- What is MEX Exchange?

- MEX Exchange Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- MEX Exchange Compared to Other Brokers

- Full Review of Broker MEX Exchange

Overall Rating 4.4

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.4 / 5 |

| Account Opening | 4.3 / 5 |

| Additional Tools and Features | 4.6 / 5 |

What is MEX Exchange?

MEX Exchange is an established broker providing Forex, Metals, Stocks, and CFDs and operating since 2012 throughout Australia and has become one of the most regarded industry institutions. MEX Exchange offers its customers trading access through advanced platforms on a range of instruments including.

- Also, MEX Exchange is a part of a global group, a quite well-known company MultiBank with offices in Sydney, Los Angeles, Vienna, Frankfurt, Madrid, Cyprus, MEXFintech in Hong Kong, along with additional branches MEX Group Worldwide offices in Hong Kong, MEX Asset Management (Austria) GmbH, Beijing, Tianjin, Hangzhou, and Ho Chi Minh City, etc.

Overall, and as we will see further the details of MEX Exchange services provided, the broker became quite a big one as its services were delivered to over 280,000 retail and institutional customers throughout over 90 countries.

MEX Exchange Pros and Cons

MEX Exchange is a reliable broker with good proposals based on MT4/MT5 and a low minimum deposit requirement. The broker provides an exceptional experience with low spreads facilitated by ECN connection. With competitive conditions and outstanding customer support, the broker is a good choice for traders of any expertise level.

On the MEX Exchange Cons, the products are limited to Forex and CFDs, and the proposals vary according to the entity.

| Advantages | Disadvantages |

|---|

| Forex and CFDs trading | Conditions vary according to the entity |

| Great trading capabilities | |

| Mainstay on MT4/MT5 | |

| Fast account opening | |

| Competitive spreads and fees | |

| Low minimum deposit amount | |

| 24/7 customer support | |

MEX Exchange Features

MEX Exchange is an online currency trading platform offering a range of features designed for different sizes of traders. The key features are summarized in 10 points, covering aspects like Instruments, Account Types, available Platforms, and more.

MEX Exchange Features in 10 Points

| 🏢 Regulation | ASIC, CySEC, MAS |

| 🗺️ Account Types | Standard, Pro, ECN Accounts |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, CFDs on Indices, Metals, Shares, Commodities, Cryptocurrencies |

| 💳 Minimum Deposit | $50 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | AUD, USD, GBP, EUR |

| 📚 Trading Education | Trading Courses, eBooks |

| ☎ Customer Support | 24/7 |

Who is MEX Exchange For?

MEX Exchange is designed for a wide range of traders, from beginners looking for a user-friendly platform to professionals seeking advanced tools and deep liquidity. According to our research and financial expert opinions, MEX Exchange is recommended for:

- Beginners

- Professionals

- Investments

- Traders from Australia

- European traders

- Algorithmic or API Traders

- EAs running

- Copy Trading

- International trading

- Scalping / Hedging Strategies

- Those who prefer MT4 and MT5 platforms

- Currency and CFD Trading

- Suitable for a Variety of Strategies

MEX Exchange Summary

Overall, MEX Exchange is a good option to consider for beginning, and professional traders, and institutional investors. MEX Exchange has a strong background and years of proven service success.

The broker also developed a powerful technology base to provide trading, enhanced offers with numerous assets to trade, availability of account types to choose from, and diverse research and trading tools.

55Brokers Professional Insights

MEX Exchange stands out as a professional and reliable broker by offering deep liquidity, ultra-fast execution, and competitive conditions tailored to various trading styles. Based on our tests, the performance and trading experience with MEX are good and well-maintained. Most traders of size or experience will find it fit. You are also able to choose a fee structure. With support from industry-popular platforms MetaTrader 4 and 5, traders benefit from numerous add-ons and education videos or sources available online, including algorithmic capabilities, copy trading with a seamless experience. Yet, if you prefere other than MetaTrader software it is not your fit then.

Lastly, the broker is with good transparency and security backed by strong regulatory oversight, safeguarding client funds and maintaining a trustworthy environment. Additionally, MEX Exchange provides flexible account types, tight spreads, and institutional-grade conditions, making it a preferred choice for traders seeking a robust and efficient platform.

Consider Trading with MEX Exchange If:

| MEX Exchange is an excellent Broker for: | - Need a well-regulated broker.

- Looking for broker with MT4 and MT5 platforms.

- Offering services worldwide.

- Access to Copy trading.

- Offering a range of popular instruments.

- Looking for broker with low minimum deposit requirement.

- Access to MAM/PAMM trading.

- Offering investment solutions.

- Providing competitive fees and spreads.

- ECN trading.

- Access to free VPS Hosting. |

Avoid Trading with MEX Exchange If:

| MEX Exchange might not be the best for: | - Looking for cTrader platform.

- Who prefer to trade with cTrader or proprietary platforms. |

Regulation and Security Measures

Score – 4.6/5

MEX Exchange Regulatory Overview

MEX Exchange operates under strong regulatory oversight, ensuring a secure and transparent environment for its clients. The broker is regulated by the Australian ASIC, providing traders with high standards of financial integrity and client protection.

Additionally, European CySEC regulation enables MEX Exchange to offer services across the European market while adhering to strict compliance and investor protection measures. The broker also holds regulation from the Monetary Authority of Singapore (MAS), reinforcing its credibility in the Asia-Pacific region.

How Safe is Trading with MEX Exchange?

As for the ASIC regulations, MEX Exchange maintains the settled international rules for the money management and operation of the traders’ accounts with the highest protection level. That involves segregation of the client accounts from the company funds, making them unreachable to the firm, and also applying security of transactions.

All in all, the set of rules makes your investment secure by the country’s legislation, securing your interests and providing transparency overall trading process.

However, the only consideration is that regulatory standards and client protection measures may vary depending on the specific entity under which the broker operates.

Consistency and Clarity

MEX Exchange has built a good reputation in the trading industry through its commitment to consistency, transparency, and trader satisfaction. With positive ratings from traders, the broker is recognized for its reliable execution, competitive spreads, and secure environment. It has also received industry awards, further solidifying its credibility as a trusted partner.

Additionally, MEX Exchange actively engages with the global trading community through sponsorships, educational initiatives, and financial events, reinforcing its presence in the industry. However, some traders have noted a few drawbacks, such as limited access to niche or exotic assets, occasional delays in customer support response times during peak hours, and commission-based accounts that may not be the most cost-effective option for smaller traders.

Moreover, regulatory restrictions may limit access for clients in certain regions. Despite these challenges, MEX Exchange continues to enhance its services, expanding its offerings and refining its customer support to maintain its reputation among traders and investors worldwide.

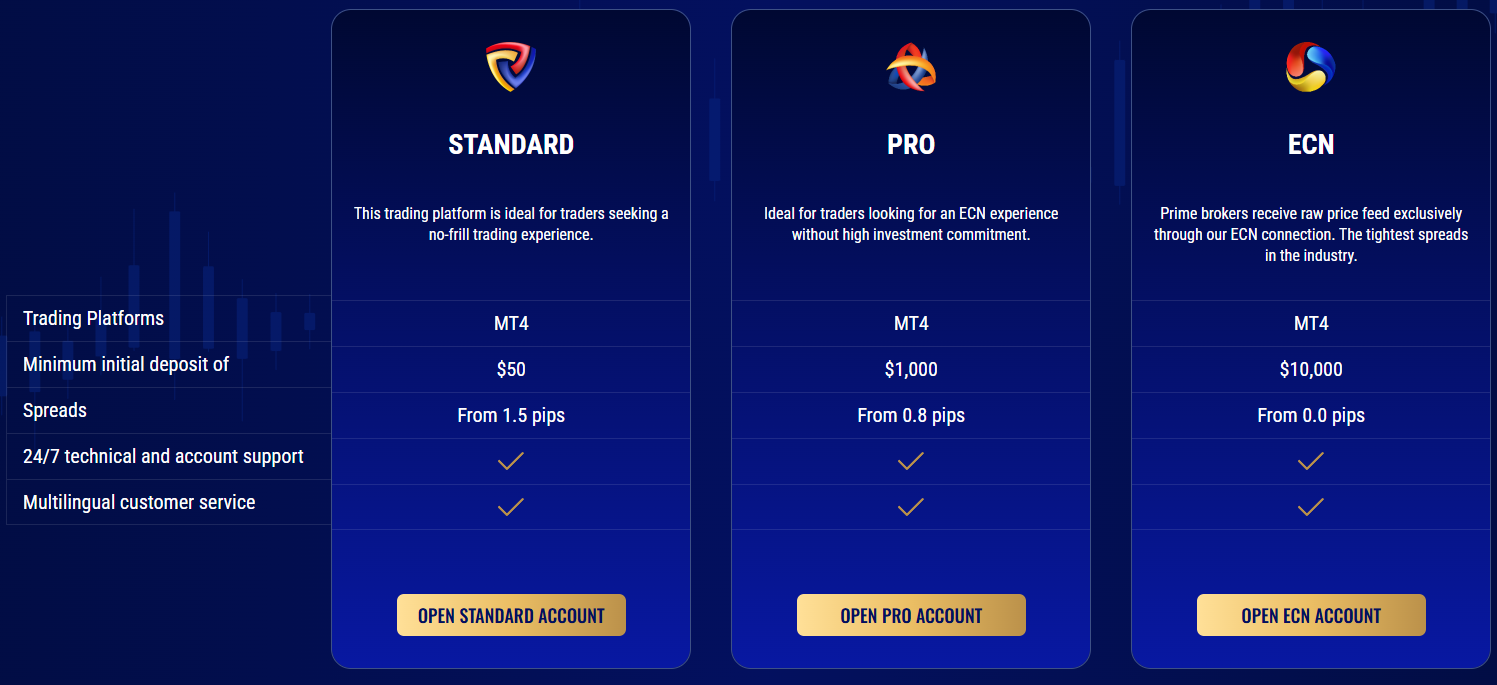

Account Types and Benefits

Score – 4.5/5

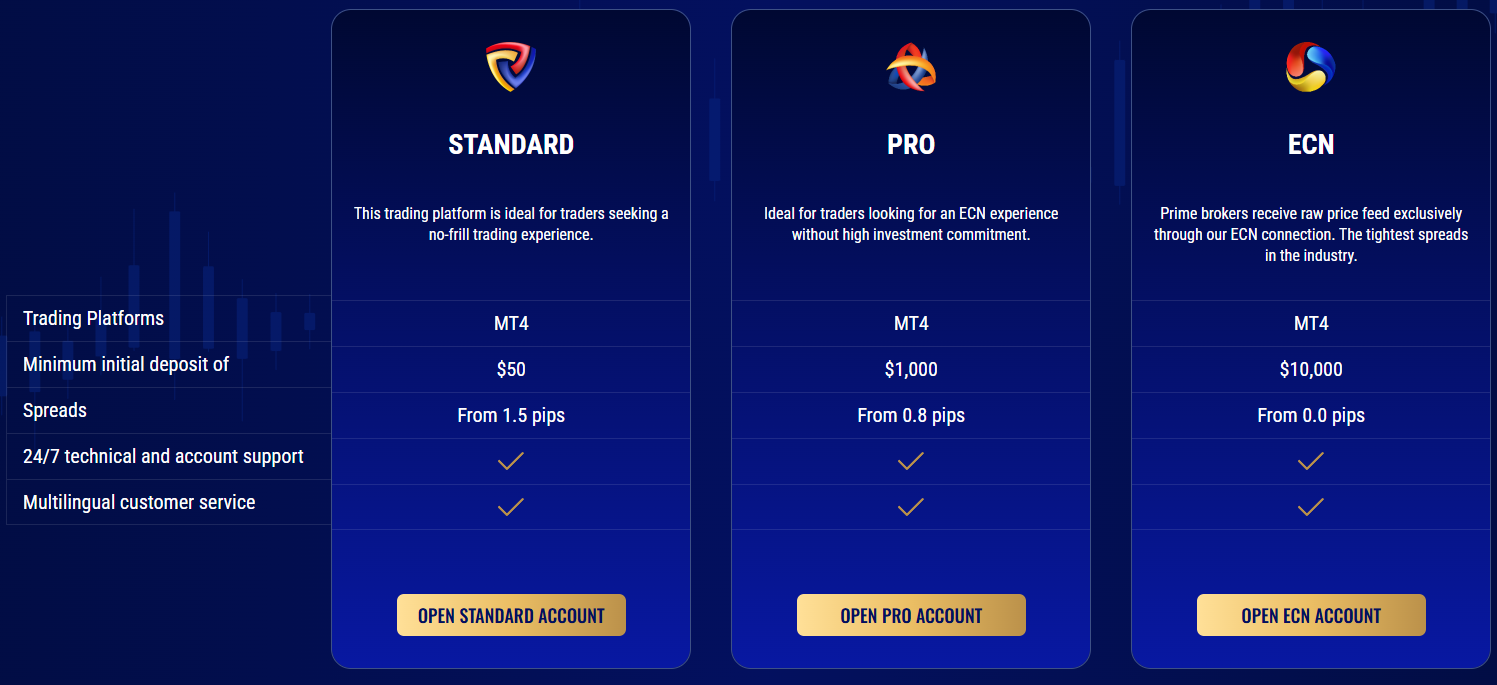

Which Account Types Are Available with MEX Exchange?

MEX Exchange provides three main account types to cater to different needs: Standard, Pro, and ECN accounts. The Standard account is ideal for beginners, offering commission-free trading with an initial deposit of just $50, instant execution, and spreads starting from 1.5 pips.

For traders seeking tighter spreads, the Pro account requires a higher initial deposit while maintaining competitive conditions. The ECN account, designed for professionals, utilizes an electronic communication network to provide raw spreads and direct market access.

Additionally, MEX Exchange offers a demo account, allowing beginners to practice trading risk-free, as well as a Swap-free account, which adheres to Sharia principles by eliminating swap or rollover interest on overnight positions.

Standard Account

The Standard Account is ideal for beginner traders with a low minimum deposit of just $50 and offers an affordable entry point into trading.

This account features spreads starting from 1.5 pips and leverage of up to 1:30, allowing traders to maximize their positions while managing risk effectively. Additionally, traders benefit from 24/7 technical and account support, along with multilingual customer service.

Pro Account

The Pro Account is designed for traders seeking lower spreads and faster execution. With spreads starting from 0.8 pips, it offers a cost-effective solution for active traders looking to optimize their trading efficiency. This account also includes advanced tools, custom indicators, and expert advisors to enhance the experience.

A minimum deposit of $1,000 is required, making it more suitable for traders who are prepared to commit additional capital.

ECN Account

The ECN Account is tailored for professional traders and institutional investors who require raw spreads, direct market access, and ultra-fast execution. With spreads starting from 0.0 pips, this account provides the most competitive conditions, with no dealing desk intervention, making it ideal for scalpers and high-frequency traders.

To open an ECN Account, traders need a minimum deposit of $10,000, positioning it as a premium option for those who demand superior conditions and deep liquidity.

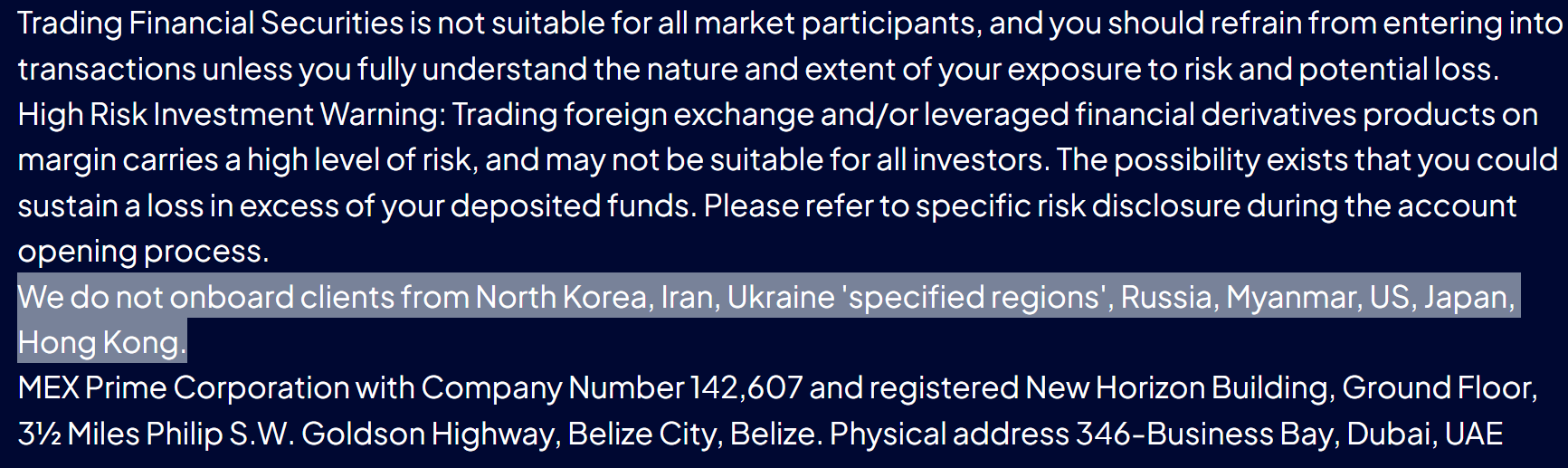

Regions Where MEX Exchange is Restricted

MEX Exchange, despite its global presence, has certain regional restrictions due to regulatory requirements. Traders from specific countries may not be able to access the broker’s services. Some of the commonly restricted regions include:

- USA

- Japan

- Hong Kong

- North Korea

- Iran

- Ukraine ‘specified regions’

- Russia

- Myanmar

Cost Structure and Fees

Score – 4.4/5

MEX Exchange Brokerage Fees

MEX Exchange fees are either built into spreads or charged as commission per trade. Also, alongside typical charge spread, or difference between the sell and buy prices, there are other payments to be considered including non-trading fees and inactivity fees.

MEX Exchange spreads are determined by the account type you choose. The average EUR/USD spread on the Standard account is 1.5 pips.

In case you prefer to use MEX ECN, you will get raw spreads starting from 0.0 pips but with a commission charge of $7.

MEX Exchange applies a $7 commission per round turn for traders using the ECN account. This commission-based structure ensures direct market access with raw spreads starting from 0.0 pips, making it an attractive option for professional traders and scalpers who prioritize tight spreads and high-speed execution.

- MEX Exchange Rollover / Swaps

MEX Exchange applies rollover fees to positions held overnight, which are calculated based on the interest rate differential between the two currencies in a trading pair. These fees can be either positive or negative, depending on whether a trader is earning or paying interest on the position.

Swap rates vary daily and are influenced by market conditions, central bank rates, and liquidity providers.

How Competitive Are MEX Exchange Fees?

MEX Exchange offers a cost-effective environment with fees that vary based on the account type and trading preferences. The broker provides tight spreads, particularly on Pro and ECN accounts, making it a competitive choice for active traders.

With no hidden charges, traders benefit from a transparent pricing model that includes clear commission structures and competitive costs. Additionally, MEX Exchange ensures efficient trade execution and access to deep liquidity, which can help minimize slippage and reduce overall expenses.

| Asset/ Pair | MEX Exchange Spread | MultiBank Spread | KAB Spread |

|---|

| EUR USD Spread | 1.5 pips | 1.5 pips | 0.1 pips |

| Crude Oil WTI Spread | 0.03 | 0.03 | 0.5 |

| Gold Spread | 0.25 | 0.25 | 0.05 |

| BTC USD Spread | 58 | 58 | - |

MEX Exchange Additional Fees

Additional costs that may apply to your positions include MEX Exchange swaps or overnight fees, which are charged if a position is held beyond a trading day. Swaps are calculated individually for each instrument, as every currency pair has its swap rate. Traders can check these rates directly on the platform.

Other potential costs include inactivity fees and transaction fees that may be waived for deposits or withdrawals, depending on the method used. A non-trading fee is charged if an account remains inactive for three consecutive months. Inactivity is defined as no new trades placed or no rollovers on existing open positions within that period. A $60 fee will be deducted per calendar month of inactivity.

Trading Platforms and Tools

Score – 4.5/5

MEX Exchange provides traders with access to the industry-leading MetaTrader 4 and MetaTrader 5 platforms, both known for their advanced charting tools, automated capabilities, and user-friendly interfaces.

MT4 remains a popular choice for Forex traders due to its simplicity and extensive support for Expert Advisors, while MT5 offers enhanced functionalities, including more timeframes, additional order types, and an improved strategy tester.

Traders can access these platforms via desktop, web, and mobile devices, ensuring seamless trading on the go. The availability of MT4 and MT5 may vary depending on the MEX Exchange entity and regulatory jurisdiction, so traders should check with the broker to confirm which platform is available for their region.

Trading Platform Comparison to Other Brokers:

| Platforms | MEX Exchange Platforms | MultiBank Platforms | KAB Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

MEX Exchange Web Platform

MEX Exchange offers the MT4 WebTrader, a browser-based version of the popular MetaTrader 4 platform that allows traders to access the markets without the need for downloads or installations. WebTrader retains the core functionalities of MT4, including one-click trading, advanced charting tools, multiple timeframes, and technical indicators, ensuring a smooth and efficient experience.

The platform is compatible with all major web browsers and provides real-time market quotes, allowing traders to execute orders instantly from anywhere with an internet connection. With its secure encryption protocols and intuitive interface, MT4 WebTrader is a convenient solution for traders who prefer flexibility and accessibility without compromising on essential tools.

Main Insights from Testing

Initially, Web Trading allows you to access the trading room without any specified software, by a simple load of pages through the browser you can get to your account and trade. This is indeed very useful under any circumstances, yet note more comprehensive tools and some add-ons or features are available only through the desktop version, so for advanced trading, you better install one.

MEX Exchange Desktop MetaTrader 4 Platform

There are few versions of the software suitable for various devices, as well as constantly undergoing development.

MT4 platform fully supports APIs, Algos, non-restricted Expert Advisors, and access through PAMM accounts available for managers, so all the comprehensive features along with thousands of research and analysis tools are here.

MEX Exchange Desktop MetaTrader 5 Platform

MEX Exchange offers the MT5 desktop platform, providing traders with a powerful and advanced environment. MT5 comes with enhanced features, including over 80 technical analysis indicators and analytical tools, giving traders a wide range of options to analyze the markets and make informed decisions.

The platform also offers more timeframes, additional order types, an economic calendar, and an improved strategy tester for algorithmic trading. It is available for Windows and macOS and ensures fast execution speeds with access to deep liquidity. The MT5 platform is offered under MEX Exchange’s European entity, so traders should confirm platform availability based on their region before opening an account.

MEX Exchange MobileTrader App

The mobile apps are also included in the package, while the apps are simple to use and packed with a wide range of tools at the same time. MT4 and MT5 mobile apps offer various charting capabilities also customization which is fantastic for mobile trading along with full management of your account.

Trading Instruments

Score – 4.7/5

What Can You Trade on MEX Exchange’s Platform?

MEX Exchange instrument range offers to trade over 20,000 instruments including Forex, CFDs on Indices, Metals, Shares, Commodities, and Cryptocurrencies. Through CFD trading, you will get access to Cash Index trading, yet with no exchange fees that are typically charged if you trade Indexes directly.

Main Insights from Exploring MEX Exchange’s Tradable Assets

MEX Exchange offers a wide range of tradable instruments, catering to various preferences and strategies. Traders can access a variety of Forex pairs, including major, minor, and exotic currencies, providing opportunities to trade in global markets.

With a broad selection of instruments, MEX Exchange provides ample opportunities for traders to diversify their portfolios and engage in multiple asset classes.

Leverage Options at MEX Exchange

MEX Exchange leverage levels have not provided high leverage ratios for the past several years since leverage is considered a risky venture hence traders settle for less:

- Retail traders’ leverage for Australian and European clients is a maximum of 1:30 for all class assets.

Nevertheless, it is always necessary to learn how to use the multiplier smartly, as many world regulators already decreased dramatically allowing leverage levels with the purpose of protecting clients. In addition, there are specified margins for the trading of particular instruments which you should check and verify too, as margin call occurs when there are not enough funds.

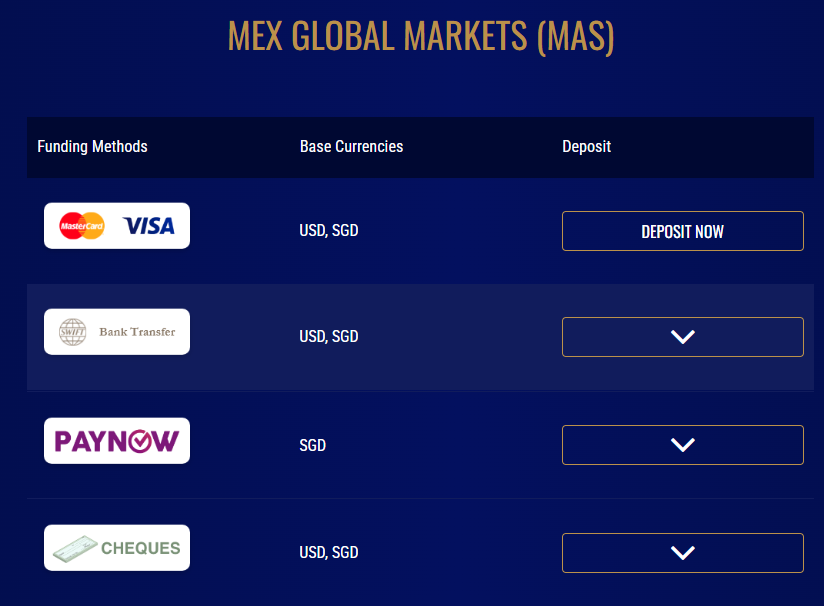

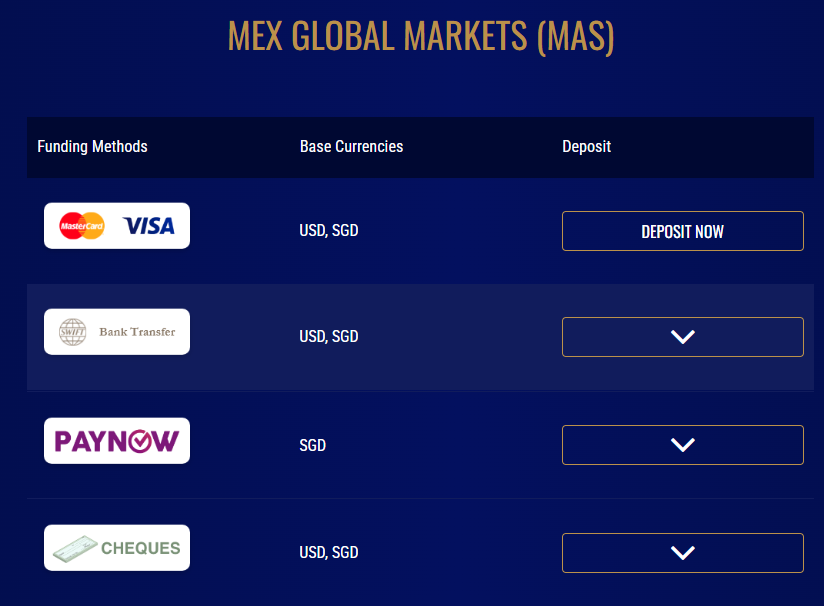

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at MEX Exchange

MEX Exchange offers several deposit options for traders, making it convenient to fund trading accounts. The available options include:

- e-wallet Neteller, Skrill, PayNow, etc.

- Wire or Bank transfer

- Card payment

MEX Exchange Minimum Deposit

The minimum deposit for the Standard Account with MEX Exchange is $50, making it an affordable option for new traders to begin their trading journey.

Withdrawal Options at MEX Exchange

MEX Exchange withdrawal charges no internal fees. Yet, depending on the payment provider as well as international laws some fees may be applicable, so you always better check them with the payment provider directly as they are falling on your side.

Typically broker confirms your withdrawal request within 1-2 business days, however always add extra days as payment providers may take their time to process the transaction, which always depends on your country of origin.

Customer Support and Responsiveness

Score – 4.5/5

Testing MEX Exchange’s Customer Support

MEX Exchange provides customers with multiple support in any case or question. The 24/7 customer service is available in 10+ languages with the service desk, onboarding, configuration, and cash management also accessible via chat, email, phone lines, etc.

Contacts MEX Exchange

For any inquiries or assistance, MEX Exchange offers multiple ways to get in touch with their support team. You can reach them via email at support@mexexchange.com for prompt assistance with account or trading-related questions. Alternatively, you can contact their customer support team directly by phone at +61 2 9195 4000. MEX Exchange is committed to providing timely and effective support to ensure a smooth trading experience for all clients.

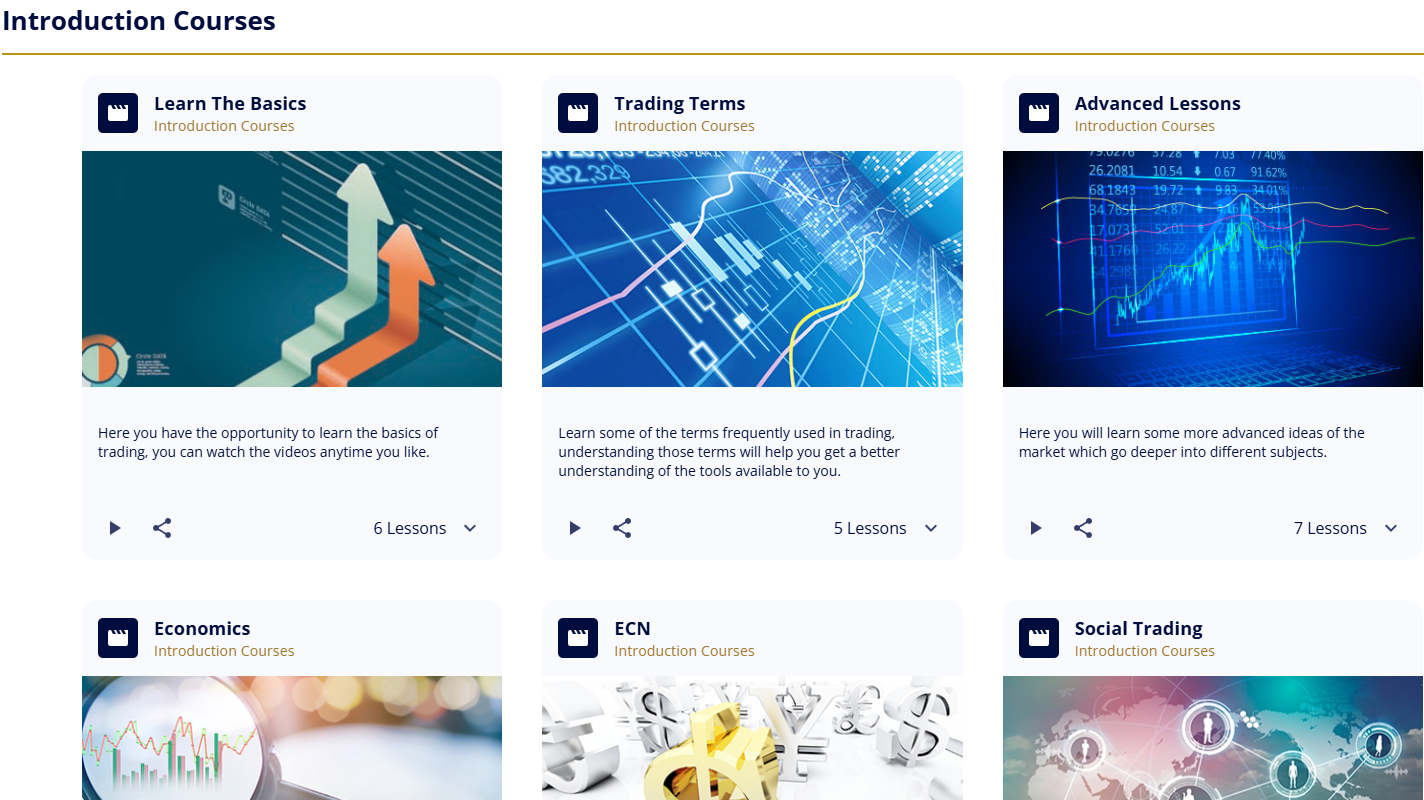

Research and Education

Score – 4.6/5

Research Tools MEX Exchange

MEX Exchange offers a variety of research tools available both on the website and platforms to support traders in making informed decisions.

- On the website, traders can access the economic calendar to stay updated on important global events, along with market news and analysis to guide their strategies.

- For enhanced performance, the broker offers a free VPS for traders who use automated strategies.

- On the platforms, traders have access to over 80 technical indicators and analytical tools on both MT4 and MT5 to conduct in-depth market analysis.

- Additionally, Fix API access is available for traders who require direct and fast connectivity to liquidity providers. These tools work seamlessly with MEX Exchange’s platforms to optimize trading opportunities and execution efficiency.

Education

MEX Exchange offers a range of educational resources to help traders improve their skills and knowledge. Traders can access courses that cover various aspects of the market, from beginner fundamentals to advanced strategies.

Additionally, the broker provides eBooks that offer valuable insights into different trading techniques and risk management practices. These resources are designed to support both new and experienced traders in their journey toward becoming more proficient in the financial markets.

Portfolio and Investment Opportunities

Score – 4.4/5

Investment Options MEX Exchange

While MEX Exchange primarily specializes in Currency and CFD trading, it also provides various investment options for traders looking to diversify their strategies. The broker offers MAM and PAMM accounts, enabling experienced traders and money managers to efficiently manage multiple client funds.

Furthermore, MEX Exchange supports copy trading, allowing investors to follow and replicate the strategies of professional traders. This feature makes it easier for beginners or passive investors to participate in the markets.

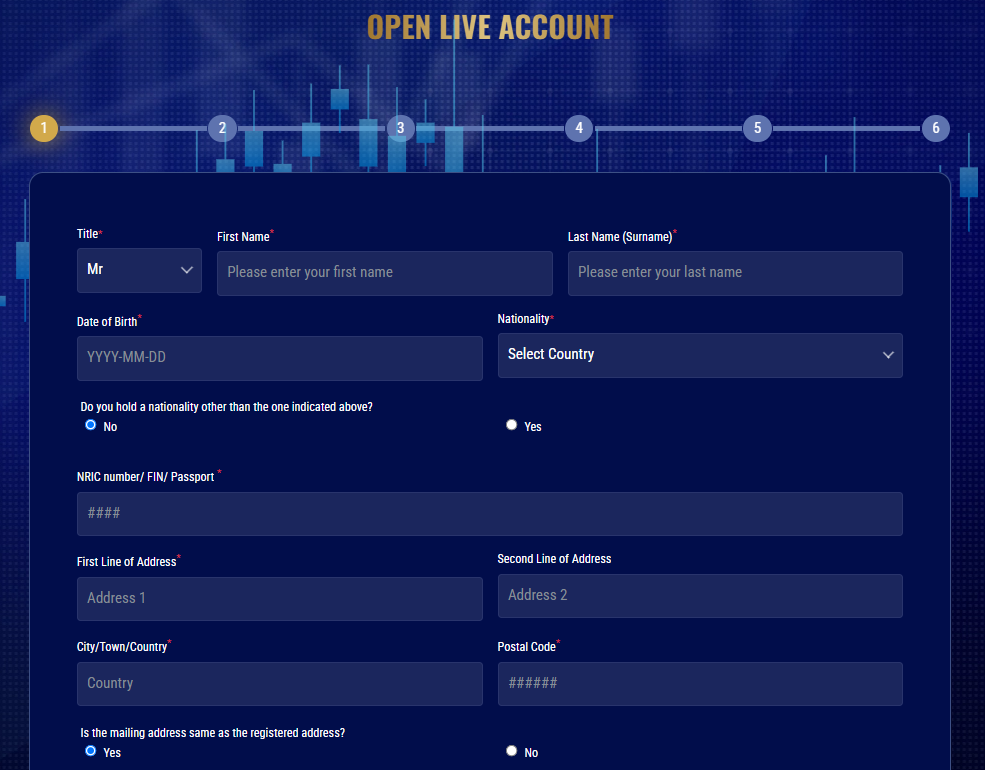

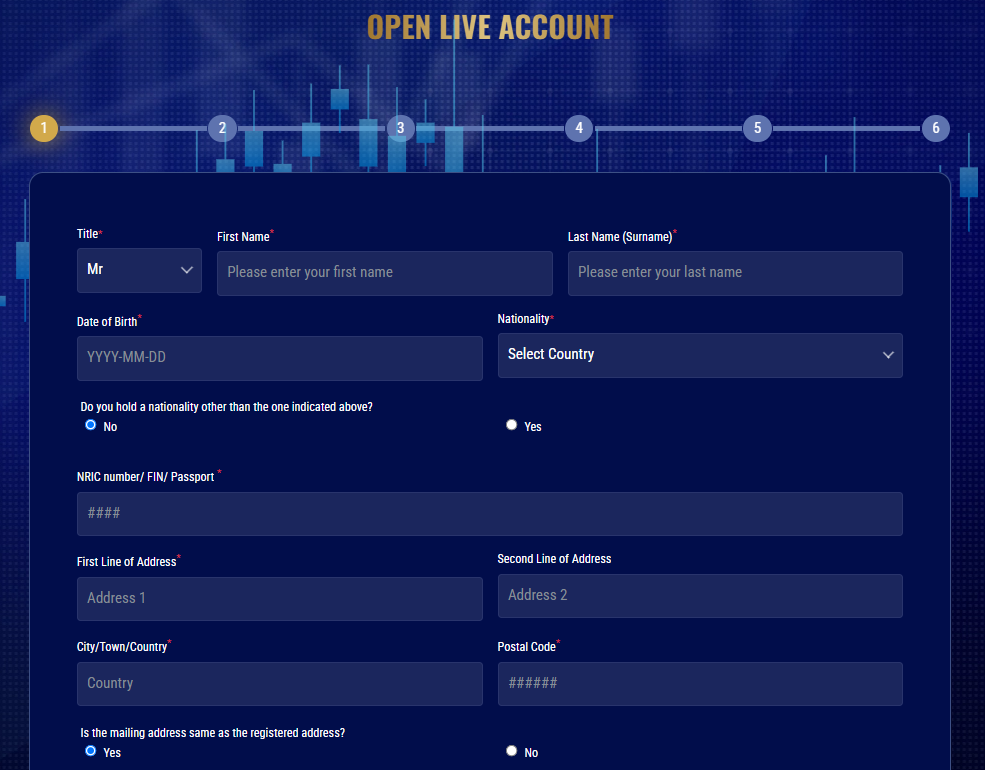

Account Opening

Score – 4.3/5

How to Open MEX Exchange Demo Account?

Opening a demo account with MEX Exchange is a simple process that allows you to practice trading without risking real money. Follow these steps to get started:

- Go to the official MEX Exchange website.

- Click on the “Open Demo Account” option and fill in your details.

- Select the type of demo account you wish to open.

- Set your preferred platform and leverage options.

- Submit the registration form, and you will receive your demo account login credentials via email.

- If you haven’t already, download the platform to begin trading.

With a demo account, you can test strategies, explore MEX Exchange’s features, and gain more experience before committing to real funds.

How to Open MEX Exchange Live Account?

To open a live account with MEX Exchange, simply visit the official website and click on the “Open Live Account” option. You will be prompted to complete a registration form with your details, including your name, email address, phone number, and residential information.

After submitting the form, you will be asked to choose the type of account you wish to open, such as Standard, Pro, or ECN, and select your preferred platform. You will also need to provide the required documents for verification, such as proof of identity and address. Once your documents are verified, you can fund your account with the minimum deposit and start trading with real money.

Additional Tools and Features

Score – 4.6/5

In addition to the research tools available on the platforms, MEX Exchange offers several features designed to enhance the trading experience.

- Traders can benefit from Signals for timely market insights and recommendations.

- The broker also provides customized risk management tools, such as stop-loss and take-profit orders, to help manage positions effectively.

- For those looking for automation, MEX Exchange supports Expert Advisors, which allow traders to automate their strategies based on specific conditions.

- Furthermore, the broker offers MAM and PAMM accounts, catering to money managers and experienced traders who wish to manage multiple client funds efficiently.

- One-Click Trading is another feature that facilitates quicker execution of trades, enhancing trading efficiency. These tools, combined with MEX Exchange’s advanced platforms, provide traders with a wide range of resources to optimize their strategies.

MEX Exchange Compared to Other Brokers

MEX Exchange stands out among its competitors by offering a well-rounded experience with both spread-based and commission-based accounts, catering to different trading preferences. While some brokers provide tighter spreads, the broker maintains competitive pricing with low costs.

Unlike certain brokers that focus on proprietary platforms, MEX Exchange supports MT4 and MT5, ensuring access to widely used tools and automated strategies. In terms of asset variety, it provides a diverse selection of instruments, though some competitors offer a broader range. The broker also maintains strong regulatory oversight under multiple authorities, ensuring a secure environment.

While its educational resources are solid, some competitors provide more extensive learning materials. With a low minimum deposit requirement, MEX Exchange remains an accessible choice for traders at all levels.

| Parameter |

MEX Exchange |

KAB |

Saxo Bank |

City Index |

Swissquote |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1.5 pips |

Average 0.1 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

0.0 pips + $3.5 |

For Share CFDs (Commission of 0.10%) |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + €2.50 |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5 |

MT5 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT4, MT5, Swiss DOTS, TradingView |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

20,000+ instruments |

300+

instruments |

71,000+ instruments |

13,500+ instruments |

400+ Forex and CFDs instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

ASIC, CySEC, MAS |

KCCI |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Limited |

Excellent |

Excellent |

Excellent |

Good |

Good |

| Minimum Deposit |

$50 |

$100 |

$0 |

$0 |

$1,000 |

$0 |

$0 |

Full Review of Broker MEX Exchange

MEX Exchange is a regulated broker offering Forex and CFD trading across multiple asset classes. Traders can choose between Standard, Pro, and ECN accounts, each designed to meet different needs. The broker provides access to MetaTrader 4 and MetaTrader 5 on web, desktop, and mobile, ensuring a seamless experience.

Additional tools like MAM/PAMM accounts, VPS hosting, FIX API, and social trading enhance the experience. Educational resources include courses and eBooks, while research tools such as the economic calendar and market analysis help traders stay informed.

With 24/7 customer support and a low minimum deposit of $50, MEX Exchange is accessible to both beginners and experienced traders.

Share this article [addtoany url="https://55brokers.com/mex-exchange-review/" title="MEX Exchange"]

Scam broker that they didn’t make client withdrawl in the whole chinese market at the past 2 months. It’s the 2nd time they did this. And now they’re moving on to middle east to continue their scam. stay away from this broker.

How am I going to make profit without a deposit?

goodday

do you offer market execution and high execution speed?

Interested

I looking for market execution type, high execution speed 0,5 second, account type std

How do I trade without a deposit ? Pls shed more light on the issue of zero account. Thanks