Bulenox 2025 Review

-

Written by:

George Rossi -

Updated:

Leverage: —

Regulation: USA

Min. Deposit: $115

HQ: USA

Platforms: Rithmic, NinjaTrader

Found in: 2021

Advertising Disclosure

Written by:

George Rossi

Updated:

Leverage: —

Regulation: USA

Min. Deposit: $115

HQ: USA

Platforms: Rithmic, NinjaTrader

Found in: 2021

Bulenox is a proprietary trading firm that specializes in futures trading. It offers a unique platform for traders at various levels, enabling them to improve their trading skills and gain access to global financial markets. The firm provides a range of funded account sizes, from $25,000 to $250,000, with different features catering to various trading strategies and risk appetites.

Bulenox offers traders a chance to trade with the company’s funds after passing a qualification challenge, allowing for real trading with minimal initial capital. This opportunity comes with certain risks and rules that should be carefully considered. More information on proprietary trading can be found here.

| Bulenox Advantages | Bulenox Disadvantages |

|---|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| High Profit Paymeny | No MetaTrader Platform |

| Free Trial | No Refund |

| Reset Available |

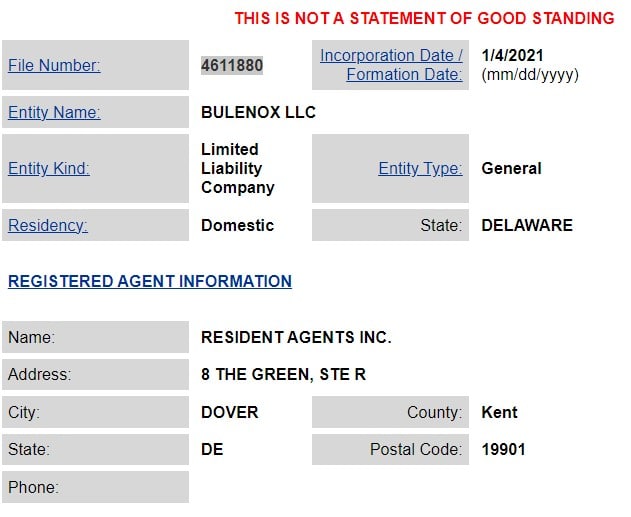

Bulenox, a US-based proprietary trading firm, is generally considered legitimate. It has positive reviews and adheres to local financial regulations, which adds to its credibility. However, as with any trading platform, it’s important to be aware of the risks and do thorough research.

Our review of Bulenox’s official website found no clear indicators of fraudulent activity, suggesting the company is not a scam. However, it’s important to note that proprietary trading firms are generally subject to less regulation by financial authorities compared to more heavily regulated entities. This lower level of regulation can make it challenging to definitively assess the legitimacy of such firms.

For proprietary trading, it’s key to understand the risks and choose a reputable, established company. While the financial risk is typically lower since you’re paying subscription fees instead of investing large sums, informed decision-making is crucial. Read about Real Trading with your own funds here.

In our Bulenox review, a crucial aspect to consider is the nature of the evaluation challenge, specifically the criteria and process for enrolling in the trading challenge. This involves understanding the type of test required to secure a Funded Trading Account and the steps to become a proprietary trader. Additionally, it’s important to be aware of the associated costs for traders, typically in the form of a registration fee.

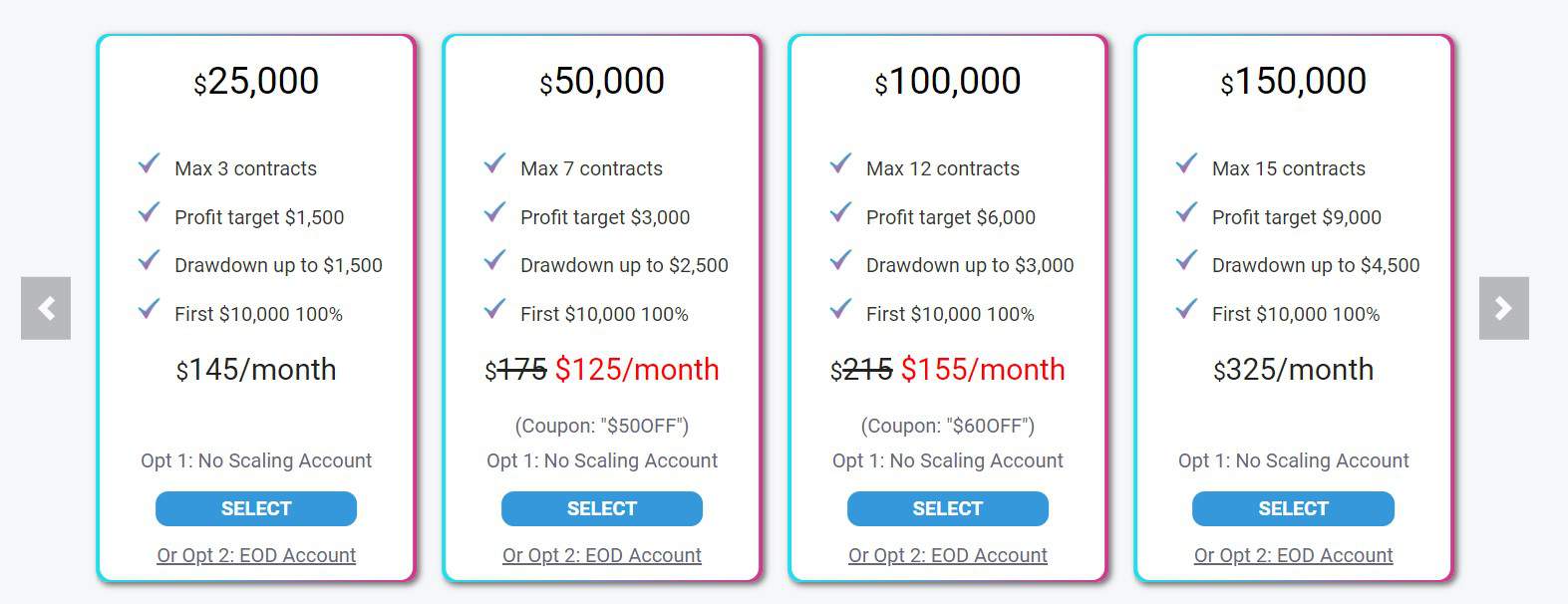

To begin with Bulenox, you first need to choose the Account Balance you wish to qualify for. The challenge conditions vary slightly based on the account size selected. This choice also influences the registration fee you’re required to pay for participating in the challenge. For a comprehensive comparison of registration fees across different account options, refer to our Registration Fee comparison table.

| Fees | Bulenox | FTMO | The Funded Trader |

|---|---|---|---|

| Minimum Account Size | $25,000 | $10,000 | $50,000 |

| Fee | $115 | €155 | $289 |

| Maximum Account Size | $250,000 | $200,000 | $400,000 |

| Fee | $535 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | No | Yes | Yes |

Bulenox sets a profit target of 6% across its various account sizes. This means that traders are required to achieve a 6% profit on their account balance to successfully complete the qualification phase and progress to the Master Account. The specific objectives and challenges differ slightly depending on the account size chosen by the trader.

The maximum loss allowed in Bulenox’s trading accounts, often referred to as the maximum drawdown, is set at 6%. This percentage represents the upper limit of loss a trader can incur relative to their account size before facing restrictions or closure of the account. It’s a crucial risk management measure to help traders and the firm manage potential losses effectively.

The minimum trading period required for Bulenox’s accounts, particularly during the qualification stage, is set at 5 trading days. This means traders must actively trade for at least five days within the qualification phase to be eligible for progressing to the next level or achieving certain program objectives.

See the detailed table with Bulenox evaluation conditions based on Account Size:

Bulenox does offer a free trial account, but it comes with specific conditions. The free trial lasts for 14 days, which includes 10 trading days, and is provided by Rithmic. This trial account is available to traders who have never used or registered with Rithmic before. At the end of the trial, traders have the option to purchase a Qualification Account from Bulenox. It’s important to note that this free trial is not a direct offering of Bulenox but rather through their partnership with Rithmic.

After successfully passing the test or challenge, the trader will have their Funded Account established, a process that usually takes a few business days to activate. It is crucial to emphasize that the account’s conditions and balance will mirror those for which you qualified during your initial test. If you wish to upgrade your account to a higher grade, you will need to start from the beginning and pass the test again for the preferred Account Balance you intend to trade with.

The profit split at Bulenox is structured in a way that benefits the trader significantly. Once a trader becomes part of the Master Account, the first $10,000 earned is withdrawn to the trader’s bank account without any commission. After this initial $10,000, Bulenox applies a commission of 10% on the profits, leaving 90% of the profits for the trader. This means that the majority of the trading profits are allocated to the trader, providing a strong incentive for successful trading.

At Bulenox, once traders are operating in the Master Account, they can withdraw their earnings following specific guidelines. The first $10,000 earned is commission-free, and for subsequent earnings, the trader retains 90% of the profits after a 10% commission to Bulenox. Payouts can be requested at any time during the month and are processed weekly on Wednesdays. To request a payout, traders must have completed a minimum of ten trading days.

The minimum and maximum withdrawal amounts vary based on the account size, and various methods like ACH/Wire Transfer and PayPal are available for withdrawals.

We review the Broker’s account options, including Platforms, Instruments, and Trading Costs. It’s crucial to consider Leverage levels and Trading conditions as well, as some Brokers restrict certain strategies in Funded accounts. Violating these terms may result in an account loss, requiring a test retake for account reinstatement. See the concise breakdown below:

Bulenox offers a diverse range of futures trading instruments, encompassing various sectors to cater to different trading preferences and strategies. Their offerings include Equity Futures, Interest Rate Futures, Currency Futures, Agricultural Futures, Energy Futures, Metal Futures, and Micro Futures.

Bulenox primarily operates as a proprietary trading firm offering futures trading, and Bulenox commissions structure is focused on the profit split between the firm and the trader. As for spreads, since Bulenox is involved in futures trading, the concept of spreads as commonly understood in forex or stock trading might not directly apply.

Bulenox does not offer leverage in its trading accounts. The trading account balance directly represents the buying power. This approach is straightforward and focuses on risk management, allowing traders to understand their trading capacity based on their account balance.

Bulenox offers compatibility with both Rithmic and NinjaTrader trading platforms, providing traders with choices for futures trading. Rithmic is known for speed and execution capabilities, while NinjaTrader offers a user-friendly interface and customization options. Traders can select their preferred platform to execute trades and manage accounts efficiently.

Based on our findings, Bulenox conditions are designed to offer traders a structured and supportive environment to showcase their trading skills and potentially access funded trading accounts. However, traders should carefully review the specific terms and conditions on Bulenox’s official website to ensure a complete understanding of the offerings and requirements.

As observed, Bulenox occasionally offers promotions with available Bulenox coupons for discounts. However, it’s important to note that these conditions are typically temporary, so it’s advisable to confirm their availability when signing in to ensure you can take advantage of any discounts or promotions currently offered by the company.

Bulenox stands out as an appealing option for funded traders due to its competitive pricing and accommodating account sizes suitable for different investment levels. Specializing in futures trading sets it apart from many other firms, offering a distinctive opportunity. Moreover, the provision of a free trial period enables traders to test the platform without initial financial obligations.

However, it’s always prudent to evaluate and compare Bulenox’s proposal with offerings from other proprietary trading firms. Some well-known firms may provide similar conditions or cater to specific trader preferences, offering a wider selection of instruments and platforms. Nonetheless, Bulenox also presents clear advantages, which we will outline below, and provide a table comparing Bulenox to other companies for your consideration.

No review found...

No news available.