Audacity Capital 2025 Review

-

Updated:

Leverage: 1:20

Regulation: UK

Min. Deposit: $59

HQ: London, UK

Platforms: MT5, MT4

Found in: 2012

Advertising Disclosure

Updated:

Leverage: 1:20

Regulation: UK

Min. Deposit: $59

HQ: London, UK

Platforms: MT5, MT4

Found in: 2012

Audacity Capital, established in 2012, has established itself as a notable forex proprietary trading firm. It specializes in offering funded accounts to traders who demonstrate proficiency in profit-making through forex trading. The firm is known for its various trader programs and its commitment to empowering professional traders worldwide.

Audacity Capital, as a Prop Trading Firm, offers a unique chance for real trading with minimal initial funding. Traders aim to become Funded Traders, trading with the firm’s capital. This requires passing a specific test or challenge to gain a funded account, allowing them to trade professionally with the company’s funds. More information about proprietary trading can be found [here]. However, it’s important to consider the associated risks detailed below before getting involved.

| Audacity Capital Advantages | Audacity Capital Disadvantages |

|---|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| Profit Share from Challenge | Only MetaTrader Platform |

| MT5 and MT4 with EAs | Fees non-refundable |

| Excellent customer support | |

| Good range of Trading Programs |

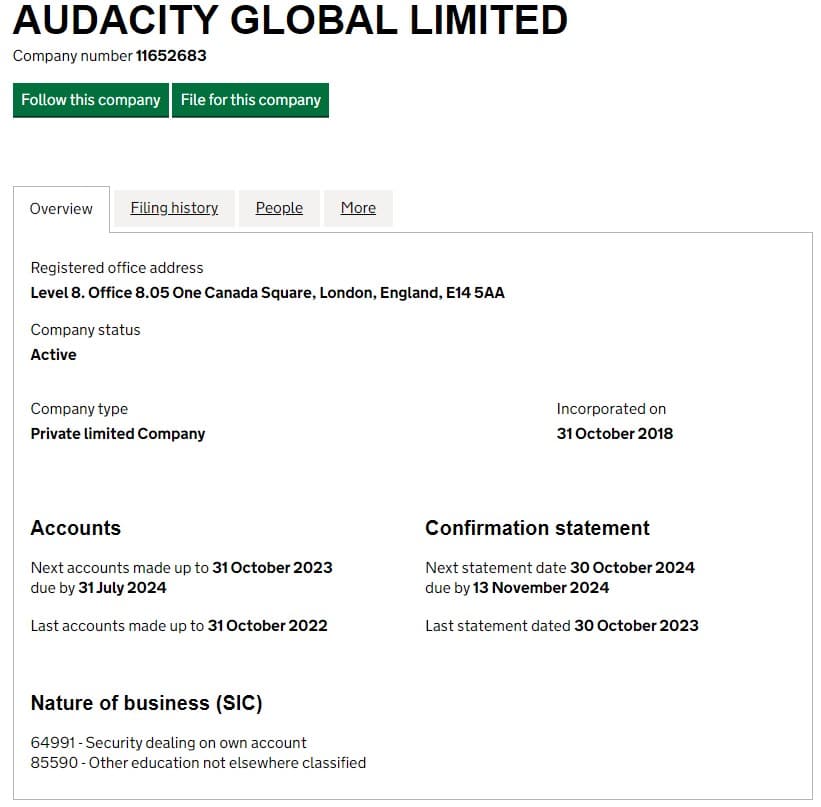

Audacity Capital is considered a legitimate proprietary trading firm. Its UK base adds to its reputation, as the UK is known for having a well-regulated financial market. The firm’s positive reviews, transparent trading programs, and focus on trader support and training further establish its legitimacy. Since its establishment in 2012, it has offered various trader programs and has a significant presence in the proprietary trading industry

Our examination of Audacity Capital’s official website found no signs of it being a scam. However, due to the generally lower regulation in the Prop Trading sector, it’s harder to definitively assess the firm’s legitimacy. Caution and thorough research are advisable before engagement.

For those considering Proprietary Trading, it’s crucial to understand the risks and choose a reputable, established company. Prop Trading generally involves lower financial risk compared to trading with personal funds, as you’re primarily paying subscription fees instead of investing your own capital.

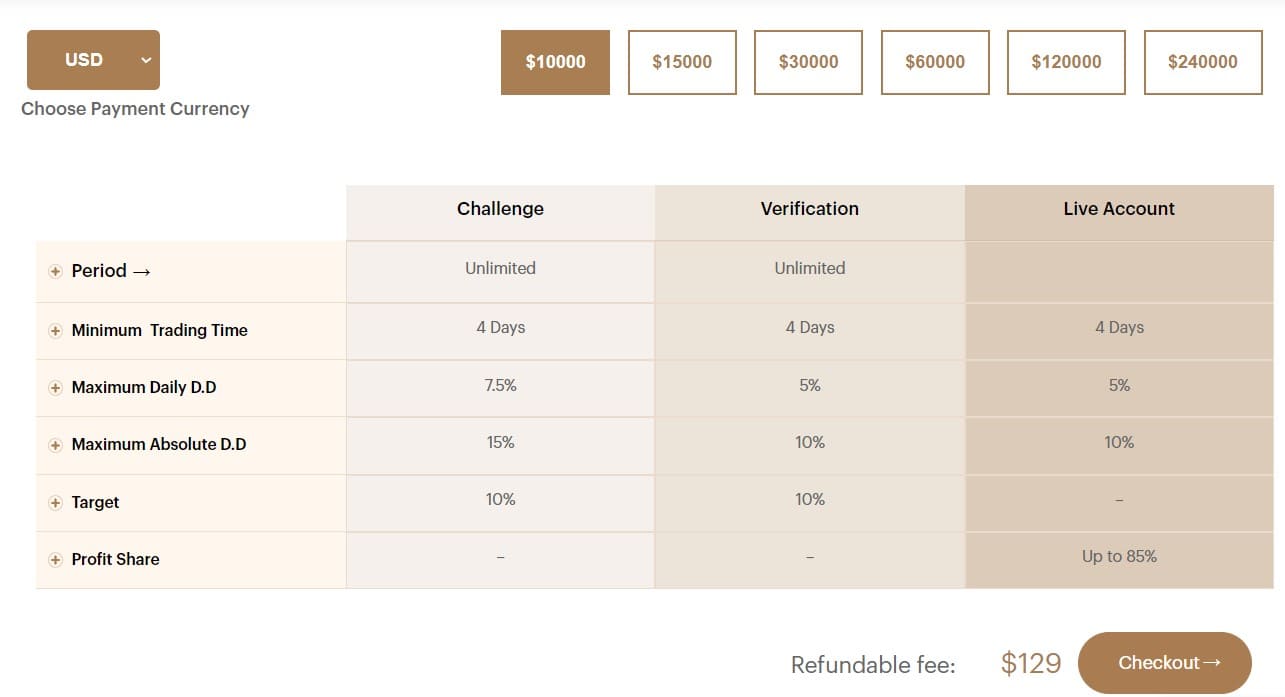

A key aspect of our review of Audacity Capital is understanding the evaluation challenge and the conditions for participating in their trading challenge. This involves examining the specific tests a trader must pass to obtain a Funded Trading Account and become a Proprietary Trader. Additionally, it’s important to consider the costs involved for a trader, typically in the form of a registration fee.

When starting with Audacity Capital, you need to choose an account model and balance, as the challenge conditions and registration fee vary by account size. Audacity Capital refunds this fee once you qualify as a Funded Trader. For specific fee details based on account sizes, refer to their Registration Fee comparison table

| Fees | Audacity Capital | FTMO | The Funded Trader |

|---|---|---|---|

| Minimum Account Size | $10,000 | $10,000 | $50,000 |

| Fee | $129 | €155 | $289 |

| Maximum Account Size | $240,000 | $200,000 | $400,000 |

| Fee | $1,559 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

The profit target for traders participating in Audacity Capital’s Ability Challenge is set at 10%. This target applies to both the Initial Challenge Phase and the Verification Phase of the evaluation process. After these phases, when a trader is trading with a live account, there is no set profit target, and the firm offers a 75% profit share on the profits earned

In Audacity Capital’s Ability Challenge and their Funded Trader Program, the maximum loss a trader can incur, also known as the maximum drawdown, is set at 10% of the initial account balance. This means that if a trader’s account equity falls below 90% of the initial balance, they would fail the challenge or be removed from the funded program.

In the Audacity Capital Ability Challenge, the minimum trading period is set at 4 days. This means that traders are required to actively trade for at least 4 days during the evaluation process, either in the initial challenge phase or the verification phase. This requirement ensures that traders demonstrate consistent trading activity and skill over a reasonable period, rather than achieving their targets through a few lucky trades

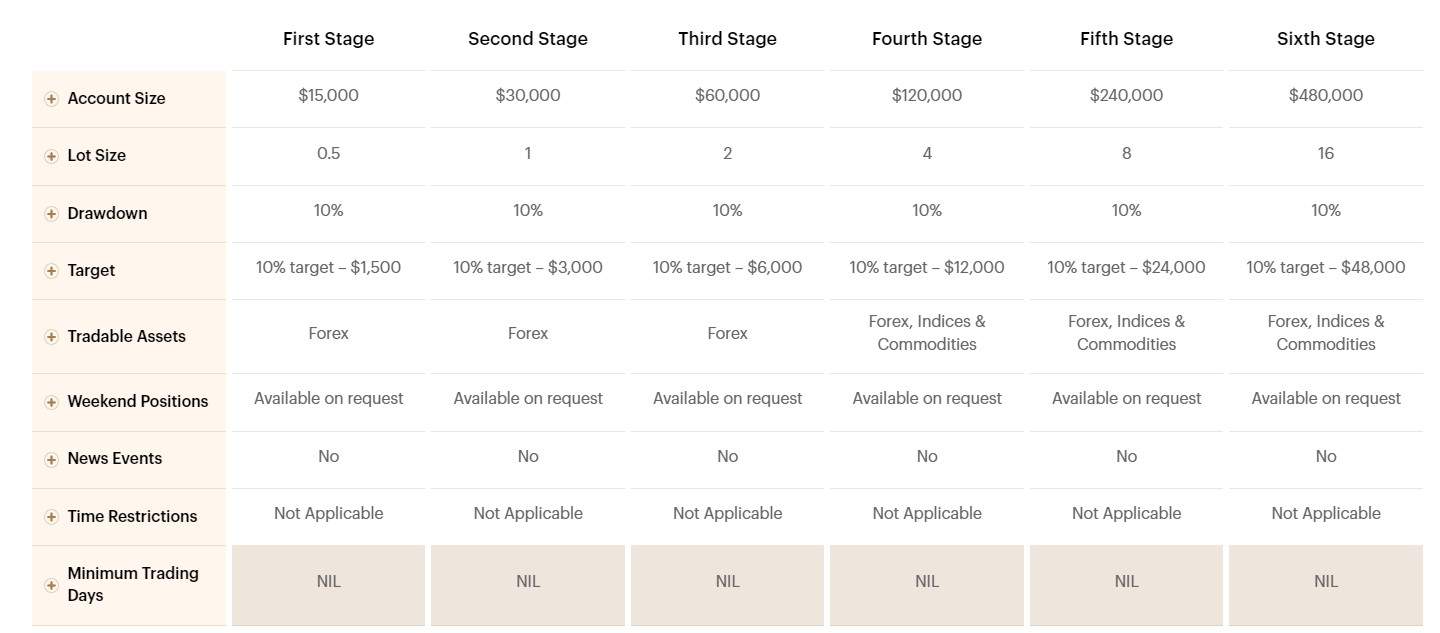

See the detailed table with Audacity Capital Challenge conditions based on Account Size:

Audacity Capital does not offer a free trial for its trading programs, including the Ability Challenge and the Funded Trader Program. Participants are generally required to pay a fee to join these programs, which includes the Ability Challenge’s evaluation process and the Funded Trader Program.

After successfully passing the test or challenge, traders receive their Funded Account, which typically takes a few business days to activate. It’s important to note that the account’s conditions and balance will align with the specifications of the test you passed. If you wish to upgrade to a higher account tier, you would need to undergo and pass the test again, starting from the beginning, for the desired account balance level.

At Audacity Capital, the profit sharing arrangement varies by program: a 50/50 split in the Funded Trader Program and a more trader-favorable 85/15 split for those who successfully navigate the Ability Challenge and proceed to live account trading

Audacity Capital processes payouts and withdrawals for its traders based on the achievement of their profit targets. Once a trader hits the 10% profit target, they can request a withdrawal through a specific form provided by Audacity Capital. The payouts are typically processed and released within a 48-hour timeframe.

The exact withdrawal methods, such as bank transfer, electronic wallets, or other methods, are not explicitly detailed in the available information. Typically, such details are provided to traders once they are enrolled in the program and have access to their trading account or dashboard.

When assessing broker account conditions, we carefully consider account preferences, platform options, instruments, trading costs, leverage levels, and trading conditions. Some brokers may restrict certain strategies or practices in funded accounts, leading to potential account loss and the need to pass the assessment again.

Audacity Capital offers a wide range of tradable instruments, including forex, commodities, and indices, providing traders with diverse trading opportunities. These instruments allow traders to engage in a broad spectrum of trading activities, from forex trading to commodities and stock market speculation.

Audacity Capital operates on a commission-free model, which means that traders do not incur commissions on their trades. Instead, the company typically charges traders a subscription fee to participate in their programs, such as the Ability Challenge and Funded Trader Program.

Audacity Capital leverage level is 1:20 for traders participating in their trading programs, including the Ability Challenge and the Funded Trader Program. This leverage ratio allows traders to control a larger position size relative to their account balance, which can amplify both potential profits and losses. Traders need to manage leverage carefully and understand the associated risks when trading with higher leverage levels

Audacity Capital offers the popular MetaTrader platforms, MT5 and MT4, and collaborates with technology providers. However, it exclusively provides MetaTrader platforms, so traders looking for alternative software options should consider other proprietary trading companies

Audacity Capital’s trading conditions are designed to create a fair and structured trading environment while offering opportunities for traders to profit and grow their trading careers

As observed, Audacity Capital occasionally offers promotions, including the availability of Audacity Capital coupons for discounts. It’s important to note that these offers typically have temporary conditions, so it’s advisable to verify their availability when you sign in or access your account

Taking into account all the information about Audacity Capital, it can be concluded that the firm presents an appealing opportunity for funded traders. The company offers competitive costs compared to industry rivals and provides a range of programs with lower entry fees, increasing opportunities for traders with budget considerations.

However, it’s important to note that Audacity Capital has limitations in terms of the variety of instruments available, such as stocks or futures, which may not align with the preferences of all traders

Still, it’s essential to compare Audacity Capital with other Prop Trading Firms, as some may offer better-suited conditions, instruments, or alternative platforms. Additionally, consider the unique advantages of Audacity Capital. Explore our alternatives and comparison table for a concise overview

No review found...

No news available.

I have a problem. I would like to discuss it with someone superior.

I’m in South Africa.