Funding Traders 2025 Review

-

Updated:

Leverage: 1:100

Regulation: UAE

Min. Deposit: $50

HQ: UAE

Platforms: MT5, MT4

Found in: 2023

Funding Traders Licenses:

- Funding Traders - registered in UAE company number 8839141.

Advertising Disclosure

Updated:

Leverage: 1:100

Regulation: UAE

Min. Deposit: $50

HQ: UAE

Platforms: MT5, MT4

Found in: 2023

Funding Traders Licenses:

Funding Traders, founded in 2023, is a proprietary trading company aimed at enabling aspiring traders to thrive by equipping them with essential capital. Their comprehensive offerings encompass access to trading funds, cutting-edge tools, educational resources with practical tips for funded account traders, and a nurturing community. Funding Traders programs cater to traders adept at navigating various markets, including Forex, indices, stocks, metals, and cryptocurrencies.

Becoming a Funded Trader entails trading with company funds rather than personal capital. Traders simply need to pass a test or challenge to qualify for a funded account, enabling them to trade as professional traders using a company account. Explore more about proprietary trading here. However, it’s crucial to review our funding details below as there are important risk factors to consider before getting involved.

The amount funded traders make varies widely based on their trading performance, the size of their funded account, and the profit-sharing agreement with the prop firm. Profits can range from a few hundred to tens of thousands of dollars per month, heavily influenced by the trader’s skill, risk management, and market conditions.

| Funding Traders Advantages | Funding Traders Disadvantages |

|---|---|

| High profit split up to 100% | Lack of Regulation |

| Zero commissions on challenge accounts | Difficult to become a funded traders |

| No swap fees | Restrictions on trading around news events |

| Low Registration Fee | No Alternative Platforms |

| MT5 and MT4 with EAs | |

| Refundable Fee | |

| Good range of Challenge Models |

Based on the information available, Funding Traders is considered legitimate, it operates within the UAE known for its stringent regulatory environment and reputable financial framework. The firm is designed to support traders by providing them with the necessary capital, tools, knowledge, and a supportive community to succeed in trading.

The prop firm has received positive reviews for its payout policies, community support, and innovative approach to prop trading. It has a customer review score of 4.9/5 on TrustPilot, highlighting the firm’s legitimacy and the satisfaction of its traders.

After reviewing the official website, we found no indication that Funding Traders is a scam. However, given that Prop Trading Firms operate with minimal regulation from financial authorities, it’s challenging to definitively determine the firm’s legitimacy.

Our recommendation is to thoroughly educate yourself about Prop Trading, grasp its risks, and opt for a reputable company with a longstanding presence for stability. While the financial commitment typically involves minimal investment beyond subscription fees, losses remain relatively low compared to direct trading with personal funds.

The focal point of our funding traders Review lies in understanding how the evaluation challenge is structured and the prerequisites for participating in the trading challenges. This encompasses the nature of the tests required to qualify for a Funded Trading Account and assume the role of a Proprietary Trader, as well as the associated costs typically linked to registration fees.

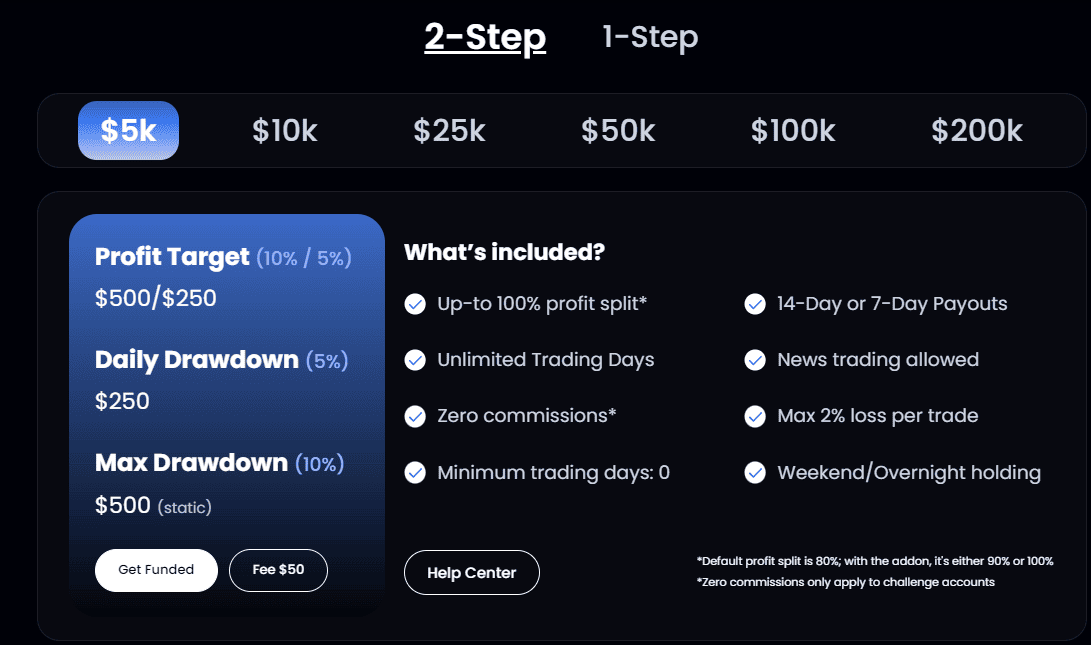

Prior to initiating the Funding Traders login process, you must first choose the model and account balance for which you aim to qualify. The conditions of the challenge vary slightly depending on the size you select. Additionally, this choice impacts the registration fee you’re required to pay to the company to partake in the challenge. However, Funding Traders provides a refund of the fee upon achieving the status of a Funded Trader.

| Fees | Funding Traders | FTMO | The Funded Trader |

|---|---|---|---|

| Minimum Account Size | $5,000 | $10,000 | $50,000 |

| Fee | $50 | €155 | $289 |

| Maximum Account Size | $200,000 | $200,000 | $400,000 |

| Fee | $1000 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

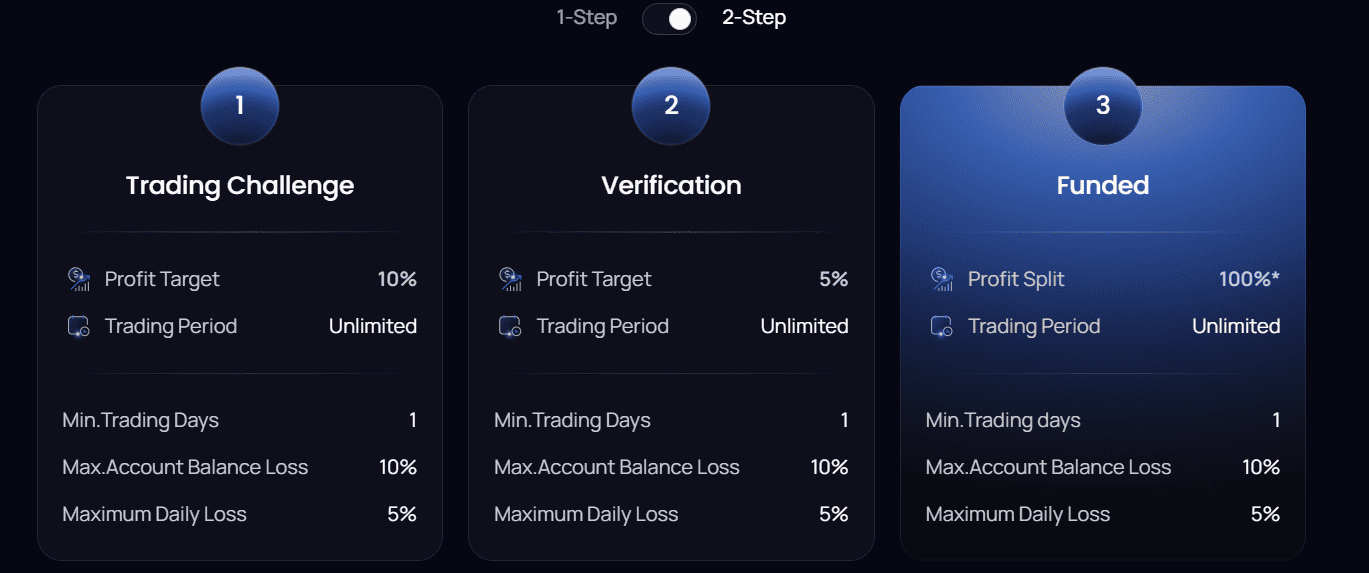

Throughout the evaluation process, traders are tasked with meeting predetermined profit objectives while adhering to maximum drawdown constraints. In a 1-step challenge, the profit target typically hovers around 10%. In contrast, a 2-step challenge entails achieving a 10% profit target in phase 1.

Funding Traders’ maximum loss policy varies depending on the specific evaluation challenge a trader participates in. Generally, for the 1-step evaluation challenge, the firm sets a maximum daily drawdown limit of 4% and an overall drawdown limit of 5% based on the initial account balance.

For the 2-step challenge, the conditions are a bit different, with the overall drawdown limit being higher. In the first phase of a 2-step challenge, the trader faces a daily drawdown of 5% and an overall drawdown of 10%, static on balance, meaning it does not adjust with the account’s equity but is based on the initial account size

The minimum trading period for traders participating in Funding Traders’ evaluation challenges varies, but generally, traders are expected to trade for a minimum of 1 day before they can qualify for a payout.

The detailed table with Funding Traders Challenge conditions based on Account Size:

Based on our research Funding Traders does not offer a free trial for their evaluation challenges or trading programs. The process to become a funded trader with them involves paying a one-time refundable fee and completing their evaluation challenge. Read about Prop Trading Firms with Free Trial here

Upon successfully completing the test or challenge, traders will have their Funded Account established, a process that generally takes a few business days to activate. It’s crucial to understand that the account conditions and balance will mirror those for which you qualified during your test. If you wish to upgrade to a higher-grade account, you’ll need to undergo testing anew for the desired account balance.

Funding Traders offers a default profit split of 80% to the trader and 20% to the firm. Traders have the option to upgrade their profit split to 90% or even 100% through a checkout process, allowing for increased earnings potential. The minimum payout is $50 profit on any account size

Successful completion of the evaluation phase leads to a funded trading account with a profit-sharing agreement. The profit split can be up to 100%, with the first payout available 7-14 days after the first trade is placed.

Eligibility for payouts requires meeting the minimum trading period and adhering to trading objectives. The minimum payout threshold is set at $50 profit across any account size.

Funding Traders offers two primary withdrawal methods: bank transfer and cryptocurrency. For bank transfers, traders need to set up a Deel account as an independent contractor and link it to their bank account, with a waiting period of 1-5 business days for the transfer. Cryptocurrency transfers are instant and are used for traders not in Deel-supported countries

Funding Traders offers traders a wide range of trading instruments, including Forex, cryptocurrencies, stocks, indices, and metals. This variety is aimed at catering to the diverse preferences and strategies of multi-instrument traders who wish to explore different markets. It’s important for traders to consider factors such as leverage, contract size, and spread, which can vary across these instruments

Funding Traders offers a unique commission structure where they do not charge any commissions on trades for challenge accounts, setting them apart from many other prop firms

Funding Traders offers leverage options varying by asset class: FX up to 1:100, indices and gold up to 1:50, and cryptocurrencies up to 1:5. This range is designed to cater to different trading strategies and risk tolerances.

Funding Traders offers its traders access to Meta Trader 4 (MT4) and Meta Trader 5 (MT5), which are among the most widely used platforms for forex trading. These platforms cater to a variety of trading strategies and are preferred for their robust features, including advanced charting tools, automated trading capabilities through Expert Advisors (EAs), and extensive back-testing environment

Funding Traders offers a comprehensive set of conditions tailored to accommodate the varying needs of traders engaging with their funded account programs.

At the moment of writing this article Funding Traders is offering a spring promotion with a 30% discount available when using the promo code “SPRING”. This could be a great opportunity for those looking to participate in their trading challenges and programs at a reduced cost.

Funding Traders stands out as a reputable prop trading firm, providing clients with thorough trading evaluation challenges. Notably, they offer zero commissions and a diverse array of trading instruments, including stocks, among others.

While their trading conditions are versatile, offering a high profit share, it’s worth noting that the firm does not provide a free trial. Additionally, their platform offering is somewhat limited. Therefore, it’s advisable to explore other options that better suit your preferences.

If you’re interested in exploring alternatives to Funding Traders, competitors like TopStep or Apex Trader Funding also offer unique benefits and focuses, including personalized mentorship, specialized markets, and competitive profit splits. Each of these firms provides a distinct approach to prop trading, catering to different trader needs and preferences

No review found...

No news available.