- What is ATFX?

- ATFX Pros and Cons

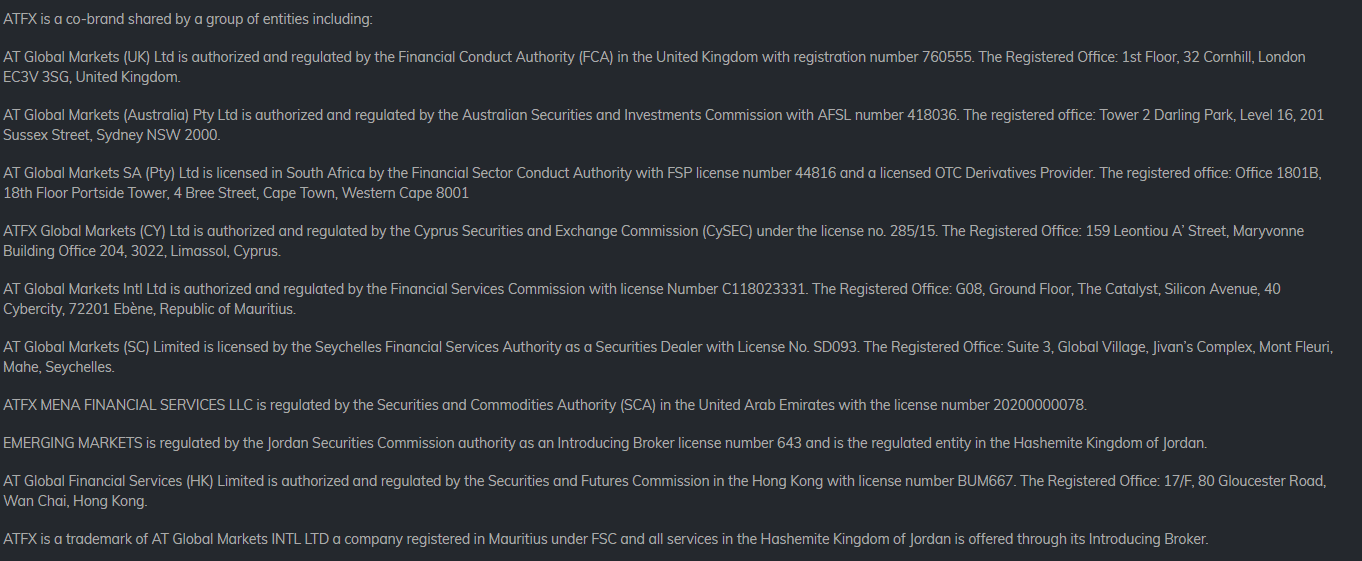

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

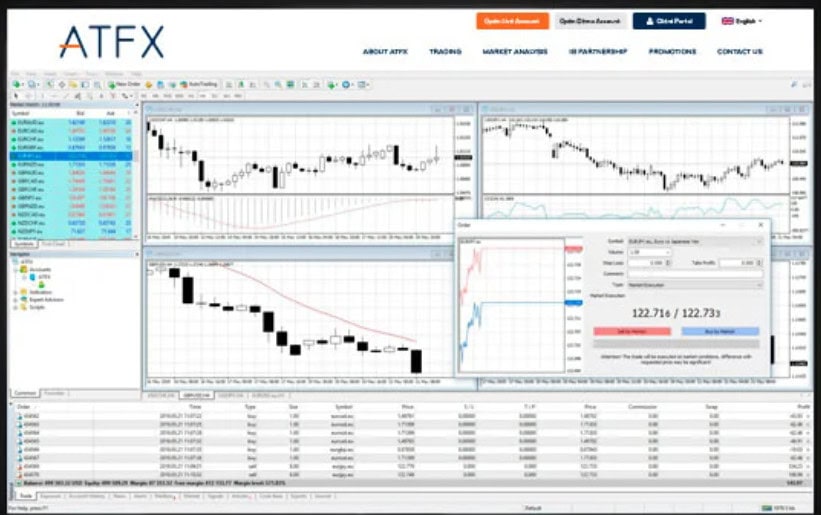

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- ATFX Compared to Other Brokers

- Full Review of Broker ATFX

Overall Rating 4.5

| Regulation and Security | 4.8 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account opening | 4.7 / 5 |

| Additional Tools and Features | 4 / 5 |

What is ATFX?

From our findings and analysis, ATFX is a brokerage firm that provides a variety of financial markets for trading, including Forex, CFDs, shares, metals, oils, indices, and cryptocurrencies. It is worth noting that the brand name ATFX is used by multiple entities operating across different regions worldwide. These entities have established their presence in several parts of the world, such as Europe, Africa, Asia, and the Middle East.

The company is subject to regulation and authorization by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. Additionally, ATFX holds international licenses in Mauritius by the FSC and in Seychelles by the FSA.

ATFX Pros and Cons

Our research revealed that ATFX is a reliable broker with secure trading conditions, innovative features, and a wide range of tradable products at competitive prices. Also, clients can access the MT4 and MT5 platforms from their desktops, web browsers, and mobile devices. The broker provides a variety of educational resources, market news, insights, and analysis as well.

For the cons, the trading conditions may differ based on the entity, and there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Heavily regulated broker with competitive trading conditions | Conditions might vary based on the entity |

| FCA and CySEC licenses and oversight | No 24/7 customer service |

| MT4/MT5 trading platforms | |

| Advanced technology | |

| IB program | |

| Low fees | |

| Institutional trading | |

ATFX Features

ATFX is a trustworthy broker with a global presence that enables access to a wide range of financial assets with favorable trading conditions. The broker offers competitive fees, innovative platforms, and carefully tailored account types to meet different trading needs. Below you can see a list of the main aspects of trading with ATFX.

ATFX Features in 10 Points

| 🗺️ Regulation | FCA, CySEC, ASIC, FSC, FSA |

| 🗺️ Account Types | Micro, Classic, Premium, Raw |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, CFDs, shares, metals, oils, indices, ETF CFDs, Shares CFDs, |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | EUR, USD, GBP |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is ATFX For?

ATFX stands out for its favorable conditions and tight regulations, appealing to traders of different levels of experience. The broker can be a good fit for clients just starting with no knowledge and trading skills, or an excellent choice for professionals who want to trade big and explore new opportunities. Here is what ATFX is especially good for:

- Traders from the UK

- Traders from Europe

- International traders

- Traders who prefer the MT4/MT5 trading platforms

- CFD and currency trading

- Beginners

- Professional traders

- Muslim traders

- Institutional trading

- Scalping/Hedging strategies

- NDD/OTC execution

- Competitive fees

- Excellent customer support

- Good educational and research materials

- EA/Auto trading

ATFX Summary

ATFX is a well-regulated and reliable broker that offers a range of trading instruments and trading accounts suitable for traders of all levels. The broker provides competitive pricing structures, fast order execution, and a variety of funding methods, making it a convenient and efficient choice for traders globally.

Customer support is also good, along with market analysis, educational resources, and research materials, which are crucial for beginners and experienced traders.

Traders also have access to alternative investment opportunities, including copy trading, and the availability of PAMM and MAM accounts.

55Brokers Professional Insights

As a regulated broker based in the United Kingdom, we have found that ATFX offers competitive trading conditions suitable for traders at all levels. Additionally, it provides a variety of trading services with low pricing and transparency, making it an attractive option for traders.

Aside from holding multiple top-tier licenses and ensuring a transparent and reliable trading environment, ATFX also offers appealing trading conditions that have attracted traders from all over the world since 2017. The broker boasts over 254K active clients, 26K active partners, and an overall positive activity track that instills assurance and trust in traders.

Clients conduct their trades through the most demanded MT4/MT5 platforms, accessing more than 300+ instruments with low pricing. ATFX also stands out for its alternative investment methods, great trading tools and features, and well-structured research and educational sections. Ever-present webinars and seminars, well-planned trading lessons and guides, and great research and analysis resources make ATFX a perfect choice for beginner traders.

All in all, ATFX consistently enhances its services and offerings, keeping up with market advancements and demand. The only aspect to be careful about is considering the possible differences in trading conditions between the entities.

Consider Trading with ATFX If:

| ATFX is an excellent Broker for: | -Beginner and intermediate traders

- Professional clients

- International traders

- Forex and CFD trading

- Clients prioritizing string regulation

- Users looking for multiple deposit and withdrawal methods

- Dedicated customer support

- MT4/MT5 platforms enthusiasts

- Traders looking for MAM and PAMM solutions

- Copy traders

- Muslim traders |

Avoid Trading with ATFX If:

| ATFX is not the best for: | - Traditional investments

- Traders looking for 24/7 support

- Clients looking for ultra-low spreads

- Weekend traders |

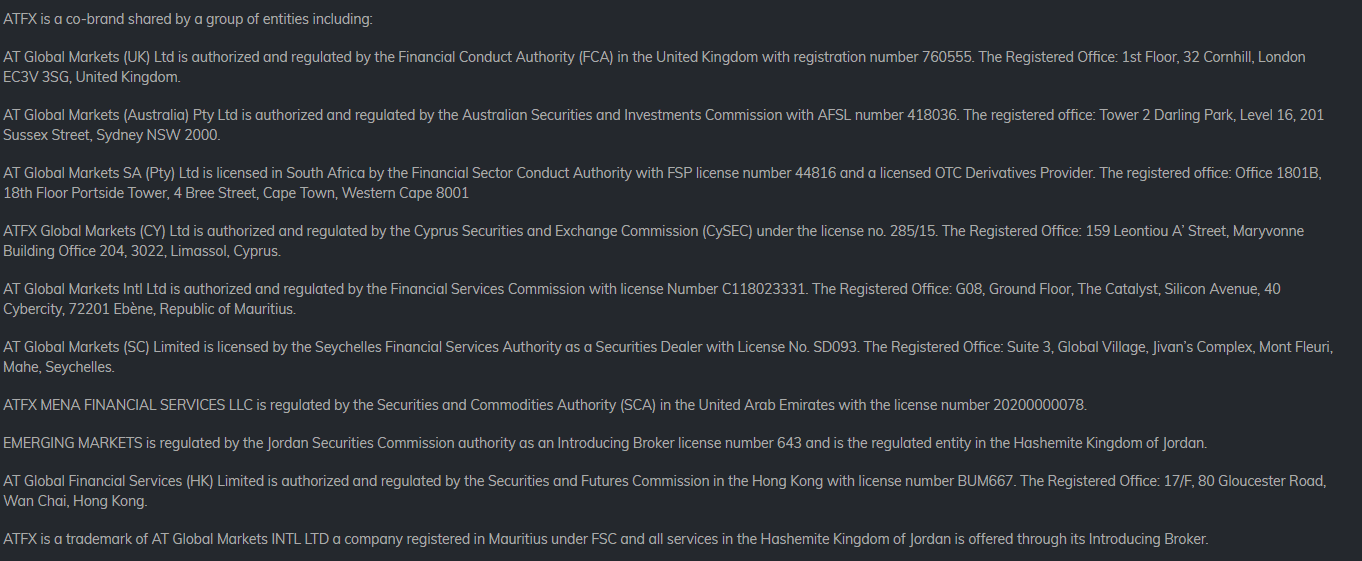

Regulation and Security Measures

Score – 4.8/5

ATFX Regulatory Overview

ATFX is not a scam. It is a trustworthy brokerage firm regulated by three reputable authorities: the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). These authorities enforce strict rules and guidelines to ensure that ATFX operates according to high standards.

- The broker prioritizes compliance with regulatory requirements and is subject to close monitoring, which ultimately increases traders’ safety and confidence in the company.

- ATFX is also regulated by the FSCA in South Africa, the FSA in Seychelles, the FSC in Mauritius, the SCA in the United Arab Emirates, and the Securities and Futures Commission in Hong Kong. As you see, the broker ensures complete adherence to strict laws and guidelines, ensuring not only global exposure but complete reliability.

How Safe is Trading with ATFX?

The company guarantees the security of clients’ funds by segregating them from its accounts and refraining from using them for operational purposes. Moreover, based on our research, the broker offers negative balance protection, which safeguards traders’ accounts from going into negative balance during times of market volatility or unexpected events.

Consistency and Clarity

We have reviewed the broker from the viewpoint of its consistency, growth, and clarity of offerings. The company has registered impressive growth in less than a decade of operation, extending its offerings globally. ATFX holds multiple licenses, some of them from top-tier financial agencies. This gives traders peace of mind and confidence while trading. The trading conditions are also constantly being enhanced and expanded, enabling traders more and more opportunities from year to year.

The broker has also received several awards for providing good service and prioritizing customer satisfaction. The customer feedback is also optimistic, pointing out security measures, dedicated multilingual customer service, advanced trading tools and features, and well-tailored offerings. There are also a few negative reviews indicating areas of improvement as the deposit and withdrawal process and account management practices.

However, the overall picture of trading with ATFX is positive, emphasizing the broker’s safety measures and consistency.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with ATFX?

From our findings, the broker provides four trading accounts to traders – Micro, Classic, Premium, and Raw accounts, each with its own set of features and advantages that suit different trader levels. The accounts permit clients to trade with various currencies, including EUR, USD, and GBP. There are certain similarities between the accounts, including the available leverage of up to 1:400, access to the trading academy, unlimited simultaneous open orders, etc.

- The Macro, Classic, and Premium accounts are spread-based with no commissions. Each account enables access to different trading costs. The lowest spreads are charged for the Premium account, starting from 1 pip. The Classic account charges spreads of 1.8 pips, and for the Micro accounts, spreads are 2.4 pips, which is considerably higher compared to the other accounts. Only the Raw account charges commissions of up to $7, based on the instrument traded.

- The Micro account is a better choice for beginner traders who transfer from their demo accounts and are just starting live trading. The Classic account is also suitable for beginners or intermediate traders. It offers clear conditions but integrates advanced features at the same time that meet more professional expectations. The Prime account has better features and a higher initial deposit requirement, which makes it a better fit for more experienced clients.

- The Premium and Raw accounts also give access to a free VPS, access to a full Trading Central Analysis suite, newsletters, and analysis.

In addition, ATFX offers Swap-Free accounts for Muslim traders who face restrictions in trading due to their faith.

Regions Where ATFX is Restricted

ATFX is regulated in many regions and provides its services to global clients from all over the world. Generally, the broker’s accessibility and international exposure are quite extensive. Still, due to regulatory restrictions, the broker does not provide its services to the residents of the following countries:

- Canada

- Japan

- Democratic People’s Republic of Korea

- Iran

- United States of America

Cost Structure and Fees

Score – 4.5/5

ATFX Brokerage Fees

ATFX fees depend mainly on its account types. The broker offers three spread-based accounts and a single commission-based account. Overall, the trading costs are in line with industry averages, with transparent offerings and no hidden fees. In addition to spreads and commissions, the broker also charges swap fees for overnight positions. Also, consider that there might be differences in trading conditions based on the entity.

ATFX offers three spread-based accounts, where all the trading costs are included in spreads. The spreads depend on the account type, instrument traded, and the entity under which the account is opened. Based on our research, the highest spreads are for the Micro account (2.4 pips), while for the Classic account, spreads start at 1.8 pips. The lowest spreads traders can find with the Premium account, still with no commissions. The Raw account is commission-based, offering spreads from 0.0 pips, paired with commissions.

Out of its four account types, only the Raw account is commission-based. The account offers very low spreads from 0.0 pips, with commissions up to $7 per lot, based on the instrument traded.

How Competitive Are ATFX Fees?

Based on our research, ATFX offers competitive pricing based on its several account types. The broker is transparent in its offerings and mentions all the applicable fees for each instrument. This is essential for traders, as it makes them calculate the applicable trading fees beforehand. The average spread for the EUR/USD pair is 1.8 pips. The gold spread is 3.8 pips on average.

All in all, the ATFX provides low trading fees with transparency and clarity. All the essential instruments offer average pricing combined with strong security and excellent trading conditions, and features. However, we recommend considering the cost differences between the entities and clarifying the applicable fees in advance. The broker’s customer support also supplies all the details on each instrument traded, with spread and commission rates.

| Asset/ Pair | ATFX Spread | BlackBull Spread | AvaTrade Spread |

|---|

| EUR USD Spread | 1.8 pips | 0.8 pips | 0․9 pips |

| Crude Oil WTI Spread | 3 pips | 7․3 pips | 3 cents |

| Gold Spread | 3.8 pips | 1.2 pips | $0.27 |

ATFX Additional Fees

There are a few additional fees added to common trading fees, like spreads and commissions. The broker imposes an inactivity fee after 12 consecutive months of inactivity. Each month, a $10 charge will be incurred from the account or 20% of the remaining balance. We also found that ATFX does not charge deposit or withdrawal fees; however, the intermediary payment provider might charge a transaction fee.

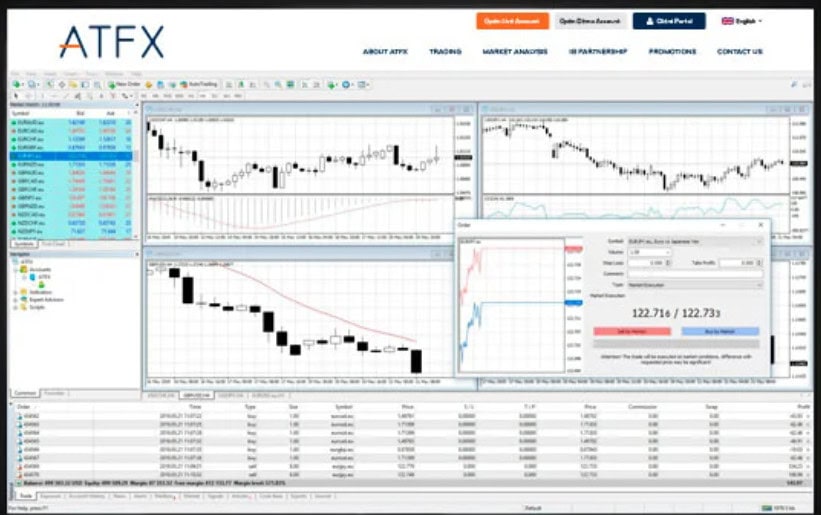

Score – 4.4/5

The trading platforms the broker provides are the widely used MetaTrader 4 and MetaTrader 5, available in desktop, web, and mobile versions. MT4 and MT5 are well-known platforms in the trading industry, known for their advanced features, user-friendly interface, and efficient trading tools.

| Platforms | ATFX Platforms | BlackBull Markets Platforms | Fortrade Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | No |

| cTrader | No | Yes | No |

| Own Platform | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

ATFX Web Platform

ATFX clients can enter their accounts and trade with ease through the broker’s web platforms. Both MT4 and MT5 platforms are available via the web browser, providing all the essential features for efficient trading. Web trading has many advantages, from the user-friendly and easy-to-use interface to in-depth charting capabilities, real-time market data, and, of course, access to essential financial assets. The ATFX web platforms enable their users to trade with flexibility, with no pressure of downloads and installations.

ATFX Desktop MetaTrader 4 Platform

The MT4 trading platform offers users advanced charting, technical analysis, trading signals, market news, alerts, and VPS. Additionally, traders can use EAs to automate their trades, which can assist in identifying market movements and improving market entry and stop-loss strategies. The platform is suitable for beginner traders with its simple interface, more than 30 technical indicators, charts, and other analysis tools, and for more advanced traders looking for professional solutions. It is available through various operating systems—Windows and macOS for desktop downloads, and Android and iOS for mobile trading.

ATFX Desktop MetaTrader 5 Platform

The ATFX MT5 platform offers more enhanced capabilities to users compared to its older version, MT4. The platform is a great tool, especially for professionals who seek more innovative features and tools for in-depth analysis and better opportunities to explore the market. The MT5 platform includes more than 80 built-in indicators and 21 timeframes. Clients also have access to historical data that, based on certain instruments, might date back to the 90s. Clients can access the full range of financial instruments(more than 300 products). Besides, traders get 24/5 access to the market and support, with 24/7 availability for some instruments. Clients favoring Expert Advisors can enjoy the automation of trades through the provided innovative and customizable features.

Main Insights from Testing

Our testing of the ATFX platforms revealed powerful and flexible solutions, enabling different clients to benefit from the ease of use, strong analytical features, and opportunities. The availability of MT4 and MT5 platforms in web, desktop, and mobile versions gives traders more flexibility and choice to conduct trades in their preferred version. Although ATFX does not provide additional platforms, such as cTrader and other popular alternatives, its platforms include all the necessary tools to explore the market, access strong analytical tools, and a good range of financial products.

ATFX MobileTrader App

Mobile apps are great alternatives to accessing trading accounts and monitoring trades with flexibility and independence. The MT4 and MT5 mobile apps are available on Android and iOS devices, providing easy access and essential trading tools for an efficient trading experience and a successful outcome. The platforms are well-equipped with analytical tools, charts, and graphs, enabling analysis and insights into the market. The mobile platforms do not restrict clients and hold back from possible trading opportunities. On the contrary, the interface is simple to use, and the opportunities are just in the palm of the hand.

Trading Instruments

Score – 4.6/5

What Can You Trade on the ATFX Platform?

Through our analysis, the offered trading instruments include Forex, CFDs, shares, metals, oils, ETFs, and indices. The broker offers over 300 tradable products across different financial assets, providing clients with the chance to expand their access to the market. Here is a detailed breakdown of the available instruments:

- 40+ Forex pairs

- Over 300 global shares, including Amazon, Alibaba, and Apple

- 15+ global stock indices

- Commodities, such as gold, silver, UK Brent oil, and US WTI oil

Main Insights from Exploring ATFX Tradable Assets

We have carefully considered ATFX’s instrument offering to see how it can appeal to different traders. With over 300 tradable products across various assets, ATFX enables traders to have a measured opportunity to explore the market and expand their portfolios. While the offering will attract traders who invest in popular products, such as currency pairs, commodities, and global CFD shares, clients looking for wider exposure to the market and more unique products to invest in will find the ATFX proposal limited. Besides, the offering is not suitable for real stock traders either. Traditional investors will not be able to invest with ATFX as it offers mainly CFD-based products.

Another important note for international traders: as the broker operates under several entities, the trading conditions, including instrument availability, costs, and overall conditions, might differ from entity to entity. We encourage traders to determine all the nuances of trading under the entity they open a trading account.

Leverage Options at ATFX

Leverage can increase profits in trading, but it can also lead to losses if not handled properly. Therefore, it is crucial to understand how to use it correctly before trading.

ATFX leverage is offered according to the FCA, CySEC, ASIC, FSC, and FSA regulations:

- UK and European traders can use low leverage up to 1:30 for major currency pairs.

- For international traders, the maximum leverage is 1:400.

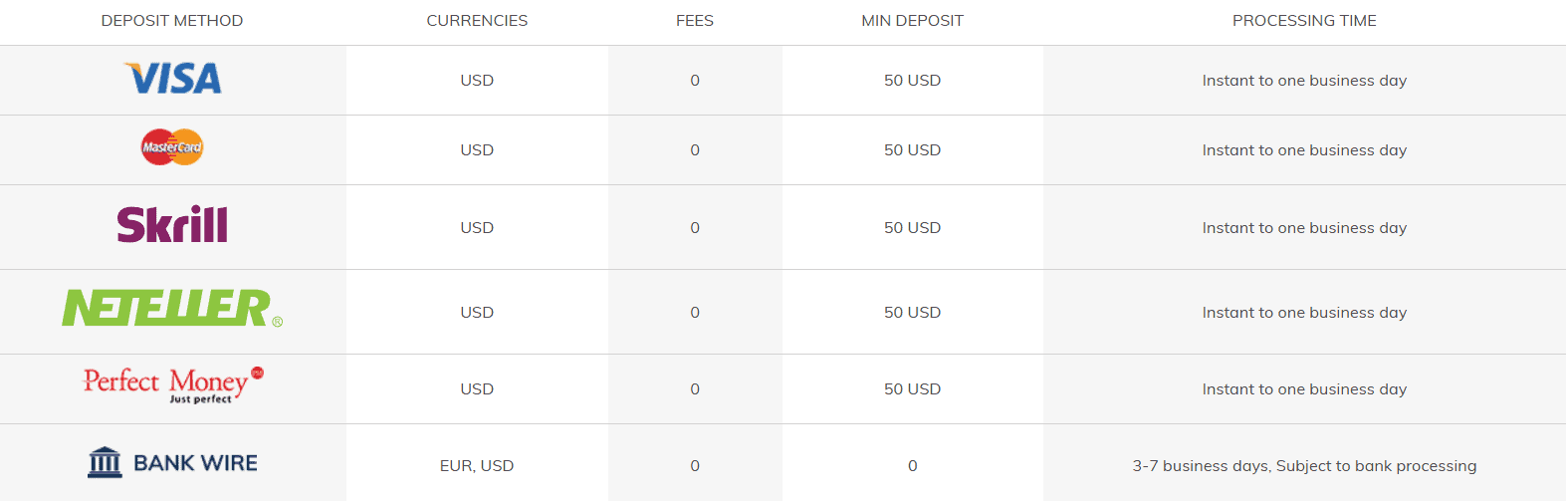

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at ATFX

Various payment methods are available for ATFX’s clients to deposit funds into their trading accounts, including Bank Wire, Credit/Debit cards, Skrill, Neteller, and Perfect Money. However, it is important to note that some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions. There may also be restrictions based on the entity.

Minimum Deposit

The deposit minimum amount depends on the account type. For the Micro account, the minimum deposit requirement to open an account is $100. For further deposits, traders need to fund their accounts with no less than $100. Other account types require higher deposits. On the other hand, the maximum deposit amount depends on the funding method: e-wallets have a daily limitation of $10,000, while for credit and debit cards, the daily funding is limited to $35,000.

Withdrawal Options at ATFX

ATFX enables its clients to withdraw their funds with ease and efficiency. The processing time for withdrawals may vary depending on the method used, but it usually takes 3 to 5 business days. For e-wallets, the withdrawal processing is either instant or takes one business day.

- Withdrawals of up to $100 are free, while for larger amounts, a fee of $5 is charged. There is no daily limitation for withdrawals; however, for large amounts, the broker might contact its clients for confirmation.

Customer Support and Responsiveness

Score – 4.6/5

Testing ATFX Customer Support

ATFX offers 24/5 customer support through Live Chat, Phone lines, and Email at ATFX. Also, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues. Traders can indicate their location to communicate with the customer support teams closest to them.

- Based on our testing, the support is solid, and the answers and assistance are quick and detailed.

Contacts ATFX

ATFX offers dedicated customer assistance 24/5, providing its clients with quick responses and help. Clients can choose from several options according to the urgency of the issue or their preferences.

- The quickest responses are provided by the Live chat, where the answers are accurate and come almost instantly.

- Traders who prefer direct contact with the support team can use the phone line (+44 203 957 777) and ask their questions to the support agent.

- An email to sales.uk@atfx.com is another option to receive quick and detailed solutions to questions or trading-related problems.

- At last, the broker is also active on social media, providing updated information on its operation and the market changes, keeping traders informed. Clients can find ATFX on Facebook, Instagram, X, LinkedIn, and YouTube.

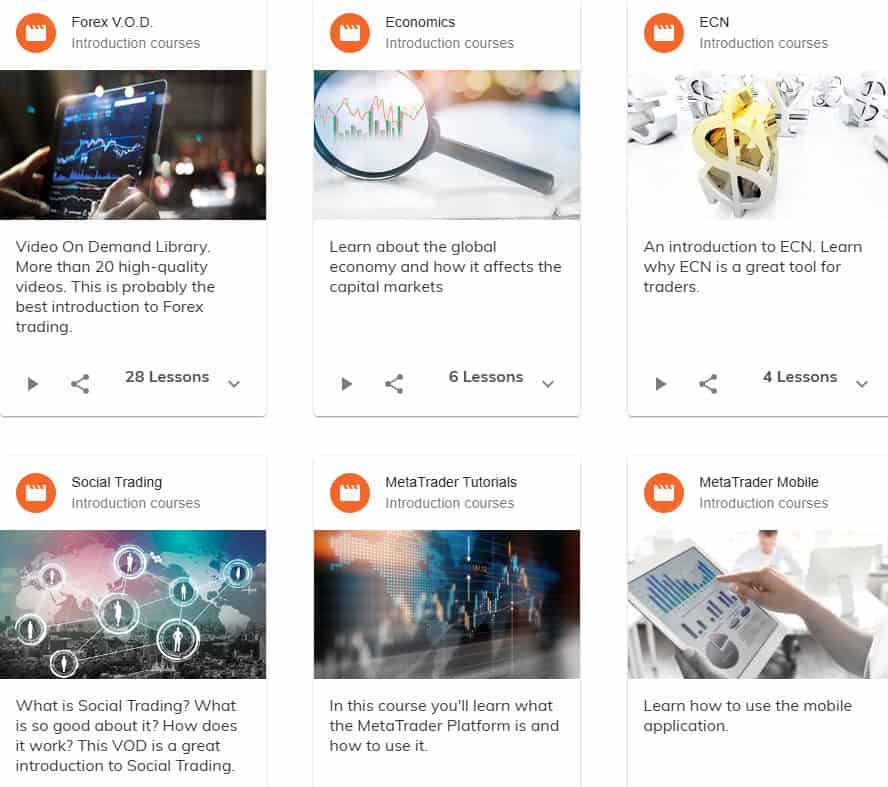

Research and Education

Score – 4.5/5

Research Tools ATFX

Based on our research and testing, ATFX offers an extensive research section, equipping its clients with essential tools for in-depth research and insights. In addition to its already innovative platforms, traders can access the following research tools:

- The financial market analysis section includes deep technical and fundamental analysis, provided by a professional analyst team. Traders can get insights on the major markets, including Forex, precious metals, indices, etc.

- The economic calendar will inform traders about the market’s upcoming changes and developments, shaping their decisions and trading outcomes.

- Traders also have access to daily market news to freshen and update their knowledge about the current situation in the market through detailed and insightful market news.

- The Financial Events section includes all the essential events that have affected the market or have the potential of it.

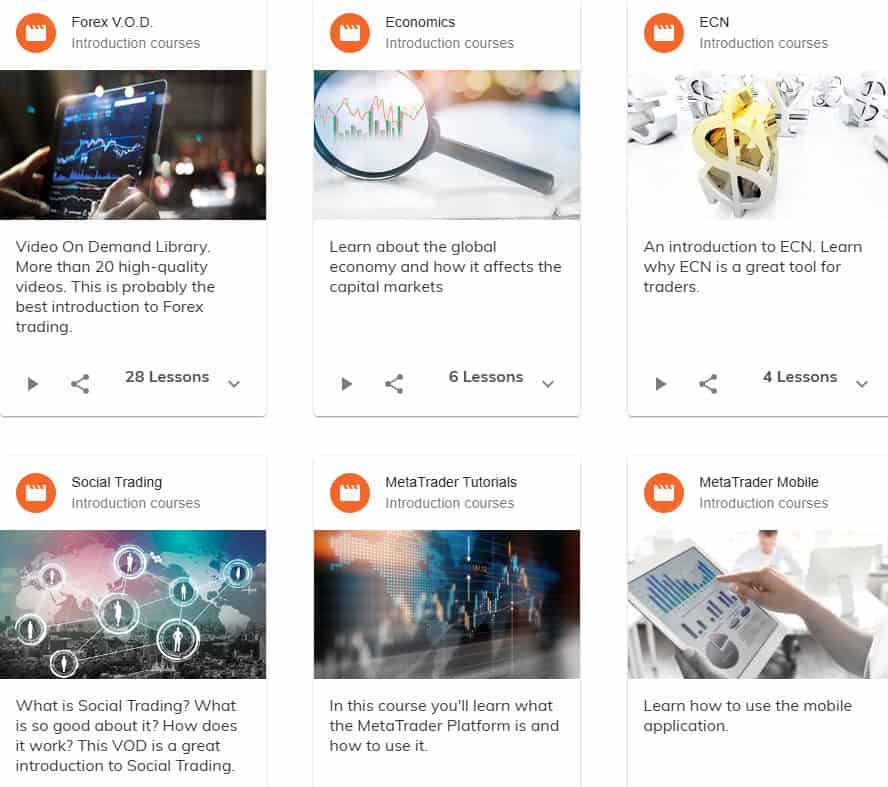

Education

ATFX’s educational section is impressive, equipped with helpful educational materials and tools, webinars and seminars, Trading Central, guides and courses, and well-planned lessons on different trading-related topics. The section will assist not only beginner traders but also, with its comprehensive materials, will be helpful for professional traders.

- Traders have access to Trading Central, one of the most powerful technical analysis resources. Access to Trading Central depends on the account type chosen. Traders get 24-hour coverage of the market, up-to-date information from acclaimed analysts, multiple language availability, and many other privileges.

- ATFX offers webinars and seminars on an ongoing basis, providing its clients with deep and insightful information and knowledge on different financial and trading-related topics. Webinars and seminars are the best way to learn from professionals and discover the market further.

- The broker offers trading lessons and courses. The lessons cover different topics and offer detailed information to empower traders with strong market knowledge and insights.

Is ATFX a Good Broker for Beginners?

A detailed analysis of ATFX and its offerings has made it clear that the broker is an excellent choice for different clients, offering a secure trading experience with favorable market conditions. The broker is suitable for beginner traders for multiple reasons. It provides a demo account for novice traders to gain trading skills before diving into live trading. Besides, the broker’s Micro account is a great opportunity to step from demo accounts into real trading, with a low deposit requirement, easy-to-use platforms, great features and simple analysis tools, and many other advantages. In addition, ATFX includes an impressive educational section to guide and lead beginners in their trading journey.

Portfolio and Investment Opportunities

Score – 4.3 /5

Investment Options ATFX

ATFX offers a good range of trading instruments, enabling traders to access more than 300 tradable products across multiple financial assets. The offering is mainly concentrated on Forex pairs and CFDs. While many traders can enjoy the proposal and explore the market, expanding their portfolios, some will find the offering limiting. Traditional investors and long-term traders will feel left out, as they cannot engage in stock investment or own the underlying assets.

That said, ATFS has developed multiple investment alternatives to diversify trading opportunities.

- Copy trading, offered by ATFX, will give less experienced traders an excellent chance to mirror the trades of professionals and make a profit. All they need to do is copy trades that are proven successful. No time or effort commitment is necessary, which will help clients succeed with ease.

- ATFX also offers MAM and PAMM accounts through its MT4 and MT5 platforms. MAM and PAMM accounts enable professionals to manage multiple trading accounts simultaneously and earn profits.

Account Opening

Score – 4.7/5

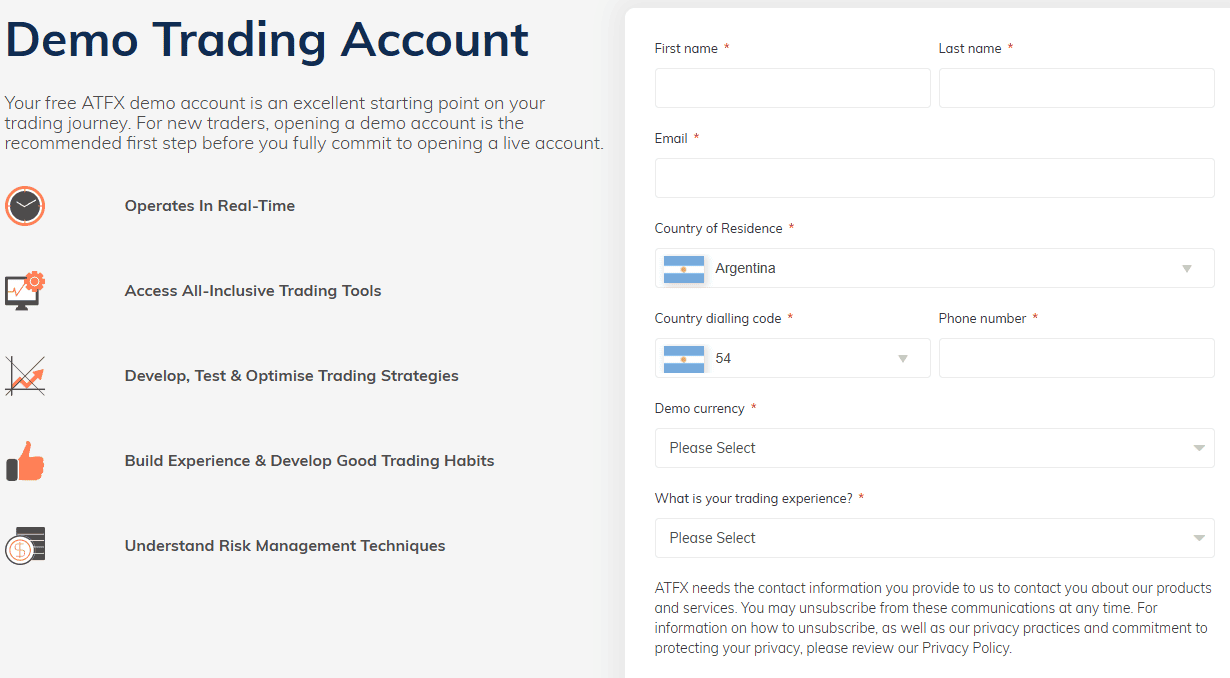

How to Open an ATFX Demo Account?

A demo account is a great opportunity for traders who want to practice their skills before switching to live trading. A demo account creates the same feel and environment as a live account; only the funds used are virtual. To open a demo account with ATFX, traders need to follow several simple steps:

- Visit the broker’s demo account page.

- Fill out the registration form, providing name, phone, email, etc.

- Receive the account credentials via email.

- Use them to enter the account.

- Download the MT4 platform.

- Log in to the platform.

- Start practicing.

How to Open an ATFX Live Account?

Opening an account with the broker is easy and will take up to 24 hours to complete. Traders should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open Account” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming the trading experience.

- Wait for the approval, which may take up to 24 hours.

- Once the account is activated and verified, traders can proceed with a money deposit.

Score – 4/5

ATFX offers great trading tools and features, as well as research and educational materials that enable traders to conduct efficient and profitable trades. The broker also has a Trading Central, a client portal, and an economic calendar, which we discussed in the research and education section. Other than the mentioned proposals, we did not find additional tools to mention here.

ATFX Compared to Other Brokers

After researching ATFX services and reviewing each aspect of trading separately, we will compare the broker to other well-regarded firms in the market. Starting from the regulation, we can conclude that AFTX is heavily regulated, holding multiple licenses from serious authorities. Similarly, Pepperstone and Forex.com also follow strict regulatory rules. All three hold licenses from the top-tier FCA, ASIC, and CySEC, with additional licenses from other respected authorities.

The fee structure ATFX offers depends on the account type chosen and the entity. Overall, the trading costs are in line with the market average, combined with the transparency and clarity of the offering. Spreads for the Classic account are 1.8 pips, which is a little higher when compared to HFM’s 1 pip and Pepperstone’s 0.7 pips. ATFX offers the popular MT4 and MT5 platforms, a common offering for most of the brokers we reviewed, including IC Markets, Forex.com, and others. However, IC Markets also includes the advanced cTrader, while Pepperstone offers TradingView. eToro, on the other hand, offers only its proprietary platform.

As to the available instruments, ATFX offers 300+ tradable products, which is considered a good range. However, FP Markets has a far more extensive offering of over 10,000 instruments. At last, ATFX’s educational section includes essential materials for beginners, standing out for its webinars, seminars, well-planned courses, Trading Central, and other tools. Pepperstone and FP Markets are also beginner-friendly and provide well-organized educational resources.

| Parameter |

ATFX |

HFM |

FP Markets |

IC Markets |

Pepperstone |

eToro |

Forex.com |

| Spread-Based Account |

From 1.8 pips |

From 1 pip |

From 1 pip |

From 1 pip |

Average 0.7 |

Average 1 pip |

From 0.8 Pips |

| Commission-Based Account |

0.0 pips + up to $3.5 |

0.0 pips + $3 |

0.0 pips + $3 |

0.0 pips + $3.50 |

0.0 pips + $3.50 |

Available at US eToro Crypto |

0.0 pips + $5 |

| Fees Ranking |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

Low |

Average |

Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, HFM App |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5,cTrader |

MT4, MT5, cTrader, TradingView |

Proprietary Platform |

MT4, MT5, Forex.com Platform |

| Asset Variety |

|

500+ instruments |

|

1,000+ instruments |

1,200+ instruments |

2,000+ instruments |

500+ instruments |

| Regulation |

FCA, CySEC, ASIC, FSC, FSA |

FCA, DFSA, FSCA, FSA, CMA |

ASIC, CySEC, FSCA, CMA |

ASIC, CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FCA, CySEC, ASIC, FSAS, NFA for Crypto Exchange |

FCA, NFA, IIROC, ASIC, CFTC, CySEC, JFSA, MAS, CIMA |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/5 support |

| Educational Resources |

Excellent |

Good |

Excellent |

Good |

|

Good |

Good |

| Minimum Deposit |

$100 |

$0 |

$100 |

$200 |

$0 |

$200 |

$100 |

Full Review of Broker ATFX

Our experience with ATFX was smooth and positive, providing us with a good basis to talk about the favorable and secure services the broker provides. ATFX is a flexible broker with diverse offerings and enhanced conditions. It ensures high standards for profitable trading via innovative features, in-depth analysis, advanced platforms, and well-tailored account types.

ATFX is heavily regulated by the FCA, ASIC, and CySEC and holds additional licenses that enable the broker to accept international clients. The broker offers the popular MT4 and MT5 platforms. Traders can also access copy trading, MAM, and PAMM accounts. The trading costs are average and depend on the account types and the instrument traded. The only commission-based account offers tight spreads from 0.0 pips with commissions of up to $7 per lot.

ATFX is a good broker for professionals, as well as for beginners looking for extensive educational materials, such as webinars, seminars, trading courses, etc. The research section is also helpful, including an economic calendar, Trading Central, market news, and more. Overall, ATFX is a favorable broker if it meets the trading expectations of clients and is considered a safe choice to explore the market.

Share this article [addtoany url="https://55brokers.com/atfx-review/" title="ATFX"]