KAB Review

Leverage: 1:30

Regulation: CySEC

Min. Deposit: 100 US$

HQ: Cyprus

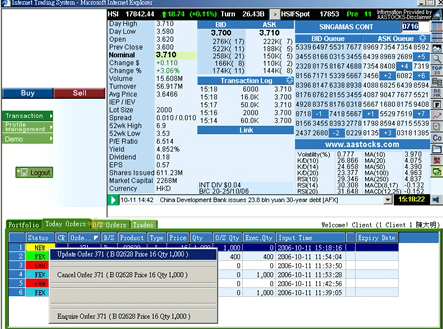

Platforms: MT4, KAB HK/China Securities Trading Platform

Found in: 2002

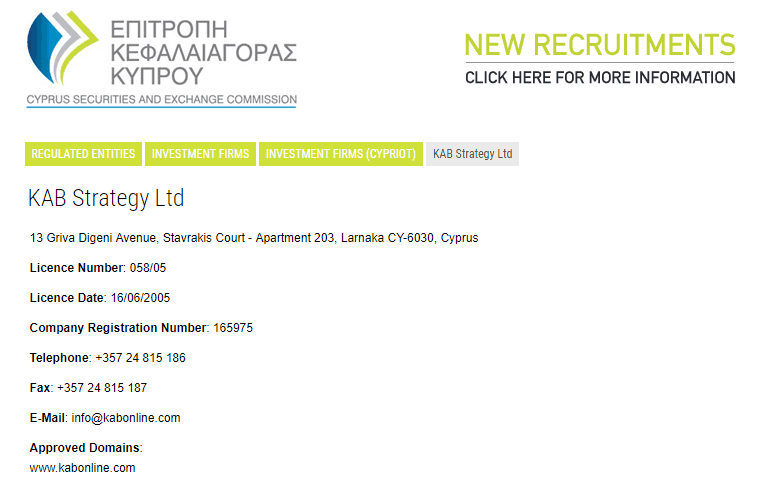

KAB Licenses

- KAB Strategy Limited - authorized by CySEC (Cyprus) registration no. 058/05

Leverage: 1:30

Regulation: CySEC

Min. Deposit: 100 US$

HQ: Cyprus

Platforms: MT4, KAB HK/China Securities Trading Platform

Found in: 2002

KAB Licenses

KAB is an international FX and CFDs trading broker founded in 2002 nowadays operating international services through the integrated multinational financial group KAB International Holdings Ltd., which is located in Hong Kong and China. As well operates Online Trading through a subsidiary of Cyprus Investment Firm – KAB Strategy Ltd.

Generally speaking, KAB group offers its services all across the globe including the Middle East, Europe, and Asia while including various entities to provide its financial investment solutions and vast trading solutions.

The Kuwait branch was established simultaneously with the China office and operates under the brand name KAB Kuwait Group regulated by the local authority CMA.

KAB is a reliable broker with top-tier regulation and very good technology for trading, including Futures, Portfolios, and other popular assets trading suitable for advanced or professional traders.

On the negative side, beginners might not choose KAB since the technology is rather good for experienced traders, there are no spread basis accounts and proper education.

| Advantages | Disadvantages |

|---|---|

| Good reputation | Only Forex and CFDs |

| Wide range of trading platforms | No 24/7 support |

| Global expansion including Australia, Asia, MENA, Africa regions and Europe | Only MT4 platform |

| Low Spreads | |

| Competitive trading conditions |

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation and License | CySEC |

| 📉 Instruments | Stocks, IPOs and ETFs, Rolling Futures/CFDs, Spot Metals and Currencies and Portfolio Management Services |

| 🖥 Platforms | MT4, KAB HK/China Securities Trading Platform |

| 💰 Costs | Futures commission is 40$ per open side |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | EUR, GBP, USD, |

| 💳 Minimum deposit | US$100 |

| 📚 Education | Research tools |

| ☎ Customer Support | 24/5 |

Based on our Expert finds and reviews KAB is considered a good broker with reliable service and very favorable trading conditions, that are suitable for beginners or experienced traders.

| Ranking | KAB | XM | Pepperstone |

|---|---|---|---|

| Our Ranking | ⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantage | Instruments | Education | Platform |

However, KAB instrument offering is mainly limited to Forex and CFDs and the education section is missing. Even though, spreads, platforms and education are really good at KAB is good to consider other brokers too, see our selection of Alternative Brokers below:

No, KAB is not a scam. The broker is highly regulated and strongly adheres to regulatory laws. moreover, it has a long operation history during which the broker has proven itself to have a good reputation and keep its clients satisfied with the services it provides.

KAB STRATEGY LIMITED or better known as a KAB is a licensed and regulated Cypriot Investment Firm, which also authorized under the Cyprus Securities and Exchange Commission to operate within all member states of the EU according to the MiFID regulations.

In addition to that, and due to the established operation of KAB in the MENA region, the broker is also authorized in Kuwait to offer trading services.

See our conclusion on KAB Reliability:

| KAB Strong Points | KAB Weak Points |

|---|---|

| Good Reputation and Strong Establishment | None |

| Global Service Coverage | |

| CySEC Regulated | |

| Negative Balance Protection | |

| Compensation Scheme | |

| Global expands including Asia, MENA, Africa regions |

The above regulation provides a safe state to global traders, restricts and requires a licensed company to provide a sufficient level of security to the clients, as well as operate a reliable financial service. Client investments and funds are kept separately from the company’s own accounts, ensuring better protection for the client.

Finally, being a member of the Investor Compensation Fund set up by the Central Bank of Cyprus and the Cyprus Securities and Exchange Commission, KAB provides another layer of protection for eligible clients in case of the broker’s insolvency or unlikely events.

At KAB, the leverage level allowed its clients to take advantage of is defined by the law of ESMA European regulatory standards, therefore typically low.

Leverage tool indeed is a powerful feature, yet you should learn deeply how to use it the best way, as leverage may work in reverse to your gains too.

From what we have found, the broker provides multiple account types each catering to particular trading needs. The types at KAB are designed by the trading markets as well as by the execution model according to the instrument you will trade.

In addition, since the broker KAB branch is located in Kuwait it also offers Islamic or Swap-free accounts that are suitable for Muslim customers

| Pros | Cons |

|---|---|

| Fully digital fast account opening process | Conditions and proposals very depending on the account type |

| Demo Account | |

| Low minimum deposit | |

| Islamic account |

The broker offers a wide range of financial products and services through one multi-purpose account tailored to investors’ individual needs, whilst fulfilling the requirements of various EU regulatory bodies.

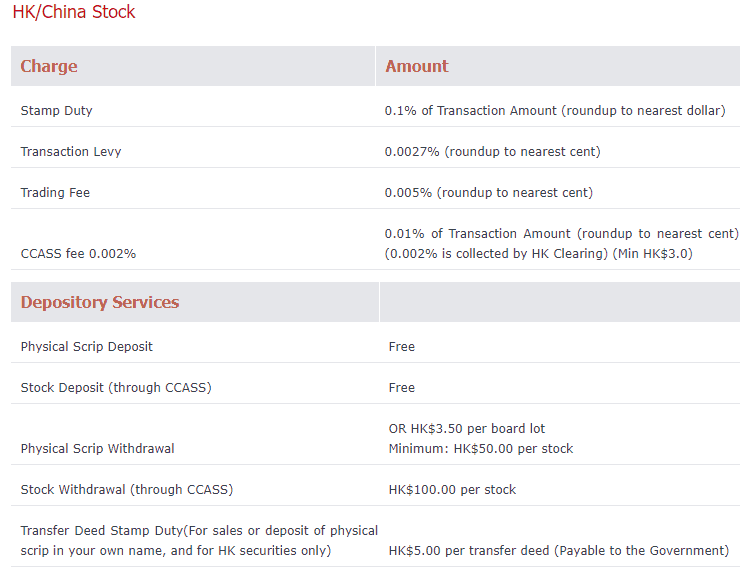

The product offering includes Hong Kong Stock Exchange-traded securities, such as Stocks, IPOs, and ETFs, Rolling Futures/CFDs, Spot Metals and Currencies, and Portfolio Management Services, provided at reasonable, competitive tight spreads and commissions.

Yet, it seems like KAB is a more convenient choice for professional traders and active ones due to its high possibilities and technological proposals through advanced features.

KAB fees are mainly a commission charge, while the account offerings along with the commissions and general trading conditions may be slightly different from the proposal to the European or any other residence clients. So for the best-updated information, you should refer to customer support stating the country of origin and get the most recent and correct offering before you sign-up an account with KAB.

| Fees | KAB | Dukascopy | Interactive Brokers |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | Low |

KAB charges are typically built into a commission that is divided and calculated according to the trading instrument, but also a mainstay on fixed spread (find the best forex broker with lowest fixed spread) option while as an example, Futures commission is 40$ per open side, the Gold spread is 0.50$ with 40$ commission fee, and ECN accounts commissions are negotiable with raw spread offerings for Forex instruments.

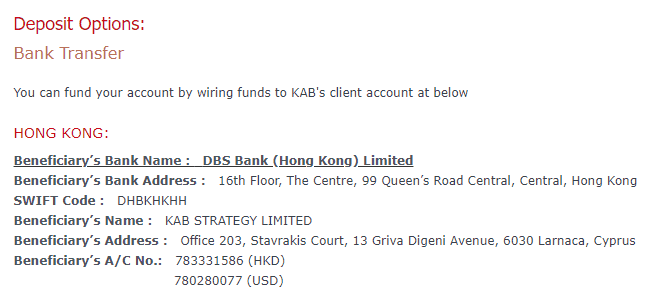

To make the deposit and start live trading you should process the request from the “My Account” area and proceed with payment either via

Even though payment options look limited, these are actually the most convenient ones, while the KAB broker does not charge any fees or commissions for depositing funds, however, some payment providers may charge additional fees which are solely your responsibility.

Here are some good and negative points for KAB funding methods found:

| KAB Advantages | KAB Disadvantages |

|---|---|

| Fast digital deposits, including Neteller, and Credit Cards | None |

| Multiple Account Base Currencies | |

| 0$ deposits and free withdrawals | |

| Withdrawal requests confirmed 12-24 hours |

The minimum deposit amount for KAB defines 5 main types of investment types, while each consists of more than 40 types of products with a specifically defined minimum investment amount. For example, for precious metals, the initial margin for one lot of a standard contract is US$ 1,000, but you may access it through 0.1 lot of mini-contract that requires US$ 100. For more details, you better contact customer service and check on of necessary instrument.

KAB minimum deposit vs other brokers

| KAB | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

MT4 trading account is based on USD, thus funding with other currencies will apply the prevailing market rate. KAB withdrawals are the same and simultaneously connected to the Bank or Credit Card holder’s designates.

Fast, stable, and reliable online trading platforms enable you to access Precious Metals, Equities, Indices, Commodities, and Forex just with the click of a button, around the clock, anywhere in the world the trader might be.

| Platforms | KAB Platform | XM Platform | Pepperstone Platform |

|---|---|---|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| Own Platforms | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

KAB also provides well-rounded support for financial trading moves and enhanced the platform by their development of two versions either for the PC or by Mobile application.

Another point to admit is the great customer support provided by KAB. Their commitment to the client’s satisfaction includes a 24-hour live chat facility and support available in various languages.

See our find and Ranking on Customer Service Quality:

| Pros | Cons |

|---|---|

| Fast and relevant responses | No 24/7 support |

| Multiple languages available | Live Chat not available |

For our final thoughts, KAB is a company with reliable operations in the industry of financial trading and stock exchanges, as well as the unique opportunity to trade through HK/ China Stock trade. Being a part of the larger global group, KAB is a well-regulated broker that provides a safe trading environment. As for the investment offering, it is mainly focused on stock trading and CFDs on Indices, Commodities, and more. Yet, the traders or investors preferably professional level or active traders may find useful benefits that are comfortable with personal demands.

Based on Our findings and Financial Expert Opinion KAB is Good for:

No review found...

No news available.

been trying contact them for ever for no success