- What is Scandinavian Capital Markets?

- Scandinavian Capital Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

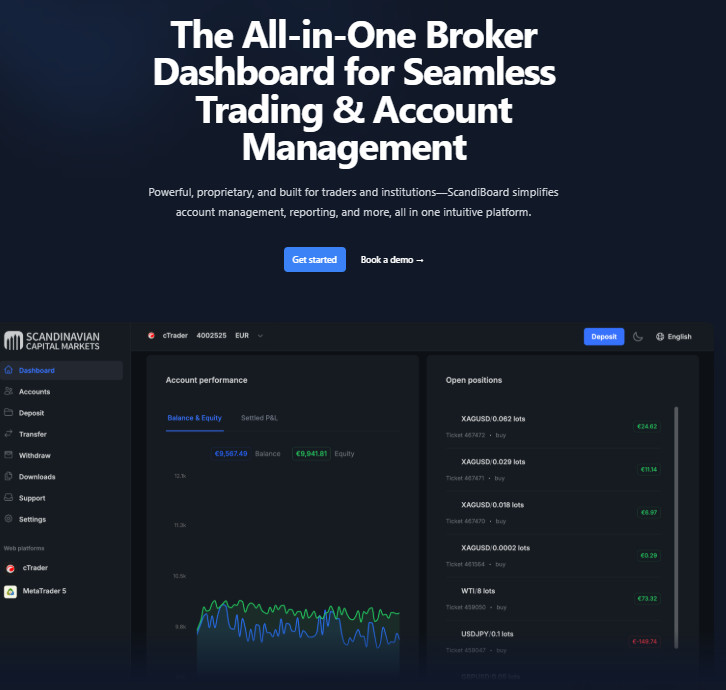

- Trading Platforms and Tools

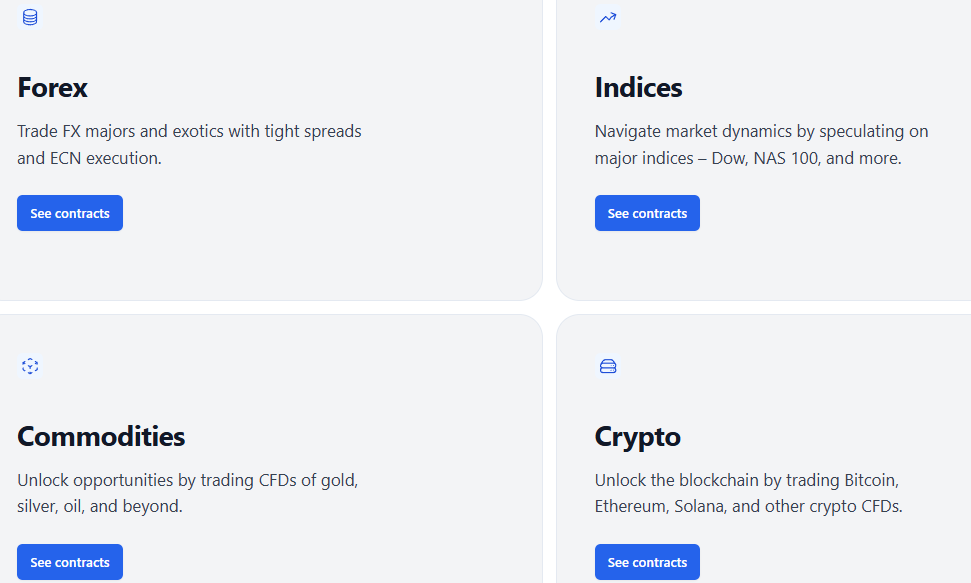

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

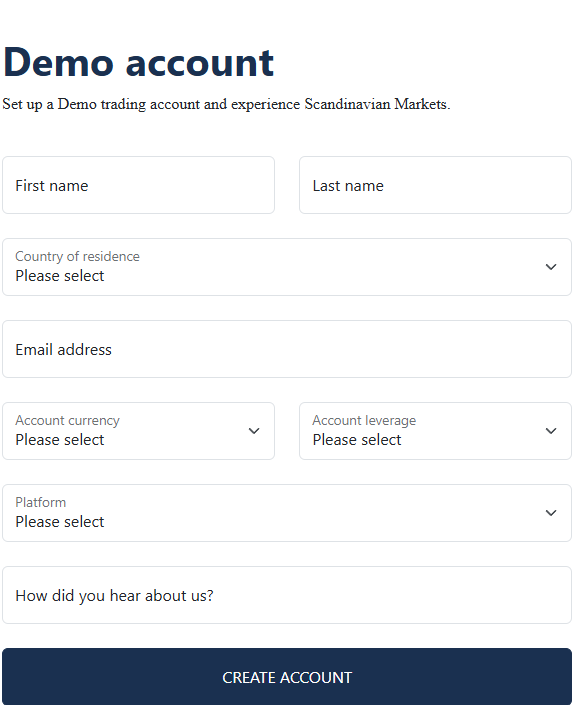

- Account Opening

- Additional Tools And Features

- Scandinavian Capital Markets Compared to Other Brokers

- Full Review of Broker Scandinavian Capital Markets

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.4/5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is Scandinavian Capital Markets?

Scandinavian Capital Markets is a Swedish-based financial services provider that focuses on offering Forex trading and investment solutions. Its services extend to various global financial markets, including Forex, commodities, indices, cryptocurrencies, etc.

Functioning as an ECN broker, Scandinavian Capital Markets operates under the STP execution model. This means that the broker facilitates direct access to liquidity providers, allowing for fast and transparent order execution.

According to our findings, Scandinavian Capital Markets, founded in 2011, strives to offer competitive pricing, efficient trade execution, and a robust infrastructure to assist traders and investors in achieving their financial goals.

Scandinavian Capital Markets Pros and Cons

Like any financial services provider, the broker has advantages and disadvantages. On the positive side, the company offers competitive trading conditions suitable for both retail and institutional clients, easy account opening, and access to advanced trading platforms such as cTrader and MT4/MT5.

For the cons, the availability of comprehensive educational materials on the website may be limited, and the range of financial instruments might not be extensive. Moreover, the broker does not possess a top-tier regulatory license, which may raise concerns for some traders in terms of regulatory oversight. Therefore, traders should carefully evaluate these factors and conduct thorough research before deciding whether the company aligns with their specific trading needs and preferences.

| Advantages | Disadvantages |

|---|

| European license and oversight | Limited education and research |

| MT4 and cTrader | No top-tier license |

| STP/ECN execution | Limited trading instruments |

| Competitive spreads | |

| Retail and professional trading | |

| Low minimum deposit | |

Scandinavian Capital Markets Features

Based on our analysis, the firm provides a reliable trading environment with competitive trading solutions, making it an appealing choice for traders. Scandinavian Capital Markets provides sophisticated trading platforms, enabling users to access popular financial instruments. To assess the broker and see where it stands in the market, we have reviewed it from different aspects. Have a quick look at the main offerings and conditions of Scandinavian Capital Markets:

Scandinavian Capital Markets Features in 10 Points

| 🗺️ Regulation | Finansinspektionen, Vanuatu Financial Services Commission |

| 🗺️ Account Types | Free forever, Growth, Institutional |

| 🖥 Trading Platforms | MT4, MT5, cTrader |

| 📉 Trading Instruments | Forex, Metals, Commodities, Cryptocurrencies, etc. |

| 💳 Minimum deposit | $25 |

| 💰 Average EUR/USD Spread | 0.1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, GBP, EUR |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is Scandinavian Capital Markets For?

Scandinavian Capital Markets is a reliable and well-established broker that ensures favorable trading conditions for traders of different levels. The broker’s offerings align with the market expectations and demands. Based on our findings and expert opinion, Scandinavian Capital Markets is good for the following:

- European traders

- Traders who prefer the MT4/MT5 and cTrader trading platforms

- Currency trading

- Beginners

- Advanced traders

- Institutional trading

- STP/ECN execution

- Islamic traders

- Competitive spreads

- Good trading tools

Scandinavian Capital Markets Summary

Scandinavian Capital Markets is a regulated brokerage firm that stands out for its competitive trading conditions, access to popular financial instruments, and advanced trading platforms. Traders can benefit from favorable pricing and tight spreads across various trading activities. Although there might be limitations in terms of educational and research materials, the broker compensates by providing market insights, news updates, and informative articles on Forex trading.

Overall, the broker offers a favorable trading environment suitable for traders of different skill levels. Yet, the firm does not possess a top-tier license, so potential clients should conduct thorough research and carefully assess whether the broker’s services and offerings align with their trading requirements.

55Brokers Professional Insights

Scandinavian Capital Markets being a Sweden-based broker with proper regulations and adherence to local laws is a great choice for traders from EU, providing good costs and suitable for most of the trading startegies either long term or daily trading. The broker includes great features and tools, providing favorable trading conditions for beginner and institutional clients.

The broker provides a sufficient selection of the most popular trading platforms, such as MT4, MT5, also a cTrader, which is an advantage with great choice of trading software available, along with with FIX API facilities. The choice among different trading accounts with raw spreads and various fee structures ensures that every trader finds the ideal conditions based on their trading expectations. Instrument availability is limited to the most famous assets, including Forex, commodities, indices, and crypto. The educational section is also limited, restricting learning opportunities for beginner traders, which can be a drawback if you look for this feature available.

At last, Scandinavian Capital Markets also operates an offshore entity, which means that the conditions and offerings between the entities might be different.

Consider Trading with Scandinavian Capital Markets If:

| Scandinavian Capital Markets is an excellent Broker for: | - European traders

- Beginner and institutional traders

- Forex and CFD traders

- Algo & API Traders

- Cost-conscious clients

- The MT4/MT5 platforms enthusiasts

- Clients preferring the cTrader platform |

Avoid Trading with Scandinavian Capital Markets If:

| Scandinavian Capital Markets is not the best for: | - Traders looking for comprehensive education

- Long-term investors

- Stock-traders

- Clients looking for 24/7 customer support

- Clients looking for top-tier regulations |

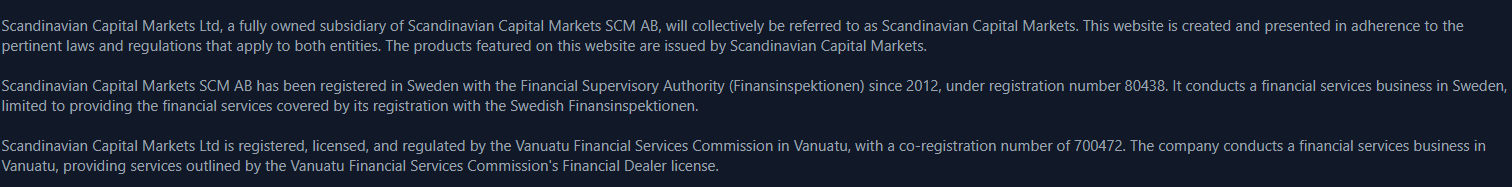

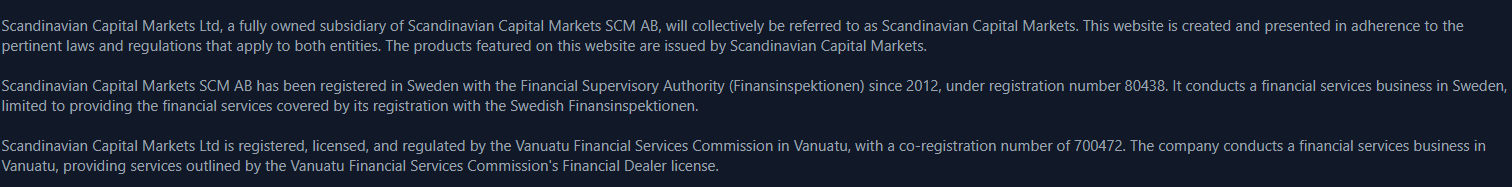

Regulation and Security Measures

Score – 4.4/5

Scandinavian Capital Markets Regulatory Overview

Scandinavian Capital Markets is a legit and regulated broker, and as a financial investment company based in Stockholm, Sweden, Scandinavian Capital Markets adheres to the necessary legal procedures to ensure secure trading conditions. The regulatory body responsible for overseeing and regulating trading firms in Sweden is the Swedish Financial Supervisory Authority, also known as Finansinspektionen. Therefore, Scandinavian Capital Markets is duly registered and compliant with the regulations outlined by the mentioned authority. Moreover, the company fully complies with the European ESMA regulation and the MiFID directive.

- The broker is also authorized by the Vanuatu Financial Services Commission, with a co-registration number of 700472. Although this is an offshore entity, Scandinavian Capital Markets’ adherence to ESMA regulation ensures the safety of trades and adherence to strict rules and guidelines.

How Safe is Trading with Scandinavian Capital Markets?

When engaging in trading or investing with Scandinavian Capital Markets, clients can benefit from guarantees of transaction transparency, as the company’s technological foundation ensures the absence of conflicts of interest. Additionally, the authorized status of Scandinavian Capital Markets ensures adherence to numerous rules concerning the treatment of clients and the handling and safeguarding of funds, which sets it apart from offshore firms.

- Moreover, European regulations offer cross-border regulated status and involve participating brokers in a compensation scheme designed to protect clients in the event of the broker’s insolvency.

Consistency and Clarity

We have reviewed Scandinavian Capital Markets from the viewpoint of consistency, clarity of its services, and transparency. The broker has been in the market since 2011. In over a decade of operation, the broker has earned more than 3000 active traders and their loyalty. As we reviewed its offerings over the years, we have noticed the implementation of new tools and features. This speaks about the consistent development of the broker and the striving to deliver the best to its clients.

We have also considered the feedback from clients pointing out the advantages of the broker and a few aspects for improvement. As advantages, traders mention Scandinavian Capital Markets’ advanced trading platforms, good customer support in several languages, reliability and transparency in costs, deposit/withdrawal processes, and other positive trading experiences. However, some traders express their concerns about widening spreads and slippage that result in small earnings. Based on both the positive and negative points mentioned, we recommend traders research the broker and its offerings and see how they meet their expectations.

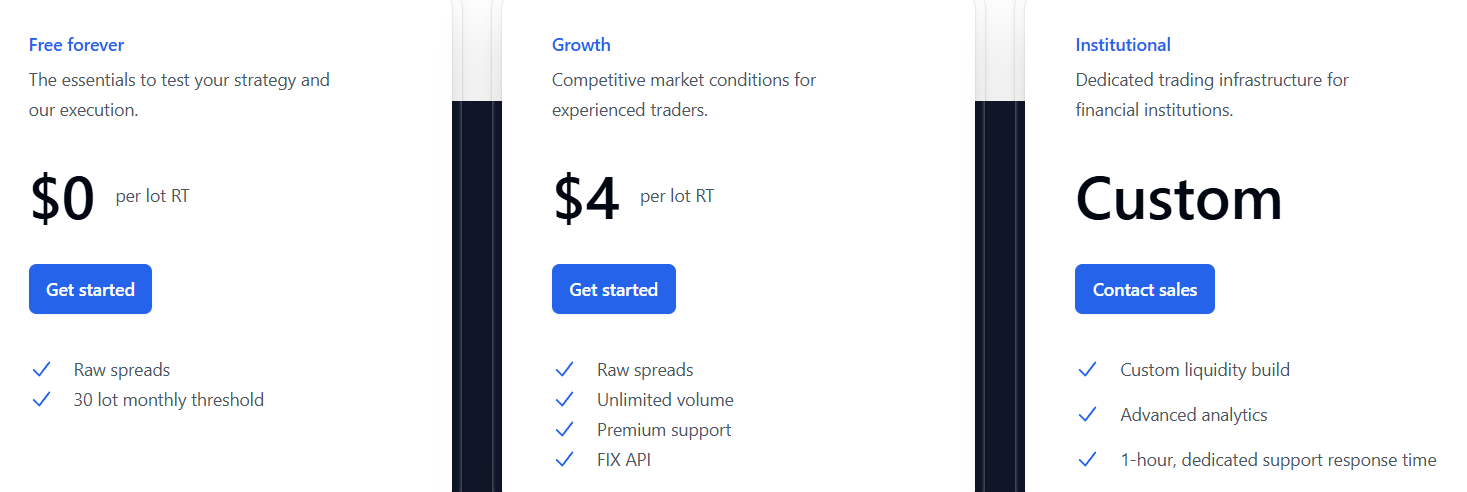

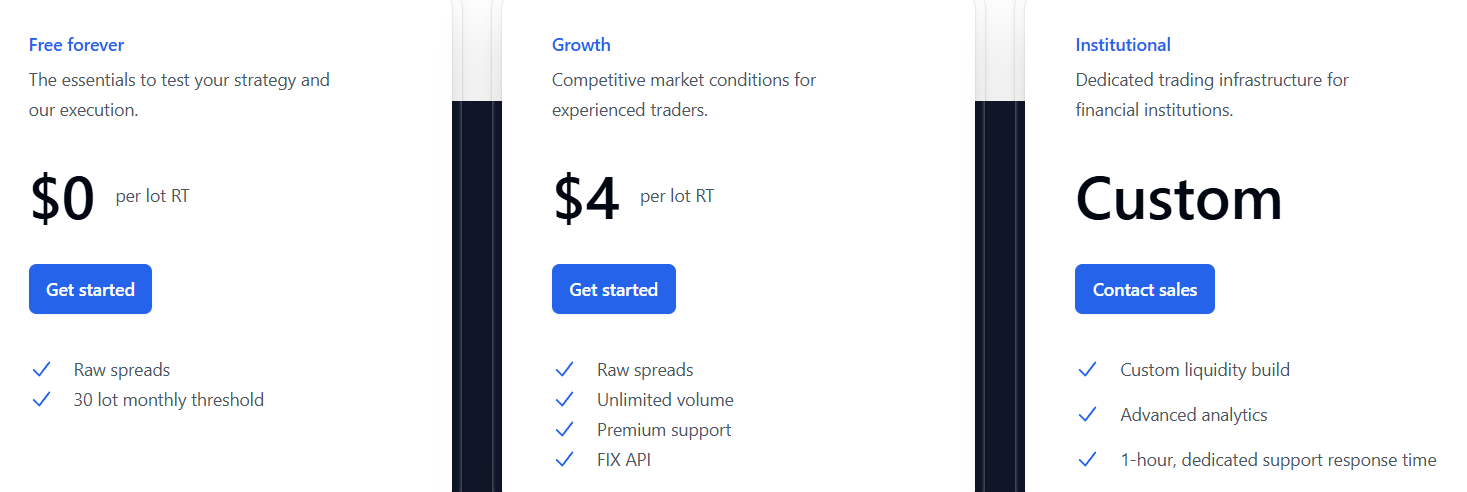

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Scandinavian Capital Markets?

According to our research, Scandinavian Capital Markets provides traders with a range of prime account packages defined by the operated trading size, eventually offering better conditions for higher-grade traders. Therefore, there are three account types – Free forever, Growth, and Institutional, all with quite competitive low costs based on a raw spread and commission charges.

Free Forever Account

The Free Forever account is a spread-based account with no commissions applied. All the costs are integrated into raw spreads that start from 0.1 pips. The minimum deposit requirement is $25. Traders can access up to 1:500 leverage. The account enables traders to make withdrawals twice per month. The account provides 24/7 customer support.

Growth Account

The Growth account has many common features with the Free Forever account, including the minimum deposit, the available leverage, and other conditions. The main difference between the two accounts is the fee structure. The Growth account is a commission-based account with spreads from 0.0 pips and fixed commissions of $4. Also, clients are allowed to make withdrawals 4 times per month. Another advantage is the availability of the FIX API feature, which is not available for the Free Forever account.

Institutional Account

The institutional account is tailored for high-frequency traders, giving advanced opportunities to explore the market to the fullest. The account type offers raw spreads with custom solutions. Traders have access to custom liquidity, custom commissions, FIX API, dedicated support, and many other advanced features that are not available for the other account types. The minimum deposit amount for the institutional account is $10,000.

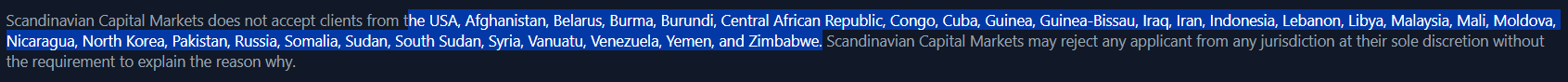

Regions Where Scandinavian Capital Markets is Restricted

The Scandinavian Capital Markets offers its services to a wide range of countries, enabling access to its services. Based on our research, we have revealed that the broker does not accept clients from the following countries:

- USA

- Afghanistan

- Belarus

- Burma

- Burundi

- Central African Republic

- Congo

- Cuba

- Guinea

- Guinea-Bissau

- Iraq

- Iran

- Indonesia

- Lebanon

- Libya

- Malaysia

- Mali

- Moldova

- Nicaragua

- North Korea

- Pakistan

- Russia

- Somalia

- Sudan

- South Sudan

- Syria

- Vanuatu

- Venezuela

- Yemen

- Zimbabwe

Cost Structure and Fees

Score – 4.4/5

Scandinavian Capital Markets Brokerage Fees

Reviewing the broker’s fee structure, we found that the applicable charges are determined by the chosen account type and can be spread-based or commission-based. All in all, the fees are competitive and transparent, with low spreads and fixed commissions. The Institutional account gives clients custom fees and services, depending on the trade size, trading experience, and other determinants.

- Scandinavian Capital Markets Spreads

The broker offers a spread-based fee structure and a commission-based structure. Spreads vary according to the account type. The Free Forever account is based on spreads and integrates all the trading fees and charges raw spreads from 0.1 pips for the highly traded EUR/USD currency pair in the Forex market, while the spread on XAU/USD is 0.45 pips. On the other hand, for the commission-based account, spreads begin from 0.0 pips, combined with fixed spreads.

- Scandinavian Capital Markets Commissions

The broker applies commissions for its commission-based account. Commissions are combined with very low spreads from 0.0 pips plus a commission fee of $4 per lot. The Institutional account has custom-based commissions that depend on trading volume, liquidity provider agreements, and specific client requirements.

How Competitive Are Scandinavian Capital Markets Fees?

Scandinavian Capital Markets offers its clients a competitive fee structure tailored to meet different trading needs and expectations. The Free Forever account is suitable for cost-conscious traders looking for lower-volume trading. On the other hand, the Growth and Institutional accounts offer better exposure to the market, with wider opportunities and lower spreads. The fixed commission of $4 per lot enables traders to have more clarity about the applicable fees for each trade.

To sum up, the broker’s fees have a transparent structure, with clarity in the costs and no hidden fees. In addition, the broker may apply a few non-trading fees, which are also common in trading.

| Asset/ Pair | Scandinavian Capital Markets Spread | JFD Brokers Spread | Eightcap Spread |

|---|

| EUR USD Spread | 0.1 pips | 0.2 pips | 1 pips |

| Crude Oil WTI Spread | 0.06 | 0.57 | 3 pips |

| Gold Spread | 0.45 | 0.01 | 1.2 pips |

Scandinavian Capital Markets Additional Fees

Based on our research, we have found that Scandinavian Capital Markets charges non-trading fees as well, which are common among brokers. There are no monthly maintenance fees, yet the broker does charge a monthly inactivity fee in case the account has been dormant for 12 months. The inactivity fee is $20 or the equivalent in the account’s base currency.

We also researched if the broker charges deposit or withdrawal fees to find that there are normally no such fees, except that Scandinavian Capital Markets charges a $25 fee for withdrawals if there was no trading activity or if the amount requested is lower than $25.

Score – 4.6/5

Scandinavian Capital Markets provides traders with access to the well-known MetaTrader 4, its newer version MT5, a proven software cTrader, and its FIX API, which allows traders to execute trades by sending and receiving messages in the FIX format. By offering advanced trading platforms, the broker caters to the diverse needs of its clients. Per our analysis, each platform utilizes intelligent trading technology and is a full-featured software with risk management, trade activities, and full settlement packages included.

| Platforms | Scandinavian Capital Markets Platforms | JFD Brokers Platforms | Capital.com Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | No |

| cTrader | Yes | No | No |

| Own Platform | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Scandinavian Capital Markets Web Platform

The broker allows web trading through the MT4, MT5, and cTrader web versions, enabling access to the platforms without the need for downloads and installations. This is one of the fastest and most flexible ways for clients to enter their accounts and monitor the trades. The web platform mostly retains all the essential tools and features, enabling access to multiple charts, graphs, and other analytical tools. Traders can access the platform directly from any browser and conduct their trades without any complications.

Scandinavian Capital Markets Desktop MetaTrader 4 Platform

Scandinavian Capital Markets’ MT4 platform is equipped with the most essential tools and features, providing deep market analysis, access to a good range of financial assets, and availability of risk, liquidity, and trading reports. The platform enables FIX API functionality, EAs, and, most importantly, ultra-fast execution. Besides, the MT4 platform supports various charts, different order types, and the capability to customize various indicators.

Scandinavian Capital Markets Desktop MetaTrader 5 Platform

The MT5 platform, based on our research, has been implemented recently, enabling traders more opportunities and diversity. The platform includes a good range of analytical tools, including charts, multiple timeframes, and technical indicators, enabling traders to conduct in-depth market analysis for successful trading outcomes. The MT5 platform, much like the MT4 platform, supports EAs and allows FIX API, taking trading to another more advanced level. In addition, the platform includes a built-in economic calendar and other innovative features, allowing more insight into the market.

Scandinavian Capital Markets cTrader Platform

cTrader is another advanced platform provided by Scandinavian Capital Markets. This is an innovative platform providing users with professional trading opportunities, fast entry, and order processing. cTrader integrates multiple innovative and sophisticated tools and features, including FIX API and automated trading, and also, offers a great variety of charts and pre-installed technical indicators. The platform is easily accessible through different versions for desktop, web, or mobile app, making it an available option for traders.

Scandinavian Capital Markets MobileTrader App

The mobile app is available for MT4, MT5, and cTrader. The mobile platforms provide maximum flexibility and ease of access to the account. Traders can access the most essential features and analytical tools, monitor their trades, access trade history, and use customizable alerts—all from the palms of their hands.

Main Insights from Testing

Our testing of the broker’s platforms has revealed advanced, versatile platforms with innovative features, suitable for traders of different needs and levels. All three platforms—MT4, MT5, and cTrader—are available through the web browser, desktop, and mobile app, ensuring maximum convenience and ease of access. Traders gain full access to a wide range of instruments across various financial assets, with raw spreads and small commissions. All in all, the platforms are reliable, ensure fast execution of trades, and provide in-depth analysis tools, technical indicators, charts, graphs, and customizable alerts.

Trading Instruments

Score – 4.4/5

What Can You Trade on the Scandinavian Capital Markets Platform?

The broker provides traders with popular financial markets to engage in, including Forex, metals, commodities, cryptocurrencies, and more. By offering this diverse range of trading products, Scandinavian Capital Markets allows traders to expand and diversify their portfolios. Moreover, traders have the opportunity to engage in multiple markets based on their individual preferences and trading strategies.

Scandinavian Capital Markets offers 65 currency pairs across major, minor, and exotic pairs, which is considered a good offering. The broker also offers 14 CFDs and 7 metals, including gold, silver, oil, etc. Lastly, the cryptocurrency offering includes Bitcoin, Ethereum, Dogecoin, and other popular options.

Main Insights from Exploring Scandinavian Capital Markets Tradable Assets

Scandinavian Capital Markets allows its traders access to a good range of currency pairs, commodities, popular cryptocurrencies, and indices, including Dow, NAS 100, and more. All in all, the offering is basic, with only the most popular instruments available for trading. However, with low and transparent costs and clarity, the offering is favorable for different traders.

On the other hand, as Scandinavian Capital Markets’ instruments are mainly based on CFDs, clients do not have much opportunity for diversification in trading, and exploring more investment opportunities. Long-term investments, like stock or ETF trading, are excluded, which might be a drawback for those who are looking for ownership of an asset, and traditional investments.

Leverage Options at Scandinavian Capital Markets

While leverage can provide benefits by allowing traders to enter the market with a smaller initial investment, traders should be aware of the potential risks it carries. Having a comprehensive understanding of leverage enables individuals to make well-informed decisions and effectively manage the associated risks when engaging in leveraged trading.

Scandinavian Capital Markets leverage is offered according to Swedish FSA regulation:

- Retail traders may access a maximum of 1:30 for major currency pairs and even lower for other instruments.

- Professionals may use a higher leverage of up to 1:200.

- Through the offshore entity, traders have access to leverage ratios of 1:500.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Scandinavian Capital Markets

We found that the broker provides a range of payment options to clients, which include bank wire transfers, credit/debit cards, e-wallets like Skrill, and the ability to make payments using popular cryptocurrencies such as USDT. Scandinavian Capital Markets does not charge fees for currency conversion. While making deposits through a bank transfer, clients are asked to write their trading account number as a reference. This is especially encouraged if traders have several trading accounts.

Minimum Deposit

The broker’s minimum deposit is $25, which is considered lower than the market average. Institutional clients are required to make a minimum of a $10,000 initial deposit.

Withdrawal Options at Scandinavian Capital Markets

The withdrawal process is simple and requires a few simple steps. Traders need to choose the withdrawal option from the dashboard on the broker’s platform and submit the form. If there is sufficient margin in the trading account to hold the positions, the withdrawal will be processed. Usually, it takes up to two business days for the funds to reach the account.

- For the Free Forever account, traders can make two withdrawals every month.

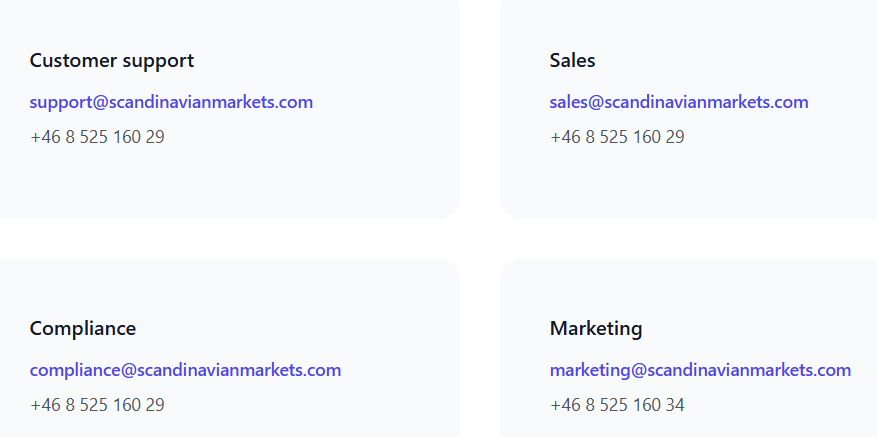

Customer Support and Responsiveness

Score – 4.5/5

Testing Scandinavian Capital Markets Customer Support

Broker’s customer support is available 24/5 through email, phone, and live chat. Moreover, the support team is proficient in addressing various needs, including technical inquiries, providing analysis recommendations, answering general questions, and assisting with operational matters.

- The broker also offers an FAQ section where traders can find answers to various common questions, such as those related to account management, deposits and withdrawals, platform-related questions, and much more.

- Additionally, Scandinavian Capital Markets is social, with pages on FB, IG, X, LinkedIn, and YouTube, providing the latest updates on its operations and overall market changes and news.

Contacts Scandinavian Capital Markets

Based on our testing, Scandinavian Capital Markets provides dedicated customer support with quick and detailed answers. Clients can choose the most convenient option for communication, as all the methods ensure quick and detailed answers.

- The live chat is a quick way to get answers to urgent questions and solutions to issues. The answers are detailed and provided in a matter of minutes.

- The same quick and responsive attitude is ensured for the email requirements. The answers are quick, clear, and understandable. The email address is support@scandinavianmarkets.com. The broker provides separate email addresses for sales, marketing, and compliance-related inquiries.

- Clients can also contact the support team through the provided phone number: +46 8 525 160 29.

Research and Education

Score – 4/5

Research Tools Scandinavian Capital Markets

While reviewing the broker’s research section, we found that Scandinavian Capital Markets includes all the research tools and features in its advanced and innovative platforms, providing in-depth market analysis opportunities, an in-built economic calendar, a good range of analytical tools, and advanced functionalities that take trading to another level. However, on its website, the broker does not offer any additional research features, which some traders might see as a drawback.

Education

The education section is also basic, with a limited range of educational resources, such as news and financial articles. However, traders looking for comprehensive educational materials, including webinars, online courses, a trading glossary, and other essential learning materials, will be disappointed with the broker’s offering. While the available materials can keep traders informed about market updates, they are still not adequate for beginner or intermediate traders who need assistance and guidance for a profitable start.

Is Scandinavian Capital Markets a Good Broker for Beginners?

Scandinavian Capital Markets is a reliable broker with raw spreads, average commissions, and low minimum deposit requirements. The broker offers platforms with in-depth research tools and a simple interface suitable for all types of traders. Besides, Scandinavian Capital Markets has a demo account offering, which is a great opportunity for beginner traders, who can practice trading before engaging in live trading. The only drawback that might hold back beginner and intermediate traders is the lack of a proper education section. Novice traders who decide to open an account with the broker will be obliged to find alternative educational resources.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options Scandinavian Capital Markets

Scandinavian Capital Markets offers a basic range of instruments, including major, minor, and exotic Forex pairs, commodities, indices, and cryptocurrencies. However, the range of instruments is limited and mainly based on CFDs. This means that traders do not get an opportunity to engage in traditional trading with access to real stocks, fractional stocks, or ETFs. This limitation of instruments does not allow traders to expand their portfolios and make long-term investments.

- However, traders still have passive investment opportunities through the available MAM and PAMM accounts.

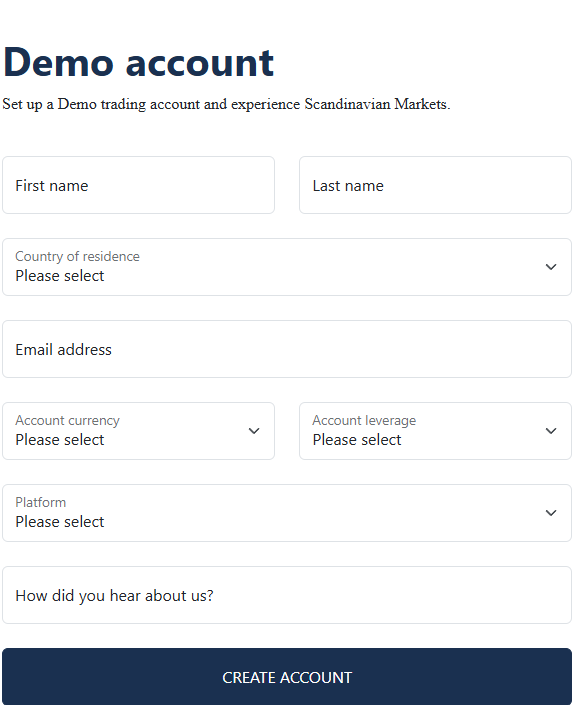

Account Opening

Score – 4.6/5

How to Open a Scandinavian Capital Markets Demo Account?

By opening a demo account, clients of the Scandinavian Capital Markets can trade without any financial losses. The broker provides virtual funds to explore the market in a setting similar to real-time trading to practice before going live. Here are the main steps to open a demo account and start practicing:

- Visit the official website and select the ‘Try demo’ option.

- Complete the demo account registration form by providing the name, email address, phone number, etc.

- Choose the account configurations.

- Receive account credentials via email.

- Download the platform and, by using the credentials from the email, enter your demo account.

- Start practicing.

How to Open a Scandinavian Capital Markets Live Account?

Opening an account with a broker is an easy process, as you can log in and register with Scandinavian Capital Markets within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Get Started” button.

- Enter the required personal data (name, email, phone number, etc.).

- Fill in the questionnaire on the financial background, employment status, etc.

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- The account is verified and activated within 24 hours.

- Use the credentials to enter your account and start trading.

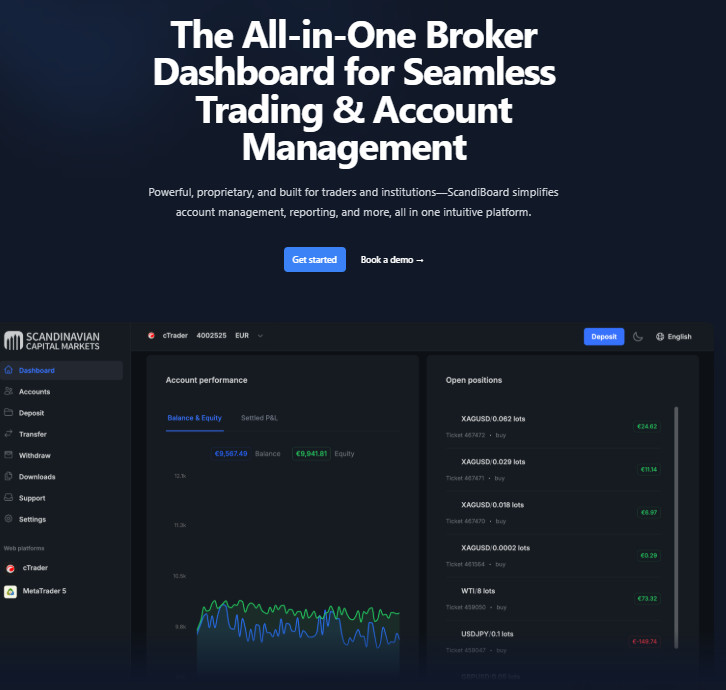

Score – 4.2/5

Scandinavian Capital Markets is a broker with advanced and innovative platforms that offer impressive trading tools and features. The availability of different tools helps traders take trading to another level. Here are the additional opportunities the broker provides its clients:

- Scandboard is an all-in-one dashboard that simplifies account management, including everything in one intuitive platform. The platform ensures real-time analytics, seamless connectivity, and quick deposits and withdrawals of funds.

- The white-label program assists its clients in establishing their own branded Forex brokerage with great efficiency under the cTrader platform.

Scandinavian Capital Markets Compared to Other Brokers

We have also compared Scandinavian Capital Markets to other brokers with similar offerings and services to see how the broker stands out in the market or what its weak aspects are compared to others.

The first thing to mention is that the broker is regulated in Sweden and holds a license from Finansinspektionen, a respected authority in the country. Besides, the Financial Capital Markets holds an offshore license, ensuring its global presence. However, when compared to brokers, such as Forex.com and Fortrade, that hold multiple top-tier licenses, Scandinavian Capital Markets lacks the reliability and layers of protection these two brokers provide.

When we compared the broker’s fee structure and the applicable trading-related costs, it was evident that Scandinavian Capital Markets charges average/low costs, depending on the instrument. Spreads starting from 0.1 pips are a much lower proposal when compared to JP Markets’ 2 pips or FXTB’s 3 pips. The selection of trading platforms (MT4/MT5, cTrader) with FIX API functionality is also impressive and is better than JP Markets’ only MT5 platform availability. Another advantage we noticed about the broker is its low $25 initial deposit requirement. Other brokers, such as TMGM, Forex.com, and Fortrade, require $100 initial funding.

However, Scandinavian Financial Markets has a few drawbacks that will make especially beginner traders think twice before opening an account with the broker. It is the lack of proper research and educational resources. In this respect, JFD Brokers and FXTB stand out with excellent educational materials, including webinars, courses, a forex glossary, and other essential materials to assist traders in their journey.

| Parameter |

Scandinavian Capital Markets |

JP Markets |

FXTB |

JFD Brokers |

TMGM |

Forex.com |

Fortrade |

| Spread Based Account |

Average 0.1 pips |

Average 2pip |

Average 3 pip |

Average 0.2 pip |

Average 1 pips |

From 0.8 Pips |

Average 2 pip |

| Commission Based Account |

0.0 pips + $4 |

0.5 pips + $3 |

No commission |

0.0 pips + $2.7 – $5 |

0.0 pips + $3.5 |

0.0 pips + $5 |

No commission |

| Fees Ranking |

Average |

Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5, cTrader |

MT5 |

MT4, Web Trader |

MT4, MT5, Stock3 |

MT4,MT5, TGM app |

MT4, MT5, Forex.com Platform |

Fortrader Platform, MT4 |

| Asset Variety |

100+ instruments |

100+ instruments |

300+ instruments |

1500+ instruments |

12,000+ instruments |

500+ instruments |

300+ instruments |

| Regulation |

Finansinspektionen, VFSC |

FSCA |

CySEC |

CySEC, CNMV, VFSC |

ASIC, FMA, VFSC, FSC |

FCA, NFA, IIROC, ASIC, CFTC, CySEC, JFSA, MAS, CIMA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

| Customer Support |

24/5 support |

24/5 |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Basic |

Basic |

Excellent |

Excellent |

Excellent |

Good |

Good |

| Minimum Deposit |

$25 |

R100 ($5.42) |

€250 |

R100 ($5.42) |

$100 |

$100 |

$100 |

Full Review of Broker Scandinavian Capital Markets

Summing up our review of Scandinavian Capital Markets, the broker operates under the Finansinspektionen’s oversight. The broker also complies with the European ESMA regulation and the MiFID directive, ensuring adherence to strict guides and rules.

The broker constantly enhances its proposals, offering traders enhanced and advanced platforms, including the popular MT4, MT5, and cTrader, combined with FIX API functionalities. Scandinavian Capital Markets offers different trading conditions for a wide range of clients, from beginners to institutional clients. For novice traders, the minimum deposit is only $25, enabling them to start with the smallest investments. Clients get access to the most essential instruments across Forex, commodities, global indices, and the most popular cryptocurrencies.

Scandinavian Capital Markets offers fast and effective deposit and withdrawal methods, ensuring quick transfer of funds and safety. The customer support is also helpful, and answers come in a matter of minutes. One of the only concerns about the broker is its lack of educational materials, which can negatively affect beginner traders, leaving them to look for educational resources elsewhere.

Share this article [addtoany url="https://55brokers.com/scandinavian-capital-markets-review/" title="Scandinavian Capital Markets"]