Purple Trading 2025 Review

-

Written by:

George Rossi -

Updated:

Leverage: 1:30 | 1:500

Regulation: CySEC, FSA

Min. Deposit: $100

HQ: Cyprus

Platforms: MT4, MT5, cTrader

Found in: 2016

Advertising Disclosure

Written by:

George Rossi

Updated:

Leverage: 1:30 | 1:500

Regulation: CySEC, FSA

Min. Deposit: $100

HQ: Cyprus

Platforms: MT4, MT5, cTrader

Found in: 2016

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.5 / 5 |

Purple Trading is an online Forex brokerage firm that provides access to global financial markets, including currencies and CFDs on commodities, indices, stocks, and futures.

The broker operates through L.F. Investment Ltd., which is regulated by the Cyprus Securities and Exchange Commission (CySEC) and adheres to strict European Union financial standards to ensure transparency and the protection of client funds.

In addition, it operates in Seychelles via AXSE Brokerage Ltd., licensed by the Seychelles Financial Services Authority (FSA) as a Securities Dealer under the Seychelles Securities Act. As a result, the broker is regulated in both an EU jurisdiction and an offshore jurisdiction, meaning that regulatory protections and standards may vary depending on which entity and license your account falls under.

The broker also promotes STP/ECN-style execution, offering tight spreads and fast order execution, an attractive option for traders seeking transparent and efficient execution.

Purple Trading offers several advantages and some drawbacks for traders. On the positive side, it provides access to a popular range of markets, including Forex, commodities, indices, stocks, and futures, with competitive STP/ECN-style execution, tight spreads, and fast order processing.

The broker is regulated by the European CySEC, offering a level of regulatory oversight and client fund protection. Additionally, it supports industry-known platforms like MT4, MT5, and cTrader and offers features suitable for automated trading.

For the cons, the availability of certain instruments is limited depending on the client’s jurisdiction. Additionally, some traders may find that the offshore entity provides fewer protections compared to the EU-regulated entity.

| Advantages | Disadvantages |

|---|---|

| CySEC regulation and oversee | No 24/7 customer support |

| Competitive trading conditions | Conditions vary based on the entity |

| Forex and CFD trading | |

| European traders | |

| International trading | |

| Professional trading | |

| Client protection | |

| Advanced trading platforms | |

| Good learning and research materials |

Purple Trading offers a variety of features to cater to different levels of traders, combining advanced technology, flexible account options, and regulatory oversight to create a transparent and efficient environment. Here are the main features that the broker offers:

| 🏢 Regulation | CySEC, FSA |

| 🗺️ Account Types | ECN, STP, Managed Account, PRO Account |

| 🖥 Trading Platforms | MT4, MT5, cTrader |

| 📉 Trading Instruments | Forex, CFDs on commodities, indices, stocks, futures |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 1.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, GBP |

| 📚 Trading Education | News, Ebooks, Articles, Newsletter, Guide, Market Analysis, FAQs |

| ☎ Customer Support | 24/5 |

Purple Trading is suitable for a wide range of traders, from beginners seeking a reliable and regulated platform to experienced and professional traders looking for advanced execution, tight spreads, and access to global financial markets. According to our findings, the broker is Good for:

In summary, Purple Trading is an online brokerage that provides access to a broad range of financial markets, including Forex, CFDs on commodities, indices, stocks, and futures. The broker operates under dual regulatory oversight, offering varying levels of client protection depending on the entity.

Traders benefit from STP/ECN-style execution, competitive spreads, fast order processing, and support for popular platforms, which offer automated trading capabilities.

Overall, Purple Trading delivers a reliable and flexible financial environment with a balance of efficiency and regulatory oversight.

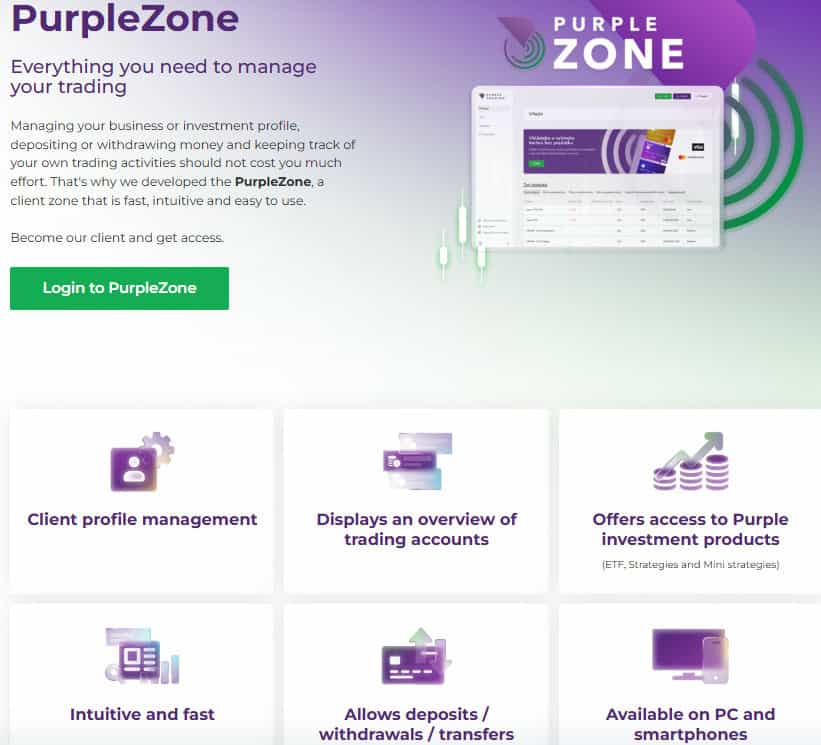

Purple Trading distinguishes itself in the brokerage industry through its commitment to providing a professional and transparent environment. One of its standout features is the PurpleZone, a sophisticated client portal that offers intuitive navigation, real-time statistics, and seamless management of deposits and withdrawals.

Additionally, the broker provides copy trading services, allowing users to replicate the trades of successful traders. This feature is particularly beneficial for those who may not have the time or expertise to trade actively but wish to participate in the financial markets.

Also, Purple Trading’s cTrader mobile app offers a premium trading experience on the go, providing access to global assets with advanced charting tools, technical analysis features, and customizable settings. These features collectively highlight Purple Trading’s dedication to delivering a comprehensive and user-friendly platform that caters to the diverse needs of investors.

| Purple Trading is an excellent Broker for: | - Need a well-regulated broker․ - Offering a range of popular trading instruments. - Secure trading environment. - Providing competitive trading conditions. - Offering Copy trading features. - European trading. - International trading. - Currency trading. - Various strategies allowed. - Who prefer higher leverage up to 1:500․ - Get access to MT4, MT5, and cTrader platforms. - Need good research tools. - Beginners and professional traders. - Need broker with fast execution. - Offering a variety of account types. |

| Purple Trading might not be the best for: | - Who prefer 24/7 customer service. - Looking for broker with access to VPS Hosting. - Who prefer proprietary trading platforms. |

Score – 4.5/5

Purple Trading is regulated by the European CySEC, which enforces strict compliance with EU financial standards such as MiFID II. This regulation guarantees transparency, client fund segregation, and investor protection through the Investor Compensation Fund (ICF).

Additionally, the broker operates internationally and is licensed by the FSA in Seychelles as a Securities Dealer. This dual regulatory setup allows the broker to maintain high operational standards within the EU while offering more flexible conditions to clients registered under its offshore entity.

Trading with Purple Trading is generally considered safe, especially under its CySEC-regulated EU entity, which ensures fund segregation, negative balance protection, and membership in the Investor Compensation Fund.

These measures safeguard client assets and enhance transparency. However, the level of protection varies depending on whether you trade under the EU or the Seychelles FSA entity.

While the broker maintains a solid regulatory framework, traders should remain aware of the risks associated with leveraged CFDs and the differences in protection standards between jurisdictions, as those trading under offshore regulation may receive fewer safeguards compared to clients regulated by stricter authorities.

Purple Trading has built a solid reputation in the trading community since its establishment, recognized for its transparent operations and client-centered approach.

The broker generally receives positive reviews from traders, highlighting its reliable execution, professional customer support, and competitive conditions.

However, some users note limitations such as restricted product offerings and the absence of certain advanced features. Over the years, Purple Trading has strengthened its credibility through regulatory compliance, industry recognition, and active engagement in social and educational initiatives.

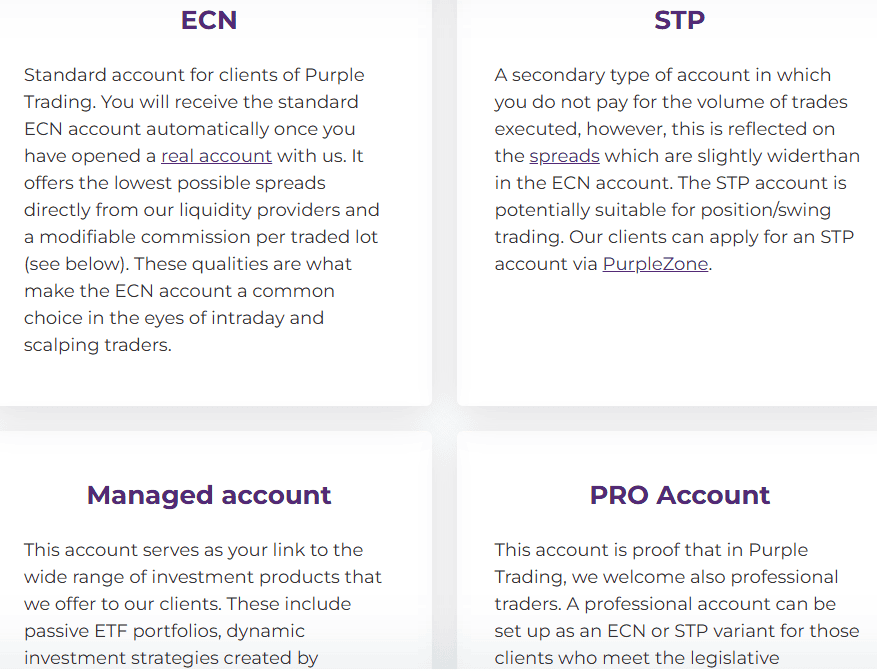

Score – 4.6/5

Purple Trading offers a variety of account types for different styles and experience levels. The ECN account is for active traders and features very tight spreads combined with a commission per lot.

The STP account is more suited for position or swing trading, offering no per-trade commission but slightly wider spreads.

For experienced or professional clients, there is the PRO account, which can be set up as either ECN or STP, depending on requirements and typically involves higher leverage and premium conditions.

Additionally, Purple Trading offers a Managed Account option, allowing clients to invest in passive portfolios or follow professional traders’ strategies.

Also, a demo account is available, enabling clients to test the platforms and account conditions in a risk-free environment before committing real funds.

STP Account

The STP Account at Purple Trading is for traders who prefer a simpler structure. With this account, you pay no commission on trade volume, but the spreads are slightly wider compared to the ECN variant. Spreads begin at around 1.3 pips in the standard status.

This account type is particularly suitable for position or swing traders who hold trades for longer periods rather than engaging in rapid scalping or high-volume intraday trading. The entry-level minimum deposit is $100, making it accessible for many traders.

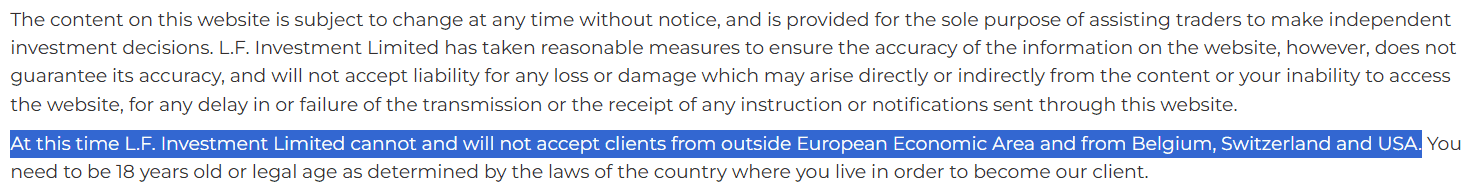

Purple Trading does not provide services in certain jurisdictions due to regulatory restrictions and compliance requirements. Residents of the following countries are not eligible to open accounts:

Score – 4.5/5

Purple Trading’s brokerage fees are transparent and straightforward. Traders pay spreads on trades, which vary depending on market conditions, and commissions apply on certain account types or instruments.

Additional costs include overnight swap fees for positions held beyond a trading day and occasional inactivity fees for dormant accounts. Overall, the fee structure is designed to be clear and predictable, allowing traders to manage costs effectively.

Purple Trading offers competitive spreads across its instruments, with the average EUR/USD spread of 1.3 pips. Spreads vary depending on market conditions, liquidity, and the type of account used.

This level of spread makes Purple Trading suitable for both short-term and long-term strategies, providing transparency and cost-effectiveness for traders.

Purple Trading charges commissions primarily on ECN accounts, typically ranging from $5 to $10 per standard lot, depending on the trader’s account status.

Higher-status clients, such as Prime or VIP accounts, usually pay towards the lower end of this range. These commissions are combined with tight spreads, offering a transparent and predictable cost structure for active traders.

Purple Trading applies rollover fees for positions held overnight, reflecting the interest rate differential between the currencies or instruments traded.

These fees can be either positive or negative, depending on the direction of the trade and the underlying rates. Swap rates are clearly displayed in the platform, allowing traders to anticipate holding costs and manage positions effectively.

In addition to spreads, commissions, and swap fees, Purple Trading charges additional fees in certain situations. The broker applies a dormant account fee of $15 per quarter for accounts that remain inactive over a specified period.

The broker may also charge deposit or withdrawal charges depending on the payment method used. Such fees are clearly outlined in the broker’s terms and conditions, ensuring transparency so that users can plan and manage their overall costs effectively.

Purple Trading’s fees are generally competitive within the online brokerage industry. The broker balances cost-efficiency with transparent pricing, ensuring that traders can access global markets without excessive charges.

While not the absolute lowest in the market, the overall fee structure, including spreads, commissions, and additional costs, is designed to provide good value for both casual and professional traders, supporting a fair environment.

| Asset/ Pair | Purple Trading Spread | Ultima Markets Spread | GBE Brokers Spread |

|---|---|---|---|

| EUR USD Spread | 1.3 pips | 1 pip | 0.8 pips |

| Crude Oil WTI Spread | 0.03 | 1 | 3 |

| Gold Spread | 0.09 | 0.3 | 3 |

| BTC USD Spread | - | 11 | 40 |

Score – 4.7/5

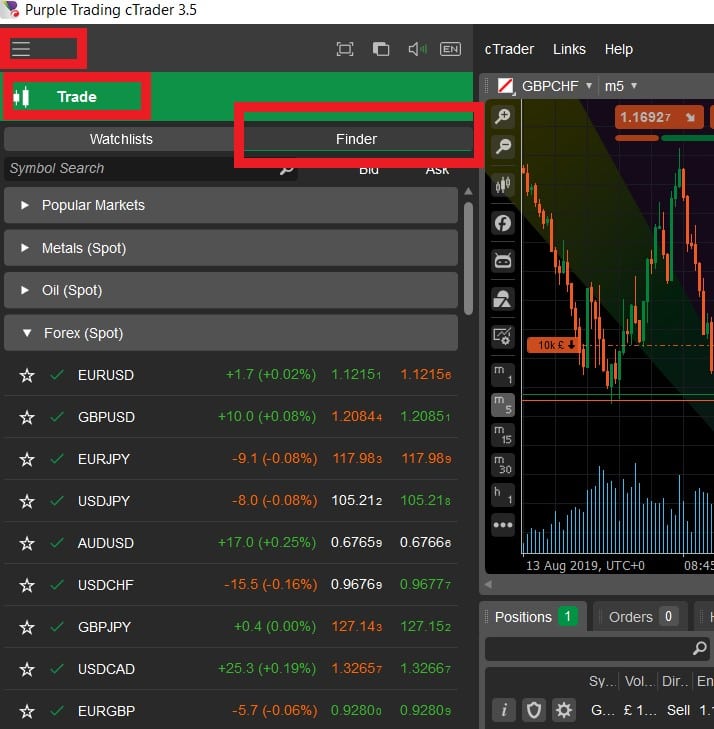

Purple Trading offers a range of advanced platforms to cater to different trader preferences and strategies. Clients can access MetaTrader 4 and MetaTrader 5, both of which provide robust charting tools, automated capabilities, and a wide selection of technical indicators.

For those seeking a more modern interface and professional-level features, cTrader is also available, offering intuitive charting, algorithmic trading, and enhanced order management.

| Platforms | Purple Trading Platforms | Ultima Markets Platforms | GBE Brokers Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | Yes | No | No |

| Own Platforms | No | No | No |

| Mobile Apps | Yes | Yes | Yes |

Purple Trading’s cTrader web platform provides a modern, intuitive, and efficient experience accessible directly from any browser without installation. It offers advanced charting tools, customizable layouts, one-click trading, and access to detailed market depth information.

The platform also supports automated trading, enabling users to develop and run robots and strategies. With fast execution speeds and a clean interface, cTrader delivers a transparent and responsive environment ideal for traders who value precision and control in their activities.

Testing the cTrader platform with Purple Trading reveals a smooth and efficient experience, characterized by fast order execution and high transparency. The platform stands out for its modern interface, precise pricing display, and customizable layout options that suit different trading styles.

The broker’s MT4 desktop platform is a trusted and widely used solution that offers traders a stable and feature-rich environment for executing trades. Known for its reliability and user-friendly interface, the platform provides powerful charting tools, multiple order types, and support for Expert Advisors (EAs) for automated trading.

Traders can analyze markets using numerous technical indicators, customize strategies, and manage positions efficiently from a single interface.

Purple Trading’s MetaTrader 5 desktop platform offers an enhanced experience with more advanced features and greater flexibility than its predecessor.

It provides improved charting tools, additional timeframes, and an expanded range of technical indicators to support in-depth market analysis. The platform supports automated trading, faster order execution, and integrated economic calendars, enabling traders to stay informed and react swiftly to market changes.

Purple Trading offers mobile solutions through the MT4, MT5, and cTrader apps, allowing traders to manage their accounts and execute trades anytime, anywhere.

These mobile apps provide access to real-time market data, interactive charts, and essential tools directly from smartphones or tablets.

The broker offers AI and automation-enhanced options, including support for algorithmic systems like Expert Advisors and automated strategies on platforms such as MetaTrader 4 and cTrader.

These tools enable traders to execute predefined rules, risk-management parameters, and trade entries/exits without needing constant manual intervention. These automation features reduce emotional decision-making and help streamline the trading process.

Score – 4.5/5

Purple Trading offers clients access to over 200 instruments, including major and minor Currency pairs, CFDs on commodities, indices of key global markets, shares, and futures contracts of various underlying assets.

This instrument offering enables traders to diversify their strategies across different market segments, coming from trends in currencies, price movements in commodities, index changes reflecting economic shifts, or corporate dynamics through stock CFDs.

Exploring Purple Trading’s tradable assets reveals a well-balanced and versatile offering to meet the needs of different trading styles. The broker ensures smooth market access, reliable execution, and fair pricing across its instruments.

This diversity allows traders to implement various strategies and manage risk effectively, while benefiting from stable conditions and a transparent market environment.

Purple Trading offers flexible leverage options that vary depending on the trader’s account type, experience level, and regulatory jurisdiction. The broker provides the multiplier, allowing traders to control larger positions with a smaller initial investment, thereby enhancing potential returns while also increasing risk exposure.

Score – 4.4/5

Purple Trading offers two main deposit methods: wire transfer and credit card deposits, both designed for quick and convenient funding.

The broker Purple requires a minimum deposit of $100 to open a standard account.

Purple Trading offers the same methods for withdrawals as for deposits: wire transfer and credit card. Both methods provide secure and convenient access to funds, with processing times varying depending on the method.

While most withdrawals are free, international bank transfers may incur small fees, still allowing flexibility and convenience for clients accessing their funds.

Score – 4.5/5

The broker provides 24/5 customer support through multiple channels, including live chat, email, and phone lines.

The support team is generally responsive and knowledgeable, helping traders navigate the platform, understand conditions, and resolve issues efficiently.

Clients can contact Purple Trading’s customer support via phone at +420 228 884 711 and +357 25 123 977 for general inquiries, while current clients can reach the dedicated email support team at support@purple-trading.com for assistance with accounts, technical issues, or trading-related questions.

Score – 4.6/5

Purple Trading provides a variety of research and analytical tools to help users make informed decisions.

Purple Trading offers a comprehensive educational section to support traders of all levels. Clients can access news updates, articles, and market analysis to stay informed about global financial trends, as well as ebooks, guides, and FAQs to deepen their knowledge.

Additionally, the broker provides a regular newsletter highlighting key market developments and insights, helping traders make well-informed decisions and improve their skills over time.

Score – 4.3/5

While Purple Trading primarily operates as a CFD broker, it also offers investment-oriented solutions such as copy trading and PAMM accounts.

These services allow clients to follow and replicate the strategies of experienced traders or invest in professionally managed portfolios, providing an alternative to active trading. By combining traditional CFD trading with these investment options, the broker caters to both hands-on traders and those seeking more passive ways to participate in the markets.

Score – 4.4/5

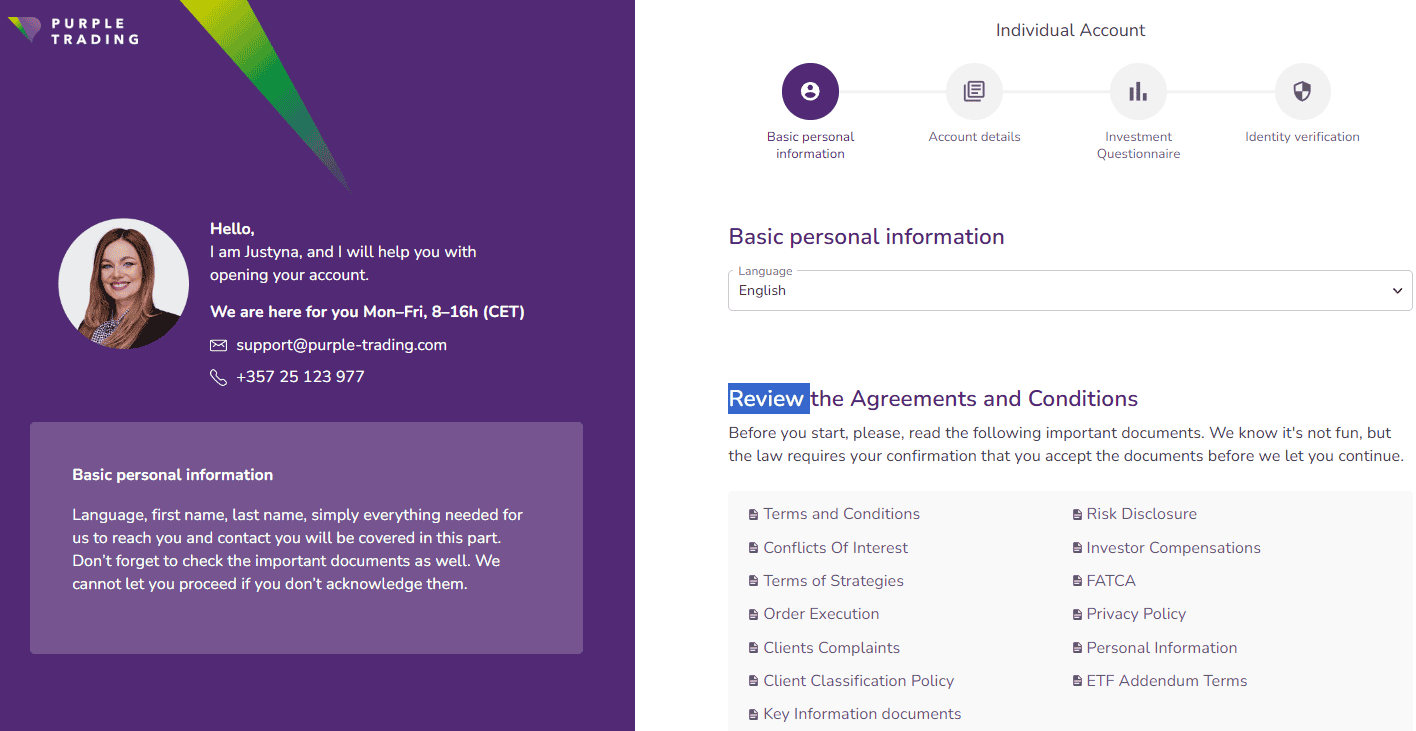

Opening a Purple Trading demo account is a simple way for traders to practice strategies and explore the platform without risking real money. The process can be completed quickly online by following these steps:

Opening a Purple Trading live account is straightforward and can be completed online. Traders begin by visiting the Purple Trading website and selecting the “Open Account” option, then providing their personal information and verifying their identity as part of regulatory requirements.

After choosing the desired account type, leverage, and base currency, clients can fund their account using one of the available deposit methods, such as wire transfer or credit card. Once the account is verified and funded, traders can log in to their chosen platform and begin live trading.

Score – 4.5/5

Purple Trading offers several additional tools and features to enhance the overall experience beyond standard research resources.

Compared to its competitors, Purple Trading positions itself as a solid all-around broker with a balanced offering across pricing, platforms, and support.

While some brokers provide broader asset selections or slightly lower costs, Purple Trading distinguishes itself through transparency and a focus on professional-grade environments with access to MT4, MT5, and cTrader.

Its fee structure is competitive, especially for commission-based accounts, offering a good balance between spreads and execution quality. In terms of education, the broker provides reliable learning materials and research tools, though some competitors may have more extensive libraries.

Overall, Purple Trading appeals most to traders seeking a regulated, well-rounded, and user-friendly experience.

| Parameter | Purple Trading | GBE Brokers | Ultima Markets | Colmex Pro | Taurex | CMC Markets | ActivTrades |

| Spread Based Account | Average 1.3 pips | Average 0.8 pips | Average 1 pip | Average 4 pips | Average 1.7 pips | Average 0.5 pips | Average 0.5 pips |

| Commission Based Account | 0.3 pips + $2.5 per side | 0.0 pips + $3.5 per side | 0.0 pips + $2.5 per side | For stock CFDs, $0.01 per share + a minimum of $1.5 per side | 0.0 pips + $2 per side | 0.0 pips + $2.50 | For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking | Low/ Average | Average | Low/ Average | Average | Low/ Average | Low/ Average | Low/ Average |

| Trading Platforms | MT4, MT5, cTrader | MT4, MT5, TradingView | MT4, MT5, MT4 WebTrader, Mobile App | Colmex Pro 2.0, MT4 | MT4, MT5, Taurex Trading App | CMC Markets Next Generation Web Platform, MT4 | ActivTrader, MT4, MT5, TradingView |

| Asset Variety | 200+ instruments | 1000+ instruments | 250+ instruments | 28,000+ instruments | 1,500+ instruments | 12,000+ instruments | 1,000+ instruments |

| Regulation | CySEC, FSA | CySEC, BaFin, FSA | FCA, CySEC, FSC | CySEC, FSCA | FCA, FSA, SCA | FCA, ASIC, BaFin, IIROC, FMA, MAS | FCA, CMVM, FSC, SCB |

| Customer Support | 24/5 | 24/5 | 24/7 | 24/5 | 24/5 | 24/5 | 24/5 |

| Educational Resources | Good | Excellent | Good | Limited | Excellent | Good | Good |

| Minimum Deposit | $100 | $1,000 | $50 | $500 | $10 | $0 | $0 |

Purple Trading is a regulated online Forex and CFD broker that offers a transparent and professional environment for both beginner and advanced traders.

The broker provides access to popular platforms, including MetaTrader 4, MetaTrader 5, and cTrader, supporting a good range of over 200 instruments such as currencies, commodities, indices, stocks, and futures.

Traders can choose between spread-based and commission-based accounts with competitive conditions. Clients benefit from educational resources, market analysis, and research tools, while deposits and withdrawals are supported via wire transfer and credit card.

With solid customer support and a focus on transparency, Purple Trading delivers a secure and efficient trading experience.

No review found...

No news available.