- What is Blueberry Markets?

- Blueberry Markets Pros and Cons

- Is Blueberry Markets safe or a scam?

- Leverage

- Accounts

- Fees

- Spread

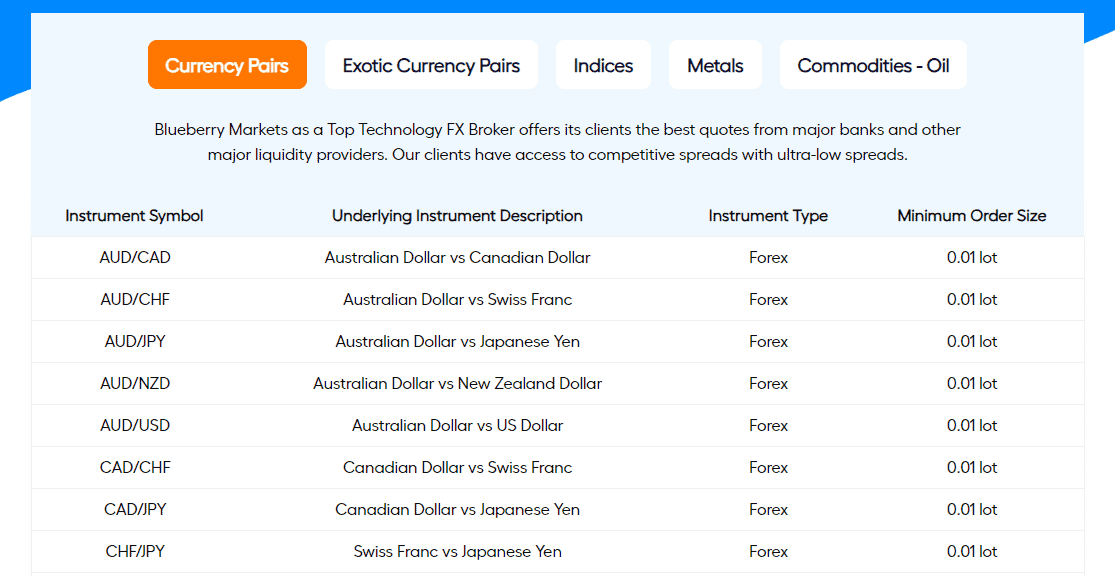

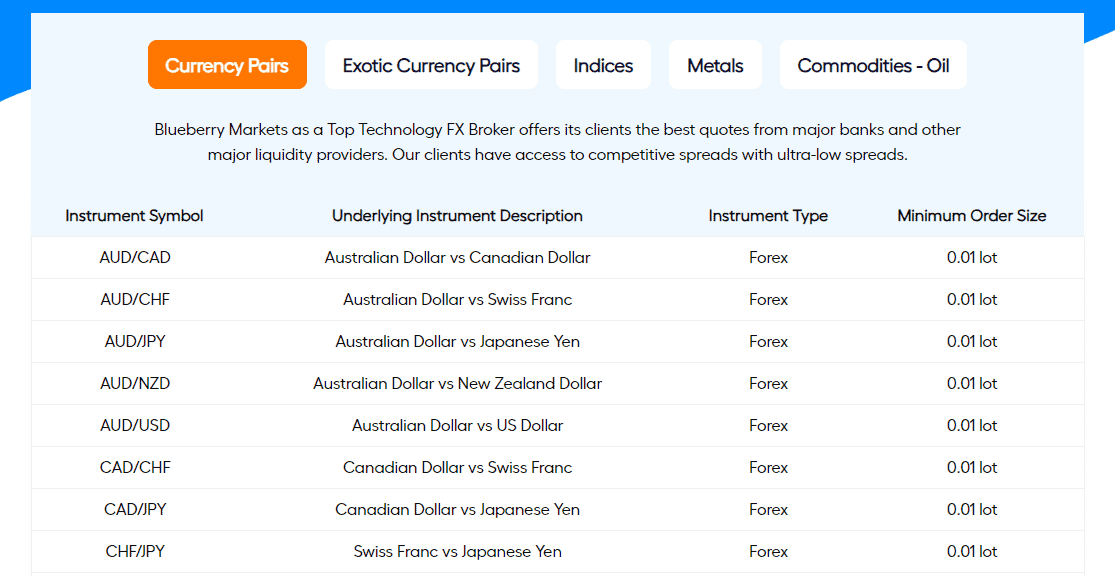

- Market Instruments

- Deposits and Withdrawals

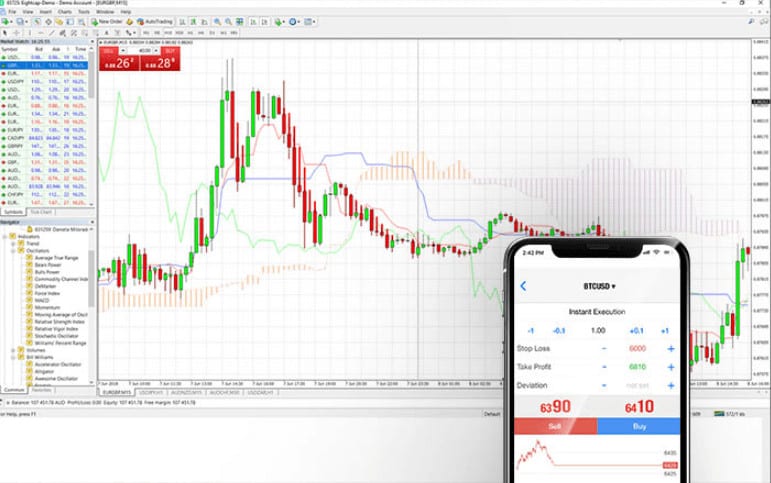

- Trading Platform

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about Blueberry Markets.

What is Blueberry Markets?

Blueberry Markets is an Australian Forex trading broker, also a trading name that operates under a quite popular larger broker ACY that offers transparent pricing and allows to benefit from industry-leading technology solutions using various liquidity providers.

The broker has been operating for over a decade and since then has gained a great reputation among traders and the industry itself. Blueberry Markets do provide not only tight spreads and light-speed execution but also tailored its solution towards ambitious traders that strive to become good players in a long-term game.

What Type of Broker is Blueberry Markets?

Blueberry Markets is an ECN broker offering Forex, share CFDs, crypto CFDs, commodities and metals, and indices. Based on our research, we found out that the broker offers Forex fundamental and technical analysis trading strategies, as well as, Forex day trading, momentum, support, and resistance strategies.

Where is Blueberry Markets Based?

Blueberry Markets is an Australian Forex and CFDs broker. The headquarter of the broker is located in North Sydney, NSW 2060, Australia

Blueberry Markets Pros and Cons

Blueberry Markets is a reputable, well-regulated broker famous for Forex, CFDs, indices, and commodities trading. The broker carries a top-tier regulatory license by ASIC (AU). For the Pros, we found that Blueberry also offers advanced trading platforms MT4/MT5.

In our expert opinion, there are not so many Cons for Blueberry Markets like regulation availability in an offshore zone, some limited financial instruments, and so on.

| Advantages | Disadvantages |

|---|

| Regulated by ASIC

| Free-of-charge withdrawals only in Australia |

| Low Minimum deposit | International regulation available via offshore zone |

| Over-the-counter Market | Limited financial instruments |

| Spreads from 0.0 | |

| MT4/MT5 platforms | |

| Competitive low pricing | |

| 24/7 Customer service | |

Blueberry Markets Review Summary in 10 Points

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | ASIC, VFSC |

| 🖥 Platforms | MT4, MT5 |

| 📉 Instruments | Major and minor currency pairs, oil, gold, silver and global indices |

| 💰 EUR/USD Spread | 1 pips |

| 🎮 Demo Account | Yes |

| 💳 Minimum deposit | $100 |

| 💰 Base currencies | Various currencies supported |

| 📚 Education | Education not available, only research tools |

| ☎ Customer Support | 24/7 |

Overall Blueberry Markets Ranking

Based on our Expert findings, Blueberry Markets is considered a reputable broker with safe and quality trading conditions. The broker offers a range of trading services designed for both beginner traders and professionals with low initial deposit amounts.

- Blueberry Markets Overall Ranking is 7 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | Blueberry Markets | HFM | BalckBull Markets |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Low Spreads and Pricing | Education | Spreads |

Blueberry Markets Alternative Brokers

Blueberry Markets is an ASIC-regulated broker providing Forex and CFDs with low spreads from 0.0 pips, fast and reliable execution, and a user-friendly platform. However, there are a number of other brokers that offer similar services. Here are some of the best alternatives to Blueberry Markets:

Awards

Blueberry Markets is a trusted worldwide trading platform for Forex and CFD trading, commodities trading, and more. The broker has also garnered collective recognition from award-giving bodies in the industry:

Is Blueberry Markets Safe or Scam?

Based on our research we found out that Blueberry Markets is not a scam broker. Blueberry Markets is a trading name used by ACY respectively registered with the Australian Securities and Investments Commission (ASIC), which means the broker is subject to strict regulation. Furthermore, Blueberry Markets holds an AFSL License, so it is required to adhere to certain standards of conduct.

Is Blueberry Markets Legit?

In simple words, ASIC is a license received in Australia thus Blueberry Markets is a fully legit and regulated broker which also means a trustable broker, as authority constantly oversees firms’ activity and trading services they provide, in reverse guaranteeing your safe investment. ASIC is also a recognized world authority that regulates Forex and the trading industry and is a custom-oriented regulator.

- Blueberry Markets has a strong focus on customer service and provides 24/7 support via live chat, phone, and email. The broker also offers a demo account so that traders can test out the platform before committing to a live account.

See our conclusion on Blueberry Markets Reliability:

- Our Ranked Blueberry Markets Trust Score is 7 out 0f 10 for good reputation and services over the years, with powerful trading tools, tight spreads, and live support.

| Blueberry Markets Strong Points | Blueberry Markets Weak Points |

|---|

| Regulated by ASIC | International Regulation Available via Offshore Zone |

| Over-the-Counter Market | |

| Spreads from 0.0 | |

| Negative Balance Protection | |

How Are You Protected?

Therefore, Blueberry Markets and its ACY company meet the highest standard of governance, financial reporting, and disclosure. All retail client funds are kept separately from business funds in segregated bank accounts while the broker also undertakes additional protection by the professional indemnity insurance policy.

Leverage

One of the great features of Forex trading and a part of Blueberry Markets Review and check is an allowance to use leverage, which may increase your potential gains timely.

Blueberry Markets Leverage fall under regulatory restrictions being an Australian brokerage still allows high leverage ratios:

- Maximum leverage 1:30 for Forex instruments

- Leverage 1:500 for International resident clients

This all in all brings vast opportunities specifically for retail traders, as your trading size may magnificently enlarge. Nevertheless, always learn deeply about how to use maximum leverage smartly as “unhealthy” use may increase your risk dramatically and demands some higher margins as well.

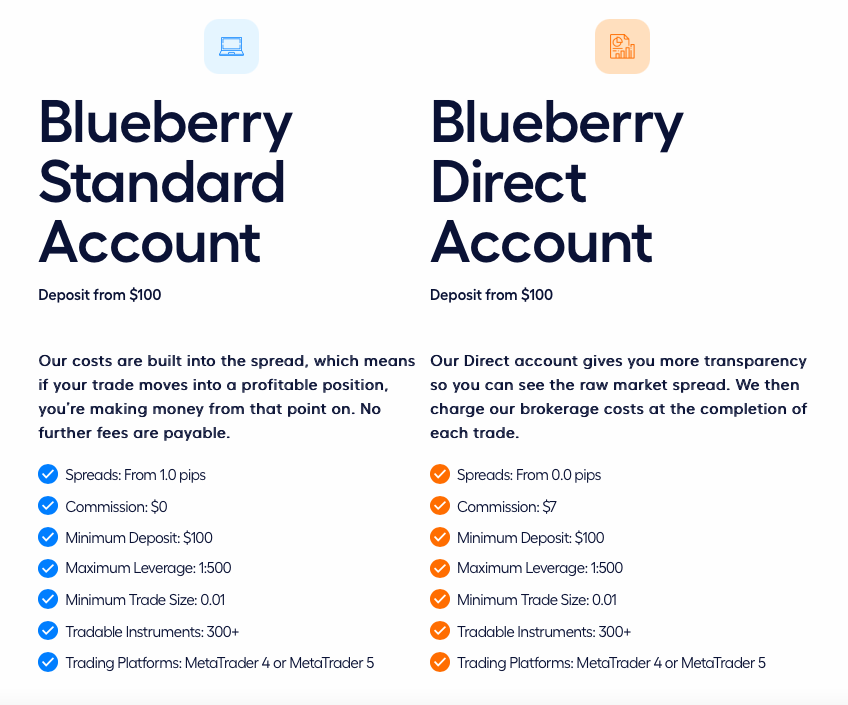

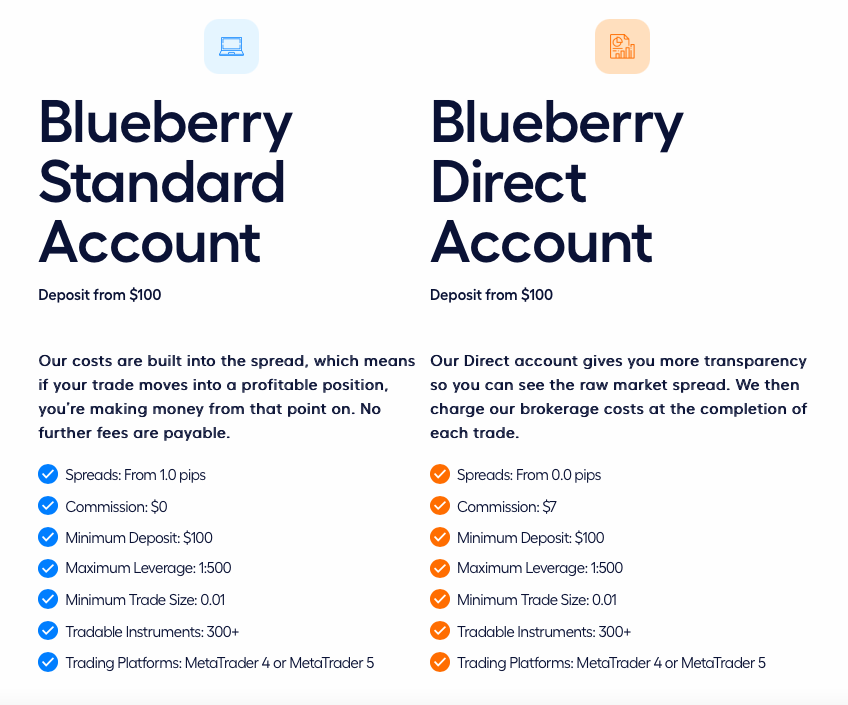

Account Types

The main two types of accounts offered by Blueberry Markets are a Blueberry standard account with $0 commission, and a Blueberry Direct account with raw spreads and a commission fee. A risk-free Demo account is also available in Blueberry Markets.

We also found out that if you’re a professional trader there is a possibility to trade through a Premium account with better conditions and tailored solutions suitable for traders with experience and those that operate bigger sizes. See some of our notes about Blueberry Markets accounts below:

| Pros | Cons |

|---|

| Easy account opening | Accounts and offers depends on the entity |

| 300+ trading instruments | |

| Low minimum deposits | |

| No hidden fees | |

How to Trade in Blueberry Markets?

Starting to trade with Blueberry Markets, you will first need to open an account and deposit funds. The process is simple and can be done entirely online. Once your account has been approved, you can then make a deposit using one of the many methods available. Based on our research we found out that Blueberry Markets offers a user-friendly platform with all the tools and resources you need to trade successfully.

How to Open Blueberry Markets Live Account?

Opening an account with Blueberry Markets is quite simple. You should follow the opening account or sign-in page and proceed with the guided steps:

- You would be advised to upload a copy of your ID and residence in order to prove your identity

- Once the account is confirmed you will get access to your Client Portal where all your account management is happening, and proceed with the first deposit.

Blueberry Markets Trading Instruments

The marker range also includes access to vast trading instruments offered by Blueberry ECN including Forex, Oil and Metal commodities, Indices, Cryptocurrencies, and Australian and the US Share CFDs. The total number is around 300 instruments across major and most traded instruments.

- Blueberry Markets Market Range Score is 7 out of 10 for 300+ financial instruments among Currencies, Indices, Metals, Cryptocurrency CFDs, and Share CFDs

Can You Trade Crypto on Blueberry Markets?

Our experts found out that you can trade cryptocurrencies with Blueberry Markets as CFDs, which will let you speculate on the price movement of cryptocurrencies without taking ownership of the actual underlying assets.

Blueberry Markets Fees

Blueberry Markets fees are based on a tight spread offering from 0.0 pips for professionals, also broker applies 0 commission on a standard account but charges a higher spread with service markup.

What is Swap Fee?

Also, always consider the overnight fee as a cost referred to as the Rollover rate, an interest for holding positions open overnight in Forex trading. It is determined by the overnight interest rate and is a differential between two involved in trade currencies.

- Blueberry Markets fees are ranked low with an overall rating of 8 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity offering, see our findings of fees and pricing in the table below, however, Blueberry Markets’ overall fees are considered good.

| Fees | Blueberry Markets Fees | AvaTrade Fees | eToro Fees |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | No | Yes | Yes |

| Fee ranking | Low | Average | High |

Spreads

Blueberry Markets Standard accounts with spread-only spreads are higher, due to costs that are inbuilt into the spread, so you will get around 1 pip for EUR USD, which is actually still considered a good proposal.

What is Blueberry Markets Commission?

If you trade with a professional account, there is a commission charge of $7, which is also may be lowered for high-volume traders and the spread is interbank offering typically 0.2 pips for EUR USD pair.

- Blueberry Markets Spreads are ranked low with an overall rating of 8 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower than the industry average of 1.2 pips for EURUSD, and spreads for other instruments are very attractive too

Comparison between Blueberry Markets fees and similar brokers

| Asset/ Pair | Blueberry Markets Spread | AvaTrade Spread | eToro Spread |

|---|

| EUR USD Spread | 1 pips | 1.3 pips | 3 pips |

| Crude Oil WTI Spread | 4 | 3 | 5 |

| Gold Spread | 30 | 40 | 45 |

Deposits and Withdrawals

The number of payment methods to fund the trading account will allow you to transfer funds quickly by the use of Visa/MasterCard, Skrill, POLi Payment, fasapay, and Bank Wire Transfers.

While you may choose a base account currency which will also assist in seamless transfer with no conversion fees.

- Blueberry Markets Funding Methods we ranked Good with an overall rating of 8 out of 10. The minimum deposit is among average in the industry, yet fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity

Here are some good and negative points for Blueberry Markets funding methods:

| Blueberry Markets Advantage | Blueberry Markets Disadvantage |

|---|

| $100 is a first deposit amount | Methods and fees vary in each entity |

| Fast digital deposits, including Skrill, and Credit Cards | |

| No internal fees for deposits and withdrawals | |

| Withdrawal requests confirmed 1-3 business days | |

Deposit Options

In terms of funding methods, Blueberry Markets offers numerous payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

Blueberry Markets Minimum Deposit

The minimum deposit amount requires $100 if you apply for a Standard account based on spread only. For professionals and accounts with tailored solutions, $2,000$ as the first deposit is considered a great opportunity for high-volume traders.

Blueberry Markets minimum deposit vs other brokers

|

Blueberry Markets |

Most Other Brokers |

| Minimum Deposit |

$100 |

$500 |

Blueberry Markets Withdrawals

Blueberry Markets does not charge any internal fees for deposits or withdrawals, and also includes a wide selection of payment methods. Yet, you should check with your payment provider in case any fees are waived due to international policies for money transfers, as some charges may be applicable, as well as regulatory requirements for Withdrawals to Bank Accounts only or so.

How Withdraw Money from Blueberry Markets Step by Step:

We found out that Blueberry Markets process the withdrawal transactions within 24 hours.

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

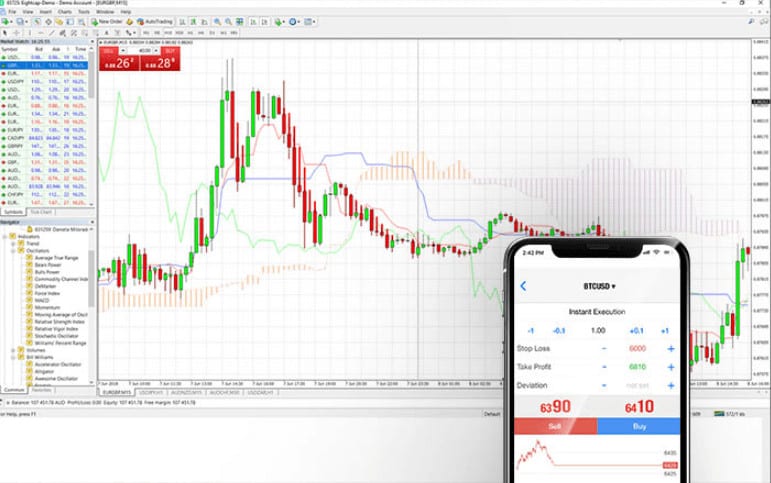

Trading Platforms

Blueberry Markets Platform offers MetaTrader4 and MetaTrader 5 its newer version as a platform, and the choice is not a surprise as its numerous features and tools bring the perfect combination to the technological execution. The platforms are available for almost any device including Web versions, desktop, and Mobile apps.

- Blueberry Markets Platform is ranked Excellent with an overall rating of 8 out of 10 compared to over 500 other brokers. We mark it as excellent being one of the best proposals we saw in the industry, and a great range including MT4, and MT5, suitable for professional trading. Also, all are provided with good research and excellent tools

Trading Platform Comparison to Other Brokers:

| Platforms | Blueberry Markets Platforms | Pepperstone Platforms | Plus500 Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | No |

| cTrader | No | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Desktop Platform

Eventually, both platforms do not require much saying, as being an “industry standard” software bringing powerful capabilities through great chart features, numerous add-ons, automated trading opportunities through live Forex trading room, and much more.

In addition, Blueberry desktop advanced platforms are packed with free tools, in-depth trading history, and access to more capabilities available exclusively to Blueberry Markets traders, which is great for both beginners and professionals.

Mobile Trading Platform

Also, you may use the Blueberry Markets mobile app that gives you full capacity of control over your orders or an account. Applications are available for both MetaTrader versions and are suitable for any smartphone along with push notifications and great customization.

Customer Support

What we should mention with good points is a responsive 24/7 Customer Service that Blueberry Markets run. Their answers are quick and relevant, so you can count on good support and understanding of your concerns at any time. You can contact customer service via Live chat, emails, phone lines, or leave a message with the contact form.

- Customer Support in Blueberry Markets is ranked Excellent with an overall rating of 7 out of 10 based on our testing. We got some of the fastest and most knowledgeable responses compared to other brokers, also quite easy to reach during the working days

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| 24/7 customer support | None |

| Availability of Live Chat | |

| Quick response | |

| Relevant answers | |

Blueberry Markets Education

Blueberry Markets provide their clients with daily Forex market updates via their official YouTube page. They also update their trading blog daily which is accessible via their website.

Blueberry Markets will support only good research tools that are inbuilt into the platforms and available for free use. Also, there are copy trade options so you can get some trading ideas as well.

- Blueberry Markets Education ranked with an overall rating of 9 out of 10 based on our research. Blueberry provides very good quality educational materials, and excellent research also cooperates with market-leading providers of data.

Blueberry Markets Review Conclusion

Concluding Blueberry Markets review, we admit a safe broker to trade with, also established with respect to Australian laws and competitive pricing. What we really appreciate in its offering, is a great balance between the trading conditions, environment, and support Blueberry Markets provides. Also, both beginning and experienced traders may find it good may in possible long-term trading success.

Based on Our findings and Financial Expert Opinions Blueberry Markets is Good for:

- Beginners

- Professional traders

- Traders prefer MT4/MT5 platforms

- Algorithmic or API traders

- Forex and CFD trading

- Tight spreads

- Suitable for a variety of trading strategies

- Traders who need 24/7 customer support

Share this article [addtoany url="https://55brokers.com/blueberry-markets/" title="Blueberry Markets"]

Don’t be afraid narrate your problems to nexusinvestigationsgroup,,.com

Worst broker i ever came across. I couldnt even get verified. Stuck on verification screen.Tried so many ways but still dosnt work. even with the help of 2 agents. Even from mobile. Red flag 1 right there.

when i registered my email i didnt receive email verification….Red flag 2….

Ill pass on this

Hi Do you accept clients from South Africa?

Do not open blueberry market account, set my stop lost also need to paid extra 10 over pips.the platform can not trust. Buy and sell need 5sec or more to get verified. V.poor system.

If you’re a beginner $100 is safe to start bud use proper risk management (0.01 lots size)

Good Day

Do you guys accept clients from Canada?

Can I trade U.S stocks with you?

What amount do I need to be able to trade US30 and Nas100 besides the pairs..I’m in US

Do you accept clients from Canada? Particularly those residing in Alberta, Canada?

I notice you looking for a Tax number for Irish traders. Does the account get reported to the Irish revenue

Trade spot forex or cfd forex ?

hi iam basically from india but currently working in mauritius so can i able to do trade with your system

Hi, Jubin. Thank you for showing interest in our platform. Yes, you may open an account with us. Please visit our website at blueberrymarkets.com for more information. Cheers!

Do they accept client from uae? There are fx brokers here but most of them are fraudulent.. So anyone can tell if they accept client from uae??

Hi, Ali. Thank you for reaching out. Yes, we do accept clients based in UAE. You may visit our website at blueberrymarkets.com to open an account 🙂

Hello. Do you accept clients from Vietnam?

Hi Maximum Electra, unfortunately, we do not accept clients from Vietnam as of now.

Does Blueberry Markets accepts customers from Japan? Thanks

Hi Andre, absolutely! We accept clients from Japan.

Do you accept client from indonesia?

Hi Irvan, Yes! Clients from Indonesia are welcome at Blueberry Markets.

Do you accept client from Malaysia? Is blueberry market legit in Malaysia? Thanks.

Hi, ALi. Absolutely! We accept clients based in Malaysia. For the full list of requirements, please visit our website at blueberrymarkets.com

Hi, Pedro! Many thanks for your kind words here. Cheers, mate!

Hi, Ankit! Unfortunately, we do not accept clients from India as of now.

Cis this platform be trading by own or havin account manager to trade for myself?

Hi, Roberto. Great question! Our clients will have their own dedicated account managers who will help them with their trades whenever they sign up for an account with us.

do you accept clients from Tanzania?

Hi, Saqilo. We currently do not accept clients from Tanzania.

do you accept client from india??

Hi from Philippines.Yes they have very good customer support all doubtful question on my mind answered clearly. Thank you very much. Keep it up guysss. 😁😁😁

Hi Pasindu, we are incredibly sorry for your negative experience. We tried looking up your name on our records but we could not find you. Is it possible for you to reach out to our Support Team so that we can address your needs. Thank you for the honest assessment and we will use it as a springboard to improve our overall customer experience.

If you had finally received your withdrawal then why are you going around complaining in every platform? No broker is perfect. So let them be!I have not yet opened an account with them, but I have read lots of reviews about them.

Money withdrawal is annoying. Terrible process! Such a waste of time. Had to contact support several times even the bank wire transfer is within Australia.

Ex – Initial deposit US$ 500

After trading one week Balance $691 (Equity 100%)

I have to submit one request for $500, they will only send it to master card.

Rest $191 , I have to use bank wire method.

They charge $20 if the bank is not in Australia

Complete bulshit! And high spreads as well

U expect us 🇺🇸 traders?

Hi Warren yes US traders are welcome

Why are there only 2 metals to trade namely gold and silver ? What about copper and palladium and the other less well

metals ?

Hello, Do you also accept clients from Nigeria?

I guess this is same question i also have

Hello! Yes we accept clients from Nigeria! You are very welcome to reach out to us at support@blueberrymarkets.com. We have a very friendly and responsive support team who can walk you through the application process