- What is FXTrading?

- FXTrading Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- FXTrading Compared to Other Brokers

- Full Review of Broker FXTrading

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.5 / 5 |

What is FXTrading.com?

FXTrading, also known as FXT, is a Forex and CFD trading provider founded in Australia in 2014. The broker provides various CFD trading products, including Forex, crypto, shares, commodities, spot metals, energies, and indices.

FXTrading.com is regulated and authorized by the reputable Australian Securities and Investments Commission, providing a secure and transparent trading experience. The broker is also licensed by the Vanuatu Financial Services Commission, providing Forex trading services to international traders.

FXTrading supports the industry-renowned MT4 and MT5 trading platforms and offers both spread-based and commission-based account types with competitive spreads and commissions.

FXTrading Pros and Cons

FXTrading offers several advantages for traders, including access to the popular MT4 and MT5 platforms, competitive spreads, and a range of popular trading instruments to suit different trading styles. The broker is regulated by the top-tier Australian ASIC, which provides a strong level of security.

For the cons, international trading is conducted through an offshore entity. Additionally, the broker offers limited educational resources, which may be a drawback for beginners who need in-depth learning support.

| Advantages | Disadvantages |

|---|

| ASIC regulation and oversee | Conditions may vary according to regulation and entity |

| Competitive trading conditions | No 24/7 customer support |

| Forex and CFDs trading | Poor learning materials |

| Suitable for beginners and professionals | |

| Client protection | |

| MT4 and MT5 trading platforms | |

| Low spreads and fees | |

| International trading | |

FXTrading.com Features

FXTrading offers a range of features to support traders of all levels, including access to industry-known platforms like MT4 and MT5, as well as competitive trading conditions with tight spreads and fast execution. The key features are summarized in 10 points, covering aspects like Trading Platforms, Account Types, available Trading Instruments, and more.

FXTrading Features in 10 Points

| 🏢 Regulation | ASIC, VFSC |

| 🗺️ Account Types | Standard, Pro Accounts |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | CFDs on Forex, Crypto, Share, Commodities, Spot Metals, Energies, Indices |

| 💳 Minimum Deposit | $50 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, AUD, GBP, EUR |

| 📚 Trading Education | Market News, FXT Analysis, Trading Insight |

| ☎ Customer Support | 24/5 |

Who is FXTrading For?

FXTrading is a reliable trading broker that meets the needs of a diverse range of traders, from beginners exploring Forex to seasoned professionals seeking advanced tools and competitive pricing. Based on our findings, FXT is Good for:

- Beginners

- Advanced traders

- International trading

- Australian traders

- Traders who prefer MT4/MT5

- Forex and CFD trading

- Variety of trading strategies

- Competitive trading conditions

- API trading

- Multi-asset trading

- Algorithmic/EA trading

- Low fees and competitive spreads

- Good customer support

FXTrading Summary

In conclusion, our review of FXTrading reveals that the broker provides competitive trading conditions for Forex and CFD traders and access to global markets through the popular trading platforms. The broker operates under strict regulatory oversight of ASIC, earning high regard from its clients.

Retail traders can easily open a live trading account with a minimal deposit, making it accessible to a broad audience. While educational resources are limited, FXTrading provides comprehensive trading tools and reliable customer support, making it accessible for beginner traders as well.

55Brokers Professional Insights

FXTrading stands out with its combination of secure regulatory oversight, advanced trading technology, and cost-effective trading conditions.

Regulated by Australia’s ASIC, the broker offers traders trust and transparency. Additionally, it supports both MT4 and MT5 platforms, providing access to diverse trading products and instruments, along with fast execution speeds.

What truly sets FXTrading apart are its tight spreads starting from 0.0 pips, flexible account types, and proprietary tools like FXT Navigator that enhance market analysis, as well as access to Trading Central and API trading.

Overall, these features make FXTrading a competitive choice for traders of all levels seeking both a good trading environment and reliability.

Consider Trading with FXTrading If:

| FXTrading is an excellent Broker for: | - Need a well-regulated broker.

- Looking for broker with low minimum deposit requirement.

- Australian traders.

- Looking for broker suitable for beginners and professional traders.

- Providing competitive fees and spreads.

- Offering a range of popular trading instruments.

- Secure trading environment.

- Offering MAM and PAMM Trading.

- Looking for broker with MT4 and MT5 trading platforms.

- Broker with a variety of trading strategies.

- Who prefer higher leverage up to 1:2000.

- Access to VPS.

- Providing copy trading.

- International traders.

- Providing floating spreads. |

Avoid Trading with FXTrading If:

| FXTrading might not be the best for: | - Who prefer 24/7 customer service.

- Looking for cTrader platform.

- Need comprehensive educational materials. |

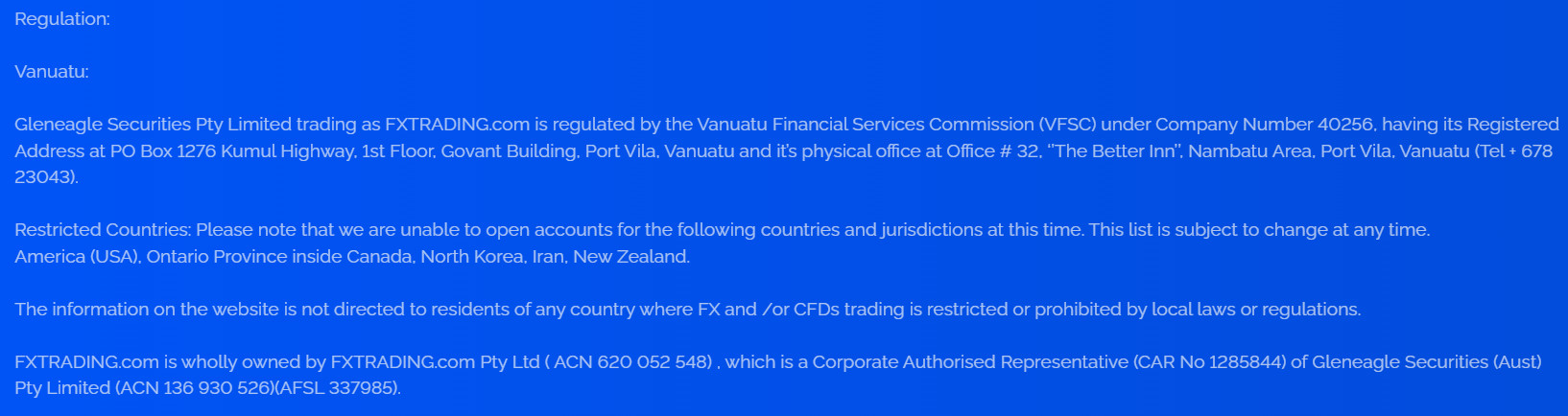

Regulation and Security Measures

Score – 4.5/5

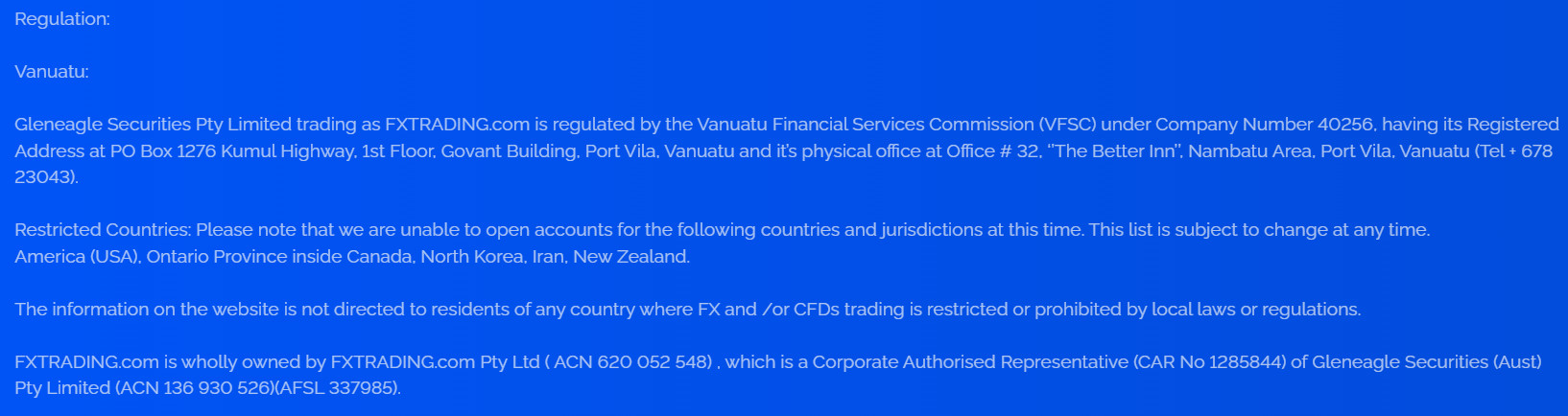

FXTrading.com Regulatory Overview

FXTrading is authorized and regulated by the Australian Securities and Investments Commission (ASIC), a top-tier regulator known for its strict compliance standards and robust investor protection measures.

In addition to its ASIC regulation, the broker also holds a license from the Vanuatu Financial Services Commission (VFSC), which provides an offshore trading option with potentially more flexible conditions. While the VFSC regulation allows for broader market access and higher leverage, traders should be aware that offshore entities generally have fewer investor protections compared to ASIC-regulated accounts.

How Safe is Trading with FXTrading?

Trading with FXT is considered safe due to its Australian regulation. ASIC imposes capital requirements and client fund segregation rules, as well as provides negative balance protection, ensuring a high level of transparency and security.

While the presence of an offshore license may raise caution for some, the broker’s adherence to ASIC’s regulatory standards helps build trust and offers a secure environment for most retail and professional traders.

Consistency and Clarity

FXTrading has built a reliable reputation among traders for offering competitive trading conditions, fast execution, and strong platform support since its establishment in 2014. Traders often highlight benefits such as tight spreads and platform stability, while also pointing out improvement areas, like limited educational resources.

Although not recognized with industry awards or actively engaged in financial events and sponsorships, its steady operations and positive trader reviews reflect a broker that prioritizes clarity, trust, and long-term service.

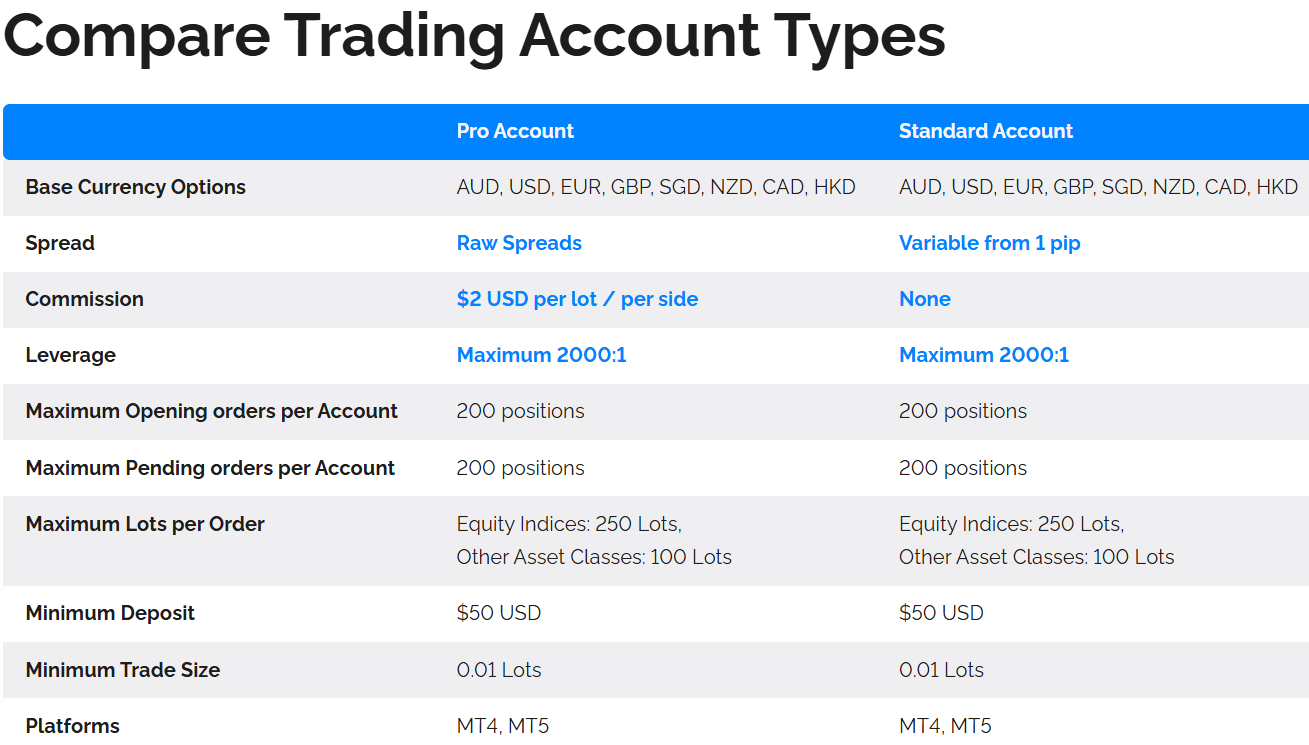

Account Types and Benefits

Score – 4.4/5

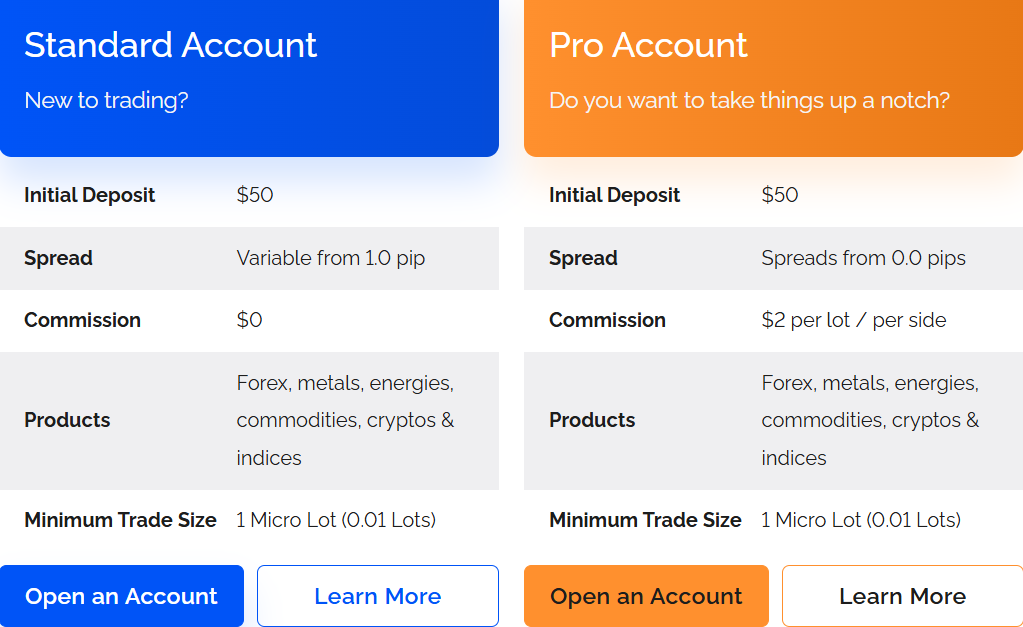

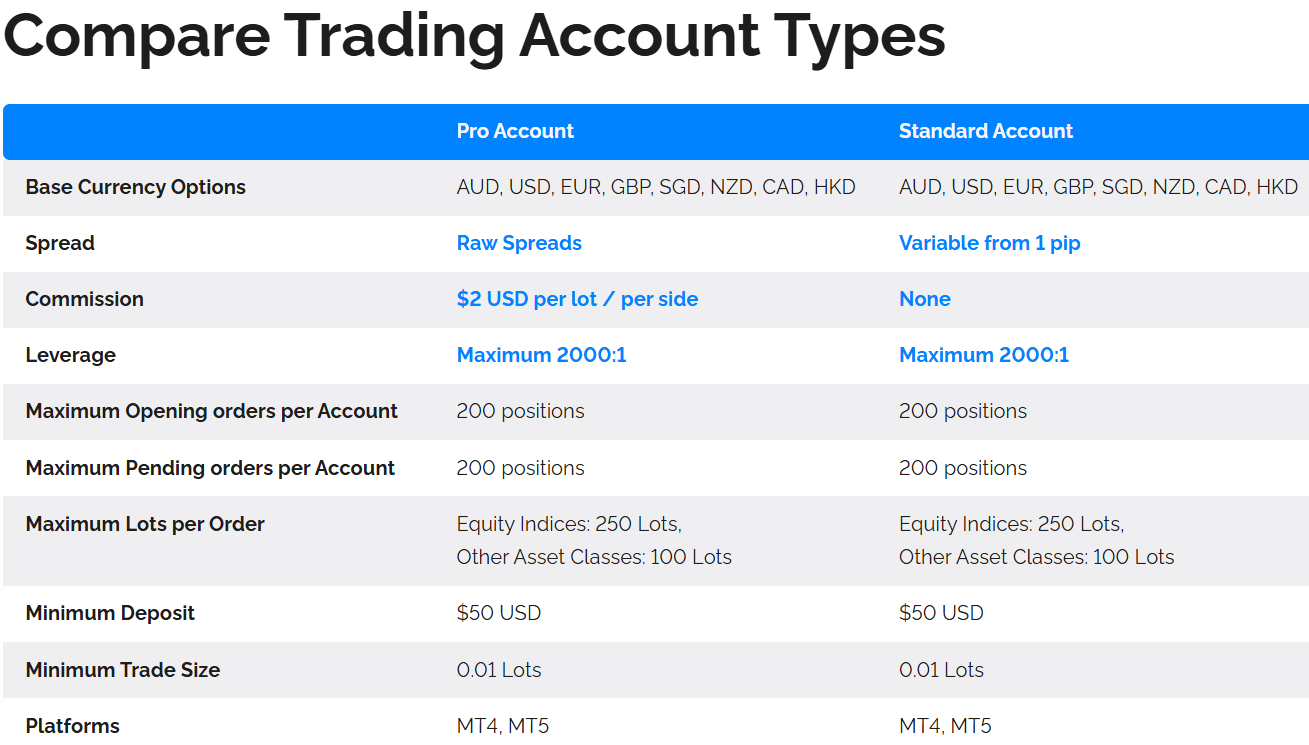

Which Account Types Are Available with FXTrading?

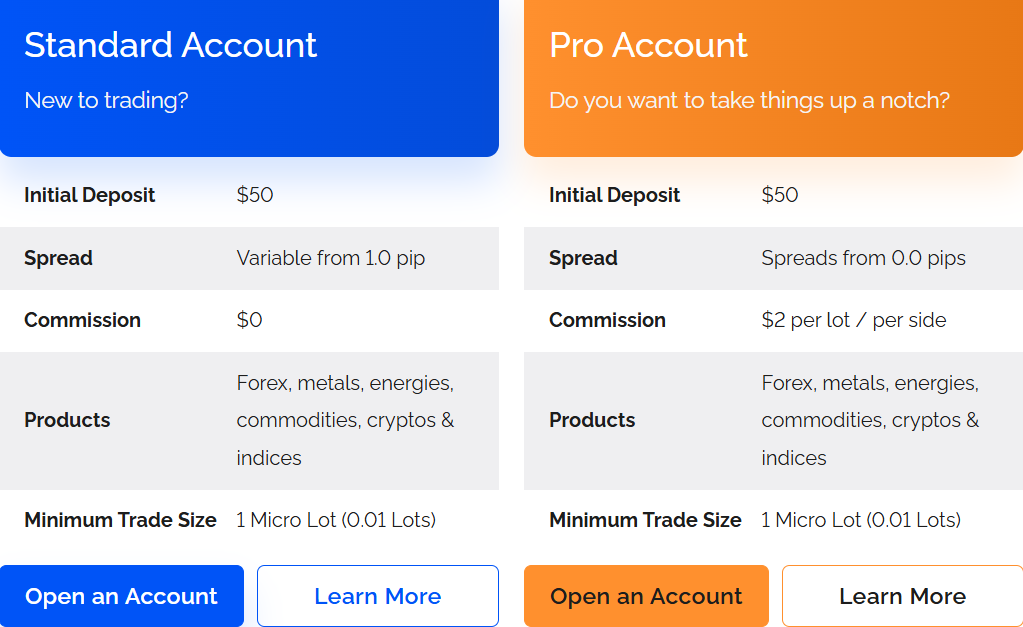

FXTrading offers two account types that suit different trading needs and experience levels. Traders can choose between the Standard Account, which features no commission and slightly wider spreads, and the Pro Account, which offers tighter spreads starting from 0.0 pips with a competitive commission structure, more suitable for professional traders.

In addition to live trading accounts, FXT also provides a demo account, allowing beginner traders to practice and get familiar with the trading platforms in a risk-free environment before committing real funds.

Standard Account

The Standard Account is ideal for beginners with spreads starting from 1.0 pip and no additional trading commission. The minimum deposit requirement to open the account is $50, allowing easy access for new traders.

Users can trade on both the MetaTrader 4 and MetaTrader 5 platforms, benefiting from trading strategies like hedging or EA trading.

Pro Account

FXTrading’s Pro Account is tailored for more experienced traders who require tighter spreads and are comfortable with a commission-based fee structure. Spreads start from as low as 0.0 pips, with a commission of $2 charged per side.

The minimum deposit amount for the Pro Account is $50 as well. Like the Standard option, the Pro Account supports both MT4 and MT5 platforms, ensuring access to advanced features, fast execution, and a range of trading instruments.

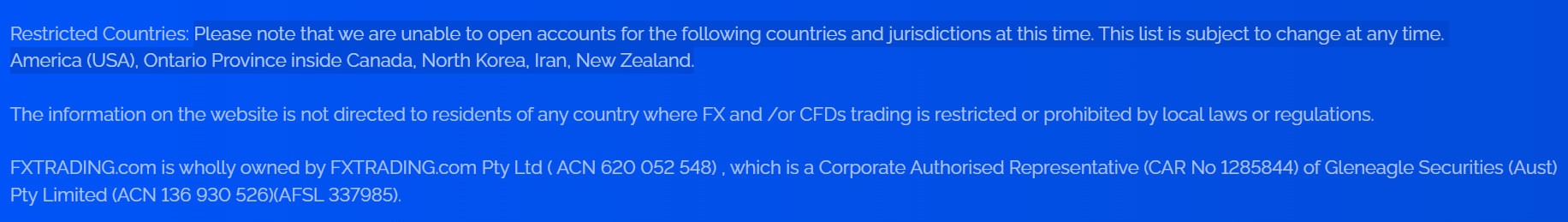

Regions Where FXTrading is Restricted

FXTrading’s services are restricted in certain regions due to regulatory and compliance requirements. The broker does not provide trading services in countries including:

- USA

- Ontario Province in Canada

- North Korea

- Iran

- New Zealand

Cost Structure and Fees

Score – 4.6/5

FXTrading Brokerage Fees

FXT’s trading fees are based on account type, spread-based or commission-based. The broker maintains a competitive fee structure suitable for various trading styles and experience levels.

Additionally, for most deposit and withdrawal methods, there are no fees, however, this may vary depending on the payment method used, so traders should check in advance. Also, FXT does not charge inactivity fees, which is a very cost-effective option for traders.

FXTrading offers competitive spreads that vary depending on the selected account type. For Standard Accounts, the average EUR/USD spread is 1 pip; for Pro Accounts, the spreads start from as low as 0.0 pips. Overall, the broker’s spreads are in line with industry standards, providing a transparent trading cost environment.

FXTrading’s Pro Account operates on a commission-based pricing model, with a commission of $2 per lot per side ($4 round-turn). This is tailored for experienced or high-volume traders who benefit from ultra-tight spreads and transparent pricing.

- FXTrading Rollover / Swaps

FXTrading applies rollover or swap fees for positions held overnight, which reflect the interest rate differential between the two currencies in a pair.

These charges can be either positive or negative, which depends on the trade direction and market conditions. Swap rates are displayed within the trading platform, allowing traders to plan their positions accordingly.

How Competitive Are FXTrading Fees?

FXTrading offers a competitive fee structure in the industry that accommodates a wide range of trading styles. With transparent fee policies and no hidden charges, the broker ensures that traders can manage their trading costs effectively.

The absence of inactivity fees and flexibility in payment methods further enhances its appeal to traders.

| Asset/ Pair | FXTrading Spread | Colmex Pro Spread | TastyFX Spread |

|---|

| EUR USD Spread | 1 pip | 4 pips | 0.8 pips |

| Crude Oil WTI Spread | 22 | 0.10 | - |

| Gold Spread | 8 | 0.68 | - |

| BTC USD Spread | 323 | $195.45 | - |

FXTrading Additional Fees

FXTrading maintains a generally low-fee environment, however, traders should be aware of certain additional charges that may apply depending on the payment method used.

For example, deposits and withdrawals via Neteller incur a 1.5% fee. International bank wire transfers may also involve fees, which vary depending on the intermediary and receiving banks involved. While most other payment methods are free of charge, traders should check with both the broker and their payment provider to understand the full cost of transactions.

Trading Platforms and Tools

Score – 4.5/5

FXTrading offers access to the well-known MetaTrader 4 and MetaTrader 5 platforms. These platforms are known for their robust functionality, including advanced charting tools, customizable indicators, automated trading capabilities, and real-time market analysis.

In addition to MT4 and MT5, the broker provides various trading tools such as VPS hosting, API trading, and access to third-party services like Trading Central, enhancing the overall trading experience with powerful analytical and execution features.

Trading Platform Comparison to Other Brokers:

| Platforms | FXTrading Platforms | Colmex Pro Platforms | TastyFX Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

FXTrading Web Platform

FXTrading provides access to MT4 and MT5 WebTrader platforms, allowing users to trade directly from any web browser without the need to download software.

These platforms offer the main functionalities of their desktop counterparts, including real-time price quotes, advanced charting tools, technical indicators, and one-click trading.

FXTrading Desktop MetaTrader 4 Platform

The broker’s MT4 desktop platform provides a reliable trading environment for users who prefer a traditional trading setup. Known for its stability and user-friendly interface, the platform supports a variety of charting tools, multiple order types, expert advisors, and a range of technical indicators.

Traders can customize the layout to suit their strategies and take advantage of powerful backtesting capabilities.

FXTrading Desktop MetaTrader 5 Platform

The MetaTrader 5 desktop platform offers enhanced functionality and performance for traders seeking more advanced tools. MT5 builds upon the strengths of MT4, featuring more timeframes, additional order types, an integrated economic calendar, and improved charting capabilities.

With faster processing speeds and a more intuitive interface, the platform is ideal for traders who require deeper market analysis and more flexibility in trade execution.

Main Insights from Testing

Testing FXT’s MT5 platform showed efficient performance, fast execution speeds, and access to a wide range of tools. The interface was user-friendly, and the advanced features, such as economic calendar and more charting options, made it ideal for in-depth market analysis.

FXTrading MobileTrader App

FXTrading offers mobile trading through the MT4 and MT5 apps, available for iOS and Android devices. The mobile apps provide users full access to their accounts on the go, featuring real-time quotes, interactive charts, technical indicators, and the ability to open and manage trades seamlessly.

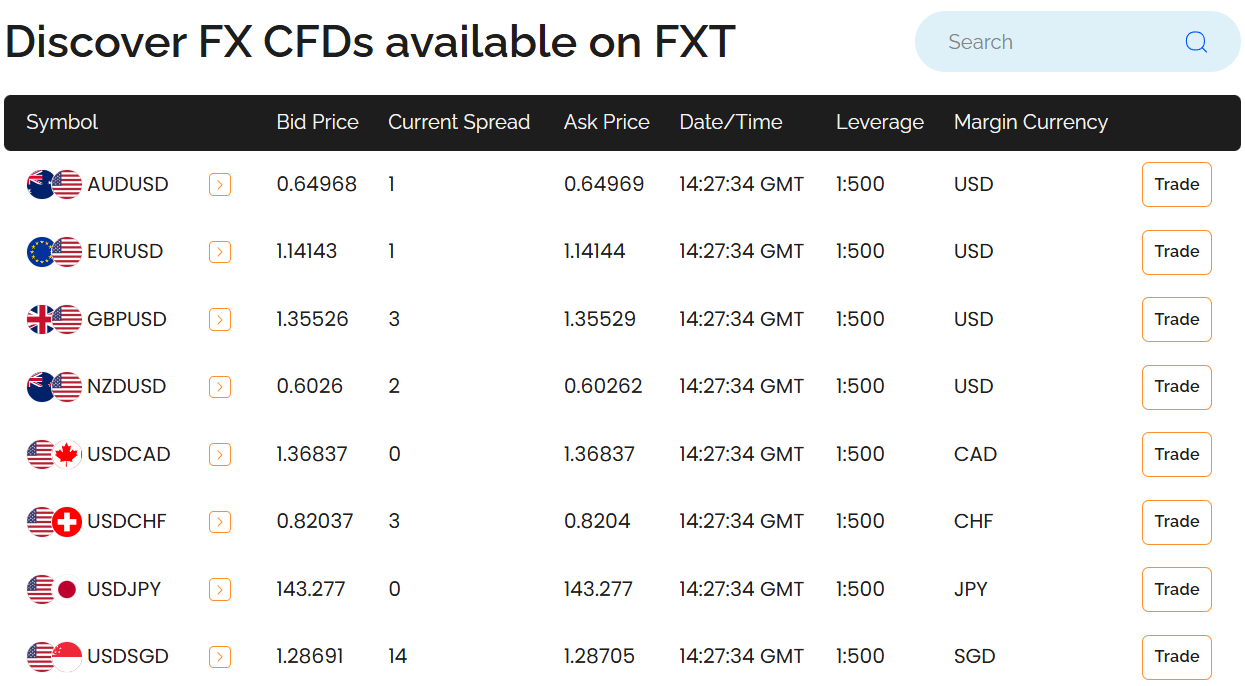

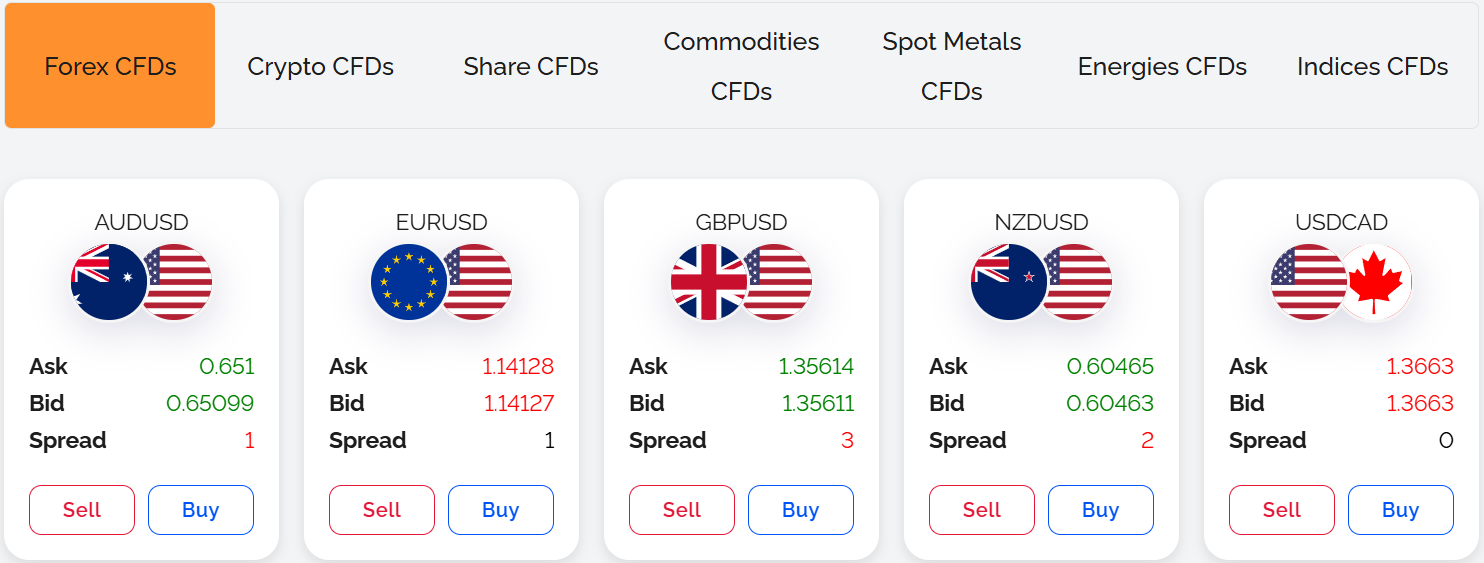

Trading Instruments

Score – 4.4/5

What Can You Trade on FXTrading’s Platform?

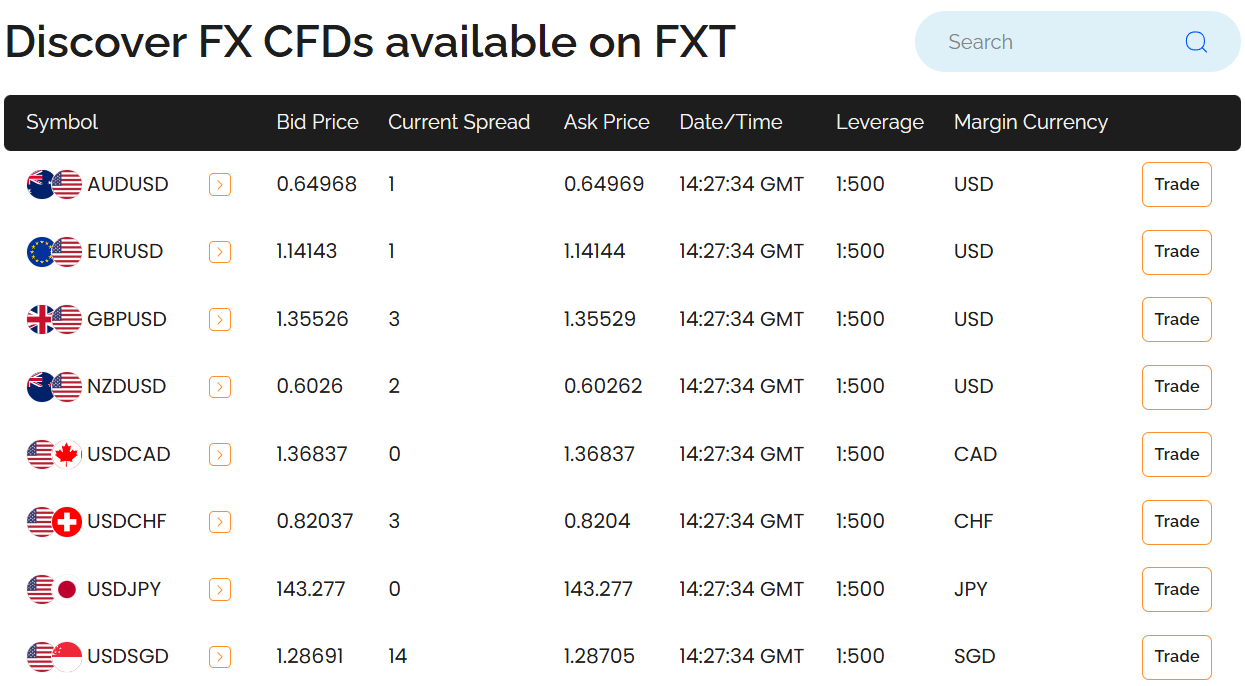

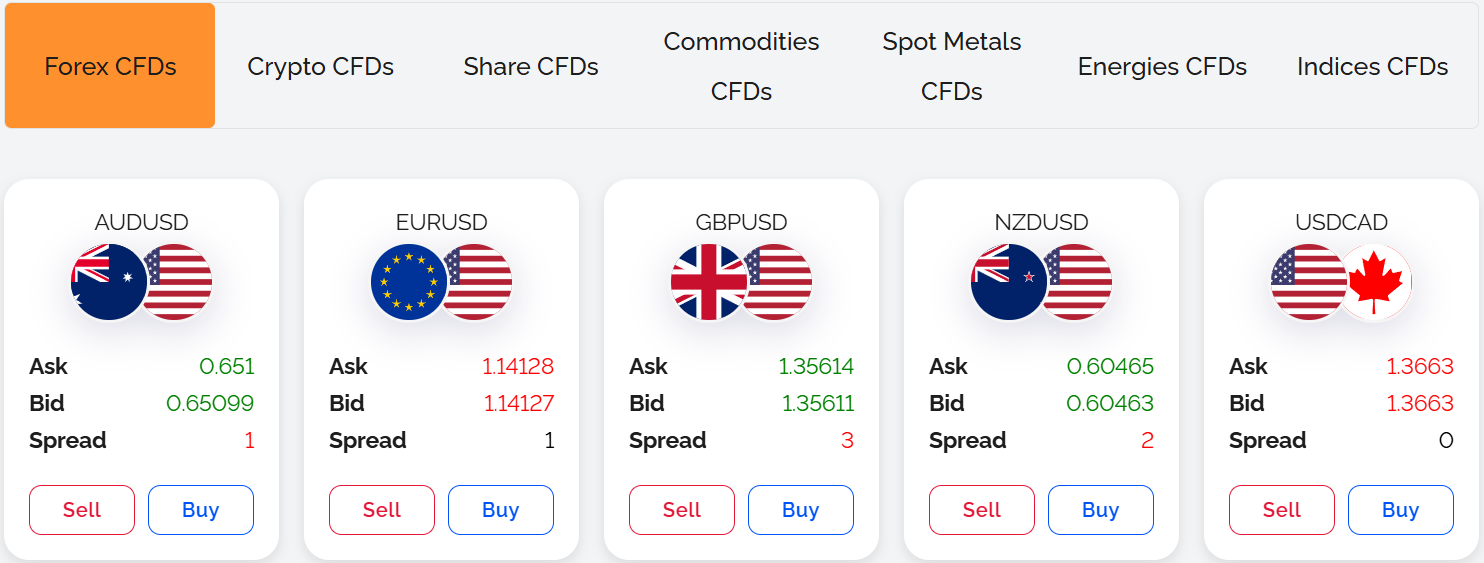

FXTrading provides access to over 1,000 trading instruments, including CFDs on Forex, Crypto, Shares, Commodities, Spot Metals, Energies, and Indices.

This selection allows traders to capitalize on different market conditions and trading opportunities across global financial markets.

Main Insights from Exploring FXTrading’s Tradable Assets

Exploring FXTrading’s tradable assets reveals a well-structured offering suitable for all levels of traders. Trading assets are presented with detailed specifications, helping traders make informed decisions based on contract size, leverage, and trading hours. The overall setup supports smooth access to the global markets with transparency and efficiency.

Leverage Options at FXTrading

Leverage levels offered by FXTrading depend on the entity you open an account. It is a useful tool that enables traders to enter the market with limited capital, yet its use can lead to both substantial profits and losses. As such, you should have a comprehensive understanding of how the multiplier works and its possible consequences before engaging in any trading activities that involve leverage.

- Australian clients can use a maximum leverage of 1:30.

- For international traders, the maximum leverage is 1:2000.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at FXTrading

In terms of funding methods, FXT offers numerous payment methods, which is a very good plus. However, we advise checking funding methods as they might vary based on the client’s country of residence.

FXTrading Minimum Deposit

FXT requires a minimum deposit of $50 to open a live trading account, making it accessible for traders at all levels.

Withdrawal Options at FXTrading

FXTrading offers a variety of withdrawal options, including credit cards, electronic payments, international bank wire transfers, and local bank transfers.

Most withdrawal methods are free of charge, however, Neteller incurs a 1.5% fee, and international bank wire transfers may involve fees depending on the banks involved. Withdrawal requests are processed within 24 hours, with the time for funds to reach your account varying by the method.

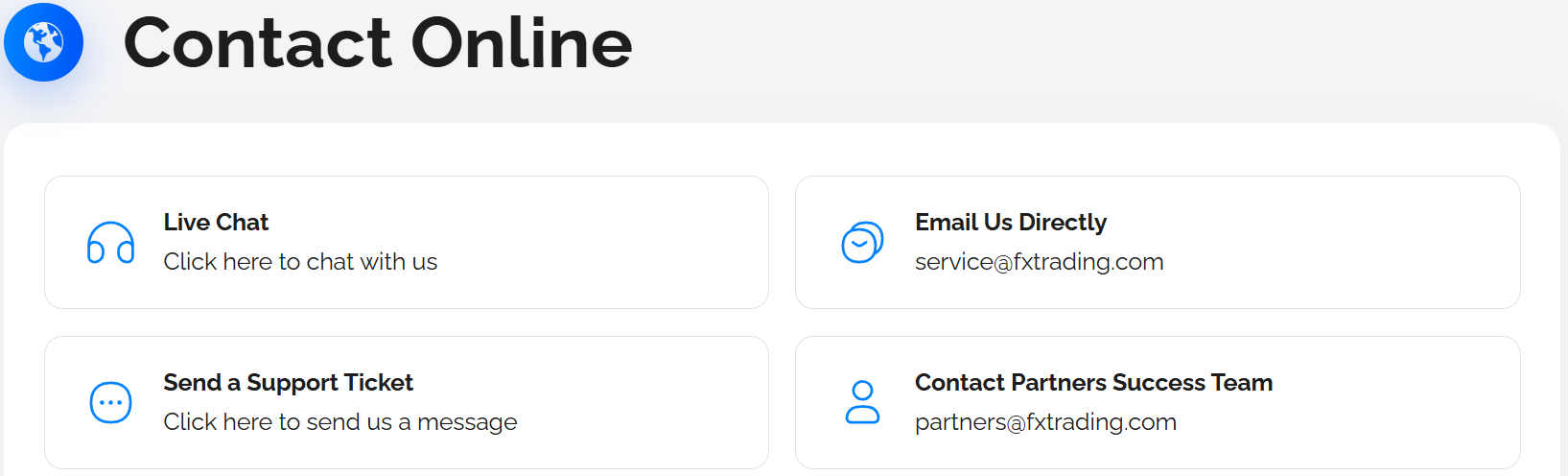

Customer Support and Responsiveness

Score – 4.5/5

Testing FXTrading’s Customer Support

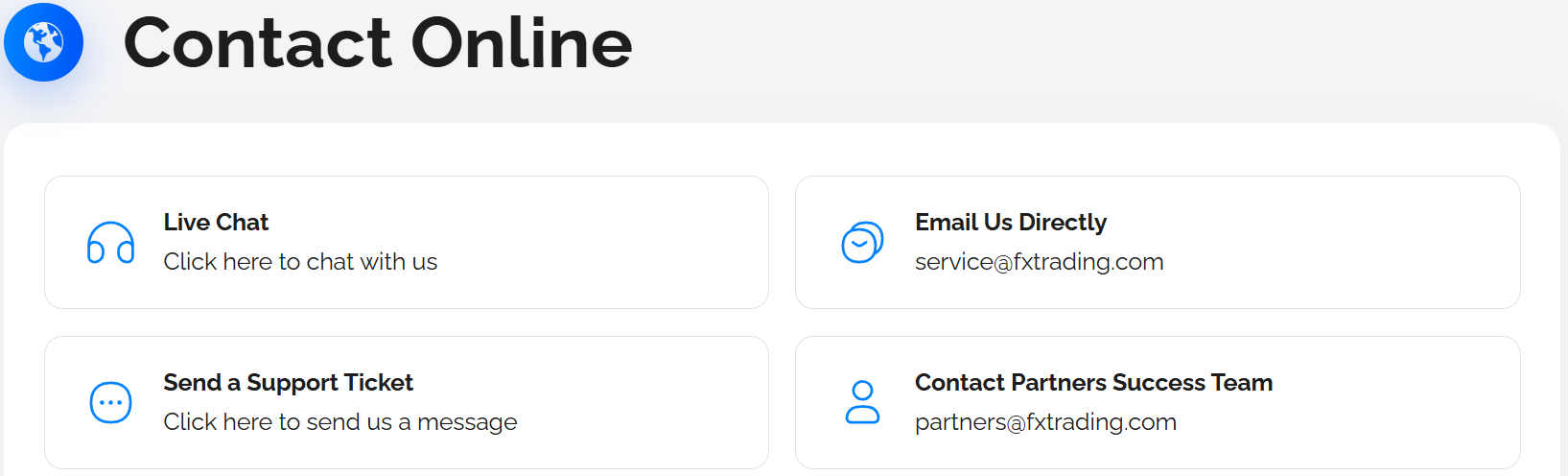

FXTrading provides 24/5 customer support via email, live chat, and phone, ensuring accessibility for traders across different regions. The team is well-trained to handle technical issues, account-related queries, and general trading assistance.

Contacts FXTrading

FXTrading offers multiple contact options for clients who need assistance. Traders can reach their customer support team via email at service@fxtrading.com or by phone. For Australian clients, there is a local line, 02 8039 7366. International clients can call +61 (0) 2 8039 7366.

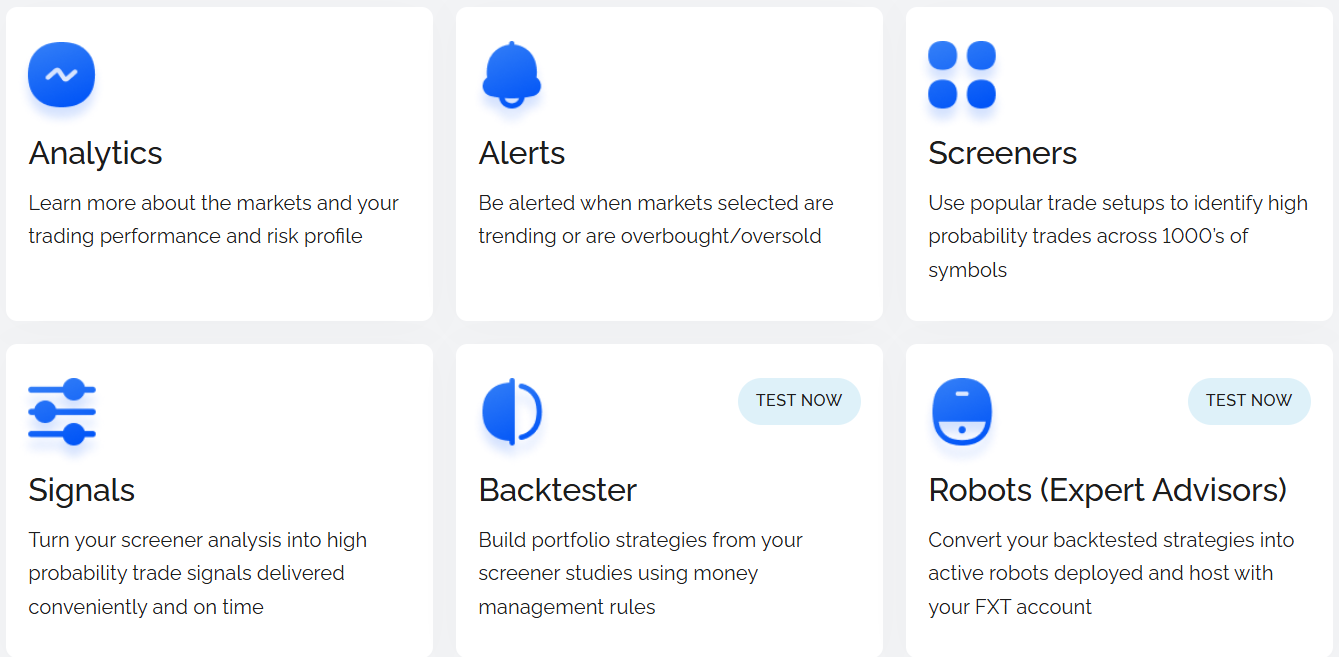

Research and Education

Score – 4.6/5

Research Tools FXTrading

FXTrading provides traders with a range of research tools accessible through its website and trading platforms.

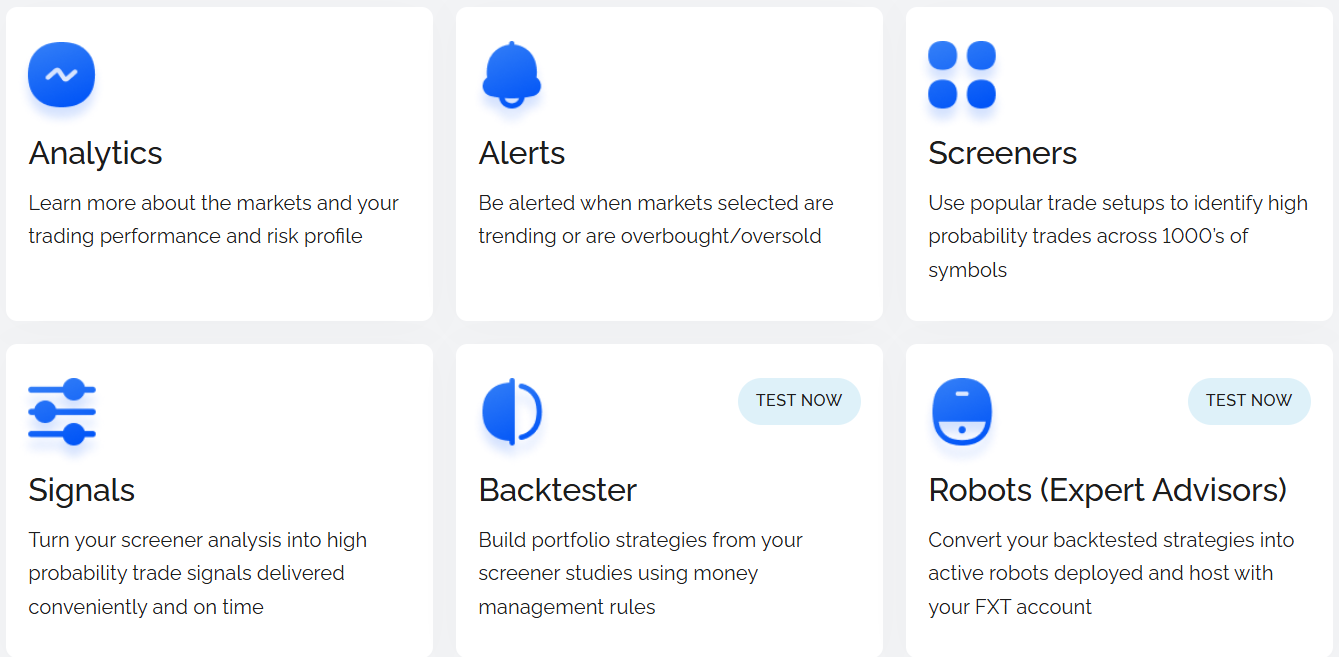

- On the website, traders can access the proprietary FXT Navigator, which provides advanced features such as market analytics, customizable alerts, screeners, and trading signals.

- The broker also integrates Trading Central, a renowned third-party service that offers technical analysis, trading signals, and market insights, further enhancing the research capabilities available to traders.

- MT4 and MT5 trading platforms offer real-time market analysis, interactive charting capabilities, and a wide range of technical indicators. Traders can use Expert Advisors for automated trading strategies and leverage the Strategy Tester for backtesting.

Education

The broker provides educational content through Market News, FXT Analysis, and Trading Insights aimed at helping traders stay informed and develop their strategies.

However, the educational materials are relatively limited compared to other brokers that provide more comprehensive learning resources such as webinars, video tutorials, and seminars.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options FXTrading

While FXT primarily focuses on Forex and CFD trading, it also offers investment solutions like MAM/PAMM trading and copy trading. The MAM and PAMM accounts enable fund managers to control multiple sub-accounts from a single master account, allowing for flexible trade allocation methods and real-time performance tracking.

Additionally, the FXT CopyPro feature allows traders to automatically copy the trades of experienced investors, providing an accessible option for those who prefer a hands-off approach to investing.

Account Opening

Score – 4.4/5

How to Open FXTrading Demo Account?

Opening a demo account with FXTrading is a simple and quick process that allows you to explore the trading environment without financial risk. New clients can visit the demo registration form on the Client Portal, provide their name, a valid email address, and phone number, and the demo account will be created instantly.

On the other hand, already existing clients can log into the Client Portal, navigate to the “Manage Accounts” section, click on “Open New Account,” select the “demo” account option, customize settings, and confirm to create the new demo account.

This setup enables traders to familiarize themselves with FXT’s platforms and test strategies in a risk-free environment.

How to Open FXTrading Live Account?

Opening an account with FXT is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Visit the official FXTrading website.

- Click on the “Open an Account” link on the homepage.

- Fill out the registration form with your details (name, email, phone number, etc.).

- Verify your identity by submitting the required documents (passport, ID, proof of address).

- Choose your account type.

- Make your initial deposit.

- Download and set up your preferred trading platform.

- Log in to your trading account and start trading.

Additional Tools and Features

Score – 4.5/5

In addition to its main research tools and features, FXTrading.com also offers a range of additional tools designed to enhance the trading experience.

- These include VPS (Virtual Private Server) services for uninterrupted trading and faster execution,

- API trading options for advanced users seeking automated strategies, and an Economic Calendar to keep traders informed about important market events.

- Additionally, the broker provides Market Sentiment indicators that provide insights into the overall trader mood.

Together, these tools support all levels of traders in making more informed and timely decisions.

FXTrading Compared to Other Brokers

FXTrading offers competitive trading conditions and a range of features that suit traders of all levels. It provides access to popular trading platforms MT4 and MT5, like many of its competitors, ensuring a familiar and reliable trading environment.

While its asset variety is broad, it may not be as extensive as some brokers that offer thousands of instruments, but it still covers the essential markets well. Being regulated by a respected Australian authority adds credibility, although a few competitors are regulated by multiple top-tier agencies.

FXT’s fee structure is generally competitive, appealing to both retail and professional traders, with a relatively low minimum deposit that makes it accessible. However, educational resources are more limited compared to some brokers that provide comprehensive learning materials, seminars, and webinars.

Overall, FXTrading offers balanced trading conditions, platform availability, and regulatory assurance that aligns well with industry standards, making it a preferable choice for traders who need a trustworthy and efficient broker.

| Parameter |

FXTrading |

TastyFX |

Tickmill |

Colmex Pro |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1 pip |

Average 0.8 pips |

Average 0.1 pips |

Average 4 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.0 pips + $2 per side |

None |

0.0 pips + $3 |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/Average |

Low/ Average |

Low/ Average |

Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5 |

tastyfx, MT4, TradingView, ProRealTime |

MT4, MT5, Tickmill Trader |

Colmex Pro 2.0, MT4 |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

1,000+ instruments |

80+ currency pairs |

180+ instruments |

28,000+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

ASIC, VFSC |

CFTC, NFA |

FCA, CySEC, FSCA, FSA |

CySEC, FSCA |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Limited |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$50 |

$100 |

$100 |

$500 |

$50 |

$0 |

$0 |

Full Review of Broker FXTrading.com

FXTrading is a well-established Forex trading broker offering access to a good range of CFD products through widely used MetaTrader 4 and MetaTrader 5 platforms, known for their reliability and advanced trading features.

The broker provides two account options that suit different trading styles and budgets, with competitive spreads and transparent fee structures. Regulated by Australia’s ASIC, FXT ensures a high level of security and regulatory compliance.

Although its educational resources are limited, the broker compensates it with robust trading tools such as FXT Navigator, Trading Central, VPS, API Trading, and more.

Customer support is responsive and available during market hours, helping traders resolve issues efficiently. Overall, FXTrading offers a comprehensive and trustworthy trading environment suitable for traders of all experience levels.

Share this article [addtoany url="https://55brokers.com/fxtrading-review/" title="FXTrading"]