- What is KGI Securities?

- KGI Securities Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

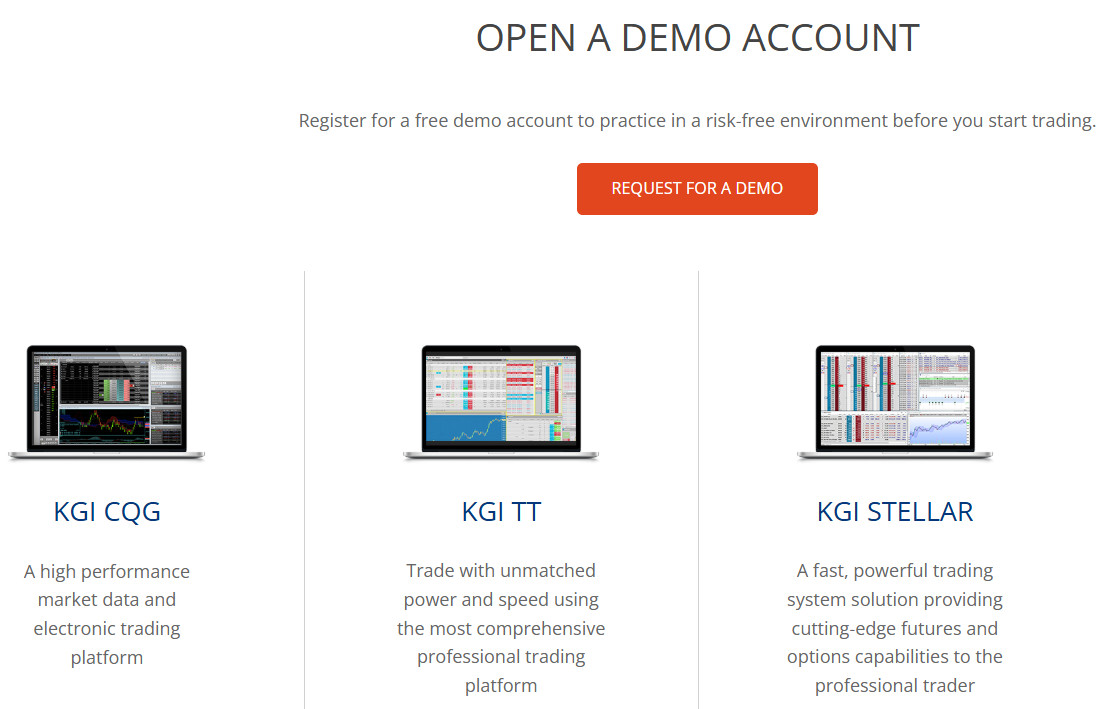

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- KGI Securities Compared to Other Brokers

- Full Review of Broker KGI Securities

Overall Rating 4.4

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.5 / 5 |

What is KGI Securities?

KGI Securities is a Taiwan-based investment firm, offering a wide range of securities, brokerage, investment, and financial solutions to retail and institutional clients.

Founded in 1988, the firm has expanded internationally, with offices in Hong Kong, Singapore, Indonesia, and Thailand. The company provides trading services for equities, derivatives, futures, and foreign securities, supported by advanced platforms for desktop, web, and mobile access.

KGI also offers margin trading and leveraged investment options, enabling clients to optimize their capital and strategies. As a regulated firm under the Financial Supervisory Commission in Taiwan, KGI Securities emphasizes transparency, compliance, and professional client service, while maintaining a strong presence in Asia’s financial markets.

Is KGI Securities Stock Broker?

Yes, KGI Securities is a stock broker that provides securities trading services to investors. The firm offers access to domestic and international stock markets, supporting equity, derivatives, and futures through advanced online and mobile platforms.

As a regulated broker in Taiwan, KGI Securities facilitates investment, margin trading, and other brokerage services while ensuring compliance and professional client support.

KGI Securities Pros and Cons

KGI Securities provides several advantages, including a strong presence in Taiwan, Hong Kong, and Singapore, access to a wide range of domestic and international securities, and sophisticated platforms that support desktop, web, and mobile trading.

The broker also offers research reports, market analysis, and multi-asset trading options, helping clients make informed investment decisions.

For the Cons, the minimum deposit requirement is relatively high, which may limit accessibility for beginner investors. Also, there is a lack of comprehensive educational materials, and some fee structures or conditions are not fully transparent

Overall, KGI is well-suited for investors seeking a reputable and technologically capable Asian broker, though newcomers may face some challenges.

| Advantages | Disadvantages |

|---|

| Secure investing environment | Conditions and offering vary depending on the entity and regulations |

| Strong presence in Asian markets | Minimum deposit is high for some entities |

| Advanced trading platforms | Limited educational materials |

| Global market access | No 24/7 customer support |

| Stock trading and Investment solutions | |

| Long history of operation | |

| Proprietary software and API solutions | |

| Might be more suitable for trading professionals and traders of bigger size | |

KGI Securities Features

KGI Securities offers a wide range of investment and trading services to both retail and institutional clients. With a strong presence in Taiwan, Hong Kong, and Singapore, the firm provides access to domestic and international markets, advanced platforms, and multi-asset products. Here is a detailed overview of its main features:

KGI Securities Features in 10 Points

| 🏢 Regulation | FSC, MAS, SFO |

| 🗺️ Account Types | Individual, Joint, Corporate Accounts |

| 🖥 Trading Platforms | KGI e-World Trading website, KGI e-Strategy App, KGI e-Agent App, MT5 |

| 📉 Trading Instruments | Stocks, ETFs, Options, Futures, Mutual Funds, Warrants, Bonds, and more |

| 💳 Minimum Deposit | $10,000 |

| 💰 Average Stock Commission | NT$20 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | TWD, USD, HKD, JPY, CNY |

| 📚 Trading Education | Investor Education, Events, Market News, Insights |

| ☎ Customer Support | 24/5 |

Who is KGI Securities For?

KGI Securities is designed for a wide range of investors, from individual retail traders to professional and institutional clients. It is suitable for those seeking access to both domestic and international markets, advanced platforms, and a variety of financial products. The firm also caters to investors who value research insights, multi-asset trading options, and professional support. According to our findings, KGI Securities is best suited for:

- Investing

- Asian traders

- Direct Market Access

- Real Stock Trading

- Competitive conditions

- Options trading

- Advanced traders

- Retail investors

- Real Futures trading

- Professional trading

- Long-term investors

KGI Securities Summary

In summary, KGI Securities is a leading brokerage firm in Asia, with a strong presence in Taiwan, Hong Kong, and Singapore. Established in 1988, the company provides a wide range of investment services, including stocks, ETFs, bonds, futures, options, and other multi-asset products.

It offers advanced platforms for desktop, web, and mobile, along with research insights and market analysis to support informed decision-making.

KGI Securities caters to retail investors, professional traders, and institutional clients, combining technological solutions, regulatory compliance, and professional support to deliver a comprehensive and reliable trading experience.

55Brokers Professional Insights

KGI Securities stands out as a leading brokerage in Asia due to its strong regional presence, technological innovation, and comprehensive product offerings.

The firm provides investors with access to domestic and international markets, including equities, ETFs, derivatives, bonds, and multi-asset products, allowing for diversified strategies. Its advanced platforms, available on desktop, web, and mobile, offer real-time data, charting tools, and seamless execution, catering to both active traders and institutional clients.

KGI also delivers professional research, market analysis, and investment insights, helping clients make informed decisions in volatile markets. The broker’s regulatory compliance across Taiwan, Hong Kong, and Singapore, combined with reliable customer support, ensures a secure and trustworthy environment. These factors collectively make KGI Securities a standout choice for investors seeking a well-regulated and technology-driven brokerage solution.

Consider Trading with KGI Securities If:

| KGI Securities is an excellent Broker for: | - Need a well-regulated broker.

- Suitable for professional traders and investors.

- Stock Trading and Investment.

- Looking for Reputable Firm.

- Asian investors.

- Offering popular financial products.

- Providing diverse trading tools, and trading strategies.

- Access to robust proprietary trading platforms.

- Looking for broker with a long history of operation.

- Providing global market access.

- Secure trading environment.

- Competitive trading conditions.

- Options Trading.

- Advanced trading technology.

- Diversified portfolio managers.

|

Avoid Trading with KGI Securities If:

| KGI Securities might not be the best for: | - Clients seeking 24/7 support.

- Investors with small capital.

- Beginner investors.

- Users needing fully global access. |

Regulation and Security Measures

Score – 4.5/5

KGI Securities Regulatory Overview

KGI Securities is a well-regulated brokerage firm, ensuring compliance with financial authorities across its key markets in Asia. In Taiwan, it is authorized and overseen by the Financial Supervisory Commission (FSC), guaranteeing adherence to local securities and investment regulations.

In Singapore, KGI Securities operates under the license of the Monetary Authority of Singapore (MAS), providing a secure and compliant environment for trading stocks, derivatives, and other financial products.

Meanwhile, its Hong Kong operations are regulated by the Securities and Futures Commission (SFC), ensuring that clients benefit from strict regulatory oversight, transparency, and protection.

How Safe is Trading with KGI Securities?

Trading with KGI Securities is generally considered safe due to its strong regulatory oversight and established presence in Asia. The firm implements robust security measures on its platforms and adheres to transparent operational practices, giving clients confidence that their funds and personal information are well-protected.

Consistency and Clarity

KGI Securities has built a solid reputation in the financial industry over decades of operation, earning trust from investors across Asia. The broker consistently receives positive scores for its reliable platforms, professional research, and broad market access, while reviews from traders often highlight its strengths in execution speed, multi-asset offerings, and regional expertise.

At the same time, some users note drawbacks such as higher minimum deposits, limited educational resources for beginners, and occasional lack of full fee transparency. Beyond its operational performance, KGI Securities has been recognized with industry awards and actively participates in social initiatives, including sponsorships and community engagement events, reflecting its commitment to corporate responsibility and presence in society.

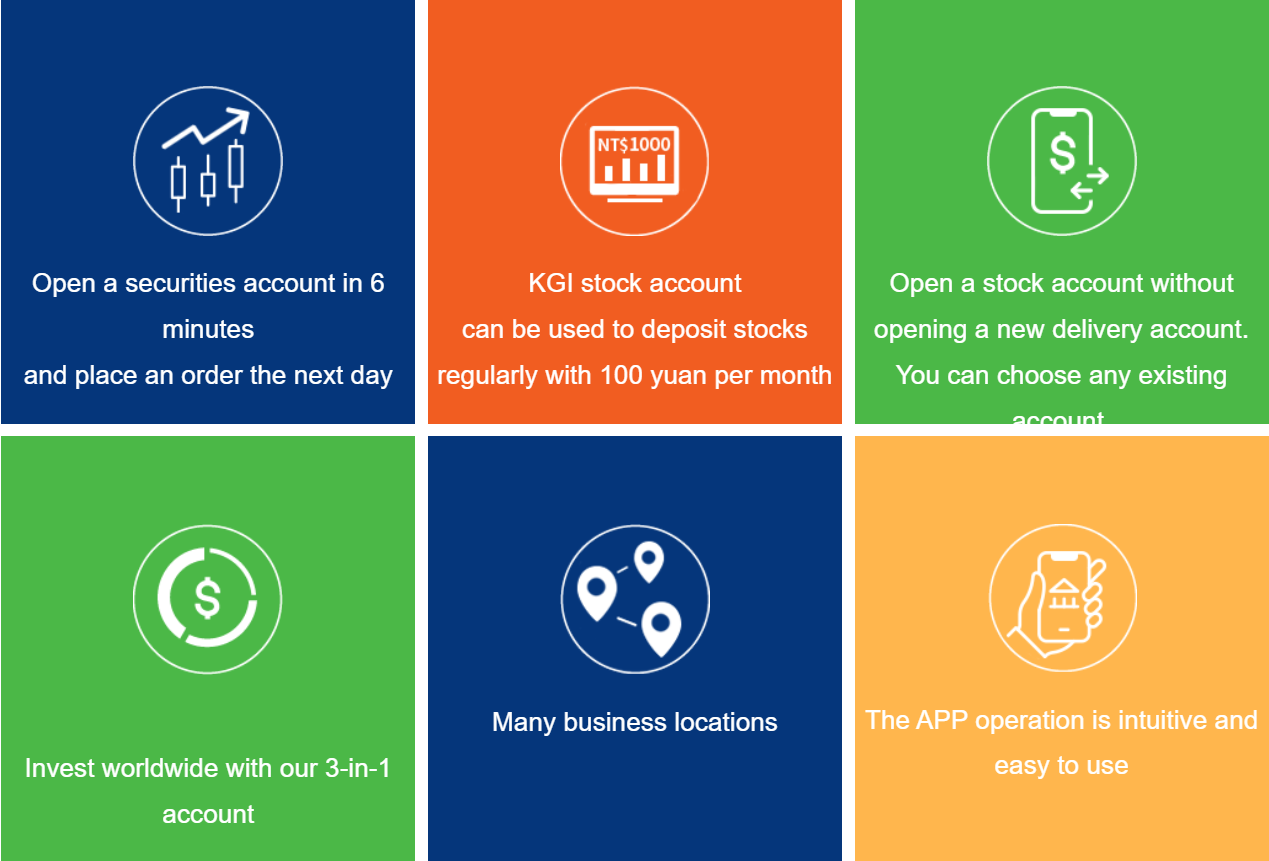

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with KGI Securities?

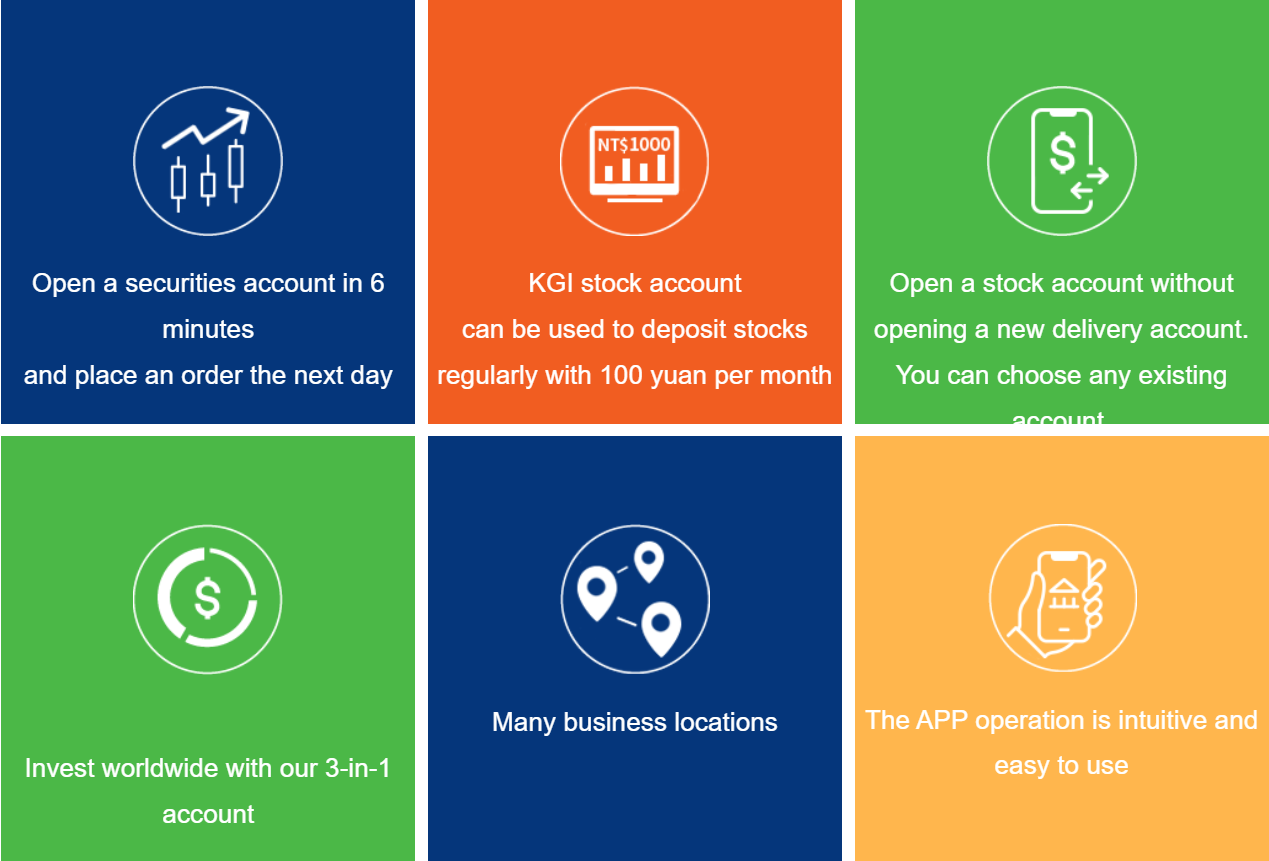

KGI Securities offers a variety of account types to meet the diverse needs of its clients. For individual investors, it provides individual accounts that allow full access to domestic and international markets.

Joint accounts are available for two or more investors who wish to manage investments collectively, while corporate accounts cater to businesses and institutional clients looking for multi-asset financial solutions.

In addition, the firm offers demo accounts for clients who want to practice trading or familiarize themselves with the broker’s platforms without risking real funds.

Individual Account

An individual account allows investors to trade a wide range of domestic and international securities, including stocks, ETFs, bonds, and derivatives.

For the Singapore entity, the account typically requires a minimum deposit of $10,000 to start trading. Account holders gain access to advanced platforms, real-time market data, and professional research reports, enabling informed investment decisions.

This account type is ideal for retail investors who want full control over their personal trading activities while benefiting from the security and regulatory oversight provided by KGI Securities.

Regions Where KGI Securities is Restricted

While KGI Securities serves clients across many countries, certain regions have restrictions due to local regulations or international compliance requirements, including:

- USA

- North Korea

- Iran

- Syria, etc.

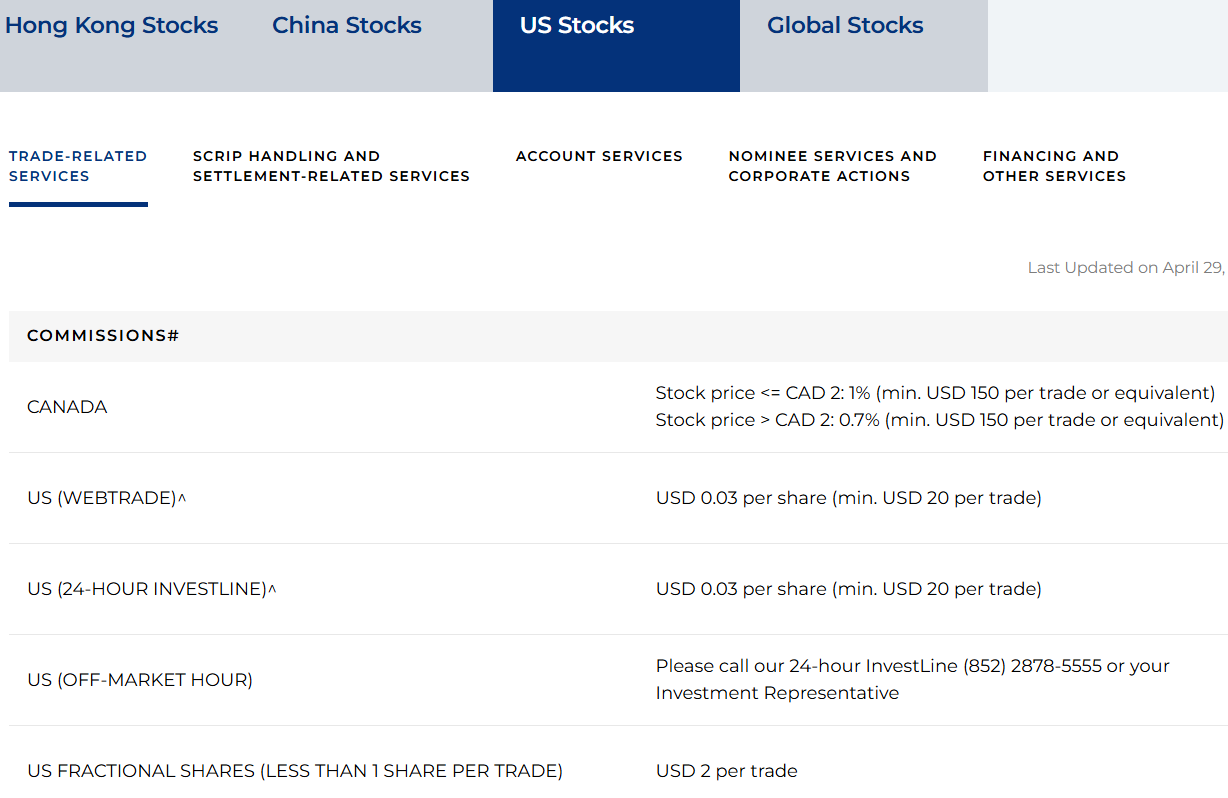

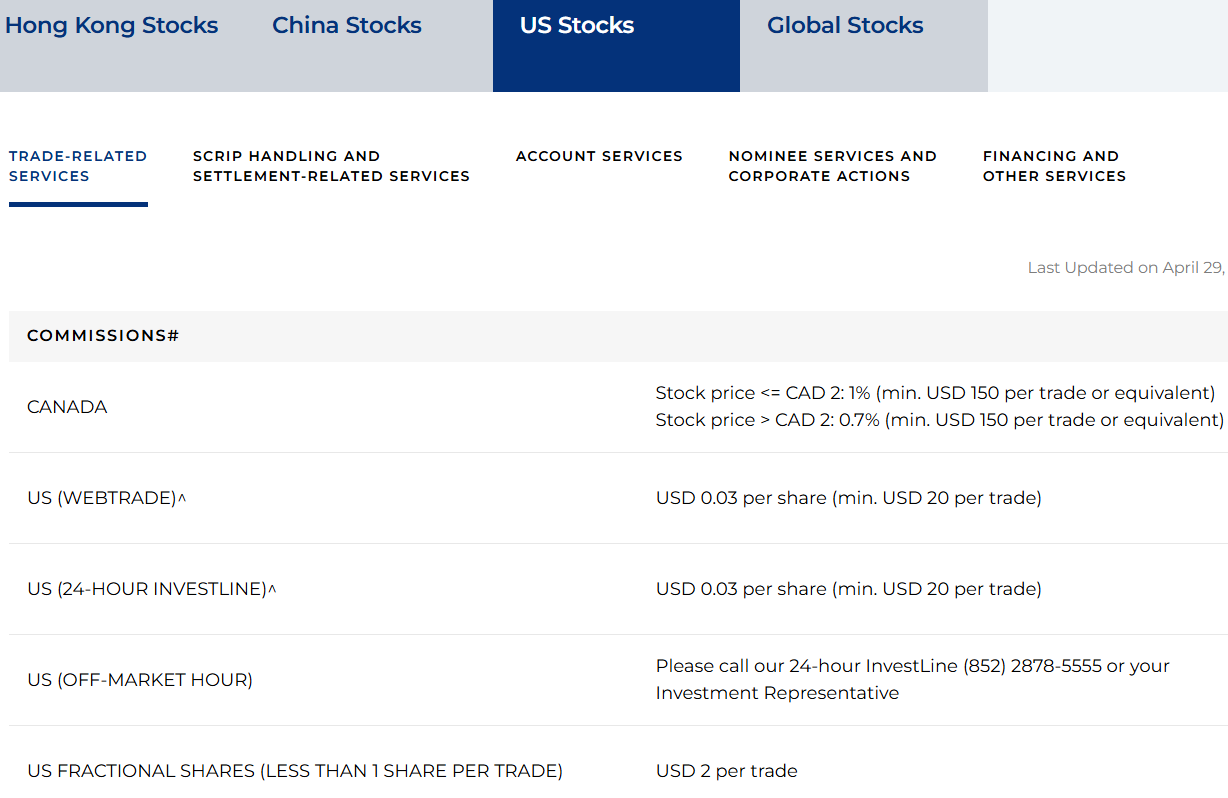

Cost Structure and Fees

Score – 4.5/5

KGI Securities Brokerage Fees

KGI Securities charges brokerage fees that vary depending on the market, account type, and product. For stock trading, commissions are typically calculated as a percentage of the transaction amount, with minimum fees applied per trade.

Fees may differ across regions, and can be subject to promotional discounts or negotiated rates for high-volume traders. In addition to standard commissions, clients may also incur taxes, exchange fees, and other transaction-related charges. Overall, KGI Securities’ fee structure is competitive for investors seeking access to multiple markets and a variety of financial products.

- KGI Securities Commissions

KGI Securities charges commissions based on the value of each trade, typically expressed as a percentage of the transaction amount. For stock trading in Taiwan, the average stock commission is NT$20, which serves as the minimum fee per trade.

Rates may vary depending on the market, financial product, and whether orders are executed online or via a broker-assisted service. Certain accounts or higher trading volumes may qualify for discounted commission rates, making the structure flexible for both retail and professional investors.

- KGI Securities Exchange Fee

In addition to commissions, trading through KGI Securities incurs exchange and regulatory fees that vary depending on the market and product type.

These fees are charged by the stock exchanges and regulatory authorities to cover transaction processing, market oversight, and compliance costs. For example, trades executed on the Taiwan Stock Exchange are subject to a securities transaction tax, while other markets like Hong Kong or Singapore may have their own exchange fees.

These charges are separate from brokerage commissions and are applied automatically to each trade, ensuring compliance with local regulations and maintaining orderly market operations.

- KGI Securities Rollover / Swaps

When trading leveraged products such as futures or contracts for difference (CFDs), KGI Securities applies rollover or swap fees for positions held overnight. These fees reflect the cost of carrying a position beyond the trading day and may be positive or negative depending on the interest rate differentials of the underlying assets.

Rollover rates can vary by instrument and market conditions, and details are usually provided directly on the platform or by request from the broker.

How Competitive Are KGI Securities Fees?

KGI Securities’ fees are generally competitive within the Asian financial market. The broker provides flexible pricing structures that can accommodate all levels of clients, with opportunities for negotiated rates for high-volume traders.

While some investors may find certain charges higher than discount brokers, the overall value is reinforced by KGI’s regulatory security, advanced platforms, and comprehensive market coverage, which together justify the fee structure for many active traders and long-term investors.

| Asset/ Pair | KGI Securities Commission | Cobra Trading Commission | BiG Commission |

|---|

| Stocks Fees | NT$20 | From $0.0015 | From €6 |

| Fractional Shares | Yes | - | - |

| Options Fees | From $20 | $0.30 | From $0 |

| ETFs Fees | From $25 | From $0.0015 | From €6 |

| Free Stocks | No | No | No |

KGI Securities Additional Fees

Beyond standard commissions and exchange charges, KGI Securities applies additional fees depending on the type of service or account activity. These include account maintenance fees, custody fees for holding certain securities, and charges for corporate actions such as dividend processing or proxy voting.

Broker-assisted trades, research services, or access to premium market data may also incur extra costs. For international trading, currency conversion fees and cross-border settlement charges may apply. While many of these fees are common across the industry, clients should review the fee schedule carefully to understand the full cost of trading with the broker.

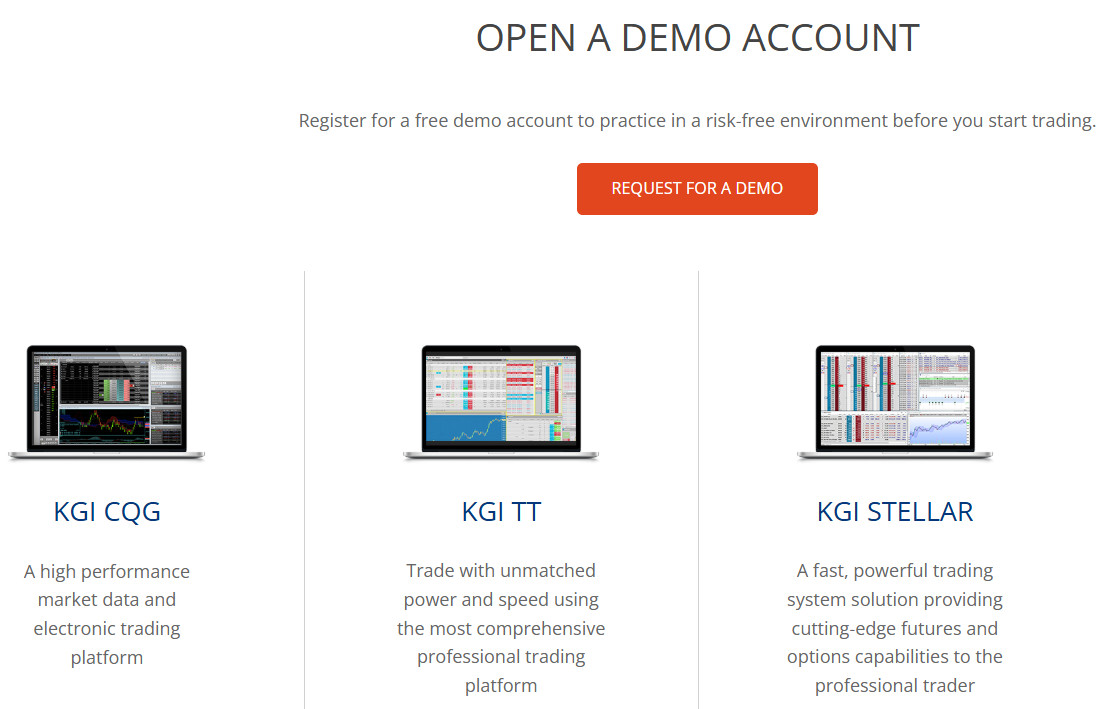

Trading Platforms and Tools

Score – 4.7/5

KGI Securities provides a diverse range of platforms and tools for different levels of investors. Its KGI e-World Trading website offers convenient browser-based access to global markets, while the KGI e-Strategy App enables mobile users to execute trades, monitor portfolios, and access market insights on the go.

For clients who prefer a more personalized approach, the KGI e-Agent App provides additional support and account management features. In addition, KGI also supports MetaTrader 5, a widely recognized platform known for advanced charting, algorithmic trading, and comprehensive market analysis, making it suitable for active traders seeking professional-grade tools.

Trading Platform Comparison to Other Brokers:

| Platforms | KGI Securities Platforms | Cobra Trading Platforms | BiG Platforms |

|---|

| MT4 | No | No | No |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

KGI Securities Web Platform

KGI Securities offers the KGI e-World Trading website, a browser-based platform that provides investors with seamless access to domestic and international markets.

The platform features real-time market data, advanced charting tools, and portfolio monitoring capabilities, allowing users to make informed decisions. It supports multiple order types and provides access to research reports, news updates, and market insights, a comprehensive solution for users who prefer trading directly from their web browser without installing additional software.

Main Insights from Testing

Testing KGI Securities’ web platform reveals a user-friendly and responsive interface that allows smooth navigation between markets and account features.

Order execution is generally fast and reliable, with minimal lag even during volatile market conditions. The platform provides a clear visualization of portfolio performance, customizable watchlists, and intuitive charting tools, helping traders analyze trends effectively.

KGI Securities Desktop MetaTrader 4 Platform

KGI Securities does not offer the MT4 platform. Traders looking to use the MetaTrader 4 platform should consider alternative brokers that support it.

KGI Securities Desktop MetaTrader 5 Platform

KGI Securities offers MetaTrader 5 as its desktop platform, catering to professional and active traders. MT5 provides advanced charting tools, technical indicators, and customizable strategies, including automated algorithmic trading.

The platform supports multiple order types, real-time market data, and risk management features, allowing traders to execute strategies efficiently across global markets. Its robust performance, combined with analytical capabilities, makes MT5 a preferred choice for those seeking a professional-grade environment.

KGI Securities MobileTrader App

KGI Securities provides mobile solutions through the KGI e-Strategy App and KGI e-Agent App, for investors who want to manage their portfolios on the go.

The e-Strategy App allows users to execute trades, track market movements, and access real-time quotes and research reports, all from a mobile device. The e-Agent App adds enhanced account management features, offering personalized support and notifications to keep investors informed.

AI Trading

KGI Securities leverages artificial intelligence to enhance its services, particularly through its e-Strategy App. This app utilizes AI and big data to assist investors in constructing personalized investment portfolios and managing risk. It offers over 160 stock allocation strategies and provides cloud-based transaction monitoring, enabling clients to make informed and confident investment decisions.

Additionally, KGI Securities has demonstrated a commitment to AI by investing in the AI Venture Fund II, L.P., with a commitment of up to US$8 million. This move underscores the company’s dedication to integrating AI technologies into its operations and services.

Trading Instruments

Score – 4.6/5

What Can You Trade on KGI Securities’s Platform?

KGI Securities provides access to a wide array of financial products, allowing investors to diversify across multiple asset classes. Clients can trade stocks, ETFs, options, futures, mutual funds, warrants, bonds, and other financial instruments.

This extensive product offering enables both retail and professional traders to implement a variety of investment strategies, manage risk effectively, and take advantage of opportunities in domestic and international markets.

Main Insights from Exploring KGI Securities’s Tradable Assets

Margin Trading at KGI Securities

KGI Securities offers margin trading for eligible clients, allowing investors to borrow funds to increase their trading capacity and potentially amplify returns.

The broker sets specific multiplier ratios and margin requirements depending on the asset class and account type. While margin trading can enhance profit opportunities, it also carries higher risk, including the possibility of losses exceeding the initial investment. KGI provides risk management tools and real-time monitoring to help clients manage their leveraged positions responsibly.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at KGI Securities

KGI Securities provides clients with a variety of deposit options to fund their accounts conveniently, including:

- Bank wire transfers

- Cheque deposits

- Internet banking

- ATM transfers

- Regional payment methods, etc.

KGI Securities Minimum Deposit

To open an individual account with KGI Securities, the minimum deposit requirement is $10,000. While the deposit threshold may be higher than that of some discount brokers, it reflects the broker’s focus on professional and serious investors seeking access to a wide range of investment opportunities.

Withdrawal Options at KGI Securities

KGI Securities offers clients multiple withdrawal options, including bank wire transfers, internet banking, and ATM transfers, depending on the account’s region and currency.

Withdrawal requests are typically processed within a few business days, pending verification and account security checks. The broker may also provide guidance on currency conversion and any applicable fees, ensuring clients can efficiently transfer their funds while maintaining compliance with local regulations.

Customer Support and Responsiveness

Score – 4.5/5

Testing KGI Securities’s Customer Support

The broker provides 24/5 customer support via phone, live chat, LINE, and email, allowing clients to choose the most convenient method.

Support representatives are generally knowledgeable about the broker’s products, platforms, and procedures, providing clear guidance and timely solutions.

Contacts KGI Securities

KGI Securities provides several ways for clients to reach its support team. Investors can contact the broker by phone at +886-2-2389-0088 for assistance with trading or account services. For written communication, clients can send inquiries via email at service1@kgi.com.

In addition, regional offices in markets like Singapore, Hong Kong, and Thailand provide localized contact numbers and support, ensuring accessibility for international clients.

Research and Education

Score – 4.6/5

Research Tools KGI Securities

KGI Securities offers a wide range of research tools across its website and platforms to support informed decision-making.

- Clients have access to real-time market data, stock screeners, technical charting tools, analyst reports, and economic calendars. The broker also provides market news updates, investment strategies, and fundamental research reports tailored to regional and global markets.

- On platforms like KGI e-World Trading, KGI e-Strategy App, and MT5, traders can use advanced charting features, indicators, portfolio analysis tools, and AI-driven insights, making it easier to evaluate market trends and build effective strategies.

Education

KGI Securities provides a variety of educational resources designed to help investors enhance their market knowledge and skills. Clients can access investor education materials, guides, and resources tailored to different experience levels.

Traders can also benefit from events that cover investment strategies and market outlooks. In addition, KGI shares market news and expert insights to keep investors informed about global and regional financial developments.

Portfolio and Investment Opportunities

Score – 4.5/5

Investment Options KGI Securities

KGI Securities provides a comprehensive suite of investment solutions to support both retail and institutional clients. Beyond access to traditional products like stocks, ETFs, bonds, and mutual funds, the firm offers portfolio management, wealth planning, and structured investment strategies tailored to client goals.

Investors can also benefit from research-driven insights, risk management tools, and customized advisory services that help optimize asset allocation and long-term financial planning. These solutions ensure that clients are not only trading but also building sustainable investment strategies aligned with their objectives.

Account Opening

Score – 4.4/5

How to Open KGI Securities Demo Account?

Opening a demo account with KGI Securities is a simple process that allows traders to practice in a risk-free environment using virtual funds. Here are the steps to get started:

- Visit the official KGI Securities website.

- Navigate to the “Open a Demo Account” section.

- Fill in the online registration form with basic details (name, email, phone, etc.).

- Set up your login credentials (username and password).

- Receive your demo account details via email or on-screen confirmation.

- Download and log in to the chosen platform with your demo credentials.

- Start practicing with virtual funds in real market conditions.

How to Open KGI Securities Live Account?

To open a live account with KGI Securities, investors need to complete an online application through the broker’s official website.

The process typically involves selecting the account type, filling out the registration form with personal and financial details, and uploading verification documents such as proof of identity and proof of address to meet regulatory requirements.

Once the application is reviewed and approved, clients can proceed with the minimum deposit funding through supported payment methods. After funding, traders gain full access to KGI Securities’ platforms and investment solutions to begin live trading.

Additional Tools and Features

Score – 4.5/5

Beyond standard research and platforms, KGI Securities offers a variety of additional tools and features to enhance the trading experience.

- These include API access for automated trading and integration with third-party software, alerts and notifications for price movements or market events, and customizable dashboards for portfolio monitoring.

- Other features include advanced order types, risk management tools, and reporting functionalities, allowing traders to tailor their strategies, improve efficiency, and stay informed in real time.

KGI Securities Compared to Other Brokers

KGI Securities positions itself as a solid brokerage option in Asia, offering a broad range of tradable assets and multiple platforms that cater to both retail and professional investors.

Compared to many international competitors, KGI stands out with its regional regulatory coverage, robust platform options, and comprehensive investment solutions.

While some global brokers may provide lower minimum deposits, wider educational resources, or 24/7 customer support, the firm focuses on providing reliable trading infrastructure, access to multiple markets, and professional-grade tools, making it well-suited for serious investors seeking security, market variety, and tailored investment strategies.

| Parameter |

KGI Securities |

BiG |

Interactive Brokers |

Cobra Trading |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Stock Commission NT$20 |

Stock Commission from €6 |

$0.85 |

Stock Commission from $0.0015 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Average |

Low/Average |

Low |

Average |

Low |

Low/Average |

Low |

| Trading Platforms |

KGI e-World Trading website, KGI e-Strategy App, KGI e-Agent App, MT5 |

PMyBOLSA, BiGlobal Trade, CFD Trading Platforms |

TWS, IBKR WebTrader, Mobile |

DAS Trader Pro, Sterling Trader Pro, TradingView |

Freetrade Platform |

Power E*TRADE Pro, Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, ETFs, Options, Futures, Mutual Funds, Warrants, Bonds |

Stocks, ETFs, ETPs, Futures, Options, Funds, CFDs, Warrants & Certificates |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds, CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

FSC, MAS, SFO |

Banco de Portugal, CMVM |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Limited |

Limited |

Excellent |

Limited |

Limited |

Excellent |

Good |

| Minimum Deposit |

$10,000 |

€1,000 |

$100 |

$30,000 |

$0 |

$0 |

$0 |

Full Review of Broker KGI Securities

KGI Securities is a well-regulated Stock trading broker offering a comprehensive range of investment solutions. Clients can access multiple asset classes, including stocks, ETFs, options, futures, mutual funds, bonds, and warrants, allowing for diversified portfolios and strategic trading. The broker provides several account types, such as individual, joint, and corporate accounts, with minimum deposit requirements varying by entity.

Investment is supported through multiple platforms, including the KGI e-World Trading website, KGI e-Strategy App, KGI e-Agent App, and MetaTrader 5, catering to both beginners and professional traders. The firm also offers additional tools like research resources, portfolio monitoring, and AI-driven insights to support informed decision-making.

Overall, KGI Securities stands out as a reliable and professional broker, providing robust infrastructure, diverse investment options, and comprehensive support services for investors at different levels.

Share this article [addtoany url="https://55brokers.com/kgi-securities-review/" title="KGI Securities"]

Hey there, I think your blog might be having browser compatibility issues. When I look at your blog site in Firefox, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, fantastic blog!