- What is GBE Brokers?

- GBE Brokers Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

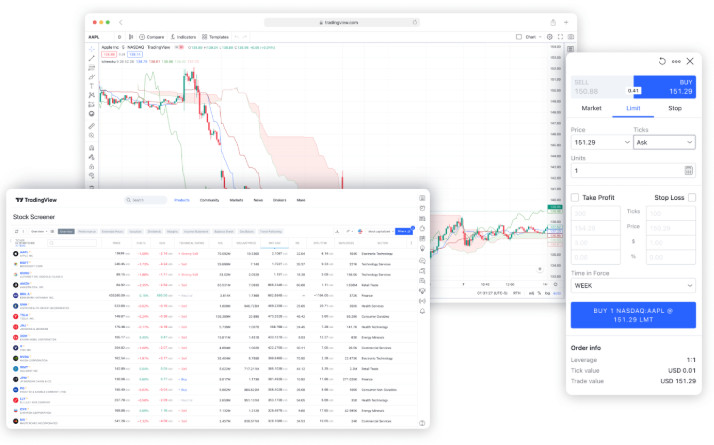

- Trading Platforms and Tools

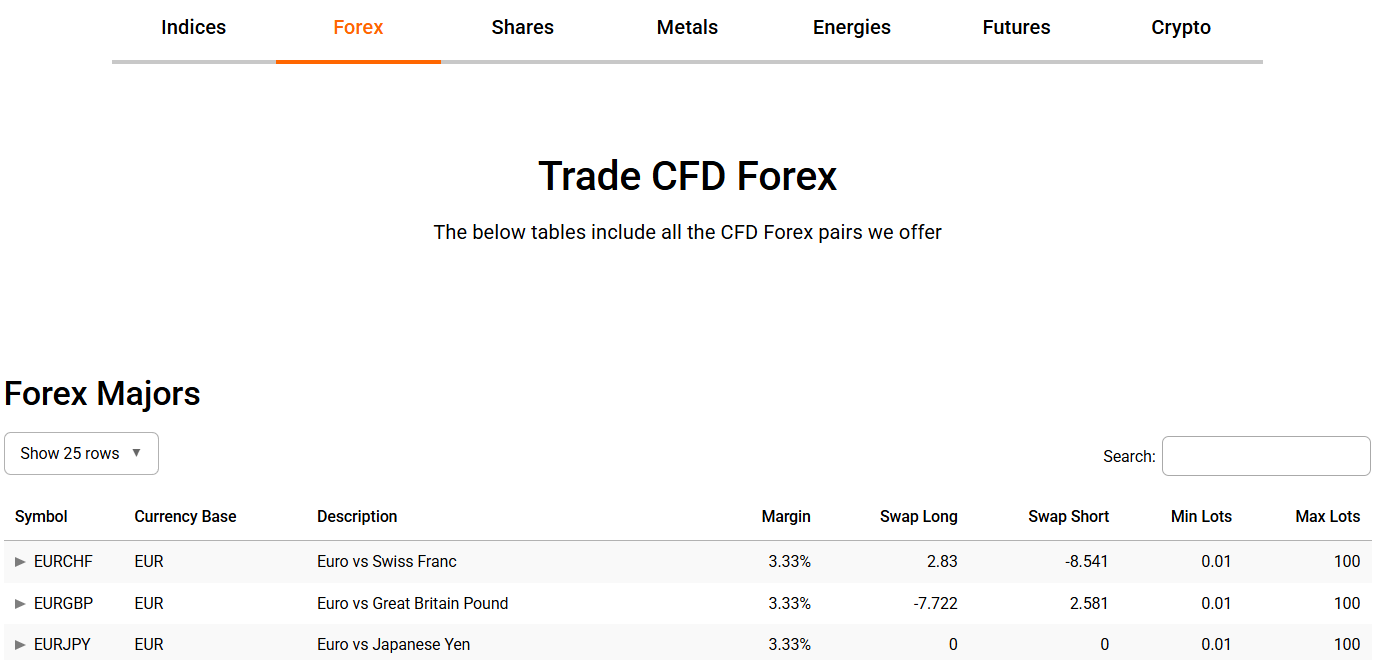

- Trading Instruments

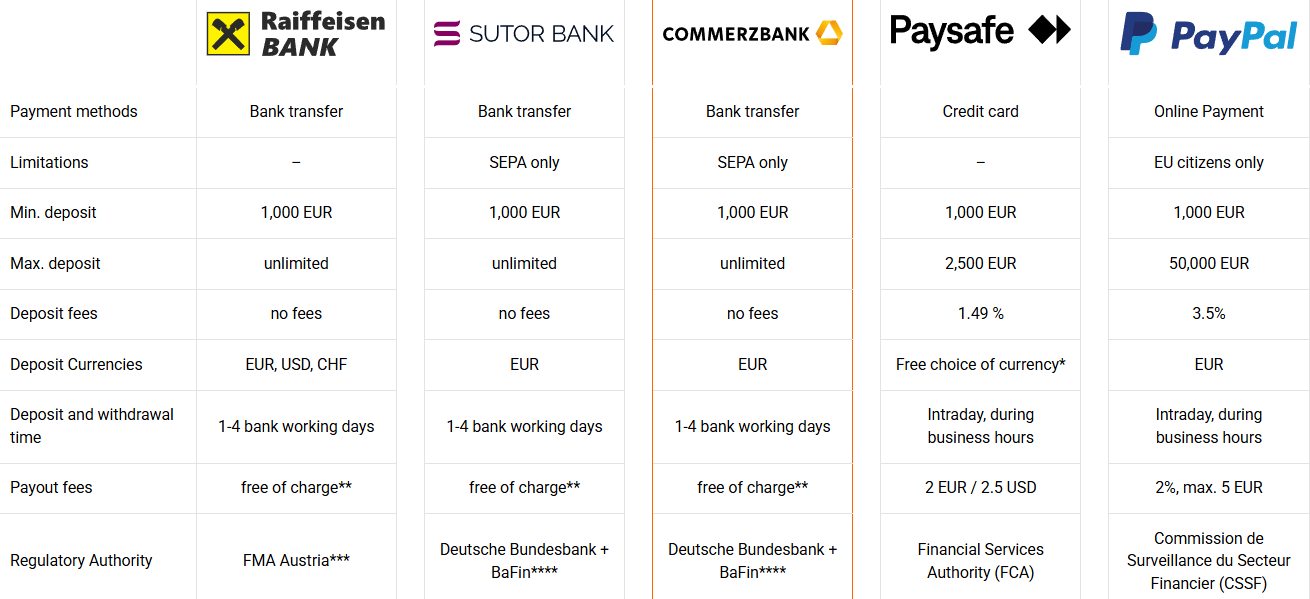

- Deposit and Withdrawal Options

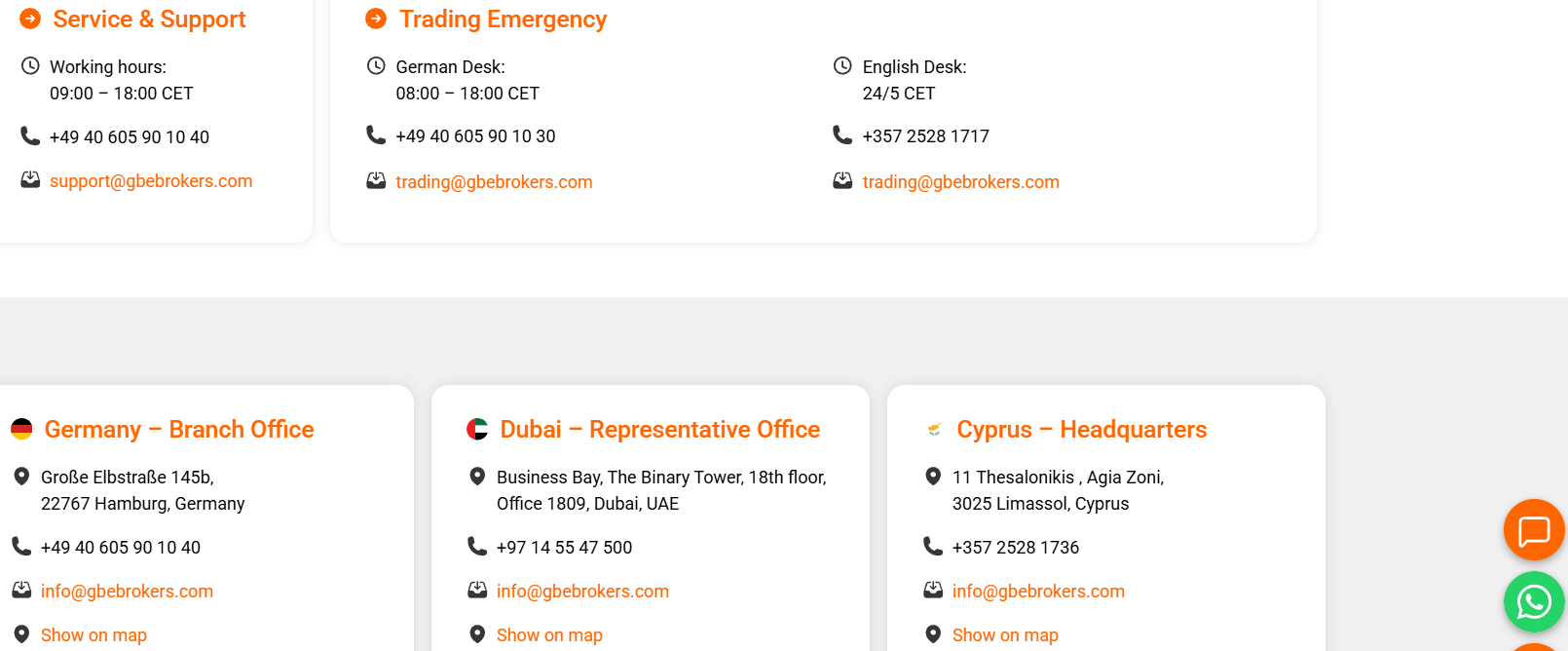

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- GBE Brokers Compared to Other Brokers

- Full Review of Broker GBE Brokers

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

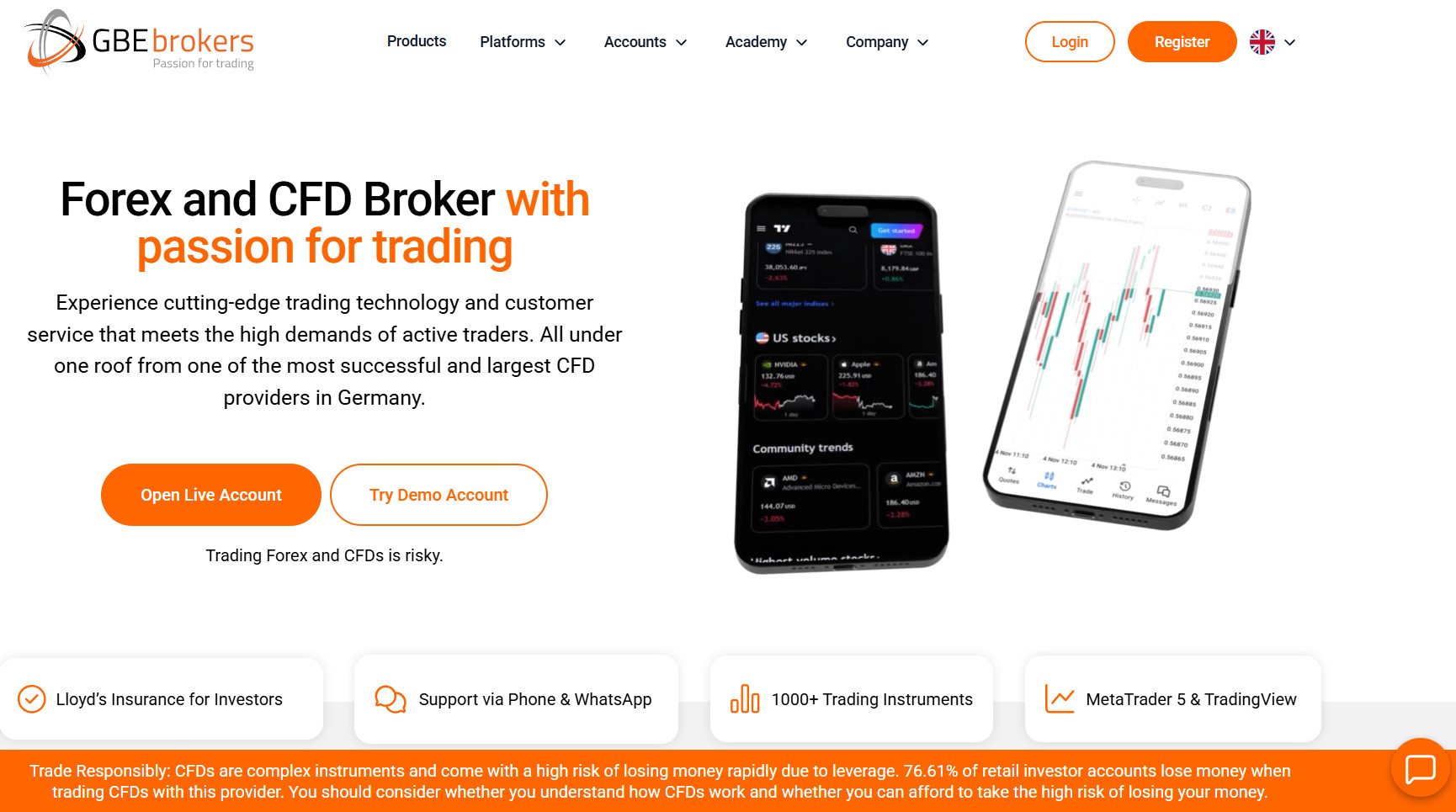

What is GBE Brokers?

GBE Brokers is a Cyprus-based online broker, founded in 2013 and regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Federal Financial Supervisory Authority (BaFin) in Germany.

The broker provides access to Forex and CFD trading on currencies, indices, commodities, metals, shares, futures, and cryptocurrencies through the MetaTrader 4 and MetaTrader 5 platforms.

GBE Brokers is known for its STP execution model, offering competitive spreads and deep liquidity to both retail and professional traders. In addition to its CySEC and BaFin licenses, the broker also operates a global entity regulated by the Financial Services Authority (FSA) in Seychelles, allowing it to serve a broader international client base. The company further extends its services through GBE Prime, which delivers liquidity solutions for institutional clients.

GBE Brokers Pros and Cons

GBE Brokers offers several advantages, including strong regulation under CySEC and BaFin in Europe, as well as access to the popular MetaTrader 4, MetaTrader 5, and TradingView platforms, which feature an STP execution model that ensures competitive spreads and deep liquidity.

Traders also benefit from a wide range of instruments, professional account options, and institutional services through GBE Prime.

For the cons, the minimum deposit amount is higher compared to some competitors, and there are fewer account type choices than those offered by larger international brokers. Overall, GBE Brokers is best suited for experienced retail and professional traders who value reliable execution and regulated trading conditions.

| Advantages | Disadvantages |

|---|

| CySEC and BaFin regulation and oversee | Conditions vary based on the entity |

| Competitive trading conditions | No 24/7 customer support |

| Forex and CFD trading | Higher minimum deposit amount |

| International trading | |

| European traders | |

| Client protection | |

| Good learning and research materials | |

| Popular trading platforms | |

| Professional trading | |

GBE Brokers Features

GBE Brokers combines strong regulation, advanced platforms, and institutional-grade conditions to deliver a comprehensive trading experience. Below is a comprehensive list of its main features:

GBE Brokers Features in 10 Points

| 🏢 Regulation | CySEC, BaFin, FSA |

| 🗺️ Account Types | GBE Classic, GBE Plus*, GBE VIP* Accounts |

| 🖥 Trading Platforms | MT4, MT5, TradingView |

| 📉 Trading Instruments | Forex, CFDs on Indices, Shares, Metals, Energies, Futures, Crypto |

| 💳 Minimum Deposit | $1,000 |

| 💰 Average EUR/USD Spread | 0.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, CHF |

| 📚 Trading Education | Webinars, Videos, Trainings, Newsletter, Blog |

| ☎ Customer Support | 24/5 |

Who is GBE Brokers For?

GBE Brokers is designed for traders who seek a regulated and transparent environment with professional-grade conditions. It is particularly suitable for experienced retail traders, professional investors, and institutions looking for deep liquidity, advanced platforms, and reliable execution. According to our findings, the broker is Good for:

- Retail traders

- Professional traders

- Traders who prefer the MT4 and MT5 platforms

- European traders

- International trading

- Copy trading

- Currency trading

- CFD trading

- Good strategies

- Swap-free trading

- Competitive conditions

- Good research and learning materials

GBE Brokers Summary

Overall, GBE Brokers is a well-established CFD broker that combines strong European regulation under BaFin and CySEC with global oversight from the FSA in Seychelles, making it accessible to traders worldwide.

It provides trading through MetaTrader 4, MetaTrader 5, and TradingView, supported by an STP execution model that delivers tight spreads, fast execution, and deep liquidity.

With a diverse range of instruments, professional account options, and institutional services via GBE Prime, the broker caters to both individual and institutional clients.

While it has higher minimum deposits, GBE Brokers stands out as a reliable choice for experienced traders who value transparency, advanced platforms, and regulated conditions.

55Brokers Professional Insights

A key factor that sets GBE Brokers apart is its ability to bridge the gap between retail and institutional trading by offering professional-grade conditions within a regulated environment.

The broker’s STP execution model provides traders deep liquidity and competitive spreads, creating a highly efficient and transparent experience, suitable for most trading styles or strategies, either you’re holding long term positions or prefer day trading or scalping.

With support for MetaTrader 4, MetaTrader 5, and TradingView, clients can choose from industry-leading platforms equipped with advanced tools and charting capabilities. Beyond retail services, GBE Brokers also distinguishes itself through GBE Prime, its institutional arm that delivers tailored liquidity solutions to professional clients and financial institutions.

Overall, Backed by tight establishmenthe broker combines trust, technology, and flexibility, making it a standout choice for traders seeking reliability and professional insights along with quality trade environment.

Consider Trading with GBE Brokers If:

| GBE Brokers is an excellent Broker for: | - Need a well-regulated broker․

- Offering a range of popular trading instruments.

- Secure trading environment.

- Who prefer higher leverage up to 1:400․

- Providing competitive trading conditions.

- Copy trading.

- European trading.

- International trading.

- Currency trading.

- MAM/PAMM trading.

- Need comprehensive educational materials.

- Professional clients and financial institutions.

- Various strategies allowed.

|

Avoid Trading with GBE Brokers If:

| GBE Brokers might not be the best for: | - Looking for cTrader platform.

- Looking for broker with access to VPS Hosting.

- Who prefer 24/7 customer service. |

Regulation and Security Measures

Score – 4.5/5

GBE Brokers Regulatory Overview

GBE Brokers operates under a strong regulatory framework that enhances its credibility and client protection standards. The broker is licensed by the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with EU regulations under MiFID II, and providing access to investor protection schemes.

In addition, the broker maintains a presence in Germany, where it is registered with the Federal Financial Supervisory Authority (BaFin), further strengthening its reputation within the European financial market.

To extend its services globally, the broker also operates under the supervision of the Financial Services Authority (FSA) in Seychelles, offering flexibility to international clients.

How Safe is Trading with GBE Brokers?

Trading with GBE Brokers is considered safe due to its strong regulatory oversight and client protection measures. The broker is licensed by CySEC in Cyprus, registered with BaFin in Germany, ensuring compliance with international standards.

However, traders under offshore regulation may face fewer protections compared to those under stricter jurisdictions like the BaFin or CySEC.

Consistency and Clarity

GBE Brokers has built a solid reputation in the financial community since its establishment in 2013, earning recognition for its consistent service quality and transparent operations.

Trader reviews often highlight its reliable execution, competitive trading conditions, and professional-level platforms, while some note areas for improvement, such as higher deposit thresholds.

The broker’s credibility is reinforced by its regulation under CySEC and registration with BaFin, which together signal stability and trustworthiness.

Beyond trading, GBE Brokers actively contributes to its visibility and reputation through industry participation, community engagement, and sponsorship activities that reflect a commitment to building long-term relationships with clients.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with GBE Brokers?

GBE Brokers offers a selection of account types tailored to different experience levels. The GBE Classic Account is designed for standard retail traders, providing access to all instruments with competitive spreads and straightforward conditions.

For more active and professional traders, the broker offers the GBE Plus Account and the GBE VIP Account, both of which feature lower spreads, enhanced conditions, and additional benefits suited to higher-volume trading.

To support practice and skill development, GBE Brokers also provides a demo account, allowing traders to test strategies in a risk-free environment. Additionally, swap-free accounts are available upon request, ensuring compliance with Sharia law for clients who require interest-free trading.

Classic Account

The GBE Classic Account is the standard entry-level account type offered by GBE Brokers, designed to suit retail traders seeking straightforward access to the markets.

It requires a minimum deposit of $1,000, providing access to a wide range of instruments including Forex, commodities, indices, shares, and cryptocurrencies. This account features competitive spreads without the need for commission-based pricing, suitable for traders who prefer simplicity in cost structure.

Overall, the Classic Account is an ideal choice for traders who want a balanced combination of accessibility, regulated security, and professional conditions without the higher capital requirements of advanced account types.

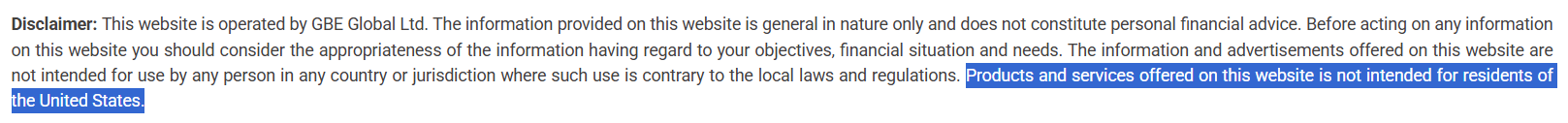

Regions Where GBE Brokers is Restricted

GBE Brokers is restricted from offering its services in certain regions due to regulatory and legal requirements. Excluded countries include:

- USA

- Canada

- Belgium

- Japan

- North Korea

- Iran

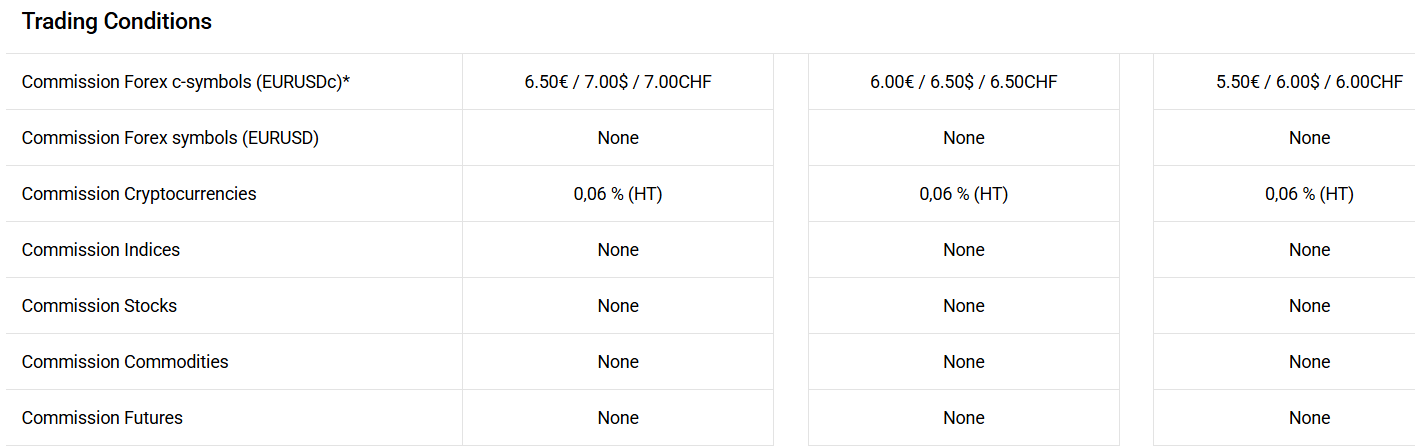

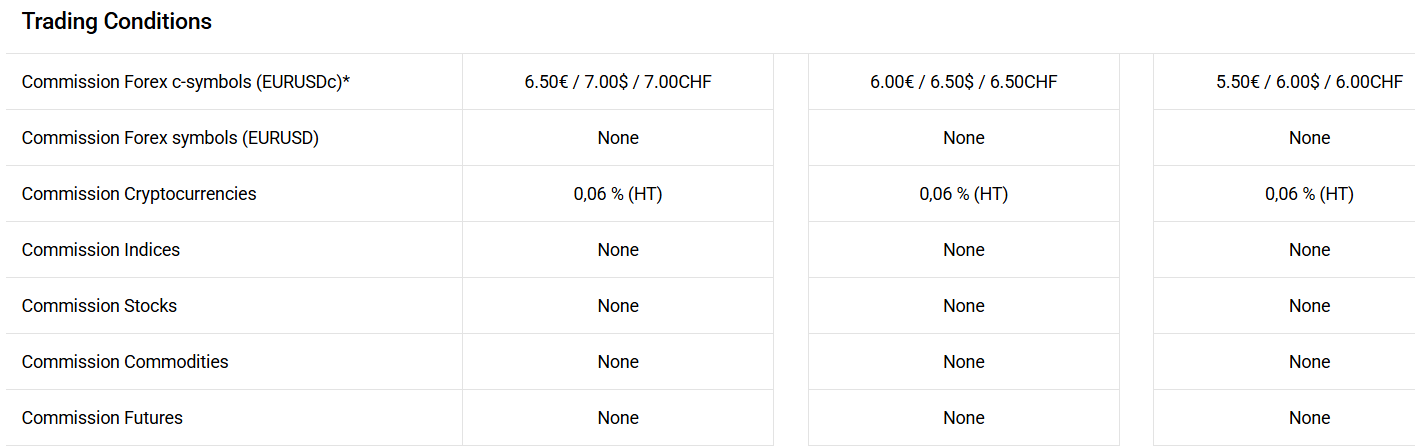

Cost Structure and Fees

Score – 4.5/5

GBE Brokers Brokerage Fees

GBE Brokers applies a transparent and competitive fee structure that combines tight spreads with clear costs. The fees are primarily derived from spreads, with commissions applicable on certain conditions, while overnight financing charges apply to positions held beyond the trading day.

Overall, the broker’s fee model is designed to balance cost efficiency with transparency, making it appealing to traders who value clarity in their expenses.

GBE Brokers offers competitive spreads that are well-suited for both retail and professional traders. On major currency pairs, spreads remain tight, with the average EUR/USD spread at 0.8 pips, providing cost-effective trading opportunities for active Forex traders.

Spreads may vary depending on market conditions, volatility, and the chosen platform, but the broker is recognized for maintaining transparent and fair pricing without hidden markups.

GBE Brokers applies commissions under specific account conditions, particularly for traders who opt for tighter spreads and institutional-style pricing.

For example, commissions on EUR/USDc for GBE Classic are €6.50/$7.00/CHF7.00 per lot, while GBE VIP is €5.50/$6.00/CHF6.00. The presence of commissions depends on the specific account type and instrument traded, with some products like shares having no commission.

- GBE Brokers Rollover / Swaps

GBE Brokers charges rollover fees, also known as swaps, on positions held overnight, which reflect the interest rate differential between the two currencies in a pair or the cost of holding CFDs.

These charges can be either positive or negative, depending on the direction of the trade and market conditions. For traders who require interest-free trading, GBE Brokers also offers swap-free accounts upon request, ensuring compliance with Sharia principles.

How Competitive Are GBE Brokers Fees?

GBE Brokers positions itself as a cost-effective choice for traders by aligning its pricing with professional market standards. Its fee structure is tailored to meet the needs of active traders who value efficiency, making it competitive within the industry while still maintaining regulatory compliance and high-quality execution.

| Asset/ Pair | GBE Brokers Spread | FinPros Spread | FXNovus Spread |

|---|

| EUR USD Spread | 0.8 pips | 1.6 pips | 2.5 pips |

| Crude Oil WTI Spread | 3 | 0.75 | 2.8 |

| Gold Spread | 3 | 1.2 | 1.4 |

| BTC USD Spread | 40 | 1.2 | 396 |

GBE Brokers Additional Fees

In addition to the main costs, GBE Brokers applies certain non-trading fees that clients should be aware of. These include charges for deposits or withdrawals depending on the chosen payment method, as well as an inactivity fee of €20 per month if a client has not placed any buy or sell trades within the last three calendar months.

While such fees are standard in the industry, the broker maintains a transparent approach by clearly outlining them in its terms, ensuring traders know what to expect.

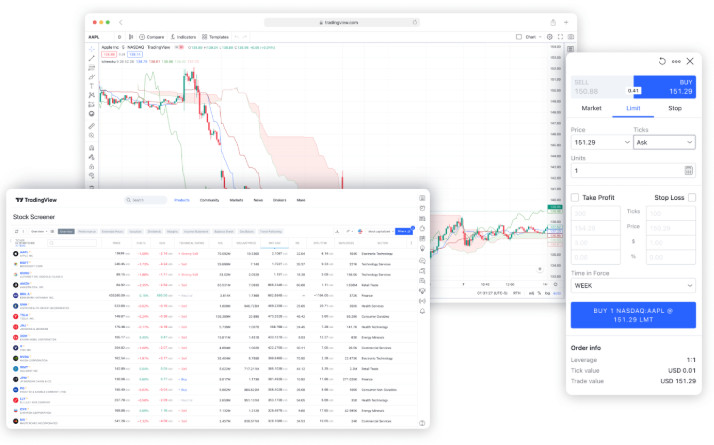

Trading Platforms and Tools

Score – 4.7/5

GBE Brokers provides traders with access to a versatile range of platforms, including MetaTrader 4, MetaTrader 5, and TradingView, ensuring flexibility for different styles and preferences.

MT4 remains a popular choice for its user-friendly interface and vast library of indicators and Expert Advisors, while MT5 offers enhanced features such as more timeframes, advanced order types, and improved analytical tools.

For traders seeking modern charting and social trading opportunities, TradingView delivers powerful web-based charts, community-driven insights, and seamless execution.

However, the availability of trading platforms may differ based on the entity.

Trading Platform Comparison to Other Brokers:

| Platforms | GBE Brokers Platforms | FinPros Platforms | FXNovus Platforms |

|---|

| MT4 | Yes | No | No |

| MT5 | Yes | Yes | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

GBE Brokers Web Platform

GBE Brokers ensures convenient access to the markets through web-based versions of all its supported platforms, MetaTrader 4, MetaTrader 5, and TradingView.

These WebTrader solutions allow clients to trade directly from any browser without the need for downloads or installations, making them ideal for traders who prefer flexibility and mobility. Despite being browser-based, the platforms maintain full functionality, including advanced charting, technical analysis tools, and real-time order execution.

GBE Brokers Desktop MetaTrader 4 Platform

The MT4 desktop platform is a widely recognized financial environment known for its stability, reliability, and extensive features. It provides advanced charting tools, technical indicators, and automated capabilities through Expert Advisors (EAs).

The platform supports multiple order types, real-time market data, and customizable interfaces, allowing traders to tailor their workspace to individual strategies.

GBE Brokers Desktop MetaTrader 5 Platform

The MetaTrader 5 desktop platform is an advanced trading environment that builds on the features of MT4 with enhanced functionality. The platform offers more timeframes, additional order types, and an improved charting system, making it ideal for traders seeking deeper market analysis and strategy flexibility.

It supports automated trading, sophisticated technical indicators, and an economic calendar directly within the platform.

Main Insights from Testing

Testing the MT5 platform highlights its speed, reliability, and advanced analytical capabilities. The platform handles multiple charts and instruments smoothly, allowing traders to monitor markets and execute trades efficiently.

Its intuitive interface, combined with built-in tools for technical analysis and automated strategies, makes it suitable for both active traders and those developing algorithmic trading systems.

GBE Brokers MobileTrader App

GBE Brokers offers mobile apps for all three of its platforms, allowing traders to manage their accounts and execute trades on the go.

The apps provide full access to real-time quotes, advanced charting tools, technical indicators, and order management features directly from smartphones or tablets.

Designed for both iOS and Android devices, these apps maintain the core functionality and reliability of their desktop counterparts, ensuring that traders can monitor markets, analyze price movements, and act on opportunities anytime and anywhere.

AI Trading

GBE Brokers supports AI-assisted trading by providing tools that help traders analyze markets, identify trends, and automate strategies more efficiently.

Through its platforms, clients can access advanced algorithmic features, including EAs on MetaTrader 4 and 5, which allow automated execution based on predefined rules.

In addition, TradingView integration offers AI-powered charting insights and strategy alerts, helping traders make data-driven decisions. These AI tools enhance efficiency, reduce manual monitoring, and enable both novice and professional traders to implement sophisticated approaches with greater precision.

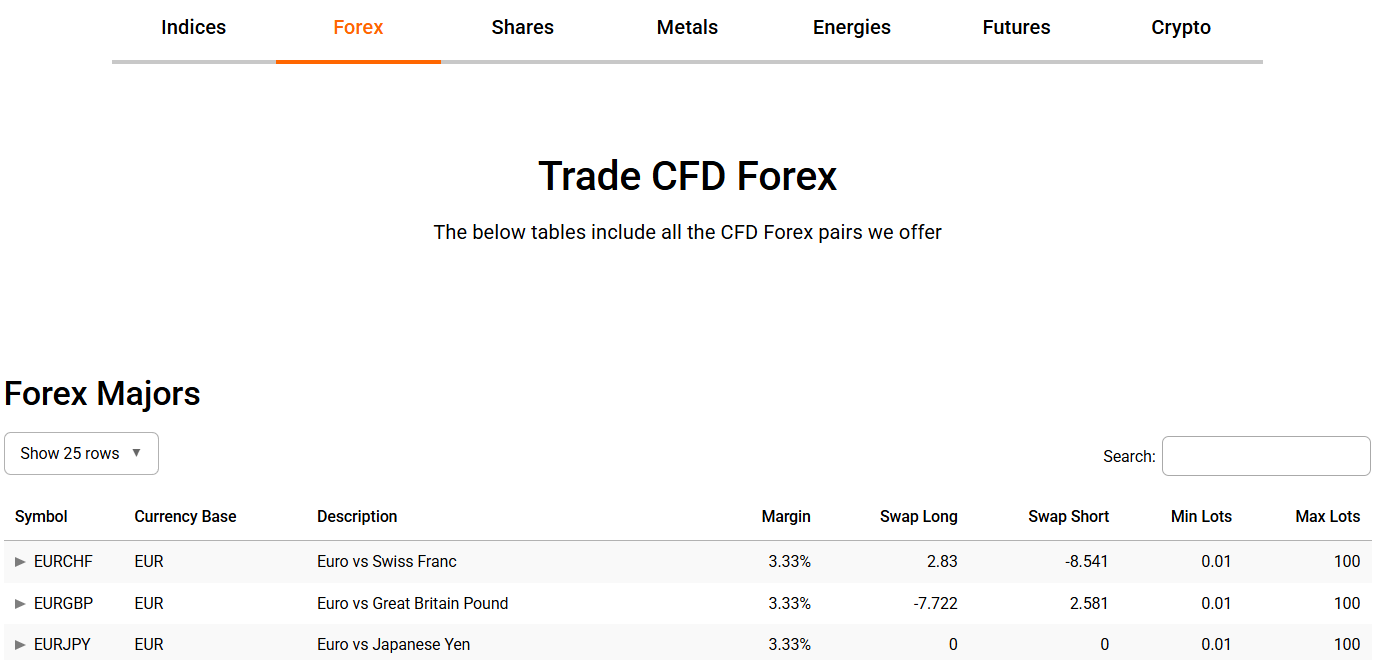

Trading Instruments

Score – 4.6/5

What Can You Trade on GBE Brokers’s Platform?

GBE Brokers offers a diverse portfolio of over 1,000 instruments, giving traders access to a wide range of markets. Clients can trade Forex across major, minor, and exotic currency pairs, as well as CFDs on indices, shares, metals, energies, and futures.

Additionally, the broker provides exposure to cryptocurrencies, allowing traders to capitalize on digital asset movements. This extensive variety of instruments, combined with professional platforms and competitive execution, enables traders to diversify strategies, hedge positions, and explore opportunities across multiple asset classes.

Main Insights from Exploring GBE Brokers’s Tradable Assets

Exploring GBE Brokers’ tradable assets reveals a platform designed for flexibility and market depth, catering to a wide range of strategies.

Traders benefit from access to both highly liquid instruments and niche markets, allowing for diversified portfolio management. The broker’s organized structure, real-time pricing, and seamless execution make it easy to analyze and act on market opportunities.

Leverage Options at GBE Brokers

Trading with leverage can be advantageous, as it allows traders to access the market with a smaller initial investment. However, you should have a thorough understanding of how the multiplier works and the potential risks involved before engaging in leveraged trading.

- Trades from Europe are eligible to use low leverage up to 1:30 for major currency pairs.

- For international traders, the maximum leverage is 1:400.

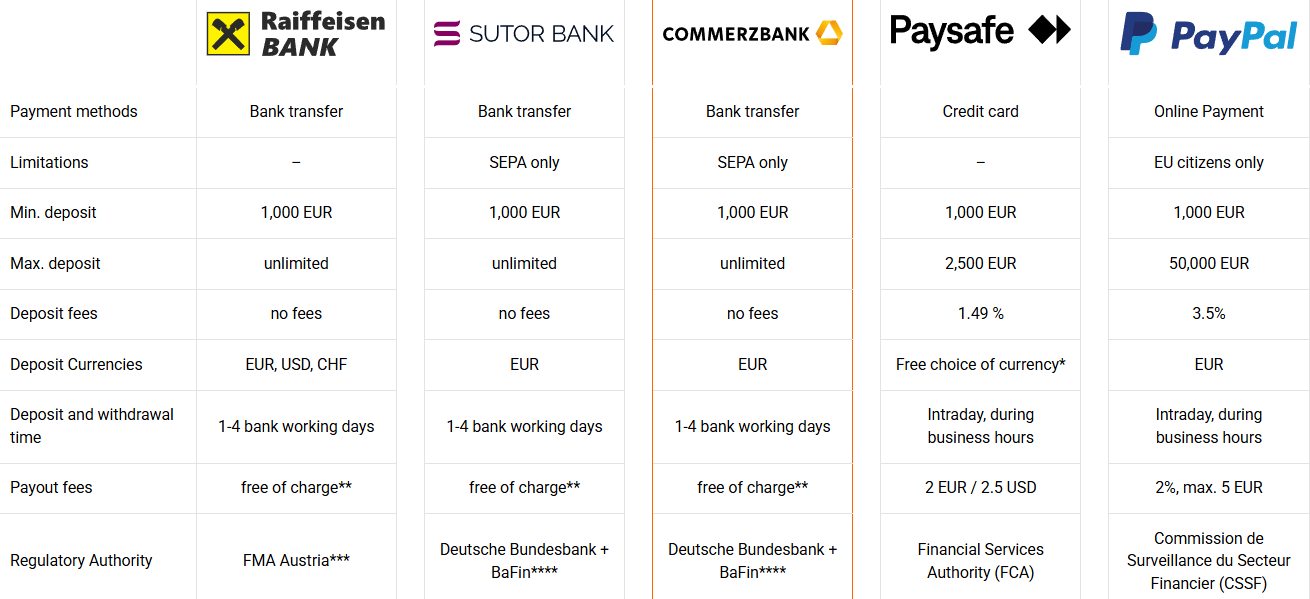

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at GBE Brokers

In terms of funding methods, GBE Brokers offers a few payment methods for funding traders’ accounts quickly and securely, including:

GBE Brokers Minimum Deposit

The broker requires a minimum deposit of $1,000 to open a live account. This deposit level reflects the broker’s focus on providing professional-grade services and access to advanced platforms.

Withdrawal Options at GBE Brokers

GBE Brokers offers a variety of withdrawal options to ensure convenient access to client funds. Withdrawals can be made via bank transfers, credit/debit cards, and selected e-wallets, depending on the client’s region and account type.

The broker processes withdrawal requests efficiently, with timelines varying by payment method, while maintaining transparency and security throughout the transaction process.

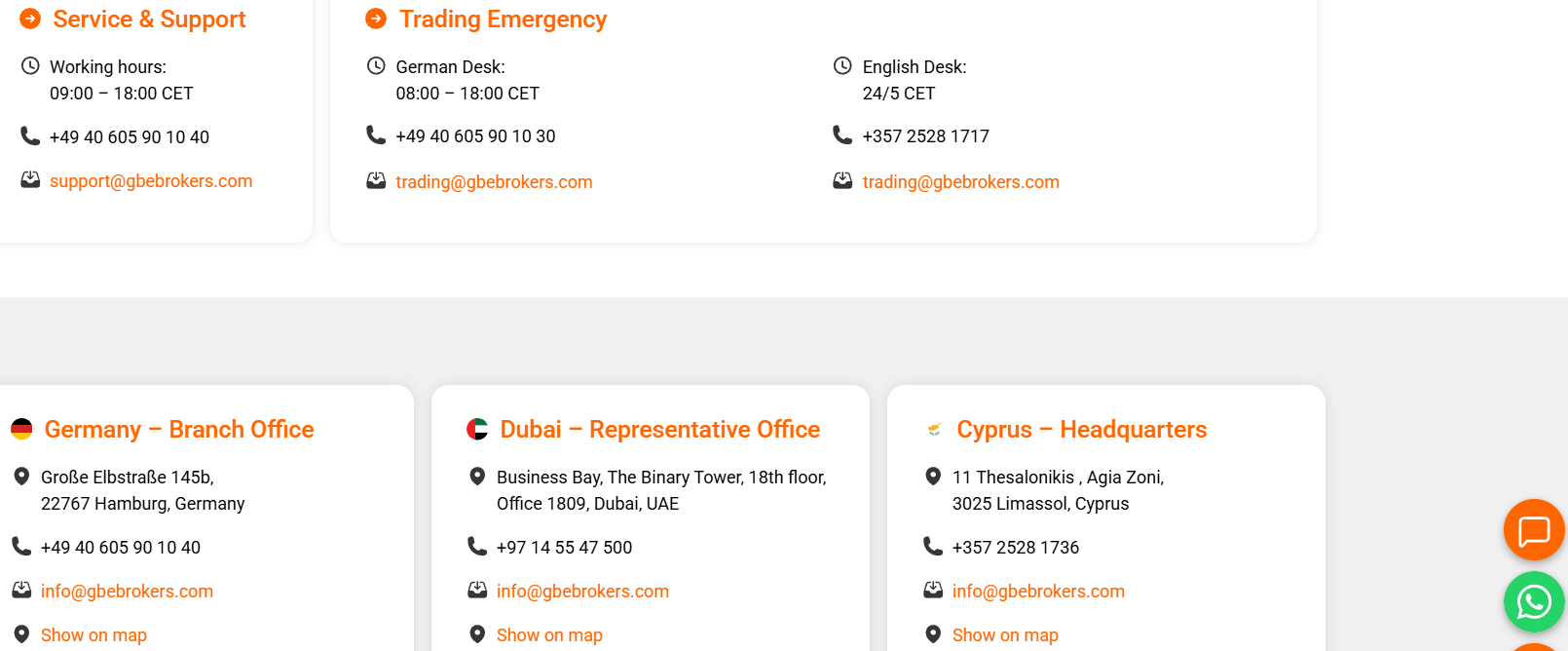

Customer Support and Responsiveness

Score – 4.4/5

Testing GBE Brokers’s Customer Support

GBE Brokers provides 24/5 customer support through multiple channels, including live chat, email, and phone, to assist clients with account, trading, and technical inquiries.

The support team is responsive and knowledgeable, offering guidance in navigating platforms, resolving issues, and providing general assistance.

Contacts GBE Brokers

Clients can reach GBE Brokers’ service and support team via phone at +49 40 605 90 10 40 or by email at support@gbebrokers.com. The support team is available to assist with account inquiries, technical issues, and general questions, ensuring responsive and professional service for all clients.

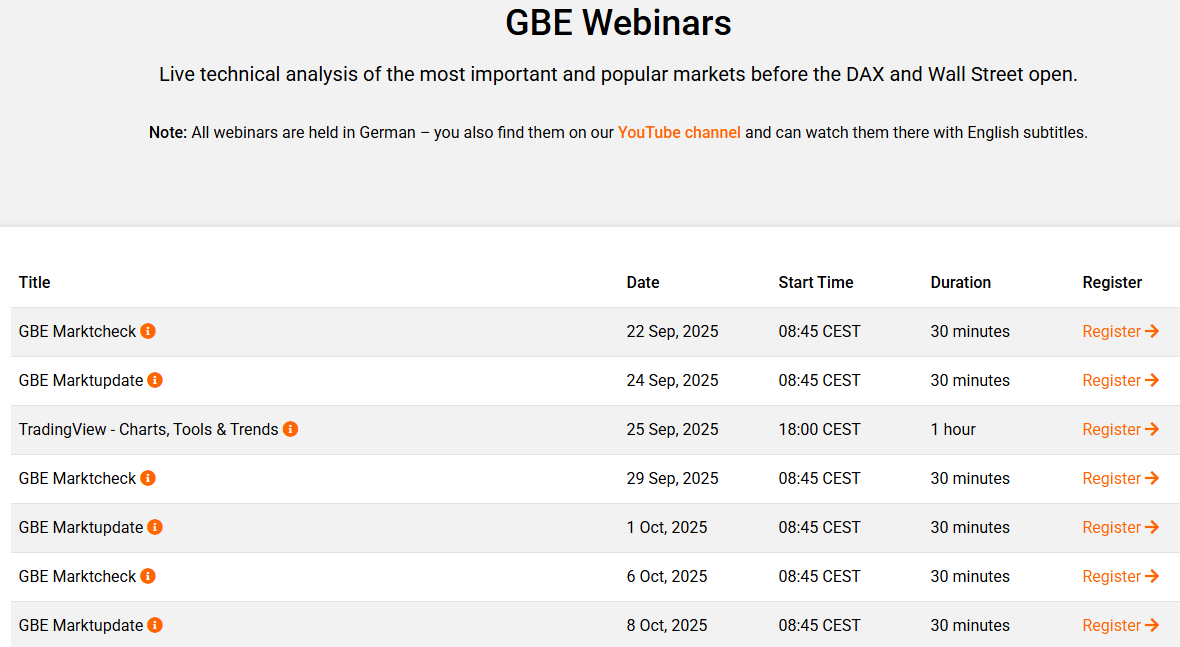

Research and Education

Score – 4.6/5

Research Tools GBE Brokers

GBE Brokers provides a range of research and trading tools designed to enhance analysis and decision-making, available on both its website and platforms.

- On its platforms, traders can utilize Expert Advisors (EAs) for automated strategy execution, customizable chart layouts for detailed technical analysis, and the FIX API for direct market access and integration with advanced systems.

- Additional tools include real-time market news, economic calendars, and analytical resources that support both short-term and long-term trading strategies. These features collectively enable clients to optimize their approach, streamline execution, and gain deeper insights into market movements.

Education

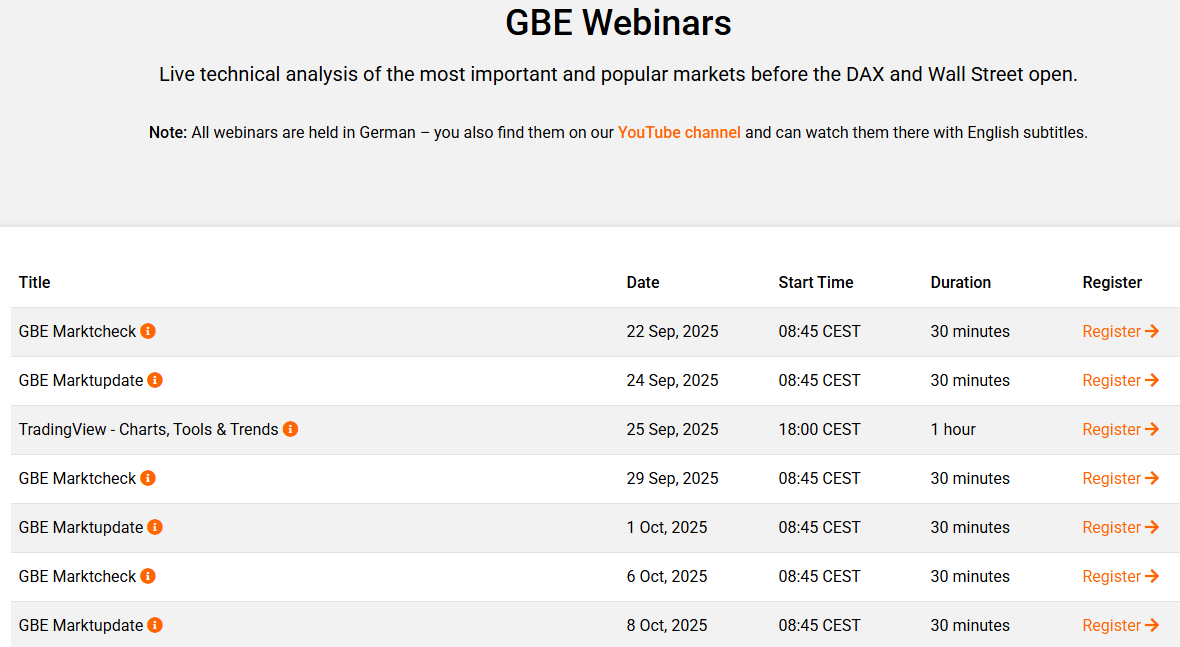

The broker provides a range of educational resources, including webinars, instructional videos, and training sessions that cover strategies, platform usage, and market analysis.

GBE Brokers also provides a regular newsletter with updates, insights, and market commentary, as well as an informative blog featuring articles on trading trends, tips, and financial news.

Portfolio and Investment Opportunities

Score – 4/5

While GBE Brokers primarily operates as a CFD broker, it also offers additional investment opportunities for clients seeking portfolio diversification.

These include MAM and PAMM accounts, which allow investors to allocate funds to professional traders for managed trading, as well as copy trading options that enable clients to replicate the strategies of experienced traders.

Account Opening

Score – 4.5/5

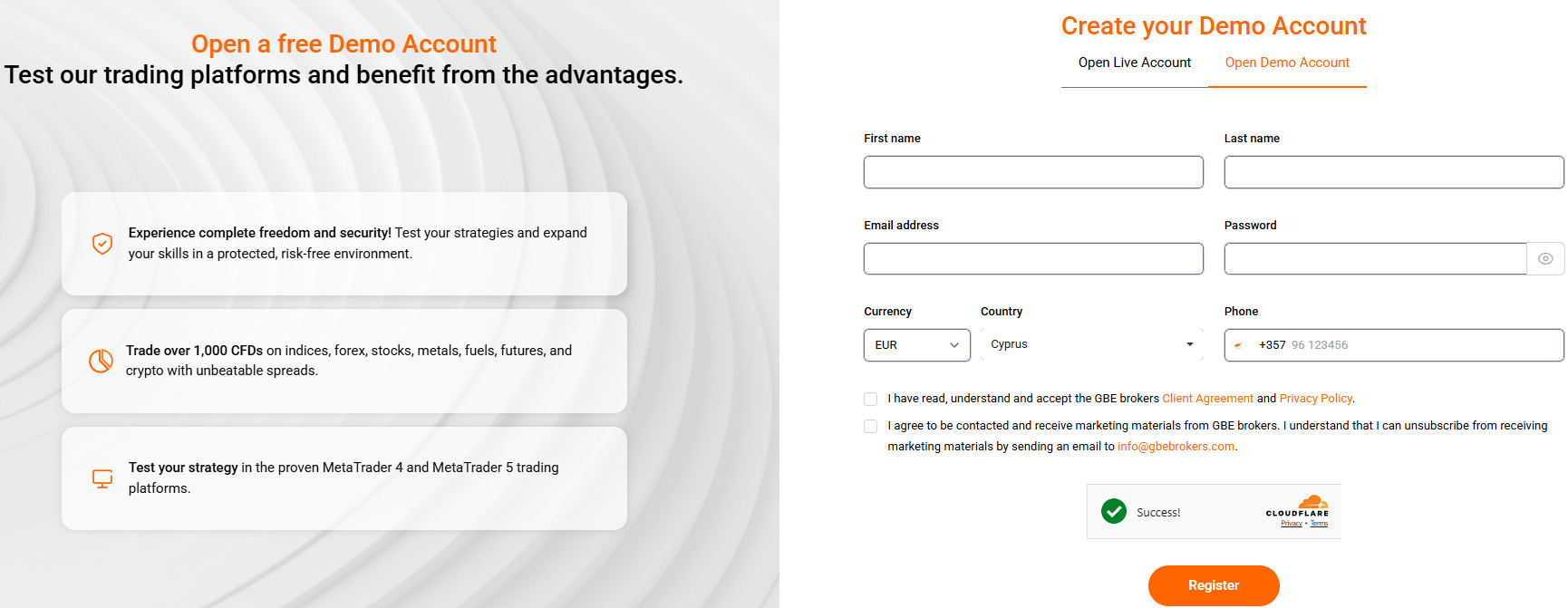

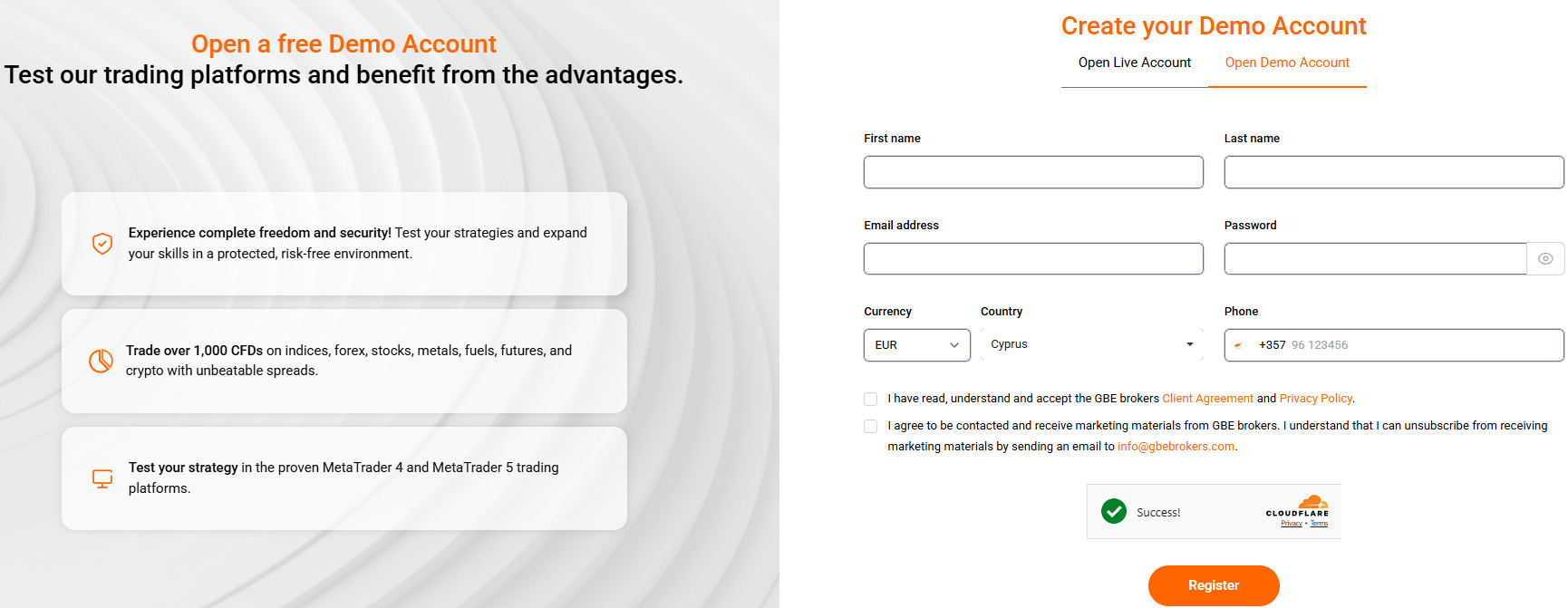

How to Open GBE Brokers Demo Account?

Opening a demo account with GBE Brokers is a simple way to practice trading in a risk-free environment before committing real funds. The process can be completed in a few steps:

- Visit the GBE Brokers website and navigate to the “Demo Account” section.

- Fill out the registration form with your personal details, including name, email, and phone number.

- Choose your preferred platform and account type for the demo.

- Set your virtual balance to simulate real conditions.

- Confirm your registration via email and log in to the platform to start trading.

This allows traders to explore the broker’s features, test strategies, and become familiar with the platforms without any financial risk.

How to Open GBE Brokers Live Account?

Opening a live trading account with GBE Brokers is a straightforward process. Traders begin by visiting the GBE Brokers website and completing the online registration form with their personal details.

They then select their preferred account type and platform, and provide the required documentation for identity and address verification, as part of the broker’s KYC process.

Once the account is verified, clients can make their minimum deposit and gain full access to the platforms, allowing them to trade Forex, CFDs, cryptocurrencies, and other instruments in a secure and regulated environment.

Additional Tools and Features

Score – 4.4/5

In addition to its research tools, GBE Brokers offers a variety of additional features designed to enhance the trading experience and improve decision-making.

- These include risk management tools such as stop-loss and take-profit orders, alerts and notifications to monitor market movements in real time, and account analytics that provide insights into trading performance.

- Clients also benefit from market sentiment indicators available both on the website and platforms. Together, these tools help users stay informed, manage risk effectively, and execute strategies with greater confidence and precision.

GBE Brokers Compared to Other Brokers

GBE Brokers positions itself competitively among online brokers by offering a broad range of tradable instruments, advanced platforms, and regulated trading conditions.

Compared to many competitors, it provides a solid balance of accessible tools and professional-grade features. While some brokers may offer lower minimum deposits or more extensive asset libraries, GBE Brokers stands out for its combination of platform versatility, regulatory oversight across multiple jurisdictions, and comprehensive educational and support resources.

Overall, it presents a reliable option for users seeking a well-rounded and secure financial environment without compromising on execution quality or analytical capabilities.

| Parameter |

GBE Brokers |

FXNovus |

Earn |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 0.8 pips |

Average 2.5 pips |

Average 0.1 pips |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.0 pips + $3.5 per side |

Not available |

0.0 pips + 0.007% per side |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Average |

Average |

Low/ Average |

Average |

Low/Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, TradingView |

Webtrader, Trading App |

MT4, MT5, Earn.Broker |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

1000+ instruments |

160+ instruments |

950+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

CySEC, BaFin, FSA |

FSCA, CySEC |

CySEC |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Good |

Limited |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

$1,000 |

$250 |

$100 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker GBE Brokers

GBE Brokers is a fully regulated CFD and Forex broker headquartered in Cyprus. It offers a wide range of instruments, including over 1,000 assets across Forex, CFDs, cryptocurrencies, indices, and commodities.

Clients can trade using popular platforms like MetaTrader 4, MetaTrader 5, and TradingView, all accessible via web, desktop, and mobile. GBE Brokers is regulated by the CySEC and the BaFin, ensuring a secure trading environment.

It also offers robust customer support, educational resources such as webinars and training materials, and a suite of tools to assist traders in their strategies. Overall, GBE Brokers is a reliable choice for traders seeking a regulated and versatile brokerage firm.

Share this article [addtoany url="https://55brokers.com/gbe-brokers-review/" title="GBE Brokers"]