- What is Scope Markets?

- Scope Markets Pros and Cons

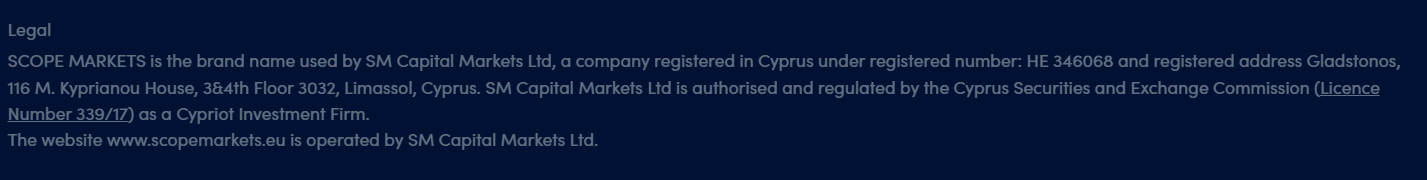

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Scope Markets Compared to Other Brokers

- Full Review of Broker Scope Markets

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 3.8 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4 / 5 |

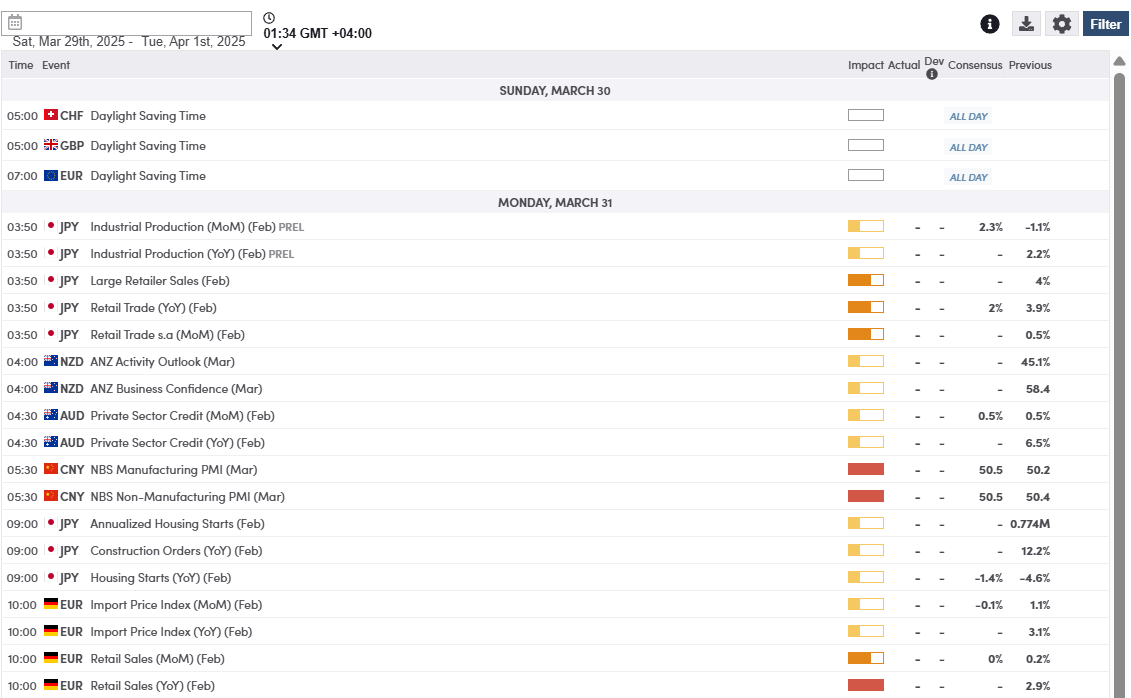

What is Scope Markets?

Scope Markets (formerly known as SMFX) is a Forex and CFD broker offering institutional and retail trading services to businesses and traders worldwide. The broker has more than 20 years of experience in the industry, providing a range of instruments to traders, including Forex, indices, metals, energies, shares, cryptocurrencies, and more. Trades are conducted on the popular MT5 platform, with access to low spreads, no commission, and overall favorable trading conditions. Scope Markets operates a no-dealing desk or STP execution model, a simple yet sophisticated enough trading environment suitable for either beginner or professional traders.

The company operates through two locations: in Belize, where the offshore entity Scope Markets Ltd. is based, and in Cyprus, under the name SM Capital Markets Ltd.

Scope Markets Pros and Cons

Scope Markets is a CySEC-regulated broker with a good reputation earned over its operating years. The account opening is easy, and there is a wide range of trading tools and user-friendly software. Scope Markets offers competitive fees and trading conditions and also excellent multilingual customer support. The minimum deposit requirement is $200 for its One account, tailored for all types of traders.

For the cons, one of the regulations is in the offshore zone, and there is no 24/7 customer support. Also, the platform offering is limited to the MT5 platform.

| Advantages | Disadvantages |

|---|

| CySEC-regulated international broker | Operate offshore entity In Belize |

| Global coverage and years of operation | No 24/7 customer support |

| Competitive trading conditions | Limited range of platforms |

| Quality customer support with live chat and fast response | |

| Negative balance protection applied | |

| Low trading costs | |

Scope Markets Features

Scope Markets is a Forex and CFD broker that has been operating since 2014. Since then, the company has gained and delivered valuable trading conditions while deeply understanding what traders are looking for in a forex broker. We have reviewed different aspects of trading with the broker and compiled them in one place:

Scope Markets Features in 10 Points

| 🗺️ Regulation | CySEC, FSC |

| 🗺️ Account Types | One account, Plus account, Scop Invest, Scope Elite |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | CFDs on Commodities, Forex, Metals, Indices, and Energies, Crypto, Shares, Stocks, ETFs |

| 💳 Minimum deposit | $200 |

| 💰 Average EUR/USD Spread | 0.9 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP, and AED |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is Scope Markets For?

We have researched Scope Markets’ offerings and different aspects of trading, and based on our findings and financial expert opinions, Scope Markets is good for the following:

- Beginners

- Advanced traders

- Traders who prefer MT4/MT5 trading platforms

- Currency and CFD trading

- Variety of trading strategies

- Low fees and competitive spreads

- Algorithmic or API traders

- Good customer support

Scope Markets Summary

Scope Markets is a broker with flexible trading conditions, options between account types, and execution models, which all in all bring ease of mind through the overall trading experience.

Low trading fees are another advantage of Scope Markets; also, despite its entity being in an offshore zone, the broker complies with European standards of running a Forex business due to its CySEC license. So overall, we would recommend trading with Scope Markets as a balanced option for either beginners or seasoned traders.

55Brokers Professional Insights

Scope Markets is considered a quality broker with safe and favorable trading conditions. The broker offers a range of trading services suitable for both beginner traders and professionals, as an advantage there is low initial deposit amount and some of the lowest spreads for most instruments offered. We admit, also a really good range of trading instruments across multiple financial markets, and real investing opportunities through Stocks and ETFs.

Another comfortable feature is that broker offers One account with the best conditions and opportunities. Also, there are several other options tailored for professionals and investors.

Scope Markets operates under CySEC and FSC, an offshore entity, therefore we have noticed a difference in trading conditions across the entities, such as in account type selection, the minimum deposit requirement, instrument range, and applicable fees. Overall, Scope Markets has been in the market for over a decade and has proved its reliability through years of dedication and development.

Consider Trading with Scope Markets If:

| Scope Markets is an excellent Broker for: | - Traders looking for diverse trading instruments

- Stock trading

- Trader looking for ETF investment

- MT4/MT5 platform enthusiasts

- Cost-conscious traders

- Traders looking for MAM and PAMM account availability

- Clients prioritizing responsive and dedicated customer service

- Beginner and advanced traders

- Algorithmic or API traders |

Avoid Trading with Scope Markets If:

| Scope Markets is not the best for: | -Traders looking for very high leverage

- Clients looking for platforms other than MT4/MT5

- Those looking for 24/7 support

- Traders looking for comprehensive educational materials |

Regulation and Security Measures

Score – 4.4/5

Scope Markets Regulatory Overview

Scope Markets is a brand operated through two locations, including offshore Belize and Cyprus. While Belize registration does not really provide the sharp conditions that are necessary to guarantee a safe trading environment, CySEC is a European authority that sets numerous standards. We learned that as a licensed broker, Scope Markets is subject to strict European laws, providing its financial services guaranteed by legal regulatory agencies.

- We have also found that Scope Markets is a part of Rostro group – a full-service financial services group, concentrated on delivering all kinds of trading services. The group includes several regulated brokerage houses, becoming a huge trading network that offers a wide range of financial products and services to traders and investors worldwide.

How Safe is Trading with Scope Markets?

As we learned, being compliant with EU ESMA regulations, Scope Markets brings its clients confidence about its security conditions and applied measures on how their orders are managed.

- Besides, a CySEC-regulated broker assures funds are segregated at all times and covered by the compensation funds in case of company insolvency.

Consistency and Clarity

We have carefully considered Scope Markets and its services to see how reliable the broker is. Scope Markets has been in the market for over a decade, consistently enhancing its offerings and providing a trustworthy and secure environment with favorable conditions. The broker has also garnered collective recognition from award-giving bodies in the industry, holding a large range of awards for different aspects of its operation. This is more proof of the broker’s consistency and constant development.

We have also reviewed real customer feedback to see how traders rate Scope Markets. Most reviews are positive, pointing out the broker’s advanced services, low costs, fast withdrawals, and reliable customer support. However, some traders mention higher costs than other brokers and withdrawal issues. We recommend considering all the available feedback, reviewing the broker’s offerings and trading conditions, and then deciding to open an account with Scope Markets. Also, remember the differences in conditions between the entities.

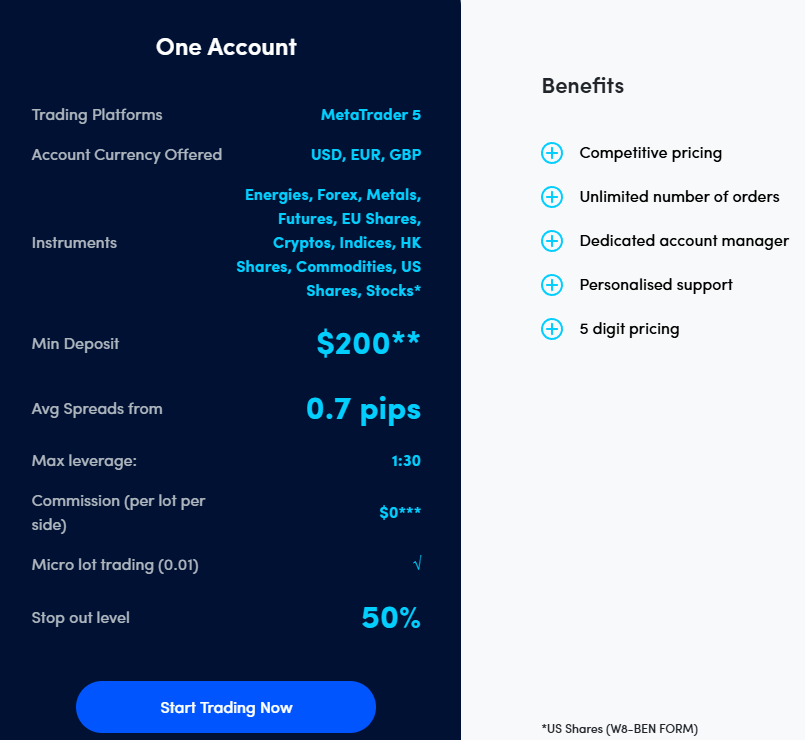

Account Types and Benefits

Score – 4.5/5

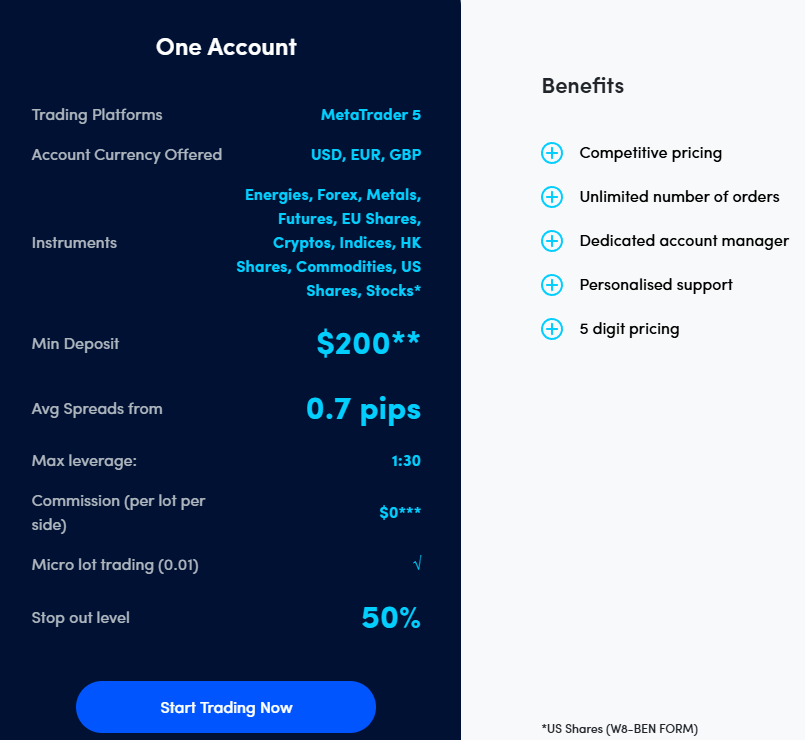

Which Account Types Are Available with Scope Markets?

As we have already mentioned, Scope Markets’ offerings differ from entity to entity. Here we will consider the available account types under the European entity. Scope Markets offers the following accounts: One account and Plus account. The broker also offers special conditions for professionals.

One Account

One account is for traders of different levels—from beginners to serious investors. The account allows access to a wide range of instruments, including energies, forex, metals, futures, EU shares, cryptos, indices, HK shares, commodities, US shares, and stocks. Trades are conducted through the MT5 trading platform, with competitive pricing and an unlimited number of orders. Spreads start from 0.7 pips, with no transaction fees. The available multiplier is up to 1:30, based on the instrument traded. The available account currencies are USD, EUR, and GBP. Traders can open an account by depositing a minimum of $200.

Plus Account

The Plus account offers different trading conditions and is tailored for more advanced clients. The minimum deposit requirement of $10,000 is much higher compared to One account; consequently not designed for beginner or intermediate traders. Clients have access to the same range of instruments with 1:30 leverage opportunities. Spreads start lower at 0.6 pips with no commissions. However, there might be commissions for CFD shares.

Professional Traders

Scope Markets offers special conditions for professional traders, with tighter spreads and higher leverage opportunities. However, the broker strictly checks whether traders meet the requirements to be considered professional. Clients who want to be treated as professionals should have at least 40 trades of significant sizes placed during a year, an impressive portfolio of at least €500,000, and work experience in a financial field. These are the primary requirements, but there might be other criteria determining the eligibility of traders.

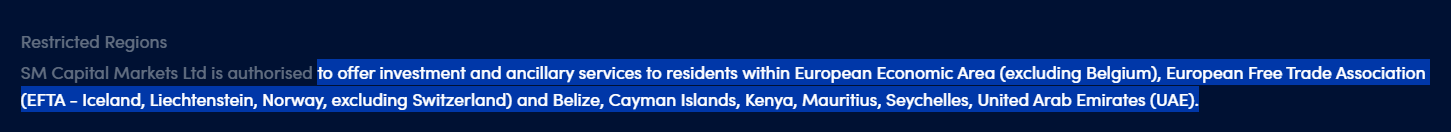

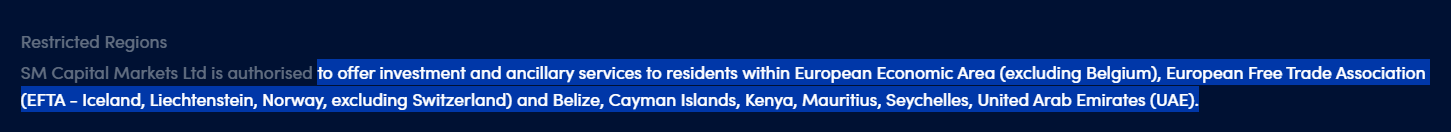

Regions Where Scope Markets is Restricted

We have also reviewed the availability of Scope Markets in various regions. Through its different entities, the broker offers its services all over the world. However, through its FSC entity, the broker restricts the following countries:

- American Samoa

- Australia

- Austria

- Belgium

- Bulgaria

- Canada

- Croatia

- Cyprus

- Czechia

- Denmark

- El Salvador

- Estonia

- Finland

- France

- Germany

- Greece

- Guam

- Hungary

- Iceland

- Indonesia

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Myanmar

- Netherlands

- Northern Mariana Islands

- Norway

- Poland

- Portugal

- Puerto Rico

- Romania

- Singapore

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom of Great Britain and Northern Ireland

- United States of America

- Virgin Islands (U.S.)

- UNITED STATES MINOR OUTLYING ISLANDS

Cost Structure and Fees

Score – 4.5/5

Scope Markets Brokerage Fees

Scope Markets offers competitive and transparent fees, many based on spreads, and includes all the trading fees in spreads. All in all, the fee structure is clear, and the spreads are in line with the market average. Commissions may be applied only for CFD shares.

Scope Markets offers two account types, and both are spread-based, including all the trading costs in them. There are no commissions for most of the instruments. The average spread for the EUR/USD pair is 0.9 pips for the One account, and spreads for gold are 36 points. All in all, the broker clearly mentions its spreads for all the instruments for each account type.

- Scope Markets Commissions

Scope Markets does not apply commissions for most of its tradable products. However, there are exclusions, including CFD shares, futures, and commodities. For shares, the commission can vary based on the market, while for futures and commodities, there is a $5 transaction fee per lot per side. For the global traders, the Scope Elite account applies commissions of $3.50 per lot per side with tight spreads starting from 0.0 pips.

- Scope Markets Rollover / Swap Fees’

Scope Markets also applies swap fees for the positions held overnight. There are short and long swaps for each instrument. The broker mentions each separately for every tradable product, thus, traders can find the updated data right on the official website. The long swap for the EUR/USD pair is 2.51, and the short swap is -8.18.

How Competitive Are Scope Markets Fees?

After reviewing the Scope Markets fees, we have concluded that the broker offers low/average fees that differ from account to account. The average spread for the EUR/USD pair is 0.9 pips, which is lower than the market average, especially since all the trading fees are already integrated into spreads. The commissions are applied only for certain instruments. Altogether, the trading fees applied by the broker are all common charges for forex trading. The broker also applies swap fees, which depend on the instrument and are changeable based on market changes.

An important notice about Scope Markets fees is that the fees differ between the broker’s entities. For instance, for the global website, the Scope Elite account applies spreads from 0.0 pips with fixed commissions of $3.50. Thus, these differences should be considered so as not to get confused.

| Asset/ Pair | Scope Markets Spread | FxPro Spread | Pepperstone Spread |

|---|

| EUR USD Spread | 0.9 pips | 1.4 pips | 1 pips |

| Crude Oil WTI Spread | 24 | 39.04 cents | 2.4 pips |

| Gold Spread | 36 | 36.49 cents | 0.15 pips |

| BTC USD Spread | 4000 | 30$ | 20.22 |

Scope Markets Additional Fees

We have found a few non-trading fees that Scope Markets may charge. The broker charges an inactivity fee of $10 if the account has been dormant for six consecutive months. This fee is charged to cover the administrative costs. Accounts that have been dormant for more than 12 months might be closed by the broker. As to deposits and withdrawals, the broker does not incur additional charges. However, based on the payment provider policies, there might be certain fees that are not connected with Scope Markets.

Score – 4.4/5

Based on our findings, as a majority of brokers, Scope Markets offers the industry leader MetaTrader4. MT4 is one of the most popular platforms used by both beginners and professionals due to its user-friendly interface but great possibility of powerful capabilities, numerous add-ons, and great charting packages. In addition, MT5 is also available while trading with Scope Markets.

| Platforms | Scope Markets Platform | FxPro Platforms | XM Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Scope Markets Web Platform

The MetaTrader 4 and 5 web trading platforms will bring clients all the benefits and powerful capabilities without any download or hassle; traders simply need to go to any internet browser and log in to their accounts. Its flexibility is one of the main reasons why MT4 and MT5 web platforms are well-regarded and used by various traders. The platform includes the basic tools and capabilities essential for everyday trading.

Scope Markets Desktop MetaTrader 4 Platform

The MT4 platform is one of the first choices for traders who want access to the financial market. The Scope Markets’ MT4 platform includes all the necessary and advanced features for profitable trading. The platform offers over 50 technical indicators, various chart types, 9 timeframes, and trading signals.. Traders gain access to multiple markets, including CFDs on FX, spot metals, shares, spot indices, spot energies, and futures with competitive spreads and overall favorable trading conditions. Traders can also use historical data, a built-in strategy tester, and the MQL4 language. The platform is available through various devices, making it more accessible for any trader.

- Note that the MT4 platform is available only for global traders.

Scope Markets Desktop MetaTrader 5 Platform

The Scope Markets offers a more advanced MT5 platform available for its clients worldwide. It is a highly dynamic and flexible platform, including the most innovative tools and features to explore the market to the fullest. Traders gain access to 6 types of pending orders, a built-in economic calendar, technical indicators of 22 analytical objects, and 46 graphical objects. Traders also have access to EAs, trading robots, and strategy automation. MetaTrader 5 is available via desktop, web trader, iOS, and Android mobile applications.

Scope Markets MobileTrader App

The mobile app is also offered with its simple to use and still a good range of tools allowing you to make analyses and trade on the go. Also, MT4 and MT5 mobile platforms are adjustable with its charting features and good support traders will enjoy. Through the mobile platforms, traders can manage positions, monitor the markets and conduct technical analysis from the palm of a hand.

Main Insights from Testing

Based on our testing, Scope Markets’ MT4 and MT5 platforms offer traders great flexibility and versatility to trade in a comfortable and innovative setting. The platforms are competitive with different devices and operation systems. Both the MT4 and MT5 platforms include a wide range of tradable products with competitive trading conditions. Besides, the platforms offer great analytical tools, charts, and indicators. We have noticed that global clients have access to MT4 and MT5 platforms, while those who trade under the CySEC entity can conduct their trades only through the MT5 platform.

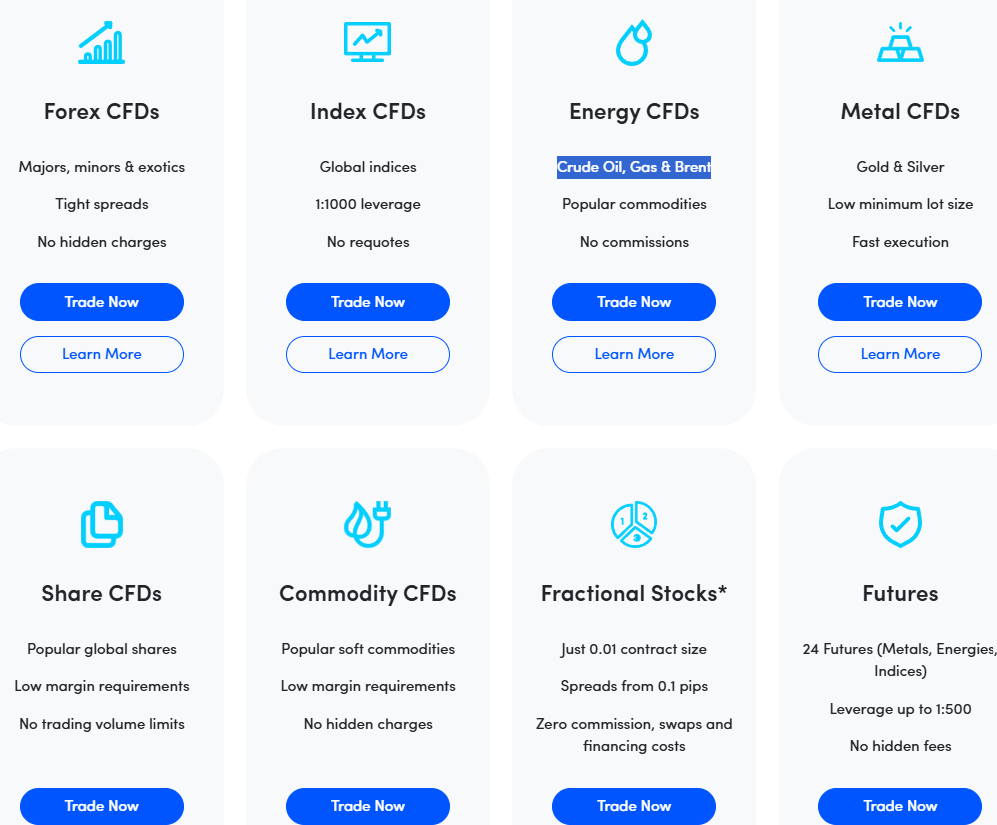

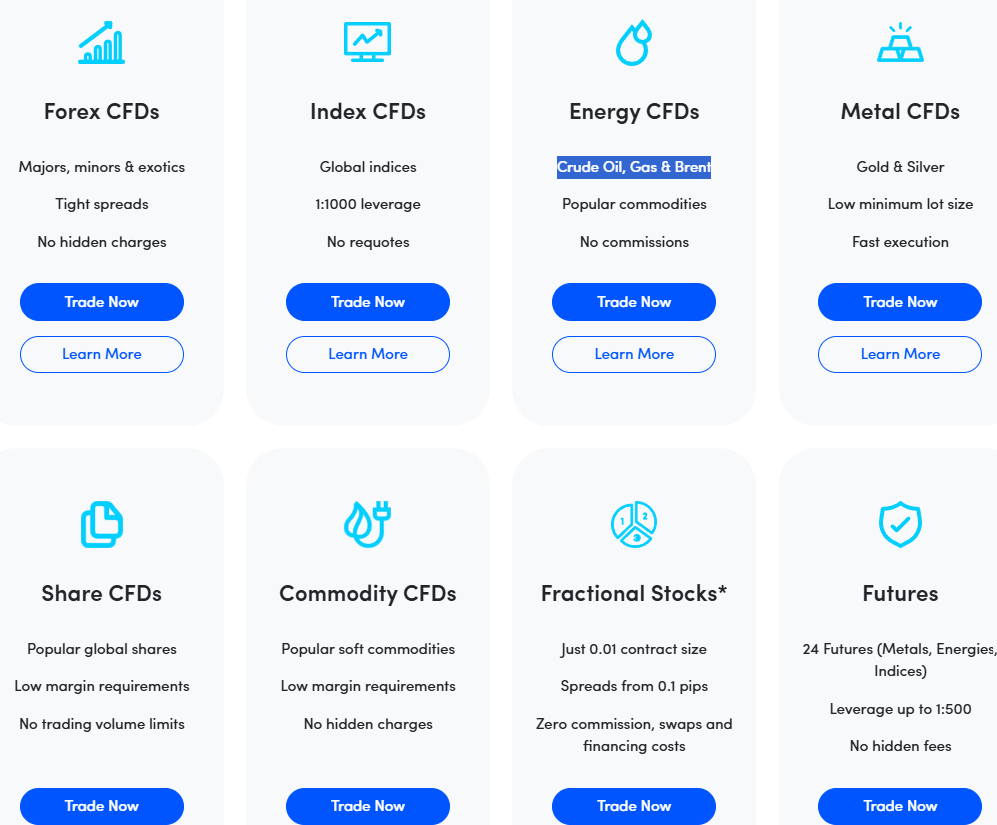

Trading Instruments

Score – 4.5/5

What Can You Trade on the Scope Markets Platform?

Scope Markets provides developed services with tight spreads and access to FX, CFDs on metals, energy, indices, shares, commodities, 24 futures, and more. The broker also offers more than 1,000 real stocks and dozens of ETFs. The range of supported currency pairs is also good, with access to major, minor, and exotic pairs. All in all, Scope Markets has one of the most extensive ranges of instruments, providing about 40,000 tradable products across multiple financial assets.

Main Insights from Exploring Scope Markets Tradable Assets

We have carefully researched Scope Markets’ available instruments to find that the broker offers an impressive range of trading products, enabling traders to explore the financial market to its fullest. The broker offers a range of currency pairs, global indices, crude oil, gas, Brent, and other popular instruments.

The best part of trading with Scope Markets is the long-term investment opportunity with 1000+ real stocks from different industries worldwide. This way, traders are able to own the asset rather than speculate on the price movement of the underlying asset. Scope Markets, with its instrument offering, enables traders to diversify their portfolios in a reliable and regulated environment with reasonable trading costs.

Leverage Options at Scope Markets

While trading with Scope Markets, you will also be offered leverage, a great tool that allows clients to increase their trading size. As a European broker, Scope Markets leverage automatically complies with ESMA restrictions towards leverage; thus, traders won’t be able to access high leverage since the regulator lowered leverage ratios to a maximum of 1:30 for major currency pairs and even lower for other instruments.

- Nevertheless, since Scope Markets also runs an entity in the offshore zone available for international clients, higher leverage up to 1:1000 for Forex Majors, Metals, and Indices Major is available. Yet, always be cautious about leverage use, as with its magnifying possibilities, the risks are increased as well.

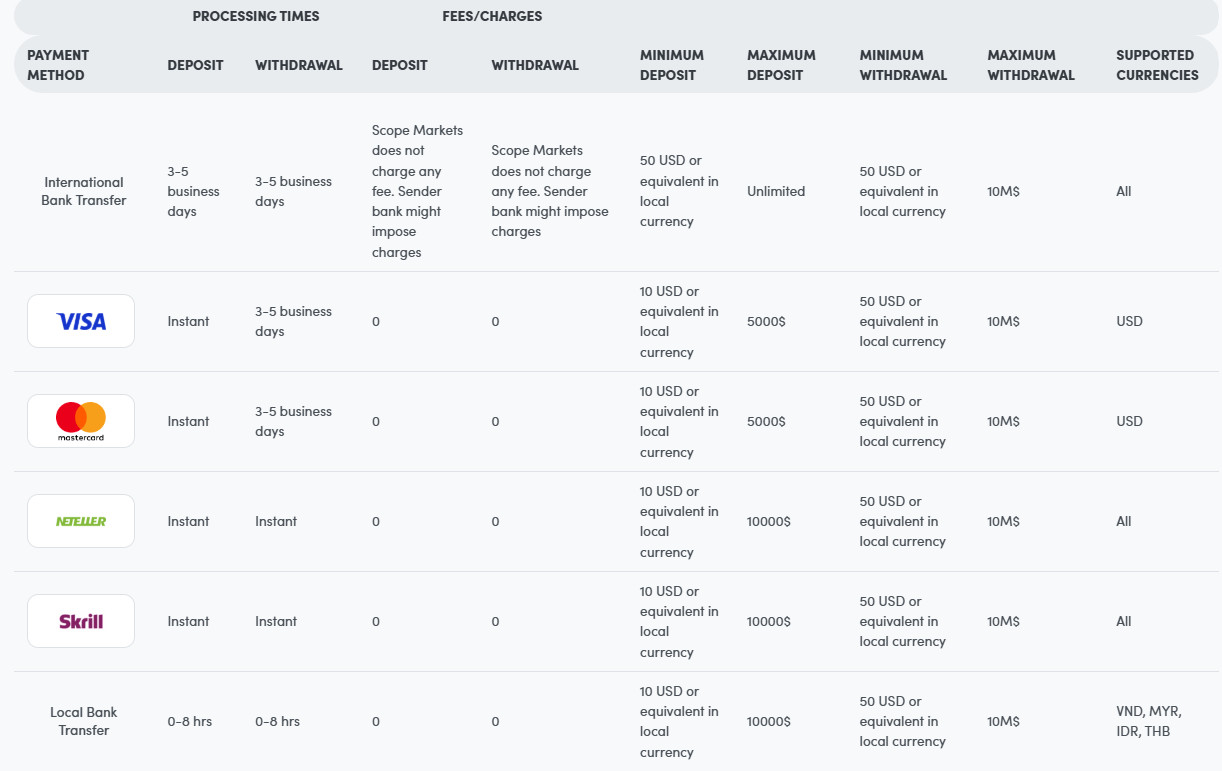

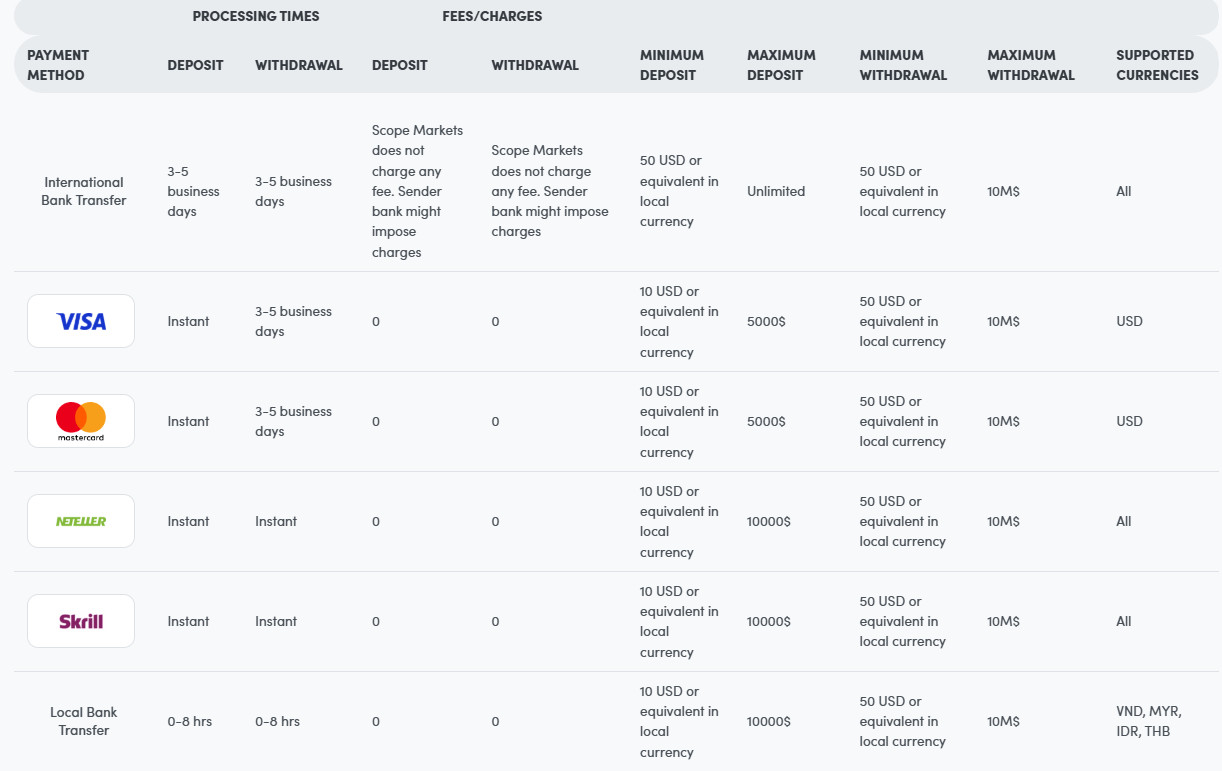

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Scope Markets

To deposit or withdraw funds, you may use proven methods so the transfer is convenient and safe. We found that the money management and funding methods at Scope Markets are quick and simple, which is important for account management convenience. The availability of funding methods depends on the entity. Through the CySEC entity, deposits and withdrawals can be made via bank transfer, Visa, and Mastercard. The global entity offers a wider range of available funding methods, which are as follows:

- International Bank Transfer

- Visa

- Mastercard

- Neteller

- Skrill

- Local Bank Transfer

- UnionPay

- Alipay

- ZaloPay

Minimum Deposit

The Scope Markets minimum deposit amount is $200. However, the broker recommends depositing at least $500 in order to be able to trade more effectively. Yet, through the global entity, the minimum deposit requirement is much lower, starting from $10.

Withdrawal Options at Scope Markets

Generally, Scope Markets does not charge funding fees; however, payment providers may add on some fees again according to jurisdiction or international rules. Scope Markets ensures quick and efficient withdrawals.

- The minimum withdrawal amount allowed is $50. For bank transfers and Mastercard, the withdrawal processing might take 3-5 business days. E-wallets, such as Neteller and Skrill, are instant.

Customer Support and Responsiveness

Score – 4.6/5

Testing Scope Markets Customer Support

Based on our research, traders can contact Scope Markets’ support at their convenience and get a relevant and appropriate answer. Even though the broker does not provide 24/7 support, the broker is responsive during the weekdays. Scope Markets offers communication through email, phone line, and live chat.

- Scope Markets also offers a detailed FAQ section that includes answers to trading-related questions that may arise while trading.

- Besides, Scope Markets connects with its clients through social platforms, providing updates on its operations and market changes on its X, LinkedIn, FB, IG, and YouTube pages.

Contacts Scope Markets

Scope Markets offers dedicated customer service via multiple options. We have found the following convenient methods to find quick answers and assistance when needed:

- Scope Markets provides the support@scopemarkets.eu email address to send requests and questions.

- Through the Get in Touch section, traders can send a quick request to the broker by mentioning their names and email addresses and composing the main message.

- The phone number provided by the broker is +357 25 281811 for clients who want to connect with the broker directly.

- The live chat is the quickest and most efficient way to ask the broker a question and seek assistance.

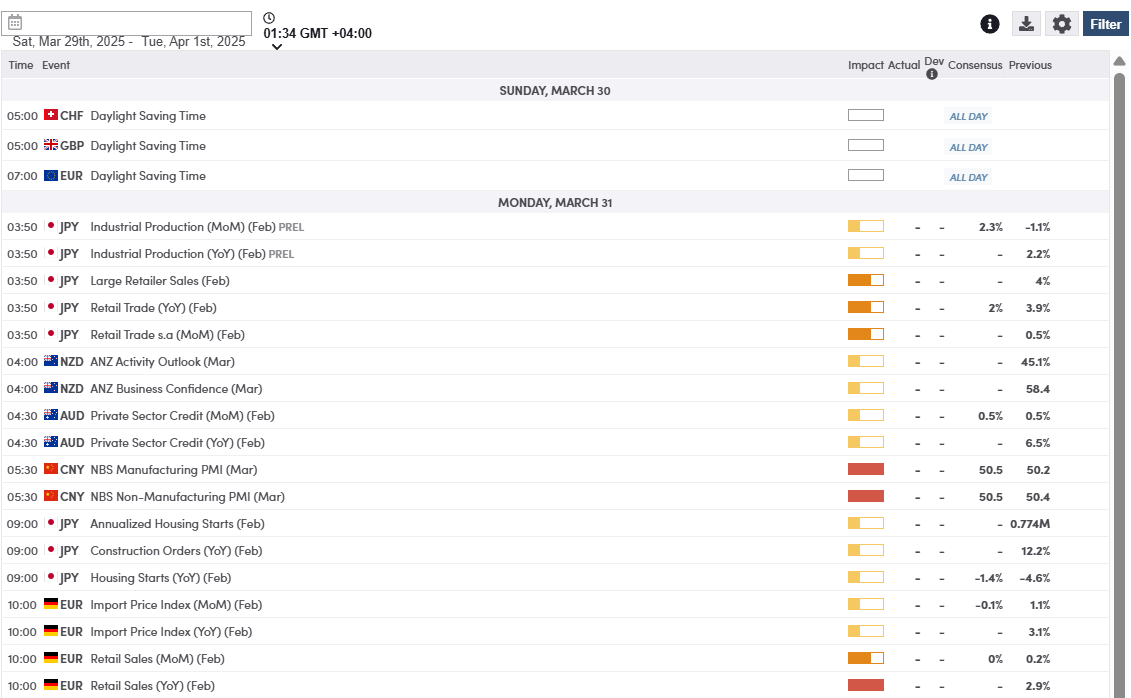

Research and Education

Score – 3.8/5

Research Tools Scope Markets

We have reviewed the broker’s research and education sections to see how the broker assists its clients with resources to elevate their trading skills and experience. However, we have not been able to find much.

Most of Scope Markets’ research tools are included in the broker’s platforms, providing in-depth research of the market; on its website, we were only able to find the economic calendar.

- The Economic Calendar is an essential tool that helps traders learn about significant market changes and movements and organize their trading in a way that will be beneficial.

Education

Scope Markets’ education section is not extensive either. There are only a few articles on CFDs and Forex trading. Traders will not be able to find any other resources. This lack of educational materials may be a great disadvantage for traders who prioritize good education and guidance from the side of the broker. Beginner traders will either have to find another broker with a better availability of educational materials or find an alternative source of education to enhance their trading skills and knowledge.

Is Scope Markets a Good Broker for Beginners?

Based on our research of different aspects of trading with Scope Markets, we find the broker’s offerings suitable for beginners. With its low spreads, transparent fee structure, demo account availability, and low minimum deposit requirement, especially for global traders, we find Scope Markets favorable for any trader. The only drawback that may limit beginner traders is the lack of a good education section.

Portfolio and Investment Opportunities

Score – 4.6 /5

Investment Options Scope Markets

As we have found, Scope Markets gives its clients great options for longer-term investments. With Scope Markets, traders can engage in traditional investments with access to over 1000 real stocks and dozens of ETFs. This is a perfect opportunity to extend portfolios with stocks from different industries and global markets.

Besides, Scope Markets offers alternative options for investment, too, giving traders even more chances to explore the market further and extend the scope of investments:

- The MAM accounts are tailored for experienced traders to trade on behalf of their clients. MAM account managers can trade Forex, shares, indices, and more CFDs on your client’s behalf, while clients are able to monitor their accounts and follow the trade in real time.

- The Percentage Allocation Money Management account (PAMM) is another great opportunity to trade on behalf of the investor and get a percentage from each trade.

Account Opening

Score – 4.6/5

How to Open a Scope Markets Demo Account?

Opening a demo account with Scope Markets and enhancing your trading knowledge and skills is a great idea, especially for beginner traders. The demo account enables clients to trade with initial virtual funds without risking real investments. When traders feel confident enough to trade with real money, they can switch to a live account.

Here are the main steps to open a demo account with Scope Markets:

- Visit the Scope Markets website and choose the demo account option.

- Fill out the registration form.

- Specify the desired account type, platform, currency, leverage, etc.

- Submit the form and wait for a confirmation letter.

- Receive your demo account credentials through email and log in to your account.

- Start trading with virtual funds.

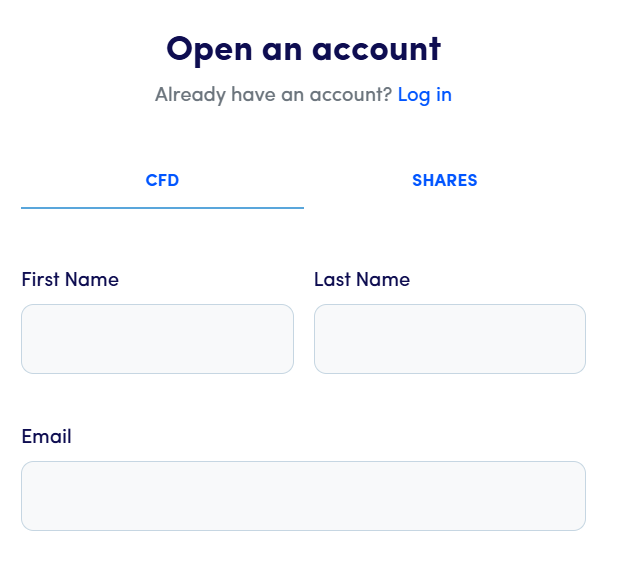

How to Open a Scope Markets Live Account?

Opening a live account with Scope Markets is an easy process. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open an Account” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- After the provided documents are verified, complete the electronic quiz confirming your trading experience.

- Receive your account credentials to enter your live account.

- Once your account is activated and proven, follow with the money deposit.

Score – 4/5

Generally, Scope Markets includes all essential tools and features in its trading platforms. It only offers additional opportunities and features to its more professional clients through partnership programs.

- Through the Cashback Rebate Program, Scope Markets’ registered IBs can encourage clients to trade. As a result, IBs boost their own rebates, as rebates are earned from every qualified trade.

Scope Markets Compared to Other Brokers

As a final part of our review, we have compared Scope Markets to other well-established brokers. Scope Markets holds a CySEC license that ensures a reliable and trustworthy trading environment. Also, the broker has an offshore license from the FSC. Similar regulatory compliance is offered by AvaTrade; still, the latter also holds multiple other licenses from well-regarded authorities, ensuring an extra layer of safety.

The fee structure of Scope Markets is competitive, with low spreads and no commissions for most of the instruments. Scope Markets’ average spread is 0.9 pips, much like spreads from AvaTrade and IC Markets. On the contrary, Exness spreads are much lower, starting at 0.2 pips.

The instrument range is one of the most impressive parts of trading with the broker. It includes over 40.000 tradable products, which is a rare offering. Other brokers like IC Markets and XM offer 1.000 instruments, which is also a good offering, yet much less than what Scope Markets provides. As to the trading platforms, Scope Markets enables trading through the industry’s popular MT4 and MT5 platforms. Exness has a similar offering, while AvaTrade offers an impressive range of trading platforms, allowing traders a selection of additional choices, such as DupliTrade, ZuluTrade, AvaSocial, and Capitalise.ai.

At last, we have reviewed Scope Markets’ education section, to reveal that the broker does not offer any learning materials. On the other hand, XM’s education section is one of the best in the market, providing traders with great materials and guides to enhance their trading knowledge and skills.

| Parameter |

Scope Markets |

IC Markets |

Exness |

AvaTrade |

HFM |

XM |

| Spread Based Account |

0.9 pips |

From 1 pip |

From 0.2 pips |

From 0.9 pips |

Average 1 pip |

Average 1.6 pips |

| Commission Based Account |

Only for CFD shares, futures, and commodities |

0.0 pips + $3.5 |

0.0 pips + $3.5 |

For Professional Account only |

0.0 pips + $3 |

Only on Shares Account |

| Fee Ranking |

Average |

Low/ Average |

Low |

Low |

Average |

Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, cTrader |

MT4, MT5 |

MT4, MT5, WebTrader, AvaTrade App, AvaOptions, DupliTrade, ZuluTrade, AvaSocial, Capitalise.ai |

MT4, MT5, HFM App |

MT4, MT5, XM WebTrader |

| Asset Variety |

40,000+ Instruments |

1,000+ Instruments |

200+ Instruments |

250+ Instruments |

500+ Instruments |

1,000+ Instruments |

| Regulation |

CySEC, FSC |

ASIC, CySEC, FSA |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

Bank of Ireland, ASIC, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

FCA, CySEC, ASIC, FSAS, NFA for Crypto Exchange |

ASIC, CySEC, FSC, DFSA |

| Customer Support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

24/5 support |

24/7 support |

| Education |

No education |

Good |

Fair |

Excellent |

Good |

Excellent |

| Minimum Deposit |

$200 |

$200 |

$10 |

$100 |

$0 |

$5 |

Scope Markets Review Conclusion

To sum up our review of the broker, we find Scope Markets a reliable and favorable broker, suitable for different trading expectations and styles. Due to its tight regulatory oversight by CySEC, the broker ensures the safety of investments. Besides, Scope Markets has been in the market for over a decade and has proved its consistency and transparency through the years.

Scope Markets offers low/average fees, mostly integrated into spreads, that give traders clarity and transparency with no hidden fees. Traders can access a good range of analytical tools, technical indicators, and charts through the popular MT4/MT5 platforms. The platforms are available on web and desktop platforms and via a mobile app.

The instrument availability of Scope Markets is one of the most impressive features of the broker. Traders can access over 40,000 tradable products across multiple assets. Besides, Scope Markets gives real investors a wonderful opportunity to invest in stocks and ETFs, enabling them to extend their portfolios. Another way to extend the portfolios and invest is access to PAMM and MAM accounts.

The only drawback we noticed about the broker is its lack of proper educational materials. This is especially unfavorable for beginner traders who need guidance and knowledge to trade successfully. However, we still consider Scope Markets a reliable and favorable choice that will give traders a successful start in forex trading.

Share this article [addtoany url="https://55brokers.com/scope-markets-review/" title="Scope Markets"]