- What is 26 Degrees?

- 26 Degrees Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

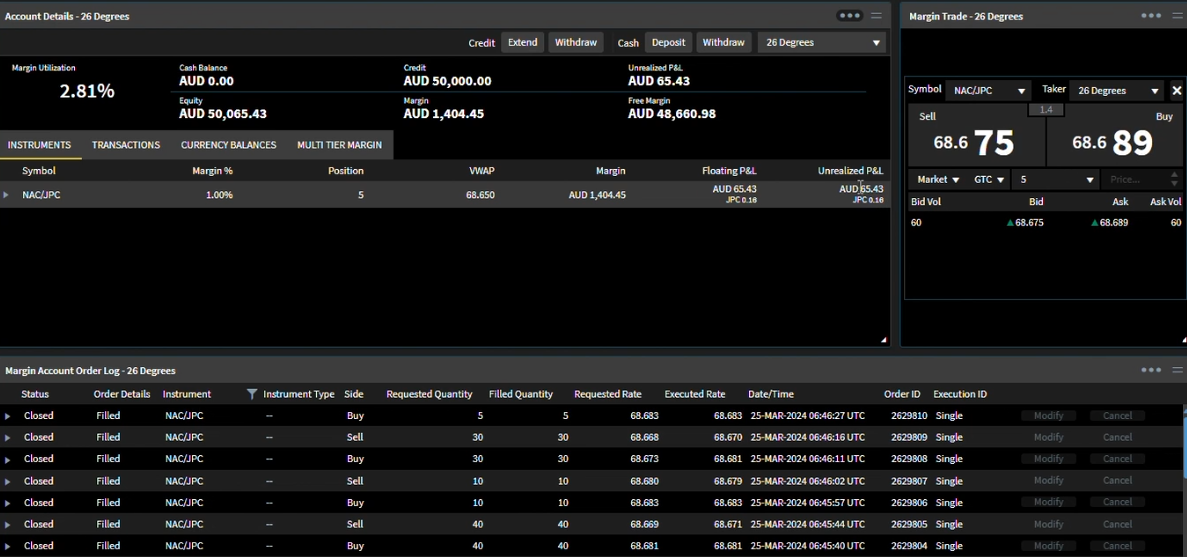

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- 26 Degrees Compared to Other Brokers

- Full Review of Broker 26 Degrees

Overall Rating 4.3

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.2 / 5 |

| Customer Support and Responsiveness | 4.3 / 5 |

| Research and Education | 4.1 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account opening | 4.4 / 5 |

| Additional Tools and Features | 3.8 / 5 |

What is 26 Degrees?

26 Degrees is a multi-asset prime service provider that serves institutional investors, hedge funds, and professional traders with access to global financial markets. The broker is an Australian fully regulated broker based in Sydney and specializes in Forex trading, also provides access to other asset classes such as Forex, equity and ETF CFDs, index and commodity CFDs, and metals CFDs.

- 26 Degrees is a new name of Invast Global, a Broker known in the industry and been reviewed by us previously too, as the parent company of Invast Global a Japanese publicly listed company with a history of operation of over 60 years as a security brokerage cooperating with numerous prime brokers.

Overall, the broker is known for providing a trustworthy trading environment and offering competitive trading services through advanced trading platforms.

26 Degrees Pros and Cons

Being an STP non-bank prime broker, 26 Degrees delivers transparent conditions and offers multi-asset trading, liquidity optimization, Algorithmic Trading, and prime services. 26 Degrees also provides access to multiple asset classes and advanced trading platforms, enabling traders to execute trades efficiently. Moreover, the broker is authorized and regulated by the top-tier ASIC, instilling a sense of trust and security.

For the cons, the broker’s fee structure and minimum deposit requirement are relatively higher compared to some other brokerage firms, which could be a disadvantage for traders with smaller capital. Additionally, the broker has limited availability of research and educational resources and also lacks 24/7 customer support, which means that assistance may not be available at all times.

| Advantages | Disadvantages |

|---|

| ASIC license and oversight | No 24/7 customer support |

| Top-tier license | Limited education and research |

| STP execution | High minimum deposit |

| Professional trading | |

| Competitive spreads | |

| Available for Australian traders | |

26 Degrees Features

26 Degrees (formerly Invast Global) is not a typical retail broker. It is a prime brokerage mostly catering to institutional clients, including hedge funds, asset managers, proprietary trading groups, and other financial institutions. This is why their overall offering is different, including account types’ structure and trading platforms. Below we have accumulated the main aspects of trading with 26 Degrees:

26 Degrees Features in 10 Points

| 🗺️ Regulation | ASIC |

| 🗺️ Account Types | For Broker-Dealers and Hedge Funds |

| 🖥 Trading Platforms | FlexTrade, TraderEvolution, FIX API, oneZero |

| 📉 Trading Instruments | Forex, Single Stock CFDs, ETFs, Equities, Futures, Commodities |

| 💳 Minimum deposit | $5,000 |

| 💰 Average EUR/USD Spread | 0.2 pips |

| 🎮 Demo Account | Not available |

| 💰 Account Base currencies | AUD, USD |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is 26 Degrees For?

Based on our financial expert opinions, 26 Degrees is a good brokerage with unique offerings that will meet different trading needs and expectations. Below we have listed the main aspects and beneficial points of the broker and what it can be good for:

- Traders from Australia

- Broker-dealers

- Liquidity Solutions

- Hedge funds

- Proprietary trading firms

- CFD and currency trading

- Equity and ETF CFDs

- Advanced traders

- Institutional trading

- Competitive spreads

- Good trading tools

26 Degrees Summary

26 Degrees is a prime brokerage firm that offers a reliable and competitive trading environment through advanced trading platforms. While its services are primarily for hedge funds and broker-dealers, the broker provides access to various asset classes, and the conditions it offers are rather competitive.

While there may be certain limitations, such as the availability of educational and research materials, overall, 26 Degrees presents a comprehensive trading solution for experienced traders and institutions, prioritizing security, technology, and competitive services. However, we advise conducting your research and evaluating whether the offerings suit your specific trading requirements.

55Brokers Professional Insights

26 Degrees, formerly Invast Global, is an Australia-based brokerage firm with tailored prime solutions for hedge funds, broker-dealers, and proprietary trading firms and is ranked excellent in its proposal. The company is dedicated to providing innovative and customer-oriented solutions as offers a wide range of services, including liquidity solutions, optimized execution, and transparency. However, if you’re a beginner trader or a regular trader, the solution might be not so suitable for you, so we advise to check our other categories of Brokers reviewed for your easyy selection.

26 Degrees is not a common broker with regular offerings. It rather focuses on providing quality prime services for the development of its clients’ businesses. 26 Degrees has established good connections with Tier 1 investment banks, enabling the clients to access global equity, foreign exchange, precious metals, index, and commodity markets. However, it is essential to remember that 26 Degrees is not a good match for retail traders.

Overall, 26 Degrees has a good reputation and tight regulatory oversight, ensuring safety and reliability while signing in with the broker.

Consider Trading with 26 Degrees If:

| 26 Degrees is an excellent Broker for: | - Tailored Prime Services

- Access to multi-asset liquidity

- Availability of the global markets

- Professional traders

- CFD and currency trading

- Hedge funds and proprietary trading firms

- Traders from Australia |

Avoid Trading with 26 Degrees If:

| 26 Degrees is not the best for: | - Retail traders

- Beginners

- Small-scale trading

- Traders looking for standard accounts based on MT4/MT5 platforms |

Regulation and Security Measures

Score – 4.5/5

26 Degrees Regulatory Overview

26 Degrees Global Markets is a registered trading name of 26 Degrees Global Markets Pty Ltd. regulated by ASIC under the license number (ABN 48 162 400 035 | AFSL 438283). The broker implements a strong concept for its trading conditions delivered by the regulatory restrictions and constant audits by the top-tier Australian ASIC. The authority provides an additional layer of assurance regarding the broker’s operations, ensuring that they adhere to the regulatory requirements.

- The company also has offices in Sydney, Cyprus, and Tokyo, serving institutional clients worldwide.

How Safe is Trading with 26 Degrees?

Being an ASIC-regulated broker, there is a sharp commitment 26 Degrees follows toward the protection of the client’s interests and the promotion of “healthy” FX service on a global scale.

Along with a strong background and reliability, ASIC deploys a necessary level of fund security and processing of the trading itself, as well as a strong liability within all services it offers.

Consistency and Clarity

Our research of the broker has revealed that 26 Degrees is regulated by a well-regarded authority and ensures complete reliability and safety. The broker previously went under the name Invast Global. Later, it evolved into 26 Degrees and provides a favorable environment for Tier 1 Prime Services.

Per our analysis, 26 Degrees is an active participant in various global exhibitions, trading industry activities, and investment innovations. It has been awarded many times for demonstrating its development and great commitment. 26 Degrees was honored with the Best FX Prime of Prime at the FX Markets Asia Awards for four consecutive years.

We have also reviewed 26 Degree’s customer feedback for reviews based on real experience. Overall, the feedback was positive; however, the number was limited. For more clarity and insight into the broker’s reliability and consistency, we recommend researching the broker and seeing how its offerings meet your trading expectations.

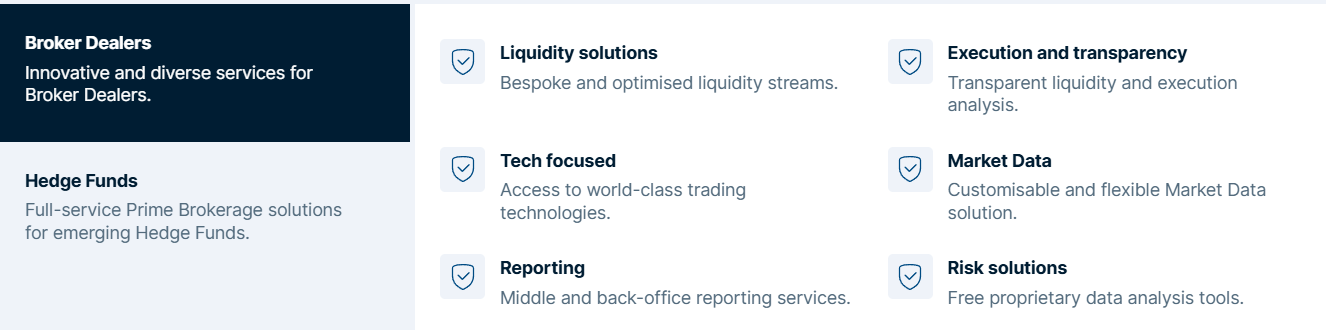

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with 26 Degrees?

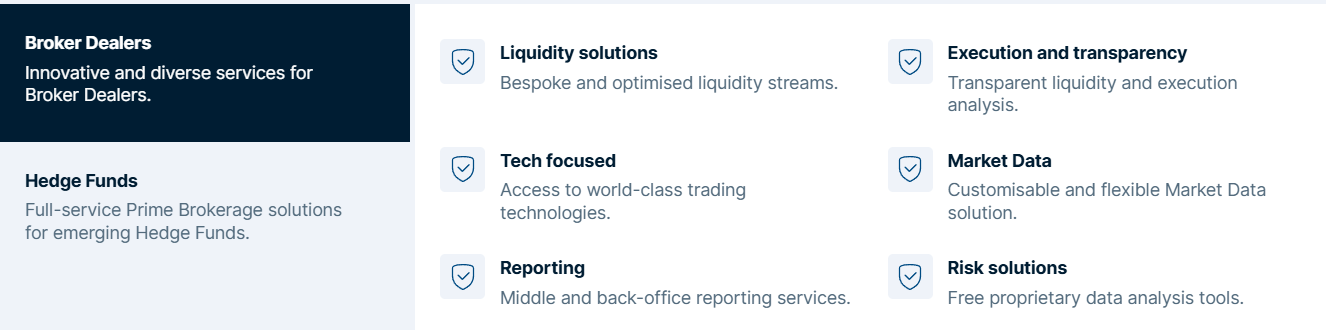

26 Degrees offering of account types differs from retail trading accounts. They do not provide standard retail conditions. Instead, 26 Degrees accounts are based on customized prime brokerage solutions that meet the needs of institutional clients, hedge funds, and family offices. Here is the main scope of activities of the broker:

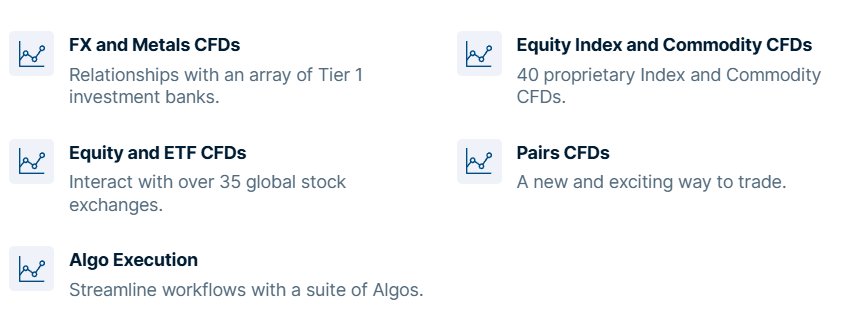

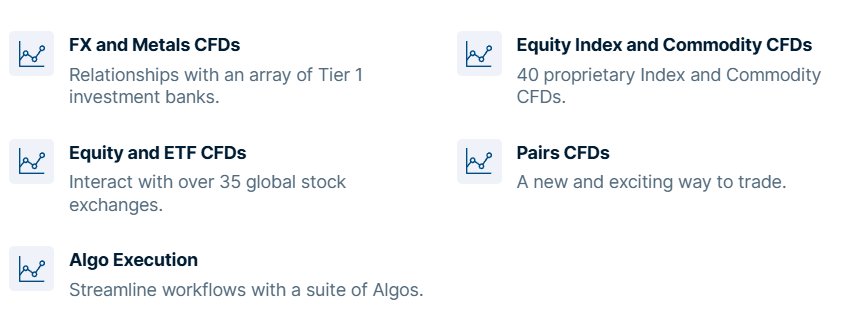

- Broker-Dealers: Full access to a broad range of asset classes, including Metals CFDs and FX, Equity Index and Commodity CFDs, Equity and ETF CFDs, Pairs CFDs, and Algo Execution services. Broker-dealers have access to over 26,000 instruments which gives them a great opportunity for diversification. Besides, clients get essential information through different liquidity tools, allowing them insights into the market. in addition, clients have access to risk management tools for data analysis

- Hedge Funds: Products and services include Equity and ETF Synthetics, Equity Algorithm Suite, Precious Metals and FX trading, Index and Commodity CFDs, and Synthetic Futures. Clients have access to the DMA Portal where all the operations are streamlined.

Regions Where 26 Degrees is Restricted

We have found that 26 Degrees offers its servers in London, New York, and Tokyo. The real-time data provided by the broker allows reliability and stability across global trading operations. 26 Degrees is not available in countries or entities where CFD distribution is not permitted.

Cost Structure and Fees

Score – 4.5/5

26 Degrees Brokerage Fees

26 Degrees is mainly focused on offering prime solutions to institutional investors. The structure and details of fees are specifically tailored for each client and are not disclosed publicly. In order to receive thorough information about the broker’s fees and commissions, clients should contact 26 Degrees directly.

- However, we have found that 26 Degrees offers liquidity solutions with both fixed and variable spreads for a large selection of assets. Per our test, the broker mainstays on raw variable spread offering, with an average spread of 0.2 pips. Yet, spreads can differ based on different factors. To obtain detailed information regarding spreads, we recommend visiting the broker’s official website or getting in touch with their customer support.

How Competitive Are 26 Degrees Fees?

Based on our research, 26 Degrees offers highly competitive fees, tailored specifically for each client. Their pricing model is designed for institutional clients so that they can get maximum cost efficiency based mainly on trading volume and strategies employed. Although real commission fees and spreads remain undisclosed, clients are guaranteed tailor-made fee structures according to their liquidity needs.

| Asset/ Pair | Invast Global Spread | Fortrade Spread | JustMarkets Spread |

|---|

| EUR USD Spread | 0.2 pips | 2 pips | 0.6 pips |

| Crude Oil WTI Spread | 0.2 pips | 0.04$ | 4 cents |

| Gold Spread | 0.2 pips | 0.45$ | 0.16 |

26 Degrees Additional Fees

As 26 Degrees offerings have a customized nature, specific details regarding additional costs, including platform fees, inactivity fees, or other charges, are not disclosed. These costs are different based on the client, the trading volumes, and expectations.

Score – 4.4/5

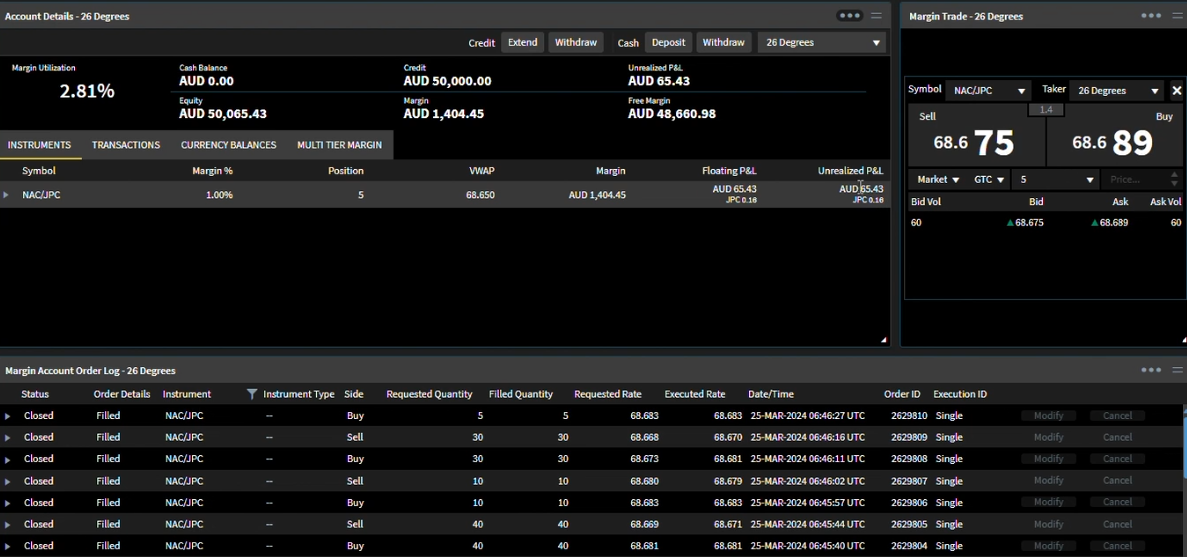

26 Degrees Global Markets offers institutional clients high-performance and dynamic trading infrastructure such as OneZero, PrimeXM, FX-Cubic, Centroid, Bloomberg, and Iress. This kind of connectivity ensures around-the-clock execution and enhanced risk management. 26 Degrees also offers FIX API connectivity where clients can integrate proprietary trading systems for straight-through access to markets. With trading platforms cross-connection to tier-one liquidity providers and based in LD4, NY4, and TY3 data centers, the broker enables low-latency pricing and high-speed execution across FX, metals, and other asset classes.

- Each trading platform has unique specifications that make it suitable for specific strategies or purposes. For instance, Iress is tailored for sophisticated traders, offering advanced features and capabilities. On the other hand, Bloomberg is a multi-asset software that seamlessly integrates order routing across a vast network of over 1,300 brokers and provides access to more than 6,000 DMA (Direct Market Access) programs or destinations.

| Platforms | Invast Global Platforms | Fortrade Platforms | Plus500 Platforms |

|---|

| MT4 | No | Yes | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

26 Degrees Desktop MetaTrader 4 Platform

26 Degrees Global Markets offers institutional clients access to a variety of trading platforms. The main offerings include FIX API connectivity. The broker does not offer MetaTrader 4 or MetaTrader 5 platforms, which are more suitable for retail traders.

26 Degrees MobileTrader App

26 Degrees is concentrated on providing advanced services to professional traders, hedge funds, and broker-dealers. That is why the broker offers more sophisticated platforms. There is no mention of an available mobile app on the broker’s official website. Thus, all platform-connected questions should be directed to the support team for more specified answers.

Main Insights from Testing

Based on our research, 26 Degrees does not provide the market-popular MT4/MT5 platforms to conduct trades. Its offerings include more sophisticated platforms, including OneZero, PrimeXM, FX-Cubic, Centroid, Bloomberg, and Iress. These platforms offer advanced liquidity, risk management, and direct market access.

Trading Instruments

Score – 4.5/5

What Can You Trade on the 26 Degrees Platform?

The instrument offering of 26 Degrees is directed to Broker-Dealers and Hedge funds, here we highlight some of the differences so not to confuse the offering:

- For broker-dealers, 26 Degrees offers FX and Metals CFDs, equity, and ETF CFDs, with access to over 35 global stock exchanges, access to over 40 index and commodity CFDs, and pairs CFDs. 26 Degrees has an innovative offering that will be available from April, enabling 16 continuous hours per trading day with access to the US equity markets for your clients, including pre- and post-market sessions.

- For hedge funds, 26 Degrees offers equity and ETF synthetics, with direct market access to 39 stock exchanges, FX, and precious metals with world-class liquidity, synthetic futures, including 17 global exchanges, an equity algorithm suite, and index and commodities with transparent pricing.

Main Insights from Exploring 26 Degrees Tradable Assets

26 Degrees offers a selection of popular markets for traders to engage in, including Forex, DMA CFDs (Single Stock and ETFs), Equities, Futures, Commodities, and more. With its over 26,000 available trading products, the broker enables its clients to diversify their portfolios and participate in various markets according to their preferences, overall ranked like very good offering compared to the industry competitors.

Additionally, 26 Degrees provides institutional-grade liquidity solutions and assures competitive pricing and ultra-fast trade execution, so is well suited for various traders needs and size of investors.

Leverage Options at 26 Degrees

While leverage can be advantageous, allowing traders to enter the market with a smaller initial investment, you should be aware of the potential risks associated with it. By comprehensively understanding the concept of leverage, you can make informed decisions and effectively manage the risks involved in engaging in leveraged trading.

I26 Degrees leverage is offered according to the ASIC regulation:

- The Australian clients that hold ASIC-regulated 26 Degrees accounts are entitled to up to 1:30.

- As 26 Degrees primarily serves institutional clients, such as broker-dealers and hedge funds, leverage levels are likely to be adjusted based on the individual needs of clients.

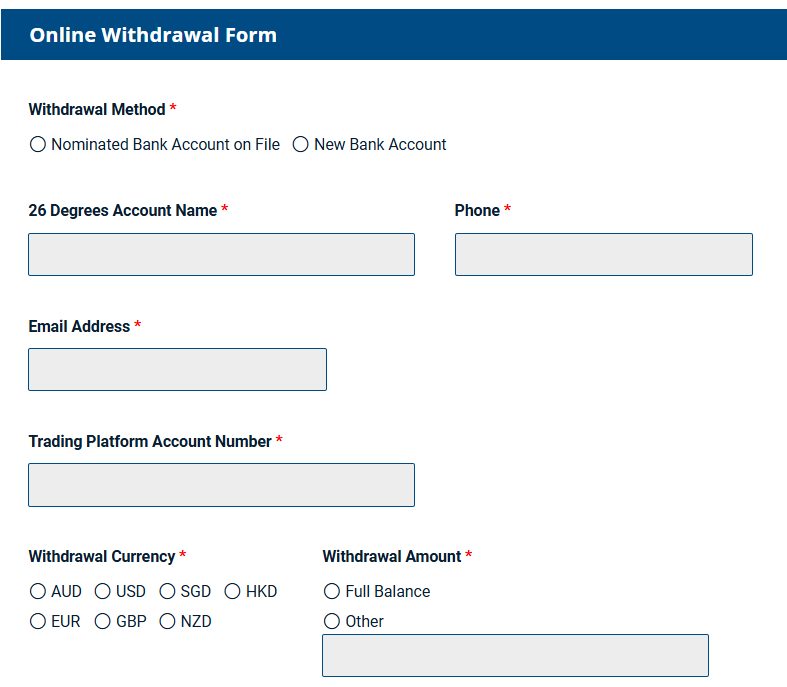

Deposit and Withdrawal Options

Score – 4.2/5

Deposit Options at 26 Degrees

When depositing funds into the account, you may choose between a range of base currencies so the fund transaction will be a smooth process. However, 26 Degrees operates only bank transfers due to obligatory restrictions, yet Bank Wire is the best option after all for both deposits and withdrawals.

- 26 Degrees does not accept debit/credit card, or PayPal payments.

- To verify the source of funds, clients might be asked to submit a copy of a bank statement or wire receipt with the name and account of the customer.

Minimum Deposit

26 Degrees minimum deposit is $5,000, which is considered rather high within the industry. Yet, considering its professional environment and highly developed proposal, it is dedicated to institutional clients. However, the starting amount can vary from proposal to proposal. The exact initial deposit amount can be clarified only by contacting the broker and stating your trading needs.

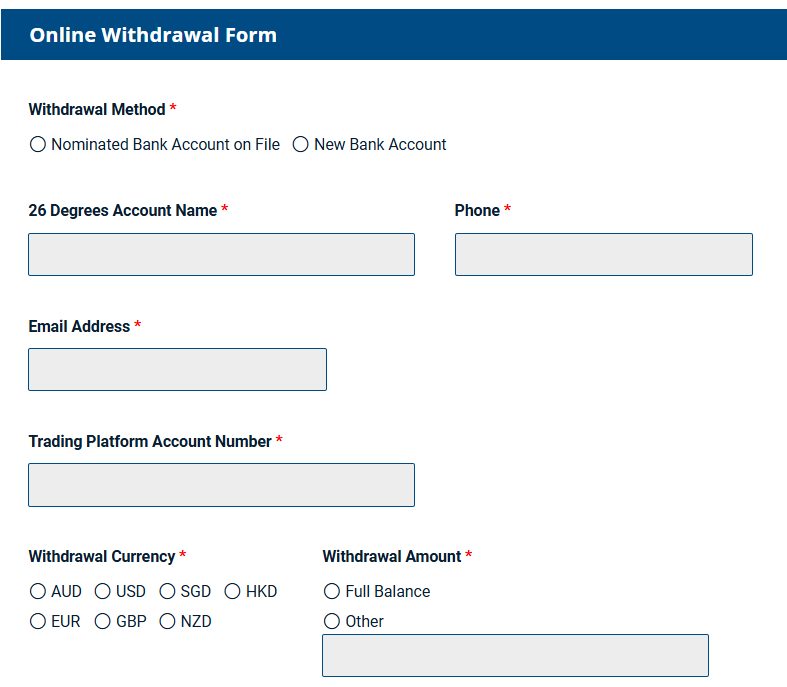

Withdrawal Options at 26 Degrees

To make a withdrawal, clients need to fill out the online withdrawal form available on the broker’s website.

- If the 26 Degrees Withdrawal Request Form is completed in respect of a joint/corporate/trust or corporate trust account, the broker will also require email confirmation from all additional account holders.

- 26 Degrees makes payment in the name of the account holder only.

- In case all the account balance is withdrawn, 26 Degrees will still enable the users to access their accounts for another 12 months. After that, the account will be closed.

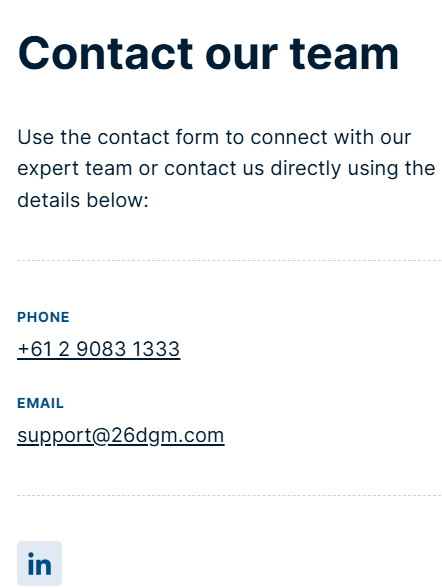

Customer Support and Responsiveness

Score – 4.3/5

Testing 26 Degrees Customer Support

The 26 Degrees has a dedicated customer team that supports its clients through multiple channels. The broker enables its clients to start a conversation through an online form or to direct their questions by using an email or the provided phone number.

- 26 Degrees also has a LinkedIn page, where they post the latest updates on the company and market.

Contacts 26 Degrees

We found that 26 Degrees delivers prompt and dedicated customer support.

- The main way to connect with the broker is to start a conversation. For that, clients should complete the provided form and indicate the issue they want to solve. The ‘Start conversation’ button is also how clients register with the broker.

- The broker also provides an email address (support@26dgm.com) for directing different questions and issues.

- Clients can also use the provided phone number (+61 2 9083 1333) to communicate with the 26 Degrees customer team directly.

Research and Education

Score – 4.1/5

Research Tools 26 Degrees

Based on our research, 26 Degrees offers a useful set of research tools to assist clients in decision-making. Here are the main offerings of the broker:

- The proprietary data analysis provides clients with a comprehensive analysis of crucial aspects, such as market impact, volume, exposure, important insights, etc.

- 26 Degrees provides insights into pre-trade and post-trade activities to assist in deep analysis and optimizing trading strategies.

Education

26 Degrees Global Markets is intended for institutional clients. As its clients are not beginner traders but hedge funds and broker-dealers, 26 Degrees concentrates on providing innovative solutions rather than educational materials. So if you in need of particularly Trading Academy, better opt for another Broker and check the Trading Academy Brokers we reviewed.

Is 26 Degrees a Good Broker for Beginners?

We have conducted thorough research on the broker’s offerings and have come to the following conclusion: 26 Degrees is focused on providing advanced services to institutional clients. Its services, solutions, and platforms are intended for those who are at ease using sophisticated platforms and advanced strategies. Besides, the minimum deposit is very high and is not affordable for traders who want to start small.

Beginner traders should seek a broker with intuitive platforms, clear account offerings, low minimum deposit requirements, demo account availability, and good educational resources.

Portfolio and Investment Opportunities

Score – 3.8 /5

Investment Options 26 Degrees

We have reviewed all the offerings by 26 Degrees and concluded that its available instruments are based on CFDs. The company does not allow direct access to real stock or stock fractions. This can be a limiting factor for clients who are interested in traditional investments. With 26 Degrees, clients can only speculate on price changes.

- We have also considered if the company offers MAM or PAMM accounts. The research showed that these types of accounts are also unavailable with 26 Degrees.

- 26 Degrees does not offer copy trading either, as it is more suitable for beginner or intermediate traders to copy trades of more professional traders, whereas 26 Degrees’ offerings are tailored for institutional clients.

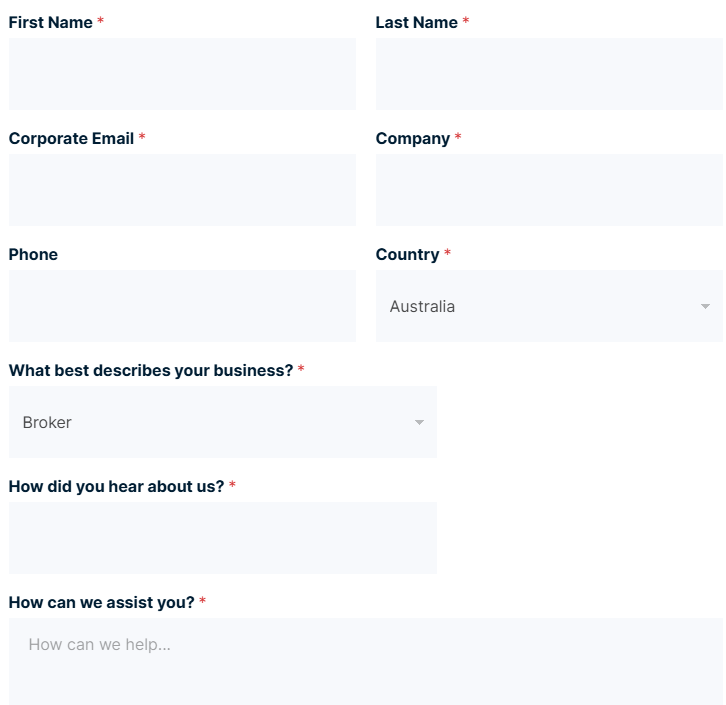

Account Opening

Score – 4.4/5

How to Open a 26 Degrees Live Account?

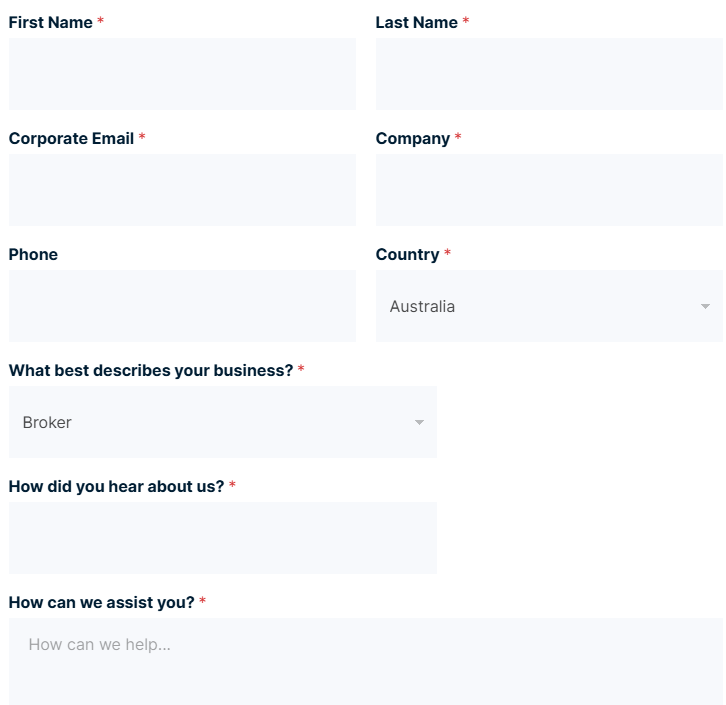

We have revealed that 26 Degrees does not offer demo accounts. Demo accounts are intended for individual retail traders, while the company’s services are directed at institutional clients. Below you can only find how to open a live account with 26 Degrees. The process differs from the standard steps clients take while opening an account with retail brokers:

Here are the main steps for a live account opening:

- Visit the official website.

- Click on the ‘Start Conversation’ button.

- Fill out the form.

- Provide name, email, company name, and phone number.

- Also, describe your business.

- Mention what kind of assistance or relationship you expect.

- Submit the request and wait for the support team to get back to you with further steps.

- The further steps depend on what type of client you are and what specific approach you expect.

Score – 3.8/5

We have found that all the major tools and features offered by 26 Degrees are already included in the broker’s sophisticated platforms. Here we have singled out a feature that can take the trading experience to another level:

- 26 Degrees offers algorithms and enables clients to execute advanced strategies with efficiency. The following algos are available: VWAP, TWAP, Iceberg, target percentage of market volume, smart order routing, etc.

26 Degrees Compared to Other Brokers

We have reviewed and then compared 26 Degrees and its offerings to other well-regarded brokers to see where it stands in the market. We have found that 26 Degrees’ services stand out in the market and are different from any other retail broker.

In contrast to OneRoyal and XS, 26 Degrees mainly concentrates on providing high-end services to institutional clients, while both OneRoyal and XS mainly focus on retail traders. Besides, while most brokers provide the popular MT4 and MT5 platforms, 26 Degrees offers more sophisticated platforms that would not be suitable for retail traders who need a simple interface and ease of use.

Besides, 26 Degrees does not have a demo account, as its clients are professionals rather than beginner traders who need guidance and practice of their skills. For that same reason, 26 Degrees does not provide educational materials. However, we found that Admiral Markets includes excellent educational materials in its offerings, thus being a suitable broker for novice traders.

At last, regarding the regulatory status of the broker, 26 Degrees holds a license from ASIC, which ensures a safe and reliable environment. Brokers like Forex.com, XS, and Admiral Markets also hold a license from ASIC. However, the mentioned brokers hold licenses from such reputable authorities as CySEC, NFA, IIROC, etc., which add an extra layer of protection.

| Parameter |

26 Degrees |

Admiral Markets |

Forex.com |

XS |

OneRoyal |

Xtrade |

Tradeview |

| Spread Based Account |

Average 0.2 pip |

From 0.6 pips |

Average 1.3 pips |

Average 1.1 pips |

Average 1 pip |

Average 2 pips |

Average 0.3 pips |

| Commission Based Account |

No specified commissions |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $3.50 |

No commissions, based on fixed spreads |

0.0 pips + $2.5 |

| Fees Ranking |

Average |

Low/ Average |

Average |

Average |

Average |

Average |

Low/ Average |

| Trading Platforms |

Iress Trader, Iress ViewPoint, Iress Pro, and Bloomberg |

MT4, MT5, Admiral Markets app |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, MT5 |

Xtrade WebTrader |

MT4, MT5, cTrader |

| Asset Variety |

26,000+ instruments |

8000+ instruments |

6000+ instruments |

1000+ instruments |

2,000+ instruments |

1,000+ instruments |

200+ instruments |

| Regulation |

ASIC |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FSC, FSCA |

MFSA, CIMA, FSC, FS |

| Customer Support |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Unavailable |

Excellent |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$5,000 |

$1 |

$100 |

$0 |

$50 |

$250 |

$1000 |

26 Degrees Review Conclusion

We have conducted thorough research on the broker 26 Degrees and found that its main offerings are directed at institutional clients, hedge funds, and broker-dealers. Being regulated by the well-regarded ASIC and having a positive track record as Invast Global (the former name of the company), 26 Degrees ensures transparency, stability, and security. With its focus on multi-asset trading, algorithmic execution, and prime services, 26 Degrees is an appealing offering for advanced clients.

26 Degrees is not suitable for retail traders, with a primary focus on institutional clients, hedge funds, and broker-dealers. Besides, it does not have a demo account, which is a drawback for beginner traders. Overall, for traders who are looking for prime solutions, transparent trading conditions, and sophisticated platforms, 26 Degrees is a favorable option. We recommend potential customers carefully examine the broker’s offerings and determine if they align with their investment strategy.

Share this article [addtoany url="https://55brokers.com/invast-global-review/" title="26 Degrees"]