Hirose Financial Review

Leverage: 1:30

Regulation: FCA

Min. Deposit: $20

HQ: Japan, UK

Platforms: MT4, LION Trader

Found in: 2004

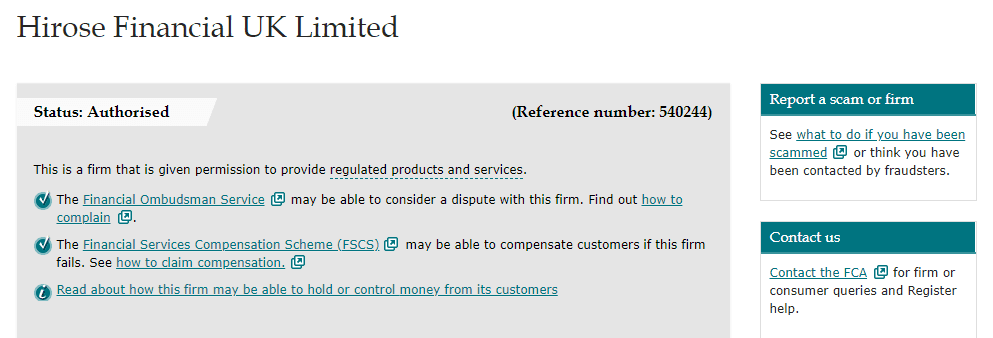

Hirose Financial Licenses

- Hirose Financial UK Ltd. - authorized by FCA (UK) registration no. 540244

Leverage: 1:30

Regulation: FCA

Min. Deposit: $20

HQ: Japan, UK

Platforms: MT4, LION Trader

Found in: 2004

Hirose Financial Licenses

Hirose Financial is a Forex trading provider offering a range of FX trading instruments to over 200,000 clients worldwide.

Hirose Financial UK is a trading company established as an enhancement of FX services of Hirose Tusyo Japan incorporated in 2004. The company is considered one of the biggest, and multiple awarded OTC brokers in Japan.

The UK operations started back in 2010, while additionally, the Global group offers financial services in Hong Kong and Malaysia to cover the customers’ demand.

Hirose Financial uses advanced trading technology offering non-dealing desk (NDD) execution to enable traders to trade Forex instruments, particularly currencies, on its platforms. The broker employs the use of two leading industry platforms MT4 and LION Trader (ActTrader).

The broker executes orders through 15 liquidity providers that are fed into an aggregator, while the charge is incorporated into the variable spread without any commission charges making it a convenient option.

For the cons, Hirose Financial does not offer 24/7 customer support to its clients. Additionally, the broker has a limited number of trading instruments available on its platforms, which may not be sufficient for some traders who are looking for a diverse range of assets to trade.

| Advantages | Disadvantages |

|---|---|

| FCA license and overseeing | No 24/7 customer support |

| Regulated broker with competitive trading fees and spreads | Limited number of trading instruments |

| No commission fees | |

| Access to MT4 trading platform | |

| Funds protection | |

| Fast execution |

| 🏢 Headquarters | Japan, UK |

| 🗺️ Regulation and License | FCA |

| 📉 Instruments | Forex, Binary Options, Commodities |

| 🖥 Platforms | MT4, LION Trader |

| 💰 EUR/USD Spread | 0.8 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | GBP, EUR, USD, etc. |

| 💳 Minimum deposit | $20 |

| 📚 Education | Trading manuals, essential trading components, technical analysis overviews, economic indicators |

| ☎ Customer Support | 24/5 |

Hirose Financial is a well-regulated broker that offers traders competitive spreads and fees as well as safe trading conditions.

| Ranking | Hirose Financial | LMAX | BP Prime |

|---|---|---|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantages | Trading Fees | Spreads | Trading Conditions |

Although Hirose Financial provides low-cost and competitive trading services, there are several other brokerage firms in the market that offer similar services. To help traders explore their options, we have compiled a list of some of the leading alternatives to Hirose Financial:

Hirose Financial has been awarded multiple times for its dedication to providing high-quality service to its clients. See some of the awards in the screenshot below.

No, Hirose Financial is not a scam. It is the trading name of Hirose Financial UK Ltd., which is authorized and licensed by the Financial Conduct Authority (FCA).

Yes, Hirose Financial is a legit and regulated broker. It is considered a safe broker, as among the top priorities of any authorized company is the safety of the client’s funds along with the protected operational standards.

See our conclusion on Hirose Financial Reliability:

| Hirose Financial Strong Points | Hirose Financial Weak Points |

|---|---|

| Funds protection | No negative balance protection |

| Compensation scheme | |

| Segregated accounts |

Along with the operational standards and requirements to operate trading services, Hirose maintains safety measures towards client funds, while money is always kept at bank trust segregated accounts. Also, trading with the UK branch every client is covered by the Financial Services Compensation Scheme (FSCS), which secures the client in case of the company insolvency up to £85,000.

While trading with Hirose Financial you are offered to use the leverage that may magnify your profits, due to the possibility of the increase in trading size you operate. However, together with its unique opportunities, leverage increases risks too that’s why it is very important to use it smartly. With this regard, regulatory obligations and restrictions, as Hirose Financial is the UK-regulated broker, mandate lower leverage levels towards retail traders.

Hirose Financial leverage is offered according to FCA regulation:

Hirose Financial provides its clients with live and demo trading accounts, which differ based on the platform used. Each account type comes with its own conditions regarding commission, margin calls, leverage, and other factors.

| Pros | Cons |

|---|---|

| Fast account opening | None |

| Demo and Live accounts | |

| $20 is the minimum deposit amount | |

| Account base currencies GBP, USD, EUR |

Opening an account with Hirose Financial is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

Hirose Financial offers a variety of trading instruments for its clients to choose from, mainly focusing on Forex instruments such as currency pairs. In addition to Forex instruments, Hirose Financial also offers trading in commodities, such as gold and silver, as well as several indices, and binary options.

However, it is worth noting that the range of trading instruments available at Hirose Financial is relatively limited compared to some other brokers in the market.

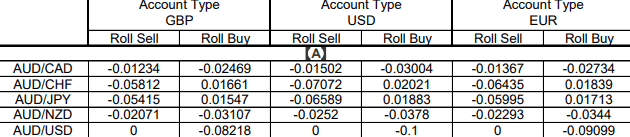

Hirose Financial costs are built into a competitive spread that varies according to the account type or platform, while the broker consistently stays at a tight and low spreads strategy with no hidden costs. The Standard Account and Pro Account costs are all built into a variable spread, while Prime Account offers a lower spread but with commission per trade.

It is worth noting that there may be additional costs to consider, such as the overnight fee or swap rate, which is charged if a position is held for longer than a day.

| Fees | Hirose Financial Fees | LMAX Fees | BP Prime Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | No | Yes | No |

| Fee ranking | Low | Low/Average | Low/Average |

Hirose Financial provides its clients with tight and floating spreads, which means that the spreads may vary depending on the market conditions. The typical spread for EUR/USD pair is 0.8 pips and commodities trade is presented with low margins of 0.5%.

| Asset/ Pair | Hirose Financial Spread | LMAX Spread | BP Prime Spread |

|---|---|---|---|

| EUR USD Spread | 0.8 pips | 0.2 pips | 0.3 pips |

| Crude Oil WTI Spread | - | 4 | 0.01 |

| Gold Spread | 0.01 | 25 cents | 0.01 |

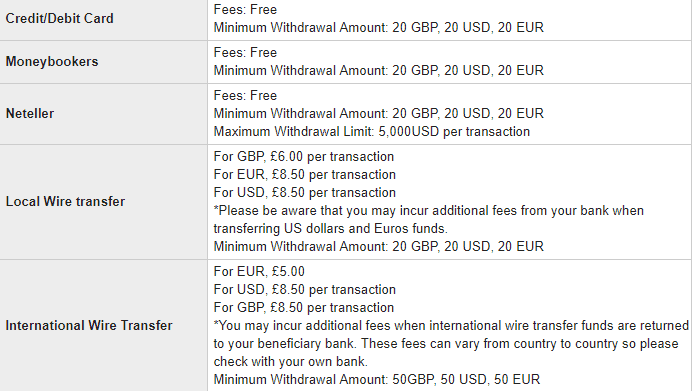

Hirose Financial offers a number of simple ways to fund your trading account and withdraw funds with convenience and relative ease. Payments can be made in GBP, EUR, and USD, while funding methods include Credit/Debit Cards, Skrill or Neteller transfers, as well as Bank Wire Transfers.

Here are some good and negative points for Hirose Financial funding methods found:

| Hirose Financial Advantage | Hirose Financial Disadvantage |

|---|---|

| Fast digital deposits, including Credit/Debit Cards | None |

| No fees for deposits and withdrawals | |

| Multiple account base currencies |

Hirose Financial minimum deposit is $20 with no strict requirement while all fees are covered by Hirose. Credit/debit card payment may not be available in some countries, and card type availability will change from country to country.

Hirose Financial minimum deposit vs other brokers

| Hirose Financial | Most Other Brokers | |

| Minimum Deposit | $20 | $500 |

Hirose Withdrawals are processed via online form request and are eligible to be returned to the source from which the initial deposit was done. Typically there are no fee charges for the transaction of withdrawal, yet local or international wire transfers may require an additional processing fee, of around $10.

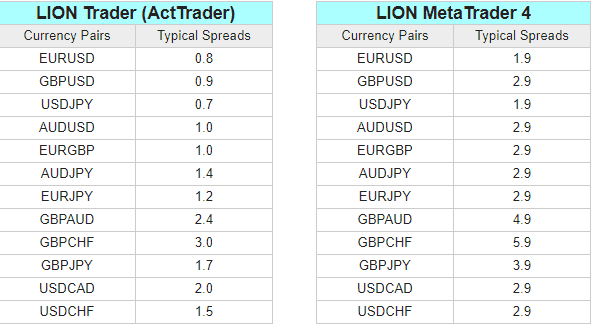

Hirose Financial offers its clients access to two popular trading platforms MetaTrader 4 (MT4) and LION Trader (ActTrader).

MT4 is a widely-used trading platform that offers advanced charting capabilities, technical analysis tools, and the ability to use automated trading strategies. It is available as a desktop application, web-based platform, and mobile app.

LION Trader (ActTrader) is a proprietary trading platform developed by Hirose Financial. It offers a user-friendly interface and a range of trading tools, including advanced charting, market analysis, and risk management tools. LION Trader is also available as a web-based platform and mobile app. This platform is good for scalpers and hedging too, with access to 50 currency pairs with the most convenient and good cost conditions. Moreover, there is the potential to use Expert Advisors through Actfx language.

While MT4 does not require too much introduction, apart from its advanced charting features and indicators that are fully customized, MT4 support most progressive area for automatic trading through the MQL4 language and thousands of EAs to choose from.

Trading instruments include 46 currency pairs through a margin of 0.33% and a typical spread from 1.9 pips. There are also a few versions of MT4 accessible by PC or Mobile, which allows you to trade on the go and to manage Forex position easily.

| Patforms | Hirose Financial Platforms | LMAX Platforms | BP Prime Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platform | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Hirose Financial offers multilingual 24/5 customer service support through live chat, phone, e-mail, and Skype. The support team consists of trading experts who are available to assist traders with various matters such as technical support, analysis advice, general inquiries, and operational issues.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|---|

| Quick responses | No 24/7 customer support |

| Relevant answers | |

| Availability of live chat |

Traders of any level can find their benefits and necessary tools at Hirose Financial. Educational Materials present a range of tools to choose from including trading manuals, essential trading components, technical analysis, economic indicators, and a Demo account to improve skills.

Hirose Financial Review presents a subsidiary company established on Japan’s expertise and success, which offers financial investment services with market execution and a range of leading competitive offerings. The pleasant conditions are featured for the beginning traders, along with a great choice between platforms, education, and a simple costs system with all charges included in the spread. Yet, professional traders will find their benefits also, due to the transparent operational policy and comprehensive tech proposals, with competitive trading costs.

In general, traders have provided positive feedback on Hirose Financial’s trading conditions and services. However, we recommend doing your own research before choosing to sign up with the broker to ensure it is the right choice for you.

Based on Our findings and Financial Expert Opinions Hirose Financial is Good for:

No review found...

No news available.