- What is HYCM?

- HYCM Pros and Cons

- Awards

- Is HYCM Safe or a Scam?

- Leverage

- Account Types

- Fees

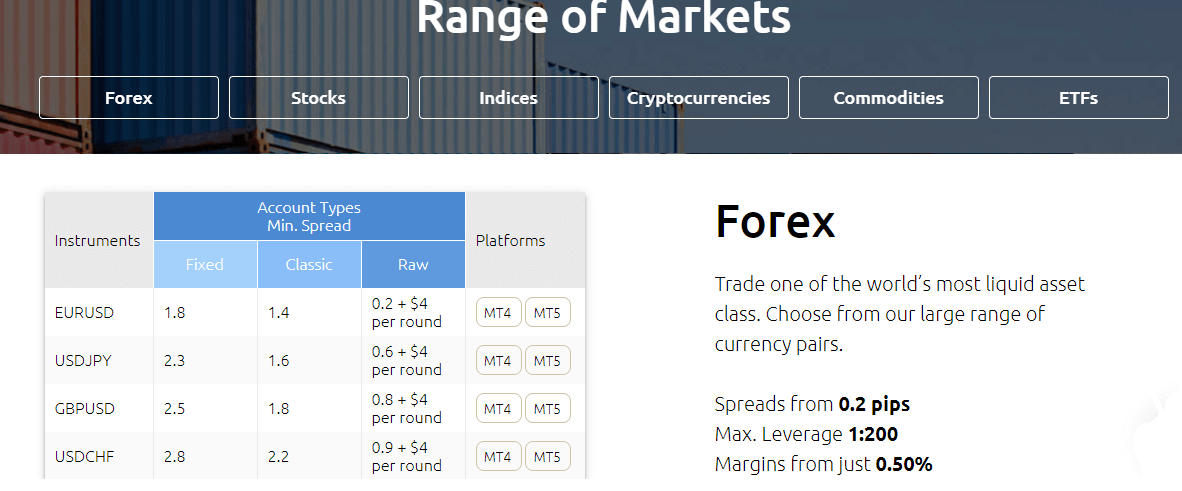

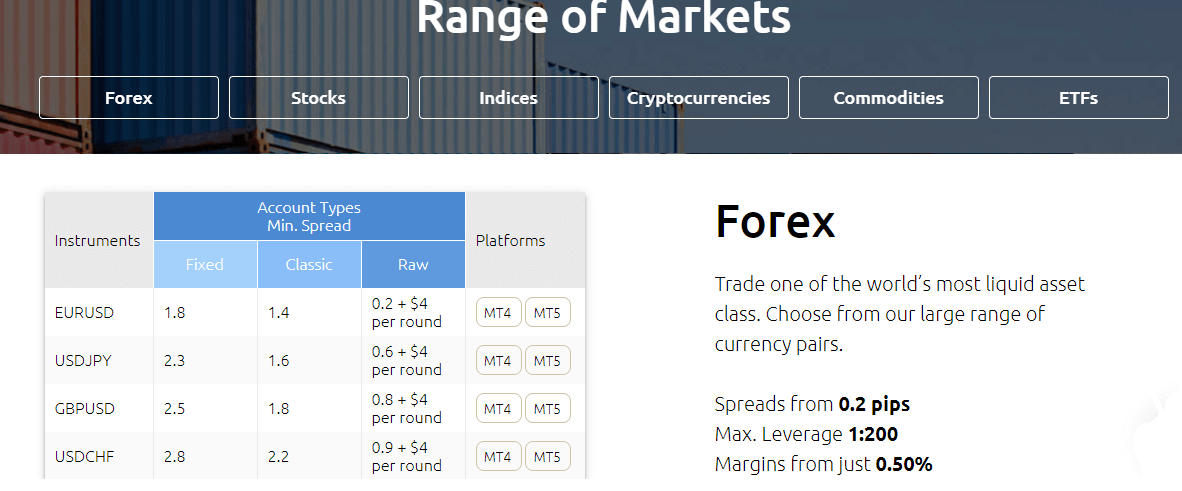

- Trading Instruments

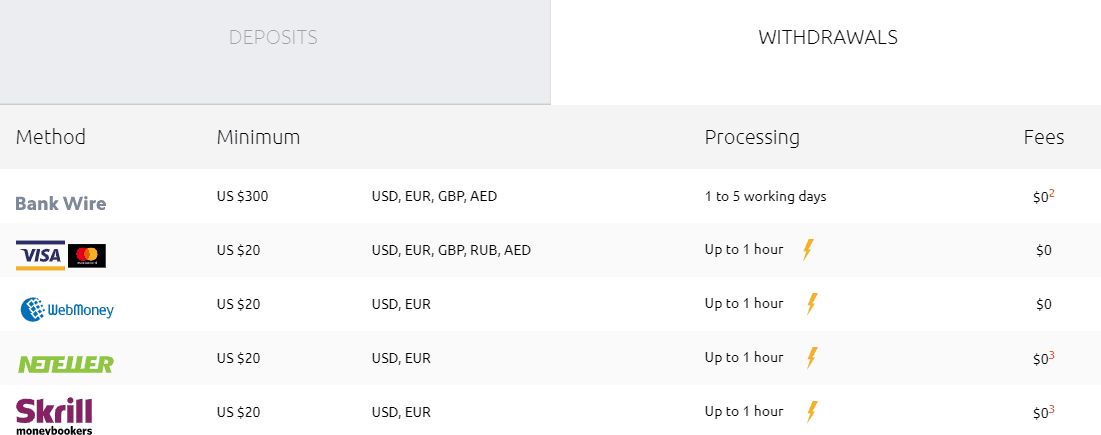

- Deposits and Withdrawals

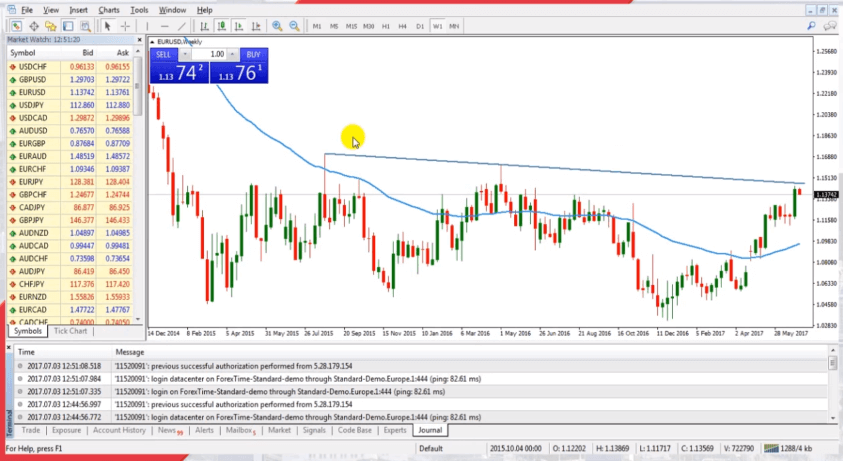

- Trading Platform

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about HYCM.

What is HYCM?

HYCM is rightfully considered one of the leaders among Forex brokers and at the moment shares more than 40 years of experience in the market. The broker is a member of the Henyep Group, the international financial holding company established in 1977 which headquarters in London, UK operating in financial services, education, and real estate.

As the main pro of the HYCM firm is the strict regulation that the broker has throughout its offices in major cities around the world London, Limassol (Cyprus), Hong Kong, and Dubai while complying with regulatory agencies in each jurisdiction. Besides HYCM maintain powerful trading capabilities, offering an advanced range of trading instruments and accompanying its clients with dedicated support.

What Type of Broker is HYCM?

Based on our findings, HYCM is a global CFD and Forex broker providing access to more than 300 trading instruments. The broker offers clients good trading conditions, great liquidity, and low spreads and fees.

HYCM Pros and Cons

HYCM has a long history of operation and is a heavily regulated Broker. We found that the account opening is easy and offers various account types while costs are low. With HYCM you can use various options to deposit or withdraw funds. The broker enables trading through the MT4 and MT5 platforms, also, it offers its own App.

For the Cons, proposals vary according to the entity, and there is no 24/7 support.

| Advantages | Disadvantages |

|---|

| Globally recognized financial institution | No 24/7 customer support |

| Sharp adherence to regulation in multiple jurisdiction | Proposal vary according to the entity |

| Long history of operation and excellent reputation | |

| Forex and CFDs trading

| |

| Great Forex trading education and research | |

| Competitive trading conditions | |

HYCM Review Summary in 10 Points

| 🏢 Headquarters | UK, Dubai, HK, Kuwait, Cyprus |

| 🗺️ Regulation | FCA, CySEC, DFSA, CIMA |

| 🖥 Platforms | MT4, MT5 , HYCM Trader |

| 📉 Instruments | Forex, metals, gold and silver, energy products oil and gas, commodities, indices and stocks |

| 💰 EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | $20 |

| 💰 Base currencies | Various currencies |

| 📚 Education | Professional Education with Live webinars and Seminars |

| ☎ Customer Support | 24/5 |

Overall HYCM Ranking

Based on our Expert findings, HYCM is considered a good broker with safe and very favorable trading conditions. The broker offers a range of trading services designed for both beginner traders and professionals with low initial deposit amounts. As one of the good advantages, HYCM covers almost the globe, so traders from various countries can sign in, also with the lowest spreads.

- HYCM Overall Ranking is 8.9 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | HYCM | Pepperstone | AvaTrade |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Fees | Platforms | Trading Conditions |

HYCM Alternative Brokers

We learned that HYCM offers a range of trading instruments, good trading conditions, and also low trading spreads and fees. However, there are a number of other brokers that offer similar services. Here are some of the best alternatives to HYCM:

- AvaTrade – Good Instruments and CopyTrading

- FxPro – Low Spreads and Competitive Trading Conditions

- XM – Wide Range of Trading Opportunities

Awards

HYCM maintains a professional trading environment and is a highly regarded broker with not only a long history of operation but also numerous clients from all around the world and a trading community consistent with HYCM traders. In fact, the HYCM trademark is a much-respected brand among traders and investors in the financial industry, which is also confirmed by gained international awards.

Is HYCM Safe or Scam?

No, HYCM is not a scam. We found that HYCM is part of a global company with a high trust solid track record and is regulated by several authorities like FCA, CySEC, and DFSA. Therefore, HYCM is considered low risk and secure broker to trade with.

Is HYCM Legit?

We learned that the broker’s main office is Henyep Capital Markets, headquartered in London. HYCM is respectfully regulated by the FCA, which guarantees its customers the appropriate legal security and provides convenient conditions for cooperation. Other, additional branches hold appropriate licenses from Dubai, Cyprus, etc. which confirms an unparalleled follow of the operational guidelines.

See our conclusion on HYCM Reliability:

- Our Ranked HYCM Trust Score is 9.2 out of 10 for good reputation and service over the years, also reliable top-tier licenses, and serving regulated entities in each region it operates. The only point is that regulatory standards and protection vary based on the entity.

| HYCM Strong Points | HYCM Weak Points |

|---|

| Multiply regulated broker with a strong establishment | Regulatory standards and protection vary based on the entity Regulated by top-tier authorities |

| Regulated by top-tier authorities | Offshore entities |

| Good reputation and global expands over 140 countries | |

| Negative balance protection | |

How Are You Protected?

In simple words, strict regulation means customers are protected while deposits are always segregated, stored separately from the company’s funds, and not available for personal or business use by HYCM. In addition, company clients are participants of the FSCS compensation program applicable to a particular entity.

We found that in case HYCM by virtue of certain circumstances is unable to provide further financial services, customers may receive compensation. However, note regulation varies according to a particular entity where conditions and audit rules are diverse as well.

Leverage

Based on our findings, HYCM leverage actually, depends on which regulation and jurisdiction the trading account complies with. Meaning each jurisdiction falls under particular rules and laws, therefore depending on your residence various leverage levels and trading conditions likewise are applicable.

- 1:30 for the UK and European traders.

- The high leverage up to 1:500 opens the path to the smaller retail traders, as a quite small initial deposit will cover margins.

- In addition, the leverage offered to Japanese traders is as high as 1:1000.

The rest and the majority of HYCM accounts will fall under European ESMA regulation, which recently limited leverage to a maximum of 1:30 for Forex instruments.

Account Types

We learned that HYCM account types include three accounts: Fixed, Classic, and Raw Spread Accounts. HYCM uses either a fixed spread (also check fixed spread Forex brokers) model with a slightly higher spread, which means commissions are not charged on trades. The classic account offers variable spreads, and the Raw spread is provided by interbank spread from 0 pips with commission per trade. However, trading accounts and conditions may vary according to jurisdiction rules.

| Pros | Cons |

|---|

| Fast digital account opening | Account types and proposals may vary according to jurisdiction |

| Specified account types offered | |

| ECN trading | |

| Demo and Islamic accounts available | |

| Access to a wide range of financial instruments | |

How to Open HYCM Live Account?

Opening an account with HYCM is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Click on the “Open an Account” icon on the HYCM homepage

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by upload of documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit

Trading Instruments

We learned that HYCM specializes in providing trading services and offers a wide range of over 300 different financial instruments to trade with access to Forex, metals such as gold and silver, energy products like oil and gas, commodities, indices, and stocks. Also, HYCM constantly improves its range of instruments and now offers a wide selection of Cryptocurrencies.

- HYCM Markets Range Score is 8.9 out of 10 for wide trading instrument selection among Forex, Metals, Indices, Cryptos, and more.

HYCM Fees

Based on our Expert research, HYCM fees will vary according to the account type you select or trade, so see which one is suitable for your trading style.

You should consider the HYCM overnight fee or a swap rate. The fee originally varies from one currency to another, for example, EUR/USD buy order will equal -3.25%, while selling will add 1.25% respectively.

Also, what you should also consider is an inactivity fee, meaning HYCM will charge $10 per month in case the trading account has no activity for a certain time.

- HYCM Fees are ranked average with an overall rating of 8.9 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity offering, see our findings of fees and pricing in the table below, however, HYCM overall fees are considered good.

| Fees | HYCM Fees | XM Fees | AvaTrade Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | Yes | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low, Average | Average | Average |

Spreads

We found that HYCM Spread depends on the account type. Fixed spread conditions offer a slightly higher spread but with stability under any circumstances. While Classic Accounts with variable spreads will include lower spreads that are changing according to volatility and market conditions. Lastly, Raw spread is a choice for mainly professional traders as trading fees inbuilt into the commission per round, which is $4.

Besides, there are Islamic trading accounts available for traders with no adjustments.

- HYCM Spreads are ranked low with an overall rating of 8.5 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower than the industry average, and spreads for other instruments are very attractive too.

| Asset/ Pair | HYCM Spread | XM Spread | AvaTrade Spread |

|---|

| EUR USD Spread | 1.2 pips | 1.6 pips | 1.3 pips |

| Crude Oil WTI Spread | 6 pips | 5 pips | 3 pips |

| Gold Spread | 32 | 35 | 40 |

| BTC USD Spread | 50 | 60 | 0.75% |

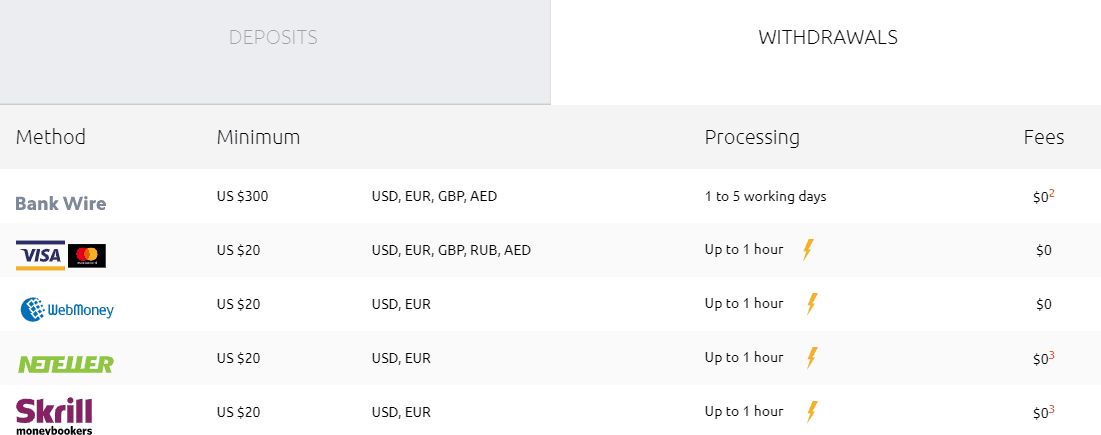

Deposits and Withdrawals

Based on our findings, there are plenty of ways to consolidate trading accounts, as well as to withdraw funds from the account further on. HYCM applied democratic policy to money transfers, yet conditions and methods may vary according to the particular HYCM entity.

- HYCM Funding Methods we ranked good with an overall rating of 8.5 out of 10. The minimum deposit is among average in the industry, yet fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity.

Here are some good and negative points for HYCM funding methods found:

| HYCM Advantage | HYCM Disadvantage |

|---|

| $100 is a first deposit amount | Methods and fees vary in each entity |

| No internal fees for deposits and withdrawals | |

| Fast digital deposits, including Skrill, Neteller, and Credit Cards | |

| Multiple Account Base Currencies | |

| Withdrawal requests confirmed within 1 business day

| |

Deposit Options

In terms of funding methods, HYCM offers numerous payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller

- UnionPay, and more

HYCM Minimum Deposit

HYCM minimum deposit varies according to the chosen account and starts from $20. However, the Raw spread account requires $200 at the start.

HYCM minimum deposit vs other brokers

|

HYCM |

Most Other Brokers |

| Minimum Deposit |

$20 |

$500 |

HYCM Withdrawals

Another pleasing addition from HYCM is the $0 fee for deposits and withdrawals. Meaning you can easily manage expenses, yet make sure to deposit in your account base currency and avoid conversion.

How Withdraw Money from HYCM Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

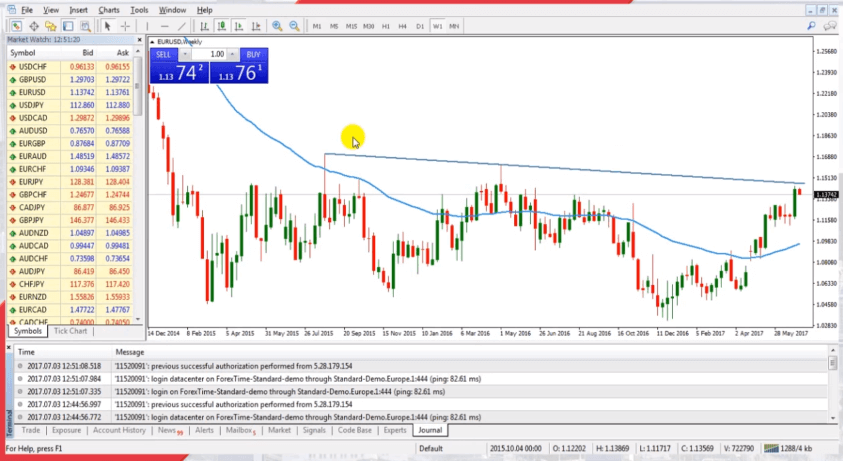

Trading Platforms

We learned, as a leading financial services provider, HYCM offers its traders advanced trading platforms. HYCM gave its preference and reliability to the popular MetaTrader 4 platform and has made it the mainstay, yet you always can choose a new version of Metatrader5.

- HYCM Platform is ranked good with an overall rating of 9.2 out of 10 compared to over 500 other brokers. We mark it as good being one of the best proposals we saw in the industry, and a great range including MT4, and MT5 suitable for professional trading. Also, all are provided with good research and excellent tools.

Trading Platform Comparison to Other Brokers:

| Platforms | HYCM Platforms | XM Platforms | FxPro Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Web Trading Platform

MetaTrader 4, which is an industry-leading software is loved for many reasons, but mainly for its ease of use and comprehensive features. Web Platform is a great choice due to its easy access via any browser and does not require any installation or specific settings.

The only gap could be a limited number of tools and drawing applications available via Web Version so for a more comprehensive analysis you better choose desktop MT4.

Desktop Platform

Nevertheless, professional and day trading traders would need a desktop platform which is a full version of the MT4 or MT5 platform offering a maximum of its trading capabilities.

Moreover, MT4 is suitable for beginner traders and includes security and 24-hour support, automated trading capability, integrated technical analysis tools, and indicators, streaming market news, personal VIP dealer services, expert advisors, and many more.

Mobile Platform

We found that HYCM has also a HYCM Trader mobile app, for traders who prefer to trade on the go, which allows trading at any time and anywhere. HYCM Trader is available on both Google Play and the App Store (all you have to do is search HYCM).

Customer Support

We learned that HYCM supports any case and questioning through its established 24h customer service available in various languages and performed via the service desks covering global needs. Even though, customer service is available on working days only it is quite responsive and reachable via Live Chat, International Phone lines, email, etc.

- Customer Support in HYCM is ranked good with an overall rating of 8.9 out of 10 based on our testing. We got fast and knowledgeable responses, also quite easy to reach during the working days.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick responses | No 24/7 customer support |

| Relevant answers | |

| Supporting numerous languages | |

| Availability of Live Chat | |

HYCM Education

Based on our research, we found that HYCM provides Webinars and Seminars in various locations, enabling traders to obtain a grasp of the market sentiment, analyze market movements, and benefit from live Q&A sessions.

- HYCM Education ranked with an overall rating of 8.2 out of 10 based on our research. The broker offers access to valuable webinars and seminars, allowing traders to enrich their knowledge and make well-informed decisions in the market.

HYCM Review Conclusion

Concluding the HYCM review, we admit a strong and very reliable company in the financial market. The time-timed broker offers professional services to the traders while highly regulated and regarded by traders as well. Small retail traders can find their way to open a live trading account, as a very small deposit of only $100 allows so. Beginners are most welcome to the company too, with a quality customer support team and good education or research.

Based on Our findings and Financial Expert Opinions HYCM is Good for:

- Beginners

- Advanced traders

- Traders who prefer MT4/MT5

- Forex and CFD trading

- Variety of trading strategies

- Low fees and competitive spreads

- Good customer support

- Excellent educational materials

Share this article [addtoany url="https://55brokers.com/hycm-review/" title="HYCM"]

I don’t think I have traded with the broker with so many licenses.

As for me thy are mandatory to trade with peace of mind. Psycholgical comfort is a big part of success in tarding.

HYCM is very fairly ranked by this author and 5/5 starts is alos fitting them.🤑

I have heard of a lot of very good and interesting stuff and I decided to try it by myself and I am very satisfied and the guys who told me about hycm were true. It is really a pleasure working with them but I have a small question. I want to find some webinars and seminars from hycm but it is kind of hard for me. Do they even have that kind of educational materials?

This is a very detailed overview of the HYCM and I actually very much agree with the authors. But of course there is a lot of better stuff for the higher ranked accounts.

I do think that it is a kind of diversification. So it is even better for traders.

Usually, big reviews of brokers, like this one, are often time outdated, and after reading through this speedily, I don’t think the broker is much different. Of course, the review has left some new developments out but it has done a pretty good job.

Yeah… you are absolutely right there. Reviews are hardly reviewed and updated. New reviews by other people are just written and I can spot a few outdated things in this one as well.

The overall number of regulations and licenses the broker has made it one of the most reliable brokers on the forex scene.

With so many regulations over the globe, it does not get any better than that for traders who are obsessed with security and legitimacy of a broker. HYCM is a well-known entity by all the authorities and so many traders worldwide, that it became like a common thing to know about them. It is one of the trendsetters of the industry offering a great experience in the markets.

Their collection of trophies is massive, like seriously huge. I mean, they’ve won so many accolades that their award cabinet could probably rival even Real Madrid’s!

Aint surprising why traders and investors all over the world trust this brand!

I’m sure that everyone who read this article paid attention to the licenses this broker has.

This list is really impressive. It can only indicate one thing. HYCM is a reliable and legal broker.

I couldn’t resist commenting on this article. They listed the following as cons of HYCM: “Account types and proposals may vary according to jurisdiction.” :)))

The person who wrote this article or made this argument seems to lack a complete understanding of how regulation actually functions. The broker must comply with the regulations of each jurisdiction they operate in and, therefore, must offer different account types and proposals to meet those regulations. For example, in the EU, they can not offer leveraged trading for retail clients over 30:1, while in other jurisdictions, they may offer higher leverage.

A pretty weighted, balanced overview of this broker. I’d say it’s even unbiased at some point, as disadvantages are transparently pointed out.

All in all, the company takes its share on the market and fully deserves it.

I’m telling you, the Raw account with the tightest spreads is amazing for algo trading.

In spite of many years of experience, this broker can pleasantly surprise 😉

This is a reliable broker with a solid track record, and HYCM trading conditions are among the most commendable, such as:

1. Trustworthy and Reliable;

2. Regulatory Compliance: Regulated by reputable authorities;

3. Diverse Trading Instruments: forex, commodities, indices, and cryptocurrencies;

4. Competitiveness: HYCM provides fast execution, tight spreads, and a range of account types, catering to various trading styles;

5. Technological Advancements: HYCM embraces cutting-edge technologies, offering traders the latest tools and features for enhanced trading experiences;

6. Educational Resources and Support: HYCM provides educational resources, webinars, tutorials, and market analysis to empower traders, along with dedicated customer support for assistance.

HYCM has the rare combination of amazing conditions to trade! I give it ⭐⭐⭐⭐⭐!!!

I think for a broker of this quality and history HYCM could do more in terms of accounts and trading assets.

However I’d be honest and say that the reliability and reputation of the company is like no other broker has. Which is far more important for financial entity.

Is it realistic to do basic technical analysis using this broker’s mobile app?

If you are talking about the MTs, then absolutely. No doubt that you can even carry out advanced analysis on your mobile device with the apps.

Yes, I believe it is real. How can I be so sure? I use it myself. I trade with the mobile app of this broker and frankly I am doing very well. So if it is possible for me then it will be possible for you too.

Old but reliable trading platform.

I placed a withdrawer in my account but the customer service asked me to pay a tax and l wanted to know weather it’s true.

I have an account with hycm for some time now and I wanted to withdraw but the customer service demanding that l pay tax before receiving the money and want to know weather it’s true.Thanks

MT5 platform is perfect for this broker and shares trading.

HYCM provides traders with a user-friendly dashboard that offers a range of educational resources for beginners. The platform offers a variety of account types with low minimum deposits and a good leverage.

However, the broker lacks a proprietary trading platform which makes the entire experience less personalized and more generic, if you ask me. It is really things like this that make a broker stand out in this age.

HYCM is just alright.

HYCM has a nice story and that is what attracted me in this broker, I believe such companies has a better quality of services, than those established a year or two ago. By the way, are trading platforms functional?

Totally. Even though the broker is old, their services, platforms, integration and connectivity are definitely not outdated .You don’t have to worry about HYCM being technologically advanced, no problems there.

interesting broker with its own features

The broker has a good variety of trading accounts that each client can open.

Thanks to this opportunity I was able to pick up those trading conditions that are more consistent with my trading strategy.That is, I get more profits thanks to it. And I feel comfortable trading in financial markets. It means a lot for professional traders.

In addition to top-notch platforms, HYCM also has great customer service.

I often see on the Internet lately information that some financial exchanges or companies providing trading services have stopped their activities. Perhaps, this is because they do not have enough capital to hold on in economic troubles.

I feel that HYCM is a powerful company with a lot of capital. Because the quality of service is impressive.

But is there any credible confirmation of this?

HYCM as a company has probably seen every kind of market environment and regulatory processes there could be. I wouldn’t worry about their presence, since they are literally veterans in this sector, which adapted to every type of change and shift in the trends that passed by throughout all these years.

Lots of equities to trade on, but a small portion of them available for MT4.

I’ve been trading with hycm not for a very long period, still I managed to raise some bucks here and acquire some new knowledge. The latter is due to comprehensive educational system implemented by the broker. Moreover, I may be mistaken, but there is even a blog. I’ll check it out later if it exists.

Anyway, conditions here are attractive for me – several account types with different spreads, modern trading platforms and contemporary instruments. It’ll be a real sin to complain about such brilliant services. Probably, one may notice some minor downsides of this broker, but, overall – there is nothing to talk about.

The peculiarity of this broker is its conservatism. It upgrades its services not very often, but uses the best and only time-tested tools.

HYCM is a big player in industry. That is why I like the analytics they provide. Always good to know opinions of the professionals that were here for years. Company provides a good quality on this, so you would better check it out.

Only after you start using quality services you begin to appreciate comfort! Yes, with this broker I forgot about small technical dificulties.

My Hycm account is only a couple of weeks old, but from the first perspective this broker is a reliable place for trading and making money.

Yet what platform should I take if I want to trade stocks mainly?

Regarding the fact that MT4 has very little stocks to trade on, about 10 items if I’m not mistaken. You should definitely take the MT5 platform.

On top of that MT5 has better functionality, more timeframes and built-it indicators, in case you’ll need it.

Highly regulated forex broker, which equals highly credible and reliable too.

As it is very well-known that regulation defines security in this sphere.

The only complaint is that, for some unknown reason, MT4 platform has less trading instruments than MT5.

It’s a good choice for anybody willing to trade intraday or practice affiliate marketing.

I owe so much to this platform. I have been trading for years and this company has been there for me throughout all those years.

I filed an email complaint to broadoak-capital cum after this company scammed and i was able to recoup my loss. It was a long journey, too long to fit into one post but i hope other people get help too. I almost lost my sanity because of that horrid experience but grateful i got help.

Hycm professional education is what attracted me to this company. It was really unusual for me to see such a wide range of educational opportunities.

As a rule, forex brokers give access to some basic articles, and some youtube videos, at best.

At Hycm there are not only basic articles and videos for beginners and not only. But also different live events with the company’s experts, webinars and seminars.

If it’s not enough, there is a Blog with additional trading knowledge at your disposal.

This is a brilliant review of a great broker! I agree and recommend them to be your main broker =))

I used to work with a couple dubious broker but both of them was questionable. I mean lack of regulation is one of the reason I didn’t continue to trade there. In addition, trading platforms were not as comfortable as Metatrader is. That’s why I began to work with HYCM – it’s regulated and has MT as their main platform. And I would like to know if Expert Advisors available here?

Numerous regulations make Hycm broker one of the most reliable companies that provide brokerage services out there. At the end of the day it’s the requirement that every reasonable trader needs.

It’s not a scam and I tell it as their client.

I think it is great that company offers Metatrader trading platform as the main one. Companies nowadays want to be spotted and roll out a proprietary software, but these platforms are taking time to master it and they are not made for trading but for marketing needs only.

In this regard good old MT is much better as a lot of traders has an experience working with it. They say it is an industry standard and I can not disagree.

Hycm offers a perfect array of account types that fit all traders. Perfectly thought out😉

Do you think it’s real to make a lot of money with this broker?

I suppose it’s easy to make money with any broker, especially with this one. Why I highlighted “especially”? Everything is because this company for me is a top 3 brokers I have traded in my life with. The conditions here are universal and might be suitable for all types of traders.

Why I consider trading activity as an easy one? I believe everything is concluded in our mind. We draw the borders in our mind and are convinced that where is easy money, there is either a scam or it’s not simple at all. If you will eliminate these borders and cease restricting yourself – everything will be okay.

Yeah, it’s possible to earn money here, but it depends on your trading skills.

HYCM’s raw spreads are great for trading big money.

I don’t have a problem with the broker having the MetaTrader platforms as the only platforms available. The MT4 and 5 satisfy the needs of traders and I don’t see a reason not to like them. They are the most popular and most used trading platforms and almost all traders know how to easily use either one of these platforms or both of them. I see this as a plus for the broker and not a negative.

Quite a reliable broker that was my first impression of HYCM. You get hundreds of instruments across 5 markets. All this under the umbrella of strict regulations and decades of brokerage.

Nevertheless the entry threshold is pretty high for newbies especially.

What are the real spreads on a raw account? It seems to me that they are super tight, but is it real?

didn’t find something surprising here. several types of account – yeah, they are quite interesting, but I saw lots of accounts with tons of conditions. it can’t surprise me.

however, the broker is pretty attractive.

I read on forums that HYCM offers great trading conditions. This article is confirmation!

while HYCM seems to be legit please be careful of a scam artist who has created an app called HYCM with very little information and claiming to be part of the real HYCM company, look for clues and ensure you read about it. about us area will have spelling mistakes, grammatical mistakes. i was unable to find any website warning people about this place. i have personally lost money on this app so beware of this scam.

I think the best broker advantage is that every customer can choose account type that suits them best.

Yes, HYCM has several account types. Each account type has its own special trading conditions. I can choose account which fits my trading style.

Also, it’s possible to open several trading accounts with different conditions. For example, I use many trading strategies and trade on two accounts at the same time. I can quickly switch accounts in trading platform and control my trades.

Such possibilities allow traders to improve themselves! And no need to look for brokers with different trading conditions.

What I like about HYCM is that it guarantees safety and security of customers’ funds and personal data!

I take it very seriously when it comes to personal data and funds. It is important to me that company I entrusted my data or money to is not only honest but also safe!

I think that HYCM is one of the most honest and safe companies. This is confirmed by several proofs:

1. Company’s reputation

Broker has great experience in providing brokerage services and is respected by traders. This means that company is providing stable and high-quality services. So it means reliability!

2. Protection of customers’ funds

Broker uses separate accounts for customers’ funds to keep them apart from company’s funds. In addition, customers are protected by FSCS (Financial Services Compensation Scheme) and ICF (Investor Compensation Fund). These funds protect HYCM customers’ funds from possible emergencies.

3. Data protection

Broker’s trading services are designed to meet rigorous security standards of international financial and banking institutions.

I think that proofs show highest level of security. I am 100% sure my data and funds are safe! 🔒

Oh yeah, it’s really safe place. Looks like broker guarantees very serious client funds protection! I don’t know where my money would be more secure in bank or with HYCM!

I like the way hycm executes its duties. once applied to customer support in order to solve a problem with verification of my account, everything was okay but I had to wait for a certain amount of time.

don’t like to wait, but at the same time I understand that this procedure requires waiting.

generally, the broker offers cool conditions, especially types of account. they are awesome!

once my friends advised me to start trading with hycm broker, they boasted that they managed to earn 100-200$ per several days and I was impressed by such results.

decided to start trading with this broker and actually… don’t regret that made up such a decision. broker is comparatively strong and really offers lots of opportunities, however someone can tell me what’s with the requotes on real accounts?

I have been trading on MT5 platform at HYCM broker for couple of years. Before that, I was trading on MT4 platform for about year. Sure I will be able to give comprehensive answer to your question.

Order execution depends a lot on situation on financial markets. If you try to open position during important news releases, you might get requotes. Liquidity provider that supplies quotes to broker will be to blame for such requotes. HYCM, for its part, executes orders instantly.

In addition, order execution speed may depend on Internet connection speed.

In short. Suppose you have fast Internet connection and no high market volatility due to important news. In that case, HYCM will execute your order instantly.

By the way, once I opened order on news and everything was fine. Maybe it was luck, or perhaps HYCM provided high speed.

I have been trading for several weeks on a real account and haven’t saw anything differ from demo. I think this is a good indication for broker and its infrastructure

generally, I liked the broker but there are some weird things like the existence of classic and fixed account where distinguishing traits are only spreads and trading with expert advisors.

Is HYCM broker suitable for novice traders? How difficult are MT4 and MT5 platforms to use?

There is an opportunity to deposit money via bitcoin wallet. And actually there are dozens of methods how to deposit and withdraw money. I like it. Always use several methods in security reasons. .

The accounts there are also quite fascinating. No issues at all. Cool spreads, even on fixed account. 1.2 pips not so high, especially if they are fixed.

Yeah, they widen during high volatility times on the market, but not significantly of course. Generally – try it out, won’t regret! 🤗

several regulators has personally impressed me.

I kind of understand that this is obvious due to they offer their services to traders from different countries.

But still, it seems quite impressive 👌👌

broker is stable, has three account types, clear license, dozens of instruments and two metatrader trading platforms. no need more for profits

The broker is beginner-friendly that’s for sure. Also it seems to me that it has the characteristics that are universal for all types of traders no matter thу experience.

1. Diversity of markets. Crypto, forex, commodities, all you need whether you are a newbie or a veteran of trading battles.

2. Account types. Fixed or classic, accounts that would be more suitable for novices. They have no commission, variable spreads with a minimum deposit of $100, which is something that even a student can afford, if he saves some money on beer:) And raw for trading masters, it is commission based, but has very tight spreads.

3. Trust. Trust is important for everybody no matter what. HYCM is a company you can trust. Not only its history has decades of financial services, but the broker is regulated by the major financial authorities throughout the world.

4. Platforms. All HYCM trading accounts have access to Meta Trader 4 & 5 platforms. These platforms are available on every devices: desktop, mobile, iOS, android whatever you need.If you are new to trading MT is what you should learn. If you’re an old-timer you already know how to deal with it. There’s no need for a proprietary platform at all.

wow! you’ve allocated so much things as I dunno know what to comment on. I’d just note that presence of types of accounts and diversity play the major role in this list.

Many traders underestimate the fact of having all the main instruments in trading, because they trade actually one or two lol, but I, for example, prefer to switch between forex trading, crypto trading, stock trading and so on.

From my trading experience, I prefer to trust strong brokers with years of licensing. Regulation and registration are fine. As I know, hycm is a broker with decades of experience. No matter what is going on around, our funds should be in a safe place. I’m cool with it. I make my trades, and profit comes, so everything goes by its plan.

For me, the reliability of a broker is the key. That’s why I chose HYCM for the most part. The first thing you notice is the number of major regulators that HYCM has, FCA, MiFID, CySEC, DFSA & CIMA. Each jurisdiction has its own respectable authority. Also the company has segregated funds in top tier banks, like barclays or eurobank.

It’s equally important that a broker has offices in different parts of the world, to provide stable trading services worldwide, and it’s important from a client’s perspective to be in touch with the broker not only virtually but also physically.

One of the oldest broker company on forex market with clear registration and regulation by global and national institutions.

For me all pros and cons of a topic are the same as i see it.

I also trade by using metatrader platform also with my phone. I started with demo account and with 100$ real money by using educational platform knowledges i start to make good trades. my deposit is growing.

It is clear that each broker has advantages and disadvantages. Still, overall I have no complaints at all reharding HYCM

Is there any problem with order execution or withdrawal? reqoutes, spikes?

I’ve been working with broker for several years. no problems. everything is fast and clean. i heard they have help centr, just in case

I also want to say that during my trading with HYCM, I had no problems at all. Every order was executed instantly. Unless, of course, you trade on strong news. I have no problems with deposit and withdrawal.

In my opinion, this is exactly what you expect from big broker.

I am sure that HYCM company is truly safe. I trusted my money when I wanted to earn extra money for acquiring a bike by making greater depo for my trading strategy, and everything was okay. Yeah, there might be delays with withdrawing money but it’s okay. I have never complane about such details, as I understand they have many withrawal request.

company is well regulated and as you may check on website won dozens of awards. AT least, for me, such things are sigh of a reliable broker.

what are the difference between hycm accounts?

the difference is the amount of spread you you to pay and a comission per trading volum. Starting from zero and so on.

From all three types of accounts, according to the results of the special form, I have chosen fixed account. Minimum deposit as small as 100$. This sum seems to me pretty acceptable.

Spreads on fixed account from 1.8 pips. It’s also okay but of course I wouldn’t refuse if I was offered tighter spreads

For opportunity to get vip stsuas of your account you need to execute special conditions in order to get it. This is my goal for now.

Reliability which hycm obtains has certain price.

Surely, HYCM is one of the most regulated and one of the oldest forex brokers, which makes it absolutely credible and trsutworthy in my eyes. However, such stability and consistency is definetely not free of charge. It just cannot be so. That is why, trading conditions here are not the best on the market but they are still pretty competitive. It is up to you what you need more: reliability or best trading conditions.

I’ve been trading with HYCM for about 6 months and I cannot say anything bad about this broker.

It works pretty consistently, the orders are executed in a fast manner, so that there are no slippages or requotes. I also had a chance to talk to the customer support and I found it very effective. All of my questions were answered and I got all the necessary information. However, I think that the trading conditions could be better but probably it is the right price for such a good service.

Hycm is an amazing broker which supports mt platforms

the speed of order exuction is really fast. I mean that there is nothing more irritating in trading than slippages and requotes. However, they happen qute rare when we are talking about trading with hycm.

So, these very things make me confident about the fact that I made the right decision when I started to trade with hycm.

The broker is time-tested… Trading with HYCM, I can be sure for the safety of my funds and for the fact that any of my questions will not go unanswered.

I started trading here not too long ago and this is my first broker. Before that, I only studied theory, but it was here, thanks to great webinars, that my puzzle came together and I started to trade with small profits… I trade on mt4, and would like to switch to mt5.

Can you tell me if there is any training on the functions of mt5 trading platform?

Guess that as for the training on mt5, you can just open the platform and train on a real account, or you can use it on demo. However, I never advise traders to stay on demo for so long, because it may cause unpleasant consequences. You will never feel the risk on demo and this habbit will blow your real money depo

Many traders are looking for opportunities and I think brokers like HYCM can help.

Of course at the first stage there can be some problems. For example, there are problems with trading platforms and account types.

Metatrader 4 and 5 are not the easiest platforms in the world, so you need some time on the demo account to learn how to use it.

It’s difficult, I agree, but the result will be nice…

This broker…. and how I feel it tunes my mindset to something serious. You know when a broker is experienced with over twenty years of working in this sphere and …..trading conditions for true professionals, it all helps to be more disciplined and organized. Maybe you may find me too sensitive but I really feel like this.

I tune down leverage to small numbers and trade conservatively in the long term. For me it’s hard to imagine differently with this broker.

I like the system of trading account types there. I mean that surely, all of us have different preferences concerning trading and concerning spreads in particular. I like the fact that hycm can offer fixed or floating spreads and the minimal deposits for these accounts are quite the same. So, you don’t need to be a millionaire in order to avoid trading with the more preferrable conditions, you can choose what suits you best!

I came to HYCM after being out of forex trading for a while. The support staff was very patient with me. Not one question went unanswered. They gave me faith in myself and provided me with all the tools I needed to succeed. HYCM is a truly honest broker in a world filled with scammers and sharks.

In addition, here you can choose an account with fixed spreads and not be afraid of over-the-top trading fees. the spreads here are small…

I highly recommend them to everyone!

I want to know which platform you can recommend me here for scalping, MT4 or MT5?

I feel that it is more like a matter of taste. I believe that it is better to learn mt5 as it is more modern and updated, it can offer much wider functionality.

MetaTrader 5 is a widely used trading platform for Forex and especially CFDs. It is more powerful than the MetaTrader 4 platform, offering enhanced social and copy trading features, as well as better back testing and analytical functionalities. I would choose MT5 trading platform, however we shouldn’t exclude MT4 from this list as well. I prefer MT5 and i would reccomend it for any strategies as I supoose the days of MT4 will last someday.

I haven’t been working with HYCM that long, and I haven’t formed any stable opinion about it yet.

On the one hand I like that they do not have any special difficulties. All goes well so far.

On the other hand fixed spreads, that I have tried here, haven’t helped me much, on the contrary, I have “overpaid” much for sure orders.

I’m still thinking what to do next.

A few months ago, I opened my first HYCM trading account for the first time. Before that, I traded a demo account with this company.

I liked the trading software and what this company promises so I stayed here and am now a HYCM broker trader.

To be honest, I immediately chose this broker because it is the most experienced one. This company’s been operating for ages and I think it means a lot.

I am sure that if there were any problems or a scam, the company would have ceased to exist.

As for the live account, I chose raw spreads. They are very small because the broker does not add their markup. This is great.

Of course, there is not a big commission, but it is too small and it is better than having an unpredictable large spread.

Now I have certain knowledge and I think that trading will be successful.

My best friend couldn’t get a job for a long time and was very nervous about it. I wanted to help him, just when I was opening a new store, I offered him the position of manager. I tried not to control him and didn’t interfere in his work too much.

But one day I saw open charts on his computer that had nothing to do with work LOL

I started to ask him what he was doing and found out that he was trading forex with a HYCM broker. It all became interesting to me, especially when I realized that earnings here are not limited. Now me and my friend are trading with this broker. I don’t suggest quitting the business – I didn’t personally – but you can combine trading with almost any job. It doesn’t take all day.

In HYCM I saw for the first time such a phenomenon as raw spreads, yes, it definitely has its own characteristics.

You’ll need some time to get to grips with it, but basicall raw means ‘very tight’. That’s about all u need to know.

HYCM looks really decent and honest to me. Not every broker is capable of surviving for more than 40 years in such a competitive and even toxic environment as forex market. More than that, the broker is also regulated by several third-party organisations whicb only strenghtens my trsut to these guys. I’ve heard that hycm has some statuses system and I am really confused of how to choose the status which would suit me the most? Is there any life hack to that?

You are talking about some kind of statuses .. hmmm .. probably you meant the types of accounts.

This is true, there are types of accounts with different spreads:

– fixed;

– variable;

– raw spread.

In order to understand which one you need, HYCM broker has some kind of quiz on the site. There are 5 questions. When you answer this, you will be prompted which account you need.

It’s actually easier than it looks. 😉

I think that one of the main advantages of the HYCM broker is the experience of this company. The company has been providing financial services for many years. I have known about them for a long time.

So I read different HYCM reviews like this one.

I think I will open a larger account here. To be honest, at first there were some doubts, but now I understand that there are no drawbacks because of which it would be difficult for me to trade here.

I came to trade here by friend advice . Iopened a Classic account with floating spreads from 1.2 pips.

The minimum deposit here is only $100.

I like the educational section, which has everything: video lessons, e-books, description of trading strategies. There are also great courses for beginners. In this section I picked up a suitable trading strategy and modified it for me.

I am very impressed with the way the broker works.

First of all, I like the excellent trading conditions. I can choose an account with low spreads. I like raw spreads. I just opened such an account and the commission is not high, and I hardly notice the spread.

Second is experience. The company has been working for a long time and this means that the broker knows different situations and can solve any questions and problems. HYCM always knows what traders need.

Third, these are the Metatrader trading platforms. There are 4 and 5. You can choose.

I like the fact that HYCM broker offers more than 40 currency pairs for trading and leverage up to 1:500. For stocks, the leverage here is lower, about 1:20, but that is not surprising, many stockbrokers offer low leverage.

The spreads here are average, although the broker’s website says that the spreads start at 0.1 pips, I have not yet had to deal with such spreads. I often trade stocks on MetaTrader 5 trading platform, it is a pity that there is no possibility to use mt4 for stock trading.

As a broker HYCM is very strong. It is not for nothing that it has been on the market for so many years and has high positions everywhere. The application for mobile trading is clear, it replaces the full-size terminal completely.

Always ready to help. I got lost in the settings of the terminal, called the manager. We set it up together in a couple of minutes. And that’s the way it is with everything.

The broker has groups on Skype, Vyber, Telegram, Watsap and Facebook. I recommend this broker.

What do you think of this mobile app?

Mobile application seemed to me pretty convenient and I didn’t spend so much time on sorting out how to use this mobile application. Actually, this details was the main for me, so I can claim that everything is okay with it.

I never use mobile apps for trading. They can’t beat a full-fledged desktop platform in terms of functionality. This broker absolutely suites me but I trade on its Metatrader and not on its app.

Previously, I could not understand how a HYCM company can have more than 40 years of experience if online trading has become popular only in this century.

Then I found out that this is a group of companies that provides various financial services. Then I believed in the competence of HYCM and believed that I needed to trade with this broker.

To be honest, I have no regrets. I have been trading here for half a year and have already started making good money. So there is a chance here to make money, but everyone will have to study and work a lot.

I can’t complain about this broker because it has not let me down yet. It offers good trading conditions. I opened a Fixed account because I needed fixed spreads for night trading. I mostly trade major currencies and cryptos here.

HYCM was incorporated in 2016 when the Henyep Group merged its investment brands. HYCM has already won more than 20 world awards in three different categories. When I was looking for a broker for myself, I certainly paid attention to this information.

I wanted an account with low fixed spreads, that was one of the reasons why I registered with this broker. Also this broker has an account with floating spreads and trading conditions on this account are as good as on the fixed one.

Another thing that was if not very important to me, but nevertheless was a nice bonus is the availability of withdrawal to Webmoney system. I created myself this wallet more than 15 years ago, when the whole world was just starting online trading. Yes, the commissions may be large, but how convenient it is for online payments.

I like this broker. During the time I worked with it there were no negative moments. Despite the reviews about unregulated market, I managed to make about 100% profit in a year with this broker. So, if there is a good broker and a profitable trading strategy, the result is guaranteed. In addition, trading signals from the broker can also be a good support to hedge risks from your own inexperience.

I can also say that there are good trading conditions here, there are accounts with fixed and floating spreads, with floating spreads starting from 0.2 pips, which, you must agree, is a very small figure.

I chose this broker to test my trading strategies. I should note that I always test my strategies on real accounts. A demo account is a worthless toy to my mind.

To successfully test my strategies, there should be the following conditions.

A broker with a good execution. I can give you a prompt: as a rule, only regulated brokers can ensure good execution.

Metatraders, Metatrader 4 would be the most preferable because I work with customized indicators with the EX4 extension.

Fixed spreads. It would take much time to explain, just believe that I need this.

This broker gave me all of this.

I cannot (or do not want to) install on my computer any software to trade Forex with HYCM broker. Will I be able to trade Forex in this case?

The broker offers different options for using the platform for trading, offering desktop and web versions of the MT4 platform.

Since HYCM broker is only focused on using MetaTrader, mobile versions of the MT4 app for iOS and Android are quite standard and available for download from the Apple iTunes and Android Playstore.

Although MT4 at all brokers is standard with slight variations in functionality, significant differences can be in how the platform is set up in terms of trading spreads and commissions, order execution and other tools, features and administrative areas. You can also see the differences in the web version settings.

I think that I could have labeled this broker as ideal but some European regulators spoiled the situation, but there’s nothing to do about it. So, in European branches of the broker one can’t trade Fx instruments with leverage higher than 1:30. However, if you are lucky to trade on Dubai or CIMA accounts with this broker, you can count on 1:500 leverage for these instruments.

In all other regards, the broker is very good. Look, it’s regulated and provides both fixed and floating spreads.

HYCM is a nice broker with the long history of operation on the market. Actually, the broker was founded in 1977 if my memory serves me right. This says a lot about credibility of the brokerage because it is impossible to work for so long being a dishonest organization and a scam.

I started to trade with hycm several months ago and I am going to share my experience with you here. One of the most important things in trading is your mediator with the market, I am talking about trading platform. Hycm offers a choice between mt4 and mt5 and that is really awesome as I am a fan of mt products. I didn’t have to change my trading habits after switching to hycm and I am really happy about it. Spreads are quite competitive on the market, so that they don’t take a lot from my profits.

You can be lucky only in the beginning, but then it passes quickly. And if you want to earn continuously – you need to learn constantly. Consider trading as a job. And here on the broker’s website all the materials are at your fingertips, which is very convenient. Believe me, among the ocean of brokers, only a couple or three are really good. HYCM broker is just one of them, tested. The broker is constantly evolving and gives its users a wide choice of accounts with different trading conditions. I don’t think it makes sense to look for something else when you trade with a broker with better conditions.

I need a trustworthy broker with specific trading conditions for night trading and I fortunately found it. As for specific conditions, I mean fixed spreads. They give an advantage when trading at night because unlike floating ones, they don’t widen at night.

This broker provides traders with lots of instruments and tools in order to make trading activity much more comforotable. Traders are always in search of such conditions, I’m sure. So, I believe that this broker must strengthen its position on the market and try to implement as much new and useful features as it can. The main here is just to listen to trading community and its wishes. Moreover, i would note an interesting system of types of accounts. I see it quite perspective, by the way, anyone knows how can I determine which types is the most suitable for me?

To my mind the main advantage of this broker is that it allows to choose between floating and fixed spreads. I personally chose fixed spreads because they are good for high volatility trading. Respectively, if you intend to trade in a high volatility session, you’d better open a Fixed account. It’s quite a universal account,except for scalping. If you like to scalp, open a Raw account because it offers tight spreads.

Yes, HYCM broker has really different three types of accounts in terms of trading conditions. How to determine which type of account is right for you? Probably it depends on your trading type first of all. To determine that, you should take into consideration how many positions you open, whether you prefer to trade on the news or on a quiet market, whether you trade at night or in the evening, or during European and American sessions. All this affects the choice of trading account.

For example, even though I like to trade on the news, I chose for myself an account with floating spreads, because at this broker I didn’t notice significant spread widening, so I make much more profit on this account.

You can start with an account with fixed spreads, that’s what all newbies usually do.

That is a nice overview of what hycm is all about. It is cool that you’ve mentioned educational center of the broker which is pretty awesome. I mean that there is lots of materials about trading and trading strategies and they are of great help for me in spite of the fact that I have certain experience in trading. I always find there something new and try to implement it immediately on my trading. By doing so, I improve my trading and its versitality which really important in order to be able to catch up with the market which is constantly changing.

I don’t really have anything to compare it with because it’s my first broker. But for my first company and my first experience in trading, my impressions of HYCM are very positive and pleasant! You know, at first I was scared, because I had no knowledge or experience, but after I had studied all the materials available on the website, my confidence immediately increased, because I knew that they would help me and do everything to make money! That’s how it turned out in the end. In fact, this is a very old and experienced broker who offers trading on two trading platforms MT4 and MT5. I can also tell you about the withdrawal of money. I’ve been withdrawing money to e-wallets, there were no problems with verification or timing of payments. One of the most worthy brokers in the forex market.

This broker is quite universal and ensures decent execution. Before opening a trading account here I learned that it belongs to the category of the veteran brokers and this fact made me trust it because I realize the whole importance of regulation in trading.

As for my words that it’s “universal” I mean that it caters to both scalpers and long-term traders. Here you can scalp with the tightest possible spreads or trade in the long term with wider spreads. The broker is also good for night and news trading. For this purpose, you can choose an account with fixed spreads.

I am still thinking about which new broker to choose, so, speaking of hycm I can see that it is a multi regulated broker with the good reputation among the traders which is really great because now I understand that this brokerage is trustworthy. However, I would like to try my hand in algo trading in order to make my trading decisions less emotional and more logical. I believe that such a change will stand a chance to improve my trading results in the long run. So, my question is whether I will be able to use EAs in my trading if start working with hycm?

Broker HYCM has trading platforms Metatrader 4 and 5. This software has the ability to connect trading robots and advisors.

This broker seems very advantageous for nearly any trader. It offers to choose between fixed and tight floating spreads and doesn’t offer unproven products such as mediocre customized platforms. Instead, traders can work on tried and tested Metatraders.

It’s a regulated broker that automatically excludes any fraud scenario.

The only downside of this broker is that its British and EU clients can count on 1:30 leverage due to local strict regulation.

I chose this broker solely for long-term trading. Despite it also offers decent opportunities for scalping such as a Raw account with tight spreads, I’m not interested in this offer. Instead, I’m interested in long-term trading. When I intend to hold trades for years, I want to be confident in my broker. I want to know for sure that someday they will not be forcibly closed. So, I need the ultimate reliability and that’s the reason I decided to open a Fixed account here. I’m not so interested in fixed spreads, although sometimes I trade at night when fixed spreads are most advantageous. In most cases, I open trades in the daytime and try to hold them as long as possible. The main thing is that the broker is very reliable, which is good for my long-term trading. It has more than 40 years of experience – one of the oldest brokers in the world.

When I decided to become a trader I decided to find a 100% honest and professional broker. For me, forex trading is a new occupation and I must be confident in the company which I will give my deposit to. I read a lot that HYCM is an experienced company and there are conditions for profitable trading. For example, I liked the low spreads and high leverage.

This is all good, but it is important for me to know which organization controls the work of this broker?

That is a very good question. Actually hycm is regulated by 4 organisations which are: FCA, CySEC, DFSA and CIMA.

There are lots of advantages which can point this broker out from other brokers. However, I want to grab your attention to the variety of accounts which are represented here. There are several types of account and each of these types has its own peculiarities. What is more important is that you can answer five questions in order to understand which type of account suits you most. I believe it’s very convenient for those who can’t determine which account type to choose. Plus, it really saves your time.

Great broker with decent and consistent reputation. The most important thing is that I am always confident that my deposit is safe and it helps me avoid many nervous situations. I like the trading process with hycm as there is a great choice of trading platforms, so I can choose the platform that I got used to and shouldn’t change it. It is great that the broker cares about traders’ preferences.

Please please stay away from hycm especially if they offered you the choice to register your account in Saint Vincent and the Grenadines ( in which they are allegedly licenced)…

Market orders execuated through them run perfectly until you start gaining real profits:

Your orders start getting seriously delayed ( until major market price changes has occured)…

Other profitable orders don’t even get through even when trying multiple times…

They did this twice to me in a way that was too obviously intended to hurt my account ( after gaining good profits each time)…

And every time, they used ridiculous excuses:

Internet speed issues, software glitches, market volatility..

Of course with other respectable brokers, you never face those type of issues ( especially when it is very obvious it’s intentional and timely)..

I got so many recorded videos showing clearly how they screw up your orders…

To be fair to them, when it comes to withdrawing money : they always sent the requested amount in very brief time ( at least this is my personal experience).

They are definitely a fraudulent company that would throw ambiguous technical reasons for you to make you accept how you got ripped of your money…

Please please go with more trusted brokers: they are simply not worth risking your money.

The broker HYCM offers very good spreads to trade, and there is an opportunity to open an account with both fixed and variable spreads. The spread size depends on the account type. For example, on a Fixed account, fixed spreads start from 1.8 pips, no commission. The Classic account offers variable spreads from 1.2 pips. The Raw account offers spreads from 0.2 pips.

In this article, you mentioned their inactivity fee as a downside of this brokerage company. I don’t agree with it. I think that it’s a normal penalty on the part of the broker. You should realize that your funds are stored on segregated accounts and such storage costs money. Respectively, when you don’t trade, the broker can’t earn on spreads and can’t pay for keeping your money there. So, take it for granted.

I know that many traders who trade with HYCM broker make good money. Tell me, what trading strategies and tactics do you use to achieve success in trading?

Good day to all! I have been trading with HYCM for over four years now and I have nothing bad to say about them. Quite a stable broker. With regard to payments, they come almost instantly. Personally, I try to withdraw money until about 10:00, then you can see the money on your e-wallet before 12:00, and from the e-wallet I transfer money to the card, which comes within five minutes!

As for the terms of trading here, they are one of the best. The most important thing is the minimum lot for trading – 0.01 deposit!

For all beginners, I can only recommend this broker because only he has such low entry thresholds, which will allow even people with small deposits to follow the rules of money management.

I’m more than just satisfied with this broker. It gave me peace of mind. It’s hard to expect something different from a company with more than 40-year experience. It doesn’t offer the richest choice of assets and bonuses, but I know that it’s reputable and regulated. So, I can trade major assets here. I trade instruments unavailable here with other brokers. For example, some altcoins.

Here I trade on a Raw account. It’s good for both scalping and long-term trading.

Please tell me can I trade fixed spreads on MT4 HYCM broker account ??

Yes, HYCM allows its users to trade fix spreads on all the platforms that this brokerage works with and MT4 is not an exception.

I came to HYCM broker after trading with another broker. I will say one thing – why did I not know that there was this broker before? I don’t want to say anything bad about the second broker, everything is fair, transparent and there is a normal software there too. But in terms of trading conditions and service, HYCM outperforms them very well. And in terms of analytics too, I am very happy with the in-house analytics that HYCM provides to its clients. I definitely recommend HYCM.

Very convenient registration, even from a mobile phone. A good site that is not overloaded with information. Excellent terminal performance. Unobtrusive technical support. Excellent order execution speed; during the entire trading period, there were no particular problems.

I have been trading with this broker for a long time. I really like that HYCM has licenses from various government agencies. This is very important for me, because I’m so calm about my money.

I use MetaTrader 4. The platform works quickly, I did not notice any delays. Orders are closed on time, for which a million big thanks.

But I use floating spreads. What are the advantages of raw spreads? Maybe I should change the account type? Very attractive offfer if you think about it.

The main reason for my registration with a HYCM broker is the raw spreads account. There is a lot of talk about this on the FOREX forums and I decided to give it a try. I have been trading scalping for many years, but I didn’t like the spreads of my former brokers. Everything is different here. This HYCM broker account has spreads from 0.2 pips and it really helps for my trading.

I am also amazed at the broker’s honesty and the speed of withdrawing funds.

In my opinion, HYCM is interested in long-term trading of clients. No task to quickly drain. All information on spreads and other things is completely open on the site, all conditions are described in documents that anyone can look at. Even when you trade and compare on a demo account, everything is the same: spreads, quotes. You can deposit from $ 100 to a real account. The leverage for forex trading is set at 1: 200 and the small lot is 0.01. It all depends on the trader whether he can trade profitably. The broker, for his part, provides everything.

I’m still in the process of exploring this broker. I’m already trading on a Raw account. Despite its name, it’s actually an ECN one that suggests trading with tight spreads and a commission. I see no lags and fraud here that corresponds to a good reputation of this regulated veteral broker. I also intend to open a Fixed account to try fixed spreads. I think I will have money for this already next month.

This broker can’t attract you with bonuses and ultra-low deposits if you are used to receiving such offers. But the company has one indisputable advantage. That’s one of the oldest Forex brokers in the world with a more than 40-year experience. Of course, it’s regulated. So, it will not steal your money. The rest depends on you, how you forecast the market.

The only inconvenience that you may face with this broker if you join HYCM (Europe) Ltd (CySEC) or Henyep Capital Markets (UK) Ltd (FCA). These European branches of the broker are strictly regulated by local watchdogs that results in 1:30 leverage for Forex instruments. If you have such an opportunity, register a trading account with HYCM LTD (St. Vincent). In this case, you can enjoy 1:500 for Forex assets.

Nothing is perfect, but I tried to look for the perfect broker)) I think it is said loudly .. to put it simply, HYCM is a broker that meets my wishes. Here’s what I need: trading tools that I constantly study. I think that’s the way it should be. I always read a lot of information on each asset to make a better forecast. Technical analysis is great, but I also use fundamental analysis. I’m pretty sure you need to use both analyzes to be sure. I started trading Forex to make money, so there should be no mistakes!

I have been working with hycm for the second year already. In general, I was satisfied with the trading conditions and the service provided. Not without problems, of course, but, as they say, that it is not mistaken and there are no problems only for those who do nothing. Their support helped to quickly solve all problems. I hope they won’t disappoint in the future.

There is a convenient form of 5 questions, answering which you can understand which type of trading account is best suited.

When registering, I opened a trading account of the Fixed type, it seemed to me the most suitable – the minimum deposit is $ 100, the minimum transaction is 0.01 lot, spreads from 1.8 pips, there is no commission, there is no EA trading.

I attracted a wide selection of trading instruments, it seems to me that such a diverse selection of instruments as hycm is simply not available anywhere else. I tested the terminal day and night and made sure that the execution of transactions was excellent at any time. I decided to stay trading only here, although at the same time I wanted to open in another company.

Do you think this broker has enough indicators to do good trading analysis?

I made up my mind to register a trading account with this broker once I learned about its very rich experience of working in the industry – more than 40 years. It immediately made this company trustworthy in my eyes. Needless to say, it’s regulated.

That’s a good choice for conservative traders, just like me.

This broker doesn’t offer any fancy features such as bonuses, robots, points for activity and other questionable stuff that can hardly make your trading more productive.

I opened a Fixed account because fixed spreads allow me to avoid chaotic drawdowns typical to floating spreads.

I’ve already told that I don’t need signals. I even don’t rely on many indicators. Awesome Oscillator is the only indicator worth my attention. I especially benefit from its bearish or bullish divergence signals. It helps me to timely spot the upcoming correction.

I joined this company following the recommendation of my friend. By that time I had a series of unpleasant experiences with unregulated brokers and this company turned out to be a good solution for me.

What does HYCM broker offer to people who want to make money fast?

If you are a beginner, you can hardly earn a lot of money fast. First, you should learn how to forecast the market. If you succeed in this, you can work on short timeframes trading intensively in daytime. For this purpose, the broker offers everything required. These are Metatrader 5 or Metatrader 4. These platforms have all the necessary tools to analyze the market. I advise you to take some time to learn how to analyze the market properly. Earning money fast on Forex is possible but it requires practice and a great deal of dedication.

All HYCM accounts offer mobile trading and Islamic accounts are available for all three account types. HYCM take customer service very seriously and have a number of ways to contact their support team. Customer support is available from 11:00 pm GMT on Sundays until 9:00 pm GMT on Fridays.

In addition to being able to be contacted in writing, there is a telephone support line, and a handy live graph viewer is also available 24 hours a day from Monday to Friday. There are five different email addresses on the HY Markets website so that you can easily contact the relevant department to resolve issues or answer questions.

HYCM provides clients with three types of trading accounts Fixed, Classic and Raw. The max leverage reaches up to 1: 500. The choice of additional instruments is wide, clients can trade energies, precious metals, stocks, indices, commodities, crypto, on such trading platforms as MT4 / MT5, MT4 / MT5 Webtrader, MT4 / MT5 Mobile.

I have been trading with hycm for a long time. I recently learned about the existence of cooperation in the framework of the partner program “Partner”. Can you please tell me, has anyone participated in this type of program? What are its benefits?

It happens that the FX market offers lucrative opportunities on some exotic cross-rates, while HYCM does not have them in MT4. But it’s OK for me to switch to the MT5 platform as they are quite similar. Anyway, I make my analysis separately from the platform. I like the Fixed account due to lower spreads, and I don’t need Expert Advisors. I also have an additional income on the HYCM affiliate programme as I talk to many people involved in trading. Reliable broker with strong support from all sides.

I like the Raw account type in HYCM. There are minimal floating spreads, fast and accurate order execution.

I think this account is the best for scalping and intraday trading, which I like to do. Because of my strategy, I trade on short timeframes up to the daily one.

On a Raw account, it is convenient to make short trades. I make the quick placing of orders and their closing. Trades are executed with good speed even in a highly volatile market.

Adequate European broker. There are no problems with the withdrawal, there is no slippage, the Expert Advisors do a good job. Every month I receive a report on transactions, if there are questions – technical assistance always promptly satisfies the request. Hedging risks and protecting funds under the compensation scheme deserves special respect.

I would like to say separately about the compensation scheme – this is the first thing I paid attention to. If something happens to the broker (as it often happens in the market), or he does not pay the deposit, etc. – the fund guarantees the withdrawal of funds under any conditions. I didn’t use it myself, but the presence of this fund already guarantees that I can always get my money by working with hycm.