FxGrow 2026 Review

-

Written by:

George Rossi -

Updated:

Leverage: 1:30

Regulation: CySEC

Min. Deposit: $100

HQ: Cyprus

Platforms: MT4, MT5, WebTrader, Mobile App

Found in: 2008

Advertising Disclosure

Written by:

George Rossi

Updated:

Leverage: 1:30

Regulation: CySEC

Min. Deposit: $100

HQ: Cyprus

Platforms: MT4, MT5, WebTrader, Mobile App

Found in: 2008

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

The FxGrow brokerage firm was established in 2008 and has since significantly expanded its operations, serving institutional and retail clients in more than 100 countries. The broker provides transparent conditions through STP execution of orders and the lowest ECN spreads starting from 0.00001, along with negative balance protection to ensure the client’s funds’ safety. The execution time takes less than 10 milliseconds.

Due to its good selection of learning materials and a decent set of tools, the broker is a suitable choice for both novice traders and experienced professionals with years of successful experience.

FxGrow is a regulated broker with easy account opening, a large instrument range, and quality STP execution with platforms and tools included. There are learning materials and a wide range of deposit methods supported.

For the cons, fees for some instruments might be higher, and there is no 24/7 support.

| Advantages | Disadvantages |

|---|---|

| CySEC regulation and oversee | No 24/7 customer support |

| Forex and CFD trading | |

| Negative balance protection | |

| Wide range of trading instruments | |

| Advanced trading platforms | |

| Fast account opening | |

| Competitive trading conditions |

FxGrow is a trustworthy broker that provides good conditions and client protection for its clients. With flexible account options and access to global financial markets, the firm aims to deliver a smooth and efficient experience.

| 🏢 Regulation | CySEC |

| 🗺️ Account Types | ECN, ECN Plus, ECN Elite Accounts |

| 🖥 Trading Platforms | MT4, MT5, WebTrader, Mobile App |

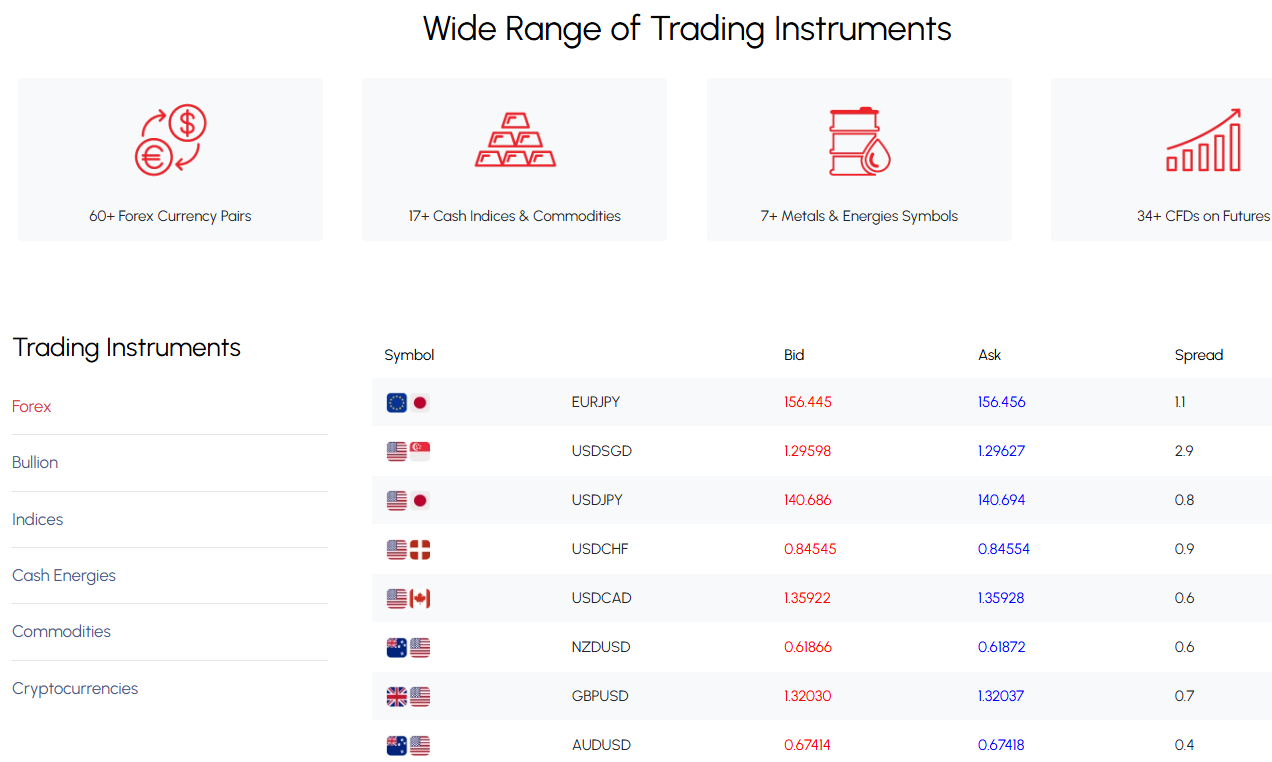

| 📉 Trading Instruments | Forex, CFDs on Indices, Commodities, Metals, Energies, Cryptocurrencies, Futures |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 1.1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, PLN |

| 📚 Trading Education | Educational Academy, Analysis |

| ☎ Customer Support | 24/5 |

FxGrow is designed for users who are looking for a simple yet versatile platform to access the financial markets. It suits both beginners starting their financial journey and experienced traders seeking flexible conditions and diverse instruments. Based on our findings and Financial Expert Opinion, FxGrow is Good for:

In summary, FxGrow is a broker that combines accessibility with practical tools, making it suitable for a wide range of users. It offers diverse account types, a variety of tradable instruments, and conditions aimed at supporting both new and experienced market participants.

Its earned trust comes from several factors, including being fully regulated under applicable laws and offering competitive low spreads within the industry. Overall, the broker positions itself as a straightforward option for those seeking flexible and efficient online trading.

FxGrow stands out by combining regulatory reliability with trader-focused features that appeal to a broad audience. One of its key strengths is its commitment to transparency and compliance, which helps build trust among users by ensuring that client funds and trading practices adhere to established standards.

The broker also offers competitive pricing, including low spreads and flexible account options, which can enhance cost efficiency for both frequent and long-term traders. Additionally, FxGrow provides access to a wide selection of financial instruments, from Forex and commodities to indices and cryptocurrencies, allowing users to diversify their strategies.

Coupled with practical tools, responsive customer support, and multiple platform choices, these elements contribute to FxGrow’s reputation as a versatile and dependable option for traders at different experience levels.

| FxGrow is an excellent Broker for: | - Need a well-regulated broker․ - Secure environment. - Offering a range of popular instruments. - Providing competitive conditions. - Offering Copy trading features. - European trading. - Currency and CFD trading. - Various strategies allowed. - Get access to MT4 and MT5 platforms. - Beginners and professional traders. - Offering a variety of account types. - Access to MT4 VPS hosting. - Need broker with fast execution. - Automated trading. |

| FxGrow might not be the best for: | - Need a broker with a Top-Tier license. - Who prefer 24/7 customer service. - Prefer MAM/PAMM trading. - Need cTrader platform. |

Score – 4.5/5

FxGrow, a brand name of Growell Capital, is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC).

In accordance with this, the broker is governed by directives set out by MiFID in the European Union and is respectively authorized for cross-border services by many European authorities.

To create safe and secure conditions, FxGrow provides safe and secure operations with transparent transactions. All client funds are kept in segregated customer accounts, while maintained in the safest top-tier banks and supervised daily.

Retail client funds are insured by the Investor Compensation Fund for Customers of Cypriot Investment Firms with up to 20,000 EUR per client. Along with durable safety protocols, which ensure site and platform integrity.

FxGrow’s reputation in the financial industry reflects a mix of strengths and areas for improvement that help paint a comprehensive picture of the brand’s standing. The broker has operated since 2008 and built recognition through multiple industry awards, which underscore its commitment to transparency and quality service delivery.

Trader reviews are mixed: some users praise FxGrow for competitive spreads, reliable execution, efficient deposits and withdrawals, and supportive customer service, while other independent review platforms show a range of positive and negative feedback that highlights occasional concerns around support responsiveness and conditions.

This balance of feedback, combined with its regulatory status, long operational history, and industry recognitions, positions FxGrow as a broker with an established presence in the market, trusted by many but still subject to the varied experiences that come with global online brokers.

Score – 4.6/5

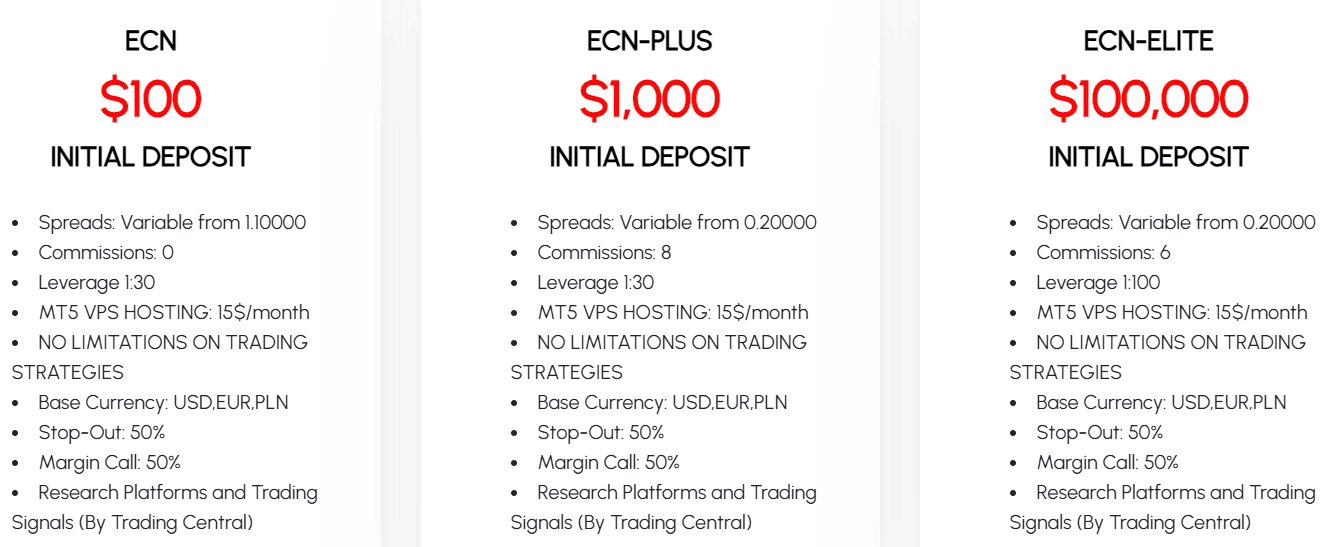

FxGrow offers three main account types: ECN, ECN Plus, and ECN Elite. These accounts differ based on the required deposit amount and the conditions applied. While the standard ECN account is spread-based, the other two combine both spread and commission-based pricing. All account types operate under an ECN execution model.

In addition to these live accounts, FxGrow also provides a demo account for practice trading without risk, as well as the option for swap-free accounts for users who need compliant Islamic conditions.

ECN Account

The ECN Account at FxGrow is the broker’s entry-level live option, ideal for clients who want to start with a lower initial investment while still accessing a professional ECN execution model.

It requires a minimum deposit of $100, making it accessible for beginners and those testing the markets. The account features variable spreads starting from around 1.1 pips and does not charge additional commission, as fees are included within the spread itself.

Traders using this account can execute a range of strategies, including scalping and hedging, and benefit from transparent pricing and no limitations on trading styles.

FxGrow is not available to users in certain countries due to regulatory limitations and compliance requirements. Residents of the following countries are not eligible to open accounts:

Score – 4.5/5

The pricing strategy at FxGrow is designed to ensure transparent costs with no hidden fees, allowing users to access low interbank spreads that are typically reserved for market makers and institutional participants, but are available for the benefit of FxGrow’s clients.

Another cost to consider is the overnight fee, or swap rate, which applies when a position is held longer than one day. Islamic traders may request a swap-free account, in line with their specific principles.

FxGrow provides competitive and transparent spreads across its instruments, designed to reflect real market conditions. The average EUR/USD spread of 1.1 pips helps users maintain cost-efficient execution without hidden markups.

FxGrow charges commissions on its ECN Plus and ECN Elite accounts. For the ECN Plus account, the commission is $8 per lot, while the ECN Elite charges $6 per lot, providing lower costs for higher-tier traders.

FxGrow applies rollover fees, also known as swaps, to positions held overnight. These fees reflect the interest rate differential between the currencies in a trade and are automatically calculated and applied to open positions.

Users who follow Islamic principles can request swap-free accounts, allowing them to trade without incurring overnight interest while still maintaining standard conditions.

FxGrow’s fees are generally competitive within the financial industry, thanks to its transparent pricing and access to tight interbank spreads.

With no hidden charges and clear commission structures on higher‑tier accounts, many users find the overall cost of trading, including spreads, commissions, and swap rates, to be cost‑efficient compared with other brokers. The availability of low spreads and the option for swap‑free accounts further enhances its appeal for a wide range of trading styles.

| Asset/ Pair | FxGrow Spread | OnEquity Spread | Doto Spread |

|---|---|---|---|

| EUR USD Spread | 1.1 pips | 1.5 pips | 1.1 pips |

| Crude Oil WTI Spread | 1 pip | 12 | 8.6 pips |

| Gold Spread | 0.5 pips | 150 | 42 pips |

| BTC USD Spread | 40 | 60 | 20.1 pips |

In addition to spreads, commissions, and rollover/swaps, FxGrow may charge minimal additional fees for specific services, such as withdrawals to certain payment methods or currency conversion.

These fees are generally transparent and clearly outlined, ensuring users are aware of any extra costs before completing transactions. Overall, FxGrow keeps additional charges low to maintain cost-effective conditions.

Score – 4.6/5

By performing the STP execution, FxGrow indeed reduces the speed of transaction to nanoseconds for real pricing, which is a crucial factor in trading. Therefore, the platform performance is essential for success too, as such a majority of the companies FxGrow chose well-known MetaTrader 4 and MetaTrader5, with available versions for desktop and mobile use.

WebTrader is currently one of the most advanced technologies provided by the broker, since the workstation utilises Java technology for streaming financial data and advanced charting tools, does not require installation, and is always “ready.”

| Platforms | FxGrow Platforms | OnEquity Platforms | Doto Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

The FxGrow Web Trader is a browser‑based platform that allows users to access markets without downloading software. It offers a clean and intuitive interface with essential charting tools, real‑time pricing, and quick order execution, making it suitable for traders who want flexibility and convenience.

The web platform works across devices and operating systems, enabling traders to monitor and manage positions from any internet‑connected device.

The FxGrow Desktop MetaTrader 4 platform is a powerful and widely used terminal that provides advanced charting tools, technical indicators, and customizable layouts.

Designed for desktop use, it offers fast trade execution, one‑click trading, and support for Expert Advisors for automated strategies. With extensive analytical features and reliable performance, MT4 is a popular choice for both beginner and experienced traders looking for a robust environment.

The FxGrow Desktop MT5 platform offers an enhanced experience with more advanced tools and features compared to its predecessor. It supports a wider range of order types, more built‑in technical indicators, and an improved economic calendar, making it well‑suited for in‑depth market analysis.

MT5 also allows trading across multiple asset classes from a single interface and provides support for automated strategies, giving users greater flexibility and control in executing their trading plans.

Testing FxGrow reveals a broker that prioritizes transparency, reliability, and user accessibility. The platform delivers smooth trade execution with minimal downtime, and its customer support is responsive and helpful.

Users benefit from flexible account options, fast deposits and withdrawals, and a variety of instruments that cater to different strategies. Overall, FxGrow demonstrates a balanced mix of professional tools and practical features, making it suitable for both new and experienced users.

The broker’s Mobile app offers users the flexibility to manage their accounts and trade on the go from smartphones and tablets. With a user‑friendly interface, real‑time pricing, and essential charting tools, the app makes it easy to place and monitor trades from anywhere with an internet connection.

Its streamlined design ensures smooth navigation and quick access to key features, helping users stay connected to the markets throughout the day.

FxGrow does not currently promote proprietary artificial intelligence‑driven solutions; however, it supports automated trading through its platform features. Clients can use tools like automated strategies and copy trading options, and the broker’s technology infrastructure improvements aim to enhance overall analytics and execution capabilities.

Score – 4.4/5

FxGrow offers a wide range of instruments, giving users access to more than 160 tradable markets across various asset classes, including Forex, CFDs on Indices, Commodities, Metals, Energies, Cryptocurrencies, and Futures.

This broad selection helps traders diversify their portfolios and trade different financial markets from a single platform.

Exploring FxGrow’s tradable assets highlights the broker’s commitment to offering flexibility and variety for different strategies. The platform provides a seamless experience with reliable pricing, fast execution, and tools that help clients analyze and act on market movements efficiently.

Trading with leverage can be advantageous, as it allows users to access the market with a smaller initial investment. However, you should have a thorough understanding of how the multiplier works and the potential risks involved before engaging in leveraged trading.

Score – 4.5/5

Once an account is opened, you can deposit funds into accounts using one of the accepted multiple methods, including:

FxGrow’s minimum deposit requirement starts at $100 for its standard ECN account, making it accessible for users who want to begin with a relatively low initial investment.

FxGrow does not charge any fees for transactions using the FxGrow withdrawal option card payments; however, the e-wallet may require additional fees, which vary from one payment to another.

Score – 4.4/5

As for customer support, clients can reach out to the customer support team 24/5. The broker is available through email, phone, or live chat. Also, the service is of good quality with reliable answers, which confirms FxGrow’s client-oriented policy.

Users can reach FxGrow’s support team via phone or email for inquiries or assistance. The broker’s contact details are: Phone: +357-25-211707 and Email: support@fxgrow.com. The customer service team is available to help with account setup, trading questions, and technical support.

Score – 4.6/5

FxGrow offers a comprehensive set of research and analytical tools designed to help users make more informed decisions.

FxGrow offers a range of educational resources to help users build their skills and market understanding. Through its Educational Academy, users can access structured learning materials covering key topics like technical and fundamental analysis, risk management, and trading strategies.

The broker also shares regular market analysis and insights to keep traders informed about current trends and opportunities.

Score – 3.8/5

FxGrow primarily focuses on Forex and CFD trading, allowing users to access a wide range of currency pairs and CFD instruments across markets.

While it does offer traditional investment products like managed portfolios or long‑term asset accounts, the broker supports copy trading, which lets users follow and replicate the strategies of experienced traders. This feature acts as an investment-oriented option for those who prefer a more hands‑off approach or want to diversify their trading exposure.

Score – 4.4/5

Opening an FxGrow demo account is a simple way to explore the platform and practice trading without risking real funds. It allows you to test strategies and become familiar with the trading environment before moving to a live account. Steps to open a demo account:

To open a live account with FxGrow, users need to visit the broker’s official website and complete the online registration form by providing their personal details.

After creating an account, users must verify their identity by uploading the required documents, such as proof of identity and address, in line with regulatory requirements.

Once the verification is approved, the account can be funded using one of the available payment methods, after which traders can access the platform and begin live trading.

Score – 4.3/5

Beyond research and core platforms, FxGrow offers several extra tools and features that enhance the overall experience.

Based on the comparison, FxGrow positions itself as a well-balanced broker within the competitive landscape. It offers a solid mix of competitive pricing, multiple platforms, and a range of popular instruments, making it suitable for both beginners and more experienced traders.

While some competitors may stand out in specific areas such as ultra-low entry requirements, wide product ranges, or advanced proprietary platforms, FxGrow distinguishes itself through consistent conditions, transparent fee structures, and reliable regulatory oversight.

Its customer support and educational resources are also in line with industry standards, helping to create a stable and accessible environment compared to many alternative brokers in the market.

| Parameter | FxGrow | Purple Trading | Interstellar FX | Colmex Pro | Taurex | CMC Markets | ActivTrades |

| Spread Based Account | Average 1.1 pips | Average 1.3 pips | Average 1 pip | Average 4 pips | Average 1.7 pips | Average 0.5 pips | Average 0.5 pips |

| Commission Based Account | 0.2 pips + $4 per side | 0.3 pips + $2.5 per side | 0.0 pips + $3.50 per side | For stock CFDs, $0.01 per share + a minimum of $1.5 per side | 0.0 pips + $2 per side | 0.0 pips + $2.50 | For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking | Average | Low/ Average | Average | Average | Low/ Average | Low/ Average | Low/ Average |

| Trading Platforms | MT4, MT5, WebTrader, Mobile App | MT4, MT5, cTrader | MT4 | Colmex Pro 2.0, MT4 | MT4, MT5, Taurex Trading App | CMC Markets Next Generation Web Platform, MT4 | ActivTrader, MT4, MT5, TradingView |

| Asset Variety | 160+ instruments | 200+ instruments | 100+ instruments | 28,000+ instruments | 1,500+ instruments | 12,000+ instruments | 1,000+ instruments |

| Regulation | CySEC | CySEC, FSA | FCA, FSA | CySEC, FSCA | FCA, FSA, SCA | FCA, ASIC, BaFin, IIROC, FMA, MAS | FCA, CMVM, FSC, SCB |

| Customer Support | 24/5 | 24/5 | 24/5 | 24/5 | 24/5 | 24/5 | 24/5 |

| Educational Resources | Good | Good | Limited | Limited | Excellent | Good | Good |

| Minimum Deposit | $100 | $100 | $50 | $500 | $10 | $0 | $0 |

FxGrow is a well-established Forex broker that aims to deliver a transparent and accessible experience for a wide range of traders. The platform offers flexible account types, reliable execution under an ECN model, and a variety of instruments that support diversified strategies.

With intuitive platforms, including web, desktop, and mobile options, users can engage with markets conveniently across devices. The broker also provides valuable support through educational resources and research tools that enhance market understanding and decision-making.

Competitive pricing, clear commission structures, and additional features such as VPS hosting and copy trading further contribute to its appeal. Overall, FxGrow presents itself as a dependable choice for all levels of traders seeking a balanced and user-oriented environment.

No review found...

No news available.