- What is ALB?

- ALB Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

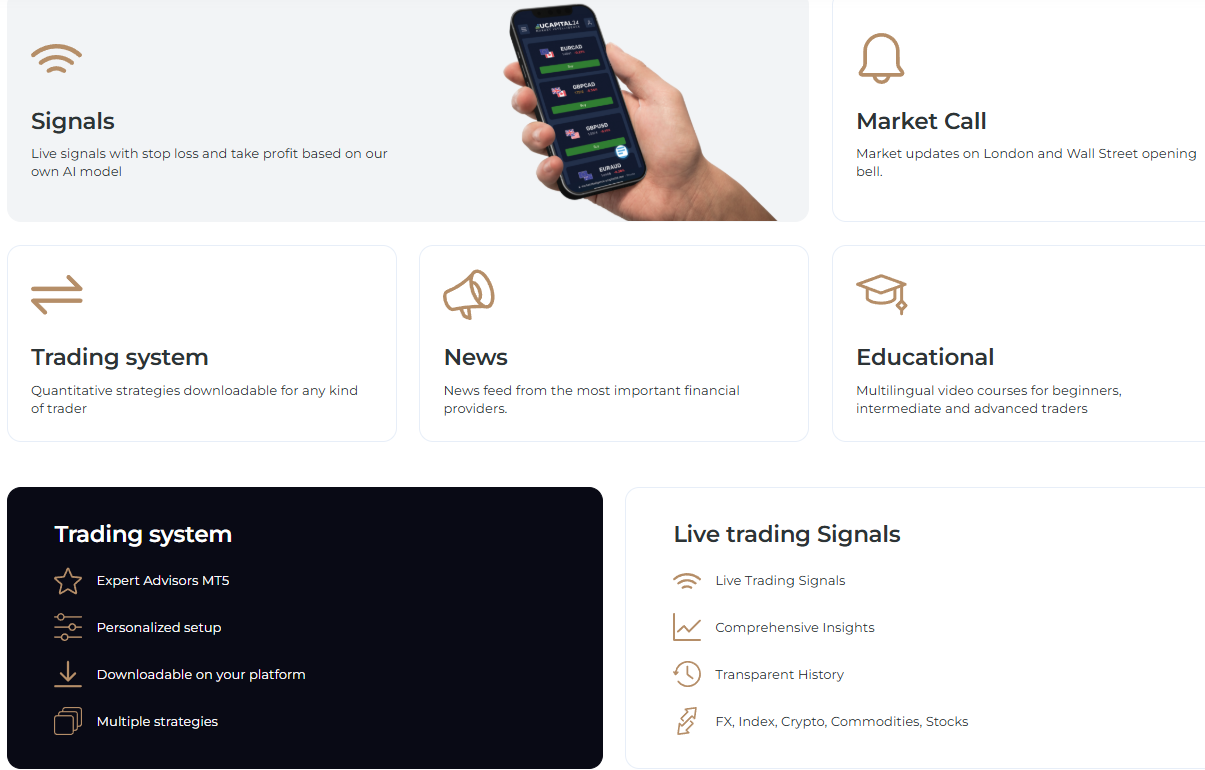

- Trading Platforms and Tools

- Trading Instruments

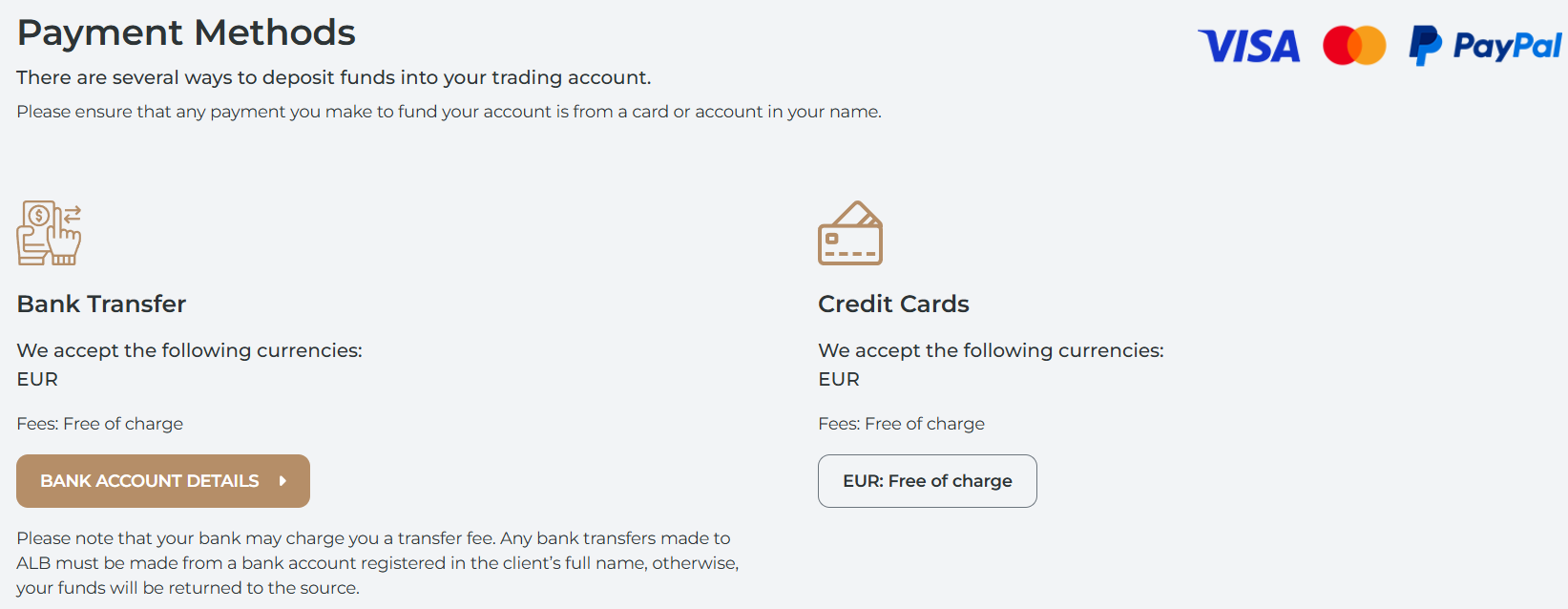

- Deposit and Withdrawal Options

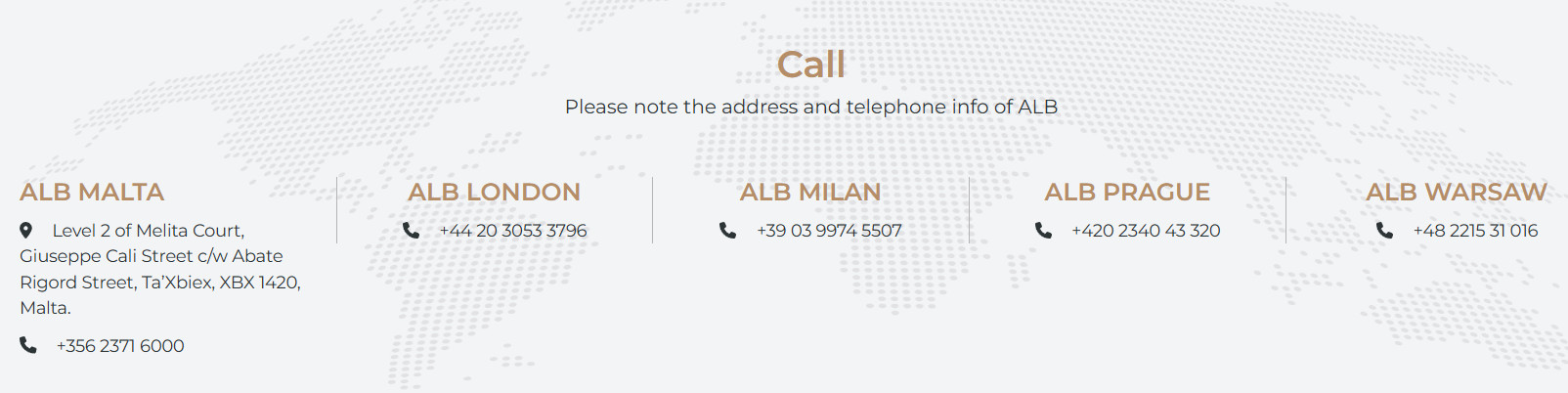

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

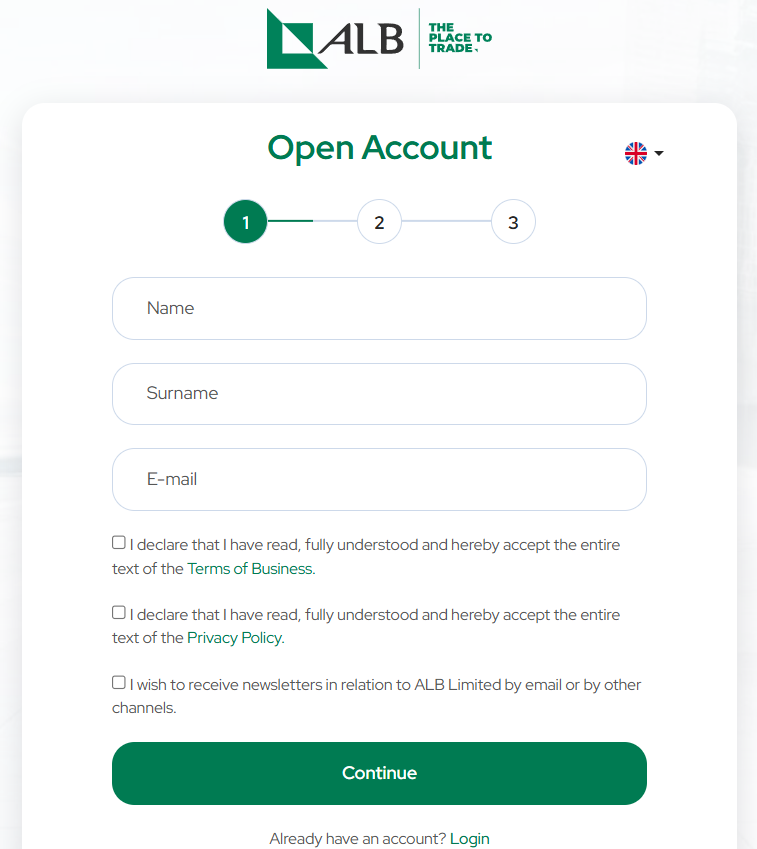

- Account Opening

- Additional Tools And Features

- ALB Compared to Other Brokers

- Full Review of Broker ALB

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is ALB?

ALB is a CFD and Forex trading brokerage firm that offers over 100 major and exotic Forex pairs, stock indices, commodity and crypto CFDs, metals, bonds, and more.

The ALB company is based in Malta and is authorized by the Malta Financial Services Authority (MFSA). Overall, the broker aims to provide competitive trading conditions, a wide range of trading products, and an advanced MetaTrader trading platform suitable for traders of all skill levels.

ALB Pros and Cons

ALB has several advantages and disadvantages that you should consider when selecting the firm as your Forex trading broker. On the positive side, the company provides a variety of trading instruments, competitive trading fees, and access to the popular MT5 trading platform. Additionally, the broker offers good research tools and features.

For the cons, the website lacks comprehensive educational materials and seminars, which may not be ideal for traders seeking in-depth learning resources. Moreover, ALB does not possess a top-tier license, even though it is regulated in Europe, which may be a concern for traders who prioritize brokers with higher regulatory credentials.

| Advantages | Disadvantages |

|---|

| European license and oversee | No top-tier license |

| MT5 trading platforms | Limited education |

| Popular trading instruments | No 24/7 customer support |

| Competitive fees and spreads | |

| Good trading tools | |

| Suitable for beginners and professionals | |

ALB Features

ALB offers favorable trading conditions for a range of financial products. Traders can benefit from access to advanced trading platforms that provide a robust set of tools and features to enhance their trading experience. Below are the main points to consider when choosing ALB as your Forex trading broker.

ALB Features in 10 Points

| 🏢 Regulation | MFSA |

| 🗺️ Account Types | Standard, Pro, Corporate Accounts |

| 🖥 Trading Platforms | MT5, UCapital24 |

| 📉 Trading Instruments | Forex, CFDs, Commodities, Metals, Energies, Indices, Share, Stock, Bonds, Cryptos |

| 💳 Minimum Deposit | $200 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, GBP |

| 📚 Trading Education | Analysis, News, Blogs |

| ☎ Customer Support | 24/5 |

Who is ALB For?

ALB is designed for traders of all levels looking to explore the markets, seeking advanced tools, diverse instruments, and regulated trading conditions under the EU framework. Based on our findings and Financial Expert Opinions, ALB is Good for:

- European traders

- Traders who prefer the MT5 trading platform

- Currency trading

- Beginners

- Advanced traders

- STP/NDD execution

- Competitive spreads

- Good trading tools

- Supportive customer service

ALB Summary

In conclusion, ALB is a regulated brokerage firm that offers competitive trading conditions, access to a popular range of financial instruments, and advanced trading platforms. The broker provides favorable pricing, along with tight spreads for various trading activities.

Although ALB lacks extensive educational materials, it compensates with a variety of trading tools, including advanced charting features.

Overall, ALB offers a competitive trading environment that caters to traders of various skill levels. However, the broker does not possess a top-tier license, so you should conduct thorough research and carefully assess whether the broker’s services and offerings align with your trading requirements before deciding.

55Brokers Professional Insights

What sets ALB apart in the competitive financial market is its quality trading performance and conditions provided, also being one of European Broker with good regulatory backing with client protection and transparency. The proposal , in our opinion, is most suited for traders from EU, day traders, swing traders and pattern traders, since conditions of trading performance are technically good also with better costs on commission based account.

The broker offers access to the advanced MetaTrader 5 platform so if you look for other software opt to other brokers, while the provided multi-asset trading comes at fast execution speeds and there are powerful analytical tools, which is big plus for all types of traders. ALB stands out with its tailored account types, commission-free trading on major instruments, and personalized support for both retail and professional clients.

Lastly , we mark commitment to a client-centric approach, that makes ALB a trusted choice for traders seeking reliability, flexibility, and innovation.

Consider Trading with ALB If:

| ALB is an excellent Broker for: | - Need a well-regulated broker.

- Providing competitive fees and spreads.

- Offering popular trading instruments.

- Get access to MT5 trading platform.

- Broker with a variety of trading strategies.

- Beginners and professional traders.

- Secure trading environment.

- European traders.

|

Avoid Trading with ALB If:

| ALB might not be the best for: | - Providing Copy Trading.

- Need broker with access to VPS Hosting.

- Need broker with Top-Tier license.

|

Regulation and Security Measures

Score – 4.4/5

ALB Regulatory Overview

ALB is a regulated brokerage firm authorized and supervised by the European MFSA regulatory authority. Being regulated means that the broker operates within the framework of established financial regulations and is subject to oversight to ensure compliance with industry standards.

However, conduct your research, read user reviews, and consider other factors to assess the legitimacy and reputation of any brokerage firm before engaging in trading activities.

How Safe is Trading with ALB?

We found that ALB adheres to certain industry standards and compliance requirements, which include client fund protection and segregation from company funds, as well as dispute resolution mechanisms. Additionally, the broker offers additional protections, such as negative balance protection, which ensures that clients do not incur losses exceeding their account balance.

However, we recommend carefully reviewing the broker’s documentation, legal agreements, and policies to fully understand the specific trading protections offered by ALB before engaging in trading activities.

Consistency and Clarity

ALB has established a solid reputation in the trading community through consistent regulatory compliance, transparent operations, and a commitment to client satisfaction. Regulated by the Malta Financial Services Authority, the broker ensures adherence to strict EU standards, which reinforces trust among its clients.

Trader reviews often highlight ALB’s user-friendly platform, multilingual support, and competitive trading conditions as key strengths, though some mention limited publicly available information on spreads and customer support hours as areas for improvement.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with ALB?

ALB offers flexible account types to suit various traders, including Standard, Pro, and Corporate Accounts, each tailored for different levels of experience and trading volume.

Additionally, ALB offers a Demo Account that allows new users to practice in a risk-free environment using virtual funds on the MetaTrader 5 platform, perfect for learning or strategy testing before moving into live trading.

Standard Account

The Standard Account at ALB is designed for everyday retail traders who seek a simple and accessible way to enter the markets. With a minimum deposit of €200 or $200, this account offers commission-free trading on major instruments like Forex, commodities, and indices.

Spreads are competitive, and trading is executed on the MT5 and UCapital24 platforms. This account is ideal for traders looking for a low-cost, straightforward trading environment without complex fee structures.

Pro Account

The Pro Account is tailored for experienced or high-volume traders who meet ALB’s eligibility criteria as professional clients. While a higher minimum deposit may apply, traders benefit from tighter spreads, higher leverage, and premium trading conditions.

Commission structures may vary depending on the instruments traded, especially for advanced products like cryptocurrencies. Like the Standard Account, the Pro Account is accessible via all trading platforms, offering sophisticated charting tools, algorithmic trading capabilities, and real-time data for a more refined trading experience.

Regions Where ALB is Restricted

ALB primarily serves clients within the European Economic Area (EEA). However, due to regulatory and compliance considerations, the broker restricts services to residents of certain countries, including:

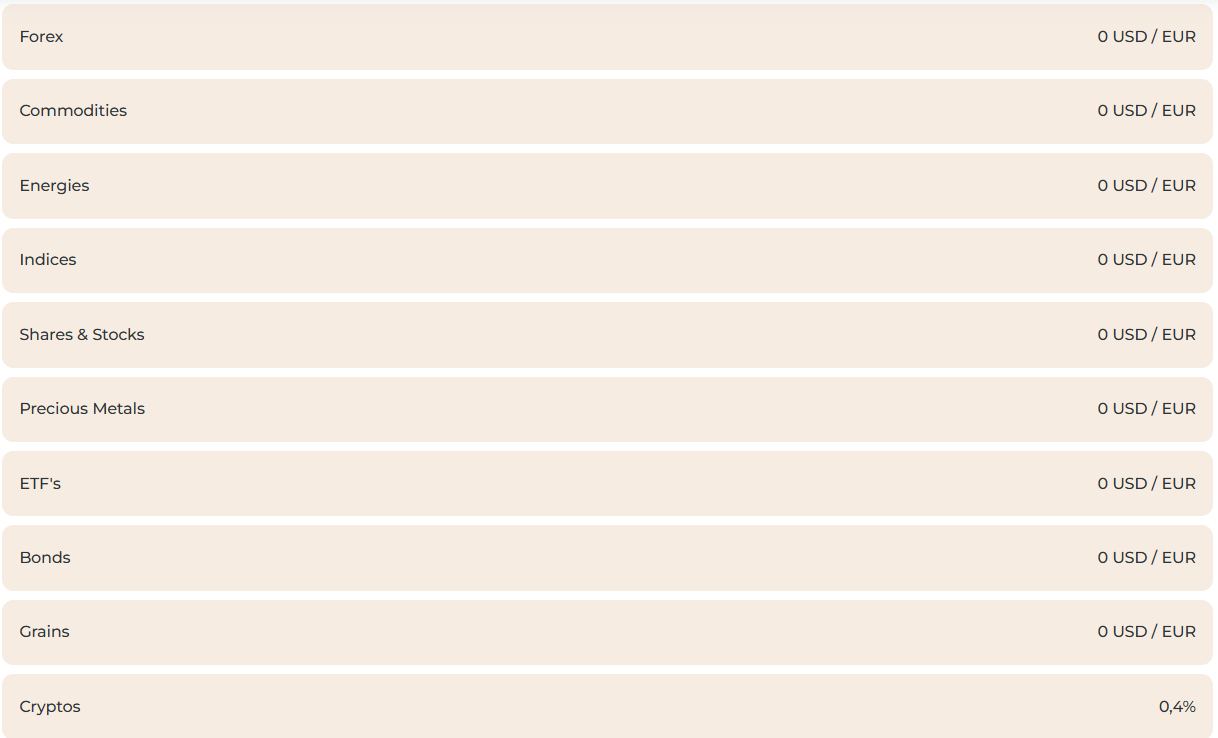

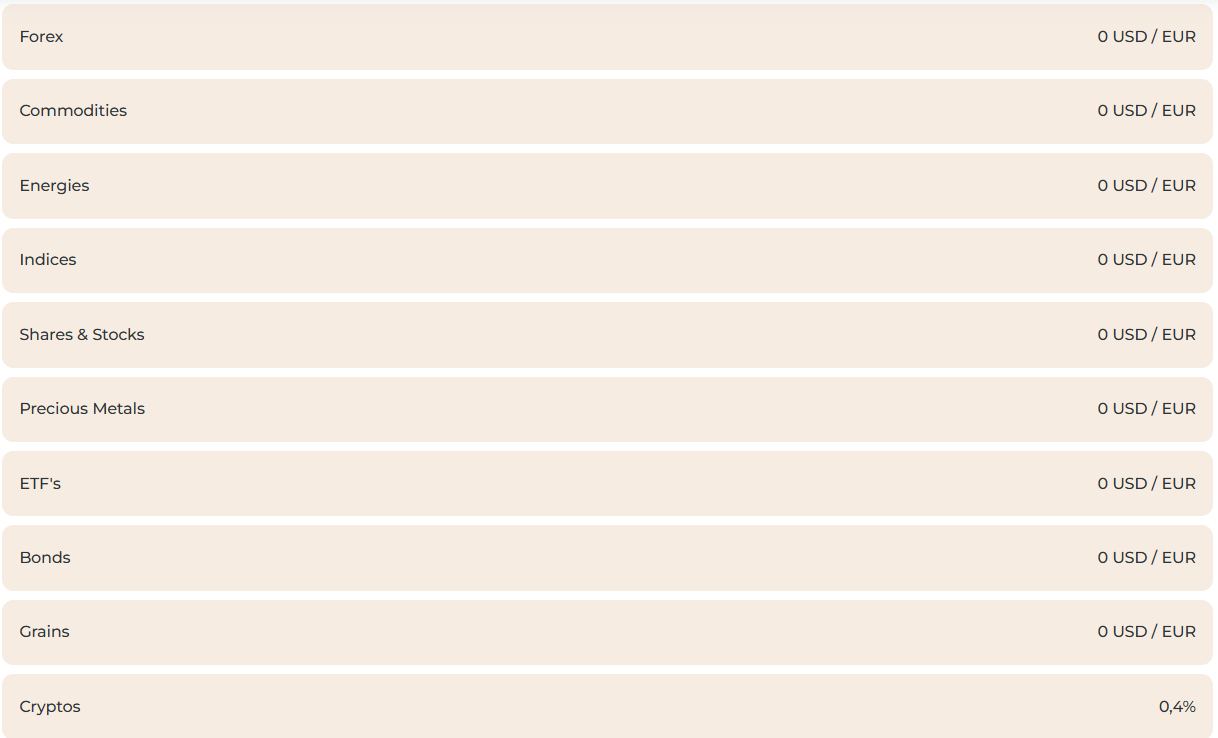

Cost Structure and Fees

Score – 4.4/5

ALB Brokerage Fees

ALB provides competitive pricing and commissions for a majority of its trading services. However, there might be fees associated with deposits and withdrawals, as well as swap fees depending on the funding method and account type chosen.

So, you should carefully examine the broker’s fee structure to fully understand the applicable charges and their potential impact on trading activities.

ALB provides competitive and tight spreads, with an average spread of 1.5 pips for the EUR/USD currency pair in the Forex market.

However, spreads might vary depending on market conditions, volatility, and liquidity. Therefore, we recommend checking the broker’s website or contacting their customer support for detailed information.

ALB does not charge commissions on most instruments, including Forex, indices, and commodities. The only exception is cryptocurrency trading, where a 0.4% commission is applied per transaction.

ALB applies rollover rates to positions held overnight, reflecting the interest rate differential between the currencies involved in a trade. These rates are charged or credited daily, with a triple swap applied on Wednesdays to account for weekend holding costs.

Swap rates can result in either a credit or a debit, depending on the direction of the trade and prevailing market conditions. As these rates are subject to frequent changes due to market fluctuations, traders should regularly review the latest swap rates on ALB’s platform to manage their positions effectively.

ALB maintains a transparent and cost-effective fee structure, ensuring that traders can manage their finances without unexpected charges.

The broker does not impose additional fees for account opening, deposits, withdrawals, or account maintenance. Specifically, deposits via bank transfer, credit card, or prepaid card are free of charge, and there are no fees for withdrawing funds through bank transfer or credit/debit cards. Moreover, ALB does not set a minimum withdrawal amount, and account closure is free of charge.

How Competitive Are ALB Fees?

ALB offers a competitive fee structure, particularly appealing to traders looking for cost-effective trading solutions. With no commissions on most trading instruments, ALB allows traders to maximize their profits by reducing transaction costs.

Additionally, ALB’s tight spreads on major instruments further enhance its appeal, making it an attractive choice for both novice and professional traders seeking transparent and affordable pricing without hidden charges.

| Asset/ Pair | ALB Spread | ADS Securities Spread | Cornertrader Spread |

|---|

| EUR USD Spread | 1.5 pips | 0.7 pips | 0.2 pips |

| Crude Oil WTI Spread | 3 | 6 pips | 3 |

| Gold Spread | 1.4 pips | 5 pips | 0.5 |

| BTC USD Spread | 14 pips | $120 | 190 pips |

Trading Platforms and Tools

Score – 4.5/5

ALB provides traders with the robust MetaTrader 5 platform, renowned for its advanced trading capabilities and user-friendly interface. The platform supports algorithmic trading through Expert Advisors and is accessible via desktop, web, and mobile devices, ensuring flexibility and convenience for traders on the go.

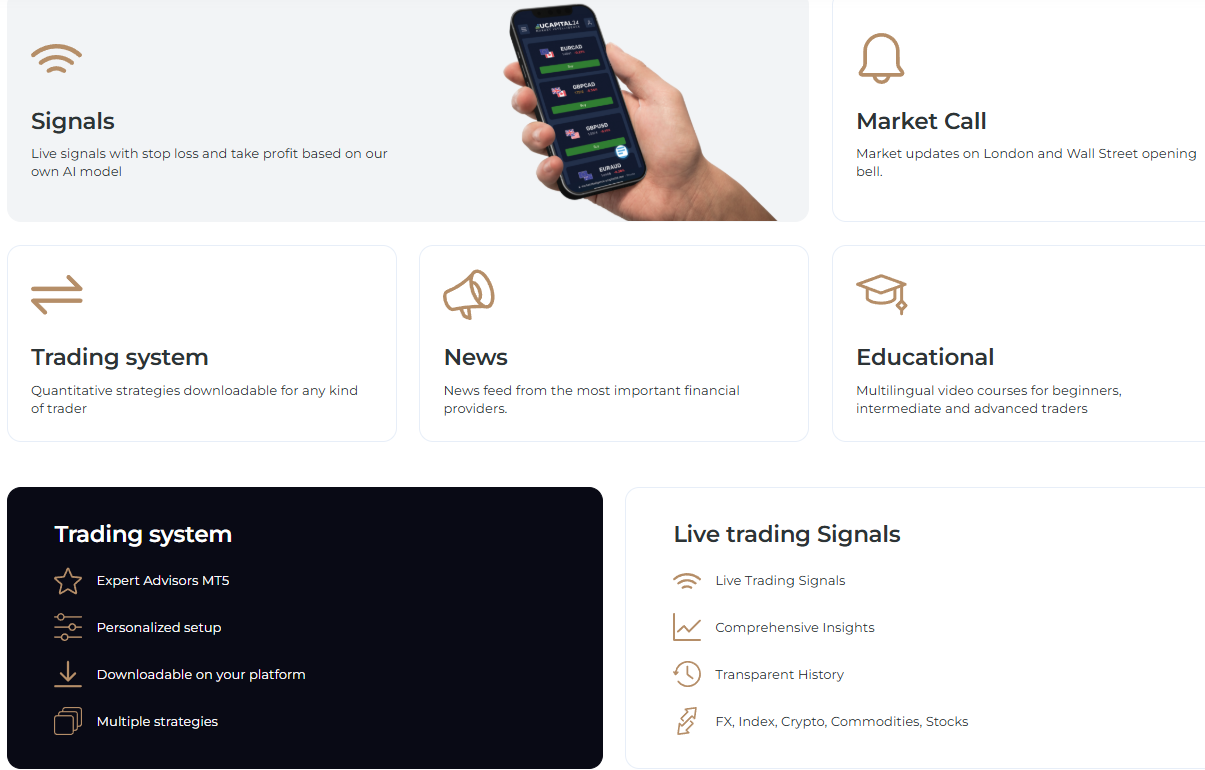

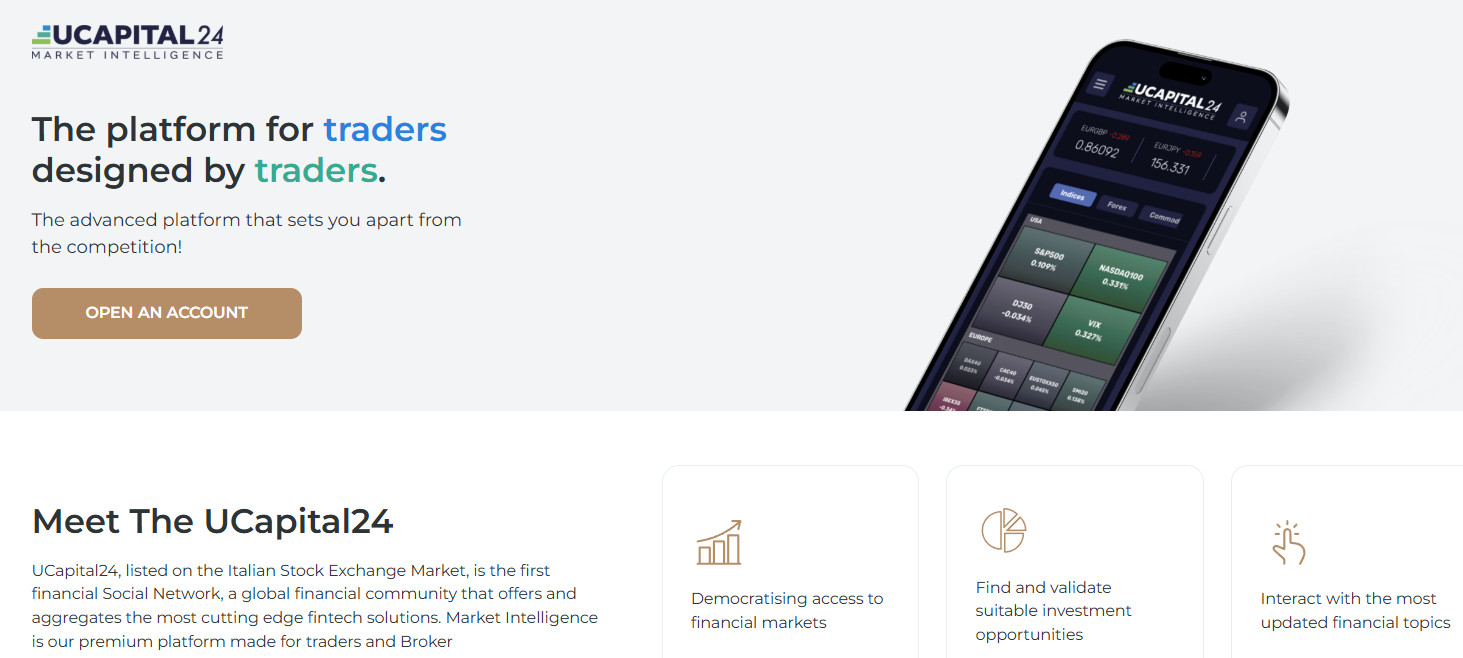

In addition to MT5, ALB integrates with UCapital24, a financial social network platform that enhances the trading experience by providing access to live quotes, technical and fundamental analysis, and a library of indicators and market tools.

UCapital24 also offers live trading signals based on AI models, market updates, and educational resources, making it a valuable tool for traders seeking comprehensive market insights and community engagement.

Trading Platform Comparison to Other Brokers:

| Platforms | ALB Platforms | FinecoBank Platforms | ADS Securities Platforms |

|---|

| MT4 | No | No | Yes |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

ALB Web Platform

ALB offers the MT5 WebTrader, providing traders with a powerful and flexible trading experience directly through their web browsers. This platform eliminates the need for any software downloads, allowing users to access their trading accounts from any device with an internet connection.

The MT5 web platform supports both real and demo accounts, enabling traders to execute various types of orders, including market and pending orders, with ease. The platform is compatible with all major operating systems and browsers, ensuring seamless access for traders worldwide. With its user-friendly interface and robust functionality, MT5 is an ideal solution for those seeking a convenient and efficient trading platform.

ALB Desktop MetaTrader 4 Platform

ALB does not offer the MetaTrader 4 platform, instead, it supports the more advanced MetaTrader 5 platform for all trading activities.

ALB Desktop MetaTrader 5 Platform

The ALB Desktop MT5 platform delivers a powerful and feature-rich trading environment tailored for both beginners and experienced traders. It comes equipped with more than 38 preinstalled technical indicators, 44 analytical charting tools and supports 3 chart types across 21 timeframes, providing in-depth market analysis and flexibility.

Traders can benefit from advanced order functionality, including additional pending order types like Sell Stop Limit and Buy Stop Limit, as well as 1-click trading, trade-from-chart, and trailing stop features for faster execution. The platform also provides ultra-fast execution, with most orders faster than 14 milliseconds.

The platform also offers detachable charts, a fully customizable interface, and the ability to add custom Expert Advisors and indicators. An integrated Economic Calendar, Depth of Market (DOM) view, and easy-to-use layout make MT5 on desktop a complete solution for active traders. It is available for both Windows and Mac operating systems, ensuring wide accessibility.

Main Insights from Testing

Testing the MT5 platform with ALB revealed a smooth and responsive trading experience with stable performance even during high market volatility.

Order execution was fast and reliable, with minimal slippage. The platform’s multi-asset support and intuitive interface made it easy to navigate between instruments, and the overall functionality met the demands of both manual and automated trading strategies.

ALB MobileTrader App

ALB provides traders with the MetaTrader 5 mobile app, available for both iOS and Android devices. This app offers a comprehensive trading experience, featuring real-time quotes, interactive charts, and a suite of technical analysis tools. Traders can execute orders, monitor their accounts, and stay connected to the markets from anywhere, ensuring flexibility and convenience.

In addition to MT5, ALB integrates with UCapital24, a financial social network platform accessible via its dedicated mobile app. UCapital24 offers live market updates, financial news, and educational resources, enabling traders to stay informed and make data-driven decisions.

Trading Instruments

Score – 4.6/5

What Can You Trade on ALB’s Platform?

ALB offers a comprehensive range of trading instruments, providing clients access to over 2,000 financial products across various asset classes, including over 100 Forex pairs, stock indices, commodity and crypto CFDs, metals, futures, bonds, and more.

This extensive selection allows traders to diversify their portfolios and engage in various markets according to their individual preferences and trading strategies.

Main Insights from Exploring ALB’s Tradable Assets

Exploring ALB’s tradable assets reveals a well-structured and diverse product offering that caters to both conservative and high-risk traders.

The instruments are categorized for easy navigation, and asset availability is supported by real-time data and efficient execution. The platform’s variety encourages portfolio diversification, while the inclusion of trending markets like crypto and global equities adds modern appeal to traditional trading choices.

Leverage Options at ALB

Leverage can be beneficial for traders as it enables them to enter the market with a smaller initial investment. Nevertheless, they should possess a comprehensive understanding and the associated risks before participating in leveraged trading.

ALB multiplier is offered according to the MFSA regulation:

- Traders from Europe are eligible to use a maximum of up to 1:30 for major currency pairs.

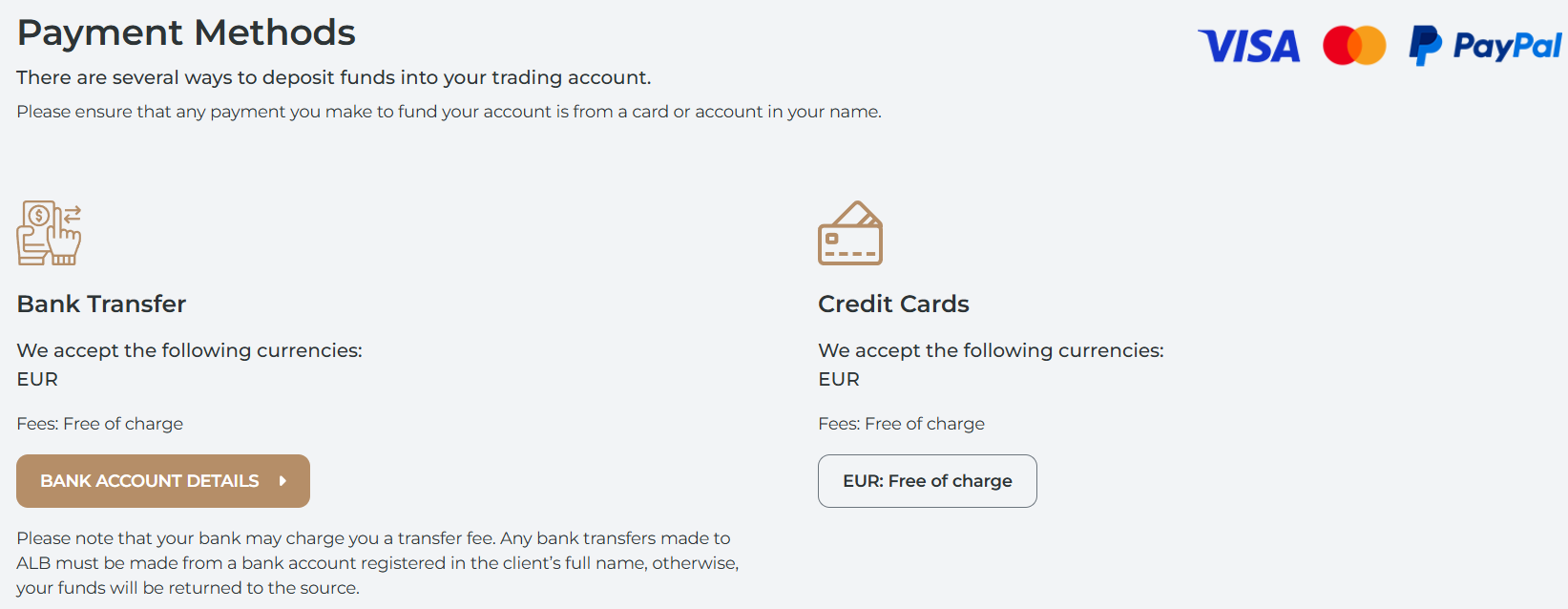

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at ALB

The broker offers a few funding methods to deposit funds into your trading account.

ALB Minimum Deposit

The minimum deposit required to open a live trading account with ALB is € $200. This entry-level threshold makes it accessible for a wide range of traders to begin trading across various financial instruments.

Withdrawal Options at ALB

As we found, to withdraw funds from your account, you can choose the trading account and enter the desired withdrawal amount. If your bank operates in a different currency than your trading account, currency conversion will take place when the payment is received by your bank.

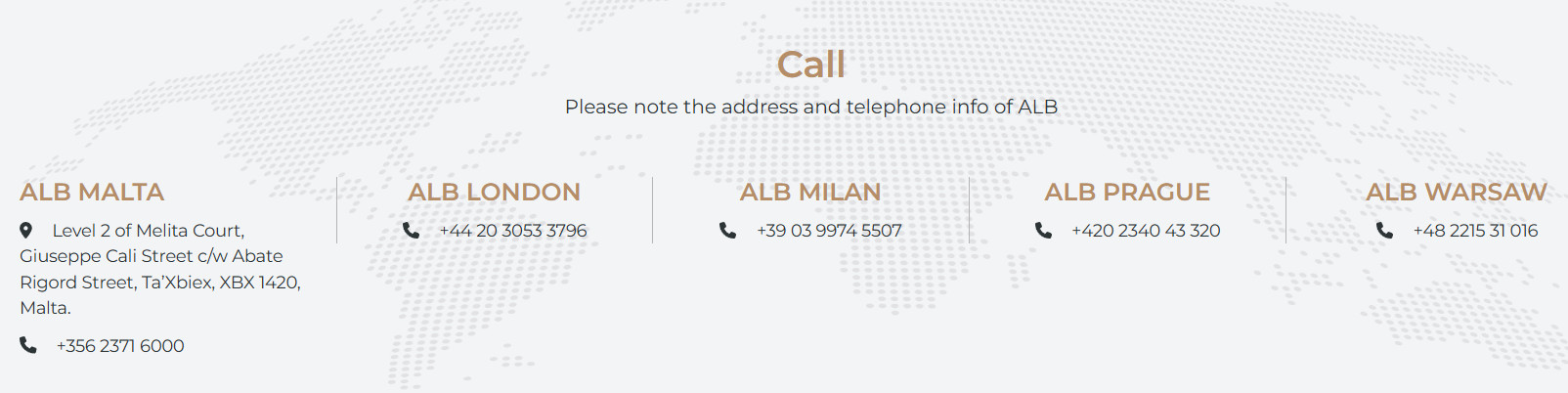

Customer Support and Responsiveness

Score – 4.4/5

Testing ALB’s Customer Support

The broker offers 24/5 customer support through various channels, including phone, email, live chat, and social media platforms.

Moreover, the support team at ALB is proficient in addressing various needs, including technical inquiries, providing analysis recommendations, answering general questions, and assisting with operational matters.

Contacts ALB

ALB provides dedicated customer support across its international offices. For inquiries, clients can reach the main office in Malta at +356 2371 6000. Additionally, the Milan branch is available at +39 03 9974 5507.

These contact numbers ensure that clients can receive assistance tailored to their regional needs. For more contact options and to get in touch with other ALB offices, please visit their official contact page.

Research and Education

Score – 4.3/5

Research Tools ALB

ALB offers a wide range of research tools accessible both on its website and through its platforms.

- On the website, traders can find up-to-date market news, economic calendars, and technical analysis reports to assist with decision-making.

- MT5 provides a variety of built-in technical indicators, advanced charting tools, and real-time market data, allowing traders to analyze trends and execute trades with precision.

- Additionally, UCapital24, ALB’s financial social network, offers live trading signals, market analysis, and a trading community to enhance collaborative trading strategies. The platform also integrates an economic calendar and tools for trade automation with EAs, helping traders stay informed and automate their strategies for better market engagement.

Education

The broker’s website does not offer extensive educational and research materials, seminars, or webinars, only providing a blog, analysis, and news. This lack of comprehensive educational resources can be seen as a disadvantage, as such resources are essential for traders to enhance their skills and knowledge.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options ALB

ALB primarily operates as an online broker specializing in Forex and CFD trading. The broker does not directly offer traditional investment products such as mutual funds, bonds, or structured investment products. Instead, the company focuses on providing trading services through its platforms, catering to both retail and professional traders seeking to engage in leveraged trading of various financial instruments.

Account Opening

Score – 4.4/5

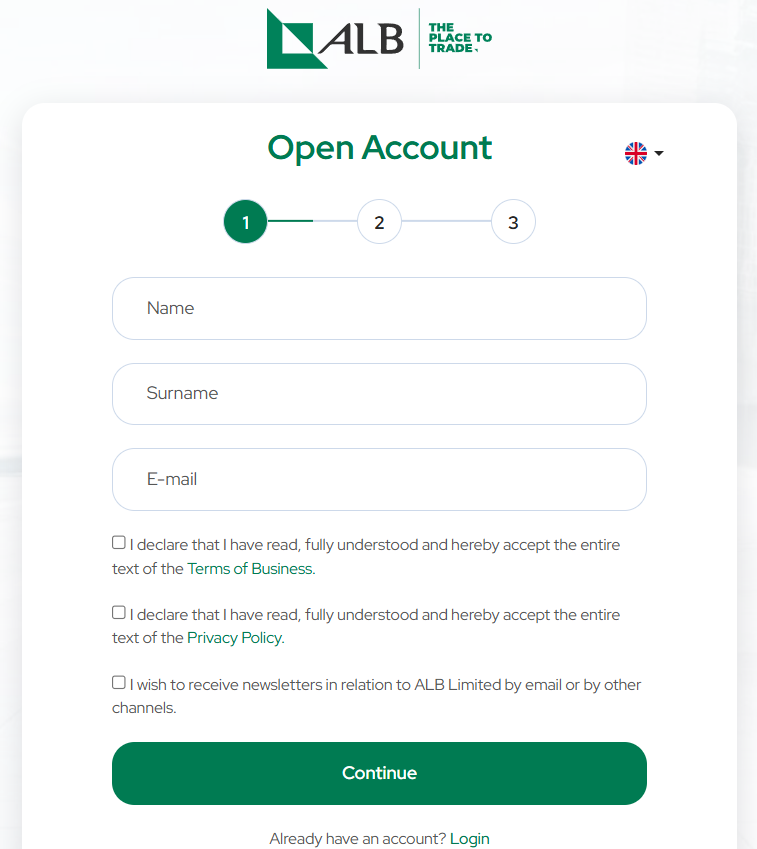

How to Open ALB Demo Account?

Opening a demo account with ALB is a simple process that allows you to practice trading without risking real money. Here is how you can get started:

- Visit the ALB website and navigate to the “Open a Demo Account” section.

- Fill in the registration form with your basic details, such as name, email, and phone number.

- Choose the account type you wish to open (Demo account).

- Select the trading platform and the preferred account settings, such as leverage.

- Complete the registration process and verify your details if necessary.

- Download the platform and log in using your demo account credentials.

- Start practicing with virtual funds and explore various trading strategies in a risk-free environment.

How to Open ALB Live Account?

To open a live account with ALB, you first need to visit their official website and complete the registration form by providing your details, such as your name, email, phone number, and residential address.

You will then be asked to upload necessary verification documents, such as a government-issued ID and a recent utility bill or bank statement, to confirm your identity and address. After reviewing and accepting ALB’s terms and conditions, your application will be processed.

Once your documents are verified, your account will be approved and activated, allowing you to deposit funds and start trading. The process is designed to ensure compliance with regulatory requirements and provide a secure trading environment.

Additional Tools and Features

Score – 4.3/5

In addition to its core research tools, ALB provides several other features to enhance the trading experience.

- These include integrated risk management tools, such as stop loss and take profit functions, as well as margin and profit calculators available through the platform.

- Traders also benefit from multi-language support, ensuring accessibility for a global audience.

- ALB offers account management features, such as customizable dashboards and real-time portfolio tracking, to help users stay on top of their trades.

- The integration with UCapital24 further allows for access to community-driven insights, news feeds, and sentiment analysis, providing a more comprehensive view of the market.

ALB Compared to Other Brokers

Compared to its industry competitors, ALB positions itself as a mid-range broker, offering a balanced suite of services suitable for retail and professional traders alike. While it may not match the extensive product range or institutional-grade platforms of giants like Saxo Bank or CMC Markets, ALB provides a solid foundation with access to MT5 and UCapital24, appealing to traders who value modern tools and user-friendly interfaces.

Its fee structure is relatively average, though it stands out by only applying commission fees to crypto trading, unlike some competitors who charge across multiple asset classes.

In terms of educational resources, ALB falls short when compared to brokers offering comprehensive learning materials and webinars. However, its support offerings and account setup process remain on par with industry norms, making it a good choice for those seeking simplicity and reliability in their trading experience.

| Parameter |

ALB |

ADS Securities |

Saxo Bank |

City Index |

Velocity Trade |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1.5 pips |

Average 0.7 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

For Crypto trading 0.4% commission is applied |

0.0 pips + $3 |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

$3 per side per 100,000 units traded |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT5, UCapital24 |

ADSS Platform, MT4 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

V Trader |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

2,000+ instruments |

1,000+ instruments |

71,000+ instruments |

13,500+ instruments |

250+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

MFSA |

SCA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$200 |

$100 |

$0 |

$0 |

$500 |

$0 |

$0 |

Full Review of Broker ALB

ALB is a regulated Malta-based broker offering access to over 2,000 trading instruments across Forex, indices, commodities, shares, and cryptocurrencies. The broker supports the popular MetaTrader 5 platform, along with integration with UCapital24 for added trading tools, live signals, and user-friendly features.

ALB offers multiple account types, including Standard, Pro, Corporate, and a demo account, with a minimum deposit starting at $200. Spreads are average, with commission only applied to crypto trading at 0.4%. Traders can access the platforms via desktop, web, and mobile, with 24/5 customer support. While educational content is limited, the broker maintains a strong regulatory foundation and offers a secure trading environment suitable for both beginner and experienced traders.

Share this article [addtoany url="https://55brokers.com/alb-review/" title="ALB"]

Very sad... scam.