- What is TastyTrade?

- TastyTrade Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- TastyTrade Compared to Other Brokers

- Full Review of Broker TastyTrade

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.8 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.5 / 5 |

What is TastyTrade?

TastyTrade is a US-based online trading broker specializing in stock, option, and futures trading, designed primarily for experienced traders and investors. The firm, originally launched as Tastyworks in 2017, was acquired by IG Group for $1 billion in 2021 and rebranded in 2023.

The broker offers a good range of trading tools, including customizable dashboards, advanced charting, and real-time market data. With competitive pricing, such as $0 commissions on stock and ETF trades and $1 per options contract, Tastytrade provides a cost-effective solution for high-frequency trading.

Is TastyTrade Stock Broker?

Yes, TastyTrade is a Stock trading platform that offers a range of brokerage services, including investment opportunities in stocks, options, futures, ETFs, and cryptocurrencies to its customers. The broker is known for its focus on investors, providing robust trading tools and educational resources through its affiliated media network, tastylive.

TastyTrade Pros and Cons

TastyTrade is a reliable company that offers several advantages to investors. Trading conditions and proposals are good, which include low-cost trading with $0 commissions on stocks and ETFs. The platform is also well-developed and has good research.

Moreover, the broker stands out with its extensive educational content, which is especially beneficial for options traders looking to deepen their knowledge.

For the Cons, the broker has limited access to certain asset classes like mutual funds and international equities, which may not suit more diversified investors. Additionally, popular trading platforms like MT4 to MT5 are not offered.

| Advantages | Disadvantages |

|---|

| Heavily regulated broker with a strong establishment | No popular trading platform available |

| CFTC registered broker | No 24/7 customer support |

| No minimum deposit | |

| Stock Trading and Investment | |

| Suitable for professionals and investors | |

| Good quality educational materials and research | |

| Low fees and commissions | |

TastyTrade Features

TastyTrade is a US-based brokerage firm known for its comprehensive range of trading services, low-cost fees, and robust trading platform designed for both investors and professional traders. Below is a comprehensive list of its key features:

TastyTrade Features in 10 Points

| 🏢 Regulation | CFTC, NFA, FINRA, SIPC |

| 🗺️ Account Types | Individual, Retirement, Joint, Entity/Trust, International Accounts |

| 🖥 Trading Platforms | tastytrade, TradingView |

| 📉 Trading Instruments | Stocks, Options, Futures, Crypto, Futures Options, ETFs |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | $0.0008 + $0.000166 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | Courses, tastylive Learn Center |

| ☎ Customer Support | 24/5 |

Who is TastyTrade For?

TastyTrade is best suited for active and experienced traders, particularly those who focus on options and futures strategies. The broker’s low-cost structure and in-depth educational content make it an attractive choice for self-directed investors who want more control over their trading decisions. Based on our findings, TastyTrade is Good for:

- Advanced traders

- Investing

- US Traders

- International Traders

- Professional Trading

- Options Trading

- Real Stock Trading

- Commission-based trading

- Cryptocurrency Trading

- Competitive trading fees

- Social Trading

- Good education

- Supportive customer service

TastyTrade Summary

Overall, TastyTrade is a well-regulated brokerage platform with a strong focus on options and futures. Known for its low-cost trading, offering commission-free stock and ETF trades, and competitive pricing for options, it appeals to investors looking for advanced tools and strategy-driven features.

The platform is backed by robust educational content through tastylive network, making it a powerful hub for learning and trading. While TastyTrade’s interface may be complicated for beginners, and it lacks access to certain asset classes, it remains a top choice for those who need real stock trading, in-depth market insights, and cost efficiency.

55Brokers Professional Insights

TastyTrade stands out for its quality and professional specialization in investment services within a robust trading conditions, proprietary platform, offering advanced trading tools and competitive commissions great for investment and traders looking for Futures, Options and Stocks. Besides, company is quite large and if you preefer to trade Forex there is a separate offering provided by TastyFX check our though by the link. The platform’s intuitive yet highly customizable interface is tailored for traders who look for speed, efficiency, and control over their strategies.

Additionally, TastyTrade has a strong reputation for security and regulatory compliance. It benefits from the regulatory reliability of IG Group and oversight by US regulators, including FINRA and the CFTC. Its comprehensive offering, combined with a user-friendly experience and responsive customer service, makes it a preferred choice for investors.

Consider Trading with TastyTrade If:

| TastyTrade is an excellent Broker for: | - Need a well-regulated broker.

- Suitable for professional traders and investors.

- Low fees and commissions.

- Access to robust proprietary trading platform.

- Looking for broker with Top-Tier licenses.

- Stock Trading and Investment.

- Access to TradingView platform.

- Need broker with no minimum deposit requirement.

- Secure trading environment.

- Good trading tools and trading technology.

- Looking for broker with social trading feature.

- Excellent educational materials.

- For US and international trading.

- Offering popular trading products.

|

Avoid Trading with TastyTrade If:

| TastyTrade might not be the best for: | - Who prefer to trade with industry-known MT4/MT5, or cTrader.

- Offering MAM/PAMM accounts.

- Providing VPS hosting.

- Looking for broker with 24/7 customer support.

- Beginner traders.

|

Regulation and Security Measures

Score – 4.7/5

TastyTrade Regulatory Overview

TastyTrade is a well-regulated brokerage firm that operates under the oversight of multiple reputable financial authorities. It is a member of the Financial Industry Regulatory Authority (FINRA), ensuring compliance with securities industry standards, and is also regulated by the CFTC for its futures trading services.

Additionally, the broker is a registered member of the National Futures Association (NFA), which enforces strict conduct and compliance rules for futures brokers.

As a subsidiary of IG Group, a UK-based financial services provider listed on the London Stock Exchange, TastyTrade benefits from the group’s global regulatory compliance framework. This top-tier regulatory oversight ensures that the broker maintains high standards of financial integrity and client protection.

How Safe is Trading with TastyTrade?

Trading with TastyTrade is considered safe due to its robust regulatory oversight and comprehensive security measures.

Additionally, client accounts are protected through membership in the SIPC, which provides up to $500,000 in protection (including $250,000 for cash) in case of broker-dealer failure.

Consistency and Clarity

TastyTrade has built a strong reputation within the trading community for its consistent focus on innovation, transparency, and trader education. Backed by the well-regarded IG Group, the firm benefits from financial stability and global recognition.

Overall, the broker has received positive ratings from professional traders, who praise its intuitive platform, low-cost trading structure, and robust educational content.

However, some traders point out drawbacks such as the lack of mutual fund access and the absence of a demo account, which may limit appeal to certain investor profiles. While not widely known for high-profile industry awards or major sponsorships, the broker’s commitment to empowering traders and maintaining regulatory compliance contributes to a positive and trustworthy image.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with TastyTrade?

TastyTrade offers a diverse range of account types to cater to various trading needs. These include Individual accounts, Joint accounts, and a variety of Retirement accounts such as Traditional, Roth, SEP, and Beneficiary IRAs.

For businesses and trusts, TastyTrade provides Entity accounts, including LLCs, partnerships, S-Corps, C-Corps, and Trust accounts. International clients from eligible countries can also open Individual or Joint accounts, either as cash or margin accounts.

While TastyTrade does not offer a traditional Demo Account, it provides Live Demos designed to help users familiarize themselves with their trading platforms and tools. These sessions are typically 45 minutes and hosted via Zoom, covering various topics such as account setup, platform navigation, and specific trading products like crypto and futures.

Individual Account

TastyTrade’s Individual Account is a flexible option for investors and traders, offering both Cash and Margin account types to suit different experience levels. There is no minimum deposit required to open an individual account, making it accessible for traders at all levels.

However, to maintain full margin privileges, traders are advised to have a minimum balance of $2,000.

Joint Account

The Joint Account allows two individuals to manage investments together. Similar to individual accounts, there is no minimum deposit required to open a joint account. For margin accounts, having a minimum balance of $2,000 is necessary to retain full margin benefits.

The fee structure is like individual accounts, offering commission-free trading for stocks and ETFs, and a $1.00 fee per options contract to open, with no charge to close.

Also, the accounts can be funded via free ACH transfers or wire transfers, providing flexibility in managing shared investments.

Regions Where TastyTrade is Restricted

TastyTrade restricts account openings in several regions and countries due to regulatory and compliance considerations, including:

- Some EU countries

- UK

- Iran

- South Korea

- Syria

- Some African countries

- UAE, etc.

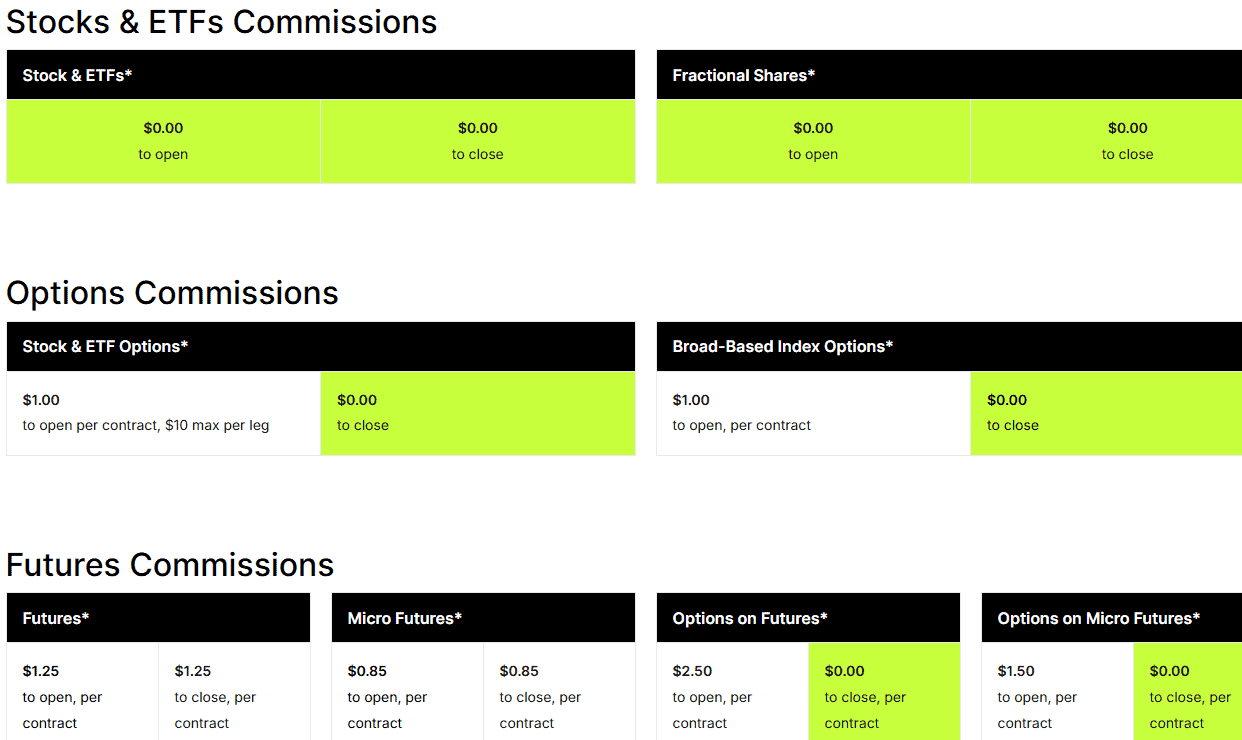

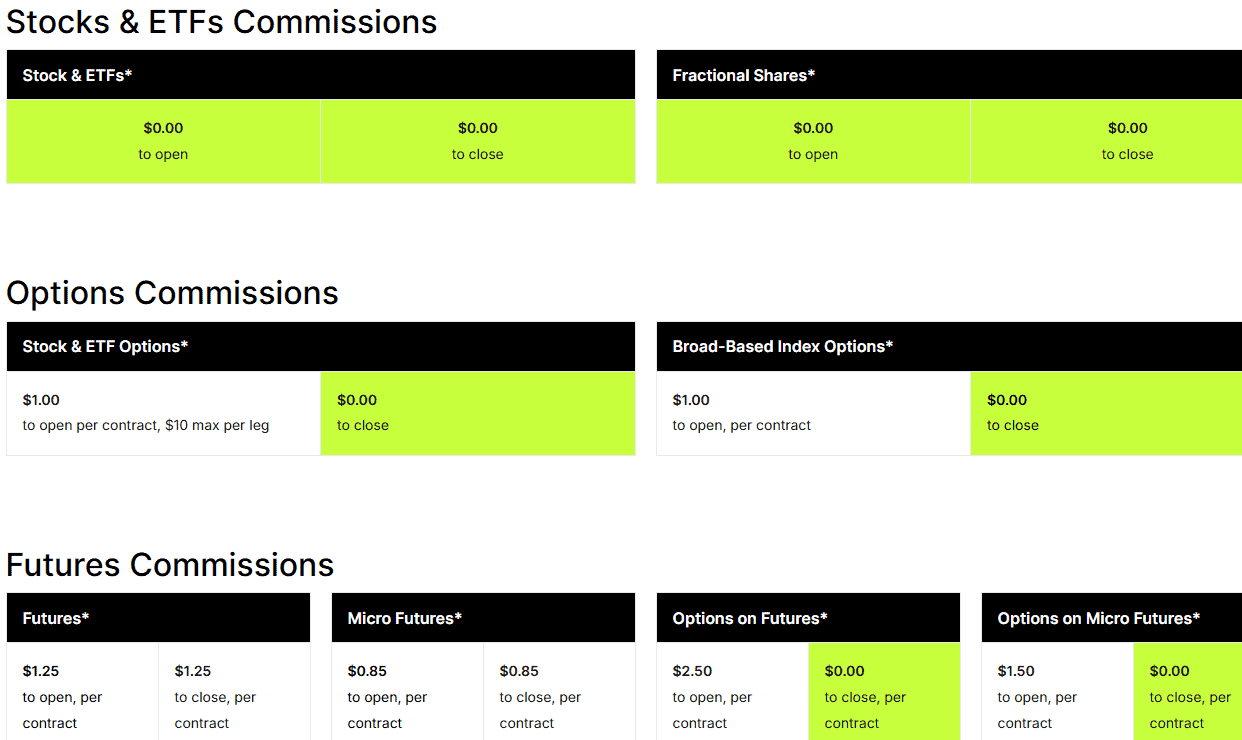

Cost Structure and Fees

Score – 4.6/5

TastyTrade Brokerage Fees

TastyTrade has a clear and competitive fee structure designed for investors. It offers zero commissions on stocks and ETFs, and low-cost options trading at $1 per contract to open with no fees to close.

Futures and crypto trading are also available with straightforward pricing, and there are no account maintenance, inactivity, or platform fees, which makes TastyTrade a cost-effective choice.

Tastytrade does not charge fees based on spreads. Instead, its costs come primarily from transparent commissions. While bid-ask spreads exist as part of normal market trading, the broker does not mark up or add additional spreads as part of its fee structure.

TastyTrade offers a competitive commission structure, keeping trading costs low for its users. Stocks and ETFs can be traded with zero commissions, making it an attractive option for investors focused on these products.

However, there are still small charges, such as the average stock commission includes a $0.0008 per share clearing fee and a $0.000166 per share regulatory fee.

For options trading, the firm charges a flat fee of $1 per contract to open a position, with no commission fees to close the contract.

Additionally, futures and cryptocurrency trading on the platform come with transparent, flat-rate commissions. Overall, TastyTrade’s commission system is affordable and transparent, catering especially to those using complex trading strategies.

- TastyTrade Rollover / Swaps

The platform does not charge rollover or swap fees for futures positions. However, traders should be aware of the overnight margin requirements and interest rates that may apply when holding positions beyond the trading day.

These rates can vary based on the type of futures contract and the account balance.

How Competitive Are TastyTrade Fees?

TastyTrade’s fees are competitive within the online brokerage industry, particularly for active and cost-conscious traders. The platform focuses on transparency and simplicity, offering a clear pricing structure without hidden charges.

Additionally, the broker avoids common fees like platform, maintenance, or inactivity charges, making it an attractive option for frequent and occasional traders.

| Asset/ Pair | TastyTrade Commission | FinecoBank Commission | Interactive Brokers Commission |

|---|

| Stocks Fees | $0.0008 + $0.000166 | $3.95 | $0.0005 |

| Fractional Shares | $0 | No | $0.01 |

| Options Fees | $1 | $3.95 | $0.15 |

| ETFs Fees | $0 | $3.95 | $0.0005 |

| Free Stocks | Yes | No | Yes |

TastyTrade Additional Fees

In addition to its commission fees, TastyTrade imposes several additional fees that traders should consider. These include clearing and regulatory fees, like stock trades are subject to a clearing fee of $0.0008 per share and a regulatory fee of $0.000166 per share, while options trades incur a $0.10 clearing fee per contract, plus applicable regulatory charges.

Futures and options on futures trades are subject to a $0.30 per contract clearing fee, along with exchange and NFA fees. For standard and E-mini futures contracts, TastyTrade charges a broker commission of $1.25 per contract per side, totaling $2.50 for a round-trip trade.

Banking-related fees include $25 for domestic wire transfers and $45 for international wires. Outgoing ACAT transfers incur a $75 fee, and closing an IRA account costs $60. While Tastytrade does not charge for ACH deposits and withdrawals, traders should be aware of these additional costs when planning their trading activities.

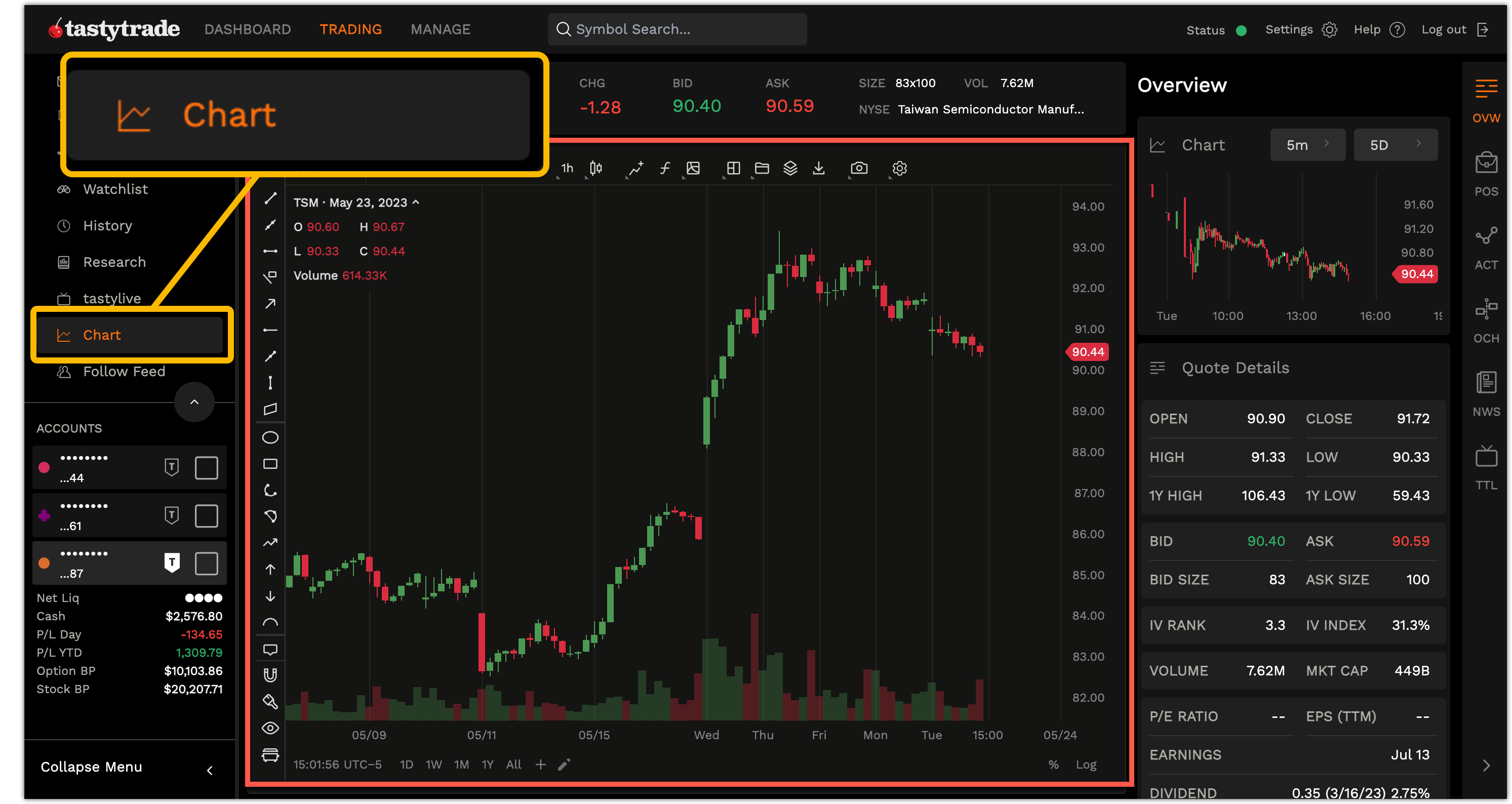

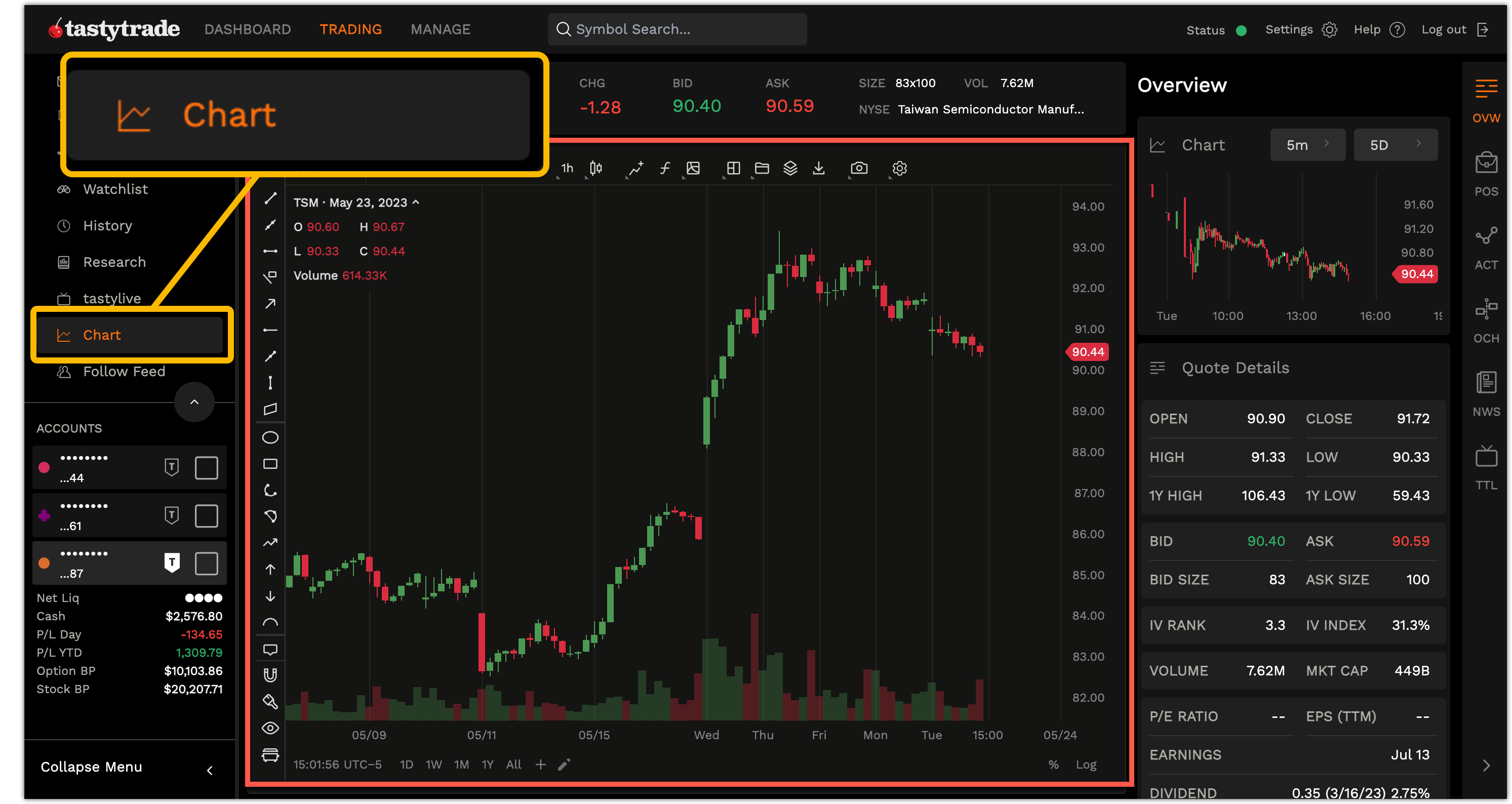

Trading Platforms and Tools

Score – 4.4/5

TastyTrade offers its proprietary platform, tastytrade, with an intuitive interface, advanced charting, real-time data, and strategy-focused tools.

Additionally, the platform has integrated with TradingView, allowing users to leverage professional-grade technical analysis and interactive charts. These platforms provide a flexible trading experience across desktop, web, and mobile devices.

Trading Platform Comparison to Other Brokers:

| Platforms | TastyTrade Platforms | FinecoBank Platforms | Interactive Brokers Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

TastyTrade Web Platform

TastyTrade’s proprietary web platform provides a dynamic and intuitive trading experience directly from your browser, without the need for downloads. The platform offers a customizable interface that supports multi-leg options strategies, real-time quotes, watchlists, and risk analysis tools.

One standout feature is tastytrade’s Open API, which helps users to integrate their own trading algorithms or third-party tools into the platform. This allows traders to tailor their setups, automate strategies, and enhance overall efficiency, all while staying within TastyTrade’s ecosystem.

Main Insights from Testing

Testing TastyTrade’s web platform reveals a fast and responsive interface that caters effectively to investors. Its layout is intuitive, with customizable modules that support multitasking and efficient navigation.

Key features like the curve and table view for options trading, as well as integrated news and economic calendar tools, provide a seamless trading experience. While beginners may need some time to adapt, experienced traders will benefit from the platform’s performance and depth of functionality.

TastyTrade Desktop MetaTrader 4 Platform

TastyTrade does not offer the MT4 platform. Traders looking to use MT4’s interface or automated trading features will need to consider alternative brokers that support it.

TastyTrade Desktop MetaTrader 5 Platform

Similarly, the broker does not support MetaTrader 5. TastyTrade focuses on its proprietary trading platform, instead of offering third-party platforms like MT5.

TastyTrade MobileTrader App

The broker’s proprietary platform is available in a mobile version, ensuring that traders can access real-time data, advanced charting tools, and fast execution from their mobile devices.

The app features an intuitive interface optimized for both iOS and Android, combining functionality and user-friendly design, making it a valuable tool for traders who require a comprehensive mobile trading solution.

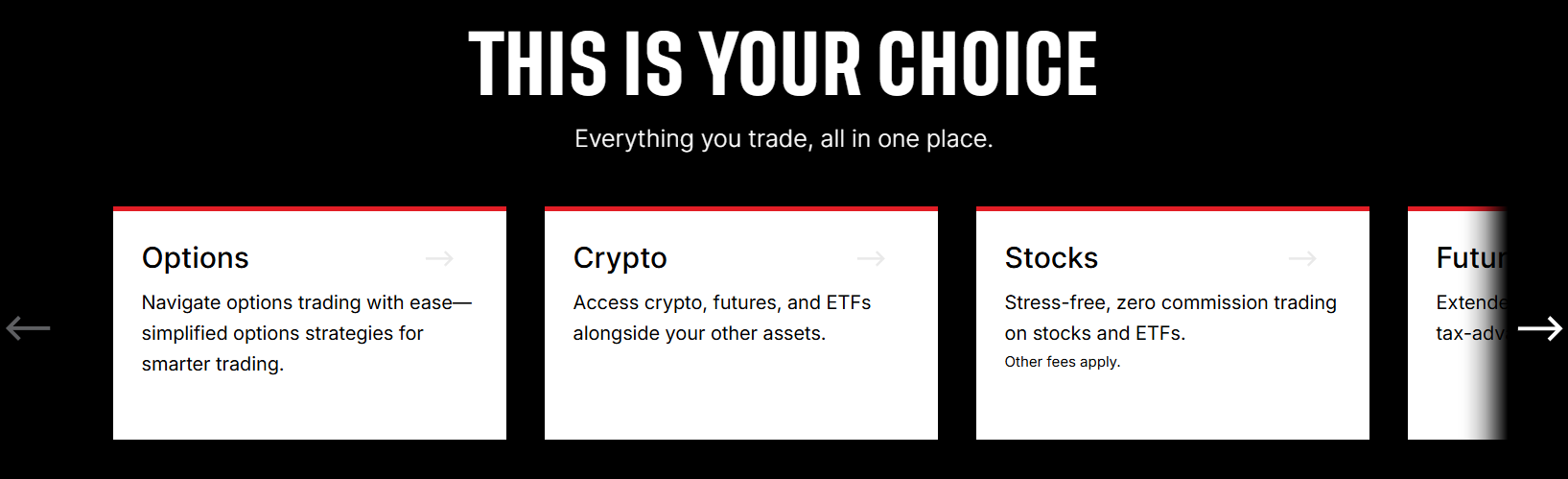

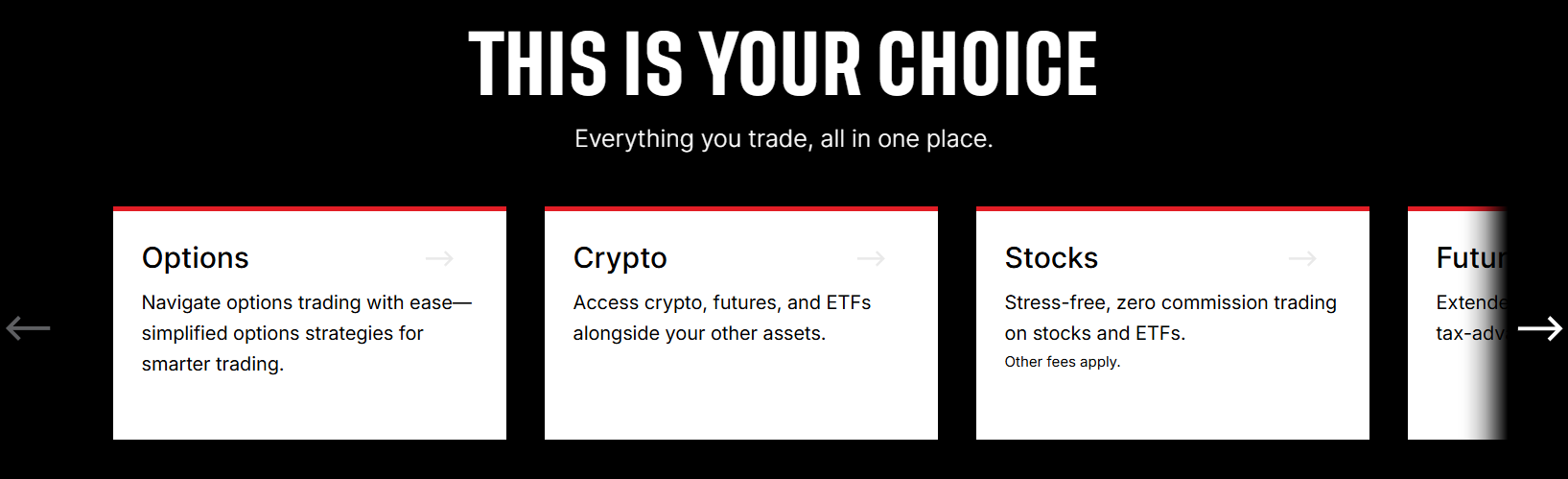

Trading Instruments

Score – 4.6/5

What Can You Trade on TastyTrade’s Platform?

TastyTrade offers a diverse range of investment products, including over 8,000 US-listed stocks and ETFs, which are available for trading with zero commissions.

The platform is also known for its options trading capabilities, supporting multi-leg strategies across ETFs and indices. For those interested in derivatives, futures and futures options are available, including various asset classes such as commodities, indices, and interest rates.

Additionally, the broker offers cryptocurrency trading, allowing users to trade digital assets like Bitcoin and Ethereum directly through the platform.

Main Insights from Exploring TastyTrade’s Tradable Assets

Exploring TastyTrade’s tradable assets reveals a clear emphasis on flexibility and strategy-driven trading. The platform supports both straightforward and complex trading approaches, with seamless access to a variety of tradable assets.

Traders benefit from the ability to switch easily between asset types depending on market conditions or strategy preferences. Overall, the platform offers a well-rounded trading environment that appeals especially to those looking to actively manage and expand their portfolios.

Leverage Options at TastyTrade

TastyTrade offers leverage options through its standard margin and portfolio margin accounts:

- Standard margin accounts provide up to 1:2 leverage.

- For more advanced traders, TastyTrade’s portfolio margin accounts offer up to 1:6.7 leverage.

To qualify for a portfolio margin account, traders must have at least $175,000 in account equity and meet specific eligibility criteria. These multiplier options enable traders to manage larger positions with less capital, but they also bring increased risk and require careful risk management.

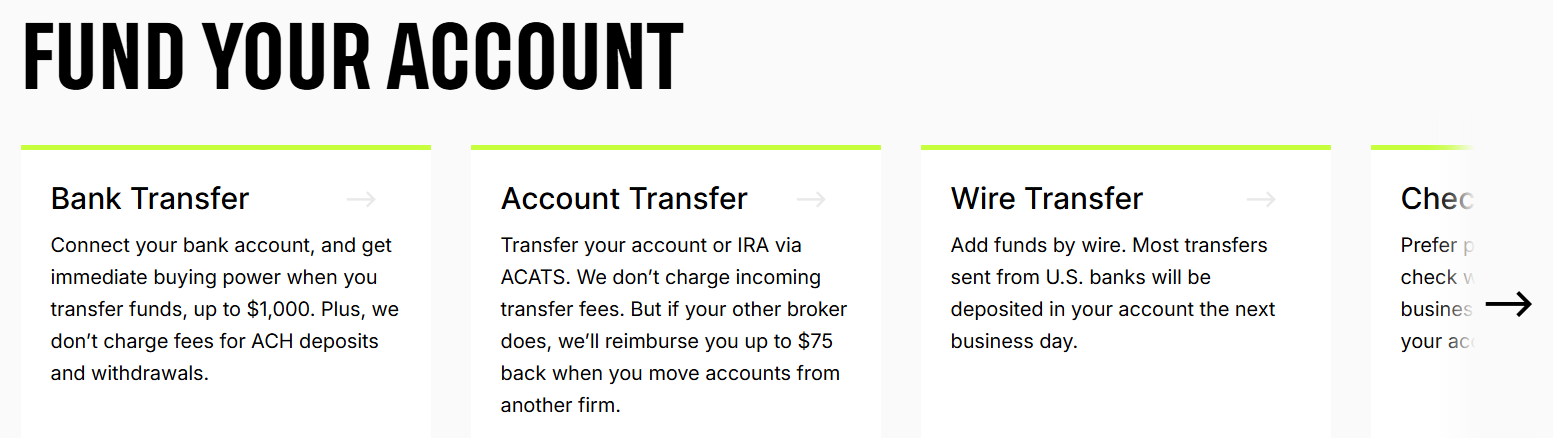

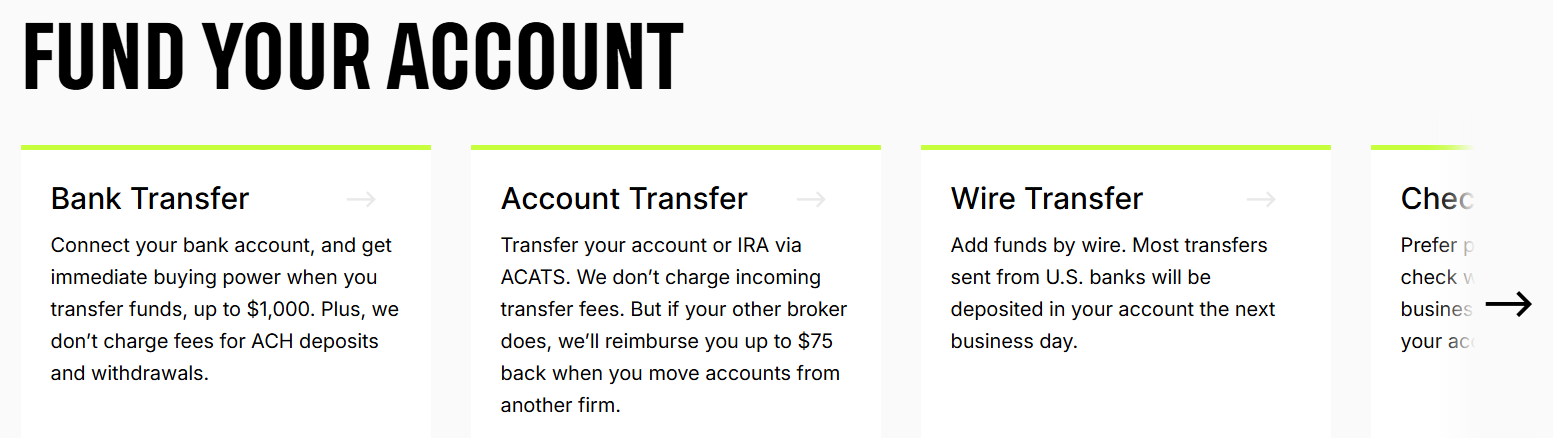

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at TastyTrade

In terms of funding methods, TastyTrade offers the following payment methods:

- ACH (Automated Clearing House) Transfer

- Wire Transfer

- Check Deposit

- ACATS (Automated Customer Account Transfer Service) Transfer

TastyTrade Minimum Deposit

There is no minimum deposit requirement for TastyTrade. However, traders will need to maintain a minimum account balance of $2,000 to apply to margin accounts, which is essential for engaging in leveraged trading strategies.

Withdrawal Options at TastyTrade

TastyTrade offers flexible withdrawal options, including free ACH transfers, domestic and international wire transfers, and check withdrawals.

Users can easily request a withdrawal through the “My Money” section of their TastyTrade account. Wire transfers are typically processed within one business day domestically, while international transfers may take 3-5 business days.

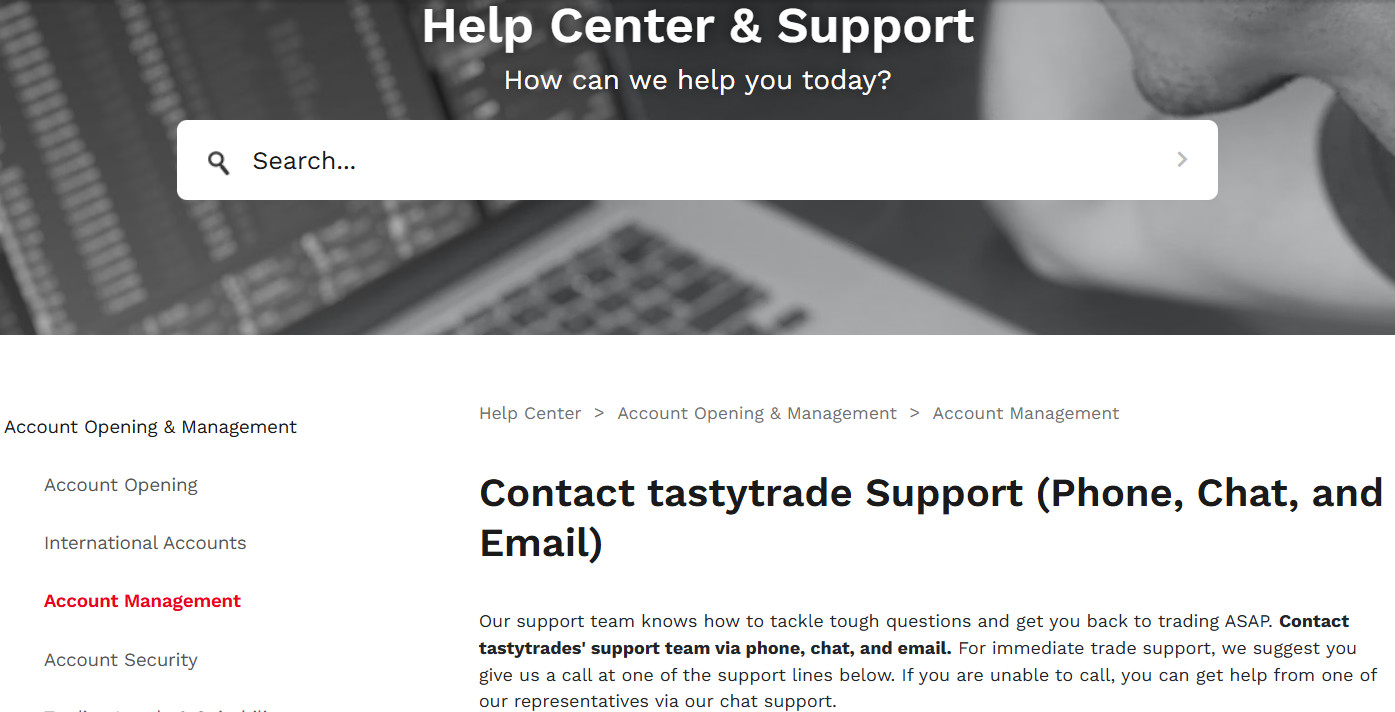

Customer Support and Responsiveness

Score – 4.4/5

Testing TastyTrade’s Customer Support

TastyTrade offers 24/5 qualified customer support via phone, email, live chat, and Help Center. Support specialists are quick to answer inquiries, providing clear and helpful responses on both technical platform issues and account-related questions.

Contacts TastyTrade

To get in touch with TastyTrade, clients can reach out via phone or email for prompt assistance. For general support, you can call 888-247-1963 or 312-724-7075 or email Support@tastytrade.com. For account-specific inquiries, contact Accounts@tastytrade.com.

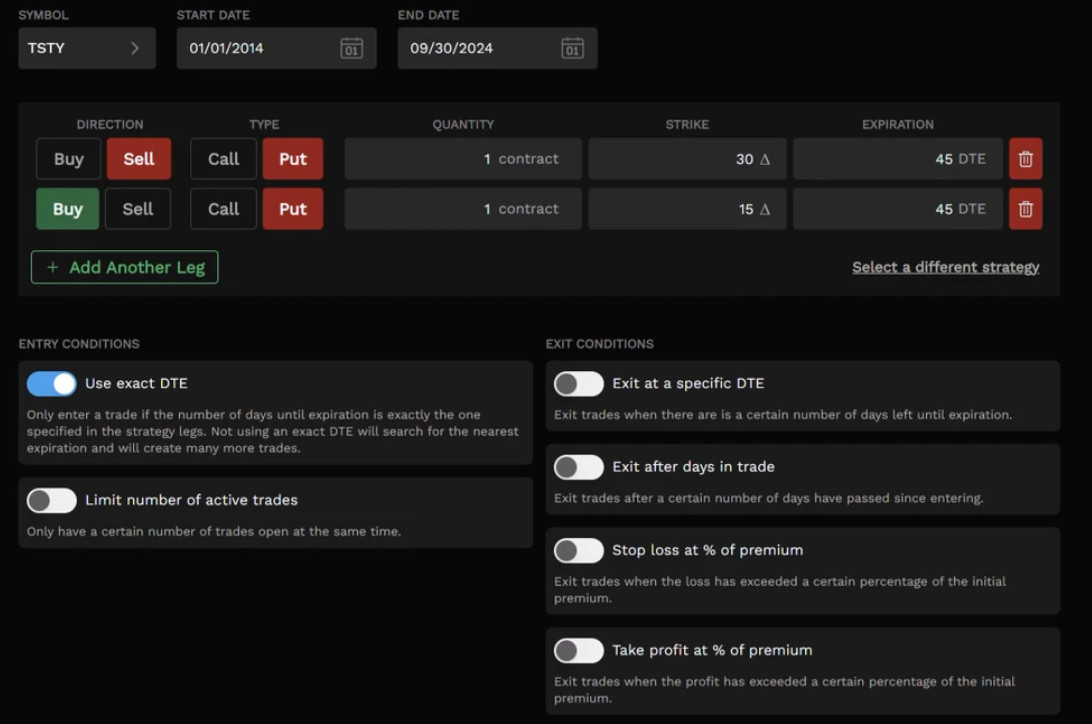

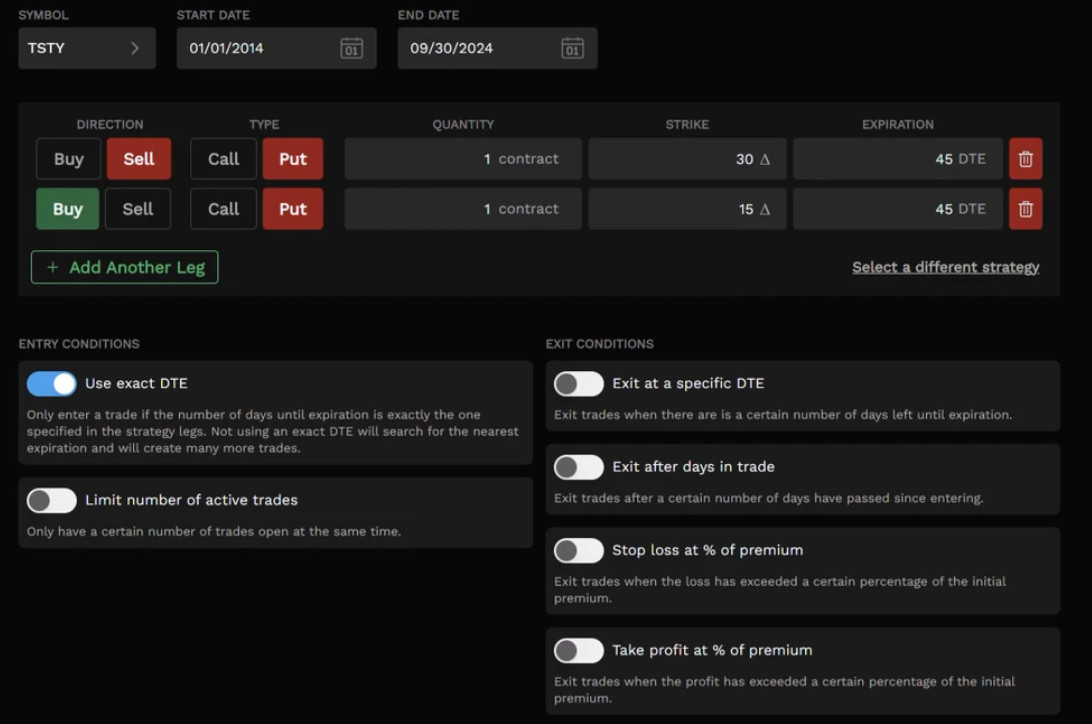

Research and Education

Score – 4.7/5

Research Tools TastyTrade

TastyTrade provides diverse research tools across its website and trading platforms, designed to support informed trading decisions.

- Key features include an options backtesting tool, allowing investors to simulate strategies using over a decade of historical data to assess performance metrics like profit/loss, return on capital, and drawdowns.

- The Analysis Tab offers detailed risk assessments, probability evaluations, and volatility analyses to help users understand potential outcomes before executing trades.

- Additionally, the platform integrates TradingView’s advanced charting tools, providing real-time data, technical indicators, and customizable drawing tools for in-depth market analysis.

These tools empower traders to conduct thorough research and develop well-informed trading strategies.

Education

Tastytrade offers robust educational resources and courses on trading concepts, strategies, and risk management.

Additionally, the broker complements this through tastylive network and Learn Center, which provide live-streamed and on-demand video content delivering daily market insights, expert commentary, and in-depth tutorials from experienced traders.

This combination of structured learning and live content makes TastyTrade a valuable educational destination for both new and experienced investors.

Portfolio and Investment Opportunities

Score – 4.8/5

Investment Options TastyTrade

TastyTrade offers a good range of investment options for active and self-directed traders. Beyond traditional assets like stocks, options, futures, and crypto, the platform emphasizes strategic investing with tools that support complex strategies and portfolio management.

Additionally, the firm excels in delivering self-directed investment opportunities through its intuitive proprietary platform, customizable watchlists, and integrated research features.

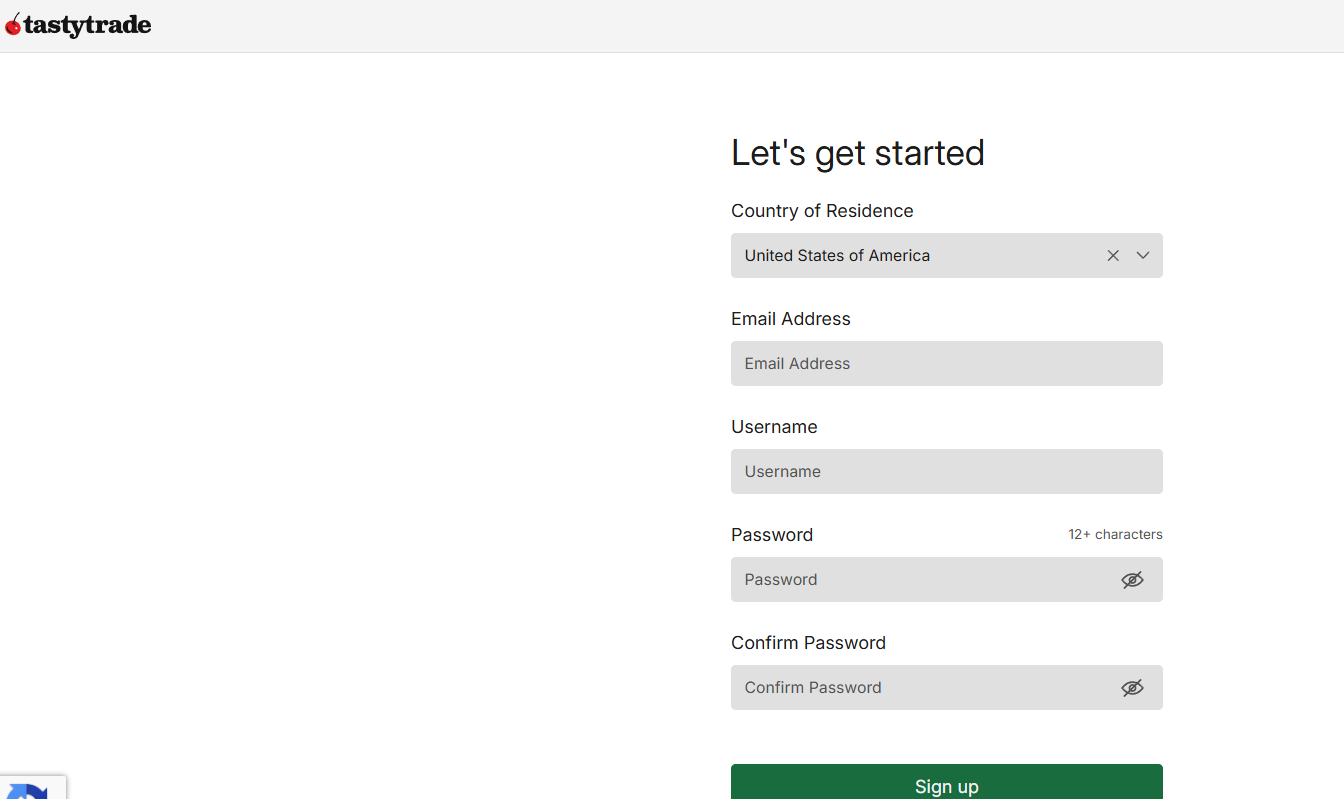

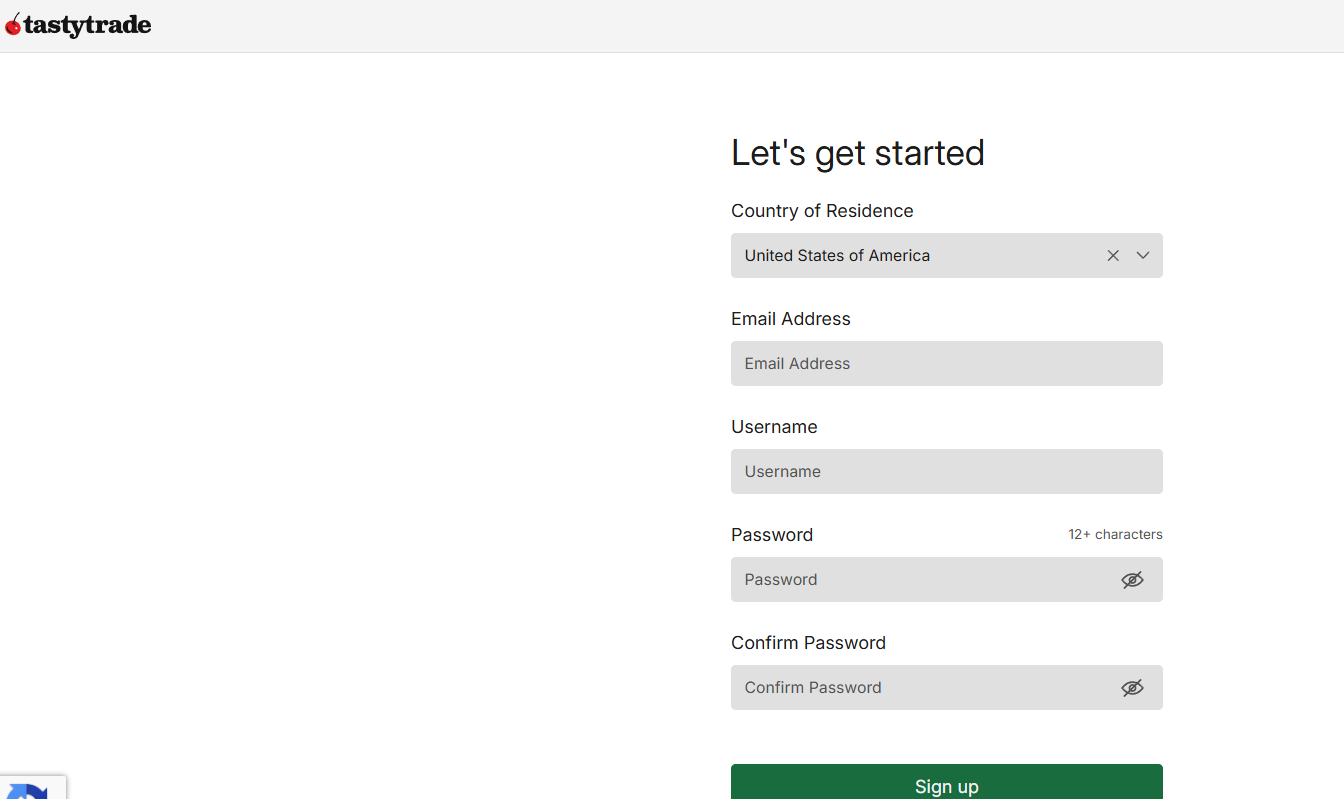

Account Opening

Score – 4.4/5

How to Open TastyTrade Demo Account?

TastyTrade does not currently offer a traditional demo or paper trading account where users can simulate trades with virtual funds. However, the platform provides free interactive live platform demos hosted via Zoom, typically held mid-month.

These 45-minute sessions help traders familiarize themselves with the platform’s features and functionalities. To participate, you can sign up through the Tastytrade Demos & Events page.

How to Open TastyTrade Live Account?

To open a live account with TastyTrade, visit the broker’s “Open an Account page, and complete the online application by providing your email address, creating a username and password, and selecting your country of residence.

You will then need to choose your desired account type and employment details. TastyTrade may also request identity verification documents, like a government-issued ID. Once approved, you can fund your account via ACH, wire, or check.

While there is no minimum deposit required to open a cash account, a minimum of $2,000 is necessary to access margin trading features.

Additional Tools and Features

Score – 4.5/5

In addition to its core trading tools, TastyTrade offers additional tools and features that enhance the trading experience beyond standard research capabilities.

- These include a powerful Open API, allowing traders to integrate and automate their strategies.

- As well as social trading functionalities, where users can follow and learn from experienced traders.

- The platform also provides customizable watchlists, real-time alerts, and in-depth portfolio analysis tools, catering especially to active traders looking for control and insight into their trading activity.

TastyTrade Compared to Other Brokers

TastyTrade stands out as a competitive Stock Trading provider, especially for those focused on options and futures trading. Compared to its competitors, it offers a user-friendly trading experience with low fees, strong regulatory oversight, and no minimum deposit requirement, making it appealing for all levels of investors.

While other brokers like Trade Station and Interactive Brokers offer wider asset selections and advanced platforms for global markets, TastyTrade stands out with cost-efficiency, an intuitive interface, robust educational content, and integration with TradingView.

It may not cater to traders looking for thousands of international instruments, but its focused offering and transparent pricing model make it a strong choice for stock and options traders.

| Parameter |

TastyTrade |

Trade Station |

Interactive Brokers |

TD Ameritrade |

NinjaTrader |

E-Trade |

WeBull |

| Broker Fee – Futures E-mini and Standard Contract |

$1.25 |

$1.50 |

$0.85 |

$1.50 |

$1.29 |

$1.50 |

$1.50 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Average |

Low |

Average |

Average |

Average |

Average |

| Trading Platforms |

tastytrade, TradingView |

TradeStation Desktop, Web Trading, Mobile Apps, FuturesPlus, TSCrypto, API |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Proprietary NinjaTrader Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform |

| Asset Variety |

Stocks, Options, Futures, Crypto, Futures Options, ETFs |

Stocks, ETFs, Options, Futures, Futures Options, Crypto, Bonds, Mutual Funds |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs , Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Futures, Forex, Options, Equities, Stocks |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, ETFs, OTC, ADRs, Crypto, Forex, Shares, Futures |

| Regulation |

CFTC, NFA, FINRA, SIPC |

SEC, FINRA, CFTC, NFA, SIPC, FCA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

NFA, CFTC |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Good |

Excellent |

Good |

Good |

Good |

Excellent |

| Minimum Deposit |

$0 |

$0 |

$100 |

$0 |

$400 |

$0 |

$0 |

Full Review of Broker TastyTrade

TastyTrade is a reliable US-based brokerage known for its focus on stock trading and investing. It offers a user-friendly platform with powerful tools, low-cost commissions, and an education-first approach that appeals to both beginners and experienced traders.

Clients can access popular investment products, including stocks, ETFs, options, futures, and crypto, all through a proprietary trading platform. With strong regulatory oversight and transparent pricing, TastyTrade focuses on trader independence and accessibility.

The platform also features integrated research tools, educational resources, and API connectivity, making it a solid choice for self-directed investors looking to manage their portfolios.

Share this article [addtoany url="https://55brokers.com/tastytrade-review/" title="TastyTrade"]