OneUp Trader 2025 Review

-

Written by:

George Rossi -

Updated:

Leverage: 1:100

Regulation: US

Min. Deposit: $650

HQ: US

Platforms: NinjaTrader

Found in: 2017

Advertising Disclosure

Written by:

George Rossi

Updated:

Leverage: 1:100

Regulation: US

Min. Deposit: $650

HQ: US

Platforms: NinjaTrader

Found in: 2017

OneUp Trader operates as a proprietary trading firm with a focus on futures trading. They offer their clients access to funded trading accounts, which vary in value from $25,000 to $250,000. To maintain access to these accounts, clients are required to pay a monthly fee. This arrangement allows traders to engage in futures trading without needing to provide their own capital upfront.

UneUp Trader offers a unique opportunity to begin real trading for a monthly subscription instead of a deposit. By successfully passing our test or challenge, you can become a Funded Trader and access company funds. While exploring proprietary trading, it’s essential to carefully consider and evaluate the associated risks before making your decision. Read more about Proprietary Trading here.

| FundedNext Advantages | FundedNext Disadvantages |

|---|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| Profit Share from Challenge | Only MetaTrader Platform |

| MT5 and MT4 with EAs | |

| Refundable Fee once you become Funded Trader | |

| Good range of Challenge Models | |

| Free Competitions |

Overall, OneUp Trader is considered a legitimate option for traders looking to access funded trading accounts and develop their trading skills, offering a transparent evaluation process and a range of tools and resources to support traders. The company is headquartered in US and is a registered company.

We verified the legitimacy of OneUp Trader by examining their official website and found no evidence of it being a scam. However, due to the limited regulation of Prop Trading Firms by financial authorities, it remains challenging to definitively determine whether the firm’s nature is trustworthy or questionable.

Our professional recommendation is to thoroughly educate yourself about Prop Trading, grasp its inherent risks, and opt for a company with a solid and established reputation, preferably one that has been operating for many years to ensure stability. Moreover, since you are not investing a substantial amount of capital but rather paying subscription fees, potential losses are relatively lower when compared to engaging in real trading with your own funds.

The key focus of our OneUp Trader Review is to examine the structure of the evaluation challenge and the requirements for participating in it. This includes understanding the specific test or criteria necessary to qualify for a Funded Trading Account and become a Proprietary Trader. Additionally, we will delve into the associated costs involved in pursuing this path, typically in the form of a Registration Fee.

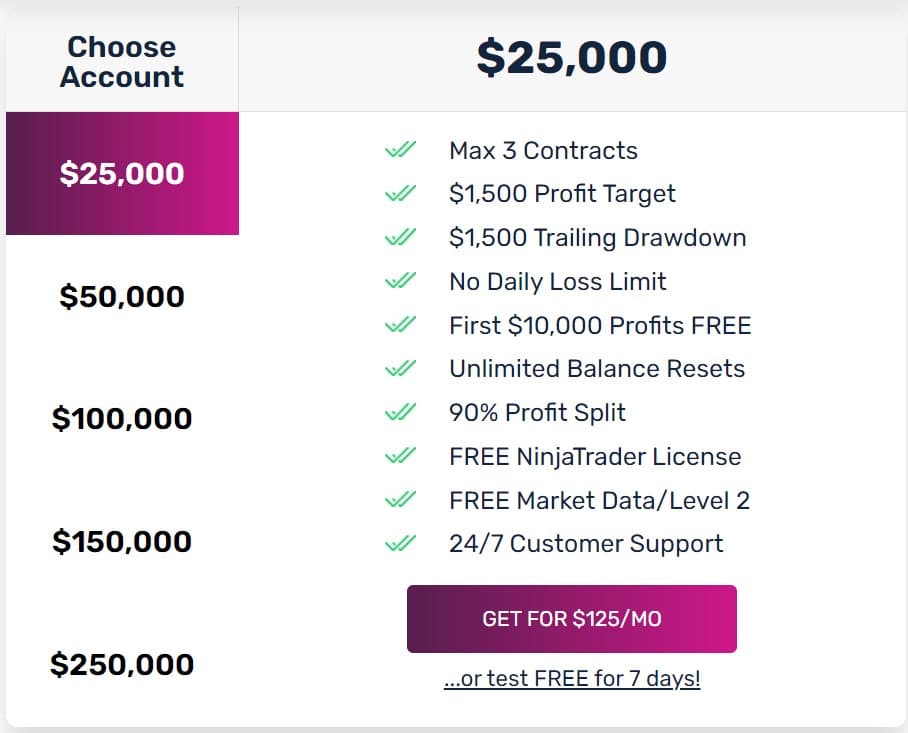

Before logging into OneUp Trader, select your desired Account Balance to determine the challenge conditions, which can vary based on your choice. Keep in mind that your selection also affects the registration fee, and please note that OneUp Trader does not offer subscription fee refunds. Check the Registration Fee comparison table below for details.

| Fees | OneUp Trader | FTMO | The Funded Trader |

|---|---|---|---|

| Minimum Account Size | $25,000 | $10,000 | $50,000 |

| Fee | $125 | €155 | $289 |

| Maximum Account Size | $250,000 | $200,000 | $400,000 |

| Fee | $650 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | No | Yes | Yes |

So the challenge itself includes numerous rules you have to follow to prove your sucessful strategy and performance, one the most important parameters is Profit Target. OneUp Trader’s evaluation requires traders to meet a profit target of 6% of their chosen account size. For instance, a $25,000 account would have a $1,500 profit target. Successful achievement of this target within the evaluation rules is necessary to qualify for a funded account

OneUp Trader sets maximum loss limits for its traders, which are generally referred to as “drawdown limits.” These limits are typically set at 6% of the account balance, mirroring the profit targets. For example, for a $25,000 account, the maximum loss limit would be $1,500, which is 6% of the account size.

Another important rule typically used in Proprietary Trading tests is to be Profitable within minimum of the required days or periods.The minimum trading period for OneUp Trader’s evaluation is 15 trading days. This period does not need to consist of consecutive days, offering flexibility to traders during volatile market periods

See detailed table with OneUp Trader Challenge conditions based on Account Size:

We found out that OneUp Trader offers a free trial for those interested in trying out their platform. This trial typically lasts for 7 days, allowing prospective traders to experience OneUp Trader’s interface and features without any financial commitment. Which is a big plus since not many prop firm offer a free trial.

Once the test or the challenge is successfully passed trader will get his Funed Account set, which may typically take few business days to activate. It is important to note, that the account conditions and balance will be exactly as the one you qualify for in your test, in case you would like to change Account to higher grade there will be a need to pass test from the very beginning for the Account Balance you prefer to trade with.

OneUp Trader offers a 90/10 profit split where the trader keeps 90% of the profits. The monthly fee varies depending on the account size, starting at $125 for a $25,000 account. They offer various benefits such as zero monthly data fees for funded traders and an unrestricted trading schedule

OneUp Trader’s Express Funding option allows traders to get funded in just 5 days. This expedited evaluation process is available to traders who have previously had a funded account with OneUp Trader but lost it within the last 30 days. The Express Funding account option provides a quicker path to reacquire funding compared to the standard evaluation process

As a funded trader with OneUp Trader, traders are entitled to unlimited free profit withdrawals starting from the first day, provided they meet the minimum withdrawal threshold. The minimum amount traders can withdraw is $1,000, with no upper limit on the withdrawal amount. Additionally, withdrawal requests are processed on the same day, ensuring quick access to your profits.

OneUp Trader withdrawal methods for withdrawing profits from funded accounts include traditional banking methods like bank wire transfers and modern digital methods such as cryptocurrency transfers.

When assessing Account Conditions, we meticulously review the Broker’s account preferences, Platforms, Instruments, Trading Costs, Leverage levels, and Trading conditions. Some Brokers may limit strategies and practices in Funded accounts, potentially resulting in Account loss, requiring a retest for recovery. See the detailed breakdown below:

OneUp Trader primarily offers a platform for trading futures contracts. The specifics of the instruments depend on the chosen trading platform, but they generally include metal futures, e-mini futures, and forex futures. The platform does not support the use of automated trading systems like bots for its funded accounts.

OneUp Trader includes in its commission schedule for funded traders a combination of regulatory fees, trade commissions, platform fees, and exchange fees. These total commissions are integrated into your overall account balance as trades are executed.

OneUp Trader provides leverage for its funded accounts, but the specific leverage ratios offered depend on the type of program and the instruments being traded. For futures trading, the leverage is typically set at 1:1.

OneUp Trader allows traders to choose from a variety of trading platforms. The recommended platform is NinjaTrader, but traders have the option to select from over 19 other platforms including Sierra Chart, R-Trader, and Order Flow Trading. This flexibility enables traders to use a platform they are comfortable with, enhancing their trading experience.

OneUp Trader’s trading conditions and rules are quite specific and cater to ensuring a disciplined and consistent trading approach.

We noticed that OneUp Trader occasionally offers OneUp Trader promo codes, including specific coupon OneUp Trader codes for reduced rates. These promotions might also feature discounts on account resets. However, these offers are typically temporary, so it’s advisable to check the current availability and specifics when you sign up with OneUp Trader.

OneUp Trader offers a focused platform emphasizing risk management and discipline, suitable for traders seeking funded accounts. While it has diverse tools and high profit-sharing, traders should be aware of its fees and specific trading requirements. Its free trial is an advantage, but those interested in non-futures trading might explore other prop trading firms.

When considering OneUp Trader, it’s advisable to also explore and compare offers from other proprietary trading firms. Different firms may provide better-suited options for individual traders, such as a wider range of instruments or alternative trading platforms. While OneUp Trader has its unique advantages, comparing it against other firms can help in making an informed choice that aligns with specific trading needs and preferences.

No review found...

No news available.