- What is KAB?

- KAB Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- KAB Compared to Other Brokers

- Full Review of Broker KAB

Overall Rating 4

| Regulation and Security | 3.8 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4 / 5 |

| Trading Instruments | 3.9 / 5 |

| Deposit and Withdrawal Options | 4.2 / 5 |

| Customer Support and Responsiveness | 4.3 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 3.9 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4 / 5 |

What is KAB?

KAB is a Forex and CFDs trading broker founded in 2002. It operates internationally through its parent company, KAB International Holdings Ltd., a multinational financial group based in Hong Kong and China. As part of its global expansion, KAB established KAB Kuwait Group to promote its financial products and services in the Middle East.

While the company offers a range of instruments, investors should carefully review its regulatory status before engaging in trading activities.

KAB Pros and Cons

KAB is a good broker offering advanced trading technology and a range of popular assets, making it suitable for traders of all experience levels.

However, on the downside, the broker is not licensed by any well-known regulatory authorities, which may raise concerns about investor protection. Additionally, it lacks comprehensive educational resources, which could be a drawback for beginner traders looking to develop their skills.

| Advantages | Disadvantages |

|---|

| Popular trading instruments | No Top-Tier license

|

| MT5 trading platform | No 24/7 support

|

| Traders from the Middle East | |

| Long years of operation | |

| Competitive trading conditions | |

| Suitable for beginners and professionals | |

KAB Features

KAB offers a range of features designed to cater to both beginner and experienced traders. The broker provides access to Forex and CFDs trading with a variety of popular assets. The key features are summarized in 10 points, covering aspects like Instruments, Account Types, available Platforms, and more.

KAB Features in 10 Points

| 🏢 Regulation | KCCI |

| 🗺️ Account Types | Standard, Elite, Corporate Accounts |

| 🖥 Trading Platforms | MT5 |

| 📉 Trading Instruments | Forex, CFDs on Precious Metals, Indices, Energy, U.S Shares, UK Shares, EU Shares |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 0.1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP |

| 📚 Trading Education | Chart Analysis, Market Insights |

| ☎ Customer Support | 24/5 |

Who is KAB For?

Based on our expert findings and reviews, KAB is considered a good broker with reliable service and favorable conditions, making it suitable for both beginner and experienced traders. According to our research and financial expert opinions, KAB is recommended for:

- Beginning traders

- Professional traders

- Traders from the Middle East

- EAs running

- Automated trading

- Scalping / hedging strategies

- Traders who prefer MT5 platform

- Currency and CFD trading

- Suitable for a variety of strategies

KAB Summary

For our final thoughts, KAB is a company with reliable operations in the industry of financial trading. Being a part of the larger global group, KAB is a well-regulated broker that provides a safe environment.

As for the financial offering, it is mainly focused on Currency trading and CFDs on Indices, Commodities, and more. Yet, the traders or investors preferably professional level or active traders may find useful benefits that are comfortable with personal demands.

55Brokers Professional Insights

KAB stands out as a Forex and CFD broker with a strong presence in the Middle East, offering a range of instruments and advanced technology to enhance the experience. The broker provides access to major financial markets with flexible conditions.

One of its key advantages is its seamless trading infrastructure, which ensures fast execution speeds and competitive spreads. However, a major drawback is its lack of regulation by well-known financial authorities, raising concerns about investor protection. Additionally, while KAB offers a variety of assets, its educational resources and research tools are limited, which may not be ideal for traders seeking in-depth market analysis.

Consider Trading with KAB If:

| KAB is an excellent Broker for: | - Looking for broker with low minimum deposit requirement.

- Providing competitive fees and spreads.

- Offering popular instruments.

- Access to MT5 platform.

- Broker with a variety of strategies.

- Beginners and professional traders.

- Who prefer higher leverage up to 1:300.

- Secure environment. |

Avoid Trading with KAB If:

| KAB might not be the best for: | - Looking for broker with 24/7 customer support.

- Need a broker authorized by Top-Tier authorities.

- Providing Copy Trading. |

Regulation and Security Measures

Score – 3.8/5

KAB Regulatory Overview

KAB operates under the oversight of the Kuwait Chamber of Commerce and Industry (KCCI), which primarily functions as a business registry rather than a financial regulator.

Unlike brokers regulated by well-known authorities such as the FCA or CySEC, KAB lacks strict investor protection measures, such as segregated client funds and compensation schemes.

While the broker provides access to various financial markets, traders should exercise caution and conduct thorough research before investing. For those prioritizing strong regulatory oversight, choosing a broker regulated by a top-tier financial authority may be a safer option.

How Safe is Trading with KAB?

Trading with KAB comes with both advantages and risks. While the broker operates under the KCCI, this entity is not a recognized financial regulator, meaning KAB does not adhere to strict international regulatory standards.

The lack of oversight from reputable bodies raises concerns about investor protection, fund security, and dispute resolution mechanisms. On the positive side, KAB provides access to various instruments and utilizes advanced technology for trade execution. However, without strong regulatory backing, traders should proceed with caution, conduct thorough research, and consider the potential risks before investing.

Consistency and Clarity

While KAB has gained some positive feedback for its advanced technology and diverse asset offerings, reviews are mixed due to concerns over its regulatory status and lack of investor protection. The broker’s operational establishment under the KCCI provides a foundation, but it lacks the rigorous oversight that traders may expect from top-tier regulatory bodies.

KAB’s participation in sponsorships and active marketing efforts help raise its profile, yet the absence of notable industry awards or recognition for service excellence may make some traders hesitant. Overall, while KAB has managed to establish itself in the financial community, potential users should carefully weigh the advantages of its platform against the drawbacks of limited regulation and transparency.

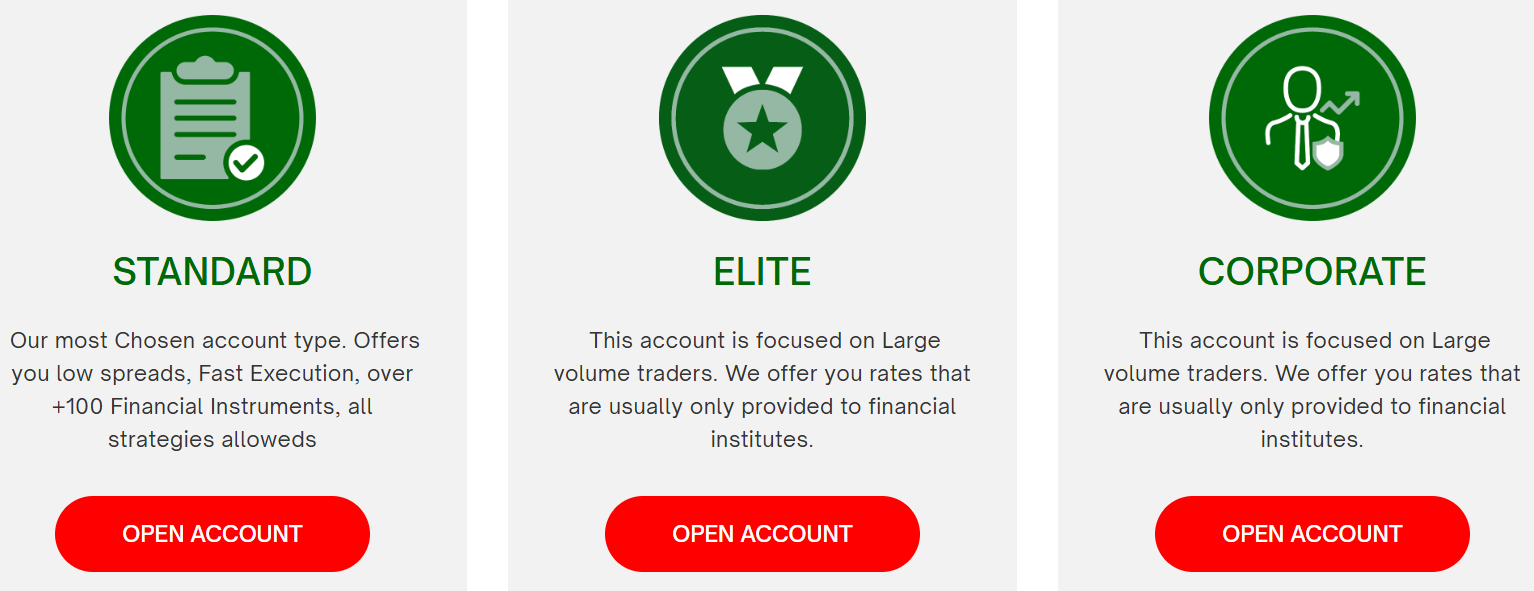

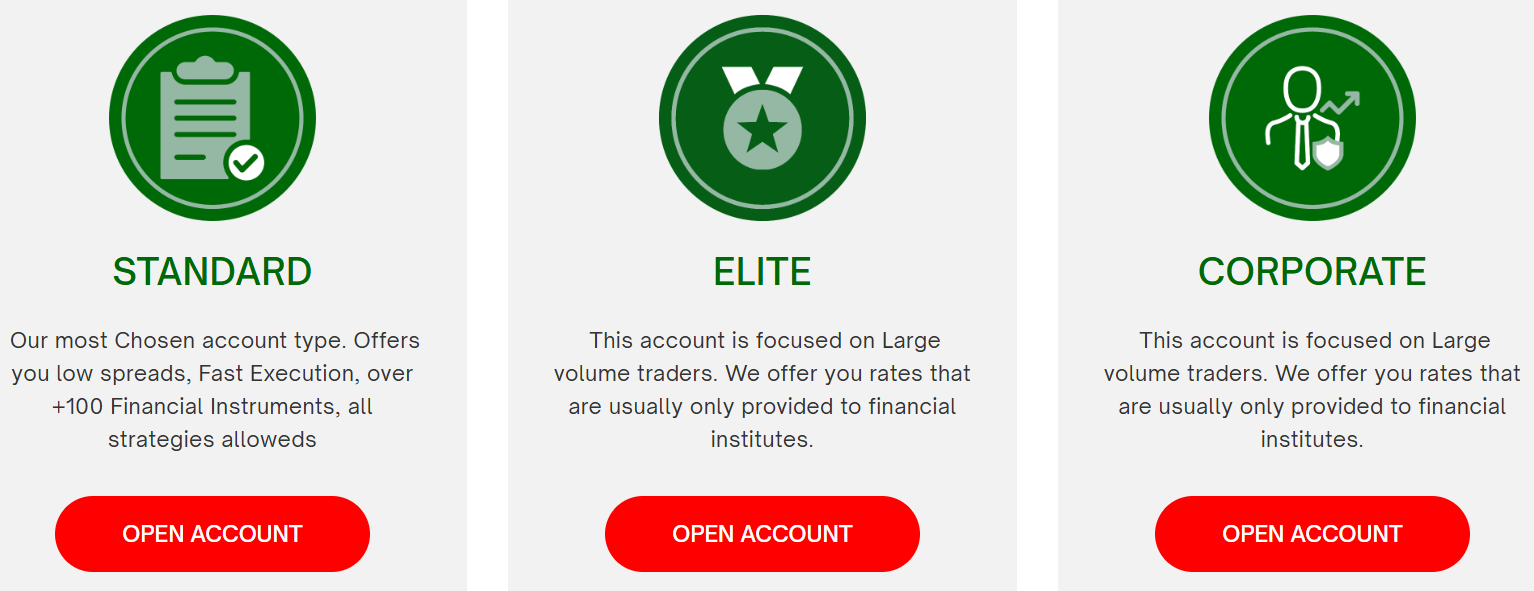

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with KAB?

KAB offers a variety of account types to cater to different traders’ needs, including Standard, Elite, and Corporate accounts. The Standard account is designed for individual traders and provides access to a range of financial instruments with competitive spreads and basic features.

The Elite account is tailored for more experienced traders, offering enhanced features such as lower spreads, faster execution, and additional tools for better market analysis. For businesses and institutional clients, KAB provides Corporate accounts, which offer customized solutions and higher volume trading capabilities.

Additionally, the broker offers a Demo account, allowing new traders to practice and familiarize themselves with the platform without risking real money.

Standard Account

The Standard Account is for individual traders who prefer more straightforward conditions. The minimum deposit requirement for this account is $100, making it accessible to most retail traders.

Spreads start at competitive levels, as low as 0.1 pips, but may vary depending on market conditions. While the account offers basic trading features, it still provides access to a range of financial instruments such as Forex, CFDs, and commodities.

Elite Account

The Elite Account is tailored for experienced traders who require more advanced features and better conditions. Spreads are much tighter compared to the Standard Account, offering a more cost-effective environment for active traders.

The account also provides faster trade execution, priority customer support, and access to advanced tools and features. Traders on this account type can expect a more refined experience with reduced fees for higher-volume trades.

Corporate Account

The Corporate Account is designed for businesses, institutional traders, or high-net-worth individuals who require customized solutions. The minimum deposit for a Corporate Account is significantly higher than that of the Standard or Elite accounts, as it caters to larger trading volumes.

This account type offers institutional-grade features, such as tailored spreads, high-leverage options, and advanced risk management tools. Fees and spreads for this account vary based on volume, with more favorable conditions provided for larger trade sizes.

Regions Where KAB is Restricted

KAB is not available in certain regions due to regulatory requirements or local laws governing financial services. While the broker primarily operates in Kuwait and the broader Middle Eastern region, traders should check the specific regulatory restrictions in their country.

KAB does not offer its services in regions where trading Currency and CFDs are heavily regulated or prohibited, such as:

- USA

- European countries, etc.

Cost Structure and Fees

Score – 4.4/5

KAB Brokerage Fees

KAB imposes various brokerage fees depending on the account type, instrument, and market conditions. The broker’s fees are primarily based on spreads, which start as low as 0.1 pips but may fluctuate based on liquidity and volatility.

While KAB offers commission-free trading on some accounts, certain asset classes or premium services may involve additional charges. Traders should also be aware of potential non-trading fees, such as withdrawal charges, inactivity fees, or overnight swap rates for leveraged positions.

KAB offers competitive spreads across various instruments. The broker’s average EUR/USD spread is 0.1 pips, providing tight pricing for Forex traders. However, spreads may fluctuate depending on market conditions, liquidity, and account type.

Standard accounts typically have slightly wider spreads compared to Elite and Corporate accounts, which offer more favorable pricing for high-volume traders.

KAB primarily operates with a spread-based pricing model, meaning many trades are commission-free. However, for certain instruments or account types, the broker charges commissions on trades, particularly for lower-spread or professional-grade accounts like the Elite or Corporate accounts.

Commission rates vary depending on the asset class, trade volume, and market conditions. While Currency trading may remain largely commission-free, other asset classes, such as shares, incur additional charges of 0.10%.

KAB applies rollover or swap rates on positions that are held overnight. These rates are the interest charged or earned for keeping a trade open beyond the daily market close. The swap rate varies depending on the asset being traded, market conditions, and the direction of the trade.

Typically, the rates reflect the interest rate differential between the two currencies in a Currency pair or the underlying asset in other markets.

KAB charges additional fees beyond standard commissions and spreads. These fees include charges for specific services such as withdrawal fees, and rollover/swaps for positions held overnight.

Depending on the type of asset, there may also be additional fees tied to particular markets or financial instruments. For example, fees may apply to transactions involving shares or commodities, as well as for currency conversions.

How Competitive Are KAB Fees?

KAB offers competitive fees when compared to other brokers in the region. The broker’s fees are generally in line with industry standards, with low spreads, minimal commissions, and clear pricing structures for various asset classes.

The broker’s fee structure is designed to cater to traders of all levels, from beginners to experienced professionals. However, traders should always review the fee schedule for specific costs related to their trading activities.

| Asset/ Pair | KAB Spread | Rakuten Spread | City Index Spread |

|---|

| EUR USD Spread | 0.1 pips | 0.5 pips | 0.8 pips |

| Crude Oil WTI Spread | 0.5 | 6.10 | 0.4 |

| Gold Spread | 0.05 | 1.5 | 0.3 |

| BTC USD Spread | - | - | 35 |

Trading Platforms and Tools

Score – 4/5

KAB primarily offers the MetaTrader 5 platform, which is available in desktop, and mobile versions. This platform provides advanced financial functions, as well as superior tools for technical and fundamental analysis. Traders can utilize automated trading features through robots and signals.

The mobile version of MT5 allows clients to trade on the go, ensuring flexibility and accessibility across various devices.

Trading Platform Comparison to Other Brokers:

| Platforms | KAB Platforms | Rakuten Platforms | City Index Platforms |

|---|

| MT4 | No | No | Yes |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

KAB Web Platform

The broker offers the MT5 platform, but only in the desktop version. The desktop version of MT5 provides traders with advanced tools for market analysis, automated features, and a full range of order types.

KAB Desktop MetaTrader 4 Platform

KAB does not offer the MetaTrader 4 platform for trading. Instead, the broker exclusively provides the MetaTrader 5 platform, available in the desktop version.

MT5 is a more advanced and feature-rich platform compared to MT4, offering enhanced charting tools, more timeframes, and improved order execution options.

KAB Desktop MetaTrader 5 Platform

KAB offers the MT5 desktop platform, which combines cutting-edge technology with a user-friendly interface to provide an exceptional trading experience. This platform gives traders access to all major instruments, including Forex, commodities, indices, and more.

With its simplicity and intuitive layout, MT5 ensures that both beginners and experienced traders can navigate the platform with ease. It also supports automated trading through Expert Advisors, allowing traders to set up custom strategies for execution without manual intervention.

Main Insights from Testing

MetaTrader 5 offers a comprehensive set of tools for both technical and fundamental analysis. The platform excels in providing seamless order execution, advanced charting options, and customizable indicators.

It supports multiple timeframes and a variety of order types, enhancing the experience. Additionally, MT5 allows for the use of automated trading through Expert Advisors, enabling traders to implement strategies without constant manual input. Overall, MT5 offers a robust, flexible environment suitable for traders of all experience levels.

KAB MobileTrader App

The broker offers the MT5 Mobile app, allowing traders to access their accounts and trade on the go. This mobile version provides the same powerful features as the desktop platform, including advanced charting, real-time market data, and the ability to place orders from anywhere.

With the mobile app, traders can stay connected to the markets and execute trades seamlessly, making it a convenient solution for those who require flexibility and mobility in their activities.

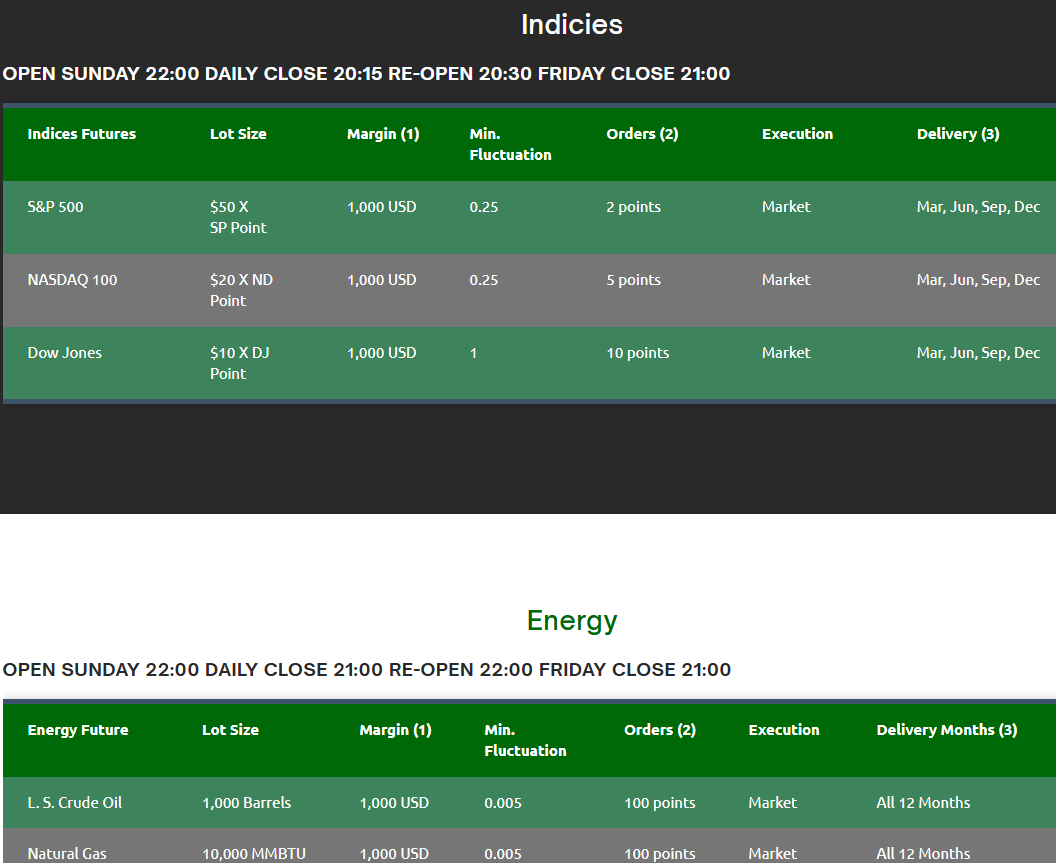

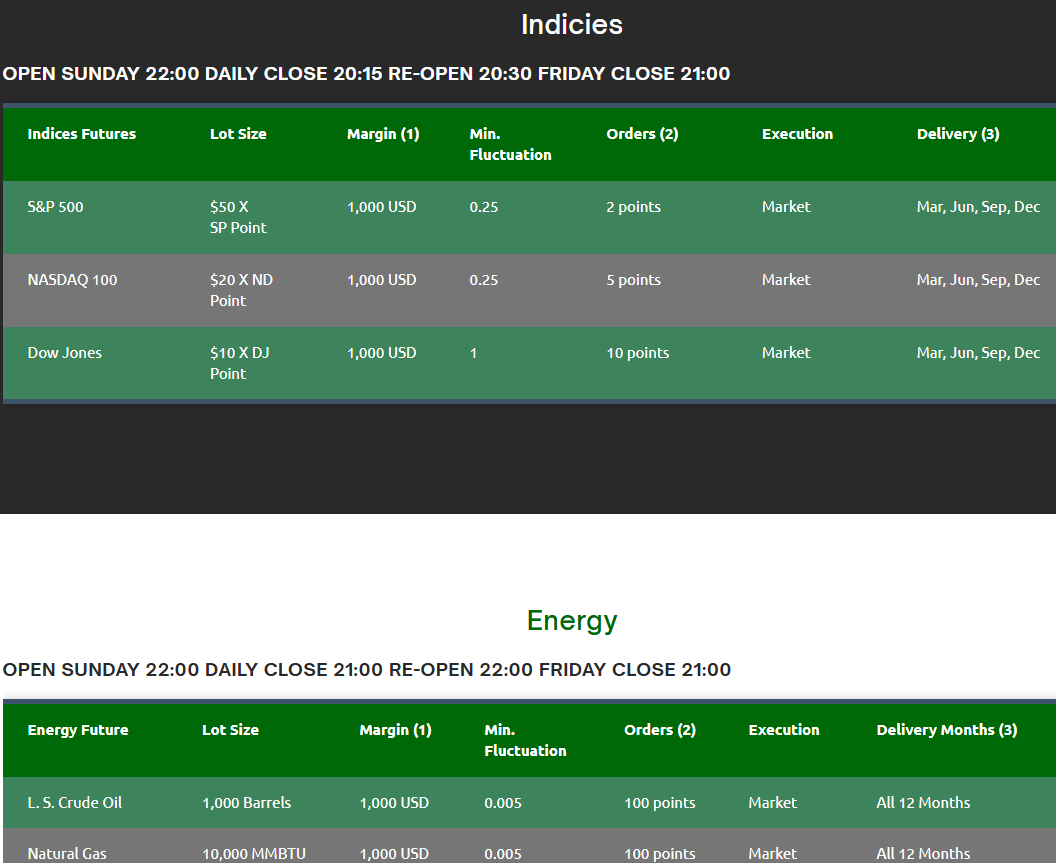

Trading Instruments

Score – 3.9/5

What Can You Trade on KAB’s Platform?

On KAB platform, traders have access to over 300 instruments across a range of asset classes. This includes Forex, offering currency pairs from major, minor, and exotic markets, as well as CFDs on Precious Metals like gold and silver.

Traders can also explore Indices, Energy products like crude oil, and a variety of shares, including U.S., UK, and EU shares.

Main Insights from Exploring KAB’s Tradable Assets

KAB’s tradable assets reveal that the broker offers a solid selection of instruments, catering to a variety of strategies. While their range may not be as extensive as some other brokers with more diverse options, it still provides sufficient variety for traders seeking opportunities in popular asset classes like Forex, CFDs, and shares.

Overall, KAB’s asset selection meets the needs of most traders, though those seeking highly specialized or niche instruments may find the range somewhat limited compared to other brokers with broader offerings.

Leverage Options at KAB

At KAB, the multiplier level depends on the regulation and jurisdiction governing the account.

- Traders from Kuwait are eligible to use a high leverage of up to 1:300 for major currency pairs.

Leverage tool indeed is a powerful feature, yet you should learn deeply how to use it the best way, as leverage may work in reverse to your gains too.

Deposit and Withdrawal Options

Score – 4.2/5

Deposit Options at KAB

KAB offers several deposit options for traders, making it convenient to fund accounts. The available options include:

- Knet Bank Card: Only applicable for Kuwait locals

- Visa/Mastercard: Available for traders in Qatar, Saudi Arabia, and the UAE

- SCARDU and Bipi Pay: Additional payment methods for deposits

KAB Minimum Deposit

The broker requires a minimum deposit of $100 to begin trading, making it an accessible option for traders at all levels.

Withdrawal Options at KAB

KAB offers several withdrawal options for traders, allowing them to easily access their funds. The available methods include bank transfers, Visa and Mastercard, and other payment services like SCARDU and Bipi Pay.

Withdrawal processing times may vary depending on the method chosen, and fees could apply depending on the payment option and region.

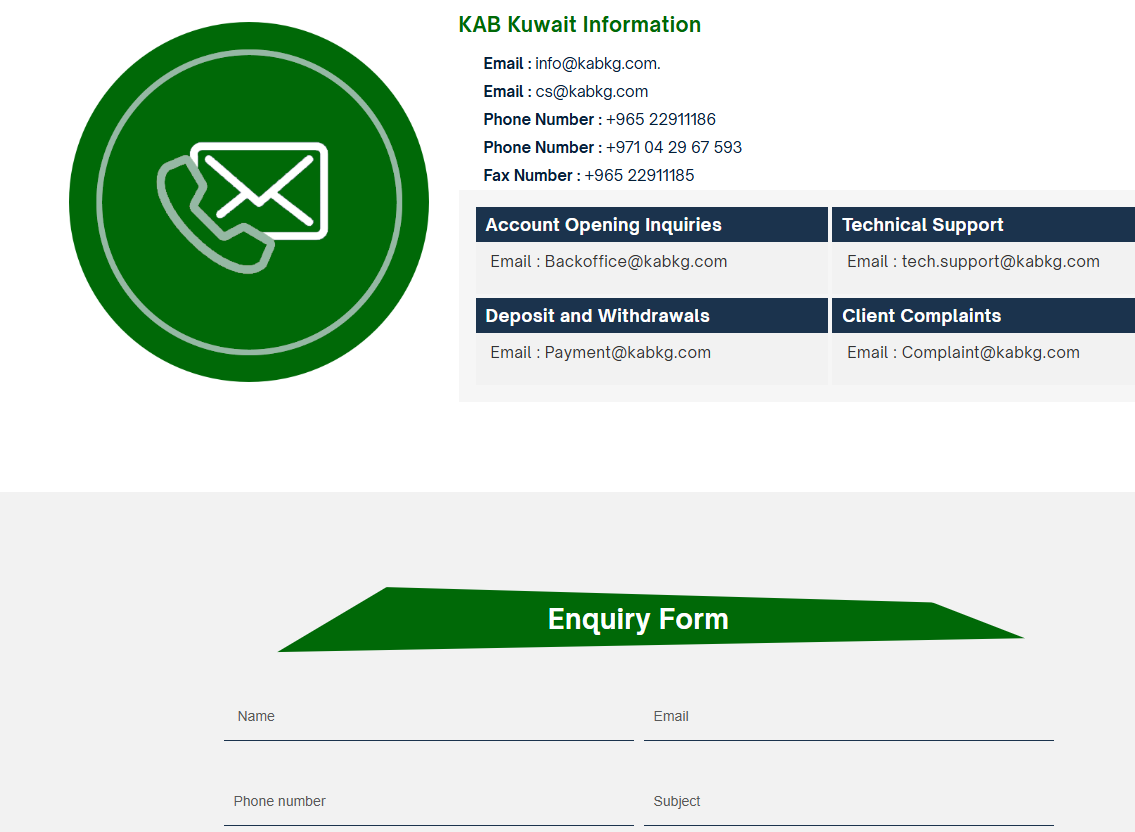

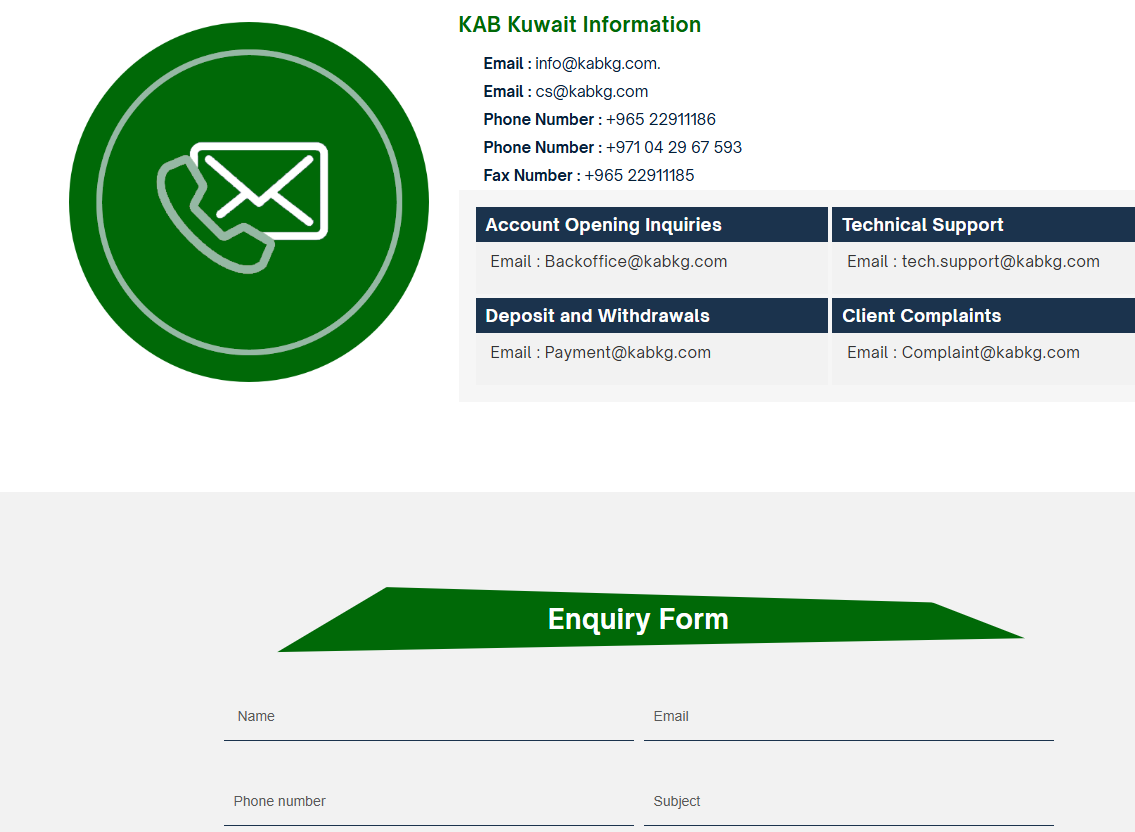

Customer Support and Responsiveness

Score – 4.3/5

Testing KAB’s Customer Support

KAB offers reliable and professional customer support, ensuring traders have access to assistance whenever needed. Their support team is available 24/5 through email, and phone, providing quick responses to inquiries and resolving issues efficiently.

Contacts KAB

For inquiries and support, you can contact KAB via email at info@kabkg.com for general inquiries or cs@kabkg.com for customer support. For direct communication, their phone numbers are +965 22911186 (Kuwait) and +971 04 29 67 593 (UAE). Their dedicated team is available to assist with any questions or concerns related to trading, account management, or technical support.

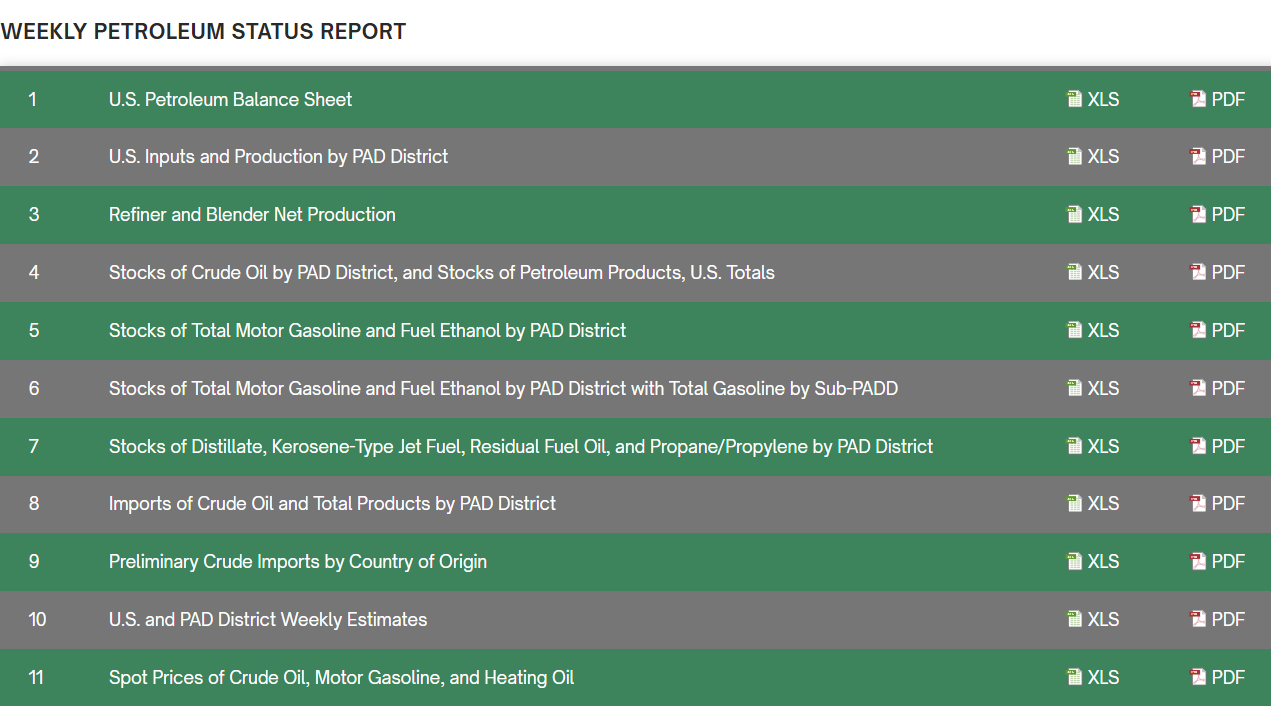

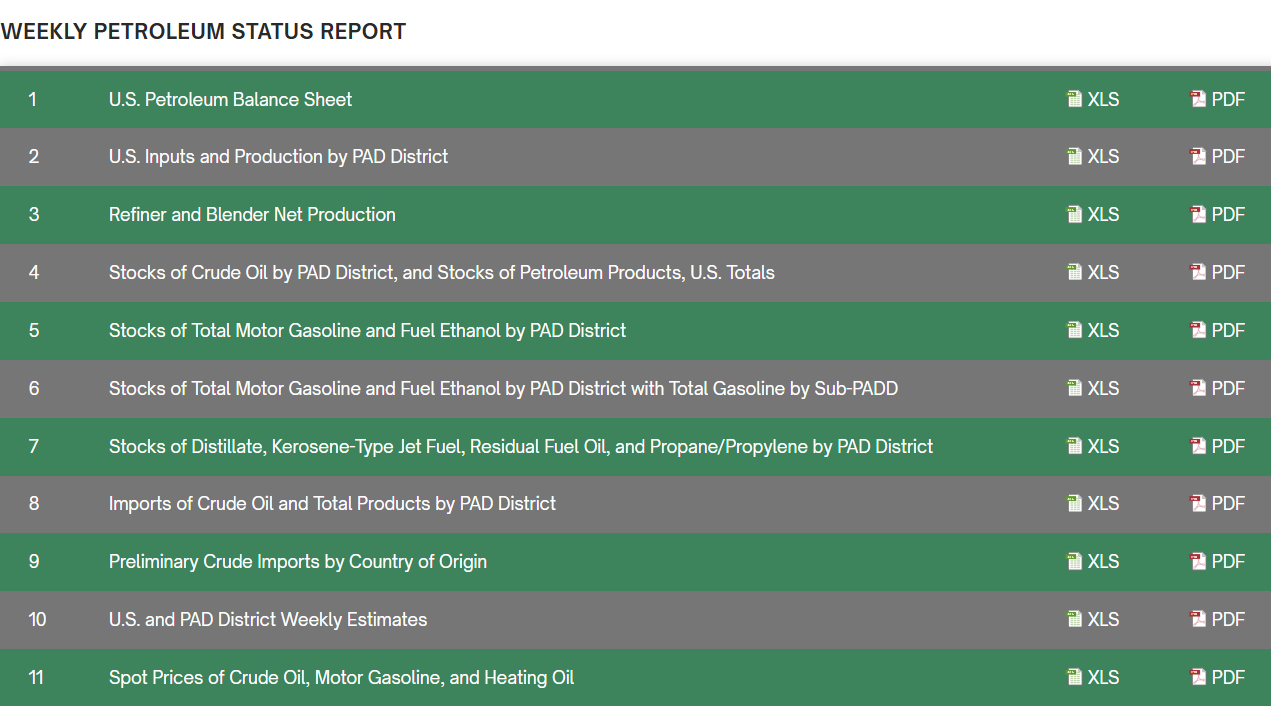

Research and Education

Score – 4.2/5

Research Tools KAB

KAB offers a few research tools on its website and through the MT5 platform to assist traders in making informed decisions.

- On the website, traders can access market analysis, economic calendars, and news updates to stay current with global financial events.

- The MT5 platform enhances the research experience by providing advanced charting tools, technical indicators, and a variety of order types, allowing traders to analyze market trends and execute strategies efficiently.

- With real-time market data, customizable charts, and the ability to use Expert Advisors, KAB ensures that traders have comprehensive tools for both technical and fundamental analysis.

Education

KAB offers limited educational materials for traders, focusing mainly on market insights and chart analysis. While the broker provides some valuable content to help traders stay updated on market trends, the educational resources are not as extensive as those found with other brokers.

The materials available mainly include regular market analysis, insights into price movements, and technical charting. However, there are no in-depth courses or structured educational programs for traders looking for more comprehensive learning.

Portfolio and Investment Opportunities

Score – 3.9/5

Investment Options KAB

KAB primarily focuses on Currency and CFD trading, offering a range of currency pairs, commodities, and indices for trading. While the broker is mainly centered on these markets, it also provides the opportunity to trade shares from major markets like the USA, EU, and UK. This allows traders to diversify their portfolios by gaining exposure to well-known global companies.

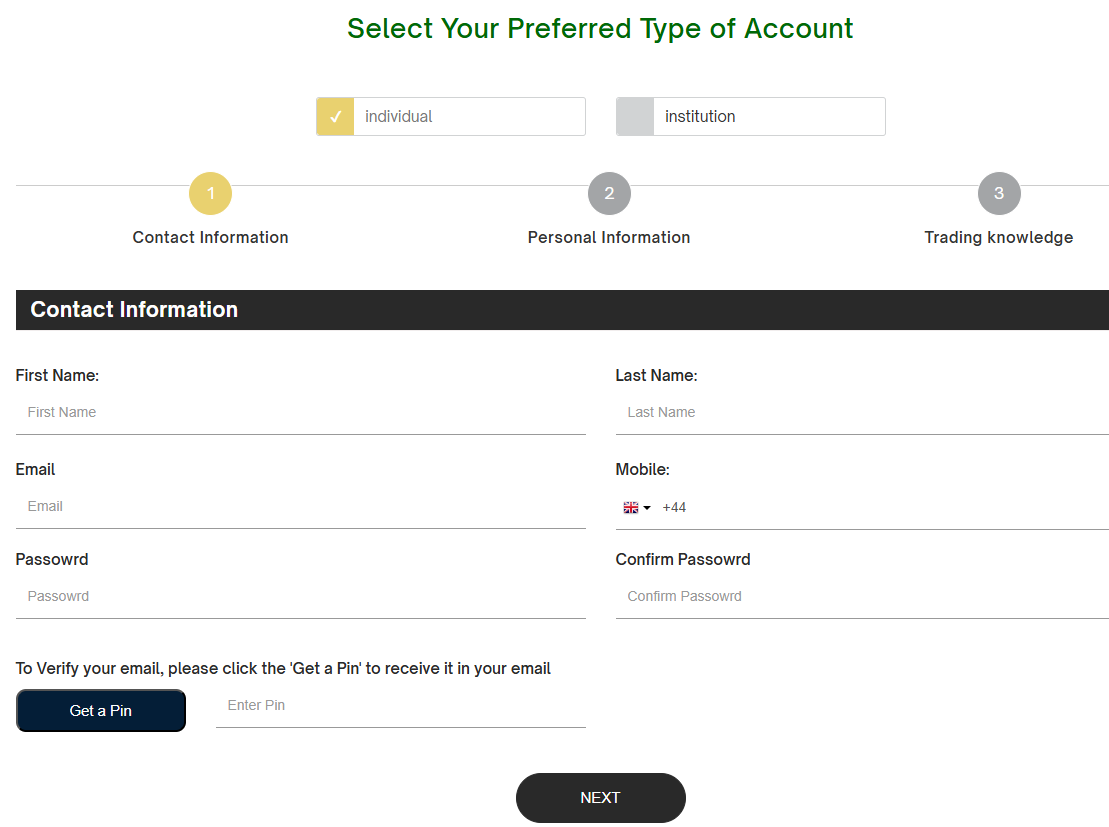

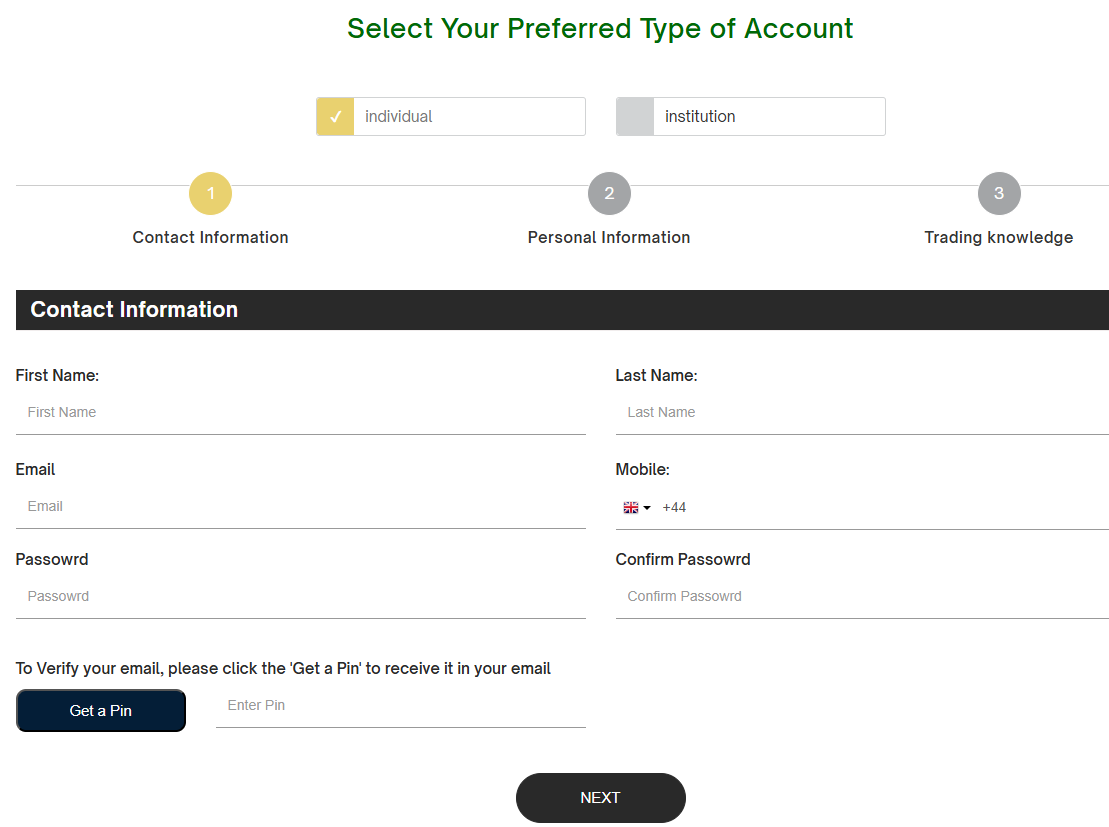

Account Opening

Score – 4.4/5

How to Open KAB Demo Account?

Opening a KAB demo account is a straightforward process designed to help traders practice their strategies without risking real money. To get started, simply visit the broker’s website and navigate to the demo account registration page.

From there, you will need to fill in a short registration form with your details, including your name, email, and contact information. Once submitted, you will gain access to the demo account, which allows you to trade with virtual funds on the MT5 platform. This is a good way to explore the platform, test strategies, and familiarize yourself with the market before moving to a live account.

How to Open KAB Live Account?

To open a live account with KAB Kuwait Group, follow these simple steps:

- Go to the official KAB website and navigate to the account registration page.

- Choose the option to open a real account.

- Provide your details, including your full name, email address, phone number, and country of residence.

- Select from the available account types, based on your trading needs.

- Submit the required identification and proof of address documents for account verification.

- Deposit the minimum required amount of $100 using one of the available payment methods.

- Once your account is verified and funded, you can begin trading on the MT5 platform.

Additional Tools and Features

Score – 4/5

In addition to the research tools available on the KAB platform, the broker offers additional tools and features to enhance the experience.

- One of the key tools is signals, which provide valuable insights into potential market movements, helping traders make more informed decisions. These signals are based on expert analysis and technical indicators, giving traders an edge when executing trades.

- Additionally, real-time price alerts and customizable chart settings, provide a comprehensive suite of features to support both novice and experienced traders.

KAB Compared to Other Brokers

When comparing KAB to its competitors in the brokerage industry, it stands out with competitive spreads, popular instruments, and an industry-average minimum deposit amount.

However, some competitors offer more robust educational materials and access to a wider variety of assets. Additionally, KAB’s platform options, including the popular MT5, are in line with industry standards, although some competitors provide more diverse platform choices, such as proprietary systems or platforms with enhanced functionalities.

In terms of fees, KAB’s commission structure is transparent, although its fees may be higher than those of some brokers that offer commission-free trades. Overall, KAB’s offering is competitive, but some of its competitors excel in platform variety, educational support, and asset diversity.

| Parameter |

KAB |

Rakuten Securities |

Saxo Bank |

City Index |

Swissquote |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 0.1 pips |

Average 0.5 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

For Share CFDs (Commission of 0.10%) |

For Stock CFDs (Commission of RM1 to a maximum of RM100 in Malaysia) |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + €2.50 |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT5 |

Rakuten FX Webr, MARKETSPEED FX, iSPEED FX |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT4, MT5, Swiss DOTS, TradingView |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

300+ instruments |

1000+

instruments |

71,000+ instruments |

13,500+ instruments |

400+ Forex and CFDs instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

KCCI |

SFC, SCM |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Excellent |

Excellent |

Excellent |

Excellent |

Good |

Good |

| Minimum Deposit |

$100 |

$0 |

$0 |

$0 |

$1,000 |

$0 |

$0 |

Full Review of Broker KAB

KAB is a well-established broker offering a range of services with a focus on Forex and CFD trading. It provides competitive spreads and a user-friendly MetaTrader 5 platform, allowing traders to access various financial instruments like precious metals, indices, energy, and more.

With a low minimum deposit requirement, KAB caters to both beginner and experienced traders. The broker also offers market insights and chart analysis and has a straightforward commission structure for share trading.

While customer support is available during market hours, KAB lacks some advanced features and a broader range of educational tools compared to other brokers. Overall, it provides a solid experience for those looking for reliable execution and competitive fees.

Share this article [addtoany url="https://55brokers.com/kab-review/" title="KAB"]

been trying contact them for ever for no success