 🗺️ Account Types | Trade.MT5, Invest.MT5, Zero.MT5, Trade.MT4, Zero.MT4 |

| 🖥 Trading Platforms | MT4, MT5, Admirals Platform, Admirals Mobile App |

| 📉 Trading Instruments | Forex, Stocks, Commodities, Indices, ETFs, Bonds |

| 💳 Minimum deposit | $1 |

| 💰 Average EUR/USD Spread | 0.6 pips |

| 🎮 Demo Account | Available |

| 💰 Base currencies | USD, EUR, JOD, AED, GBP |

| 📚 Trading Education | Trading Academy |

| ☎ Customer Support | 24/7 |

Who is Admiral Markets For?

Based on Our Expert findings Admiral Markets is suitable for a wide range of traders as its offerings are quite versatile with robust features and services. Find what Admiral Markets is good for:

- Experienced traders

- Beginners

- Run Scalping

- Those who prefer the MT4 and MT5 platform

- EAs trading

- Low Spreads

- Copy trading

- Suitable for a Variety of Strategie

- Looking for a wide range of instruments

Admiral Markets Summary

Admiral Markets is a highly regulated and respected online broker. It offers access to deep liquidity from top-tier providers, ensuring high-speed order executions and the ability to start trading with a relatively low initial deposit. The broker also employs an attractive pricing strategy. Technical solutions and optimizations are implemented intelligently, utilizing the industry-leading MT4 and MT5 platforms.

55Brokers Professional Insights

Admiral Markets with its large community of clients from all over the world, and over two decades in the market, is a trustworthy broker with enhanced conditions that might suit wide range of trading demands. We find Admiral Markets a perfect match for beginners at most, due to almost global coverage and favorable offering. Although the broker offers enhanced technologies that perfectly suit traders with experience too with more complex strategies, also Investors since there is invest account available with good diversification too, actually quite rare proposal among Forex brokers. Admiral Markets is a favorable broker to start with due to its extensive educational and research tools and resources, that guide clients from zero to success while costs and conditions are all good.

The fee structure, account selection, and platform availability are also quite versatile, with good diversification of trading products that meeting different needs and preferences. Admiral Markets also has additional features and tools that make the trading process more innovative, yet platforms are mainly offered on MetaTrader technology so if you’re not a fan of that software might better to check other Brokers too. The only note for clients is that based on the entity the account is registered with, the conditions might vary, also in the past Admiral Markets had some concerns on operation via International branch, we would advise traders check all the details before starting.

Consider Trading with Admiral Markets If:

| Admiral Markets is an excellent Broker for: | - Traders giving preference to strict regulatory oversight

- Beginner traders

- Traders with experience

- Access to multiple assets and a wide range of instruments

- Different advanced strategies

- Low initial deposit availability

- Low spreads and commissions

- Extensive education to start from the beginning |

Avoid Trading with Admiral Markets If:

| Admiral Markets is not the best for: | - Traders looking for fixed spreads

- Looking for very high leverage

- Islamic accounts are available only for one account type

- Other platforms like cTrader, Proprietary software |

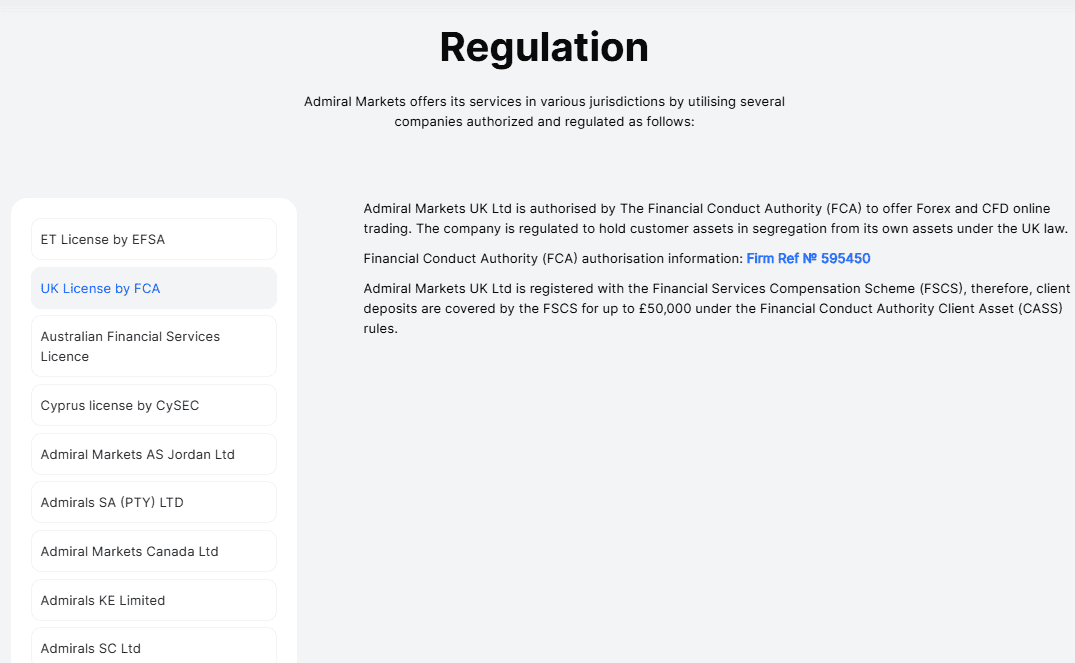

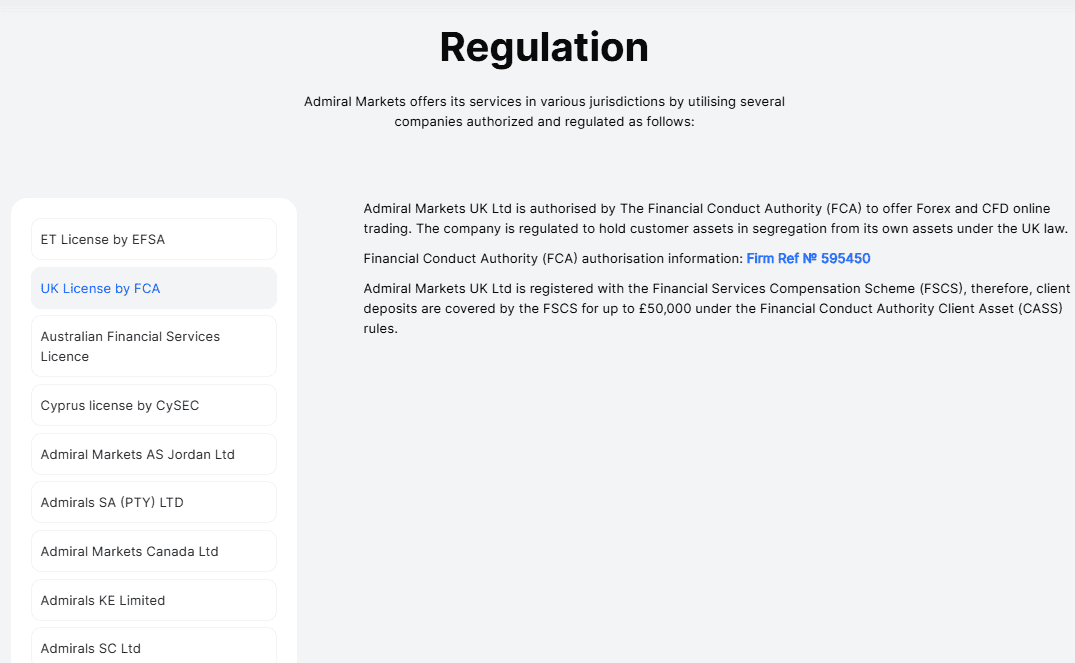

Regulation and Security Measures

Score – 4.6/5

Admiral Markets Regulatory Overview

Admiral Markets (Admirals) is heavily regulated by the world’s most reputable authorities including FCA in the UK, CySEC in Cyprus, and ASIC in Australia. The broker’s regulatory status and licenses confirm its legitimacy, ensuring that its operations and services are regulated, authorized, and closely monitored at every step. Therefore, traders and investors may trade with a confident state of mind knowing the broker is overseen, while various jurisdictions may apply slightly different requirements, yet equally safe trading environment.

How Safe is Trading with Admiral Markets?

In accordance with rules and restrictions, the company should follow certain operational models while providing a secure online trading service and a high level of financial confidence.

- All clients’ funds are kept separate from the company’s operating funds, in designated client bank accounts, ensuring it is protected and segregated.

- The broker enables additional insurance coverage of up to 100,000 USD.

- Admiral Markets UK Ltd is registered with the Financial Services Compensation Scheme (FSCS). This means that the FSCS covers client deposits for up to £50,000 under the Financial Conduct Authority Client Asset (CASS) rules.

Consistency and Clarity

Admiral Markets is an international company that has proved itself to be a responsible and trustworthy broker since its establishment. Since 2001, the broker has accumulated a large community, achieving their loyalty and trust.

Admiral Markets provides its traders with quality security measures and stability, which are due to the multiple licenses from some of the best regulatory authorities in the financial world. It is evident that through the years, Admiral Markets has consistently maintained high standards of services and operational transparency. Its lasting reputation is proof of commitment and consistent performance, constantly striving for improvements. We also considered real reviews clients left about the broker on different platforms, which are mostly positive. However, some have noted issues with Admiral Markets, including fees, platform suitability for professionals over beginners, or specific experiences with the broker. For this reason, it is best to conduct your own research and determine whether the broker meets your expectations.

Account Types and Benefits

Score – 4.5/5

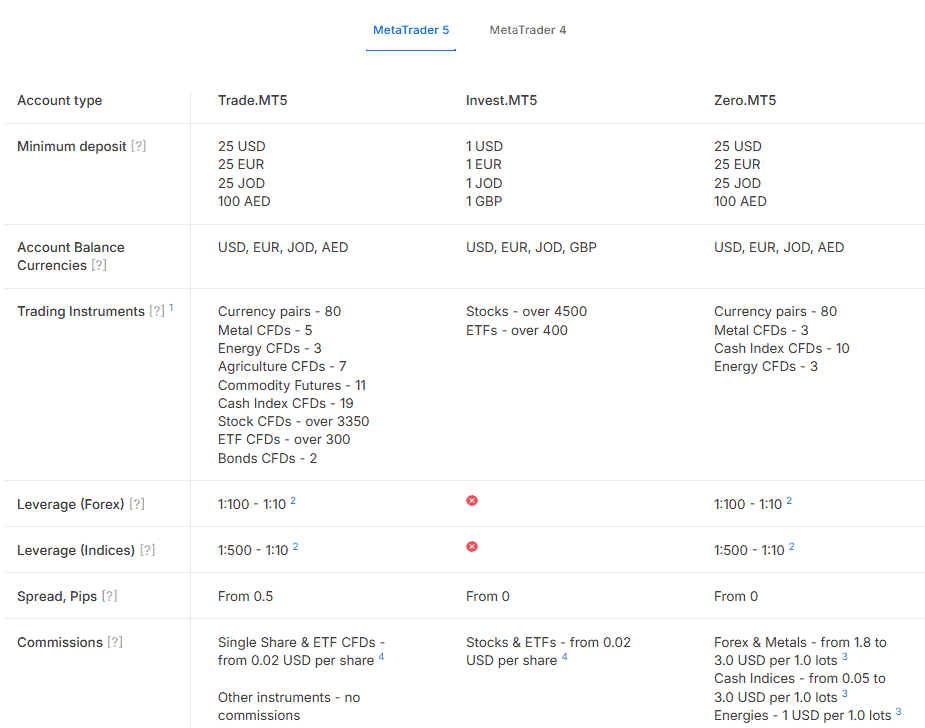

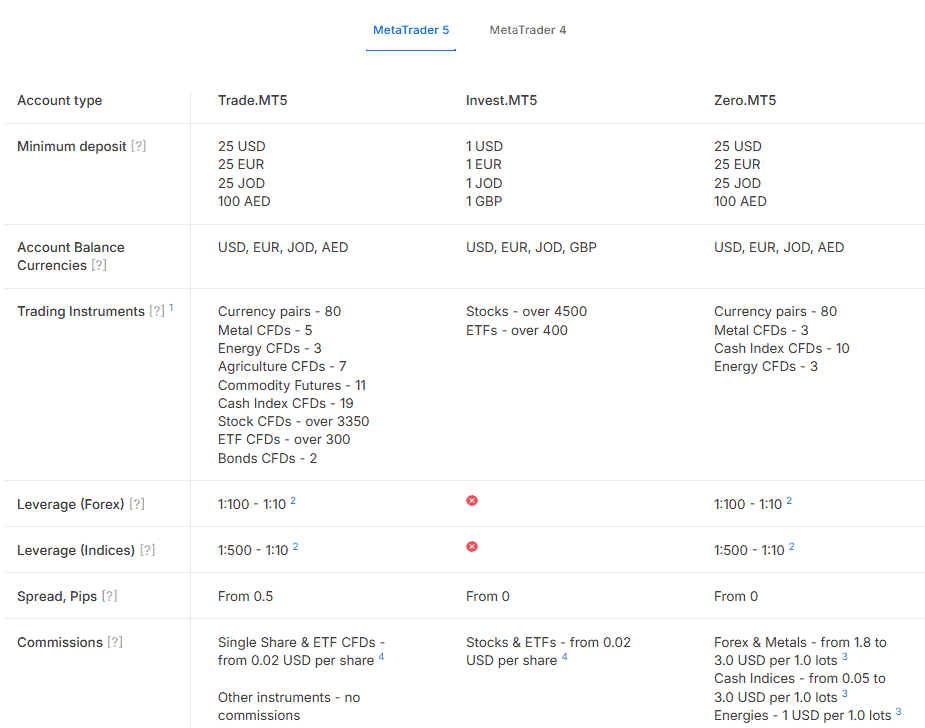

Which Account Types Are Available with Admiral Markets?

Admiral Markets offers a range of platform-based account types, with different conditions and features, meeting various needs and expectations. The MT5 platform-based accounts are Trade.MT5, Invest.MT5, and Zero.MT5. The MT4 platform-based accounts are Trade.MT4 and Zero.MT4.

Clients can choose an account based on the available minimum deposit, platform preference, leverage, fee structure, and other features that determine the trading experience. Note, that an Islamic account option is available only for the Trade.MT5 account type. The available leverage for most of the accounts is 1:100 for Forex, while for Indices it is up to 1:500.

Trade.MT5 Account

The Trade.MT5 allows to start trading with just a $25 initial deposit and gain access to multiple assets. Spreads start from 0.5 pips. Only for Single Share and ETF CFDs, there is a commission of 0.02 USD per share. For all the other instruments, there is no commission.

The Trade.MT5 account supports Market Execution, allowing access tighter spreads and faster trade completion without requotes. Besides, client have access to various strategies, like Hedging, and different useful tools like Economic Calendar, Trading Central, and Market News and Analysis by Dow Jones.

Invest.MT5 Account

Invest.MT5 is another account option by Admiral Markets, enabling trading with only a $1 minimum deposit. It gives access to over 4500 Stocks and 400 ETFs and supports Exchange Execution, by ensuring price transparency, especially beneficial for trading Stocks and ETFs. Spreads start from 0 pips, with commissions for Stocks and ETFs from 0.02 USD per share (a single-sided trade). The account also includes a variety of features, including Market analysis, Market Depth, Economic Calendar, and many others.

Zero.MT5 Account

The Zero.MT5 gives access to over 80 Currency pairs, Metal CFDs, Cash Index CFDs, and Energy CFDs. Spreads for the Zero.MT5 accounts are from 0 pips with commissions that differ for each instrument, ranging from $0.05 to $3.0. It is important for traders to pay attention to these details in fee structure, determine the instrument, and learn the respective costs. The account also supports different strategies and advanced tools, like Expert Advisors, Signals by MetaQuotes, and other features.

Trade.MT4 Account

To start with Trade.MT4 account, clients need to make an initial $25 deposit and gain access to multiple assets. Although the instrument range is a bit limited compared to the Trade.MT5 accounts, the Trade.MT4 is considered the most favorable option for new traders. Spreads for this account type start from 0.5 pips, while commissions are applicable only for Single Share and ETF CFDs starting from $0.02 per share. For other instruments, there are no commissions. The account enables access to Expert Advisors, different intricate strategies, diverse tools, and features that will meet both beginners’ and professionals’ expectations.

Zero.MT4 Account

Some features of the Zero.MT4 account is identical to the Trade.MT4 account, including the platform availability, the minimum $25 deposit, and the leverage range. However, this account type gives access to a comparatively limited range of instruments, including Currency pairs, Metal CFDs, Cash Index CFDs, and Energy CFDs. Spreads start as low as 0 pip, plus commissions, which are different for each instrument and start from $0.05 to $3.0. The account base currencies are USD, EUR, JOD, and AED.

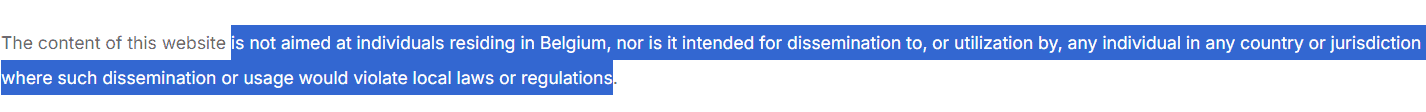

Regions Where Admiral Markets is Restricted

Admiral Markets is a global broker and is available in a very large list of countries worldwide. The only restricted country the broker mentions on its website is Belgium and also countries or regions where the local laws or regulations set certain restrictions to this kind of financial services. This means, clients should check the broker’s availability in their region before registering with it.

Cost Structure and Fees

Score – 4.5/5

Admiral Markets Brokerage Fees

Admiral market’s fees are strongly dependent on the chosen account type. Each account comes with a different fee structure, based on the instrument chosen. Also, it is important to remember that costs may vary from one entity to another. Below you can find the main fees of Admiral Markets, that are included in the trading costs:

Admiral Markets offers floating spreads starting from 0 pips. The typical spread offered for the EUR/USD pair is 0.6 pips. However, all the account types are commission-based, which means that in addition to spreads, there is also a certain amount of commission charged based on the instruments traded (mostly for Shares and ETFs).

- Admiral Markets Commissions

Admiral Markets all accounts are with floating spreads starting from 0 pips and apply certain commissions, depending on the instrument chosen. The commissions are not fixed, they are different based on the account type chosen and on the instrument traded. For instance, for the Trade.MT5 accounts, the spreads start from 0.5 pips, and commissions from 0.02 USD for Share and ETF CFDs. For all the other instruments for this account, which include Currency pairs, Metal CFDs, Energy CFDs, and other instruments, there is no commission applied. On the other hand, Zero.MT5 account’s spreads start from 0 pips, with slightly higher commissions for Forex and Metals – from $1.8 to $3.0, Cash Indices – from $0.05 to $3.0, Energies – $1.

As it is evident, commissions depend on the entity, account types, and instruments, thus before starting trading, we recommend traders check with the broker both the spreads and commissions under the specific jurisdiction. Luckily, the fees are quite transparent, and in the Account Types and Contract Specification sections, you can find detailed information both on spreads and commissions.

- Admiral Markets Rollover / Swap Fees

The swap fees, known also as the Forex rollover rate, are charged on positions held overnight in the Forex market and on CFDs. The swap value can be both negative and positive, depending on the swap rate and the position taken. The EUR/USD long swaps are -0.912, while the short ones are 0.154. The swap fees depend on a range of conditions and they are changeable, thus traders need to check them out beforehand.

How Competitive Are Admiral Markets Fees?

Admiral Markets’ fee structure depends largely on the entity the account is registered with, and, of course, the chosen account type and instrument. We found the broker’s fees quite transparent, although a little confusing, as for each account type and instrument, the commissions are different. The good news is that all spreads and commissions are clearly mentioned, and clients can check them easily, depending on the account type they choose.

All in all, with floating spreads starting from 0 pips and low commissions, Admiral Markets is a great choice for cost-conscious traders. However, we also found some real reviews from those, who state that for beginners, the fee structure is a bit complicated.

| Asset/ Pair | Admiral Markets Spread | ThinkMarkets Spread | XM Spread |

|---|

| EURUSD Spread | 0.6 pips | 1.1 pips | 1.6 pips |

| Crude Oil WTI Spread | 0.03 pips | 0.03 | 3 cents |

| Gold Spread | 0.25 pips | 19 cents | 0.27 pips |

| BTC USD Spread | 0.3% | 12 USD | 95 |

Admiral Markets Additional Fees

Like many other brokers, Admiral Markets has some additional fees the clients should be aware of. The broker charges an Inactivity fee equal to $10 per month for accounts that have not been active for the last 24 months. Thus, clients should take this into consideration. Also, Admiral Markets charges Conversion fees for trades conducted in currencies different from the trading account’s base currency. The conversion fee depends on the current exchange rate. These are the main fees applied, however, be careful, as the fees charged also depend on the entity.

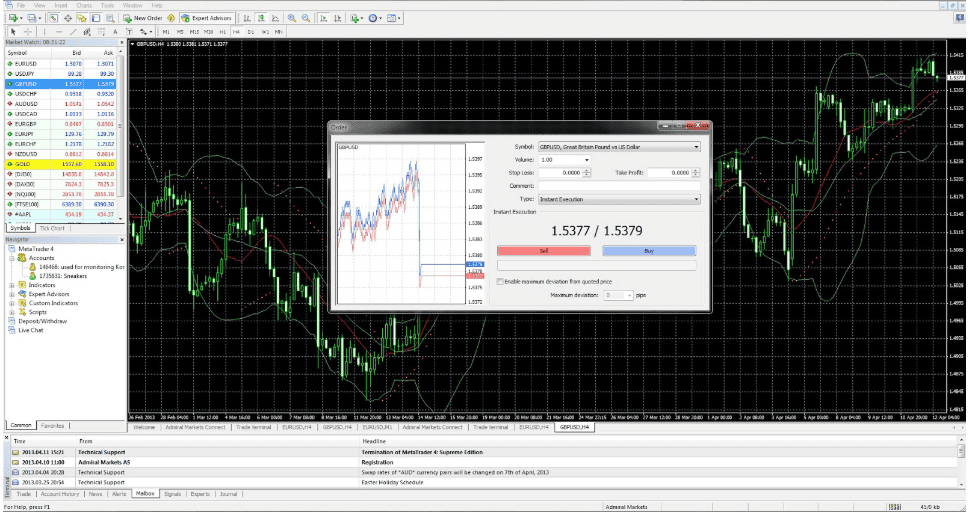

Score – 4.5/5

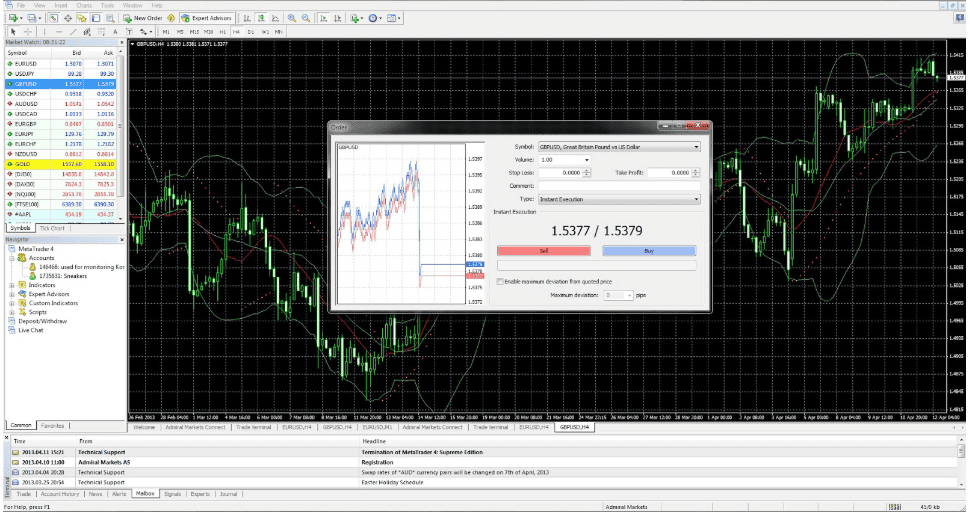

Admiral Markets offers trading on the popular MT4 and MT5 platforms, and its account types are MT4 and MT5 platform-based. This means that traders should choose the account types based on their platform preference, and, of course, considering other conditions each account offers. The broker also offers Meta Trader web trader and Admirals mobile app.

| Platforms | Admiral Markets | FXTM Platforms | XM Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| Own Platform | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Admiral Markets Web Platform

Admiral Markets WebTrader is the browser-based version of the MetaTrader 4 and MetaTrader 5 platforms that enable clients to conduct trades with no installation required, no downloads needed, and is compatible with PC or Mac. Through WebTrader, traders can access Forex, CFD, metals, stocks, indices, energies, and bonds.

The average order execution time is 170 milliseconds, with no requotes which is considered very good among industry offering. WebTrader is available for both of the platforms (MT4/MT5) and for all the account types. The web platform offers various features and tools, such as most of the technical indicators available from the desktop platform.

Main Insights from Testing

Admiral Markets WebTrader is a browser-based version of MT4 and MT5, enabling clients to start trading without any installations or downloads. It operates easily on both PC and Mac. We found that traders have access to a range of instruments, many advanced features that are supported by the desktop platform, and fast execution, which ensures fast and profitable trades. WebTrader is a versatile solution that prioritize flexibility and efficiency.

Admiral Markets Desktop MetaTrader 4 Platform

Admiral Markets MT4 offers access to advanced trading in a fast, safe, and trustworthy environment. The main features of the platform are intuitive design, adaptable configurations, and highly efficient performance. The platform offers enhanced charting capabilities, automated trading, and an easily customizable interface. Through the platform, traders have access to free real-time charting, news, and analysis offering flexibility and comprehensive tools for informed decision-making.

Those who choose trading via the MT4 platform also get benefits, such as historical backtesting, trading signals, 35+ technical indicators, algorithmic trading, alerts and financial news, and many other features that enhance the trading experience, taking it to another level.

Admiral Markets Desktop MetaTrader 5 Platform

MT5 of Admiral Markets is a powerful platform that enables access to a range of advanced tools, including trading robots, advanced charting tools, 21 chart time frames, 6 pending orders, and 50+ technical indicators.

Traders also have access to a wide range of financial instruments. The platform is available from a browser, PC, and Mac and the mobile app can be downloaded for both iOS and Android, making it easily accessible.

Algorithmic trading strategies and copy trading are also supported, combined with expanded market-depth data, market news, and availability of the MQL5 programming language, which is excellent for creating trading signals.

Admiral Markets MobileTrader App

The Admirals mobile application is easy and secure, with instant access to an extensive product range: CFDs on Forex currency pairs, stocks, indices, commodities, and ETFs. The Admirals stock trading application, with its user-friendly interface developed wholly in-house, makes it possible for clients to easily trade from anywhere and at any time via the mobile phone. The app enables Admiral Markets clients to monitor their accounts with ease, and promptly manage their open positions.

Main Insights from Testing

For those who are looking for flexible trading on the go, the Admiral Markets app is an excellent choice for monitoring trades without sticking to desktops. The app provides flexibility, security, and access to real-time trading, available for both iOS and Android devices. The app also enables users to start with a demo account to practice before trading with real funds.

With an intuitive interface, enhanced mobility, and advanced tools, the broker’s app supports real-time trading from anywhere. Yet, users should be aware that the app might be somewhat limited in comparison with the desktop platform and the advanced features it provides.

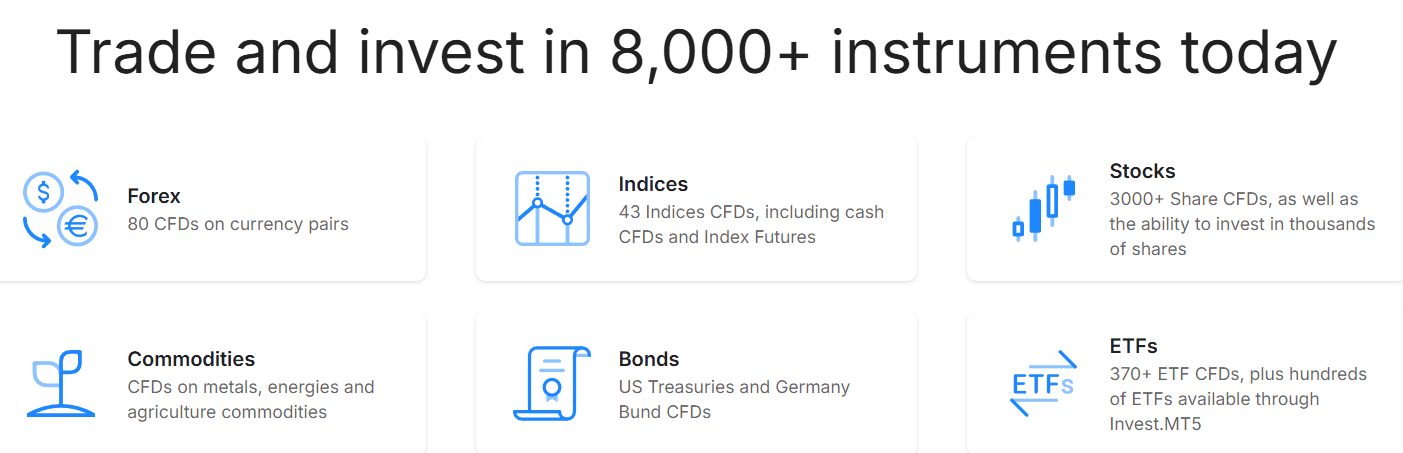

Trading Instruments

Score – 4.6/5

What Can You Trade on the Admiral Markets Platform?

Admiral Markets offers over 8000 instruments across different assets. The broker enables access to over 80 CFDs on currency pairs on major, minor, and exotic currencies, CFDs on shares of major companies from markets, and access to global Indices. This wide range of offerings enables traders to diversify their trading and explore the market with advanced features and great market conditions.

Clients should consider that the availability of certain instruments depends on the account chosen, and the platform. Thus, this is something to learn before starting trading. All in all, below you can see the products Admiral Markets offers its clients:

- Forex

- Index CFDs

- Share CFDs

- Bond CFDs

- Commodity CFDs

- ETFs

Main Insights from Exploring Admiral Markets Tradable Assets

Admiral Markets offers a wide range of assets that enable both beginner traders and professionals to explore new opportunities. Traders have access to over 80 currency pairs, which is an impressive offering and considerably higher than the market average offering, also they have access to global indices, CFDs on government treasury bonds, CFDs on shares of major companies from markets, etc. Besides, the Invest.MT5 account enables stock ownership, thus Admiral Markets also supports its clients on traditional investments, to further diversify their trading and help get the most out of it.

The only note is to scrutinize each account type, as instrument accessibility depends on the account chosen. All in all, each account offers different opportunities, conditions, and fee structures, so this is very important to remember. Also consider the entity you are registered with, as this can also impact the instrument accessibility.

Leverage Options at Admiral Markets

Since Admiral Markets is an international brokerage that delivers its service through various worldwide offices to choose from, there are applicable differences according to the jurisdiction. Admiral Markets does offer marginal trading, meaning you can trade through a multiplied amount of your initial deposit and operate larger positions. As this tool gives a great advantage and may increase your potential gains, you should learn how to use the multiplier smartly.

Admiral Markets Leverage levels depend on the jurisdiction and are different for each country, that’s why we recommend verifying these conditions well:

- Admiral Markets offers lower levels of leverage for retail traders due to the European updates in regulatory requirements with 1:30 for Europe.

- Australian regulation does not allow a high level of leverage any longer and maintains 1:30 for Forex instruments.

- International clients may use higher leverage ratios based on instruments.

- For some instruments, mainly for Indices, also depending on the account traded, leverage can be as high as 1:500.

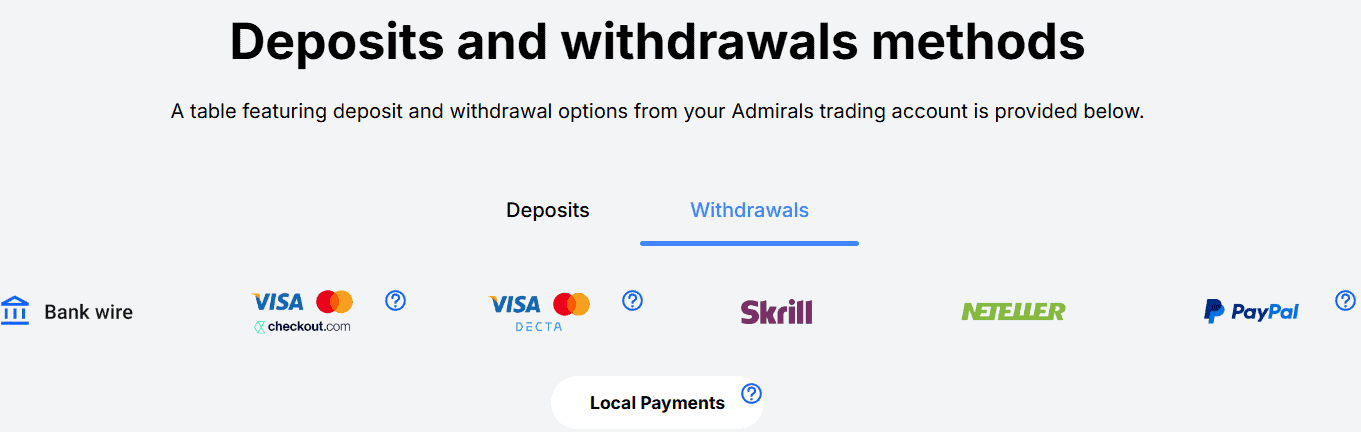

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Admiral Markets

Admiral Markets offers different funding methods to make convenient deposits. As the broker caters to the needs of international clients, it offers deposit offers based on the regions, thus, some methods might not be available for certain countries and regions. Traders should check the availability of each method on their own.

The main deposit methods available with the broker are:

- Bank Transfers

- Credit/Debit cards

- Skrill

- Neteller

- PayPal (not in all regions)

- Local payment methods

Minimum Deposit

The minimum deposit Admiral Markets offers is for its Invest.MT5 accounts and start just from $1. For all the other account types, there is only a $25 initial deposit, which is considered rather low and cost-efficient for beginners as well.

Withdrawal Options at Admiral Markets

Clients may submit Payment requests at any time provided that the client is compliant with both the general Account Terms as well as the Payment Terms of Admirals. In case of withdrawal of funds, Admiral Markets reserves the right to execute such a request to the same bank, intermediary bank, and to the same account used by the client for making the initial or any previous Payment, regardless of the withdrawal method chosen or preferred by the client. Also, the broker may request additional documents if found applicable for processing the withdrawals.

- Each month one withdrawal request is free from any commissions, whereas for each next withdrawal will be applied $10.

- The withdrawal method depends on the region and jurisdiction the client is registered with. So, it is up to the trader to check the availability of a withdrawal method.

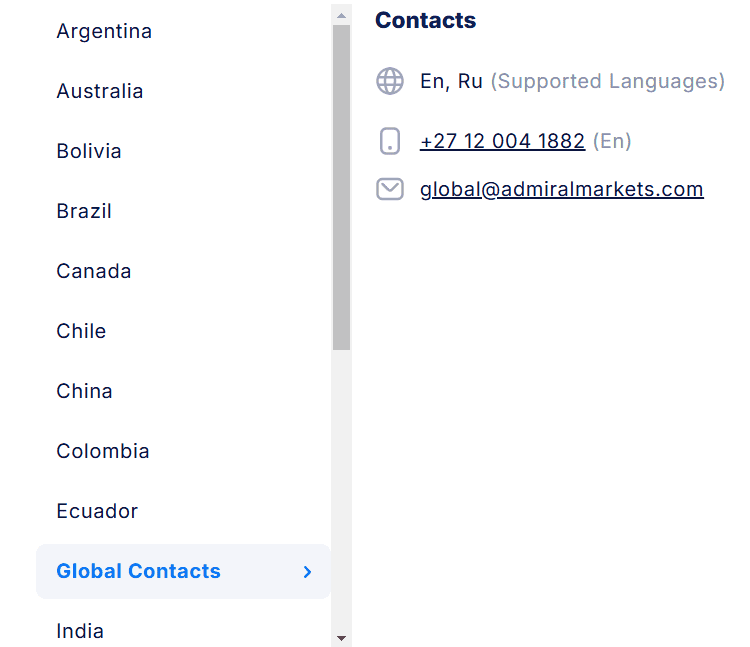

Customer Support and Responsiveness

Score – 4.6/5

Admiral Markets traders have easy access to support through phone, live chat, or email. The customer support team is responsive and professional, ensuring reliable assistance from the broker. All the questions receive prompt and detailed answers.

- For General questions, clients can also refer to the FAQ section, where the most common questions can find detailed answers.

Contacts Admiral Markets

Customers can use various options to communicate with the broker in case any questions or trading-related issues arise:

- Live Chat is one of the quickest ways to contact the broker right from the website and get instant answers. We found that if the live chat AI bot is not able to deliver instant answers, Admiral Markets support team later sends you detailed answers to your questions, which is great, of course.

- The global email is global@admiralmarkets.com. The email can be different for different countries, so traders can easily find the email for their region.

- Phone support is available with the global number +27 12 004 1882. However, clients should check, if there is a specific phone line for their region.

- At last, Admiral Markets is very active on social media, providing important and up-to-date information on the market. This is another way to keep up with the broker and its services.

Research and Education

Score – 4.7/5

Research Tools Admiral Markets

Good research tools are very important for traders to analyze the market and plan their trades accordingly. Admiral Markets, besides the tools available through its MT4 and MT5 platforms, offers additional research tools that give extra insight into the market, equipping traders with market knowledge and insight.

- Forex Calendar assists traders in keeping track of significant financial events that may affect the economies and create changes in the market. Economic calendars are essential for traders of all levels. To use the Calendar, clients need to adjust the location and time zone, choose the language, mark the timespan, and use filters for specific countries.

- Trading News helps traders to make informed decisions on their investments. The section reflects on different events in the industry to keep the clients aware and ready if any event can impact the market and their performance.

- Premium Analytics portal with market news, technical analysis, economic calendar, and global sentiment indicators equips clients with fundamental knowledge. All content is provided by leading financial firms – Dow Jones, Trading Central, and Acuity.

- Fundamental Analysis is focused on the daily macro and micro economic factors that influence the value of the investments. Here clients can access reports on everything from the state of the economy to the company`s internal management for making informed decisions about whether to make an investment or not.

Education

Admiral Markets offers a trading Academy to empower its clients with essential market knowledge. The broker provides diverse educational materials, suitable for different needs and levels of experience.

- Admiral Market’s education section includes Forex and CFD articles on different topics, tutorials with trading insights, psychological tricks, currency market analysis strategies, and many other articles on financial topics.

- Free live webinars are a great way for traders to improve their skills and learn how to form strategies.

- Zero to Hero covers everything about trading in 20 days. From basic technical and fundamental analysis to using trading techniques in real-time and real market conditions clients will be able to form the attitude, and mindset to become successful.

- Risk Management Techniques concentrate on the importance of using risk-management tools to avoid financial losses and recognize their limit in trading.

- Trader’s Glossary is an accumulation of Forex terms. The knowledge of the essential forex terms is essential for a successful outcome in trades. This is especially useful for beginners who enter the market without much knowledge, and learning the basic financial terms is essential for them.

Is Admiral Markets a Good Broker for Beginners?

We found Admiral Markets an excellent broker for beginners with its extensive education that includes articles, courses, webinars, Market analysis, Economic Calander, Trader’s Glossary, and advanced analytical tools. All of this combined provides traders with market insight and fundamental knowledge. The wide range of materials is good both for beginner traders and for professionals who are looking for more opportunities.

Besides, the broker’s advanced platform, equipped with great analysis tools, and the selection of account types with initial low deposits, enable traders to immerse into trading with a successful start.

Portfolio and Investment Opportunities

Score – 4.5/5

Investment Options Admiral Markets

Admiral Markets offers a wide range of instruments to its traders, although the fact that the products are mostly CFD-based, the broker also allows its traders to make traditional investments through its Invest.MT5 account, which is not offered by so many Forex brokers in the industry so is definitely big plus. The account enables access to over 4500 Stocks and 400 ETFs. This way, clients are able to buy and own real stocks and ETFs. Some of the examples of stocks include the NYSE, NASDAQ, and European exchanges. The broker charges a commission starting from $0.02 per share.

- Besides, Admiral Markets offers Copy Trading, which enables traders to become a part of a huge community. To start copy trading, clients can search the community leaderboards and find trades that suit their expectations and needs the most. Before starting, Admiral Markets also requests traders to answer suitability questions to assess their risk tolerance.

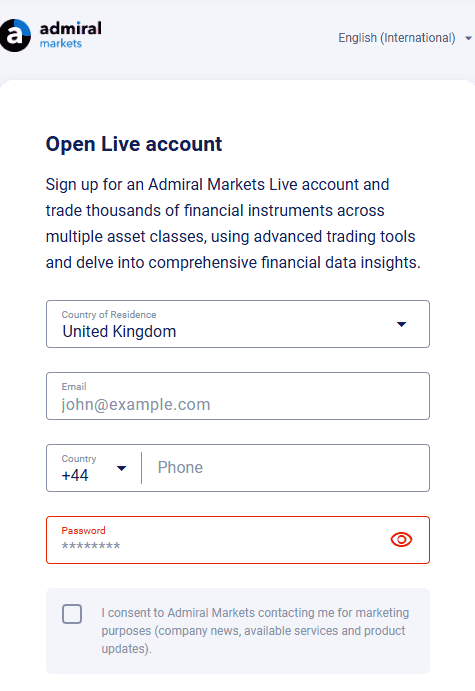

Account Opening

Score – 4.6/5

How to open a Demo Account?

Opening a Demo Account with Admiral Markets will take only a few minutes. Here are the main steps to follow:

- Click on Try Demo on the broker’s website

- Fill out the registration form with the required information

- After registration, receive a confirmation email and verify

- Configure the demo account settings, choosing the trading conditions

- Choose and download the trading platform (MT4/MT5)

- Start your Demo account

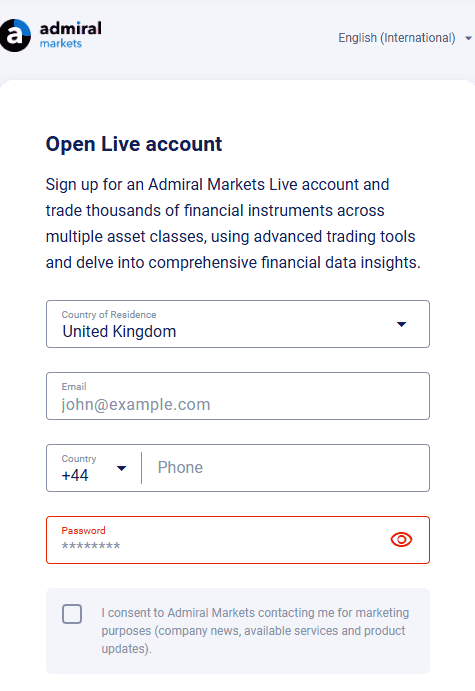

How to Open an Admiral Markets Live Account?

In order to open a live account, traders need to follow the steps below:

- Choose the ‘Getting Started’ section

- Provide the required personal details

- Upload the required documents

- Wait until your application is approved

- Go to the “Accounts” section and click “Live”

- Click “add account” and choose the type of account trading (CFDs) or investment (stocks and ETFs). Once you have selected your account type, set that live account’s base currency and password.

- Start trading

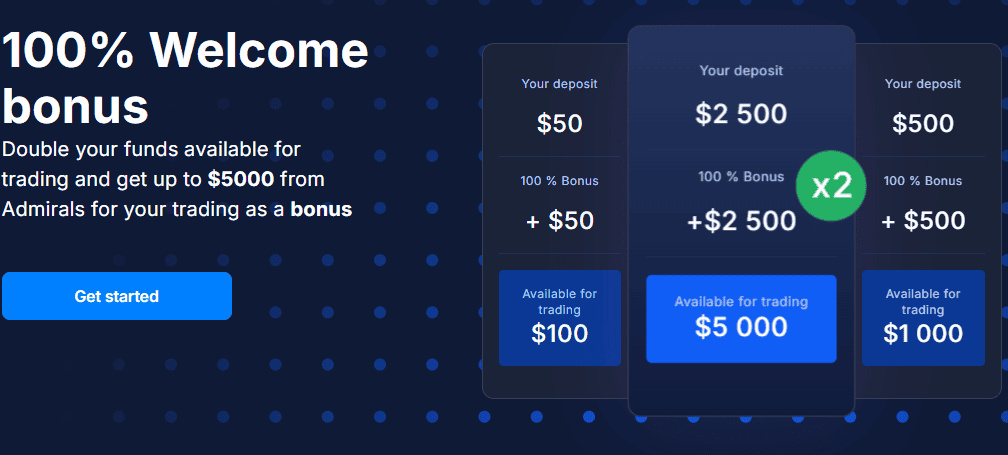

Score – 4.6/5

Admiral Markets is a broker that offers in additional to the tools available on the platform or its website, there are various advanced tools and features, boosting the trading experience both for beginner and experienced traders. However, the broker also has some additional and unique features, that make the offerings more complete and enhanced.

- StereoTrader with Admirals is a game-changer for trading. Being a MetaTrader trading panel with unique features that give more flexibility and options in trades, it enables users to place over 30 different orders at lightning speed with just a click, evaluate trades and strategies using historical data, set goals and risk management level and use Limit Pullback, Dynamic Trailing, Stealth, and other intelligent orders.

- The Virtual Private Server service (VPS), enables users to benefit from the trading platform anywhere, any time, and on any device. Using VPS ensures access to all MT4 and 5 functions around the clock, including their own EAs and indicators. The VPS for Forex and CFD trading provides 24/7 support, ensuring that clients get all the support to use their VPS for trading.

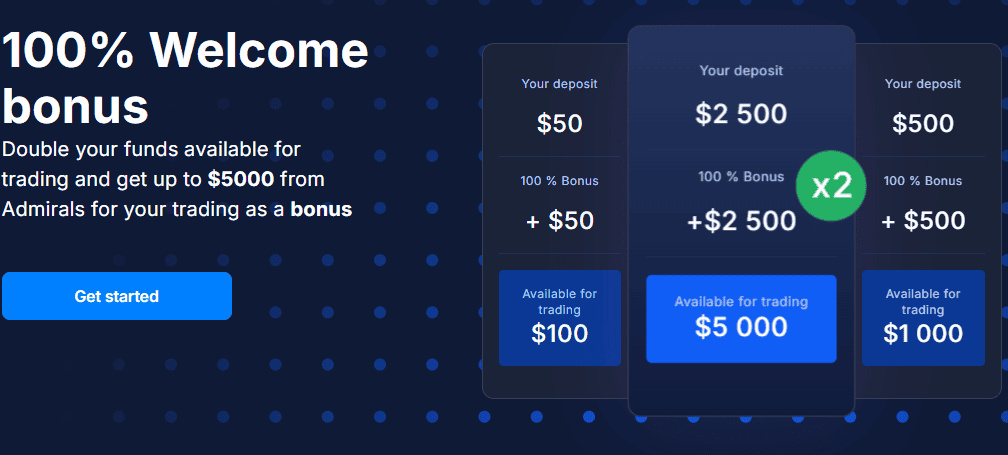

- The Welcome Bonus is a great way to start a trading journey. It is credited to the account immediately after opening a live trading account with the broker. The bonus is also available for withdrawals. However, the bonus is not provided in case of internal transactions, for instance, for transfers from Wallet to the trading account or from one trading account to another.

- Parallels is the leading virtualization solution for devices running MacOS. It allows users to run Windows applications on their Mac, including MT4 and MT5, by creating a virtual environment of Windows within their existing operating system.

- The Market Map is used to track price movements and daily trading intelligence, view the largest movements in the market, and stay in touch with long and short trading opportunities, Daily trends, Volatility, and other key metrics.

Admiral Markets Compared to Other Brokers

Admiral Markets holds multiple top-tier licenses, thus ensuring a safer and more trustworthy trading environment for its clients than brokers with only offshore licenses, such as RoboForex. Our research shows that a start with Admiral Markets is easy due to its $1 initial deposit for its investment account and $25 for all the other account types, which is again considered very low, especially compared to brokers with $500, which is the market average.

The 8000+ offering of tradable instruments across multiple assets is a great way to diversify trading, as many brokers like Exness, with its 200+ trading products, offer a more limited instrument range. Admiral Markets enables clients to conduct trades through the MT4/MT5 platforms, which is great, yet we found that FP Markets has a wider selection of platforms, including cTrader, IRESS, and its Proprietary Platform. Thus, in terms of platforms, the offering is very common.

However, the thing to consider if comparing to other Broker is fee structure which in times is confusing since all fees are based on commission plus to interbank charges. So traders prefer solely spread based account better check Brokers like Exness , HFM or FP Markets. An all, as compared to many other brokers in the industry, Admiral Markets has been around for about two decades, which speaks about trust and reliability, and years to prove its standing in the market.

| Parameter |

Admiral Markets |

Pepperstone |

RoboForex |

Exness |

FP Markets |

HFM |

Eightcap |

| Spread Based Account |

From 0.6 pips (0.02 commissions for Share and ETF CFDs) |

From 1 pip |

Average 1.3 pip |

From 0.2 pips |

From 1 pip |

Average 1 pip |

Average 1 pip |

| Commission Based Account |

0.0 pips + from $0.02 to $3.0 |

0.0 pips + $3.5 |

0.0 pips + $4 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + $3 |

0.0 pips + $3.5 |

| Fees Ranking |

Low/Average |

Low/Average |

Average |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

MT4, MT5, Admiral Markets app |

MT4, MT5, cTrader, TradingView |

MT4, MT5, R StocksTrader |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, HFM App |

MT4, MT5, TradingView |

| Asset Variety |

8000+ instruments |

Over 1,200 instruments instruments |

12,000+ instruments |

200+ instruments |

10,000+ instruments |

500+ instruments |

800+ instruments |

| Regulation |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FSC |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

ASIC, SCB, CySEC, FCA |

| Customer Support |

24/7 support |

24/7 |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Excellent |

Excellent education and research |

Good |

Fair |

Excellent |

Good |

Good |

| Minimum Deposit |

$1 |

$0 |

$10 |

$10 |

$100 |

$0 |

$100 |

Full Review of Broker Admiral Markets

Admiral Markets is a well-regulated broker, offering a robust environment good for traders of any level of experience. With deep liquidity, instant execution of orders, and competitive prices Admiral Markets has great market conditions and a wide range of account options to meet different needs in trading. Besides, low deposit requirements and seamless integration with platforms like MT4 and MT5 are favorable for beginners who are looking for an uncomplicated start.

Admiral Markets also stands out for its advanced technical solutions, optimized for multiple trading strategies, including EA-based automated trading. Access to a great number of instruments (8000+), real stocks, and ETFs, together with low spreads and flexible account options, Admiral Markets offers diversity, versatility, and an efficient trading experience.

Yet, one of the best features of Admiral Markets is its education, enhancing its clients’ skills through webinars, articles, special courses, and a glossary of Forex terms, and making it easier especially for new clients to navigate the market.

Share this article [addtoany url="https://55brokers.com/admiral-markets-review/" title="Admiral Markets"]

This info is invaluable. How can I find out more?

Thank you 18. for your comment

Dodgy Admiral markets

Trading experience from 6th May 2020 to 9th June 2022. I have forwarded dodgy Admiral Markets snapshot of my trading MT5 portal with name, account & trading history details, but the dodgy folks are not accepting in order to delet my review in collusion with equally dodgy Trustpilot.

Admiral markets is aggressively involved in unethical practices by,

– offering dodgy historic Forex data (for MT5 backtesting) through spread manipulation and they do acknowledge their data inaccuracy. Optimised result from strategy tester totally contradict in visualisation mode, thus further discouraging use of automated trading systems,

– for manual trading on live account, these utterly dodgy folks, delay opening & closing of positions by 6-7 times slower compared to demo account,

– erratic spread widening (GBPUSD, 11 – 23.2 pips spread compared to 1.2 – 4.7 pips by Think Markets on 26Nov2021 from 20:15 hrs onward instead of 23:55),

– offering spread for each instrument-account within a range, typically higher end if live trading and lower if not trading.

– deploying real-time deceptive and adversarial strategies through collusion and at discretion for insane price manipulation, throttling, spread widening, slippage and SL hunting, all in-tandem or simultaneously – more akin to market maker than STP they claim to be,

– deliberately disconnecting from fast network Access Point with lowest ping and reconnecting to slowest one,

– deliberately closing multiple timeframe charts,

– closing auto traded positions before they hit TP,

– modifying live account leverage from 1:500 to 1:50 to force stop out/liquidate open positions deliberately and their pathetic excuse for this is utterly rubbish,

– posting 4* and 5* FAKE reviews. If 76% of traders (in reality more than 90%), lose money with Admiral Markets, then how come 89% are happy/satisfied reviewers/customers?

– bugged and outdated indicators attached to the chart from Admiral Markets when closed, also force close automated trading system,

– making easy to top-up account as many times a day as possible, but can withdraw only once per month!

– blocking account top-up for even a penny less than min £50, but allowed to withdraw more than once per month for hefty fine, without ANY warning!

– denying and then flashing ethical badge of FCA authorisation, if complained, for their shady business process. FCA is not monitoring live trades like a referee on the field and so admiral markets can do and claim whatever they please.

– OTC + no or false accountability + zero sum game = blown accounts.

Admiral Markets is absolutely dodgy to the core.

I do not advise anyone to trade with Admiral Markets broker. This company attracts customers with the promise of a 100% bonus, which will serve to open positions and keep them open, at first it really was like that, but suddenly, out of nowhere, they decided to change the rules, and the bonus passed to no longer serve to maintain open positions, and the worst, they did not even bother to warn clients, applying stop-out and closing all client positions, causing recurring losses, and acting with total disregard for it. , in a revolting and absurd attitude.

The back office team is always overworked, and never clearly answers any question that is addressed to them, acting with total disrespect to their customers.

If you don’t want to lose your capital, and don’t even have annoyances almost every day, avoid this brokerage at all costs, who warns, friend is.

I do not advise anyone to trade with Admiral Markets broker. This company attracts customers with the promise of a 100% bonus, which will serve to open positions and keep them open, at first it really was like that, but suddenly, out of nowhere, they decided to change the rules, and the bonus passed to no longer serve to maintain open positions, and the worst, they did not even bother to warn clients, applying stop-out and closing all client positions, causing recurring losses, and acting with total disregard for it. , in a revolting and absurd attitude.

The back office team is always overworked, and never clearly answers any question that is addressed to them, acting with total disrespect to their customers.

If you don’t want to lose your capital, and don’t even have annoyances almost every day, avoid this brokerage at all costs, who warns, friend is.

I also have a bad experience with them.

Putting money on account is no problem, but withdraw is not possible without providing all the personal data of your account including balance and payments

When I ask why they need to know everything I do on my bankaccount they say it’s a law by Cysec…

Really sad they don’t want to return my money

Admiral markets is aggressively involved in unethical practices by,

-> offering dodgy historic FX data (for backtesting) through spread manipulation,

-> erratic spread widening (GBPUSD, 11 – 23.2 pips spread compared to 1.2 – 4.7 pips by Think Markets on 26Nov2021 from 20:15 hrs onward instead of 23:55),

-> deploy real-time adversarial strategies for price manipulation through collusion – more akin to market maker than STP they claim to be,

-> closing positions before they hit TP,

-> modifying live account leverage from 1:500 to 1:50 to force liquidate positions,

-> indicators attached to the chart from Admiral Markets when closed, also force close automated trading systems,

-> easy to top-up account as many times a day as possible, but can withdraw only once per month!

-> account top-up is blocked for even a penny less than min £50, but allowed to withdraw more than once per month for fine, without any warning!

-> when complained, they deny and flash ethical badge of FCA authorisation for their shady business process. FCA isn’t monitoring live trades like a referee on the field and so admiral markets can do and claim whatever they please. OTC + no accountability + zero sum game = blown accounts.

-> recent call was put in loop of “your position in the queue is one and please stay on the line” for ages!!

Admiral Markets is absolutely dodgy to the core.

In 2018 I was a subject of an aggressive disinformation campaign by Admiral Markets UK

Ltd about the future ESMA decision 2018/786. I was misinformed about the consequences of

this decision on my previously open CFD positions, in particular while not changing my

client status from retail to professional. Admiral Markets decided to change the leverage

from 1:100 to 1:33 in order to meet the ESMA decision requirements. While, the new

requirements were intended by ESMA to impact only new positions, Admiral Markets

decided to change it also for CFD positions, which had been opened before the ESMA

decision entered into force. “Retail clients are not required to post additional margin for

existing CFD positions to meet the initial margin protection requirement under Article 1(d)

and Annex I of Decision 2018/796. Retail clients are only required to provide margin

required under Article 1(d) and Annex I for CFD positions entered into after the date of

application.” Changing the rules during the game is not what I expect from the honest IB

acting in the best interest of its clients. They simply claimed that they may change the margin

requirements at “any time”, even if it was clearly stated at the web page that: “We retain the

right to change with special notice the length of the pre-close margining period and leverage

rates maximums in response to extraordinary economic or political events.” The ESMA

decision was not an extraordinary economic nor political event. In effect I lost huge part of

my savings and gains from earlier investments (around EUR 50 000). Admiral Markets never

replied to my complain. Unfortunately, the financial ombudsman was not helpful. It took

them extra long up to 2020 to respond to my complain. In their response they simply referred

to the “at any time” margin rule while completely disregarding the “extraordinary economic

or political events” factor.

In 2018 I was a subject of an aggressive disinformation campaign by Admiral Markets UK Ltd about the future ESMA decision 2018/786. I was misinformed about the consequences of this decision on my previously open CFD positions, in particular if I while not changing my client status from retail to professional.

Admiral Markets decided to change the leverage from 1:100 to 1:33 in order to meet the ESMA decision requirements. While, the new requirements were intended by ESMA to impact only new positions, Admiral Markets decided to change it also for CFD positions, which had been opened before the ESMA decision entered into force.

“Retail clients are not required to post additional margin for existing CFD positions to meet the initial margin protection requirement under Article 1(d) and Annex I of Decision 2018/796. Retail clients are only required to provide margin required under Article 1(d) and Annex I for CFD positions entered into after the date of application.”

Changing the rules during the game is not what I expect from the honest IB acting in the best interest of its clients. They simply claimed that they may change the margin requirements at “any time”, even if it was clearly stated at the web page that:

“We retain the right to change with special notice the length of the pre-close margining period and leverage rates maximums in response to extraordinary economic or political events.”

The ESMA decision was not an extraordinary economic nor political event.

In effect I lost huge part of my savings and gains from earlier investments.

Unfortunately, FCA was not helpful. It took them extra long up to 2020 to respond to my complain. In their response they simply referred to the “at any time” margin rule while completly disregarding “extraordinary economic or political events”.

So the last opportunity to fight with this SCAM is to go to the court.

Admiral Markets is a big trap, or rather, there are several traps, every day I was surprised by an unpleasant surprise.

Trap number 01:

Early on, attracted by the offer of a 100% bonus offered by AGLOBE ADMIRAL, I opened my account and made my first deposit.

I had an unpleasant surprise because my bonus didn’t come in, so I made a complaint, and they came up with a lame excuse that I had to have activated the promotion link on the site, since it is in a difficult to access area, almost hidden in the website home page.

All right, I activated the tiny hidden link, made another deposit and the bonus came in, but only on the second deposit, the first one I missed.

Trap number 02:

I started trading, it was a Friday, I had some trades open during the day, so far so good, but with a few minutes to go before the Friday trading session, they just closed all my trades automatically. Once again I made a complaint, as I had free margin, and there was no reason for my positions to have been closed, and what was my surprise when they informed me, that every Friday, a few minutes before the trading session, they reduce leverage to 1:50, mine being 1:1000, that is, it was inevitable that my positions had not been closed, noting that this notice about reducing leverage every Friday was written in lowercase, also in a barely visible place on the site.

Trap number 03:

So, even though I was extremely upset by this trap mentioned above, I transferred more money, in order to take advantage of my bonus that had been generated initially.

I was at 112% free margin when all of a sudden all my positions were closed again. This time, their excuse was that the margin did not cover any loss, in this case it had a balance of – BRL 23.00, but with open positions giving profit, and more than BRL 3,000.00 in bonuses, when in the regulation of the bonus, the following is foreseen:

“3.1. Bonus provides additional free margin and increases the amount of funds available.

to trade (ie to open new positions and maintain the margin requirements for such

positions).”

If the bonus is used to maintain the margin requirements, they didn’t have the right to close my positions as they did, otherwise it would be useless to have this bonus. One more trap, one more loss.

In other words, after numerous and recurring losses and unpleasant surprises I had with ADMIRAL MARKETS, the only thing I can do, in addition to being legally involved to enforce my rights, is to alert unsuspecting clients so that they DON’T FALL INTO THIS NETWORK OF TRAPS OF THIS COMPANY, WHICH JUST HAS A NAME, THE REST IS NON-PLEASANT LOSS AND SURPRISES.

ADMIRAL MARKETS IS A RIGHT LOSS, if you don’t want to lose money, stay away from this company, they are not serious people, and they have total disregard for the customer.

The warning remains.

Good luck to everyone.

A Admiral Markets é uma grande armadilha, ou melhor, são várias armadilhas, todos os dias era surpreendida por uma desagradável surpresa.

Armadilha número 01:

Logo no início, atraída pela oferta de um bônus de 100% ofertada pela AGLOBE ADMIRAL, abri minha conta e fiz o meu primeiro depósito.

Tive uma desagradável surpresa, pois meu bônus não entrou, então fiz uma reclamação, e eles vieram com uma desculpa furada que eu tinha que ter ativado o link da promoção pelo site, sendo que o mesmo fica numa área de difícil acesso, quase oculta na página inicial do site.

Tudo bem, ativei o minúsculo e oculto link, fiz outro depósito e o bônus entrou, mas apenas sobre o segundo depósito, o primeiro eu perdi.

Armadilha número 02:

Começei a operar, era uma sexta-feira, estava com algumas operações abertas durante o dia, até ai tudo bem, mas faltando alguns minutos para o encerramento do pregão de sexta, simplesmente eles fecharam todas as minhas operações automaticamente. Mais uma vez fiz uma reclamação, pois estava com margem livre, e não tinha razão para minhas posições terem sido fechadas, e qual foi minha surpresa quando eles me informaram, que todas as sextas, alguns minutos antes do pregão, eles reduzem a alavancagem para 1:50, sendo a minha era 1:1000, ou seja, inevitável que minhas posições não tivessem sido encerradas, ressaltando que este aviso sobre redução da alavancagem toda sexta, estava escrito em letras minúsculas, também em local pouco visível do site.

Armadilha número 03:

Então, mesmo extremamente chateada por mais essa armadilha citada anteriormente, transferi mais dinheiro, de forma a aproveitar meu bônus que tinha sido gerado inicialmente.

Estava com 112% de margem livre, quando, de repente, mais uma vez todas as minhas posições foram fechadas. Dessa vez, a desculpa deles foi que a margem não cobria nenhuma perda, no caso estava com um saldo de – R$ 23,00, porém com posições abertas dando lucro, e mais de R$ 3.000,00 de bônus, quando no regulamento do bônus, está previsto o seguinte:

“3.1. O bónus fornece uma margem livre adicional e aumenta a quantidade de fundos disponíveis

para fazer trading (ou seja, para abrir novas posições e manter os requisitos de margem para tais

posições).”

Se o bônus é utilizado para manter os requisitos de margem, eles não tinham o direito de encerrar minhas posições como fizeram, pois se assim fosse, de nada serviria ter esse bônus. Mais uma armadilha, mais um prejuízo.

Ou seja, após inúmeros e recorrentes prejuízos e surpresas desagradáveis que tive com a ADMIRAL MARKETS, a única coisa que posso fazer, além de estar entrando juridicamente para fazer valer meus direitos, é alertar a clientes desavisados, para que NÃO CAIAM NESSA REDE DE ARMADILHAS DESSA EMPRESA, QUE DE ADMIRÁVEL SÓ TEM MESMO O NOME, O RESTO NÃO PASSA DE PREJUÍZOS E SURPRESAS DESAGRADÁVEIS.

ADMIRAL MARKETS É PREJUÍZO CERTO, se você não quer perder dinheiro, fique longe dessa empresa, não são pessoas sérias, e tem total descaso pelo cliente.

Fica o aviso.

Boa sorte a todos.

Admiral Markets is a big trap, or rather, there are several traps, every day I was surprised by an unpleasant surprise.

Trap number 01:

Early on, attracted by the offer of a 100% bonus offered by AGLOBE ADMIRAL, I opened my account and made my first deposit.

I had an unpleasant surprise because my bonus didn’t come in, so I made a complaint, and they came up with a lame excuse that I had to have activated the promotion link on the site, since it is in a difficult to access area, almost hidden in the website home page.

All right, I activated the tiny hidden link, made another deposit and the bonus came in, but only on the second deposit, the first one I missed.

Trap number 02:

I started trading, it was a Friday, I had some trades open during the day, so far so good, but with a few minutes to go before the Friday trading session, they just closed all my trades automatically. Once again I made a complaint, as I had free margin, and there was no reason for my positions to have been closed, and what was my surprise when they informed me, that every Friday, a few minutes before the trading session, they reduce leverage to 1:50, mine being 1:1000, that is, it was inevitable that my positions had not been closed, noting that this notice about reducing leverage every Friday was written in lowercase, also in a barely visible place on the site.

Trap number 03:

So, even though I was extremely upset by this trap mentioned above, I transferred more money, in order to take advantage of my bonus that had been generated initially.

I was at 112% free margin when all of a sudden all my positions were closed again. This time, their excuse was that the margin did not cover any loss, in this case it had a balance of – BRL 23.00, but with open positions giving profit, and more than BRL 3,000.00 in bonuses, when in the regulation of the bonus, the following is foreseen:

“3.1. Bonus provides additional free margin and increases the amount of funds available.

to trade (ie to open new positions and maintain the margin requirements for such

positions).”

If the bonus is used to maintain the margin requirements, they didn’t have the right to close my positions as they did, otherwise it would be useless to have this bonus. One more trap, one more loss.

In other words, after numerous and recurring losses and unpleasant surprises I had with ADMIRAL MARKETS, the only thing I can do, in addition to being legally involved to enforce my rights, is to alert unsuspecting clients so that they DON’T FALL INTO THIS NETWORK OF TRAPS OF THIS COMPANY, WHICH JUST HAS A NAME, THE REST IS NON-PLEASANT LOSS AND SURPRISES.

ADMIRAL MARKETS IS A RIGHT LOSS, if you don’t want to lose money, stay away from this company, they are not serious people, and they have total disregard for the customer.

The warning remains.

Good luck to everyone.

Admiral Markets est un gros piège, ou plutôt, il y a plusieurs pièges, chaque jour j’ai été surpris par une mauvaise surprise.

Piège numéro 01 :

Très tôt, attiré par l’offre d’un bonus de 100% offert par AGLOBE ADMIRAL, j’ai ouvert mon compte et effectué mon premier dépôt.

J’ai eu une mauvaise surprise car mon bonus n’est pas entré, alors j’ai déposé une plainte, et ils ont trouvé une excuse bidon que j’ai dû activer le lien de promotion sur le site, car c’est dans une zone difficile d’accès , presque caché dans la page d’accueil du site Web.

D’accord, j’ai activé le petit lien caché, fait un autre dépôt et le bonus est arrivé, mais seulement sur le deuxième dépôt, le premier que j’ai raté.

Piège numéro 02 :

J’ai commencé à trader, c’était un vendredi, j’avais quelques trades ouverts pendant la journée, jusqu’à présent tout va bien, mais avec quelques minutes avant la séance de trading du vendredi, ils viennent de fermer automatiquement tous mes trades. Encore une fois, j’ai déposé une plainte, car j’avais de la marge libre, et il n’y avait aucune raison pour que mes positions aient été fermées, et quelle fut ma surprise lorsqu’ils m’ont informé que tous les vendredis, quelques minutes avant la séance de bourse, ils réduisaient effet de levier à 1:50, le mien étant à 1:1000, c’est-à-dire qu’il était inévitable que mes positions n’aient pas été fermées, notant que cet avis sur la réduction de l’effet de levier tous les vendredis était écrit en minuscule, également dans un endroit à peine visible sur le site.

Piège numéro 03 :

Ainsi, même si j’étais extrêmement contrarié par ce piège évoqué plus haut, j’ai transféré plus d’argent, afin de profiter de mon bonus qui avait été généré initialement.

J’étais à 112% de marge libre quand tout d’un coup toutes mes positions ont été fermées à nouveau. Cette fois, leur excuse était que la marge ne couvrait aucune perte, dans ce cas elle avait un solde de – BRL 23,00, mais avec des positions ouvertes donnant des bénéfices, et plus de BRL 3 000,00 en bonus, quand dans le règlement du bonus, ce qui suit est prévu :

“3.1. Le bonus fournit une marge gratuite supplémentaire et augmente le montant des fonds disponibles.

de négocier (c’est-à-dire d’ouvrir de nouvelles positions et de maintenir les exigences de marge pour ces

postes).”

Si le bonus est utilisé pour maintenir les exigences de marge, ils n’avaient pas le droit de fermer mes positions comme ils l’ont fait, sinon il serait inutile d’avoir ce bonus. Un piège de plus, une défaite de plus.

Autrement dit, après de nombreuses et récurrentes pertes et mauvaises surprises que j’ai eues avec ADMIRAL MARKETS, la seule chose que je puisse faire, en plus d’être légalement impliqué pour faire respecter mes droits, est d’alerter les clients sans méfiance afin qu’ils NE TOMBERENT PAS DANS CELA RÉSEAU DE PIÈGES DE CETTE ENTREPRISE, QUI A JUSTE UN NOM, LE RESTE EST DES PERTES NON AGRÉABLES ET DES SURPRISES.

ADMIRAL MARKETS EST UNE PERTE JUSTE, si vous ne voulez pas perdre d’argent, éloignez-vous de cette entreprise, ce ne sont pas des gens sérieux et ils ont un mépris total pour le client.

L’avertissement demeure.

Bonne chance à to

Hello.very bad site,cheating me,I had about 6 months trading with…

Hello.I had about 6 months trading with admiralmarkets

and lost alot of money,But suddenly i recieved an mail says that we are decided to terminate business with you,I asked them why?But they did not answer my question in 2 weeks time they close my account,Which this not fair,This admiralmarkets is untrustable site,Beware of that and do not invest your money there,I have all my mail and proof what i just said,

I want to denounce the existing complicity to scam between Admiral Markets and the well-known swindler José Luis Cases Lozano, through a project called Reto 20k, where prizes of thousands of euros are offered just by registering and for this it is required to open a broker account at Admiral Markets. Everything was a scam, without any explanation everything was suspended and of course José Luis Cases Lozano with his Reto 20k project, he kept the money of the registered people and the broker Admiral Markets also scammed money with the accounts that were opened for to participate. José Luis Cases Lozano and Admiral Markets have to answer for fraud and misappropriation of funds, for the money we invested by those who registered and were swindled.

To register with Tradingchess, you need to open a broker account at Admiral Markets, and many people have registered to take part and opt for a trading course valued at more than € 500 online from traderprofesional.com, also from José Luis Cases Lozano, just for signing up. Everything was a scam, without any explanation everything was suspended and of course José Luis Cases Lozano with his Tradingchess.com project he kept the money of the registered people and the broker Admiral Markets also scammed money with the accounts that were given high and new customers.

Hello everyone,

Thank you for your patience while we investigated this. The founder of http://traderprofesional.com/ and is an Admiral Markets IB.

Unfortunately, though, a person by the name of Fernando Tejedor has been claiming to be a representative of this website, and taking fraudulent deposits. While we are taking actions at our end to stop him, he may continue to claim to represent traderprofesional.com

With this in mind, if you are contacted by someone claiming to be an Admiral Markets IB associated with the Trader Profesional website, please contact Admiral Markets or Trader Profesional via our official emails support@admiralmarkets.com, or via an @traderprofesional.com email address, and they can confirm whether you are dealing with a verified representative of Trader Profesional and Admiral Markets.

Thank you for bringing this situation to our attention. If you have any further questions or complaints, please contact us directly at support@admiralmarkets.com

Kind regards,

Admiral Markets

I like that the team of admiral markets take the task of giving measures and attention to the different accusations and problems that are generated, they are an excellent team. I only recommend you please do not continue supporting characters like “traderprofessional” you have to avoid scams in brokers, stop being a scammer for these supposed promoters of courses and brokers who only steal money.

I FEEL SCAMED, HOW ARE THEY PROVIDED FOR IBS AS A TRADER PROFESSIONAL TO SCAM?

I did the course that this ibs offers, they believe me to believe that the contestants of the Admiral Markets corridor recommend it, the course did not help me, they did not teach anything new that I have not had before on the internet.

WATCH OUT

Hello Jordan and Alex,

As the review above shares, Admiral Markets is a fully regulated broker, with licenses from the FCA, ASIC, CySEC and EFSA – we do not scam our clients.

We’re sorry to hear you’ve had issues with one of our IBs. Could you send us the details of your situation so we can investigate the situation and regain your trust? You can contact us at support@admiralmarkets.com

Kind regards,

Admiral Markets

Admiral Markets has had a good popularity for years but one of the IB’s that is known as traderprofessional, works for this company and scams many people promising bonuses they never give and keeps 50% of user deposits.

I do not trust Admiral Markets because I had a bad experience with one of their IBs who called themselves “traderprofesional”, this person unfairly took away $ 500 of the $ 1000 he had deposited in the account without giving me a specific reason and also promised me bonuses they never gave me.