- What is Spread Co?

- Spread Co Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

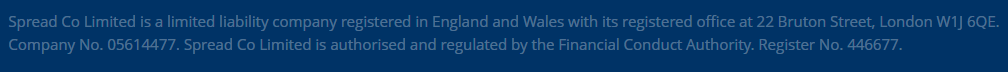

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

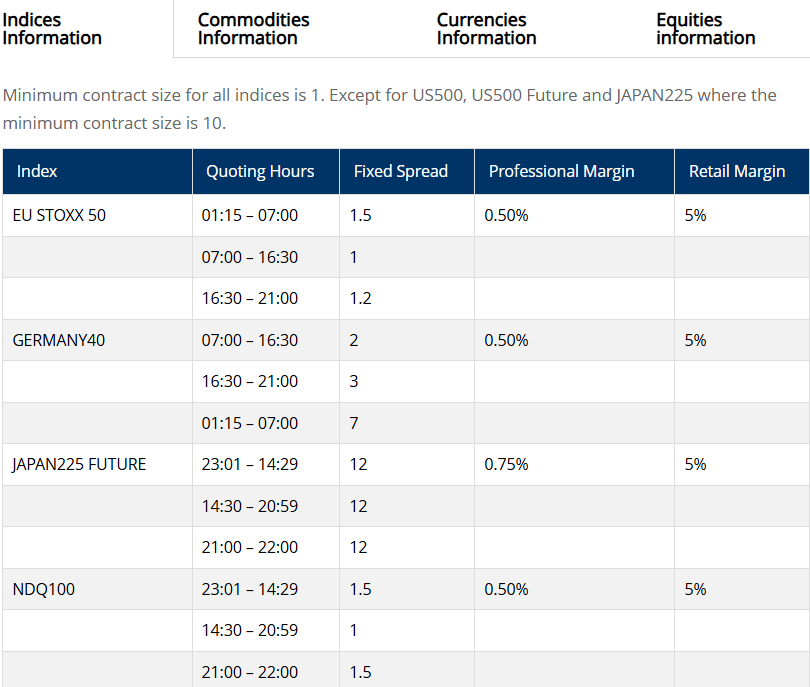

- Deposit and Withdrawal Options

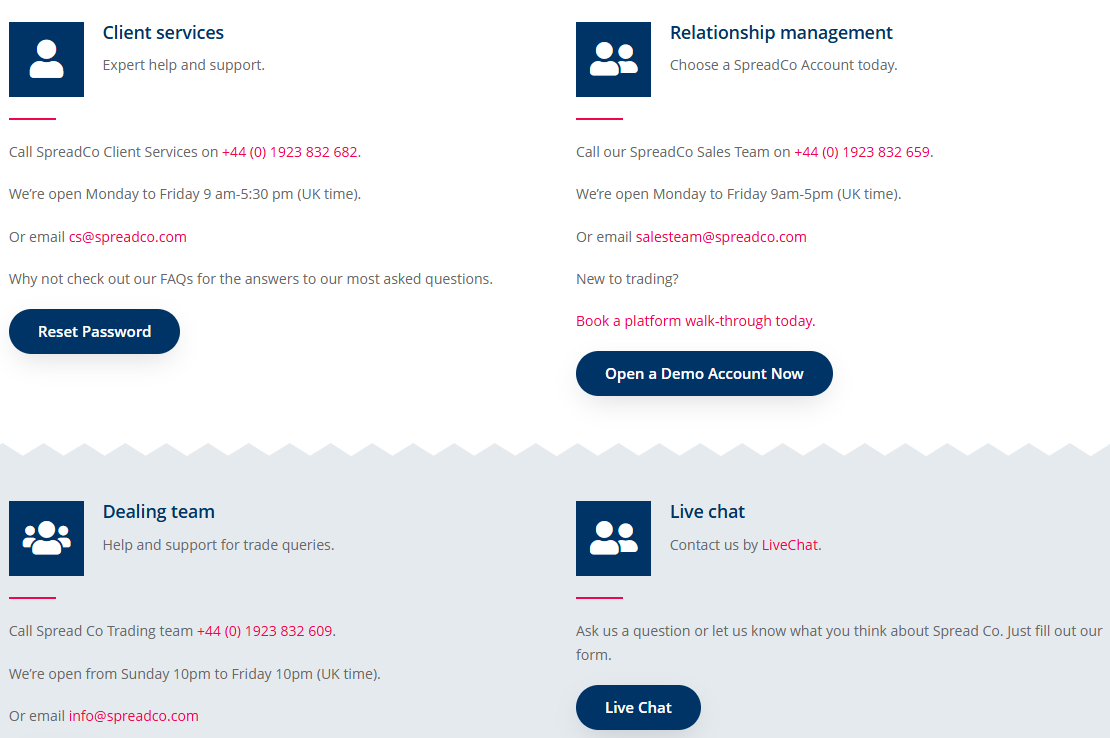

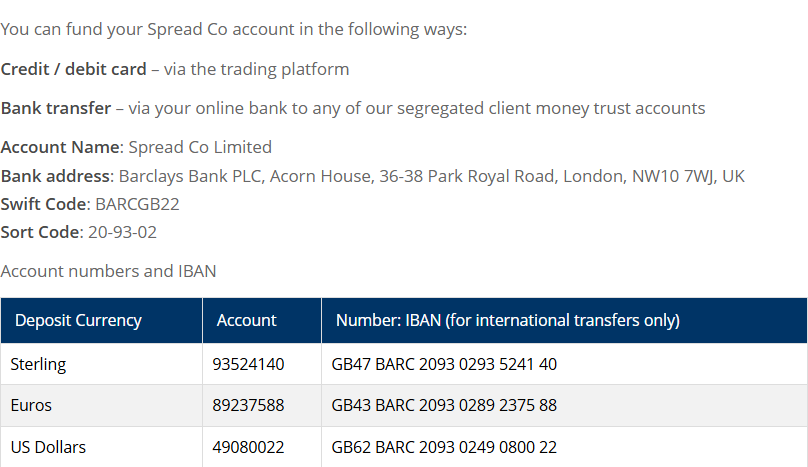

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

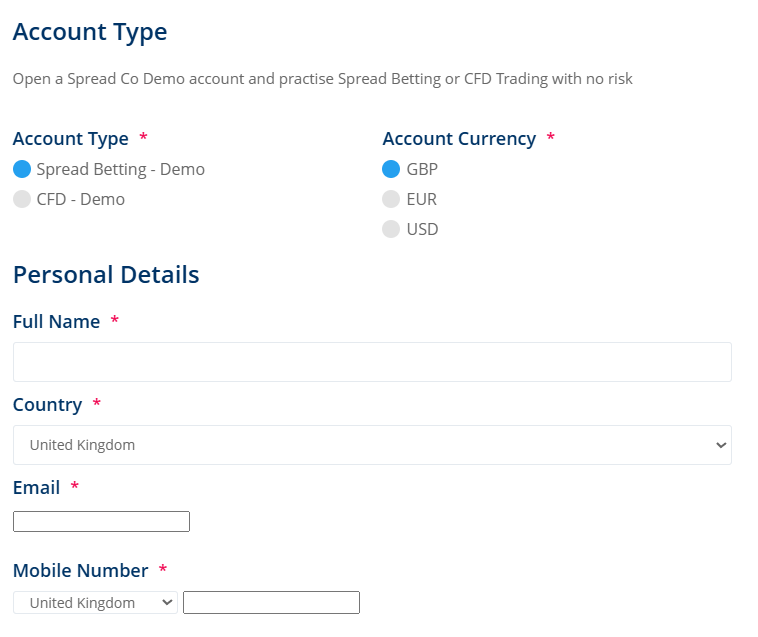

- Account Opening

- Additional Tools And Features

- Spread Co Compared to Other Brokers

- Full Review of Broker Spread Co

Overall Rating 4.3

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.2 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4 / 5 |

What is Spread Co?

Spread Co, founded in 2006, is a London-based online trading provider that gives access to trade spread betting, CFD, and Forex through currencies, equities, indices, and commodities. Among other offerings, Spread Co has competitive, tight, fixed spreads with low commissions and charges that keep the cost of trading lower while maximizing potential gain.

All trading processes at Spread Co are packed with great technology and a fixed spread strategy, allowing you to take control over the trading by calculating an exact expense along with safe knowledge about the charges.

Spread Co Pros and Cons

Spread Co provides easy digital account opening; it is a trusted broker, and there are good trading conditions with tight fixed spreads and a selection of instruments. There are various options to deposit or withdraw funds; the education section is good with trading videos and news.

On the flip side, trading instruments are limited to Forex and CFDs; fees for stock CFDs are higher, and there is no 24/7 support.

| Advantages | Disadvantages |

|---|

| Competitive trading conditions Top-tier FCA regulated | Additional non-trading fees |

| Competitive trading conditions | Small Range of Market Instruments |

| Good customer Protection | |

| Tight Spreads | |

| Small Commissions | |

| Good Education | |

| Instant Funding | |

| |

Spread Co Features

Based on our research, Spread Co is a reliable broker with a license from a well-regarded FCA. The broker offers good trading conditions for Forex, CFD, and Spread Betting. We have reviewed different aspects of trading with Spread Co, to see how favorable the fees, platforms, available account types, and other aspects of trading are:

Spread Co Features in 10 Points

| 🗺️ Regulation | FCA |

| 🗺️ Account Types | Spread Bet, CFD |

| 🖥 Trading Platforms | Web Platform, Mobile Apps |

| 📉 Trading Instruments | CFD and Forex through equities, indices, currencies and commodities |

| 💳 Minimum deposit | £200 |

| 💰 Average EUR/USD Spread | 0.8 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | USD, GBP, EUR |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is Spread Co For?

We have reviewed all the available services and trading conditions offered by Spread Co. to see who can take advantage of the offering. Based on our findings and financial expert opinion, Spread Co is good for the following:

- Beginning Traders

- Experienced Traders

- Currency Trading and CFD Trading

- Tight Spread Trading

- Spread Betting

Spread Co Summary

With over a decade of experience, Spread Co has proven itself as a well-established UK broker. The offering includes a good range of trading instruments through CFDs with a fixed spread only. This strategy keeps an easy mind while you will understand expenses at any time clearly.

However, the main cons may be that the broker does not offer popular MT4 and MT5 platforms, which are popular among traders, yet the proprietary platform is quite powerful.

55Brokers Professional Insights

Based on our expert findings, Spread Co is considered a reliable broker beain a top-tier licensed broker. There are good trading conditions for Forex, CFD, and spread betting trading available for UK Traders. Traders have access to high-quality education, guides, and a Forex glossary as a plus for beginner traders too. Spreads are fixed and lower than the industry average, combined with low commissions for some instruments, so we overal mark it as good fee proposal. There are two account types, one for spread betting and the other for CFD trading so good to be attentive and choose the relevant one for you.

Spread Co offers its own online platform and a mobile app that is equipped with advanced features and analytical tools. However, the unavailability of the market-popular MT4/MT5 platforms might be a drawback for those who prefer the mentioned platforms.

We also find the selection of instruments insufficient, lacking some of the major market instruments. All the available instruments are based on CFDs. Also, being regulated only by FCA means that Spread Co enables low leverage up to 1:30. Those who decide to trade with Spread Co should take all the advantages and drawbacks into consideration and see how the broker will meet their trading expectations.

Consider Trading with Spread Co If:

| Spread Co is an excellent Broker for: | - Beginner and intermediate traders

- Experienced traders

- Cost-conscious traders

- Spread Betting Enthusiasts

- Traders who prefer fixed spreads

- Currency trading |

Avoid Trading with Spread Co If:

| Spread Co is not the best for: | - Traders Seeking a Wide Range of Instruments

- High-Leverage Traders

- Traders who prefer the MT4 and MT5 platforms

- Traders Looking for Multi-Asset Trading |

Regulation and Security Measures

Score – 4.5/5

Spread Co Regulatory Overview

Our experts find Spread Co. a reliable broker. It provides low-risk Forex and CFD trading since Spread Co is registered in the UK and respectively regulated by the local regulator FCA.

Spread Co is a UK trading platform using the latest online security features. Also, all credits of Spread Co accounts are held by a top-tier bank in segregated accounts as per Spread Co regulation by the UK Financial Conduct Authority.

How Safe is Trading with Spread Co?

Spread Co provides its clients with the best security measures to protect their investments:

- All funds are managed by the strict rules and requirements of FCA. Also, when you deal with an FCA-regulated firm, you can use the services of the Financial Services Compensation Scheme and the Financial Ombudsman Service if you have a complaint.

- In the event that Spread Co becomes insolvent, the funds held in segregated accounts will not be a part of Spread Co’s assets and can be easily returned to the clients.

Consistency and Clarity

Spread Co has been in the market since 2006, providing quality services to its clients in a consistent and transparent environment. The broker is only an FCA-regulated entity, which means that all the trading activities are under one of the strictest financial authority’s oversight. The broker provides clarity in its services and operations, has transparent costs, and has offerings that have been enhanced through the years.

To see how favorable clients of the broker find its proposals, we have meticulously reviewed real clients’ feedback. As a result, we found that traders find Spread Co’s fees average or lower than the market average. Customer support, as clients point out, is at a high level. Some clients mention platform and instrument limitations as the main drawbacks. All in all, Spread Co has been around for a little less than 20 years, ensuring its clients’ safety and good protection.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Spread Co?

Spread Co offers its clients two types of account types, based on the trading style traders use: spread betting and CFD accounts. Each account type gives access to a different range of trading instruments and conditions. Clients can trade on the broker’s proprietary web-based platform or the mobile app. With Spread Co customers can open either a demo or a retail account. On request, the account is converted into a professional account, which brings around better opportunities.

Here are trading specifications based on the account type:

- The spread betting account gives access to more than 1000 markets, including FX, commodities, indices, and equities. The account provides clients with negative balance protection, adding a layer of security to the trades. The average spread for the EUR/USD pair is 0.8 pips. The available web and mobile platforms allow good functionality, professional charting capabilities, and deep market analysis.

- The CFD account allows access to an extensive range of markets, including shares, forex, commodities, etc. Traders do not need to pay a stamp duty while trading CFDs. The account does not charge any commissions.

Regions Where Spread Co is Restricted

Although Spread Co does not publicly disclose the exact list of restricted countries it does not accept clients from, due to its FCA regulation, Spread Co will still impose certain restrictions for countries where the regulation practices contradict the ones accepted by FCA. Thus, here is a short list of countries that may be restricted by the broker:

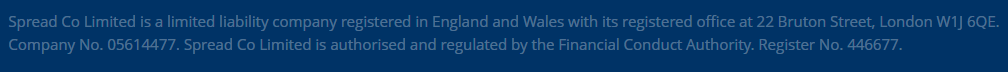

Cost Structure and Fees

Score – 4.2/5

Spread Co Brokerage Fees

Spread Co fees are competitive and mostly average or lower than the market normal. The spreads are fixed and on the lower side, while commissions are applied only for certain instruments, and are mostly integrated into spreads. The broker also charges overnight fees for open positions.

During market hours, Spread Co spreads are low, starting from 0.6 pips. The average spread for the EUR/USD pair is 0.8 pips. The UK100 spread is 0.6; however, outside the market hours, it may rise to 1.8 pips. At last, the US30 spread is also 0.8 for the US market hours and up to 2.8 pips outside the hours.

As we have found, Spread Co does not have a commission fee for the CFD or Spread betting accounts. However, for both accounts, there is a commission of 0.05% on equity trades.

- Spread Co Rollover / Swap Fees

Spread Co charges overnight rates for positions held during the non-trading hours. For each instrument there is a distinct long and short position. For instance, for UK100 the long position is 5.112%, while the short position is 1.112%. Usually swap fees depend on the market changes and are not stable. We recommend checking them beforehand to know the exact amount for the moment.

How Competitive Are Spread Co Fees?

As we have researched Spread Co’s overall costs, we have concluded that the broker charges low or average fees that will satisfy cost-conscious clients. The spreads start from 0.6 pips, which is considered lower than the market average. Besides, commissions are charged only for equities. For all the other instruments there are no commissions, and all the costs are integrated into spreads. Also, there are overnight fees clients should consider. The swap fees are changeable, and the broker updates them constantly.

All in all, we find Spread Co trading fees transparent and clear, with no hidden costs, which adds clarity and predictability to trades.

| Asset | Spread Co Spread | FXTM Spread | XM Spread |

|---|

| EUR USD Spread | 0.8 pips | 1.5pips | 1.6 pips |

| Crude Oil WTI Spread | 0.04 pips | 9 cents | 3 cents |

| Gold Spread | 0.4 pips | 36 | 0.27 pips |

Spread Co Additional Fees

A Spread Co does not charge inactivity fees. We have also found that the broker does not charge any deposit or withdrawal fees, which is great. However, the payment provider might apply certain fees not associated with the broker.

Score – 4.2/5

Spread Co offers easy-to-use platforms that allow monitoring and trading positions wherever the client is. All platforms are developed for high-quality performance over thousands of equities, indices, commodities, and Forex pairs. The broker offers proprietary web and mobile platforms.

| Platforms | Spread Co Platforms | XM Platforms | AvaTrade Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Platform | Yes | Yes | Yes |

Spread Co Web Platform

Spread Co Platform is a proprietary web-based platform that requires no download and allows users to customize all trading experiences through popular and useful features. Both experienced and novice traders will find comfortable conditions to trade. The platform offers stop-loss and limit orders that give traders more control over their risk exposure. Besides, traders get access to a good range of indicators, charts, and drawing tools that enable them to have a better understanding of the market. The platform is supported on most browsers and does not demand downloading.

Spread Co Desktop MetaTrader 4/5 Platform

We have reviewed the broker’s trading platforms to find that Spread Co has only an online proprietary web platform and a mobile app available. The popular MT4 and MT5 platforms are not available with the broker. Although Spread Co’s web platform is good and has advanced features and tools, it can still be unsatisfying for those traders who are used to trading via MT4/MT5 platforms.

Spread Co MobileTrader App

The Spread Co mobile app offers a comfortable way to trade, even when its clients are not at their desktops. The mobile app retains all the essential features available through the web platform. The app enables one-click trading, charting tools powered by TradingView, over 50 different indicators to analyze the market, an easy switching opportunity between the accounts, and an economic event notification. The app is available both for iOS and Android devices. All in all, the mobile app is a flexible way for users to take the trades with them wherever they go.

Main Insights from Testing

Our testing of the broker’s platform has revealed advanced web and mobile platforms that are packed with advanced and innovative tools and features. There are advanced charts, indicators, and other analysis tools that enable clients to explore the market with ease and success. However, those who are MT4 and MT5 platform enthusiasts might not find the Spread Co platform choice satisfying.

Trading Instruments

Score – 4.6/5

What Can You Trade on the Spread Co Platform?

Spread Co offers a decent range of trading instruments in some of the most popular markets, including indices, global equities, currencies, and commodities such as crude oil and precious metals. The broker allows speculating via CFD or spread betting. Through its CFD account, clients also gain access to stocks. The broker, however, lacks some other markets like futures and bonds. Also, the broker doesn’t provide cryptocurrency trading since the UK’s FCA imposed a ban on decentralized digital currencies in 2021.

The full range of market provided by Spread Co is as follows:

- Forex

- Gold

- Equities

- Indices

- Commodities

- ETFs

- FTSE100

Main Insights from Exploring Spread Co Tradable Assets

We have researched the broker’s instrument offering and reviewed its spread betting and CFD-based offerings to see how the broker works and what instruments are available under each proposal. We have found that through the spread betting account, traders have access to over 1000 instruments across indices, FX, commodities, and equities. The CFD account gives more diversity by allowing access to CFD-based shares in addition to the mentioned markets.

However, as all the tradable products are CFD-based or available through spread betting, clients’ ability to diversify their portfolios is limited. They can only speculate on the instrument’s prices rather than own the underlying asset. This means limited diversification opportunities, no long-term investments, and no dividend ownership.

Leverage Options at Spread Co

Leverage levels offered by Spread Co do depend on the regulatory requirement. As Spread Co is a UK brokerage and is not registered under any other entity, the set of rules established by FCA allows lower leverage levels based on the instrument:

- Up to 1:30 for Forex instruments, 1:20 for minor currency pairs

- 1:10 for Commodities

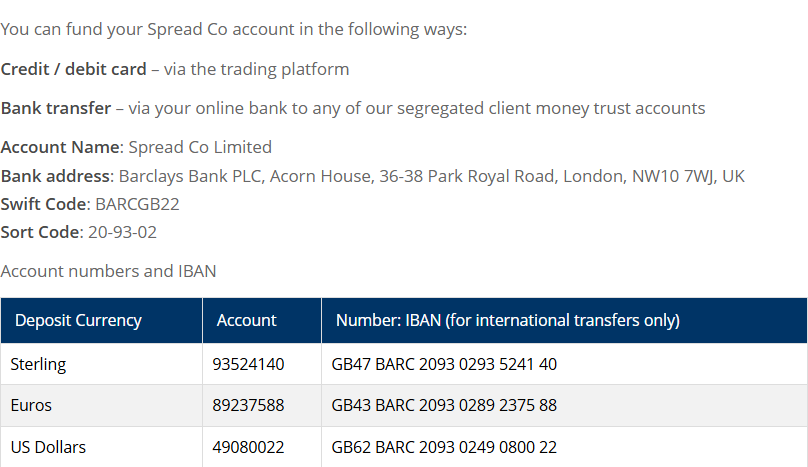

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Spread Co

In order to start Live trading, of course, you should deposit an initial requirement to start. Funding an account is an easy process done in the personal account management area, which takes only a few minutes. Fees are either none or very small, however, the broker accepts only funding via Credit/Debit Cards and Bank Transfers and doesn’t accept payments via e-wallets.

Minimum Deposit

There is no specified minimum deposit requirement. However, the broker recommends depositing at least £200 the first time as this amount of funding can give traders enough funds to place and maintain a trade.

- The broker does not charge any additional fees for deposits, however, the payment provider may add extra fees.

Withdrawal Options at Spead Co

The company policy states that withdrawals must go back to the source and may be performed by the methods applicable for deposits. Clients are allowed to withdraw a maximum of $50,000 (account currency equivalent).

- The withdrawal charges depend on when clients require their withdrawals to reach the account. Next-day withdrawals are free of charge, while same-day withdrawals entail a £10 fee.

Customer Support and Responsiveness

Score – 4.4/5

Testing Spread Co Customer Support

We have tested Spread Co’s customer support service to see how helpful and dedicated it is. The broker has a relationship team, a client services assistant, and a dealing team for trade queries. Clients can seek help through live chat, email, and a phone line.

- Spread Co also offers an FAQ section that includes answers to the most common and frequent questions that may arise while trading.

Contacts Spread Co

Here are the main options traders can use to contact the broker when an issue comes up:

- Spread Co provides live chat, which is the quickest way to solve problems and get answers to trading-related questions.

- Traders can direct their questions through an email by using the provided address: info@spreadco.com.

- The broker also provides a phone number for those clients who prefer to communicate their problems with the support team directly: 0800 078 9398.

- The broker also has social pages where clients can find relevant information, not only the broker’s updates but also news and changes on the market. Spread Co is available through FB, Twitter, and YouTube.

Research and Education

Score – 4.4/5

Research Tools Spread Co

Spread Co provides client support through relationship managers who provide assistance. Also, Spread Co provides good education and research sections. Spread Co introduces its research tools into its proprietary platform, integrating TradingView’s advanced tools. Thus, there are only a few additional features available on the broker’s website:

- The broker includes over 100 built-in technical indicators, enabling in-depth market analysis.

- The Economic Calendar of Spread Co informs traders about the major events that take place in the financial market. Being aware of the coming changes in advance helps traders make advanced trading decisions.

Education

The broker provides an educational library with multiple guides, market news and overview, and platform guides.

- Spread Co provides spread bet, CFD, and Forex guides. The guides are provided as detailed articles, giving informative and helpful information in an easily comprehensible way.

- The Glossary section includes the most essential forex terms that traders come across during trading. Being aware of the professional terms helps clients trade with more ease and understanding.

- The introduction and explanation of a good range of trading strategies give traders knowledge and more insight into the market.

Is Spread Co a Good Broker for Beginners?

Spread Co offers good trading conditions for different types of traders. As the trading costs are average or even lower than the market norm, the offering can be suitable for beginners as well. The trading platform is easy to navigate, with its customizable interface and great tools. The recommended minimum deposit is £200, which is considered slightly higher compared to other brokers. Another advantage Spread Co has is its good educational section, with guides, a glossary, and trading strategies. We advise novice traders to familiarize themselves with the broker’s services and offerings to determine how they meet their trading expectations.

Portfolio and Investment Opportunities

Score – 3.8 /5

Investment Options Spread Co

For traders who favor short-term trading based on CFDs, where they can speculate on price movements, Spread Co is a good choice with its spread betting and CFD-based products. However, traditional investment enthusiasts might find Spread Co offerings unsatisfying.

- The broker does not offer other investment alternatives as well, such as social trading, PAMM, or MAM accounts.

- The lack of longer-term investment tools is a drawback for traders who want to make traditional investments and own actual stocks. Thus, with Spread Co, the opportunities to diversify portfolios are limited.

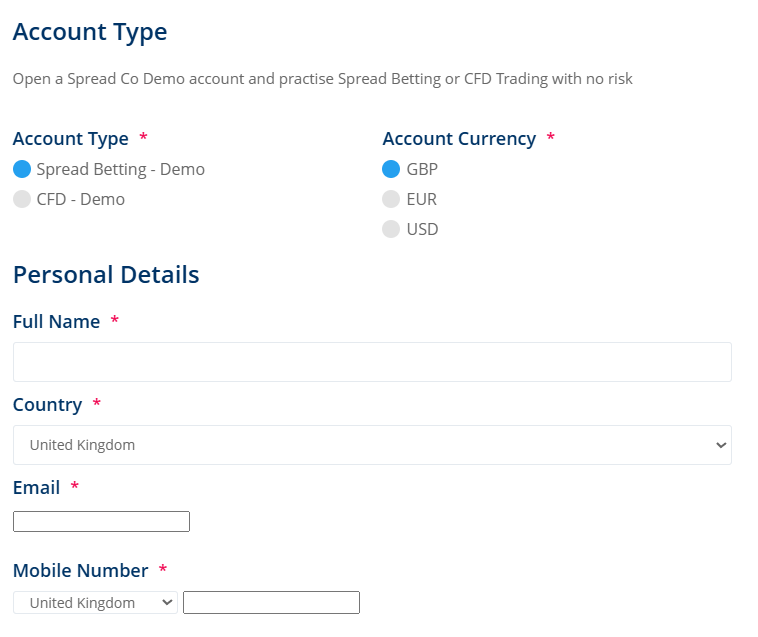

Account Opening

Score – 4.6/5

How to Open a Spread Co Demo Account?

The demo account enables traders to practice CFD and spread betting without spending any funds. The broker provides $25,000 in virtual money to start practicing. However, the demo account gives limited access to instruments compared to the live account.

Here is a step-by-step guide on how to open the account:

- Visit the broker’s website.

- Choose the Demo option.

- Fill out the registration form by providing your name, phone number, email address, country of residence, etc.

- Get the login credentials in your email.

- Use the credentials and enter your demo account.

- Explore the market and use the provided $25,000 virtual funds.

How to Open a Spread Co Live Account?

To open a Spread Co account, traders need to follow certain steps. The overall process is quick and easy. However, compared to the demo account opening, it demands more information to be provided:

Here are the main steps to follow:

- Visit the broker’s website and choose the ‘Start Trading’ button.

- Provide personal information (name, nationality, email address, phone number, etc.).

- Choose the account type and the preferred currency.

- Provide additional personal and financial information (ID, proof of residence, etc.).

- Also, mention the level of trading experience, information on employment, and income status.

- Agree to the terms, and submit the form.

- After the verification of the provided documents, receive a confirmation email.

- Use the account credentials and enter your live account.

- Make your first deposit and start trading.

Score – 4/5

We have found that Spread Co offers great tools and features, but all of them are included on the broker’s proprietary platform. The platform integrates TradingView charting and analysis tools that considerably enhance the broker’s offering.

- The spread betting offering is unique in the market. Spread Co offers mini-spread bets that reduce the risk of trading.

- Based on our research, the Spread Co tools and features are advanced and innovative, assisting in profitable trading and allowing traders to explore the market with ease and confidence.

Spread Co Compared to Other Brokers

After completing our research on the broker Spread Co, we compared it to other brokers with similar regulatory oversight and trading conditions. The aim is to see where Spread Co stands in the market.

We first compared the broker’s safety measures to other brokers in the market. Spread Co is regulated by the well-regarded FCA. The authority imposes strict rules and guidelines and ensures the safety of trade. Based on our findings, Eightcap and Fortrade also hold an FCA license. In addition, the brothers have licenses from top-tier authorities like ASIC and CySEC that add an additional layer of security.

When it comes to instrument offerings, Spread Co offers spread betting that brokers like JFD Brokers and Forex.com do not have. The available instrument range is also good, with over 1,000 tradable products. The only other broker from the ones we reviewed is JFD Brokers, with its 1,500+ available instruments across a good range of assets.

When it comes to Spread Co’s available trading platforms, the broker offers only a proprietary platform and a mobile app. Forex.com also has a proprietary platform. However, it also offers access to the popular MT4 and MT5 platforms that provide greater diversity and opportunities. At last, Spread Co has a quite good educational section with guides and a Forex glossary. Yet, FXTB has better educational resources, being an excellent broker for beginners.

| Parameter |

Spread Co |

JP Markets |

FXTB |

JFD Brokers |

Eightcap |

Forex.com |

Fortrade |

| Spread Based Account |

Average 0.8 pips |

Average 2pip |

Average 3 pip |

Average 0.2 pip |

Average 1 pips |

From 0.8 Pips |

Average 2 pip |

| Commission Based Account |

0.05% on equity trades |

0.5 pips + $3 |

No commission |

0.0 pips + $2.7 – $5 |

0.0 pips + $3.5 |

0.0 pips + $5 |

No commission |

| Fees Ranking |

Average |

Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

Proprietary platform, mobile app |

MT5 |

MT4, Web Trader |

MT4, MT5, Stock3 |

MT4, MT5, TradingView |

MT4, MT5, Forex.com Platform |

Fortrader Platform, MT4 |

| Asset Variety |

1000+ instruments |

100+ instruments |

300+ instruments |

1500+ instruments |

800+ instruments |

500+ instruments |

300+ instruments |

| Regulation |

FCA |

FSCA |

CySEC |

CySEC, CNMV, VFSC |

ASIC, SCB, CySEC, FCA |

FCA, NFA, IIROC, ASIC, CFTC, CySEC, JFSA, MAS, CIMA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

| Customer Support |

24/5 support |

24/5 |

24/5 support |

24/5 support |

24/5 support |

24/5 support |

24/5 support |

| Educational Resources |

Good |

Basic |

Excellent |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

£200 |

R100 ($5.42) |

€250 |

R100 ($5.42) |

$100 |

$100 |

$100 |

Full Review of Broker Spread Co

We have carefully reviewed Spread Co and its offerings to reveal each aspect of trading with the broker. Spread Co is a tightly regulated broker by one of the most respected authorities in the financial world—FCA. The FCA license ensures safety and reliability and provides traders with different protection measures.

Spread Co has two account types, one for spread betting and the other for CFD trading. The charges applied are reasonable and often lower than the market average. The average EUR/USD spread is 0.8 pips. Besides, commissions are applied only for equity trading. As to the trading platform, clients have access to the broker’s proprietary platform and mobile app. Other popular platforms are not available with Spread Co. However, our testing revealed an advanced platform with innovative tools and features.

The education and research section is good. Still, it does not provide extensive educational resources; traders of any level can benefit from the available materials. All in all, Spread Co is a reliable broker with good market conditions that can meet the needs of many.

Share this article [addtoany url="https://55brokers.com/spread-co-review/" title="Spread Co"]