- What is IQ Option?

- IQ Option Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

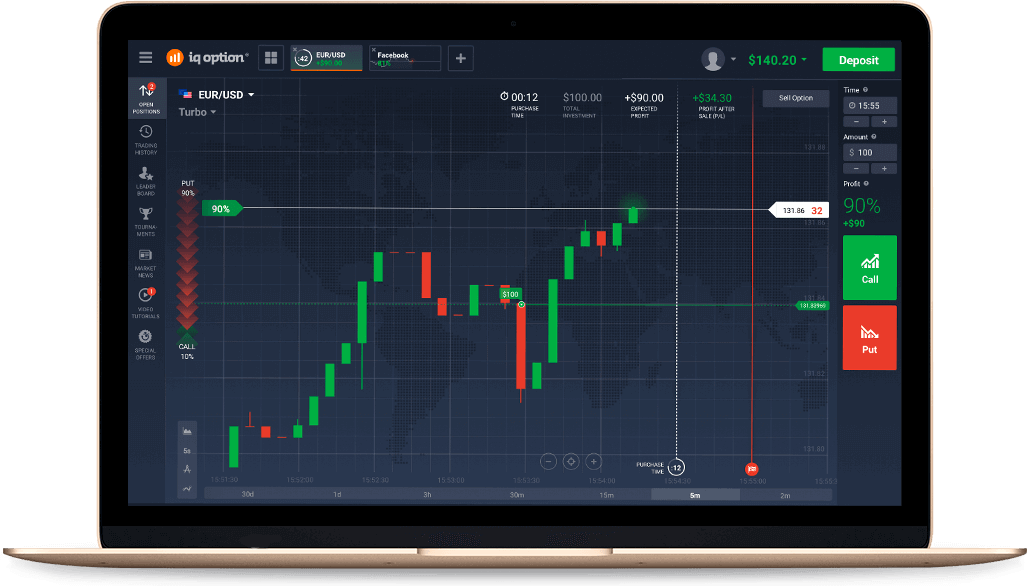

- Trading Platforms and Tools

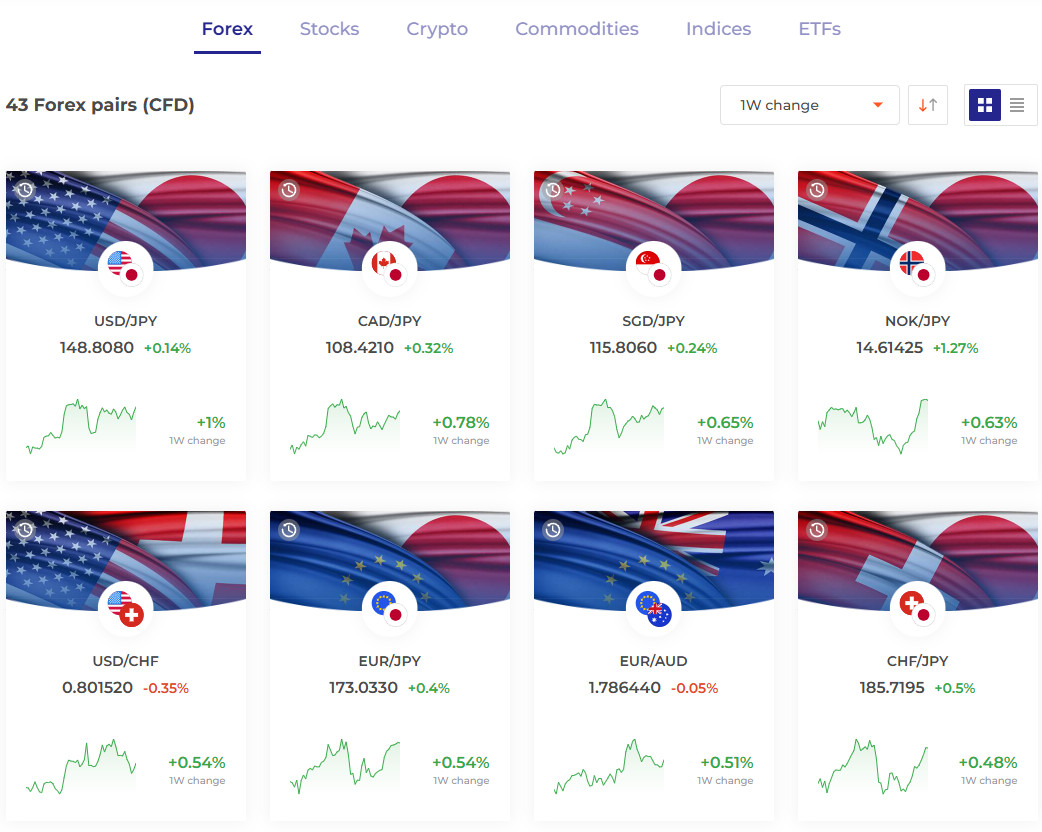

- Trading Instruments

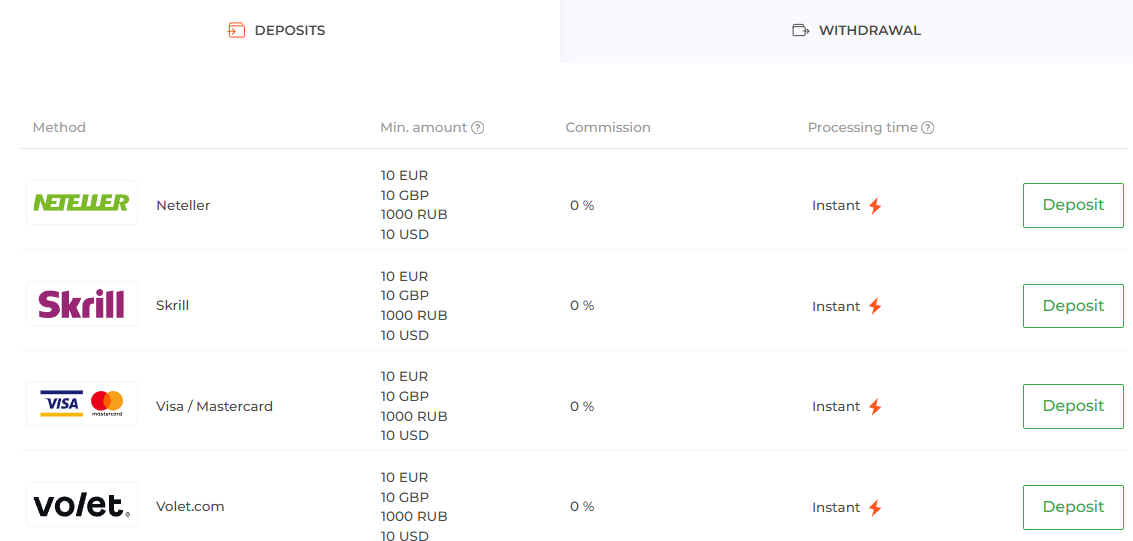

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- IQ Option Compared to Other Brokers

- Full Review of Broker IQ Option

Overall Rating 4.2

| Regulation and Security | 4.2 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4.1 / 5 |

| Account opening | 4.4 / 5 |

| Additional Tools and Features | 4 / 5 |

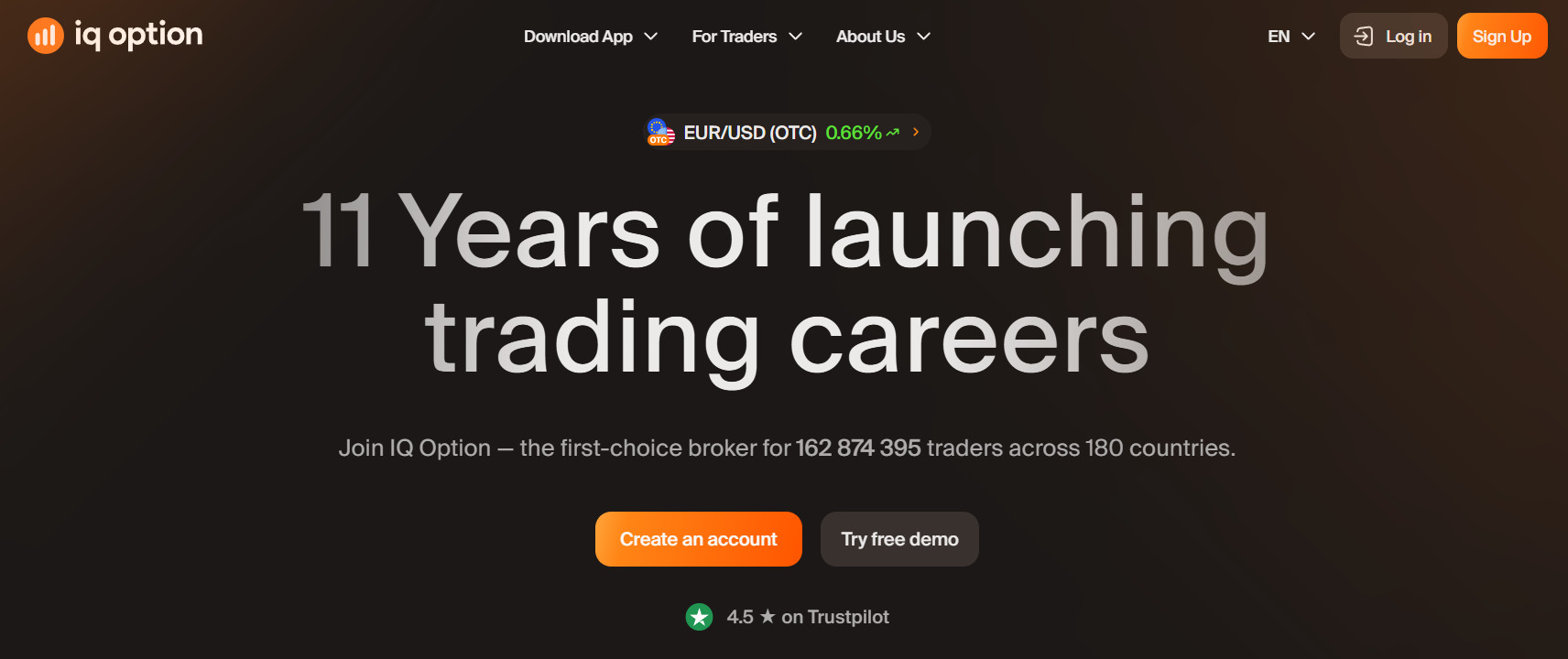

What is IQ Option?

IQ Option was founded in 2013 and offers online Forex and CFD trading with access to Forex pairs, stocks, cryptocurrencies, commodities, indices, ETFs, and binary options for non-EU clients. The broker provides its trading platform accessible directly from the browser, desktop, and a mobile app. Clients can access advanced tools and features for in-depth analysis, including a built-in economic calendar.

The broker is regulated by CySEC in Cyprus and ensures the safety and reliability of trades. For clients outside of the European region, trades are conducted under an offshore entity under the Financial Services Regulatory Commission (Antigua and Barbuda). On the other hand, the EU arm offers regulatory safeguards and measures for protection. However, until the broker got its CySEC license, IQ Option operated with no serious regulation for a long time after its establishment and was recognized as an offshore and untrustworthy broker.

At present, IQ Option offers two main account types and a demo account to practice trades and explore the market in a risk-free environment. Customer support is available 24/7 through multiple channels.

IQ Option Pros and Cons

Our review of the broker showed that IQ Option represents both advantages and disadvantages. On the positive side, the broker holds a CySEC license and provides a reliable trading environment with competitive conditions. Trading costs are average, with seemingly no hidden fees. IQ Option offers a good range of financial instruments, including binary options for its non-EU-based clients. The deposit for the Standard account is $10, which makes the broker efficient for beginner and cost-conscious clients. Another important benefit is the 24/7 customer support, ensuring that clients get help at all times.

However, IQ Option also has negative sides that should not be overlooked. One of the main points is the broker’s previous inconsistency and regulatory issues. Besides, IQ Option does not support the most demanded MT4 and MT5 platforms, as the broker offers its own platform. At last, all the products are CFD-based, eliminating the chances for long-term investments.

| Advantages | Disadvantages |

|---|

| CySEC Regulation | Traditional investments are not supported |

| Good trading conditions | No MT4 and MT5 platforms |

| Low minimum deposit | Previous complaints |

| An advanced proprietary platform | |

| A good selection of financial instruments | |

| 24/7 Customer support | |

| A range of funding methods | |

IQ Option Features

IQ Option provides reliable trading solutions with competitive pricing. The broker might be an attractive option for all levels of traders. Besides, the broker offers its advanced trading platform that allows users to trade well-known financial products.

IQ Option Features in 10 Points

| 🗺️ Regulation | CySEC, The Financial Services Regulatory Commission (Antigua and Barbuda) |

| 🗺️ Account Types | Standard and VIP |

| 🖥 Trading Platforms | Proprietary platform |

| 📉 Trading Instruments | Forex, stocks, cryptocurrencies, commodities, indices, ETFs, and binary options |

| 💳 Minimum deposit | $10 |

| 💰 Average EUR/USD Spread | 0.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | Several currencies available |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/7 |

Who is IQ Option For?

IQ Option has tailored its proposal for diverse trading needs. Based on our research, the broker can become a suitable choice for both beginner and professional traders; yet, it is best suited for the following:

- Traders from Europe

- International traders

- Traders who prefer web trading

- Advanced traders

- Investors

- CFD and currency trading

- Competitive spreads and costs

- 24/7 customer support

- Good education and trading tools

IQ Option Summary

Overall, IQ Option is a trustworthy trading option with competitive trading conditions and transparent practices. The broker provides its own platform available for web, desktop, and mobile versions. As we noticed, the tools and available trading resources are at a good level.

Overall, we found that the firm offers a good trading environment, featuring 24/7 customer support and a range of educational resources. However, there are drawbacks as well, such as trading within offshore zones. Therefore, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

IQ Option is considered a good-standing trading broker now suitable for traders of diverse experience levels. The broker holds a license from the well-respected CySEC, ensuring adherence to stringent laws and guidelines, while in the past Broker operated only via an international branch we did not recommend trading with them, as risks were too high to trade with an offshore Broker. Yet, now with CySEC license, it is considered safe to trade, but we advise to do your own research too.

As for the offered trading conditions, we find them quite well organized with two account types with distinct fee structures and conditions so that clients can choose the one best suited for their trading volume, expectations, and needs. Trades are conducted on the broker’s proprietary platform, packed with good quality and innovative capabilities that might be great for different strategies either auto or manual traders.

All in all, trading with IQ Option will become a positive trading experience, enabling traders to expand their portfolios in a favorable environment, but we would advise to stick still to CY entity for better safety and conditions overall too.

Consider Trading with IQ Option If:

| IQ Option is an excellent Broker for: | - Beginner traders

- Traders interested in diversification

- Web traders

- Non-EU traders interested in binary options traders

- Cost-conscious traders

- CFD and currency trading |

| IQ Option is not the best for: | - MT4 and MT5 platforms enthusiasts

- Traditional investors

- Novice traders looking for extensive education

- Traders looking for MAM accounts

- Traders prioritizing top-tier regulation and secure trading environment

|

Avoid Trading with IQ Option If:

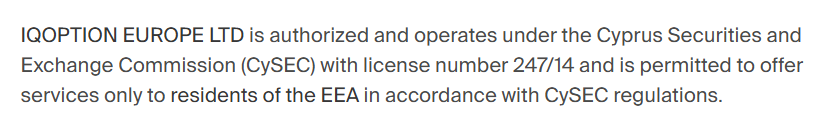

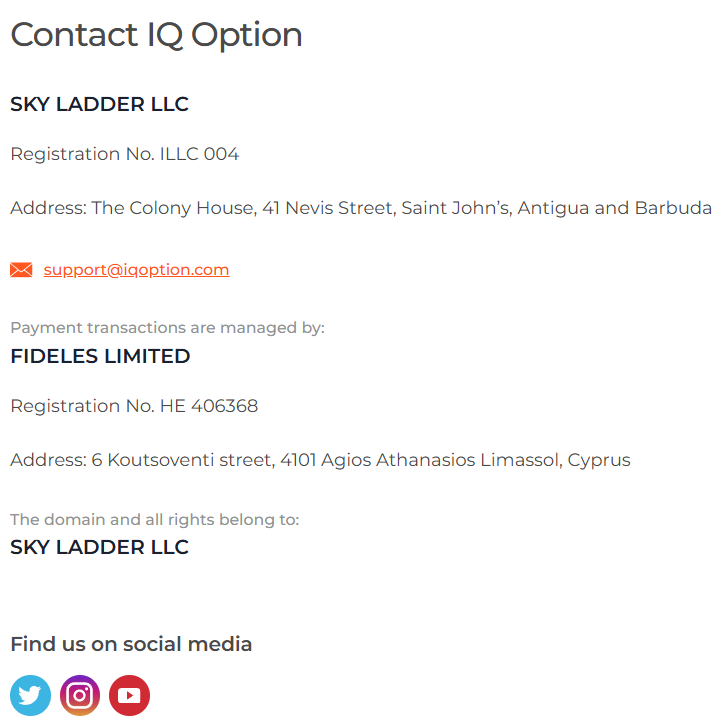

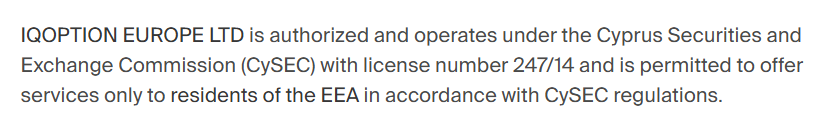

Regulation and Security Measures

Score – 4.2/5

IQ Option Regulatory Overview

IQ Option is a reliable broker with tight regulation that ensures a low-risk trading environment. It is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

Thus, IQ Option is a legitimate firm that follows regulations for offering Forex trading services.

- However, IQ Option International operates through an offshore entity, the Financial Services Regulatory Commission (Antigua and Barbuda), under SKY LADDER LLC. , which is an offshore zone with no serious oversight from a recognized authority. Under its international entity, the broker also allows access to Binary options. Note that binary options are banned in many jurisdictions, including the FCA, ASIC, and CySEC, due to the high risk they impose.

How Safe is Trading with IQ Options?

The broker’s CySEC regulation ensures adherence to essential safety measures. Clients’ funds are protected by Negative balance protection, segregation of the accounts from the company’s funds, and a compensation scheme of up to €20,000 ensured by the Cyprus Investor Compensation Fund.

Consistency and Clarity

We also reviewed the broker’s consistency over its 12 years of operation. Our research revealed that in 2016, IQ Option was fined €20,000 by CySEC for the improper execution of its practices. Later, in 2019, the broker was fined once again for compliance failure.

Besides, we found a concerning amount of negative feedback from clients, pointing out regulatory concerns, withdrawal issues, and a lack of communication from the broker’s side. On the positive side, the broker is getting more and more positive feedback lately, for its advanced yet simple platform, the low initial deposit requirement, and access to a wide range of assets.

From our side, we recommend not relying only on the positive experience of the clients but considering IQ Option from all angles before opening an account.

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with IQ Option?

IQ Option offers two main account types for different trading needs: Standard and VIP accounts. Each account offers its own conditions, allowing clients to choose the most suitable option.

- The Standard account is a good match for beginner traders who want to start small. The minimum deposit requirement is $10, making the broker easily accessible. Traders can access over 500 instruments, including Forex, commodities, ETFs, stocks, cryptocurrencies, and binary options for non-EU clients. Beginner traders also have access to educational resources and can find customer support 24/7.

- The VIP account is for more advanced traders who are ready to make higher deposits. The typical deposit requirement is $1,900. Yet it may depend on the region and promotions. The VIP account also includes a personal account manager, monthly reports, and priority support 24/7. The account is tailored for high-volume traders who prioritize additional benefits and advantages.

Regions Where IQ Option is Restricted

Due to its EU regulation, IQ Options offers its services to European clients. However, due to regulatory restrictions, the broker is not available for residents of certain countries:

The IQ Option’s services are not available in the following countries:

- USA

- UK

- Canada

- Australia

- Belgium

- Swizarland

- Iran

- Russia

- Israel

- Japan

- North Korea

- Syria

- Turkey

- Afghanistan

- Belarus

- Ukraine

Cost Structure and Fees

Score – 4.3/5

IQ Option Brokerage Fees

IQ Options offers competitive trading charges with no commissions. The trading fees are expressed in spreads that are average or lower than the market standards. We also found that for trading assets, such as stocks, commodities, indices, and cryptocurrencies, spreads are expressed in percentage, rather than pips.

IQ Option offers competitive spreads that are on the lower side. There are no transaction fees, with all the fees integrated into spreads. For the EUR/USD pair, the spreads are 0.8 pips. The gold spread is expressed as a percentage (0.01%). For WTI, the spread is 0.38%.

Generally, IQ Option does not charge any commissions. All the fees are integrated into spreads. However, we recommend checking with the support team to determine if there are any commissions based on the instrument traded or other circumstances.

IQ Option also charges swap fees for the positions held overnight. The long swap for the EUR/USD pair is -0.0024%, and -0.0027% for the short swaps.

How Competitive Are IQ Option Fees?

Based on our findings, IQ Option applies competitive fees for its instruments, offering tight spreads and reasonable swap fees for the positions held overnight. The average spread for the EUR/USD pair is 0.8 pips.

As we found, the broker does not offer a commission-based account. However, for several asset classes, spreads are expressed in percentages, not in pips.

Although IQ Option offers competitive conditions and low charges, we recommend that traders reach out to the customer support team for more details and information. Besides, the fees and costs may differ based on the entity, which also requires careful consideration.

| Asset/ Pair | IQ Option Spread | XTrend Spread | BP Prime Spread |

|---|

| EUR USD Spread | 0.8 pips | 0.2 pips | 0.3 pips |

| Crude Oil WTI Spread | 0.38% | 0.024 | 0.01 |

| Gold Spread | 0.01% | 0.07 | 0.01 |

IQ Option Additional Fees

IQ Option has a few additional trading fees to consider. The broker imposes an inactivity fee of €10 for those accounts that have been dormant for 90 days. Besides, there are no deposit or withdrawal fees for most of the funding methods.

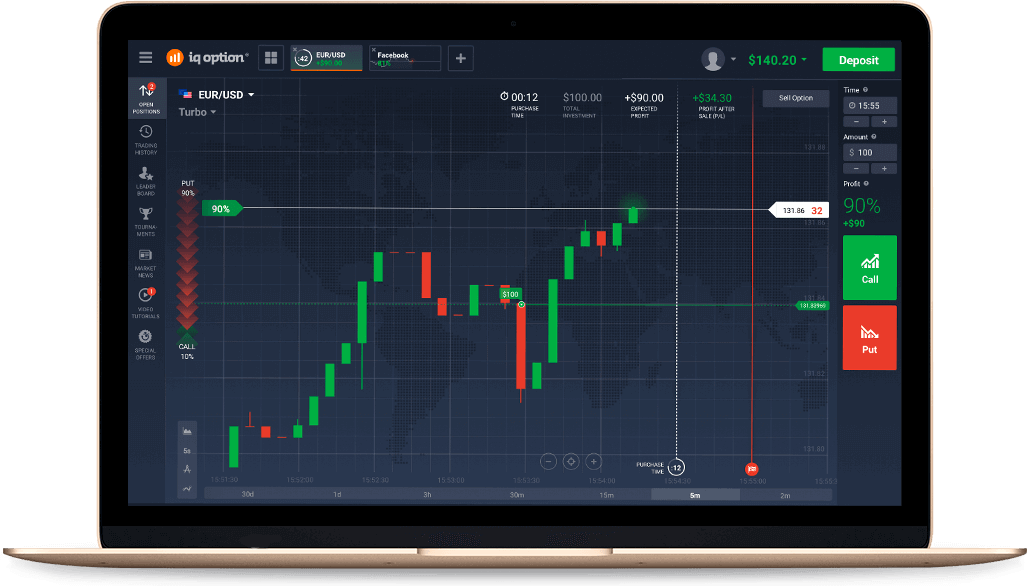

Score – 4.2/5

IQ Option offers its proprietary platform available on desktop, through a web browser, or a mobile app. The platform is advanced and easy to use, with essential research tools and features.

| Platforms | IQ Option Platforms | XTrend Platforms | BP Prime Platforms |

|---|

| MT4 | No | No | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

IQ Option Web Platform

IQ Option offers its clients access to their accounts through a web platform. The availability of Web trading ensures easy access, with no need for downloads and installations. As we have found, the platform includes all the essential tools and features to experience trading to the fullest. Traders have access to extensive analytical tools, charts, graphs, and drawing tools. The execution of trades is fast and efficient.

IQ Option Desktop MetaTrader 4/5 Platforms

Our research revealed that IQ Option does not offer the popular retail platforms most traders prioritize, such as MT4 and MT5. Even though the broker’s platform is well-structured and easy to use, with innovative tools and features, many traders will see the lack of popular platforms as a disadvantage. The broker does not offer cTrader or TradingView, other demanded and advanced options in trading.

IQ Option Proprietary Platform

IQ Option has developed its trading platform to meet the needs of its clients. The platform’s simple interface enables beginner clients to navigate with ease, while advanced clients can benefit from innovative features and tools. The broker’s platform is available through desktop, web, and mobile versions.

The platform includes technical indicators, multiple timeframes, charts and graphs, and real-time quotes. The platform is specifically designed for options, Forex, and commodities trading.

In addition, clients can take advantage of the built-in economic calendar, news, and live chat. However, the platform is not compatible with expert advisors or algorithmic trading.

IQ Option MobileTrader App

The IQ Option mobile app is available for both iOS and Android devices, giving traders easy access to the platform. IQ Option enables its traders to take advantage of the full functionality of the platform on the go, just by downloading the app on their phones.

Traders can elevate their trading experience by accessing over 100 technical indicators, trends, and real-time data. All in all, the broker’s mobile app is a combination of flexibility and innovative features that ensure an efficient trading outcome.

Main Insights from Testing

Our testing of the broker’s platform shows an advanced trading opportunity with access to multiple features and tools tailored for profitable trading.

Although IQ Option offers only its proprietary platform, it allows traders high functionality and access to a wide range of instruments with reasonable charges and favorable features. However, EAs or algorithmic traders will not be interested in the platform, as it does not support third-party tools.

Besides, traders used to the MT4/ MT5 platforms, or cTrader, will likely feel restricted.

AI Trading

Our research shows that IQ Option does not offer AI-assisted tools to automate the trading process. Traders interested in enhanced AI solutions should consider other broker options, as many brokers have already included AI tools in their proposals.

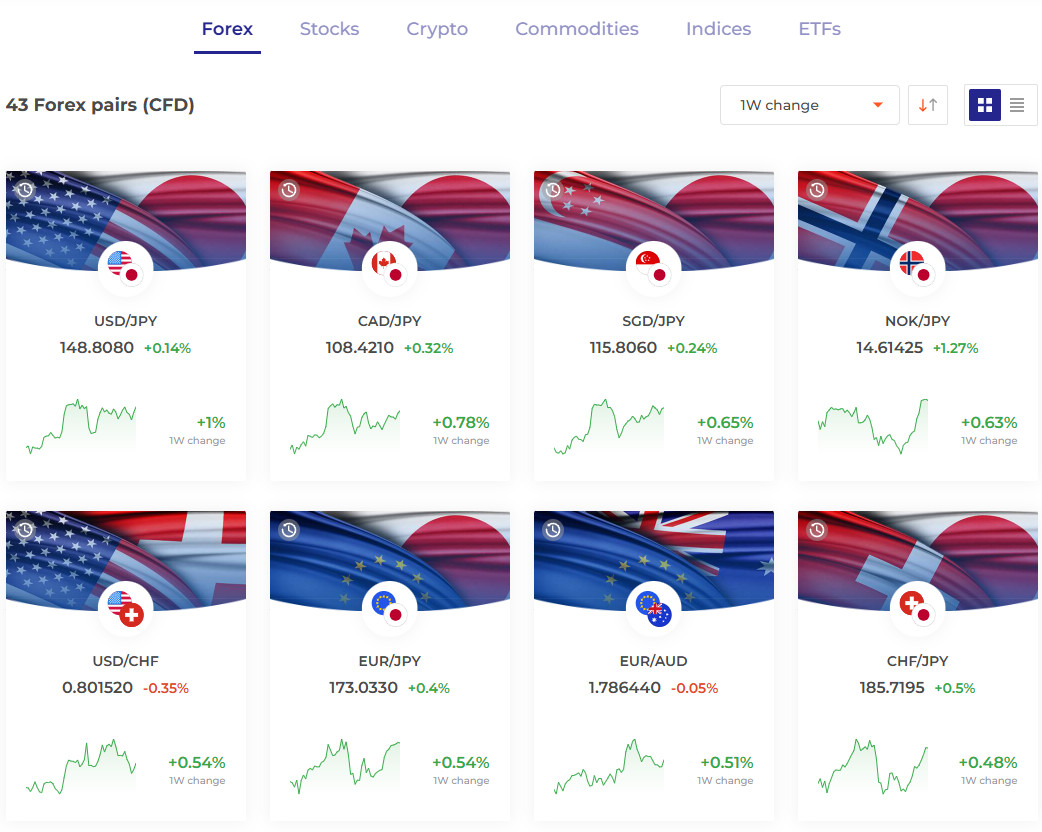

Trading Instruments

Score – 4.3/5

What Can You Trade on the IQ Option Platform?

IQ Option provides access to a selection of popular trading instruments, such as Forex, CFDs, Cryptos, Indices, Commodities, and Stocks. The overall number of tradable products is 500, enabling traders to participate in various markets based on their trading preferences and needs.

- Traders gain access to more than 43 currency pairs, can speculate on market changes of the popular stocks, and have access to global indices. With IQ Option, clients can also choose from a long list of the most popular cryptocurrencies.

- Besides, the non-EU traders can trade binary options, one of the broker’s trademark offerings.

Main Insights from Exploring IQ Option Tradable Assets

Our research and testing of the broker’s available trading instruments revealed that IQ Option offers about 500 tradable products across a range of assets. This range is enough to enable diversity. However, all the products are on CFDs, which only allows traders to make profits on the price movements rather than longer-term investments.

All in all, the broker offers major, minor, and exotic Forex pairs, a total of 43 in number. Clients can also trade CFD stocks of popular companies and access an extensive range of cryptocurrencies, including Litecoin, Ethereum, Ripple, etc. Also, traders have access to global indices and commodities (gold, silver, and oil).

Yet, as the broker operates under different jurisdictions, we advise traders to carefully check the instrument availability and proposed conditions.

Leverage Options at IQ Option

Leverage is an essential tool that can be beneficial for traders who enter the market with a smaller initial financial input. Yet, leverage comes with risks that traders need to be aware of and understand. IQ Option leverage is offered according to CySEC regulations:

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- International traders may have access to higher leverage up to 1:1000.

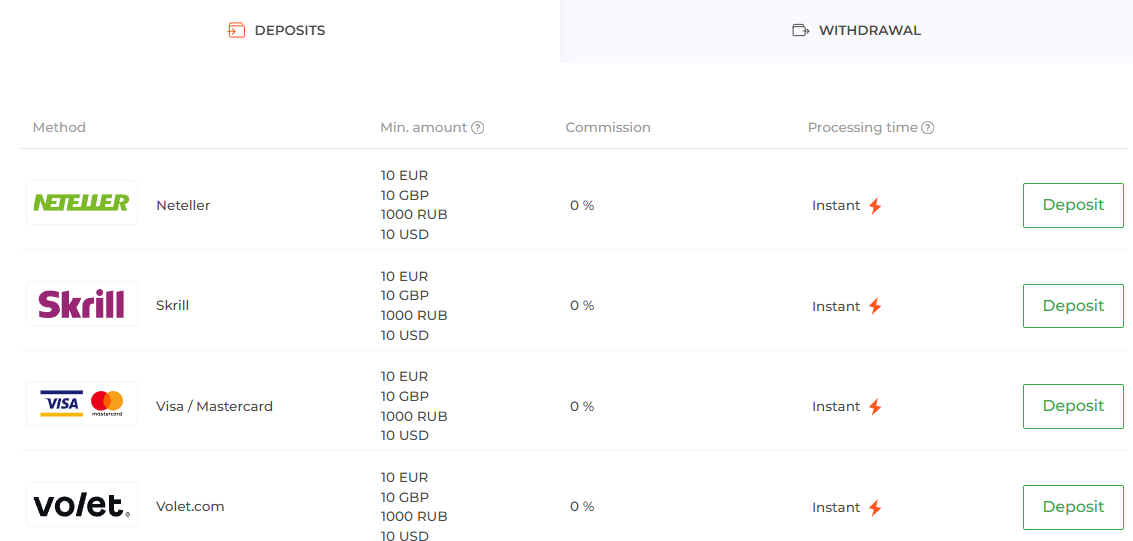

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at IQ Option

IQ Option includes a variety of funding methods for deposits and withdrawals, including credit/debit cards and e-wallets. Note that some payment methods may be unavailable due to the client’s bank or other financial institutions involved.

- Based on our research, the broker does not apply deposit or withdrawal fees. However, there might be transaction fees incurred from the payment provider.

Minimum Deposit

The broker has a cost-efficient deposit requirement with only $10 to start. For the VIP account, the first deposit is higher, starting from $1,900.

Withdrawal Options at IQ Option

The withdrawal options with IQ Option are diverse, including credit/debit cards, Skrill, Neteller, Volet, WebMoney, and Cardano. The broker also offers crypto withdrawals. The processing time is usually from 1 to 3 business days.

- Free withdrawals are available only once a month.

Customer Support and Responsiveness

Score – 4.5/5

Testing IQ Option Customer Support

According to our testing of the broker’s customer support, IQ Option provides 24/7 customer support via live chat and email. The broker also includes a Help Section with answers to general trading-related questions.

- IQ Option is also on X, Instagram, and YouTube, providing up-to-date information on its operations and the market in general.

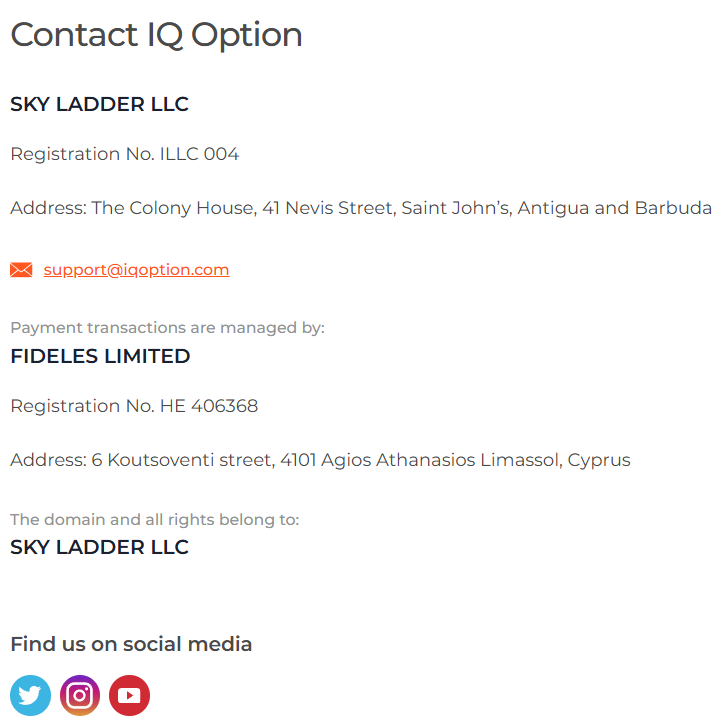

Contacts IQ Option

IQ Option has a dedicated team of support, assisting its clients through multiple channels.

- The live chat is available through the broker’s platform after signing in to the account.

- IQ Option also provides an email to send questions, suggestions, and complaints: support@iqoption

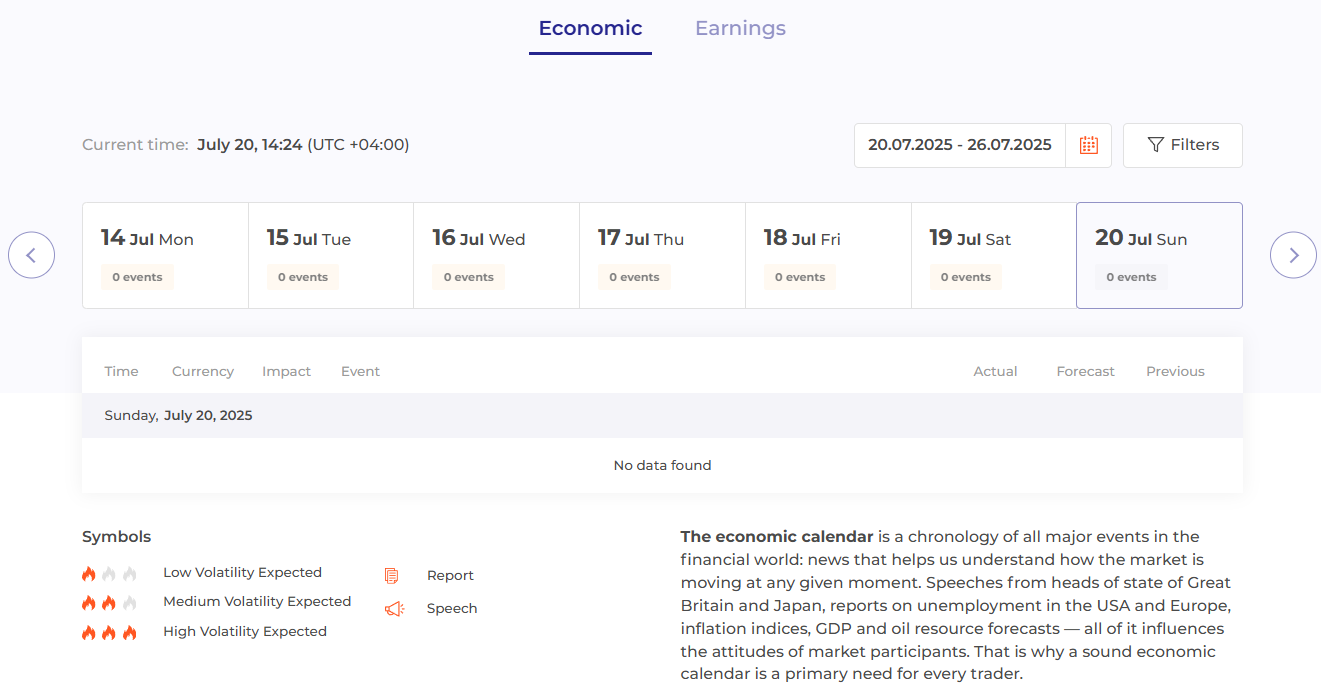

Research and Education

Score – 4.3/5

Research Tools IQ Option

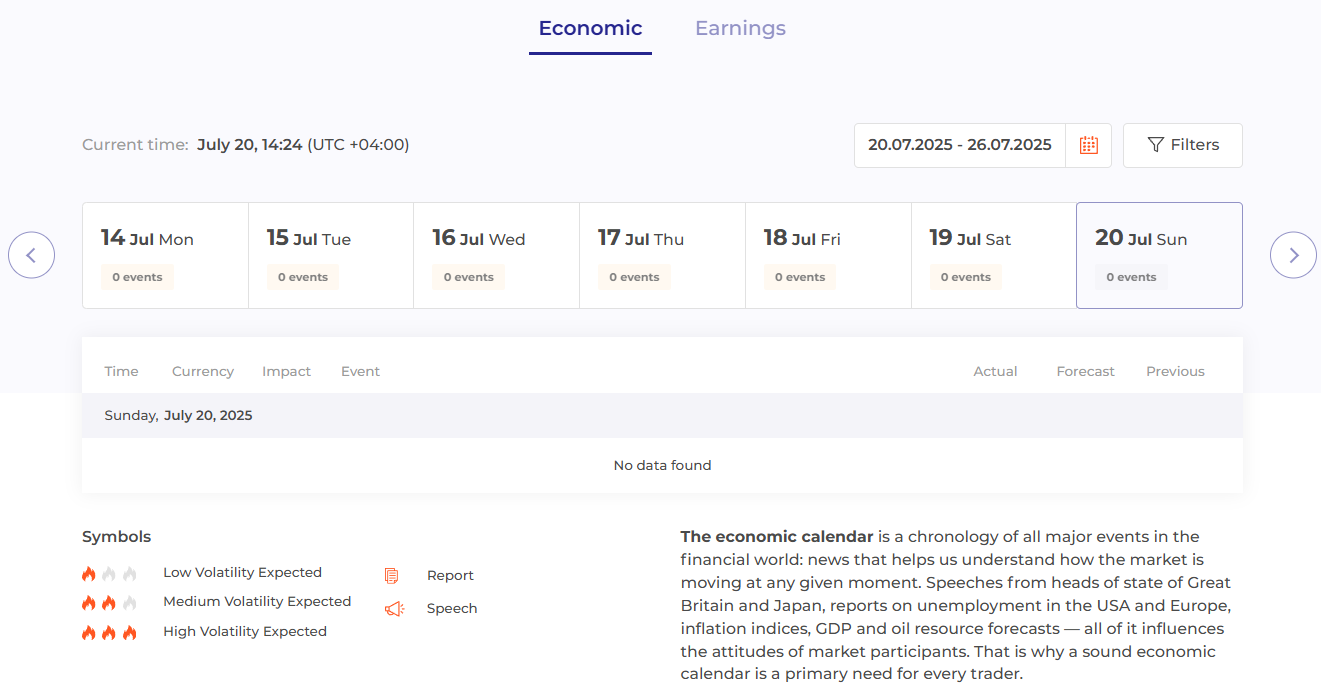

IQ Option offers advanced research capabilities through its platform. The tools and features available on the platform ensure in-depth analysis. We also found that with IQ Option, clients can benefit from a few helpful additional research tools, including:

- Economic calendar, which is one of the most essential tools to stay informed about upcoming market changes, strong enough to affect the financial world.

- The historical quotes section provides traders with information about exchange rates of currency pairs during different time spectrums.

Education

Although IQ Option does not provide an extensive education section, such as seminars, trading courses, or a Forex glossary, IQ Option still provides a well-structured video section tailored for different traders. The section explains what forex is and guides traders towards technical and fundamental analysis.

- The broker also provides webinars for its different clients, from beginners to more advanced ones.

Is IQ Option a Good Broker for Beginners?

There are several criteria based on which we can conclude that IQ Option can be a favorable choice for beginners. One of the most essential points is the low minimum deposit of $10, which makes the broker cost-effective. As we found, spreads for most products are on the lower side, too. Besides, IQ Option includes a demo account, creating a risk-free environment for traders to practice. No less important is the easy-to-use platform, equipped with essential research tools and features. Thus, our verdict on whether IQ Option is a good broker for beginners is positive.

Portfolio and Investment Opportunities

Score – 4.1/5

Investment Options IQ Option

IQ Option offers 500 products across a wide selection of financial assets, giving traders a moderate chance for diversification. This amount of tradable products is more than many brokers offer; still, there are companies in the market that ensure a better variety in this respect.

- Besides, IQ Option does not support traditional trading. Clients cannot engage in long-term trading.

- IQ Option does not support alternative investments, such as copy trading, or access to MAM or PAMM accounts.

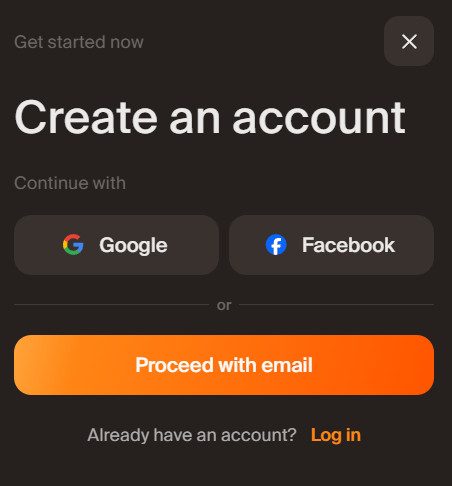

Account Opening

Score – 4.4/5

How to Open an IQ Option Demo Account?

IQ Option enables its clients to open a demo account and practice for an indefinite period of time. Traders can switch to a demo account anytime and practice whenever they like, even after opening a live account. The demo account includes all the features of the live account, except for money withdrawal.

Here are the steps to open a demo account with IQ Option:

- Go to the broker’s website and choose the demo option.

- Enter the email address and create a password. The broker may ask for confirmation of the email address.

- You will be provided with demo account credentials to access the account.

- Receive up to $20,000 and start practicing.

How to Open an IQ Option Live Account?

The live account opening is an easy process, with a few simple steps to follow:

- Go to the broker’s official website and select the live option.

- Fill out the email, country of residence, and create a password.

- Alternatively, it is possible to register with Google or Facebook.

- Create a strong password.

- Submit the form and receive the account credentials.

- Use the credentials and access your live account.

- Start trading.

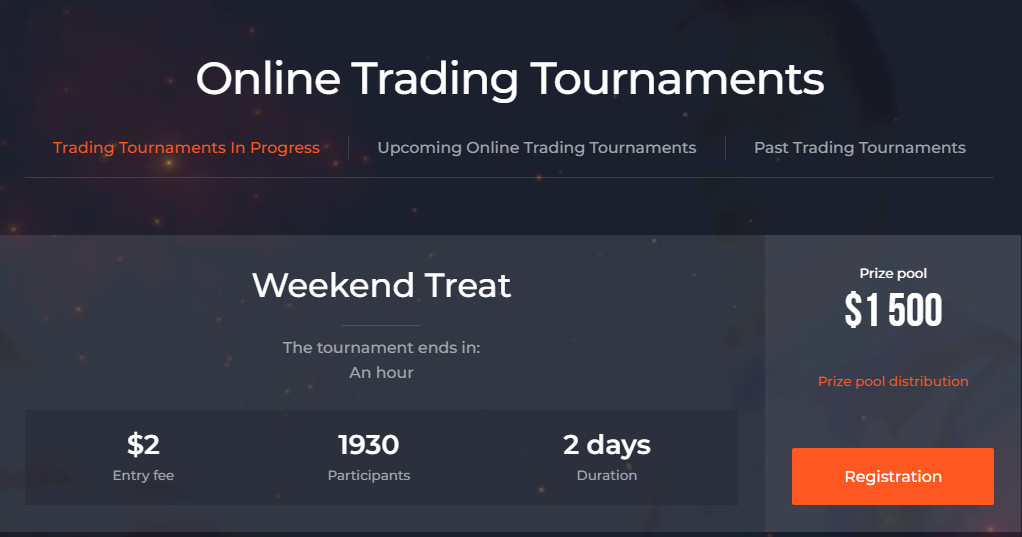

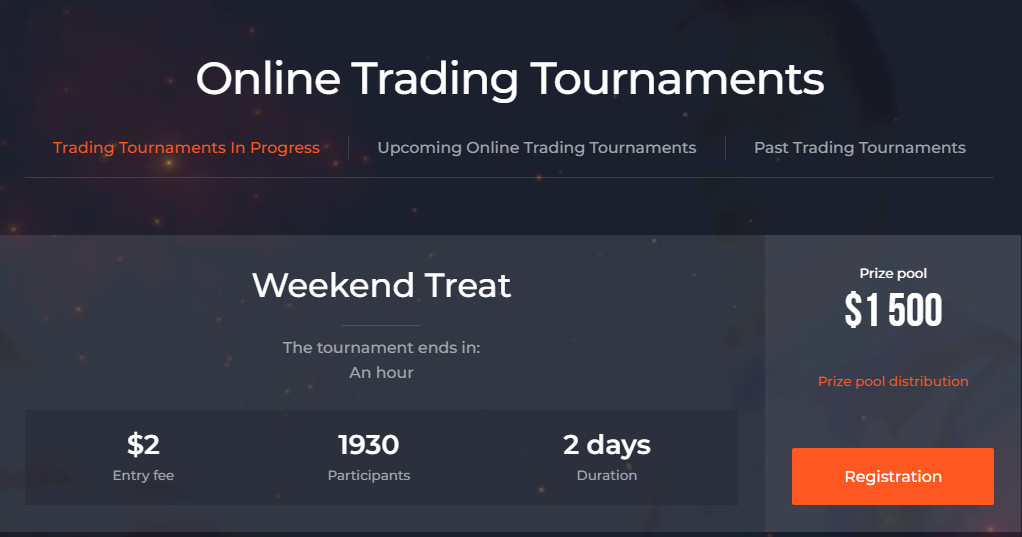

Score – 4/5

Although we did not detect many additional opportunities with IQ Option, we noticed an interesting offering available with the broker.

- The Online Trading Tournaments offered by the broker are competitive events that enable traders to buy binary options by using virtual funds. Participants receive the same amount of virtual funds to trade on the broker’s platform. The funds are virtual and cannot be withdrawn. At the end, the trader who has expanded the virtual portfolio more than others wins.

IQ Option Compared to Other Brokers

An important part of our review is to compare the broker with other good-standing brokers in the market. This is an essential step to see how the broker aligns with market standards.

IQ Option is a CySEC-regulated broker with tight safety measures in place. We found that Pepperstone, Admirals, and Exness also hold a CySEC license. They also hold top-tier licenses from ASIC and FCA, providing an additional layer of protection.

We found that IQ Option offers only its proprietary platform through web, desktop, and mobile versions. On the contrary, Pepperstone and FP Markets include an extensive range of popular trading platforms, including MT4, MT5, cTrader, and TradingView.

The number of trading products offered by IQ Option reaches 500. Whereas this number ensures certain diversity, brokers like CapTrader (12 million), FP Markets (10,000+), and Admirals (8,000+) are attractive options to explore the market to the fullest.

At last, IQ Option includes good research and education sections, with an economic calendar, webinars, and videos. Exness, in this respect, does not stand out for helpful education and research. On the other hand, CapTrader, FP Markets, and Pepperstone excel in providing educational resources.

| Parameter |

IQ Option |

Pepperstone |

Admirals |

Exness |

FP Markets |

CapTrader |

Eightcap |

| Spread-Based Account |

From 0.8 pips |

From 1 pip |

From 0.6 pips (0.02 commissions for Share and ETF CFDs) |

From 0.2 pips |

From 1 pip |

Average 0.1 pip |

Average 1 pip |

| Commission-Based Account |

No Commissions |

0.0 pips + $3.5 |

0.0 pips + from $0.02 to $3.0 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.1 pips + from $1 to $8 based on the instrument |

0.0 pips + $3.5 |

| Fees Ranking |

Low/Average |

Low/Average |

Low/Average |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

Proprietary Platform |

MT4, MT5, cTrader, TradingView |

MT4, MT5, Admiral Markets app |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

Trader Workstation TWS, TradingView, AgenaTrader, Mobile App |

MT4, MT5, TradingView |

| Asset Variety |

500 instruments |

Over 1,200 instruments |

8000+ instruments |

200+ instruments |

10,000+ instruments |

12 million instruments |

800+ instruments |

| Regulation |

CySEC, The Financial Services Regulatory Commission (Antigua and Barbuda) |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

BaFin |

ASIC, SCB, CySEC, FCA |

| Customer Support |

24/7 support |

24/7 |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Good |

Excellent education and research |

Excellent |

Fair |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$10 |

$0 |

$1 |

$10 |

$100 |

$2000 |

$100 |

Full Review of Broker IQ Option

We have researched IQ Options’ different aspects and can draw a conclusion based on our findings.

The broker is regulated by CySEC, offering services in compliance with the authority’s guidelines and laws. IQ Option also protects its clients by Negative Balance Protection, segregation of funds, and a compensation scheme of €20,000. The broker’s services outside the EU Area are provided under the registration in Antigua and Barbuda.

IQ Option offers two main account types, Standard and VIP. Each account offers different conditions and opportunities, tailored for beginners and professionals, respectively. The broker’s demo account is a helpful feature for novice traders who need to practice their skills before engaging in live trading. Trades are conducted on the broker’s proprietary platforms through web, desktop, and mobile versions.

Although IQ Option does not support long-term investments, traders can diversify their trades due to the available 500 tradable products across various financial assets. The non-EU traders can also engage in binary options trading.

Another advantage of the broker is its low initial deposit requirement of $10. Professional clients can open a VIP Account with higher deposits, starting from $1,900. At last, the broker offers a few research and educational resources to enhance their trading experience.

The only reservation about the broker is its past regulatory issues and fines by CySEC for inconsistency of services. At present, the broker has transparent and consistent practices, and the overall customer feedback is positive.

Share this article [addtoany url="https://55brokers.com/iq-option-review/" title="IQ Option"]

IQ Option’s really good! its definitely a broker you should not miss out on…

just recently chcked out out IQ Option and it’s pretty impressive.

$10 deposit amount is quite low and nice, trading’s smooth and easy with just a $1 minimum trade and more than 180 stocks

I can write a rather elegant answer to the question of IQ Option legit ore scam.

Just look at the date this article was written.

September 5, 2018.

I realize that 2018 seems like it was a year ago. No guys, 2018 was 6 years ago…

But I’m not talking about dapression, I’m talking about the fact that company has become even more popular among traders in all this time.

When I see these types of comments about something that I have good experience with, I can’t shut up.I wanted to share a brief note about my experience with IQ Option. Honestly, I’ve been using it for quite some time now, and it has consistently delivered a seamless experience. No issues whatsoever, and their payments have always been prompt.

I’m just one of over 50 million users. I paid attention to this when deciding to use the platform because my analysis led me to think: if the platform has such a vast user base, it must excel and be trustworthy in various aspects. The platform operates smoothly, and I appreciate the features it provides besides the competitive payouts and effortless accessibility from any device. I am content with my decision to use this platform.

The platform is very safe, it has different types of regulations in addition to that it started its activity in 2013 exclusively as a binary options broker, standing out for being one of the most innovative by offering its own trading platform (instead of offering one developed by another company as most of its competitors did that hardly differed from each other) and also for being a pioneer in offering a free demo account for binary options, something common in Forex brokers but not in the binary options sector.

very misleading information!

i’ve traded wiith them foor very long with a very good experience.

tbh, it’s very suspicious the recommendations they make and the total absence of any evidence supporting what they say in this post!

Looks legit, especially if the broker has all those credible regulations.

I have done a lot of research about this platform and it is quite safe, besides that the interface is quite friendly and besides that on the same IQ Option platform it has a variety of tutorial videos in which it teaches you how to use the platform and also about the different signals in Japanese candles

Are there any instructions on how to operate platform or is it so simple that I won’t need them?

I think th broker provides some tutorials on this matter somewhere on the platform.

I don’t understand why rating says that this broker is not safe.Judging by fact that this article was written in 2018 and I am now client of this company. Then we can say that the broker has been operating for at least 5 years. I think that company that is not safe is not capable of this.

I discover for you an interesting thing, but the broker has been operating in the market for even a bigger period. As far as I remember, since 2014, or even earlier.

Anyway, it’s indeed a safe one.

Looking at those licenses this broker has obtained, no questions concerning its credibility arise.

The matter is also to have a practical experience to become convinced of its reliability fully.

what to do in case they refused to give back money

The big scam is the IO platform. They excluded trading positions for me. I lost over $ 4,000. When I warned the days off my trading options, they just kept turning off. The money they took from me they never wanted to return. When I terminated my cooperation with them and deleted my registration. A few days later, my bank account was attacked.

Hello there,

could you guys update this review? I am getting confused by other sites. I am reading from other reviews that IQ Option LTD is in fact not to be trusted, but that IQ Option Europe LTD is regulated. People living in Europe are directly registered under IQ Option Europe LTD and should be safe.

Is this true?