- What is XM?

- 55brokers Professional Insights

- Bonuses

- Products

- Regulation & Security

- Deposits and Withdrawals

- Trading Conditions

- Account Options

- Trading Platforms and Tools

- Instruments Offered

- Education & Research

- Economic Calendar and Market Sentiment Tools

- Customer Service

- Reputation and Client Satisfaction

- Final Summary

Overall Rating 4.6 / 5

| Regulation and Security Measures | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.2 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.8 / 5 |

| Customer Support and Responsiveness | 4.7 / 5 |

| Research and Education | 4.8 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.9 / 5 |

| Additional Tools and Features | 4.7 / 5 |

What is XM?

If you’re in search of a broker that delivers efficient execution, consistently stable leverage during all market conditions, and competitive terms, XM remains a strong contender in today’s global brokerage landscape. As one of the largest brokers worldwide, XM facilitates nearly 14 million trades each day.

With a presence spanning over 15 years and servicing more than 15 million clients in 190+ countries, XM has cemented its reputation as a dependable and well-regarded brokerage. Its adherence to multi-jurisdictional regulation and dedication to transparent trading practices have been pivotal in establishing its status as a major regulated financial entity.

- Two key operational features – no re-quotes and no order rejections – underscore XM’s precision in trade execution. These benefits are especially valuable for clients utilizing news-based and algorithmic strategies.

- XM is engineered to support traders who demand consistent performance and power. A noteworthy advantage is the leverage of up to 1000:1*, which remains constant, even during after-hours operation, economic releases, or high-impact events such as NFP, CPI, and FOMC.

Overall, XM brings together strong regulation, lightning-fast execution, and trader-centric features, creating a dynamic and reliable environment.

*Leverage depends on the financial instrument traded and the respective XM entity with which the business relationship is established.

XM Features

XM Features

XM is a prominent broker known for its diverse offerings and user-friendly trading environment. Here are the main features that set XM apart:

XM Features in 10 Points

| 🏢 Regulation | CySEC, FSC, DFSA, FSCA |

| 🗺️ Account Types | Standard Account, XM Ultra-Low Account, Shares Account |

| 🖥 Trading Platforms | MT4, MT5, XM WebTrader, XM App |

| 📉 Trading Instruments | 1,000+ products Stocks, CFDs, Forex, Commodities, Portfolios, Metals, Thematic Indices, Turbo Stocks, Cryptocurrencies (not available to all Entities of the Group) |

| 💳 Minimum deposit | 5$ |

| 💰 Average EUR/USD Spread | 1.6 pips on Standard Account |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | 10 Base Currencies |

| 📚 Trading Education | Professional Education with webinars and Seminars |

| ☎ Customer Support | 24/7 |

55brokers Professional Insights

XM is indeed a good Broker for beginning traders, also with experience who prefer MT4 or MT5 platforms and run various strategies looking for a stable Broker. The conditions are rather average with quality product offering, software, and tools, also choice of accounts is valuable if you prefer separate account for ultra low fees or separately if you like speculation on Shares but not buying asset itself XM might be good choice. Since there is a specifically designed account for Shares trade with a tailored solution, yet the deposit needed is rather very high also at other Broker bigger range of Shares might be available.

The instrument selection is favorable too for those who prefer good diversification, not thousands like competitors, but still good. Fees across all offered asset classes we find similar to other brokers who mainstay on average Fee conditions. What is truly remarkable is great education section and we value the professional tools XM offer, so for great selection of quality tools and an excellent reputation with quality of service we admit XM a suitable choice for most traders who look for quality. Potential negatives, meanwhile, include inactivity fees, a small product range, and unavailability for American clients.

Consider Trading with XM If:

| XM is a Good Broker for: | - Looking for Reputable Firm

- Need Low minimum deposit

- Value Large range of Assets

- Good for Shares CFDs

- Prefer High Leverage access

- User-Friendly trading platforms based on MetaTrader

- Good Range of Tools and Insights from industry professionals

- Looking for excellent Social Trading and Copy Trading

- Need Broker with Professional Education- Free VPS access

- Trading Contests and Programs

- Appreciate quality Trading Conditions |

Avoid Trading with XM If:

| XM is not the best for: | – Investment Options are limited

– PAMM or MAM accounts are absent

– No wide selection of CFD Shares like thousands at other Broker

– Prefer other than MetaTrader Platforms

– Traders from certain regions like USA

– Trading on Shares Account require high deposit |

Bonuses

One of XM’s key value offerings is its broad selection of deposit and no-deposit bonuses, which provide added flexibility and increased capital for traders. These incentives can help support volume and potentially reduce the chance of a stop-out.

Welcome Bonus

XM provides a Welcome Bonus to new clients in qualifying jurisdictions, allowing them to get a hands-on experience of the platform’s live trade environment.

This bonus enables to:

- Experience real-time trade execution under live market conditions.

- Access live pricing and spreads.

- Engage with fair and easy-to-understand terms, without hidden conditions or excessive volume requirements.

By using this bonus, traders can explore XM’s trading tools and performance in real markets – beyond the demo environment – and evaluate the platform firsthand.

No Deposit Bonus (NDB)

XM offers a No Deposit Bonus to eligible clients, giving them the opportunity to trade and even withdraw profits without having to deposit any funds.

Key highlights of this offer include:

- No initial deposit required to start.

- Zero upfront cost to access live markets.

- Withdrawable profits upon fulfilling reasonable terms.

- Bonus automatically credited upon account verification.

- A true risk-free starting point for beginners.

- The opportunity to trade on live spreads and prices.

- Transparent, fair conditions with no excessive requirements.

What makes XM’s NDB unique is its fairness. Many brokers impose complicated or misleading rules around such bonuses, but XM’s straightforward approach makes it a good option for those wanting to evaluate the platform risk-free or test execution speed and order handling before committing capital.

Note: The NDB is not available in all regions.

Deposit Bonus – Up to 100%

Once clients begin funding their accounts, they gain access to XM’s deposit-based bonuses, which offer genuine flexibility.

XM’s Deposit Bonus offers:

- Bonus credited directly to trading equity (not limited to margin only).

- Capability to open larger trades, particularly those requiring high margin.

- Full withdrawal rights on profits made from the bonus.

This bonus model is especially advantageous for small to medium accounts, offering additional capital and rewards for loyalty.

Seasonal Promotions

XM periodically runs promotions that are tailored to local client bases and regional preferences. These include a variety of bonuses and incentives tied to holidays, educational events, and seminars.

Examples of typical promotions include:

- Bonuses tied to seasonal or holiday campaigns.

- Special rewards for seminar participants.

- Region-targeted promotions based on client profiles or traders behavior.

Clients are usually notified of these offers via email, the Members Area, or on XM’s website.

Products

XM Traders Club – XM’s Loyalty Rewards Program

The XM Traders Club is a loyalty initiative where clients earn rewards as they run larger volumes. Membership progresses across five levels — Bronze, Silver, Gold, Platinum, and Elite — with each stage unlocking increased perks.

Client status is determined by trading volume, and active members enjoy exclusive rewards based on their account performance.

Main features include:

- Earning XMC Points (XM Coins) with every standard lot traded.

- Converting XMCs into cash or bonus credits.

- Access to tailored promotions, premium VPS services, and advanced market insights.

- Additional benefits for higher-tier members.

This loyalty system suits high-volume clinets looking to earn ongoing benefits without changing their strategy or risk profile.

Trading Competitions

XM regularly hosts competitions on its dedicated platform – XM Competitions – where traders compete for cash prizes.

Advantages include:

- Real, withdrawable prizes.

- Entry often requires no deposit.

- Leaderboards for real-time ranking and transparency.

- Safe, risk-free participation in demo contests for strategy testing.

Disclaimer: Promotions and bonuses are not available for accounts registered under XM’s EU-based entity (CySEC) and Mena entities (DFSA). The XM Group operates globally under various entities, so products, services, and features listed here vary between XM entities. For further information, please visit the XM website.

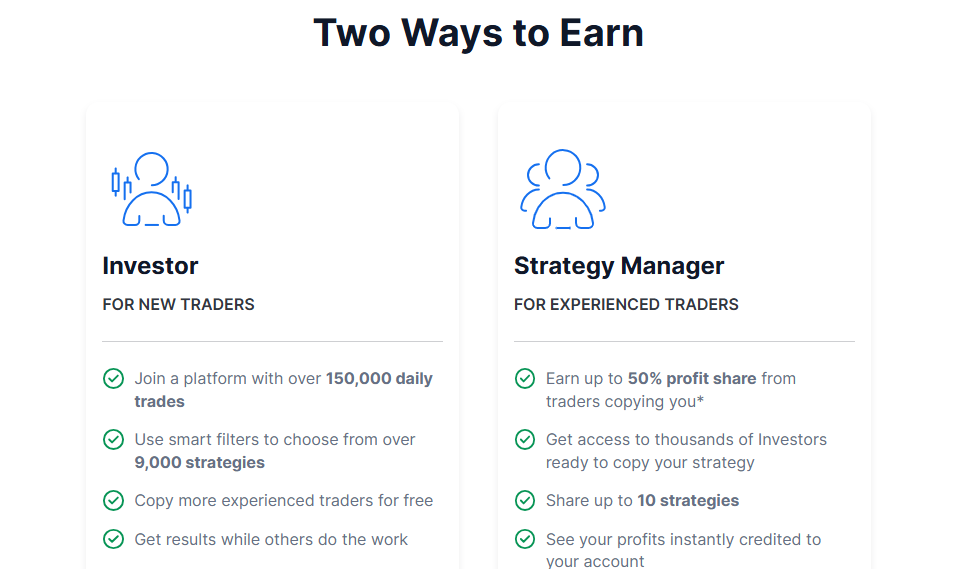

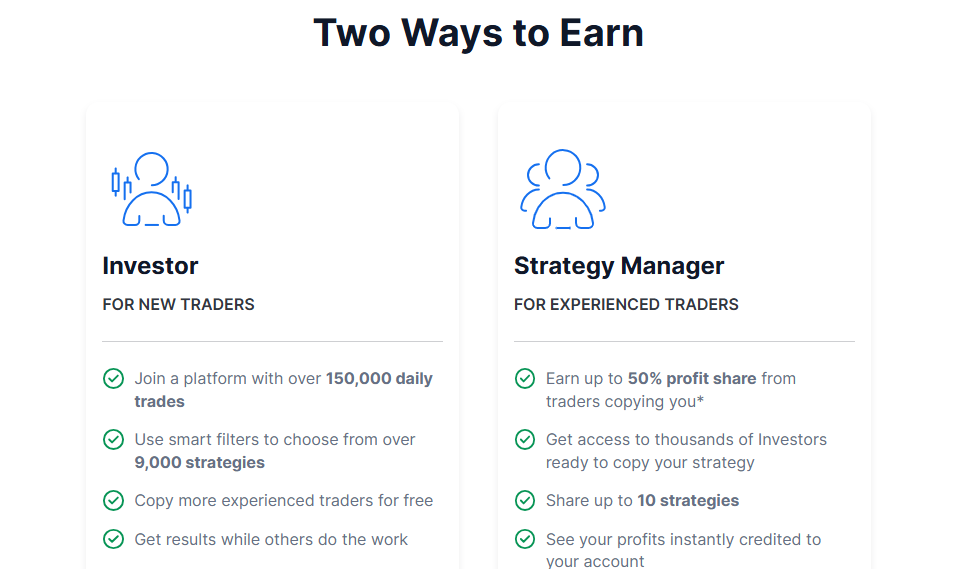

Copy Trading

XM also features a copy trading system, letting users mirror the strategies of top-performing Strategy Managers. This functionality supports both learning and diversification, making it suitable for beginners and experienced clients alike.

Key features:

- Choose from a broad range of strategies.

- Automatically copy successful traders’ positions.

- Diversify across different traders and systems.

- Learn passively by observing skilled traders.

- Strategy Managers can earn performance-based fees.

Note: The service is not available in all entities and does not constitute investment advice. Clients are advised to visit the XM website for more information.

Regulation & Security

A key consideration in broker selection is regulatory oversight – an area where XM excels. With licenses across multiple jurisdictions, XM provides clients with reassurance through adherence to strict local laws and global best practices.

XM, part of Trading Point Holdings Ltd, operates under several licensed entities. This international framework ensures clients enjoy robust protections and transparent standards.

Regulatory Entities & License Numbers

| Brand |

Regulatory entity |

Country |

License registration number |

| XM Global Limited |

Financial Services Commission (FSC) |

Belize

|

000261/27 |

| Trading Point of Financial Instruments Ltd |

Cyprus Securities and Exchange Commission (CySEC) |

Cyprus |

120/10 |

| XM ZA (Pty) Ltd |

Financial Sector Conduct Authority (FSCA) in South Africa |

South Africa |

49976 |

| Trading Point MENA Limited |

Dubai Financial Services Authority (DFSA) |

Dubai |

F003484 |

|

XM International MU Limited |

Financial Services Commission (FSC) |

Mauritius |

GB23202700 |

|

XM (SC) Limited |

Financial Services Authority (FSA) |

Seychelles |

SD190 |

Client Protection Policies

XM has a variety of industry-leading protective mechanisms that enhance trader security.

- Segregated Funds: Clients’ money is stored separately from company funds, preventing misuse.

- Negative Balance Protection: Clients cannot lose more than their deposit.

- Strict Risk Controls: Entities comply with MiFID II and equivalent local policies.

- SSL Encryption: All data is protected using high-level SSL security.

- Secure Transactions: Payment methods are verified and secured to guard against fraud.

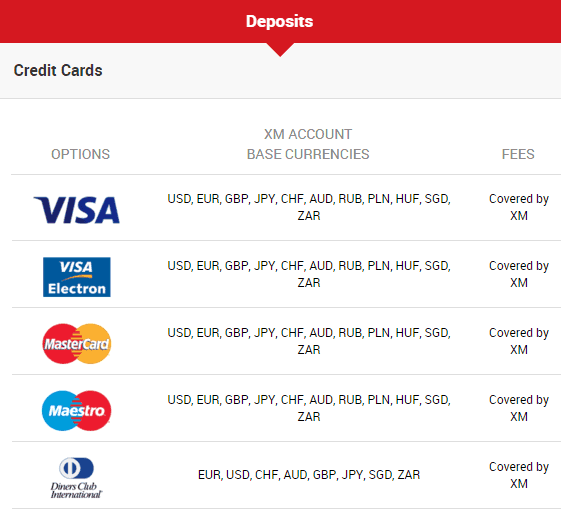

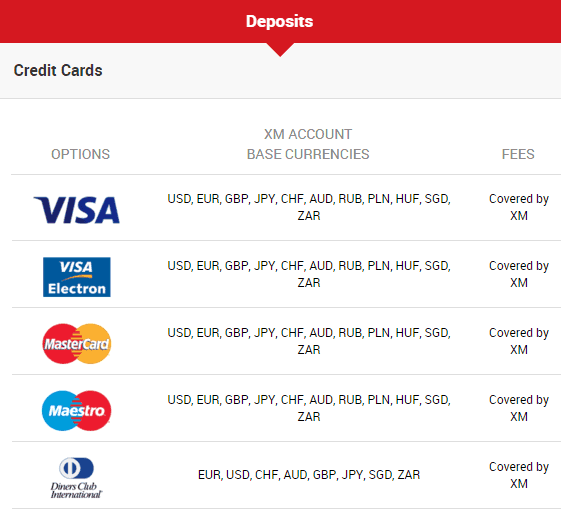

Deposits and Withdrawals

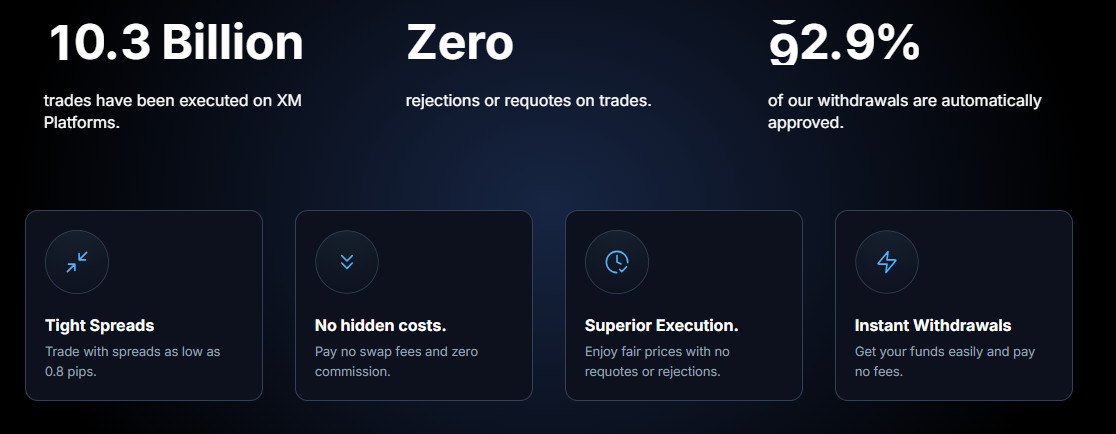

The ability to move funds quickly, safely, and without hidden fees is critical. XM delivers a seamless experience with rapid deposits and near-instant withdrawals — all at no cost. The platform supports multiple flexible options, ensuring funds are transferred promptly and securely, free from unexpected charges.

Thanks to its efficient and transparent process, XM stands out as an industry leader in funding accessibility. Whether you’re topping up your account for the first time or cashing out after a successful operation on account, XM ensures your money moves swiftly and reliably, without delays or hidden fees.

Accepted Payment Methods

XM provides a broad selection of globally trusted and regulated payment solutions, allowing clients from nearly any region to fund and withdraw from their accounts effortlessly.

Depending on your region and XM entity, available methods include:

- Credit/Debit Cards: Visa, MasterCard

- E-Wallets: Neteller, Skrill, SticPay

- Local Payment Options: Such as instant banking and mobile money services in regions like Asia, Africa, and Latin America

All payments are handled via secure, encrypted channels, and are backed by advanced anti-fraud systems to ensure maximum protection throughout the transaction process.

Instant Deposits

A standout feature is the near-instant processing of deposits for most payment methods. Funds usually reflect in your account within seconds as instant deposit, allowing you to:

- Enter trades at the optimal market timing.

- Respond swiftly to price movements or breaking economic news.

- Execute your strategies without interruption.

This quick funding capability is especially vital for traders using Expert Advisors (EAs) or those trading based on news events.

Instant Withdrawals

XM processes withdrawal requests within 24 hours (one business day) after account verification is complete. This applies to all payment methods, with many e-wallet withdrawals often processed within just a few hours.

Key aspects include:

- Rapid internal processing times.

- Clear and fair policy with no unwarranted withdrawal rejections.

- Withdrawals returned via the same method to comply with anti-money laundering regulations.

- Email notifications provided at every stage of the withdrawal process.

Although XM handles withdrawals swiftly, final clearing times may vary depending on banks or third-party providers, particularly for international wire transfers.

No Deposit or Withdrawal Fees

XM does not impose fees on deposits or withdrawals. In most cases, XM also covers transfer fees charged by payment providers, meaning:

- Deposits are fully credited to your account.

- Withdrawals are processed without extra charges.

Clients should be aware that fees from banks or third-party services may occasionally apply, depending on the payment method. XM covers transfer fees for most deposit and withdrawal options, though wire transfers below $200 may incur charges depending on the provider.

Local Payment Support

XM offers region-specific deposit and withdrawal options tailored to various markets, enhancing convenience while complying with regulatory standards.

Local payment methods are available in:

- Southeast Asia (e.g., instant bank transfers in Thailand, Malaysia, Vietnam).

- Latin America (e.g., deposits in local currencies).

- Africa (e.g., mobile money services such as M-Pesa).

- Middle East and North Africa (with Arabic-language banking interfaces).

Deposit and Withdrawal Dashboard

Through the XM Members Area, clients can:

- Initiate deposits and withdrawals.

- Review their transaction history.

- Manage preferred payment methods.

- Receive updates on the processing status.

This centralized dashboard offers complete visibility and control over their funding activities.

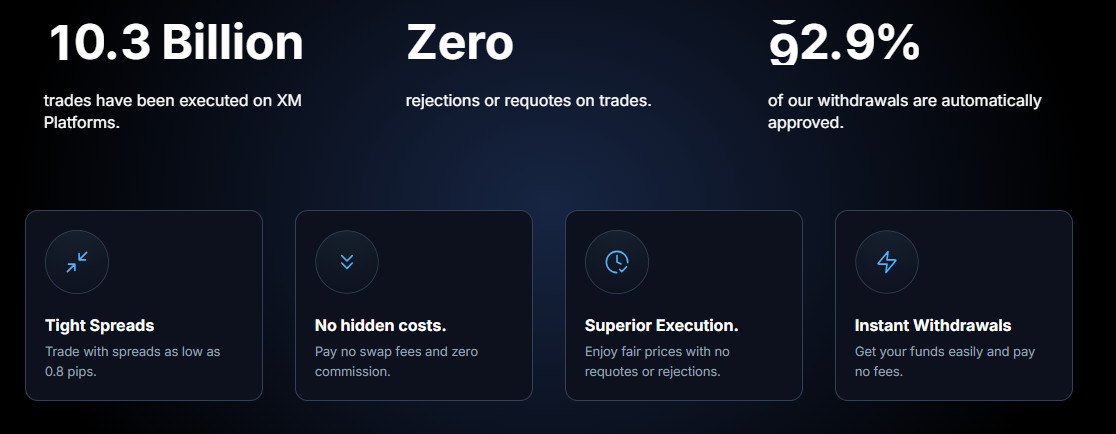

Trading Conditions

XM delivers strong conditions designed to support various strategies and experience levels — combining execution reliability, low costs, and flexibility.

Order Execution

XM’s execution engine ensures trades are filled at displayed prices with little to no slippage. With over 10.3 billion orders executed and zero rejections or re-quotes, clinets can execute with confidence.

Stable Leverage

While many brokers reduce leverage during major market events, XM maintains consistent leverage levels — up to 1000:1 — based on the client’s selected entity and classification.

Adjustable Leverage

Clients can choose leverage settings appropriate to their risk appetite and strategy — accommodating both conservative and high-exposure approaches.

Competitive Spreads

XM offers spreads starting from 0.8 pips on Ultra Low accounts — helping maintain cost efficiency. Ultra Low accounts also offer:

Swap-Free Options

On over 30 instruments, XM offers swap-free trading for Ultra Low Standard and Micro accounts, including:

- No overnight charges (subject to approval).

- Tight spreads from 0.8 pips.

- Negative balance protection.

- Entry with as little as $5.

Swap-free account is available upon request, subject to approval.

Disclaimer: Leverage depends on the financial instrument traded and the respective XM entity with which the business relationship is established.

* T&Cs apply

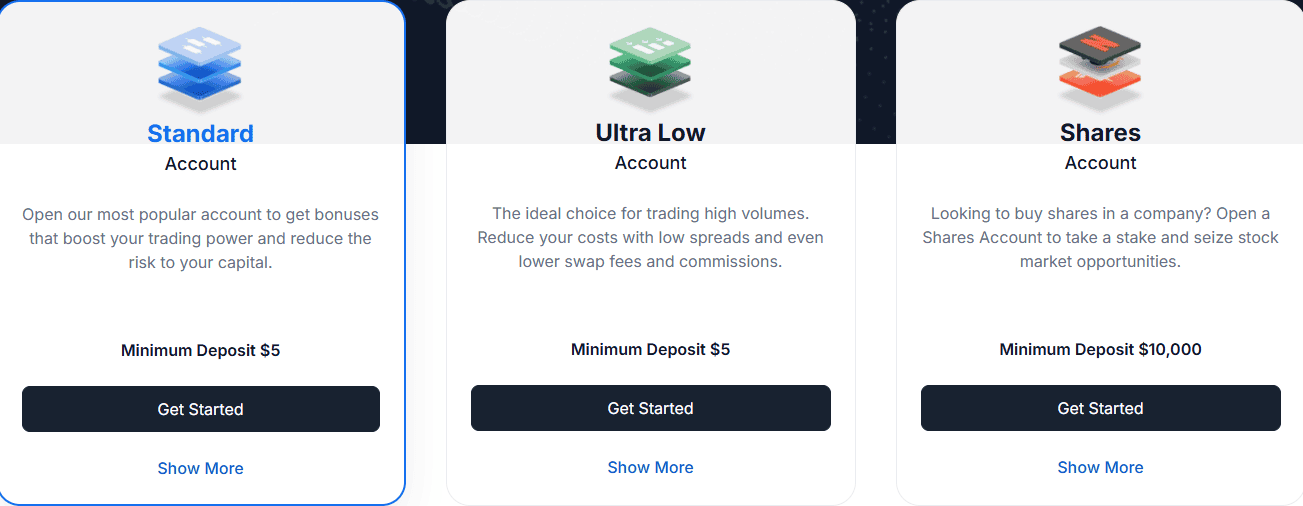

Account Options

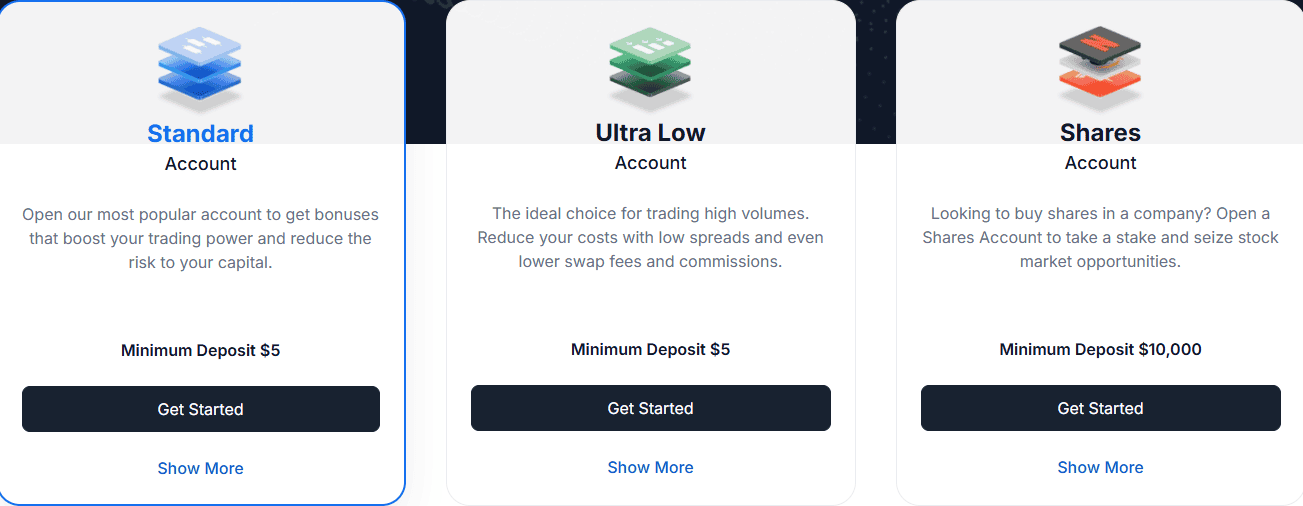

XM provides a range of account types that differ by region, including Micro, Standard, Ultra-Low, and Shares accounts. Whether you’re a beginner or an experienced trader, XM’s accounts are designed to cater to diverse preferences and styles.

- Micro Account: Offers trading under real market conditions but with lower risk. This option is ideal for traders looking to build experience, test new strategies, or manage risk with smaller execution sizes. XM also allows micro lot within its Standard and Ultra-Low Accounts.

- Standard Account: Delivers a balanced experience with zero commissions and full eligibility for bonuses. It is suitable for most traders, particularly those growing from smaller positions or honing their methods.

- Ultra-Low Account: Designed for cost-conscious clinets, the Ultra-Low Account is perfect for those who trade frequently or prioritize minimal spreads and low costs.

- Shares Account: This account is aimed at investors seeking direct ownership of shares in global companies rather than CFDs. It is best suited for long-term investors rather than short-term. The Shares Account operates on a commission-based structure, reflecting traditional equity investment approaches and providing an alternative to CFD trading.

Disclaimer: Please visit the XM website for more information regarding applicable account types under the respective XM entity with which the business relationship is established.

Account Types

XM offers a variety of account types designed to suit traders at every experience level, from novices to seasoned professionals.

- Micro Account

Ideal for beginners or those wanting to operate with a smaller risk per position.

- Lot size: 1 Micro Lot = 1,000 units

- Available instruments: Forex, commodities, indices, and more

- Leverage: Up to 1000:1 (depending on regulation)

The Micro Account allows to participate in real market conditions with lowered risk, making it suitable for gaining experience, testing new strategies, or applying precise risk management on smaller trades.

- Standard Account

Ideal for traders preferring standard lot sizes and full bonus access.

- Lot size: 1 Standard Lot = 100,000 units

This account type provides a balanced environment, combining zero commission with full access to bonuses, fitting most strategies, especially those growing from smaller stakes or refining their approach.

- Ultra-Low Account

Ideal for those focused on minimal spreads and low trading costs.

- Formats: Standard Ultra & Micro Ultra

The Ultra-Low Account is designed for cost efficiency, particularly attractive to high-frequency traders.

Disclaimer: Please visit the XM website for more information regarding applicable account types under the respective XM entity with which the business relationship is established.

How Competitive Are XM Fees?

XM Fees are ranked average based on our testing and compared to over 500 other brokers. Fees might be different based on entity, also the majority of currency pairs are on an average level for spreads across all offered asset classes and we find them similar to many other brokers, yet higher than Brokers ranked with a very low fee structure. Yet, Ultra-Low account spreads are better and among low levels. Also, additional fees like funding fees, rollover are good, since no funding fees applied, while inactivity and rollover is something typical all Brokers charge.

| Asset/ Pair | XM Spread | FXTM Spread | AvaTrade Spread |

|---|

| EUR USD Spread | 1.6 pips | 1.5pips | 0.9 pips |

| Crude Oil WTI Spread | 3 cents | 9 cents | 3 cents |

| Gold Spread | 0.27 pips | 36 | $0.27 |

| BTC USD Spread | 95 | 270 | 0.10% |

Risk Management Tools

XM equips with a robust set of risk management tools designed to protect capital and promote disciplined execution. These include:

- Negative Balance Protection – Ensures clients can never lose more than their account balance.

- Real-Time Margin Monitoring – Keep track of margin levels live and avoid margin calls.

These tools empower traders to maintain control in volatile markets, especially during unexpected economic or geopolitical events.

A broker’s technological offering is pivotal — and XM delivers an integrated, professional-grade ecosystem that works seamlessly across desktop and mobile environments.

MetaTrader 4 & MetaTrader 5

XM offers support for both MT4 and MT5, the industry’s most trusted platforms:

- MT4: Renowned for its simplicity, speed, and minimal resource usage — perfect for discretionary traders.

- MT5: Offers advanced order types, market depth, and superior analytical tools for more sophisticated strategies.

Whether you’re a beginner or an algorithmic trader, XM has you covered with both options.

XM’s Mobile App: Full Trading, Anywhere

The award-winning XM App consolidates trading, charting, and account management into one intuitive platform.

Key Features:

- Full trade execution with live charting tools

- Real-time price alerts and notifications

- Complete account management (funding, settings, transaction history)

- Integrated educational resources and support

- Available for iOS and Android

Perfect for those demand flexibility without sacrificing functionality.

The XM App offers full control of your account and 24/7 access to global markets – whether you’re travelling, commuting, or if you simply prefer via mobile.

Main Insights from Testing

Users of both Android and iOS devices can enjoy flawless experience with the XM MobileTrader app. The app lets run orders, track positions, and access real-time market data on the go, therefore preserving all vital aspects of the desktop platforms. Advanced charting tools, technical indicators, and customized notifications keep users informed about changes in the market. MetaTrader is known for its clean and good feel, also its Charting are among the most powerful offerings in the industry. So, the same as we do, you will enjoy its look and functions offered.

The tool provided quick execution speeds and a user-friendly UI throughout testing, thus making it accessible for various strategies or users. Some users, in the meantime, pointed out that the analytical powers of the app are not as strong as those of the desktop version, which is of course fact due to limited capabilities of phone screens mainly. XM MobileTrader is a dependable choice overall for traders looking for convenience and flexibility in their operations and is non-replaceable on the go.

Instruments Offered

With over 1,400 financial instruments across 7 asset classes, XM enables to construct a globally diversified portfolio — all from a single account.

Forex

XM’s Forex selection is comprehensive, making it a preferred platform for currency traders. Features include:

- 55+ currency pairs (majors, minors, exotics)

- Tight spread from 0.8 pips

- Leverage up to 1000:1 (depending on jurisdiction)

- 24/5 access with lightning-fast execution

This extensive offering allows to take advantage of macroeconomic events, news announcements, and price movements confidently, supported by XM’s robust infrastructure and execution standards.

Stock CFDs

You can speculate on global stock price movements without owning the actual shares. Highlights include:

- 1,200+ stock CFDs across US, UK, EU, and Asia

- Major names like Apple, Tesla, Meta, and Amazon

- Profit from upward or downward price movements

Equity Indices

For those interested in broader market trends, XM offers a variety of equity indices:

- US: S&P 500, Dow Jones, Nasdaq 100

- Europe: DAX, FTSE 100, CAC 40

- Asia: Nikkei 225, Hang Seng, AUS200

Both cash and futures contracts are available, allowing to select expiry dates and pricing models that suit intraday or medium-term strategies.

Commodities

XM features a diverse range of commodity CFDs, covering both hard and soft commodities, providing with opportunities to diversify into assets sensitive to inflation and geopolitical events. Categories include:

- Metals: Gold, Silver, Platinum

- Energy: WTI, Brent, Natural Gas

- Agricultural: Coffee, Corn, Cocoa

These commodities serve as effective hedges or primary vehicles during inflationary periods, geopolitical instability, or economic uncertainty.

Cryptocurrencies (Available under selected entities only)

Under XM Global, clients can access 60+ cryptocurrency CFDs:

- Top assets: Bitcoin (BTC/USD), Ethereum (ETH/USD), Ripple (XRP/USD), Litecoin (LTC/USD), Bitcoin Cash (BCH/USD).

- Go long or short with leveraged exposure.

Trade crypto CFDs on XM requires no digital wallet and lets speculate on price movements in both directions without owning the actual coins.

Note: Trading Cryptocurrency CFDs varies by regulatory jurisdiction and is not offered under all entities (e.g., not available under DFSA or CySEC).

Precious Metals & Energies

In addition to broader commodities, XM highlights metals and energy products as key markets:

- Trade Gold & Silver against USD and EUR

- Platinum, Palladium, WTI, Brent, and Natural Gas

- Tight spreads and flexible lot sizes

These are frequently used as safe-haven assets during market turmoil, and XM provides competitive fees and flexible lot sizes.

Turbo Stocks*

XM traders can take advantage of intraday volatility with leverage, and benefit from short-term price action on major stocks by trade Turbo Stocks of top brands.

- Over 1,400 assets available.

- Available on all Standard Accounts.

- Designed for intraday volatility and leveraged strategies.

Ideal for users seeking short bursts of market momentum.

Thematic Indices

Thematic Indices allow capitalize on high-growth sectors or market themes by tracking the performance of specific industries or themes, such as technology, healthcare, or blockchain.

- Cover a broad range of themes.

- Tradable on the MT5 platform.

- Available on all Standard and Ultra-Low Accounts.

*Available under selected entities

Education & Research

XM offers one of the most expansive and accessible educational programs in the industry — covering theory, strategy, and live market learning. The resources are available in multiple languages and blend theoretical knowledge with real-time practical learning.

XM Live Education

XM Live stands out as a unique and innovative educational service in the industry, unmatched by other brokers. Features include:

- Real-time commentary, analysis, and trade ideas

- Daily live streams in multiple languages

- Live Q&A and chart breakdowns with professionals

Offered in several languages, XM Live Education provides a dynamic learning environment where you can observe professional market analysis and can interact directly with experienced traders, a rare benefit in broker-led education.

Live Education Rooms

XM hosts daily Live Education Rooms separated by skill level—beginner and advanced—led by professionals and educators. These sessions cover both theory and practical concepts using fundamental and technical analysis.

Topics covered:

- Market structure and trends.

These rooms simulate a classroom-like environment and offer the opportunity to ask direct questions, get feedback on their ideas, and watch professionals analyse live charts — all in real-time.

On-Demand Video Learning (Powered by Tradepedia)

In partnership with Tradepedia, XM provides a library of professionally produced educational videos.

What does it include?

- Strategy-focused modules.

- Beginner-friendly tutorials.

- Platform tutorials (MT4/MT5/WebTrader).

- Tools and indicator video walkthroughs.

These free, well-organized, and regularly updated videos ensure clinets worldwide—including those in mobile-first or remote areas—have 24/7 access to high-quality training.

Webinars

XM also offers weekly live webinars, which are hosted daily in 20+ languages by over 70 instructors:

- Topics range from candlestick basics to advanced technical tools.

- Globally accessible in over 20 languages, regionally tailored.

- Available in multiple time zones.

- Structured into learning series (not just random events).

A highly structured learning system, ideal for step-by-step progression. Topics range from “Understanding Candlestick Patterns” to “Advanced Fibonacci Applications in Trending Markets.”

Economic Calendar and Market Sentiment Tools

For fundamental analysis, XM offers an interactive economic calendar that features:

- Upcoming news events categorized by region, impact level, and timing.

- Consensus forecasts alongside actual data releases.

- Direct links to the financial instruments affected by each event.

Additionally, market sentiment tools provide insights into the prevailing positions, aiding those who use contrarian or confirmation-based strategies.

Technical Analysis and Daily Research

XM’s dedicated team of analysts regularly publishes technical outlooks, daily trade ideas, and weekly market forecasts, accessible to registered clients.

Available resources include:

- Analysis of technical patterns such as chart formations and key price levels.

- Predictions for support and resistance zones.

- Weekly market outlooks covering FX, indices, and commodities.

- Articles authored by experts focusing on macroeconomic developments.

These tools are particularly valuable for those who want to incorporate wider market trends into their strategies or seek additional perspectives before making trade decisions.

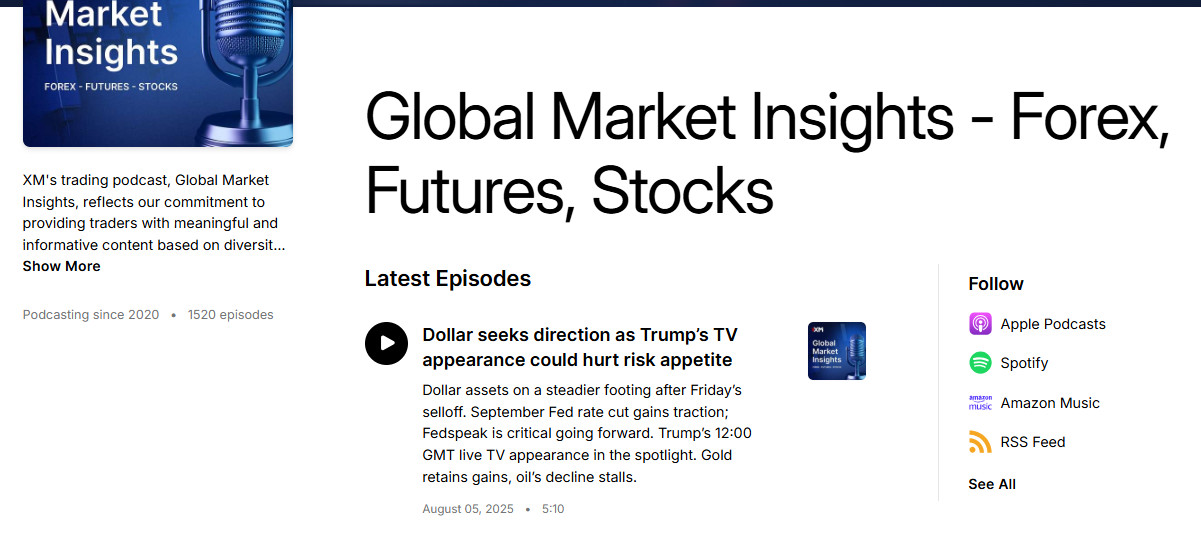

XM Podcast Series

XM offers a catered podcast series which is perfect for on-the-go platform users.

Topics include:

- Psychological strategies and macroeconomical shifts.

- Available on all major podcast platforms.

It’s available via the XM website and popular podcast platforms, helping traders stay informed even during a workout or commute.

Platform Tutorials and Tool Walkthroughs

To help new clients get started, XM offers detailed tutorials for all its platforms:

- MT4 and MT5 setup and customization.

- Placing and managing orders.

- Using indicators and drawing tools.

- Installing and optimizing Expert Advisors (EAs).

These are offered via video and step-by-step written guides.

Multilingual Learning Support

XM’s educational materials are fully translated and localized in more than 30 languages — such as Spanish, Arabic, Portuguese, Thai, Bahasa, and others — ensuring global accessibility for non-English-speaking clinets.

This reflects XM’s strong commitment to inclusivity, extending beyond customer service into trade education and development.

Customer Service

Reliable and prompt support is essential when assessing a broker. XM offers a robust, multilingual customer service system that’s available around the clock, designed to meet the needs of its diverse global audience in their preferred language.

Unlike many brokers that outsource support, XM relies on in-house teams thoroughly trained in the company’s platforms, products, and client expectations.

Availability and Operating Hours

XM provides 24/7 customer assistance aligned with global trade hours. From the Asian market open on Monday to the US market close on Friday, clients receive continuous access to support.

Multilingual Assistance in 30+ Languages

One of XM’s standout features is its ability to serve clients in over 30 different languages, including:

- Chinese

…and many more.

This multilingual capacity helps overcome language barriers for non-English speakers, seamlessly aligning with XM’s educational outreach for global users.

Support Channels

XM offers a variety of ways for clients to get help, based on their communication preferences:

- Live Chat – Accessible via the website, Members Area, and mobile app.

- Email Support – Structured ticket system for efficient tracking and response.

- Phone Support – Available in selected regions and languages.

- XM Help Center & FAQs – A searchable knowledge base for quick answers.

Dedicated Account Managers

Upon registration, each XM client is assigned a personal account manager to deliver tailored support. These managers assist with:

- Verifying accounts and managing deposits or withdrawals

- Explaining account types, features, and promotions

- Guiding users through XM’s platforms and learning tools

Though they don’t offer investment advice, account managers provide a helpful middle ground between general support and personalised assistance.

Regional Events and Local Support

In regions such as Latin America, Southeast Asia, and MENA, XM holds physical events like seminars, expos, and workshops. These include on-site support desks, giving a chance to engage directly with their account managers — a valuable trust-building initiative in areas with limited regulatory oversight.

Reputation and Client Satisfaction

XM’s customer support regularly earns high marks on platforms like Trustpilot, Google, SiteJabber, and industry sites such as forex-ratings.com, wikifx.com, tradersunion.com, and myfxbook.com.

Clients consistently highlight:

- Fast and effective issue resolution

- Professional and friendly communication

- Strong product and platform knowledge from support agents

XM has also won multiple service awards based on trader feedback.

In-App Support on the XM App

For mobile users, XM integrates live chat and ticket support directly within its app. This ensures users can get immediate assistance during market hours without leaving the platform or interrupting their activity.

Final Summary

With more than 15 million clients and over 15 years in the market, XM has built a strong reputation as a globally trusted broker. It offers reliable execution, wide asset coverage, and a balance of regulation with flexible conditions.

- For beginners, XM delivers user-friendly platforms, generous bonuses, free educational content, and round-the-clock support.

- For experienced traders, XM provides low latency execution, multiple asset classes, advanced tools, and access to real-time data.

- For investors, MT5 access to real company shares with transparent pricing offers a professional-grade experience without hidden charges.

If you’re seeking a globally regulated broker with deep educational value, 24/7 support, reliable execution, and broad market access — XM is a proven choice worth exploring.

Risk Warning: Trading on any financial market involves a significant level of risk to your capital.

Share this article [addtoany url="https://55brokers.com/ppc2-review/" title="XM Trading"]

XM Features

XM Features