TradeATF Review

Leverage: 1:30 | 1:500

Regulation: CySEC, FSC

Min. Deposit: 100 US$

HQ: Cyprus

Platforms: MT4

Found in: 2013

Leverage: 1:30 | 1:500

Regulation: CySEC, FSC

Min. Deposit: 100 US$

HQ: Cyprus

Platforms: MT4

Found in: 2013

TradeATF is a relatively new player in Forex business and a company established under the laws of Cyprus that mainstays on cutting-edge technology and striving to propose good conditions and knowledge to world traders.

Eventually, TradeATF is a brand name used by a quite known company Hoch Ltd that also serves few more trading names including iTrader and other ones. So its states about professional approach are also confirmed by other experience in Forex and Trading industry it has.

Despite the fact that Trade ATF is rather a young broker, it already serves over 10 thousand traders from different corners of the world. This could be an impact of harmonized trading conditions broker offer, while beginners will enjoy simplified conditions and fast account opening and may learn from Forex education Trade ATF provide.

And professionals will find some of the innovative tools available also with great access to the MT4 platform and its powerful trading options with no restrictions. However, read the full article and learn TradeATF Review conditions better before you decide if this is the broker you want to sign in.

TradeATF is a broker with easy account opening, good trading conditions, education and fee strategy.

From the negative side there are some complaints from the traders, instrument range is limited to Forex and CFDs, also read some recent updates below the review.

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation | CySEC, FSC |

| 🖥 Platforms | MT4 |

| 📉 Instruments | Stocks, Indices, Currencies, Cryptocurrencies and commodities |

| 💰 EUR/USD Spread | 0.6 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 100$ |

| 💰 Base currencies | Few currencies |

| 📚 Education | Education including Webinars, Courses and Research tools |

| ☎ Customer Support | 24/5 |

Based on our finds TradeATF is not safe. The broker did hold CySEC license and in case of any rules breach is fined and publically alerted, which happened already.

TradeATF operates two entities, while one is established in offshore zone Belize, and another one falls under the European registrations and regulation in Cyprus. Eventually, TradeATF is a brand, the trading name used by Hoch Capital Ltd regulated by the Cyprus Securities and Exchange Commission that set regulatory requirements for the provision of financial services within the EEA zone and beyond.

Also, being a European regulator TradeATF automatically compliant to MiFID and ESMA regulatory obligations and the way brokerage serves and treats its investors or clients.

We never recommend trading with offshore brokers on its own, you should also do your research before trading, but since TradeATF entity is regulated by European regulators we consider opening an account under a European regulation as a one that obliges to international rules and protecting your money.

Leverage being a very powerful trading tool, since magnifies your trading capital in a certain number of times, offering you great opportunity to gain higher income by the trade of smaller amounts. However, leverage hides higher risks as well, so you should always learn how to use it correctly on which instrument to apply it or on which one not.

Recognizing its risks, regulatory bodies in various jurisdictions for recent years significantly lower allowed levels or the one that retail traders may use. Yet, since TradeATF serves two entities one in Europe, Cyprus another one available for international traders and based in Belize, those two entities will offer you different leverage conditions.

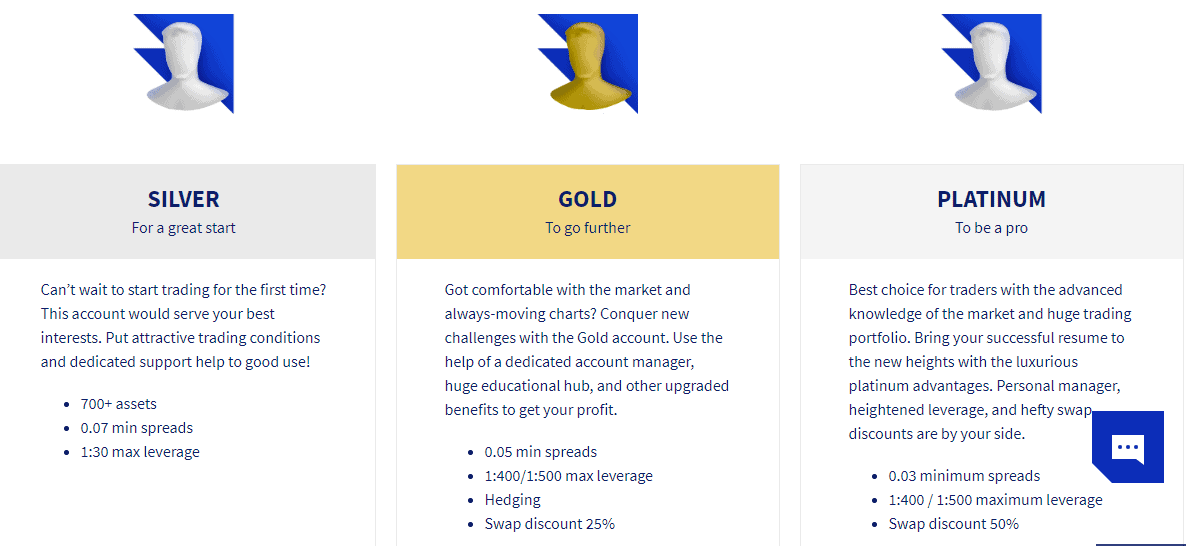

TradeATF range of account types offering three Account types – Silver, Gold and Platinum designed for traders who either just starting trading journey or future more attractive conditions as long as the account type increases. Throughout a choice of over 700+ assets each account type brings smart fee strategy also with discounts applied for Gold and Platinum account holders for swaps and spread charges.

Moreover, TradeATF supports traders following Sharia belief so Islamic Account available for every account type offered with tailored conditions according to restrictions.

As for the available markets, TradeATF offers trading on CFD basis with availability over 350 assets including popular Currency Pairs, Cryptocurrencies, Indicates, Energies, Metals, Stocks while its range continues growing. Even though some traders may find it that proposal based on CFDs is rather limited, there are numerous advantages of this type of trading as well.

While the main of it is a simplified way of trading, where you don’t need to worry about contract rollovers or connection to a particular exchange, simply through the selection of trading instruments in TradeATF platform you open chart and start trading, which is definitely a benefit.

TradeATF costs are depending on the account type you use, as well as what trading size you operate. Silver account costs starting with Minimum spreads of 0.07, while Gold account offering spreads from 0.05 with rollover discount of 25%and Platinum feature spread of 0.03 and a swap discount of 50%. Plus additional costs like funding fees, inactivity fee and swaps.

| Fee | TradeATF Fees | ETFinance Fees | OctaFX Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Average | Average | Low |

TradeATF does not charge a commission but base its costs on a spread only. This means all you have to pay for provided trading service and capabilities is a spread, or a difference between the sell and buy price charged for every position you make. Spread is also defined by the account type you use, thus Silver accounts spread starting from 0.07 pips, Gold holders enjoy discounted 0.05 and Platinum entitled for the lowest spread of 0.03 pip.

Besides, additional charge SWAP or Rollover fee is paid if you use swing strategy or holding positions longer than a day. However, Gold and Platinum traders will enjoy swap discount of 25% and 50% respectively, which is definitely great. See below the comparison table with a typical TradeATF Spread and compare brokers to other CFD Brokers consistent of fees, commission or inactivity fee. Also, for your consideration, you may check FP Markets.

| Asset/ Pair | TradeATF Fees | ETFinance Fees | OctaFX Fees |

|---|---|---|---|

| EUR USD | 0.6 pips | 0.7 pips | 0.5 pips |

| Crude Oil WTI | 3 pips | 3 pips | 2 pips |

| Gold | 36 | 37 | 20 |

Being a regulated broker TradeATF falls automatically under the money management rules, which means clients’ funds are always kept under protective measures and segregated at all times. Also, the broker enables safe transactions, means you can unprecedently transfer fund to or from your trading account.

TradeATF offers to deposit funds through the most common payment methods, through the use of popular providers. It may seem at some point like a limited choice for the EU entity, yet those methods are the most convenient and safe. Lastly, its worth mentioning that if your account is opened under the International TradeATF entity you would be offered a wider range of money providers, since regulation allows. So it is always food to check with customer service in terms of money transfer policies.

TradeATF minimum deposit is set to a EUR100 allowing you to open a Silver account, while Higher grade account will require bigger amounts of money. What is also great, there is no charges for deposits so there is no any commission, however always define it with your payment provider or Bank itself as international laws may vary.

TradeATF minimum deposit vs other brokers

| TradeATF | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

TradeATF Money withdrawals organized in customer-friendly way, as all transactions are requested and managed through your online account area.

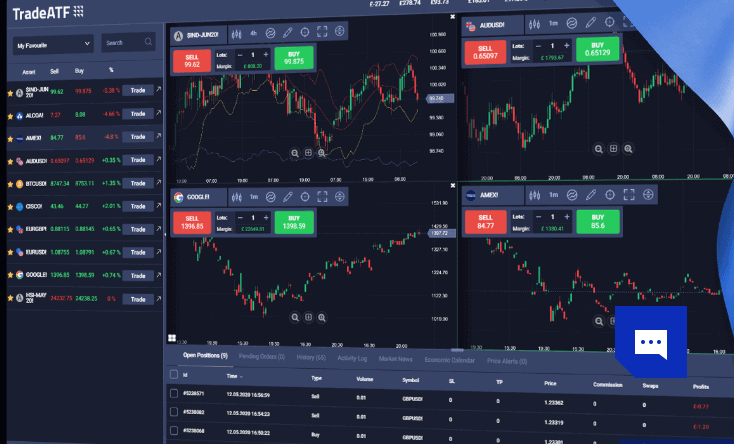

The trading platform you will use for the trading process itself is an industry leading, popular and highly regarded MetaTrader4. We are not surprised why TradeATF chooses this software and does not provide any other platform, MT4 is so flexible and packed with great features so almost you don’t want to search for something else.

| Pros | Cons |

|---|---|

| Mainstay on MetaTrader4 | No any other platform offered |

| User friendly design | |

| No limitations on strategies | |

| Fee Report, Price alerts, Fee reports available | |

| Supporting numerous languages | |

| Web, Mobile and Desktop versions | |

| Social Trading capabilities |

MetaTrader offered by TradeATF is actually a Web Version, while if you wish you may install a Desktop platform as well. Yet, all features are available and synchronized on all devices as MT4 is a cross-platform. Web Trading is definitely very comfortable since you don’t need any computer high specifications or capabilities, all you need is a browser and internet connection and platform will be available for trading right away.

MT4 is actually known and highly awarded for its great charting, customer-friendly design and intuitive navigation. So even if you not familiar with the platform you will get easy with it, also make sure to learn it well with education materials TradeATF provides too.

With a platform you will have a full track over your opening and closing of positions, also with numerous order types available including stop loss, limit loss, etc. Also, MT4 is famous for its automated trading capabilities, the use of Robots known as EAs and social trading options. TradeATF includes this package as well, so traders of various styles can join to its trading interest seamlessly.

The mobile app is also available and suitable for any mobile device you may use. Together with customized features you may even choose from defined chart types, check your fee report, enable one click trading and more, all available on the go.

Another important point while selecting a broker is to see its customer support, as you should find a quality answer and support in any matter you may have along the trading process. The good news are that TradeATF customer support is on a quite sustainable level, so you may refer to your concerns either through Live Chat, email or phone if it is better for you. Yet make sure to contact them within working hours, as customer service world 24/5 only.

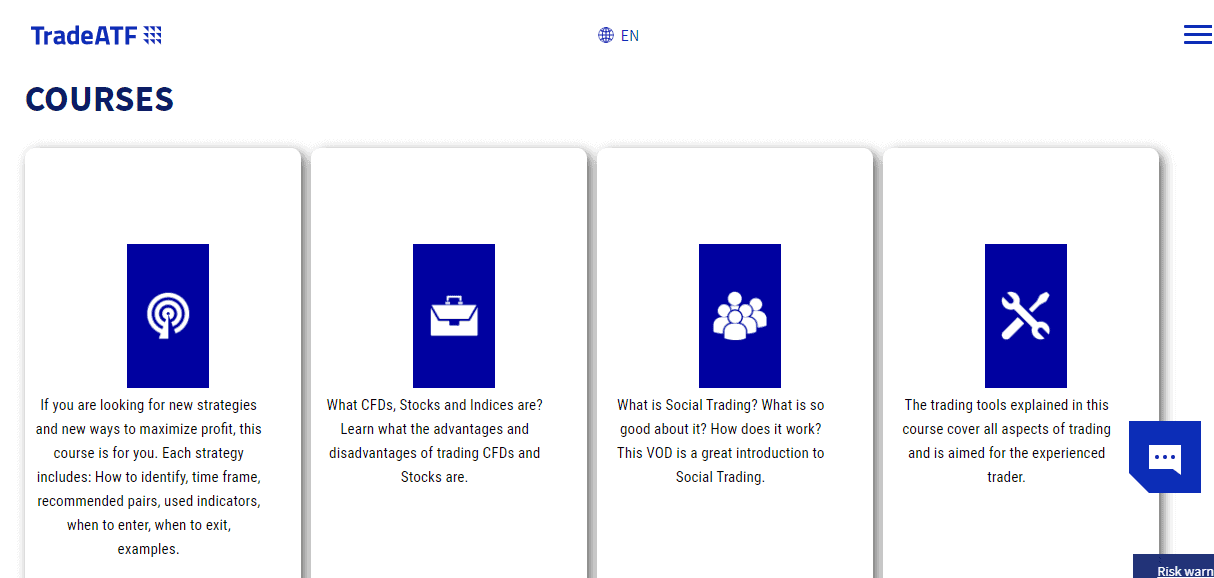

One good advantage of TradeATF is its supportive model for any type of trader you may be. There are numerous organized education and Forex learning materials, while the broker also runs courses defined by the level and topic you’re interested in. There are organized tools either for beginning traders or the ones that are interested to engage in social trading.

And another separate great prise should go to Research Tools Trade ATF provides, for almost any strategy and all aspects are covered, TradeATF tool range includes over 90+ tools that will support in trading identification, indicators, examples, signals and much more.

Recent warning as of 28 May 2020 imposed by the UK’ FCA in regards to Hoch Capital and its trading names Trade ATF and iTrader as the broker was detected in acting in a manner which is clearly prejudicial to the interests of investors.

Despite that Hoch Capital is CySEC regulated broker, FCA considers its trading practices and aggressive marketing promotion in the UK controversial to its MiFID obligations. The brokers used misleading marketing and promotion strategies which resulted in numerous complaints and has failed to carry out appropriate assessments of the compatibility of its products and its customers .

As such, Hoch Capital and its trading names imposed to notify all active accounts and must not provide any financial investment services t the UK residents.

“Hoch Capital Ltd is not permitted to provide regulated financial services to residents of the United Kingdom.” – FCA mentions, read more by the official warning link.

TradeATF Cyprus license is now under examination for voluntary renunciation of the authorization. This means, at the moment TradeATF operates solely through its Belize entity which does not fall under serious regulations. We recommend avoiding trading with TradeATF Belize entity due to lack of regulations and a better and safer alternative broker is HotForex. Read our HFM full review here.

Dear Yarin, Maria Graf trading account no: 569126 1. Account was opened on the 16/02/2021 a purchase of 0.03 of Bitcoin was purchased for an amount of 49138.68 2. On the 17/02/2021 ADA was purchased quantity 4 for an amount of 0.87236 3. On the 22/02/2021 Ethereum was purchased quantity 0.2 for an amount of 1734.93 4. On the 22/02/2021 Ethereum was purchased quantity 0.2 for an amount of 1739.99 5. On the 22/02/2021 Bitcoin was purchased quantity 0.05 for an amount of 53775.69 6. On the 22/02/2021 Bitcoin was purchased quantity 0.05 for an amount of 53800.00 7. On the 22/02/2021 Ethereum was purchased quantity 0.4 for an amount of 1792.83 8. On the 22/02/2021 Bitcoin was purchased quantity 0.05 for an amount of 54477.38 This all came to a total of R83500.00 in South African Rands. The decision to sell all the above was done on the 10/03/2021, because the swap fees were very high, even though I was not swapping anything. Also, the scam alerts on your company started to become visible on the internet. On the 10/03/2021 the following was sold 1. Ethereum 0.8 for an amount of 1842.42 2. ADA 4 for an amount of 1.25750 3. Bitcoin 0.18 for an amount of 58944.11 On the actual trading platform there are constantly running swap fees. Even though no swaps took place. Swap fees are only allowed and are only charged if you swap your Bitcoin or Ethereum to another crypto currency, according to my knowledge. When I sold, I closed my trading at R72 187.54 Once the trading stopped at R 72 187.54 there was no reason for your computerised swap fees to carry on till, I finally had to work out on my own how to stop the meter. Your staff were spoken to every 2nd day no one in your organization could help me, or tell me anything, except that I would have to wait until you were available, which you have not been until today!!!! I sent emails, I requested by chat that you call me but to no avail you were not available to help me. It is for this reason that I am now expecting the following from you and your company: R 72 187.54 Less amount paid out R 3 500.00 R 2 405.22 R 20 000.00 R 5 000.00 R 10 000.00 THEREFORE, AMOUNT OWING TO M GRAF IS R 31 282.32 I will not stop until I get what’s rightfully mine you might find that you have met your maker. You will find advertisements on Facebook, with my story, you will find it on, LinkedIn, Reddit, Quora and every advertising financial platform available to me. I am giving you 7 days to deposit the balance to my account otherwise I will be posting this advertisement about your company along with my story. This image will haunt you forever and i will also be opening a legal case, with the Fraudulent Crypto investment Platform, to find out exactly what happened with my money. You have purposefully scammed me out of my money just because this is what you do!!! Your 24/5 & 24/7 availability is a scam because only you can help people, everyone in the company answering the phones doesnt know anything or claims to know nothing!!! because once you get your claws into a customer, then you make yourself available as you please. Especially once they want to sell!!! Very dishonest people the world needs to know about you!!! Regards Maria Graf image.png this is a letter written to GLOBAL ATF TRADING

No news available.

TradeATF is a large scam. TradeATF “advisors” teach you very little about how to trade. Their function is to ask you to deposit more money. In my case, when I deposited a larger amount of money and followed the “suggestions” of my “advisor”, it turns out that I lost everything. I was never able to talk to my advisor again, he cowardly disappeared and the company covered him up. They hide behind the fact that one is the solely responsible for the operations at their platform. They made me lose almost 7000 dollars. They were unable to answer my questions and tried to buy my silence for less than 10% of what they made me lose. They are a great scam. I do not recommend them at all.

Has anyone body made payment to an ABSA bank account trading on this platform. Please let me know.

Hi Carel, Yes I have. Drop me an email please. My case is being investigated by saps.

Good day Desmond

I have a friend that was also scammed around the same time. She unfortunately gave me the information this yesterday. Are you able to assist or are we to late?

Thank you

Is there anyone out there who can still help me get my money back from this trader because in 2021 a man called Mohammed made me borrow money from the bank R250 000 with a lot of empty promises and it was not even long all my money is gone and Mohammed disappear like it’s no man’s business, left me with a lot of debts.

I had approx. 8600 ZAR on my account with them which they refused to pay out without giving any reasons. All my emails were ignored. Then my money was withdrawn by them and it was declared as “Inactivity fees”. Now my account balance is 0.0.

PURE SCAM! Be warned!

SOMEONE SHOULD SHUT THESE PEOPLE DOWN !! The same happened to me. They kept asking for more and more money with the promise of making much more. Needless to say, I lost everything. STAY AWAY FROM GLOBAL TRADE ATF

Catherina

On the 7th of March 2021 ATF Global Trade also known as:

(Bayline Trading LTD. (“The Company”) Registration number: 136,374 From: 35 Barack Road, Belize City, Belize.

Office:

Bayline Trading Ltd. Registration number: 136,374

5 Cork Street, Belize City, Belize.

4th Floor, Holden House 57 Rathbone Place, W1T1JU London, UK

Phone

+44 203 670 13 15) contact me and presented to me a scheme to invest money on the stock markets.

On the 7th of March 2021 the account was opened and I deposited an amount of ZAR 10,000-00.

Thereafter a lady named Catherina called me and said that she was appointed by her firm as my account manager.

As I am a lay person in the stock markets the lady told/guide me what to do. I followed her instructions.

The lady repeatedly told me how the stock markets react and convinced me to make two more deposits to the Companies account i.e. R 95 000 – 00 and R 100 000 – 00.

Hereafter the lady convinced me to deposit R 500 000 -00 to obtain Golden status on my account which I did in two payments of R 250 000-00 each on the 9th of March 2021. The verbal agreement between myself and the lady was that I could immediately withdraw the R 500 000-00 after the golden status on my account had been approved.

I was restricted to withdraw my R 500 000 -00 and Catharina requested more money to return my funds. (Illegal to do so)

Catharina shared me computer screen which is a criminal offence.

She asked for more and more money which is criminal.

She offered me bonusses which is criminal.

She offered me discount which is criminal.

She logged into my screen and choose what commodities I must trade on (criminal)

When I then tried to withdraw my money it was limited by your Company. (criminal)

Hereafter the lady convinced me to deposit another R 1007 000 – 00 to ge5t my money back -criminal.

At this stage my cash balance with the Company was R 1 802 294 .85 which I

want to withdraw and close my account with the Company. The lady tried to obtain another three hundred thousand rands from me which I refused. (criminal).

They scammed me out of R 1 802 294 .85. Still scamming people and get away wit it!!!!!!!!!!!!!!!!!

They just don’t stop scamming innocent people , and nobody is going after them , fucking scammers.

On the 7th of March 2021 ATF Global Trade also known as:

(Bayline Trading LTD. (“The Company”) Registration number: 136,374 From: 35 Barack Road, Belize City, Belize.

Office:

Bayline Trading Ltd. Registration number: 136,374

5 Cork Street, Belize City, Belize.

4th Floor, Holden House 57 Rathbone Place, W1T1JU London, UK

Phone

+44 203 670 13 15) contact me and presented to me a scheme to invest money on the stock markets.

On the 7th of March 2021 the account was opened and I deposited an amount of ZAR 10,000-00.

Thereafter a lady named Catherina called me and said that she was appointed by her firm as my account manager.

As I am a lay person in the stock markets the lady told/guide me what to do. I followed her instructions.

The lady repeatedly told me how the stock markets react and convinced me to make two more deposits to the Companies account i.e. R 95 000 – 00 and R 100 000 – 00.(criminal)

Hereafter the lady convinced me to deposit R 500 000 -00 to obtain Golden status on my account which I did in two payments of R 250 000-00 each on the 9th of March 2021. The verbal agreement between myself and the lady was that I could immediately withdraw the R 500 000-00 after the golden status on my account had been approved.

I was restricted to withdraw my R 500 000 -00 and Catharina requested more money to return my funds.(illegal to do so)

Catharina shared me computer screen which is a criminal offence.

She asked for more and more money which is criminal.

She offered me bonusses which is criminal.

She offered me discount which is criminal.

She logged into my screen and choose what commodities I must trade on (criminal)

When I then tried to withdraw my money it was limited by your Company. (criminal)

Hereafter the lady convinced me to deposit another R 1007 000 – 00 to ge5t my money back -criminal.

At this stage my cash balance with the Company was R 1 802 294 .85 which I

want to withdraw and close my account with the Company.

The lady tried to obtain another three hundred thousand rands from me which I refused. (criminal)

It is my demand that the company pay back an amount of R 1 802 294 .85.

If you fail to do so immediately I will follow the same route as Professor Bassy Boas Marvey in the Court case against your Company in March 2021.

Yours sincerely.

Hermann Booysens.

I’m using Adobe Acrobat.

You can view “Screenshot (9).png” at: https://documentcloud.adobe.com/link/track?uri=urn:aaid:scds:US:8ebd1589-8830-4a9d-afc6-55275f887814

Will give you the lawyer’s detail soon. High Court Case 16 March 2021 33. BASSY BOAS MARVEY v BAYLINE TRADING LTD t/a GLOBAL TRADEATF & OTHERS 13129/2021 Regards, Hermann Booysens. cell 0829569224 SA.

Important TradeATF Update

TradeATF Cyprus license is now under examination for voluntary renunciation of the authorisation. This means, at the moment TradeATF operates solely through its Belize entity which does not fall under serious regulations. We recommend avoid trading with TradeATF Belize entity due to luck of regulations and a better and safer alternative broker is HotForex. Read our HotForex full review here.Beware!!!!!!!!STAY AWAY FROM THIS SCAMMERS !!!!!!? THEIVES !!!!!!

On the 7th of March 2021 ATF Global Trade also known as:

(Bayline Trading LTD. (“The Company”) Registration number: 136,374 From: 35 Barack Road, Belize City, Belize.

Office:

Bayline Trading Ltd. Registration number: 136,374

5 Cork Street, Belize City, Belize.

4th Floor, Holden House 57 Rathbone Place, W1T1JU London, UK

Phone

+44 203 670 13 15) contact me and presented to me a scheme to invest money on the stock markets.

On the 7th of March 2021 the account was opened and I deposited an amount of ZAR 10,000-00.

Thereafter a lady named Catherina called me and said that she was appointed by her firm as my account manager.

As I am a lay person in the stock markets the lady told/guide me what to do. I followed her instructions.

The lady repeatedly told me how the stock markets react and convinced me to make two more deposits to the Companies account i.e. R 95 000 – 00 and R 100 000 – 00.(criminal)

Hereafter the lady convinced me to deposit R 500 000 -00 to obtain Golden status on my account which I did in two payments of R 250 000-00 each on the 9th of March 2021. The verbal agreement between myself and the lady was that I could immediately withdraw the R 500 000-00 after the golden status on my account had been approved.

I was restricted to withdraw my R 500 000 -00 and Catharina requested more money to return my funds.(illegal to do so)

Catharina shared me computer screen which is a criminal offence.

She asked for more and more money which is criminal.

She offered me bonusses which is criminal.

She offered me discount which is criminal.

She logged into my screen and choose what commodities I must trade on (criminal)

When I then tried to withdraw my money it was limited by your Company. (criminal)

Hereafter the lady convinced me to deposit another R 1007 000 – 00 to ge5t my money back -criminal.

At this stage my cash balance with the Company was R 1 802 294 .85 which I

want to withdraw and close my account with the Company.

The lady tried to obtain another three hundred thousand rands from me which I refused. (criminal)

It is my demand that the company pay back an amount of R 1 802 294 .85.

If you fail to do so immediately I will follow the same route as Professor Bassy Boas Marvey in the Court case against your Company in March 2021.

Yours sincerely.

Hermann Booysens.

I’m using Adobe Acrobat.

You can view “Screenshot (9).png” at: https://documentcloud.adobe.com/link/track?uri=urn:aaid:scds:US:8ebd1589-8830-4a9d-afc6-55275f887814

Sibongile Thabiso Khumalo dont talk shit…These people will be in jail soon.

i have also lost all my funds. Charles Ba says he is now leaving the country as he got offered a job somewhere else. i have reported the incident to FNB and the SAPS.

Will a person receive money back?

Guys in short … I lost my life savings in less than a month . Do not even try to use these brokers I am out of my life long savings of Two Million Rands in less than a month . If you feel like it you can contact me on my Facebook page or on Cellno. 0829569224 . My name is Hermann Booysens. Please do not burn your fingers like I did … Stay far away as possible from this broker .. be warned. Good luck .. Hermann Booysens. Here is the prove copy and paste from there web site of payments made by me to ATF :

Processing requests

No requests at the moment

Transaction History

25 Mar 13:33

Card

Approved

+30000 ZAR

23 Mar 13:48

Declined

-90500 ZAR

21 Mar 17:07

Declined

-5000 ZAR

17 Mar 17:35

Card

Completed

-16000 ZAR

16 Mar 17:59

Card

Completed

-15000 ZAR

16 Mar 15:58

Other

Approved

+150000 ZAR

16 Mar 13:57

Card

Declined

+150000 ZAR

16 Mar 13:23

Other

Approved

+150000 ZAR

16 Mar 12:12

Other

Declined

+150000 ZAR

16 Mar 11:59

Other

Declined

+150000 ZAR

16 Mar 11:52

Other

Declined

+150000 ZAR

16 Mar 11:47

Other

Declined

+150000 ZAR

16 Mar 11:37

Card

Declined

+100000 ZAR

16 Mar 11:35

Card

Declined

+150000 ZAR

16 Mar 11:34

Other

Declined

+150000 ZAR

16 Mar 11:34

Card

Approved

+150000 ZAR

16 Mar 11:33

Other

Declined

+500000 ZAR

16 Mar 11:32

Card

Declined

+300000 ZAR

16 Mar 11:31

Card

Declined

+300000 ZAR

16 Mar 11:29

Card

Approved

+300000 ZAR

10 Mar 23:21

Card

Completed

-100000 ZAR

10 Mar 23:20

Card

Completed

-16000 ZAR

10 Mar 23:19

Card

Completed

-9000 ZAR

09 Mar 23:31

Card

Completed

-9000 ZAR

09 Mar 19:39

Other

Approved

+57000 ZAR

09 Mar 19:36

Other

Approved

+100000 ZAR

09 Mar 19:31

Other

Declined

+100000 ZAR

09 Mar 19:26

Other

Approved

+100000 ZAR

09 Mar 19:22

Other

Declined

+100000 ZAR

09 Mar 19:21

Other

Declined

+257000 ZAR

09 Mar 19:09

Card

Declined

+257000 ZAR

09 Mar 19:07

Card

Declined

+260000 ZAR

09 Mar 19:05

Card

Declined

+260000 ZAR

09 Mar 18:48

Card

Approved

+250000 ZAR

09 Mar 18:38

Card

Approved

+250000 ZAR

09 Mar 18:31

Card

Declined

+250000 ZAR

08 Mar 17:12

Card

Approved

+95000 ZAR

08 Mar 16:57

Card

Approved

+100000 ZAR

08 Mar 16:16

Card

Declined

+20000 ZAR

08 Mar 16:12

Card

Declined

+20000 ZAR

08 Mar 16:07

Card

Declined

+100000 ZAR

08 Mar 15:59

Card

Declined

+100000 ZAR

08 Mar 15:42

Card

Declined

+100000 ZAR

08 Mar 15:40

Card

Declined

+100000 ZAR

07 Mar 10:50

Card

Approved

+10000 ZAR

Here is the prove people I have lost two million Rands in a months time… everything negative on this comment page happened to me as well… this is from their web site please stay away …do not cry like me.

Guys in short … I lost my life savings in less than a month . Do not even try to use these brokers I am out of my life long savings of Two Million Rands in less than a month . If you feel like it you can contact me on my Facebook page or on Cellno. 0829569224 . My name is Hermann Booysens. Please do not burn your fingers like I did … Stay far away as possible from this broker .. be warned. Good luck .. Hermann Booysens.

Processing requests

No requests at the moment

Transaction History

25 Mar 13:33

Card

Approved

+30000 ZAR

23 Mar 13:48

Declined

-90500 ZAR

21 Mar 17:07

Declined

-5000 ZAR

17 Mar 17:35

Card

Completed

-16000 ZAR

16 Mar 17:59

Card

Completed

-15000 ZAR

16 Mar 15:58

Other

Approved

+150000 ZAR

16 Mar 13:57

Card

Declined

+150000 ZAR

16 Mar 13:23

Other

Approved

+150000 ZAR

16 Mar 12:12

Other

Declined

+150000 ZAR

16 Mar 11:59

Other

Declined

+150000 ZAR

16 Mar 11:52

Other

Declined

+150000 ZAR

16 Mar 11:47

Other

Declined

+150000 ZAR

16 Mar 11:37

Card

Declined

+100000 ZAR

16 Mar 11:35

Card

Declined

+150000 ZAR

16 Mar 11:34

Other

Declined

+150000 ZAR

16 Mar 11:34

Card

Approved

+150000 ZAR

16 Mar 11:33

Other

Declined

+500000 ZAR

16 Mar 11:32

Card

Declined

+300000 ZAR

16 Mar 11:31

Card

Declined

+300000 ZAR

16 Mar 11:29

Card

Approved

+300000 ZAR

10 Mar 23:21

Card

Completed

-100000 ZAR

10 Mar 23:20

Card

Completed

-16000 ZAR

10 Mar 23:19

Card

Completed

-9000 ZAR

09 Mar 23:31

Card

Completed

-9000 ZAR

09 Mar 19:39

Other

Approved

+57000 ZAR

09 Mar 19:36

Other

Approved

+100000 ZAR

09 Mar 19:31

Other

Declined

+100000 ZAR

09 Mar 19:26

Other

Approved

+100000 ZAR

09 Mar 19:22

Other

Declined

+100000 ZAR

09 Mar 19:21

Other

Declined

+257000 ZAR

09 Mar 19:09

Card

Declined

+257000 ZAR

09 Mar 19:07

Card

Declined

+260000 ZAR

09 Mar 19:05

Card

Declined

+260000 ZAR

09 Mar 18:48

Card

Approved

+250000 ZAR

09 Mar 18:38

Card

Approved

+250000 ZAR

09 Mar 18:31

Card

Declined

+250000 ZAR

08 Mar 17:12

Card

Approved

+95000 ZAR

08 Mar 16:57

Card

Approved

+100000 ZAR

08 Mar 16:16

Card

Declined

+20000 ZAR

08 Mar 16:12

Card

Declined

+20000 ZAR

08 Mar 16:07

Card

Declined

+100000 ZAR

08 Mar 15:59

Card

Declined

+100000 ZAR

08 Mar 15:42

Card

Declined

+100000 ZAR

08 Mar 15:40

Card

Declined

+100000 ZAR

07 Mar 10:50

Card

Approved

+10000 ZAR

Guys in short … I lost my life savings in less than a month . Do not even try to use these brokers I am out of my life long savings of Two Million Rands in less than a month . If you feel like it you can contact me on my Facebook page or on Cellno. 0829569224 . My name is Hermann Booysens. Please do not burn your fingers like I did … Stay far away as possible from this broker .. be warned. Good luck .. Hermann Booysens.

Thanks so much for all the warnings. I have also had my suspicions. They are waiting for my deposit, but I told the guy I need to do some research first. Sorry for those that lost, I really hope you get something back but most importantly, this place needs to be shut down!

Hi!, trade ATF is a scam. They ask you for a first deposit, then they tell you that you won some money but you cannot withdraw it, because it’s not “convenient” so they ask you for more money and then disappear. Thus, if you want to use trading platforms DO NOT use this or you will lose your money, instead use others like etoro or your local bank or other trustable platforms which don’t promise that you will win thousands with amazon or apple stocks… trading is not that simple, it is like a game based on finances, gambling and global economy.

People. Please.. Stay away!! I lost R307 000 through them. The account managers manipulate you into depositing huge amounts and thrn they loose all your money..

Complaints department offers me R25000🤣

This is daylight thievery..

And best of all.. I phoned Yarin to help me withdraw my funds. He then told me to make a small trade and used my inexperience against me and let me open a huge trade with all my money.. Prices went down and i lost all my money… He never phoned me back, i have been asking for him to call.. If you want to leave, they put you in a bad trade, to make you loosr everything..

Hope someone can learn from my mistake

Dear Sirs,

I have been misled/scammed by the above brokers out of +/- two million Zouth African Rands.

Could you assist me by providing me with a corporate body’s detail to report the matter.

Your assistance will be highly appreciated.

Hereunder I explained what has happened to me.

Trust to hear from you soon.

Kind Regars,

Hermann Booysens.

________________________________________________________________________________________________________________________

ATF Global Trade Scammers…beware of them!!!!Stay as far away from this scammers as possible !!!!!😡 On the 7th of March 2021 Atf Global Trade also known as:

(Bayline Trading LTD. (“The Company”) Registration number: 136,374 From: 35 Barack Road, Belize City, Belize.

Office:

Bayline Trading Ltd. Registration number: 136,374

5 Cork Street, Belize City, Belize.

4th Floor, Holden House 57 Rathbone Place, W1T1JU London, UK

Phone

+44 203 670 13 15) contact me and presented to me a scheme to invest money on the stock markets.

The account was opened and I deposited an amount of ZAR 10,000-00.

Ther after a lady named Cathrine called me and said that she was appointed by her firm as my account manager.

As I am a lay person in the stock markets the lady told me what to do. I followed her instructions.

The lady repeatedly told me how the stock markets react and convinced me to make two more deposits to the Companies account ie. R 95 000 – 00 and R 100 000 – 00.

Hereafter the lady convinced me to deposit R 500 000 -00 to obtain Golden status on my account which I did in two payments of R 250 000-00 each on the 9th of March 2021. The verbal agreement between myself and the lady was that I could immediately withdraw the R 500 000-00 after the golden status on my account had been approved.

I then tried to withdraw my money which was limited by the Company.

Hereafter the lady convinced me to deposit another R 1007 000 – 00.

At this stage my cash balance with the Company was R 1 802 294 .85 which I want to withdraw and close my account with the Company.

The lady tried to obtain another three hundred thousand rands from me which I refused.

It is my demand that the company pay back an amount of R 1 802 294 .85.

Now ATF Globaltrade is ignoring my calls. Can any body assist me where to report them.

Hi Olivia,

I am sorry that you lost your money.

I have also lost money.

i just wanted to check if you where speaking to the same Yarin D that i was speaking to ?

He also forced me to deposit a lot of money.

Thank you everyone for the warning. I almost got scammed. But got suspicious and quickly dropped their call

Thanks so much for all the warnings!!

You saved me 🙂

My parents have been scammed before so I know to check properly

I can absolutely say that the last review of March0, 2021 at 7:49 has been my exact experience of them. My last money has been lost whilst I was awaiting a withdrawal! Don’t don’t don’t!

Unless you are very experienced or have money to lose, do not trade with ATF Global. They may be a registered company etc., but they haven’t lost their license to operate in UK and are under review in Cypress for no reason.

They are unethical in their dealings, say they operate out of the UK, when they actually operate and are governed in Belize.

They are very good at sucking you in and delaying withdrawals.

I lost all I invested even though I told them I had no experience and pleaded for help.

Now that a complaint has come their way they have offered me a very little amount as a gesture, in return they want a non disclosure agreement.

O wow, thank you so much, I almost fell victim, these scammers are really from hell and they are on my case currently, very convincing nd very good talkers, I hope we are all safe from these thugs yoooh

This was exactly my husband’s experience, right down to a trifling R5000 to keep him “happy” and getting him to sign a “legal” document to say he would keep quiet. They even tried to get my husband to take his small pension out and invest it. We are heartbroken pensioners.

OMG Jana ,I have also been fucked and scammed like that…Cant we put Interpol on these broker theives Globalatf traders.Where in the fuckin world are they.cyberspace theives.Robbing poor struggling people from money borrowed to invest.

DO NOT INVEST WITH global.tradeatf. Every single negative thing I have read here is correct. I recently opened an account with global.tradeatf because I was told that I will be assisted in terms of what assets to buy and when to sell. I was really interested in this because I am not experienced with analysis of assets and I do not have free time to learn. I then opened my account with the minimum R3500 and I was told that my account manager will contact me. The account manager called me the next week and told me that I had to invest more money if I want to invest in stocks to which I said I don’t have money. His solution was that I open trades with forex to try and boost my balance. I opened four trades and two of those gave me R1000 profit while the rest never gave me any profit. I called the number he usually calls me with and the lady on the switchboard picked up and told me that my account manager would call me back. He called me back a day later and I told him that I was worried about the loss I was making as also the swap fee was increasing everyday. He told me that I should not worry and that I would eventually make profit. He called me a week later and told me that my free margin is dangerously low and that I should immediately deposit money, I told him I did not have money and he said I must leave the trades open and that they would eventually make me profit. Two days later he called and told me about NASDAQ and advised that I deposit R100 000 to open a buy trade. I told him I don’t have that kind of money and he tried to influence me to get a loan. I almost did it fortunately I have a friend who advised against it. Today I have closed those trades and because of how high the loss on the asset and how high the swap fee was it has left me with R781.10.I have requested to withdraw my R781 but I got a rejection of withdrawal email(apparently my R781 is less than the minimum to withdraw). The broker may not be a scam but from my terrible experience I will never advice anyone to trade with tradeATF. All the account managers are just there to influence you to add money to your account even if your making a huge loss. Don’t be naive stay away.

good day

it so so heartbroken to read ure story coz i also have the same stress, a man with the name roy called me and he ask me if im intrest in trade ,i have no expierience and the man with the name of roy put very pressure on me and i g to someone to make a loan, of 3500that man call me evertday up until i gave tht money than he tald me that a account manager with the name prince wil call met and teach me everything on what to do , prince did not teach he tell me wht to do ,i make a profit of 1500 , the nex day he call me and said that my accout is in danger i mus put another 3500 i said i dond have money coz i told them that i borrow that money ,after that all the money was gone and i never hear form them ever , im very angrey now i must pay that loan back , please people stay away

yooh thank you for speaking up about this guys.

If you want to lose all your money then invest with this company . Their account managers are there to make sure that you will lose all your money. They are your best friends while they can get you to invest more money into your account.

Big fucking scammers, you starts with 250 usd and after they ask you for put more money for trade with other fields and the end you never can take your money back, cause your account is always is on risk and start to push for more money

Thank you Josue and Bryan P and TRade ATF for be a big thieves

I was scammed by Trade ATF worth R203500

Please report them to your bank and the financial regulatory bodies in SA and Belize

Hi

I have reported them to my bank. But I suspect it’s too late as it’s cleared my credit card.

I haven’t traded so haven’t lost any cash yet.

Can someone advise if they managed to get their cash back. If so how? Thanking you in advance.

Hi Jignesh unfortunately you won’t even be able to withdraw your money…tried it and it was approved eventually without me knowing,got no notice of payment or anything now my acc is at R0.00

BE WARNED

Stay away from Global.TradeATF

Thank you for all the warnings upfront. I will stay as far away from them as possible.

Scammed..lost R16000 in one day. This after I asked to have my money returned and the account closed. Asaf..the accounts manager promised to assist me to withdraw the next day…money is gone. Several requests made to close the account.

Let’s make a note of this : alex.ru@global.tradeatf.com and support@global.tradeatf.com is the emails they operate with.

I will send every single day of my life emails to inform people about this scam.

Please report them to your bank as well as the Financial Regulatory bodies in SA and Belize

i did try to reverse my money, my bank in SA to ld me that , since I gave the card details willingly, they are unable to assist me. My R100,000 is gone

This is a scam don’t waste your money!!!!!!!!!

Yes, I had thé same email with this Alexander Rui,I lost à lot of money, 180 000 US DOLAR.

Trade ATF is the worst trading platform globally(According to above comments a scam). The so called trade managers are clueless, think they know everything with only one thing in mind, is to take all your money!.

Don’t trust them at all. Big scammers.

The account manager Alex did not teach how to trade just told me what do to, choose from a random number and transfer me to some agent where you buy that’s after insisting i deposit R10000 in order to trade big and I lost all the money i put in then the next day, the other Indian lady calls to say, the previous account manager Alex is sick and made me loose money so i should deposit more money and she will do the right thing with me. This is a SCAM. Wish i read all this comments before

Please report them to your bank as well as the Financial regulatory bodies in SA and Belize

This guy’s are serious scamers I tryed them out. But little did they know that I was investigating them. Stay away please

Is ther any way to get your money back from.here as my fiance also joined them and put in R100000 and now lost al his money and they also blocked him he cant get hold of these people wot can we do please

Start at your bank.

Please report them to the South African and Belize regulatory bodies

TradeATF make use of misleading advertisements (invest $250 in Amazon) and once you have responded they call you to open your account and pay the money into it. This is when they start to push you to invest more money as according to them you’re nuts trying to trade with $250, but that was what they said. I then paid in another R20k to up my equity. Then the account manager drove me up the walls trying to push me to invest R500k in Tesla – money I don’t have and which he said I can borrow as I won’t have this opportunity again.

So, I decided to withdraw the money left in my account, but then they blocked me from accessing their website (it tells me they don’t trade in my country).

What can I do getting my money back, please?

Hi

The same happened to me.

Report as fraud to your bank,you’ll need an affidavit and police case. If it’s not too late you can ask for a charge back.

I’d also suggest you complain to the SA financial services as well as the Financial regulatory body in Belize

Hi Did you get your monies back.

The same happened to me I lost so much.

these scammers sound like they are chinese, but in fact these are nigerians acting like they from some where like the UK. But they sound like chinese. Please watch out for these fraudsters. They will con you and steal your money. Do not give them your banking details etc.

I find this company’s services great. It has really decent leverage and fast withdrawals. Educational resources are also perfect and help me a lot.

Really great broker to trade CFDs and bitcoin. Decent conditions, great support, comfortable platform

I don’t have years of experience in trading, but the service TradeATF provides is great! However, it took me some time and money to come up with a good strategy.

Evelyn surely you are working wit this fucking scammers, Are you not ashamed of yourself ?

best cfd broker

i mean it

guys do not belive these competitors

i made 100k rands in 2 days

best broker ever

This company is a scam. It scammed me R500 000 of my savings and from credit card and dissapeared on me today before christmas day. Left us on the streets because that’s where we are going. Thanks Andreea for fooling me.

Hi Im Mr Zwane,I have been scammed by atf trading,my R3600,went down the drain,if u want to withdraw they tell u,you can’t withdraw and ur money will take long,the account manager is one there,he calls himself by the name Ernest,he is a Nigerian,he is a scammer together some indians.Im advising u guys out there not to try and put ur money in this scam,pls I’m begging u all.

thank you for the advice, really helpful. any idea which trading platform is safe to use?

Hi Mr Zwane,yes they are scammers truly.When opening the account they called constantly and said they will assist in everything,but now I wanted to withdraw but nothing is happening even saw a withdrawal which I never made and it was approved without my permission and knowledge,you dont even get a notification by sms or email that money is withdrawn…They’ve scammed me of R3500 and I didn’t even do any Tranding

1. Does TradeATaf have offices in south Africa, Johannesburg or anywhere where in South Africa?

2.Can you please send me a link which can explain to me how investing in TradeATF is done and if are there any agencies which act as a middleman involved.

3. How many percentages are allocated for investing in TeadeATF.

4. Am I investing in another companies like Netflix via TradeATF or directly into TradeATF. I am asking from a beginner’s point of view.

Thank you.

Do not use ATF, there are more professional trading platforms.

If you are experienced you may make money, if not you can kiss your money goodbye.

They operate from Belize, seem to have an office in the UK.

You are so right, inexperienced traders like myself DO NOT touch this company specifically South Africans. I repeat, do not go near this company. Very misleading and liars brokers even their complaints department is swelling with liars.

The trading opportunities which the broker provides are exceptional. Such a variety of assets is great, and I try to make the most of this opportunity. I’m trading stocks, commodities and indices with TradeATF and I’ve already managed to gain several thousand dollars on such trades.

Important TradeATF Update

TradeATF Cyprus license is now under examination for voluntary renunciation of the authorisation. This means, at the moment TradeATF operates solely through its Belize entity which does not fall under serious regulations. We recommend avoid trading with TradeATF Belize entity due to luck of regulations. Randall says:

February 22, 2021 at 2:24 pm

Big fucking scammers, you starts with 250 usd and after they ask you for put more money for trade with other fields and the end you never can take your money back, cause your account is always is on risk and start to push for more money

Thank you Josue and Bryan P and TRade ATF for be a big thieves

Guys in short … I lost my life savings in less than a month . Do not even try to use these brokers I am out of my life long savings of Two Million Rands in less than a month . If you feel like it you can contact me on my Facebook page or on Cellno. 0829569224 . My name is Hermann Booysens. Please do not burn your fingers like I did … Stay far away as possible from this broker .. be warned. Good luck .. Hermann Booysens. Here is the prove copy and paste from there web site of payments made by me to ATF :

Processing requests

No requests at the moment

Transaction History

25 Mar 13:33

Card

Approved

+30000 ZAR

23 Mar 13:48

Declined

-90500 ZAR

21 Mar 17:07

Declined

-5000 ZAR

17 Mar 17:35

Card

Completed

-16000 ZAR

16 Mar 17:59

Card

Completed

-15000 ZAR

16 Mar 15:58

Other

Approved

+150000 ZAR

16 Mar 13:57

Card

Declined

+150000 ZAR

16 Mar 13:23

Other

Approved

+150000 ZAR

16 Mar 12:12

Other

Declined

+150000 ZAR

16 Mar 11:59

Other

Declined

+150000 ZAR

16 Mar 11:52

Other

Declined

+150000 ZAR

16 Mar 11:47

Other

Declined

+150000 ZAR

16 Mar 11:37

Card

Declined

+100000 ZAR

16 Mar 11:35

Card

Declined

+150000 ZAR

16 Mar 11:34

Other

Declined

+150000 ZAR

16 Mar 11:34

Card

Approved

+150000 ZAR

16 Mar 11:33

Other

Declined

+500000 ZAR

16 Mar 11:32

Card

Declined

+300000 ZAR

16 Mar 11:31

Card

Declined

+300000 ZAR

16 Mar 11:29

Card

Approved

+300000 ZAR

10 Mar 23:21

Card

Completed

-100000 ZAR

10 Mar 23:20

Card

Completed

-16000 ZAR

10 Mar 23:19

Card

Completed

-9000 ZAR

09 Mar 23:31

Card

Completed

-9000 ZAR

09 Mar 19:39

Other

Approved

+57000 ZAR

09 Mar 19:36

Other

Approved

+100000 ZAR

09 Mar 19:31

Other

Declined

+100000 ZAR

09 Mar 19:26

Other

Approved

+100000 ZAR

09 Mar 19:22

Other

Declined

+100000 ZAR

09 Mar 19:21

Other

Declined

+257000 ZAR

09 Mar 19:09

Card

Declined

+257000 ZAR

09 Mar 19:07

Card

Declined

+260000 ZAR

09 Mar 19:05

Card

Declined

+260000 ZAR

09 Mar 18:48

Card

Approved

+250000 ZAR

09 Mar 18:38

Card

Approved

+250000 ZAR

09 Mar 18:31

Card

Declined

+250000 ZAR

08 Mar 17:12

Card

Approved

+95000 ZAR

08 Mar 16:57

Card

Approved

+100000 ZAR

08 Mar 16:16

Card

Declined

+20000 ZAR

08 Mar 16:12

Card

Declined

+20000 ZAR

08 Mar 16:07

Card

Declined

+100000 ZAR

08 Mar 15:59

Card

Declined

+100000 ZAR

08 Mar 15:42

Card

Declined

+100000 ZAR

08 Mar 15:40

Card

Declined

+100000 ZAR

07 Mar 10:50

Card

Approved

+10000 ZAR