- What is BuoyTrade?

- BuoyTrade Pros Cons

- Is BuoyTrade Legit?

- BuoyTrade Challenge

- Funded Account

- Account Conditions

- Payout

- BuoyTrade Alternative

What is BuoyTrade Prop Trading Firm?

BuoyTrade is a proprietary trading firm that was established in February 2021, headquartered in US. The company provides traders with the opportunity to work with capital balances of up to $1,024,000, earning a 50% profit split. BuoyTrade partners with Eightcap, an Australian brokerage, to offer access to the institutional A-Book model.

As a Prop Trading Firm, BuoyTrade offers the opportunity to trade with minimal capital. Traders can become Funded Traders by passing a test and trade with company funds as professionals. Learn more about Prop Trading. However, consider the risks before engaging.

| BuoyTrade Advantages | BuoyTrade Disadvantages |

|---|

| Low Entry Fees | Is not regulated |

| Good Pricing | It is hard to become Funded Trader |

| Opportunity to Upscale | Limited Instrument Range |

| Good Profit Sgare | No Alternative Platforms |

| MT4 platform with EAs | |

| Refundable Fee once you become Funded Trader | |

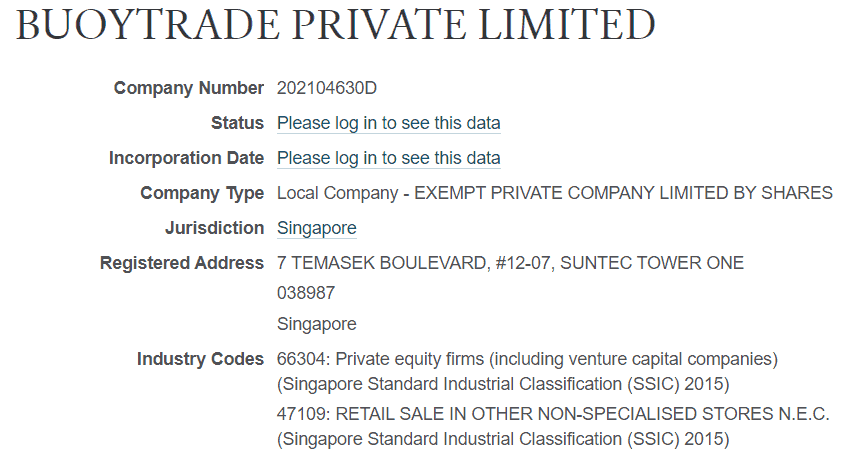

Is BuoyTrade Legit?

BuoyTrade appears to be a legitimate proprietary trading firm based in Singapore, providing funded trading accounts to traders worldwide.

- Prop Trading firms operate without a Forex Broker license. This means they face less regulation and oversight from industry regulators, making them less secure. With the company solely responsible for operations and funding trading activities, it’s crucial to grasp the associated risks thoroughly.

Is BuoyTrade Scam?

After verifying the company’s legitimacy via its official website, we found no indications that BuoyTrade is a scam. However, due to the limited regulation of Prop Trading Firms by financial authorities, determining whether a firm is a scam or legitimate can be challenging.

BuoyTrade Challenge Evaluation Rules

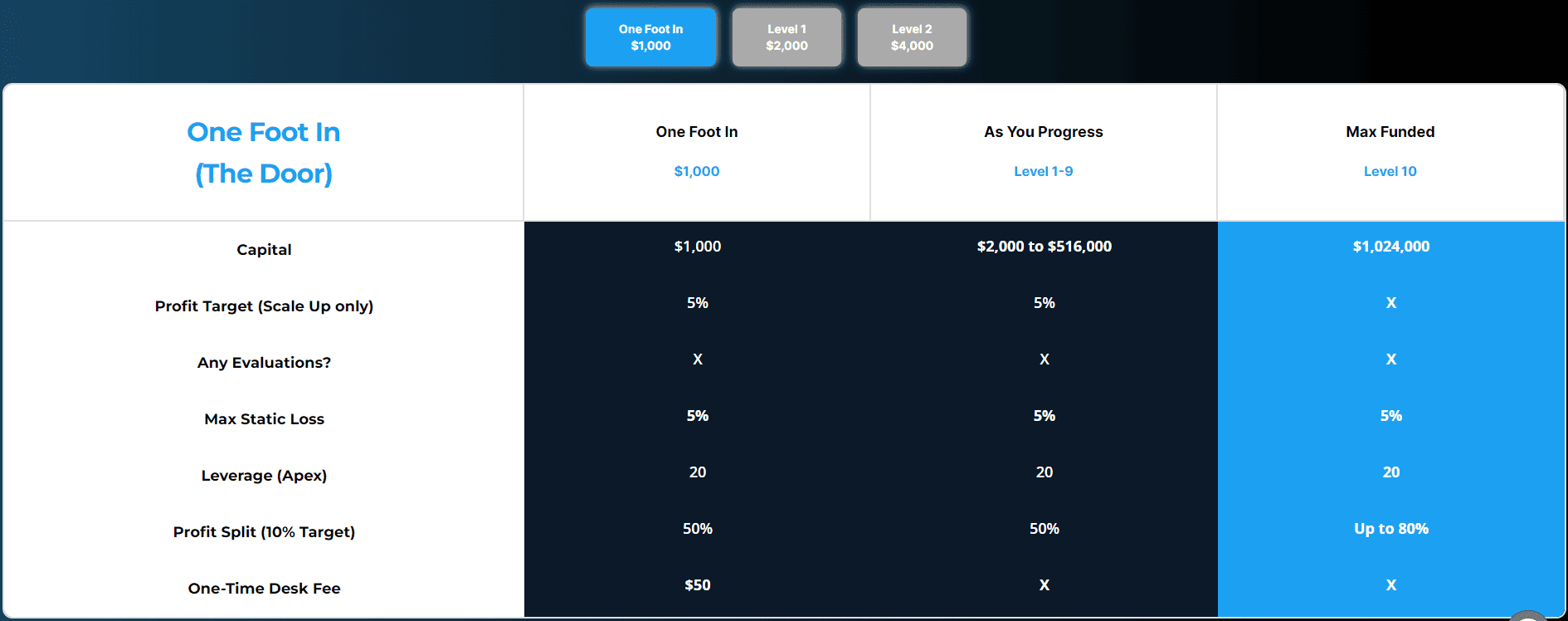

- The BuoyTrade challenge is structured as a single-step process, focusing on scaling traders through various levels based on their performance without a separate initial evaluation phase.

Account Balance and Registration Fee

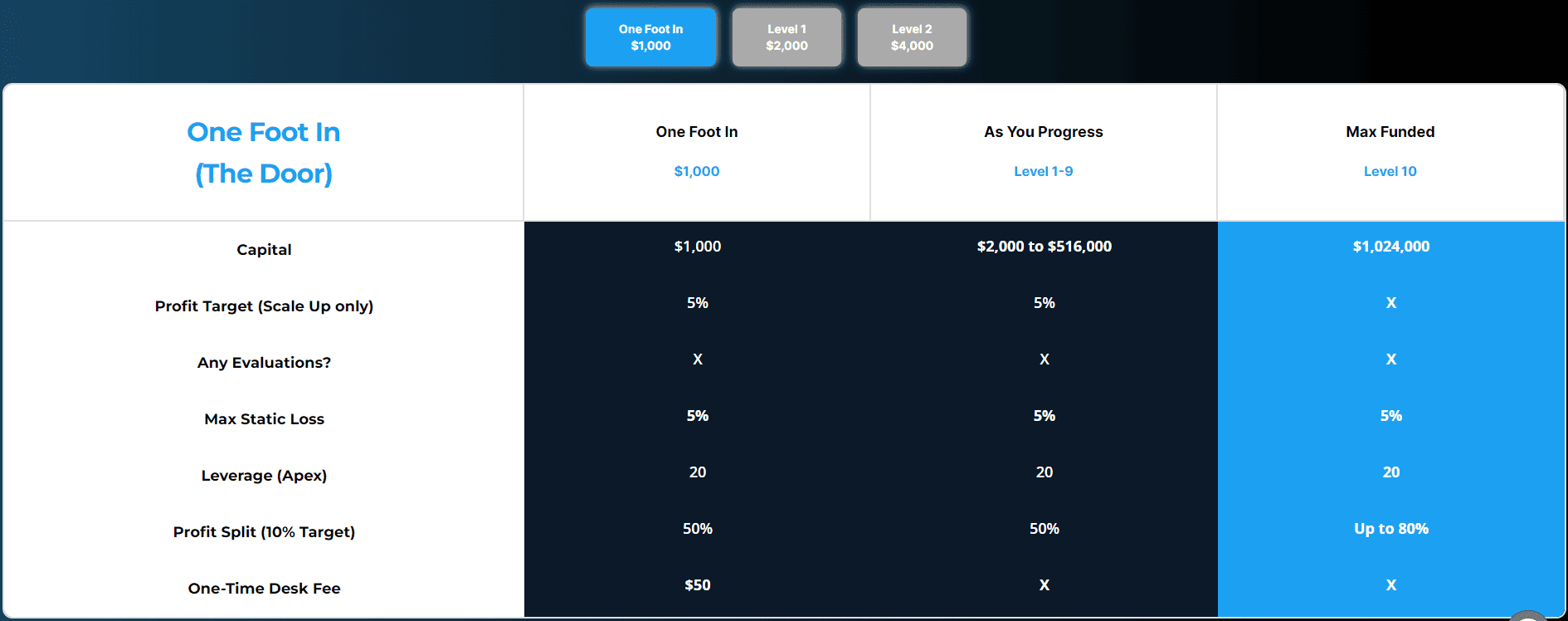

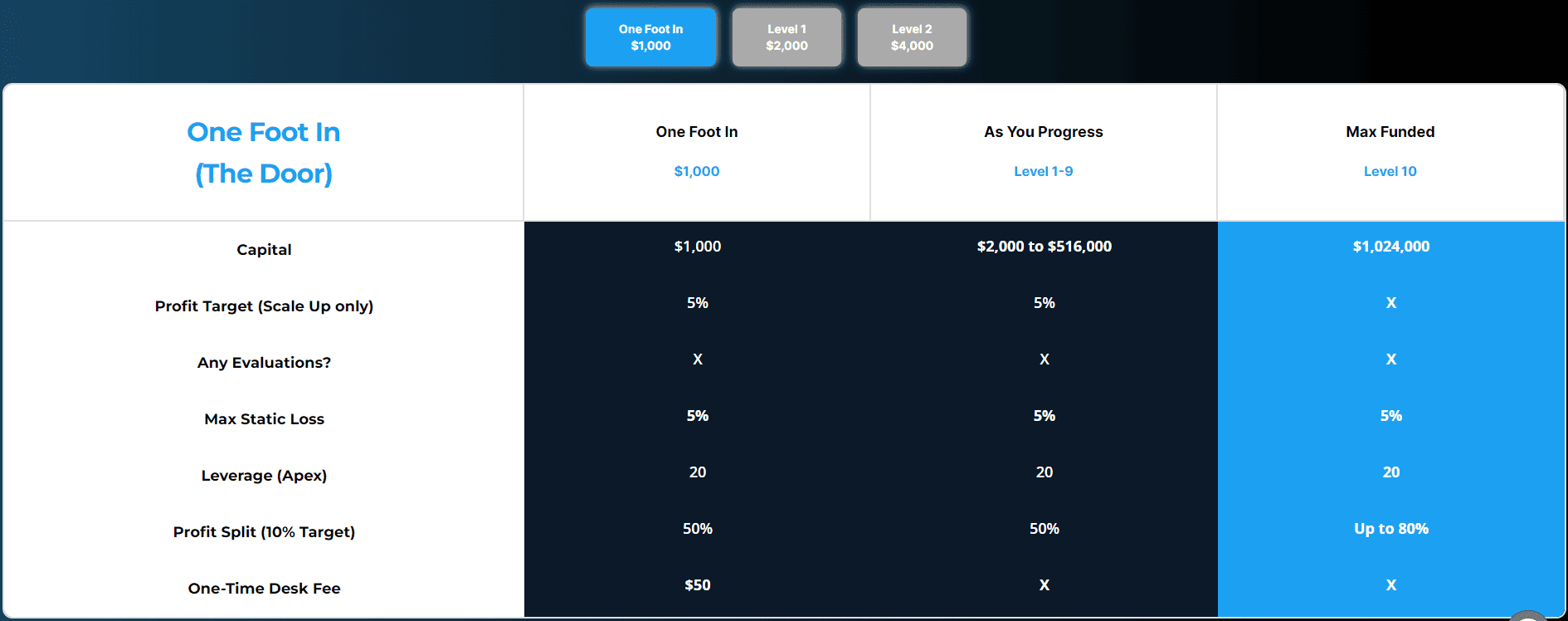

- The BuoyTrade challenge offers traders a structured pathway to scale their trading capital, starting with a “One Foot In” level and progressing through various levels up to $1,024,000. Traders begin with a $1,000 capital and can scale up by meeting a 5% profit target, with no evaluations or profit splits until reaching higher levels.

- Overall, BuoyTrade’s fee structure and account balance options are notably appealing, with both starting lower than what many competitors offer. This affordability and flexibility represent a significant advantage for traders looking to maximize their potential with minimal initial investment.

| Fees | BuoyTrade | FTMO | The Funded Trader |

|---|

| Minimum Account Size | $1,000 | $10,000 | $50,000 |

| Fee | $50 | €155 | $289 |

| Maximum Account Size | $400,000 | $200,000 | $400,000 |

| Fee | $198 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

Profit Target

The BuoyTrade challenge sets a profit target for traders looking to scale up their account levels. Specifically, traders are required to achieve a 5% profit target to progress through each level without taking a profit split. However, for those opting for a profit split, the target is set at 10%.

Maximum Loss

The maximum allowable loss is set at 5% of the account balance. This rule acts as an account stop-loss, ensuring that the equity of the trading account does not decline below 95% of the initial account balance at any time. This loss threshold includes both open and closed positions, providing traders with a buffer to manage their trades effectively while preventing significant drawdowns.

Minimum Trading Period

There is no minimum trading period required for traders in the BuoyTrade challenge. This means traders can request to scale up their account as soon as they meet the profit target, without the need to wait for a set number of trading days. This policy supports traders who can achieve their targets quickly, allowing for rapid progression through the levels without unnecessary delays.

See the detailed table with BuoyTrade Challenge conditions based on Account Size:

Free Trial

BuoyTrade does not offer a free trial or demo account as part of their program. However, they have an evaluation program with a smaller-sized account available for traders who wish to experience trading under BuoyTrade, which also includes profit-split entitlement after passing the evaluation program.

BuoyTrade Funded Account

Upon successful completion of the test or challenge, the trader will have their Funded Account established, a process that typically takes a few business days to activate. It’s crucial to understand that the account conditions and balance will mirror those for which you qualified during your test. Should you wish to upgrade to a higher-grade account, you’ll need to undergo a new test starting from the beginning for the preferred account balance you intend to trade with.

Profit Split

The profit split at BuoyTrade starts at 50% of all profits made on their accounts, with the potential to increase up to 80% based on the trader’s performance and progression through the levels. Traders get paid bi-weekly, allowing them to receive earnings from their trading activities regularly.

Payout and Withdrawals

BuoyTrade processes profit payouts on a bi-weekly basis, ensuring traders receive their share of profits promptly within 1-2 business days after submitting an invoice. If traders prefer, they can retain their profit split in the account to support growth and increase their balance and drawdown buffer, although BuoyTrade will always withdraw its share of the profit split.

Withdrawal Method

Traders can opt to receive payouts via international bank wire, PayPal, or Wise, offering flexibility in payment methods.

Account Conditions

When evaluating account conditions, we meticulously examine the broker’s range of account preferences, as well as the platforms, instruments, and associated trading costs. Equally significant is scrutinizing leverage levels and trading conditions, as certain brokers may impose restrictions on particular strategies or disallow specific practices in funded accounts. Breaching these conditions could lead to account loss, necessitating a requalification through the test. Please refer to the detailed breakdown below:

Trading Instruments

At BuoyTrade, traders can engage with a diverse array of markets. While specific details on the exact markets available for trading were not directly mentioned, platforms like BuoyTrade typically offer access to major financial markets including Forex pairs, commodities, indices, and potentially cryptocurrencies.

BuoyTrade Commission

BuoyTrade offers tight ECN spreads starting from 0.0 pips across a wide range of markets, aiming to provide low trading costs for its clients. This competitive pricing structure is achieved through the combination of tier-1 bank, non-bank, and ECN liquidity, ensuring tight spreads and fast execution for traders.

Leverage

For the “One Foot In” level, leverage is officially at 1:5, but to assist traders in scaling faster, it’s increased to 1:20 for the initial $1,000 account.

BuoyTrade App Platform

BuoyTrade primarily utilizes the MetaTrader 4 (MT4) trading platform, provided through its partnership with Eightcap. This platform is known for its customizable interface, advanced charting tools, and compatibility with a wide range of trading strategies, including the use of Expert Advisors for automated trading.

Trading Conditions

BuoyTrade stands out with its direct approach, eliminating the need for preliminary evaluations and allowing traders to dive straight into the market. With its commitment to flexibility.

- At BuoyTrade, traders have the freedom to trade a variety of instruments without limitations on strategies or position sizes. This includes discretionary trading, hedging, algorithmic trading, and the use of Expert Advisors (EAs). The platform is designed to accommodate legitimate trading strategies that can be replicated in BuoyTrade’s live corporate accounts, offering complete freedom in trading choices.

BuoyTrade Promotions

We’ve observed that the company occasionally offers promotions featuring BuoyTrade promo codes for discounts, which may include various savings opportunities. However, these promotions typically operate on a temporary basis. Therefore, it’s advisable to confirm their availability upon signing in.

BuoyTrade Alternative Brokers

In conclusion, BuoyTrade presents an opportunity for traders to engage in proprietary trading with minimal capital investment. Through a structured evaluation process, traders can qualify for funded accounts and operate as professional traders.

However, it’s also prudent to consider alternative options in addition to BuoyTrade. Exploring other proprietary trading firms can provide a broader perspective on available opportunities, potentially offering different trading conditions, support structures, and risk management approaches. By thoroughly researching and comparing alternatives, traders can make more informed decisions tailored to their individual trading goals and preferences:

Share this article [addtoany url="https://55brokers.com/buoytrade-review/" title="BuoyTrade"]