- What is JP Markets?

- JP Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

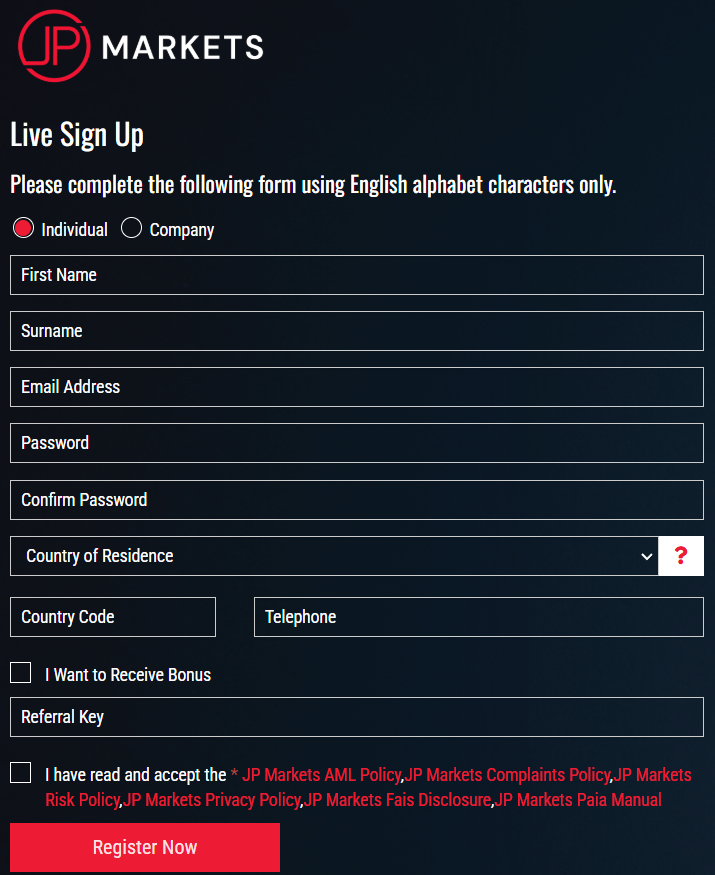

- Account Opening

- Additional Tools And Features

- JP Markets Compared to Other Brokers

- Full Review of Broker JP Markets

Overall Rating 4.2

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.1 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account opening | 4.4 / 5 |

| Additional Tools and Features | 3.8 / 5 |

What is JP Markets?

JP Markets is a South African Forex broker that started to operate in 2016. The broker provides quality, world-class services, including trading platforms and tools to make trading easy. JP Markets has earned a wide client base with over 400,000 active accounts.

The broker offers tight spreads and deep liquidity, with access to various asset classes, including forex, indices, commodities, and cryptocurrencies. The trades are conducted on the advanced MT5 platform that offers innovative features and great trading opportunities.

- While JP Markets operations are based throughout several countries across Africa, its main base is indeed South Africa, and the company that stands behind it is located there as well. However, the broker’s proposal continuously grows beyond and further. So further in our JP Markets review, we will see its offering in detail and consider whether it is a good broker or not.

JP Markets Pros and Cons

JP Markets account opening is easy and smooth, with quality trading conditions, copy trading availability, and great educational materials. The broker is highly reliable with suitable conditions for beginner and experienced traders.

Nevertheless, there are some negative aspects, too. Our research revealed negative responses and experiences with the broker, which should be considered. We advise investors to do their comprehensive checking before opening an account with JP Markets.

| Advantages | Disadvantages |

|---|

| Founded in South Africa and is a recognized African broker

| No 24/7 support |

| Has gained global industry awards | Spread conditions are not clear |

| Tight Low Spreads | Some traders had negative experience with withdrawals |

| ECN trading option | |

| Regulated by the FSCA in South Africa | |

JP Markets Features

JP Markets is a South Africa-based broker with good market conditions, advanced features, and a large offering of account types. To be more specific about the broker’s offerings and the main aspects of its services, we have formed a list where traders can get glimpses of trading with JP Markets:

JP Markets Features in 10 Points

| 🗺️ Regulation | FSCA |

| 🗺️ Account Types | Standard Micro, JPM Micro 300, Premium, VIP, Islamic , 25% Draw Down Bonus, Zero Stop Out, JPM Bonus 300 |

| 🖥 Trading Platforms | MT5 |

| 📉 Trading Instruments | Forex, indices, commodities, cryptocurrencies and stocks |

| 💳 Minimum deposit | R100 ( $5.42) |

| 💰 Average EUR/USD Spread | 2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, ZAR |

| 📚 Trading Education | Available |

| ☎ Customer Support | 24/5 |

Who is JP Markets For?

Based on our research, JP Markets has favorable offerings. It can meet the expectations of different customers and various trading needs. The broker is good for:

- Professional Traders

- Beginner Traders

- Share Trading

- Forex and CFD Trading

- Traders preferring MT5

- Floating Spread Trading

- No Commission Trading

- Scalping and Hedging

- Traders from South Africa

JP Markets Summary

JP Markets is a good broker with competitive trading conditions. JP Markets is a well-known brokerage in South Africa and recognized by international traders. It has collected an impressive number of clients in different countries. In addition, the broker is constantly growing, expanding, and making trading opportunities even better, which is another benefit for profitable investment.

55Brokers Professional Insights

JP Markets stands out for providing reliable, high-quality trading services. Its favorable conditions and diversity make it suitable for both beginners and advanced traders, patter trading, auto tradinng or holding positions with swing trading. Apart from being one of the most dynamic South Africa’s leading brokers, the company has achieved a solid foundation and obtained a huge pool of traders.

However, JP Markets’ instrument offering is mainly limited to Forex and CFDs; also, the spreads offered by the brokers are on the higher side, and there are no alternative platforms except for the MT5 platform. We have also found that JP Markets does not include some of the offerings it used to have, such as comprehensive educational materials. At present, its research and educational resources are limited. Also, JP Markets used to offer the MT4 platform to conduct trades. This offering has also changed, as now only the MT5 platform is available.

Consider Trading with JP Markets If:

| JP Markets is an excellent Broker for: | - Traders from Africa

- Beginner traders

- Professional traders

- Traders who prefer co commission structure

- Those who favor floating spreads

- MT5 platform enthusiasts

- EAs trading

- |

Avoid Trading with JP Markets If:

| JP Markets is not the best for: | - Long-term investments

- Traders who prefer traders with top-tier licenses

- PAAM or MAM account enthusiasts

- European traders |

Regulation and Security Measures

Score – 4.3/5

JP Markets Regulatory Overview

JP Markets is an incorporated firm within South Africa and a fully approved broker by the Financial Services Conduct Authority. Its license number is FSP 46855. Therefore, JP Market’s trading offering is successfully authorized as an international financial service compliant with safety measures and provides clients with transparent conditions and low risks.

- However, there are some gossip stories about JP Markets’ suspended license. The broker was licensed in South Africa, but in 2019, the regulator suspended the license without prior notice due to alleged violations toward clients. However, this was a mistake since the broker no longer operated the domain address that was accused of a violation; therefore, the JP Market record remains clear.

How Safe is Trading with JP Markets?

Eventually, South Africa showed significant growth in the Forex industry as more firms opened branches and entities under its jurisdiction. JP Markets has a strong incorporation background and is dedicated to offering favorable trading opportunities.

In simple words, licensed and regulated by FSCA, the broker provides high-quality trading conditions and maintains safety rules towards money management and market integration. Thus, there is negative balance protection, segregation of traders’ funds, and a high level of security to protect clients’ interests.

Consistency and Clarity

With almost ten years of operation in the market, JP Markets has become a reliable broker, earning many loyal clients and having more than 400,000 active accounts. It is a well-regarded broker in South Africa, fully regulated and with trustworthy operations.

However, based on our research, the broker lost its license for a while. Later, it proved that the license was revoked on the wrong grounds, and now it is again a fully regulated broker.

Another point we want to mention is that when you enter the broker’s website, you immediately see a pop-up for the Final Deadline for Unclaimed Funds Submission. We have confirmed that this is just a notice to submit claims for unclaimed funds, and the broker continues to maintain its normal operations. However, we recommend conducting your research before opening an account with the broker. It is essential to be careful and trust your money only to reliable firms.

Account Types and Benefits

Score – 4.4/5

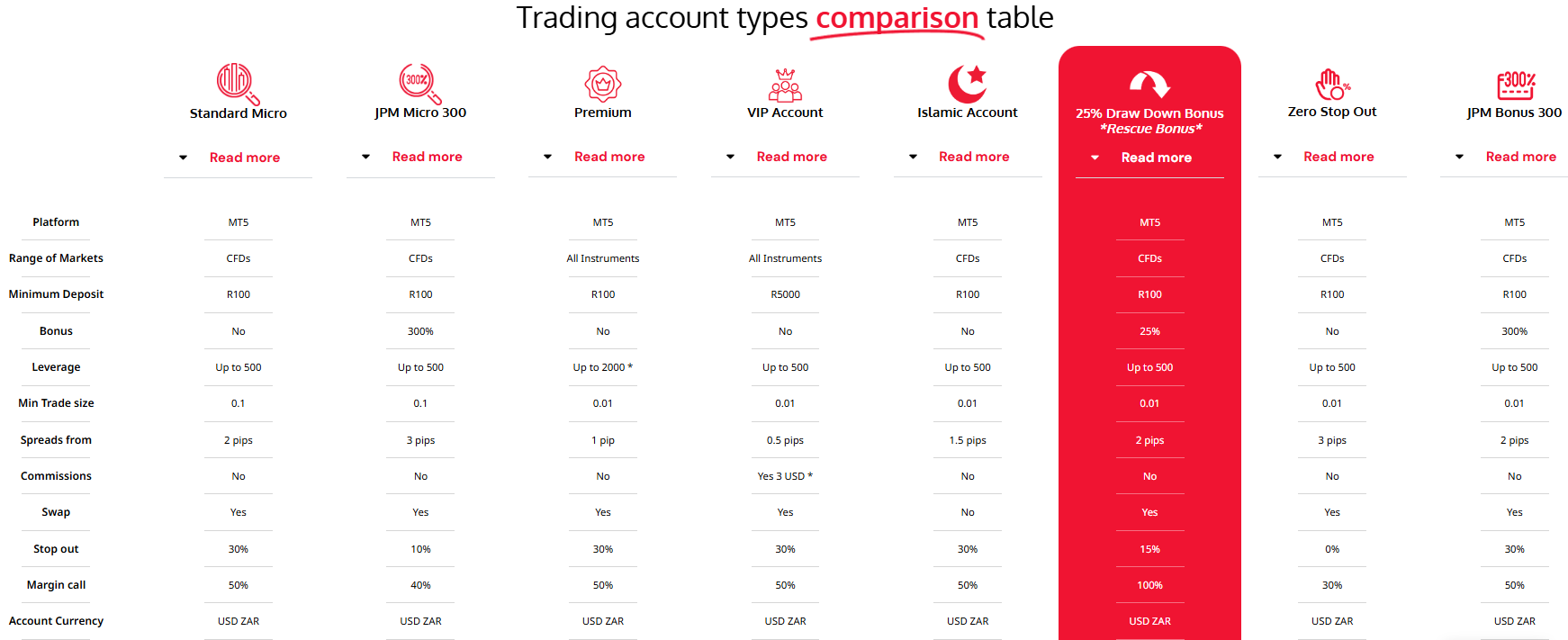

Which Account Types Are Available with JP Markets?

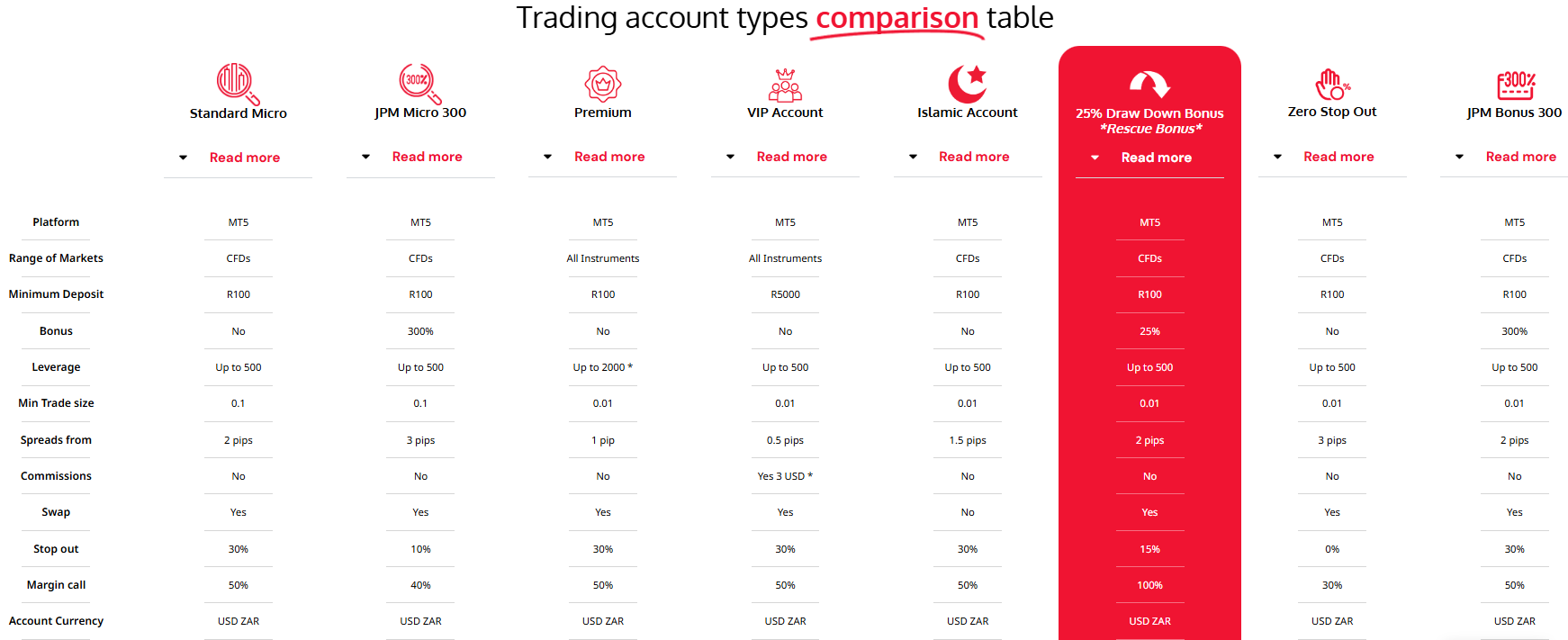

JP Markets offers a selection of account types, each with unique features and conditions. Clients can open one of these account types with JP Markets: Standard Micro, JPM Micro 300, Premium, VIP, Islamic, 25% Draw Down Bonus, Zero Stop Out, and JPM Bonus 300. There are some similarities between the accounts, but each has its own features to consider. Almost all the accounts give access to FX, metals, indices, and commodities markets with a leverage opportunity of up to 1:500. The minimum deposit for all the accounts except for the VIP account is R100. All the trades are conducted on the MT5 account.

Here are some features and differences for each account type:

- The average spread for the Standard Micro account is 2 pips.

- The JPM Micro 300 account offers a 300% bonus on the deposit. The average spread is 3 pips.

- The Premium account gives access to FX, metals, indices, and commodities, as well as US and EU shares. The available leverage is up to 1:2000. The spread for the Premium account is much lower, starting at 1 pip.

- The VIP account is the only commission-based account that offers spreads from 0.5 pips and a commission of $3. The minimum deposit is R5000.

- The Islamic account allows swap-free trading with spreads starting from 1.5 pips.

- With the 25% Draw Down Bonus account, clients can enjoy a 25% Drawdown Bonus. The average spread is 2 pips.

- The Zero Stop Out account, as the name suggests, offers a 0% stop-out level. The spreads for this account start from 3 pips.

- The JMP Bonus 300 allows a 300% credit boost with every internal transfer. The spreads are from 2 pips.

Regions Where JP Markets is Restricted

Due to regulatory restrictions, the broker does not offer its services in many regions and countries. The main regions of the broker’s operations are as follows:

Cost Structure and Fees

Score – 4.4/5

JP Markets Brokerage Fees

JP Markets offers competitive costs for its various account types. The broker’s fee structure is mostly spread-based. It only charges spreads for its seven account types with no commissions. Only the VIP account comes with a fixed commission. The fees are transparent and in line with the market average. Only for the JPM Micro 300 account, the broker charges 3 pips, which is higher than the market average.

JP Markets has eight account types. The accounts are spread-based, except for the VIP account, which also charges commissions. Each account type offers different spreads. Mostly, the spreads are average. The Standard Micro account’s spreads start from 2 pips. The VIP account spreads are the lowest, starting at 0.5 pips.

The commission is offered only for the broker’s VIP account. With spreads from 0.5 pips, there is a fixed $3 commission per turn. All the other accounts are based on spreads.

- JP Markets Rollover/Swap Fees

Traders should be aware of swaps the broker charges for the positions held overnight. The swap fees are applied for all the account types. Only the Islamic account does not include any swap fees. The swaps are changeable. We recommend checking them and considering them as trading fees.

How Competitive Are JP Markets Fees?

Our research shows that JP Markets fees are competitive and transparent. The structure the broker offers is mostly spread-based. It mentions the applicable spreads for each account type. The standard spread is 2 pips, which is not very high, considering that the account is spread-based and all the trading fees are integrated into spreads.

However, for clients who favor fixed commissions, JP Markets has a VIP account. The account is designated for more professional users and offers tighter spreads with a fixed $3 transaction fee. The broker also charges swap fees, which are common in forex trading. Also, clients should consider other non-trading fees that the broker may charge.

| Asset/ Pair | JP Markets Spread | FXTM Spread | AvaTrade Spread |

|---|

| EUR USD Spread | 2 pips | 1.5 pips | 0.9 pips |

| Crude Oil WTI Spread | 5 pips | 6 pips | 3 cents |

| Gold Spread | 26 | 9 pips | $0.27 |

| BTC USD Spread | 26 | 270 points | 0.10% |

JP Markets Additional Fees

JP Markets does not mention charges for deposits or withdrawals. Also, we didn’t find a clear indication that JP Markets charges an inactivity fee.

Score – 4.3/5

JP Markets offers the MT5 trading platform to conduct trades. It is an advanced and innovative platform that includes the most essential tools for profitable trading. However, clients who prefer other platforms, like MT4, cTrader, or TradingView, will need to consider this offering.

| Platforoms | JP Markets | Pepperstone | XM |

|---|

| MT4 | No | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| Own Platform | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

JP Markets Web Platform

The JP Markets supports web trading, giving access to advanced charting features, technical analysis tools, and automated trading. It is a flexible and comfortable way to conduct trades without downloads and installations. The good thing is that the platform includes all the essential features for an advanced and efficient trading experience.

JP Markets Desktop MetaTrader 4 Platform

We have noticed that JP Markets once offered the MT4 platform. Right now clients can conduct their trades only on its more advanced and recent version—the MT5 platform. Some traders find the MT5 platform a better substitute, with better features and opportunities. Yet, the MT4 platform has its advantages, too, and is more suitable for beginner traders with its simple interface and ease of use.

JP Markets Desktop MetaTrader 5 Platform

As we have mentioned, at present the MT5 platform is the only platform that gives access to the market. It allows trading Forex, stocks, commodities, and more. The MT5 platform offers full market depth with good levels of quotes. Clients access 21 timeframes, an economic calendar, 44 analytical objects for deep analysis, and over 38 built-in indicators. The platform enables automated trading, implementation of various strategies, and other advanced opportunities that will elevate the trading quality. In short, JP Markets’ MT5 platform is a powerful tool for conducting profitable trades and exploring the market to its fullest capacity.

Main Insights from Testing

Our research exposed the fact that JP Markets does not provide access to the MT4 platform any longer. Instead, users have access to the more recent MT5 platform, which offers a more enhanced set of tools and features and enables traders to take their trading to another level. Clients can benefit from innovative solutions and recent updates, a selection of analytical charts, market depth, pending orders, and other opportunities that the MT5 platform grants.

JP Markets MobileTrader App

Clients can easily download the mobile version of the MT5 platform from the app store. The app allows clients to access their accounts from anywhere in the world and conduct their trades with the same quality and features as the desktop platform allows. The mobile version of the MT5 platform pertains to most of the features essential for quality trading. JP Markets’ clients do not need to stick to their platforms to control their trades and are given full flexibility and versatility.

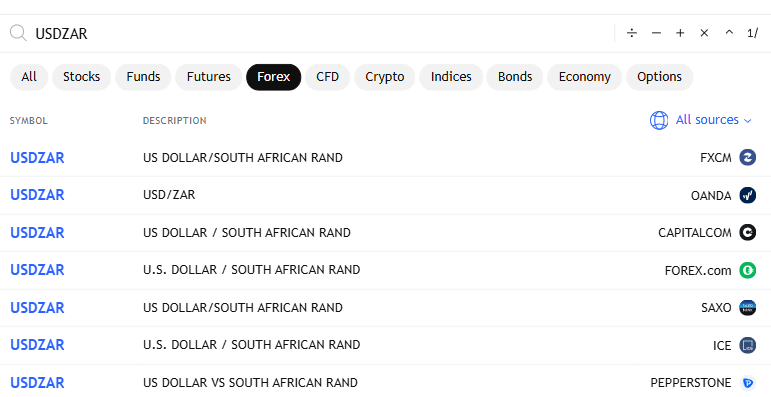

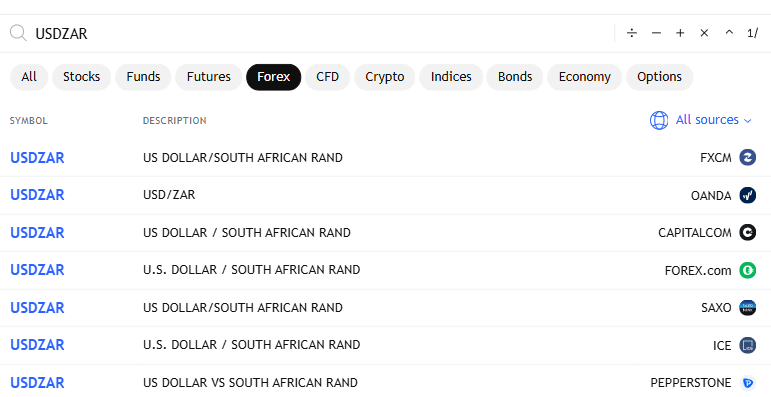

Trading Instruments

Score – 4.3/5

What Can You Trade on the JP Markets Platform?

JP Markets gives access to a good range of trading instruments based on CFDs. The availability of instruments and assets depends on the trading account type. Most account types enable access to currency trading, metals, indices, and commodities. However, the Premium and VIP accounts include access to FX, metals, indices, commodities, and US and EU shares. This means that the availability of certain instruments depends on the broker’s account types.

Main Insights from Exploring Jp Markets Tradable Assets

As we see, JP Markets enables access to instruments like FX, metals, indices, and commodities. Our research showed that the instrument range depends on the broker’s account types. The instruments are based on CFDs, which enable traders to manipulate the prices and gain profits.

However, as the broker’s website indicates, the range of the tradable assets is limited—about 100 tradable instruments, which is a very modest offering, especially when we compare it to the instrument offerings of other good-standing brokers.

Besides, as the offering is based on CFDs, clients do not have a chance for long-term investments in instruments, such as shares and stocks. This is another limitation that many traders will not favor.

Leverage Options at JP Markets

Since JP Markets is a South African broker, the local regulations still allow high leverage ratios available for retail traders. Eventually, this is one of the reasons South African brokers are gaining more popularity and growing further.

JP Market’s leverage level depends on the asset you are trading as well as the account type:

- 1:500, which is offered for all account types

- High leverage up to 1:2000 for the Premium account

Nevertheless, offered leverage and risk levels also vary according to the instrument specifications and each asset.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at JP Markets

JP Markets offers various deposit methods to assist their clients in easy and quick funding. They also include local deposit methods, as the broker serves the clients of the South African region.

Here are the main options to make deposits:

- Bank wires

- Skrill

- Ozow

- Capitec Pay

- Paystack

Minimum Deposit

JP Markets’ minimum deposit is R100, which is around $5.42. To open a VIP account, clients are asked to deposit R5,000 (about $266.14).

Withdrawal Options at JP Markets

JP Markets does not mention charges for deposits or withdrawals. However, banks or payment providers for JP Markets Withdrawal may waive some fees due to international policies, so you better check with the provider for its fees.

- The withdrawals are processed during the working hours. The processing time depends not only on the broker but also on the withdrawal method and their policies.

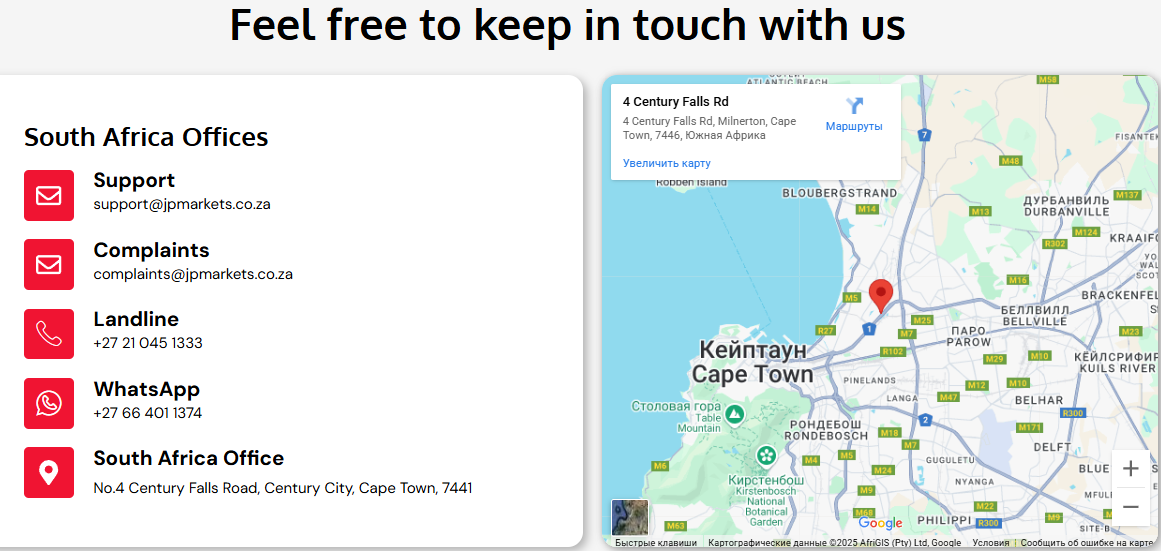

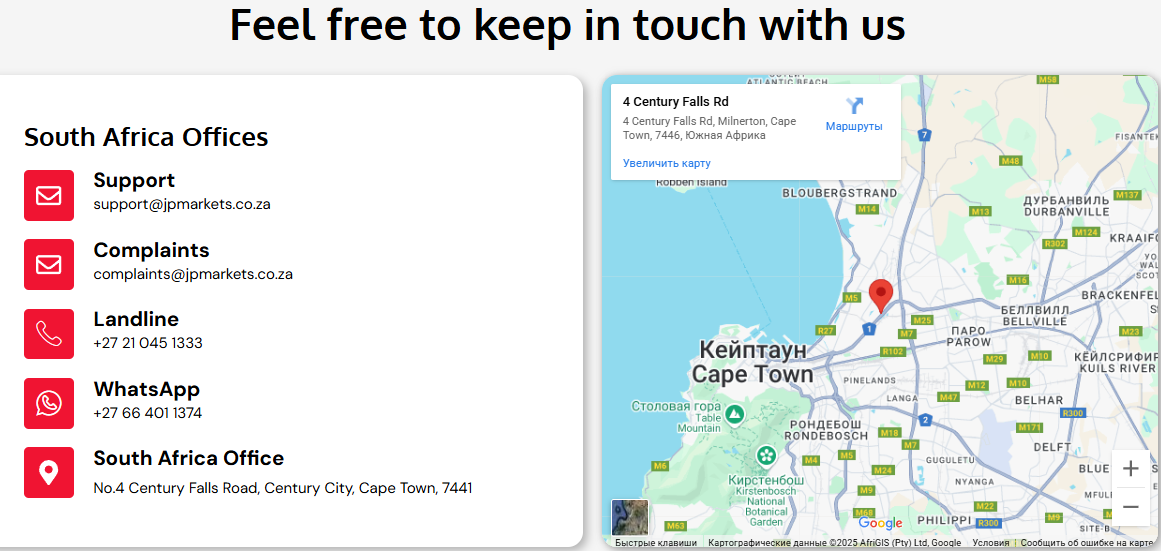

Customer Support and Responsiveness

Score – 4.5/5

Testing JP Markets Customer Support

In terms of customer support, JP Markets’ support service provides traders with detailed answers and sufficient assistance. The team can be contacted during working hours via the Live Chat. Also, clients can direct their questions and issues through a phone line, email, WhatsApp, and via a ‘Let’s Talk’ section.

- JP Markets also has an FAQ section, which is not very detailed and inclusive but includes answers to the most common questions.

Contacts JP Markets

- Our experience with the JP Markets customer support is positive. We have contacted the team to solve our issues and find assistance at a good level.

- Clients can contact the broker via a phone line using the +27 21 045 1333 number. Also, the broker provides a WhatsApp number for easier reach: +27 66 401 1374.

- The live chat is the quickest way to contact the broker. We find the answers on point. They are not instant and take about 2-5 minutes to get an answer to the question.

- The “Let’s Talk’ section is an easy way to submit a request or a question right from the broker’s website. Clients need to fill out a short form and form the question.

- For general requirements, clients can use the support@jpmarkets.co.za email address. Complaints should be directed to complaints@jpmarkets.co.za.

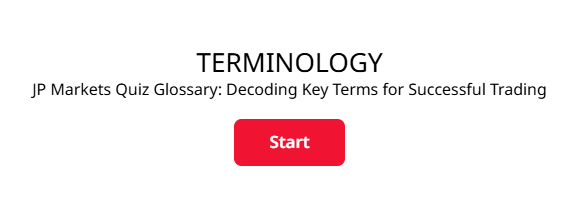

Research and Education

Score – 4.1/5

Research Tools JP Markets

Our research showed that JP Market’s research section is mostly limited to the tools and features available on the MT5 platform. While the tools integrated into the platform are advanced and innovative, the broker does not offer many additional options that would elevate the trading experience.

Here are several research tools we were able to find:

- Clients have access to real-time trading charts. The chart displays the price movements of different instruments, giving insight into the market.

- The broker also offers risk-management tools, such as stop-loss orders and position sizing, and guides on managing emotions during trading.

Education

The educational section of JP Markets is also limited. What is interesting is that the broker once provided comprehensive educational resources. At the moment, the offering is limited to the following:

- eBooks on different topics to assist and support clients in their trading journey. The eBooks broach subjects such as how to get started with Forex trading, analyzing the Forex market, unlocking the world of indices, etc.

- The broker also offers a JP Markets Quiz Glossary, which includes the main terms on the forex market and helps traders learn new terms through a quiz.

- The Blog offers clients to explore insightful forex trading materials for expert market analysis, trading tips, and industry updates.

Is JP Markets a Good Broker for Beginners?

JP Markets is a broker with quality services that enable access to the market in a safe environment. However, traders should determine if the offering meets their expectations. For beginners, it can be favorable due to the advanced but simple trading platform, a selection of trading accounts with a spread-based structure with average spreads. The broker offers a demo account that helps newbie clients practice their skills and gain knowledge on the market before investing in real funds. The only drawback that can hold back beginner traders is the limited research and educational sections, with few materials. For better resources, beginner traders should either look for a broker with a more intense educational section or find additional materials and assistance elsewhere.

Portfolio and Investment Opportunities

Score – 3.8 /5

Investment Options JP Markets

Based on what we have revealed about the broker, JP Markets does not offer investment opportunities. The broker concentrates on CFD trading, which narrows investment options. For long-term and traditional investments, JP Markets is not the best choice.

- Besides, the broker does not offer alternatives for investments either. JP Markets concentrates on direct market access and does not support managed accounts, including PAMM and MAM solutions.

- Also, the copy trading feature is unavailable.

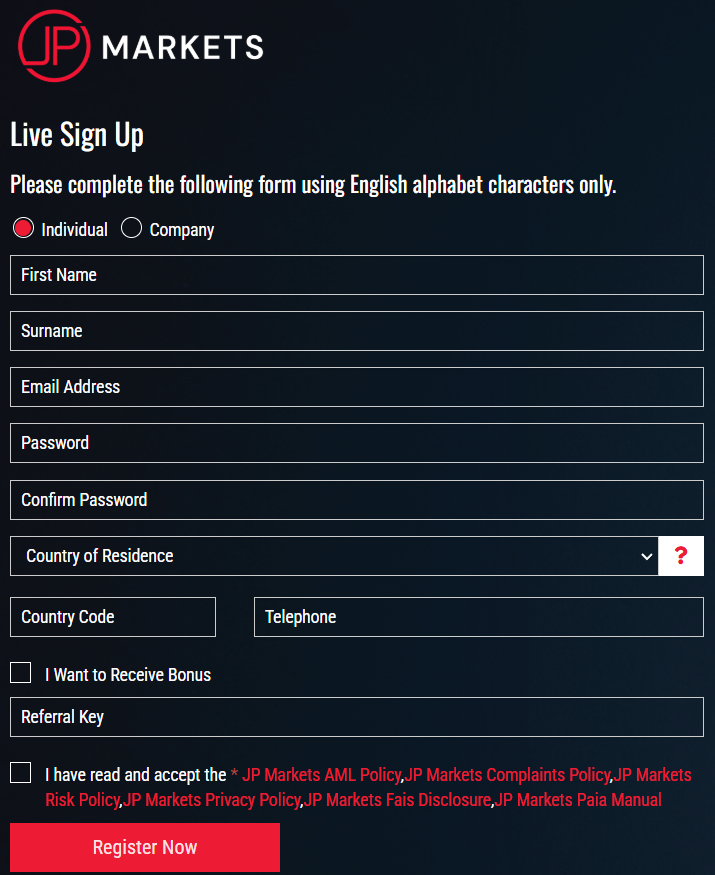

Account Opening

Score – 4.4/5

How to Open a Demo Account?

A demo account availability is a great chance for those who need to practice and gain skills before emerging into the real trading world. JP Markets enables traders to open a demo account and start with a virtual $100,000. To start, the following steps are necessary to take:

- Visit the broker’s website.

- Choose the demo account option.

- Provide personal information (name, email address, phone number, etc.).

- Enter your email and click on the received verification link for confirmation.

- Use the account credentials to access the platform.

- Set up your account by choosing the account currency, ECN/STP models, etc.

- Submit the request and wait for the account to be confirmed.

How to Open a JP Markets Live Account?

If you think that JP Markets meets your trading expectations and are ready to open a live account with the broker, you need to visit the broker’s official website and proceed with the following steps:

- Click on the ‘Open an Account’ button.

- A registration form will appear with fields to fill out (name, email, phone number, residency, etc.).

- Also, you will need to create and confirm a password.

- For account validation, you will receive an email to confirm the verification link.

- Then, you will be directed to the Client Portal.

- Verify your identity by submitting the required ID and utility bill or bank statement for proof of address.

- After your identity is verified, your account will be ready.

- You can set up the account, download the platform, and start trading.

Score – 3.8/5

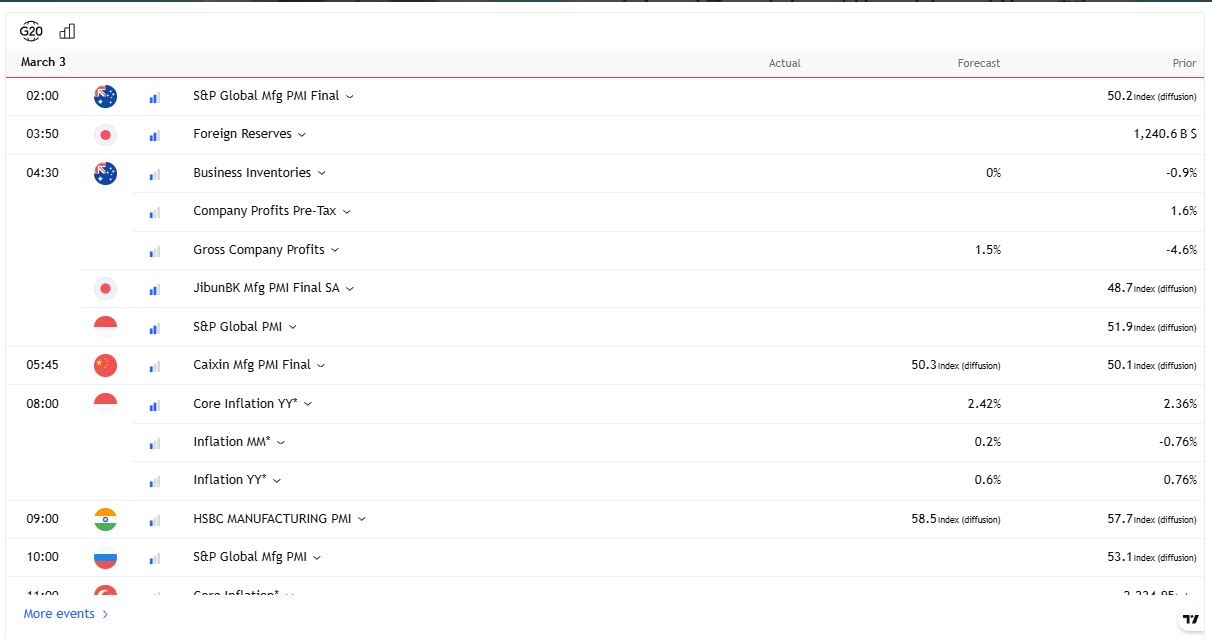

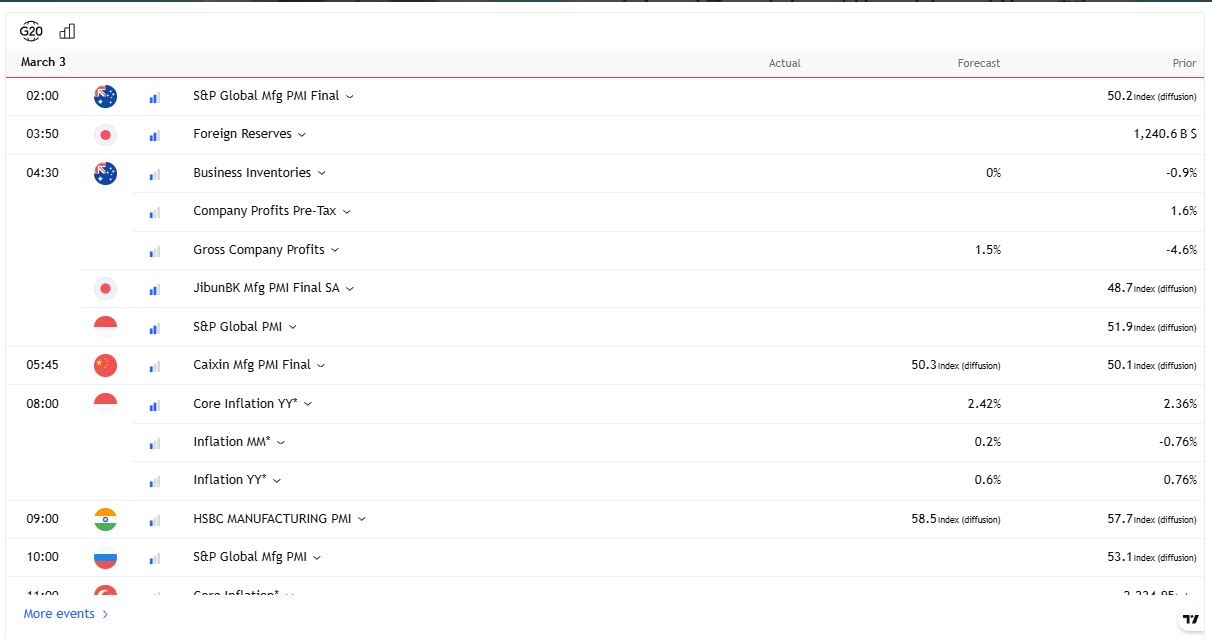

We have already discussed all the services and offerings JP Markets provides. The broker includes all its advanced tools in its platform. This is the reason why we couldn’t find additional tools on the broker’s website. The only feature that can be helpful for traders of any level is the Economic Calendar.

- The Economic Calendar is an essential indicator of the coming events in the global markets. These events are essential and have the power to impact the market. So, access to the calendar will help traders be aware of the upcoming changes and make informed decisions.

- JP Markets also has a bonus for certain account types. The JPM Micro 300 account gives a 300% bonus on the deposit. The 25% Draw Down Bonus account grants a $25 bonus.

JP Markets Compared to Other Brokers

As we finish the review on JP Markets, as the last point, we compare the broker and its different aspects of trading to other brokers. The broker is regulated by the FSCA and serves mainly the South African region. We compared the broker’s regulation to brokers like Eightcap and TMGM to find that in terms of regulatory status, they have better oversight and hold top-tier licenses from ASIC, CySEC, and FCA. Then we reviewed the broker’s fees and trading-related costs. The broker offers average spreads for its spread-based accounts. Both JP Markets and Fortrade offer spreads starting from 2 pips.

JP Markets gives access to the MT5 platform, an advanced platform with innovative features and tools. However, most brokers we reviewed have a broader selection of platforms, including the popular MT4 platform, cTrader, TradingView, and proprietary platforms. Then we compared the available instrument range. Compared to the TriumphFX 64+ available instruments, JP Markets +100 tradable products offering is good enough. However, if compared to TMGM, which offers 12,000+ instruments across various assets, JP Markets’ offering is far too modest.

At last, we compared JP Markets’ education section to other brokers to reveal that brokers like FXTB have a better educational section, with webinars, glossaries, courses, articles, and other valuable resources.

| Parameter |

JP Markets |

Eightcap |

FXTB |

TriumphFX |

TMGM |

Forex.com |

Fortrade |

| Spread Based Account |

Average 2 pips |

Average 1 pip |

Average 3 pip |

Average 0.6 pip |

Average 1 pips |

From 0.8 Pips |

Average 2 pip |

| Commission Based Account |

0.5 pips + $3 |

0.0 pips + $3.5 |

No commission |

Not available |

0.0 pips + $3.5 |

0.0 pips + $5 |

No commission |

| Fees Ranking |

Average |

Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT5 |

MT4, MT5, TradingView |

MT4, Web Trader |

MT4 |

MT4,MT5, TGM app |

MT4, MT5, Forex.com Platform |

Fortrader Platform, MT4 |

| Asset Variety |

100+ instruments |

800+ instruments |

300+ instruments |

64+ instruments |

12,000+ instruments |

500+ instruments |

300+ instruments |

| Regulation |

FSCA |

ASIC, SCB, CySEC, FCA |

CySEC |

CySEC, FSC, FSA |

ASIC, FMA, VFSC, FSC |

FCA, NFA, IIROC, ASIC, CFTC, CySEC, JFSA, MAS, CIMA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

| Customer Support |

24/5 support |

24/4 |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Basic |

Good |

Excellent |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

R100 ($5.42) |

$100 |

€250 |

$100 |

$100 |

$100 |

$100 |

Full Review of Broker JP Markets

JP Markets is a broker with favorable terms that appeal to a large spectrum of traders. The broker offers competitive trading conditions and an enhanced MT5 platform, which most traders like for its stability and extensive research tools and capabilities. JP Markets has achieved a global clientele base, particularly among South African traders, and continuously includes additional trading possibilities and technology choices in its portfolio.

Despite its advantages, JP Markets’ instrument offering is largely limited to Forex and CFDs, and the broker tends to charge wider spreads than some of its competitors. Besides, we revealed that JP Markets used to offer the MT4 platform, while, at present, clients have access to only the MT5 platform. We also found other changes that took place in the broker’s offerings; in the past, JP Markets had an impressive education section, while now the section is very modest with few offerings. Overall, JP Markets provides favorable conditions for traders of different levels, to whom the conditions seem appealing.

Share this article [addtoany url="https://55brokers.com/jp-markets-review/" title="JP Markets"]

How do you get your money back?

JP market blew my account by increasing usdzar spread to 9800. They need to be reported let us spread the message via papers,fsca,Facebook,etc.

Please sign this partition

https://www.change.org/p/financial-services-board-fsb-must-close-down-jp-markets-7e4d31fb-bbfb-4f9f-a9f5-7278a01e9c43

I don’t think FSCA is serious when it comes to its job. So many cases are reported but still jp market is operating, scamming people as usual etc. I think it’s better you gather serious evidence and expose them to the public.

I lost 130000.00 rands with them they are scammers my account went frozen while running trades I couldn’t close trades

Let us report them and put them on Facebook.

jp market is the useless broker in the word…. they give us a useless bonus.. #tag big scam in the world

whats happening guys

Sorry R3500 not 35000b

Stay away from jpmakets. Last week they have blown my account which had 35000b+bonus. This is what happened i had trades running before they introduced their 200% bonus now i was running nas100 buy on jp and avatrade. Jp nas went to the loss while avatrade was in deep profit. I asked them and they said they have introduced new terms and conditions. I asked them how can you introduce new terms into the account that was running trades long time before and they said email were sent. I said were you expecting magic to happen to our accounts when trades are already running they could answer they ended up blocking me on the Instagram DM. I need to report them to FSCA because this guys are fraudsters

SAME STORY TO MY ACCOUNT CAN U PLEASE HELP. HOW TO REPORT ON FSCA I WANT TO REPORT THEM TOO COZ THEY ARE PLAYING WITH US

I also made my withdrawal is three days now still waiting money to reach in my account.

I think they are scammers guys few minutes ago i was doing great in my account, really was going to make real money then my account frozed loses were taken without(stop loss) my permission then the account was on loss then it blowed. Don’t know how

This all happened in the same time in front of my eyes. It really shocked me,now i guess im broke again😪

i made withdrawal from JP markets aince 20 March 2020, on the 8 April 2020 they have not paid. Their service to customers is very poor. Also when i deposited my money only halve appeared on my trading account.

Have you been paid yet? I am wondering if it is a scam or not

Waiting for mine as well…. this is frustrating. Can we report them to the committee or something?

Jpmakerts scammed me of R127331 lastweek I have a proof I’ve been asking them to send my withdrawals they didn’t

I made a withdrawal since one week plus now and it has not reflected on my netteller account.

And I was emailing you them but no response from them.

They I chat with the CEO but he didn’t give me any concrete answer.

Yesterday I tried calling them on phone but they didn’t pick up at all.

Why are you guys (jpmarket) treating international clients with so much disrespect. The date of my withdrawal is 03/03/2020..i advice other traders to desist from this broker..

I made withdrawals since one week plus now and it has not reflected on my netteller account..

And I have been emailing them without no response. I even chat with the CEO but he has given me any concrete answer..why do you guys treat your international clients with so much disrespect.??

Did you get your money back? Right now they are holding my money for days saying there is a fraudulent activity.. I’m really upset with them.

I have used JP markets but they just took my $70 without any proof of a trade executed on it. It looks to me loke this is a behaviour of a scam

Jp markets is freezing the trades, blowing accounts, deposits are not reflecting in our trading accounts, withdrawals are not happening we’ve waited for over a week…no email response, they not picking up our calls, we are stucked. Poor service, we just feel like we got scammed…worst broker!!!!!!

Did you ever get your money? I’ve been waiting for mine.

I have been waiting for my withdrawal for over a week now No sms or email from JP market

No bro 3 Million gone