- What is OneRoyal?

- OneRoyal Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- OneRoyal Compared to Other Brokers

- Full Review of Broker OneRoyal

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.7 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.7 / 5 |

What is Royal Financial Trading?

OneRoyal previously known as Royal Financial Trading is a brokerage company established in 2006 to offer optimal trading conditions, tailored services, and support. Originally, the broker headquarters was in Lebanon. Still, due to the rapid spread in the world, the company established offices in leading financial world centers Cyprus and Australia, while fully complying with applicable regulations.

- The broker will provide you with real market execution of trades based on NDD execution. At the same time, the client gains can be potentially multiplied with high leverage up to 1:1000 on Forex financial instruments.

Furthermore, you may choose a trading strategy either to day trader, perform auto trading, follow professionals through Social Trading capabilities, or maybe invest through MAM technology.

Royal Financial Trading Pros and Cons

Our experts at 55Brokers find that Royal Financial Trading is among the well-regarded brokers, offering easy digital account opening, good platform tools, and comprehensive educational resources with research. Additionally, the broker provides various options for depositing or withdrawing funds and has low Forex and CFD fees. There are also no inactivity or account fees charged.

On the downside, trading fees for stocks and CFDs are higher, and there is no 24/7 customer support. OneRoyal has a limited product portfolio, covering only CFDs and Forex. Furthermore, a fee is charged for most non-wire withdrawal methods, and some educational tools, such as webinars, are missing.

| Advantages | Disadvantages |

|---|

| Multiply regulated broker with a strong establishment | Only Forex and CFDs |

| AI trading tools | Trading conditions might vary based on the entity |

| Popular trading platforms | No 24/7 customer support |

| Available for European and international traders | |

| Competitive trading conditions | |

| Variety of funding methods | |

| Multi-account manager platforms | |

| Numerous industry awards | |

| Variety of trading instruments | |

| Good research materials | |

OneRoyal Features

OneRoyal is a well-established broker that ensures access to global markets by focusing on Forex and CFD trading. Main features include:

OneRoyal Review Summary in 10 Points

| 🏢 Regulation | ASIC, CySEC, VFSC, FSA, CMA |

| 🗺️ Account Types | Classic, ECN, VIP, ECN Elite |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, CFDs, Metals, Oil, Indices, Crypto, Shares, ETFs |

| 💳 Minimum Deposit | $50 |

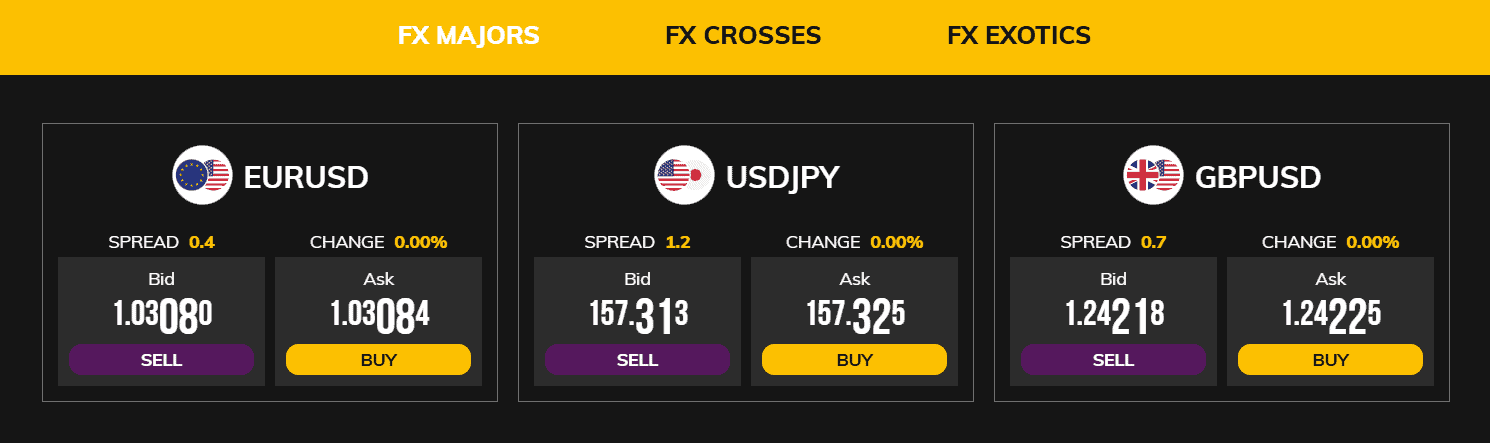

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Provided |

| 💰 Account Base Currencies | USD, EUR, GBP |

| 📚 Trading Education | Educational Videos, Knowledge Hub, Blog |

| ☎ Customer Support | 24/5 |

Who is OneRoyal For?

OneRoyal is designed for traders of all experience levels looking for intuitive trading platforms, comprehensive educational resources, and competitive trading conditions with advanced tools. According to our findings, OneRoyal is Good for:

- Beginning traders

- Professional traders

- Traders from Europe

- Australian traders

- EAs running

- Copy trading

- International trading

- Traders who prefer the MT4 or MT5 platform

- Currency and CFD trading

- Suitable for a variety of trading strategies

- MAM trading

OneRoyal Summary

Our final thought on OneRoyal cleared a reliable, globally presented brokerage company, with a competitive trading solution and several opportunities. An established direct connection, seamless trading process, and numerous technologies with low trading prices create a winning combination.

Traders of different sizes or various strategies, including social trading, can connect and choose the best option along with a good range of trading platforms and services.

55Brokers Professional Insights

OneRoyal stands out for its streamlined and reliable trading experience, offering competitive Forex spreads and fees, an intuitive digital account opening process, and access to industry-known trading platforms. The broker emphasizes transparency with no inactivity or account fees, making it an appealing choice for traders looking to minimize costs.

Additionally, it provides valuable research tools to support informed decision-making. However, there are some drawbacks to consider. Trading conditions can vary depending on the entity you’re dealing with, which may lead to inconsistencies in fees or available features across regions. Moreover, its product portfolio is limited to CFDs and Forex, and some educational tools, such as webinars, are currently missing. Despite these limitations, OneRoyal remains a competitive option for traders seeking reliable services and competitive conditions.

Consider Trading with OneRoyal If:

| OneRoyal is an excellent Broker for: | - Need a well-regulated broker.

- Looking for broker with MT4 and MT5 trading platforms.

- Offering services worldwide.

- Access to Copy trading.

- Offering popular trading instruments.

- Looking for broker with low minimum deposit requirement.

- Need a broker with diverse trading accounts

- Offering high leverage up to 1:1000.

- Looking for broker suitable for beginners and professional traders.

- Providing competitive fees and spreads.

- ECN trading and fast trading execution.

- Need good learning materials and research.

- Offering MAM trading.

- Access to VPS Hosting.

- Secure trading environment.

- Offering AI trading tools. |

Avoid Trading with OneRoyal If:

| OneRoyal might not be the best for: | - Who prefer 24/7 customer service.

- Looking for cTrader or proprietary trading platforms.

- Need broker with the lowest possible spreads. |

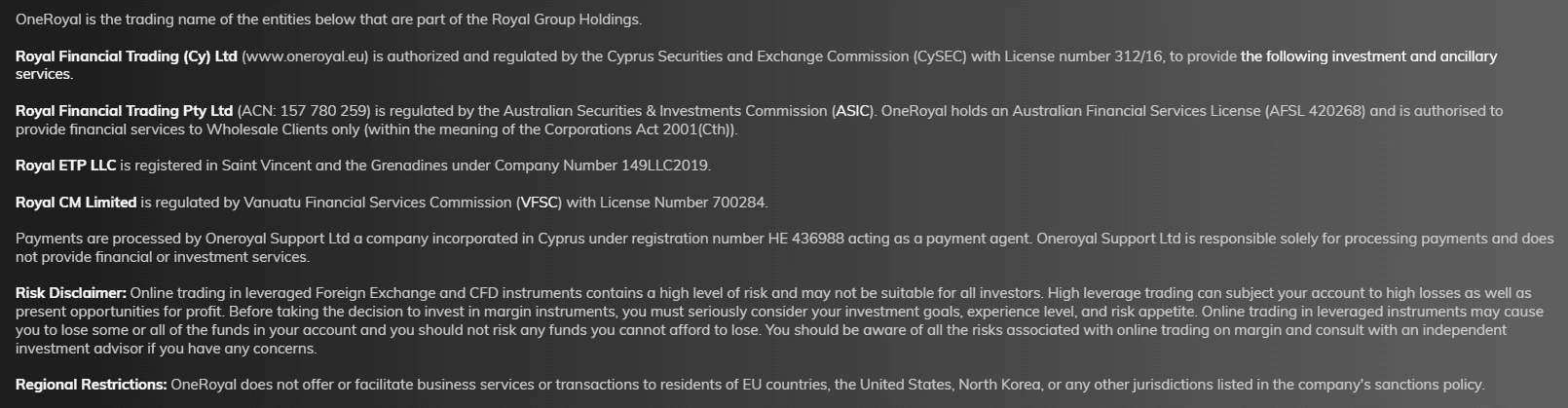

Regulation and Security Measures

Score – 4.5/5

OneRoyal Regulatory Overview

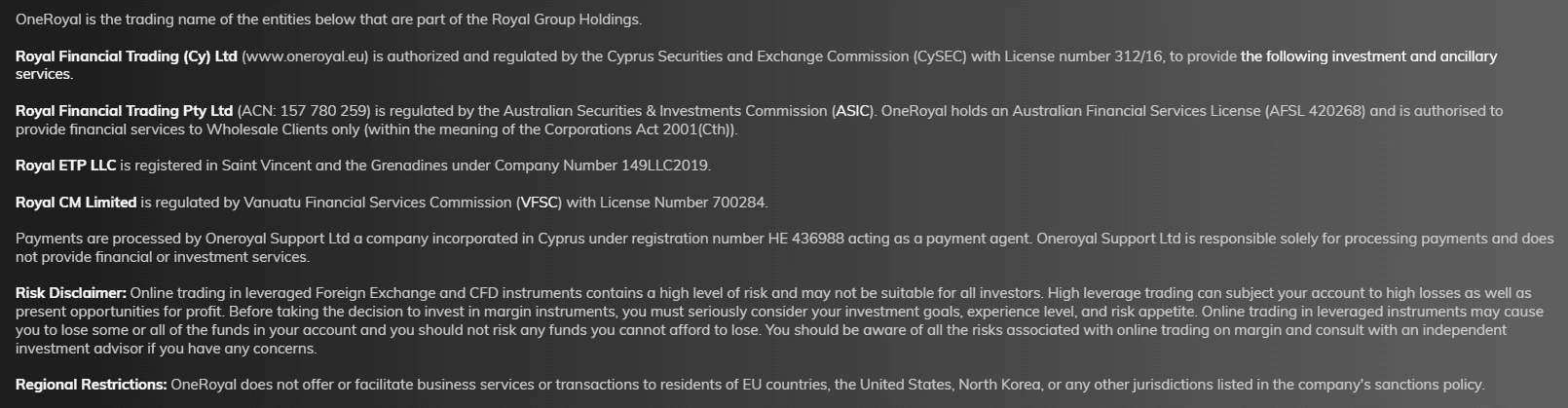

OneRoyal operates under a comprehensive regulatory framework, ensuring security and transparency for its clients. The broker is regulated by reputable authorities, including the Australian ASIC, the Cyprus CySEC, as well as CMA in Lebanon. These regulatory approvals reflect OneRoyal’s commitment to adhering to stringent industry standards.

Additionally, the broker holds international licenses in other jurisdictions, such as Vanuatu and St. Vincent and the Grenadines, expanding its global reach. However, the trading conditions, client protections, and regulations may vary depending on the entity under which a client registers. This highlights the importance of understanding the specific terms associated with the chosen jurisdiction before trading.

How Safe is Trading with OneRoyal

Trading with OneRoyal is generally considered safe, thanks to its multi-jurisdictional regulatory framework and commitment to transparency.

These regulators enforce strict compliance with financial standards, ensuring that client funds are protected through segregation from company accounts. Additionally, OneRoyal employs advanced encryption technologies to safeguard client data and transactions.

The only drawback is that international trading is available via the offshore entity, and safety can vary depending on the entity under which you register. Some jurisdictions, like Vanuatu or St. Vincent and the Grenadines, may have less stringent regulatory oversight. Therefore, clients should carefully consider the regulatory body governing their accounts to ensure the highest level of protection.

Consistency and Clarity

OneRoyal delivers a balanced picture of reliability and trustworthiness. Established in 2006, the broker has earned favorable reviews from traders for its transparent trading conditions, competitive fees, and user-friendly platforms. It consistently achieves strong scores in industry assessments, reflecting its commitment to delivering quality services.

While there are drawbacks, such as higher fees for stocks and CFDs and limited product diversity, these are outweighed by the broker’s strong regulatory oversight and customer-centric approach. OneRoyal has also garnered industry recognition, winning awards for its innovative trading solutions. Beyond trading, the broker actively participates in social initiatives, including sponsorships and community-focused activities, further solidifying its reputation as a responsible and respected player in the financial sector.

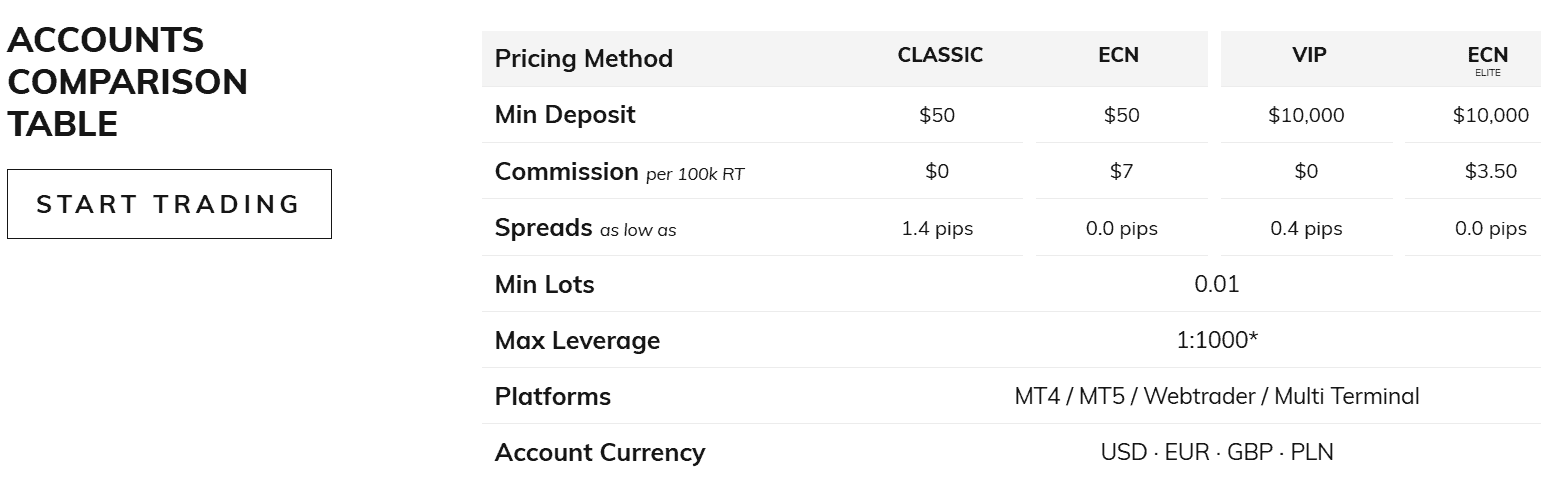

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with OneRoyal?

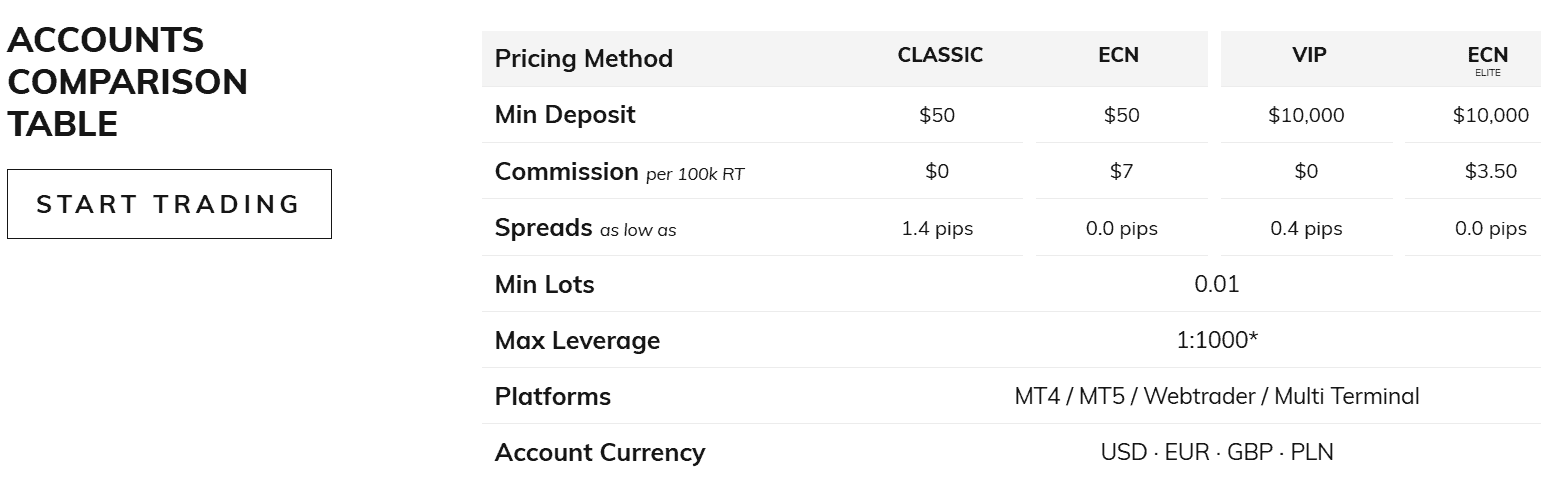

OneRoyal offers a comprehensive selection of account types to suit the unique needs of traders at all levels. These include the Classic, and Cent Accounts, perfect for beginners, the ECN Account for those seeking lower trading costs and direct market access, and the VIP Account, tailored for high-volume traders looking for premium features.

For elite professionals, the ECN Elite Account provides the tightest spreads and exclusive benefits. Additionally, traders can explore the platform risk-free with a Demo Account, while the Swap-Free Account caters to Islamic traders by adhering to Shariah principles. This diverse account lineup ensures that every trader can find an account type that aligns with their goals and trading style.

Classic Account

The Classic Account is designed for traders of all levels seeking a straightforward trading experience without commission fees. With a minimum deposit requirement of $50, this account type provides access to spreads starting from 1.4 pips.

The account supports trading on multiple platforms, including MT4, MT5, WebTrader, and MultiTerminal, and offers leverage up to 1:1000.

Cent Account

Cent Account is ideal for beginner traders who want to start trading with a smaller deposit and manage risk more effectively. The account allows traders to trade with micro-sized lots, where profits and losses are calculated in cents rather than dollars, providing a low-risk environment for new traders.

With a minimum deposit of just $10, this account provides access to a range of features with spreads starting from 1.4 pips. It is especially popular among those who want to practice or test strategies in live market conditions without committing large amounts of capital.

However, the Cent Account is part of the international trading options, and traders should be aware that regulations can differ depending on the entity governing their account.

ECN Account

The ECN Account is tailored for traders who prioritize direct market access and enjoy trading with raw spreads. With a minimum deposit of $50, this account provides spreads starting from 0.0 pips, paired with a commission of $7 per 100k round turn. This account type is ideal for traders who prefer tighter spreads and are comfortable with a commission-based structure.

The ECN Elite Account, designed for professional traders, offers an even more competitive trading environment. It requires a minimum deposit of $10,000, with a reduced commission of $3.50 per 100k round turn. Like the standard ECN Account, it supports all trading platforms, with leverage of up to 1:1000.

VIP Account

The VIP Account is designed for high-volume traders looking for premium trading conditions. With a minimum deposit of $10,000, this account offers spread-based trading with spreads starting from 0.4 pips. The account provides enhanced trading conditions for those willing to commit a larger initial investment.

Regions Where OneRoyal is Restricted

OneRoyal is restricted in several regions due to regulatory limitations or compliance requirements. These regions typically include countries with strict financial regulations or where the broker is not authorized to operate:

- USA

- Iran

- North Korea

- Canada

- Japan

- Belgium

- Myanmar

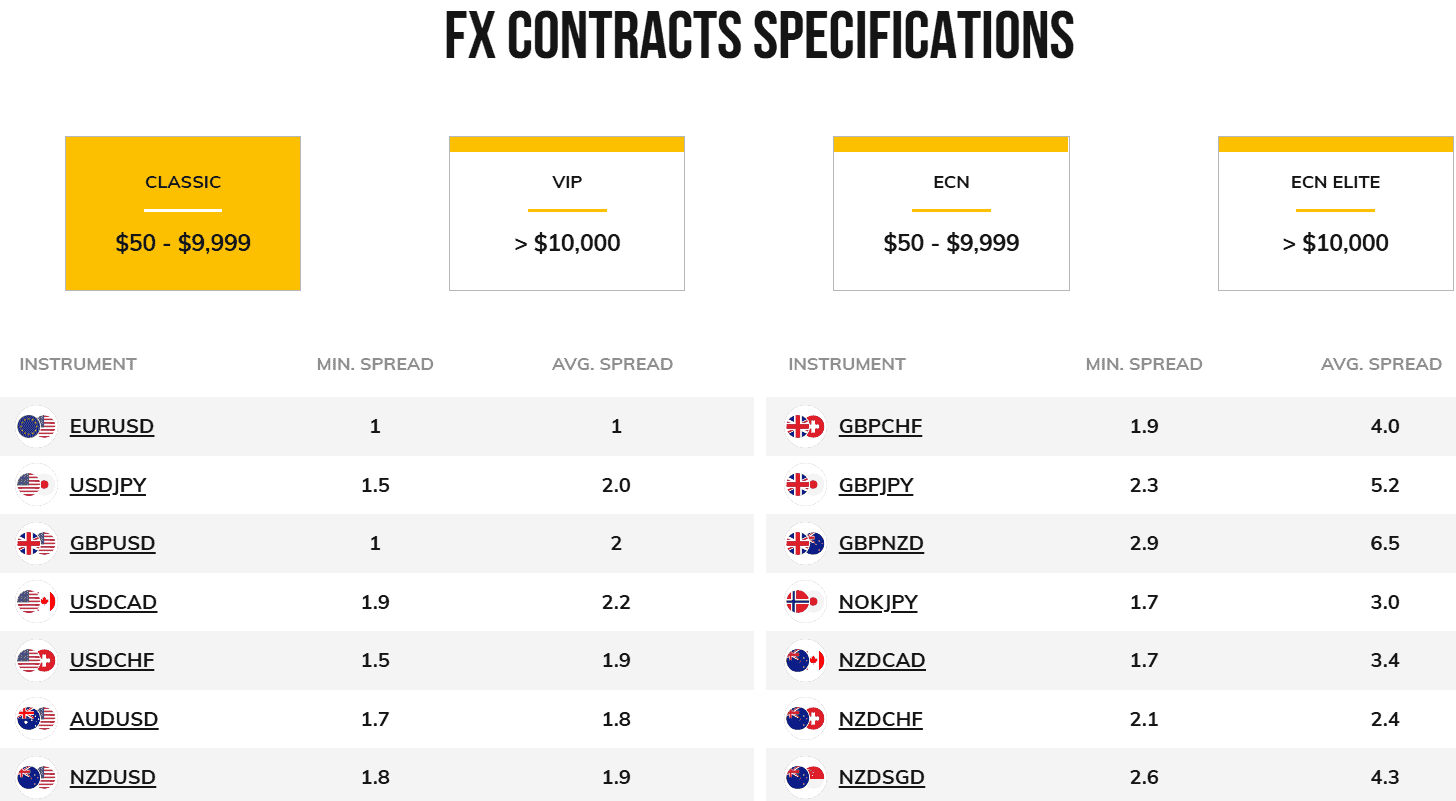

Cost Structure and Fees

Score – 4.4/5

OneRoyal Brokerage Fees

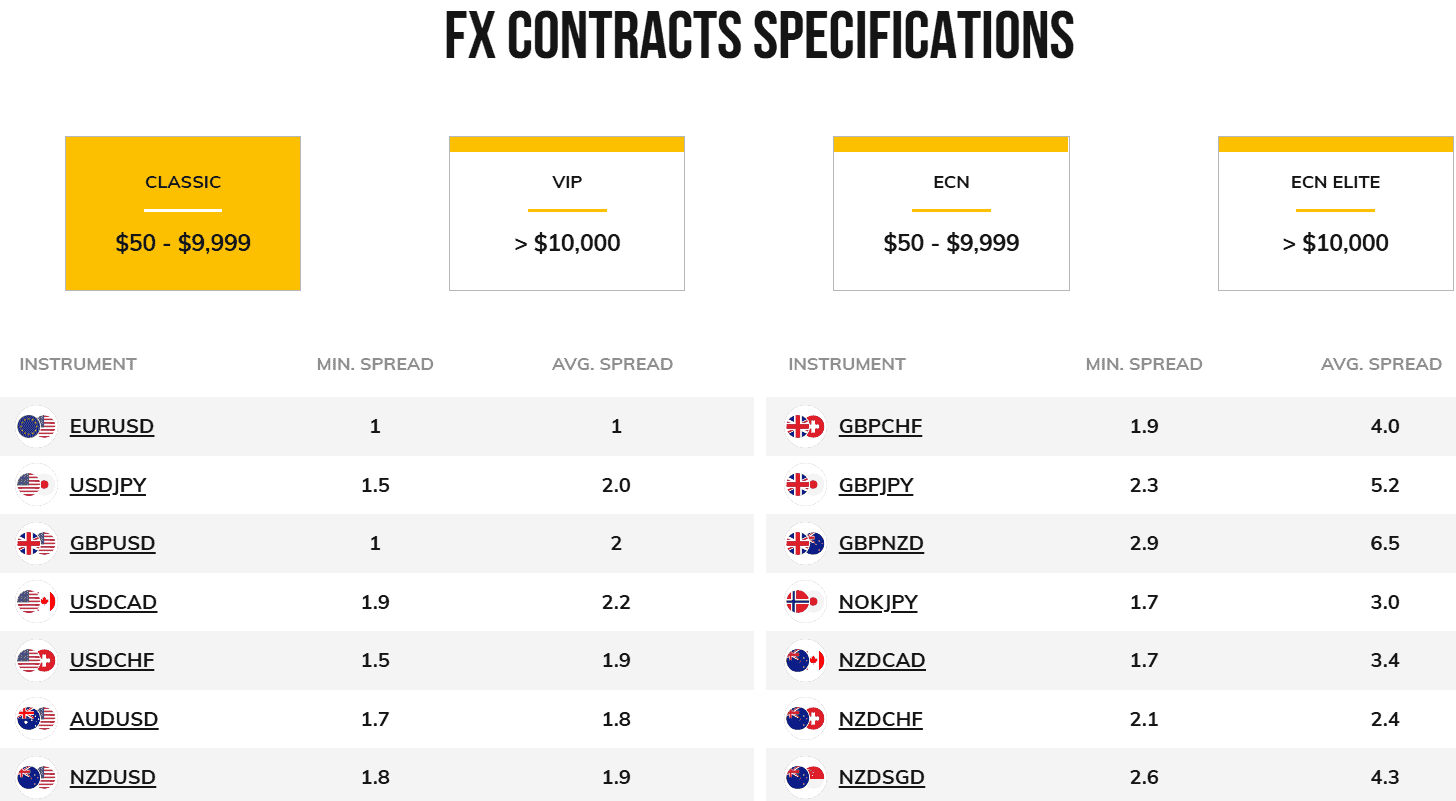

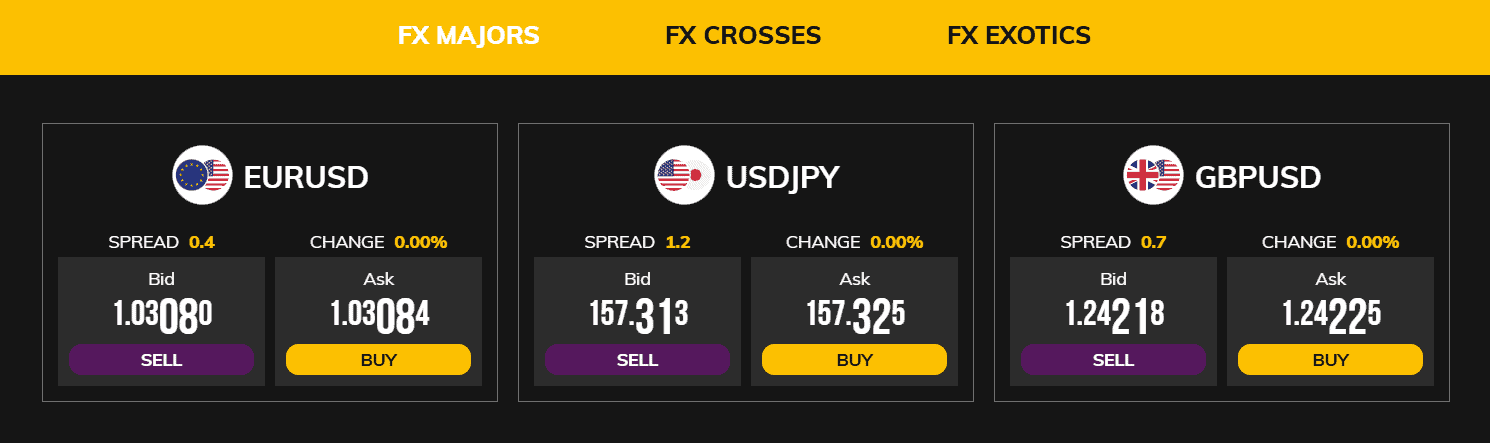

OneRoyal’s brokerage fees vary depending on the type of account and trading instrument, offering flexibility to suit different trader preferences. The broker provides both commission-based and spread-based accounts, with an average spread of 1 pip for Forex EUR/USD currency pairs in the Classic Account.

Additionally, swap fees apply for overnight positions, except for Swap-Free accounts designed for Islamic traders. While the broker does not charge inactivity or account maintenance fees, non-wire withdrawal methods may incur charges. Overall, OneRoyal’s fees are competitive, but traders should carefully review their chosen account type and trading conditions to fully understand the associated costs.

OneRoyal offers competitive spreads that vary based on the account type and trading instrument. For the Classic Account, the average Forex spread for EUR/USD is 1 pip, providing a straightforward trading experience. The VIP Account features low spreads starting from 0.4 pips, making it ideal for high-net-worth clients.

Spreads may vary depending on market conditions and the trading instruments used, so traders should monitor updates regularly. Overall, OneRoyal’s spreads are designed to provide flexibility and transparency.

OneRoyal’s commission structure is designed to cater to traders seeking different trading experiences based on their account type. The Classic Account and VIP Account are commission-free, with costs integrated into the spreads.

On the other hand, the ECN Account and ECN Elite Account charge competitive commissions. The ECN Account has a commission of $7 per 100k round turn, while the ECN Elite Account offers reduced commissions of $3.50 per 100k round turn for high-volume traders. However, traders should factor in these costs when calculating overall trading expenses.

- OneRoyal Rollover / Swaps

OneRoyal applies rollover or swap fees for positions held overnight, which is standard practice in Forex and CFD trading. These fees are calculated based on the interest rate differentials between the currencies in a trading pair and can result in either a credit or a debit to the trader’s account.

Swap rates vary depending on the trading instrument and market conditions and are applied at the end of the trading day, typically at 5 PM New York time. The broker offers Swap-Free Accounts for traders who follow Islamic principles, allowing them to trade without incurring overnight interest charges.

OneRoyal maintains a transparent fee structure but imposes certain additional charges that traders should be aware of. While the broker does not charge inactivity or account maintenance fees, some withdrawal methods may incur processing fees, depending on the payment provider.

Additionally, traders using ECN accounts should account for commission fees on trades, and swap fees are applied for positions held overnight unless trading with a Swap-Free account.

How Competitive Are OneRoyal Fees?

OneRoyal’s fees are generally competitive, appealing to various traders with varied needs. The broker offers commission-free and low-commission account options, making it flexible for different trading styles. Traders benefit from transparent pricing and the absence of inactivity or maintenance fees, which adds to the broker’s appeal.

However, some drawbacks include fees for certain withdrawal methods and overnight swaps, which can add to overall costs, especially for long-term traders. While competitive in many aspects, traders should evaluate the fee structure in comparison to other brokers to ensure it aligns with their trading goals and strategies.

| Asset/ Pair | OneRoyal Spread | Tradeview Spread | Trade.com Spread |

|---|

| EUR USD Spread | 1 pips | 0.3 pip | 1.9 pips |

| Crude Oil WTI Spread | 0.6 pips | 0 pips | 4 pips |

| Gold Spread | 3.2 pips | 3.8 pips | 0.6 pips |

| BTC USD Spread | 1321.6 | 31.3 pips | 10.01 USD |

Trading Platforms and Tools

Score – 4.5/5

OneRoyal offers fast trade execution through a robust selection of trading platforms and tools, catering to the diverse needs of traders. The broker supports the widely popular MT4 and MT5 platforms, known for their user-friendly interfaces, advanced charting tools, and automated trading capabilities.

Additionally, OneRoyal enhances the MT4 experience with the MT4 Accelerator, a suite of tools designed to optimize trading efficiency and decision-making. For professional traders and institutions, the MT4 MultiTerminal provides the ability to manage multiple accounts seamlessly, while MetaFX offers tailored solutions for money managers, enabling streamlined portfolio management.

| Platforms | OneRoyal Platforms | Tradeview Platforms | Trade.com Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platforms | No | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

OneRoyal Web Platform

OneRoyal offers web-based versions of both MetaTrader 4 and MetaTrader 5, giving traders the flexibility to access their accounts and execute trades directly from any web browser. These platforms provide the same trading features as their desktop counterparts, including powerful charting tools, real-time market analysis, and customizable indicators.

With the web version, traders can stay connected to the markets and manage their trades from any device with an internet connection, making it an ideal option for those who prefer not to install software or need to trade on the go. These web platforms offer the convenience of seamless access, providing a smooth and efficient trading experience.

OneRoyal Desktop MetaTrader 4 Platform

The broker offers the MT4 Desktop platform, providing a powerful and user-friendly trading environment. The platform delivers real-time quotes in the Market Watch window, allowing traders to monitor live price movements across a range of instruments. With 9 timeframes for comprehensive chart analysis, traders can easily customize their view to suit different trading strategies.

The platform also includes 24 analytical objects, including trend lines, channels, and Fibonacci retracements, offering deep insights into market trends. Combined with its diverse charting capabilities, automated trading options through Expert Advisors, and a wide range of order types, MT4 Desktop gives traders everything they need to execute trades efficiently and strategically.

Main Insights from Testing

Testing the MT4 platform highlights its versatility and user-friendliness, featuring robust charting tools, multiple timeframes, and a wide range of technical indicators that provide traders with comprehensive market analysis capabilities. Automated trading through EAs enables the execution of pre-set strategies, making it ideal for those who prefer to trade without constant monitoring.

Moreover, its fast execution speeds and stability under varying market conditions make MT4 a reliable platform for efficient trade execution. Overall, it delivers a well-rounded trading experience with powerful customization options.

OneRoyal MetaTrader 4 MultiTerminal

OneRoyal offers the MetaTrader 4 MultiTerminal, an advanced tool designed for professional traders and money managers who need to manage multiple accounts simultaneously. This platform allows users to monitor and trade across multiple accounts from a single interface, making it ideal for portfolio management and institutional traders.

The platform offers full access to the MT4 trading environment, including real-time market quotes, and the ability to execute orders for all linked accounts. With its intuitive interface and enhanced management capabilities, the MultiTerminal provides traders with the flexibility and efficiency required for handling large volumes of trades.

OneRoyal Desktop MetaTrader 5 Platform

The MetaTrader 5 Desktop Platform is a next-generation trading platform designed for enhanced functionality and advanced market analysis. It features over 38 pre-installed technical indicators and 44 analytical charting tools, providing traders with in-depth insights into market trends and price movements.

The platform supports 3 chart types, and offers 21 timeframes, allowing for detailed analysis tailored to any trading strategy. Additionally, MT5 delivers faster trade execution, supports multiple asset classes, and includes tools for hedging and netting. Its intuitive interface, combined with advanced features like a built-in economic calendar, makes MT5 an excellent choice for traders seeking a comprehensive and efficient trading experience.

OneRoyal MobileTrader App

The OneRoyal MobileTrader App, available as mobile versions of MT4 and MT5, offers traders the flexibility to monitor and execute trades on the go. Compatible with both iOS and Android devices, the app provides access to real-time quotes, interactive charting tools, and advanced order execution options.

With features like customizable indicators, multiple timeframes, and push notifications, traders can stay updated on market movements anytime, anywhere.

Trading Instruments

Score – 4.3/5

What Can You Trade on OneRoyal’s Platform?

On OneRoyal’s platform, traders can access an extensive selection of over 2,000 trading instruments, offering opportunities to diversify their portfolios. These include Forex currency pairs, CFDs, precious Metals like gold and silver, Oil and other energy commodities, global Indices, popular Cryptocurrencies, individual Shares of leading companies, and a variety of ETFs.

However, the range of instruments primarily focuses on Forex and CFDs, offering a robust but somewhat specialized selection for traders looking to capitalize on these markets. This targeted approach ensures a streamlined experience for those seeking liquidity and versatility in these asset classes.

Main Insights from Exploring OneRoyal’s Tradable Assets

Exploring OneRoyal’s tradable assets reveals a mix of advantages and some limitations. The platform offers a wide selection of instruments, allowing traders to diversify their portfolios across multiple asset classes. A key highlight is the inclusion of cryptocurrencies, with popular pairs like BTC/USD and ETH/USD, giving traders access to the fast-growing digital asset market.

However, the offerings are more concentrated on Forex and CFDs, which may not appeal to those seeking a broader range of niche assets. Despite this, OneRoyal stands out for its accessibility to liquid markets and the ability to trade some of the most popular instruments globally.

Leverage Options at OneRoyal

The multiplier ratios offered by the broker depend on the regulatory restrictions and rules applicable to the account with which it is opened.

- The maximum leverage level for Australian clients is 1:30.

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- International entity clients can use leverage up to 1:1000 for professional trading.

Trading with a Lebanese entity may entitle various leverage levels too, therefore, check carefully under which regulation you will fall and what levels apply to your residency status.

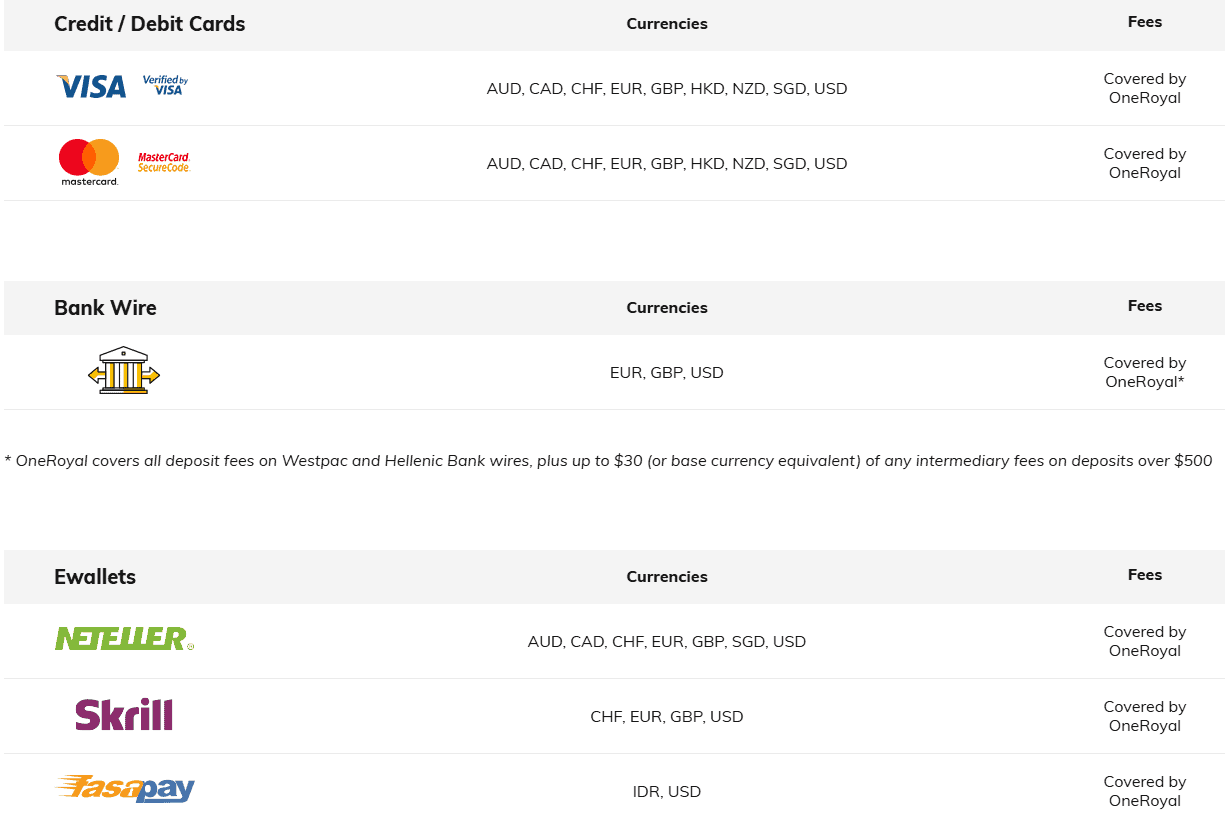

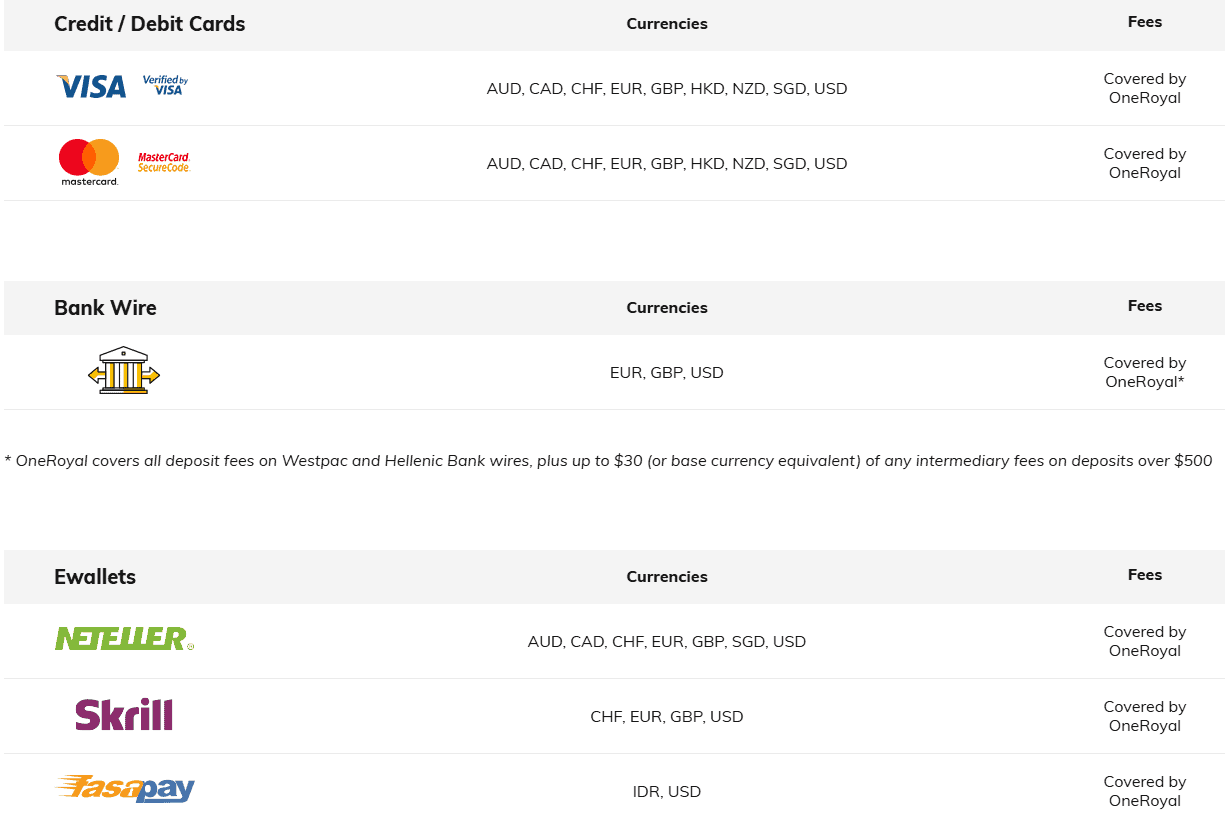

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at OneRoyal

The broker supports 13 payment methods and offers 11 account base currencies all in all supporting smooth money transfer.

The methods include a wide range of payment options yet may vary according to the country’s regulations and your residence so always good to verify this information with the support center as well.

- Credit/Debit Cards

- Bank Wire

- Skrill

- Neteller

- FasaPay, and more

OneRoyal Minimum Deposit

OneRoyal offers flexible entry points for traders with its minimum deposit requirements, which vary depending on the account type and regulatory jurisdiction.

The minimum deposit for a Classic account at OneRoyal is typically $50, making it an accessible option for traders who are just starting or those who prefer a more straightforward trading experience.

Withdrawal Options at OneRoyal

OneRoyal offers a variety of withdrawal options, allowing traders to conveniently access their funds. These options include bank transfers, credit and debit cards, as well as popular e-wallets, ensuring flexibility for users from different regions.

Withdrawal times may vary depending on the chosen method, with e-wallets typically offering faster processing compared to bank transfers. However, withdrawal methods and fees can also vary based on the account’s regulatory jurisdiction and the payment provider. For smooth and efficient transactions, traders should confirm withdrawal details, including any applicable fees, with OneRoyal’s support team before initiating a withdrawal.

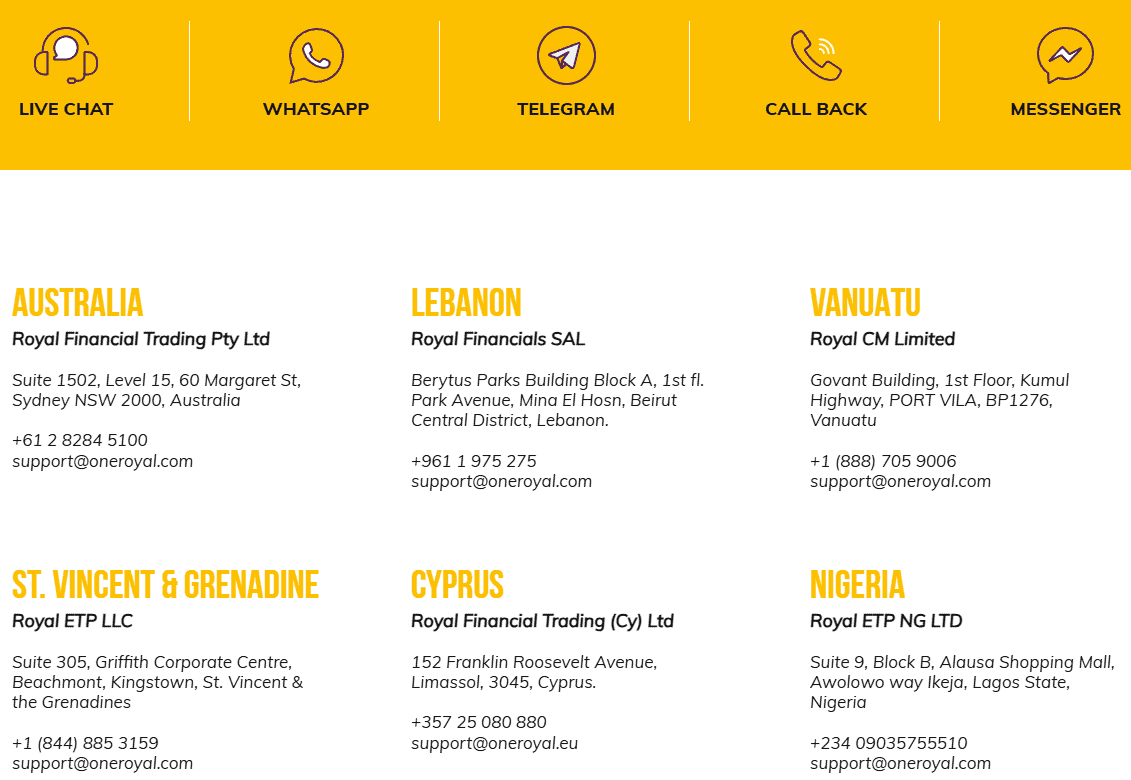

Customer Support and Responsiveness

Score – 4.7/5

Testing OneRoyal’s Customer Support

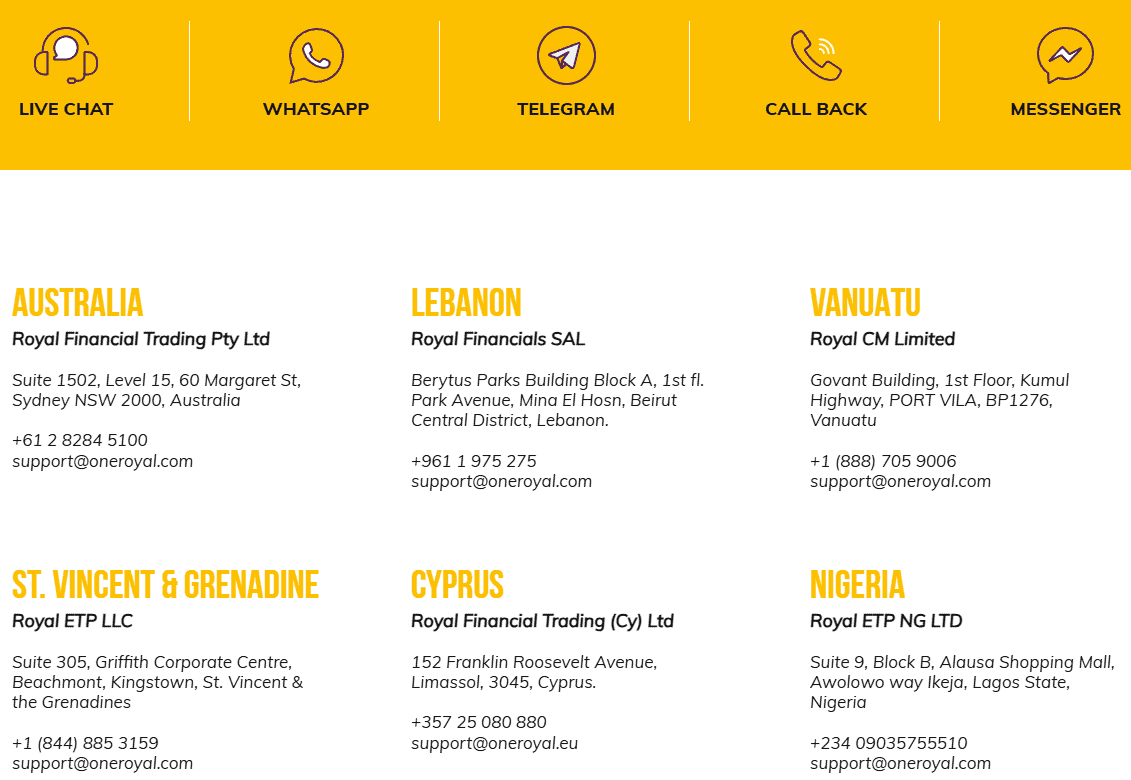

OneRoyal offers reliable and accessible customer support, ensuring that traders can get assistance whenever needed. The support team is available 24/5 through multiple channels, including live chat, email, WhatsApp, Messenger, and phone, providing timely responses to inquiries and resolving issues efficiently.

Additionally, the broker’s help center and FAQ are equipped to handle queries in various languages, catering to its global customer base. Whether you need help with account setup, trading issues, or payment inquiries, the team is dedicated to offering professional guidance.

Contacts OneRoyal

To get in touch with OneRoyal, traders can contact the broker through several convenient methods, including phone and email. The customer support team can be reached by phone at +1 844 885 3159 (for international inquiries) and +61 2 8284 5100 (for Australian customers).

Alternatively, traders can email the support team at support@oneroyal.com for general inquiries. OneRoyal ensures a responsive and professional support system, helping clients resolve issues and receive assistance promptly. For more details or specific requests, it is always advisable to contact them directly using the provided communication channels.

Research and Education

Score – 4.5/5

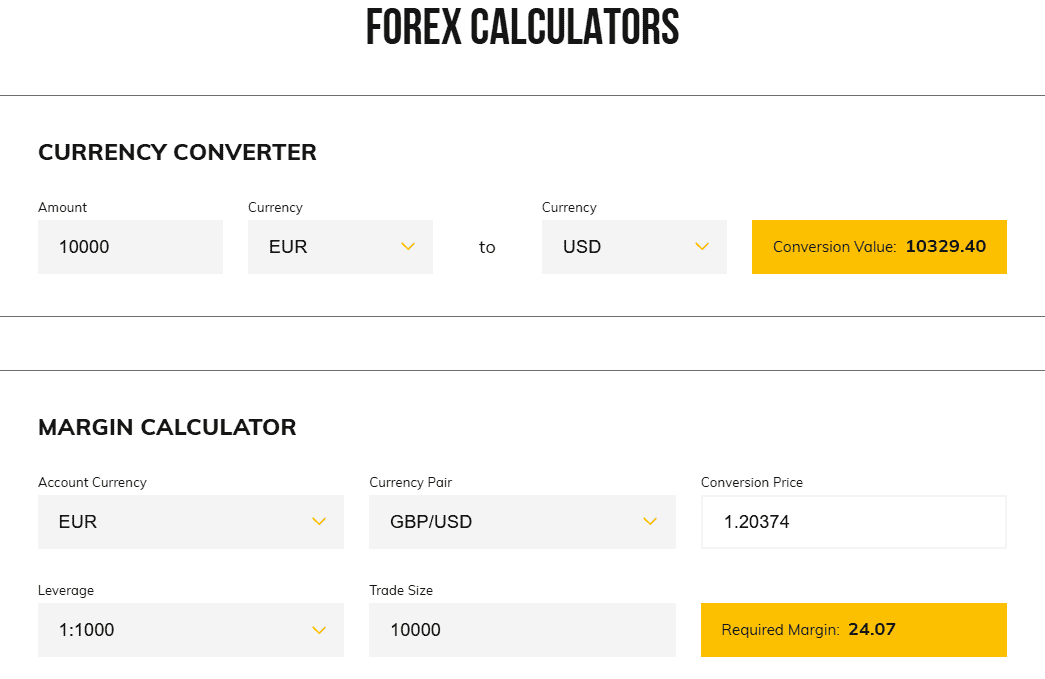

Research Tools OneRoyal

OneRoyal offers a range of research tools on both its website and trading platforms, designed to cater to traders of all experience levels.

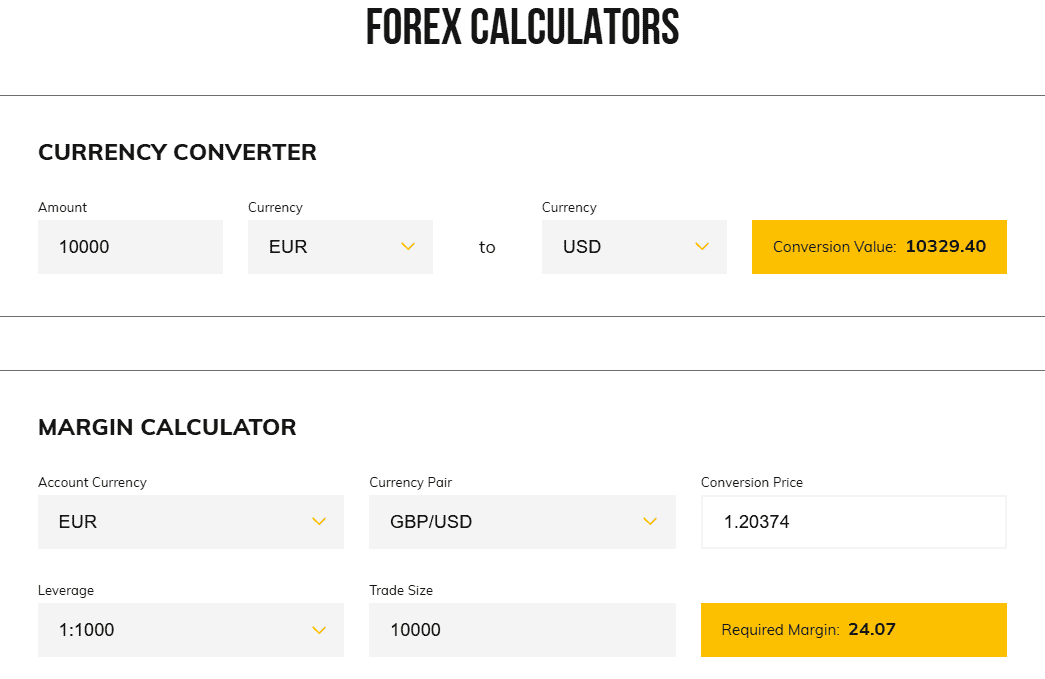

- On their website, traders can access useful Forex trading calculators to assist with margin, pip value, and profit/loss calculations, helping them make informed decisions.

- For those using trading platforms, OneRoyal provides the MT4 Accelerator, which enhances order execution speeds, and VPS Hosting for uninterrupted trading, particularly during volatile market conditions.

- Additionally, the broker offers Copy Trading through HokoCloud, a social trading platform available directly on the platform, enabling users to follow and copy strategies from successful traders. These tools collectively empower traders to make precise, timely, and efficient decisions while navigating the markets.

Education

OneRoyal offers a few educational resources to support traders in enhancing their skills and knowledge. The platform features educational videos that cover a wide range of topics, from basic trading concepts to advanced strategies, catering to traders of all experience levels.

In addition, the Knowledge Hub serves as a central resource for in-depth articles, guides, and tutorials on various aspects of trading, helping users to stay informed and sharpen their expertise. OneRoyal’s Blog also offers regular insights, market analysis, and trading tips to keep traders up to date with the latest trends and developments. These resources provide comprehensive support for traders looking to improve their trading abilities and stay ahead in the fast-moving financial markets.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options OneRoyal

OneRoyal primarily functions as a Forex and CFD trading broker. However, the platform also provides a few investment options beyond traditional Forex trading. One of the key features for investors is MAM (Multi-Account Manager) trading, which allows money managers to handle multiple client accounts from a single interface, offering scalability and personalized investment strategies.

Additionally, Copy Trading is available through the HokoCloud platform, enabling traders to replicate the strategies of successful investors and capitalize on their expertise without needing to actively manage trades. These investment options enhance the platform’s flexibility, allowing traders to explore a variety of strategies and diversify their portfolios.

Account Opening

Score – 4.4/5

How to Open OneRoyal Demo Account?

Opening a OneRoyal Demo Account is an easy process that allows traders to practice their skills in a risk-free environment. To get started, visit the broker’s website and navigate to the Demo Account registration section.

You will be required to provide some basic information, such as your name, email address, and preferred account type. Once you have completed the registration, you will receive access to a demo account where you can trade with virtual funds. This account simulates real market conditions, allowing you to familiarize yourself with the platform’s features and refine your trading strategies without any financial risk.

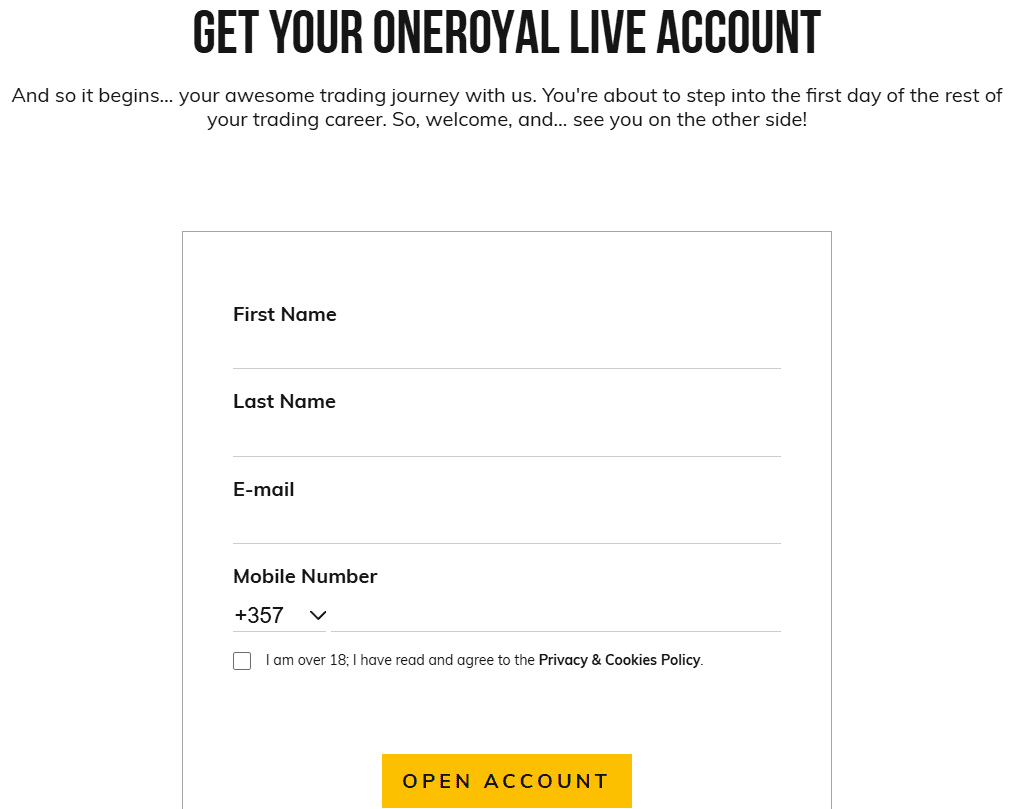

How to Open OneRoyal Live Account?

Opening a OneRoyal Live Account is a simple process that allows traders to access real market conditions and start trading with real capital. To begin trading live, follow these steps:

- Navigate to the official website and locate the account registration section.

- Choose the option to open a live account and select the type of account you wish to open (e.g., Classic, ECN).

- Fill out the registration form with your personal information, including your name, email address, phone number, and country of residence.

- submit the required identification documents (e.g., passport, utility bill) for identity and address verification, as per regulatory requirements.

- Choose your preferred payment method and deposit the minimum required amount to activate your live account.

- Select the trading platform you wish to use (e.g., MetaTrader 4) and download it to start trading.

Once your account is verified and funded, you will be ready to trade with real capital on OneRoyal’s platform.

Additional Tools and Features

Score – 4.7/5

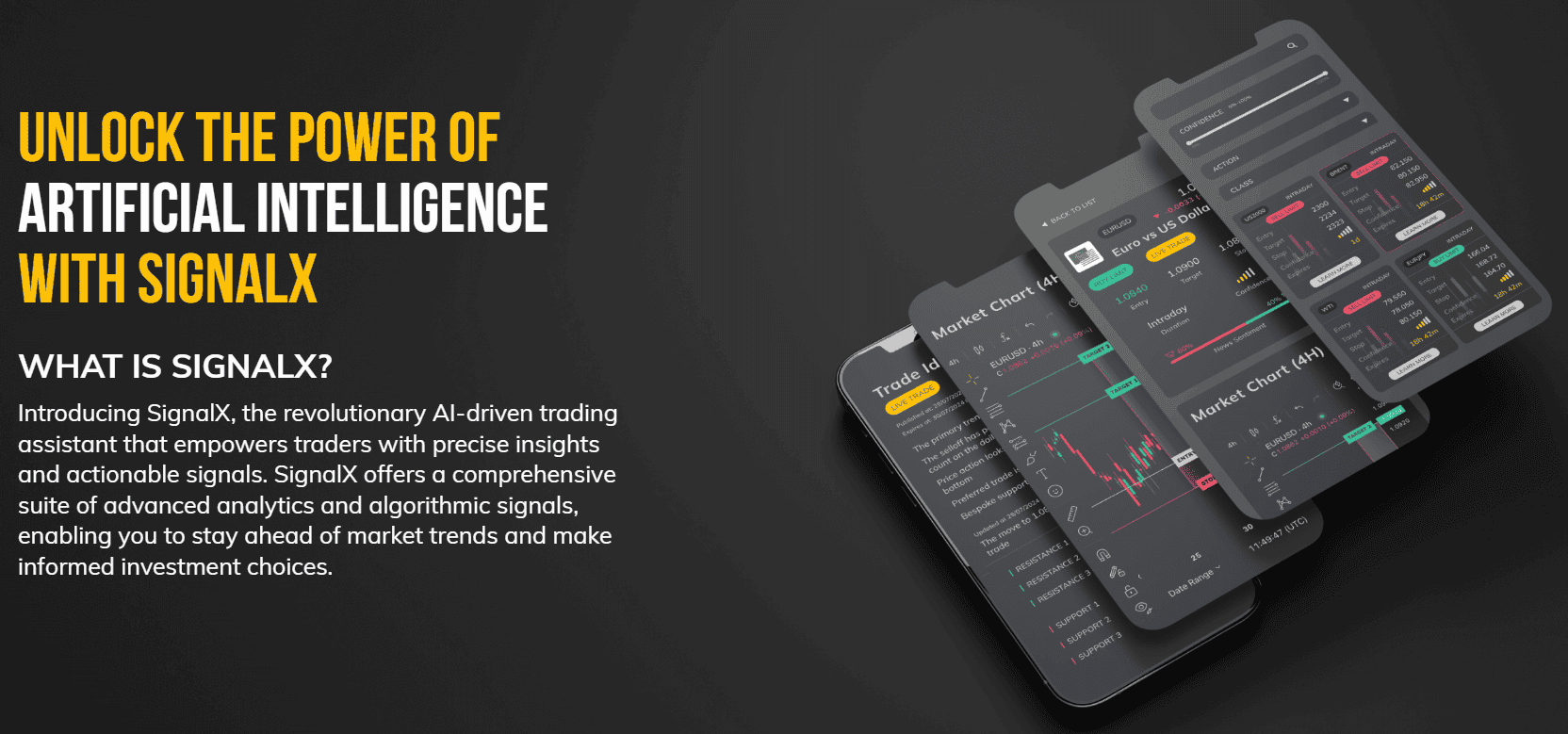

OneRoyal offers a variety of AI-powered additional tools and features to enhance the trading experience and provide valuable market insights.

- Among these is SignalX, an AI-driven tool that delivers real-time trading signals, helping traders identify potential opportunities.

- The AssetIQ feature provides in-depth analysis and data on various instruments, empowering informed decision-making.

- Traders can also benefit from Action News, a tool that delivers instant updates on breaking market news, and the Economic Calendar, which highlights key global events that may impact the markets.

- Additionally, the Market Scanner helps identify trends and opportunities across different asset classes, while Daily Intel provides concise, actionable summaries of market conditions. These tools collectively support traders in making well-informed, timely decisions while navigating the financial markets.

OneRoyal Compared to Other Brokers

OneRoyal stands out among its competitors with its competitive spreads, commission structure, and access to popular trading platforms like MT4 and MT5, which cater to both beginner and advanced traders. While its asset variety of over 2,000 instruments is solid, it falls short compared to brokers like Forex.com, which offers significantly more.

In terms of fees, the broker offers attractive options, especially for commission-based accounts, though brokers like Tradeview excel in lower trading costs. OneRoyal’s regulation and customer support align with industry standards, offering 24/5 service and reliable oversight, but its educational resources, while good, are not as comprehensive as those provided by Forex.com.

The $50 minimum deposit is an advantage for new traders, making it more accessible compared to brokers like Xtrade and Tradeview, which require higher deposits. Overall, OneRoyal offers a well-rounded trading experience but faces strong competition in asset variety and advanced trading tools.

| Parameter |

OneRoyal |

Markets.com |

Forex.com |

XS |

Axi |

Xtrade |

Tradeview |

| Spread Based Account |

Average 1 pip |

Average 1 pip |

Average 1.3 pips |

Average 1.1 pips |

Average 1.2 pips |

Average 2 pips |

Average 0.3 pips |

| Commission Based Account |

0.0 pips +$3.50 |

For Stocks Only ($1 per $1,000 trade) |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $7 |

No commissions, based on fixed spreads |

0.0 pips + $2.5 |

| Fees Ranking |

Average |

Average |

Average |

Average |

Average |

Average |

Low/ Average |

| Trading Platforms |

MT4, MT5 |

Markets.com Web, MT4, MT5, TradingView, Markets.com Social Trade App |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, Axi Trading App, Axi Copy Trading App |

Xtrade WebTrader |

MT4, MT5, cTrader |

| Asset Variety |

2,000+ instruments |

2,200+ instruments |

6000+ instruments |

1000+ instruments |

220+ instruments |

1,000+ instruments |

200+ instruments |

| Regulation |

ASIC, CySEC, VFSC, FSA, CMA |

CySEC, FCA, ASIC, FSCA, FSC, FSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, FCA, CySEC, DFSA, FSA |

FSC, FSCA |

MFSA, CIMA, FSC, FS |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Good |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$50 |

$100 |

$100 |

$0 |

$0 |

$250 |

$1000 |

Full Review of Broker OneRoyal

OneRoyal is a globally recognized broker catering to traders of all experience levels. The broker provides access to over 2,000 trading instruments and supports popular trading platforms MT4 and MT5, along with advanced AI tools.

OneRoyal offers competitive pricing and supports MAM trading and Copy Trading, allowing traders to scale and diversify their strategies.

The broker is regulated by multiple reputable authorities, ensuring a secure trading environment. Additionally, OneRoyal provides robust research tools and an educational suite, including videos, a knowledge hub, and a blog, which are particularly beneficial for new traders.

However, OneRoyal’s asset variety is limited to Forex and CFDs, and its spreads can be higher for certain trading instruments. Overall, the broker delivers a reliable and well-rounded trading experience but faces competition in areas such as asset variety, spreads, and advanced educational offerings.

Share this article [addtoany url="https://55brokers.com/oneroyal-review/" title="OneRoyal"]