- What is Ultima Markets?

- Ultima Markets Pros and Cons

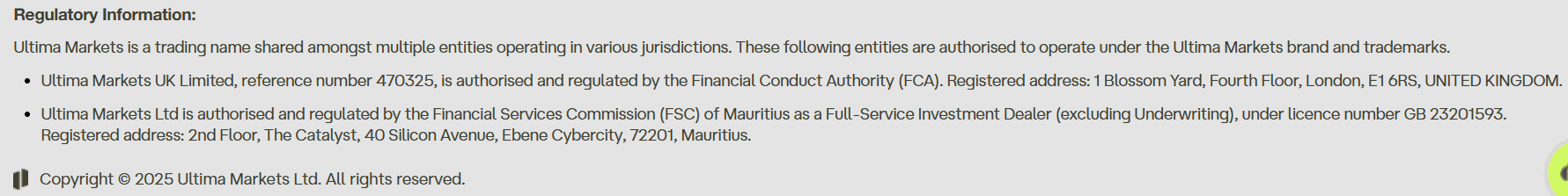

- Regulation and Security Measures

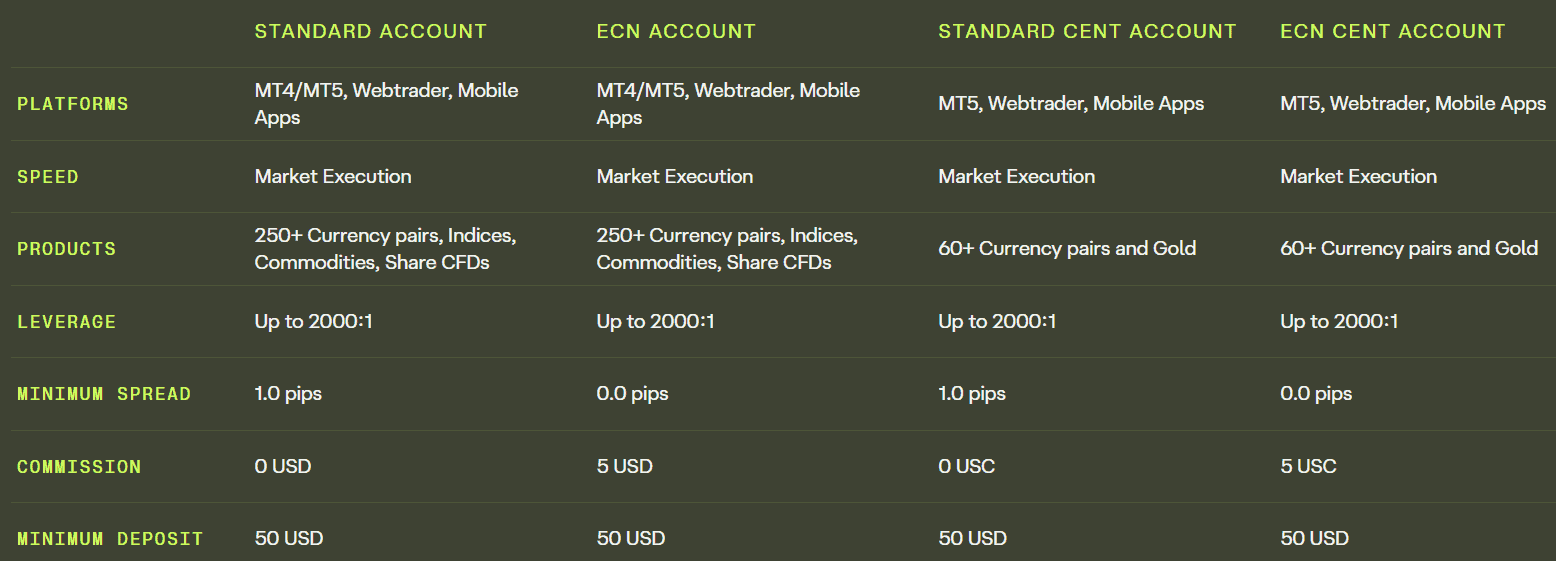

- Account Types and Benefits

- Cost Structure and Fees

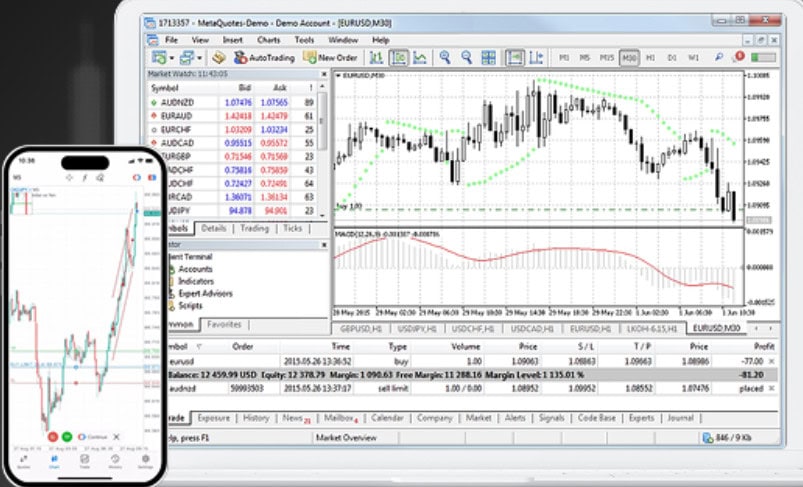

- Trading Platforms and Tools

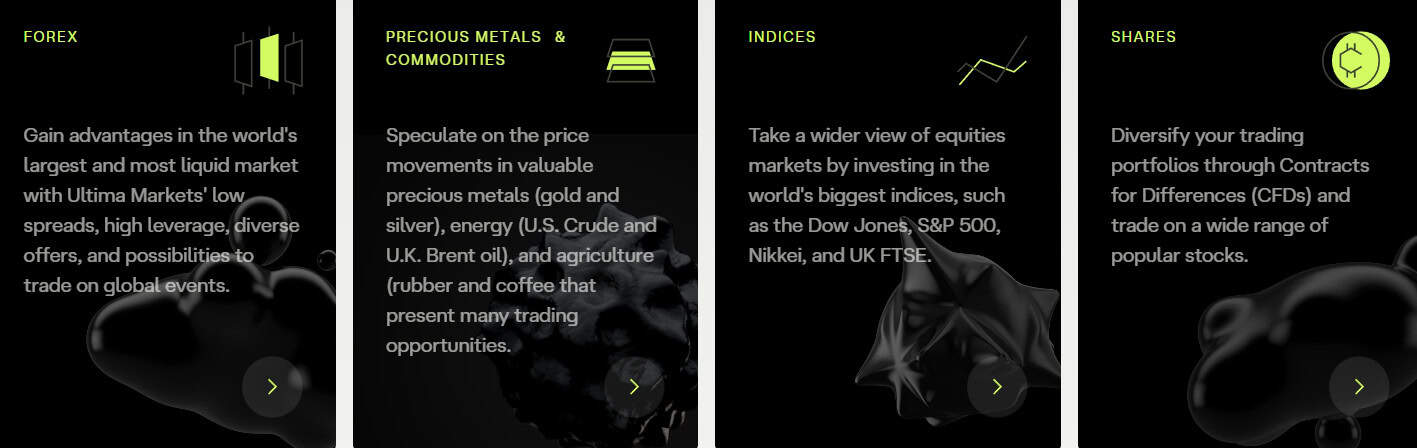

- Trading Instruments

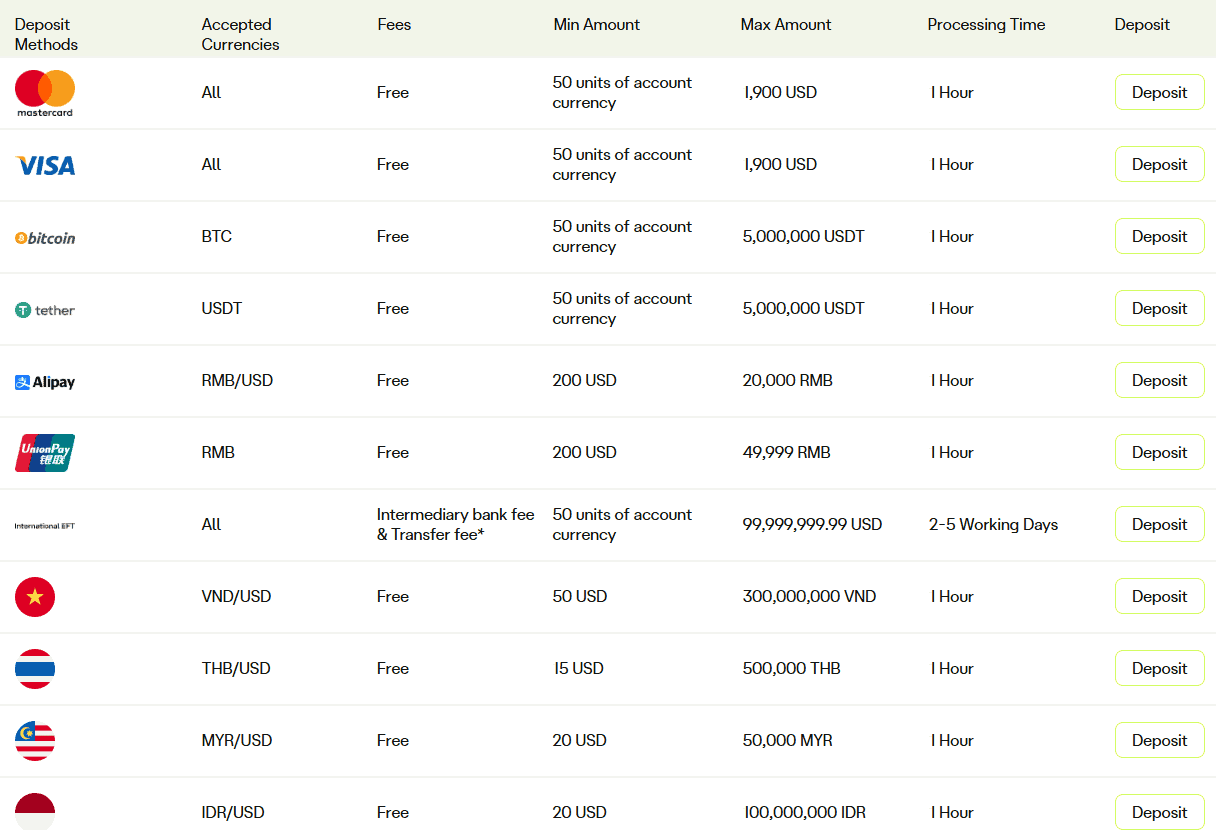

- Deposit and Withdrawal Options

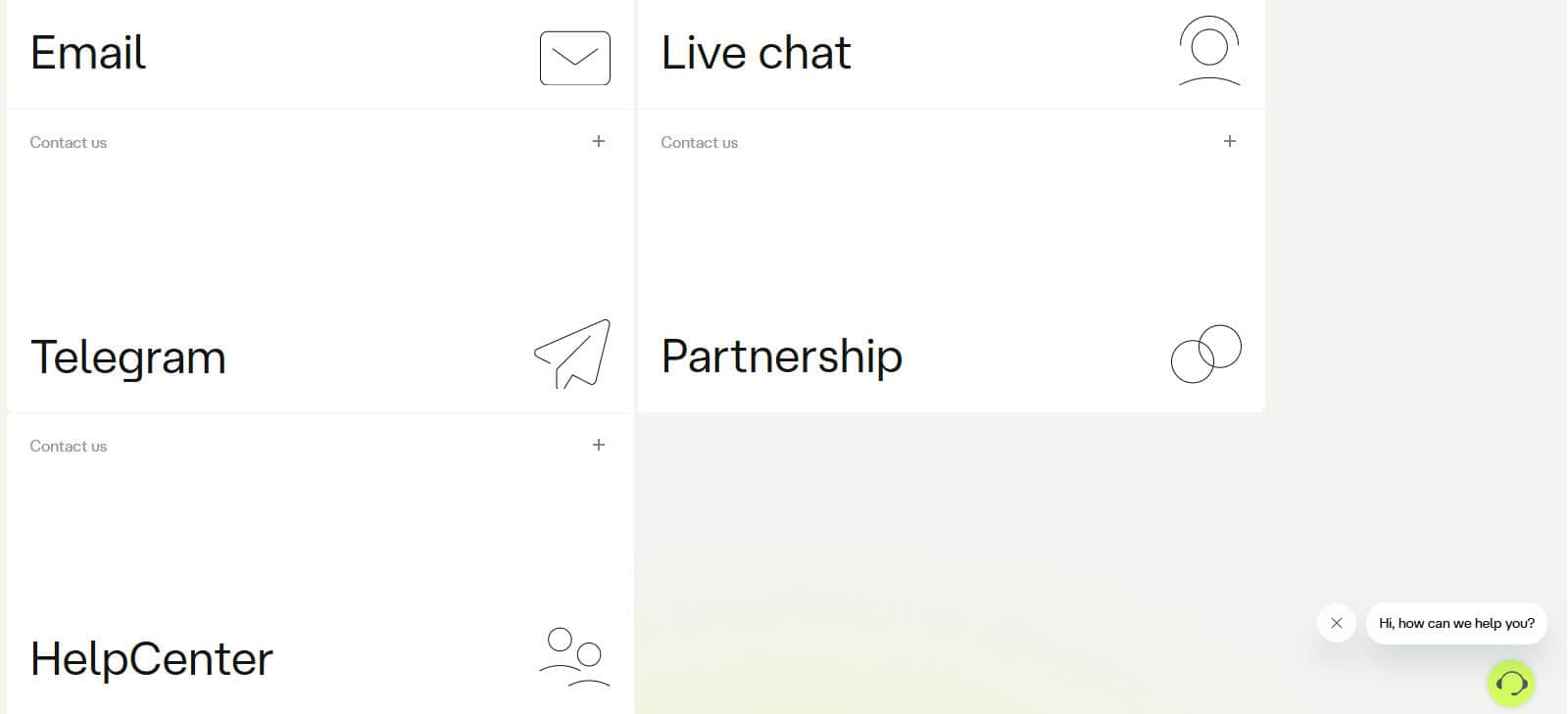

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Ultima Markets Compared to Other Brokers

- Full Review of Broker Ultima Markets

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.6 / 5 |

What is Ultima Markets?

Ultima Markets is a Forex and CFD broker that provides online trading services in various instruments, including currencies, commodities, indices, metals, cryptocurrencies, and more.

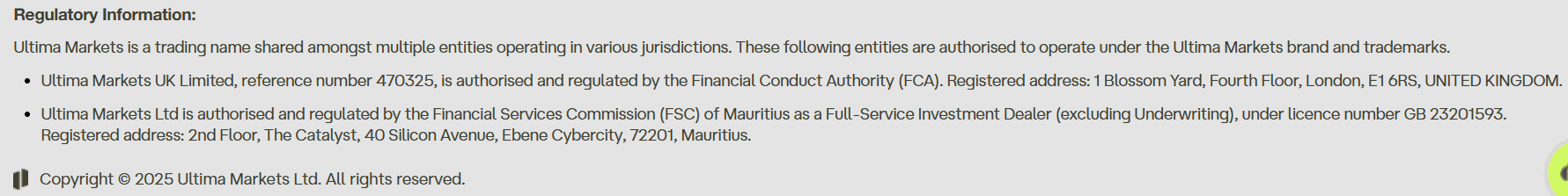

The broker operates through several entities, with varying regulatory oversight: Ultima Markets UK Limited is authorised and regulated by the UK Financial Conduct Authority, one of the most reputable global regulators; Ultima Markets Ltd in Mauritius holds a licence from the Financial Services Commission; and its former European arm, Ultima Markets Cyprus Ltd, was regulated by the Cyprus Securities and Exchange Commission.

However, the Cyprus entity has since undergone a rebranding and name change to Huaprime EU Ltd, with the approved domain now being huaprime.eu instead of ultimamarkets.eu.

Ultima Markets promotes STP/ECN-style execution, offering tight spreads and fast order processing, making it attractive for traders seeking transparent and efficient execution.

Ultima Markets Pros and Cons

Ultima Markets offers several advantages, including access to industry-known platforms like MT4 and MT5, a range of popular instruments such as Forex, commodities, and indices, and flexible account types that cater to different trading needs.

Traders can also benefit from educational resources, occasional promotions or bonuses in certain regions, STP/ECN execution, and leverage options that allow greater market exposure.

For the cons, the broker has a complex brand structure with different entity names and websites that may confuse. High leverage, though appealing, carries added risk, and frequent rebranding can create concerns about overall reliability.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversee | Conditions vary based on the entity |

| Competitive trading conditions | Relatively new to the market |

| CFDs trading | |

| MT4 and MT5 platforms | |

| Client protection | |

| Diverse account types | |

| Suitable for beginners and professionals | |

| 24/7 customer support | |

| Good learning recourses | |

Ultima Markets Features

Ultima Markets provides a range of features, including access to popular platforms, multiple account types, and a wide selection of trading instruments. Here are the key features that the broker offers:

Ultima Markets Features in 10 Points

| 🏢 Regulation | FCA, CySEC, FSC |

| 🗺️ Account Types | Standard, ECN, Standard Cent, ECN Cent Accounts |

| 🖥 Trading Platforms | MT4, MT5, MT4 WebTrader, Mobile App |

| 📉 Trading Instruments | Forex, CFDs on Indices, Shares, Precious Metals, Commodities, Bonds, Cryptocurrencies |

| 💳 Minimum Deposit | $50 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP |

| 📚 Trading Education | UM Academy, Market News, Expert Analysis |

| ☎ Customer Support | 24/7 |

Who is Ultima Markets For?

Ultima Markets is designed for a wide range of traders who value fast execution, diverse instruments, and flexible account options. It caters to individuals seeking opportunities in Forex, commodities, and indices, while also appealing to those who desire access to advanced tools and customizable strategies. We found that the broker is a good choice for:

- Retail traders

- Professional traders

- Traders who prefer the MT4 and MT5 platforms

- UK and European traders

- International trading

- Copy trading

- Currency trading

- CFD trading

- Good strategies

- Swap-free trading

- Competitive conditions

- Good research and learning materials

Ultima Markets Summary

Overall, Ultima Markets is an online broker that offers access to a diverse range of financial instruments through popular platforms such as MT4 and MT5.

It offers multiple account types, fast trade execution, and competitive conditions to different levels of traders. The broker also supports clients with educational resources, analytical tools, and promotional offers in some regions.

While it delivers flexibility and useful features, traders should be mindful of mixed feedback regarding the broker’s complex brand structure. Overall, Ultima Markets aims to combine diverse trading opportunities with accessible technology and competitive conditions.

55Brokers Professional Insights

Ultima Markets stands out by combining competitive conditions with versatile tools that appeal to a broad spectrum of traders. One of its key strengths is the availability of both MT4 and MT5 platforms, which are widely trusted for their reliability, advanced charting, and automated trading capabilities.

The broker also offers multiple account types with varying cost structures, allowing traders to choose the setup that best fits their strategies and experience level. Access to a range of markets, including Forex, commodities, indices, and more, gives clients the ability to diversify their portfolios within a single platform.

Additionally, Ultima Markets enhances the trading experience with fast execution speeds, educational resources, and market analysis, which help both beginners and seasoned traders make more informed decisions. This combination of flexibility, technology, and supportive resources is what makes the broker notable compared to many competitors.

Consider Trading with Ultima Markets If:

| Ultima Markets is an excellent Broker for: | - Need a well-regulated broker.

- Get access to MT4, and MT5 trading platforms.

- Providing competitive trading conditions.

- Need broker with fast execution.

- Offering a variety of account types.

- Who prefer higher leverage up to 1:2000.

- Various strategies allowed.

- Need good learning materials.

- UK and European traders.

- International trading.

- Looking for broker with copy/social trading features.

- Access to VPS hosting.

- Beginners and professional traders.

- Offering MAM and PAMM Trading.

- Who prefer 24/7 customer service.

|

Avoid Trading with Ultima Markets If:

| Ultima Markets might not be the best for: | - Traders who need well-established broker.

- Looking for cTrader platform.

- Who prefer proprietary trading platforms. |

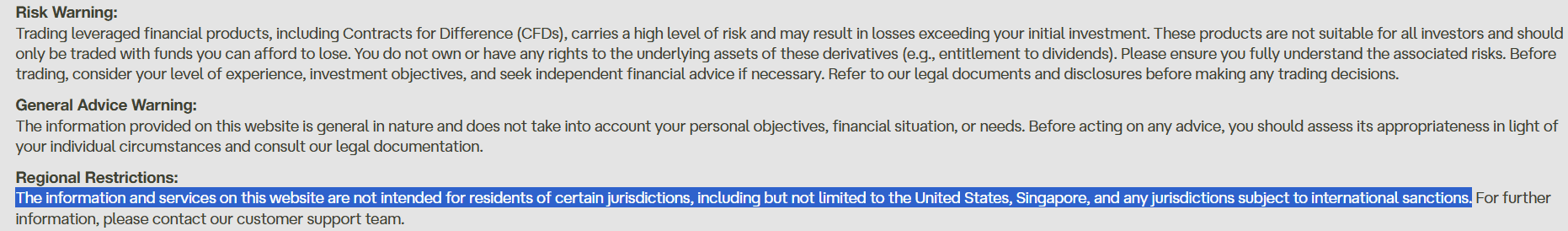

Regulation and Security Measures

Score – 4.5/5

Ultima Markets Regulatory Overview

Ultima Markets operates under a multi-jurisdictional regulatory structure that helps build trust and transparency with traders. The broker is authorized by the Financial Conduct Authority (FCA) in the UK, one of the most reputable regulators in the industry, ensuring high levels of investor protection.

It also holds authorization from the Cyprus Securities and Exchange Commission (CySEC); however, the CySEC-licensed entity now operates under a different name and website following recent changes.

In addition, the broker is regulated by the Financial Services Commission (FSC) in Mauritius, which allows the broker to extend its services to a broader international audience.

How Safe is Trading with Ultima Markets?

Trading with Ultima Markets is relatively safe due to its regulatory oversight, client fund segregation, and risk management measures. The broker offers standard safeguards like keeping client funds separate from company accounts, which adds a layer of protection for traders.

However, traders under offshore regulation may face fewer protections compared to those under stricter jurisdictions like the FCA or CySEC.

Consistency and Clarity

Ultima Markets demonstrates a mixed level of consistency and clarity when it comes to its overall reputation in the trading community. On the one hand, the broker has earned industry recognition through various awards, highlighting areas such as fund safety and trading conditions, and it actively engages in social activities and sponsorships that contribute positively to its image.

User reviews also point to advantages like fast withdrawals, responsive support, and competitive spreads, reinforcing its appeal to many traders. On the other hand, some traders report drawbacks, including limited clarity in bonus terms or multiple connected entities under different names and websites.

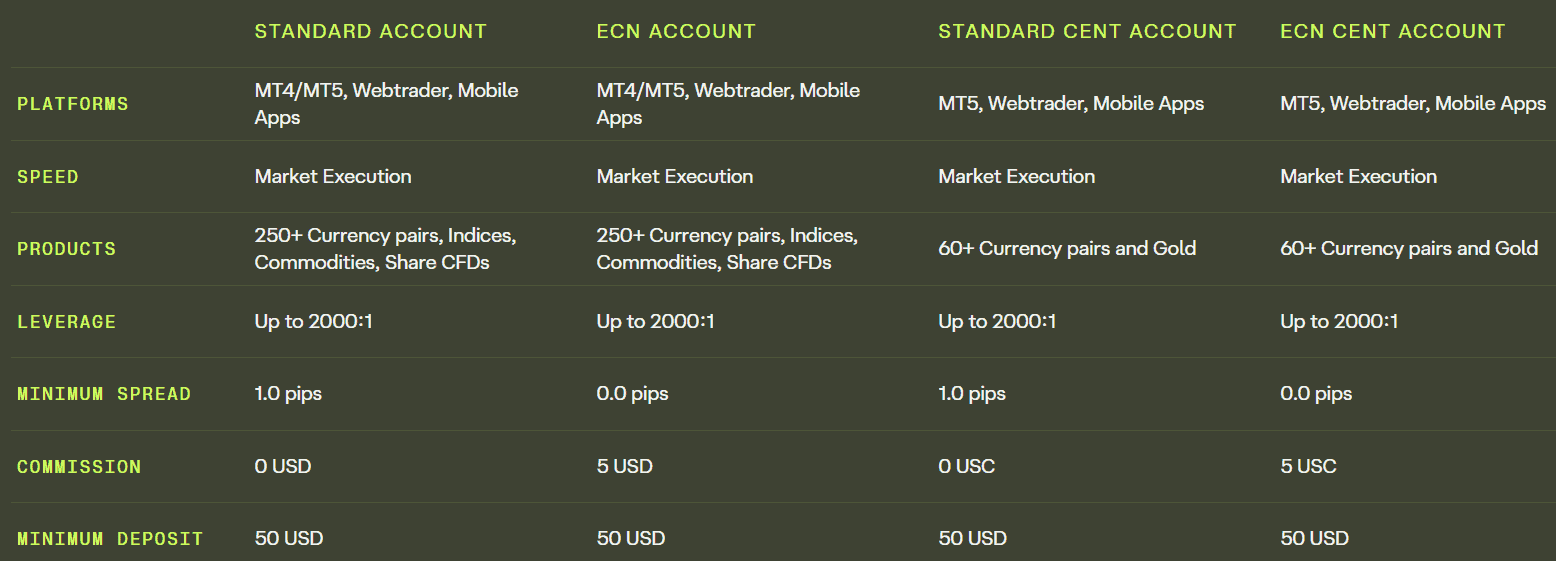

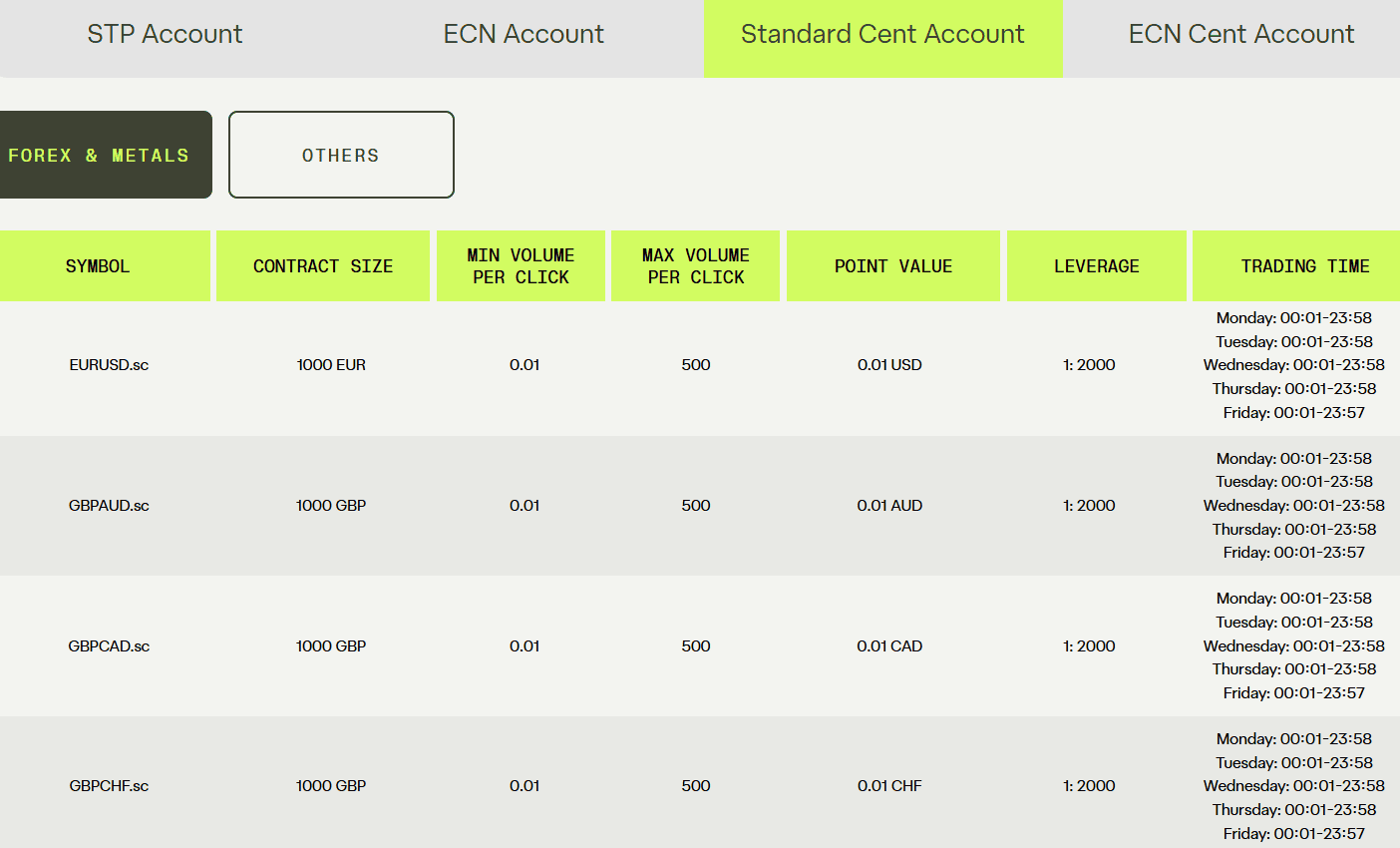

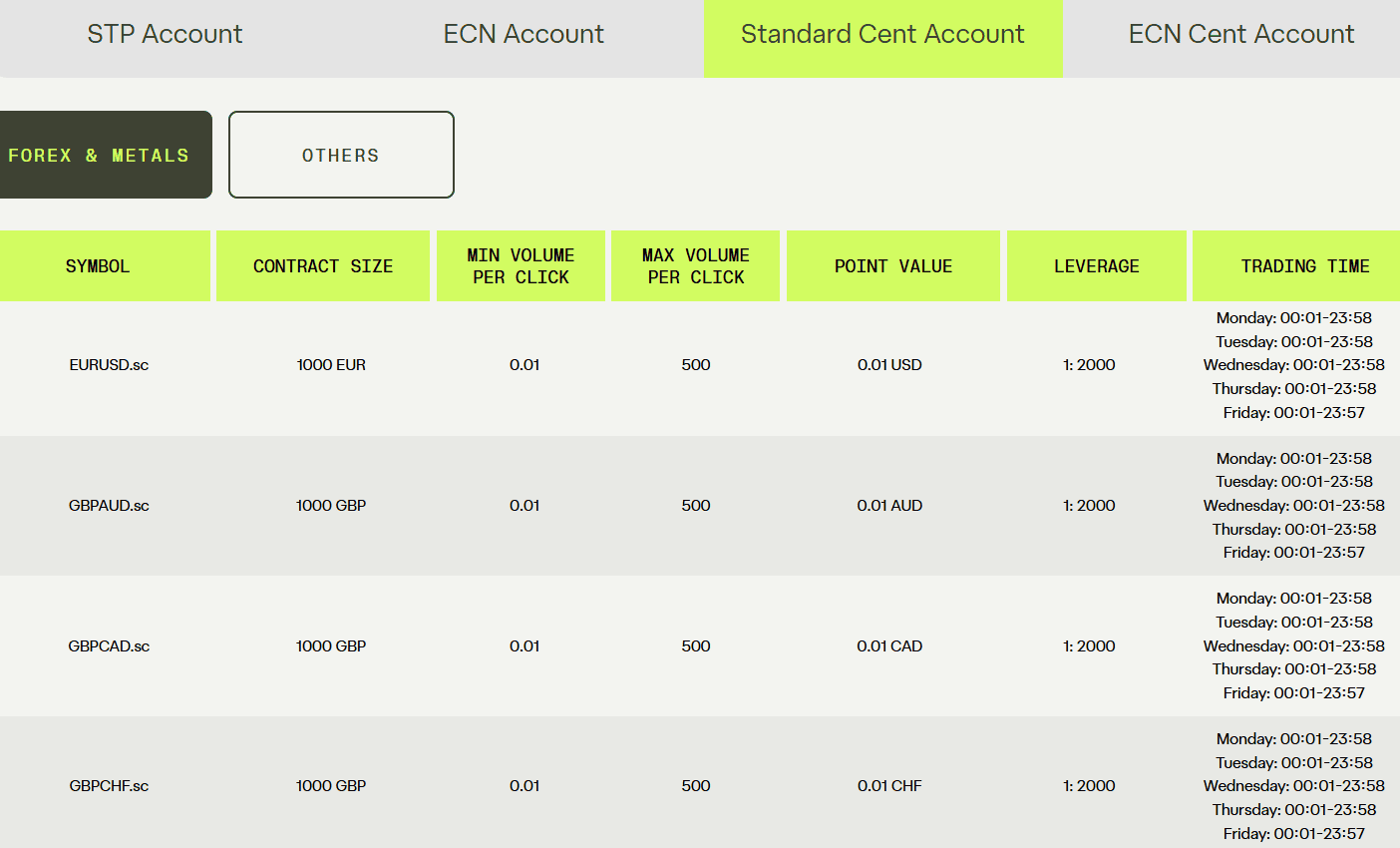

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Ultima Markets?

Ultima Markets provides a diverse range of account types to meet the needs of different traders. The Standard Account is a straightforward option with no commission charges, while the ECN Account caters to those who prefer tighter spreads with a commission-based structure.

For beginners or traders who want to start with smaller amounts, the broker offers Standard Cent and ECN Cent Accounts, both of which allow trading in smaller units while still accessing the same market conditions.

In addition, the broker supports a Demo Account with virtual funds for practice and strategy testing, as well as a swap-free option for traders who require interest-free trading in compliance with Islamic principles.

Standard Account

The Standard Account at Ultima Markets is for traders seeking a simple and cost-effective way to access the markets. It features no commission fees and offers competitive spreads, suitable for both beginners and intermediate traders.

The account requires a minimum deposit of $50, allowing clients to start trading with a manageable investment. It provides access to a wide range of instruments, including Forex, commodities, and indices, and supports trading on both MT4 and MT5 platforms.

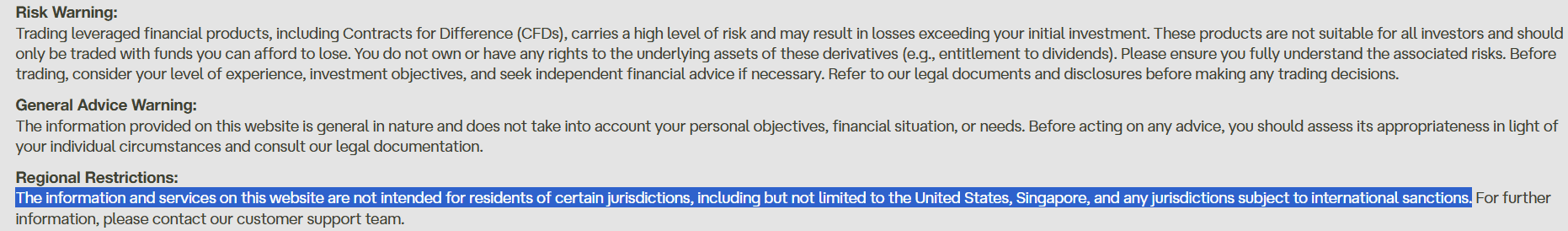

Regions Where Ultima Markets is Restricted

Ultima Markets imposes certain regional restrictions on its services due to jurisdictional and regulatory reasons. Residents of the following countries are not eligible to open accounts:

Cost Structure and Fees

Score – 4.5/5

Ultima Markets Brokerage Fees

Ultima Markets offers a range of brokerage fees tailored to different account types. For the Standard Account, traders benefit from zero commission fees, with spreads starting from 1.0 pip. This structure is ideal for those seeking straightforward trading without additional costs.

For more active traders, the ECN Account provides tighter spreads, beginning at 0.0 pips, accompanied by a $5 commission per round-trip lot. This setup is designed to offer enhanced pricing for high-volume trading.

Additionally, Ultima Markets imposes a withdrawal fee ranging from 0% to 1%, depending on the method used. Overall, the broker provides a flexible fee structure that caters to both casual and active traders, with transparent costs associated with each account type.

Ultima Markets offers competitive spreads to suit different trading needs. On the Standard Account, the average EUR/USD spread is 1 pip, providing a straightforward and cost-effective option for traders.

Spreads on other account types, such as ECN accounts, are typically tighter but include a small commission per lot.

- Ultima Markets Commissions

Ultima Markets maintains a transparent and competitive commission structure across its account types. For the Standard Account, there are no commission fees, with costs incorporated into the spread.

In contrast, the ECN Account charges a $5 commission per round-turn lot. This commission-based model is designed to benefit high-volume traders seeking lower overall costs.

- Ultima Markets Rollover / Swaps

Ultima Markets applies rollover rates to positions held overnight, reflecting the interest rate differentials between the currencies traded. These swaps can be either positive or negative, depending on the pair and the direction of the trade.

The broker also offers swap-free accounts for traders who require Islamic-compliant trading, allowing positions to be held overnight without incurring interest charges.

How Competitive Are Ultima Markets Fees?

Ultima Markets offers competitive fees that cater to a wide range of traders. The broker provides zero-commission trading on its Standard Account, making it an attractive option for those seeking straightforward pricing.

For more active traders, the ECN Account charges a $5 commission per round-turn lot, offering tighter spreads starting from 0.0 pips. Additionally, Ultima Markets does not impose fees on deposits or account inactivity, which can significantly reduce overall costs. These transparent and competitive fee structures are designed to enhance the trading experience for both novice and experienced traders.

| Asset/ Pair | Ultima Markets Spread | GBE Brokers Spread | FinPros Spread |

|---|

| EUR USD Spread | 1 pip | 0.8 pips | 1.6 pips |

| Crude Oil WTI Spread | 1 | 3 | 0.75 |

| Gold Spread | 0.3 | 3 | 1.2 |

| BTC USD Spread | 11 | 40 | 1.2 |

Ultima Markets Additional Fees

While the broker does not impose deposit or inactivity fees, certain withdrawal conditions apply. For international wire transfers, Ultima Markets covers the fee for the first withdrawal each month; subsequent withdrawals within the same month incur a fee of $20 per transaction.

Additionally, the third-party payment providers or banks may also charge their own fees, which are beyond the broker’s control. Traders should be aware of these potential charges when planning withdrawals. Also, standard swap fees apply to positions held overnight, which are determined by market conditions and the specific instruments traded.

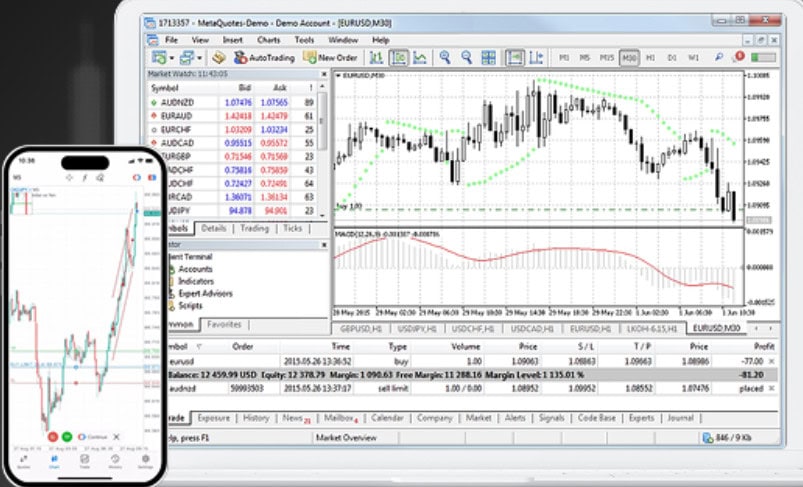

Trading Platforms and Tools

Score – 4.6/5

Ultima Markets provides traders with a choice of powerful and user-friendly platforms, including MetaTrader 4 and MetaTrader 5, known for their advanced charting, automated trading capabilities, and reliability.

In addition, the broker offers MT4 WebTrader for convenient browser-based access and a fully functional mobile app for trading on the go, ensuring flexibility and seamless account management across devices.

Trading Platform Comparison to Other Brokers:

| Platforms | Ultima Markets Platforms | GBE Brokers Platforms | FinPros Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | No | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

Ultima Markets Web Platform

The Ultima Markets Web Platform, powered by MT4 WebTrader, allows traders to access their accounts directly through a browser without the need for downloads or installations.

It offers a streamlined interface with essential tools, real-time quotes, and charting features, making it a convenient option for those who prefer fast and flexible trading from any device with internet access.

Ultima Markets Desktop MetaTrader 4 Platform

The MetaTrader 4 platform delivers a robust and reliable trading experience, equipped with advanced charting tools, customizable indicators, and support for automated strategies through Expert Advisors.

The platform provides fast execution, real-time market analysis, and a user-friendly interface, making it one of the most popular choices for desktop trading.

Ultima Markets Desktop MetaTrader 5 Platform

The Ultima Markets Desktop MetaTrader 5 platform offers an enhanced trading environment with more advanced features compared to MT4, suitable for traders seeking greater analytical depth.

It comes with over 80 built-in technical indicators and supports 21 different timeframes, allowing for highly detailed market analysis and flexible strategy development. MT5 also enables faster order execution, averaging under 20ms, advanced charting, and multi-asset trading, while maintaining a user-friendly interface.

Ultima Markets MobileTrader App

The Ultima Markets MobileTrader App gives traders the flexibility to access global markets anytime, anywhere, directly from their smartphones or tablets.

Available for both iOS and Android devices, the app supports seamless trading on MT4 and MT5, offering real-time price quotes, interactive charts, and a full set of order types.

Main Insights from Testing

Our testing of the Ultima Markets mobile app showed that it runs smoothly, with quick order execution and a clean, intuitive interface. Navigation between charts, account management, and trading functions is straightforward, making it easy for both new and experienced traders to use.

Notifications and updates are timely, helping traders stay on top of market movements while managing positions efficiently on the go.

AI Trading

Ultima Markets integrates AI-powered tools into its trading environment, particularly on the MT5 platform, to enhance decision-making and automation.

Traders can benefit from AI-driven features that support smarter risk management, advanced market analysis, and automated strategies through Expert Advisors. These tools are designed to adapt to changing market conditions, providing a more efficient and innovative trading experience while allowing users to combine traditional methods with modern technology.

Trading Instruments

Score – 4.5/5

What Can You Trade on Ultima Markets’s Platform?

Ultima Markets offers access to over 250 financial instruments, giving traders a wide variety of markets to choose from. This includes Forex, CFDs on Indices, Shares, Precious Metals, Commodities, Bonds, and Cryptocurrencies.

Main Insights from Exploring Ultima Markets’s Tradable Assets

Exploring Ultima Markets’ tradable assets shows that traders benefit from a wide variety of instruments with good liquidity and execution, especially in popular markets like Forex, gold, and oil.

However, some users note that niche markets and exotic pairs are limited, and certain assets may have wider spreads or more volatile pricing.

Leverage Options at Ultima Markets

Leverage levels offered by Ultima Markets depend on the entity you open an account with. It is a useful tool that enables traders to enter the market with limited capital, yet its use can lead to both substantial profits and losses.

Therefore, you should have a comprehensive understanding of how the multiplier works and its possible consequences before engaging in any trading activities that involve leverage.

- Trades from the UK and Europe are eligible to use low leverage up to 1:30 for major currency pairs.

- For international traders, the maximum leverage is 1:2000.

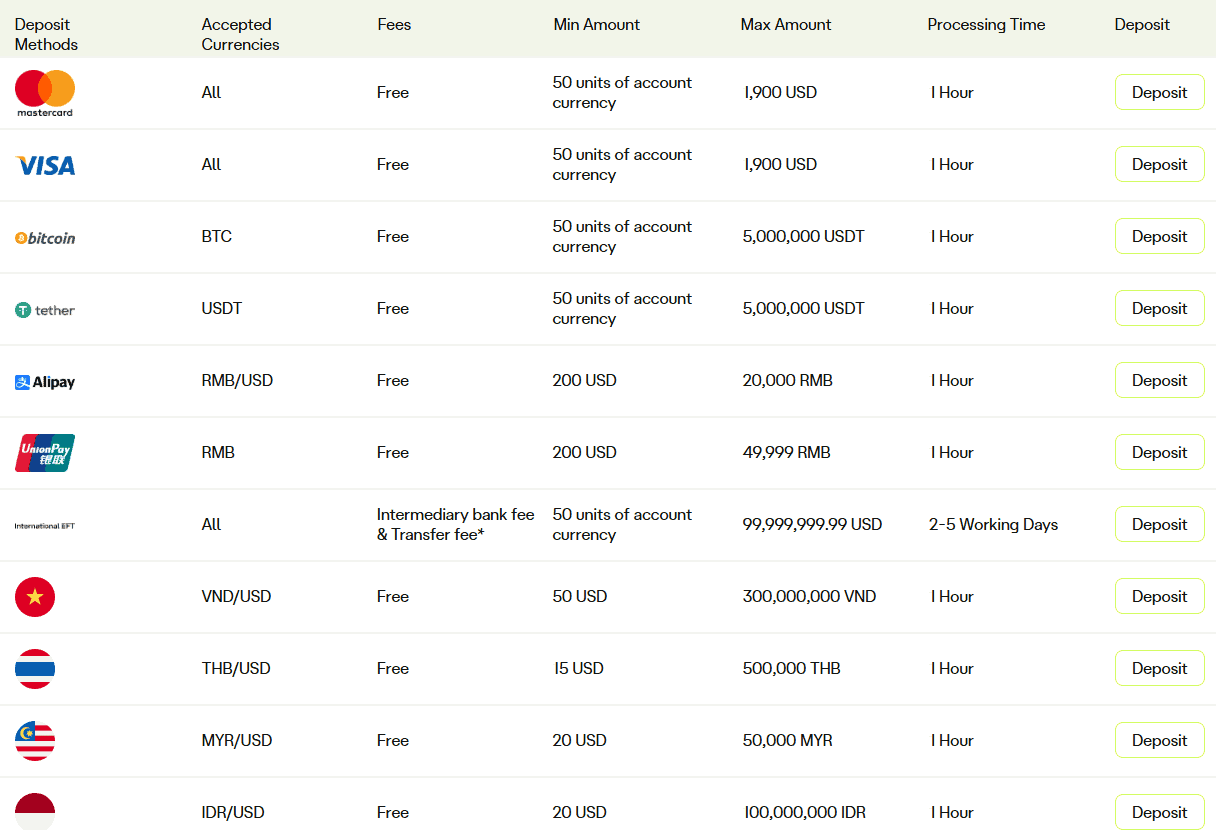

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Ultima Markets

In terms of funding methods, Ultima Markets offers a variety of payment methods for funding traders’ accounts quickly and securely, including:

Ultima Markets Minimum Deposit

The broker requires a minimum deposit of $50 to open a live account. This low entry requirement allows clients to open an account and begin trading across a wide range of instruments without committing a large amount of capital.

Withdrawal Options at Ultima Markets

Ultima Markets offers a variety of withdrawal options to provide flexibility and convenience for its clients. Traders can withdraw funds using bank wire transfers, credit/debit cards, and popular e-wallets, with processing times depending on the chosen method.

The broker aims to make withdrawals straightforward and secure, ensuring that clients can access their funds efficiently while maintaining compliance with regulatory requirements.

Customer Support and Responsiveness

Score – 4.5/5

Testing Ultima Markets’s Customer Support

The broker provides 24/7 customer support through multiple channels, including live chat, email, social media channels, and Help Center.

The support team is generally knowledgeable about account types, platforms, and technical issues, providing clear guidance to both new and experienced traders.

Contacts Ultima Markets

You can contact Ultima Markets through multiple channels for support and inquiries. If you have any questions or enquiries, you can fill in the contact form on their website or reach out via email at info@ultimamarkets.com.

Research and Education

Score – 4.6/5

Research Tools Ultima Markets

Ultima Markets provides a range of research tools to help traders make informed decisions.

- On its platforms, users have access to advanced charting, technical indicators, economic calendars, and real-time market news.

- Ultima Markets also integrates Trading Central, a professional research service that provides a variety of analytical tools for traders. This includes Daily Newsletters, Technical Views, Alpha Generation insights, and News Briefs, helping traders make informed decisions based on market trends and expert analysis.

- Additionally, the broker’s website offers market analysis, guides, and regular market updates. These tools support both new and experienced traders in analyzing trends, developing strategies, and staying up-to-date with market developments.

Education

Ultima Markets offers a comprehensive education section to support traders at all levels. Through the UM Academy, users can access learning resources covering trading basics, strategies, and platform usage.

The broker also provides up-to-date market news and expert analysis, helping traders stay informed about global financial developments and make well-informed decisions.

Portfolio and Investment Opportunities

Score – 4.2/5

While Ultima Markets operates as a CFD broker, it also provides some investment opportunities for clients seeking portfolio diversification.

These include MAM and PAMM accounts, which allow investors to allocate funds to professional traders for managed trading, as well as copy/social trading options that enable clients to replicate the strategies of experienced traders.

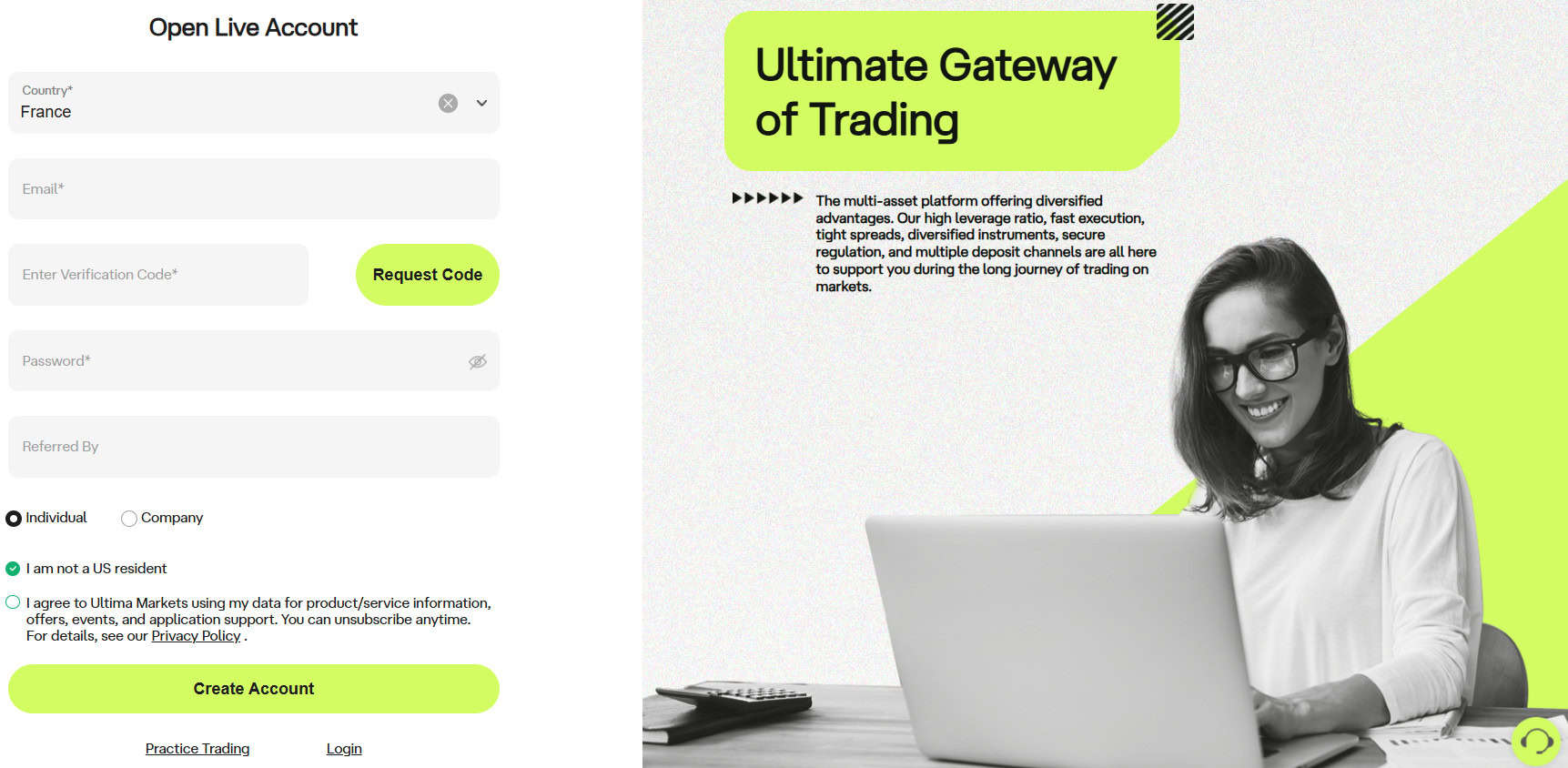

Account Opening

Score – 4.5/5

How to Open Ultima Markets Demo Account?

Opening a demo account with Ultima Markets is a simple process. Traders can visit the broker’s website, select the Demo Account option, and complete the registration form with basic personal details.

Once registered, users gain access to a fully functional trading environment with virtual funds, allowing them to practice strategies, explore the platforms, and familiarize themselves with the available instruments without risking real money. This provides a safe and practical way to build confidence before transitioning to a live account.

How to Open Ultima Markets Live Account?

To start trading with real funds, you can open a live account with Ultima Markets in a few simple steps. The process is quick and user-friendly:

- Visit the Ultima Markets website and click on “Open Live Account.”

- Fill out the registration form with your personal details, including name, email, phone number, and country of residence.

- Submit verification documents such as a government-issued ID and proof of address.

- Select your account type and choose your base currency.

- Deposit the minimum amount of $50 to activate your account.

- Access the platform via MT4, MT5, WebTrader, or the mobile app.

- Start trading once your account is verified and funded.

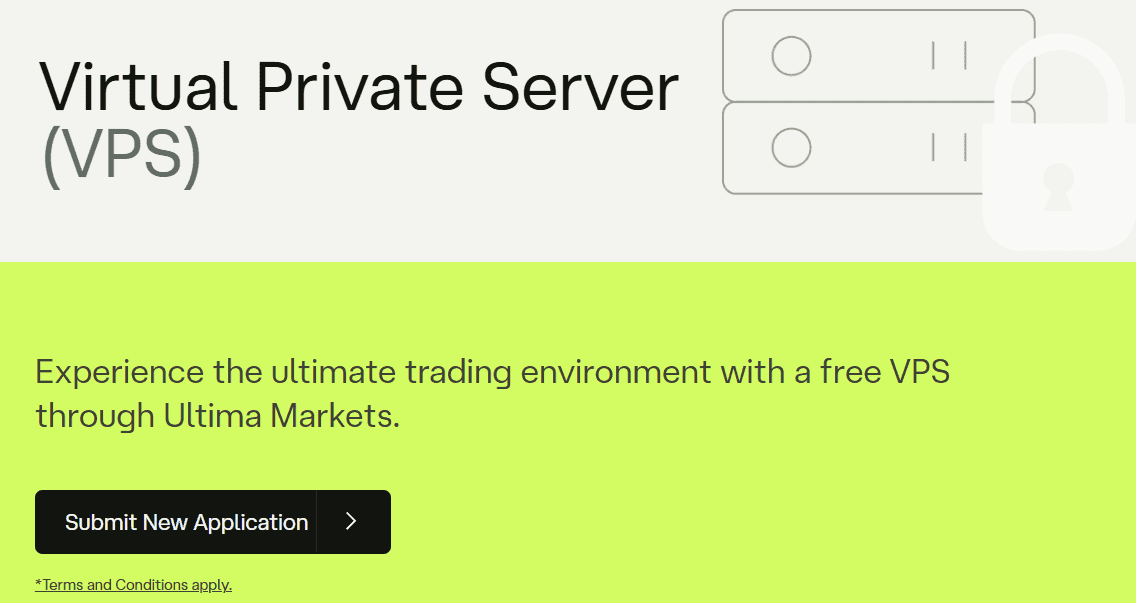

Additional Tools and Features

Score – 4.6/5

In addition to its main research tools, Ultima Markets offers additional tools and features.

- These include a VPS service for faster and uninterrupted order execution, as well as trading calculators to help plan risk management, position sizing, and potential profits or losses.

- Other features include session trackers and customizable alerts, all aimed at providing traders with practical resources to improve strategy, efficiency, and overall market awareness.

Ultima Markets Compared to Other Brokers

Ultima Markets offers a well-rounded trading experience that balances accessibility, cost-efficiency, and platform flexibility. Compared to its competitors, it stands out for its low minimum deposit and range of account types, making it approachable for all levels of traders.

While its asset variety is more limited than some high-volume brokers, it still provides access to a diverse selection of instruments. The broker supports popular platforms like MT4 and MT5, ensuring flexibility for different trading styles.

Additionally, Ultima Markets provides educational resources, market analysis, and 24/7 customer support, which enhances the overall trading experience. Overall, it positions itself as a reliable and accessible broker, though traders seeking the widest possible asset coverage or the most advanced proprietary platforms may find other brokers more suitable.

| Parameter |

Ultima Markets |

GBE Brokers |

Earn |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1 pip |

Average 0.8 pips |

Average 0.1 pips |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.0 pips + $2.5 per side |

0.0 pips + $3.5 per side |

0.0 pips + 0.007% per side |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, MT4 WebTrader, Mobile App |

MT4, MT5, TradingView |

MT4, MT5, Earn.Broker |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

250+ instruments |

1000+ instruments |

950+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FCA, CySEC, FSC |

CySEC, BaFin, FSA |

CySEC |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Excellent |

Limited |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

$50 |

$1,000 |

$100 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker Ultima Markets

Ultima Markets is a versatile online Forex broker offering a reliable trading environment. It provides a variety of account types, flexible platforms including MT4, MT5, WebTrader, and mobile apps, and access to a popular range of financial instruments such as Forex, commodities, indices, shares, and cryptocurrencies.

The broker emphasizes user support with 24/7 customer service, educational resources, and market analysis tools to help traders make informed decisions.

Competitive spreads, low minimum deposits, and additional features like demo accounts, swap-free options, and integrated research tools make Ultima Markets a solid choice for those seeking a balanced and well-rounded experience.

Share this article [addtoany url="https://55brokers.com/ultima-markets-review/" title="Ultima Markets"]