- Abshire Smith Pros and Cons

- Is Anshire Smith safe or a scam?

- Leverage

- Fees

- Spread

- Deposits and Withdrawals

- Trading Platforms

- Conclusion

What is Abshire Smith?

Abshire Smith is a London based brokerage firm that offers a vast of derivative products across a number of platforms and connections, including foreign exchange (FX), contracts-for-difference (CFD), precious metals, soft commodities as well as Futures, Equities and Securities.

One of the great features of Abshire Smith is that the Broker act as an intermediary between clients through 3 trading platforms, FIX/API connections, and platform bridges that connect orders to liquidity providers, aggregators, and major exchanges.

Abshire Smith Pros and Cons

Abshire Smith is a Regulated broker with a good record, good instrument range, and options between Standard and commission-based accounts.

For Cons, there are No comprehensive education sources and 24/7 support.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation and License | FCA |

| 📉 Instruments | FX, CFDs, precious metals, soft commodities, Futures, Equities and Securities. |

| 🖥 Platforms | VertexFX10, MT4, Straticator |

| 💰 Costs | 0.8 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | GBP, EUR, USD |

| 💳 Minimum deposit | 250$ |

| 📚 Education | Regular market analysis and updates |

| ☎ Customer Support | 24/5 |

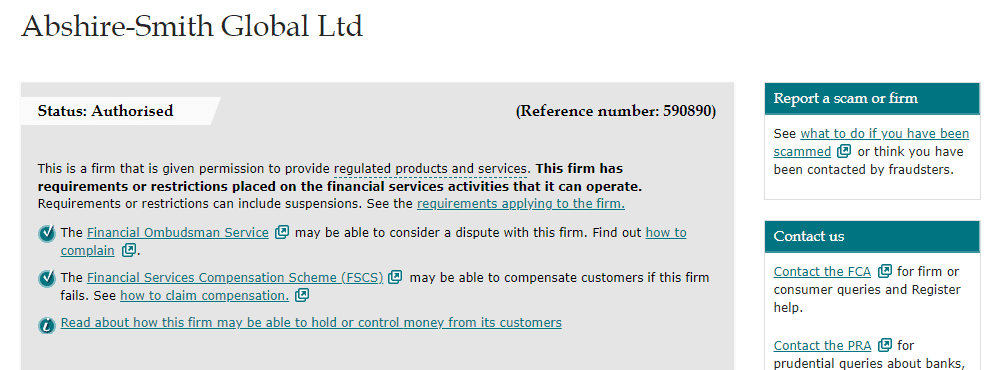

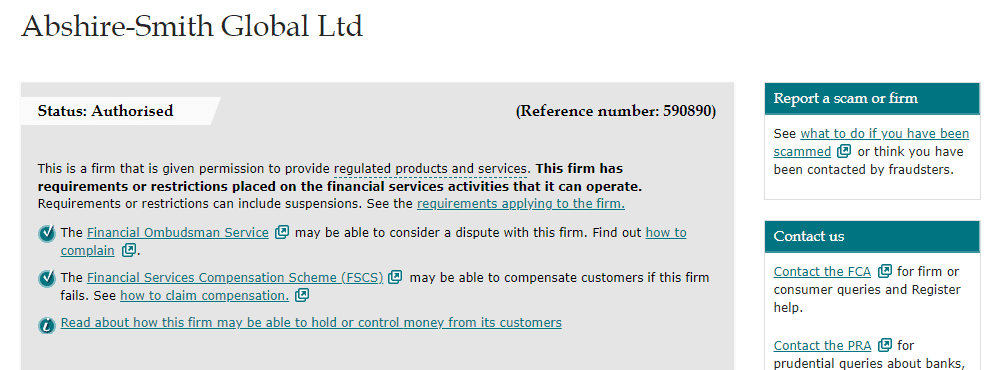

Is Abshire Smith safe or a scam

No, it’s not a scam, Being a UK-based firm, Abshire Smith Global Ltd is authorized and regulated by the Financial Conduct Authority. Therefore, in accordance with regulatory requirements the company is obliged to provide clients with information about the taken steps to obtain the best possible results whether it is an execution of the orders, compliance with the applicable regulation, or the money processing, which makes Abshire a low-risk broker.

This means that Abshire Smith meets the highest standards and regulations required by the international standards and sharp compliance to transparency. Furthermore, the regulator monitors operations on an ongoing basis that ensures adherence to the statutory regulatory requirements and best practices.

In addition, all client funds are held within client segregated accounts and are protected by the FSCS (Financial Services Compensation Scheme).

Leverage

Leverage is a quite known instrument, which obviously multiplies the initial capital you trading with and can be a very useful tool to magnify your potential gains, but in case you use it smartly.

Abshire Smith as a regulated broker in UK jurisdictions complies to provide different trading conditions according to what regulatory obligations set. Therefore, operated under the European FCA regulation you can use limited Leverage to a maximum of 1:30 on Forex instruments.

Account types

Opening a trading account with Abshire Smith enables to access the global financial markets, while variety offers each account specification for the 3 trading platforms available at Abshire Smith.

In addition, novice traders or those who would like to practice the company-trading environment are able to use the technology via a Demo account.

Also, Abshire Smith offers Shariah-compliant trading accounts and features known as Islamic Account with no swaps.

Fees

Abshire Smith delivers a choice between either fixed spread or the NDD connectivity to the liquidity providers with raw spread offering with the commission charged per traded lot. See other fee table below.

| Fees | Abshire Smith Fees | FXTM Fees | City Index Fees |

|---|

| Deposit Fees | No | No | No |

| Withdrawal Fee | No | No | No |

| Fee Ranking | Low | Average | Low |

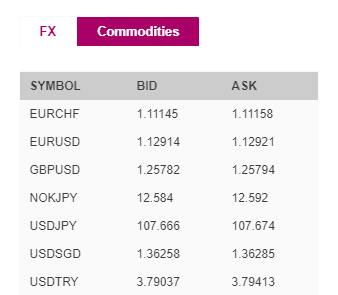

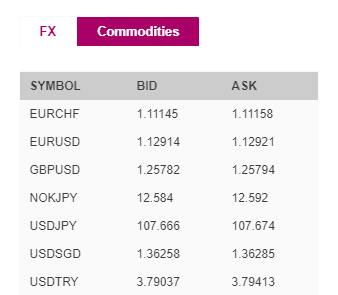

Spread

Typically Abshire Smith EURUSD spread is about 0.8 pips. Abshire Smith is able to provide NDD execution for Forex FX, CFDs and equities, while the connectivity to on-exchange futures and equities trading is possible for VIP or institutional clients either through an API or FIX connection.

| Asset | Abshire Smith Spread | FXTM Spread | City Index Spread |

|---|

| EUR USD Spread | 0.8 pip | 1.5 pips | 0.5 pips |

| Crude Oil WTI Spread | 3 | 9 | 4 |

| Gold Spread | 30 | 9 | 0.3 |

Abshire Smith Payment Methods

So once you opened a live account, funding trading account is possible through one of the three options, deposit at the local bank, make an online credit/debit transfer or fund an account through an eWallet payment gateway. The range of the payment providers for clearing deposits and withdrawals to your trading account includes

- Bank Deposits,

- Credit/ Debit Cards while payment processed by Skrill,

- as well by e-wallets CashU and Neteller.

So once you opened a lice account, funding trading account is possible through one of the three options, deposit at the local bank, make an online credit/debit transfer or fund an account through an eWallet payment gateway. The range of the payment providers for clearing deposits and withdrawals to your trading account includes Bank Deposits, Credit/ Debit Cards while payment is processed by Skrill, as well by e-wallets CashU and Neteller.

Minimum deposit

The Abshire Smith minimum deposit is 250$, which allows traders of any size from beginning to professional ones to sign up.

Abshire Smith minimum deposit vs other brokers

|

Abshire Smith |

Most Other Brokers |

| Minimum Deposit |

$250 |

$500 |

Withdrawals

Abshire Smith Withdrawal options are Bank Wire, a range of e-wallets and Debit Cards. For the transaction fees, the broker does not charge additional amounts for deposits or withdrawals that are also depending on the payment option you choose. Yet, always check with your payment provider in case any fees are waived.

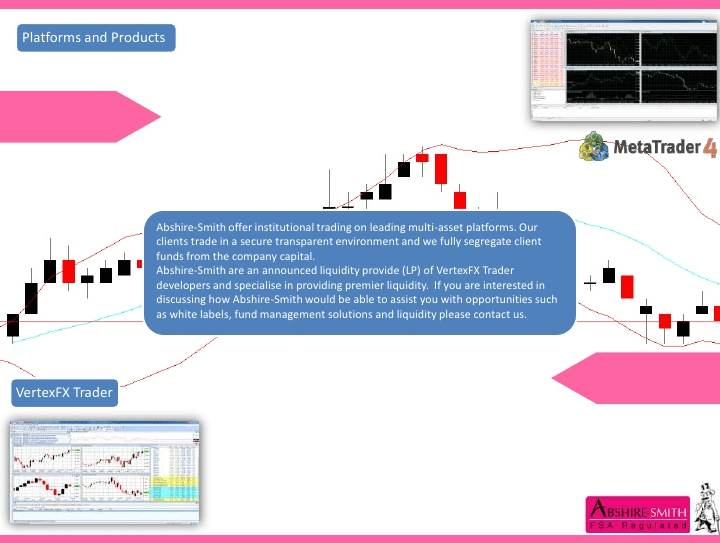

Trading Platforms

Abshire Smith provides 3 leading proprietary trading platforms with secure dedicated servers and a choice of web, mobile, or downloadable platforms to access the trading. The execution type may vary according to the chosen account since they are attached to the trading platform as well as they do depend also on the trader’s operation size.

Therefore, see below some details about each of them and then decide what is the best option for you.

– VertexFX 10 allows trading FX and CFDs on the trading platform, with fast and efficient trade execution with fixed spreads, while platform itself is a web-based or desktop downloaded software. The platform indeed is a very comprehensive trading suite, and Abshire Smith works closely with the developers to ensure it is optimized well, for institutional users the broker also provides the VertexFX 10 Bridge.

Desktop

– MetaTrader4 (MT4) is offered by Abshire Smith too, has access to FX and CFDs (Indices, Commodities, Metals and Energies) and is available as a desktop also a mobile application (iPhone, iPad and Android. As an industry, leading software MT4 advanced charting tools and features are perfectly suited to various traders demands and trading strategies preferences.

Last, but not least is a Straticator platform that ability to trade on exchange equities along with a DMA / ECN / STP / NDD FX model. The multi-asset platform has been developed from a user perspective, with essential tools and key functionality, while available as a web-based platform and as a mobile application.

Customer Support

For the provided support you can be ensured, your needs will be satisfied properly with Abshire Smith constant availability while the customer service team brings confidence to your questions. Moreover, the regular market analysis and updates about the current situations allows to make smarter decisions and to perform a quality better trading with the most recent data on hand.

Conclusion

Overall, the Abshire Smith review presents a brokerage with a strict regulatory environment, vast trading opportunities and with an advanced choice between the trading platforms or even accounts attached to them. The broker delivers an opportunity to the clients of different portfolios and type to join in, while the are options to choose from and potentially benefit from the competitive pricing. Operating an agency only business model means that Abshire Smith is unable to hold proprietary positions, or take exposure to the markets thus you can trade with an open state of mind and trade through transparent conditions.

Abshire Smith Update 2022

Abshire Smith is no longer authorized by FCA in the UK. As mentioned on FCA official website – “This firm can no longer provide regulated activities and products, but previously was authorized by the FCA and/or PRA.”

We recommend doing your own research and stay alerted to any proposals from Abshire Smith if any, since broker holds no serious licenses any longer.

Share this article [addtoany url="https://55brokers.com/abshire-smith-review/" title="Abshire Smith"]