- What is Pacific Financial Derivatives?

- Is Pacific Financial Derivatives Safe or a Scam?

- Leverage

- Fees

- Spread

- Deposits and Withdrawals

- Trading Platform

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about Pacific Financial Derivatives.

What is Pacific Financial Derivatives?

Pacific Financial Derivatives is a New Zealand-based company that provides trading services for Forex, CFDs, cryptocurrencies, commodities, indices, and other financial instruments.

Initially, as we found, the company started as an authorized Introducing Broker (IB) leveraging Japanese technology and expertise. Later on, it expanded its services and became an authorized Futures Dealer as well as a registered Financial Service Provider.

Pacific Financial Derivatives Pros and Cons

Pacific Financial Derivatives is a regulated broker that provides advanced trading technology and competitive pricing. The broker ensures secure trading conditions with support for the NDD execution model, deep liquidity, fast account opening, and other features.

For the Cons, there is no 24/7 customer support, and the educational and research materials are limited, which may make it challenging for beginner traders to get started.

| Advantages | Disadvantages |

|---|

| Competitive trading costs and spreads | No 24/7 customer support |

| Wide range of trading products | Lack of educational and research materials |

| Regulated and licensed broker | |

| NDD execution | |

Pacific Financial Derivatives Review Summary in 10 Points

| 🏢 Headquarters | New Zealand |

| 🗺️ Regulation and License | FMA |

| 📉 Instruments | Forex, Spot Metals, Commodities, CFDs, Indices, Futures, Contracts, etc. |

| 🖥 Platforms | MT4 |

| 💰 EUR/USD Spread | 0.5 pips |

| 💳 Minimum deposit | $0 |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | AUD, USD |

| 📚 Education | Provided |

| ☎ Customer Support | 24/5 |

Overall Pacific Financial Derivatives Ranking

Pacific Financial Derivatives is a well-regulated broker that provides traders with reliable trading solutions. The broker offers a diverse selection of trading instruments with competitive spreads and fees.

- Pacific Financial Derivatives Overall Ranking is 8.5 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | Pacific Financial Derivatives | Just2Trade | Globex360 |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Trading Instruments | Trading Platforms | Spreads |

Pacific Financial Derivatives Alternative Brokers

While Pacific Financial Derivatives offers good trading conditions and competitive fees, it is worth noting that there are other brokers in the market that offer similar services. Here are some of the best alternatives to consider:

Awards

Our findings show that Pacific Financial Derivatives has been recognized with several awards from reputable industry organizations, as seen in the screenshot below.

Is Pacific Financial Derivatives Safe or Scam?

No, Pacific Financial Derivatives is not a scam. We got in our research that Pacific Financial Derivatives was regulated by the New Zealand authority FMA to deal with Futures since 2011. Additionally, four years later, the company obtained the license as a Derivatives Issuer.

Is Pacific Financial Derivatives Legit?

Yes, Pacific Financial Derivatives is a legit and regulated broker.

At the beginning of the PFD history, the company was authorized by the Securities Commission as an Authorised IB with the NZ Futures and Options Exchange. Then the firm spreads its services and gained a license to behave as NZX Futures and Options Participant Firm.

See our conclusion on Pacific Financial Derivatives Reliability:

- Our Ranked Pacific Financial Derivatives Trust Score is 8.5 out of 10 for the good reputation and services provided, also for a reliable license. However, the broker is authorized by only one regulatory body for its trading services.

| Pacific Financial Derivatives Strong Points | Pacific Financial Derivatives Weak Points |

|---|

| Regulated broker | Holding one regulatory license |

| Safe trading conditions | No negative balance protection and compensation scheme |

| Segregated accounts | |

How Are You Protected?

Financial Markets Authority (New Zealand), as we found, ensures that the broker operates in compliance with key legislations, anti-money laundering measures, and fair dealing provisions, providing a safe trading environment for investors.

Generally, the FMA is an agency tasked with regulating capital markets and financial services in New Zealand, with a focus on promoting efficiency and transparency.

Leverage

Leverage tool indeed is a powerful feature, yet you should learn deeply how to use it the best way, as leverage may work in reverse to your gains too. At PFD, you will have the flexibility to choose suitable leverage for your trading needs.

Pacific Financial Derivatives leverage is offered according to FMA New Zealand regulation:

- Traders are eligible to use a maximum of up to 1:300 for accounts with equity up to $5,000, and 1:100 for above $5,000.

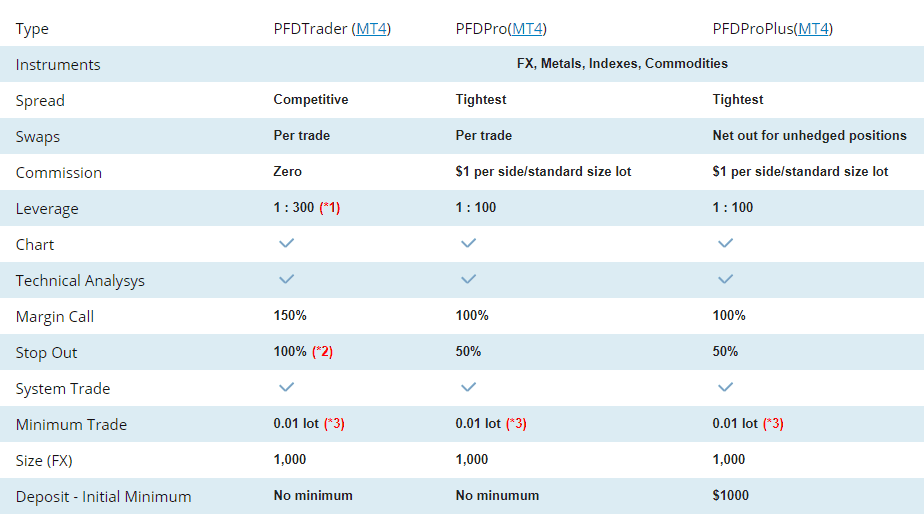

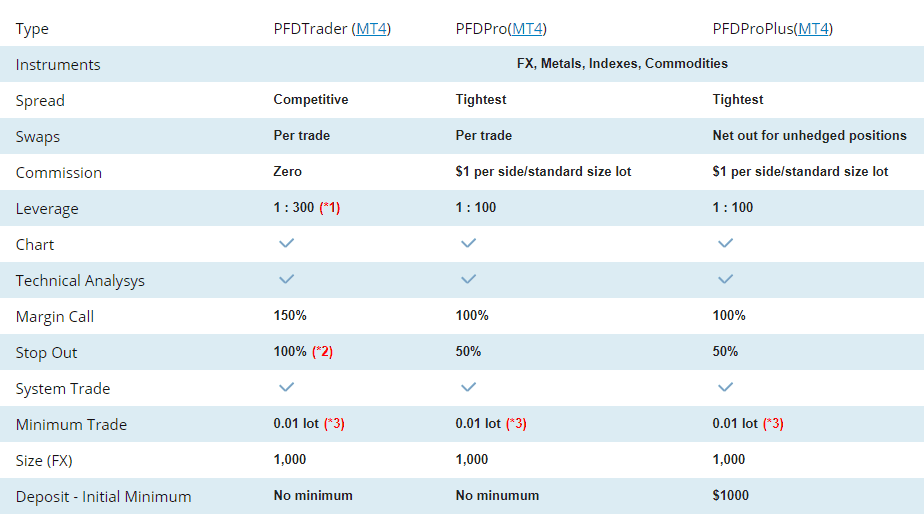

Account Types

We got in our test trade that PFD Broker has designed three account types offering access to all available trading instruments through a range of suited trading conditions. And of course, trading terminals provide daily and monthly statements, risk management through profit and loss positions, and unparalleled support.

Furthermore, there is an opportunity to open an Islamic account for clients who follows Sharia rules, which features an account with no rollover interest on overnight positions. As well as a Demo account that is available for newbie traders, to practice and polish their skills and also be aware of swap.

| Pros | Cons |

|---|

| Demo and Islamic accounts available | None |

| Fast account opening | |

| No minimum deposit amount | |

| Account base currencies AUD, USD | |

How to Open Pacific Financial Derivatives Live Account?

Opening an account with PFD is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open an Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by upload of documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Trading Instruments

Pacific Financial Derivatives offers a range of financial instruments for traders of all sizes and from around the world, including Forex, Spot Metals, Commodities, CFDs, Indices, Cryptos, Futures, and Contracts. The broker operates on the NDD model, providing a straight-through process for trading. One advantage we found is the ability to trade both Forex and CFDs with a single account.

- Pacific Financial Derivatives Markets Range Score is 9 out of 10 for wide trading instrument selection. On the other hand, stocks, shares, and bonds are not available to trade.

Pacific Financial Derivatives Fees

Our research shows that Pacific Financial Derivative fees primarily depend on the spread and the type of account you select. PFDTrader account does not have any commission fees, whereas PFDPro and PFDProPlus accounts charge a commission fee of $1 per side.

You should also be aware of swap or rollover rates that may be charged on the opened positions overnight like 1% for short positions. In addition, Pacific Financial Derivatives charges a $25 inactivity fee.

- Pacific Financial Derivatives Fees are ranked low or average with an overall rating of 8.5 out of 10 based on our testing, and compared to over 500 other brokers.

| Fees | Pacific Financial Derivatives Fees | Just2Trade Fees | PhillipCapital Fees |

|---|

| Deposit fee | Yes | No | No |

| Withdrawal fee | Yes | Yes | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low, average | Low | Low |

Spreads

As we found, Pacific Financial Derivatives spreads vary according to the account type you choose, as shown in the table below. On average, the spread for EUR/USD is 0.5 pips. Additionally, if you choose to open a PFDPro or PFDProPlus account, you will have access to some of the tightest spreads that the broker offers.

- Pacific Financial Derivatives Spreads are ranked low with an overall rating of 8.5 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower than the industry average, and spreads for other instruments are very attractive too.

| Asset/ Pair | Pacific Financial Derivatives Spread | Just2Trade Spread | PhillipCapital Spread |

|---|

| EUR USD Spread | 0.5 pips | 0.5 pips | 0.6 pips |

| Crude Oil WTI Spread | - | 0.6 pips | 4.1 pips |

| Gold Spread | 14.5 pips | 1.5 pips | 3.8 pips |

Deposits and Withdrawals

While trading with Pacific Financial Derivatives, we found that you will have various options to fund your accounts such as Bank Wire, Credit/Debit cards, PayPal, Skrill, and more. However, it is important to keep in mind that payment providers may apply fees depending on the payment method used.

- Pacific Financial Derivatives Funding Methods we ranked good with an overall rating of 8.5 out of 10. Fees are low, and also you can benefit from various account-based currencies.

Here are some good and negative points for Pacific Financial Derivatives funding methods found:

| Pacific Financial Derivatives Advantage | Pacific Financial Derivatives Disadvantage |

|---|

| Multiple account base currencies | There might be some charges for deposits and withdrawals |

| Fast digital deposits, including Credit/Debit Cards | |

| Variety of funding methods | |

Deposit Options

In terms of funding methods, PFD offers the following payment methods:

- Bank Wire,

- Credit/Debit cards,

- Skrill,

- Neteller,

- PayPal

- POLi Payments, etc.

Pacific Financial Derivatives Minimum Deposit

During our test trading, we found that Pacific Financial Derivatives has no minimum deposit amount requirements.

Pacific Financial Derivatives minimum deposit vs other brokers

|

PFD |

Most Other Brokers |

| Minimum Deposit |

$0 |

$500 |

Pacific Financial Derivatives Withdrawals

The funding fees or withdrawal fees range among the providers but average between 1.5%-2.9%. Nevertheless, there are also free-of-charge withdrawal payments through Neteller, or you will be entitled to 1.0% in case you prefer a Card payment.

How Withdraw Money from Pacific Financial Derivatives Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

Trading Platforms

We found that like the majority of brokers, PFD provides MetaTrader 4 which is the most commonly used global platform with a friendly interface and powerful characteristics.

The company is a licensed MetaQuotes partner to provide cutting-edge software for trading services and allows to trade Forex, CFD, and Futures Markets.

- Pacific Financial Derivatives Platform is ranked good with an overall rating of 8.5 out of 10 compared to over 500 other brokers. We mark it as good since it offers popular MT4 professional trading platforms.

Trading Platform Comparison to Other Brokers:

| Platforms | Pacific Financial Derivatives Platforms | Just2Trade Platforms | PhilipCapital Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platform | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Web Trading Platform

The MT4 platform is offered via web-based software, which simplifies the process of trading, as the environment is reachable from any device and via any browser and the only requirement is an internet connection. The downloadable version and Mobile Application however available too, so all set enables you to stay connected and monitor positions with full management, comfort, and ease.

Moreover, PFD’s MT4 is enhanced with MetaTrader Market, a third-party robot and technical indicator supplier, as well as a provider of numerous trading signals and a range of different-level tools. Through MultiTerminal traders will be able to trade with the single interface a number of accounts simultaneously, so Money Managers are most welcome too, with the possibility to obtain a MAM account.

Customer Support

Based on our finds, Pacific Financial Derivatives provides 24/5 customer support through various channels such as Live Chat, Phone Lines, Email, Skype, etc. The support team consists of trading professionals who can assist traders with analysis advice, technical support, and operational matters in addition to regular inquiries.

- Customer Support in Pacific Financial Derivatives is ranked good with an overall rating of 8.5 out of 10 based on our testing. We got fast and knowledgeable responses, and also easy to reach during the working days.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick responses | No 24/7 customer support |

| Relevant answers | |

| Availability of live chat, phone lines, and email | |

Pacific Financial Derivatives Education

Our research indicates that while Pacific Financial Derivatives offers some useful tools such as an economic calendar, Forex introduction, and glossary, the broker does not provide extensive education and learning materials, seminars, or webinars that are essential for beginner traders.

- Pacific Financial Derivatives Education ranked with an overall rating of 7 out of 10 based on our research. The broker does not provide seminars, webinars, insights, etc. For beginner traders, we recommend getting the necessary learning materials from other well-known brokers.

Pacific Financial Derivatives Review Conclusion

In our Pacific Financial Derivatives review, we introduced a brokerage company based in New Zealand with a solid technology infrastructure from Japan. Its STP processing allows for direct access to the market through competitive spreads and powerful trading capabilities.

Overall, we believe that the trading conditions offered by PFD are suitable for traders or investors of any size, as there are no deposit requirements and numerous possibilities to engage with the market, with always available support from the company.

Based on Our findings and Financial Expert Opinions Pacific Financial Derivatives is Good for:

- Beginners

- Advanced traders

- Investors

- Traders looking for High leverage with Regulated Broker

- CFD and currency trading

- Traders who prefer MT4

- NDD/STP execution

- Competitive spreads and fees

- EA/Auto trading

- Supportive customer support

Share this article [addtoany url="https://55brokers.com/pacific-financial-derivatives-review/" title="Pacific Financial Derivatives"]

Hie

I am in Poland and wish to know if I can also trade on your platform, if possible then how do I register?

Thakyou

Brother I traded with PFD for many years and I live in NZ you can email me or ign up for an account here, anyone can sign up from arunf the world.

I want to registered . please how do I start?

How do I register?

Dear Sylvia,

Please, follow this link https://signup.pfd-nz.com/signup/logon to register with Pacific Financial Derivatives.