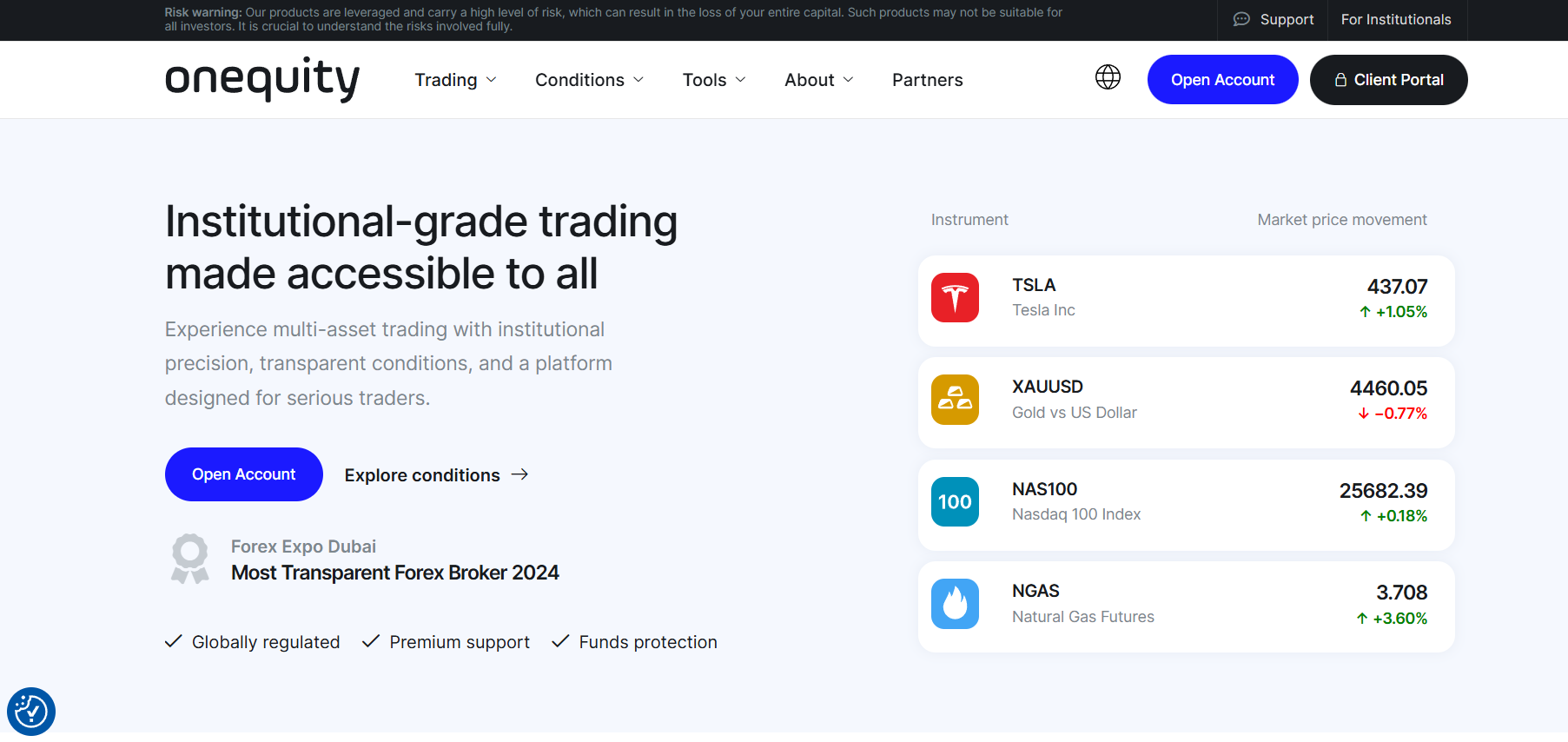

- What is OnEquity?

- OnEquity Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

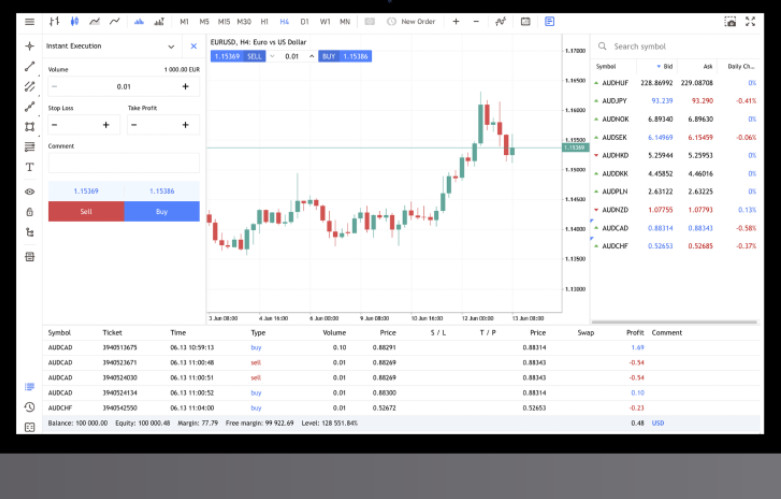

- Trading Platforms and Tools

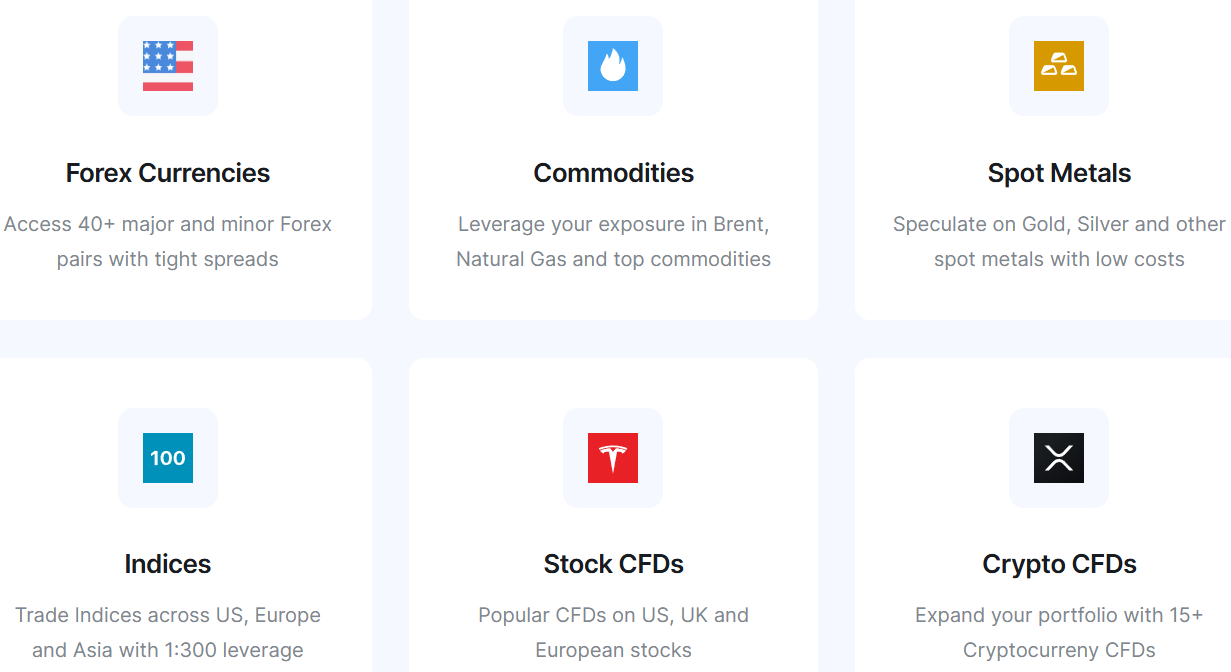

- Trading Instruments

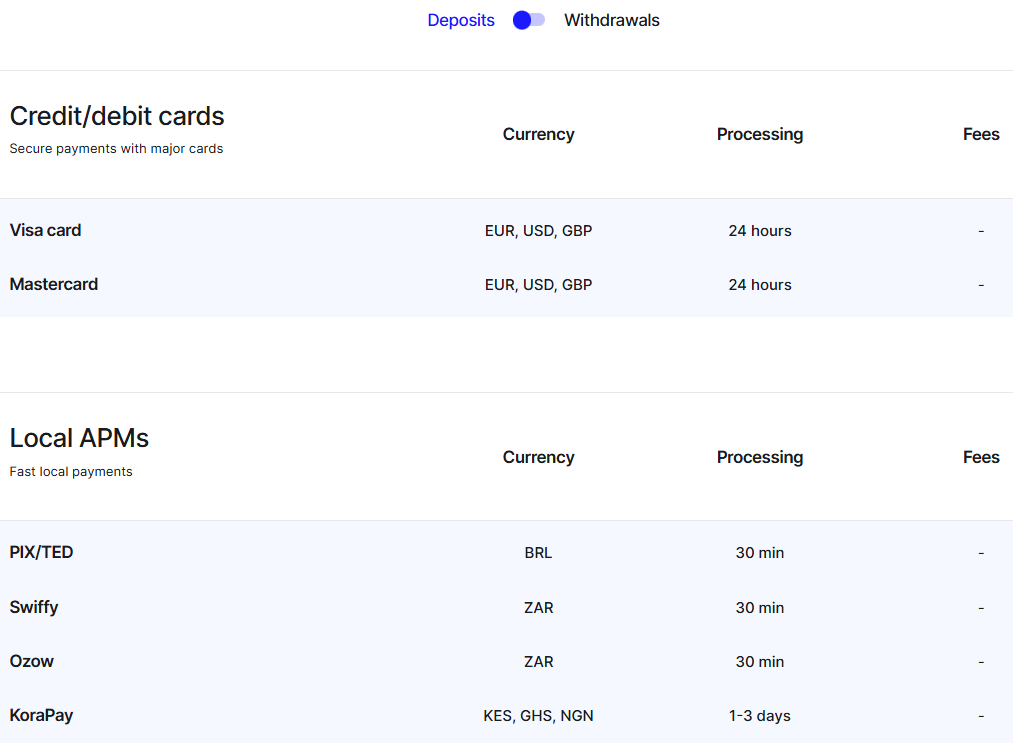

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- OnEquity Compared to Other Brokers

- Full Review of Broker OnEquity

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 3.9 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is OnEquity?

OnEquity is a Forex and CFD brokerage firm that offers access to a variety of financial markets, including Forex, CFDs on commodities, metals, indices, stocks, and cryptocurrencies, through industry-standard platforms like MetaTrader 4 and MetaTrader 5.

The company serves both retail and institutional traders with a range of account types, modern trading technology, and competitive conditions.

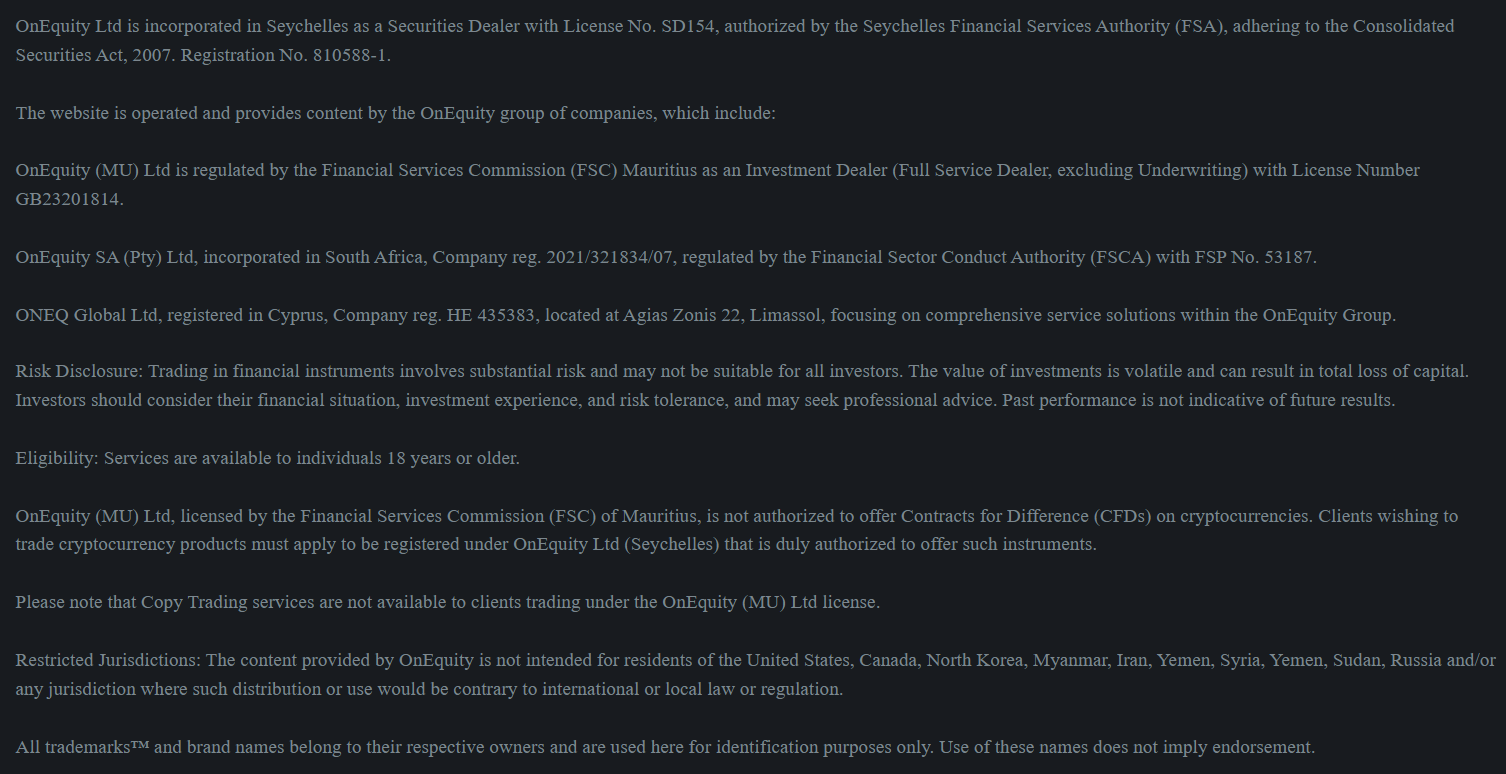

To support transparency and investor protection, OnEquity operates under multiple regulatory authorities: it is regulated in South Africa by the Financial Sector Conduct Authority, holds a Securities Dealer License from the Seychelles Financial Services Authority, and has expanded its regulatory framework to include a license from the Financial Services Commission in Mauritius; all aimed at ensuring compliance with local financial laws and safeguarding client interests.

OnEquity Pros and Cons

OnEquity offers several advantages that appeal to many users, including access to popular platforms such as MT4 and MT5, a user-friendly interface, competitive pricing with low spreads and transparent fees, multiple account types, and multilingual customer support. The broker also provides segregated client funds and negative balance protection, and supports a wide range of CFD markets.

For the cons, the broker is regulated only in mid-tier or offshore jurisdictions, rather than by top-tier authorities such as the UK’s FCA or Australia’s ASIC, which may be a concern for traders who prioritize stronger investor protection. In addition, OnEquity lacks extensive educational resources.

| Advantages | Disadvantages |

|---|

| Forex and CFD trading | Conditions vary based on the entity |

| Competitive trading conditions | Limited educational materials |

| International trading | |

| Client protection | |

| Advanced trading platforms | |

| Professional trading | |

| Low spreads and fees | |

OnEquity Features

OnEquity is designed to make trading accessible and efficient for all types of users. The broker offers a wide range of markets, advanced platforms, and customizable account options. Its features focus on speed, security, and ease of use, helping traders execute strategies confidently and manage risk effectively.

OnEquity Features in 10 Points

| 🏢 Regulation | FSCA, FSC, FSA |

| 🗺️ Account Types | Plus, Prime, Elite Accounts |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, CFDs on commodities, metals, indices, stocks, and cryptocurrencies |

| 💳 Minimum Deposit | $25 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, ZAR, JPY |

| 📚 Trading Education | News, Insights, Market Commentary, Economic Calendar |

| ☎ Customer Support | 24/5 |

Who is OnEquity For?

OnEquity is suited for traders of all experience levels, from beginners exploring the markets to experienced professionals seeking advanced tools and flexible conditions. We found that the broker is a good choice for:

- Retail traders

- Beginners

- Professional traders

- Traders who prefer the MT4 and MT5 platforms

- African traders

- International trading

- Competitive conditions

- Currency trading

- CFD trading

- Good strategies

- PAMM trading

- Algorithmic/EA trading

- Swap-free trading

OnEquity Summary

In summary, OnEquity is an online brokerage that provides access to a wide range of financial markets, including Forex, CFDs on commodities, indices, stocks, and cryptocurrencies. The broker offers popular platforms like MT4 and MT5, multiple account types, competitive spreads, and a demo account for practice.

With client funds kept segregated, negative balance protection, and multilingual support, OnEquity aims to deliver a secure and user-friendly trading experience. While regulated in mid-tier jurisdictions such as Seychelles, South Africa, and Mauritius, it may be less suitable for users seeking oversight from top-tier regulators. Overall, OnEquity serves all levels of traders looking for flexibility and reliable market access.

55Brokers Professional Insights

OnEquity provides a professional and versatile experience, standing out through its combination of advanced technology, wide market access, and strong client protections. The broker offers multiple asset classes, including Forex, CFDs, stocks, indices, and cryptocurrencies, all tradable through popular platforms like MT4 and MT5, which allow for advanced charting, technical analysis, and automated strategies.

The broker also provides flexible account types tailored to different trading styles, competitive spreads that appeal to active traders, and a demo account for risk-free practice. What truly makes the broker stand out is its focus on safety and reliability: client funds are segregated, and negative balance protection is provided, helping users manage risk effectively.

Combined with multilingual customer support and user-friendly interfaces, OnEquity delivers a trading environment designed to meet the needs of both beginners and experienced professionals looking for efficiency, flexibility, and secure market access.

Consider Trading with OnEquity If:

| OnEquity is an excellent Broker for: | - Offering a range of popular instruments.

- Providing competitive conditions.

- Secure environment.

- International trading.

- Who prefer higher leverage up to 1:1000․

- Currency trading.

- Get access to MT4 and MT5.

- Beginners and professional traders.

- Various strategies allowed.

- African traders.

- Offering a variety of account types.

- PAMM trading. |

Avoid Trading with OnEquity If:

| OnEquity might not be the best for: | - Need a broker with a Top-Tier license.

- Who prefer proprietary platforms.

- Need good learning materials.

- Who prefer 24/7 customer service.

- Looking for broker with access to VPS Hosting. |

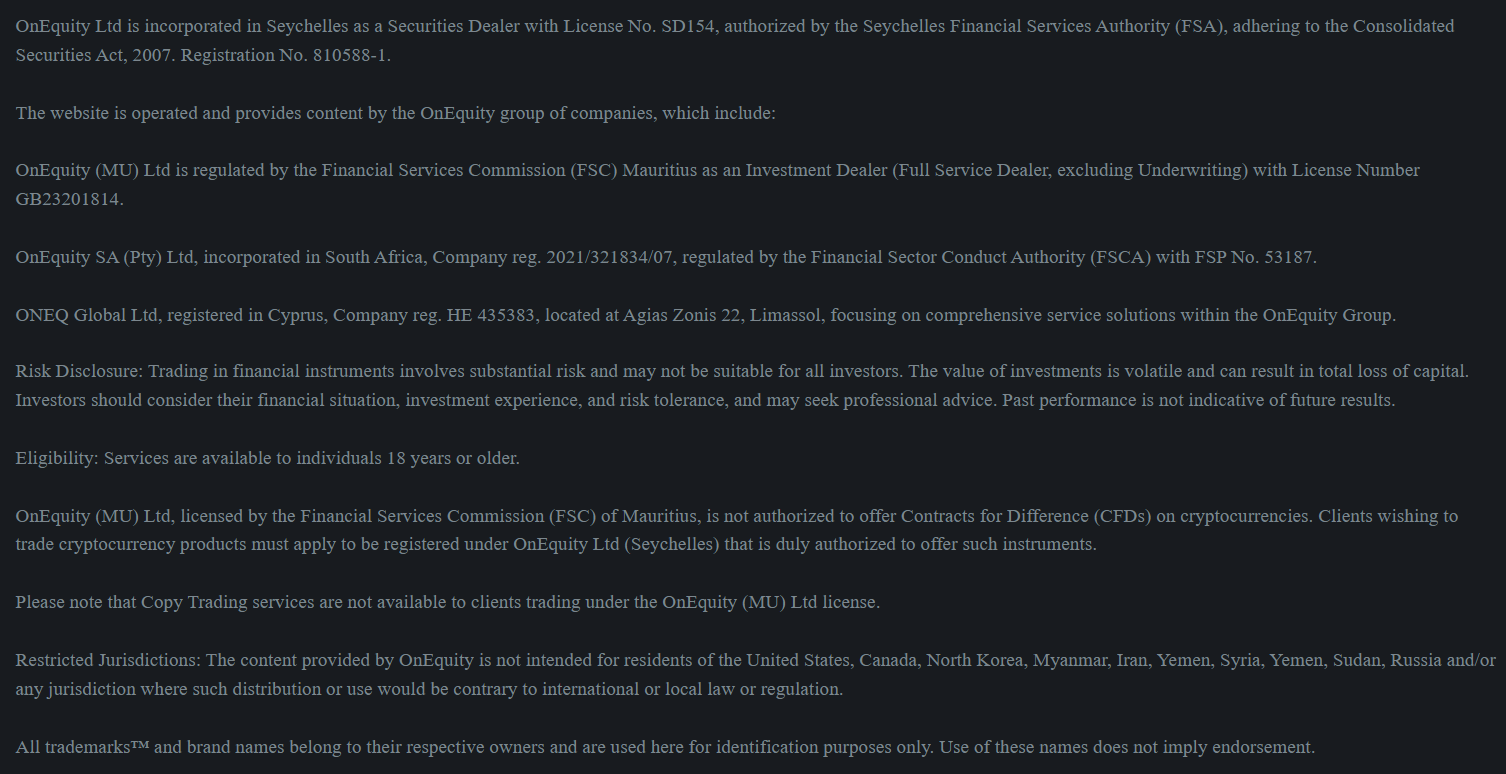

Regulation and Security Measures

Score – 4.4/5

OnEquity Regulatory Overview

OnEquity operates under a structured regulatory framework to promote compliance and client protection across multiple jurisdictions. The broker is regulated by the FSCA in South Africa, ensuring adherence to local financial standards and client safeguards. It also holds a license from the FSC in Mauritius and from the Seychelles FSA, which allows it to provide financial services from an offshore base.

While these licenses reflect a commitment to regulatory compliance and regional oversight, they are considered mid-tier compared to some top-tier regulators. As a result, traders should be aware that levels of investor protection may vary across jurisdictions.

How Safe is Trading with OnEquity?

Trading with OnEquity offers a moderate level of safety, supported by several measures designed to protect clients and their funds. The broker maintains segregated client accounts, which helps ensure that traders’ funds are kept separate from the company’s operating capital.

OnEquity also provides negative balance protection, reducing the risk of users losing more than their invested capital during volatile market conditions. As with any financial service provider, clients should carefully assess their own risk tolerance and conduct proper due diligence before investing.

Consistency and Clarity

OnEquity’s overall reputation presents a balanced picture shaped by both positive client feedback and constructive criticism. Many users highlight the broker’s reliable platforms, competitive conditions, and responsive customer support as key strengths, while some reviews point to areas such as withdrawals or account handling that could be improved.

Over time, the broker has established itself as an active market participant, supported by a growing client base and increasing visibility within the trading community. OnEquity also engages in promotional and industry activities, which help strengthen its brand presence and recognition.

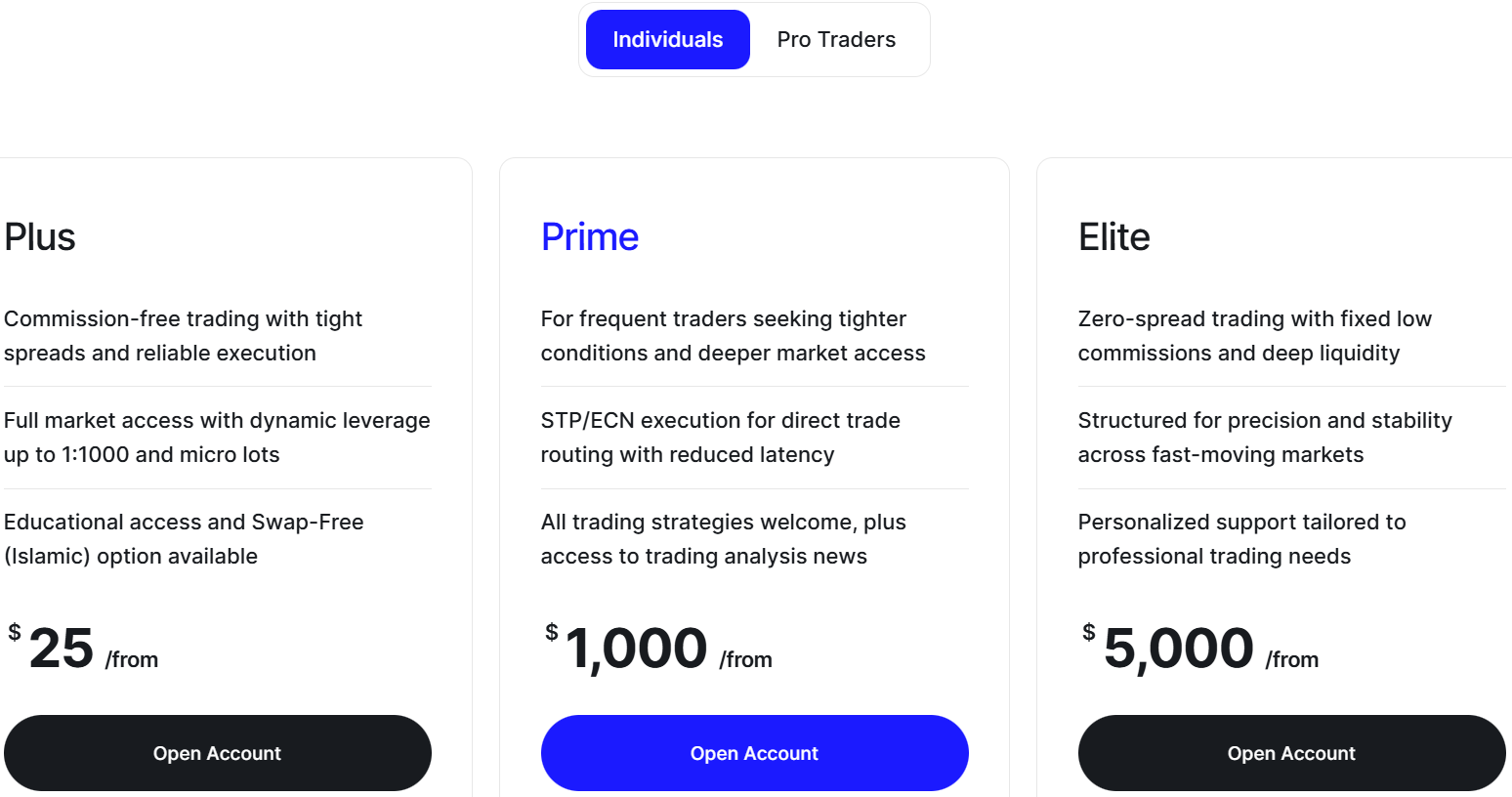

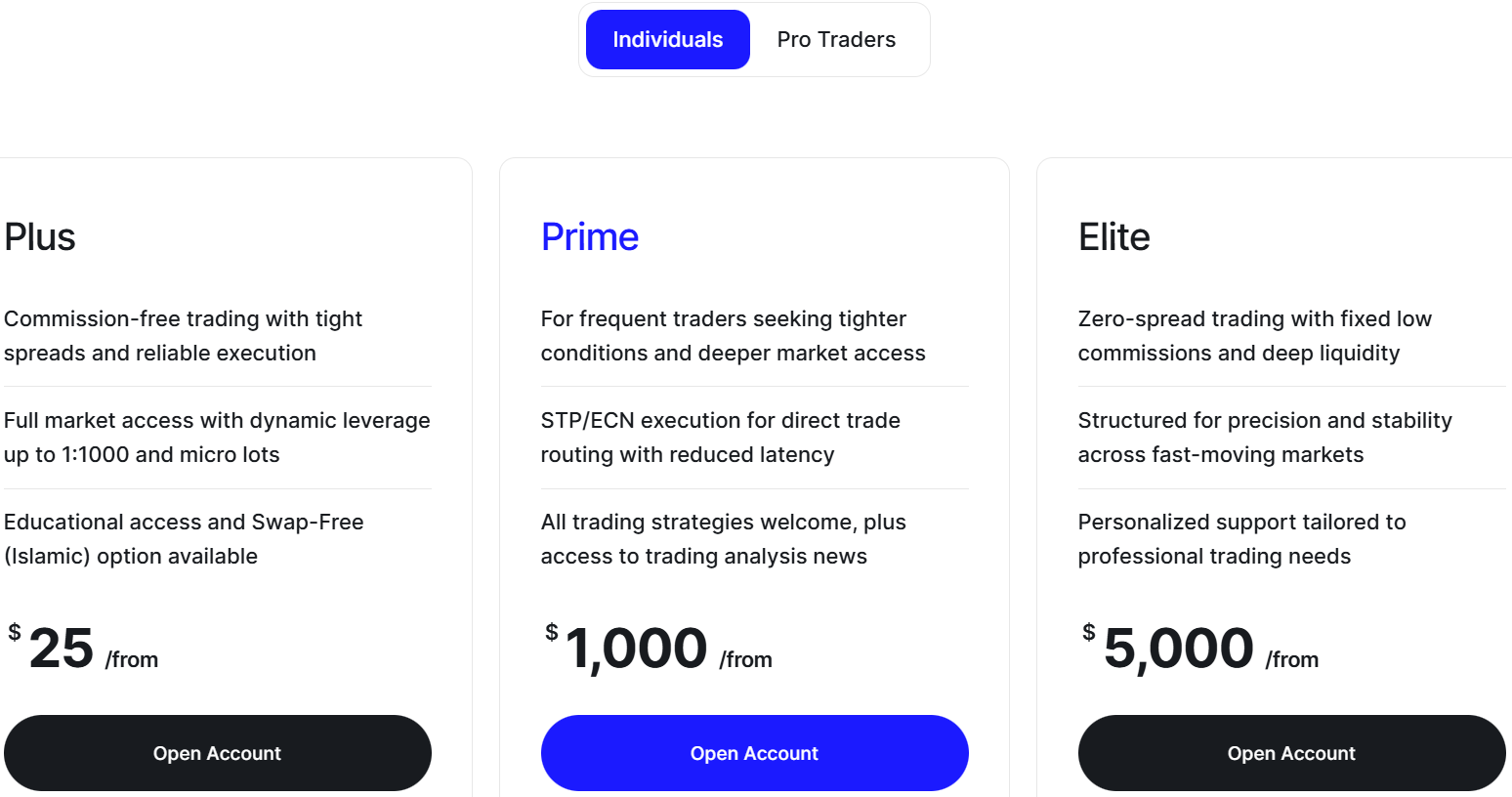

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with OnEquity?

OnEquity offers a range of account types to meet the needs of different users. For individual live trading, the broker provides Plus, Prime, and Elite accounts, each with varying features such as competitive spreads, execution speeds, and access to additional tools and services as you move up the tiers.

These options give traders flexibility in choosing a setup that aligns with their experience level and trading style. OnEquity also offers a demo account, allowing users to practice strategies and explore the platforms with virtual funds before committing real capital. Additionally, swap-free accounts are available for clients who require trading without overnight interest, catering to traders with specific preferences or religious considerations.

Plus Account

The Plus Account is an entry-level option, especially for beginners with limited capital. It requires a minimum deposit of $25, making it one of the more accessible account types in the broker’s lineup.

This account features commission-free trading with spreads starting from around 1.5 pips, and offers dynamic leverage of up to 1:1000 with micro lot trading. Overall, the Plus Account provides a solid foundation for new and casual traders to enter the markets with lower upfront costs and straightforward conditions.

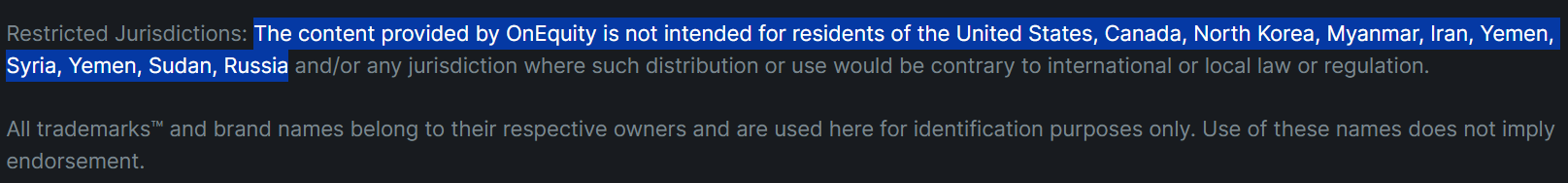

Regions Where OnEquity is Restricted

OnEquity is not available to users in certain countries due to regulatory limitations and compliance requirements. Residents of the following countries are not eligible to open accounts:

- USA

- Canada

- North Korea

- Myanmar

- Iran

- Yemen

- Syria

- Yemen

- Sudan

- Russia

Cost Structure and Fees

Score – 4.4/5

OnEquity Brokerage Fees

OnEquity’s fee structure is transparent and competitive across its range of account types. The broker generally offers tight spreads that vary depending on the chosen account, with the Plus account featuring wider, commission-free spreads and the Prime and Elite accounts offering tighter spreads with lower overall costs.

Commissions apply on higher-tier accounts, particularly for ECN-style execution, while swap rates are charged for positions held overnight unless using a swap-free account.

Overall, OnEquity aims to keep costs reasonable and competitive, but actual fees can vary by instrument, account type, and market conditions, so users should review the fee schedule carefully before choosing an account.

The broker offers competitive floating spreads across its instruments, with the average EUR/USD spread of 1.1 pips on the Standard account. Spreads vary depending on market conditions, liquidity, and the type of account used.

Overall, the broker’s spreads are in line with industry standards, providing a transparent cost environment.

OnEquity applies commissions on its higher-tier accounts. While the Plus account is commission-free, the Prime and Elite accounts charge a commission of $5 per lot traded in exchange for tighter spreads and more cost-efficient conditions for active traders.

- OnEquity Rollover / Swaps

OnEquity charges rollover fees on positions that are held open overnight, reflecting the cost of the interest rate differential between the two currencies or instruments in the trade. These fees can be either positive or negative, depending on the direction of the trade and prevailing market interest rates.

Users who prefer to avoid overnight interest can opt for a swap-free account, where swap charges are not applied in accordance with specific eligibility criteria.

How Competitive Are OnEquity Fees?

OnEquity’s fees are generally competitive, offering users a balance between cost efficiency and flexible account options. With pricing structures tailored to suit various trading styles, the broker strives to keep overall costs reasonable and transparent, making it accessible to both casual and more active traders.

| Asset/ Pair | OnEquity Spread | Doto Spread | Interstellar FX Spread |

|---|

| EUR USD Spread | 1.5 pips | 1.1 pips | 1 pip |

| Crude Oil WTI Spread | 12 | 8.6 pips | 6.8 |

| Gold Spread | 150 | 42 pips | 0.8 |

| BTC USD Spread | 60 | 20.1 pips | 50 |

OnEquity Additional Fees

In addition to spreads and commissions, OnEquity charges additional fees such as overnight rollover fees for positions held past the trading day. There may also be charges for certain deposit or withdrawal methods, depending on the payment provider.

Users should review the broker’s full fee schedule to understand all potential costs before opening an account.

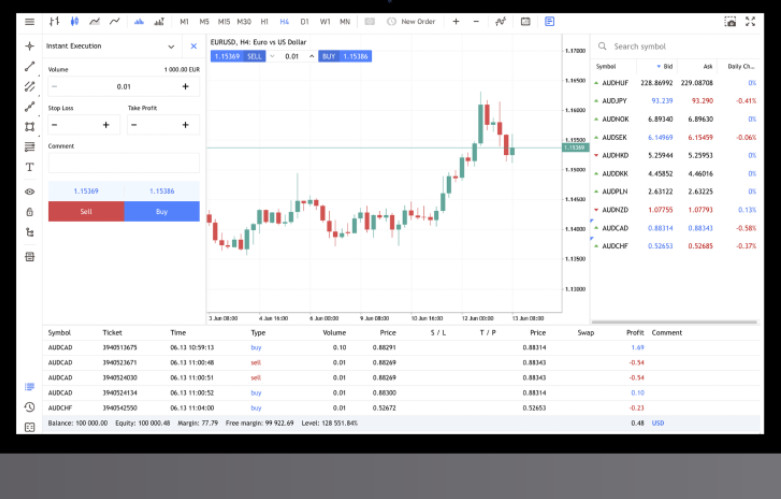

Trading Platforms and Tools

Score – 4.5/5

OnEquity provides users with access to the widely recognized MetaTrader 4 and MetaTrader 5 platforms, offering a comprehensive environment for both beginners and professionals.

These platforms feature advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors, enabling users to implement a variety of strategies. Desktop, web, and mobile versions are available, allowing users to monitor markets and execute trades from anywhere.

Trading Platform Comparison to Other Brokers:

| Platforms | OnEquity Platforms | Doto Platforms | Interstellar FX Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

OnEquity Web Platform

OnEquity offers web-based trading through MT4 and MT5 WebTrader, allowing users to access the markets directly from a browser without downloading software.

The web platforms provide real-time charts, technical indicators, and trade execution tools, delivering a convenient and flexible trading experience. This setup is ideal for users who want to monitor and trade from multiple devices or locations while maintaining access to the features of the desktop platforms.

OnEquity Desktop MetaTrader 4 Platform

OnEquity’s desktop MT4 platform offers a robust environment for all levels of traders. It features advanced charting tools, technical indicators, and automated trading through EAs. The platform supports fast trade execution, customizable layouts, and in-depth market analysis, making it a reliable choice for clients who prefer a powerful desktop-based solution.

Main Insights from Testing

Testing OnEquity’s MT4 platform reveals a stable and responsive experience with fast order execution and minimal downtime. The platform’s charting tools and technical indicators are intuitive and reliable, allowing traders to perform detailed market analysis.

Additionally, MT4’s automation features, such as Expert Advisors, function smoothly, making it convenient for strategy testing and algorithmic trading.

OnEquity Desktop MetaTrader 5 Platform

OnEquity’s desktop MT5 platform provides an advanced environment with enhanced features compared to MT4. It includes more timeframes, additional indicators, and support for automated trading with Expert Advisors.

Users can access a wide range of instruments, perform in-depth market analysis, and execute trades with precision, making MT5 suitable for both professional and active traders seeking a powerful desktop solution.

OnEquity MobileTrader App

OnEquity offers mobile trading through MT4 and MT5 apps, enabling users to access the markets on smartphones and tablets. The apps provide real-time quotes, interactive charts, technical indicators, and trade execution tools, allowing clients to monitor and manage positions on the go.

AI Trading

Currently, OnEquity does not promote any proprietary AI‑driven tools or automated artificial intelligence solutions as part of its core offering. The broker supports automated trading via Expert Advisors on MT4 and MT5 platforms, which allows users to use pre‑built or custom trading robots and algorithms, but this is standard platform functionality rather than a built‑in AI feature developed by OnEquity itself.

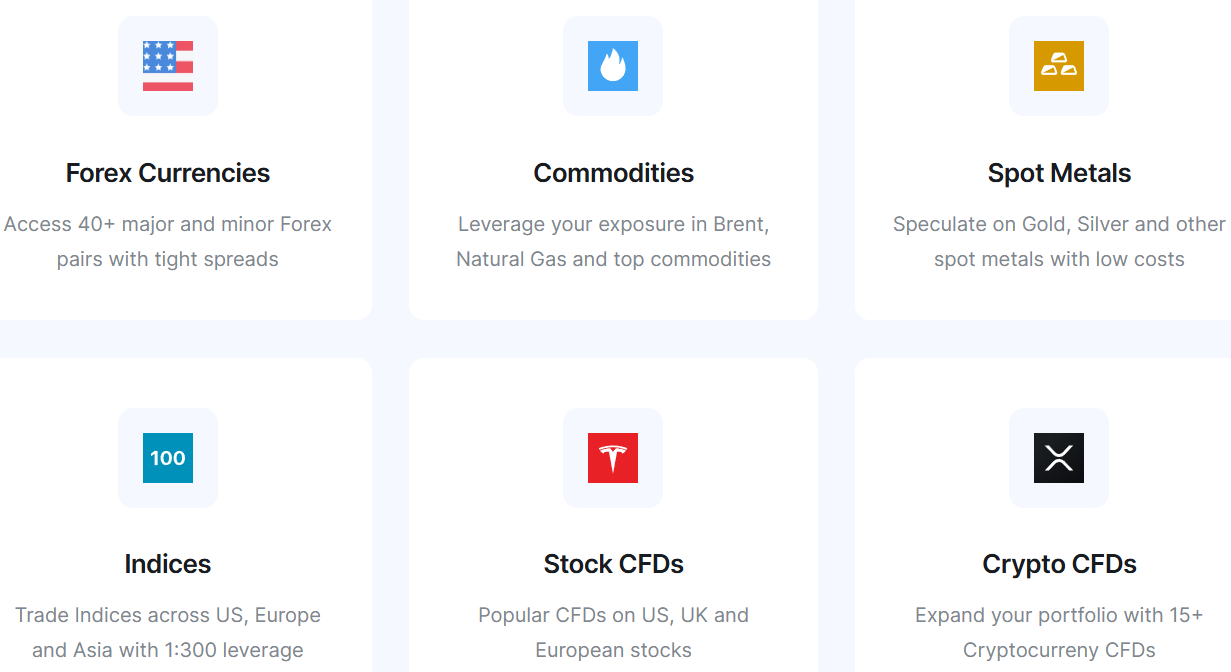

Trading Instruments

Score – 4.4/5

What Can You Trade on OnEquity’s Platform?

OnEquity offers access to a diverse range of over 300 instruments, including Forex currency pairs, CFDs on commodities such as crude oil and natural gas, metals like gold and silver, global indices, individual stocks, and cryptocurrencies such as Bitcoin and Ethereum.

Main Insights from Exploring OnEquity’s Tradable Assets

Exploring OnEquity’s tradable assets reveals a well-rounded offering suitable for different trading styles and strategies. The broker provides access to both major and minor markets, allowing users to balance risk and opportunity across currencies, commodities, stocks, and indices.

Instruments are easily accessible via MT4 and MT5 platforms, with sufficient liquidity and competitive conditions for active trading.

Leverage Options at OnEquity

Using leverage in trading can offer benefits by enabling users to enter the market with a relatively small initial investment. However, you should fully understand how the multiplier works and the risks it carries before participating in leveraged trades.

- South African clients are eligible to use low leverage up to 1:30 for major currency pairs.

- For international traders, the maximum leverage is 1:1000.

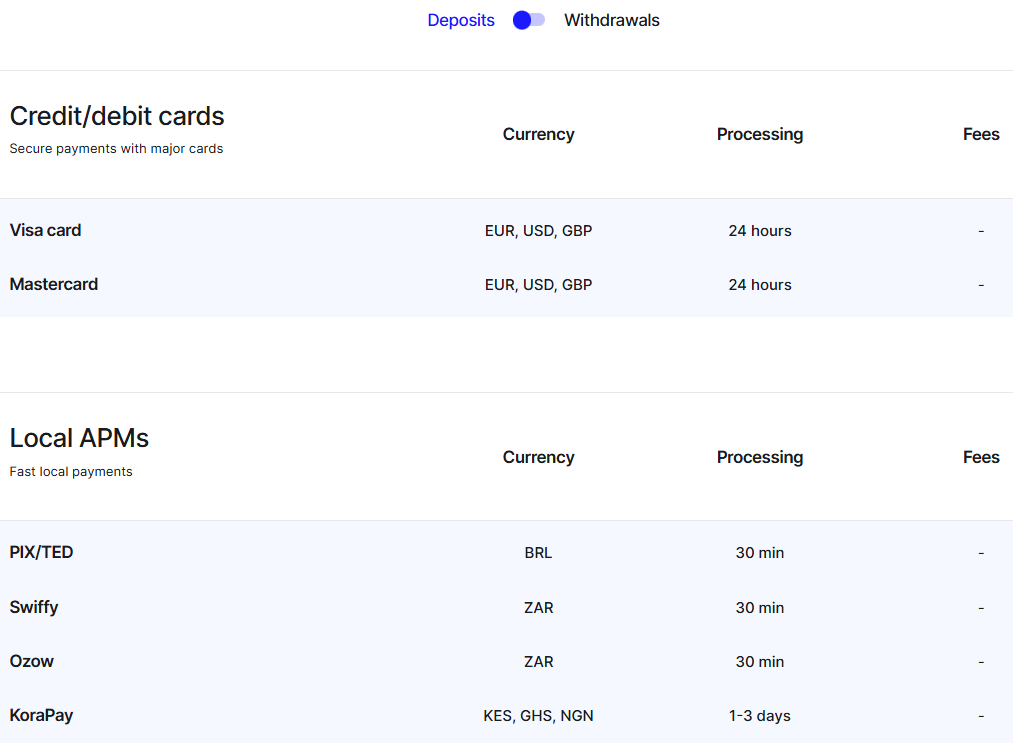

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at OnEquity

In terms of funding methods, OnEquity offers a few global and local payment methods for funding traders’ accounts quickly and securely, including:

OnEquity Minimum Deposit

The minimum deposit for an OnEquity Plus account is $25, making it accessible to beginners with limited capital.

Withdrawal Options at OnEquity

OnEquity offers a range of convenient withdrawal methods, including bank transfers, credit/debit cards, and popular e‑wallets, allowing users to choose the option that best suits their preferences.

Withdrawal processing times and any applicable fees may vary depending on the payment method and region, so users are encouraged to review the broker’s specific withdrawal policies.

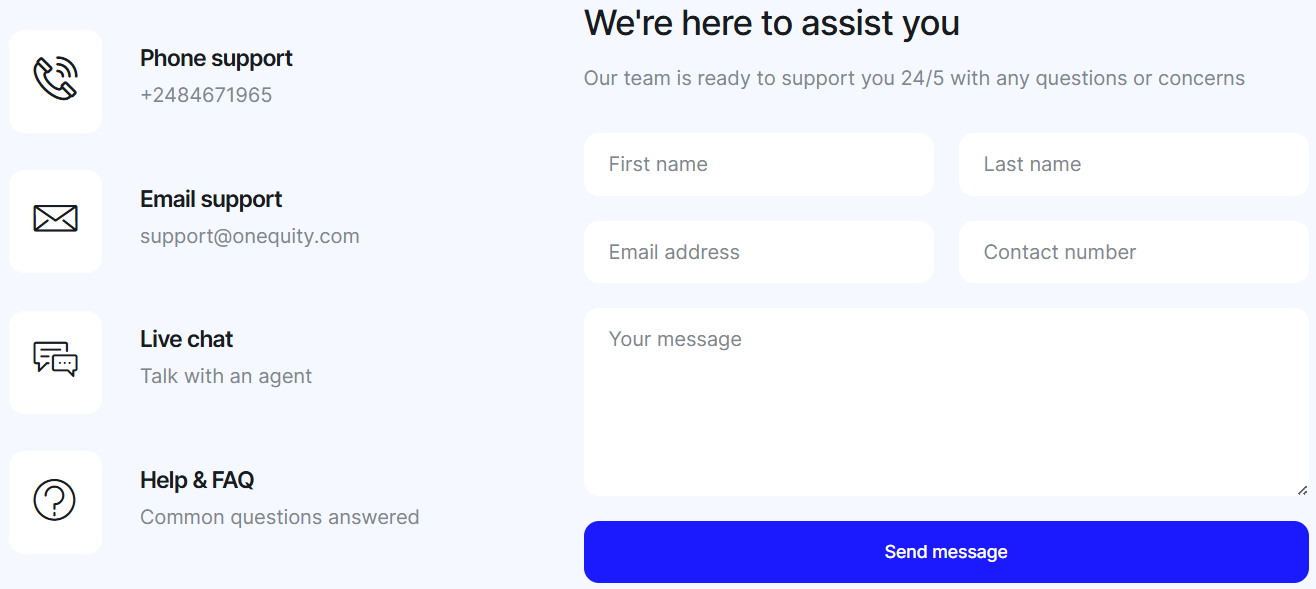

Customer Support and Responsiveness

Score – 4.4/5

Testing OnEquity’s Customer Support

OnEquity offers 24/5 customer support via multiple channels, including live chat, email, and phone. The broker provides multilingual customer support to assist users with account setup, technical issues, and general inquiries.

Contacts OnEquity

Clients can reach OnEquity’s support team via phone at +2484671965 or by email at support@onequity.com. These contact options provide direct access for inquiries about accounts, technical issues, or general trading questions, ensuring users can get assistance when needed.

Research and Education

Score – 4.5/5

Research Tools OnEquity

OnEquity provides a variety of research tools to support informed decisions.

- On its website, clients can access market news, analysis updates, and economic calendars to stay informed about market developments.

- Within the MT4 and MT5 platforms, users benefit from advanced charting features, technical indicators, and real‑time data that help with market analysis and strategy planning. Together, these tools offer a comprehensive research environment for both beginner and experienced traders.

Education

OnEquity offers limited educational resources aimed at helping users stay informed about the markets. The available materials include news updates, market insights, expert commentary, and an economic calendar.

While these resources provide useful information for market analysis, the broker does not offer extensive courses or structured tutorials, so traders may need to seek additional education elsewhere to build advanced skills.

Portfolio and Investment Opportunities

Score – 3.9/5

OnEquity primarily focuses on Forex and CFD trading, offering a wide range of instruments across currencies, commodities, indices, stocks, and cryptocurrencies.

In addition to active trading, the broker provides PAMM accounts, which allow investors to allocate funds to experienced traders and potentially earn returns based on their performance. This feature offers an investment-oriented solution for those who prefer a more hands-off approach while still participating in financial markets.

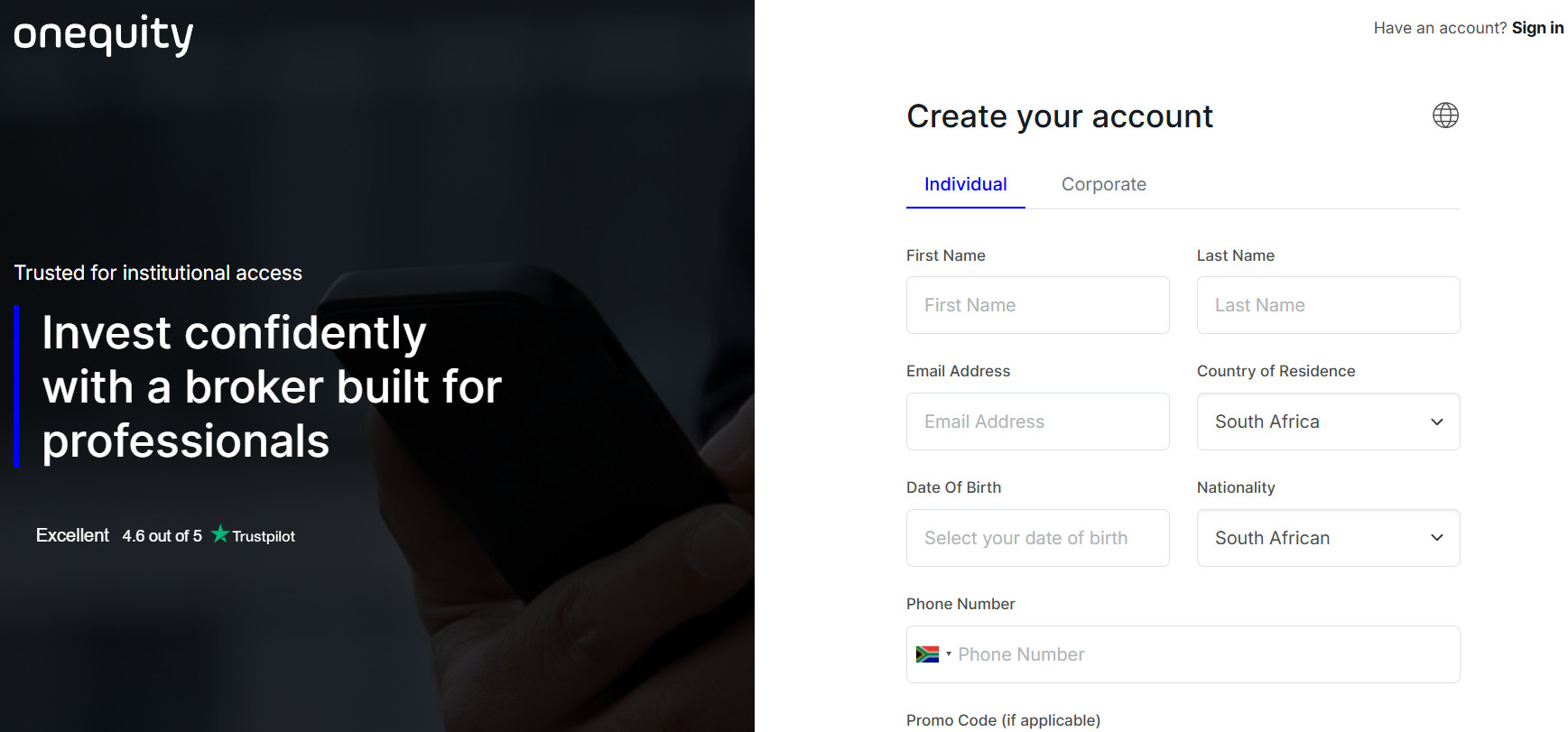

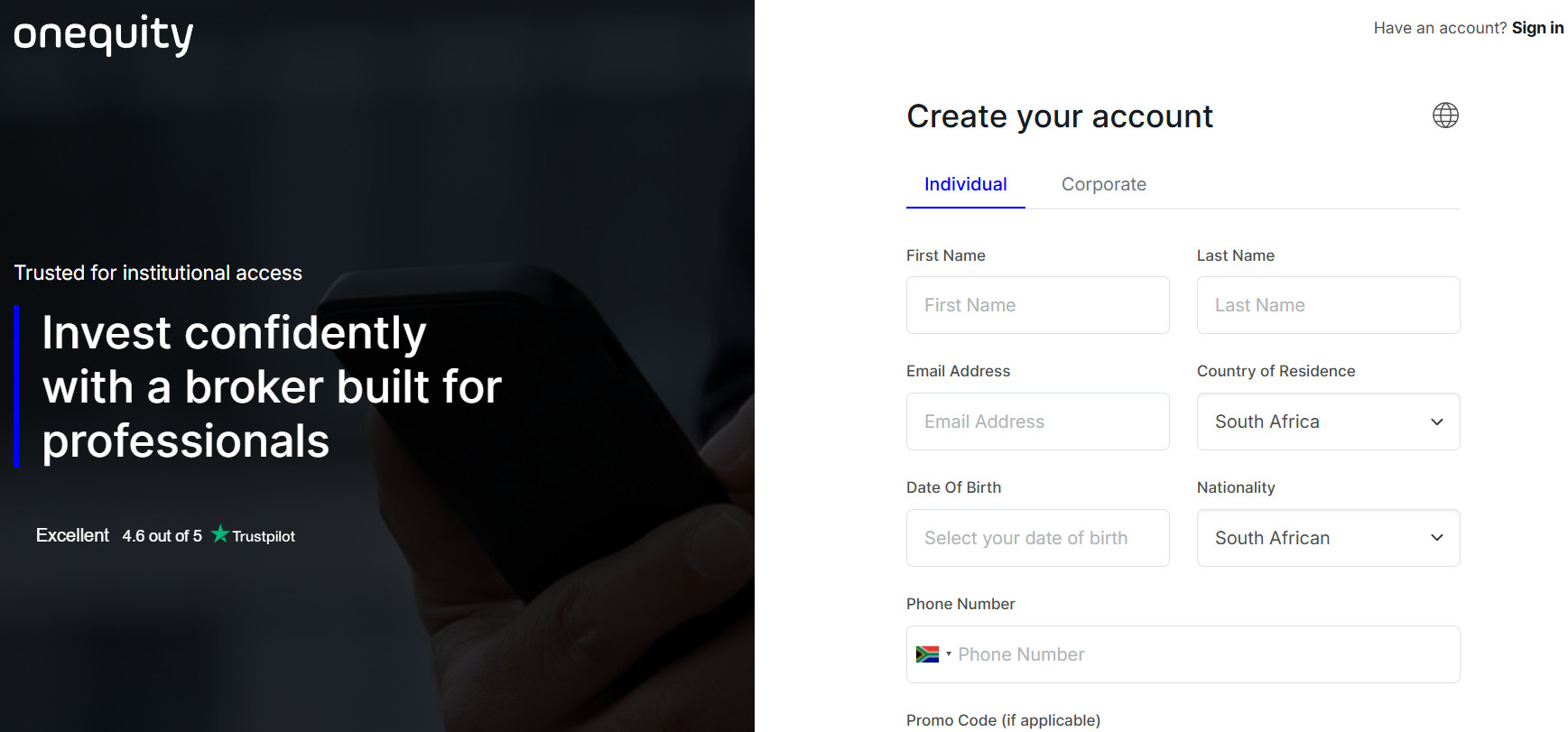

Account Opening

Score – 4.4/5

How to Open OnEquity Demo Account?

Opening a demo account with OnEquity is a simple process that allows traders to practice without risking real money. Users can register directly on the broker’s website, provide basic information, and select their preferred MT4 or MT5 platform. Once the account is set up, traders receive virtual funds to explore the markets, test strategies, and familiarize themselves with the tools and platforms before transitioning to a live account.

How to Open OnEquity Live Account?

Opening a live account with OnEquity is straightforward and designed to get users started quickly while ensuring compliance with regulatory requirements:

- Go to the official OnEquity website and navigate to the “Open Account” section.

- Provide your full name, email, phone number, and other required personal information.

- Submit identification documents (passport, ID card) and proof of address to comply with KYC regulations.

- Select from Plus, Prime, or Elite accounts based on your trading needs and capital.

- Make the minimum deposit according to the chosen account type.

- Once verified and funded, log in to MT4, MT5, or the web platform to start trading.

Additional Tools and Features

Score – 4.3/5

OnEquity offers several additional tools and features beyond standard research resources to enhance the trading experience.

- These include risk management tools such as stop loss and take profit orders, real-time price alerts, economic event notifications, and portfolio tracking features. Together, these tools help users manage positions, monitor market movements, and make more informed decisions.

OnEquity Compared to Other Brokers

OnEquity positions itself as a competitive option for traders seeking a balance of accessibility, platform variety, and asset diversity. Compared to other brokers, it offers a moderate fee structure and a relatively low minimum deposit, making it appealing to beginners or those with limited capital.

While its educational resources are somewhat limited, the broker provides a wide range of instruments and supports popular platforms like MT4 and MT5, similar to many competitors. OnEquity is regulated across multiple mid-tier jurisdictions and provides standard customer support, aligning with industry norms.

Overall, it is a solid choice for users looking for a flexible, multi-asset environment, though some competitors may offer more advanced education or a larger selection of assets.

| Parameter |

OnEquity |

Purple Trading |

Interstellar FX |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1.5 pips |

Average 1.3 pips |

Average 1 pip |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.0 pips + $2.5 per side |

0.3 pips + $2.5 per side |

0.0 pips + $3.50 per side |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Average |

Low/ Average |

Average |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, cTrader |

MT4 |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

300+ instruments |

200+ instruments |

100+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FSCA, FSC, FSA |

CySEC, FSA |

FCA, FSA |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Good |

Limited |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

$25 |

$100 |

$50 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker OnEquity

OnEquity is an international Forex and CFD brokerage offering access to a range of financial markets, including Forex, CFDs on commodities, metals, indices, stocks, and cryptocurrencies. The broker provides popular platforms like MT4 and MT5, available on desktop, web, and mobile, with tools for advanced charting, technical analysis, and automated trading.

Account options include Plus, Prime, and Elite accounts, along with demo and swap-free accounts, catering to different trading needs. OnEquity is regulated in several mid-tier jurisdictions and implements measures like segregated client funds and negative balance protection to enhance safety.

While its educational resources are limited, the broker offers news, market insights, economic calendars, and commentary to support informed trading. With competitive fees, flexible account types, and a popular selection of instruments, OnEquity serves users seeking a reliable and versatile environment.

Share this article [addtoany url="https://55brokers.com/onequity-review/" title="OnEquity"]