- What is Trade the Pool?

- Trade the Pool Pros Cons

- Is Trade the Pool Legit?

- Trade the Pool Challenge

- Funded Account

- Account Conditions

- Payout

- Trade the Pool Alternative

What is Trade the Pool Prop Firm?

Trade The Pool is a proprietary trading firm focused on stock trading, established by Five Percent Online Ltd, the company behind The5ers, a renowned online prop firm. Founded in 2022, Trade The Pool offers a unique funding solution for various types of stock traders, partnering with some of the leading companies in the industry. The firm’s approach is built on the experience of its team, which includes senior active traders, and aims to create a rewarding trading environment.

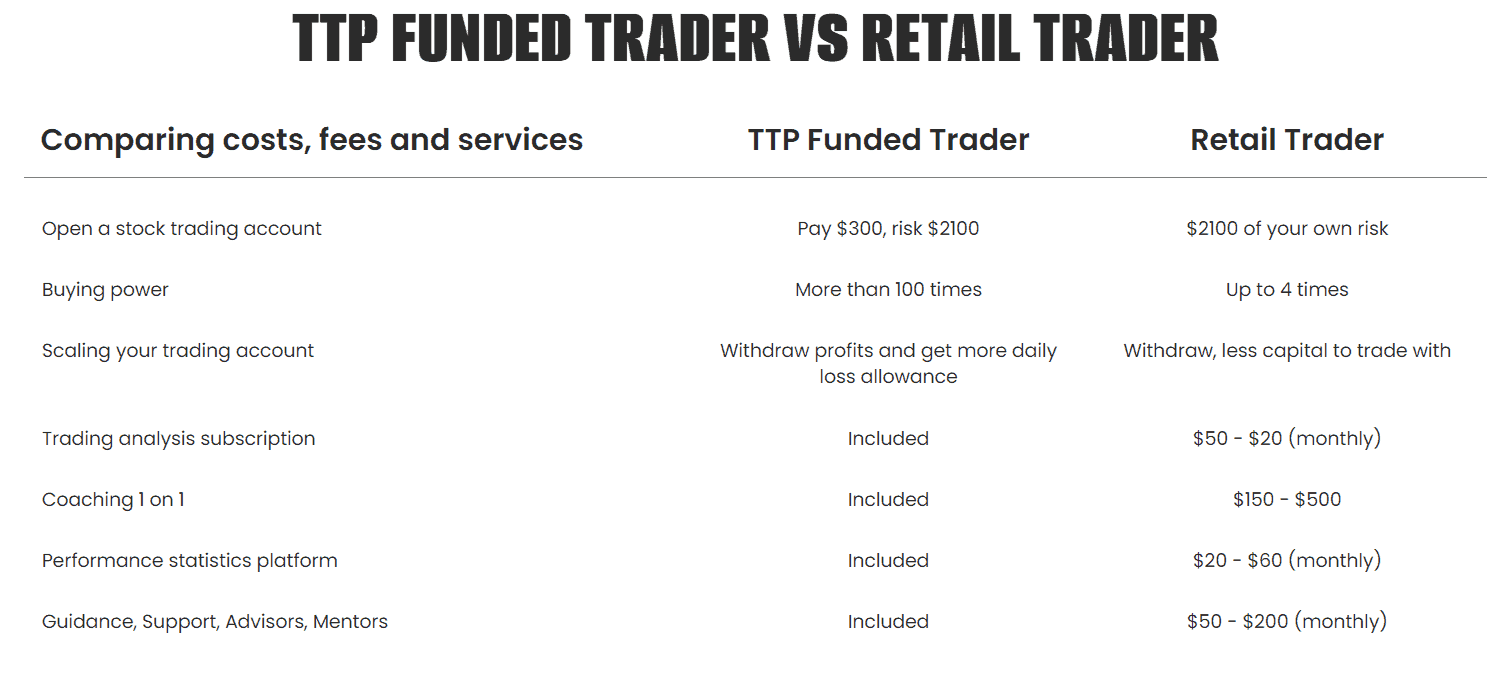

As a proprietary trading firm, Trade the Pool presents a unique opportunity for traders to engage in real trading with minimal initial funds. To become a funded trader, which means trading with the company’s funds, a trader must first successfully pass a test or challenge to obtain a funded account. Once this challenge is completed, they can trade with the company’s account as a professional trader. For a deeper understanding of proprietary trading and how it works, read our article about Prop Trading.

| Trade the Pool Advantages | Trade the Pool Disadvantages |

|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Only Stock Trading |

| Free Trial | No MetaTrader Platform |

| Offers stock trading opportunities | No Weekend Trading |

| One-phase evaluation challenge | |

| Educational Materials | |

Is Trade the Pool Legit?

Trade The Pool is based in Israel and has received a generally positive reception, with a good rating among customers. It’s seen as a legitimate prop trading firm, providing an opportunity for traders to grow or hone their skills with various support tools and educational resources.

- Proprietary trading firms like Trade The Pool are generally less regulated compared to Forex brokers, as they don’t operate under the same licensing. This lack of regulation means they’re not monitored by industry regulators, leading to a lower level of guaranteed safety. Since these firms manage their operations and provide trading funds, traders need to be aware of the risks and thoroughly understand the firm’s policies before engaging in trading activities.

Is Trade the Pool Scam?

We reviewed the legitimacy of Trade with Pool through their official website and found no evidence suggesting it’s a scam. However, given that Proprietary Trading Firms typically operate with minimal regulation by financial authorities, it’s challenging to conclusively determine the firm’s authenticity. The lesser degree of regulation in this sector means that traders should exercise caution and conduct thorough research before committing to such firms.

When considering Proprietary Trading, it’s wise to understand the risks and select a well-reputed, long-standing company for more stability. Although prop trading involves mainly subscription fees, reducing the financial risk compared to using personal funds for trading, it’s still important to approach with caution and informed decision-making.

Trade the Pool Challenge Evaluation Rules

The central aspect of our Trade the Pool review is understanding the evaluation challenge which includes the specific tests required to qualify for a Funded Trading Account and become a Proprietary Trader. Additionally, it’s important to consider the costs involved for traders, typically in the form of a registration fee. These elements are crucial in determining the feasibility and attractiveness of the program for potential traders.

- Evaluation involves a one-phase challenge where traders must meet specific targets within a set timeframe without exceeding maximum loss limits. The challenge includes a minimum number of trades to be completed and focuses on the trader’s ability to manage risk and generate profits.

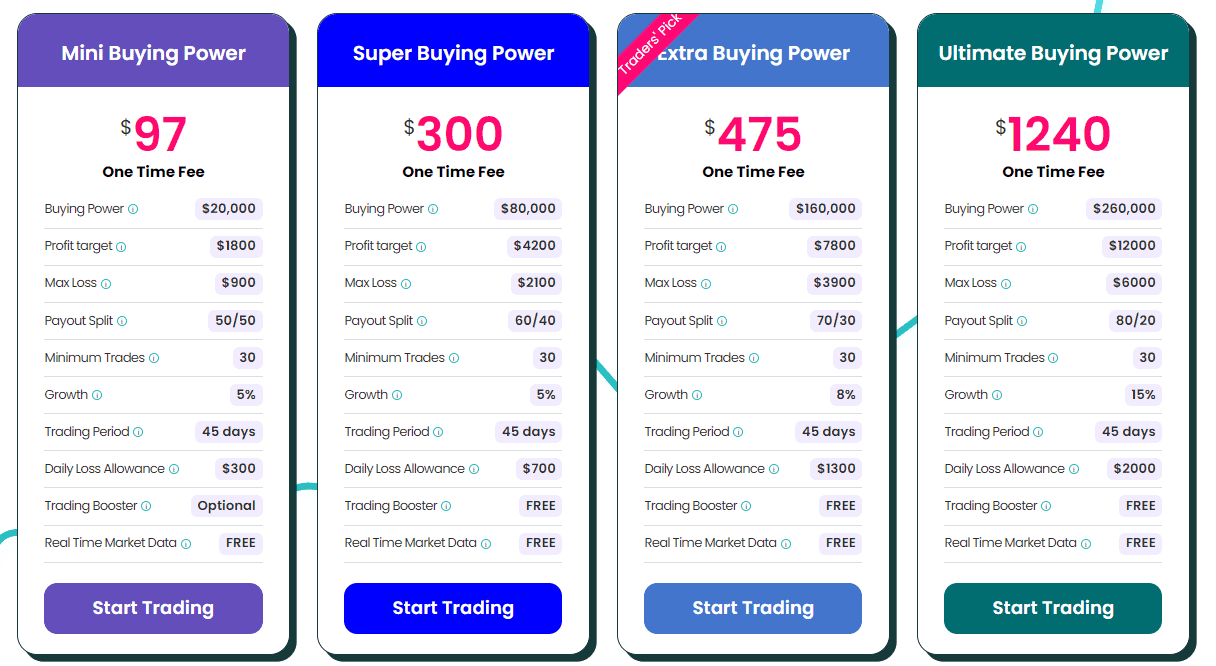

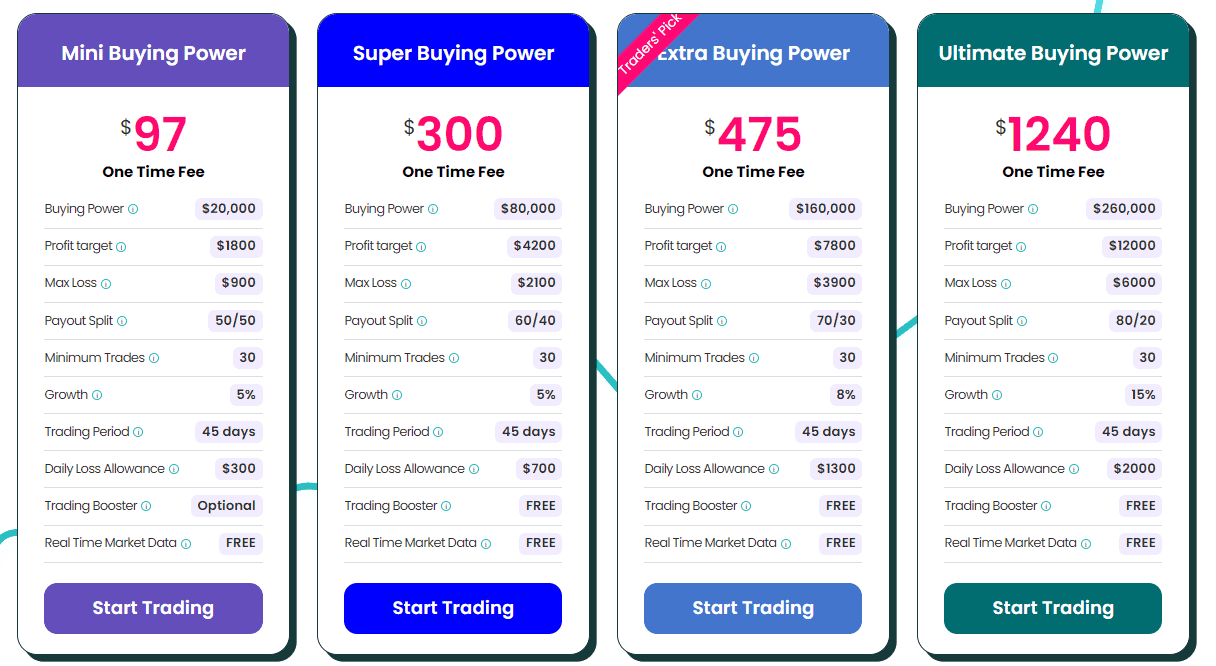

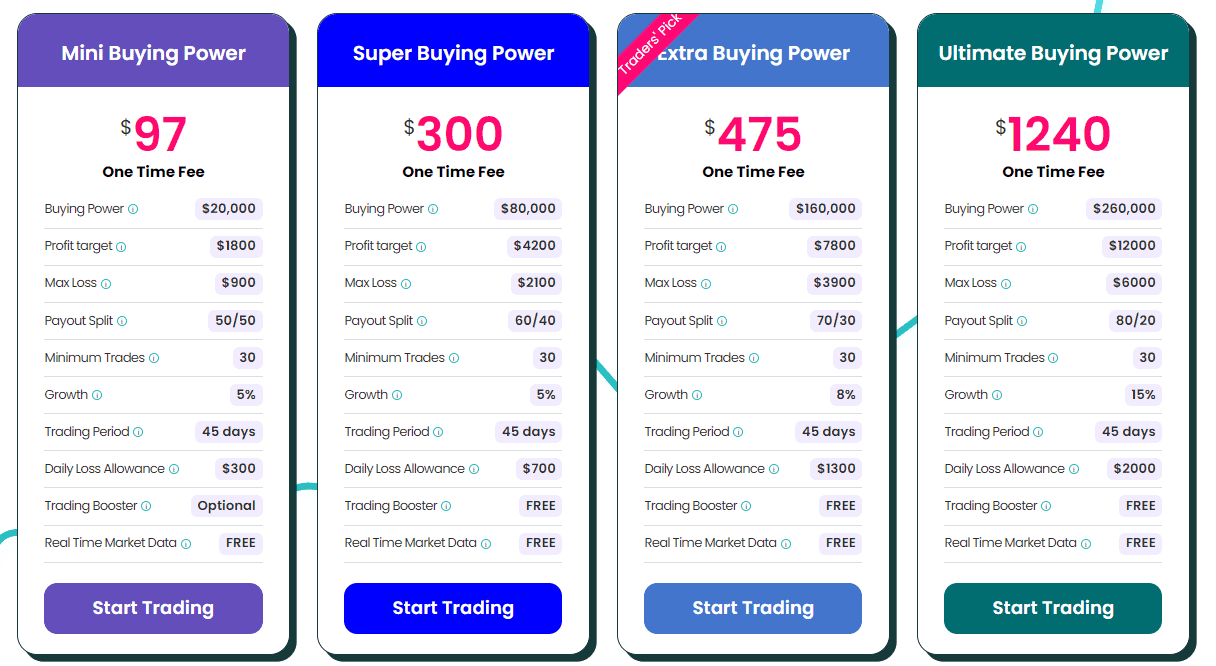

Account Balance and Registration Fee

To start with Trade The Pool, you first need to select the account balance you aim to qualify for. The chosen account size determines the specific conditions of the challenge, as each account tier has slightly different requirements. This selection also influences the registration fee required to participate in the challenge. The fee varies based on the account size and is a crucial factor to consider when deciding which account to aim for.

- Trade The Pool’s key features include a one-phase evaluation model to access a funded account, where traders must meet certain profit targets, avoid exceeding maximum drawdown and daily loss limits, and complete a minimum number of trades within a 45-day period.

- They offer different account sizes, with the smaller funded accounts starting at $20,000 and going up to $260,000 for larger accounts.

- It’s important to be aware that the fees paid for participating in Trade The Pool’s challenge are non-refundable. This means that once you have paid the registration fee to take part in the evaluation process, this fee cannot be reclaimed, regardless of the outcome of the challenge.

| Fees | Trade the Pool | FTMO | The Funded Trader |

|---|

| Minimum Account Size | $20,000 | $10,000 | $50,000 |

| Fee | $97 | €155 | $289 |

| Maximum Account Size | $260,000 | $200,000 | $400,000 |

| Fee | $1240 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | No | Yes | Yes |

Profit Target

In the evaluation phase at Trade The Pool, the profit target is set at 10% of the account’s buying power. This means that traders are required to achieve a profit that equals 10% of the total buying power they are allocated in their specific program.

Maximum Loss

At Trade The Pool, the maximum daily loss and overall maximum loss are dependent on the account type you choose. Each account type has a specific maximum loss allowance, and the daily loss allowance is set as a portion of this maximum loss. For example, in the Mini Buying Power program, the maximum loss is $900, and the daily loss allowance is $300. In the Super Buying Power program, these figures are $2,100 for the maximum loss and $700 for the daily loss allowance.

- In the Trade The Pool challenge, maintaining adherence to all rules is crucial. Failure to do so will result in the termination of the test. Participants then have the option to restart the challenge by paying a reset fee.

Minimum Trading Period

The minimum trading period for the Trade The Pool evaluation phase isn’t explicitly stated. The focus is on the overall period of 45 calendar days provided for traders to meet the challenge’s objectives.

See the detailed table with Trade the Pool Challenge conditions based on Account Size:

Trade the Pool Challenge

Free Trial

Trade The Pool offers a 14-day free trial for their services. This trial period allows potential traders to test the platform and its features before committing to the paid evaluation challenge.

Trade the Pool Funded Account

After passing the challenge, it takes a few business days to set up the funded account, which will have the same conditions and balance as the one qualified for in the test. To upgrade to a higher account level, a trader must start and pass the evaluation for that specific account tier from scratch.

Profit Split

The profit split at Trade The Pool depends on the account type. For smaller accounts, it might be a 50/50 split, and for larger accounts, the split can be more favorable to the trader, like 70/30 or 80/20. This means traders keep a significant part of their trading profits, with the percentage varying based on their account level.

Payout and Withdrawals

At Trade The Pool, once a trader successfully passes the evaluation and gets a funded account, they can withdraw their profits. The withdrawals can be processed every 14 days, provided that the trader has reached a minimum profit of $300.

Withdrawal Method

Withdrawals are processed through Wise for fiat money like USD and through Confirmo for crypto

Account Conditions

When evaluating account conditions, it’s essential to assess factors like the broker’s account options, trading platforms, instruments, and costs. Leverage and specific trading terms are crucial too, as some brokers may limit certain strategies in funded accounts, leading to potential account loss. Non-compliance with these rules might require re-taking the evaluation.

Trading Instruments

Trade The Pool offers a wide range of trading instruments, primarily focusing on stocks. Traders have access to a broad selection of over 12,000 stocks and ETFs in the US markets, including penny stocks. This extensive range allows traders to diversify their portfolios and explore various trading strategies across different sectors and market conditions.

Trade the Pool Commission

Trade The Pool offers a wide range of trading instruments, primarily focusing on stocks. Traders have access to a broad selection of over 12,000 stocks and ETFs in the US markets, including penny stocks. This extensive range allows traders to diversify their portfolios and explore various trading strategies across different sectors and market conditions.

Leverage

Trade The Pool does not apply traditional leverage in the way it’s commonly understood in Forex trading. Instead, they provide traders with a “buying power” value, which is the maximum amount a trader can invest.

Trade the Pool Platform

Trade The Pool uses the Trader Evolution platform, a professional trading platform equipped with tools of the Trade Pool service essential for traders. This includes a scalper window, market depth, super dom, and stock scanners. Trader Evolution is designed to cater to the needs of serious traders, offering a robust and efficient trading experience.

Trading Conditions

Trade The Pool has designed its trading conditions to create a balanced and well-structured environment for traders. These conditions are aimed at facilitating profitable opportunities and supporting traders’ growth and development in their trading journey.

- Traders are permitted to engage in day trading and hold positions overnight and over weekends. However, scalping and excessive trading are restricted. Additionally, traders are prohibited from using automated trading systems and must adhere to specified risk management rules.

- At Trade The Pool, traders may experience slippage due to market volatility and fast-moving conditions. It’s a common occurrence in trading and can result in a trade being executed at a slightly different price than anticipated. Traders should be aware of slippage and consider it as part of their trading strategy and risk management.

Trade the Pool Promotions

Trade The Pool occasionally offers promotions with available coupons for discounts, but these conditions are typically temporary. It’s advisable to verify the availability of these discounts at the time of your registration to ensure you can take advantage of any ongoing promotions.

Trade the Pool Alternative Brokers

Based on our research, Trade The Pool is a reliable prop trading firm that provides a unique opportunity for stock trading, which is not commonly offered by many prop firms. Their one-phase evaluation challenge with reasonable fees and conditions is suitable for both experienced and beginner traders. They also offer valuable educational materials and a rare opportunity with a free trial. This makes Trade The Pool stand out as a promising option for traders.

It’s important to compare Trade The Pool’s proposal with offerings from other prop trading firms. Some popular firms may provide similar conditions and better instrument and platform choices. However, Trade The Pool has its unique advantages. For a comprehensive assessment, consider the alternatives and refer to our comparison table below for a detailed evaluation of Trade The Pool against other companies.

Share this article [addtoany url="https://55brokers.com/trade-the-pool-review/" title="Trade the Pool"]