- Britannia Pros and Cons

- Is Britannia safe or a scam?

- Leverage

- Trading Fees

- Spread

- Funding methods

- Trading Platform

- Conclusion

What is Britannia?

Britannia Global Investments previously known as Destek Markets is a global forex and CFD broker, located and headquartered in London, UK while the company history started 25 years ago with its first group member Destek Yatirim established in Turkey.

The company was founded by an experienced team of online financial professionals that offers extensive experience to trade innovative trading products along with dedicated service and support. Since then, the company has expanded rapidly and enabled its operations across Europe and Asia.

Britannia Pros and Cons

Britannia is a good standing broker, however changed names several times, it provides good trading technology and solutions to automatic trading for a wide range of instruments.

For negative points, there is no proper education and instruments might be limited to CFDs and Forex.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation and License | FCA |

| 📉 Instruments | Currencies, Indices, Commodities and Metals. |

| 🖥 Platforms | MT4 |

| 💰 Costs | 1.57 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | GBP, USD, EUR |

| 💳 Minimum deposit | 100$ |

| 📚 Education | VIdeos, courses, Research |

| ☎ Customer Support | 24/5 |

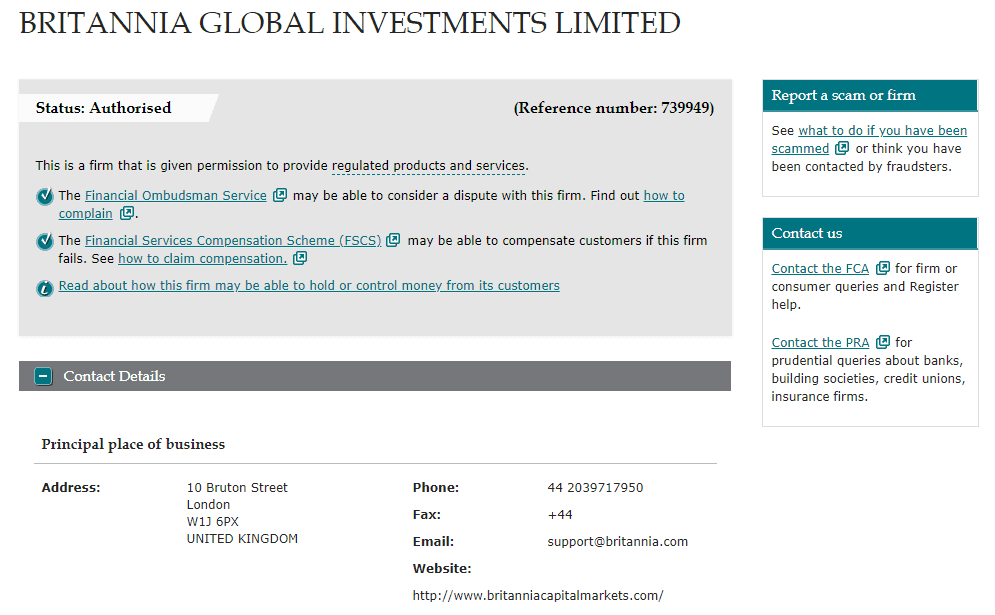

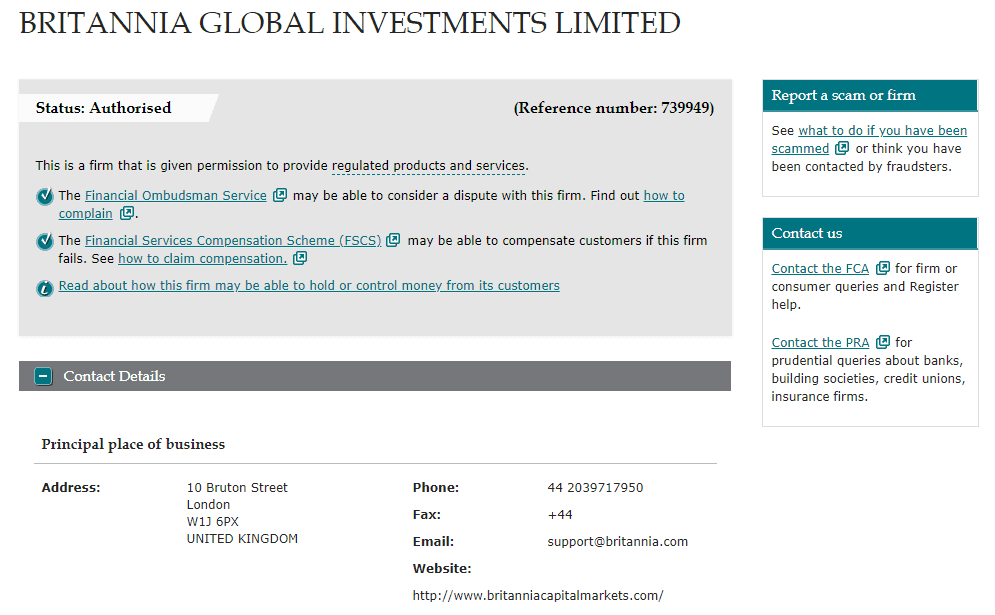

Is Britannia Global Investments safe or a scam

No, Britannia is not a scam.

Britannia Global Investment and its ex name Destek Markets is a UK based brokerage firm that is a fully authorized and regulated global company authorized by the local respected authority Financial Conduct Authority (FCA). As an FCA regulated broker, Britannia Global Investments Limited adheres to strict regulations and legislation, in order to provide the best possible protection for their clients.

Being a UK firm, which is some of the most respected jurisdictions worldwide for financial services, clients funds are held in accordance with the FCA’s Client Money Rules and segregated in Tier 1 bank accounts.

All accounts are monitored and reconciled on a daily basis to further the protection and integrity of clients’ funds. In addition, deposits up to £85,000 are also protected under the Financial Services Compensation Scheme (FSCS).

Leverage

While trading with Britannia Global you also offered to use tool leverage, which may increase your potential gains through its possibility to multiple initial accounts balance. Particularly leverage levels depending on some factors, including your personal level in trading, on the instrument, as well defined by the regulatory restrictions.

- Since, Britannia Global Investments is a UK and FCA authorized firm it demands a lower leverage level with a maximum of 1:30 for major currencies, 1:20 for minor ones and 1:10 for commodities.

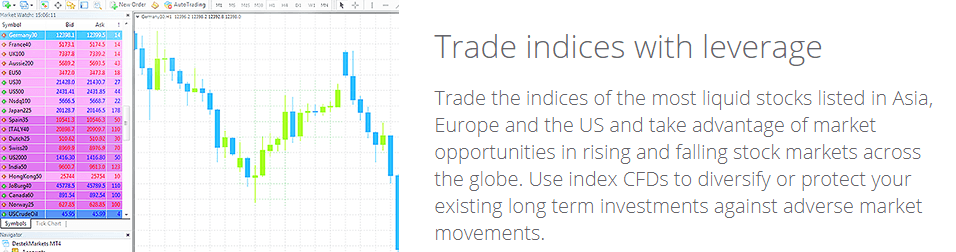

Trading Instruments

Combining technological ingenuity and range of offered services, Britannia Global delivers a trading experience that is suitable to the trader of any level.

The access to a selection of instruments on the industry-leading MetaTrader4 platform brings the capability to trade at the convenience while trading market range includes Currencies, Indices, Commodities and Metals.

Trading the world’s financial markets can be exciting and rewarding, yet sometimes daunting, especially for the new traders, and for that reason, Britannia Markets not only offers access to an advanced range of financial instruments and financial investment opportunities but also provides support to make you a better trader.

Account types

The account types to choose from start from the Standard offering which requires only 100$ initial balance and delivers an average spread of 1.57 for EURUSD based on a floating spread basis.

Further and more competitive offering divides by your personal level of experience, as well as the balance maintenance with the opportunity to get extra tight spreads.

Indeed, this diversification allows a different level of traders to choose the best suitable personally trading option. And of course, all trading accounts feature a full service designed by Britannia Global and include a range of support, analytical and other services.

Fees

Britannia fees are based on a spread and different in each account type. Other fees like funding fees or inactivity fees see in the table below.

| Fees | Britannia Fees | Axiory Fees | Plus500 Fees |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Fee ranking | Low | Average | Low |

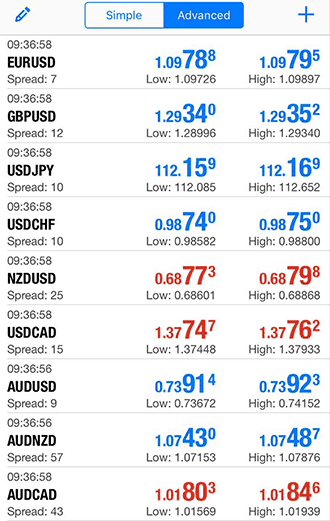

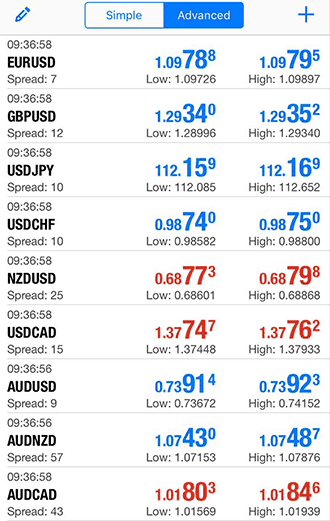

Spread

Britannia spread will be defined by the account type you trading through, while Gold Account requires 1,000$ as a deposit offering lower costs with average spread EURUSD 1.17 with no commission charges. The VIP account serves clients from 5,000$ and sufficiently decreased spreads to only 0.77 EURUSD, and the last proposal is a professional choice of ECN Account with the maintenance of 10,000$ and interbank spreads of 0.17 for EURUSD.

For instance see typical X Open Hub spreads for Forex instruments below, as well you may check BlackBull Markets spreads to know better retail pricing of the company.

| Asset | Britannia Spread | Axiory Spread | Plus500 Spread |

|---|

| EUR USD Spread | 0.7 pip | 1.2 pip | 0.6 pip |

| Crude Oil WTI Spread | 4 | 5 | 2 |

| Gold Spread | 0.2 | 0.3 | 0.29 |

Rollover

At the end of each trading day all open positions are rolled to the next day, while you will be debited or credited a rollover or overnight fee, based on the difference in interest rate between the instrument involved in the trade. For a detailed overview of the rollover charges per instrument you may see information through the platform or refer to Rollover Rates.

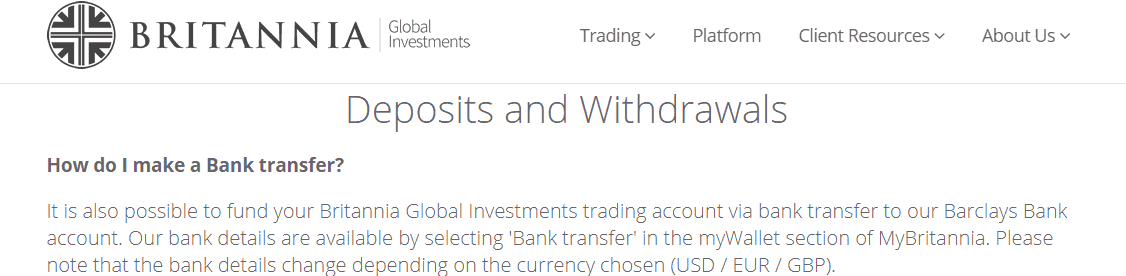

Payment Methods

Depositing funds with Britannia Global Investment is a safe and simple process, while the fastest way to fund the trading account is allowed by credit, debit card or eWallet, so the payment should reach trading account within minutes. Yet, a choice to fund an account via a bank transfer remains available too and is solely your preference.

Minimum deposit

Britannia live trading requires USD / EUR / GBP 100. For all deposits for Britannia there is a minimum deposit requirement of USD / EUR / GBP 20

Britannia minimum deposit vs other brokers

|

HYCM Britannia |

Most Other Brokers |

| Minimum Deposit |

$100 |

$500 |

Withdrawal

For withdrawal of funds from the Britannia account, the requests usually performed via secure client account management area, while once the withdrawal request has been approved funds will be sent via the chosen method. In addition, there are no fees to withdraw funds from the trading account making your transactions easier as well.

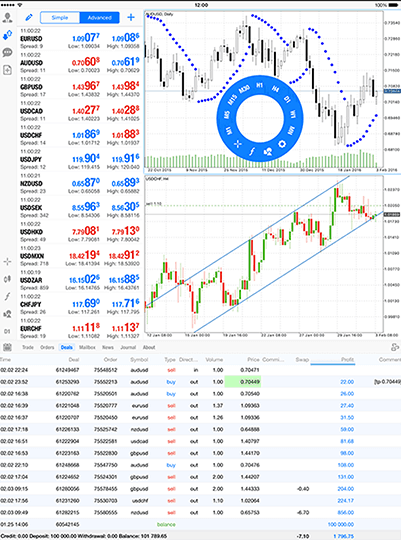

Trading Platforms

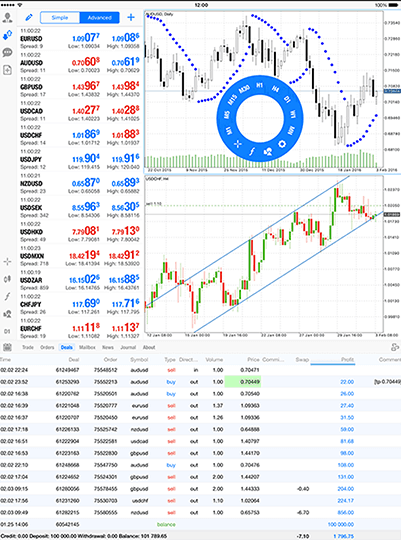

Britannia Global Investments mainstays and offers you trading through the MetaTrader4 technology that allows access to trade anywhere and at any time across multiple devices available from a single account. With a wide range of trading tools and a secure user-friendly interface, the platform is the world most popular system since it’s suitable for traders of the highest skill and the beginners as well.

The Destek Markets MT4 available as a desktop program for any operating system, as a Web application or the mobile version app, developed specifically to monitor and execute positions from the mobile or tablet.

Together with its great capabilities, MT4 powerful analytical tools packed with, allow you to increase capabilities while easily navigating through the platform and enhance the informed trading decisions. Overall, MT4 delivers flexible and convenient trading with various order types, enables interactive trading from the chart on 9 different timeframes.

Research

The selection of the tools includes 50+ indicators and analytical objects along with the trading signals that constantly monitor the market situation, as well as to automate trading via Copy trading tools.

Conclusion

Britannia review presents a company with a long operating history, previously known as Destek Markets, while the firm approached firstly the local region and further spread its services globally. Traders can enjoy a wide selection of products to trade with no hidden costs on a variety of account types and cross-device platforms.

The provided support also helping in everyday trading, along with the market analysis and trading specifications. Overall, the broker delivers a reliable offering to the traders of any level and with different capabilities that may allow international traders to engage in trading with them.

Britannia Updates

Recently Britannia website remains inactive and unavailable to reach, meaning the broker mutes its trading offering and does not propose account openings. We recommend to make your own research in case you see receive an offering about trading. Scam brokers often use ex-names of regulated brokers to attract clients.

Share this article [addtoany url="https://55brokers.com/destek-markets-review/" title="Destek Markets"]