- What is BCR?

- BCR Pros and Cons

- Regulation and Security Measures

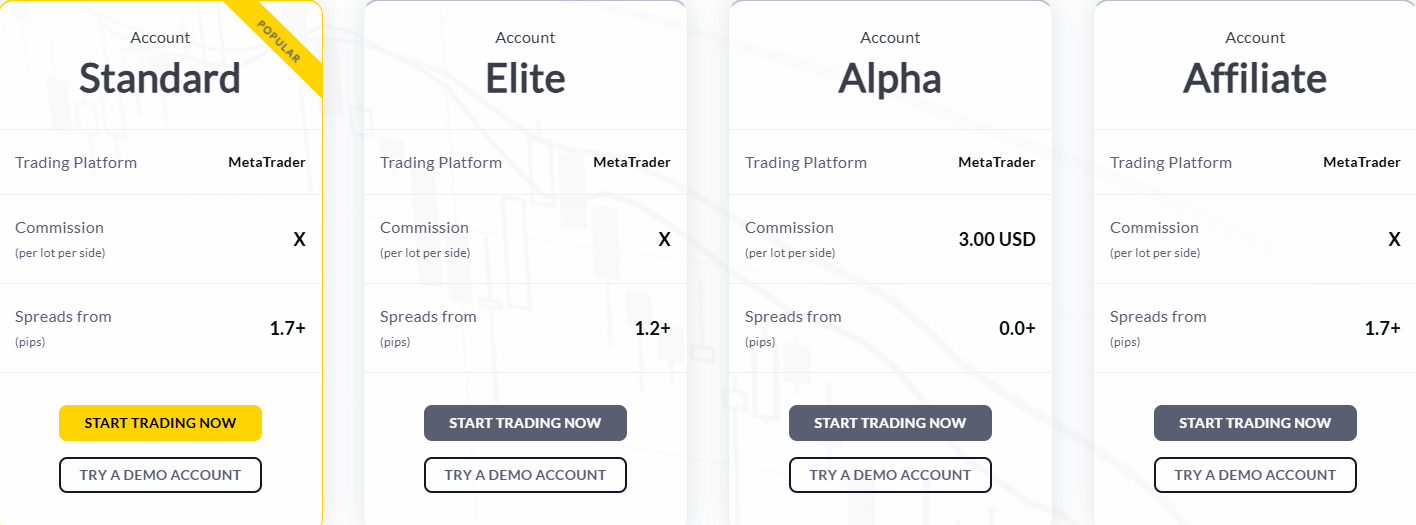

- Account Types and Benefits

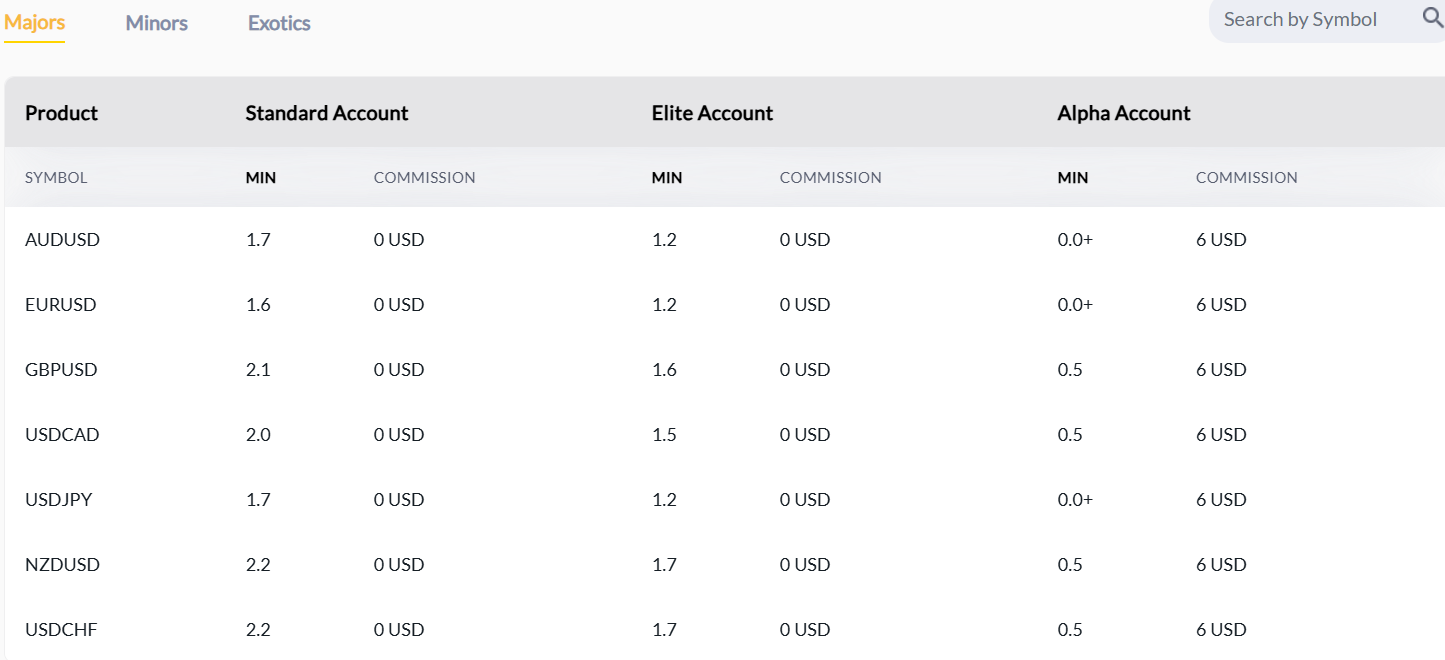

- Cost Structure and Fees

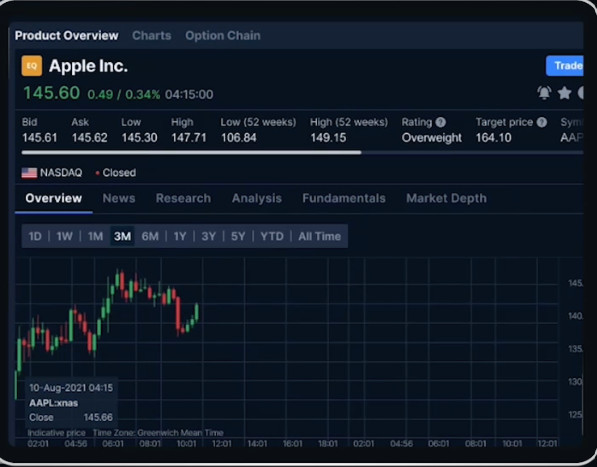

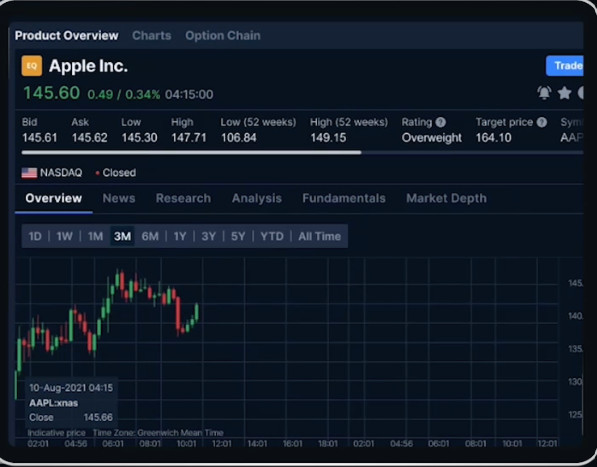

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- BCR Compared to Other Brokers

- Full Review of Broker BCR

Overall Rating 4.3

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 3.5 / 5 |

What is BCR?

BCR, or Bacera, is an incorporated Australian brokerage company that was founded in 2008 as a CFD trading provider offering to trade in forex, shares, metals, commodities, and indices. As a broker, Bacera offers its clients access to various trading platforms, a wide range of financial instruments to trade, and competitive trading conditions, including low spreads and fast execution speeds.

- The broker’s main mission is to place the client’s needs first in order to be successful. For that reason, the company provides a powerful trading platform that allows quotes to analyze and strategy development in real time without dealer intervention.

BCR Pros and Cons

BCR is among the respected Australia-regulated brokers with easy account opening and good trading conditions for CFD trading with advanced platforms, quality analysis, market overviews, and support services.

On the flip side, trading instruments are limited to CFDs and education materials are not very deep for beginning traders. Also, we have noticed that spreads for some account types and instruments are higher than the industry average.

| Advantage | DIsadvantage |

|---|

| Multiply regulated broker with a strong establishment | Runs offshore entity |

| Good Reputation | Offerings differ depending to the jurisdiction |

| The great technical solution, tools, platforms | |

| MAM account availability | |

| Competitive trading conditions | |

BCR Features

BCR is a multiply regulated broker with reliable practices, a global presence, an extensive range of markets, good account conditions, and a transparent fee structure. The broker stands out for different aspects of trading, including innovative platforms, a variety of account types, great analytical tools, etc. Based on our research, we have compiled the ten most essential points about the broker for a quick overview:

BCR Features in 10 Points

| 🗺️ Regulation | ASIC, BVIFSC, SVG |

| 🗺️ Account Types | Standard, Elite, Alpha, Affiliate |

| 🖥 Trading Platforms | MT4, MT5, MT4/MT5 WebTrader |

| 📉 Trading Instruments | CFD products Shares, Indices, Commodities, Oil, FX, Precious Metals |

| 💳 Minimum deposit | $300 |

| 💰 Average EUR/USD Spread | 1.7 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | AUD, USD |

| 📚 Trading Education | Weekly market overviews, fundamental and technical analysis |

| ☎ Customer Support | 24/5 |

Who is BCR For?

Based on our research, BCR is a good broker for different traders looking for access to a wide range of markets, favorable trading tools, conditions and environment, and advanced practices. Here, we have listed what BCR is especially good for:

- Traders of all levels of expertise

- Algorithmic Trading

- Copy Trading

- Hedging and Scalping

- Trading with MetaTrader4/5

- Currency Trading and CFD Trading

- Suitable for Multiple Strategies

- Free VPS

- EAs Trading

BCR Summary

BCR is a reliable broker regulated by the world’s top-tier ASIC. Among BCR’s competitive offerings, we should admit a developed solution for CFD products trading on an OTC basis, the powerful proprietary platform based on MetaTrader technology, quite competitive spreads, and bonus programs, which are always a plus. With its enhanced platforms and innovative features, the broker will be suitable for intraday traders, scalpers, and copy traders. Another advantage is the leverage of up to 1:400, which is considered a higher offering compared to other brokers.

55Brokers Professional Insights

Overall we find BCR a reliable broker, since is strictly regulated by ASIC and has been in operation for more than 18 years. BCR provides favorable trading conditions and a secure trading environment suitable for traders either from Australia or Internationally, also good for traders of high volume or frequent trading strategy relying of commisison based accounts. The broker offers a diverse selection of instruments with highly competitive commission, while spread account are mainly in line and at times higher than average. There are excellent platform options available, and availability for global traders is another plus.

In additiona, there are also offers copy trading, MAM accounts, and other innovative investment opportunities for more diversification. Besides, BCR has a quick and seamless deposit and withdrawal process, with multiple available funding methods.

However, the broker’s trading instrument range is limited to FX and CFDs, and the platforms will be a good choice for MetaTrader enthusiasts only. Those who are looking for more platform diversification might be disappointed. Another point to consider is that the broker operates under an offshore entity as well, which might not provide the same level of safety. Besides, the trading conditions can differ from entity to entity.

Consider Trading with BCR If:

| BCR is an excellent Broker for: | - Beginners and Professionals

- MetaTrader platforms enthusiasts

- WebPlatform seekers

- Forex and CFD traders

- Copy traders

- Day traders

- Traders prioritizing top-tier regulation and safe trading |

Avoid Trading with BCR If:

| BCR is not the best for: | - Traders looking for very low spreads

- Investors interested in traditional investments

- Traders looking for platforms other than MT4/MT5

- Beginners looking for extensive education

- Those looking for 24/7 customer support |

Regulation and Security Measures

Score – 4.5/5

BCR Regulatory Overview

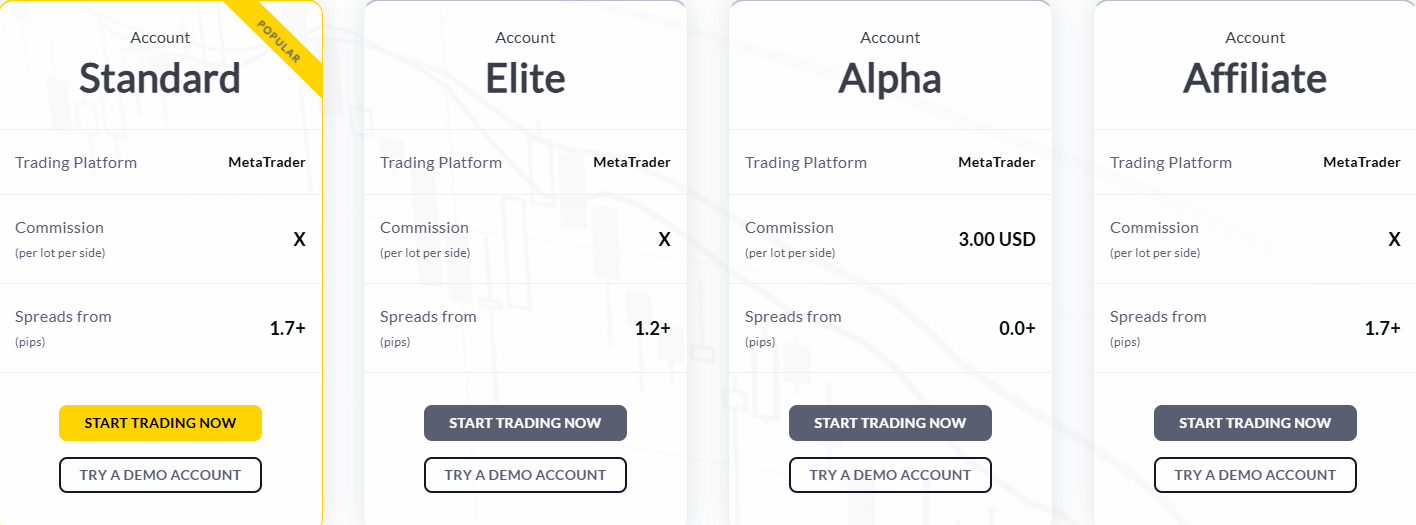

BCR is a safe and regulated broker based in Australia and is regulated by the local financial authority ASIC. The ASIC regulation ensures that the broker operates in a transparent manner, adhering to stringent laws and guidlines. BCR is a trading name of the Bacera Co., and besides being licensed and regulated by the Australian ASIC, it is also a member of the Financial Ombudsman Service.

- BCR’s unwavering commitment to regulatory compliance and clients has earned it a trustworthy reputation in the industry. By adhering to strict standards, BCR has created a secure trading environment for its clients and has ensured the safety of their funds. Despite this, it is worth mentioning that BCR has offshore entities for its international operations; BCR holds licenses from the British Virgin Islands, and Saint Vincent and the Grenadines.

How Safe is Trading with BCR?

Based on our research, BCR is considered a safe trading broker that also provides funds’ protection through several measures ensuring its safety. Deposited funds are segregated at all times with a top-tier Australian bank, along with computable protection and numerous obligations of the audit. In addition, the trading environment and all the performed transactions are fully secured through encryption, which we find essential for clients’ security.

Consistency and Clarity

We have carefully reviewed BCR and its offerings, its manner of operation, and consistency over the years. The broker has been in the market for over 18 years and has shown transparency, clarity, and consistency. We have noticed that the broker has enhanced and expanded its instrument availability, platform offerings, and other aspects of trading, making it better over time to meet the clients’ needs.

Besides, we found that the broker has been awarded by various honorable committees for its dedicated services and constant growth in the market. We have also considered real clients’ feedback to see what experiences they have had with the broker. We revealed that the customers’ reviews are mixed, from impressed and loyal clients to those dissatisfied because of delays in account confirmation, customer support, and other aspects of trading. However, most clients are satisfied with the broker’s intuitive platform, tight spreads, and dedicated customer service. We advise potential clients to carefully consider others’ experience, as well as see how the broker’s offerings meet their own trading needs.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with BCR?

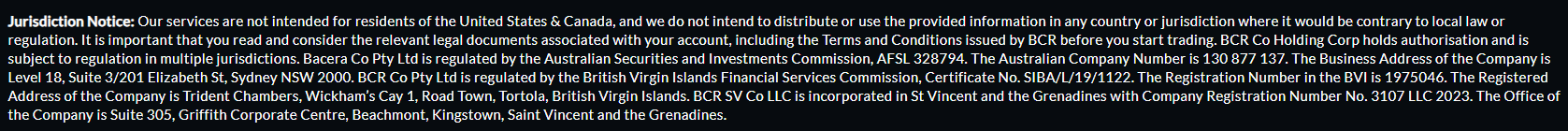

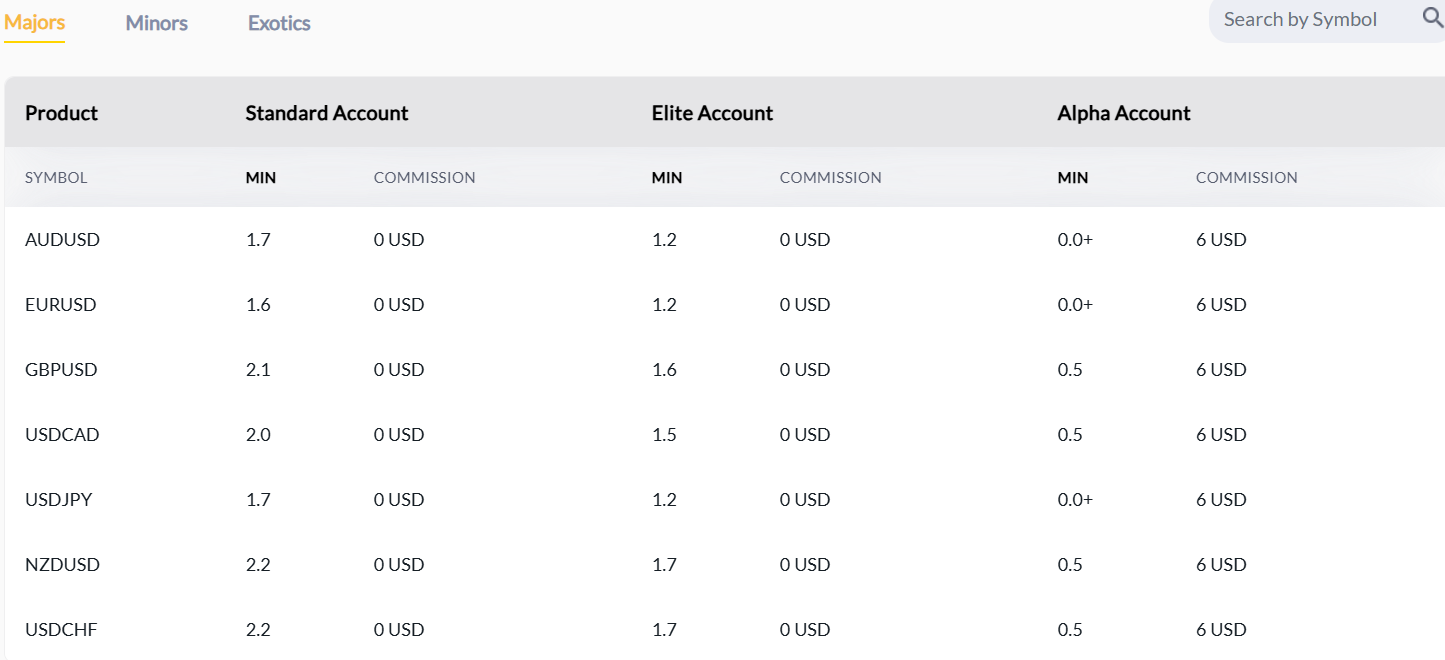

BCR account types differ based on the jurisdiction. Australian traders have a choice between two account types—Advantage and Alpha. While Advantage offers commission-free trading with fees built into spreads, ALPHA offers raw spread trading with commissions of $5-$6.

International traders, on the other hand, have wider account choices. Traders under the BVI entity can choose between 4 account types: Standard, Elite, Alpha, and Affiliate. The leverage for all the accounts is 1:400. The minimum deposit requirement is $300 for all the account types, except for the Affiliate account, which requires $3000 as the first deposit.

- As we have found, the Standard, Elite, and Affiliate accounts are spread-based, with all the costs integrated into spreads. Spreads for the Standard and Affiliate accounts are slightly higher, starting from 1.7 pips. At the same time, the Elite account offers spreads from 1.2 pips.

- On the other hand, the Alpha account is commission-based, with spreads starting from 0.0 pips and fixed commissions of $ per side per lot.

Regions Where BCR is Restricted

BCR is available in over 70 countries, enabling global traders access to Forex trading. The broker does not specify the exact list of the restricted regions. Yet, it’s common for brokers not to accept clients from regulations that are subject to sanctions or from countries with stringent regulatory oversight.

- However, BCR mentions that it does not provide services to US and Canadian residents.

Cost Structure and Fees

Score – 4.5/5

BCR Brokerage Fees

Based on our research, BCR offers slightly higher fees compared to the market average. The fees are defined by the account types. The broker offers three spread-based accounts and one commission-based account. Overall, the broker offers well-defined and transparent fees; for certain instruments, the fees can be higher. Also, costs differ from entity to entity; thus, we recommend being careful under which entity the account is opened.

BCR offers 4 account types, and 3 of them—Standard, Elite, and Affiliate are spread-based. Spreads for the Standard and Affiliate accounts start from 1.7 pips, integrating all the trading costs into them. For the Elite account, spreads are slightly lower, starting at 1.2 pips. There are no additional commissions for the mentioned accounts.

The Alpha account is fully commission-based, with spreads starting from 0.0 pips and fixed commissions of $3, which is considered in line with the market average. This commission-based structure is suitable for professional traders who are looking for fixed costs for every trade.

How Competitive Are BCR Fees?

BCR fees are competitive and well-structured, with access to three spread-based accounts with varying trading conditions and solutions. Spreads also depend on the entity under which the account is registered and the instrument traded. For XAU/USD, spreads for the Standard account are 31, while for the XTI/USD pair, spreads are 50.

All in all, we find BCR’s fees transparent and clear; the broker mentions all the applicable costs for each account and instrument separately. This clarity is essential, as traders will learn the applicable charges in advance. The broker charges commissions for the Alpha account at $3 per side per lot. The commission-based structure with spreads from 0.0 pips is suitable for professional traders looking for fixed and predictable costs.

| Asset | BCR Spread | Fortrade Spread | JP Markets Spread |

|---|

| EUR USD Spread | 1.7 pips | 2 pips | 2 pips |

| Crude Oil WTI Spread | 50 | 0.04$ | 5 pips |

| Gold Spread | 31 | 0.45$ | 26 |

BCR Additional Fees

In addition to spreads and commissions, BCR may charge a few non-trading fees. BCR does not apply deposit or withdrawal fees, however, certain payment providers might incur transaction fees. As to the inactivity fees, BCR does not openly mention them. However, we recommend that traders exercise caution, as each entity might have separate policies about dormant accounts.

- At last, BCR charges swap fees, for the positions held overnight. Swaps can be short and long and depend on the market changes.

Score – 4.4/5

BCR offers the market-popular MT4 and MT5 platforms, available via desktop, web platform, and mobile app. The platforms are available through different operating systems, including Windows, MacOS, iOS, and Android. Availability through different devices makes the platforms more easily accessible. Both platforms feature powerful charting capabilities, numerous indicators, and tools that enhance the trading process.

| Platforms | BCR Platforms | XM Platforms | Pepperstone Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platform | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

BCR Web Platform

BCR offers its clients web-based platforms for both MT4 and MT5. The web platform does not require downloads and installations, and traders can easily access their accounts from any device with an internet connection. The accounts are easily accessible through the web platform, providing an intuitive interface, advanced charts and other analytical tools, and real-time data. The web-based platform includes all the essential features and capabilities to ensure a safe and profitable trading experience.

BCR Desktop MetaTrader 4 Platform

The BCR MT4 platform is a great combination of simplicity and advanced features, enabling traders to navigate the platform with ease and gain access to innovative features and tools. Traders can make use of more than 200 customized indicators and EAs, as well as real-time market analysis. The provided charts and indicators are easily customizable. Besides, traders are able to create their own trading algorithms.

BCR Desktop MetaTrader 5 Platform

The MT5 platform is an advanced version of the MT4, providing more capabilities and the MQL5 programming language, with access to trading robots and EAs. BCR’s MT5 platform includes 38 technical indicators, 44 graphical objects, 6 pending order types, an in-built economic calendar, and 21 timeframes. Besides, the MT5 platform enables the backtesting of different strategies and access to historical data. The platform also supports Market Depth, giving traders more insight into the market.

BCR MobileTrader App

BCR also offers the MT4 and MT5 mobile apps, enabling traders to access the market from the palms of their hands. Clients gain access to live charts and great trading tools. They can place trades and manage their trading accounts from anywhere with ease and flexibility. The mobile platforms are equipped with the essential tools and features that enable clients to conduct productive trades and manage their accounts successfully.

Main Insights from Testing

BCR ensures access to the popular MT4 and MT5 platforms, with access through multiple versions, including the desktop version, web platform, and mobile app. The platforms ensure access to innovative features and tools, automation capabilities, trading indicators, graphs, and multiple charts that enhance the trading experience. The web platform and mobile app ensure complete flexibility and access to the market with great ease, with the same opportunities as the desktop platform provides. However, those traders who are looking for alternative platforms other than MT4 and MT5 will not find the broker’s platforms satisfactory.

Trading Instruments

Score – 4.6/5

What Can You Trade on the BCR Platform?

BCR offers a diverse selection of CFD products, including stocks, indices, commodities, oil, foreign exchange, precious metals, and more. Trading is facilitated through an over-the-counter model, which provides clients with fast and efficient execution, with transactions processed in milliseconds.

The overall amount of the CFD-based products exceeds 300. Traders can access about 40 major, minor, emerging, and exotic Forex pairs. Traders can also access the most trending metals, including gold, silver, and platinum, with reasonable spreads and favorable conditions. BCR provides options for both spot and futures on energy CFDs; thus, traders can choose what meets their trading expectations and style the most. At last, traders can access more than 80 global indices, including Australia, Asia-Pacific, the US, and Europe.

Main Insights from Exploring BCR Tradable Assets

Based on our research, BCR offers a good selection of tradable products across multiple assets. The overall number of instruments is 300, mainly based on CFDs. Besides, BCR gives access to over 40 currency pairs, more than 80 global indices, the most demanded commodities, and precious metals. The trading conditions and costs are also favorable, with average fees, functional platforms, and innovative solutions.

However, there are points traders should consider. Firstly, BCR offers only CFD-based products, which excludes the chances for traditional investments. Secondly, the broker operates under several entities with differing trading conditions. This said, BCR is a good choice for traders who are looking for access to the most popular instruments with easy access and satisfying conditions.

Leverage Options at BCR

Leverage in forex is a tool that allows traders to control a large amount of currency using borrowed capital from a broker. In the forex market, leverage allows traders to take larger positions in the market and generate larger returns.

The leverage from BCR varies based on factors such as the regulatory environment, the type of trading account, the instrument traded, and their level of experience and expertise.

- Australian traders have access to a maximum 1:30 leverage level for forex trading due to the recently imposed restrictions.

- The BCR’s international entity enables the flexibility to choose leverage up to 1:400, which is considered high leverage.

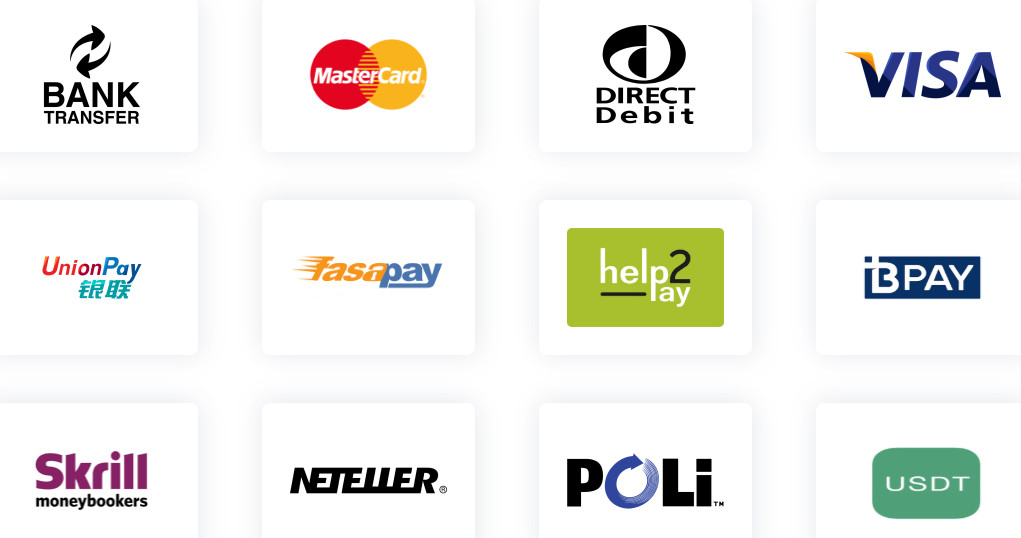

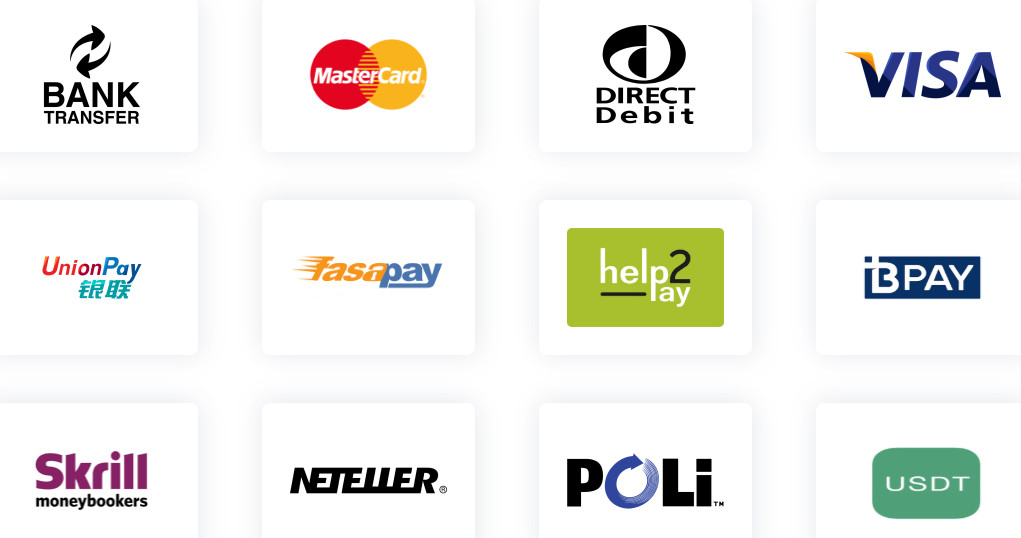

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at BCR

To fund the account and start live trading, traders can choose between bank wire transfers, credit card payments, or e-wallet payment options. The availability of deposit methods also depends on the entity. Global traders have a better selection of funding methods to ensure that everyone finds a suitable option.

Here are the main deposit options BCR offers to its clients:

- Bak Transfer

- Credit/Debit cards

- UnionPay

- fasapay

- BPay

- Neteller

- Skrill

- Poli

- USDT

Minimum Deposit

As for the minimum deposit amount, BCR requires $300 as a start for any account you choose, which is an average amount, allowing traders from beginners to professionals to start trading confidently. Only the Affiliate account has a higher requirement of $3000 to open the account.

Withdrawal Options at BCR

BCR does not charge extra fees for withdrawals and deposits; withdrawal options are wide and include bank wire, credit cards, and popular e-wallets. However, making international banking transfers may incur intermediary fees, which are the sole responsibility of the client. Withdrawals are processed within the same business day.

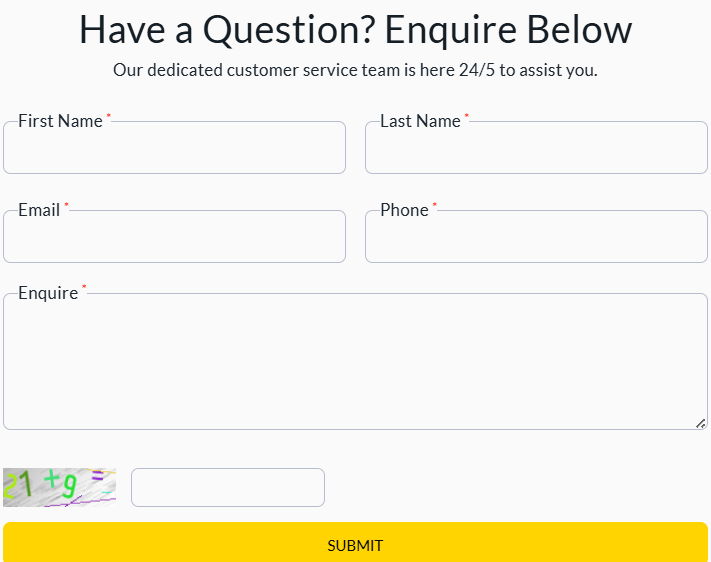

Customer Support and Responsiveness

Score – 4.6/5

Testing BCR Customer Support

We have also tested the BCR customer support to see how clients are assisted when they need help and guidance. We found that BCR provides a good range of supporting options, including phone, email, online inquiry forms, and live chat. All these options are for clients to contact the broker with the easiest and most comfortable method for them.

- In addition, the broker’s social platforms are another good source of information, market news, and broker updates, keeping its clients informed at all times. Clients can follow BCR on IG, FB, X, and LinkedIn.

Contacts BCR

Our research on the broker’s customer support revealed a dedicated and helpful team that tries to solve clients’ problems and answer their questions and inquiries in a prompt manner. Clients can contact the support team 24/5 through the following methods:

- Clients who prefer direct contact with the broker’s team can contact them through the phone line by using the provided number: +61 2 8459 8050. Please check the number based on the entity, as we have mentioned here the one for Australian clients.

- BCR also provides email addresses for different types of inquiries and issues. For general information, traders can use the info@au.thebcr.com email address.

- Live chat is one of the quickest ways to get answers and solve issues. Based on our testing, the answers and solutions are quick and on point.

- Lastly, clients can send an inquiry right from the broker’s website through the inquiry form. This is another quick and straightforward way to contact the broker’s support team.

Research and Education

Score – 4.3/5

Research Tools BCR

BCR provides great research tools through its platforms, enabling in-depth analysis. There are also a few tools traders can find on the broker’s website. We cannot say that the research section is comprehensive and impressive; however, it still gives traders an insight into the market.

- The economic calendar provided by the broker is a great way to stay informed about upcoming market changes and events. Being in the know at all times enables traders to make the right and informed decisions.

- BCR’s Market Live provides real-time updates on the market, upcoming trends, and overall conditions.

Education

The education section of BCR does not include intensive courses or webinars that will guide and support beginner traders. However, there are still a few helpful materials and features that would be useful for any level of trader:

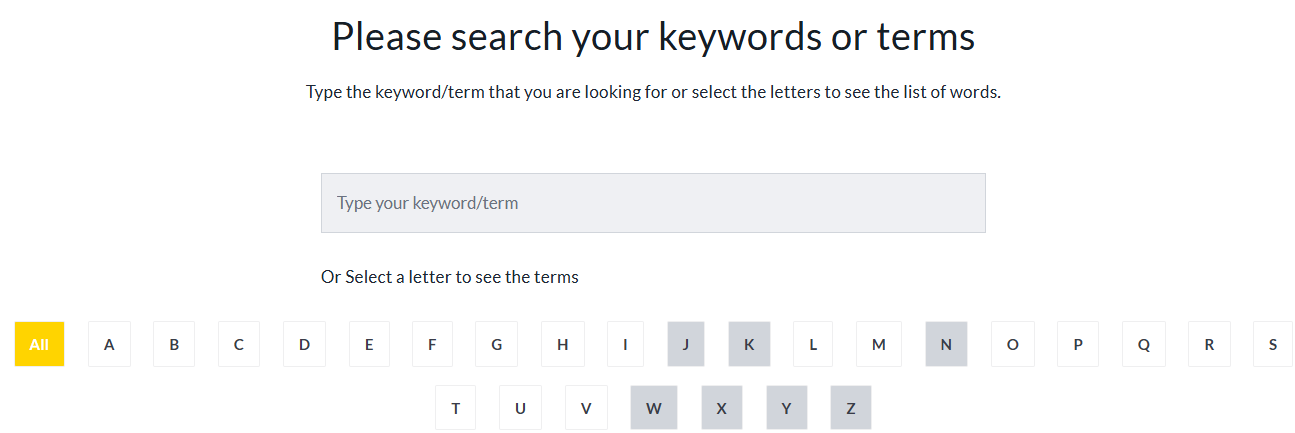

- The Glossary section provides traders with simple and clear explanations for each complex term. Understanding the forex language is essential, especially for beginner traders who still have difficulty understanding the market.

- BCR has a Market Analysis section, where it provides traders with detailed articles on various trading-related topics. This way, clients learn about the market, different aspects of trading, and the predicted changes and market movements.

Is BCR a Good Broker for Beginners?

Based on our research, BCR is a good broker with favorable conditions and advanced offerings that will meet the trading expectations of many clients. The broker is equipped with the most demanded MT4/MT5 platforms, providing easy access to the market with reasonable trading fees, a good selection of account types, and more than 300 tradable products on multiple assets. The broker also offers a few research and educational materials that will guide and assist traders in their trading journey. The support team is also helpful, offering a few reachable options for communication. To sum up, many beginner traders can find BCR a great broker for a successful start.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options BCR

BCR offers a good selection of trading instruments based on CFDs. Traders can access the most popular tradable products of different markets in a secure environment, with average costs and conditions. However, those traders who are looking for more diversity and exposure will not find the broker’s offering satisfactory. BCR is not the best option for long-term and traditional investments, real stock, or ETF trading.

- However, the broker offers the MAM feature, allowing traders comprehensive management of multiple accounts. To launch the MAM feature, clients should submit a MAM Application Form.

Account Opening

Score – 4.6/5

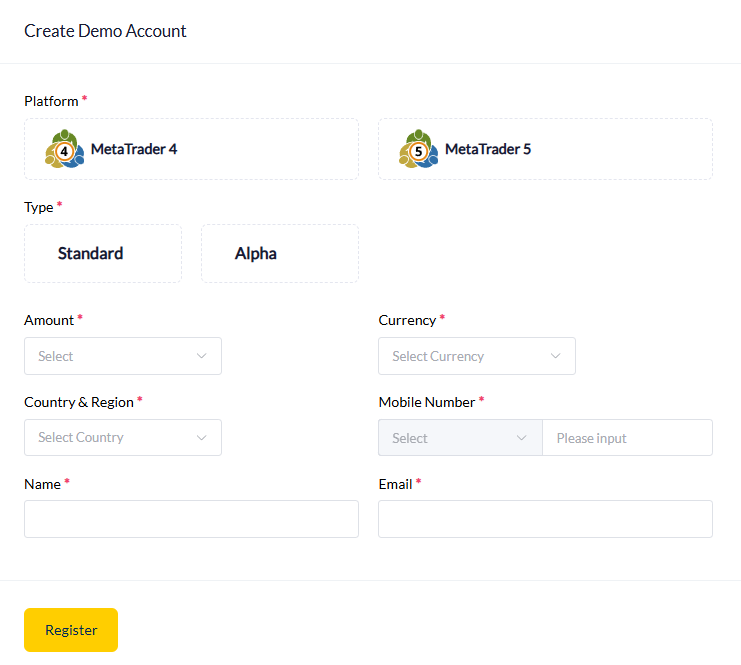

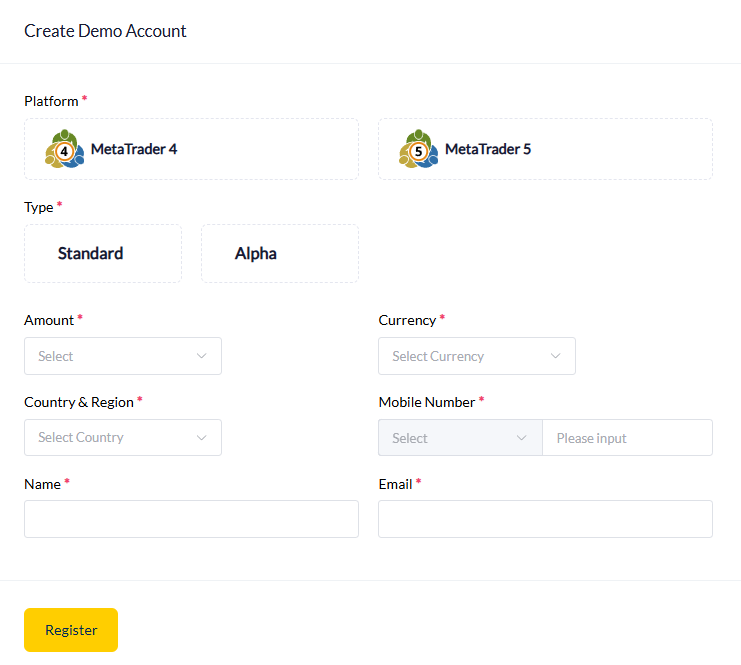

How to Open a BCR Demo Account?

BCR allows its clients to open a demo account and practice before switching to a live account with real funds. The demo account includes all the features and peculiarities of a live account, allowing traders to have the same feel of the market. There are a few simple steps to take to open a demo account with BCR:

- Visit the broker’s official website.

- Choose the ‘Try demo’ option.

- Fill out the registration form by providing your name, residency, email, etc.

- Choose the account specification, such as trading platform, account type, currency, etc.

- Submit the application and receive the account credentials through the provided email address.

- Use the credentials and enter your demo account.

- Start practicing.

How to Open a BCR Live Account?

Opening a BCR account is a quick and simple process, enabling traders to access the market with just a few steps. Below is the detailed description of how to open a BCR live account:

- Visit the broker’s website and choose the ‘Join Now’ option.

- First, provide an email address and password to initiate account creation.

- Complete the registration by providing your name, residency, phone number, etc.

- Choose the platform, account type, currency, etc.

- Submit documents for identification (ID, bank statement, etc.).

- Receive the account credentials and enter your live account.

- Fund your account and start trading.

Score – 3.5/5

We have carefully considered BCR’s offerings, features, and additional tools to see what else it has for its clients to enhance the trading experience further. However, all the main features are already included on the broker’s trading platforms, enabling them to conduct essential and profitable trades with the best practices.

- Traders who are looking for extensive additional features and opportunities, such as bonuses, promotions, and other opportunities, will not find them with BCR.

BCR Compared to Other Brokers

We have also compared BCR with a few respectable brokerage firms to see where the broker stands and how it stands out from others. We first reviewed BCR’s regulations to see how secure the broker is. As the broker holds a license from the well-regarded authority in Australia—ASIC—BCR ensures a safe and reliable environment with transparent practices. Other equally reliable brokers with the same level of safety are Admiral Markets and TMGM. Only the latter offer an additional layer of protection by holding licenses from other top-tier authorities, including FCA, CySEC, and FMA.

Next, we reviewed the trading costs BCR applies and compared them to other similar offerings. BCR offers average fees with different structures based on its various account types. For the spread-based Standard account, spreads start from 1.7 pips, which is an average offering. We found brokers with lower spreads, such as Pepperstone and FP Markets. The trading platform BCR offers is common in the market, and many brokers, such as RoboForex and TMGM, offer the MT4 and MT5 platforms and their web, desktop, and mobile versions. However, as we have noticed, TriumphFX offers only the MT4 platform.

BCR also offers dedicated 24/5 customer support through multiple options. We found that Pepperstone, RoboForex, and Admiral Markets have 24/7 support, ensuring the availability of assistance at all times. Lastly, BCR’s educational section offers a forex glossary and analytical articles. However, this is a basic offering of learning materials compared to the extensive educational resources that FP Markets and Admiral Markets offer.

| Parameter |

BCR |

Pepperstone |

RoboForex |

TriumphFX |

FP Markets |

Admiral Markets |

TMGM |

| Spread Based Account |

Average 1.7 pips |

From 1 pip |

Average 1.3 pip |

Average 0.6 pip |

From 1 pip |

From 0.6 pips |

Average 1 pip |

| Commission Based Account |

0.0 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $4 |

Not available |

0.0 pips + $3 |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Low/Average |

Average |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

MT4,MT5, WebTrader |

MT4, MT5, cTrader, TradingView |

MT4, MT5, R StocksTrader |

MT4 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, Admiral Markets app |

MT4,MT5, TGM app |

| Asset Variety |

300+ instruments |

Over 1,200 instruments instruments |

12,000+ instruments |

64+ instruments |

10,000+ instruments |

8000+ instruments |

12.000+ instruments |

| Regulation |

ASIC, BVIFSC, SVG |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FSC |

CySEC, FSC, FSA |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

ASIC, FMA, VFSC, FSC |

| Customer Support |

24/5 support |

24/7 |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

| Educational Resources |

Basic |

Excellent education and research |

Good |

Good |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$300 |

$0 |

$10 |

$100 |

$100 |

$1 |

$100 |

Full Review of Broker BCR

We have carefully reviewed every aspect of trading with BCR and are ready to sum up the broker’s offerings and its level of reliability, transparency, and credibility.

BCR is regulated by ASIC, one of the best-regarded financial authorities in the industry, which ensures the reliable practices of the broker and adherence to strict guidelines and rules. When talking about transparency, we also want to mention BCR’s trading costs, which are in line with the market average and are transparent and clear, specifying the applicable spreads and commissions for each trading instrument.

Clients can conduct their trades through the advanced MT4/MT5 platforms with great analytical tools, charts, graphs, historical data, and market depth. The platforms give access to over 300 CFD-based tradable products across shares, indices, commodities, energies, and FX. However, long-term investors may not find this instrument offering favorable, as there are no traditional investment options with BCR. Also, the broker is good for beginners, intermediate traders, and professionals. Yet, those beginners who need extensive educational resources will find BCR’s basic educational section limiting.

Share this article [addtoany url="https://55brokers.com/bcr-review/" title="BCR Bacera"]