Capital Index 2025 Review

-

Written by:

George Rossi -

Updated:

Leverage: 1:30 | 1:200

Regulation: FCA, SCB

Min. Deposit: $100

HQ: UK

Platforms: MT4, MarketBOOK Platform

Found in: 2014

Advertising Disclosure

Written by:

George Rossi

Updated:

Leverage: 1:30 | 1:200

Regulation: FCA, SCB

Min. Deposit: $100

HQ: UK

Platforms: MT4, MarketBOOK Platform

Found in: 2014

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 3 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

Capital Index is a Spread Betting, Forex, and CFD broker based on stock indices, commodities, or precious metals, providing a unique experience for traders. The broker uses NDD for transparent, fast, and secure trading. That means the best possible prices in the market, along with good security, making your opportunities wider and more efficient.

The Capital Index team, with a wealth of industry experience, recognizes that providing customer service and support together with state-of-the-art technology is central to success in the industry. Hence, the broker invested heavily in an advanced technical infrastructure to provide an efficient environment and ensure continuous growth.

Capital Index is a broker with an FCA license and regulation, and transparent conditions. The NDD execution is perfect for the platform Capital Index provides, with low spreads.

For the Cons, there is no professional education section compared to other brokers, and instruments are limited to Forex and CFDs.

| Advantages | Disadvantages |

|---|---|

| FCA licensed broker with a strong establishment | Conditions may vary according to regulation and entity |

| Operates globally | No 24/7 customer support |

| Forex and CFD trading | Limited learning materials |

| Client protection | |

| Competitive trading costs and spreads | |

| MT4 trading platform | |

| Quality customer support |

Capital Index is considered a good broker with safe and favorable conditions, with transparency. The broker offers a range of trading services designed for all levels of traders. Here are the main features that the broker offers:

| 🏢 Regulation | FCA, SCB |

| 🗺️ Account Types | Advanced, Pro Accounts |

| 🖥 Trading Platforms | MT4, MarketBOOK Platform |

| 📉 Trading Instruments | Forex, CFDs, Financial Spread Betting and Spread Trading, Commodities, Indices, Metals |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 1.6 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | GBP, EUR, USD |

| 📚 Trading Education | Trading guides, glossary, market news and analysis |

| ☎ Customer Support | 24/5 |

Capital Index is ideal for users who value a simple, transparent, and well-regulated environment. With FCA oversight, competitive spreads, and straightforward execution, it suits beginners and intermediate traders looking for a secure place to trade Forex and CFDs without unnecessary complexity. We found that the broker is a good choice for:

Overall, Capital Index is a reliable choice while regulated by the Top-Tier industry authority. Generally, the broker satisfies the most convenient and common users’ needs.

By offering a reliable platform with comprehensive financial solutions, a variety of analytical tools, strategy-enhancing features, and an STP execution model with competitive pricing that eliminates conflicts of interest, the broker provides a strong environment.

Combined with its responsive support and overall stability, it becomes a solid option for traders to consider.

Capital Index stands out by combining strict FCA regulation with a clear focus on transparency, making it a trustworthy choice for users who prioritize safety and fairness.

Its execution model, built on STP/NDD technology, ensures fast order processing without dealing-desk interference, which helps reduce conflicts of interest and provides more accurate pricing. The broker also offers competitive spreads and a streamlined platform setup, allowing traders to operate efficiently without unnecessary complexity.

Additionally, its emphasis on straightforward conditions, stable performance, and supportive customer service creates a dependable environment that appeals to those seeking reliability and simplicity over overly complicated features.

| Capital Index is an excellent Broker for: | - Need a well-regulated broker․ - Secure trading environment. - Offering a range of popular trading instruments. - Providing competitive trading conditions. - Get access to MT4 platform. - Who prefer higher leverage up to 1:200․ - Currency and CFD trading. - Various strategies allowed. - UK and international traders. - Beginners or intermediate users. - Providing competitive spreads and fast order execution. - Looking for broker with access to VPS Hosting. |

| Capital Index might not be the best for: | - Who prefer 24/7 customer service. - Need cTrader or MT5 platform. - Prefer MAM/PAMM trading. - Looking for good learning materials. |

Score – 4.5/5

Capital Index, headquartered in London, is authorized and regulated in the UK by the FCA under the entity Capital Index UK Limited.

The broker is also regulated through its Bahamas office, registered with the SCB as Capital Index Global Limited.

Capital Index follows and adheres to safety measures that, as per regulations, impose numerous restrictions and oversee how the brokerage is operated. Therefore, all client funds are fully segregated and held in separate bank accounts, ensuring they are not used for company purposes.

While the broker maintains a solid regulatory framework, traders should remain aware that offshore regulation may provide fewer safeguards compared to oversight from stricter authorities.

Capital Index demonstrates transparent conditions and maintains a solid reputation within the trading community. The broker has earned respectable scores and feedback from users, who often highlight its reliable execution, strong regulation, and straightforward platform, while also noting areas for improvement, such as its limited range of instruments.

Its long-term presence in the market, supported by reputable regulatory oversight, further enhances its credibility. Additionally, its active participation in social or sponsorship initiatives strengthens the broker’s overall image, reflecting its commitment to maintaining a positive and trustworthy standing within the financial community.

Score – 4.4/5

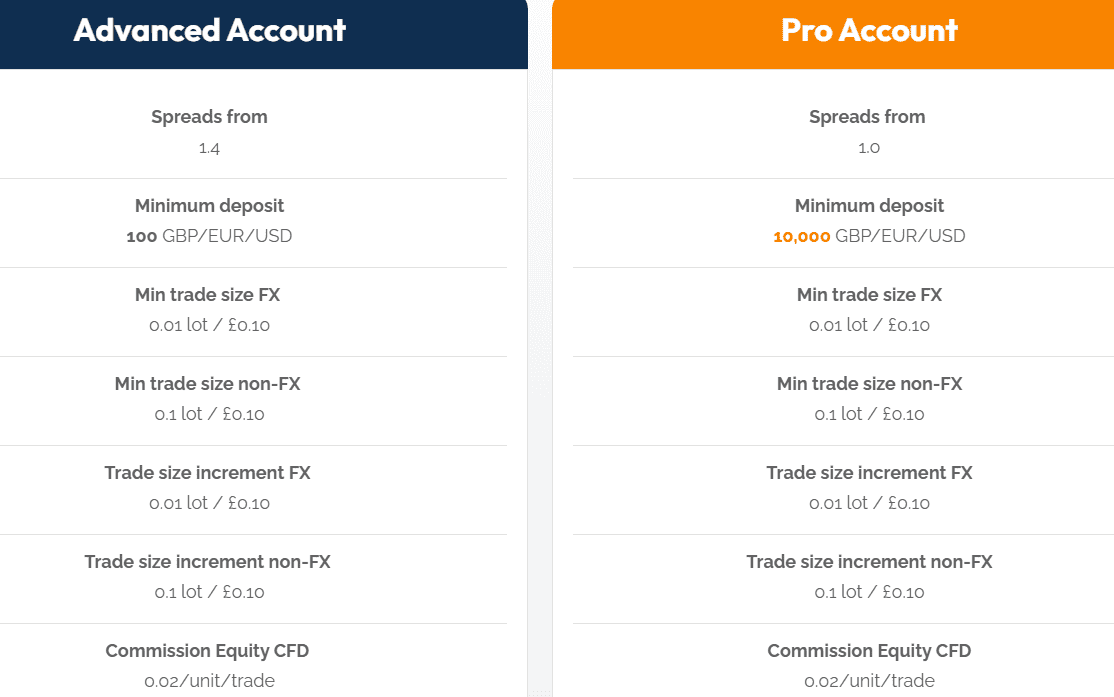

Capital Index offers two account types: Advanced Account and Pro Account. Both accounts are supported by a VPS service and various leverage levels.

Of course, in the beginning, any user can open a risk-free demo account with Capital Index.

Advanced Account

The Capital Index Advanced Account is for users who want more competitive conditions without requiring a large starting balance.

With a minimum deposit of $100, it offers accessibility while still providing improved pricing. Spreads start from 1.4 pips, giving clients a cost-efficient environment supported by fast execution and a straightforward platform setup. Overall, it is a solid option for those seeking a balance between affordability and enhanced features.

Capital Index does not provide services in certain jurisdictions due to regulatory restrictions and compliance requirements. Residents of the following countries are not eligible to open accounts:

Score – 4.5/5

Capital Index charges competitive brokerage fees, including low spreads and commissions. Users should also consider overnight fees or swaps, which apply if a position is held open for more than a day.

Additionally, other costs such as funding fees may apply, depending on the specific circumstances of your trading.

Capital Index Spreads are different depending on the account type you choose. The average spread for EUR/USD is 1.6 pips. Also, for other instruments, the broker provides good spreads for the Pro account.

Capital Index charges commissions on certain trades to ensure a transparent and cost-efficient environment. For Equity CFDs, the commission is 0.02 per unit per trade, with a minimum amount of $15.

The broker applies rollover fees for positions held overnight, reflecting the interest rate differential between the currencies or instruments traded.

These fees can be either positive or negative, depending on the direction of the trade and the underlying rates. Swap rates are clearly displayed in the platform, allowing traders to anticipate holding costs and manage positions effectively.

In addition to spreads and commissions, Capital Index applies other fees, including overnight or swap charges for positions held longer than a day, as well as funding or transaction-related fees.

The broker also charges an inactivity fee of $15 per month on accounts that have been dormant for six months or more. These additional costs vary depending on the instrument and trading activity, so users need to review them to understand the full cost of trading.

Capital Index offers competitive fees that combine low spreads with transparent commissions, making it an attractive option for clients seeking cost-efficient trading.

While additional costs such as overnight swaps, funding fees, and inactivity charges may apply, the overall fee structure is straightforward and designed to minimize hidden costs, allowing traders to manage their expenses effectively.

| Asset/ Pair | Capital Index Spread | Doto Spread | Interstellar FX Spread |

|---|---|---|---|

| EUR USD Spread | 1.6 pips | 1.1 pips | 1 pip |

| Crude Oil WTI Spread | 6.6 | 8.6 pips | 6.8 |

| Gold Spread | 0.5 | 42 pips | 0.8 |

| BTC USD Spread | - | 20.1 pips | 50 |

Score – 4.6/5

Capital Index provides clients with access to the world’s financial markets through the popular MetaTrader 4 platform, available on desktop, mobile, and tablet.

MT4 is one of the most widely used platforms for Forex and CFDs, offering advanced charting tools, technical indicators, and automated trading through Expert Advisors, which can monitor the markets and execute trades based on pre-set rules.

In addition, the broker offers the MarketBOOK platform, which provides deeper market insights, real-time pricing, and enhanced order management tools, giving traders a comprehensive suite of resources to analyze and execute their trading strategies efficiently.

| Platforms | Capital Index Platforms | Doto Platforms | Interstellar FX Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Capital Index’s proprietary MarketBOOK platform offers users real-time pricing, in-depth market analysis, and advanced order management tools.

Designed for efficiency and clarity, it provides a comprehensive environment for trading Forex and CFDs, allowing clients to monitor market movements closely and execute trades with precision.

The MT4 platform is available as a desktop program for Windows. It is actually known for its wealth of information, simple yet powerful information, charts, and custom indicators. Furthermore, MT4 brings the possibility to trade directly from the chart in manual or even automatic ways through EAs.

If you prefer to trade, analyze, or monitor your positions in real-time from your mobile phone or tablet, you can download the Android or iOS app.

Testing the MT4 platform with Capital Index highlights its reliability, user-friendly interface, and robust functionality. Clients benefit from advanced charting tools, a wide range of technical indicators, and the ability to use EAs for automated trading.

Overall, MT4 provides a stable and efficient environment for executing Forex and CFD trades across desktop, mobile, and tablet devices.

Capital Index does not offer the MetaTrader 5 platform. Traders looking to use MT5 will need to consider alternative brokers, as Capital Index currently provides trading access only through MT4 and its proprietary MarketBOOK platform.

Capital Index offers the MetaTrader 4 mobile app, allowing users to access the markets anytime via smartphones or tablets. The app provides a full range of features, including real-time quotes, advanced charting tools, technical indicators, and the ability to execute trades and manage positions on the go.

MT4 mobile ensures that traders can monitor and respond to market movements efficiently, even while away from their desktops.

Capital Index does not currently offer dedicated AI solutions. However, traders can use automated trading through MetaTrader 4’s Expert Advisors, which can monitor the markets and execute trades based on pre-set rules. While this provides automation and efficiency, it is not the same as the built-in AI-powered trading offered by some other brokers.

Score – 4.5/5

Capital Index offers CFDs based on stock indices, commodities, and precious metals, over 60 currency pairs in Forex, and Spread Betting to its clients.

Exploring Capital Index’s tradable assets highlights the broker’s focus on providing a balanced mix of instruments suitable for different strategies.

The platform delivers reliable pricing, efficient execution, and sufficient variety to allow traders to diversify their portfolios. Overall, the asset range is straightforward and accessible, supporting both short-term trading and longer-term investment approaches.

Leverage trading, which is a unique opportunity to trade larger sizes compared to your initial balance, offers to maximize your gains. However, you should carefully learn how to use this tool, since the multiplier may work in reverse as well.

Score – 4.4/5

Capital Index accepts the most common payment methods, including Debit card and Credit card payments, and Bank transfers. Deposits and withdrawals cannot be made to/from third-party accounts.

The minimum deposit is 100 units of your base currency, depending on your account type and the currency you choose to be as the main one.

Capital Index offers a Capital Index Prepaid MasterCard withdrawal option. It means when the client withdraws from the account, the funds are added to the card instantly as they are deducted from the trading account, and allowed to enjoy the same features as the MasterCard offers worldwide.

What is also great, there are no charges for deposits or withdrawals, except if you would like to perform a withdrawal on the same day.

Score – 4.5/5

Capital Index provides 24/5 customer support to its clients. Phone lines, Live chat, and Email are also available here.

Users can reach Capital Index’s support team via email at support@capitalindex.com or by phone at +44 20 7060 5120. The broker provides assistance for account inquiries, technical support, and general questions to ensure clients receive timely and helpful guidance.

Score – 4.4/5

Capital Index provides a solid set of research tools available both on its website and platforms.

The broker offers educational resources, including trading guides, a glossary of trading terms, and regular market news and analysis.

Together, these materials help users build their knowledge, understand market trends, and make more informed decisions.

Score – 3/5

Capital Index primarily operates as a CFD broker and does not offer traditional investment products or portfolio management services.

While traders can access a range of CFD instruments to speculate on price movements across Forex, commodities, indices, and shares, the broker is focused on trading rather than long-term investment or wealth management solutions.

Score – 4.4/5

To open a Capital Index demo account, first visit the broker’s website and select the option to create a demo account. Fill in the required personal details and contact information, then choose your preferred platform and set your virtual account balance.

Once completed, you will receive login credentials to access the demo account, allowing you to practice trading, test strategies, and explore the platform risk-free before opening a live account.

Opening an account with Capital Index is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

Score – 4.3/5

In addition to its research tools, Capital Index provides several other features designed to enhance the experience.

Compared to its competitors, Capital Index offers a solid and reliable environment with a focus on transparency, regulatory compliance, and efficient platforms.

While some brokers provide a wider variety of instruments or more advanced educational resources, Capital Index maintains a balanced offering that combines low-to-average fees, user-friendly platforms, and a clear regulatory framework.

Its services are well-suited for traders who prioritize security, straightforward conditions, and access to core Forex and CFD markets, even if it does not offer the extensive asset range or highly specialized tools available at some other brokers.

| Parameter | Capital Index | Purple Trading | Interstellar FX | Colmex Pro | Taurex | CMC Markets | ActivTrades |

| Spread Based Account | Average 1.6 pips | Average 1.3 pips | Average 1 pip | Average 4 pips | Average 1.7 pips | Average 0.5 pips | Average 0.5 pips |

| Commission Based Account | 0.02 per unit per trade, with a minimum amount of $15 | 0.3 pips + $2.5 per side | 0.0 pips + $3.50 per side | For stock CFDs, $0.01 per share + a minimum of $1.5 per side | 0.0 pips + $2 per side | 0.0 pips + $2.50 | For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking | Low/ Average | Low/ Average | Average | Average | Low/ Average | Low/ Average | Low/ Average |

| Trading Platforms | MT4, MarketBOOK Platform | MT4, MT5, cTrader | MT4 | Colmex Pro 2.0, MT4 | MT4, MT5, Taurex Trading App | CMC Markets Next Generation Web Platform, MT4 | ActivTrader, MT4, MT5, TradingView |

| Asset Variety | 60 currency pairs in Forex | 200+ instruments | 100+ instruments | 28,000+ instruments | 1,500+ instruments | 12,000+ instruments | 1,000+ instruments |

| Regulation | FCA, SCB | CySEC, FSA | FCA, FSA | CySEC, FSCA | FCA, FSA, SCA | FCA, ASIC, BaFin, IIROC, FMA, MAS | FCA, CMVM, FSC, SCB |

| Customer Support | 24/5 | 24/5 | 24/5 | 24/5 | 24/5 | 24/5 | 24/5 |

| Educational Resources | Limited | Good | Limited | Limited | Excellent | Good | Good |

| Minimum Deposit | $100 | $100 | $50 | $500 | $10 | $0 | $0 |

Capital Index is a well-regulated broker offering a transparent and reliable environment. With access to Forex and CFD markets, the broker provides efficient execution, competitive spreads, and user-friendly platforms, including MetaTrader 4 and its proprietary MarketBOOK.

Traders can benefit from research tools and automated trading via Expert Advisors, while support is readily available to assist with account and trading queries. Overall, Capital Index presents a solid option for those seeking a secure, straightforward, and efficient experience.

No review found...

No news available.

Total scam

I invested £200 and proceeded to make investments buying and selling

I have been trying for months to withdrawer my money but they will not release it

They look real but they’re scammers, they stole a lot from me, my hard-earned money, and I still hate myself for believing their lies. Let’s get in touch and talk better jhnwardlaw via gmail, I reported my case and I’m working on its recovery now.

They look real but they’re scammers, they stole a lot from me, my hard-earned money, and I still hate myself for believing their lies. Let’s get in touch and talk better jhnwardlaw via gmail, I reported my case and I’m working on its recovery now.

Just yesterday, i invested $100, and the profit is said to be $1633. They asked for my wallet address, i provided by later they sent msg to my email that my account is suspended because my profit exceeded my maximal withdrawal. They are asking me to pay $195 in order to synchronize my account to premium for unlimited amount of withdrawal, they said after the deposit, I will be able to withdraw that amount easily. Sincerely, I failed to understand this logic, can someone help to explain this to me before I make another little payment of what I have in their account?

Merhaba firmanizda yatırım yapmayı düşünüyordum bayaa dir takip ediyorum sizi fakat bugün gördüğüm telegram grubundan yatırım yapilamazlar arasına girmissiniz.dogrusu tam guveniyoken tekrar güvenim sarsıldı artık yatırım yapamam size.

Capital Index Global copying signals, has now retrieved the above mentioned scam signal, but instead has put 2 new scam signals, Matador Trading, Oracle Daytrading. I even did not check their other few signals, which should be provided by Pelican.

The IP address for https://signals.capitalindexglobal.com/?utm_source=sendgrid.com&utm_medium=email&utm_campaign=website is 94.237.53.243 which is registered in UK, London.. Though it concerns a Bahamas authorised financial services company.

They can only operate under FCA which is not the case, so they are unlicensed in the UK.

Capital Inxes signals are SCAM !!! They should bedelivered by Pelican .

Eg. a strategy called ‘Defensive’, declares to have a grow % of 76 % while in reality

they have more than 30 % loss. Profits are paid out from the remaining capital.

This scam structure will run up to approx. 500 % grow, and then the clients will be asked

for new funding. Again the clients will lose all their funds.

Besides of that Capital Index has no more own capital, and is factual broke.

They have made a loss of 900.000 Pounds for 3 million turnover in 2018.