- What is IronFX?

- IronFX Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

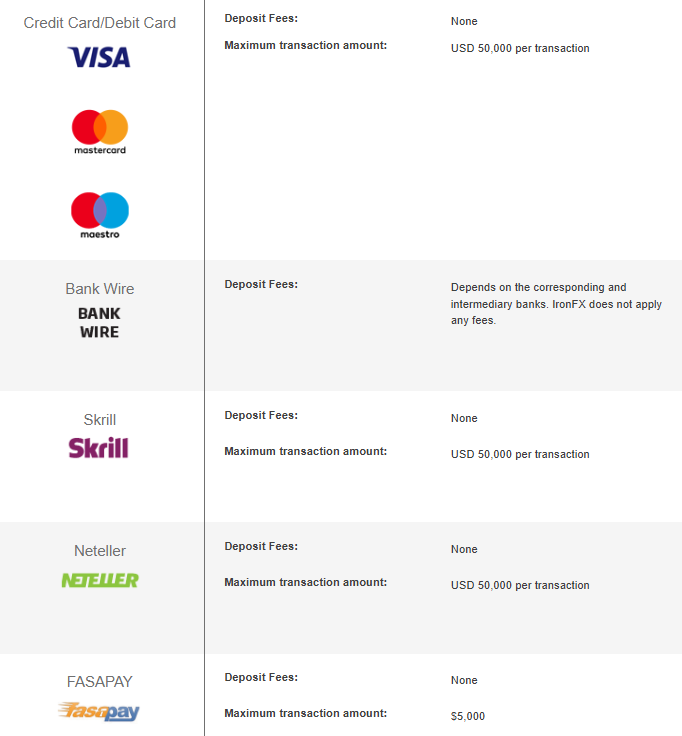

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

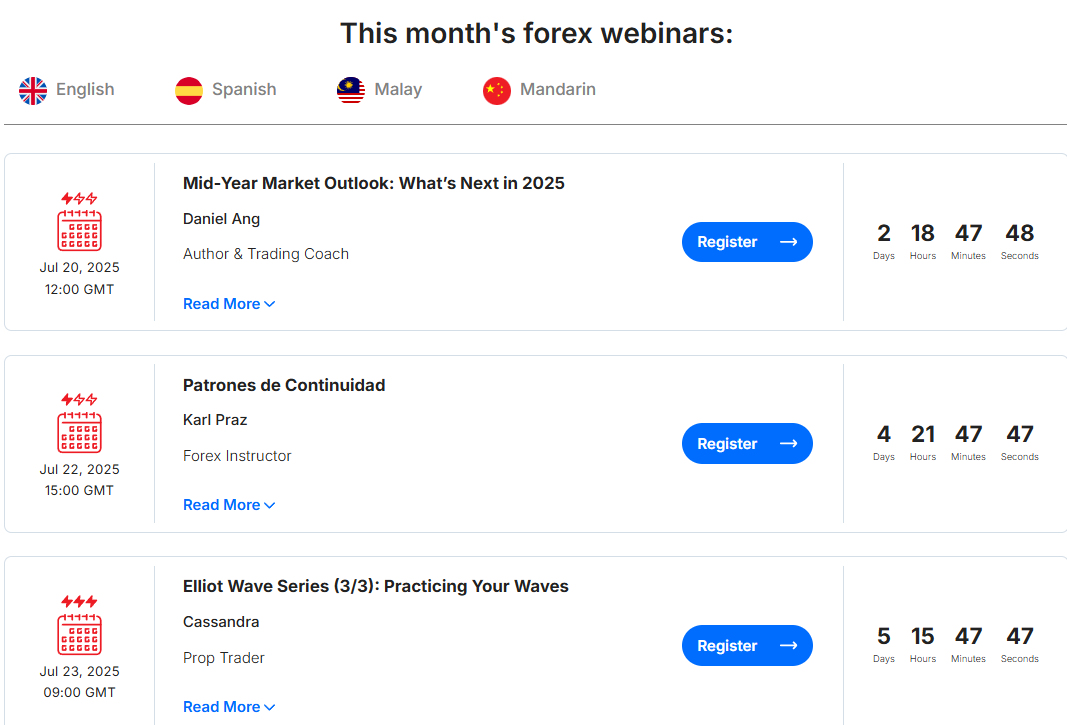

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- IronFX Compared to Other Brokers

- Full Review of Broker IronFX

Overall Rating 4.5

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is IronFX?

IronFX is a global Forex and CFD broker founded in 2010. The broker offers a wide range of trading instruments across Forex, metals, indices, futures, and shares. At present, the top-tier FCA tightly regulates the broker, while it also holds licenses from the CySEC and FSCA. However, despite the present good regulations, it is essential to mention that the broker operated under an offshore license for many years and received many complaints about its regulatory insufficiency, also been in our Broker to avoid category for years.

As of now, IronFX offers competitive conditions and a safe environment. Trades are conducted on the popular MT4 and WebTrader. IronFX also includes VPS hosting, a trade copier, and the IronFX Personal Multi Account Manager. Due to the additional features and capabilities, IronFX enables its clients to explore more opportunities in trading.

The broker also offers an extensive educational section, featuring webinars, seminars, a VIP room, and more. The available research tools are advanced and support in-depth analysis (Economic Calendar, Trading Psychology, etc.). Multilingual customer support is available 24/5 through multiple channels.

IronFX Pros and Cons

IronFX is a respectable firm regulated by multiple authorities. The broker has many advantages, yet there are also certain aspects for enhancement. One of the advantages is the wide range of tradable products. IronFX offers over 80 FX pairs, allowing great diversity. The MT4 and WebTrader ensure efficient trades based on in-depth analysis. Also, IronFX offers additional capabilities, including VPS hosting, a Trade Copier, and the IronFX Personal Multi Account Manager. Besides, traders can benefit from a comprehensive educational section.

From the cons, IronFX does not include the more advanced MT5 platform that many traders prefer. It also does not offer 24/7 customer support. At last, the broker previously faced regulatory issues and customer displeasure since been only offshore regulated firm, so the past of the Broker wasnt so bright.

| Advantages | Disadvantages |

|---|

| European license and oversight | No 24/7 customer support |

| FCA regulation | Previous regulatory concerns |

| Availability in the South African region | Under the CySEC entity individual investors are no longer accepted |

| Advanced trading platforms | |

| Competitive fees | |

| Multiple account types | |

| Comprehensive education | |

IronFX Features

IronFX has a comprehensive proposal to cover the needs of different traders. See the key points of trading with IronFX in the table below, including aspects such as the average fees, regulations, account types, available platforms, and more.

IronFX Features in 10 Points

| 🗺️ Regulation | FCA, CySEC, FSCA, Anguilla |

| 🗺️ Account Types | Standard, Premium, VIP, Zero FIXED |

| 🖥 Trading Platforms | MT4, WebTrader |

| 📉 Trading Instruments | Forex, metals, indices, futures, and shares |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP, AUD, JPY, CHF, PLN, CZK |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is IronFX For?

IronFX is a secure broker with advantageous trading conditions. With its diverse services, the broker can become a beneficial choice for many, from beginners to professionals. IronFX is also favorable for various strategies and styles. Based on our financial expert opinion, here is what IronFX is especially suitable for:

- Beginners

- Advanced traders

- Institutional clients

- Currency trading

- Forex Education

- Those who prefer the MT4 platform

- Web traders

- European traders

- Traders from South Africa

- Copy traders

- VPS hosting

IronFX Summary

Overall, we found that IronFX is a broker with over 15 years of operation, with licenses from well-regarded agencies. The broker provides services based on high technologies and advanced tools. With IronFX, traders have access to a selection of financial products. The number of available instruments may vary based on the entity.

The proposal is diverse and covers different needs. The account types offer either a spread or commission-based structure. Besides, spreads can be both fixed and floating. The account opening process is easy, with a minimum $100 deposit requirement. Clients can also practice on a demo account before accessing live trading.

55Brokers Professional Insights

We have carefully reviewed IronFX’s proposal to find that it offers simple solutions combined with advanced features and capabilities that might suit a vast range of traders from day traders to long position holders. Clients can choose from various account types, ranging from standard to zero-fixed accounts, so good diversity is at place, while each account type comes with its unique conditions and possibilities.

Traders who sign up with IronFX will have access to the popular MT4 platform and WebTrader. The good thing about the broker is the availability of additional features and tools that enhance the quality and outcome of trading, so tech traders might enjoy it too.

Also, we see IronFX is with over 17 mil clients worldwide and holds numerous awards which proves its good status, yet in the past, Broker was charged with fines and received many negative reviews from clients, including us as we advised to avoid Broker at all cost. Yet for now as the Broker maintains good licenses and reputation it is considered safe to trade, but be sure to open accounts with only serious entities for extra protection.

Consider Trading with IronFX If:

| IronFX is an excellent Broker for: | - Beginner traders

- Advanced clients

- Traders from the South African region

- European clients

- MT4 platform enthusiasts

- Cost-conscious traders

- Clients looking for an access to a wide range of assets

- Commission-free trading

- Web traders

- VPS hosting

- Copy traders |

Avoid Trading with IronFX If:

| IronFX is not the best for: | - Clients looking for the MT5 platform , cTrader, or TradingView

- Traditional investments

- Traders looking for 24/7 customer support

- Real stock traders |

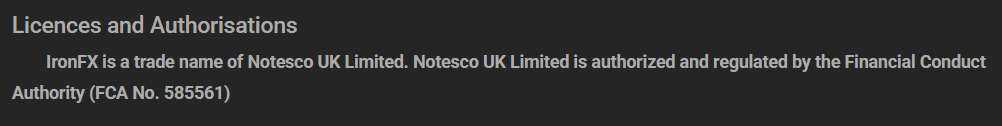

Regulation and Security Measures

Score – 4.6/5

IronFX Regulatory Overview

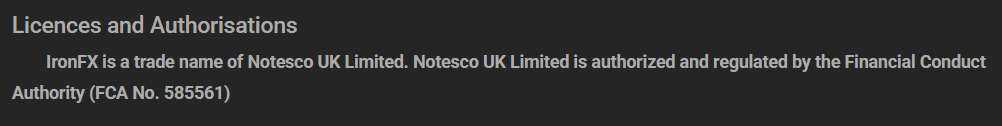

IronFX is an international Forex and CFD broker operating under the Notesco group. IronFX holds multiple licenses across some of the most respected financial jurisdictions. The broker is licensed in the UK by the top-tier FCA, in Cyprus by the CySEC, and South Africa by the well-respected FSCA. This stringent oversight ensures transparency and adherence to certain financial guidelines and rules.

Additionally, we found that the broker operates under Notesco Int. LTD in Anguilla. However, this is an offshore zone and is not regulated by any financial authority. Although the international arm of the broker might offer better conditions, including higher leverage, traders are not protected by any laws.

Thus, opening an account under FCA, CySEC, or FSCA ensures safety and protection.

How Safe is Trading with IronFX?

The broker employs different safety measures to protect its clients’ funds. Based on our findings, European clients are covered by the ICF, with €20,000 coverage in the event of insolvency. Likewise, UK clients are protected by the Financial Services Compensation Scheme, with €85,000 coverage.

- The CySEC, FCA, and FSCA regulations offer negative balance protection.

- At last, clients’ funds are kept in segregated accounts, separated from the broker’s funds.

Consistency and Clarity

We have researched and examined the broker’s development path to estimate its consistency over the years. The broker has strengthened its regulatory standards, acquiring serious licenses from the FCA, CySEC, and FSCA. This ensures safe and reliable trades in the European and South African regions. Yet, at present, the broker notifies its clients that, under the CySEC entity, the broker does not accept individual clients, so we advise checking these too.

However, in the past, the broker was fined for its inconsistency with regulatory rules and received negative feedback from its clients. In fact, for a long time, we listed IronFX as an unregulated broker with suspicious practices.

From our side, we strongly recommend that clients consider the broker’s previous status and market journey, even though for now Broker seems to be good enough, the past is still a matter of concern. Besides, we advise paying attention to the differences in trading conditions between the entities is essential. The international entity does not ensure the same level of protection as the regulated ones, so it is better to consider this difference before opening an account with IronFX.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with IronFX?

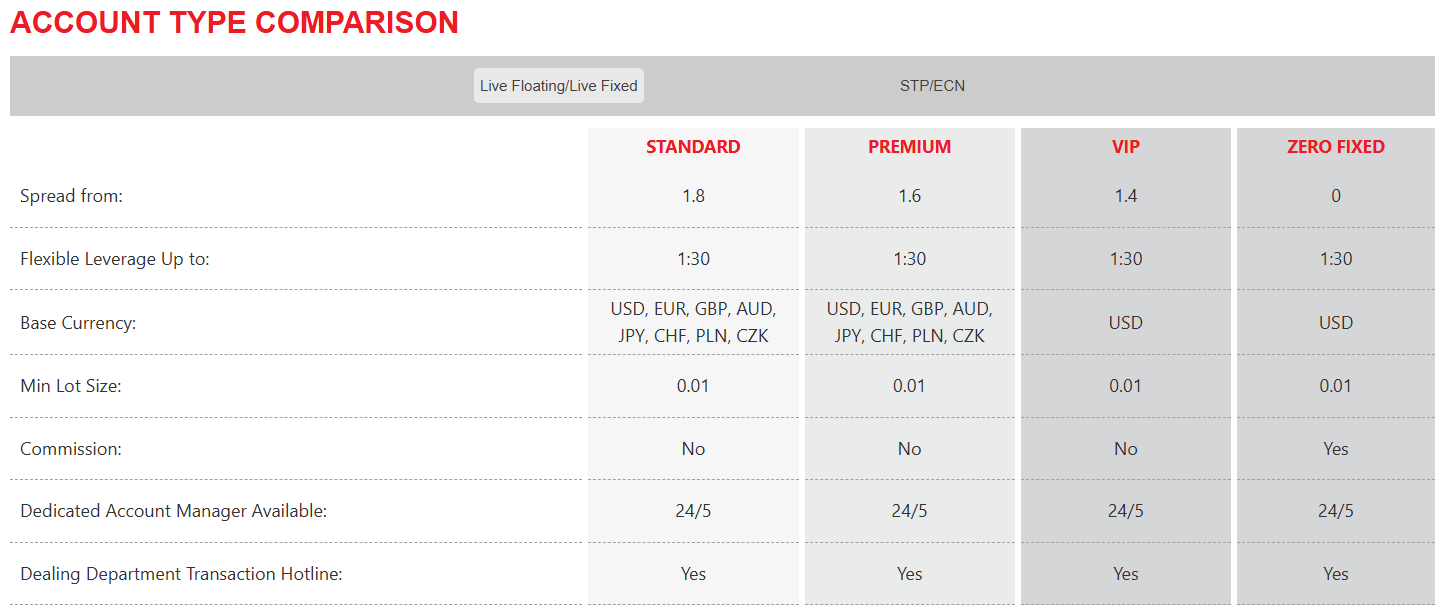

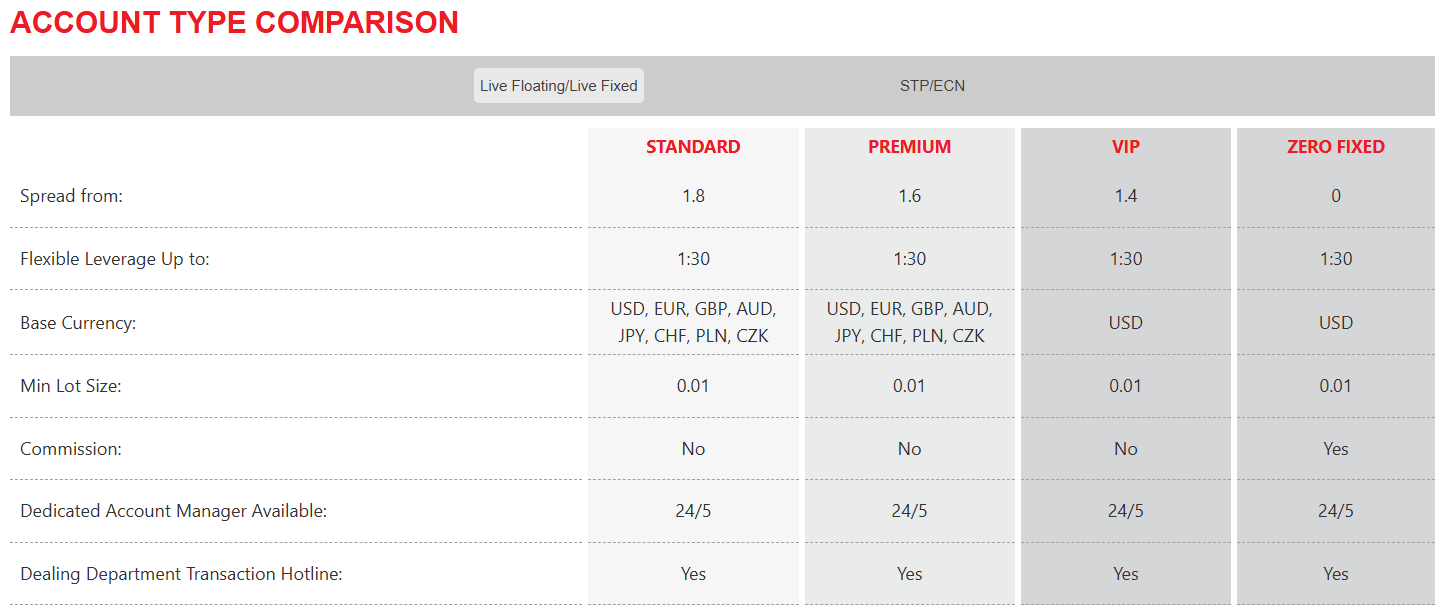

IronFX offers a range of accounts, tailored for different trading needs and experience levels. The account types and conditions may differ based on the jurisdiction. Here we have reviewed the account types available under the UK entity. IronFX offers two categories of account types. Under the first category fall the Standard, Premium, VIP, and Zero FIXED accounts.

IronFX also offers STP/ECN accounts, including No Commission, Zero Spread, and Absolute Zero accounts. Each account offers a different fee structure and conditions. The No Commission account applies spreads of 1.7 pips with no additional commissions. On the contrary, opening an Absolute Zero account, clients do not face any spreads and only pay the fixed commissions.

- The Standard account is a commission-free account, with spreads starting from 1.8 pips. Trades are conducted on the MT4 platform and WebTrader. The Standard account is a suitable option for beginner traders with a $100 initial deposit. The available leverage level is up to 1:30 for the UK jurisdiction. Other entities offer a higher leverage of up to 1:1000.

- The Premium account is another spread-based account with no additional transaction fees. For this account type, the average spread is lower, starting at 1.6 pips. The account will be a good match for intermediate traders looking for reasonable conditions. The deposit requirement is higher, starting from $1,000. This account type ensures a balance between cost-effectiveness and competitive conditions.

- For professional and institutional clients, IronFX offers the VIP account. The VIP account has higher trading volumes and requires a high initial deposit of $10,000. The spreads are tight, on average 1.6 pips. VIP account users can access the VIP Trading Room and benefit from in-depth market analysis.

- The Zero FIXED account offers fixed commissions, with no spreads, allowing complete predictability of costs. This account type is suitable for scalpers and high-frequency traders.

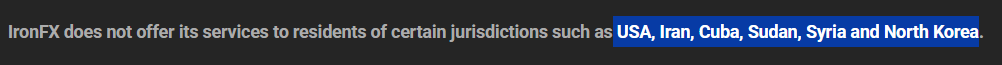

Regions Where IronFX is Restricted

As we have already mentioned, IronFX is available in over 190 countries, ensuring its global reach and availability. However, there are still restricted regions and countries where the broker’s services are unavailable. The restrictions may vary based on the jurisdiction under which the account is registered.

IronFX does not offer its services to the residents of the following countries:

- USA

- Iran

- Cuba

- Sudan

- Syria

- North Korea

Cost Structure and Fees

Score – 4.4/5

IronFX Brokerage Fees

IronFX’s trading fees are defined based on two main factors: the entity and the trading account. Overall, the broker’s trading costs are competitive and mostly in line with the market average. IronFX offers tighter spreads for certain account types and reasonable commissions for the commission-based accounts. The offering is transparent and clear, introducing spreads for each instrument.

As we have found, IronFX has two distinct fee structures: spread- and commission-based. The Standard, Premium, VIP, No Commission, and Absolute Zero accounts have a spread-based structure. The typical average spread for the popular EUR/USD pair is 1.2 pips. For Gold, the average spread is 0.15 pips. Spreads for the Absolute Zero account are as low as 0.3 pips, with no additional transaction fees.

IronFX offers two commission-based accounts: Zero Fixed and Zero Spread. For both accounts, there are no spreads. The commission is $18 per round per lot. Although there are no spreads, the offered commission is higher than the market average.

How Competitive Are IronFX Fees?

The most essential benefit of IronFX fees is the transparency and clarity of the offering. Clients can easily find the spread information on each instrument, based on the account type. This enables traders to calculate the costs even before opening an account with IronFX.

Whereas spreads are in line with the market standards, IronFX’s commissions are higher than the common commissions. This might be challenging for some clients; however, the commission-based accounts are for more experienced traders who prioritize fixed transaction fees and low or no spreads.

When it comes to the broker’s trading costs, clients should remember to check the differences between entities and make sure they have chosen the right jurisdiction for account opening.

| Asset/ Pair | IronFX Spreads | TD Markets Spreads | iFOREX spreads |

|---|

| EUR USD Spread | 1.2 pips | 1.8 pips | 1.2 pips |

| Crude Oil WTI Spread | - | 2 | 3.2 |

| Gold Spread | 0.5 | 8 | 35 |

IronFX Additional Fees

Based on our research into the broker’s additional fees, IronFX does not charge deposit fees for any of its funding methods. However, some methods might incur transaction fees.

- When clients request withdrawals without placing any trades after the deposit, the broker applies a 3% fee.

Score – 4.3/5

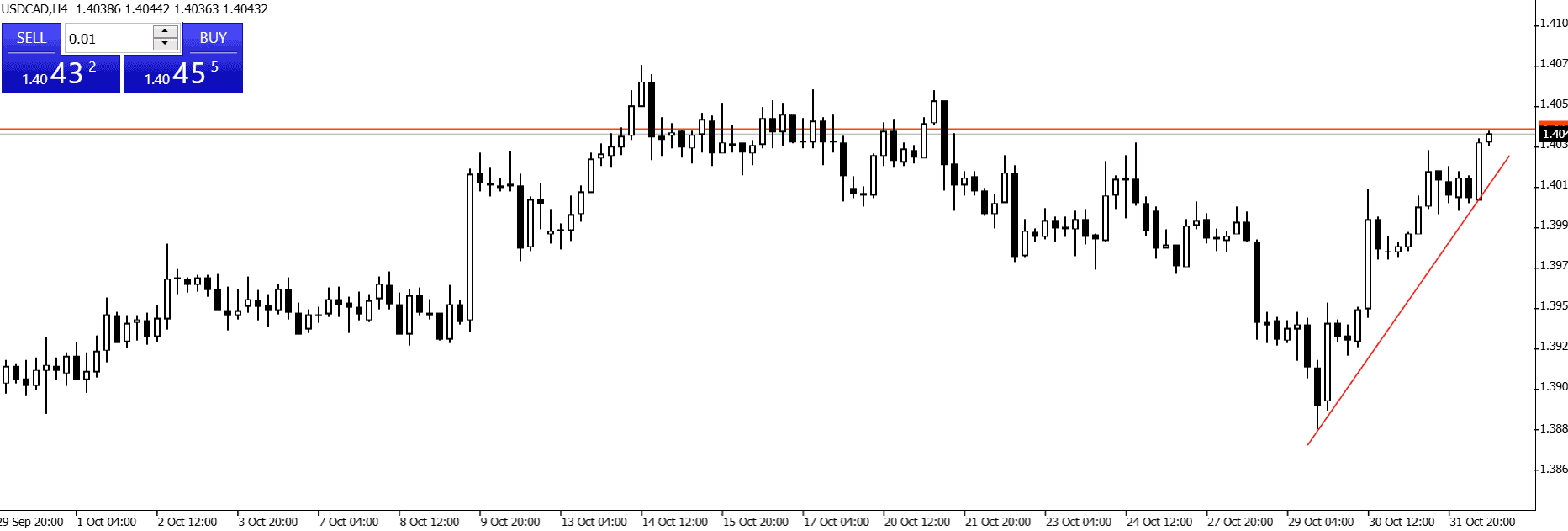

With IronFX, clients can access the popular MT4 platform and WebTrader. The platforms ensure ease of use, combined with extensive tools and capabilities. The platforms offer advanced charting, customized indicators, and a wide range of instruments. The MT4 platform is available in web, desktop, and mobile versions.

| Platforms | IronFX Platforms | TD Markets Platforms | iFOREX Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platform | No | No | Yes |

| Mobile Platform | Yes | Yes | Yes |

Web Platform

The MT4 webtrader enables clients to access the market from any web browser. This is a flexible and easy way to sign in to your account without needing any downloads or installations. The advantage of the web platform is that it allows all the essential tools and features available through desktop platforms. The synchronization between the platforms ensures an easy transition from one platform to the other. The brokers’ easy-to-use platform is suitable for beginners who prioritize simplicity, combined with favorable conditions

IronFX Desktop MetaTrader 4 Platform

The MT4 platform is one of the most demanded and popular choices among traders. The IronFX MT4 platform ensures access to financial assets with incredible efficiency and speed. Clients can benefit from the easy-to-use platform, customizable features, and in-depth analytical tools.

Along with advanced tools and capabilities, the platform also ensures the safety and transparency of trades. Due to the availability of the platform through desktop, web, and mobile versions, IronFX clients can enjoy trading in the most flexible and suitable version for them.

IronFX Desktop MetaTrader 5 Platform

The MT5 is one of the most powerful platforms in the market, ensuring access to professional-level trading. It allows traders more opportunities and efficient trades through advanced and enhanced opportunities. MT5 platform enthusiasts will not find what they are looking for with IronFX, as the broker offers only the MT4 platform and WebTrader.

IronFX MobileTrader App

The broker does not have its own proprietary app, but clients are welcome to use the MT4 app. Trades through the mobile app enable clients to follow their positions at all times and not miss essential opportunities on the go. The mobile app does not limit clients by providing all the significant tools and features for an efficient trading experience. The platform supports one-click trading, charts and graphs, and trading indicators, which make it an ideal tool for fast-paced environments.

Main Insights from Testing

We have tested the broker’s available platforms and the included tools and features to see how they align with overall market expectations and if they are enough for a positive trading experience. Based on the research, we estimate the broker’s platforms to be useful and easy to use, packed with the most essential tools. Although the broker does not offer the more advanced MT5 version or other more professional platforms, such as cTrader and TradingView, the offering will meet different expectations and satisfy many traders, from desktop traders to mobile ones.

AI Trading

There are no built-in AI-powered features offered by IronFX. Of course, IronFX enables Expert Advisors to automate trades, but it does not provide full AI solutions.

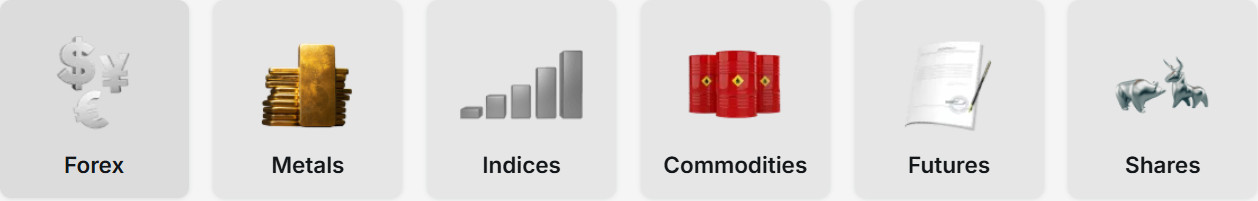

Trading Instruments

Score – 4.4/5

What Can You Trade on the IronFX Platform?

The overall number of 500 tradable products across Forex, metals, indices, futures, and shares enables clients a rather good diversity to expand their portfolios. The available instruments come with average trading costs and good market conditions. The products are on a CFD basis, which means that IronFX’s clients cannot engage in long-term investments and can rather profit from short-term trading.

Main Insights from Exploring IronFX Tradable Assets

Our research revealed an attractive number of 80 Forex pairs, which will appeal to currency traders. Clients of IronFX can also access metals, including gold, silver, platinum, and palladium. The broker’s Index CFDs offering enables traders to participate in the international market and make profits from both short and long positions. IronFX also includes futures trading across a list of products with attractive conditions.

However, the conditions and product availability may differ based on the jurisdiction. It is essential to check and ensure the proposal meets your expectations before opening an account under a certain entity.

Leverage Options at IronFX

Leverage is mostly a beneficial tool for traders, enabling them to enter the market with a smaller initial investment. However, leverage has associated risks that can lead to substantial losses. Understanding the essence and usage of leverage is essential to prevent unnecessary risks.

IronFX leverage is determined by CySEC, FCA, and FSCA regulations:

- UK, European, and South African clients can use a maximum of 1:30 leverage ratio for major currency pairs.

- The offshore entity enables the usage of up to 1:1000 leverage.

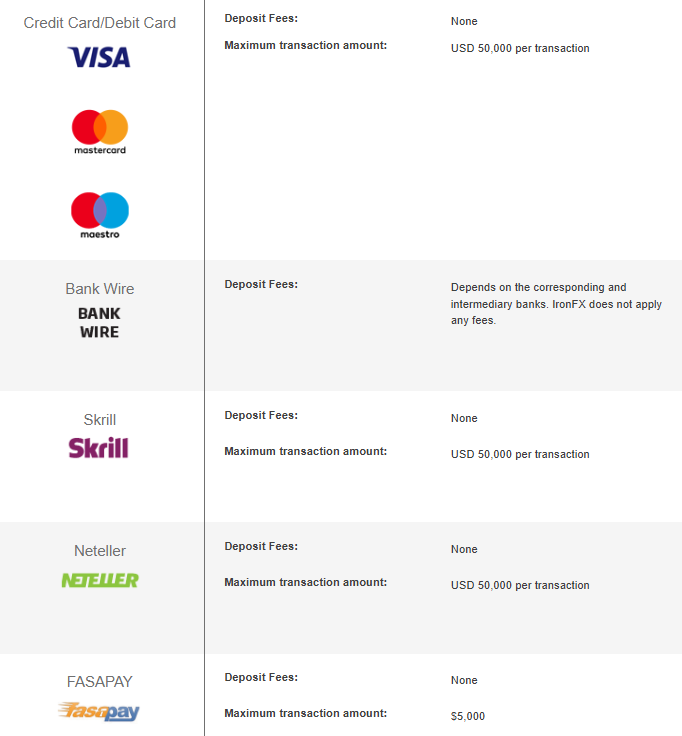

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at IronFX

IronFX is an international broker, and as a true global company, it ensures that its clients from all over the world deposit and withdraw their funds with maximum ease. As we have found, there are no transaction fees for deposits. For the bank transfers, there might be fees incurred by the provider. The maximum transaction amount for all the available methods is $50,000.

Based on our research of the available deposit methods, IronFX’s funding methods include:

- Bank wires

- Credit/debit cards

- Skrill

- Neteller

- FasaPay

Minimum Deposit

IronFX meets the trading expectations of diverse clients by offering various account types tailored carefully for different needs. The minimum deposit for the broker’s Standard account is $100, which is an average requirement and can be suitable even for cost-conscious traders.

Withdrawal Options at IronFX

IronFX clients must use the same funding method for withdrawals as for deposits. The broker offers bank transfers, credit/debit cards, and e-wallets for withdrawals. Based on our testing, e-wallets provide the fastest withdrawals, usually within a day. As to the other methods, the processing time is from 2 to 5 working days.

- However, we have found some negative feedback regarding the broker’s withdrawals; thus, clients should consider what real traders share about their experience with the broker.

Customer Support and Responsiveness

Score – 4.6/5

Testing IronFX Customer Support

Based on our research, IronFX can be reached by its clients 24/5. The broker provides quick and detailed answers to its clients’ questions and concerns. Clients can contact IronFX through email, live chat, phone lines, or write a message right from the broker’s website.

- The broker also provides an FAQ section where traders can find answers to the most common trading-related questions.

- The broker is also active on social media, sharing market news and company developments on LinkedIn, X, Telegram, TikTok, YouTube, Instagram, and Facebook.

Contacts IronFX

IronFX provides multilingual customer support available in 20 languages. Traders have access to support 24/5 via multiple channels.

- One of the most efficient ways to communicate with the team and get quick and on-point answers and solutions is the live chat.

- IronFX is also responsive through email. It is essential to choose the relevant email address based on the entity: Support@ironfx.co.uk.

- Clients can also communicate with the broker’s support team by using the provided phone number: +44 (0) 207 416 6670. For many clients, this is the most efficient option.

Research and Education

Score – 4.5/5

Research Tools IronFX

The broker offers impressive research and education sections that include essential tools and resources to support traders in their trading and learning journey.

In addition to the research features available on the IronFX trading platforms, the broker offers extra features for better research and analysis.

- IronFX provides an economic calendar to help its clients stay informed about the upcoming market events and make decisions based on them.

- Trading Psychology, which explains in detail what psychology is in trading, the emotional aspects of trading, and guidance on how to prevent falling into the trap of emotions.

- Financial news is another important source to consider when traders want to predict the market movement. IronFX provides the most up-to-date news to stay informed.

Education

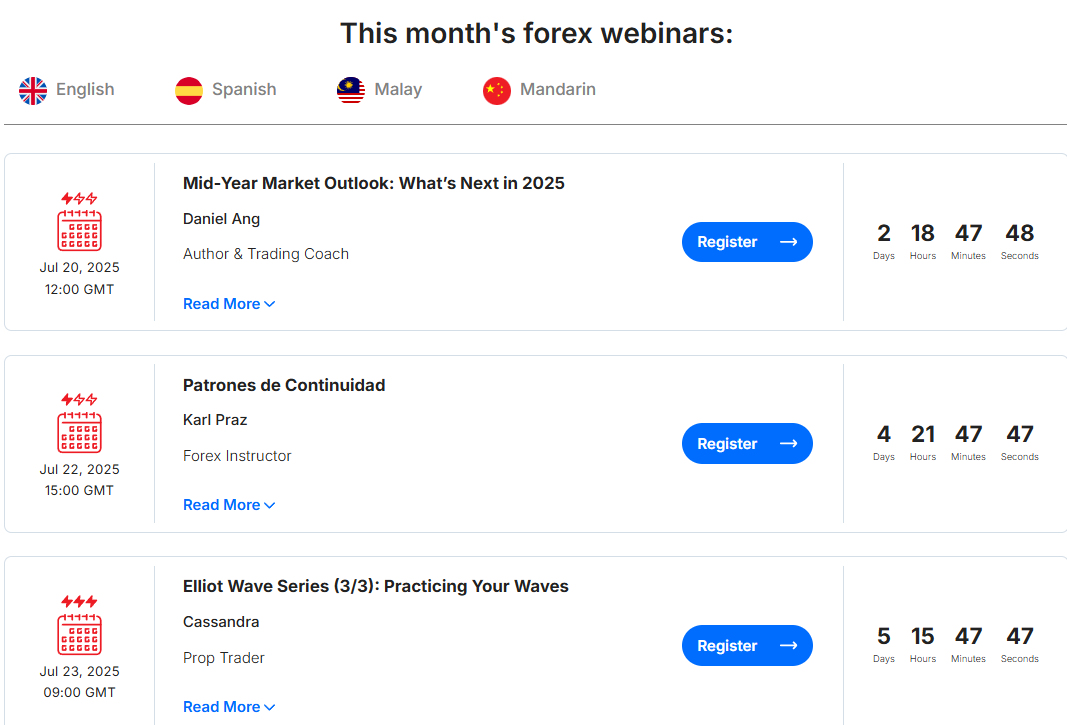

IronFX stands out for its excellent educational resources, ensuring that every client benefits from the available materials.

- IronFX organizes webinars and seminars on various financial topics, boosting their clients’ knowledge and skills in the field.

- Trading courses include various educational videos to guide the clients and share with them substantial trading knowledge and secrets.

- The trading glossary is another essential tool when it comes to beginner traders. Novice traders are often overwhelmed by the intricate financial terms and can easily be confused by them. The glossary explains all the professional terms in a comprehensive language.

- The VIP room is for VIP clients, providing them with unique educational resources and opportunities.

Is IronFX a Good Broker for Beginners?

IronFX has tailored its services to meet various trading needs, from simple to more professional. Beginner traders can consider IronFX as a good option for a successful start. With the favorable and competitive trading conditions, demo account availability, and access to a selection of great educational and research tools, IronFX guides its beginner traders towards success. The minimum funding is $100, which is not considered high based on the market standards. The MT4 account ensures clients trade through an easy-to-use yet simple platform with extensive tools for in-depth analysis.

In conclusion, we consider IronFX a favorable trading choice for novice traders who seek efficiency, accessibility, and transparency.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options IronFX

IronFX offers over 500 tradable products across 6 financial assets. This number of instruments ensures diversity and further exposure to the market. IronFX stands out for its extensive range of currencies, with over 80 Forex pairs. Yet, the products are based on CFDs, which means clients cannot engage in long-term trading and traditional investments.

- IronFX also offers alternative investment options, including the PMAM accounts and the Trade Copier. These features provide easy and simple investment opportunities for traders to expand their market exposure and benefit without actively managing trades.

Account Opening

Score – 4.6/5

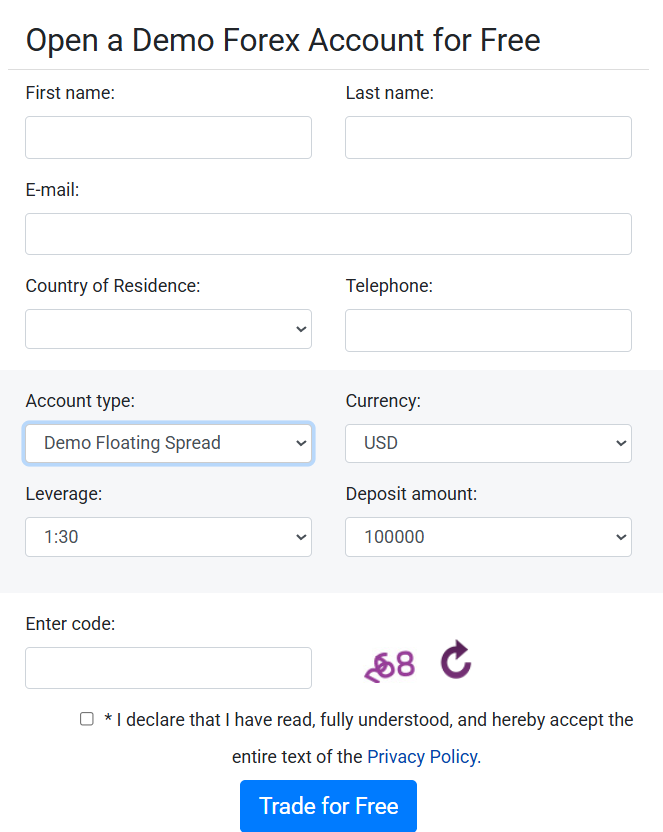

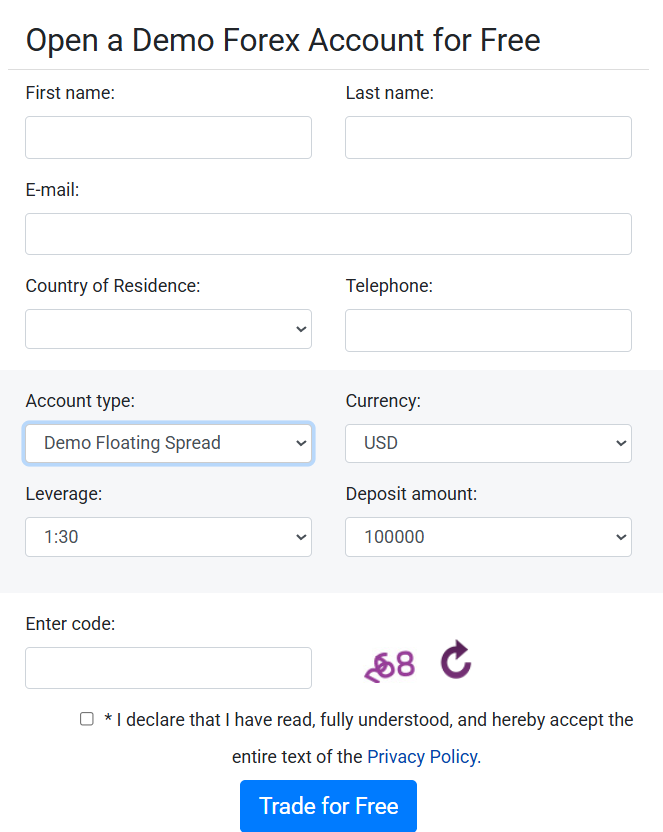

How to Open an IronFX Demo Account?

The IronFX’s demo account is ideal for those who want to enhance their trading skills in a risk-free environment and only after that start trading with real money. To do so, the broker’s clients can follow the steps below:

- Visit the broker’s website and click on the ‘Open a demo account’ button.

- Fill out the registration form (name, email, address, phone number, and country of residence).

- Also, select the leverage, spread type, the virtual balance amount, and currency.

- Submit the form and receive the account credentials through email.

- Download the platform, and use the credentials sent to your email to enter your demo account.

- Start practicing.

How to Open an IronFX Live Account?

To open an IronFX account, traders will undergo three quick registration phases. Here are the detailed steps to follow:

- Go to the broker’s website and click on the ‘Start trading’.

- Fill out the personal details and submit the form.

- Verify your identity by submitting a Government-issued ID, proof of address, etc.

- As soon as your account is verified, the confirmation email will be sent to the provided address.

- Download the platform, and log in by using your account credentials.

- Fund your account and start trading.

Score – 4.2/5

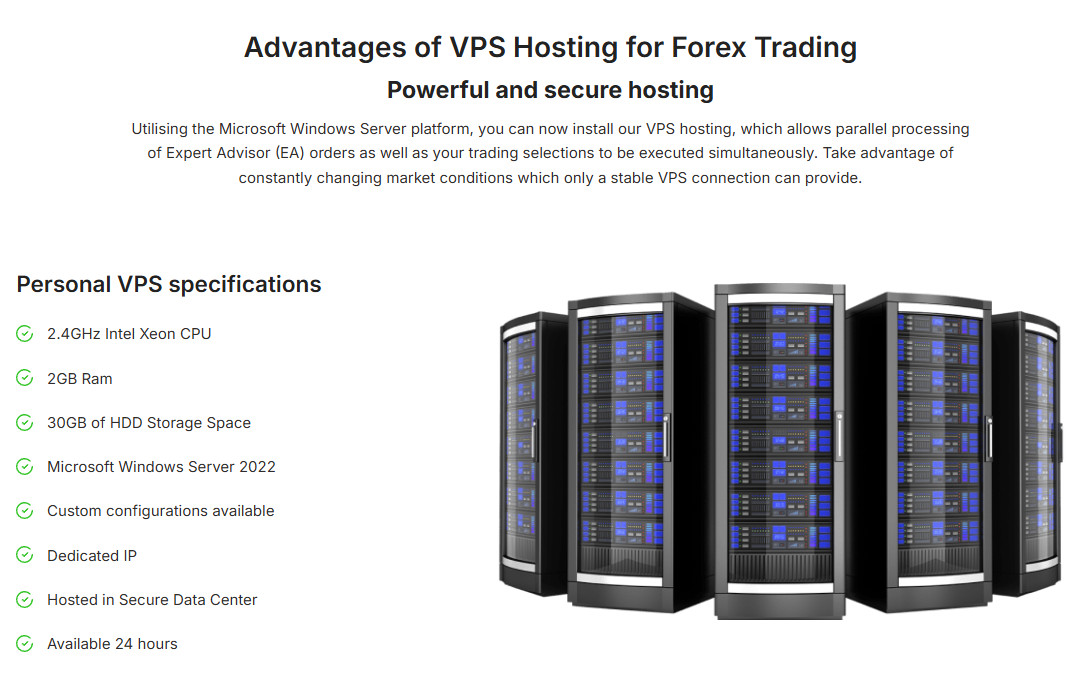

IronFX also stands out for its additional features and opportunities. Besides the already well-equipped platforms, the broker’s clients have access to the following:

- VPS Hosting is available for new and existing clients with minimum deposits of $5,000. The VPS hosting ensures access to enhanced conditions.

- The Personal Multi-Account Manager enables clients to trade and manage multiple MT4 accounts simultaneously. With the PMAM account, traders can trade, place orders, monitor prices, and trade with ease and free of stress.

- A trade copier allows traders to replicate the successful trades of professional traders. It is especially ideal for novice traders or those who don’t want to spend time on monitoring the market.

IronFX Compared to Other Brokers

When we compare IronFX to similar brokers, we see that IronFX mostly offers favorable trading conditions and reasonable costs.

Initially, we compared the brokers based on their regulatory oversight. IronFX holds licenses from the FCA, CySEC, and FSCA. On the contrary, MarketsVox is only regulated by the FSA, which does not provide the same level of protection as top-tier authorities.

IronFX offers competitive and transparent trading costs, with an average of 1.2 spreads. The commissions, however, are higher than the market standard. Other brokers we compared to IronFX offer lower spreads of 0.5 pips (CMC Markets) and 0.1 pips (MarketsVox). With IronFX, trades are conducted on the MT4 platform via desktop, web, and mobile app, and WebTrader. It does not offer the more advanced MT5 platform, like Fusion Markets and Accuindex.

The instruments available with IronFX are more than 500. Although this is a favorable number, brokers like Saxo Bank (71,000+) and CMC Markets (12,000+) offer an extensive range of instruments. The education section of IronFX stands out for its extensive materials, including webinars, seminars, courses, and videos. The minimum deposit for IronFX is $100. Yet, Fusion Markets and Saxo Bank do not require an initial deposit.

| Parameter |

IronFX |

Fusion Markets |

Saxo Bank |

City Index |

MarketsVox |

CMC Markets |

Accuindex |

| Spread-Based Account |

Average 1.2 pips |

Average 0.92 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 0.1 pips |

Average 0.5 pips |

Average 1.5 pips |

| Commission-Based Account |

0.0 pips + $5 |

0.0 pips + $2.25 per side |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + $3 per side |

0.0 pips + $2.50 |

0.0 pips + $2.5 per side |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, WebTrader |

MT4, MT5, cTrader, TradingView, DupliTrade, Fusion+ |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT5 |

CMC Markets Next Generation Web Platform, MT4 |

MT5, WebTrader |

| Asset Variety |

500+ instruments |

250+ instruments |

71,000+ instruments |

13,500+ instruments |

100+ instruments |

12,000+ instruments |

300+ instruments |

| Regulation |

FCA, CySEC, FSCA, Anguilla |

ASIC, VFSC, FSA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FSA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

ASIC, VFSC, FSA |

| Customer Support |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/7 |

| Educational Resources |

Excellent |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$100 |

$0 |

$0 |

$0 |

$100 |

$0 |

$100 |

Full Review of Broker IronFX

We have reviewed all aspects of trading with IronFX and came since IronFX now holds licenses from some of the best-regarded authorities in the financial field: FCA, CySEC, and FSCA it is considered safe choice. Although in the past we blacklisted Broker due to certain regulatory noncompliance and negative feedback from clients with recognition as an unregulated broker with malpractices, IronFX has enhanced its proposal now and operates under strict laws which is a good sign to trust IronFX again. Besides, the broker is available in over 190 countries and serves clients globally. However, holding multiple entities can lead to differences in conditions based on the jurisdiction.

IronFX includes over 500 tradable products across six financial assets, ensuring good diversification. The broker’s instruments are based on CFDs, which makes the offering suitable for shorter-term trades. However, clients can also benefit from the TradeCopier and IronFX Personal Multi Account Manager (PMAM) platform. This is how clients can benefit from alternative investments with IronFX.

The broker also offers various tools and features, in-depth research tools, and a comprehensive educational section.

The account types are tailored to meet diverse needs, with floating and fixed spreads. Clients can choose from the available options to reach the best outcome. The minimum deposit for the Standard account is $100.

Share this article [addtoany url="https://55brokers.com/ironfx-review/" title="IronFX"]

The spread on eurusd is always around 1 pip, which is okay i think

تعد أكاديمية IronFX التعليمية المكان الذي تعلمت فيه كثير من إستراتيجيات وحيل التداول الجديدة. وقد ساعدتني في تغيير عقليتي النفسية، ويعد ذلك أحد أهم المهارات اللازمة لتحقيق صفقات ناجحة. وأتذكر جيدًا كيف كنت أبالغ في التفكير في الفرص الواضحة. وأبحث عن أسباب لعدم الدخول في الصفقة. ولكن لحسن الحظ، وجهني المرشدون نحو المسار الصحيح، حيث بدأت في التعامل مع تقلبات السوق والأخبار الاقتصادية بأسلوب أكثر بساطة. فليس هناك داعٍ للاعتقاد بأن فئة معينة من المتداولين هي فقط من يربح. إذ يمكن لأي شخص تحقيق ذلك إذا كان يتمتع بنظام تداول وعقلية صحيحة. ولا أخفي عليكم أنني أستفيد أحيانًا من ‘غرفة التداول لكبار العملاء’ الخاصة بهذا الوسيط.

لقد كان فريق الدعم الفني متميزًا طوال الوقت، حيث يتسم بالسرعة في التفاعل والاستجابة الدائمة؛ ومن ثمَّ، فإنني أقدر ذلك كثيرًا!

15 years in the business speaks volumes, they have a reputation alright!

في واقع الأمر، كنت أود حقًا أن يعمل فريق خدمة العملاء على مدار 24/7 بدلاً من 24/5 فقط. إذ لا أدري لماذا، ولكن تظهر معظم تساؤلاتي خلال عطلة نهاية الأسبوع تحديدًا… أما فيما يتعلق بجانب التداول، فلا أرى حاجة لأية تحسينات؛ حيث إن الأداء جيد للغاية.

لقد استخدمت هذه المنصة لفترة طويلة بما يكفي لتقييم إيجابياتها وسلبياتها. ومن الجلي بالنسبة لي أن الإيجابيات تفوق السلبيات، وإلا لما استمررت في التداول مع جهة سيئة. ومن ناحية أخرى، فإن منصة MT4 تقوم بمهمتها على أكمل وجه كمنصة تنفيذ. إذ أستخدمها فقط لفتح الصفقات وإغلاقها، ولا أشترك في التذمر المعتاد حول “موعد ترقيتها إلى MT5”. أما بخصوص عمليات السحب، فهي تتم بسرعة، وإن كانت العملية الأولى هي الأطول كالعادة

I’ve never used VIP analytics before, it was my first time to pay for these materials. Their trading team is doing a great job in providing precise info about all markets. It saves me a lot of time.

صحيح، يعد هيكل الحسابات من أبرز نقاط القوة لديهم؛ حيث إن خياري المفضل هو حساب Raw ECN، والذي أتداول من خلاله الذهب دون أية مشكلات تذكر

لست متأكدًا من سبب منحهم 4.5 لأنواع الحسابات؛ ربما لأن بعض المتداولين يريدون مزيد من الحسابات أو يفضلون حسابًا أساسيًا واحدًا فقط

I had certain concerns about their status too, until I faced the broker myself, successfully executing some reasonable trading volume and getting it withdrawn next. No troubles and this is enough to stay here. While, the biggest benefit, dealing with this broker was their educational section of course, vip room. Talks with real prop traders, were especially valuable, bringing my trading new level

all safe to me, I trade xau/usd, pretty normal spreads and swaps

لماذا لا يتحدث أحد عن مدى أهمية وجود دعم فني موثوق. لحسن الحظ، قام فريق دعم IronFX بعمل ممتاز في مساعدتي خلال مرحلة بدء الاستخدام. حيث قدّموا لي نصائح وأدلة إرشادية واضحة، أحسنتُم

لم أكن أعلم حتى أن هذا الوسيط خاضع لتنظيم هيئة السلوك المالي البريطانية (FCA). ولكنني كنتُ واثقًا من بنيتهم التحتية المتطورة، ومن أن الانطباعات والتعليقات حولهم ليست سيئة، مما جعلني أثق بهم. لديهم بالتأكيد ما يقدّمونه في مجال تداول الفوركس، بدءًا من مجموعة واسعة من حسابات التداول، وصولًا إلى أدوات قوية للتداول الآلي مثل VPS، ومستشاري MT4 الآليين (EAs)، والمؤشرات المخصّصة.

عمليات السحب جيدة حتى الآن. ولا توجد عوائق للحصول على أرباحك.

لقد اخترت حساب فروقات سعرية ثابتة معتقدًا أنه يحتوي على تكاليف تداول ثابتة. ويبدو أنه نوع حساب أفضل بكثير، ولم يقدمه العديد من الوسطاء الآخرين. حيث يمكنني التداول أينما أريد وحساب أرباحي بقيمة فروقات سعرية ثابتة. لا أقول أنني أصبحت مستقرًا، ولكن وجود بيئة تداول شفافة كهذه، يحول تركيزي إلى التداول نفسه، وليس خوض “حروب” مع الوسطاء

لقد تواجدوا في السوق لأكثر من 15 عامًا، وهذا بحد ذاته دليل قوي لا يقبل الشك على أن الوسيط موثوق وشرعي. بالإضافة إلى ذلك، يتمتع وسيط IronFX بسمعة ممتازة بين المتداولين، خاصة بين المبتدئين. وتعتبر أكاديمية التداول الخاصة تُعدّ واحدة من الأفضل في هذا المجال.

I like how it is summarised for whom the IronFX platform can work, and what traders would avoid it. This is pretty much an objective concussion and corresponds with what I think about the broker. Yes, many think that this is best fit for new traders due to their excellent educational resources, but it can work for traders with a bit more experience in trading who like to cut the costs. The standard acc i use and can say the spreads are pretty good. Also i have great xp with withdrawals, i exceeded the initial deposited amount of $1000 and work well even when using wire transfer

This 4.3 for platforms and instruments is a bit suspicious… should be lower. For it to be 4+ they need to add mt5.

the rest is pretty accurate, broker is okay.

You briefly mention the trading terms, but want to underline that the terms on indices, the instruments in trade are excellent compared to some other brokers.

IronFX is a long-standing broker, so no wonder why they offer so many payment options, even cryptos. I used it for transferring through usdt, no issues, it was lighting-fast.

About the transfers… here is where good brokers distinguish from the average ones,, and ironfx is doing a really good job when it comes to transfers. All my withdrawals were processed without issues!

2 months and I’m already making good ones. Thanks for the webinars, I’m gonna give credit to them!

Tested the platform by the refund withdrawal. Worked. Btw good to have those 1.2 fixed spread

On major fx pairs during peak hours (the EUR/USD, GBP/USD I trade mostly) spreads are super competitive, not worse than most Ive tried for sure. I like to trade when London-NY overlap, specifically. Service quality is ok, Id say definitely shows its age, but thats not a bad thing. Most more modern ones are wearing off into a bad direction anyway.

Seems ordinary but support is not. I don’t mean only technical, analytical help was solid too,,

You guys say that the average spread is 1.2 pips? I’m trading on a raw account, and spreads are almost non-existent. They are at 0, since that’s a raw account, the commissions are taken though. Anyway, they are really small and doesn’t make trading conditions worse, only better compared to standard accounts.

spreads are even lower than stated in the review for me. on EUR/USD they dip as low as ~0.5 pips (sometimes lower). My account isnt even vip or elite, so I think its normal.

Got a dissonance… Tons of advantages, regulated broker, rich history – “is its safe to trade – no”. Guys, have you mixed things up or what?

I daily trade on this platform and has no complaints about my experience whatsoever. I don’t label the broker as the leader of the industry, but everything’s not so bad as you have pointed.

Whenever I notice ironfx somewhere in the net, I have positive emotions. Like, it was the broker that showed me what real brokerage company should look like.

There’s an attractive combination of modern trading instruments and pleasant attitude. I chit chatted with their customer support a lot of times, agents always described me the peculiarities of this or that feature on the platform. I even wanted to start partnering with the broker alongside with classical trading, but decided to refrain. I’d rather go for skills development in trading, than trying to kill two birds with one stone.

When someone I know or a random person on internet asks me about my broker I trade with, they wonder what kind of company IronFx is and why I chose it.

I answer in different ways. I listed trading conditions and explained that it has tools I need. But some time ago I came up with a simple formula.

I just say that this broker since 2011 almost every year receives awards in international prestigious competitions.

Company doesn’t just have quality or favorable conditions, this broker competes with other companies and often wins.

I think this is enough to describe this company.

My ironfx review will be positive, cuz I can’t dare say something bad about my primary broker 😀

Just a joke, of course, I know all the weaknesses and vulnerabilities of the platform, but in this review I would like to focus on the strengths, of course.

Undoubtedly, their account types system is a big strength. It caters to the needs of all traders, even beginning ones. Leverage is very high and that’s a plus for those who enter trading with minimum allowed sums. But, don’t forget to watch out!!

Additionally, the fact that there’s copy trading functionality is also appealing.

Let me write myopinion about trading conditions, tools and financial instruments that are available on this broker’s platform.

1. trading conditions regardless of the chosen account type are favorable. And peculiarities of account types allow to customize these conditions more accurately.

2. The set of financial instruments is quite large.

3. Platform is popular among many traders for a reasn.

Interesting review, but I got used to testing all the companies I am interested in with my own hands. Because oftentimes what is not appropriate for others is very appropriate for me.

The article underlines strongest features of the platform and at the same time makes a conclusion to avoid the broker.

I see some traders are confused about this thing too, lol. That is the reason why it’s important to read everything carefully, as sometimes, disregarding this rule leads to a spoiled impression of the platform.

Strange review to be honest. I don;t think that Ionfx deserves one star.

I’m not saying that this is the best broker ever, but one star?

It is said that Ironfx was listed on September of 2018 but I think that the broker is way more experienced than that.

At least I heard that it was established in the 2010 or something. Maybe i misunderstood it and it’s the date of the review.

But my point is that Ironfx is a pretty old company for a forex broker. Which is an advantage in and of itself. Cuz to withstand all the economic turmoils is a challenge on its own.

Ironfx is simply an outstanding platform. I say this because they offer a lot more tools than any other broker I have used in the past. Whatever your trading style is… the broker has probably got the tools for ya.

But let us consider the account types. Which one do you thing is the right balance?

I couldn’t make up my mind about whether to share my opinion on this broker or not, but noticed that many folks around there doing it, so probably it will come in handy for some fellow traders.

Overall impression is positive, of course. The company has a rather loud name in the industry as it ensures pleasant trading atmosphere and all required instruments such as tools for analysis, some ancillary instruments and robust trading platform which is enviable from the technical point.

I don’t even have something to pick on, cuz I didn’t have any objective to do that. Everything looks amiable.

I can’t say that this brokerage company is unsafe only because I am myself as trader on this platform for a couple of months straight. I don’t exclude that I questioned the legitimacy of broker initially, but after I found out which licenses it had, after I tested the system of depositing and withdrawing, I decided to start trusting it. Like… Everything was okay, why bother then?

So, if you know that the company fully corresponds to your demands in terms of reliability, then don’t pay attention to such articles.

The Ironfx broker has many advantages contrary to what the article says. And the broker is safe to use as well. Just head over to the website and explore for yourself.

I read carefully the “Our Review” and “IronFx User Reviews” tabs.

Very contradictory!

The vast majority of user reviews do not agree with your review of this broker.

The major red flag about your review is the fact that you have mentioned their licences and made a conclusion that this broker is not licensed properly 🙂

While I could understand if the contradiction is something about the trading terms, which we see subjectively and we can argue about it, for such an important aspect as regulation and licences I think there is no room for being subjective.

Hmm… apparently so far Ironfx is the best thing that happened to me in this forex trading business.

After a couple of failures I finally found something worthy.

Well, I guess that’s what every trader has to go through. I wonder if it’s a broker for long -term trading or more for short term?

There is a unique combination of favorable features and advantages going on in favor of traders here. From spreads to assets, academy and the VIP room is very beneficial. They also do their quarterly market trends, out of which you can do cross-industry trades with their respective hedging in your book. I think its awesome that these services are provided and what you need is to cop them if you want to make a killing in 2024.

That is absolutely nothing objective. I didn’t see any redflags with IronFx when I was looking for a broker and came across information about the broker. I didn’t see anything disturbing either after I factually opened account and traded with them. Theyve been operating for more than ten years apparently, got various regulationary licenses, a pristine reputation amongst traders and not a single bad stain attached to them. Coolzies bruh.

ironfx has so many layers inside of their platform, they are by no means an ordinary platform. because, there is so much to do here more than just trading. i personally love to hang out with the educational materials and i love their academy. it’s specially designed platform for all kinds of traders and moreover it is very customizable for oyu.

love reading? there is a ton to read. love to hear? there are audio material, love to watch? there are video materials! the important thing is youll never be bored here and every second you spend here will be worth it and can come back to you in profits

I was expecting to read some useful tips or learn something more about IronFx, but was disappointed to see a bunch of nonsense in this review. I am sorry, but if a not so much experienced trader like me can easily find out the regulation licence of IronFx, how the author of this article could not find their regulation and publish a review in which he highlights that this broker is non-regulated? I don’t understand.

It’s hard to say about Ironfx that it’s non compliant. On the contrary, this company has several branches under several regulations. So this comment doesn’t hold the water for me.

This broker has become my primary one not a very long time ago, but I am ready to evaluate it objectively.

I admire working with Ironfx because it has a fast trading platform, th customer support team is available and waiting for your inquiry, as well as leverage is quite high that opens a lot of opportunities for me.

I don’t exclude that there’s something other guys won’t like, but anyway.

ROFL. The article describes almost all the licenses the company has and then make a conclusion like it’s not safe to trade with the Ironfx broker. A kind of discrepancy happened, a’ight?

So, the broker is allowed toprovide services in the Europe and other jurisdictions, that is why it automatically becomes a safe haven, I believe. I work with thi brokerage and have no complaints about the experience whatsoever.

Great overview, even though it was mainly focused on the technical aspects of their offering as trading conditions and similar.

I want to share my experience with this broker, particularly about its customer support.

They have one of the best customer support and the most convenient way to reach them.

I always use chat, since they offer it 😀 and it is the fastest and most preferred support method by traders. Their staff is polite, knowledgeable and prompt to answer anything you need.

If you like their trading conditions, you should have no worries about the quality of their customer support!

Want to say thanks to Rafaella of ironfx support team. She was too patient with me and my silly questions about the broker and creating the account process.

But on the other hand she convinced me to join the broker with her patience:)

I already had some knowledge about the features of this broker and trading conditions before reading this review.

Therefore, I didn’t read anything new here except for one fact.

Previously, I had never thought about how long this broker has been operating. But now I realized that it has been a long time. That’s a good sign.

I thoroughly checked the trading conditions that IronFx has to offer and I would say I found them to be truly competitive… Plus, they have robust and good regulation status, possessing licences from respectable financial authorities. Why would anyone suspect IronFx as a scam broker?

You have done your homework 👍

Anyone who has done the research you have done would come to the same conclusion.

Anyway, accusations of scam are a common thing in this industry, that’s the ultimate punishment a trader can give to the broker that he thinks it’s his fault for his failure 😀

Yes, I think that the lack of knowledge and trading skills is the main reason why many people out there accuse their broker of being a scam.

In my review, I want to list some of strengths of this broker.

a) After I went through the procedure of registration and account verification (by the way, this process was simple), I funded my account. Deposit process was simple and fast. I have already had experience in funding my account, so I have something to compare it with.

b) MT4 trading platform is as always convenient and multifunctional.

c) As for the set of financial instruments, this platform has a large number of them. I have made a list of those that are more interesting to me. The rest I removed from terminal.

d) The last thing is educational courses. Sometimes I study them in order not to lose

qualification.

I guess I have a big list of advantages of this broker.

I am not sure that alll of the infomation presented here is accurate, and I am certain that the broker is regulated by multiple regulatory bodies. It is probably outdated.

I started with zero knowledge, but IronFX’s educational materials have transformed me into a confident trader. It did take some time for me to make such a leap, and also cost me some money as well.

I didn’t pay a dime for the education I got on the platform. It was all for free. However, I did make a few mistakes on my first few deposits, which I consider as a learning curve for me.

It is important to say that the education here has made me who I am today.

I know that Ironfx is a regulated broker that possesses several regulations in various jurisdictions across the globe. But does it mean my funds are properly insured?

Regulation is a guarantee of your funds protection with a kind of stretch, you know. In many cases, those rules imposed by the financial supervisor are rigid enough, so I do believe that in case of financial losses, you can create a complaint. However, brokers, including IronFX, ensure complete funds and data safety by some different means. It uses contemporary SSL data protection technology which implies thorough data cyphering.Feel free to reach out to their website, they have a separate section on it where everything is explained in one-syllable words.

I don’t understand why, despite many comments from users and objective traders, this article is not updated and corrected the part that says this broker does not have any regulation. it can be easily checked, IronFx has several regulations.

In my list Ironfx has a much higher score. I don’t say that it’s the best forex broker ever. But it’s a solid broker with multiple regulations and it certainly deserves some attention.

And also it provides some unique features like VIP room for instance. It is hard to explain, because I haven’t seen anything like this before.

Basically you get the regular forecasts on the assets, and can participate in the discussions.

It will be very useful for people that just started trading not so long ago.

I recently switched trading with IronFX, and I had a few reasons for that. I won’t talk about trading conditions, they are clearly displayed on their official website and everyone can make his own assessment or decision whether or not they are suitable for his trading strategy.

I commend IronFx for the incredibly wide list of payment methods. For successful traders like myself 😀 this is quite an important aspect. I use a couple of different payment options, including crypto transfers. The procedure of placing the inquiries is simple and they process the transaction relatively quickly.

That’s interesting. I am not doing what you are doing but sure, i respect that, everyone is entitled to do whatever is comfortable for them:)) I personally use a single payment method for all the operations since i cannot be bothered with multiple services at once, you know, running and managing all the accounts, remembering their passwords and whatnot 😀 I didn’t even know if all of them works, but sure, its ironfx, so every single one of those methods must be functioning properly

That’s weird. Perhaps article’s author didn’t do a really good research.

I didn’t see any mention of awards that this broker has. And there are really a lot of them.

My broker has received these awards for participation in independent international competitions.

And please don’t take offense at me, I trust them more than no-name author of this article.

I know that the broker is licensed by multiple regulatory bodies, so I do not know why the review says that the broker is not safe to use. I have used the broker with no issues for quite some time.

Guys, pay attention to what year this article was written!

I am not writing this to point out that it is outdated, but to draw attention to an interesting fact.

As you can see from 2018, conditions of this company have not changed much. And it continues to carry out its activities.

This all indicates that broker has a solid reputation and a stable financial position.

They have a very interactive platform to manage your portfolio, mitigate your risk, monitor your trades, everything. Great place to be on top of your financial freedom, let’s get it boyz!

A good breakdown of the company which shapes certain perception of the company in the masses. I just want to put my two cents here. Their dedication to surround customers with comfortable environment which undoubtedly makes them earn money, hone skills and expand horizons, is notable due to the services they deliver. Trading room, different accounts, robust regulation – these are all noticeable traits.

Ironfx is a very good broker. Good brokers are safe and regulated. The reviewer has got many of the facts right, but still needs to be updated.

I do not mean to offend anyone but I think there is something wrong with this article…

Author lists all the signs that broker is safe (licenses and regulations, deposit and withdrawal methods, as well as in which countries company operates).

And at the same time he concludes that he doesn’t recommend this company. It looks like this review was written by two different people.