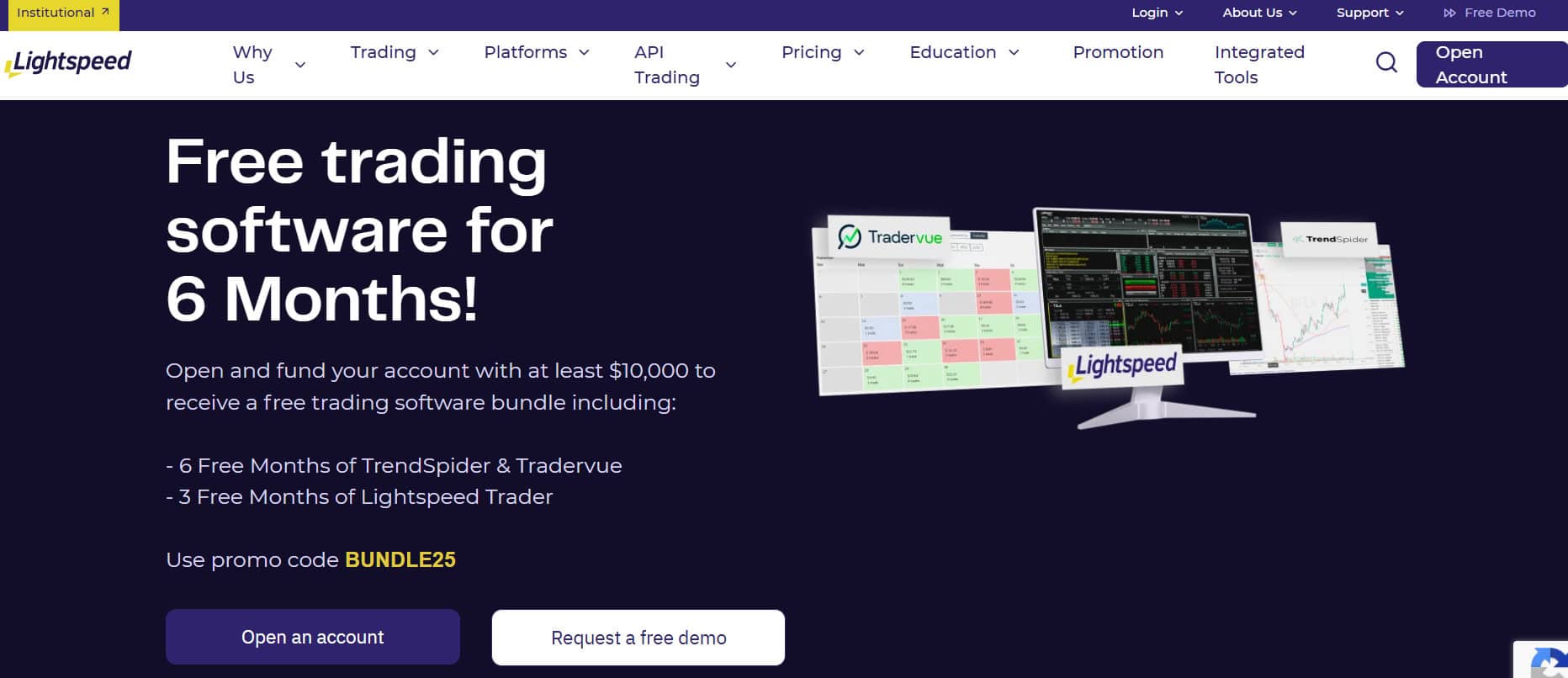

- What is Lightspeed?

- Lightspeed Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

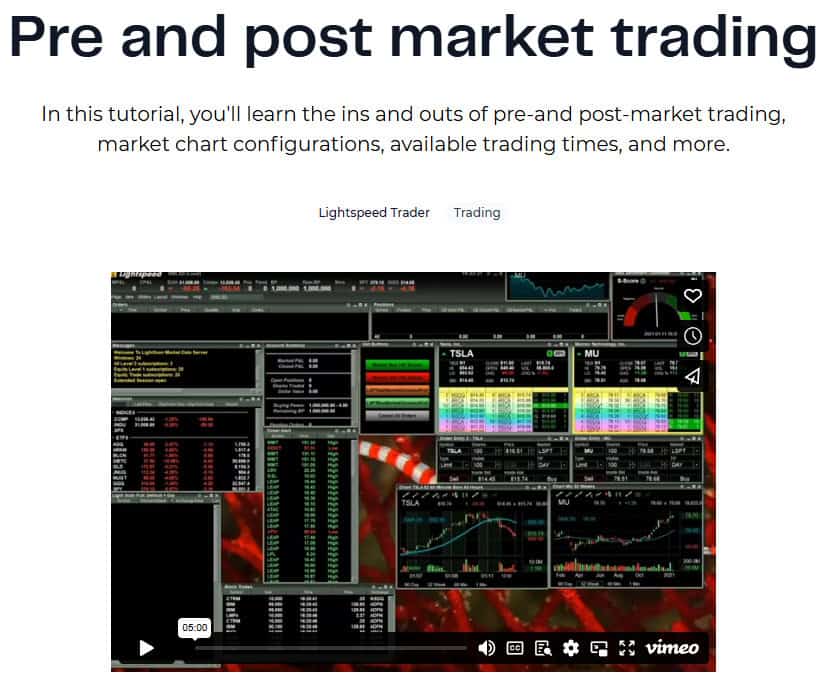

- Research and Education

- Portfolio and Investment Opportunities

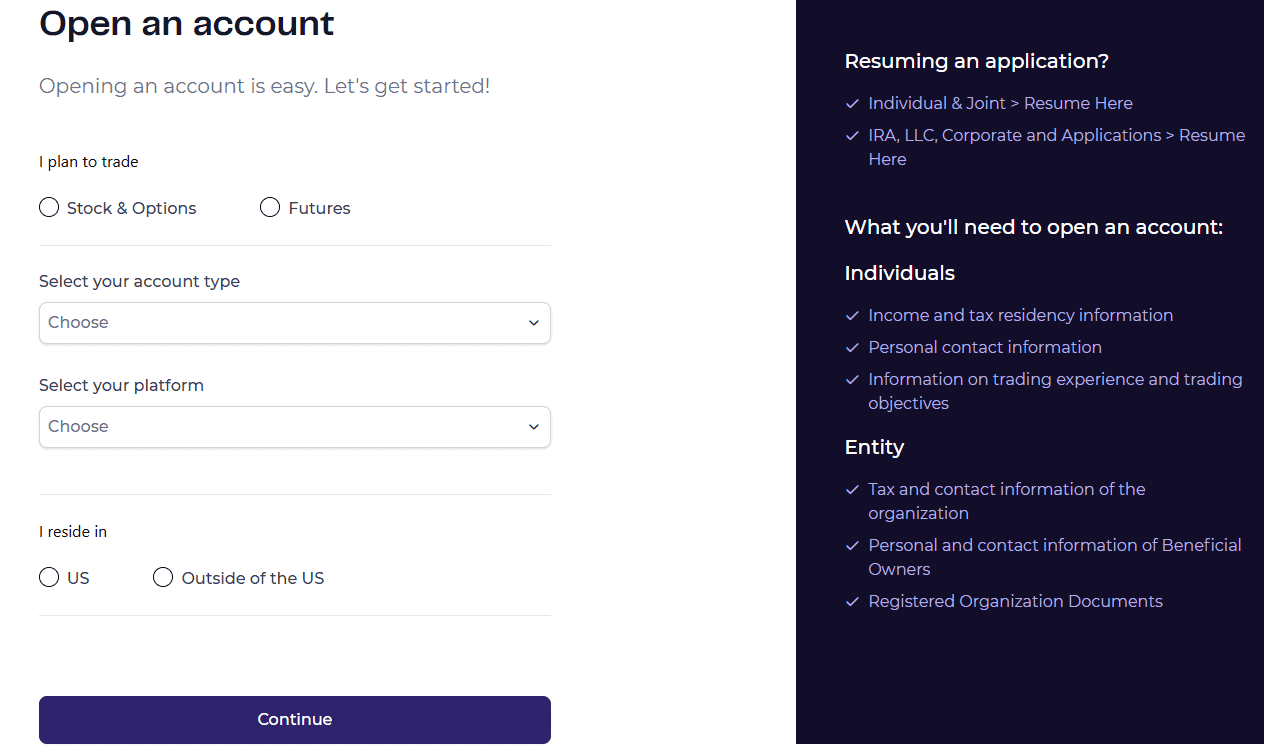

- Account Opening

- Additional Tools And Features

- Lightspeed Compared to Other Brokers

- Full Review of Broker Lightspeed

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Lightspeed?

Lightspeed is a Real Stock Trading company that provides opportunities for experienced traders and investors to engage in trading various financial instruments such as stocks, ETFs, equities, options, and futures.

Established in 2006 in the United States, the firm is a registered broker-dealer under the US Securities and Exchange Commission (SEC) and holds memberships with regulatory bodies like the Financial Industry Regulatory Authority (FINRA), National Futures Association (NFA), and the Securities Investor Protection Corporation (SIPC).

Overall, the broker is known for its focus on active and professional traders, providing them with a variety of trading platforms that offer advanced trading tools, low-latency execution, and direct market access.

Is Lightspeed Stock Broker?

Yes, Lightspeed is a Stock trading broker that provides competitive options for Real Stock trading and Investment, with other options including ETFs, Shares, Futures, etc. The brokerage firm provides advanced trading platforms and tools, real-time market data, technical indicators, and a range of charting tools, along with quite powerful trading conditions and solutions overall, which makes Lightspeed quite a good choice among US Traders.

Lightspeed Pros and Cons

Lightspeed has several pros and cons that traders should consider. On the positive side, the company offers sophisticated trading platforms tailored for investors and professionals involved in Stocks, Futures, and Options trading. Additionally, it provides low commissions and fees, various account types, and a professional trading environment. Moreover, traders can benefit from the broker’s extensive educational resources, research materials, and the Academy program.

For the cons, the product offering could be more limited in comparison to certain well-established brokerage firms. Also, the minimum deposit is relatively higher; however, this might not be seen as a disadvantage due to Lightspeed’s Prime brokerage classification. The lack of 24/7 customer support could potentially be a drawback for traders who require assistance throughout the day.

| Advantages | Disadvantages |

|---|

| SEC, FINRA regulation and oversee | Limited trading instruments |

| For US traders, professionals, and investors | No 24/7 customer support |

| Competitive trading conditions | High minimum deposit |

| Advanced trading platforms | |

| Real Stock Trading and Investment | |

| Direct Market Access | |

| Various account types | |

| Shares and Futures trading | |

| Good education and research | |

Lightspeed Features

Lightspeed provides competitive Stock trading services, low commission fees, and advanced trading platforms and tools for investors and professionals. Below is a comprehensive list of its core features:

Lightspeed Features in 10 Points

| 🏢 Regulation | SEC, FINRA, NFA, SIPC |

| 🗺️ Account Types | Standard, Institutional Accounts |

| 🖥 Trading Platforms | Lightspeed Trader, Eze EMS Pro and Eze EMS Express, Sterling Trader Pro, DAS Trader Pro, Sterling Vol Trader, SILEXX OEMS, Futures trading platforms |

| 📉 Trading Instruments | Stocks, Options, ETFs, Futures |

| 💳 Minimum Deposit | $25,000 |

| 💰 E-mini and Standard Contract | $1.29 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | Webinars, Options Trader Academy, Active Trader Blog, Glossary |

| ☎ Customer Support | 24/5 |

Who is Lightspeed For?

Lightspeed is suitable for active traders, professional investors, and institutions who need fast execution speeds, customizable trading platforms, and competitive commission structures. Based on our findings and Financial Expert Opinions, Lightspeed is Good for:

- Real Stock Trading

- Investing

- Traders from the USA

- Advanced traders

- Professional trading

- Access to Futures and ETF trading

- DMA execution

- Commission-based trading

- Auto trading

- Good education and trading tools

Lightspeed Summary

To sum up, Lightspeed is a well-regarded Stock trading brokerage known for its comprehensive offerings tailored to advanced traders and investors. It holds strong regulatory credentials from top-tier US financial authorities, adding trust and confidence among US traders.

Lightspeed provides traders with advanced proprietary and third-party trading platforms enhanced with powerful charting capabilities, real-time market data, and customizable layouts. Additionally, the broker offers a wide range of educational materials and research resources to support traders in expanding their knowledge and staying informed about the market.

However, there are also some drawbacks to consider, including a restricted range of available trading products, the absence of 24/7 customer support, and a comparatively higher minimum deposit requirement.

Overall, we found that the broker provides a good trading environment for investment; however, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

Lightspeed is a good Broker fo traders looking for Stock trading specifically ideal for active and professional traders who prioritize speed, control, and execution quality. Its standout feature is the direct market access technology, which enables traders to route orders to specific exchanges with minimal latency, crucial for those using scalping, algorithmic, or high-frequency strategies.

Lightspeed’s proprietary platform, Lightspeed Trader packed with fully customizable layouts, advanced charting tools, hotkeys, level II market data, and real-time risk management features, giving users full command over their trading environment. We did enjoy trading over the platform, it provides extensive analysis and great visial chart analysis too.

Additionally, the broker offers tiered pricing structures, which reward high-volume traders with lower commissions, so is another advantage for cost-effective trading. With dedicated support, institutional-grade infrastructure, and access to stock, options, and futures markets, Lightspeed remains a trusted choice for hedge funds, proprietary trading firms, and experienced individual traders.

Consider Trading with Lightspeed If:

| Lightspeed is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- Suitable for professional traders and investors.

- Looking for broker with a long history of operation and strong establishment.

- Low fees and commissions.

- Access to robust trading platforms.

- Excellent trading tools and trading technology.

- US investors.

- Stock Trading and Investment.

- Providing diverse trading strategies.

- Good educational materials and research.

- Secure trading environment.

- Offering popular financial products.

- Active traders.

|

Avoid Trading with Lightspeed If:

| Lightspeed might not be the best for: | - Need diverse investment products.

- Looking for broker with 24/7 customer support.

- Need a broker with trading services worldwide.

|

Regulation and Security Measures

Score – 4.7/5

Lightspeed Regulatory Overview

Lightspeed is a legit and regulated Stock Trading Broker that follows the strict rules and guidelines established by the SEC, FINRA, and NFA (USA), which are Top-Tier regulations and provide low-risk Stock and Futures trading.

How Safe is Trading with Lightspeed?

Lightspeed is a reliable and secure investment firm that focuses on following rules and regulations set by top-tier US authorities, which ensures that Lightspeed operates within established financial guidelines and provides a secure trading environment for its clients.

The broker is a member of the Securities Investor Protection Corporation (SIPC) in the USA, which provides limited protection for clients in the event of a brokerage failure. Each account receives coverage of up to $25,500,000 without incurring any additional fees. Also, SIPC offers protection of up to $500,000, with a maximum of $250,000 applicable to cash credit balances.

Additionally, Lightspeed’s focus on low-latency trade execution and direct market access helps ensure that clients’ trades are executed swiftly and at desired prices, reducing the risk of slippage.

Consistency and Clarity

Lightspeed has earned a solid reputation in the financial trading community for its reliability, transparency, and consistent performance. It is praised in user reviews for its fast execution, advanced trading tools, and responsive customer support, although some traders note its higher minimum deposit requirements as drawbacks for beginners.

The broker maintains good ratings across major review platforms and has been recognized for its technological excellence and platform performance. Lightspeed continues to build credibility through longstanding industry presence, regulatory compliance under FINRA and SIPC, and participation in educational initiatives.

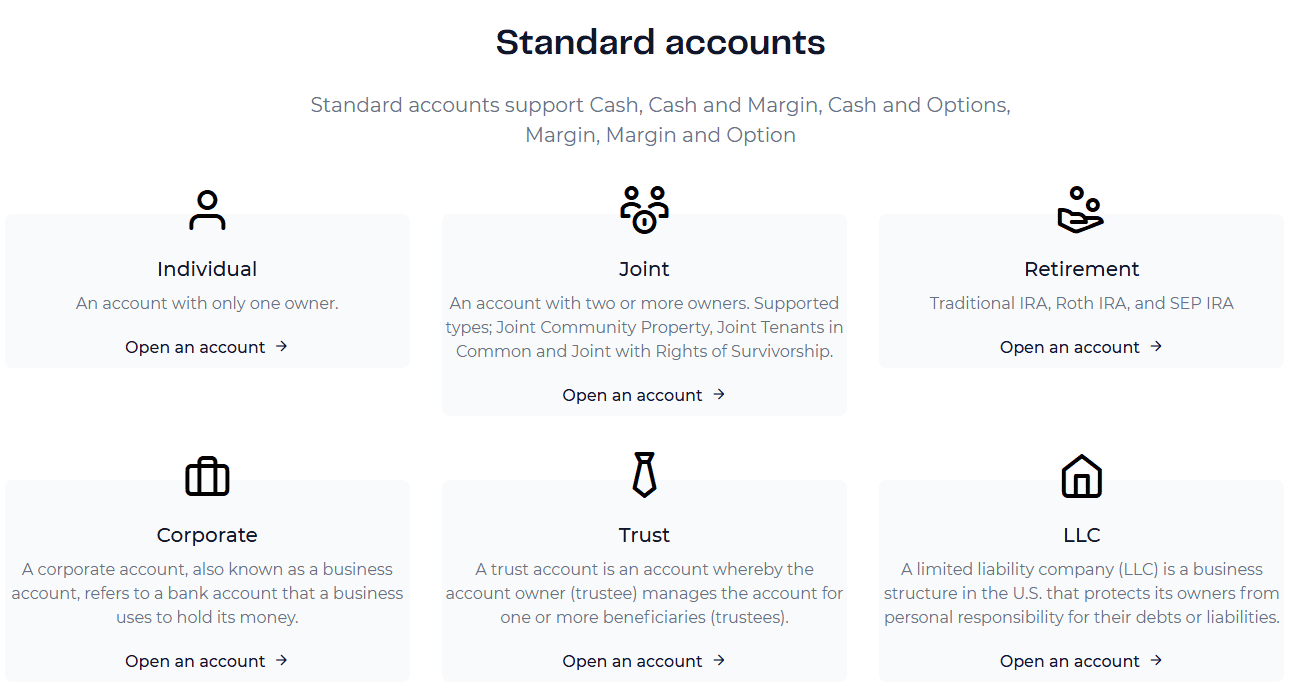

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Lightspeed?

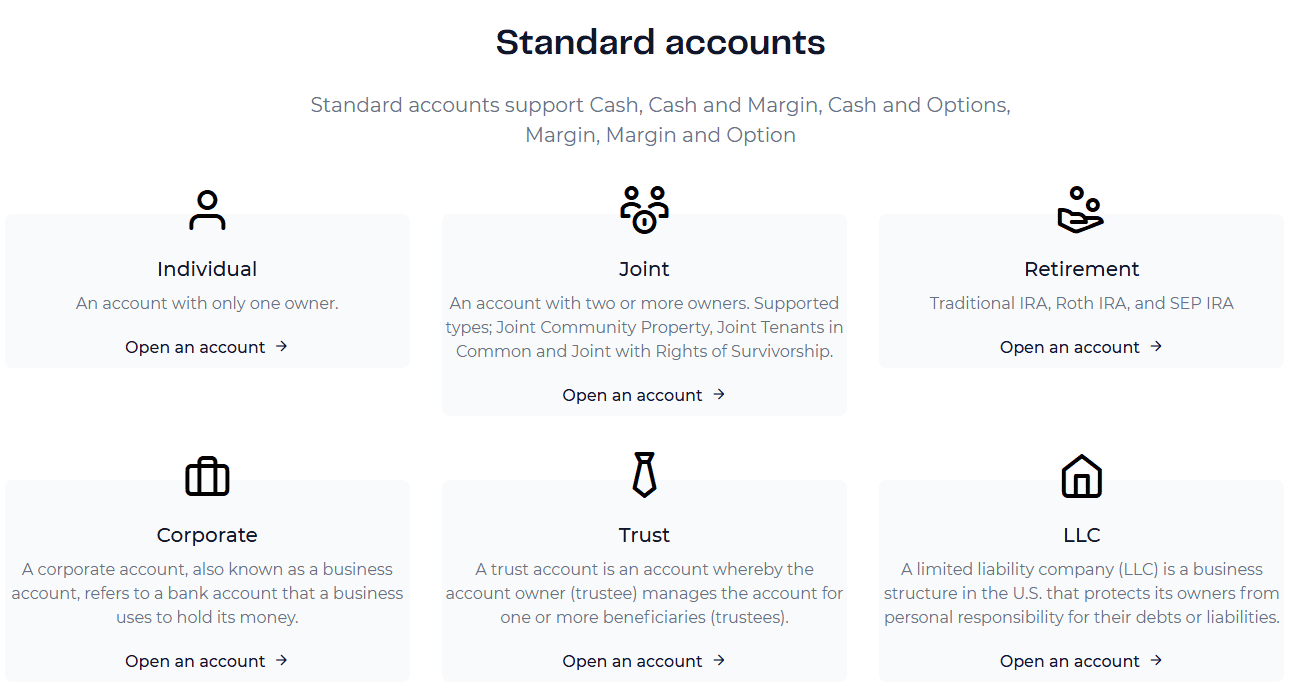

The brokerage provides a range of account options categorized as both Standard and Institutional accounts, tailored to meet the requirements of professional traders and investors. For Standard accounts, Lightspeed supports Cash, Cash and Margin, Cash and Options, Margin, and Margin and Option.

Additionally, Lightspeed provides a Demo account, which is an advantage for traders to test their strategies in a virtual environment that replicates real market conditions without risking actual funds on the stock exchange.

Standard Accounts

Lightspeed offers a range of Standard Accounts to suit various trader profiles and entity types, including Individual, Joint, Retirement (IRA), Corporate, Trust, and LLC accounts.

These account types provide flexibility to access advanced trading tools and direct market access. The minimum deposit required to open a standard account varies depending on the platform, $10,000 for web and mobile trading, and $25,000 for access to the full-featured Lightspeed Trader desktop platform, aligning with active trading standards.

Each account type supports trading in equities, options, and futures, and provides access to robust risk management tools, real-time data, and customizable interfaces.

Regions Where Lightspeed is Restricted

Lightspeed’s services are restricted in certain regions and countries due to regulatory limitations, local laws, or political factors:

- Iran

- Iraq

- North Korea

- Syria

- Cuba, etc.

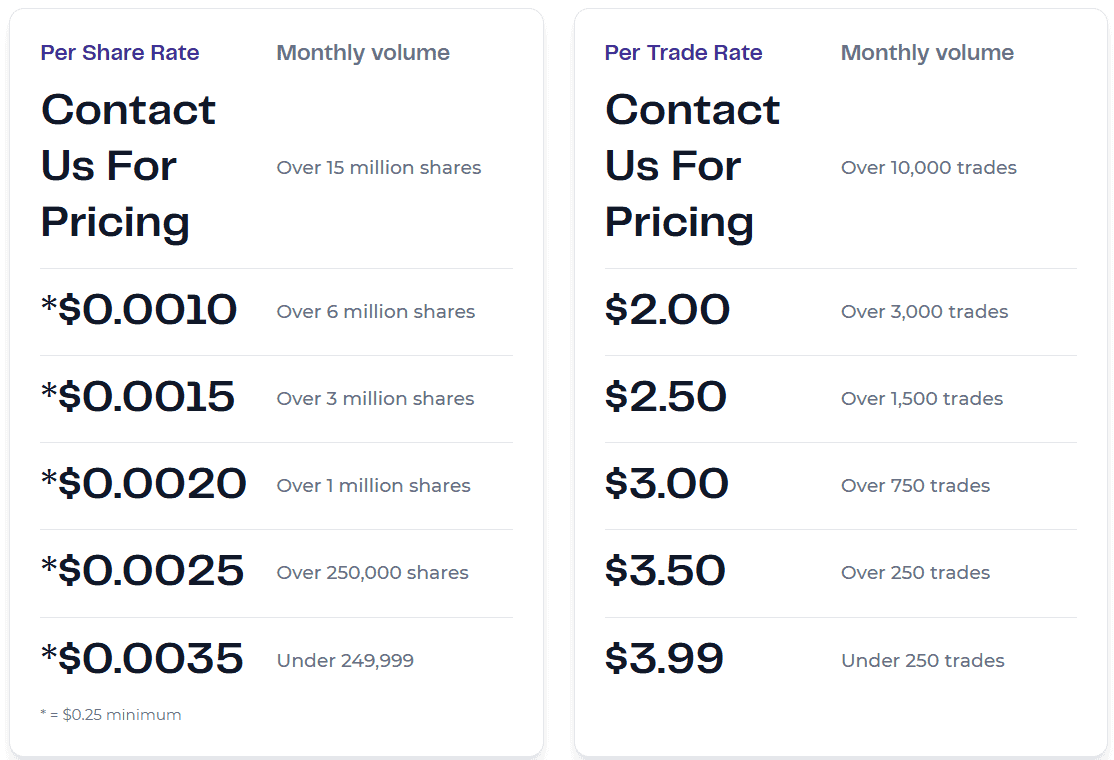

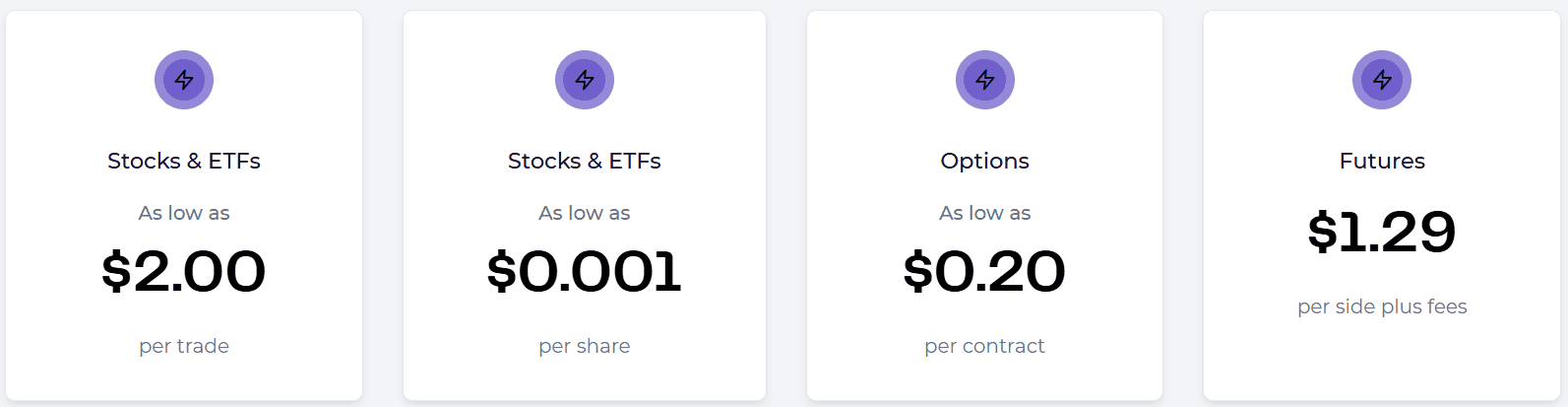

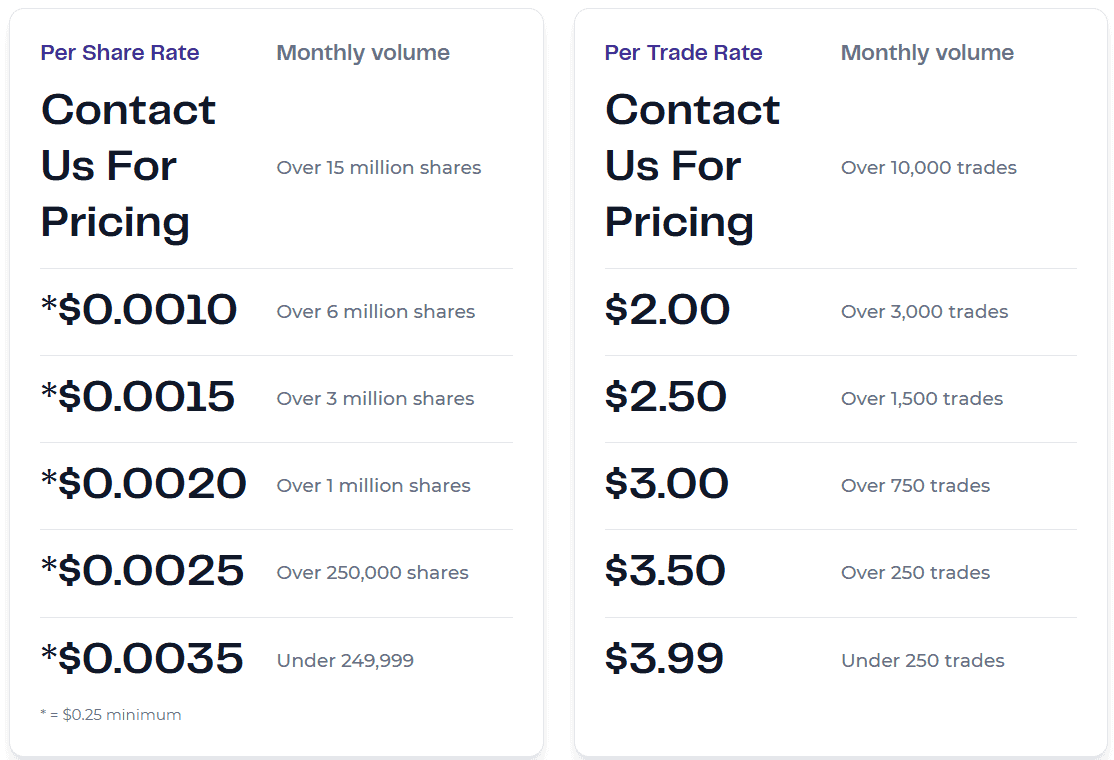

Cost Structure and Fees

Score – 4.5/5

Lightspeed Brokerage Fees

The broker provides competitive pricing for the majority of trading services. While Lightspeed does not charge for electronic (ACH) transfers, additional fees may be applicable during trading activities. Moreover, Margin trading also involves interest charges on borrowed funds.

Therefore, traders should carefully review Lightspeed’s stock price structure and terms and conditions to gain a comprehensive understanding of the associated charges and their potential impact on trading operations.

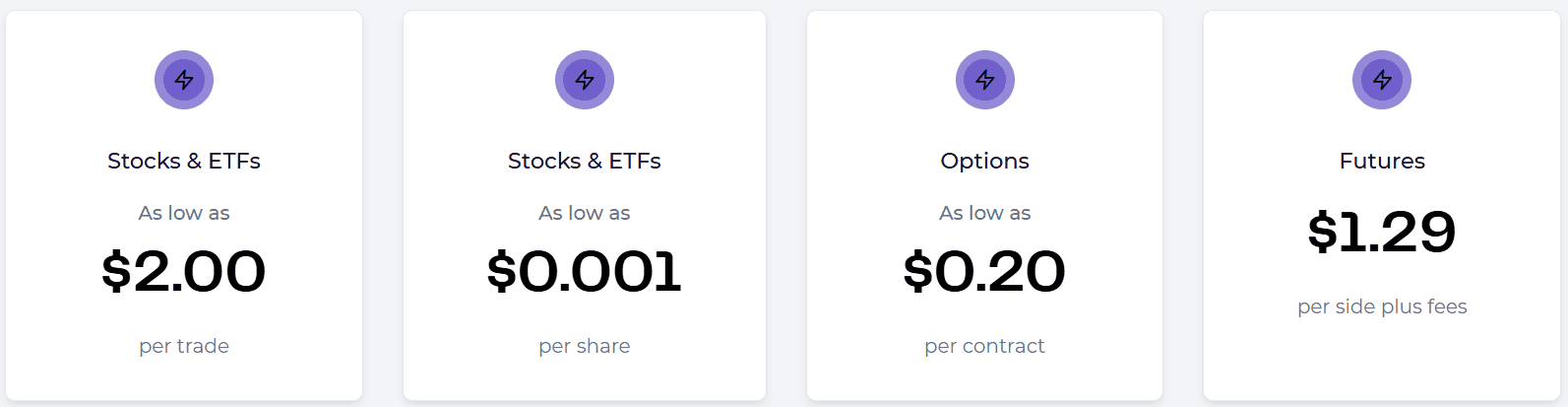

Lightspeed offers competitive and transparent pricing for futures traders, catering especially to active market participants. For E-mini and Standard Contracts, the broker charges a flat commission of $1.29 per side, providing fast and direct market access essential for high-frequency strategies.

In addition, the broker supports trading in Micro Contracts, which are ideal for traders looking to manage risk with smaller positions; these come with a lower commission of $0.25 per side. All trades are also subject to standard exchange, clearing, and regulatory fees, which vary depending on the product and exchange.

Lightspeed’s exchange fees are standard costs set by the respective futures exchanges, such as the CME, NYMEX, COMEX, and CBOT. These fees vary depending on the contract type and whether the trader is accessing live data or participating as a member or non-member.

The total trading costs include exchange fees, clearing fees, and NFA fees, all of which are detailed on the account statements for full transparency.

- Lightspeed Rollover / Swaps

Lightspeed does not charge traditional rollover or swap fees commonly associated with Forex or CFD brokers, as it primarily offers direct access to investment products like stocks, options, and futures.

How Competitive Are Lightspeed Fees?

Lightspeed’s fee structure is considered competitive, especially for active traders who prioritize execution speed and cost-efficiency. The broker offers transparent pricing with the potential for volume-based discounts, ideal for professional traders who execute large numbers of trades.

Additionally, the broker avoids hidden markups, instead separating platform, data, and commission costs. Overall, Lightspeed provides great value for those who are actively involved in the markets and require professional service without inflated costs.

| Fees | Lightspeed Fees | Webull Fees | AMP Fees |

|---|

| Broker Fee - E-mini and Standard Contract | $1.29 | $0.70 | $1.25 |

| Exchange Fee | Defined by Exchange | Defined by Exchange | Defined by Exchange |

| Trading Platform Fee | Yes | No | No |

| Data fee | Yes | No | Yes |

| Fee ranking | Low/Average | Low | Low |

Lightspeed Additional Fees

In addition to trading commissions, Lightspeed applies several additional fees that traders should be aware of. These include a monthly platform fee, such as $130 for the Lightspeed Trader desktop platform, which may be waived or reduced based on monthly commission activity.

There are also charges for market data subscriptions, which vary depending on the level of access and selected exchanges. Accounts with balances below $15,000 will be subject to a minimum monthly commission fee of $25.

Other additional costs include wire transfer fees, paper statement fees, and inactivity charges, depending on account usage.

Trading Platforms and Tools

Score – 4.7/5

Lightspeed offers a range of sophisticated trading platforms to cater to the needs of active and professional traders. These include the broker’s proprietary platforms and multiple third-party trading platforms, including Eze EMS Pro and Eze EMS Express, Sterling Trader Pro, DAS Trader Pro, Sterling Vol Trader, and more.

The most notable is the Lightspeed Trader, a desktop-based platform known for its advanced charting tools, real-time market data, customizable layouts, and rapid trade execution.

Additionally, Lightspeed provides a web-based platform called Lightspeed Web Trader, offering accessibility from any browser, as well as the Lightspeed API. The broker also offers a mobile trading app for trading on the go, ensuring flexibility for traders in various situations.

Trading Platform Comparison to Other Brokers:

| Platforms | Lightspeed Platforms | Webull Platforms | TradeZero Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Lightspeed Desktop Platform

Lightspeed Trader is Lightspeed’s proprietary desktop platform, built for professional and active stocks and options traders who require speed, precision, and advanced functionality.

Known for its low-latency execution and fully customizable interface, the platform supports equities, options, and futures trading with features such as real-time Level II quotes, hotkey trading, advanced charting tools, and risk management capabilities.

Traders can create tailored layouts, use algorithmic orders, and monitor multiple markets simultaneously. Although the platform requires a monthly fee, it can be compensated by sufficient trade volume.

Main Insights from Testing

Testing Lightspeed Trader revealed a platform built for speed, reliability, and deep market visibility. The user interface is intuitive yet highly customizable, allowing traders to set up efficient workflows with ease.

Order execution is fast, and the platform remains stable even during periods of high market volatility. Overall, the platform provides a smooth and responsive trading experience.

Lightspeed Desktop MetaTrader 4 Platform

Lightspeed does not support the MetaTrader 4 platform, as its services are tailored toward professional traders who require direct market access and advanced execution tools. Instead of MT4, the broker offers its proprietary desktop platform, which provides more robust features and lower latency suited for equities, options, and futures trading.

Lightspeed Desktop MetaTrader 5 Platform

Similarly, MT5 is not available through Lightspeed. The broker focuses on delivering an institutional-grade trading environment through its proprietary and third-party trading platforms.

Lightspeed MobileTrader App

Lightspeed’s mobile app typically offers features such as real-time market data, order placement, account management, and customizable alerts, technical indicators, enabling traders to stay connected to the markets and manage their portfolios from virtually anywhere.

This mobile app complements Lightspeed’s desktop and web-based platforms, providing flexibility and convenience for traders who require accessibility and responsiveness in today’s dynamic financial markets.

AI Trading

Lightspeed does not currently offer built-in AI trading features or automated trading systems commonly associated with retail platforms.

However, its advanced platforms, like Lightspeed Trader and Sterling Trader Pro, support API access and integration with third-party tools, allowing users to implement their own algorithmic or AI-driven strategies. This flexibility appeals to institutional traders who build custom models using machine learning or data-driven analytics.

Trading Instruments

Score – 4.5/5

What Can You Trade on Lightspeed’s Platform?

Lightspeed provides access to popular trading instruments, such as Stocks, Options, ETFs, and Futures. The broker enables investors to diversify their portfolios and participate in various markets according to their individual preferences and trading strategies.

While the broker does not support Forex, cryptocurrencies, or CFDs, its offerings cover the core instruments needed for equity and derivatives trading strategies.

Main Insights from Exploring Lightspeed’s Tradable Assets

The broker focuses on providing direct market access to U.S. markets, enabling fast and efficient execution for active and professional traders. The available instruments are integrated with advanced trading tools and real-time market data, ensuring precise control and optimal performance.

Margin Trading at Lightspeed

The leverage ratio can vary depending on the specific financial instruments and markets being traded. It allows traders to potentially amplify their potential returns; however, increased leverage also comes with increased risk. Therefore, traders should carefully consider their risk tolerance and trading strategy before utilizing leverage.

The broker offers a multiplier to traders on margin accounts. The intraday leverage is 1:2, which corresponds to 50% of the overnight initial margin rate. In certain cases, it can also be as high as 1:4, equivalent to 25% of the overnight initial margin rate.

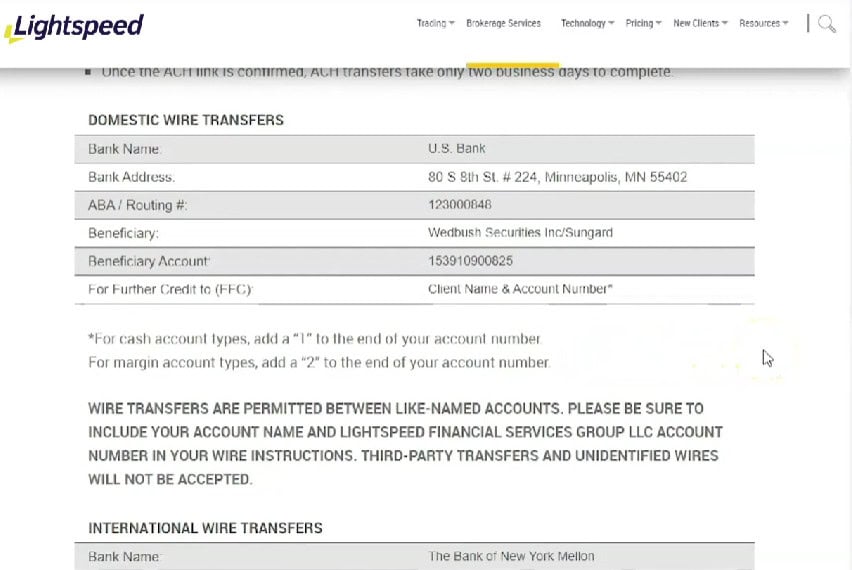

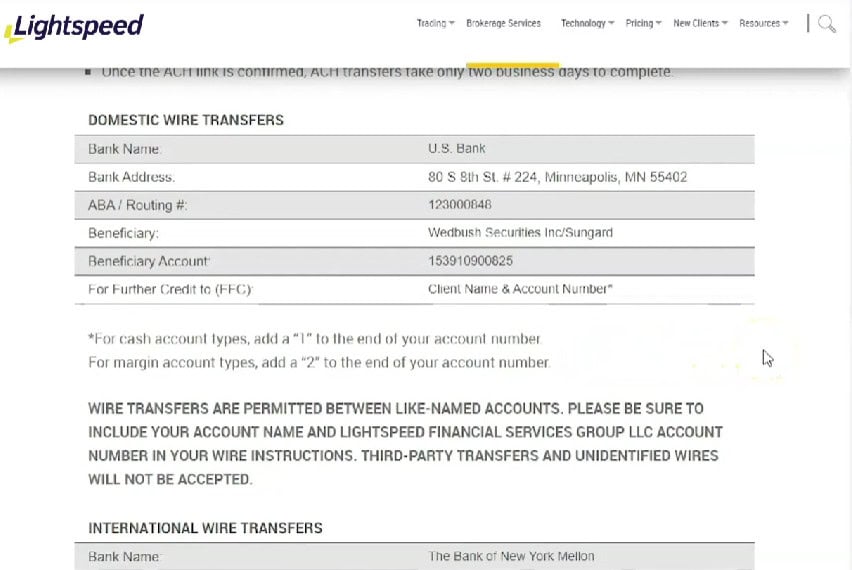

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Lightspeed

The broker offers a few funding methods to deposit funds into your trading account, such as ACH electronic transfers, wire transfers, and account transfers.

Lightspeed Minimum Deposit

Lightspeed requires a minimum deposit of $10,000 for web and mobile accounts, while access to advanced desktop platforms like Lightspeed Trader or Sterling Trader Pro requires a $25,000 minimum deposit.

Withdrawal Options at Lightspeed

The broker offers a fast and secure withdrawal process for traders to access their funds. Clients can typically initiate withdrawals through their online account portal, choosing from various withdrawal methods, including electronic transfers and wire transfers.

The requested withdrawal amount is confirmed before submission, and once processed, funds are typically transferred to the specified destination, such as a bank account. The time it takes for funds to reach the designated account may vary depending on the chosen withdrawal method and other factors.

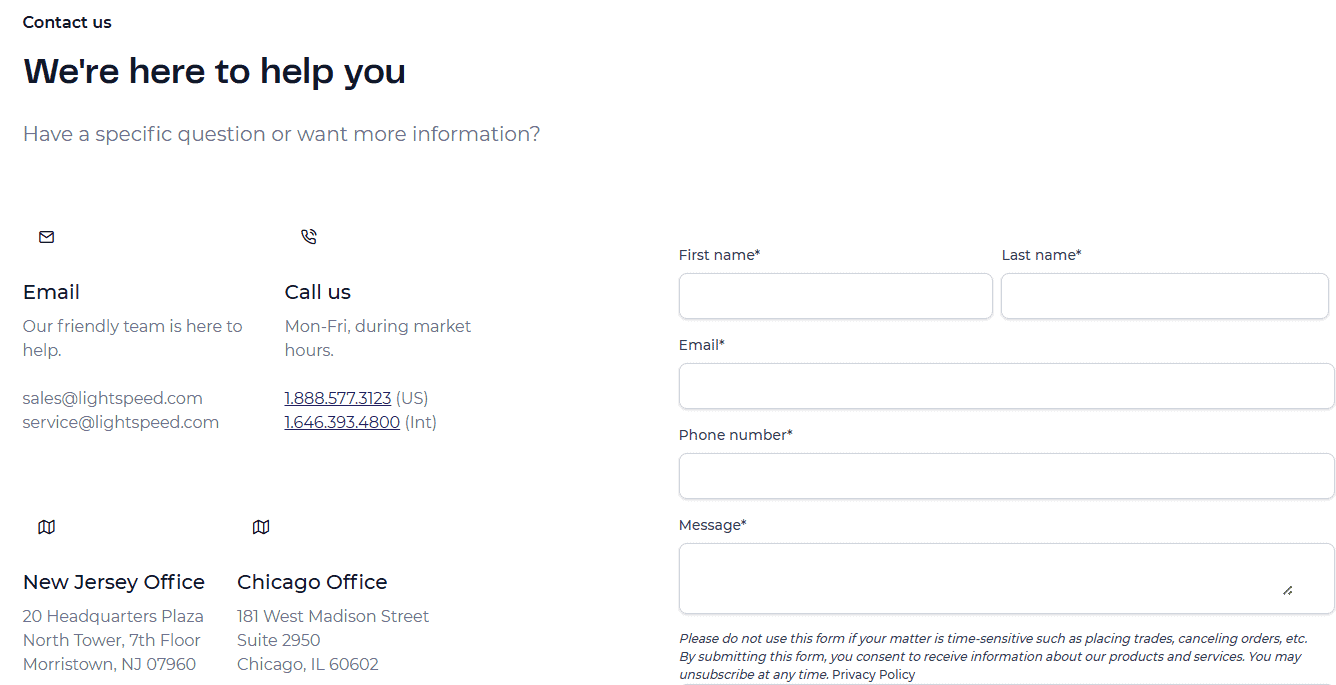

Customer Support and Responsiveness

Score – 4.5/5

Testing Lightspeed’s Customer Support

Lightspeed support is available 24/5 through email, phone lines, social media channels, and a comprehensive FAQ section, staffed by trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

Contacts Lightspeed

Lightspeed offers responsive support through multiple channels. For general inquiries or account assistance, you can email service@lightspeed.com, while sales-related questions can be directed to sales@lightspeed.com. Phone support is available at 1‑888‑577‑3123 (US) or +1‑646‑393‑4800 (international).

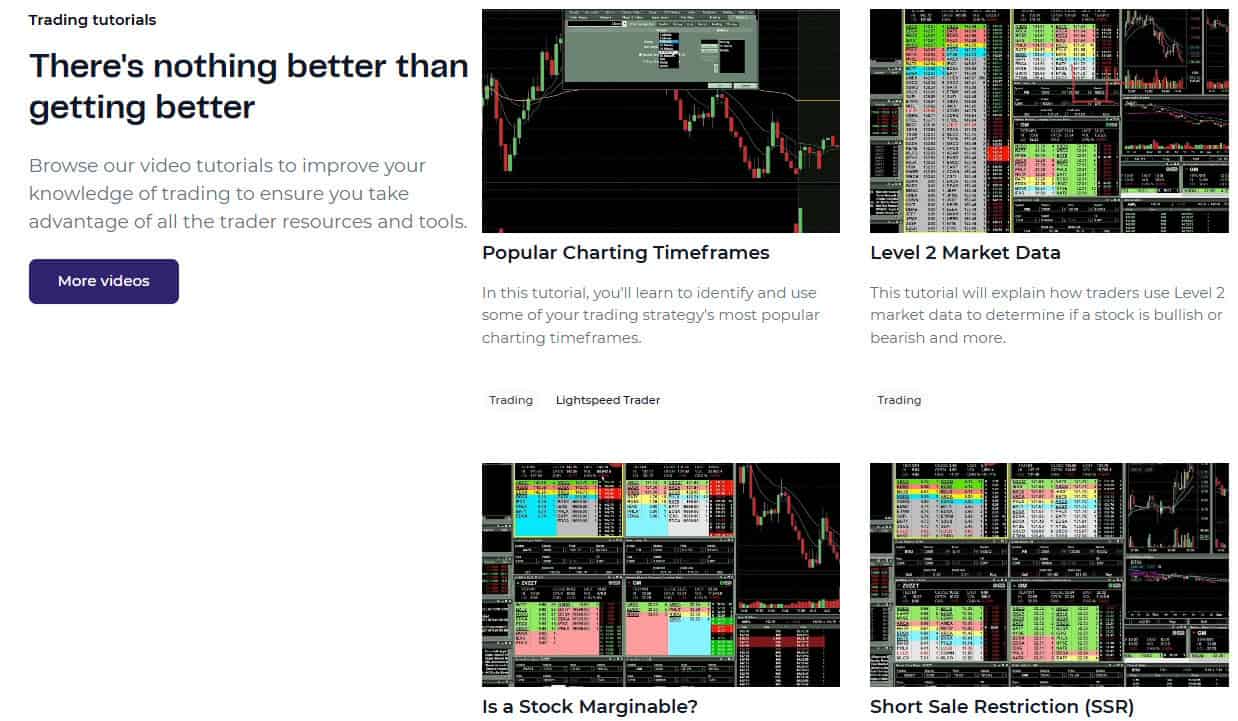

Research and Education

Score – 4.7/5

Research Tools Lightspeed

Lightspeed provides a wide range of research and analytical tools across its website and trading platforms:

- On the website, clients can integrate with premium third-party services via the Lightspeed Connect API, including TrendSpider, Tradervue, Context Analytics, SignalStack, TipRanks, and eSignal.

- Within Lightspeed Trader, the platform offers built-in features such as multi-asset charting with technical studies, a powerful LightScan market scanner, customizable hotkeys, complex order routing, and comprehensive SRM risk-management tools.

- Lightspeed’s toolkit is further enhanced by advanced options flow, real-time tracking, and professional-grade reporting features.

Education

The broker offers a range of educational resources, including live webinars, trading tutorials, videos, options Academy, news, market insights, and more.

These resources help traders build knowledge and confidence in navigating the financial markets effectively. The education focus benefits both active and professional traders who rely on advanced tools and insights for informed trading decisions and success.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options Lightspeed

Lightspeed focuses primarily on active trading solutions rather than traditional long-term investment services. While it offers access to stocks, ETFs, options, and futures, its platform is designed for high-frequency traders, proprietary firms, and institutional clients rather than passive investors.

The broker does not provide managed portfolios, mutual funds, or robo-advisory services commonly found at investment-focused firms. Instead, Lightspeed provides self-directed traders with direct market access, advanced order routing, and robust risk management tools.

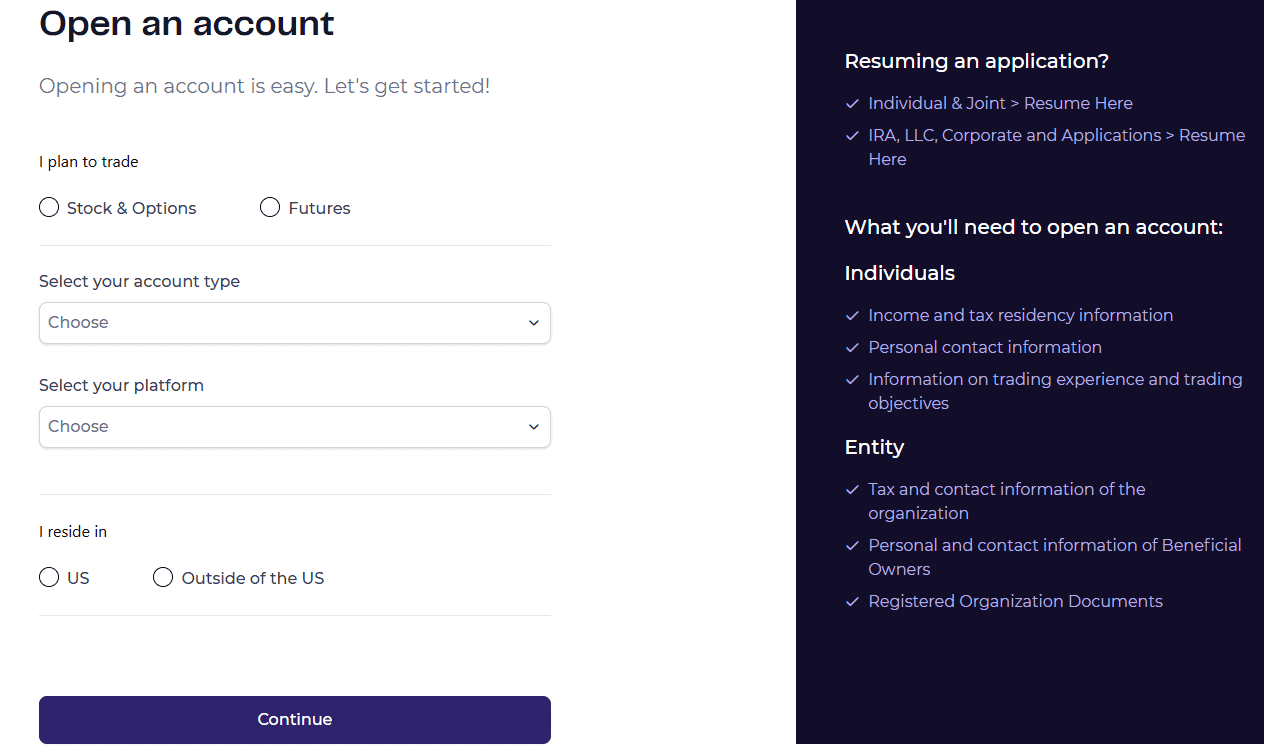

Account Opening

Score – 4.5/5

How to Open Lightspeed Demo Account?

The demo account provides a simulated trading environment where you can test strategies and get familiar with the platform’s tools and interface. Here is how you can open a Lightspeed demo account:

- Go to the official Lightspeed website, and click on “Request a Free Demo.”

- Fill out the form with your name, email, phone, etc.

- Check your email for login credentials and installation details.

- Log in and start trading in the simulated environment.

How to Open Lightspeed Live Account?

To open a Lightspeed live trading account, visit the official Lightspeed website and click on “Open an Account.” You will select the asset classes you want to trade, choose your account type, and pick your preferred platform.

During the application process, you will be asked to provide personal or entity details such as contact information, tax residency, trading experience, and financial background. After submission, the Lightspeed team will review your application; however, approval timelines can vary, especially for international applicants.

Once approved, you can fund your account via ACH or wire, and you will be ready to begin trading live.

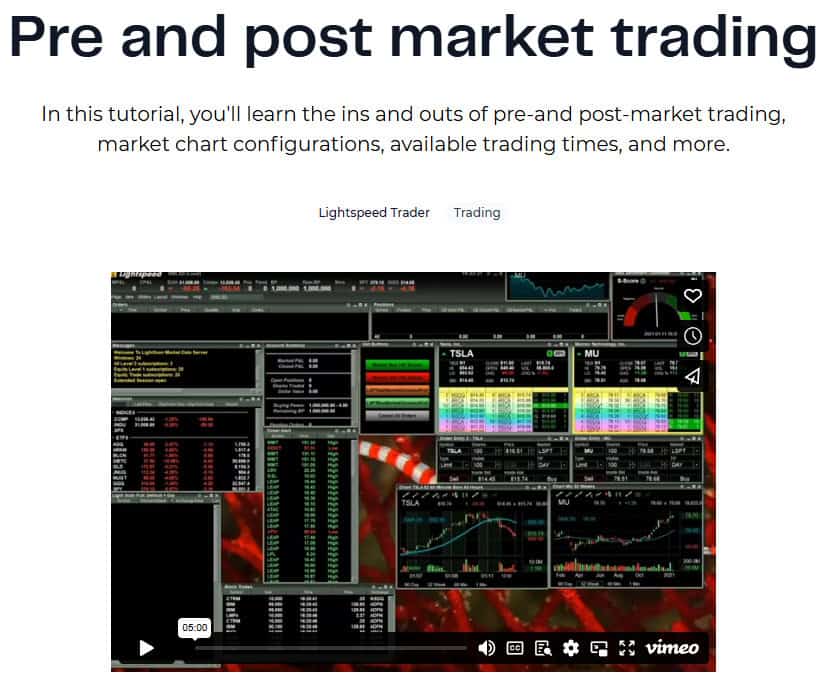

Additional Tools and Features

Score – 4.3/5

In addition to its core research tools, Lightspeed offers several advanced features designed to enhance trading efficiency and control.

- The platform also supports complex order routing strategies, allowing traders to direct orders to specific exchanges or liquidity providers for optimal fills.

- Pre and post-market trading access, alerts, and multi-monitor support further boost user experience, making Lightspeed a comprehensive solution for professional and active traders.

Lightspeed Compared to Other Brokers

Compared to its competitors, Lightspeed stands out as a Stock Trading Broker, providing solutions for active and professional traders and focusing on execution speed, advanced platforms, and direct market access.

While other brokers like TD Ameritrade, Fidelity, and Interactive Brokers offer a broader variety of investment products and cater to both beginners and long-term investors, Lightspeed is designed primarily for traders who operate with high frequency or follow institutional-grade trading approaches.

The broker’s educational resources and support are great; however, its offerings are not intended for casual investors or those looking for accounts with minimal funding requirements. Overall, Lightspeed may not offer the widest asset variety or the lowest entry point, but it delivers a professional-grade trading environment for those who value speed, control, and reliability.

| Parameter |

Lightspeed |

AvaFutures |

Interactive Brokers |

TD Ameritrade |

Fidelity |

AMP |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

$1.29 |

$0.49 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.25 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low |

Low |

Average |

Low |

Low |

Low |

| Trading Platforms |

Lightspeed Trader, Eze EMS Pro and Eze EMS Express, Sterling Trader Pro, DAS Trader Pro, Sterling Vol Trader, SILEXX OEMS, Futures trading platforms |

MT5 |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Active Trader Pro, Fidelity Go, Fidelity.com Web |

MT5, TradingView, CQG, Rithmic, TT, and more |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, Options, ETFs, Futures |

Futures |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, Mutual Funds, ETFs, Options, Bonds, CDs, Precious Metals, Crypto |

Futures Contracts, Commodities, Options on Futures |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEC, FINRA, NFA, SIPC |

ASIC, MiFID, Bank of Ireland, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

SEC, FINRA, IIROC |

NFA, CFTC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Excellent |

Excellent |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

$25,000 |

$100 |

$100 |

$0 |

$0 |

$100 |

$0 |

Full Review of Broker Lightspeed

Lightspeed is a reliable US investment firm, providing access to stocks, ETFs, options, and futures markets. The broker offers advanced trading platforms like Lightspeed Trader, powerful trading tools, and real-time market data for active and high-frequency traders.

Additionally, Lightspeed provides low-latency execution, customizable interfaces, and transparent pricing. While it requires a higher minimum deposit and may not cater to beginners, the firm stands out for its robust performance and direct market access.

Regulated by Top-Tier US authorities, the broker provides a secure environment along with quality educational resources and responsive customer support. Overall, Lightspeed is well-suited for experienced traders seeking full control, institutional-grade tools, and a competitive investment environment.

Share this article [addtoany url="https://55brokers.com/lightspeed-review/" title="Lightspeed"]