- What is Moomoo?

- Moomoo Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Moomoo Compared to Other Brokers

- Full Review of Broker Moomoo

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.6 / 5 |

What is Futu Moomoo?

Moomoo, a subsidiary of Futu Holdings Limited, is renamed from FutuTrade to Moomoo and operates as a Stock trading company, allowing individual investors and traders to buy and sell Stocks, ETFs, Options, Fractional Shares, Crypto, and Futures.

The firm adheres to strict regulatory oversight by the US SEC, FINRA, and SIPC. In various locations such as Australia, Canada, Singapore, Japan, and more, Moomoo has established entities that adhere to local rules and regulations and assist investors.

Overall, the company offers a favorable environment and an intuitive interface for clients to manage their investment portfolios, access market research, and execute trades.

Is Moomoo Stock Broker?

Yes, Moomoo is a Stock broker. The company is a subsidiary of Futu, a U.S.-based firm specializing in various financial services, including brokerage offerings for trading stocks and other Moomoo financial products.

Moomoo Pros and Cons

The firm comes with a set of advantages and drawbacks. On the positive side, it offers a user-friendly online trading platform, access to research and extensive educational resources, and a competitive fee structure for investors. Additionally, being part of a larger financial entity like Futu adds confidence in terms of security and regulatory compliance.

For the cons, the platform has limitations in terms of available financial instruments and lacks certain advanced features. Additionally, any changes in the parent company’s policies or disruptions in its operations could potentially impact the services offered by Moomoo.

| Advantages | Disadvantages |

|---|

| Strict regulation by SEC, FINRA, SIPC, and ASIC | Limited investment products |

| $0 minimum deposit | |

| Low trading fees | |

| Stocks and Options trading | |

| Paper trading | |

| US and International traders | |

| Good education and research | |

| 24/7 customer support | |

Moomoo Features

Moomoo is a professional-grade trading platform offering advanced charting, real-time Level II data, and AI-driven insights. A summary of its standout features is as follows:

Moomoo Features in 10 Points

| 🏢 Regulation | SEC, FINRA, SIPC, ASIC, MAS |

| 🗺️ Account Types | Cash, Margin Accounts |

| 🖥 Trading Platforms | Moomoo Desktop, Moomoo Mobile |

| 📉 Trading Instruments | Stocks, ETFs, Options, Fractional Shares, Crypto, Futures |

| 💳 Minimum Deposit | $0 |

| 💰 E-mini and Standard Contract | $1.99 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | Articles, Courses, Webinars, Market Insights, Blogs, Moomoo Learn Premium Program, and more |

| ☎ Customer Support | 24/7 |

Who is Moomoo For?

Moomoo is designed for investors who want to take a hands-on approach to investing, from beginners exploring the markets to experienced traders needing advanced tools. Its mix of intuitive design, professional-grade analytics, and community-driven insights makes it a versatile platform for different trading styles and skill levels. Based on our findings, Moomoo is Good for:

- Traders from the US

- Investing

- Australian investors

- International trading

- Stocks and Options trading

- Advanced traders

- Professional trading

- Low fees

- Paper trading

- Competitive investment environment

- Good education and research tools

- 24/7 customer service

Moomoo Summary

In conclusion, Moomoo stands as a reliable online platform offering a user-friendly experience, comprehensive conditions, and competitive fee structures. Additionally, the firm provides extensive educational resources, equipping traders with the knowledge and tools necessary to make informed investment decisions.

Overall, we found that Moomoo provides a good environment for investment; however, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

Moomoo distinguishes itself by delivering a feature set typically found on institutional platforms, while keeping it accessible to everyday investors.

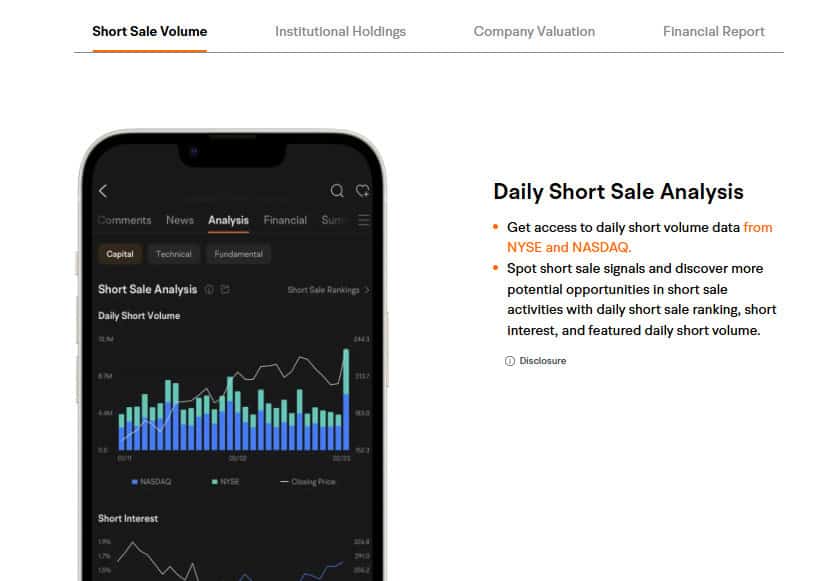

One of its standout advantages is the availability of real-time Level II market data and Nasdaq TotalView, giving traders a deeper look into order flow and market liquidity.

Its advanced charting system supports over 60 technical indicators, dozens of drawing tools, and multi-chart layouts, making it highly adaptable for in-depth technical analysis. Beyond trading tools, Moomoo integrates AI-powered analytics, personalized screeners, and comprehensive market research from leading providers like Bloomberg and Dow Jones, ensuring users have the insights they need to make informed decisions.

The platform also promotes learning and practice with paper trading, backtesting, and a supportive global investor community where users can exchange strategies.

Combined with extended hours, strong regulatory backing, and seamless cross-device usability, Moomoo positions itself as a standout broker that caters equally to beginners looking to build skills and professionals seeking a data-rich, efficient environment.

Consider Trading with Moomoo If:

| Moomoo is an excellent Broker for: | - Looking for Reputable Firm.

- Competitive trading conditions.

- Stock Trading and Investment.

- Secure trading environment.

- Professional trading.

- Offering popular financial products.

- Looking for broker with 24/7 customer support.

- US and Australian investors.

- Looking for broker with Top-Tier licenses.

- Traders who need advanced trading tools.

- Low fees and commissions.

- Investors who prefer robust learning resources.

|

Avoid Trading with Moomoo If:

| Moomoo might not be the best for: | - Need a broker with trading services worldwide.

- Investors who want access to a broader range of assets.

- Who require multiple account types. |

Regulation and Security Measures

Score – 4.7/5

Moomoo Regulatory Overview

Moomoo is a reliable Stock trading broker that follows the strict rules and guidelines established by the SEC, FINRA, SIPC, and ASIC, along with international licenses the broker operates. These Top-Tier regulations safeguard client assets and provide low-risk Stocks and Options trading.

How Safe is Trading with Moomoo?

Moomoo is a legitimate and regulated investing firm. It is regulated by financial authorities in the countries where it operates and has a good reputation and integrity in the financial industry.

The firm prioritizes the security and protection of its clients’ investments by adhering to regulatory standards and industry best practices. This commitment includes implementing measures to prevent fraud and unauthorized account access, along with stringent identity verification processes.

Moreover, being a member of SIPC, the company protects customer accounts up to $500,000 (including $250,000 for cash), providing an extra level of security. However, traders should remain cautious, regularly monitor their investments, and practice safe online habits to enhance their protection further.

Consistency and Clarity

Moomoo has built a solid reputation, earning recognition for its reliability, innovative platform, and commitment to investor education.

Established as a subsidiary of Futu Holdings, a Nasdaq-listed fintech company, Moomoo benefits from strong financial backing and regulation by major authorities such as the SEC, FINRA, MAS, and ASIC, which enhances its credibility.

Independent reviews and trader feedback highlight its strengths in providing professional-level tools, intuitive usability, and competitive pricing, though some users note drawbacks such as limited product offerings compared to multi-asset brokers and certain fees on specific services.

The broker has also received industry awards for its technology and customer-focused innovation, further strengthening its profile. Beyond trading, Moomoo actively engages with the wider community through sponsorships, social initiatives, and educational activities.

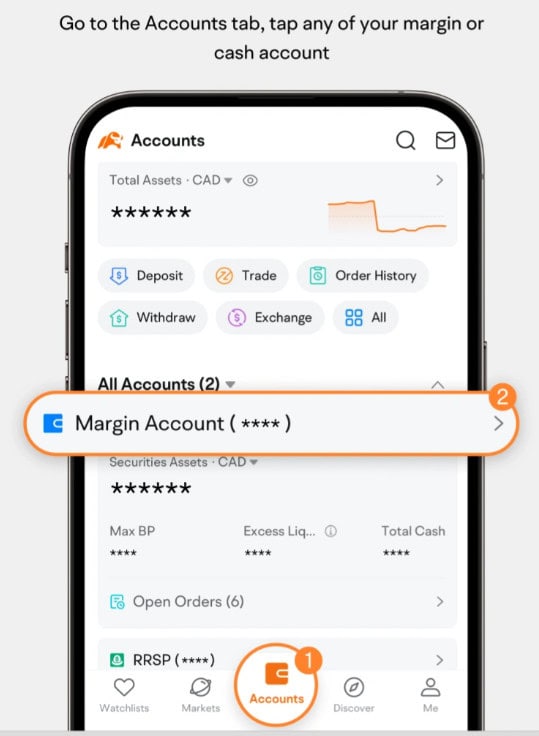

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Moomoo?

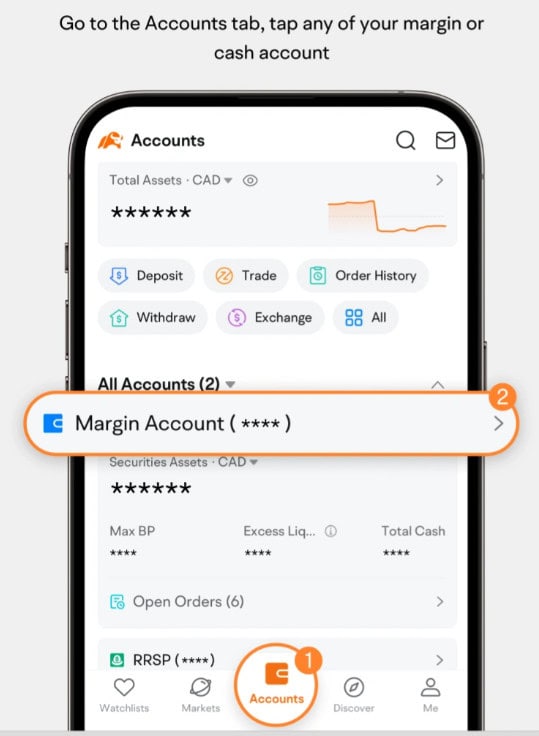

Moomoo offers a range of account types to fit different needs, including Cash Accounts, which allow investors to trade using only the funds they deposit, and Margin Accounts, which provide access to borrowed capital for increased buying power and more advanced strategies.

For those who want to practice without financial risk, Moomoo also provides a Paper Trading Account, enabling users to simulate trades in real market conditions and build confidence before committing real funds.

Cash Accounts

Moomoo’s Cash Account allows investors to trade using only their own funds, with no minimum deposit required. Users can buy and sell stocks, ETFs, and other supported assets while maintaining full ownership of their investments.

This account type is ideal for all levels of investors who want full control over their funds while benefiting from Moomoo’s advanced tools and real-time market data.

Regions Where Moomoo is Restricted

Moomoo’s availability varies by country due to regulatory restrictions and market considerations. The platform is not available in mainland China, as the China Securities Regulatory Commission has ordered Futu Holdings, Moomoo’s parent company, to cease accepting new customers from that region.

Additionally, the broker does not accept clients from India and several other countries where it does not have official operations or regulatory approval.

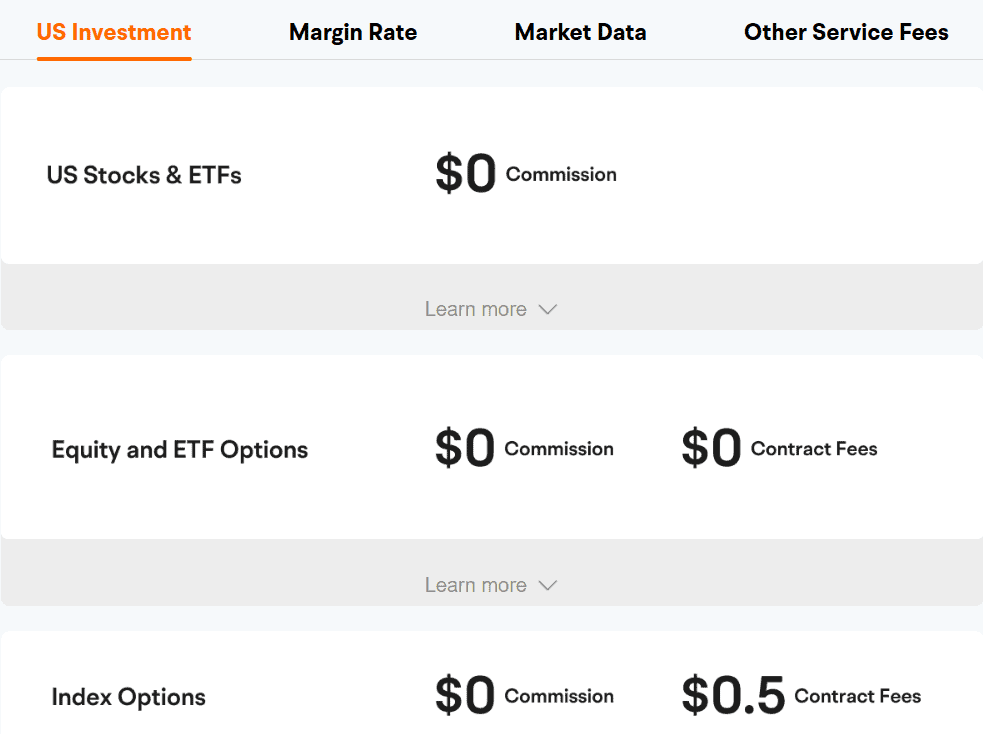

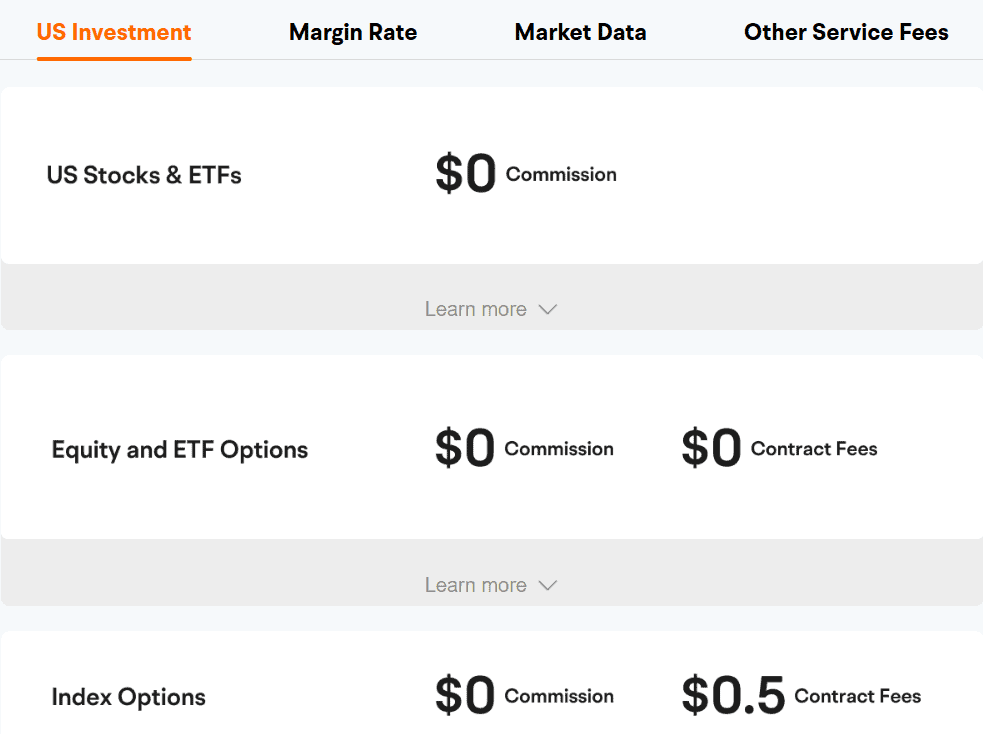

Cost Structure and Fees

Score – 4.6/5

Moomoo Brokerage Fees

The company offers low costs, making it an attractive choice for cost-conscious investors. However, specific fees can vary depending on the investment products used and other factors. Therefore, investors should review Moomoo’s current fee schedule and terms as they can change over time.

For futures trading, the E‑mini S&P 500 contracts are charged $1.99 per contract, while Micro E‑mini contracts cost $0.99 per contract.

Combined with commission-free stock and ETF trading in many regions, these low fees help traders manage costs while accessing professional-grade tools and real-time market data.

In addition to commissions, Moomoo charges exchange and regulatory fees that cover the costs imposed by market operators and regulatory bodies.

These fees vary depending on the asset and market but are generally transparent and included in trade confirmations. They ensure compliance with regulations and access to exchanges like NASDAQ, NYSE, and CME, helping maintain a secure and fully regulated environment for all users.

Moomoo charges rollover or swap fees for positions held overnight in margin or futures trading. These fees reflect the cost of borrowing funds or maintaining leveraged positions and vary depending on the asset, position size, and prevailing interest rates.

Traders should review the platform’s swap schedule to understand overnight costs and manage their positions accordingly.

In addition to trading, exchange, and swap fees, Moomoo applies additional fees for services such as wire transfers, paper statements, or margin interest.

While many standard features like stock and ETF trading are commission-free, users should review the broker’s fee schedule to understand any potential extra costs and ensure they are prepared for all account-related charges.

How Competitive Are Moomoo Fees?

Moomoo’s fees are considered highly competitive within the online brokerage industry, particularly for retail traders seeking low-cost access to global markets.

The platform combines minimal costs with robust tools and resources, allowing investors to execute strategies efficiently without excessive charges.

| Fees | Moomoo Fees | TradeStation Fees | Degiro Fees |

|---|

| Broker Fee - E-mini and Standard Contract | $1.99 | $1.50 | |

| Exchange Fee | Defined by Exchange | Defined by Exchange | Defined by Exchange |

| Trading Platform Fee | No | No | No |

| Data Fee | No | Yes | No |

| Fee ranking | Low/Average | Low/Average | Low |

Trading Platforms and Tools

Score – 4.7/5

Moomoo provides traders with versatile platforms, offering both Moomoo Desktop and Mobile options. The Desktop platform is tailored for more comprehensive and in-depth experiences on desktop computers, providing advanced features and tools.

On the other hand, Moomoo Mobile caters to users who prefer trading on the go, offering a mobile-friendly interface with essential functionalities for convenient and efficient trading from smartphones or tablets.

Trading Platform Comparison to Other Brokers:

| Platforms | Moomoo Platforms | Angel One Platforms | Wealthsimple Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Moomoo Desktop Platform

Moomoo’s Desktop Platform offers a professional and highly customizable experience, combining advanced charting tools, real-time Level II market data, and AI-driven analytics.

Its intuitive interface allows traders to monitor multiple markets simultaneously, set alerts, and execute trades efficiently, making it suitable for both beginners and experienced investors seeking a powerful desktop environment.

Main Insights from Testing

Testing Moomoo’s desktop platform highlights its speed, reliability, and depth of features. Users benefit from smooth navigation, customizable layouts, and a variety of order types, making strategy execution efficient.

Additionally, the integrated news feeds, research tools, and alerts enhance decision-making, providing a comprehensive environment for active traders.

Moomoo Desktop MetaTrader 4 Platform

Moomoo does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support Forex or CFD trading typically associated with MT4.

Moomoo Desktop MetaTrader 5 Platform

Moomoo does not support MetaTrader 5 either. The firm does not provide access to advanced platforms like MT5, maintaining its focus on its platform.

Moomoo MobileTrader App

Moomoo offers a user-friendly mobile application designed to provide a seamless and efficient trading experience. The app is available for download on smartphones and tablets, allowing users to trade stocks and other financial instruments from the convenience of their mobile devices.

The app typically features real-time market data, customizable charts, research tools, and an intuitive interface, empowering investors to stay informed and execute trades on the go.

AI Trading

Moomoo leverages AI-powered tools to help traders make more informed decisions and optimize their strategies. Its AI features include smart stock predictions, sentiment analysis, and institutional activity tracking, providing insights into market trends and potential opportunities.

Combined with customizable screeners and alerts, these tools allow binvestors to analyze data efficiently, identify signals, and enhance overall portfolio management.

Trading Instruments

Score – 4.6/5

What Can You Trade on Moomoo’s Platform?

Through the platform, traders can buy and sell Stocks, ETFs, Options, Fractional Shares, Crypto, and Futures. This selection of trading instruments provides users with the flexibility to create diversified portfolios or engage in more specialized investment strategies.

Main Insights from Exploring Moomoo’s Tradable Assets

Exploring Moomoo’s trading instruments shows that the platform provides robust functionality and precision for executing trades. The instruments are integrated with advanced analytics, real-time data, and customizable order options, enabling traders to manage positions efficiently and adapt strategies quickly in dynamic markets.

Margin Trading at Moomoo

The platform provides margin trading options, allowing investors to borrow funds against their existing securities to potentially amplify their positions.

While margin trading can enhance returns, it also involves increased risk, and investors should carefully consider their risk tolerance and market conditions before engaging in multiplier trading on the broker’s platform.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Moomoo

The firm offers electronic funds transfers (ACH) and wire transfers to enable users to deposit funds into their accounts conveniently. By providing these funding options, Moomoo allows traders to fund their trading and investment activities on the platform efficiently.

Moomoo Minimum Deposit

The platform offers no minimum deposit requirement for opening a new account. Investors can open an account and start trading with any amount they are comfortable with.

Withdrawal Options at Moomoo

The company allows traders to initiate withdrawals from their accounts using the same methods they used for funding.

While Moomoo does not typically charge for deposits, users should be aware of any potential fees associated with bank transactions or currency conversions, depending on their circumstances and the financial institutions involved.

Customer Support and Responsiveness

Score – 4.6/5

Testing Moomoo’s Customer Support

The firm offers 24/7 Moomoo customer service to assist users with inquiries, technical issues, and account-related concerns. The support channels typically include phone support, email assistance, and live chat, providing traders with multiple options to seek help and guidance.

Contacts Moomoo

You can contact Moomoo’s customer support through multiple channels for assistance. In the US, the phone number is +1 888 721 0610, and inquiries can also be sent via email at cs@us.moomoo.com. Support is available for account-related questions, technical issues, and general assistance.

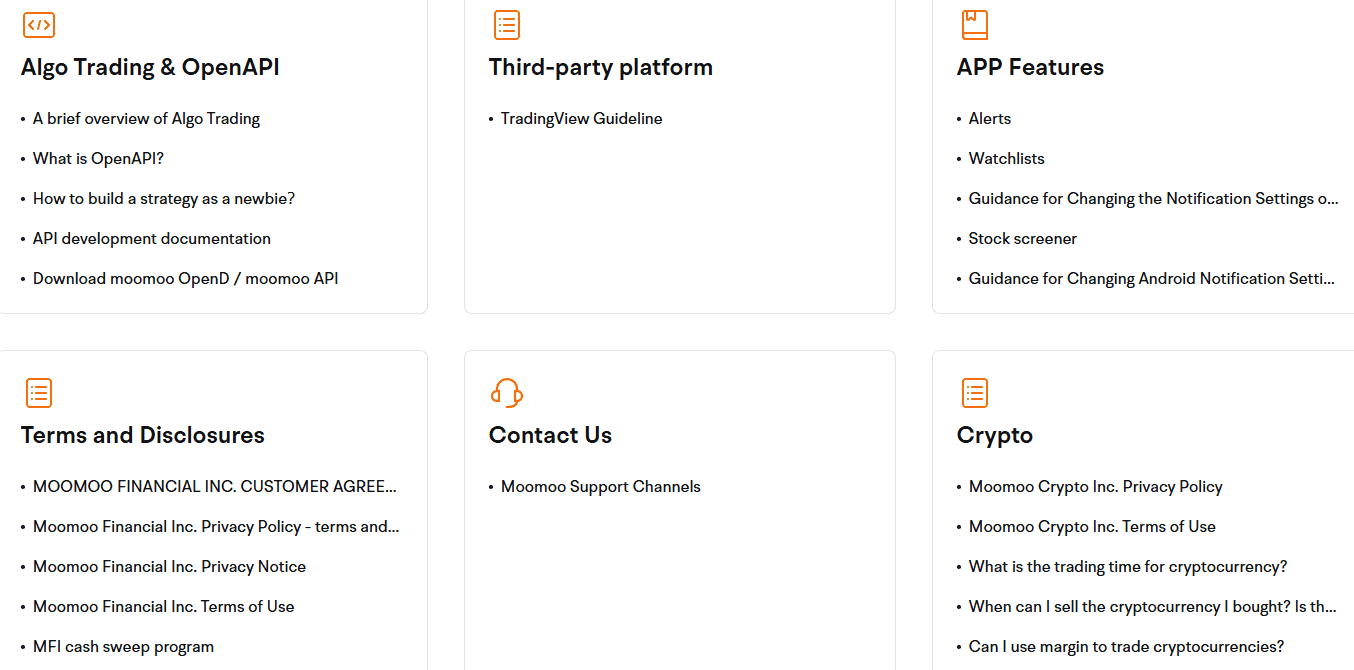

Research and Education

Score – 4.7/5

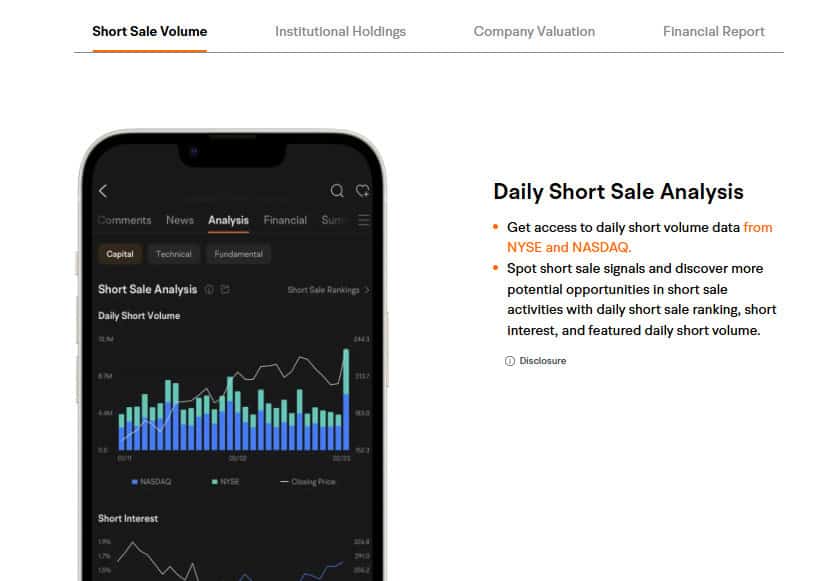

Research Tools Moomoo

Moomoo provides a comprehensive suite of research tools across its website and platforms, including real-time news, financial reports, analyst ratings, and customizable screeners.

- Traders can also access advanced charting, technical analysis tools, and AI-driven insights directly within the desktop and mobile platforms.

- Additionally, Moomoo offers OpenAPI, allowing developers and advanced users to build custom applications, automate strategies, and integrate third-party tools for a more personalized trading experience.

Education

The broker provides a range of educational resources to empower investors with knowledge and insights into financial markets. These resources include articles, learning courses, webinars, a library, market insights, and the Moomoo Learn Premium program.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options Moomoo

Moomoo provides a variety of investment tools to help investors build and manage their portfolios effectively. These include stocks, ETFs, options, and futures, all supported by real-time data and advanced analytics.

The platform’s tools enable users to screen, analyze, and track investments efficiently, supporting both short-term strategies and long-term portfolio management.

Account Opening

Score – 4.5/5

How to Open Moomoo Demo Account?

To get started with Moomoo without risking real money, users can open a Demo Account through the platform’s paper trading feature.

To open a Demo Account, first download the Moomoo app on desktop or mobile, or visit their website, and register using your email or phone number. After completing any required verification steps, navigate to the Paper Trading section within the dashboard to activate your demo account.

You will receive virtual funds to practice trading, explore markets, and test strategies using the platform’s full suite of tools, all without risking real money. This allows traders to build confidence and refine their approach before engaging in live trading.

How to Open Moomoo Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or Moomoo login page and proceed with the guided steps:

- Select and click on the “Sign Up” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.6/5

Moomoo offers a range of additional tools and features that enhance the trading experience beyond standard research capabilities.

- These include TradingView integration for advanced charting and visualization, in-depth stock analysis tools, Level II market data for deeper insights into order flow, and an economic calendar to track key events impacting markets.

- Combined with customizable alerts, watchlists, and portfolio tracking, these features give traders and investors the resources to plan strategies, monitor opportunities, and respond quickly to market developments.

Moomoo Compared to Other Brokers

Moomoo provides a strong, user-friendly experience, combining low fees, advanced desktop and mobile platforms, and reliable customer support.

Its tools, including AI analytics, real-time data, and paper trading, offer robust support for market analysis and strategy testing. However, when compared with larger competitors like Interactive Brokers, TradeStation, or TD Ameritrade, Moomoo’s range of tradable instruments is more limited, focusing mainly on stocks, ETFs, options, and select futures.

While this narrower asset selection may suit casual investors, active traders seeking global diversification or complex strategies may find other brokers more comprehensive. However, Moomoo’s affordability, regulatory compliance, educational resources, and integration of modern trading tools provide a compelling package for users prioritizing usability, cost-efficiency, and technological innovation.

| Parameter |

Moomoo |

TradeStation |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

$1.99 |

$1.50 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low/Average |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

Moomoo Desktop, Moomoo Mobile |

TradeStation Desktop, Web Trading, Mobile Apps, FuturesPlus |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, ETFs, Options, Fractional Shares, Crypto, Futures |

Stocks, ETFs, Options, Futures, Futures Options, Crypto, Bonds, Mutual Funds |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEC, FINRA, SIPC, ASIC, MAS |

SEC, FINRA, CFTC, NFA, SIPC, FCA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Excellent |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

$0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Moomoo

Moomoo is a digital investment platform that offers commission-free trading on U.S. stocks, ETFs, and options.

It provides a user-friendly interface across desktop and mobile platforms, equipped with advanced charting tools, real-time market data, and AI-driven analytics.

The platform also features a paper trading mode, allowing users to practice strategies without financial risk. Moomoo’s integration with Nasdaq and partnerships with financial institutions enhance its educational resources and market access.

While it offers a range of investment tools, its asset selection may be more limited compared to some competitors. Overall, Moomoo stands out for its low-cost structure and robust technological features, making it a compelling choice for traders seeking an intuitive environment.

Share this article [addtoany url="https://55brokers.com/moomoo-review/" title="Moomoo"]